Non Resident Indians or NRIs love to connect with India all the time. Generally, Indians immigrate to various international countries every year for higher studies, work, and business opportunities. NRIs always want to purchase houses, lands, properties, etc. in India but sometimes they won’t get enough finances to build or renovate a house or property. In such situations, NRI’s can get instant help from NRI Loan. Grab the opportunity of gaining knowledge about NRI Home Loan from this page.

- What is NRI Home Loan?

- Types of Home Loan for Non-Resident Indians or NRIs

- Assets Eligible for NRI Home Loan

- Eligibility Criteria for NRI Home Loan

- NRI Home Loan Eligibility Calculator

- How to Apply Housing Loan for NRI?

- Documents Required to Apply Online for NRI Loan in India

- What do banks examine while approving a home loan?

- Interest Rate on NRI Home Loan

- Lowest NRI Home Loan Interest Rates Nov 2021

- Extra Home Loan Fees and Charges for NRI’s

- NRI Home Loan Repayment Plan

- Maximum Loan Amount and Repayment Period of Housing Loan

- Tax Benefits for NRI Housing Loan

- Non Resident Indians (NRI) Home Loan EMI Calculator

- Key Points to Remember for NRI Loan

- FAQs on NRI Home Loan in India

What is NRI Home Loan?

Home Loan and NRI Home Loan are slightly similar to each other. The main motive of a home loan in India is providing financial assistance to purchase or renovate the home. Whereas NRI Home Loan is also the same as buying a house property in India with the help of lenders or bankers.

Purchasing land or house in India will make them feel connected to their roots. An extensive variety of home loans is available to NRIs to buy their home. Each financial institution or bank has its own set of rules and norms. Some banks like HFC or NBFC in India give home loans for NRIs at attractive interest rates.

Banks provide finance of upto 80% to 85% of the value of the property, subject to the Gross Monthly Income (GMI) of an NRI. Also, some financial institutions and banks provide personal loans for NRI.

Types of Home Loan for Non-Resident Indians or NRIs

The following are the NRI Home Loan Types that can pick by an individual as per their purpose of the home loan:

1. Plot Loans: Loans are granted against the purchase of residential plots for the house construction within 3 years time period.

2. Top Up Loan: Top Loan is an additional loan over a home loan provided to existing customers.

3. Home Improvement Loans: Home Improvement loans are available for existing as well as new customers.

4. Home Balance Transfer: Balance Transfer or Takeover of your existing home loan with another financial institution is also possible.

5. Home Renovation Loans: Home Renovation loans are available for existing as well as new customers.

Recommended Pages:

Assets Eligible for NRI Home Loan

For any of the below-mentioned housing assets, you can easily avail NRI Home Loan from banks/lenders:

- Purchasing of a plot

- Construction of property on an owned plot

- Under development

- Ready for possession

- Corrections/ extension of the current property

- For taking over of the Home Loan liability from another lender (re-finance)

Eligibility Criteria for NRI Home Loan

The following table helps NRI candidates to check their minimum eligibility conditions before applying for a home loan in India:

| Eligibility Criteria | Salaried and Self-Employed |

|---|---|

| Income Criteria | Minimum salary for Home Loan Rs.5 lakhs per month |

| Age Criteria | Minimum: 21 years Maximum: 70 years |

| Loan Tenure | Up to 30 years |

| Loan Amount | The loan amount varies from bank to bank starting from 70% of property value to no cap where the loan amount is based on repaying capability of the borrower |

| Interest Rate | 8.20% – 12% |

| Processing Fees | 0.25% to 3% |

| Prepayment Charges | Nil to a maximum of 2% |

| Late Payment Charges | 1% to 3% |

| Nationality | Indian |

NRI Home Loan Eligibility Calculator

Satisfying the minimum eligibility will help you proceed further to take a home loan. Every home loan eligibility relies on different factors such as your monthly income, current age, credit score, fixed monthly financial obligations, credit history, retirement age, etc.

This eligibility calculator supports you to understand how much loan you can obtain from a bank on the basis of the specified parameters. It is hassle-free and too easy to navigate. Simply give the needed details in the fields and click on the button to comprehend how much loan you are eligible for.

How to Apply Housing Loan for NRI?

NRI can apply for a home loan to the lender by submitting the duly filled application form & important documents either directly or through a POA holder. Follow the steps carefully,

- Firstly, NRI should meet the required eligibility criteria of a Home loan.

- Next, you have to get the application form to apply for NRI Housing Loan.

- There are two ways. One is by visiting the lender physically and the other is online by referring to the website of the lender.

- Now, fill the application form and gather all the required documents to submit.

- After submission, the lender will take time to accept or reject your application and offer a Home loan for NRI.

Documents Required to Apply Online for NRI Loan in India

In order to apply home loan for NRIs, the submission of the following documents to the lender is required:

- KYC documents:

- Proof of residence

- Passport

- Income documents:

- Last 3 months’ Salary Slips

- Photocopy of the Employment Contract / Appointment Letter / Offer Letter

- Photocopy of last 6 months Bank Statements of the NRE / NRO account in India

- Credit Bureau Report – Check CIBIL Score Free (in case available in the country where you are residing)

- Photocopy of last 6 months Bank Statements, showing salary credits

- Photocopy of last 6 months Bank Statements of the NRE / NRO account in India

- Property Documents (in case property is identified):

- Proof of ownership of property

- Up to date tax paid receipt

- The allotment letter of the builder/society in terms of flats.

What do banks examine while approving a home loan?

Banks consider the following:

- Your credit score

- Your annual income

- Status of existing loans

- Number of years you have been staying overseas

- Your business details, including the number of years it has been operational overseas

- The type of property you are planning to purchase or construct

- The co-applicants credit score and additional details

Interest Rate on NRI Home Loan

NRI Loan Interest rate for Housing will vary as per the risk score of the customer. Available lowest NRI home loan interest rate is starting from 6.85% p.a which is quite engaging and on the lower side in comparison to all other categories of loans.

Lowest NRI Home Loan Interest Rates Nov 2021

| Banks | Interest Rates |

| SBI | 6.90% – 7.50% p.a. |

| Bank of Baroda | 6.85% – 7.20% p.a. |

| PNB Housing Finance Limited | 7.50% – 9.70% p.a. |

| Axis Bank | 6.90% – 8.55% p.a. |

| HDFC Ltd. | 6.90% – 8.00% p.a. |

| Canara Bank | 6.90% – 8.90% p.a. |

| Federal Bank | 7.90% – 8.05% p.a. |

| Bank of India Star Pravasi Home Loan | 6.90% onwards |

| Indian Overseas Bank | 7.05% – 7.30% p.a. |

| Indiabulls | 8.99% p.a. |

| ICICI NRI Home loan | 6.90% – 8.05% p.a. |

| Rate of Interests (Floating – Linked to LHPLR) Current LHPLR – 14.70% | ||

| Loan Slab (CIBIL >= 700) | Salaried & Professional | Non-Salaried & Non-Professional |

|---|---|---|

| Up to 2 crs | 6.66% | 6.66% |

| More than 2 crs & up to 15 crs (For Griha sidhi/Apna Ghar/Advantage plus) | 6.90% | 7.00% |

| More than 2 crs & upto 3 crs (2020 Homecoming) | 7.10% | 7.20% |

| More than 3 crs & upto 5 crs (2020 Homecoming) | 7.20% | 7.30% |

Extra Home Loan Fees and Charges for NRI’s

| Processing Fee | Up to 2% of the loan amount |

| Foreclosure Charges | Up to 4% of the total outstanding |

| Loan Conversion Fees | As per the bank’s discretion |

| Cheque Return Charges | Up to Rs.500 per instance |

| Duplicate Statement Issuance Charges | Up to Rs.250 per instance |

| Title Documents Photocopy Issuance Charges | Up to Rs.250 per instance |

| Duplicate NOC Issuance Charges | Up to Rs.500 per instance |

| Credit Report Issuance Charges | Up to Rs.50 per instance |

NRI Home Loan Repayment Plan

Loan repayment is in Equated Monthly Installments (EMI) containing principal and interest via Post Dated Cheques/ Electronic Clearance System across whole loan tenure.

The repayment of home loans for NRI can be possible through Non-resident External (NRE) or Non-resident Ordinary (NRO) accounts with the allowance from abroad. Hence, they need to have an NRE/ NRO account in India to produce EMI payments. The major point about repayment is it has to be made in Indian Rupees only.

Maximum Loan Amount and Repayment Period of Housing Loan

Here is the subject to the repaying potential and age of the applicant.

Loan to Property Cost

- 90% of Property value for loan upto Rs.30 lakh

- 80% of Property value for loan more than Rs. 30 lakh and upto Rs.75 lakh

- 75% of Property value for loan above Rs.75 lakh

Maximum NRI Housing Loan Repayment Tenure

- For salaried upto 30 years

- For self-employed upto 20 years

In the range of 5 to 30 years, there is an availability of an NRI Loan. Also, the tenure of home loans for NRI may get extended by the lenders even beyond 20 years in rare cases, subject to the eligibility of the NRI.

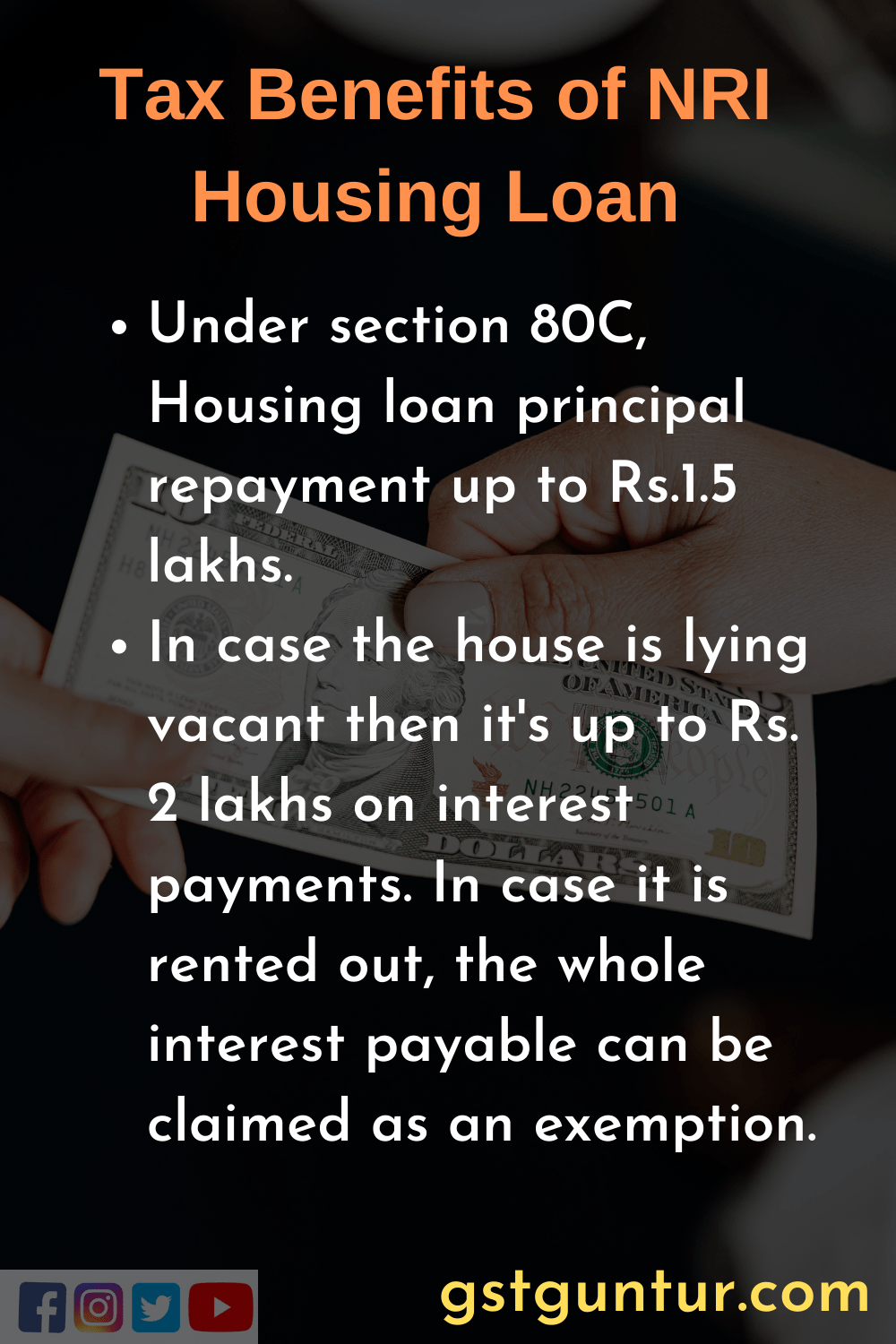

Tax Benefits for NRI Housing Loan

NRI’s are eligible for a tax deduction on interest paid and loan repayment on the home loan according to the income tax definition and register your income tax returns in India.

Applying candidates are eligible for deduction of:

- Under section 80C, Housing loan principal repayment up to Rs.1.5 lakhs.

- In case the house is lying vacant then it’s up to Rs. 2 lakhs on interest payments. In case it is rented out, the whole interest payable can be claimed as an exemption.

Non Resident Indians (NRI) Home Loan EMI Calculator

One of the main aspects that NRI or every Indian citizen needed while clearing the loan to lenders is the EMI Calculator. It helps people to understand how much you will have to pay as EMI. You can find the home loan EMI calculator by visiting the official website of the bank.

You have to enter the data in the given fields like Loan Amount, Interest Rate, and Tenure in years. Once you click on the submit button then it will automatically calculate the NRI housing loan EMI amount to be paid to the respective bank.

Key Points to Remember for NRI Loan

- It is essential for NRI’s to verify their housing status in accordance with Foreign Exchange Management Act, 1999 (FEMA) and the Income-tax Act, 1961.

- Non-Resident Indians (NRIs) are not allowed to purchase agricultural land out of NRI Home Loan.

- It is advisable for NRI to nominate a Power of Attorney(POA) in India who will perform on his/her behalf in his/her absence.

- Need to hold an NRE/ NRO account in India to make EMI payments.

- They can buy property in India matter to completion of required conditions.

FAQs on NRI Home Loan in India

1. Can I get home loan as NRI?

Yes, you can take an NRI Home loan for various housing needs that involves the purchase of flat/house/plot, construction, and towards costs of renovating/repair of the current residence. NRI Housing Loans are available with the lowest interest rate beginning from 6.85% p.a.

3. How much home loan can NRI get in India?

In case, the loan amount is Rs.30 lakhs, NRI can receive a maximum of 90% funding, 80% funding up to Rs.75 lakhs, and 75% funding for loan amounts above Rs.75 lakhs.

4. What is the maximum loan amount can be offered to NRI who is purchasing property in Tier I cities?

The maximum loan amount that can be obtained to NRI to purchase a property in Tier I Cities is up to Rs 150 lakhs.

5. Is there any penal charge for Bank NRI Home Loans?

Of course yes, on missing the payments there is a penal charge for NRI’s that is levied as per bank policy.

6. Which bank is best for NRI home loan in India?

Here is the list of the top 5 banks which are best to apply online for home loans in India:

- SBI.

- Axis Bank.

- Bank of Baroda.

- Citibank.

- ICICI.

7. What are the types of Interest rates on NRI Home Loan?

Basically, the following two types of interest rates for NRI Home Loan are available for NRI’s to choose from while applying for the housing loans.

- Floating Rate Loans

- Fixed Rate Loans