Browsing through Nature of Contracts – CA Foundation Law Notes help students to revise the complete subject quickly.

Nature of Contracts – CA Foundation Business Law Notes

What is law?

Law is a mechanism for regulating the human conduct in a society.

If It consists of rules and principles enforced by an authority to regulate people’s behaviour with a view to secure justice, peaceful living and social security.

What is mercantile law?

→ There are various branches of law such as civil law, criminal law, tax law, labour law, business law etc.

→ Mercantile Law, Commercial Law or Business Law is that branch of law, which regulates business and commercial transactions. It includes the laws relating to Contract, Sale of Goods, Partnership, Companies, Negotiable Instruments, Insurance, Carriage of goods etc.

Law of contracts:

→ The law of contract forms the basis of the commercial/business law. It is concerned with enforceability of promises.

→ For example, if a supplier ‘S’ has promised to supply goods to a manufacturer ‘M’ on a specific date, there is a binding contract. Based on this promise, the manufacturer M will plan his production schedule and accept orders from his customers.

Now if the supplier fails to supply the goods in time. (i.e. commits a breach of promise) M can claim damages for the loss he has suffered. Thus the purpose of the Law of Contract is to ensure that the expectations created by promises of the parties are fulfilled and obligations created by agreements are enforced.

→ In the absence of the Law of Contract it will be impossible to carry on trade and commerce. The businessman who has made a promise should fulfil it or else he will be liable to pay damages to the other party. The object of law of contract is to introduce certainty and definiteness in business transactions. To quote Anson, “The law of contract is intended to ensure that what a man has been led to expect shall dome to pass; and that what has been promised to him shall be performed”.

(a) Applicability to business community as well as others:

The law of contract is applicable not only to the business community, but also to others. Every one of us enters into contracts day after day. When you buy a book, or keep your vehicle at the cycle/ scooter stand or travel in a bus, or take a DVD for home viewing, in all these transactions of daily life, you are entering into a contract.

(b) Sources of Law of Contract:

→ The law of contract in India is contained in the Indian Contract Act, 1872. The Act came into force on the first day of September, 1872 and it applies to the whole of India except the State of Jammu & Kashmir.

→ It mentions elements necessary for a valid contract; it says which persons are capable of entering into enforceable agreements; it mentions the cases in which agreements are avoid-able; it declares certain kinds of agreements void; it deals with performance of contract and it prescribes remedies for breach of contracts.

→ Apart from Indian Contract Act, 1872, the other sources of law of contract are: Judicial de-cisions or precedents; and customs and usages of trade. The decisions of the Supreme Court are binding on the lower courts. The judicial decisions constitute an important source of the law of contract, especially when the Act is silent on a point or there is ambiguity.

→ Customs /usages refer to a generally accepted practice or behaviour among members of a business community. A custom or usage to be legally binding must not be inconsistent with statutory law and must be widely known, certain and reasonable.

→ The Contract Act will prevail over any usage or custom of trade. However, any usage, custom or trade will be valid and binding as long as it is not inconsistent with the provisions of the Contract Act.

(c) The Act is not exhaustive

The Contract Act is not exhaustive. It does not deal with all the branches of the law of contract. There are separate Acts which deal with contracts relating to negotiable instruments, transfer of 8 property, sale of goods, partnership, insurance, etc.

For example, if you are buying a house the law § applicable will be the Transfer of Property Act while if you are buying a car, the governing law is g the Sale of Goods Act. The Partnership Act regulates the partnership agreements. The Contract Act thus, contains the general principles of contract and does not deal with contractual relationships H which are dealt under special statutes.

(d) What is the Scheme of the Act?

The scheme of the Act may be divided into two groups:

(a) General Principles of the law of contract (Secs. 1-75).

(b) Specific kinds of contracts, viz.;

- Contracts of Indemnity and Guarantee (Secs. 124-147).

- Contracts of Bailment and Pledge (Secs. 148-181)

- Contracts of Agency (Secs. 182-238).

Sections 76-123 relating to Contracts of Sale of Goods were repealed in 1930 and a separate Act called the Sale of Goods Act was enacted. Similarly, sections 239-266 relating to partnership were repealed in 1932 when the Indian Partnership Act was passed.

(e) The subject matter of contract can be discussed under the following heads:

- The Nature of contract.

- Formation of contract i.e. how a contract is made, what things are necessary for the formation of a contract.

- Operation of Contract, i.e. whom the contract affects, and how the contract is performed.

- Discharge of contract, i.e. when the rights and obligations arising out of a contract are extinguished.

- Remedies for a breach of contract.

What is A Contract?

According to Section 2(h) of the Indian Contract Act: “An Agreement enforceable by law is a con-tract”. Thus a contract consists of two elements:

(a) An agreement

(b) Legal obligation i.e. a duty enforceable by law.

(a) Agreement:

An agreement is defined in section 2(e) “Every promise and every set of promises, forming the con-sideration for each other is an agreement”.

Now, what is promise?

Promise is defined as an accepted proposal, for section 2(b) says. “A proposal, when, accepted becomes promise ”. Thus an agreement is an accepted proposal OR

Agreement = Offer + Acceptance

The process of definition comes down to this:

An agreement comes into existence when one party makes a proposal or offer to the other party and that other party gives his acceptance thereto. Thus there should be exchange of promises. There must be two or more persons to make an agreement because one person cannot enter into an agreement with himself. There should also be consensus-ad-idem i.e. both the parties must agree on the same thing in the same sense.

(b) Legal Obligation:

For an agreement to become a contract, it must give rise to a legal obligation i.e. a legal duty which is enforceable by law. The parties must have the intention to impose a duty on the promisor to fulfil the promise and bestow a right on the promisee to claim its fulfilment. This obligation must not be merely moral alone; it must be legal.

For example, A invites B to join his marriage party and B promises to do so. But B eventually fails to keep up his promise. In this case, there is a full-fledged agreement between A and B. But behind this agreement there is no intention on the part of the parties to impose a duty on the promisor (i.e., A) and bestow a right on the promisee (i.e. B) to claim the fulfilment of the contract. Therefore, the agreement is not enforceable by law.

All Contracts Are Agreements But All Agreements Are Not Contracts:

Agreement is the genus of which contract is the species. An agreement is a wider term than a contract. It may be a legal agreement (i.e. enforceable by law) or a social agreement (i.e. not enforceable by law). Agreements relating to social matters like an agreement to go to movie together or a visit to a hotel do not create legal obligations between the‘parties and hence are not contracts. Only those agreements grow into contracts, which create legal obligations.

Distinction between Agreement and Contract:

| Agreement: |

Contract: |

| 1. Agreement is a promise. Offer and acceptance together constitute an agreement. |

Contract is an agreement enforceable by law. |

| 2. Agreement is a wider term. It is a genus. It includes legal as well as social agreement. |

Contract is a specie of an agreement. It is a narrower term. |

| 3. Agreement may not create any legal obligation. |

A contract necessarily creates a legal obligation. |

| 4. All agreements are not contracts. |

All contracts are agreements. |

What type of legal obligations are dealt with by the law of contracts?

Obligations may arise from different sources. The law of contract deals only with such legal obligations which arise from agreements. Obligations which are not contractual in nature are outside the purview of the law contract. For example, obligation to observe traffic rules does not fall within the scope of the Contract Act.

The other sources of obligations are: obligations under the trust law or the law of tort or the fundamental duties under the Constitution etc. They are outside the purview of the Contract law since they are not voluntarily created through an agreement. Salmond has rightly observed:

“The law of contracts is not the whole law of agreements, nor is the whole law of obligation.

It is the law of those agreements which create obligations and those obligations, which have X their source in agreements.”

Contract creates Right in Personam:

“The law of contract creates ‘right in personam’as against ‘right in rem. ”Right in personam means a right available against a particular person. For example, A buys TV from B for ₹ 20,000. B has a right to recover this amount. This right can be exercised only by B and only against A. This right of B is right in personam.

Right in rem:

Right in rem means a right available against the whole world. If A is the owner of a house property he has the right of peaceful possession and enjoyment of the property against the whole world.

What are the essential elements of a valid contract?

Section 10 provides “all agreements are contracts if they are made by the free consent of parties competent to contract for a lawful consideration and with a lawful object, and are not hereby expressly declared to be void”.

The essential elements or essentials of a valid contract (or enforceable agreement) are:

- An offer or proposal by one party and an acceptance of that offer by another party resulting in an agreement.

- An intention to create legal relations or an intent to have legal consequence.

- Free consent between the parties.

- The parties to contract are legally capable of contracting.

- The object of the contract is legal and is not opposed to public policy.

- The agreement is supported by consideration

- The agreement must not have been expressly declared to be void under the Act.

- The terms of the contract are certain.

- The agreement is capable of being performed, i.e. it is not impossible to perform the contract.

- Where agreement is required to be in writing under any law it must be in writing; and where both writing and registration are required by some Act or Law, the agreement must be in writing and registered.

Offer and acceptance:

There must be a “lawful offer” and a “lawful acceptance” of the offer, thus resulting in an agree-ment. The adjective lawful implies that the offer and acceptance must satisfy the requirements of the Contract Act in relation thereto.

Intention to create legal relations:

There must be an intention among the parties that the agreements should be attended by legal consequences and create legal obligations. Agreements of a social or domestic nature do not con-template a contract. An agreement to dine at a friend’s house is not an agreement intended to create legal relations and therefore is not a contract.

Balfour Vs Balfour, 1919, 2 KB 571:

Mr. & Mrs. Balfour who were living in Ceylon went to England. Mrs. Balfour fell ill. Mr. Balfour had to come back to Ceylon to join his duties. However he promised to pay 30 pounds per month to his wife. On his failure to pay, Mrs. Balfour sued him for the recovery of the amount. It was held that it was a domestic agreement and the husband never intended to create any legal relations out of it.

In commercial agreements an intention to create legal relations is presumed. Thus, an agreement to buy and sell goods intends to create legal relationship, and hence is a contract, provided other requisites of a valid contract are present.

Lawful consideration:

Consideration means ‘something in return.’ An agreement is enforceable when each of the parties to it gives something and gets something in return. If A agrees to sell his house to B for ₹ 5 lac, the consideration for A’s promise is ₹ 5 Lac and B’s promise is a house. Thus consideration is the price paid by one party for the promise of the other. The payment of money is a common form of consideration. But it may also consist of an act, forbearance, and a promise to do or not to do something. Consideration must be real, valuable and lawful.

Capacity of parties:

The parties to an agreement must be competent to contract; otherwise it cannot be enforced by a court of law. Every person is competent to contract who is (a) of the age of majority, (b) of sound mind and (c) is not disqualified from contracting by any law. (Sec. 11)

Free consent:

The consent of the parties must be free i.e. the parties should enter into contract voluntarily and free will. Section 14 lays down that consent is not free if it is caused by –

- coercion

- undue influence

- fraud

- misrepresentation

- mistake

Lawful object K:

The object of the agreement should be lawful. It should be authorised or sanctioned by law. The object of an agreement is unlawful if it is forbidden by law or is fraudulent or is immoral or opposed to public policy. For example a “suparF contract for unlawful recovery of money or a smuggling agreement is unlawful hence unenforceable.

Agreement not expressly declared void:

The Indian Contract Act, 1872, has expressly declared certain agreements to be not enforceable at law, e.g. agreements in restraint of marriage, agreements in restraint of trade, wagering agreements etc. The parties to the agreement should ensure that their agreement do not fall in the category of these void agreements, otherwise the agreement will not be enforceable even if all the other essentials of valid contract are present.

Certainty:

The terms of the contract should be certain and definite and not vague. Section 29 says “Agreements, the meaning of which is not certain or capable of being made certain are void.” For example, A agrees to sell B “a hundred tons of oil”. There is nothing whatever to show what kind of oil was intended. The agreement is not enforceable because it is vague and uncertain.

Possibility of performance:

Yet another essential feature of a valid contract is that it must be capable of performance. Section 56 lays down that “An agreement to do an act impossible in itself is void.” If the act is impossible in itself, physically or legally, the agreement cannot be enforced at law. For example, A agrees with B to discover treasure by magic. The agreement is void due to impossibility.

Writing and registration:

According to the Indian Contract Act, a contract may be oral or in writing. An oral contract is as much enforceable as a written contract. However, if there is a provision in any law prescribing that contracts should be in writing/registered then, this formality of writing and registration should be followed.

For example, in certain special cases the Contract Act prescribes that the contract should be in writing or/and registered. Section 25 of the Contract Act requires that an agreement to pay a time barred debt must be in writing and an agreement to make a gift for natural love and affection must be in writing and registered.

Similarly, certain other Acts also require writing or/and registration to make the agreement enforce-able by law which must be complied with. Thus (i) an arbitration agreement must be in writing as per the Arbitration Act, 1996, (ii) an agreement for a sale of immovable property must be in writing and registered under the Transfer of Property Act, 1882 before they can be legally enforced, (iii) for example, contract with the Government should be in writing. Article 299, Constitution of India.

Kinds of Contracts:

On the basis of enforceability or validity a contract can be classified under following heads:

- Valid Contracts

- Void Agreement

- Voidable Contract

- Void Contract

- Unenforceable Contract

- Illegal or Unlawful Agreement

On the basis of Formation a contract can be classified as:

- Express Contract

- Implied Contract

- Quasi-Contract

- E.com. Contract

On the basis of performance it can be classified as:

- Executed Contract

- Executory Contract

Executory contract can further be classified as:

- Unilateral Contract

- Bilateral Contracts

(a) Valid Contrac:

A valid contract is one which contains all the essential elements of a valid contract. It is an agreement which is binding and enforceable by law.

(b) Void agreement:

“An agreement not enforceable by law is said to be void. [Sec. 2(g)]

Features:

(a) A void agreement does not give rise to any legal consequences. It is void ab-initio, i.e. from the very beginning. If any of the essentials of a valid contract, other than free consent, is missing, the agreement is void, i.e. it cannot be enforced at courts of law. For example, an agreement with a minor or an agreement without consideration.

(b) Certain agreements have been expressly declared as void by the Indian Contracts Act, in sections 11, 20, 23-30 and section 56.

(c) There cannot be restitution of benefit under a void agreement and if something has been paid it cannot be recovered. However, when an agreement is discovered to be void or when a contract becomes void, any person who has received any advantage under such agreement or contract is bound to restore it, or to make compensation for it, to the person from whom he received it. (Sec. 65).

For example, A pays B ? 50,000 in consideration of B’s promising to sell his car to him. The car is destroyed in an accident at the time of the promise though neither party was aware of the fact. In this case the agreement is discovered to be void and B must repay A ₹ 50,000. It should be noted that when the agreement is known to be void, no restitution is allowed. Thus if A pays ? 10,000 to ^B to assault. C, the money cannot be recovered.

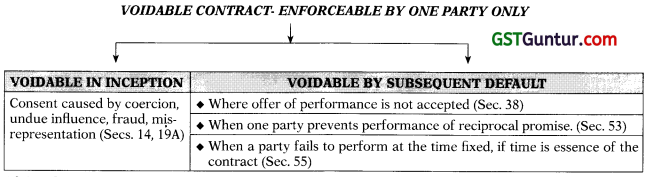

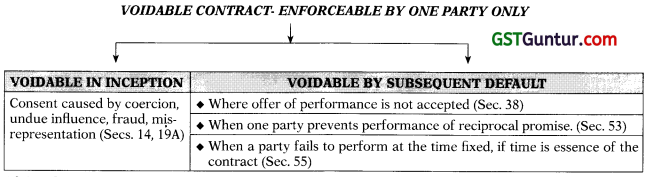

(c) Voidable contract

An agreement which is enforceable by law at the option of one or more of the parties thereto, but not at the option of the other or others, is a voidable contract.” [Sec. 2(i)].

Features:

→ A voidable contract is enforceable at the option of one party. For ex. if X is forced to sign a contract the contract is voidable at the option of X. X may either rescind (avoid or repudiate) the contract or elect to be bound by it.

→ A voidable contract continues to be good until it is avoided by the party entitled to do so.

→ The aggrieved party must exercise his option of rejecting the contract (i) within a reasonable time and (ii) before the rights of third parties intervene, otherwise the contract cannot be repudiated.

→ The party rescinding a voidable contract shall if he has received any benefit thereunder from another party to such contract, restore such benefit, so far as may be, to the person from whom it was received (Sec. 64)

The various circumstances in which a contract is voidable are depicted by the following chart:

(d) Void contract:

“A contract which ceases to be enforceable by law becomes void when it ceases to be enforceable”. [Section 2(j)].

Features:

a. The term void contract appears to be contradictory, but it is a nice way of describing a situation where a contract is valid in the beginning but becomes void subsequently. Note that a Contract becomes void. it is never void ab initio.

b. A void contract is one, which was valid when it was made but becomes void later on. For example, A agrees to supply liquor to B but before he gives delivery, the Government declares total prohibition. The contract becomes void. A void contract is not void from its inception and its valid and binding on the parties when originally entered but subsequent to its formation it becomes invalid.

c. Restitution of benefit allowed when contract becomes void: According to Section 65 when a contract becomes void, the party who received any advantage under such agreement, should restore or make compensation for it to the party from whom he received it. For example, A takes an advance of ? 1000 for singing at a concert for B. A is too ill to sing. A must refund to B the 1000 rupees paid in advance.

The reasons which transform a valid contract into a void contract as given in the Contract Act are as follows:

→ Supervening impossibility (Section 56): A Contract becomes void if it becomes impossible to perform, after it is made. A and B contracted to marry each other. Before the time fixed for the marriage A goes mad. In this case the contract becomes void due to subsequent impossibility.

→ Subsequent illegality (Section 56): A contract becomes void if it becomes illegal after it is made. A agrees to sell B 100 bags of wheat at ₹ 550 per bag. Before delivery, the government bans private trading in wheat. The contract becomes void due to subsequent illegality.

→ Repudiation of a voidable contract: When a voidable contract is rescinded, the contract becomes void.

→ Subsequent impossibility of contingent event (Sec. 32): A contingent contract to do or not to do something on the happening of an uncertain future event, becomes void, when the event becomes impossible.

→ The following are the points of differences between various types of contracts discussed above:

| Void agreement |

Void contract |

| 1. It is void ab-initio |

It is not void ab-initio. Initially a valid contract comes into existence but it becomes void and unenforceable later on due to reasons like impossibility of performance, illegality etc. |

| 2. No restitution of benefit is allowed |

When a contract becomes void, restitution of benefit is allowed under section 65. |

The legal effect of void agreements and void contract is the same. Both cannot be enforced in a Court of Law. Note that a contract cannot be void ab-initio and only an agreement can be void ab-initio.

| Void agreement |

Voidable contract |

| 1. It is void ab-initio |

It is not void ab-initio. It becomes void and unenforceable only when the aggrieved party chooses to void it. |

| 2. No contract comes into existence |

Contract comes into existence and remains valid unless it is avoided. |

| 3. No restitution of benefit is allowed |

The party rescinding the contract shall restore the benefit, if he has received any, to the other party under section 64. |

| 4. No question of compensation since a void agreement has no legal effect. |

If a party rightfully avoids the contract it can claim compensation from other party for loss suffered by him on account of nonperformance of contract. |

| 5. A third party cannot acquire any title to the goods under a void agreement. |

A third party acquires a valid title to the goods obtained under a voidable contract if it has been obtained in good faith for a value and before the contract is avoided. |

| Void contract |

Voidable contract |

| 1. A void contract is one which is valid when it is made but becomes void later on. |

A voidable contract is one, which is enforceable by law at the option of one of the parties. |

| 2. A void contract cannot be enforced |

A voidable contract can be enforced if the aggrieved party elects to carry out the contract. |

| 3. A contract becomes void due to certain reasons like impossibility of performance, subsequent illegality etc. |

A contract becomes voidable, if consent is caused by coercion, undue influence, fraud and misrepresentation or failure to perform at the time fixed if time is essence of the contract. |

| 4. Compensation is not payable except only when party knows beforehand about the impossibility of the performance. |

In a voidable contract the aggrieved party can claim damages. |

(e) Unenforceable contract:

An unenforceable contract is one, which suffers from some technical defect. It is valid in itself, but Is not capable of being enforced in a court of law because of non-observance of some technical formalities such as insufficiency of stamp, want of registration, attestation etc.

In some cases such contracts can be enforced if their technical defects are removed, for example, the defect of under stamping can be removed by affixing the right value of stamps.

(f) Illegal or unlawful agreement:

An illegal agreement is one, which is contrary to law. According to section 23 an agreement is illegal and void if its object or consideration.

- is forbidden by law, or

- is of such a nature that, if permitted, it would defeat the provisions at any law, or

- is fraudulent, or

- involves or implies injury to the person or property of another, or

- the court regards it as immoral or opposed to public policy (Sec. 23)

An illegal agreement may attract punishment and prosecution under criminal law. An agreement which is collateral to an illegal agreement also becomes illegal. It is like an contagious disease and is fatal not only to the main contract but to collateral transactions as well.

Difference between Void & Illegal agreements:

→ Scope – An illegal agreement is narrower in scope than a void agreement. All illegal agreements are void but all void agreements are not necessarily illegal. E.g. an agreement with a minor is void, but not illegal.

→ Collateral Transactions – When an agreement is illegal, other agreements which are incidental or collateral to it are also tainted with illegality, hence void.

Example:

India and Pakistan are playing test match in Nagpur. X of Nagpur, agrees to pay ₹ 1 lac to Y, if India wins. The match is won by India and in order to pay Y, X borrows ₹ 1 lac from Z, who is aware of the purpose.

The agreement between X and Y is void being wagering (betting) agreement and it is also illegal in Maharashtra. The agreement between X and Z being collateral agreement is also void because the main agreement is between X and Y is illegal.

→ Restitution – In the case of illegal agreement, no right/remedy is available to either party. Hence money paid under an illegal agreement cannot be recovered. Under sec. 65 if an agreement is discovered to be void any person who has received advantage/benefit must restore it or make compensation for it.

→ Punishment – In case of an illegal agreement the parties may be punished under the criminal law, in case of a void agreement (which is not illegal) there is no such punishment.

(g) Express contract:

An express contract is created by the words of the parties, whether oral or written. Section 9 of the Act provides that if a proposal or acceptance of any promise is made in words the promise is said to be express. For example: A tells B that he offers to sell his house for ₹ 20 lakhs and B replies that he accepts the offer.

(h) Implied contract:

An implied contract is created by implication of law or by the conduct of the parties. For example; A coolie in uniform picks up the luggage of Mr. S to be carried out of the railway station without being asked by S and S allows him to do so. Here, S is compelled to pay to the coolie for his services.

Tacit Contracts: Tacit means Silent. These are the contracts that are inferred through action of the conduct of the parties without any words spoken or written. For example; Mr. V steps into a bus to go to a certain location. V is bound to pay the fare, although he has not in words promised to do so. Other examples of Tacit contracts are obtaining cash from an ATM, sale by fall of hammer at an auction sale etc. Tacit contracts are not separate forms of contracts but they fall within the scope of implied contracts.

(i) Quasi-Contract:

Quasi contract is a contract in which there is no intention on the part of either party to make a contract but law imposes a contract upon parties. These are not actual contracts but they resemble a contract which is created by law under certain circumstances. Here, law creates legal rights and obligations when there is no real contract. For example; obligation of finder of lost goods to return them or liability of person whom money is paid by,mistake to repay it back.

(j) E-Com Contract:

These are also known as e-commerce contracts, EDI contracts, Cyber contracts, mouse click contracts or e-contracts. These contracts are created by parties using electronic means such as email. Different parties create networks which are linked to other networks through Electronic Data Interchange (EDI). When you buy a mobile phone from an online shopping website or through a mobile application, you enter into an e-contract.

(k) Executed contracts:

An executed contract is one that has been performed by all parties. A buys a TV set from B for ₹ 20,000. A pays the price and B delivers the TV. It is an executed contract. Both the parties have performed their respective obligations.

(l) Executory contracts:

An executory contract is one where both the parties have still to perform their respective contractual obligations. A contract may be partly executed and partly executory. For example: A contracts to sell and deliver a TV to B for ₹ 20,000 to be paid in 3 weeks. A delivers the TV. The contract is executed as to A, executory as to B, as B has not yet paid the agreed price.

(m) Unilateral contracts:

In case of a unilateral contract, only one partly has to perform his obligation and the other party has performed his obligation at the time of formation of contract or before. If A buys a railway ticket for his journey from Nagpur to Bombay.

A has performed his duty under the contract by paying the fare but the railways are yet to perform their promise i.e. of carrying him from Nagpur to Bombay. A unilateral contract is partly executed and partly executory. Such contracts are also called as contracts with executed consideration or one-sided contracts.

(n) Bilateral contracts:

A bilateral contract is one in which both the parties are yet to perform their respective obligations at the time of formation of contract. They are similar to executory contracts and are called as contracts with executory consideration.

(o) Formal and simple contracts:

This classification is made in the English Law.

Formal Contract:

Formal Contract is expressed in a particular form. Its validity depends on form alone. It is in writing. The signature is usually attested Le. witnessed. No consideration is necessary. The Indian Contract Act does not recognize these contracts since consideration is a necessary element in a contract subject to certain exceptions mentioned in Sec. 25.

Formal contracts can be sub-divided into:

- Contract of Record

- Contracts under seal

(a) Contract of Record: A contract of record consists of either a judgment of a court or recognizance. They derive their binding force from the authority of the Court. A Court Judgment on being recorded is called a contract of record. It is an obligation imposed upon the parties by the court as a judicial authority. It is not a contract in the real sense since it is not based on any agreement.

Recognisance is conditional judgment arising in criminal proceedings binding a person to be of good behaviour or to appear as a witness, subject to a money penalty if the obligation is broken. It sort of a written acknowledgement to the State by an accused that on his default to be of good conduct etc. he is bound to pay to the State a certain some of money.

(b) Contract under seal: They are also called as specialty contracts or deeds. All the terms of such contracts are reduced to writing and then the contract is signed, sealed and delivered. Consideration is not essential to support a deed or a contract under a seal.

Simple Contracts:

These contracts are also called as parol contracts. This class includes all contracts not under seal and for their enforcement they require the fulfilment of the essential elements of the contract i.e. consideration, free consent etc. Simple contracts may be made orally or in writing.