Sale on Approval Basis – CA Foundation Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

Sale on Approval Basis – CA Foundation Accounts Study Material

Question 1.

Meaning of sale on approval basis.

Answer:

As per the definition given under the Sale of Goods Act, 1930, in respect of such goods, the sale will take place or the property in the goods pass to the buyer:

- When he signifies his approval or acceptance to the seller

- When he does some act adopting the transaction

- If he does not signify his approval or acceptance to the seller but retains the goods without giving notice of rejection, on the expiry of the specified time (if a time has been fixed) or on the expiry of a reasonable time (if no time has been fixed).

![]()

Question 2.

A merchant sends out his goods casually to his dealers on approval basis. All such transactions are, however recorded as actual sales and are passed through sales book. On 31.12.2005, it was found that 100 articles at a sale price of ₹ 200 each sent on approval basis were recorded as actual sales at that price. The sale price was made at cost plus 25%. You are required to: (a) give adjustment entries (b) show how they will appear in final a/ c.

Solution:

The sales includes goods which remained unsold on 31.12.2005.

Value = 100 x 200 = 20,000.

The reversal entry will be:

Sales a/ c Dr. 20,000

To Debtors a/c 20,000

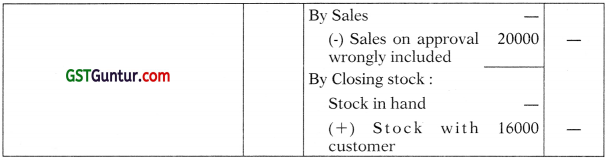

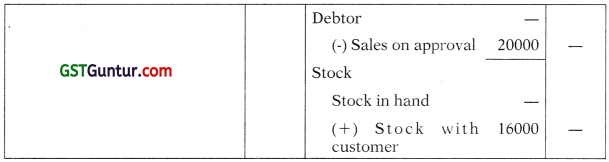

In the final accounts sales and debtors will be after reducing this ₹ 20000/-. The cost of this goods ₹ 16000 (2000 ÷ 25 x 100) will be accounted as closing stock.

Trading A/c (Extract)

Balance Sheet (Extract)

Question 3.

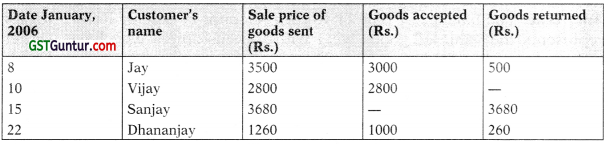

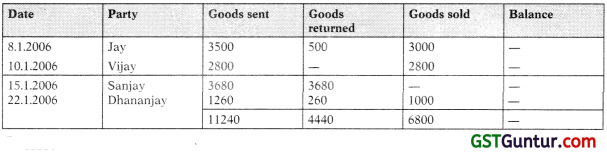

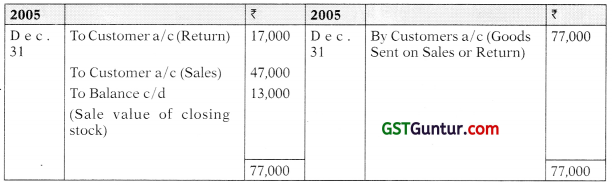

Ramesh sends goods on approval basis as follows:

Show how the transactions will be dealt with when memorandum books are kept on double entry system.

Solution:

Memorandum Records

Goods on sale or return register

Entries:

(i) When goods are sent on approval

Individual customer a/c Dr. 11,240

To Sales on approval a/c 11,240

(ii) When goods are returned

Sales on approval a/c Dr. 4,440

To Individual customer a/c 4,440

(iii) When the goods are accepted/time expired

Sales on approval a/c Dr. 6800

To Individual customer a/c 6800

Note: Now this is the actual sales hence it will be recorded in accounts books in the usual manner debiting individual customer account and crediting sales a/c.

(iv) Balance of goods at the end of the year

This will show the sales value of goods still lying unsold with customers. Cost of such goods will be included and accounted as stock in books of account.

![]()

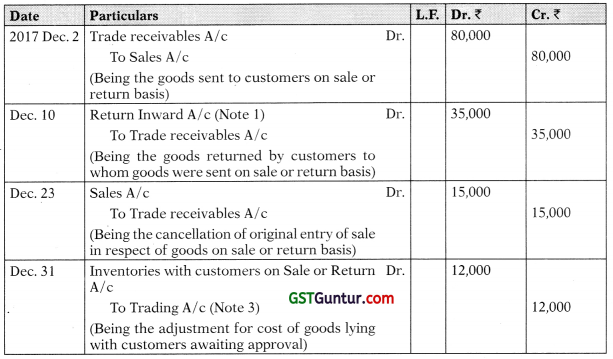

Question 4.

‘X’ supplied goods on sale or return basis to customers, the particulars of which are as under:

Date of Despatch Party’s Name Amount Rs. Remarks

| Date of Despatch | Party’s Name | Amount Rs. | Remarks |

| 10.12.2005

12.12.2005 15.12.2005 20.12.2005 25.12.2005 30.12.2005 |

ABC Co.

DEF Co. GHI Co. DEF Co. ABC Co. GHI Co. |

10,000

15,000 12,000 16,000 11,000 13,000 |

No information till 31.12.2005

Returned on 16.12.2005 Goods worth Rs. 2,000 Return on 20,12.2005 Goods Retained on 24.12.2005 Goods Retained on 28.12.2005 No information till 31.12.2005 |

Goods are to be returned within 15 days from the date of despatch, failing which it will be treated as Sales. The books of ‘X’ are closed on the 31st December, 2005.

Prepare the following account in the book of ‘X’:

(i) Goods on Sales or Return, Sold and Returned Day Books.

(ii) Goods on Sales or Return Total Account.

Solution:

In the Books of ‘X’

(i) Goods on Sales or Return, Sold and Returned Day Books.

(ii) Goods on Sales or Return Total Account

Note: (1) Entry for recording sales of ₹ 47,000/- will be passed in Accounts book debiting customers (debtors) a/c and crediting sales a/c. & Goods lying with customer sale value ₹ 13,000 will be included in closing stock at cost.

(2) The above are memorandum records.

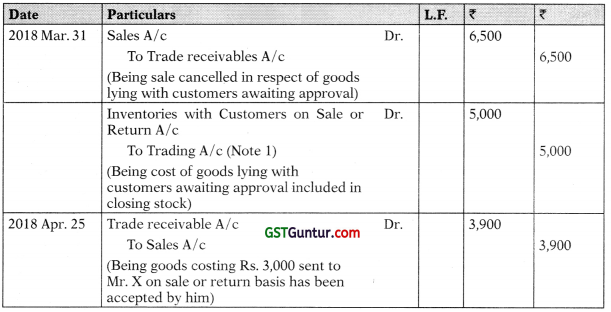

Question 5.

Mr. Badhri sends goods to his customers on Sale or Return. The following transactions took place during the month of December 2017.

- December 2nd – Sent goods to customers on sale or return basis at ₹ 80,000 cost plus 25%

- December 10th – Goods returned by customers ₹ 35,000

- December 17th – Received letters from customers for approval ₹ 30,000

- December 23rd – Goods with customers awaiting approval ₹ 15,000

Mr. Badhri records sale or return transactions as ordinary sales. You are required to pass the necessary Journal Entries in the books of Mr. Badhri assuming that the accounting year closes on 31st Dec. 2017.

Solution:

(I) In the books of Mr. Badhri

Journal Entries

Note:

- Alternatively, Sales account or Sales returns can be debited in place of Return Inwards account.

- No entry is required for receiving letter of approval from customer.

- Cost of goods with customers = ₹ 15,000 x 100/125 = ₹ 12,000

- It has been considered that the transaction values are at invoice price (including profit margin).

![]()

Question 6.

Mr. Ganesh sends out goods on approval to few customers and includes the same in the Sales Account. On 31.03.2018, the Trade Receivables balance stood at ₹ 75,000 which included ₹ 6,500 goods sent on approval against which no intimation was received during the year. These goods were sent out at 30% over and above cost price and were sent to –

Mr. Adhitya ₹ 3,900 and Mr. Bakkiram ₹ 2,600

Mr. Adhitya sent intimation of acceptance on 25th April, 2018 and Mr. Bakkiram returned the goods on 15th April, 2018.

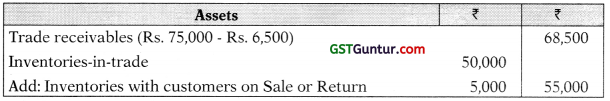

Make the adjustment entries and show how these items will appear in the Balance Sheet as on 31st March, 2018. Show also the entries to be made during April, 2018. Value of Closing Inventories as on 31st March, 2018 was ₹ 50,000.

Solution:

In the Books of Ganesh

Journal Entries

Extract of Balance sheet of A & Co. as on 31st March, 2018

Notes:

- Cost of goods lying with customers = \(\frac { 100 }{ 130 }\) x 6,500 = ₹ 5,000

- No entry is required on 15th April, 2018 for goods returned by Mr. Bak-kiram.

True or False

Question 1.

Sales or Return Account in the Sale or return ledger represents the value of goods still lying with the customers for approval.

Answer:

True: The balance of Sale or Return Account in Sale or Return ledger represents the value of goods lying with the customers who have neither returned nor intimated for goods till date.