HDFC Bank Personal Loan: If you are searching everywhere on How to Apply for an HDFC Bank Personal Loan? If so, this article has got you covered on everything you need to know about an HDFC Bank Personal Loan. Go through the entire article to be well versed with the details like HDFC Bank Contact Details, HFC Bank Headquarters, and its Address, HDFC Bank Personal Loan Eligibility, Application Process of HDFC Bank Loan, How to get HDFC Bank PersonaL Loan, Documents needed for HDFC Bank Personal Loan, Benefits, etc.

Curious to check other banks’ offered Personal loan features, eligibility, interest rates, tax benefits, and a repayment plan. Go with our one-stop Personal Loan Page & swipe out your doubts within no time.

HDFC Bank

-

- About HDFC Bank

- Overview of HDFC Bank Personal Loan

- Features of HDFC Bank Personal Loan

- How to Apply for HDFC Bank Loan?

- HDFC Bank Loan Purpose

- HDFC Bank Personal Loan Eligibility

- Documents Needed for Applying for HDFC Bank Personal Loan

- HDFC Bank Personal Loan Repayment as Equated Monthly Installments

- Repayment Duration for HDFC Bank Personal Loan

- Security

- Reasons for Rejection of HDFC Personal Loan Application

- Myths regarding HDFC Personal Loan

- HDFC Bank Contact Details

- Lower Interest Rates Personal Loans as on 10th November 2021

About HDFC Bank

HDFC is a Private Sector Bank that began in India having total assets of 9712 crores. It started in Year 1994 and has its headquarters is in Mumbai. There are a total of 4014 branches and a total of 971211766 ATMs in the Country.

The Bank is known for providing financial services to its customers such as saving deposit, fixed deposit, recurring deposit, home loans, personal loan, car loan, education loan, gold loan, PPF account, lockers, net banking, mobile banking, RTGS, NEFT, IMPS, E-Wallet, Pradhan Mantri Suraksha Bima Yojana, Atal Pension Yojana, Pradhan Mantri Jandhan Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana and many more.

Products of HDFC Bank

| Home Loan | Personal Loan |

| Education Loan | Business Loan |

| Car Loan | Two Wheeler Loan |

| Gold Loan | FD Interest Rates |

| RD Interest Rates | Bank ATMs |

| PPF Account |

Overview of HDFC Bank Personal Loan

| Interest Rate | 10.75% – 21.50% |

| Loan Amount | Up to Rs. 40 Lakhs |

| Loan Tenure | 1-5 Years |

| Processing Fee | Up to 2.50% (One Time Fee) |

*Note: All the Details listed above are for reference. Kindly follow the terms and conditions before applying for any personal loan.*

Features of HDFC Bank Personal Loan

There are plenty of advantages of using the HDFC Bank Personal Loan. They are as follows

- You can get the maximum loan amount.

- Unlike other banks, it is fast and easy processing of personal loan applications.

- Quick Loan Approval is possible for this.

- Special schemes and discounts can be availed by large companies’ employees.

- There is no need for security to have a personal loan.

- A guarantor isn’t insisted upon by the bank.

- Multiple Loan Repayment Options are available.

How to Apply for HDFC Bank Loan?

Go through the step-by-step procedure listed below to learn how to apply for HDFC Bank both online and offline.

Application Process for Online: Visit the official website of HDFC Bank and fill up the Personal Information, Work Information and upload necessary documents. Check for the loan eligibility and then apply.

Application Process Offline: Visit any HDFC Bank Branch along with the needed documents and fill up the form to get the loan approval process started.

HDFC Bank Loan Purpose

The whole purpose behind introducing the HDFC Bank Personal Loan is to meet all your financial needs such as holiday trips, repayment of an existing loan, payment of credit card bill, medical emergencies, and many more without bothering about keeping any collateral or property.

HDFC Bank Personal Loan Eligibility

Below are the Eligibility Criteria you need to meet in order to be eligible for HDFC Bank Personal Loan. They are as follows

- People of the Age Group between 21 to 58 years are Eligible for this Personal Loan.

- Permanent Employees of State/Central Govt, Public Sector Undertakings, Corporations, Private Sector Companies, and reputed establishments.

- Anyone who is Salaried / Self – Employed with regular income can apply for this.

- If you have stayed in a job/business/ profession upto 3 years then you are eligible for the HDFC Bank Personal Loan.

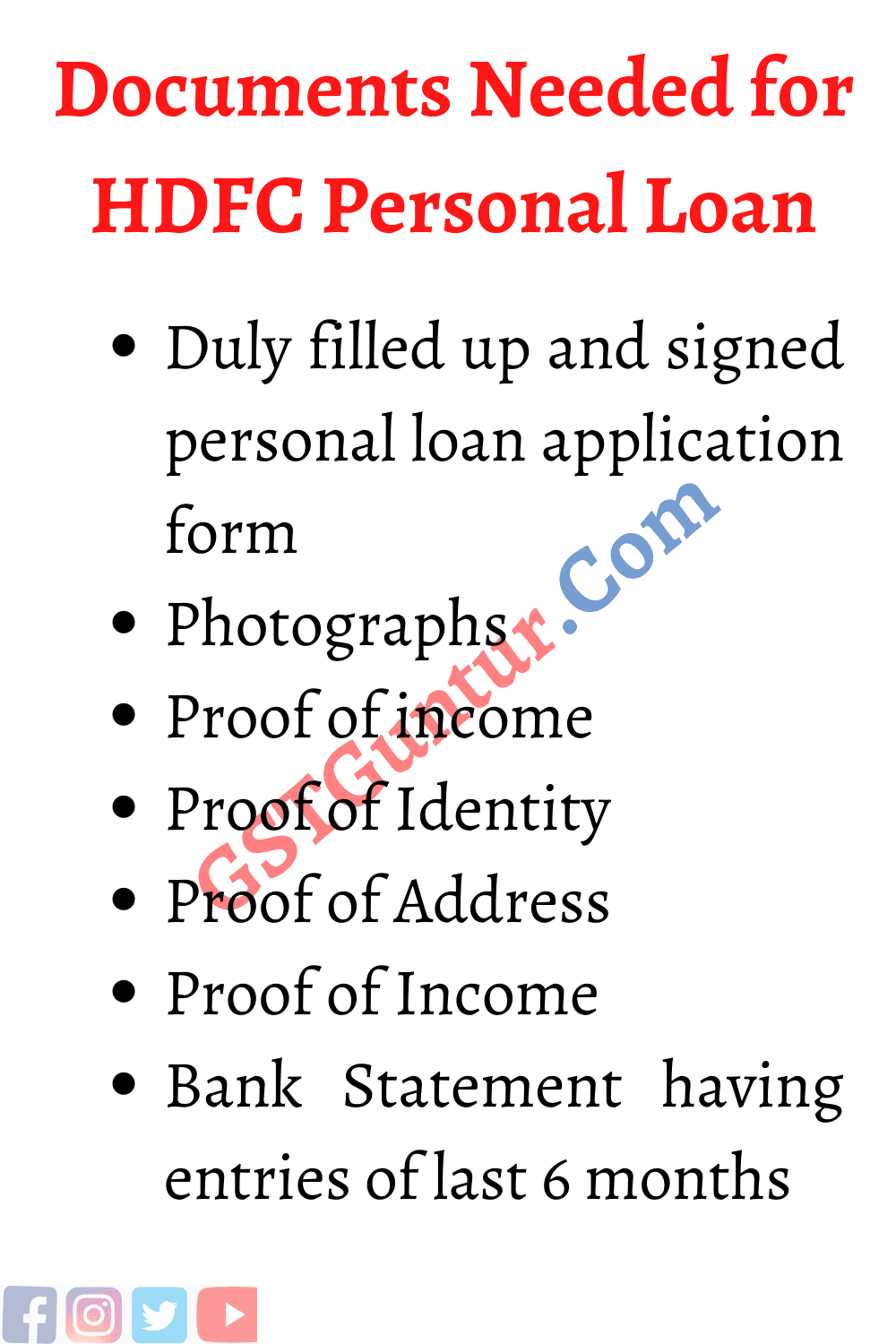

Documents Needed for Applying for HDFC Bank Personal Loan

One who wants to apply for the HDFC Bank Personal Loan should keep the following documents handy. They are along the lines

- Duly filled up and signed personal loan application form

- Photographs

- Proof of income -Latest salary slip showing all deductions or Form 16 along with recent salary certificate (for salaried individuals)

- Proof of Identity- Passport, Voter ID card, Driving license, PAN card, Aadhar Card, Government department ID card

- Proof of Address – Bank account statement, Latest electricity bill, Latest mobile/telephone bill, Latest credit card statement, Existing house lease agreement

- Proof of Income- Income Tax Returns of 2 previous financial years (for other than salaried individuals)

- Bank Statement or Bank Pass Book of having entries of last 6 months

Repayment Duration for HDFC Bank Personal Loan

A maximum of 60 EMIs are allowed for repayment of personal loan. 12 EMIs Option is also available. Repayment tenure depends on your Credit Score.

HDFC Bank Personal Loan Repayment as Equated Monthly Installments

You can use the below listed methods at the time of repayment. They are as under

- Standing instruction registration at your bank

- Through Internet Banking solution

- Automated Payment through ECS (Electronic Clearing Service)

- Through Mobile Banking App, if provided by the bank

Security

There is no need for security to get the HDFC Personal Bank Loan.

Reasons for Rejection of HDFC Personal Loan Application

Below are the reasons for the rejection of your HDFC Personal Loan Application. They are outlined as under

Poor Credit Score: A Credit Score is the measure of the creditworthiness of a person. A Good Credit Score determines the credibility for repayment of the loan. The lender can assess the risk of default by seeing a person’s credit score. The majority of the Personal Loan Applications get rejected due to less credit scores. A person with a credit score of less than 750 can face personal loan rejection.

Higher Size of Existing Debt: In the case, you have taken a lot of loans and the ratio of loan to net income is greater than 40% then lenders might reject the loan application.

Higher Loan Enquiries: On applying for Credit, the Lender asks for a credit report from the credit bureaus which is known as inquiry. Credit Bureau considers such inquiries as hard inquiries and lists them in a credit report. You shouldn’t ask for too many inquiries though it is available for free. Too many inquiries have a negative impact on your credit score.

Myths regarding HDFC Personal Loan

- It is not true that pre-payment of a personal loan will lead to a penalty.

- It is not true that a personal loan taken at low-interest rates is best. There are several other factors that need to be considered while taking the personal loan such as processing fee, eligible amount, tenure of loan repayment, service components, etc.

- Loans obtained at a fixed rate wouldn’t affect though there is a hike in interest rates. In the case of floating loans, if you don’t want the EMIs to go up you can increase the tenure.

- You can still get a Personal Loan though you don’t have a stable source of income i.e. by adding a joint holder who earns a regular source of income.

- Longer tenure Repayments are not a better option just because you get to pay lower monthly EMIs. Longer Tenure brings higher interest rates too.

- You can still get a personal loan from many other cooperative banks and NFBs.

- Carrying a good credit score does not guarantee personal loan approval.

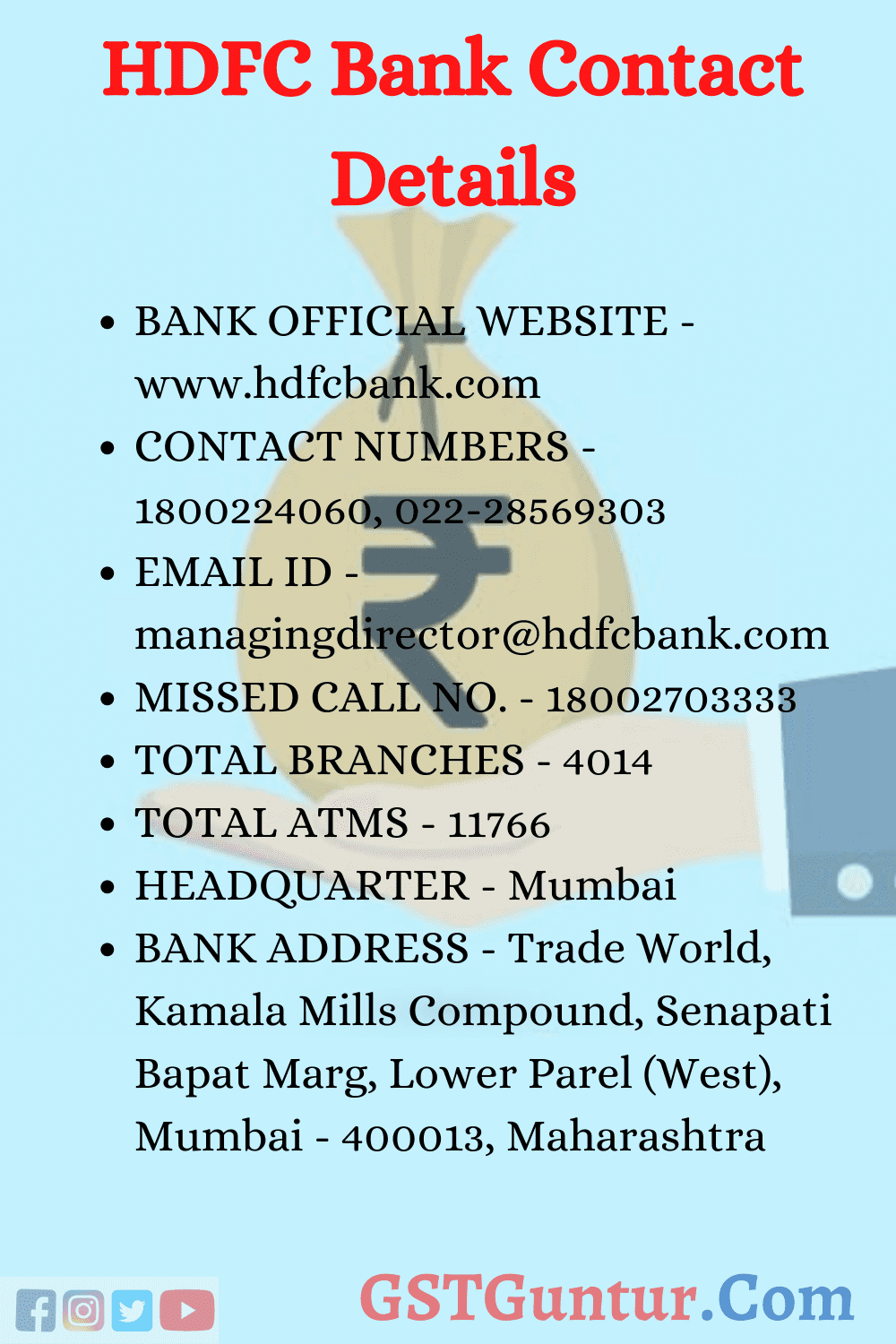

HDFC Bank Contact Details

- BANK OFFICIAL WEBSITE – www.hdfcbank.com

- CONTACT NUMBERS – 1800224060, 022-28569303

- EMAIL ID – managingdirector@hdfcbank.com

- MISSED CALL NO. – 18002703333

- TOTAL BRANCHES – 4014

- TOTAL ATMS – 11766

- HEADQUARTER – Mumbai

- BANK ADDRESS – Trade World, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel (West), Mumbai – 400013, Maharashtra

Lower Interest Rates Personal Loans as on 10th November 2021

| Bank | Interest Rate | Tenure |

|---|---|---|

| South Indian Bank | 10.90% – 15.00% | Tenure max. upto 48 Months |

| Oriental Bank Of Commerce | 11.20% to 12.95% | Maximum Tenure 60 months |

| Uco Bank | 11.35% to 11.60% | Maximum Tenure 60 months |

| Central Bank Of India | 11.40% | Maximum Tenure of 48 Months |

| Kotak Mahindra Bank Limited | 11.5% to 24% | Maximum Tenure 60 months |

| Andhra Bank | 11.50% to 13% | Contact Bank Branch |

| Icici Bank Limited | 11.59% to 22.00% | Maximum Tenure 60 months |

| Dhanalakshmi Bank | 11.68% to 15.65% | Max. Tenure 60 months |

| Indian Overseas Bank | 11.80% | Maximum Tenure 60 months |

| Punjab National Bank | 11.90% to 14.90% | Contact Bank Branch |

| Yes Bank | 11.99% – 20.00% | Maximum Tenure 60 months |

| Indusind Bank | 11% to 30.50% | Maximum Tenure 60 months |

| Catholic Syrian Bank Limited | 12.00% to 19.00% | Maximum Tenure 60 months |

| Idbi Bank | 12.20% | Maximum Tenure 60 months |

| State Bank Of India | 12.45% | Maximum Tenure of 48 Months |

| Bharatiya Mahila Bank Limited | 12.45% | Maximum Tenure of 48 Months |

| State Bank Of Mysore | 12.45% | Maximum Tenure of 48 Months |

| State Bank Of Hyderabad | 12.45% | Maximum Tenure of 48 Months |

| State Bank Of Patiala | 12.45% | Maximum Tenure of 48 Months |

| State Bank Of Travancore | 12.45% | Maximum Tenure of 48 Months |

| State Bank Of Bikaner And Jaipur | 12.45% | Maximum Tenure of 48 Months |

| Vijaya Bank | 12.50% to 13.50% | Maximum Tenure 60 months |

| Bank Of Maharashtra | 12.75% | Maximum Tenure 36 months |

| Corporation Bank | 12.75% to 13.75% | Maximum Tenure 60 months |

| Punjab And Sind Bank | 12.75% to 14% | Maximum Tenure 60 months |

* Note: The Interest Rates are Tentative and are with effect on 10th November 2021. There can be a variation at times do keep in mind*