A home is a permanent residence for a family, household, or individual. Every individual’s dream is to construct their own house or purchase flats in the community. In the olden days, the dream of building a home was accomplished when one’s financial situation is good. But now, there are several alternatives to achieve this and one of the best approaches is Home Loan.

Now, your brain gets confused with various questions like what is a home loan, how to get it in the lowest interest rate, home loan eligibility criteria, required documents, fees, and charges, etc. To answer all your queries, we have come up with this Home Loan Page. Jump into this page and clarify all your queries regarding housing loan schemes and offers.

- What is Home Loan?

- Things That Affect Your Home Loan Approval

- How Does A Home Loan Works in India?

- How to Apply for a Home Loan?

- Eligibility Criteria To Apply for Home Loan

- Home Loan Interest Rates

- Housing Loan Interest Rate of all Banks 2021

- Home Loan at Lowest Interest Rate (10 Nov 2021)

- Objective of Home Loan

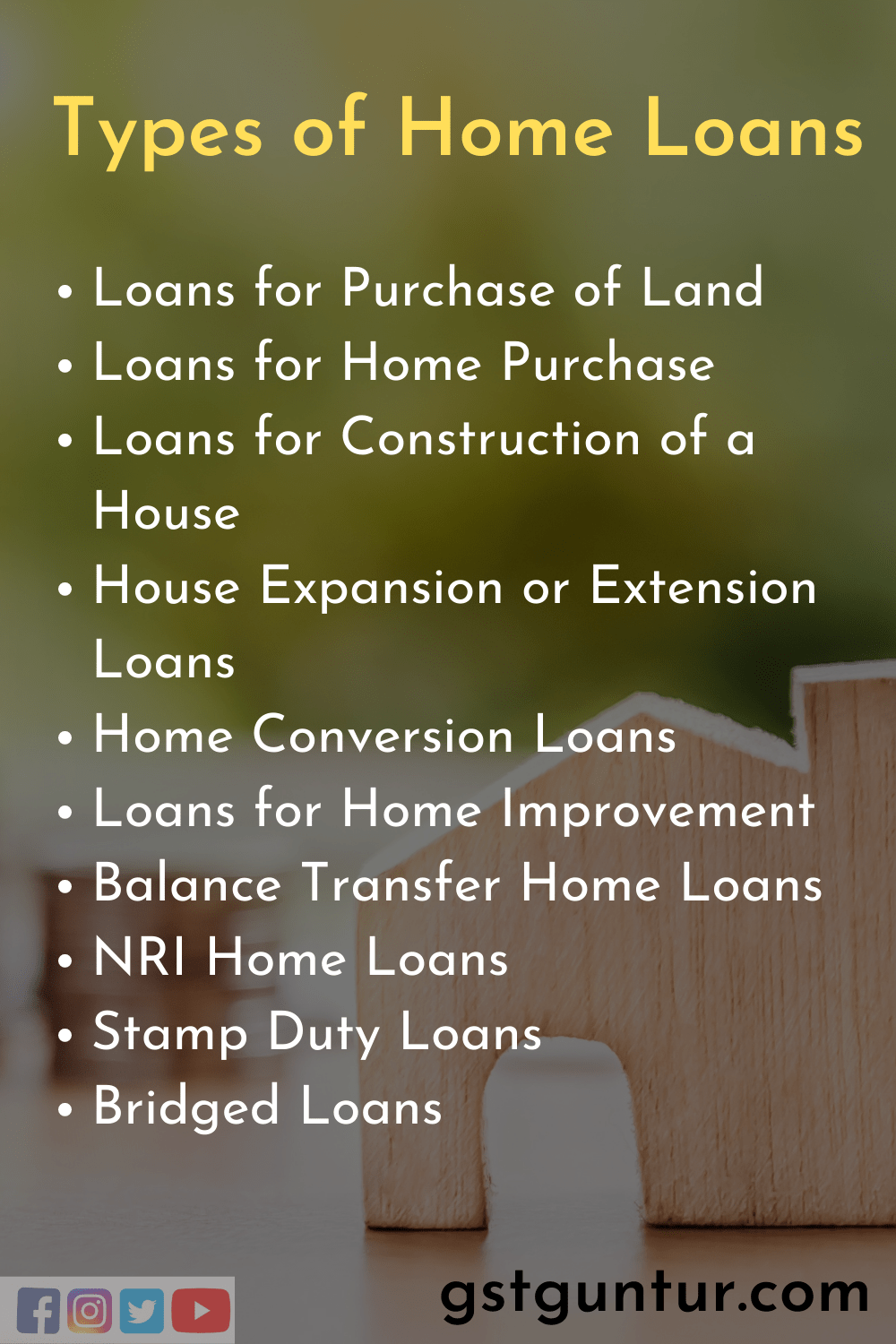

- Types of Home Loans

- Required Home Loan Documents

- Income Proof Documents

- Important Documents for all Non-Resident Indians (NRIs) Applicants

- Income Proof Documents for NRI

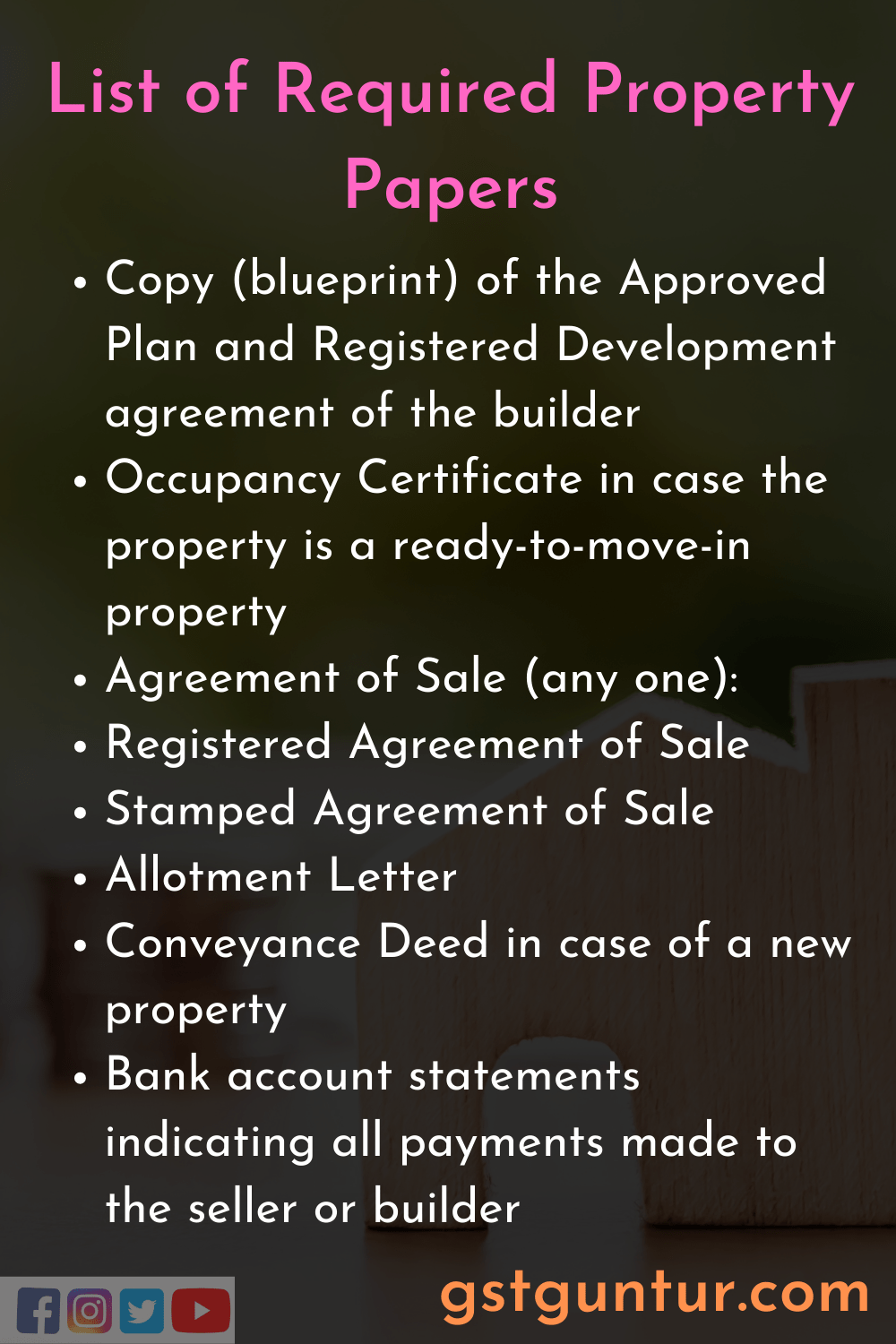

- Necessary Papers of your Property/Property Documents

- List of Home Loan Fees and Charges

- Dos & Don’ts while Applying for Home Loan

- FAQs on Home Loan Schemes

What is Home Loan?

A Home Loan is an amount of money that a person borrows from a money lending company or bank at some fixed interest rate to be paid every month using the EMI option. For security purposes, a bank or money lending company handover the property or gold for sanctioning the home loan.

In case, the borrower failed to pay the dues then the lender will possess all the legal rights to get back the loan amount by selling the property they kept for security. The property can be personal or commercial in nature.

Things That Affect Your Home Loan Approval

Here are a few factors that can make your home loan rejected or can affect the home loan approval:

- Age

- Monthly Income

- Age of Property

- Credit Score Check

How Does A Housing Loan Works in India?

A home loan in India is the quick & easy method to get funds for purchasing a dream house. As it provides generous funds for home purchases and has a long repayment tenor too. However, going with a home loan that has a nominal rate of interest, advanced features, no hidden fees and charges can make your housing loan experience smooth and tension-free.

Have a glance at the simple steps that should be followed to get a good home loan in India.

- Research the market to pick the right lender.

- Check the eligibility requirements of a home loan.

- Ensure that you have a good credit score.

- Gain knowledge about fees and charges

- Save funds for down payments and plan repayment in advance

- Gather all required documents and property papers handy

How to Apply for a Home Loan?

Basically, home loan applications follow a certain procedure such as:

Online/Offline Application: You are required to fill the home loan application online or at bank branches/loan centers.

Loan Sanction: Post submission of your application and review of certain KYC and documents of financial stability, the bank shall sanction your loan amount.

Review: Once the loan is sanctioned, you have to submit the documents pertaining to the property against which your loan is sought, for technical and legal review.

Approval & Disbursal: Upon validation of your loan amount and the property sought, the bank shall approve and disburse your loan.

The process can be varied based on the banks’ norms.

Eligibility Criteria To Apply For Home Loan

Following are the Eligibility Criteria you should satisfy to be eligible for a Home Loan Application. They are as follows:

| Eligibility Criteria | Requirement |

| Age | Minimum Age: 18 years and Maximum Age: 70 years |

| Resident Type | The applicant must have (any one):

|

| Employment | The applicant should be (any one):

|

| Net Annual Income | At least Rs.5-6 lakh depending on the type of employment |

| Residence | The applicant should have (any one):

|

| Credit score | A good credit score of at least 750 or more obtained from a recognized credit bureau |

Home Loan Interest Rates

The percentage of the major amount charged by the banker to the borrower for using the principal amount is known as the home loan interest rate. The interest rate charged by banks and non-financial institutions determines the cost of your home loan.

In order to apply for the best housing loan scheme, you can compare the lowest home loan interest rate starting from 6.40% p.a. by using the provided list of current housing loan rates of interest in India from all reputable banks and financial institutions.

Housing Loan Interest Rate of all Banks 2021

| Banks | Starting Interest Rate (p.a.) | Processing Fees |

| Kotak Mahindra Bank | 6.50% | 0.50% |

| Citibank | 6.75% | Rs. 10,000 |

| Union Bank of India | 6.40% | – |

| Bank of Baroda | 6.75% | Rs. 8,500 – Rs. 25,000 |

| Central Bank of India | 6.85% | Rs. 20,000 |

| Bank of India | 6.85% | Rs. 1,500 – Rs. 20,000 |

| State Bank of India | 6.75% | 0% – 0.35% |

| HDFC LTD | 6.70%* | Rs. 3,000 – Rs. 5,000(plus taxes)* |

| ICICI Bank | 6.90% | Rs. 3,000 |

| LIC Housing Finance | 6.90% | Rs. 10,000 -Rs. 15,000 |

| Axis Bank | 6.90% | Rs. 10,000 |

| Canara Bank | 6.90% | Rs. 1,500 – Rs. 10,000 |

| Punjab and Sind Bank | 6.85% | Full Waiver |

| IDFC First Bank | 6.90% | Rs. 5,000 – Rs. 5,000 |

| Bank of Maharashtra | 6.90% | Rs. 10,000 |

| Indian Overseas Bank | 7.05% | 0.50% (Max Rs. 20,000) |

| Punjab National Bank | 6.95% | 0.35% (Max Rs. 15,000) |

| United Bank of India | 8.00% | 0.59% (Rs. 1,180 – Rs. 11,800) |

| UCO Bank | 6.90% | 0.15% (Rs. 1,500 – Rs. 15,000) |

| DBS Bank | 7.30% | 0.25% (Rs. 10,000) |

| IDBI Bank | 6.75% | 0.50% (Rs. 2,500 – Rs.5,000) |

| HSBC Bank | 6.64% | 1% (Rs. 10,000) |

| Karur Vysya Bank | 7.20% | Rs. 5,000 |

| Saraswat Bank Home Loan | 6.70% | Nil |

| Jammu and Kashmir Bank | 7.20% | Rs. 500 – Rs. 10,000 |

| South Indian Bank | 7.85% | 0.50% (Rs. 5,000 – Rs. 10,000) |

| PNB Housing Finance | 7.20% | 0.25% – 0.50% (Rs. 10,000) |

| Federal Bank | 7.65% | Rs. 3,000 – Rs. 7,500 |

| Standard Chartered Bank | 7.99% | 1% |

| Aavas Financiers | 8.00% | 1.00% |

| Karnataka Bank | 7.50% | Rs. 250 |

| Sundaram Home Finance | 6.95% | Rs.3,000 (for salaried) |

| Dhanlaxmi Bank | 7.85% | Rs. 10,000 |

| Tata Capital | 6.90% | 0.50% |

| Tamilnad Mercantile Bank | 8.25% | Rs. 15,000 |

| IIFL | 10.50% | 1.25% |

| DHFL Housing Finance | 8.75% | Rs. 2500 |

| Bandhan Bank | 8.50% | 1% (Rs.5,000) |

| Yes Bank | 8.95% | 1% (Rs. 10,000) |

| Hudco Home Loan | 9.45% | NA |

| Indiabulls | 8.65% | 2% |

| Aditya Birla | 9.00% | 1% |

| GIC Housing Finance | 7.45% | Rs. 2,500 |

| Reliance Home Finance | 9.75% | Rs. 3,000 – Rs. 6,500 |

| Shriram Housing | 8.90% | NA |

| India Shelter Finance | 12.00% | 2.00% |

*Note: Given list of data on home loan rate of interest is True to our Knowledge. Still, you have to cross-check with the bank terms and conditions before confirming.*

Home Loan at Lowest Interest Rate (10 Nov 2021)

The list of banks that are offering lower interest rates for the housing loan of 10 November 2021 are presented here to aid the required people in selecting the suitable bank for availing the home loan schemes.

| Bank | Interest Rate | Tenure |

|---|---|---|

| Dcb Bank Limited | 10.24% | 20 Years |

| City Union Bank Limited | 10.50% – 13.00% | 15 Years |

| State Bank Of India | 7.90% to 8.30% | 30 Years |

| Bharatiya Mahila Bank Limited | 7.90% to 8.30% | 30 Years |

| State Bank Of Mysore | 7.90% to 8.30% | 30 Years |

| State Bank Of Hyderabad | 7.90% to 8.30% | 30 Years |

| State Bank Of Patiala | 7.90% to 8.30% | 30 Years |

| State Bank Of Travancore | 7.90% to 8.30% | 30 Years |

| State Bank Of Bikaner And Jaipur | 7.90% to 8.30% | 30 Years |

| Punjab National Bank | 7.90% to 8.70% | 30 Years |

| United Bank Of India | 8.00% to 8.15% | 30 Years |

| Central Bank Of India | 8.00% to 8.30% | 30 Years |

| Oriental Bank Of Commerce | 8.00% to 8.55% | 480 Months, , including the moratorium period of 18 months |

| Hdfc Bank | 8.00% to 8.80% | 30 Years |

| Canara Bank | 8.05% to 10.05% | 30 Years |

| Uco Bank | 8.05% to 8.15% | 30 Years |

| Corporation Bank | 8.10% to 8.35% | 30 Years |

| Bank Of India | 8.10% to 9.00% | 30 Years |

| Idfc Bank Limited | 8.15% | 30 Years |

| Andhra Bank | 8.15% to 8.30% | 30 Years |

| Syndicate Bank | 8.15% to 8.40% | 30 Years |

| Bank Of Baroda | 8.15% to 9.15% | 30 Years |

| Dena Bank | 8.15% to 9.15% | 30 Years |

| Vijaya Bank | 8.15% to 9.15% | 30 Years |

| The Nainital Bank Limited | 8.15%-8.20% | 25 Years |

*Note: Above is the banks that give Lower Interest Rates on Personal Loan effect to 10th November 2021. Just review them before applying for Home loans as they may change at times as per the bank’s terms and conditions.*

Objective of Home Loans

We find various purposes to obtain home loans and some of them are listed here:

- Home Purchase Loan – The purpose of taking this home loan is to purchase a house.

- Home Extension Loan – It is obtained to add more space to your existing home.

- Residential Plot Loan – To purchase a residential plot of land in an urban area, and to build your house subsequently.

- Home Construction Loan – For the purpose of self-construction of a residential home.

- Home Improvement Loan – This loan purpose is internal or external repairs, waterproofing, electrical works, painting, roofing, plumbing, etc.

- Land Purchase Loans/Plot Loans – For the purpose of purchase of a plot of land for construction or as an investment.

Home Loan Types | Types of Housing Loans

The following table represents how many types of home loan schemes are involved presently to avail along with short description:

| Sr No | Scheme | Brief Description |

|---|---|---|

| 1 | Regular Home Loan | Regular and most demanding Loan Scheme |

| 2 | Home Loan as Overdraft | Home Loan is taken as Overdraft |

| 3 | Home Top-Up Loan | Borrow amount over and above the home loan amount |

| 4 | Balance Transfer of Home Loan | Transfer home loan from other institution |

| 5 | NRI Home Loan | NRIs and PIOs can get a home loan |

| 6 | Flexipay Home Loan | Exclusively designed for salaried to get a higher loan |

| 7 | Privilege Home Loan | Exclusively designed for government employees |

| 8 | Home Improvement Loan | For furnishing houses or flats at a very low-interest rate |

| 9 | Pre-Approved Home Loan (PAL) | Sanction of loan limit before finalizing property |

| 10 | Realty Home Loan | Exclusively to purchase a plot for construction |

| 11 | Bridge Home Loan | Upgrade home |

| 12 | Reverse Mortgage Loan | Loan against mortgage of residential property |

| 13 | CRE (Commercial Real Estate) Home Loan | Loan to customers who own at least 2 houses |

| 14 | Pradhan Mantri Awas Yojana (PMAY) | Subsidized home loan for eligible urban beneficiaries |

| 15 | Step Up Home Loan | Offers higher loan amount as compared to your actual loan eligibility |

| 16 | Fixed Home Loan 24/36 months | The fixed interest rate for the first 2/3 years |

Required Home Loan Documents

- Identity Proof (any one)

- Driving License

- PAN

- Voter ID

- Valid Passport

- Residence Proof (any one)

- Copy of Electricity Bill/Water Bill/Telephone Bill

- Copy of valid Passport/Aadhaar Card/Driving License

- Other Documents

- Employer Identity Card

- Duly filled loan application form affixed with 3 passport size photographs

- Loan account statement for the previous 12 months if the applicant has any other ongoing loan from other banks/financial institutions

- Applicant’s last six months Bank account statements for all the bank accounts.

Income Proof Documents

| For Self-employed Applicant/Co-applicant | For Salaried Applicant/Co-applicant |

| Income Tax Returns for the last 3 years | Salary Slips for the last three months |

| Certificate of Qualification (for Doctors/CA and other professionals) | Copy of Form 16 or Income Tax Returns for the last two years |

| Balance Sheet audited by a certified CA and Profit and Loss account for the previous 3 years | |

| Business License Details | |

| Business address proof | |

| TDS Certificate |

Important Documents for all Non-Resident Indians (NRIs) Applicants

| Identity Proof (any one) | Residence Proof (any one) | Other Documents |

| PAN | Telephone bill | Attested copy of the applicant’s/co-applicants’/guarantor’s valid passport and visa |

| Valid Passport | Electricity bill | Proof of residence indicating the applicant’s current overseas address |

| Driver’s License | Water bill | Employer Identity Card |

| Voter ID Card | Piped Gas bill | If the applicant is employed in the Merchant Navy, the applicant is required to submit a copy of the Continuous Discharge Certificate (CDC) |

| Valid Passport | PIO Card issued by the Government of India in case the applicant/co-applicant is a Person of Indian Origin (PIO). | |

| Driving License | Duly filled completed loan application form with three passport size photographs of the applicant and co-applicants. | |

| Aadhaar Card | The attestation of the documents can be done by: 1. Indian Embassy/Consulate 2. Overseas Notary Public 3. FOs/Representative Offices 4. Officials of Branch/Sourcing Units based in India |

Income Proof Documents for NRI

- For Salaried Applicant/Co-applicant

- Valid work permit

- Salary slips for the last 3 months

- Bank statements indicating salary credit for the last 6 months

- Employment contract (translated in English) attested by the employer/consulate/embassy/Indian foreign office if the contract is in another language.

- Copy of the Identity Card issued by the current employer along with the latest salary slip (original).

- Copy of the individual Tax Return for the last assessment year. – Not applicable to employees in the Merchant Navy and NRIs/PIOs located in the Middle East countries.

- For Self-employed Applicant/Co-applicant:

- Proof of income if the applicant/co-applicant is a self-employed professional/businessman.

- Business address proof

- Individual Tax Return for the last 2 years – Not applicable to NRIs/PIOs located in the Middle East countries.

- Balance Sheet and Profit and Loss accounts audited by a certified CA for the last 2 years

- Bank statement of the individual’s as well as the business/company’s overseas account for the last 6 months.

Necessary Papers of your Property/Property Documents

- Copy (blueprint) of the Approved Plan and Registered Development agreement of the builder

- Occupancy Certificate in case the property is a ready-to-move-in property

- Agreement of Sale (any one):

- Registered Agreement of Sale

- Stamped Agreement of Sale

- Allotment Letter

- Conveyance Deed in case of a new property

- Bank account statements indicating all payments made to the seller or builder

List of Home Loan Fees and Charges

Based on the type of housing loan you have applied for, the following fees and charges may be collected by the bank. They are as follows:

- Processing fees

- Prepayment charges

- Conversion fees

- Cheque dishonour charges

- Fees on account of external opinion

- Home insurance

- Default charges

- Incidental charges

- Statutory/regulatory charges

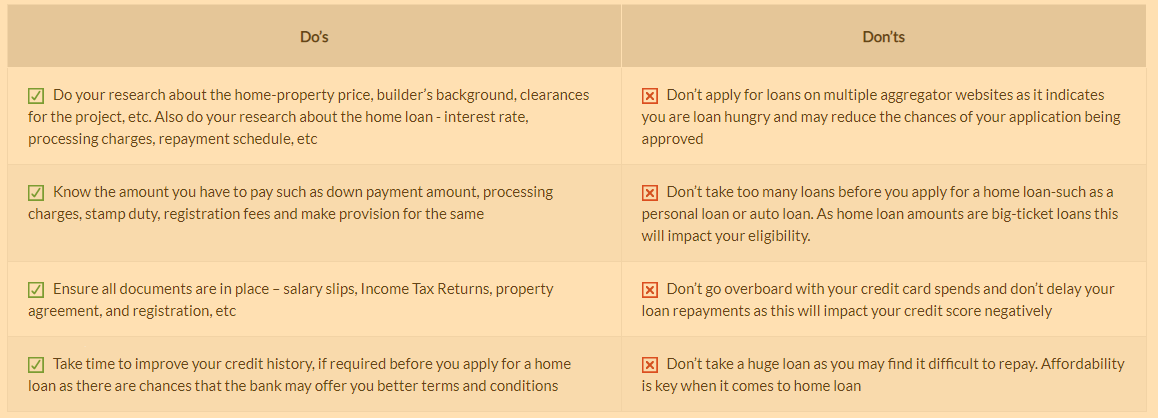

Dos & Don’ts while Applying for Home Loan

FAQs on Home Loan Schemes

1. How to get a home loan for the first time?

If you are a new borrower to get a home loan, you need to check for eligibility, compare interest rates, tenure, loan amount at first. You can apply for a home loan after getting a complete idea of the scheme and choosing the best bank or online home loan portals.

2. Is the security needed for a home loan?

Yes, without security any housing loan is not sanctioned. Basically, a home loan is a secured loan that needs the borrower to keep collateral with the banket or lender. In this case, the collateral is the home itself for which the loan is taken.

3. What are the types of interest rates in Home Loans?

Mainly, there are two types of interest rates in a home loan that can be charged by the banks.

- Fixed Interest Rate

- Floating Interest Rate