Dissolution of Partnership Firms – CA Inter Advanced Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Dissolution of Partnership Firms – CA Inter Advanced Accounting Question Bank

Question 1.

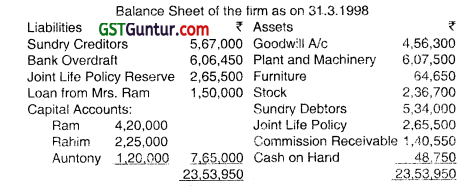

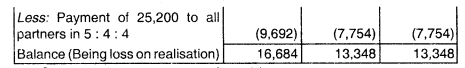

Ram, Rahim and Auntony were in partnership sharing profits and losses in the ratio of 1/4, 1/3 and 1/6 respectively. They decided to dissolve the partnership firm on 31.3.1998 when the Balance Sheet of the firm appeared as under:

The following details are relevant for dissolution:

(i) The joint life policy was surrendered for ₹ 2,32,500.

(ii) Ham took over goodwill and plant and machinery for ₹ 9,00,000.

(iii) Ram also agreed to discharge bank overdraft and loan from Mrs. Ram.

(iv) Furniture and stocks were divided equally between Ram and Rahim at an agreed valuation of ₹ 3,60,000.

(v) Sundry debtors were assigned to firms creditors in full satisfaction of their claims.

(vii) Commission receivable was received in to in time.

(vii) A bill discounted was subsequently returned dishonoured and proved value less ₹ 30,750 (including ₹ 500 noting charges).

(viii) Ram paid the expenses of dissolution amounting to ₹ 18,000.

(ix) Auntony agreed to receive ₹ 1,50.000 in full satisfaction of his rights title and interest in the firm.

You are required to show the accounts relating to closing of books, on dissolution of the firm. (Nov 1998, 15 marks)

Answer:

Notes:

(i) No entry is required regarding assignment of sundry debtors to Sundry creditors in full satisfaction of their Claims.

(ii) The amount of excess payment to Auntony (‘₹ 1,50,000 Less ‘₹ 138,600 i.e. ₹ 11,400) has been debited to Ram & Rahim in the ratio of 3:2.

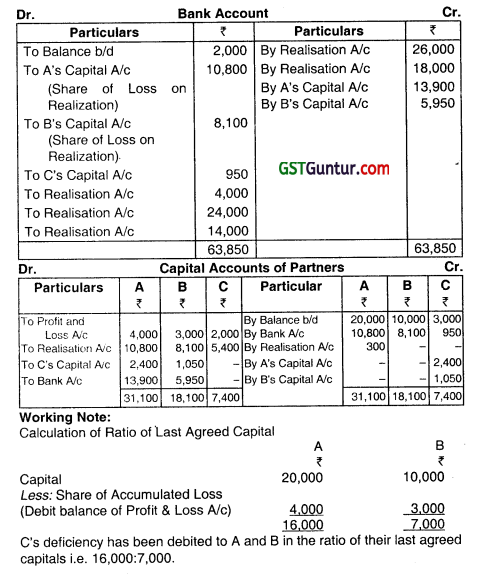

Question 2.

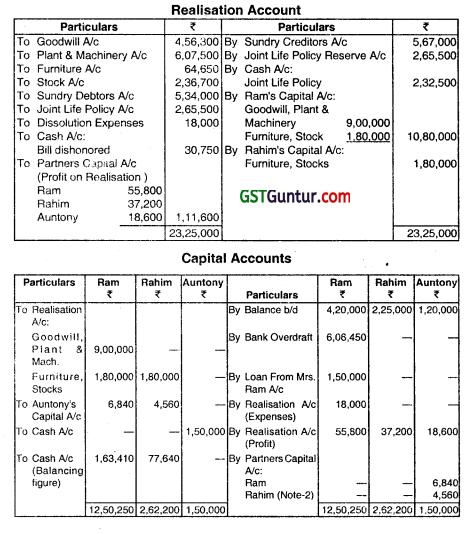

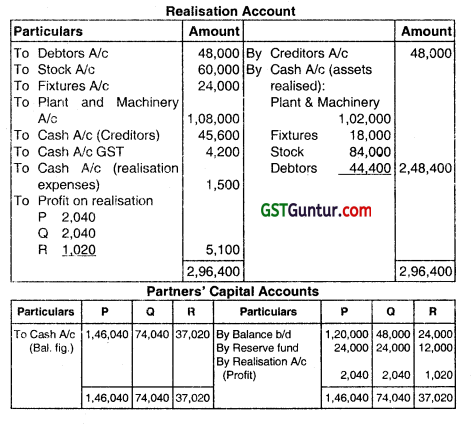

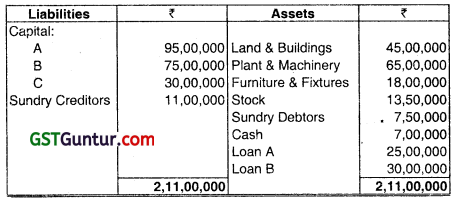

P, Q and R are partners sharing profits and losses in the ratio of 2: 2 :1. Their Balance sheet as on 31 March. 2009 is as follows:

They decided to dissolve the firm. The following are the amounts realised from the assets:

| ₹ | |

| Plant and Machinery | 1,02,000 |

| Fixtures | 18,000 |

| Stock | 84,000 |

| Sundry debtors | 44,400 |

Creditors allowed a discount of 5% and realisation expenses amounted to ₹ 1,500. A bill for ₹ 4,200 due For GST was received during the course of realisation and this was also paid.

You are required to prepare:

(a) Realisation account

(b) Partners capital account

(c) Cash account. (Nov 2009, 6 marks)

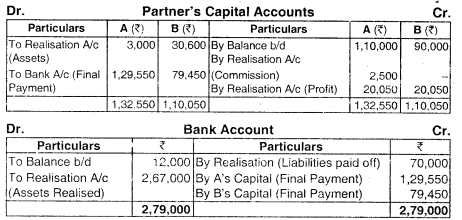

Answer:

Question 3.

Answer of the following:

(e) Amil paid ₹ 50,000 as premium to other partners of the firm at the time of his admission to the firm, with a condition that it will not be dissolved before expiry of five years. The firm is dissolved after three years. Amit claims refund of premium. Explain.

(1) Whether ho is entitled to get a refund of the premium? If ,yes, list the criteria for the calculation of the amount of the refund.

(2) Also explain any two conditions when no claim in this respect will arise. (Nov 2018, 5 marks)

Answer:

1. If the firm is dissolved before the term expires, as in this case, Amit being a partner who has paid premium of ₹ 50,000 on admission will have to be repaid/refunded:

The Criteria for calculation of refund amount are:

- Terms upon which admission was made.

- The time period for which it was agreed that the firm will not be dissolved.

- The time period for which the firm has already been in existence.

2. No claim for refund will arise if:

- The firm is dissolved due to death of a partner.

- If the dissolution of the firm is basically because of misconduct of Amit,

- If the dissolution is through an agreement and such agreement does not have a stipulation for refund of premium.

Question 4.

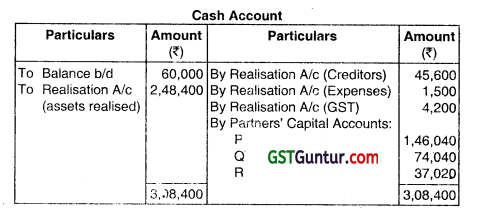

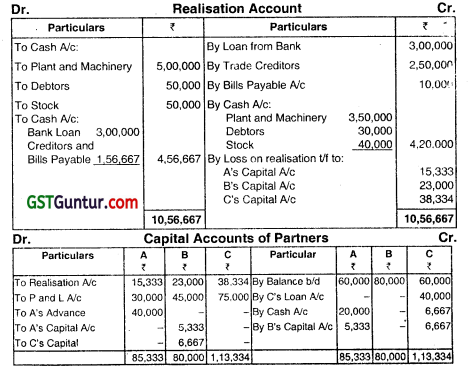

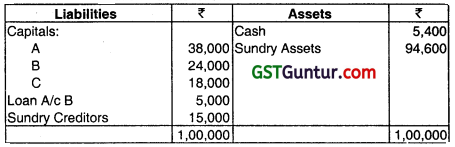

AB and C are Partners of the Firm ABC and Co, sharing Profits and Losses in the ratio of 4:3:2. Following is the Balance Sheet of the Firm as at 31st March:

|

Capital and Liabilities |

₹ | Properties and Assets |

₹ |

| Partner’s Capitals | Fixed Assets | 5,00,000 | |

| A | 4,00,000 | Stock -In-Trade | 3,00,000 |

| B | 3,00,000 | Sundry Debtors | 5,00,000 |

| C | 2,00,000 | Cash in Hand | 10,000 |

| General Reserve | 90,000 | ||

| Sundry Creditors | 3,20,000 | ||

| 13,10,000 | 13,10,000 |

Partners of the firm decided to dissolve the Firm on the above date. It was found that a credit purchase ₹ 20000 ¡n March had not been recorded in the books of the Firm.

1. Fixed Assets realized ₹ 5,20,000 and Book Debts ₹ 4,40,000.

2. Stock were valued at ₹ 2,50,000 and it was taken over by Partner B.

3. Creditors allowed discount of 5% and the expenses of realization amounted to ₹ 6,000.

Prepare Realisation Account, Partners Capital Account and Cash Account.

Answer:

![]()

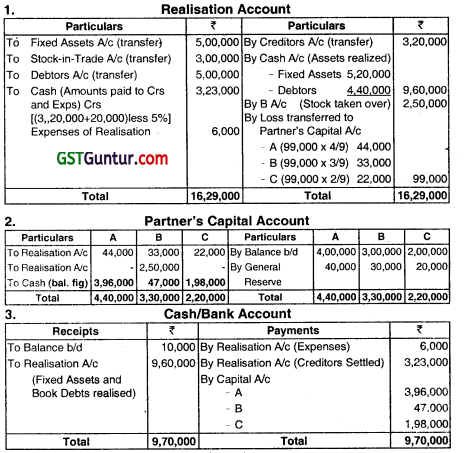

Question 5.

A, B and C give you the following Balance Sheet as on 31st March.

The Partners shared Profits ano Losses in the ratio of A 4/9, B 2/9 and C 1/3.

The firm was dissolved on the above date and you are given the following information:

(a) C had taken a Loan from Insurers for ₹ 5,000 on the security of Joint Life Policy, The Policy was surrendered and Insurers paid a sum of ₹ 10,200 after deducting ₹ 5,000 for C’s Loan and ₹ 300 as interest there on.

(b) One of the Creditors took some of the Patents whose book value was ₹ 6,000 at a valuation of ₹ 4,500. The balance due to that Creditor was paid In cash.

(c) The Firm has previously purchased some shares in a Joint Stock Company and had written them off on finding them useless. The Shares were now found to be worth ₹ 3,000 and then Loan Creditor agreed to accept the Shares at this value.

(d) The remaining assets realized the following amounts: Plant and Machinery ₹ 17,000, Fixtures and Fittings ₹ 1,000, Stock ₹ 9,000, Debtors ₹ 16,500, and Patents 50% of their Book Value.

(e) The Liabilities were paid and a total discount of ₹ 500 was allowed by the Creditors.

(f) The expenses of Realisation amounted to ₹ 2,300.

Prepare the Realisation Account, Bank Account and Partners Capital Accounts in Columnar form.

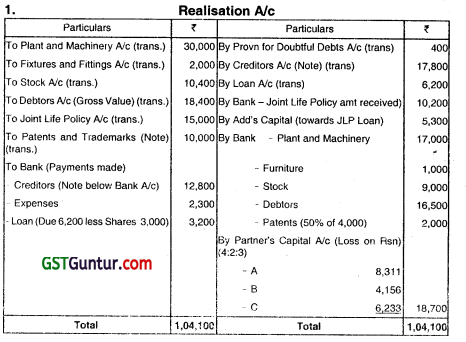

Answer:

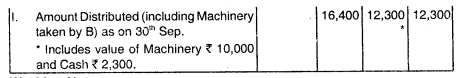

Note: Payment to Creditors = Due 17,800 less Patents valued at 4,500 less

Discount Received 500 = Net 12,800

Question 6.

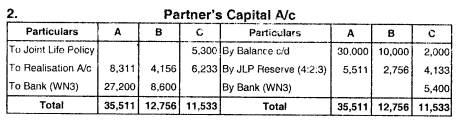

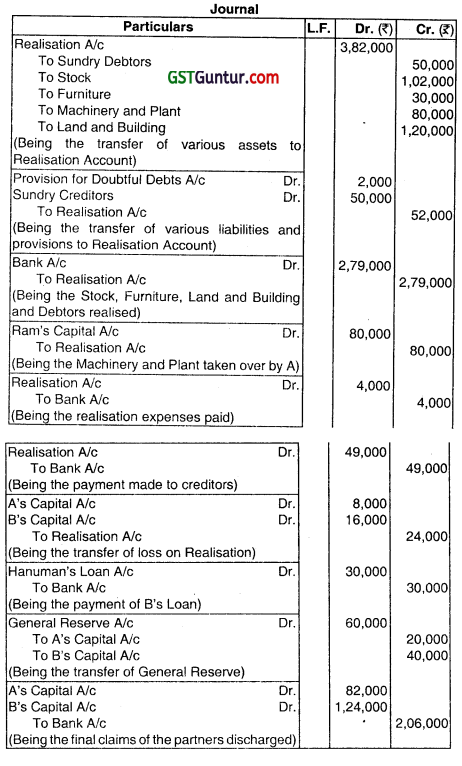

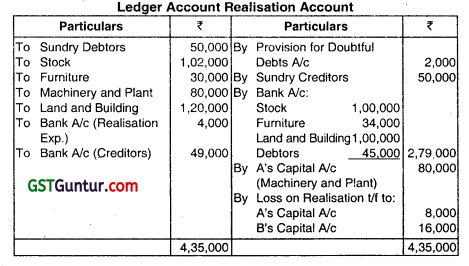

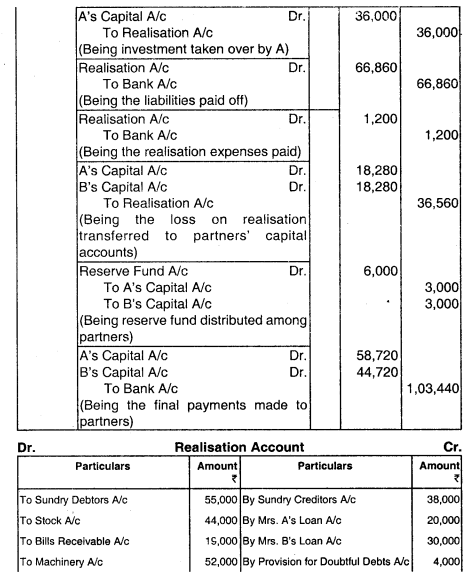

A. and B are partners in a turn. They share profits and losses in the ratio of 1:2. On 1st April, 2018. they decided to dissolve the partnership and on that date the Balance Sheet of the firm was as under:

The sales of firm’s properties realized ₹ 1,00,000 from stock, ₹ 34,000 from furniture and ₹ 1,00,000 from Land and Building. ₹ 45.000 were collected from Debtors and Creditors were paid off at a discount of ₹ 1,000. Machinery and Plant are taken over by A at their book value. The expenses of realisation amounted to ₹ 4,000. Required: Pass Journal Entries to close the books of the firm and prepare necessary ledger accounts.

Answer:

Question 7.

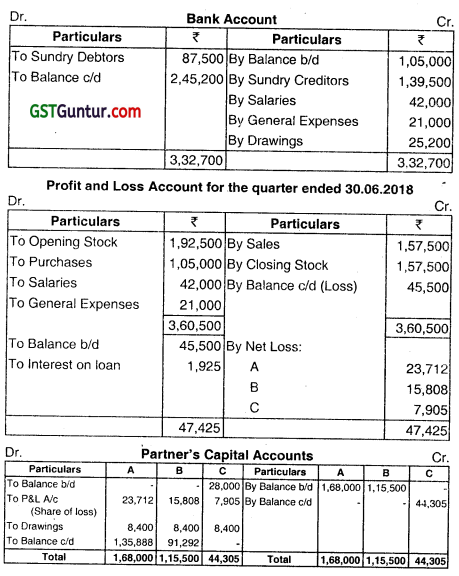

A. B and C are partners in a firm Mis ABC & Co. sharing profits and losses in the ratio 3:2:1. They are also entitled to interest on loan at 10% p.a., but not interest on Capital The partners decided to dissolve the firm on 30.06.2018. The following is their Balance Sheet which was drawn upto 31.03.2018.

M/s. ABC & Co.

| Liabilities | ₹ | Assets | ₹ |

| Capital Accounts: | Building | 2,10,000 | |

| A | 1,68,000 | Furniture | 35,000 |

| B | 1,15,500 | Motorcycle | 1,40,000 |

| A’s Loan | 77,000 | Stock | 1,92,500 |

| Sundry Creditors | 2,80,000 | Sundry Debtors | 1,40,000 |

| Bank Overdraft | 1,05,000 | C’s Capital A/c | 28,000 |

| 7,45,500 | 7,45,500 |

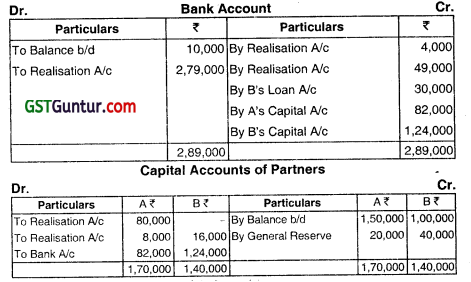

Between the Balance Sheet date and the date of dissolution, purchases amounted to ₹ 1,05,000 and sales ₹ 1,57,500. In addition to payments made to Creditors, a sum of ₹ 42,000 and ₹ 21,000 were paid on account of Salaries and general expenses.

Each partner withdrew ₹ 2,800 per month. On 30.06.2018 Debtors, Creditors and Stock amounted to ₹ 2,10,000. ₹ 2,45,500 and ₹ 1,57,500 respectively. During course of proceedings, the partners decided to transfer the entire business to a private limited company with all assets, liabilities and partners loan for a consideration of ₹ 3,15,000. Dissolution expenses amounted to ₹ 9,800 and were borne by A.

Required:

Prepare necessary Ledger Accounts, Profit and Loss Account, Partners Capital Account and Balance Sheet as at 30.06.2018 of the firm M/s. ABC & Co. Also ascertain the amount of profit on realisation.

Answer:

Question 8.

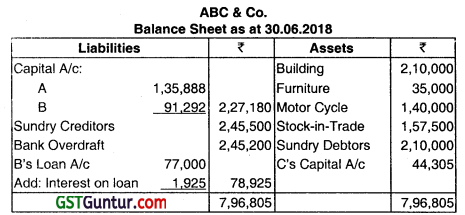

The following is the Balance Sheet of A and B as on 31 December, 2018.

The firm was dissolved on December 31st, 2006 and asset realised and settlements of liabilities as follows:

(a) The realisation of the assets were as follows: Sundry Debtors: ₹ 52,000;

Stock: ₹ 42,000: Bills Receivable:’ ₹ 16,000; Machinery: ₹ 49,000.

(b) Investment was taken over by A at agreed value of 36,000 and agreed to pay of Mrs As loan.

(c) The Sundry Creditors were paid off less 3% discount.

(d) The realisation expenses incurred amounted to ₹ 1,200.

Journalise the entries to be made on the dissolution and prepare realisation account, bank account and partner capital accounts.

Answer:

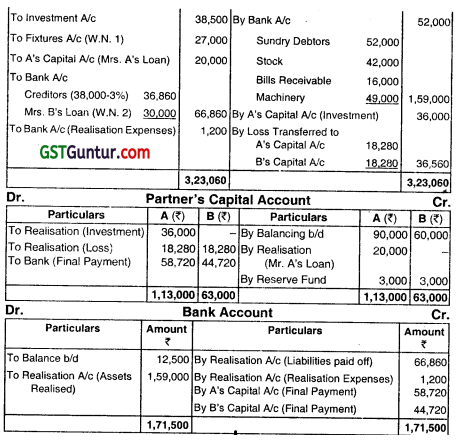

Question 9.

A and B were partners sharing profits and losses equally. On 31.03.2018 their Balance Sheet was as follows:

The firm was dissolved on the above date and the assets and liabilities were settled as follows:

(a) Stock was sold at 25% less than book value arid machinery realised 20% more than the book value.

(b) Debtors of ₹ 10,000 proved bad and rest paid the amount due.

(c) A typewriter, which was fully depreciated, is now valued at ₹ 3,000 and is taken over by A at this value.

(d) B took over 40% of investments at 15% discount ad remaining investments were handed over to a creditor of ₹ 60,000. The balance payment of creditors was made in cash.

(e) A was appointed to realise the assets and pay off the liabilities; for which he was to be paid commission of ₹ 2,500.

(f) Land and Buildings were valued at ₹ 70,000. Bank took it to settle of the loan of ₹ 50,000 and paid the balance amount of ₹ 20,000 to the firm. Prepare the Realisation Account. Partner’s Capital Accounts and Bank Account to close the books of the firm.

Answer:

Question 10.

A, B and C commenced business on 1st January 2005 with capitals of. A ₹ 2,00,000 B – ₹ 2,00,000 and C – ₹ 1,00,000. Profits are shared on the ratio of 4:3:3. Capital carried interest @5% pa. During the year 2015. the firm suffered a toss of ₹ 1,50,000 before allowing interest on capital. Drawings of each partner during the year were ₹ 20,000.

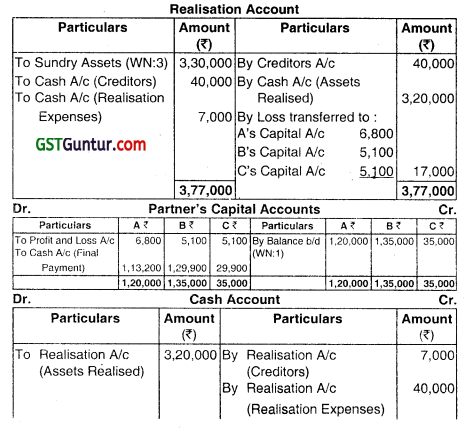

On 31st December 2015, the partners agreed to dissolve the firm as it was no longer profitable. The creditors on that date were ₹ 40,000. The assets realised a net value of ₹ 3,20,000 and the expenses of realisation were ₹ 7,000. Prepare the Realisation Account, Partners Capital Accounts and Cash Account along with necessary working to close the books of the firm.

Answer:

Question 11.

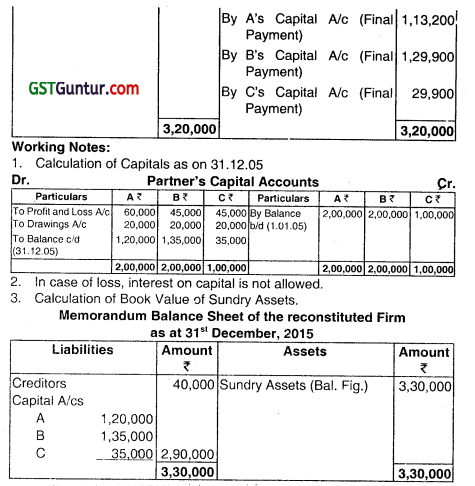

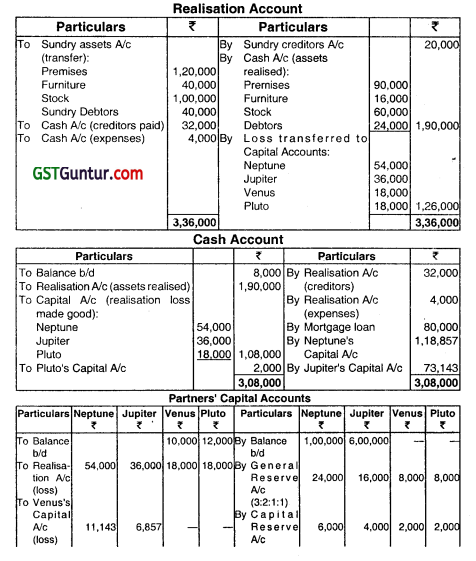

Neptune, Jupiter, Venus and Pluto had been carrying on business in partnership sharing profits and losses in the ratio of 3:2:1:1. They decide to dissolve the partnership on the basis of the following Balance Sheet as on 30th April, 2003:

(ii) Expenses of dissolution amounted to ₹ 4,000.

(iii) Further Creditors of ₹ 12,000 had to be met.

(iv) General Reserve unlike Capital Reserve was built up by appropriation of profits.

You are required to draw up the Realisation Account, Partners’ Capital Accounts and the Cash Account assuming that Venus became insolvent and nothing was realised from his private estate. Apply the principles laid down in Gamer vs Murray. (Nov 2003, 16 marks)

Answer:

Note:

(1) Venus in unable to pay ₹ 18,000 capital account of Pluto is showing a debit balance (before the realization) therefore he will not be liable to bear any portion of this loss and it will be borne by Neptune and Jupiter in the proportion of 130:80 or 13: 8, i.e. in the ratio of capital before dissolution but after transfer of reserves.

(2) No distinction need be made between General Reserve and Capital Reserve.

As per the Gamer Vs. Murray Rule:

(i) First, the solvent partners should bring in cash equal to their respective share of the loss on realization; and

(ii) Therefore, the loss due to the insolvency of a partner should be divided among the other partners In the ratio of their capitals then standing.

![]()

Question 12.

Answer the following:

X, Y and Z are partners. X became insolvent on 15.4.2007. The Capital account balance of partner Y is on the debit side. Partner Y is solvent. Should partner Y bear the loss arising on account of the insolvency of partner X? (May 2007, 2 marks)

Answer:

When some partner is having debit balance in his capital account and is not insolvent, then he cannot be called upon to bear the loss on account of the insolvency of the other partner. Therefore Y need bear the loss due to insolvency of partner X.

Question 13.

Answer the following:

(c) Explain Garner v/s Murray rule applicable in the case of partnership firms. State. when is this rule not applicable. (May 2008, May 2013, May 2019, 4 marks each)

Answer:

Garner Vs. Murray Rule:

A Partner may owe some money to partnership firm. This money should be paid by him to the firm. However, in case he becomes insolvent he may not be in a position to pay the amount owed by him to the firm in full. The amount not so paid is a loss to the firm. Th,s loss has to be borne by the solvent partners on the basis of the following rule based on the decision given in the case of Gamer Vs. Murray.

- The solvent partners should bring in cash as per their share of loss on reaisation.

- The loss on account of insolvency of a partner should then be born by the solvent partners in the ratio of their capitals after bringing in cash, such loss on realisatlon.

In order to calculate the above ratio of capital for this purpose, it has to be seen whether capitals of partners are fixed or fluctuating. In case of fixed capital no adjustment will be made and the ratio of fixed capital will be taken If capital is fluctuating, ratio should be calculated on the basis of correc capital immediately before dissolution.

Non-applicability of Rule:

As per this rule, solvent partners will bear the loss of capital deficiency of insolvent partners in the ratio of their capitals. If incidentally, a solvent partner has a debit balance in his capital account he will escape the liability to bear the loss. It does not apply when the firm having only two members. It also does not apply when there is an agreement between the partners to share the deficiency in capital account of insolvent partner. When all the partners of the firm are insolvent this rule is not applicable.

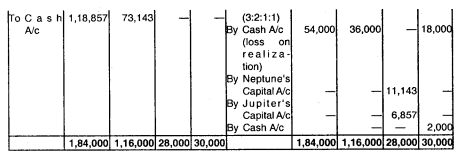

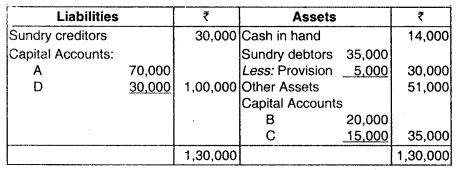

Question 14.

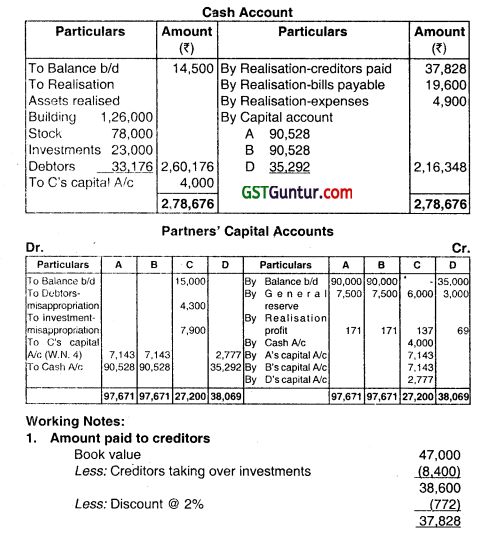

A. B, C and D are sharing profits and losses in the ratio 5: 5: 4 : 2. Frauds committed by C during the year were found out and it was decided to dissolve the partnership on 31st March 2010 when their Balance Sheet was as under:

Following information is given to you:

(i) A cheque for ₹ 4,300 received from debtor was not recorded in the books and was mis appropriated by C.

(ii) Investments costing ₹ 5,400 were sold by C at ₹ 7,900 and the funds transferred to his personal account. This sale was omitted from the firm’s books. A creditor agreed to take over investments of the book value of 5,400 at 8,400. The rest of the creditors were paid off at a

discount of 2%.

(iv) The other assets realised as follows:

Building 105% of book value

Stock ₹ 78,000

Investments The rest of investments were sold at a profit of ₹ 4,800

Debtors The rest of the debtors were realised at a discount of 12%

(y) The bills payable were settled at a discount of ₹ 400.

(vi) The expenses of dissolution amounted to ₹ 4,900.

(vii) It was found Out that realisation from C’s private assets would only be ₹ 4,000.

Prepare the necessary Ledger Accounts. (Nov 2010, 16 marks)

Answer:

This deficiency of ₹ 17,063 in C’s capital account will be shared by other partners A, B and D in their capital ratio of 90: 90 : 35 by Accordingly.

As share of deficiency =[17,063 x (90/215)] = ₹ 7,143

B’s share of deficiency = [17.063 x (90/215)] = ₹ 7,143

D’s share of deficiency = [17,063 x (35/215)] = ₹ 2,777

Question 15.

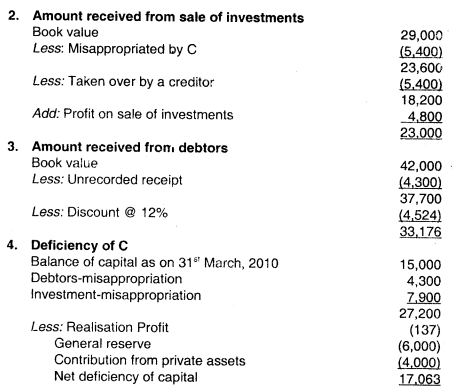

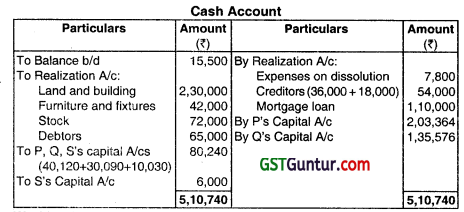

P, Q, R and S had been carrying on business in partnership sharing profit & losses in tho ratio of 4:3:2: 1. They decide to dissolve the partnership on the basis of following Balance Sheel as on 30th April, 2011:

(i) The assets were realized as under:

Land & Building 2,30,000

Furniture & Fixture 42,000

Stock 72,000

Debtors 65.000

(ii) Expenses of dissolution amounted to ₹ 7,800

(iii) Further creditors of 18,000 had to be met.

(iv) R became insolvent and nothing was realized from his private estate.

Applying the principles laid down in Garner Vs. Murray, prepare the Realisation Account, Partner’s Capital Accounts and Cash Account. (Nov 2011, 16 marks)

Answer:

Working Note:

As per Gamer Vs. Murray rule, solvent partners have to bear the loss due to insolvency of a partner in their capital ratio.

Though S is a solvent partner yet he cannot be called upon to bear loss on account of insolvency of R because his capital account has a debit balance.

Therefore. capital ratio of P & Q = 216:144 = 3 :2

Deficiency of R = ((25,000 + 20,060) – (19,000 + 5,000)) = 45,060 – 24,000= 21,060.

Deficiency of R will be shared by P & Q in the capital ratio of 3 : 2 i.e.

P= ₹ 21,060 x 3/5 = ₹ 12,636

Q = ₹ 21,060x 2/5 = ₹ 8,424

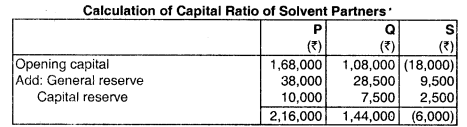

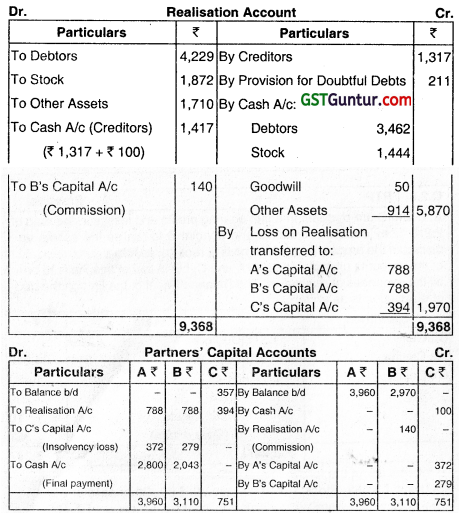

Question 16.

A, B and C are partners in a firm sharing profits and losses in the ratio of’ 2:2:1. They decide to dissolve and appoint B to realise the assets ar distribute the proceeds for which he is to receive, as his remuneration, 5 of the amounts ultimately paid to A and C, but in lieu of this, he is to bear all the expenses of realisatlon. The Batenc Sheet of the firm on the date of dissolution is as under:

B informs about the following realisations:

Debtors: ₹ 3,462, Stock:₹ 1,444, Goodwill: ₹ 50, Other assets: ₹ 914.

Creditors which were not recorded in books are now paid ₹ 100. The expenses of realisation amounted to ₹ 310. C is able to contribute only ₹ 100 beyond which he expresses his insolvency. Close the books of the firm.

Answer:

Working Note: Cornputaon of commission payable to B:

B’s commission is 5% of amount ultimately paid to A and C. Here ultimately nothing is being paid to C, hence B’s commission is to be 5% of the amount finally paid to A.

Let B’s commission be denoted by ‘x’.

We can find the realisation loss before taking into account B’s commission.

It is ₹ 1,830. Therefore, loss after B’s commission is = 1 ,830 + ‘x’

A’s Share of this loss = 732 + (2×15)

B’s Share of this loss = 732 + (2×15)

C,s Share of this loss = 366 + (x/S)

C’s deficiency borne by A and B in their capital ratio i.e., 3,960: 2,970 or 4:3 (Gamer Vs Murray)

5%of [2,872-(1835)] =x

5/100 × [2872 – (18 ×/35)] = X

(2,872 – (18 ×/35)] = 20x × p

(2,872 × 35) – 18x =20x ×35

718x = ₹1,00,520

x =₹ 140

Assumption:

It has been assumed that the realisation expenses have been met by B out of his private funds.

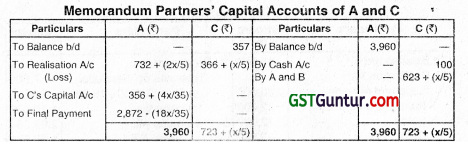

![]()

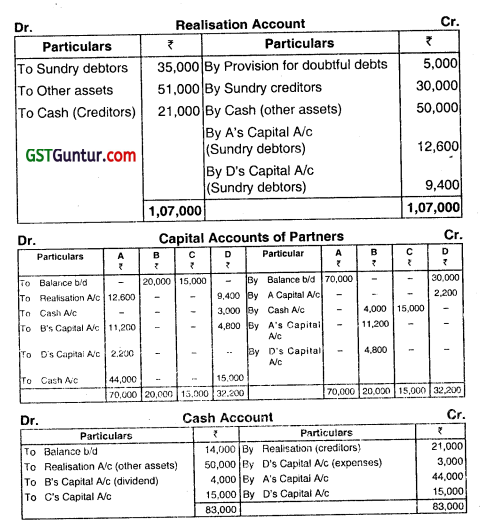

Question 17.

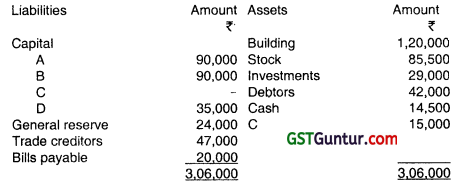

A, B and C are partners sharing profits and losses in the ratio of 4:3:2. Their Balance Sheet as at 31.3.2018 stood as follows:

The firm was dissolved on that date. Stock was taken over by the banker, and it realised 80%. Bank paid back ₹ 4,000 after recovering its overdraft and interest due thereon. Machinery was disposed off for 60% and debtors realised ₹ 14,000 only. Loan was fully paid off along with interest due ₹ 1,000. Sundry creditors were discharged at 10% discount. Expenses amounted to ₹ 300, which were paid by A. C became insolvent and only ₹ 950 could be recovered from his private assets. Prepare the necessary ledger accounts to close the books of the firm. Apply Garner vs Murray rule.

Answer:

Question 18.

A, B C and D are partners in a firm sharing profits and losses in the ratio of 4:1:2:3. The f000wing is their Balance Sheet as at 31st March. 2018.

On 31st March, 2018 the firm is dissolved. The partnership agreement provides that the deficiency of an Insolvent partner Will be borne by the solvent partners in the ratio of capitals as they stand just before dissolution.

The following arrangements are agreed upon:

(a) A is to take over 60% of book debts at 70% and D is to take over the balance at 75%. Further they are to be allowed ₹ 2,100 and ₹ 1,100 respectively to cover future losses.

(b) D is to realise other assets and to payoff the creditors. He is to receive 5% gross commission on the amounts finally payable to other partners but to bear expenses of realisation. He reports as follows:

Other assets realised at a loss of 2% on net collection, and the creditors. were paid oft at a discount of 30%. Realisation expenses amounted to ₹ 3,000 but the same is paid by the firm. B is declared insolvent and a Dividend of 20% in a rupee is realised from his estate. Prepare Cash account, Realisation Account, Capital Accounts. (Ignore Commission while

determining Realisation Loss).

Answer:

Working Notes:

(i) Net collection from other assets = ₹ 51,000 – (₹ 51,000 x 2/102) = ₹ 50,000

(ii) B’s deficiency (₹ 16,000) has been debited to A and D in the ratio of their capitals i.e., 7:3.

(iii) C will not bear any portion of the toss due to B’s insolvency since he had a debit balance in his capital account prior to the date of insolvency.

(iv) D’s commission

= 5/105 of the amount due to A before commission payable to D

= 5/105 of ₹ 46,200 = ₹ 2,200.

Question 19.

A, B and C were in partnership sharing profits and losses in the ratio of 2:3:5. They prepared the following balance sheet as at 31st March 2018. when they decided to dissolve:

Plant and Machinery realised 70%; Debtors 40% less and Stock, 80%. A has a private estate, valued at ₹ 1,00,000 and his liabilities amounted to ₹ 40,000. The private estate realised only ₹ 60,000, and B is insolvent. C can pay only 50 paise in the rupee of what is payable on his own account to the firm. Prepare the necessary ledger accounts, assuming that the loss on

the realisation is to be determined after considering the amount ultimately paid to the creditors.

Answer:

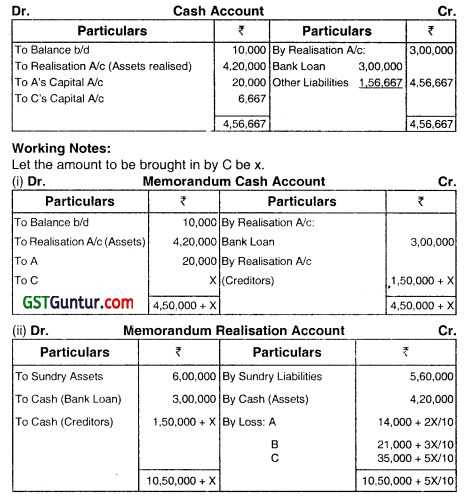

Question 20.

A. B and C are partners sharing profits and losses in the ratio of 5: 3: 2. Their capitals were ₹ 9,600: ₹ 6,000 and ₹ 8,400 respectively.

After paying creditors, the liabilities and assets of the firm were:

Liability for interest on Investments 1.000

Loans from Spouses of partners 2,000 Furniture 2,000

Machinery 1,200

Partners 1,000 Stock 4,000

The assets realised in full in the order in which they are listed above. B is insolvent. You are required to prepare a statement showing the distribution of cash as and when available, applying maximum possible loss procedure. (Nov 1999,15 marks)

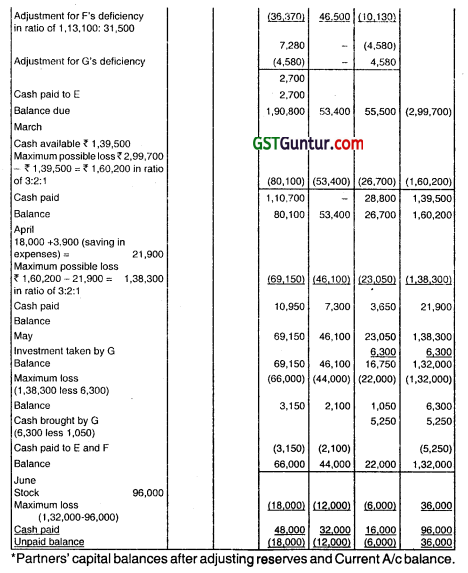

Answer:

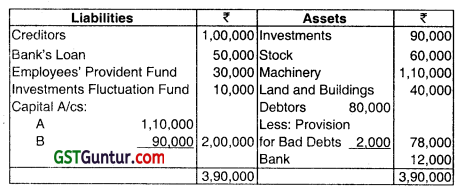

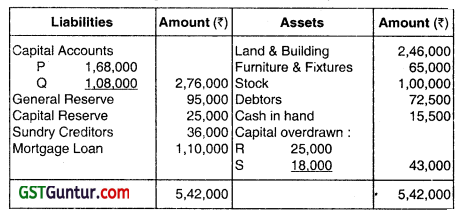

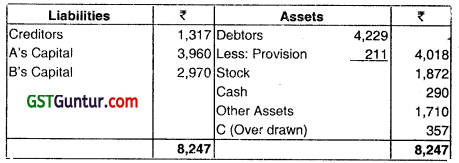

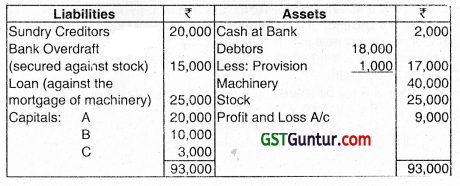

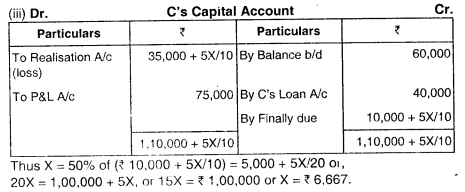

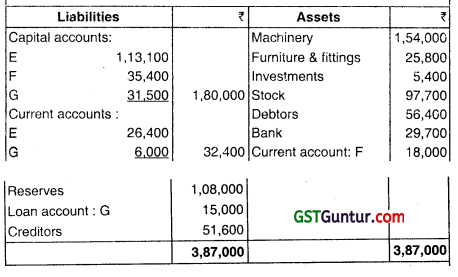

Question 21.

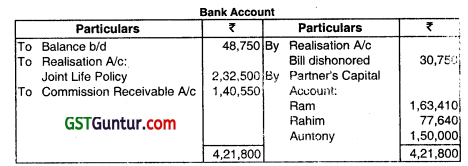

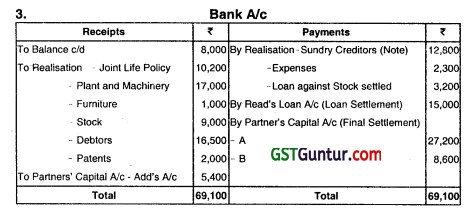

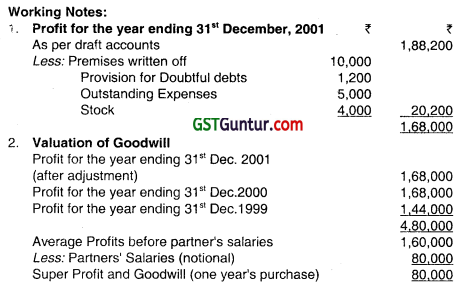

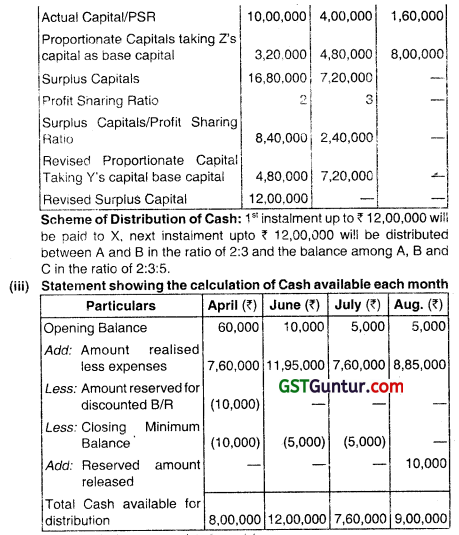

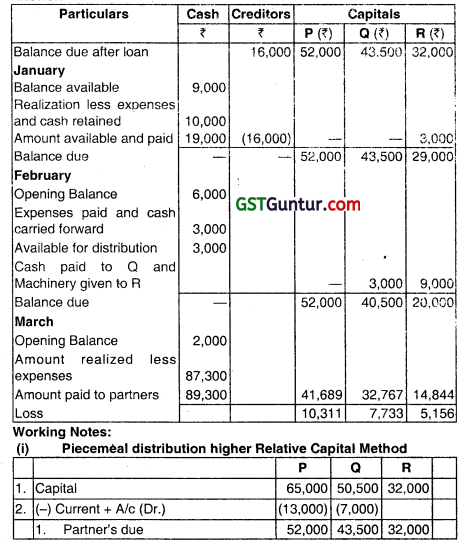

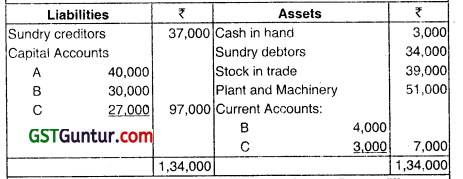

E, F and G were partners in a firm, sharing profits and losses in the ratio of 3: 2: 1, respectively. Due to extreme competition, it was decided to dissolve the partnership on 31st December 2017. The balance sheet on that date was as follows:

The realization of assets is spread over the next few months as follows: February. Debtors, ₹ 51,900; March, Machinery. ₹ 1,39,500; April. Furniture, etc. ₹ 18,000; May, G agreed to take over investment at ₹ 6,300; June, Stock, ₹ 96,000.

Dissolution expenses, originally provided, were ₹ 13,500. but actually amounted to ₹ 9,600 and were paid on 30th April. The partners decided that after creditors were settled for ₹ 50,400, all cash received should be distributed at the end of each month in the most equitable manner. You are required to prepare a statement of actual cash distribution as

received using “Maximum loss basis” method- (Nov 2018, 20 marks)

Answer:

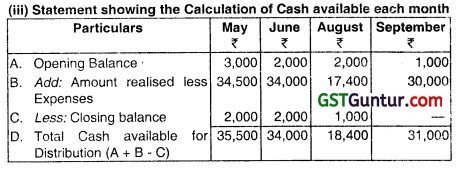

Working Note:

Statement showing the cash available for distribution:

Feb. ₹ 29,700 + 51.900 – 13,500 = ₹ 68,100

March ₹ 1,39,500

April 18000 + 3,900 = 21,900

May- Nil

June ₹ 96,000

![]()

Question 22.

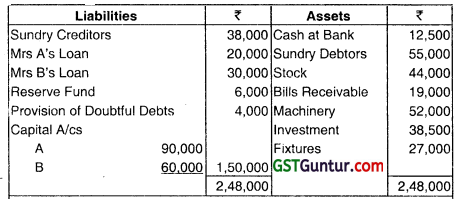

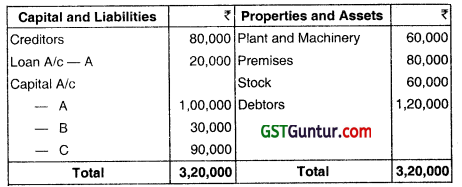

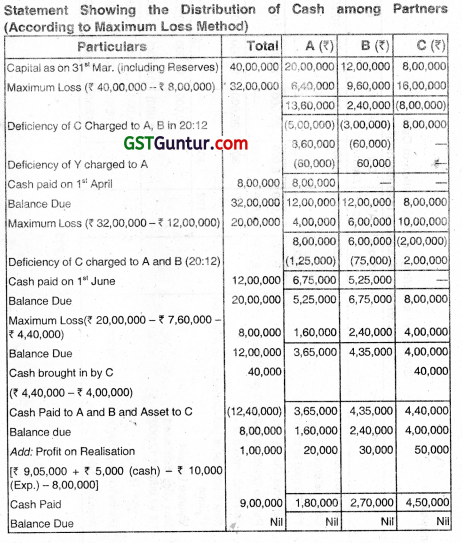

A, B and C are in Partnership. The following Is their Balance Sheet as on 31st March on which date they dissolve the partnership. They share Profit in the ratio of 5:3:2.

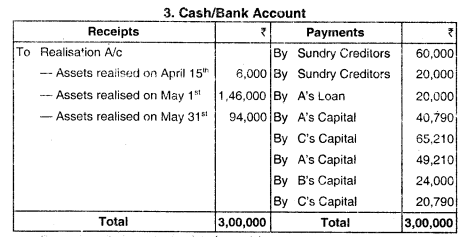

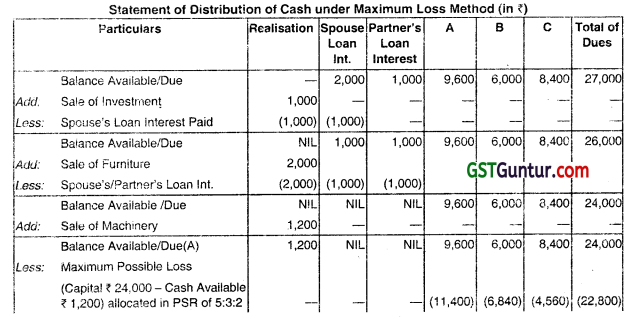

It was agreed to repay the amounts due to the Partners as and when the Assets were realised, viz. 15th April ₹ 60,000 1st May ₹ 1,46,000 31st May ₹ 94,000 Prepare a statement showing how the distribution should be made under Maximum Loss Method and write up the Cash Account and Partner’s Capital Account.

Question 23.

A, B and C are Partners. sharing Profits and Losses in the ratio of 5:3:2. Their Capitals were ₹9,600, ₹ 6,000 and ₹ 8,400 respectively. After paying Creditors, the LiabiHties and Assets of the Firm were:

Liability for Interest on Loan from: Investments 1,000

– Spouses of Partners 2,000 Furniture 2,000

– Partners 1,000 Machinery 1,200

Stock 4,000

The assets realised in full in the order in which they are listed above. B s insolvent. Prepare a statement showing the distribution of cash as and when available, applying maximum possible loss procedure.

Answer:

Question 24.

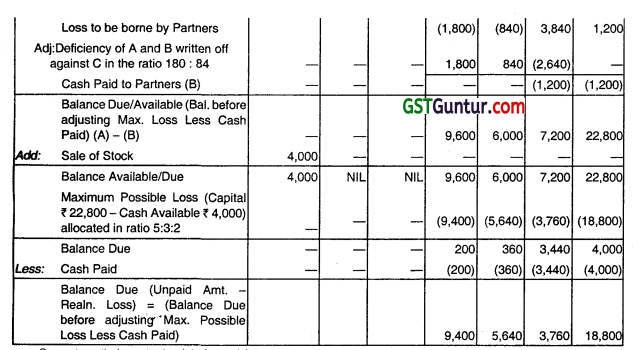

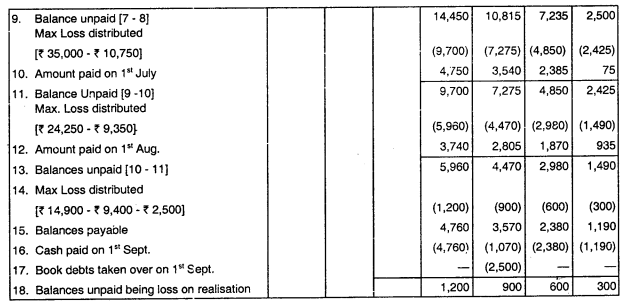

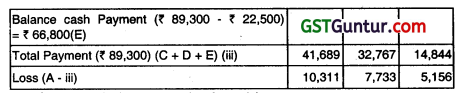

A, B, C and D were partners in a firm. The capital of the firm consisted of ₹ 40,000 contributed originally in the proportion of 4 : 3: 2 :1. The profits and losses were shared in the same proportion. The firm was dissolved on 31st March 2018. The Balance Sheet as on that date was as under:

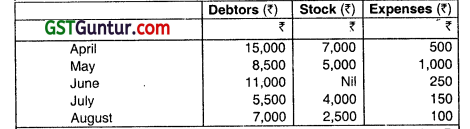

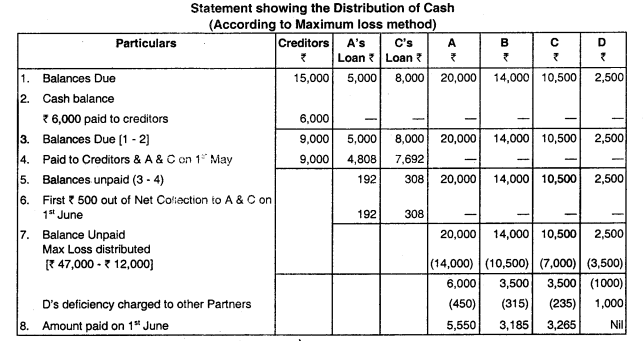

It was decided on 15th April that the net realisations should be distributed on the first of each month in the appropriate order. The realisation and expenses at the end of each month were as under:

The stock was completely disposed off. It was further agreed that B should take over the remaining debts for ₹ 2,500.

Required: Show how the cash was distributed according to Maximum Loss Method.

Answer:

Question 25.

Following is the Balance Sheet of A, B and C who were sharing in the ratio of 2:3:5 as at 31st March, 2018, when they decided to dissolve the firm:

Note: There was a bill for ₹ 10,000 due on 15th Aug. under discount.

The sundry assets were realised as follows:

1st April ₹ 7,70,000 Expenses ₹ 10,000

1st June ₹ 12,35,000 Expenses ₹ 40,000

1st July ₹ 780,000 Expenses ₹ 20,000

1st July z decided to take some sundry assets having book value of ₹ 1,00,000 at ₹ 4,40,000

15th Aug. ₹ 9,05,000 Expenses ₹ 20,000

Partners decided to keep a minimum cash balance of ₹ 10,000 in the first two months and ₹ 5,000 thereafter. The acceptor of the bill under discount met the bill on the due date. Prepare the Statement showing the distribution of cash among the partners according to (a) Maximum Loss Method (b) Proportionate Capital Method.

Answer:

Question 26.

What is Piecemeal payments method under Partnership Dissolution?

Briefly explain the two methods to flowed for determining the order in which the payments are made? (May 2010, 4 marks)

Answer:

Assets sold in case of dissolution of partnership are realised only in small instalments over a period of time. In such situation, the choice is either to distribute whatever is collected or to wait till the whole amount is collected. Generally, the first course is adopted. in order to ensure that the distributed cash amongst the partners is in proportion to their interest in the partnership concern either of the two methods described below may be followed for determining the order in which the payment should be made.

(i) Maximum Loss Method: Each instalment realised is considered to be the final payment i.e. outstanding assets and claims are considered worthless and partners’ accounts are adjusted on that basis each time when a deposit is made following either Gamer Vs. Murray rule or the profit sharing ratio rule.

(ii) Highest Relative Capital Method: Under this method, the partner who has the higher relative capital, that is, whose capital is greater in proportion to his profit-sharing ratio is first paid off. This method is also called as a proportionate capital method.

![]()

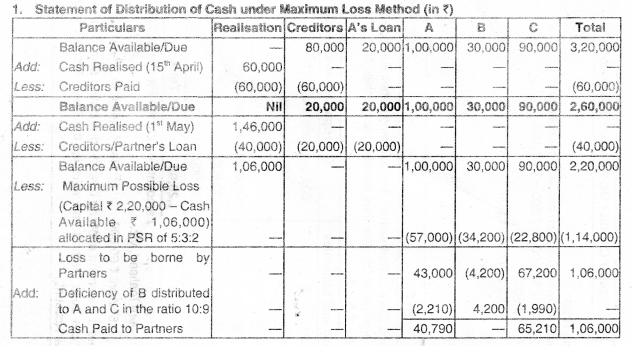

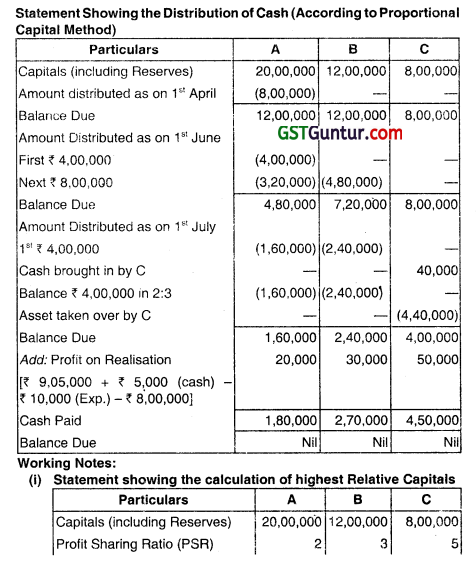

Question 27.

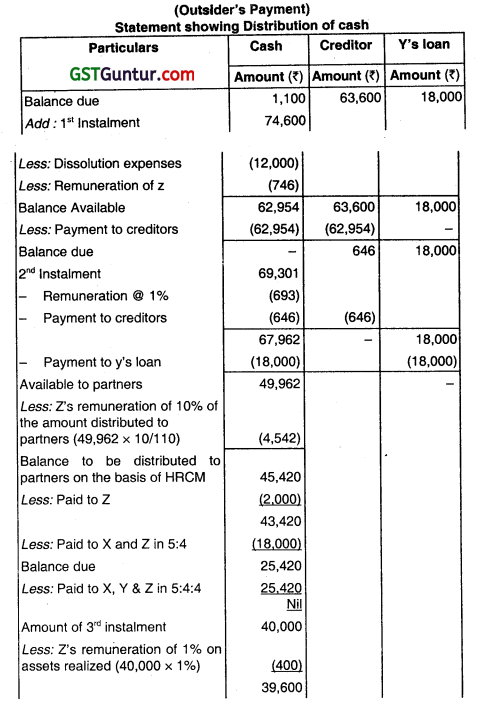

Aay Enterprise, a Partnership firm in which A, B and C are three partners sharing profits arid losses in the ratio of 4: 3 : 3. The balance sheet of the firm as on 31st December 2011 is as below:

| Liabilities | ₹ | Assets | ₹ |

| A’s Capital | 15,000 | Factory Building | 24,160 |

| B’s Capital | 7,500 | Plant & Machinery | 16,275 |

| C’s Capital | 15,000 | Debtors | 5,400 |

| B’s Loan A/c | 4,500 | Stock | 12,390 |

| Sundry Creditors | 16,500 | Cash at Bank | 275 |

| 58,500 | 58,500 |

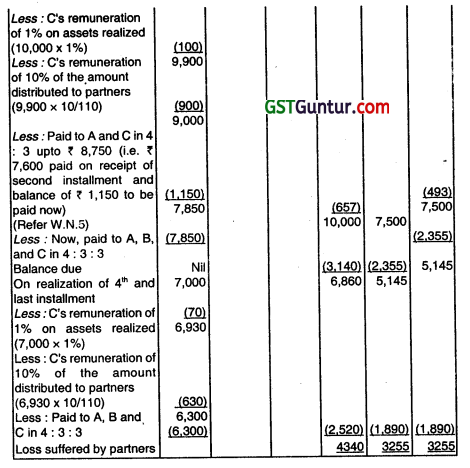

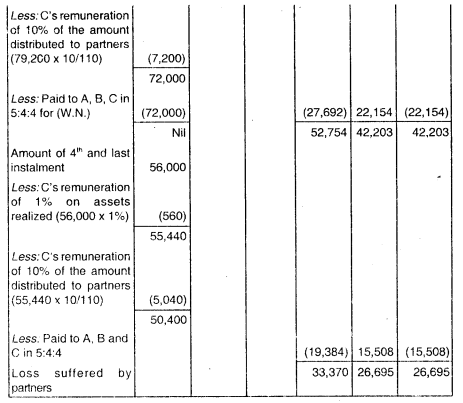

On balance sheet date all the three partners have decided to dissolve their partnership. Since the realization of assets was protracted, they decided to distribute amounts as and when feasible and for this purpose they. appoint C who was to get as his remuneration 1% of the value of the assets realized other than cash at Bank and 10% of the amount distributed

to the partners.

Assets were realized piece-meal as under

First instalment ₹ 18,650

Second instalment ₹ 17,320

Third instalment ₹ 10,000

Last instalment ₹ 7,000

Dissolution expenses were provided for estimated amount of ₹ 3,000

The creditors were settled finally for ₹ 15,900

Prepare a statement showing distribution of cash amongst the partners by higher Relative capital method’. (May 2012, 16 marks)

Answer:

Working Note:

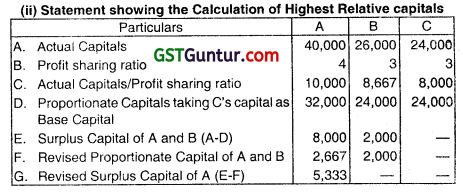

Computation of amount paid to partners on the basis of Highest Relative Capital Method

Therefore, first ₹ 3,750 will be paid to C. Then A and C will recekde in proportion of 4 : 3 up to ₹ 8,750 to bring the capital of all partners A, 13 and C in proportion to their profit sharing ratio. Thereafter, balance available will be paid to all partners viz A, B and C in their profit sharing ratio of 4: 3: 3.

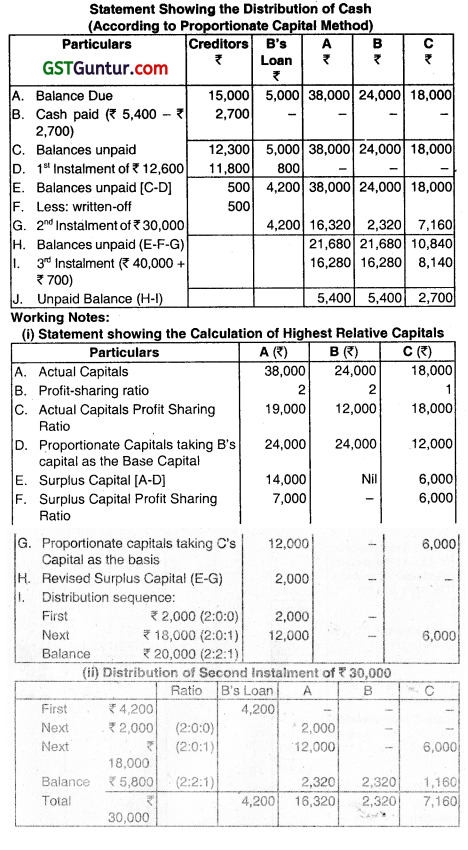

Question 28.

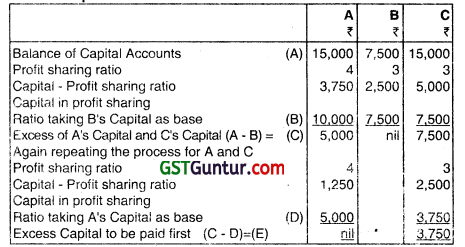

The partners P, Q & R have called you to assist them in winding up the affairs of their partnership on 31.12.2013. Their balance sheet as on that date is given below:

| Liabilities | Amount ₹ | Assets | Amount ₹ |

| Capital Account: | Land & Building | 50,000 | |

| P | 65,000 | Plant & Machinery | 46,000 |

| Q | 50,500 | Furniture & Fixture | 10,000 |

| R | 32,000 | Stock | 14,500 |

| Sundry Creditors | 16,000 | Debtors | 14,000 |

| Cash at Bank | 9,000 | ||

| Loan P | 13,000 | ||

| Loan Q | 7,000 | ||

| Total | 1,63,500 | Total | 1,63,500 |

(a) The partners share profit and losses in the ratio of 4: 3: 2.

(b) Cash is distributed to the partners at the end of Lach month.

(c) A summary of liquidation transactions are as follows:

January 2014

₹ 9,000 collected from debtors; balance is uncollectabte.

₹ 8,000 – received from the sale of entire furniture

₹ 1,000 – Liquidation expenses paid.

₹ 6,000 – Cash retained in the business at the end of month February 2014

₹ 1,000- Liquidation expenses paid.

As part payment of his capital, R accepted a machinery for ₹ 9,000 (book value ₹ 3,500)

₹ 2,000 – Cash retained in the business at the end of month March 2014

₹ 38,000 – received on the sale of remaining plant and machinery.

₹ 10,000 – received from the sale of entire stock.

₹ 1,700 – Liquidation expenses paid.

₹ 41,000- Received on sale of land & building.

No Cash is retained in the business.

You are required to prepare a schedule of cash payments amongst the partners by “Higher Relative Capital Method” (May 2014, 16 marks)

Answer:

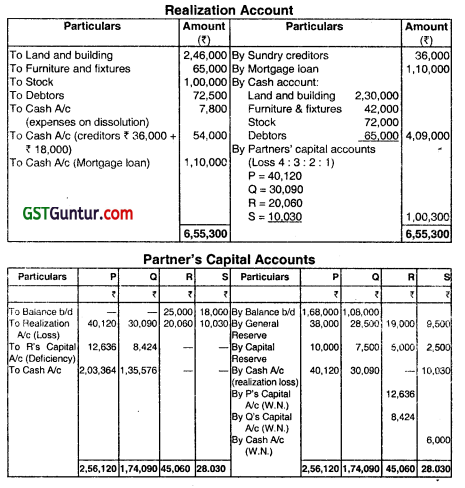

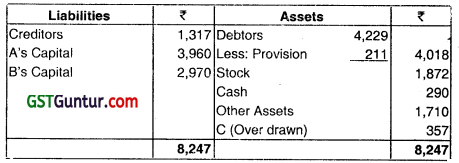

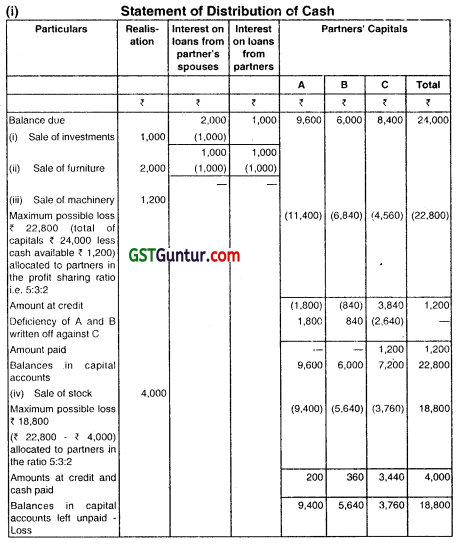

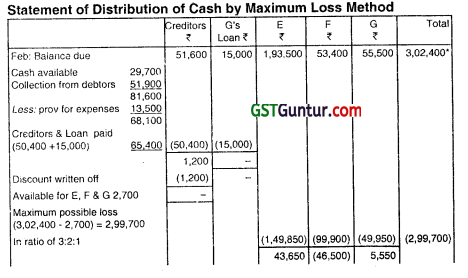

Question 29.

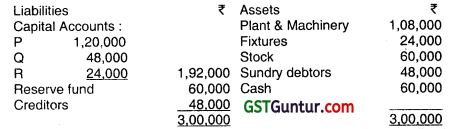

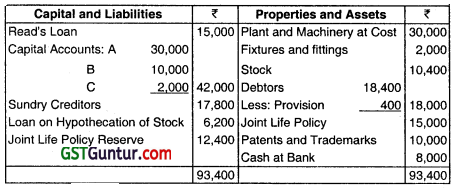

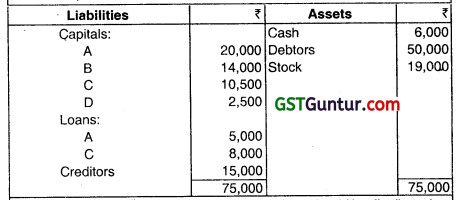

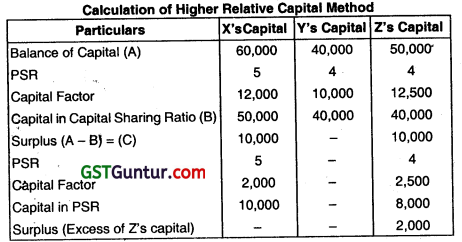

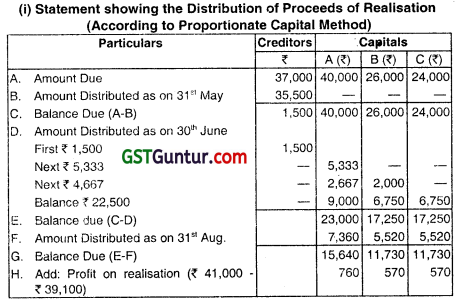

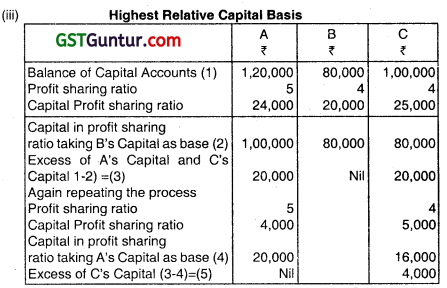

X, V and Z are In partnership sharing profits and losses in the ratio of 5: 4: 4. The Balance Sheet of the firm as on 31st March 2016 is as below:

| Liabilities | Amount (₹) | Assets | Amount (₹) |

| X’s Capital | 60,000 | Factory Building | 96,640 |

| Y’s Capital | 40,000 | Plant and Machinery | 65,100 |

| Z’s Capital | 50,000 | Trade Receivable | 21,600 |

| Y’s Loan | 18,000 | Inventories | 49,560 |

| Trade Payable | 66,000 | Cash at Bank | 1,100 |

| 2,34,000 | 2,34,000 |

On Balance Sheet date, alt the three partners have decided to dissolve their partnership. Since the realisation of assets was protracted, they decided to distnbute amounts as and when feasible and for this purpose they appoint Z who was to get as his remuneration 1% of the value of the assets realised other than cash at bank and 10% of the amount distributed

to the partners.

Assets were realised Piecemeal as under:

₹

First instalment 74,600

Second instalment 69,301

Third instalment 40,000

Last instalment 28000

Dissolution expenses were provided for estimated amount of ₹ 12,000

The creditors were settled finally for ₹ 63,600

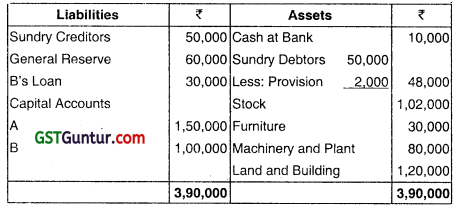

You are required to prepare a statement showing distribution of cash amongst the partners by Highest Relative Capital Method”. (Nov 2016, 16 marks)

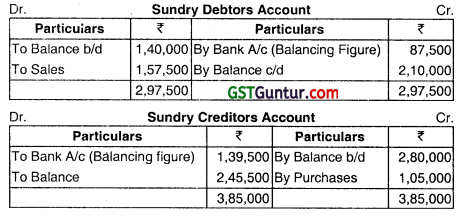

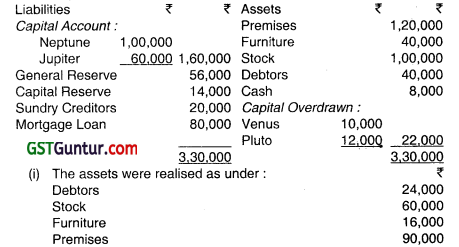

Answer:

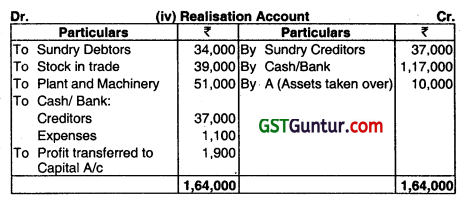

Therefore, at first ₹ 2,000 is to be paid to Z, then X and Z to be paid in proportion of 5:4 upto ₹ 18,000 to bring the capital of all partners X, Y and Z in proportion to their profit sharing ratio. Thereafter, balance available will be paid in the profit sharing ratio 5:4:4 to all partners viz X, Y and Z.

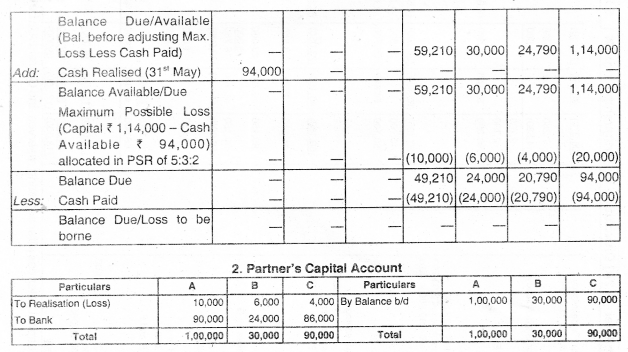

![]()

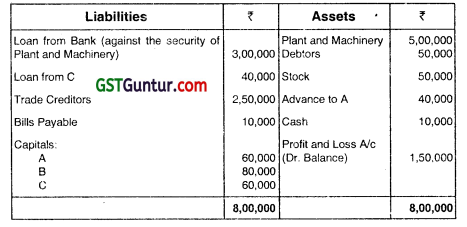

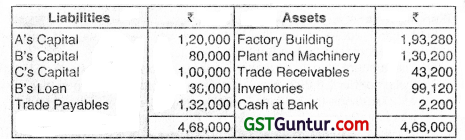

Question 30.

Ananya Enterprises is a partnership firm is which A, B and C are three partners sharing profits and losses in the ratio of 5: 3: 2. The Balance Sheet of the firm as on 31st October, 2019 is as below:

On the Balance Sheet date all the three partners have decided to dissolve their partnership and called you to assist them In winding up the affairs of the firm. They also agreed that asset realisation is distributed among them at the end of each month.

A summary of liquidation transactions is as follows:

November 2019

₹ 3,00,000 – collected from debtors, balance is uncollectable

₹ 11,00,000 – received from the saie of entire furniture

₹ 2,00,000 – liquidation expenses paid

₹ 6,00,000 – Cash retained in the business at the end of month

December 2019

₹ 2,20,000 – Liquiciavon expenses paid

As part payment of his capital, C accepted a machinery for ₹ 9,00,000 (Book value ₹ 6,00,000)

₹ 2,00,000 – Cash retained in the business at the end of month.

January 2020

₹ 28,00,000 – Received on the sale of remairing plant & machinery

₹ 9,00,000 – Received f rom the sale of entire stock

₹ 1,50,000 – Liqwdation expenses paid

₹ 63,00,000 – Received on sale of Land & Buildings

No cash is retaned in the business.

You are required to prepare a schedule of cash payments amongst the partners by “Highest Relative Capital Method” as on 31st January, 2020. (Jan 2021, 15 marks)

Question 31.

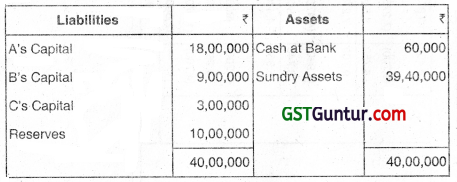

The firm of Rich persons presented you with the following Balance Sheet drawn as on 31st March, 2018:

Partners shared profits and losses in the ratio of 4:3:3. Dueto differences among the partners, it was decided to wind up the firm, realise the assets and distribute cash among the partners at the end of each month. The following realisations were made:

(i) May ₹ 15000 from debtors and ₹ 20,000 by sale of stock. Expenses on realisation were ₹ 500.

(ii) June Balance of debtors realised ₹ 10,000. Balance of stock fetched ₹ 24,000.

(iii) August Part of machinery was sold for ₹ 18,000, Expenses incidental to sale were ₹ 600.

(iv) September Part of machinery valued in the books at ₹ 5,000 was taken by B, in part discharge at an agreed value of ₹ 10,000. Balance of machinery was sold for ₹ 30,000 (net).

Partners decided to keep a minimum cash balance of ₹ 2,000 in the first 3 months and ₹ 1,000 there after. Show how the amounts due to partners will be sottled.

Answer:

Working Notes:

(i) Assumption: As the firm is dissolved duo to differences among the partners. all partners are presumed to be solvent and the problem has been worked out on the basis of the highest relative capital.

While distributing surplus among partners, 1st instalment up to ₹ 5,333 will be paid to A, next instalment up to ₹ 4,667 will be distributed between A and B in the ratio 01 4:3 and the Balance among A. B and C in the ratio of 4:3:3.

Question 32.

A partnership firm was dissolved on 30th June, 2011. Its Balance Sheet on the date of dissolution was as follows:

The assets were realised in instalments and the payments were made on the proportionate capital basis. Creditors were paid ₹ 14,500 in full settlement of theIr account. Expenses of realisation were estimated to be ₹ 2,700 but actual amount spent on this account was ₹ 2,000. This amount was paid on 15th September. Draw up a Memorandum of distribution of

Cash, which was realised as follows:

On 5th July ₹ 12,600

On 30th August ₹ 30,000

On 15th September ₹ 40,000

The partners shared profits and losses in the ratio of 2:2:1.

Answer:

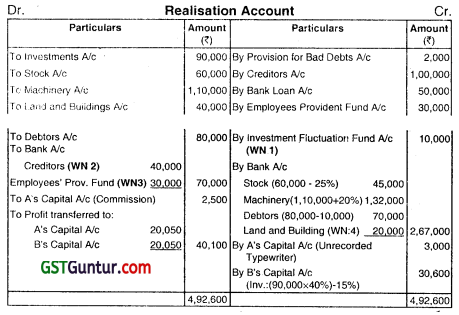

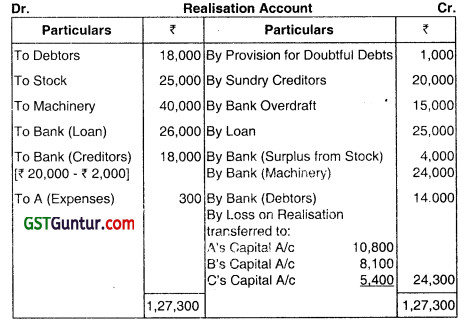

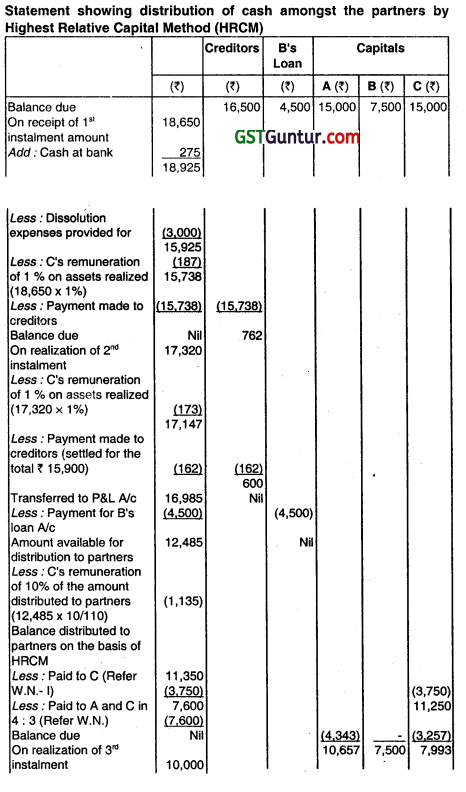

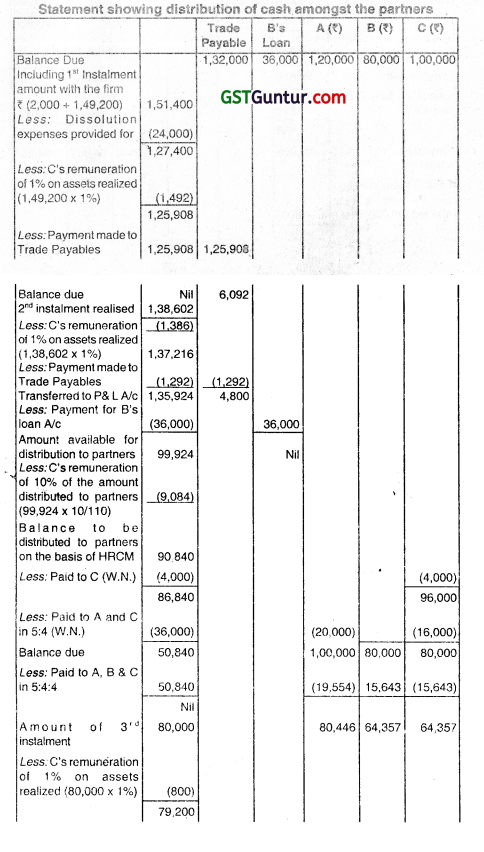

Question 33.

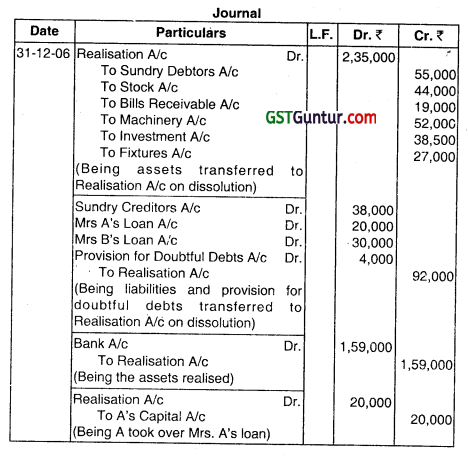

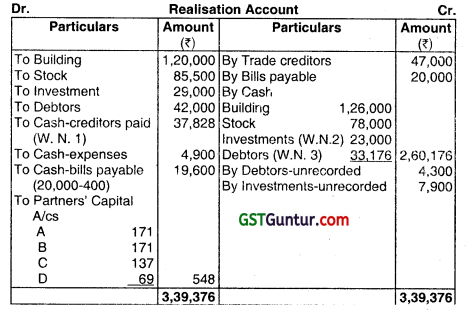

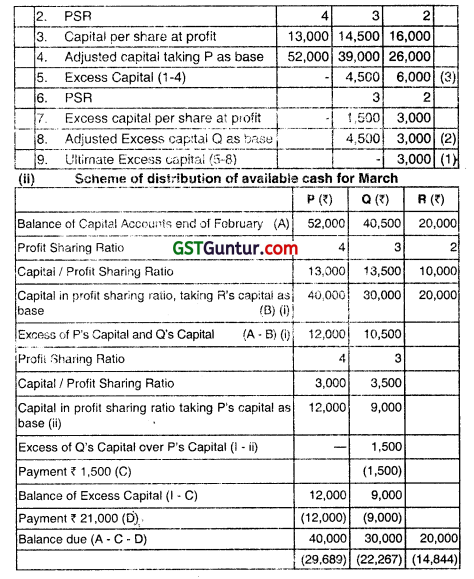

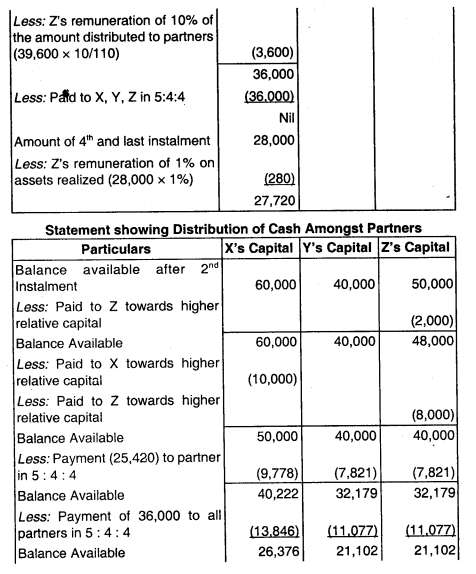

A, B and C are in partnership sharing profits and losses in the ratio of 5:4:4. Ihe Balance Sheet of te firm as on 31st March, 2018 Is as below:

On Balance Sheet date, all the three partners have deciled to dissolve their partnership. The partners decided to distribute amounts as and when feasible and br this purpose tney appoint C who was to get as his remuneration 1% of the value of the assets realised other than cash at bank and 10% of the amount distributed to the partners. Assets were realised piecemeal as under:

You are required to prepare a statement showing distribution of cash amongst the partners by Highest Relative Capital Method”.

Answer:

Working Note

(i) ₹ 2,200 added lo the first instalment received on sale of assets represents the Cash in Bank

(ii) The amount due to Creditors at the end of the utilization of First Instalment is ₹ 6,092. However, since the creditors were settled for ₹ 1,27,200 only the balance ₹ 1,292 were paid and the balance ₹ 4,800 was transferred to the Profit & Loss Account.

Therefore, firstly ₹ 4,000 is to be paid to C, then A and C to be paid in proportion of 5:4 up to ₹ 36,000 to bring the capital of all partners A, B and C in proportion to their profit sharing ratio. Thereafter, balance available will be paid in the profit sharing ratio 5:4:4 to all partners viz A, B and C.

![]()

Question 34.

Answer the following:

Under what circumstances, an LLP can be wound up by the Tribunal. (May 2015, May 2017, 4 marks each)

Answer:

- Circumstances when an LLP can be wound up by the tribunal:

- The partnership shall be dissolved if there is unlawful object of the firm.

- The partnership firm shall be dissolved when all the partners become insolvent.

- The partnership firm is dissolved by order of court.

- If there is any criminal law or case on the firm, the firm shall be dissolved.

- If partnership is under loss on continuous basis then firm shall be dissolved by the tribunal.

- If partnership violates any rule of partnership Act then court may give order for dissolution,

Question 35.

Answer the following:

What are the distinction between an Ordinary Partnership Firm and a Limited Liability Partnership (LLP)? (May 2016, 4 marks)

Answer:

Distinction between an Ordinary Partnership Firm and a Limited Liability Partnership (LLP):

| Basis of Difference | Partnership | LLP |

| 1. Applicable Law | Indian Partnership Act, 1932. | Limited Liability Partnerships Act, 2008. |

| 2. Formation | Formed by an Agreement. | Formed by Law. |

| 3. Registration | Optional. | Compulsory with ROC. |

| 4. Body Corporate | Not a body corporate | A Body Corporate after registration with ROC, it becomes a body corporate. |

| 5. Separate Legal identity | It has no separate legal Identity. | All body corporate are said to have a separate legal identity. |

| 6. Perpetual Succession | No perpetual succession. | It has perpetual succession. |

| 7. Number of Partners | Minimum 2 and Maximum 100. | Minimum 2 but no Maximum limit. |

| 8. Liability of Partners/ Members | Liability of the partners is unlimited. Partners are severally and jointly liable for actions of other partners and the firm and their liability extends to personal assets. | Liability of the partners is limited to the extent of their contribution towards LLP except in case of intentional fraud or wrongful act of omission or commission by a partner. |

| 9. Principal Agent Relationship | Partners are the agents of the firm and of each other i.e. Mutual agency. | Partners ace agents of the firm only and not of other partners. No Mutual agency. |

Question 36.

Write short notes on Designated Partner ¡n a Limited Liability Partnership land what are their liabilities. (Nov 2016, 4 marks)

Answer:

Designated Partners:

As per Sec. 7 of the LLP Act, every limited liability partnership shall have at least two designated partners who are individuals and at least one of them shall be a resident in India. Provided that in case of a limited liability partnership in which all the partners are bodies corporate or in which one or more partners are individuals and bodies corporate, at least two individuals who are partners of such limited liability partnership or nominees of such bodies corporate shall act as designated partners.

Explanation:

Subject to the purpose of this Section the term resident in India means a person who has stayed in India for a period of not less 182 days during the immediately preceding one year. Subject to the provisions of sub-section (1).

1. lIthe incorporation document:

(a) Specifies who are to be designated partners, such person shall be designated partners on ‘incorporation; or

(b) States that each of the partners from time to time of limited liability partnership is to be designated partner, every such partner shall be a designated partner.

2. Any partner may become a designated partner by and in accordance with the limited liability partnership agreement and a partner may cease to be a designated partner in accordance with limited liability partnership agreement.

3. An individual shall not become a designated partner in any limited liability partnership unless he has given his prior consent to act as such to the limited liability partnership in such form and manner as may be prescribed.

4. Every limited liability partnership should file with the registrar the particulars of every individual who has given his consent to act as designated partner in such form and manner as may be prescribed within thirty days of his appointment.

5. An individual eligible to be a designated partner shall satisfy such conditions and requirements as may be prescribed.

Liabilities of Designated Partners: As per Sec. 8 of LLP Act, unless expressly provided otherwise in this Act, a designated partner shall be:

(a) responsible for the doing of all acts, matters and things as are required to be done by the LLP in respect of compliance of the provisions of this Act including filing of any document, return, statement and the like report pursuant to the provision of this act and as may be specified the limited liability partnership agreement; and

(b) liable to all parties imposed on the limited liability partnership for any contravention of those provisions.

Liabilities of Designated Partners:

As per Sec. 8 of LLP Act, unless expressly provided otherwise in this Act, a designated partner shall be:

(a) responsible for the doing of all acts, matters and things as are required to be done by the LLP in respect of compliance of the provisions of this Act including filing of any document, return, statement and the like report pursuant to the provision of this act and as may be specified in the limited liability partnership agreement; and

(b) liable to all parties imposed on the limited liability partnership for any contravention of those provisions.

Question 37.

Explain the nature of Limited Liability Partnership. Who can be a designated partner In a Limited Liability Partnership? (Nov 2017, 4 marks)

Answer:

1. Nature of LLP:

| Point | LLP |

| Governing law | The Limited Liability Partnership Act, 2008 |

| Registration | Registration with registrar of LLP mandatory. |

| Name | Name should contain limited liability partnership as suffix. |

| Creation | Created by law |

| Separate entity | Separate legal entity under LLP Act, 2008. |

| Perpetual succession | LLP has perpetual succession, and partners may come and go. |

| Legal proceedings | A LLP is a legal entity can sue and be sued. |

| Annual filing of forms | Annual statement of Accounts and Solvency & Annual return to he filed with registrar every year. |

| Digital signature for partners | As e-forms are filled electronically at least one designated partner should have digital signature. |

| Agency Relationship | Partners act as agents of LLP and not of the other partners. |

| Liability o f Partners | Limited, to the extent their contribution towards LLP, except in case of. Intentional fraud or wrongful act of omission cx commission by partner. |

2. Designated partners:

Sec. 7 of LLP Act deals with designed partners, and Sec. 8 deals with liabilities of Designated partners, given below:

(a) Every LLP shall at least 2 designated partners (DPs).

(b) DPs shall be individuals only.

(Note: If all partners of LLP are bodies corporate, or one or more partners are individuals or bodies corporate, at least 2 individuals who are partners of such LLP or Nominees of such bodies corporate, shall act as designated partners).

(c) At least I OP should be resident in India.

(Note: Resident means a person who has stayed in India 182 days during. The immediately preceding 1 year).

(d) An individual can become a DP in any LLP, only if he has given his consent to act as such, to the LLP.

Question 38.

Write short notes on extent of liability of LLP and its Partners. (May 2018, 5 marks)

Answer:

Under Sec. 27(3) of the LLP Act, 2008 an obligation of an LLP arising out of a contract or otherwise, shall be solely the obligation of the LLP. The limitations of liability of an LLP and its partners are as follows:

- The liabilities of an LLP shall be met Out of the properties of an LLP:

- A partner is not personally liable, directly or indirectly (for an obligation of an LLP arising out of a contract or otherwise), solely by reason of being a partner in the LLP;

- An LLP is not bound by anything done by a partner in dealing with a person, if:

- The partner does not have the authority to act on behalf of the LLP in doing a particular acts, and The other person

- knows that the partner has no authority of does not know or believe him to be a partner in the LLP.

- The liability of the LLP and the partners perpetrating fraudulent dealings shall be unlimited for all or any of the debts or other liabilities of the LLP.

![]()

Question 39.

Answer the following:

Under what circumstances an LLP can be wound up by the tribunal? (Nov 2020, 5 marks)