Partnership – CA Foundation Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

Partnership – CA Foundation Accounts Study Material

Question 1.

Rules applicable in absence of partnership deed.

Answer:

Rules applicable in absence of partnership deed:

In the absence of any provision in partnership deed, following provisions of partnership Act are applicable:

- Profit/Loss sharing ratio will be equal

- No interest is to be allowed on capital

- No interest is to be charged on drawings

- 6% per annum interest is to be given on partner’s loan

- No salary is to be paid to any partner

- Interest and salary, if payable, will be paid only if there is profit unless agreement provides otherwise.

- Student should use above, whenever question is silent with regard to this items.

Question 2.

Meaning of Limited Liability Partnership.

Answer:

Limited Liability Partnership:

A need has been felt to make a new legislation related to a new corporate form of business organization in India to meet with the contemporary growth of the Indian economy. It provides an alternative to the traditional partnership with unlimited liability on the one hand and the statute-based governance structure of the limited liability company on the other hand, in order to enable professional expertise and entrepreneurial initiative to combine, organize and operate in flexible, innovative and efficient manner.

Limited Liability Partnership (LLP) is a corporate business organization that provides the benefits of limited liability but also allows its members the flexibility of organizing their internal structure j ust like in case of a partnership, based on a mutually arrived agreement. The LLP form enables entrepreneurs, professionals and enterprises providing services of any kind or engaged in scientific and technical disciplines, to form commercially efficient vehicles suited to their requirements. Owing to flexibility in its structure and operation, the LLP is a suitable vehicle for small enterprises and for investment by venture capital.

A LLP is a new form of legal business entity with limited liability. It is a separate legal entity where LLP itself is liable to the third parties upto the assets it owns but the liability of the partners is limited. It is an alternative corporate business vehicle that not only gives the benefits of limited liability at low compliance cost but allows its partners the flexibility of organising their internal structure as a traditional partnership. It gives the benefits of limited liability of a company and the flexibility of a partnership.

LLP is also called as a hybrid between a company and a partnership as it contains elements of both, a corporate entity as well as a partnership. Since LLP contains elements of both ‘a corporate structure’ as well as ‘a partnership firm structure’ LLP is called a hybrid between a company and a partnership.

![]()

Question 3.

Salient features of LLP

Answer:

Characteristic/Salient features of LLP are:

1. A body corporate:

A LLP is a body corporate formed and incorporated under LLP Act and is a legal entity separate from the partners constituting it. [Sec. 3]

2. Separate Legal Entity:

The LLP is a separate legal entity. It is liable to the full extent of its assets but liability of the partners is limited to their agreed contribution in the LLP. In other words, creditors of LLP shall be the creditors of LLP alone and not of the partners.

3. Perpetual Succession:

Death, insanity, retirement or insolvency of partners has no impact on the existence of LLP. The LLP can continue its existence irrespective of changes in partners. It can enter into contracts in its own name. It can also hold properties in its own name. It is created by law and law alone can dissolve it.

4. Absence of Mutual Agency:

The cardinal principal of mutual agency of partners in a partnership is missing in LLP. In case of LLP, the partners of LLP are agents of LLP alone and not of the other partners. Hence, no partner can be held liable on account of the independent or un-authorized actions of other partners. Thus individual partners cannot be held liable for liability incurred by another partner’s wrongful business decisions or misconduct.

5. LLP Agreement:

The partners are free to make rules related to the mutual rights and duties of the partners as per their choice. This is done through an agreement. In the absence of any such agreement, the mutual rights and duties shall be governed by the provisions of the LLP Act, 2008.

6. Artificial Person:

A LLP is an Artificial legal person created by law capable of enjoying all the rights of an individual. It can do everything which a natural person can do, except the contracts of very personal nature like, it cannot marry, it cannot go to jail, cannot take an oath, cannot marry or get divorce. Further, it cannot practice a learned profession like CA, Law or Medicine. A LLP is invisible, intangible, immortal but not fictitious because it really exists.

7. Common Seal:

Being an artificial person, a LLP work on its own but it has to act through its partners. Hence, it may have a common seal which can be considered as its official signature. [Section 14(c)]. It should be noted that it is not mandatory for a LLP to have a common seal. If it decides to have one, then it shall remain under the custody of some responsible official and it shall be a fixed in the presence of at least 2 designated partners of the LLP.

8. Limited Liability:

Every partner of a LLP is, for the purpose of the business of LLP, the agent of the LLP, but not of other partners (Section 26). The liability of the partners will be limited to their agreed contribution in the LLP.

9. Management of Business:

The partners in the LLP are entitled to manage the business of LLP. However, only the designated partners are responsible for legal com¬pliances.

10. Minimum and Maximum number of Partners:

Every LLP shall have least two partners and shall also have at least 2 individuals as designated partners. It is mandatory that at least one of the designated partners shall be resident in India. Further, there is no maximum limit of partners in LLP.

11. Business for profit Only:

LLP can be formed only for carrying on any lawful business with a view to earn profit. Thus, LLP cannot be formed for charitable or not-for- profit purpose.

12. Investigation:

The Central Government shall have powers to investigate the affairs of an LLP by appointment of competence authority.

13. Compromise or Arrangement:

Any compromise or arrangement including merger and amalgamation of LLPs shall be in accordance with the provisions of the LLP Act, 2008.

14. Conversion into LLP:

A firm, private company or an unlisted public company would be allowed to be converted into LLP in accordance with the provisions of LLP Act, 2008.

15. E-Filling of Documents:

Every form or application of document required to be led or delivered under the act and rules made thereunder, shall be led in computer read¬able electronic form on its website www.mca.gov.in and authenticated by a partner or designated partner of LLP by the use of electronic or digital signature.

16. Foreign LLPs:

Section 2(l)(m) defines foreign limited liability partnership “as a limited liability partnership formed, incorporated, or registered outside India which established a place of business within India”. Foreign LLP can become a partner in an Indian LLP.

Advantages of LLP Form:

The following are the advantages of LLP form of business organization:

- It is easier to form a LLP as compared to a company.

- The partners of a LLP enjoy limited liability.

- It operates on the basis of an agreement.

- It is not rigid as far as capital structure is concerned.

- It provides flexibility without imposing detailed legal and procedural requirements.

- It is easy to dissolve an LLP as compared to a Company.

Question 4.

Essential elements to incorporate LLP.

Answer:

Under the LLP Act, 2008, the following elements are very essential to form a LLP in India:

- Persons intending to incorporate a LLP shall decide a name for the LLP.

- A LLP shall execute a limited liability partnership agreement between the partners inter se or between the LLP and its partners. In the absence of any agreement the provisions as set out in First Schedule of LLP Act, 2008 will be applied.

- Then they shall complete and submit the incorporation document in the form prescribed with the Registrar electronically, along with the prescribed fees.

- There must be at least two partners for incorporation of LLP [Individual or body corporate].

- A LLP shall have a registered office in India so as to send and receive communications.

- It should appoint atleast two individuals as designated partners who will be responsible for number of duties including doing of all acts, matters and things as are required to be done by the LLP. At least one of them should be resident in India. Each designated partner shall hold a Designated Partner Identification Number (DPIN) which is allotted by MCA.

- As soon as the process is completed, a certificate of registration shall be issued which shall contain a Limited Liability Partnership Identification Number (LLPIN)

Steps or process for incorporating an LLP:

Step 1: Reservation of name

- The first step while incorporating a LLP is the reservation of name of LLP.

- The name of a LLP shall not be similar to that of an existing LLP, Company or a Partnership Firm.

- The applicant has to file e-form 1, for ascertaining the availability and reservation of name. 6 names in order of preference can be indicated.

- The name should contain the suffix “Limited Liability Partnership” or “LLP”.

Step 2: Incorporation

- In the second step, the applicant has to file e-form 2 for incorporating a new LLP.

- This form contains the details of the proposed LLP and the Partners and Designated Partners along with their consent to act as such.

Step 3: Execute a LLP Agreement –

→ It is mandatory to execute LLP Agreement. [Sec. 23]

→ LLP agreement shall be filed with the registrar in e-form 3 within 30 days of incorporation of LLP.

→ The contents of the LLP Agreement are enumerated below:

- Name of LLP

- Name and address of partners and designated partners

- Form of contribution & interest on contribution

- Profit sharing ratio

- Remuneration of Partners

- Rights & Duties of Partners

- Proposed Business

- Rules for governing LLP.

![]()

Question 5.

Partnership and Joint Venture Comparison.

Answer:

Partnership and Joint Venture Comparison:

→ When two or more persons join together, to do business on joint ac¬count on regular basis & to share the profits or losses such relationship is known as partnership & the persons are known as partners.

→ When two or more persons join temporarily to do a particular job or work & to share profits or losses, is known as joint venture & the persons are known as coventurer’s.

→ Partnership is a relationship between persons who have agreed to share profits or losses of a business carried on by all or any of them acting for all.

→ Whereas, a joint venture is a contractual agreement whereby two or more parties undertake an economic activity which is subject to joint control.

→ Thus joint venture is a temporary partnership formed for a particular economic activity or venture.

→ The following additional differences exist between joint venture and other forms of partnership.

- Accrual basis of accounting is followed in case of partnership and a joint venture generally follows cash basis of accounting.

- The financial results of a partnership are obtained at regular intervals i.e. on annual basis. On the other hand, the financial results of a joint venture are obtained generally at the end of the venture.

Question 6.

LLP & Partnership firm.

Answer:

LLP & Partnership firm:

| Basis | LLP | Partnership |

| 1. Regulating Act | The Limited Liability Partnership Act, 2008. | The Indian Partnership Act, 1932. |

| 2. Body corporate | It is a body corporate. | It is not a body corporate. |

| 3, Separate legal entity | It is a legal entity separate from its members. | It is a group of persons with no separate legal entity. |

| 4. Creation | It is created by a legal process called registration under the LLP Act, 2008. | It is created by an agreement between the partners. |

| 5. Registration | Registration is mandatory. LLP can sue and be sued in its own name. | Registration is voluntary. Only the registered partnership firm can sue the third parties. |

| 6. Perpetual succession | The death, insanity, retirement or insolvency of the partner(s) does not affect its existence of LLP. Members may join or leave but its existence continues forever. | The death, insanity retirement or insolvency of the partner(s) may affect its existence. It has no perpetual succession. |

| 7. Name | Name of the LLP to contain the word Limited Liability Partners (LLP) as suffix. | No guidelines. The partners can have any name as per their choice. |

| 8. Liability | Liability of each partner limited to the extent to agreed contribution except in case of wilful fraud. | Liability of each partner is unlimited. It can be extended upto the personal assets of the partners. |

| 9. Mutual agency | Each partner can bind the LLP by his own acts but not the other partners. | Each partner can bind the firm as well as other partners by his own acts. |

| 10. Designated partners | At least two designated partners and atleast one of them shall be resident in India. | There is no provision for such partners under the Indian Partnership Act, 1932. |

| 11. Common seal | It may have its common seal as its official signatures. | There is no such concept in partnership |

| 12. Legal compliances | Only designated partners are responsible for all the compliances and penalties under this Act. | All partners are responsible for all the compliances and penalties under the Act. |

| 13. Annual filing of documents | LLP is required to file: (i) Annual statement of accounts (ii) Statement of solvency (iii) Annual return with the registration of LLP every year |

Partnership firm is not required to file any annual document with the registrar of firms. |

| 14. Foreign partnership | Foreign nationals can become a partner in a LLP. | Foreign nationals cannot become a partner in a partnership firm. |

| 15. Minor as partner | Minor cannot he admitted to the benefits of LLP. | Minor can be admitted to the benefits of the partnership with the prior consent of the existing partners. |

Question 7.

LLP & Limited Liability Company.

Answer:

LLP & Limited Liability Company:

| Basis | LLP | Limited Liability Company |

| 1. Regulating Act | The LLP Act, 2008. | The Companies Act, 2013. |

| 2. Members/Partners | The persons who contribute to LLP are known as partners of the LLP. | The persons who invest the money in the shares are known as members of the company. |

| 3. Internal governance structure | The internal governance structure of a LLP is governed by agreement between the partners. | The internal governance structure of a company is regulated by statute (i.e., Companies Act, 2013). |

| 4. Name | Name of the LLP to contain the word “Limited Liability Partnership” or “LLP” as suffix. | Name of the public company to contain the word “limited” and Private company to contain the word “Private limited” as suffix. |

| 5. Number of members/ partners | Minimum – 2 members Maximum – No such limit on the members in the Act. | Private company: Minimum – 2 members Maximum – 200 members Public company: Minimum – 7 members Maximum – No such limit on the members. Members can be organizations, trusts, another business form or individuals. |

| 6. Liability of members/ partners | The members of the LLP can be individuals / or body corporate through the nominees. | Liability of a member is limited to the amount unpaid on the shares held by them. |

| 7. Management | Liability of a partners is limited to the extent of agreed contribution except in case of wilful fraud. | The affairs of the company are managed by board of directors elected by the share-holders. |

| 8. Minimum number of directors/ designated partners | The business of the company managed by the partners including the designated partners authorized in the agreement. | Private Co. – 2 directors

Public Co. – 3 directors |

Question 8.

A, B & C were partners in a firm. Their partnership deed provides the following:

(a) Interest on capital will be allowed @ 1096 p.a

(b) Interest on drawing will be charged @ 1096 p.a

(c) A is entitled for ₹ 2000 per month as salary

(d) 1096 of the net profit is to be transferred to reserve

(e) A is entitled for 1096 of Net profit as his commission

(f) B is entitled for 1096 of Net profit as his commission after charging his commission

(g) C is entitled for 1096 of Net Profit as his commission after charging A’s commission, B’s commission & his own commission

(h) Profits were to be shared in the following manner:

(i) Upto ₹ 30,000 in equal ratio

(ii) Above ₹ 30,000 in 5 : 3 : 2

On 1st January 2015, their capital were₹ 60,000,₹ 80,000 & ₹ 50,000 respectively. During the year they withdrew ₹ 8,000, ₹ 12,000 & ₹ 6,000 respectively as their drawings. During the year 2015, the firm earned Net profit of ₹ 1,62,000, it was later discovered that while calculating profit of the year, depreciation of ₹ 18,000 on Plant was overlooked.

Prepare Profit & Loss Appropriation Account for year 2015.

Solution:

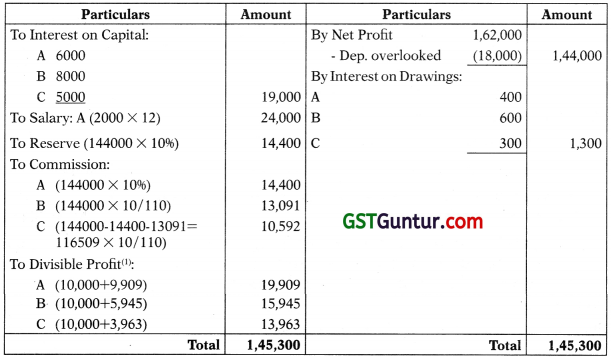

Profit & Loss Appropriation Account

for the year ended 31st, December 2015

Working Notes:

1.Calculation of Divisible Profit:

Question 9.

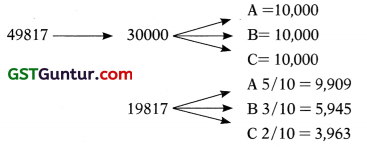

A, B, C were partners in a firm sharing profit in the ratio 5:3:2. They distributed their profits of ₹ 30,000 of the year in equal ratio. Give necessary entry for the effect.

Solution:

Rectified Entry:

| B’s Capital A/c Dr. | 1,000 | |

| C’s Capital A/c Dr. | 4,000 | |

| To A’s Capital A/c | 5,000 |

(Being the adjustment made for profit divided in wrong ratio)

![]()

Question 10.

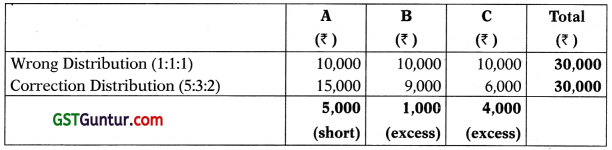

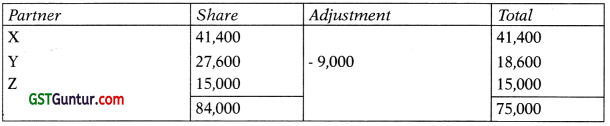

The Chartered Accountants X, Y and Z form a partnership, profits being divisible in the ratio of 3 : 2 : 1 subject to the following:

i. Z’s share of profit is guaranteed to be not less than ₹ 15,000 p.a.

ii. Y gives guarantee to the effect that gross fees earned by him for the firm shall be equal to his average gross fee of the preceding five years when he was carrying on profession alone (which average works out at ₹ 25,000).

The profit for the first year of the Partnership is ₹ 75,000. The gross fees earned by Y for the firm are ₹ 16,000. You are required to show the distribution of profits.

Solution:

Summary

Question 11.

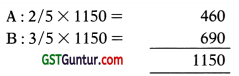

A and B were in partnership sharing profits and losses in the ratio of 3:2. In appreciation of the services of their clerk C. Who was in receipt of a salary of ₹ 2,400 p.a. and a commission of 5% on the net profit after charging such salary and commission. They took him into partnership as from 1st April, 2005, giving him one-eight share of profits.

The agreement provided that any excess over his former remuneration to which, C becomes entitled will be born by A and B in the ratio of 2:3.

The profit for the year ended 31st March, 2006, amounted to ₹ 44,400. Prepare statement showing the distribution of the profit amongst all the partners.

Solution:

(i) Share of ‘C’ as partner 44,400 X 1/8 = 5,550

(ii) C’s remuneration as clerk

| Profit

(-) Salary to clerk Profit before commission (-) Commission 42000 x 5/105 Profit after Salary & comm. |

44,400

2,400 |

| 42,000

2,000 |

|

| 40,000 |

Total remuneration to ‘C’ 2,400 + 2,000 = 4,400

(iii) Excess to ‘C (i) – (ii) = 5,550 – 4,400 = 1,150 to be borne by A & B as follows:

Summary:

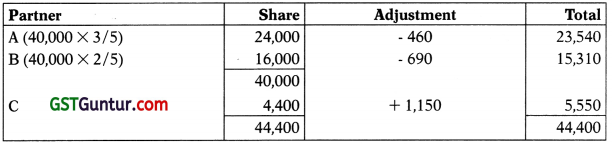

Question 12.

X,Y & Z start business in partnership, X put in ₹ 20,000 for the whole year, Y puts ₹ 30,000 at first and increases it to ₹ 40,000 at the end of four months but withdraws ₹ 20,000 at the end of six months, while Z puts ₹ 40,000 at first but withdraws ₹ 10,000 at the end of nine-months. At the end of the year how should they divide a profit of ₹ 79,000 on the basis of effective capital employed by each partner?

Solution:

Profit = ₹ 79,000

To be divided in the ratio of effective capital, which in monthly terms is 2,40,000 : 3,20,000 : 4,50,000, among X, Y & Z. i.e. 24 : 32 : 45

| X’s share = 79,000 X 24/101=

Y’s share = 79,000 X 32/101= Z’s share = 79,000 X 45/101= |

18,772

25,030 35,198 |

| 79,000 |

Question 13.

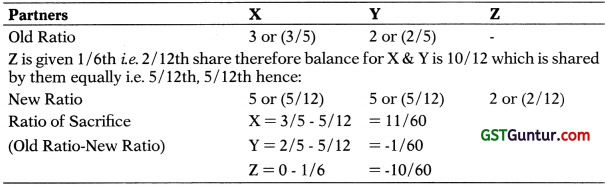

Partners A & B are sharing in the ratio of 3:2 (i.e. 3/5 & 2/5). They admit C. Calculate new ratio in the following alternative cases.

Solution:

(1) ‘C’ is admitted with 1/6th share.

C’s share is 1 /6th of the total profit.

∴Balance profit left for A & B = 1 – 1/6 = 5/6.

Because nothing is specified we will assume that A & B will share balance in old ratio.

∴ A’s share – 5/6 X 3/5 = 15/30 = 3/6 & B’s share = 5/6 X 2/5 = 10/30 = 2/6

Thus the new ratio of A, B & C will be 3/6, 2/6 & 1/6 or 3 : 2 : 1

(2) ‘C’ is admitted with 1 / 6th share & ‘A’ & ‘B’ decided to share equally in future.

‘C’ share = 1/6 ∴ Balance is 5/6

which will be shared equally by A & B.

∴ \(\frac { 5 }{ 6 }\) x \(\frac { 1 }{ 2 }\) = \(\frac { 1 }{ 2 }\) = \(\frac { 2.5 }{ 6 }\) and B’s are \(\frac { 5 }{ 6 }\) x \(\frac { 1 }{ 2 }\) = \(\frac { 2.5 }{ 6 }\) = \(\frac { 5 }{ 12 }\)

Thus the New Ratio of A, B & C = 5/12, 5/12, 2/12 OR 5 : 5 : 2

(3) ‘C’ is admitted with 1 / 6th share, which he purchased from B.

C’s share =1/6 which will come from B

∴ B’s New share = 2/5 – 1/6 = 12/30 – 5/30 = 7/30.

∴ A’s New share will remain as the old share i.e. 3/5 = 18/30.

Thus, the New Ratio of A, B & C will be 3/5, 7/30 & 1/6. i.e. 18/30, 7/30, 5/30 i.e. 18 : 7 : 5

(4) ‘C’ is admitted with 1 /6th share which he bought from A & B in 2:3 ratio.

C’s share is 1 / 6

Purchased from ‘A’ 1/6 x 2/5 = 2/30

Purchased from ‘B’ 1/6 x 3/5 = 3/30

∴ A’s share 3/5 – 2/30 = 18/30 – 2/30 = 16/30 & B’s share 2/5 – 3/30 = 12/30 – 3/30 = 9/30

Thus, the New Ratio of A, B, C will be 16/30, 9/30 & 5/30 le. 16:9:5

(5) ‘C’ is admitted. He purchased 1/3rd of A’s share & 2/3rd of B’s share.

C’s share = Purchased from A + Purchased from B

Purchased from A = 3/5 x 1/3 = 1/5 i.e. 3/15

Purchased from B = 2/5 x 2/3 = 4/15

∴ A’s share = 3/5 – 1/5 = 2/5 = 6/15

B’s share = 2/5 – 4/15 = 6/15 – 4/15 = 2/15

C’s share = 1/5 + 4/15 = 3/15 + 4/15 = 7/15

Thus, the New Ratio of A, B, C will be 6/15, 2/15 & 7/15 i.e. 6 : 2 : 7.

(1) When we say new partner is purchasing share that means old partners are selling their share. Similarly in case of death/retirement, outgoing partner will sell his share and other will purchase it.

(2) Similarly ratios will be worked out in case of Retirement/Death. In such cases wording may be like outgoing partners sells his share or other partner purchases share from the outgoing partner. When nothing is specified, it can be assumed that the remaining partner will continue to share in their old ratio.

![]()

Question 14.

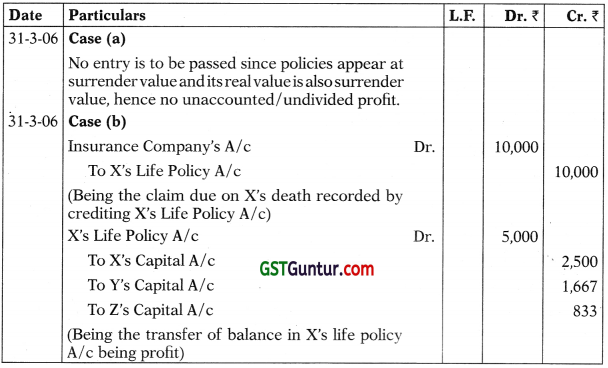

X, Y and Z were sharing profits and losses in the ratio of 1/2: 1/3: 1/6 respectively. The firm had insured the partner’s lives severally. The surrender values of the life policies appearing in the balance sheet as at 31st March, 2006 were – X for ₹ 5,000, Y for ₹ 4,000 and Z for ₹ 3,000. The surrender values represents 50% of the sum assured in each case. Y and Z decide to share equally in future. Give the necessary journal entries assuming (a) If X retires on 31-3-2006 (b) If X dies on 31-3-2006.

Solution:

Question 15.

A, B and C were partners sharing profits, and losses in the ratio of 2:2:1. C retired on 1st July, 2005 on which date the capitals of A, B and C after all necessary adjustments stood at t 74,000, ₹ 63,750 and 42,250 respectively. A and B continued to carry on the business for six months without settling the accounts of C. During the period of six months from 1 -7-2005, a profit of ₹ 20,500 is earned by the use of the firm’s property. State which of the two options available u/s 37 of the Indian Partnership Act, 1932 should be exercised by C.

Solution:

(i) Share in the subsequent profits attributable to the use of his balance.

\(\frac{₹ 42,250}{₹ 1,80,000}\) x ₹ 20,500 = ₹ 4,812

(ii) Interest @ 6% p.a. on the use of his balance = ₹ 42,250 x 6/12 x 6/100 = ₹ 1,267.50

C should exercise option (i) since the amount payable to him under this option is more as compared to the amount payable to him under option (ii).

Question 16.

X and Y are in partnership sharing profits and losses as 3:2. They admit Z into the firm, Z paying a premium (share in goodwill) of ₹ 36,000 for 1 /6th share of the profits. As between themselves, X and Y agree to share future profits and losses equally. Draft journal entry showing the appropriation of premium (goodwill) money.

Solution:

This means that ‘X’ has sacrificed 11/60, whereas ‘Y’ has gained 1 /60 & ‘Z’ has gained 10/60. ‘Z’ is bringing ₹ 36,000 as Goodwill for 10/60 share.

∴ Total goodwill of the firm = \(\frac{36,000 \times 60}{10}\) = 2,16,000

Y is also gaining (means his new ratio is higher)

∴ He will also have to contribute towards goodwill to the extent of his gain.

∴ His contribution = 2,16,000 x 1/60 = 3,600

X has sacrified in favour of Y and Z

∴ He should get the credit for it.

Question 17.

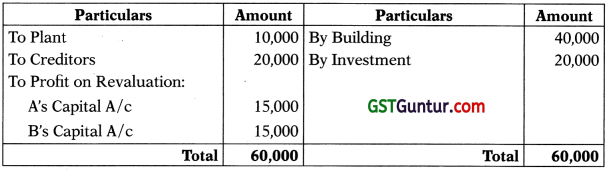

A and B were partners in 1:1. They admitted C as a new partner for 1 / 5th share. At the time of his admission following Revaluation were made:

Building of ₹ 60,000 at ₹ 1,00,000

Plant of ₹ 40,000 at ₹ 30,000

Creditors of ₹ 50,000 at ₹ 70,000

At the time of revaluation some unrecorded investment of ₹ 20,000 were found. Show necessary Accounting treatment in the following cases:

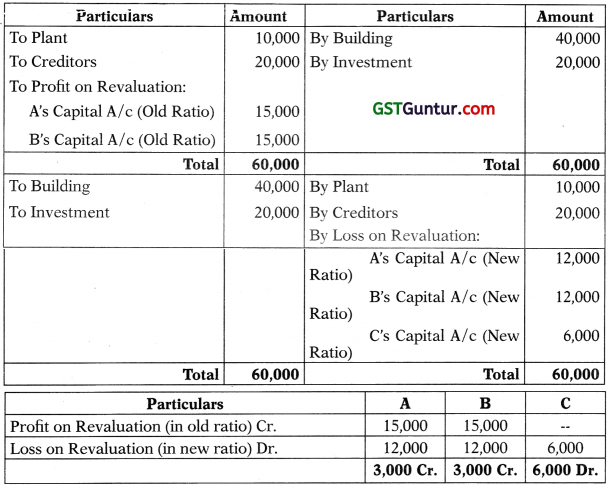

Case I. When Revised figures of Assets and Liabilities were to be shown in the Balance Sheet of the New Firm (or When Revaluation A/c is to be prepared)

Case II. When Revised figures of Assets and Liabilities were not to be taken in the Balance Sheet of the New Firm (or When Memorandum Revaluation Account is to be prepared)

Solution:

Case I:

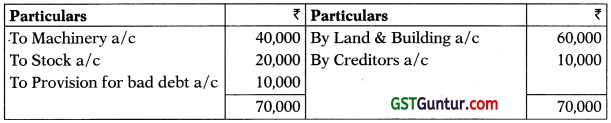

Revaluation Account

Journal entries:

(Being transfer of profit on revaluation to old partners in their old profit sharing ratio)

Case II:

Memorandum Revaluation Account

| C’s Capital A/c Dr. | 6,000 | |

| To A’s Capital A/c | 3,000 | |

| To B’s Capital A/c | 3,000 |

(Being adjustment of profit or loss on revaluation made among the partners)

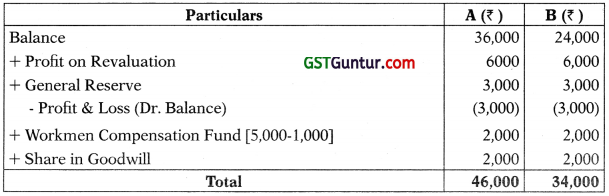

Question 18.

A and B were partners in a firm in equal ratio. They admit C as a new partner for 1 /5th share. C introduced the required sum of capital and his share of goodwill of ₹ 4,000 in cash. On the date the following balances appears in the books of the firm:

| A’s Capital A/c | 36,000 |

| B’s Capital A/c | 24,000 |

| Profit on Revaluation | 12,000 |

| General Reserve | 6,000 |

| Profit & Loss (Dr. Balance) | 6,000 |

| Workmen Compensation Fund | 5,000 |

There was Workmen Compensation liability of 11000. Calculate the amount of capital of the Incoming Partner.

Solution:

Working Note:

| ₹ | |

| Total capital of A & B for 4/5th Share (46,000+34,000) | 80,000 |

| Total capital of the firm (on the basis of capital of A&B) (80,000 x 5/4) | 1,00,000 |

| Capital of C for 1 /5th Share (1,00,000 x 1/5) | 20,000 |

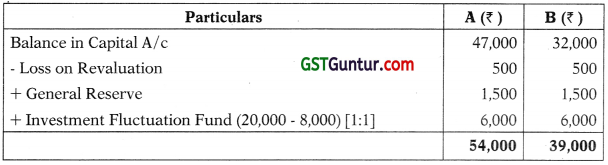

Question 19.

A and B were partners in a firm. They admit C for 1 / 5th share. C introduced ₹ 40,000 as his Capital. On the date following balances appeared in the books of the firm:

| A’s Capital A/c | 47,000 |

| B’s Capital A/c | 32,000 |

| Loss on Revaluation | 1,000 |

| General Reserve | 3,000 |

| Investment Fluctuation fund | 20,000 |

On the date Investment of the firm of ₹ 50,000 was valued at ₹ 42,000. Give necessary accounting treatment regarding Goodwill.

Solution:

Calculation of Hidden Goodwill:

Journal Entry:

| C’s Capital A/c Dr. | 13,400 | |

| To A’s Capital A/c | 6,700 | |

| To B’s Capital A/c | 6,700 |

(Being incoming partner’s current account debited for his share of goodwill & credited to old partners in their sacrificing ratio).

Question 20.

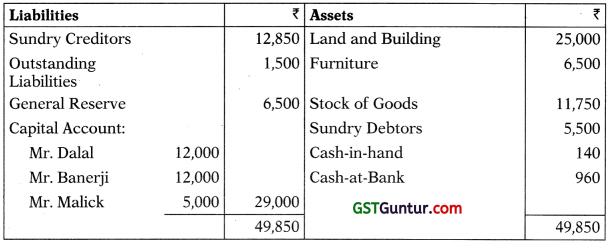

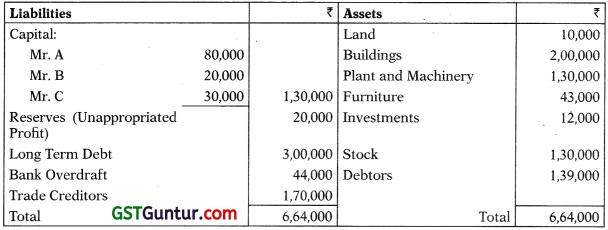

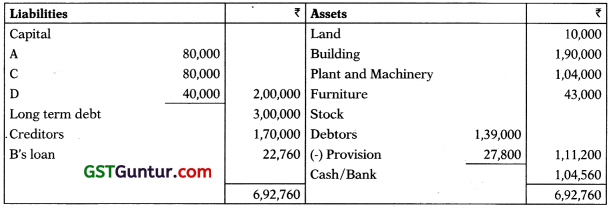

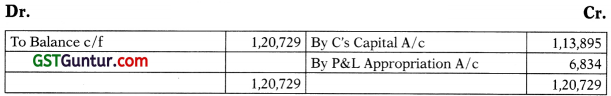

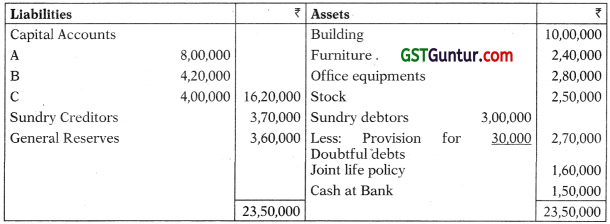

Messrs Dalai, Banerji and Malick is a firm sharing profits and losses in the ratio of 2:2:1. Their Balance Sheet as on 31st March, 2006, is shown as below:

The partners have agreed to take Mr. Mistri as a partner with effect from 1st April, 2006 on the following terms:

(a) Mr. Mistri shall bring ₹ 5,000 towards his capital and required sum of goodwill.

(b) The value of stock should be increased by ₹ 2,500.

(c) Provision for bad and doubtful debts should be provided at 10% of the debtors.

(d) Furniture should be depreciated by 10%.

(e) The value of land and buildings should be enhanced by 20%.

(f) The value of the goodwill be fixed at ₹ 15,000.

(g) General Reserve will be transferred to the Partners’ Capital Accounts.

(h) The new profit sharing ratio of Dalai, Banerji, Malick and Mistri shall be 5:5:3:2.

(i) The Outstanding liabilities include ₹ 1,000 due to Mr. Sen which has been paid by Mr. Dalai. Necessary entries were not made in the books.

Prepare –

(i) Revaluation Account

(ii) The Capital Accounts of the partners, and

(iii) The Balance Sheet of the firm as newly constituted.

Solution:

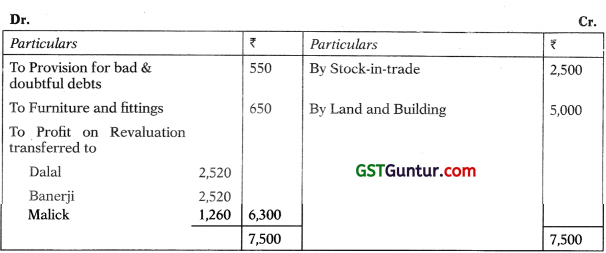

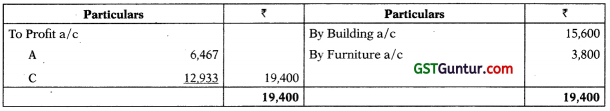

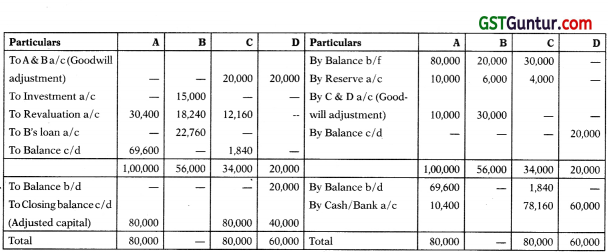

Revaluation A/c

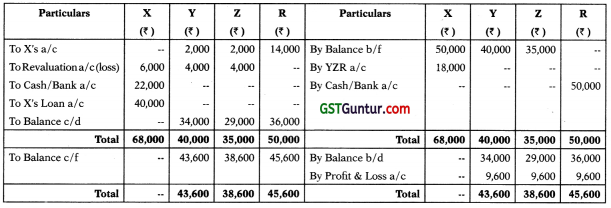

Capital Accounts of Partners

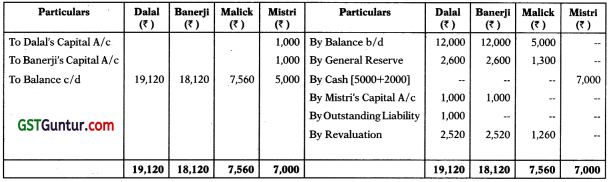

Balance Sheet of M/s. Dalai, Banerji, Malick & Mistri as on 1st April, 2006

Working Note:

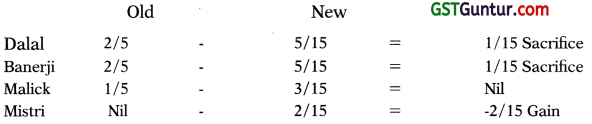

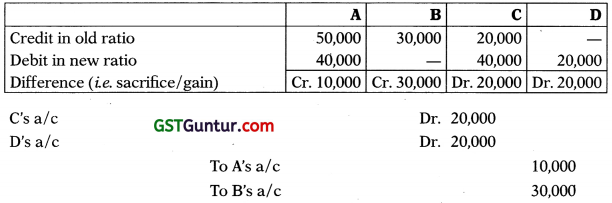

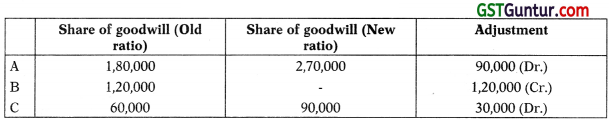

1.Calculation of Sacrifice/Gain of Partners:

2.Goodwill Treatment:

| Mistri’s Capital A/c (15000 x 2/15) Dr. | 2,000 | |

| To Dalai’s Capital A/c (15000 x 1/15) | 1,000 | |

| To Banerji’s Capital A/c (15000 x 1/15) | 1,000 |

Question 21.

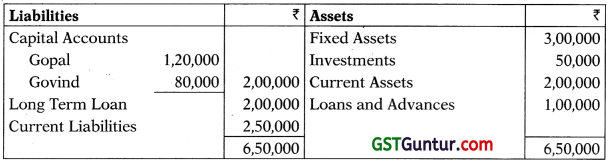

Gopal and Govind are partners sharing profits and losses in the ratio 60:40. The firms Balance Sheet as on 31-3-2006 was as follows:

Due to financial difficulties, they have decided to admit Guru as a Partner in the firm from 1-4-2006 on the following terms:

Guru will be paid 40% of the profits. Guru will bring in cash ₹ 1,00,000 as capital. It is agreed that goodwill of the firm will be valued at 2 years purchase of 3 years normal average profits of the firm and Guru will bring in cash for his share of Goodwill. It was also decided that the partners will not withdraw their share of goodwill nor will the goodwill appear in the books of account.

The profits of the previous three years were as follows:

- For the year ended 31-3-2004 Profit ₹ 20,000 (includes insurance claim received of ₹ 40,000).

- For the year ended 31.3.2005 Loss₹ 80,000 (includes voluntary retirement compensation paid ₹ 1,10,000).

- For the year ended 31.3.2006 Profit of ₹ 1,05,000 (includes a profit of ₹ 25,000 on the sale of assets).

It was decided to revalue the assets on 31.3.2006 as follows:

| Fixed Assets | 4,00,000 |

| Investments | Nil |

| Current Assets | 1,80,000 |

| Loans and Advances | 1,00,000 |

The new profit sharing ratio after the admission of Guru was 35 : 25 : 40.

Pass Journal Entries on admission, show goodwill calculation and prepare Revaluation Account, Partners Capital Accounts and Balance Sheet as on 1.4.2006 after the admission of Guru.

Solution:

Calculation & Adjustment for Goodwill.

Entry:

| Cash a/c Dr. | 24,000 |

| To Gopal | 15,000 |

| To Govind | 9,000 |

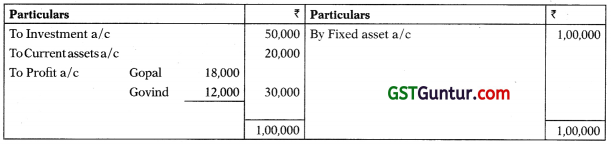

Capital Account

Revaluation A/c

Balance Sheet as on 1st April 2006

Question 22.

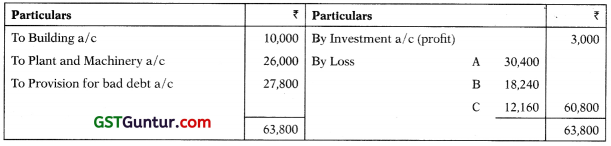

The Balance Sheet of A & B, a partnership firm, as at 31st March, 2006 is as follows:

A & B share profits and losses as 1:2, They agree to admit C (who is also in business on his own) as a third partner from 1-4-2006.

The Assets are revalued as under:

Goodwill – ₹ 18,000, Land and Building ₹ 30,000, Furniture ₹ 6,000.

C brings the following assets into the partnership Goodwill ₹ 6,000, Furniture ₹ 2,800, Stock ₹ 13,600.

Profits in the new firm are to be shared equally by the three partners and the Capital Accounts are to be so adjusted as to be equal. For this purpose, additional cash should be brought in by the partner or partners concerned.

Prepare the necessary accounts and the opening Balance Sheet of new firm, showing the amounts of cash, if any, which each partner may have to provide.

Solution:

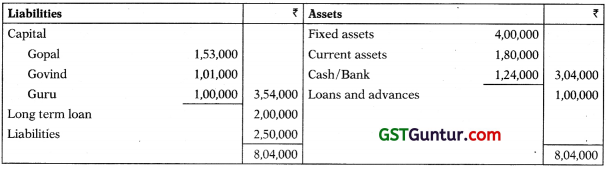

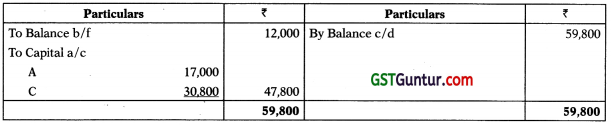

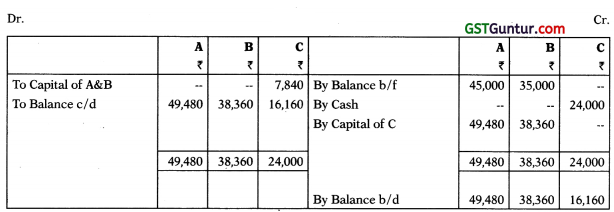

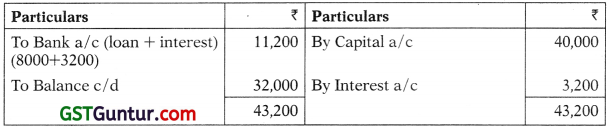

Capital Account

Revaluation A/c

Cash/Bank A/c

Balance Sheet

It represents personal goodwill of incoming partner, brought by C as asset, later on written off in new ratio.

Working Notes:

(1) Goodwill Treatment:

| C’s Capital A/c (18000 x 1/3). Dr. | 6,000 |

| To B’s Capital A/c (18000 x 1/3) | 6,000 |

(Being adjustment for goodwill made between the partners)

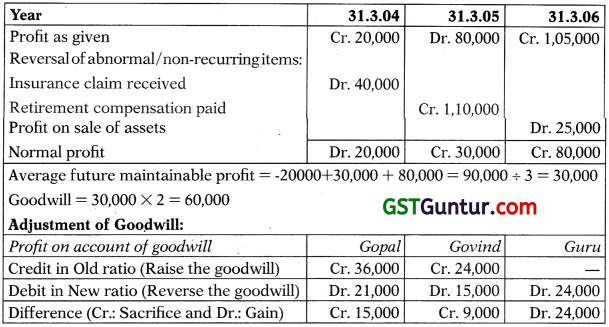

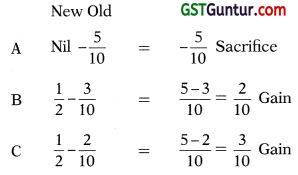

(2) Calculation of Sacrifice/Gain:

Adjustment of Capital:

→ Capital can be adjusted if required by the question.

→ It can be adjusted in any ratio and taking anybody’s capital as base.

→ But if not clarified in the question then adjust in profit sharing ratio.

→ If not clarified take total capital as base, in this case partner whose cap¬ital is short will bring cash and cash will be repaid to the partner whose capital is excess. Total capital will remain unchanged.

→ If highest capital (highest capital per share of profit) is taken as base then other partners capital will fell short and they will contribute the required cash (in this question it was hinted that partner or partners shall bring cash). Total capital will increase.

→ If smallest capital (smallest capital per share of profit) is taken as base then other partners capital will show excess capital and the same will be repaid to them.

→ Adjustment of capital can be done through cash or through current account.

![]()

Question 23.

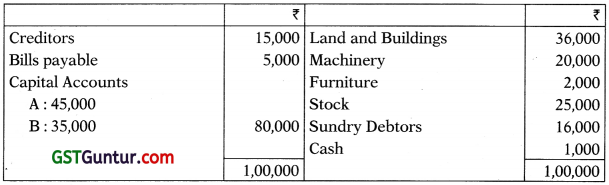

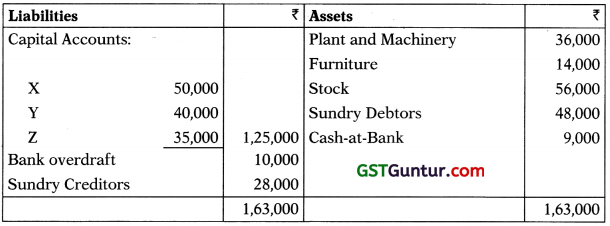

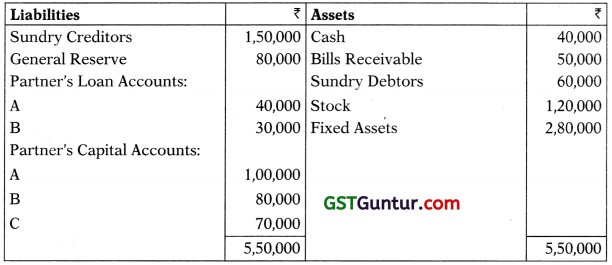

The following is the balance sheet of A and B who share profits and losses as 4/7 and 3/7:

They agree to take C into partnership and give him a share of 20 paise in the rupee subject to the following terms and conditions:

- C is to contribute capital @ ₹ 12000 for each 10 paise share in the rupee.

- Land and Buildings are to be increased to ₹ 40000.

- Machinery is to be depreciated by 1096 and Furniture by ₹ 500.

- Stock is to be appreciated by ₹ 1000.

- Goodwill of the firm is to be valued at 2 years’ purchase of average profits of the last three years. (Profits for the last three years were ₹ 14500, ₹ 20000 and ₹ 22500.)

- A provision of 2 1/2% is to be made for bad debts and another of ₹ 2500 for outstanding expenses.

- A trade creditor for ₹ 1600 is not traceable for a number of years and the amount is to be written back.

Show Journal entries and capital accounts of the partners assuming no goodwill account is to be opened and the book values of assets and liabilities are not to be disturbed.

Also prepare the Balance Sheet of the new firm.

Solution:

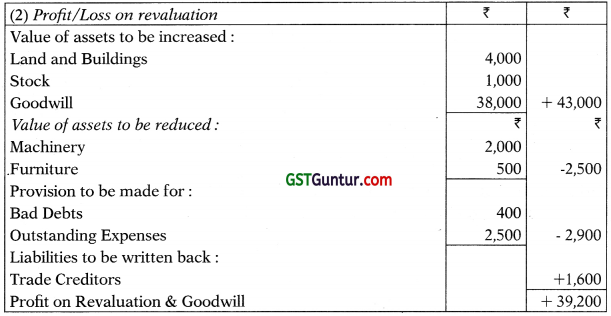

Working notes:

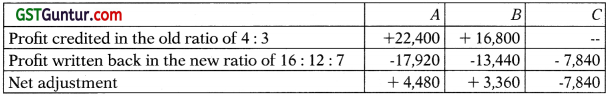

(1) New Profit sharing ratio:

C comes for 20 paise share in the rupee, i.e., for share, the share left for A and B is (1 – \(\frac { 1 }{ 5 }\)) or \(\frac { 4 }{ 5 }\)

So, A’s share is \(\frac { 4 }{ 7 }\) of \(\frac { 4 }{ 5 }\) or \(\frac { 16 }{ 35 }\)

And, B’s share is \(\frac { 3 }{ 7 }\) of \(\frac { 4 }{ 5 }\) or \(\frac { 12 }{ 35 }\)

Hence, new ratio is \(\frac { 16 }{ 35 }\) : \(\frac { 12 }{ 35 }\) : \(\frac { 7 }{ 35 }\)

Value of Goodwill:

Average profit of the last three years : \(\frac{1,500+20,000+22,500}{3}\) = ₹ 19,000

Value of Goodwill on the basis of 2 years’ purchase ₹ 19,000 x 2 = ₹ 38,000

(3) Adjustment required:

Journal Entry

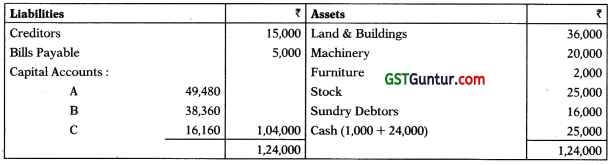

Capital A/c

Balance Sheet as at …..

Question 24.

On 31st March 2006, the Balance Sheet of M/s. Ram, Rahul and Rohit sharing profits and losses in proportion to their capitals, stood as follows:

On 31st March, 2006, Ram desired to retire from the firm and the remaining partners decided to carry on. It was agreed to revalue the Assets and Liabilities on that date on the following basis:

1. Land and Buildings be appreciated by 30%.

2. Machinery be depreciated by 20%.

3. Closing stock to be valued at ₹ 80,000.

4. Provision for bad debts be made at 5%.

5. Old credit balances of Sundry Creditors ₹ 10,000 be written back.

6. Joint Life Policy of the partners surrendered and cash obtained ₹ 60,000.

7. Goodwill of the entire firm be valued at ₹ 1,80,000 and Ram’s share of the Goodwill be adjusted in the Accounts of Rahul and Rohit who share the future profits equally. No Goodwill account being raised.

8. Total capital of the firm is to be the same as before retirement. Individual capital be in their profit sharing ratio.

9. Amount due to Ram is to be settled on the following basis: 5096 on re¬tirement & the balance 5096 within 1 year.

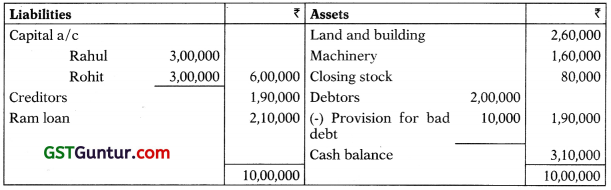

Prepare Revaluation Account, Capital Account of Partners, Rahul & Rohit. Loan Account of Ram, Cash Account and Balance Sheet as on 1.4.06 of M/s. Rahul and Rohit.

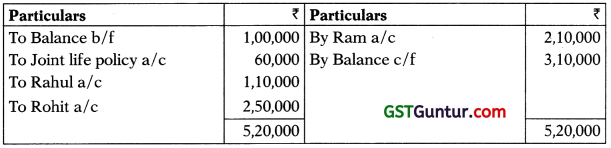

Solution:

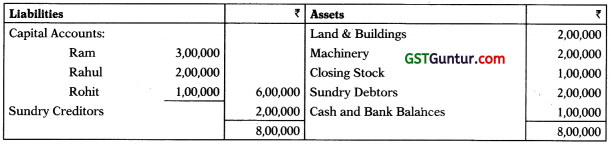

Capital A/c

Revaluation A/c

Cash/Bank A/c

Adjustment of Goodwill

| Rahul Dr. | 30,000 | |

| Rohit Dr. | 60,000 | |

| To Ram | 90,000 |

Joint life policy A/

Balance Sheet as on 1st April, 2006

Question 25.

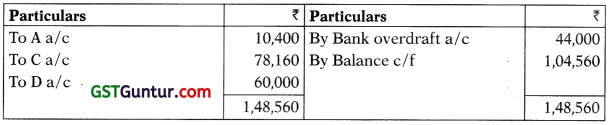

Dowell & Co. is a partnership firm with partners Mr. A, Mr. B and Mr. C, sharing profits and losses in the ratio of 10:6:4. The Balance Sheet of the firm as at 31st March, 2006 is as under:

It was mutually agreed that Mr. B will retire from partnership and in his place Mr. D will be admitted as a partner with effect from 1 st April, 2006. For this purpose, the following adjustments are to be made:

i. Goodwill is to be valued at ₹ 1 lakh but the same will not appear as an asset in the books of the reconstituted firm.

ii. Buildings and Plant & Machinery are to be depreciated by 5 per cent and 20 per cent respectively. Investments are to be taken over by the retiring partner at ₹ 15,000. Provision of 20 per cent is to be made on debtors to cover doubtful debts.

iii. In the reconstituted firm, the total capital will be ₹ 2 lakhs which will be contributed by Mr. A, Mr. C and Mr. D in their new proRt sharing ratio, which is 2 : 2 : 1.

iv. The surplus funds, if any, will be used for repaying the Bank Overdraft.

v. The amount due to the retiring partner shall be transferred to his loan account.

You are to prepare:

(a) Revaluation A/c;

(b) Partner’s Capital Accounts;

(c) Bank Account; and

(d) Balance Sheet of the reconstituted firm as on 1st April, 2006.

Solution:

Capital Account:

₹ 2,00,000 capital balance is written in new ratio 2:2:1 and the shortfall in capital account then is contributed by the new partners A, C & D.

Revaluation Account

Cash/Bank Account

Table of Goodwill Adjustment

Balance Sheet as on 1st April, 2006

G

G

Question 26.

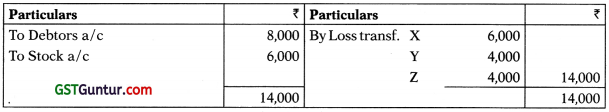

X, Y and Z are partners sharing profits and losses in the proportion of 3:2:2 respectively. The Balance Sheet of the firm as on 1-1-2006 was as follows:

X retired on 1-1-2006, on which date R is admitted as a new partner. For the purpose of adjusting the rights as between old partners, goodwill to be valued at ₹ 42,000 and Sundry Debtors and Stock to be reduced by ₹ 8,000 and to ₹ 50,000 respectively. X is to receive ₹ 22,000 in cash on the date of retirement and the balance due to him is to remain as loan at 896 p.a. Repayment of loan to be made at the end of each year by annual instalments representing 2596 of the future profit before charging interest on loan.

R is to bring in ₹ 50,000 in cash as his capital on the date of admission. The new partners are to share profits and losses equally after paying the interest on X’s loan.

The net profit for the year ended 31st Dec., 2006, is ₹ 32,000 before taking into account the instalment payable to X.

You are required to show :

(a) Profit and Loss Appropriation Account for the year ended 31st Dec., 2006.

(b) Capital Accounts of the new partners; and

(c) X’s Loan Account as on 31st Dec., 2006.

Solution:

Revaluation Account

Capital Accounts

Working Notes:

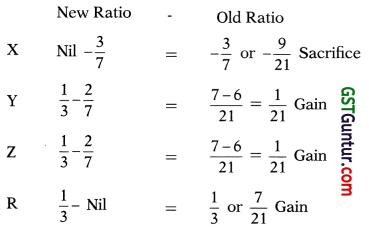

1. Calculation of Gain/Sacrifice:

2. Goodwill Treatment:

| Y(42,000 x 1/21) | Dr. | 2,000 | |

| Z(42,000 x 1/21) | Dr. | 2,000 | |

| R(42,000 x 7/21) | Dr. | 14,000 | |

| To x (42,000 x 9/21) | 18,000 |

(Being adjustment for goodwill made between the partners)

X’s Loan Account

Repayment of loan is 25°6 of profit before interest i.e. 32,000 X 25% = ₹ 8,000/- paid together with the interest accrued for the year ₹ 3,200/-

P&L Appropriation Account

For the year ended 31.12.2006

Question 27.

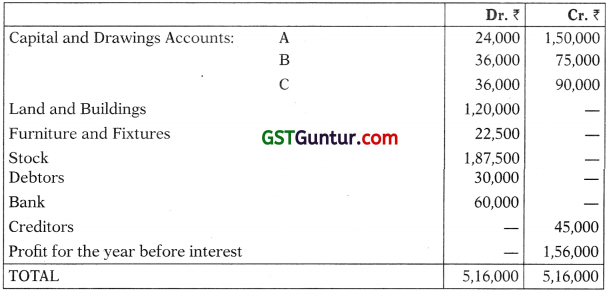

A, B and C were in partnership sharing profit and losses in the proportion of 4 : 3 : 3. The balances in the books of the firm as on 31-12-2006, subject to final adjustment, were as under:

Trial Balance

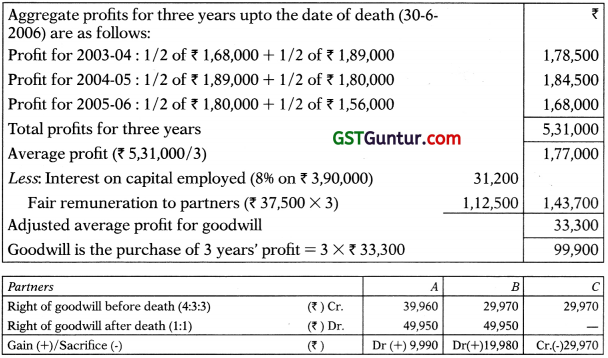

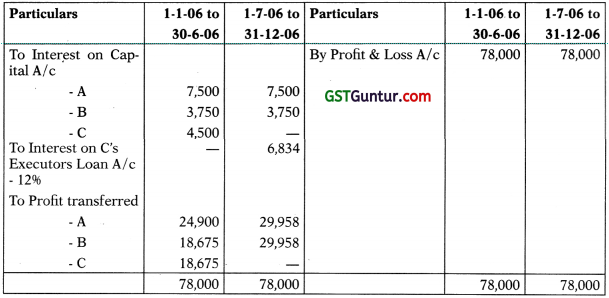

Adjustment: C died on 30-6-06. The Partnership deed provided that:

1. Interest was to be credited on capital accounts of partners at 1096 p.a. on the opening balance.

2. On the death of a partner, (i) Goodwill to be valued at 3 years’ purchase of average annual profits of 3 years up to the date of death, after deducting interest on capital employed at 896 p.a. & a fair remuneration for each partners; (ii) Fixed assets were to be valued by a valuer & all other assets-liabilities to be taken at book value.

3. Wherever necessary, profit or loss should be apportioned on a time basis.

4. The amount due to the deceased partner’s estate was to receive interest @ 12% p.a. from the date of the death until paid.

You ascertain that:

- Profits for three years, before charging partner’s interest were: 2003 -₹ 1,68,000; 2004 – ₹ 1,89,000; 2005 – ₹ 1,80,000;

- The independent valuation at the date of death revealed: Land and Building ₹ 1,50,000; Furniture & Fixtures ₹ 15,000;

- A fair remuneration for each of the partners would be ₹ 3 7,500 p.a. & that capital employed in the business to be taken as ₹ 3,90,000 throughout.

It was agreed among the partners that:

- Goodwill was not to be shown as an asset of the firm as on 31-12-06. Therefore adjustment for goodwill was to be made in Capital A/c;

- A & B would share equally from the date of death of C;

- Depreciation on revised value of assets would be ignored.

You are required to prepare:

- Partner’s Capital Accounts and

- Balance – Sheet of the firm as on 31-12-06.

Solution:

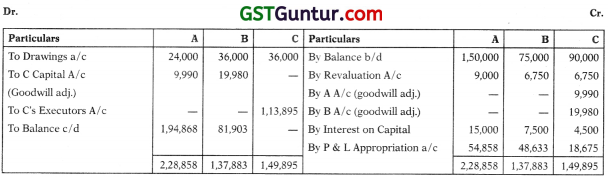

Partners’ Capital Account

Balance Sheet as on 31-12-2006

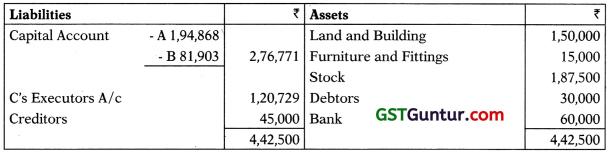

(1) Revaluation Account

(2) Adjustment in regard to Goodwill

(3) Profit & Loss Appropriation Account

(4) C’s Executor Loan Account

Question 28.

Firm ABC consist of 3 partners A, B and C, sharing profits and losses in the ratio 5:3:2 respectively. The partner A died on February 20,2006, Profit and Loss Account for the period upto date of death and Balance Sheet as on that date were prepared. The Balance Sheet as on that date was as given by the side.

In addition to the assets shown above, the firm had 3 life policies in the name of each partner, for insured value of 20,000 each, the premium of which were charged to Profit & Loss Account.

According to the partnership deed, on death of partner, the asset and liabilities are to be revalued by a valuer. The re-valued figures were :

(1) Goodwill ₹ 21,000, Machinery ₹ 45,000, Debtors are subject and to a provision for doubtful debts at 10% and Furniture at ₹ 7,000.

(2) Provision for taxation to be created for ₹ 1,500.

(3) Death-claim for policy in the name of A will be realised in full & the surrender values of the other 2 policies were ₹ 7,500 each.

The business will be continued by B & C, henceforth sharing profits and losses equally. The net balance due to A is transferred to a Loan account which will be paid off later.

Show Capital Account, Revaluation Account and the new Balance Sheet of the firm.

Solution:

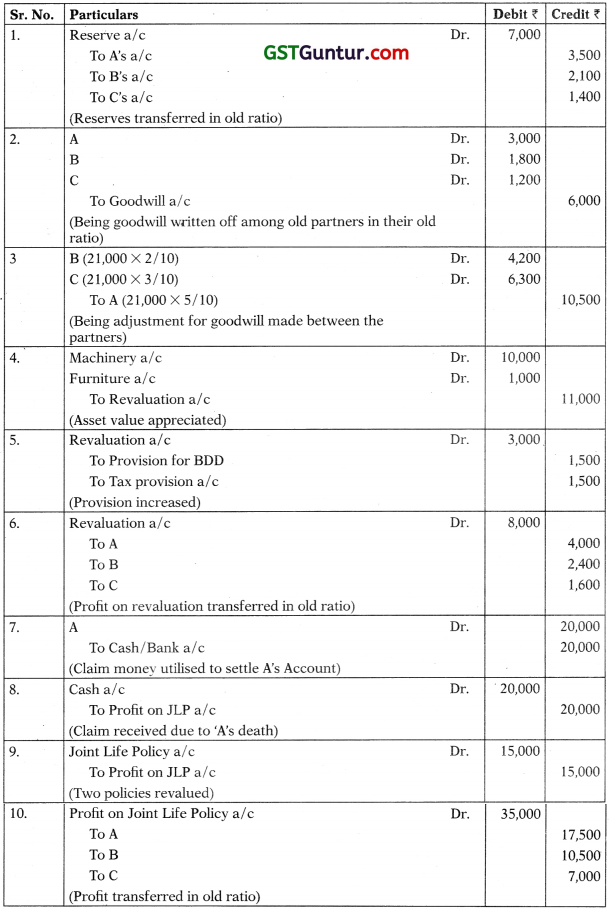

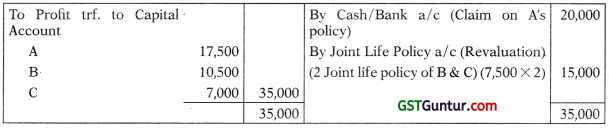

Journal Entries

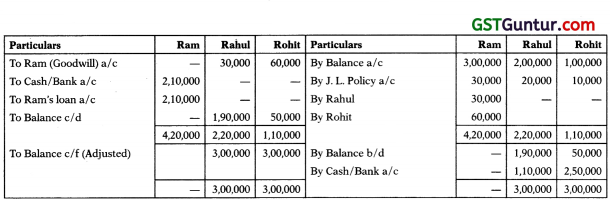

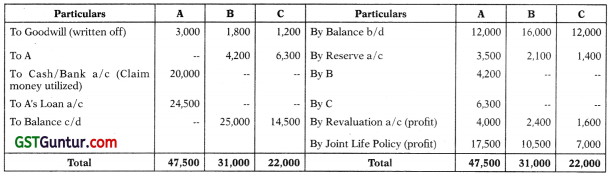

Capital Account

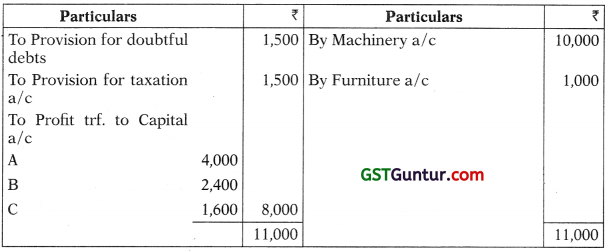

Revaluation Account

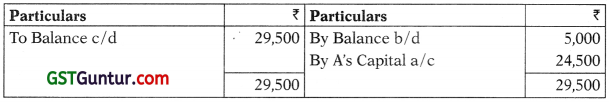

A’s (Legal heirs/representatives) Loan Account)

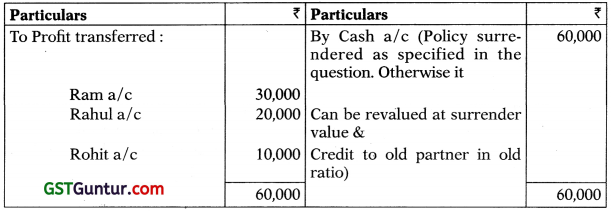

Profit on Joint Life Policy Account

Balance Sheet

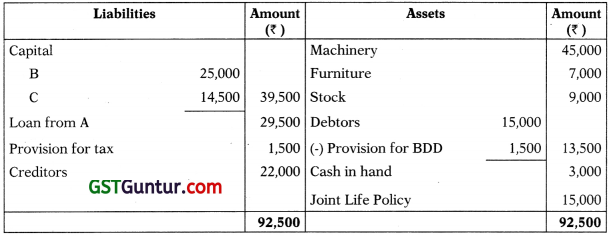

Working Note:

1. Calculation of Gain/ Sacrifice:

Question 28.

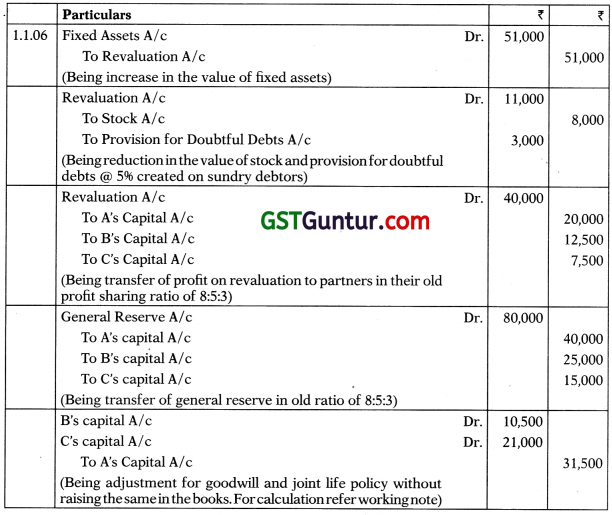

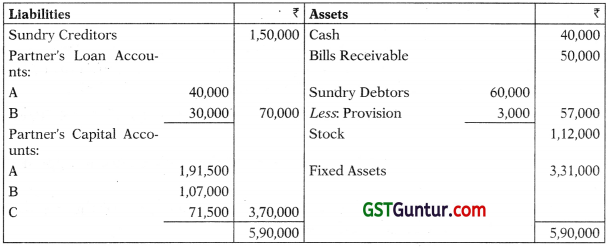

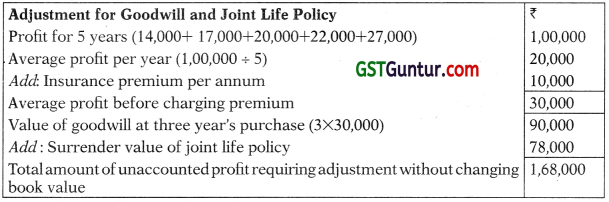

A,B and C are partners in a firm sharing profits and losses as 8:5:3. The Balance Sheet as at 31st December, 2005 was as follows:

From 1st January, 2006 they agreed to alter their profit-sharing ratio as 5:6:5. It is also decided that:

(a) The fixed assets should be valued at ₹ 3,31,000;

(b) A provision of 5% on sundry debtors be made for doubtful debts;

(c) The goodwill of the firm at this date be valued at three years’ purchase of the average net profit of the last five years before charging insurance premium; and

(d) The stock be reduced to ₹ 1,12,000.

There is a joint life insurance policy for ₹ 2,00,000 for which an annual premium of ₹ 10,000 is paid, the premium being charged to Profit and Loss Account. The surrender value of the policy on 31st December, 2005 was ₹ 78,000.

The net profits of the firm for the last five years were ₹ 14,000, ₹ 17,000, ₹ 20,000, and ₹ 127,000.

Goodwill and the surrender value of the joint life policy was not to appear in the books.

Draft Journal Entries necessary to adjust the capital accounts of the partners and prepare the revised Balance Sheet.

Solution:

M/s A, B and C

Journal Entries

Balance sheet (revised)

As on 1st January, 2006

Working Note:

Question 29.

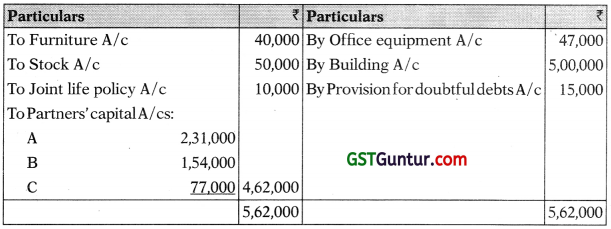

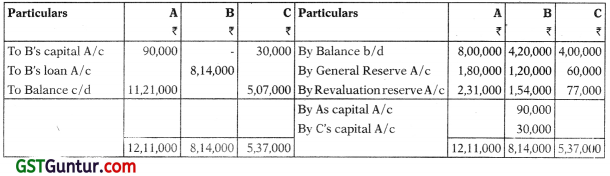

A, B and C are partners sharing profits in the ratio of 3 : 2 : 1. Their Balance Sheet as at 31st March, 2018 stood as:

B retired on 1st April, 2018 subject to the following conditions:

(i) Office Equipments revalued at ₹ 3,27,000.

(ii) Building revalued at ₹ 15,00,000. Furniture is written down by ₹ 40,000 and Stock is reduced to ₹ 2,00,000.

(iii) Provision for Doubtful Debts is to be created @ 5% on Debtors.

(iv) Joint Life Policy will appear in the Balance Sheet at surrender value after B’s retirement. The surrender value is ₹ 1,50,000

(v) Goodwill was to be valued at 3 years purchase of average 4 years profit which were:

| Year | ₹ |

| 2014 | 90,000 |

| 2015 | 1,40,000 |

| 2016 | 1,20,000 |

| 2017 | 1,30,000 |

(vi) Amount due to B is to be transferred to his Loan Account

Prepare the Revaluation Account, Partners’ Capital Accounts and the Balance Sheet immediately after B’s retirement.

Solution:

Revaluation A/c

Partners’ Capital A/c

Balance Sheet as on 1.4.2018 (After B’s retirement)

Working Notes: Calculation of goodwill:

1. Average of last 4 year’s profit

= (90,000 + 1,40,000 + 1,20,000 + 1,30,000)/4 = ₹ 1,20,000

2. Goodwill at three years’ purchase = ₹ 1,20,000 x 3 = ₹ 3,60,000

Goodwill adjustment

Question 30.

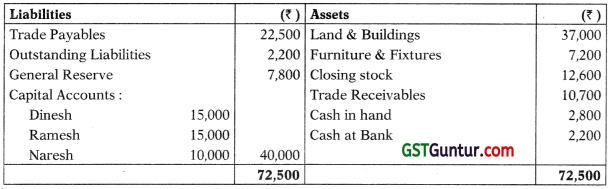

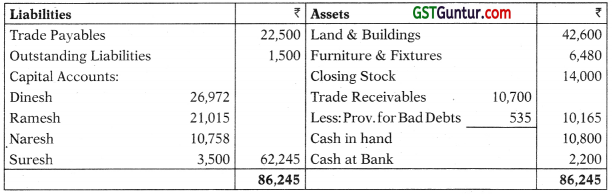

Dinesh, Ramesh and Naresh are partners in a firm sharing profits and losses in the ration of 3 : 2 : 1. Their Balance Sheet as on 31st March, 2018 is as below :

The partners have agreed to take Suresh as a partner with effect from 1st April, 2018 on the following terms :

(i) Suresh shall bring ₹ 8,000 towards his capital.

(ii) The value of stock to be increased to ₹ 14,000 and Furniture & Fixtures to be depreciated by 10%.

(iii) Reserve for bad and doubtful debts should be provided at 5% of the Trade Receivables.

(iv) The value of Land & Buildings to be increased by ₹ 5,600 and the value of the goodwill be fixed at ₹ 18,000.

(v) The new profit sharing ratio shall be divided equally among the partners.

The outstanding liabilities include ₹ 700 due to Ram which has been paid by Dinesh. Necessary entries were not made in the books.

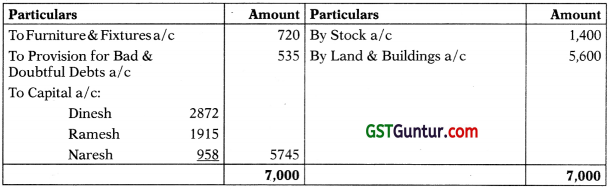

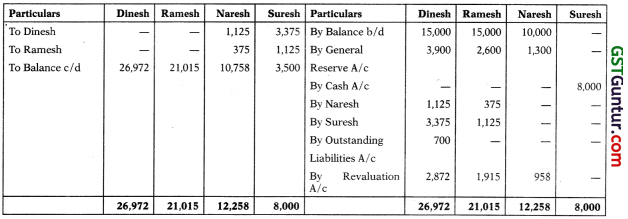

Prepare (i) Revaluation Account, (ii) Capital Accounts of the Partners, (iii) Balance Sheet of the firm after admission of Suresh.

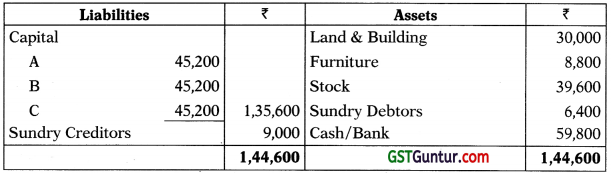

Solution:

Revaluation A/c

Partner’s Capital A/c

Working Note:

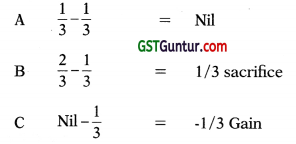

Calculation of Sacrificing Ratio

Sacrificing Ratio = Old Ratio-New Ratio

Dinesh = \(\frac { 3 }{ 6 }\) – \(\frac { 1 }{ 4 }\) = \(\frac { 3 }{ 12 }\) (Sacrifice)

Ramesh = \(\frac { 2 }{ 6 }\) – \(\frac { 1 }{ 4 }\) = \(\frac { 1 }{ 12 }\) (Sacrifice)

Naresh = \(\frac { 1 }{ 6 }\) – \(\frac { 1 }{ 4 }\) = \(\frac { 1 }{ 12 }\) (Gain)

Suresh = Nil – \(\frac { 1 }{ 4 }\) = \(\frac { – 1 }{ – 4 }\) Nil – (Gain)

Sacrifice by Mr. Dinesh = 18,000 x \(\frac { 3 }{ 12 }\) = 4,500

Sacrifice by Mr. Raraesh = 18,000 x \(\frac { 1 }{ 12 }\) = 1,500

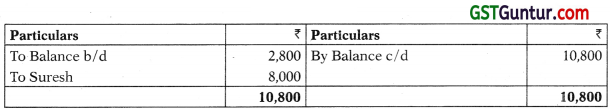

Cash A/c

Balance Sheet of the new firm as on 1.4.2018

Note: The effect of above calculation is that extra ₹ 1,000 to Z is borne by X & Y in their profit sharing ratio i.e. 3:2.

Question 31.

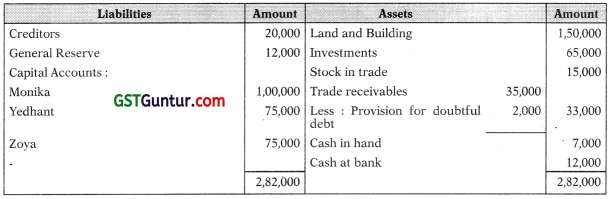

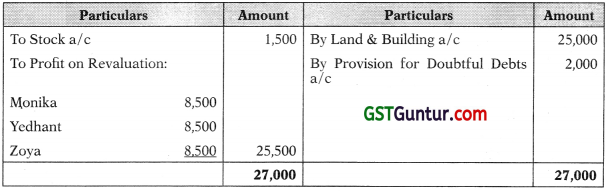

Monika, Yedhant and Zoya are in partnership, sharing profits and losses equally. Zoya died on 30th June 2018. The Balance Sheet of Firm as at 31st March 2018 stood as.

In order to arrive at the balance due to Zoya, it was mutually agreed that:

(i) Land and Building be valued at ₹ 1,75,000

(ii) Debtors were all good, no provision is required

(iii) Stock is valued at ₹ 13,500

(iv) Goodwill will be valued at one Year’s purchase of the average profit of the past five years. Zoya’s share of goodwill be adjusted in the account of Monika and Yedhant.

(v) Zoya’s share of profit from 1st April 2018, to the date of death be calculated on the basis of average profit of preceding three years.

(vi) The profit of the preceding five years ended 31st March were :

| 2018 | 2017 | 2016 | 2015 | 2014 |

| 25,000 | 20,000 | 22,500 | 35,000 | 28,750 |

You are required to prepare :

(1) Revaluation account

(2) Capital accounts of the partners and

(3) Balance sheet of the Firm as at 1st July 2018.

Solution:

Revaluation Account

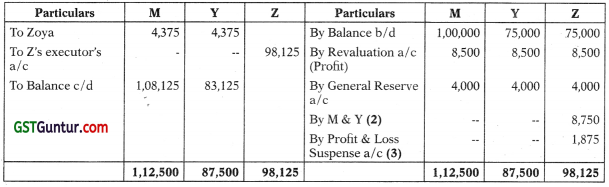

Capital Account

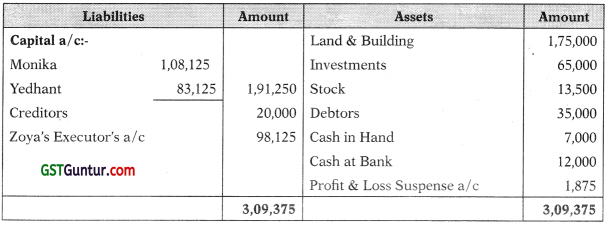

Balance Sheet of the firm as at 1st July, 2018(after death)

Working Notes:

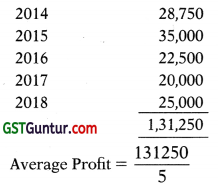

(1) Calculation of Goodwill

Profits of the past five years:

= ₹ 26,250

= 26,250 x 1 year purchase

= ₹ 26,250

(2) Treatment of Goodwill

| Monika | Dr. | 4,375 |

| Yedhant | Dr. | 4,375 |

| To Zoya | 8,750 |

(Being goodwill adjusted in the gaining ratio 1:1)

(3) Calculation of Zoya’s share of profit, upto the date of death

True or False

Question 1.

A partner who devotes more time to a business than other partners is entitled to get a salary.

Answer:

False: No partner is entitled for salary unless it is provided for in the partnership deed.

Question 2.

Partners can share profits or losses in their capital ratio, when there is no agreement.

Answer:

False: If there is no agreement profits or losses are to be shared equally among the partners.

Question 3.

The business of partnership firm must be carried on by all the partners.

Answer:

False: The business of the partnership firm can be carried on by all the partners or by any one of them acting for all.

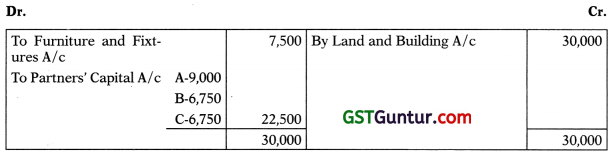

![]()

Question 4.

Goodwill brought in by an incoming partner in cash for joining a partnership firm is taken away by the old partners in their new profit sharing ratio.

Answer:

False: When a new partner brings in cash for goodwill, it is taken away by the old partners in their sacrificing ratio.

Question 5.

Goodwill is fictitious asset.

Answer:

False: Goodwill is an intangible asset.

Question 6.

Goodwill is in the nature of personal account.

Answer:

False: Goodwill is an intangible asset so it is in nature of real account.

Question 7.

If a partner retires, then other partners have a gain in their profit sharing ratio.

Answer:

True: If a partner retires, his share of profit or loss will be shared by the other partners in their profit sharing ratio unless otherwise agreed.

Question 8.

Minor can be admitted to the benefits of LLP.

Answer:

False: Minor cannot be admitted to the benefits of LLP.

Question 9.

The objective of taking a joint life policy by the partnership firm is to secure the lives of the existing partners of the firm.

Answer:

False: The objective of taking a joint life policy is to enable the firm to make payment to the legal representatives of a deceased partner or to the retiring partner.

![]()

Question 10.

LLP has no separate legal entity.

Answer:

False: LLP has separate legal entity.

Question 11.

LLP Partners act as agents of LLP and other partners.

Answer:

False: LLP Partners act as agents of LLP and not of other partners.

Question 12.

When there is no partnership deed prevails, the interest on loan of a partner to be paid @ 6%.

Answer:

True: When there is no partnership deed then the provisions of the Indian Partnership Act are to be applied for settling the dispute. Interest on loan is payable @ 6% p.a.

as per Indian Partnership Act.

Question 13.

Limited Liability Partnership (LLP) is governed by Indian Partnership Act, 1932.

Answer:

False: LLP is governed by LLP Act, 2008.