GST Registration is compulsory for business owners who exceed the minimum turnover. Registered Companies under Service Tax or VAT need to register under GST. The Online Registration Process makes it easy for business owners to fill a form in the Official GST Portal and get the GST Registration done. Go through the page to be well versed with the Goods and Service Tax Registration Process, Fees, Who should register for it, How to Register GST Online in detail.

GST Full Form – “Goods and Service Tax”

- What is GST Registration?

- What is GSTIN Number?

- Who Should Register for GST?

- Features of GST Registration

- GST Registration Fees

- Documents Required for GST Registration

- How to Apply for GST Registration Process in India?

- GST Registration Process for New Business

- Benefits of GST Registration

- What is the Penalty for GST Registration?

- What are the Compliances after GST Registration?

- FAQs on GST Registration

What is GST Registration?

GST is the biggest tax reform in India by improving the ease of doing business. Tax Complexities are reduced with the introduction of a single simple system. GST Regime mandates all entities included in buying or selling goods to and obtain the GSTIN. It is necessary if you cross a minimum threshold or when the individual begins a new business that exceeds the prescribed limit.

What is GSTIN Number?

GST Registration Number is an Identification that is assigned to each firm or individual. It is similar to a PAN Number and is a 15 digit unique tax identification number. The first two digits represent state code and the other 10 digits represent the PAN Number of the Person. Next 1 Number denotes the State Code and the other 2 numbers are Random.

Who Should Register for GST?

- Individuals registered under Pre GST Law of Exercise, VAT or Service Tax.

- Individuals paying tax under reverse charge mechanism i.e. a mechanism in which goods/ service recipients need to pay GST.

- In the case of any individual supplying online information who comes under the non-taxable persons in India.

- Agents belonging to supplier and input supply distributor.

- Persons supplying inputs through e-commerce aggregators.

Features of GST Registration

- New GST Registration – It is a blend of all other taxes such as VAT/CST or Service Tax or Excise Duty or Entertainment Tax, etc., and are introduced in India in July 2007.

- GST Registration Limit – If business turnover exceeds a turnover of 40 Lakhs Rupees in a year.

- GST Registration Tax Rates – GST Tax Rates vary depending on the product or services and range in between 0 – 28% on the same.

- GST Input Tax Credit Scheme – GSTIN Holders who are registered under the GST can use the input tax credit scheme through which they can claim the tax paid while purchasing products or services.

- GST Return Filing Concept – GSTIN Holders need to file the GST Returns on a monthly or quarterly basis. However, they should pay the taxes every month.

- GST Registration under Composition Scheme – If you have less than 1 cr turnover then you can use this option and pay taxes ranging from 1% to 5% without claiming the Input Tax Credit.

GST Registration Fees

The government will not charge any registration fees and you can visit the GST official portal and complete the 11 step registration process online itself.

Documents Required for GST Registration

We have outlined the documents list for GST Registration of various businesses. They are along the lines

Proprietorship

- PAN Card or Address Proof of Proprietor

- Firm Registration Certificate such as MSME Registration.

Private Limited/ One Person Company

- COI, MOA, and AOA of the Company

- PAN Card of the Company

- Board Resolution with Directors Ids as well as Address Proofs

Partnership/ LLP

- PAN Card of Partnership Firm along with the Partnership Deed.

- Partnership Registration Certificate

- ID Proofs & Address Proofs of Partners

How to Apply for GST Registration Process in India?

GST Registration Process is listed in the following sections. They are as such

1. Firstly, visit the GST Portal i.e. www.gst.gov.in

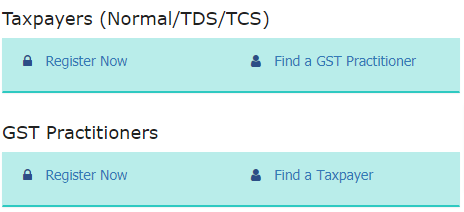

2. Home Page Screen will be opened. After that, check for the ‘Register Now’ link in the Taxpayers Tab.

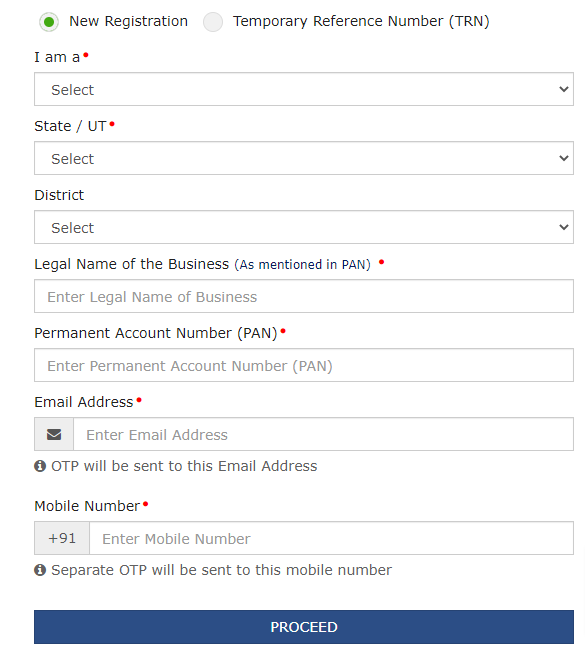

3. Click on New Registration and fill in the required details and then click on Proceed.

4. As a part of the next step fill the OTP sent to your Email Address and Mobile Number in the allotted boxes.

5. Make a note of the Temporary Reference Number shown on the screen.

6. Revisit the GST Portal and click on Register present below the Taxpayers Menu.

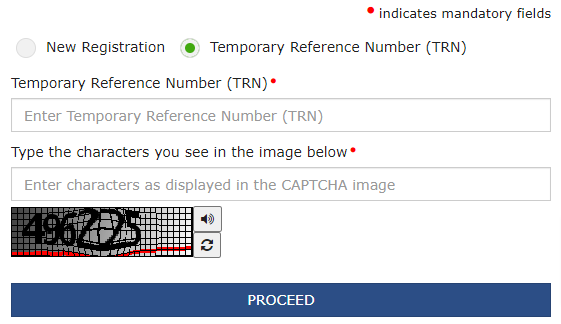

7. Choose the Temporary Reference Number and enter the details like TRN and captcha details and then click on proceed.

8. Enter the OTP sent to your Mobile Number and Email Address.

9. Your Application Status will be available on the next page. On the right side, click on the Edit Icon.

10. After completion a message will be displayed on the screen and you will be sent an Application Reference Number both to your Mobile and Email Address.

GST Registration Process for New Business

Follow the simple steps listed below to learn about the GST Registration Process for New Business. They are in the below way

Step 1: Visit the GST Portal i.e. www.gst.gov.in

Step 2: Begin filling the part A of the Registration Form

Step 3: After that, you will receive an application reference number to your mobile number and email.

Step 4: Now, fill the second part of the registration form and upload the necessary documents as per the business type.

Step 5: Get the Registration Certificate from the GST Portal.

Step 6: Submit the necessary documents within 7 working days along with GST REG-04

Step 7: Check your mail and look for any errors. In case of any errors, Your application might be rejected and the same will be notified in your GST REG-05

Benefits of GST Registration

There are several benefits of doing GST Registration and we have listed some of them. They are along the lines

- You can be more strong compared to your competitors as it gives you a valid legal entity registration and you can show it to others.

- GST Taxpayers can avail input tax credit while purchasing goods and services.

- GST Registration holders can purchase or sell products anywhere across the country.

- GSITN Holders can easily open a current business account by making use of the GST Registration Certificate.

- If you are willing to sell your products across e-commerce websites like Amazon, Flipkart you can sell them using GST Registration Number.

- You can bid for all the Government Projects using the valid GST Number.

- You can accept projects from MNCs since you are a valid business.

- Issuing a Valid GSTIN Tax invoice creates trust and brand value among customers.

What is the Penalty for GST Registration?

As per the GST Act Law if you are liable for GST Registration but didn’t pay the GST TAx Amount then you need to bear the penalty i.e. 10% of the total tax amount and a minimum can range from Rs. 10,000/-. However, it can be 100% if you intentionally evade paying taxes.

What are the Compliances after GST Registration?

Once you finish the GST Registration one needs to file the GST Returns as per the Compliance. If you register under the regular GST Scheme, then you need to file monthly returns. Composition dealers need to file on a Quarterly Basis adhering to certain conditions.

FAQs on GST Registration

1. What is the GST registration fee?

There is no registration fee and you can finish the entire process by simply visiting the official website for GST.

2. Who should register for GST in India?

Businessmen whose turnover exceeds 40 Lakhs should register themselves for GST.

3. What does GSTIN stand for?

GSTIN Stands for Goods and Services Tax Identification Number.

4. Is PAN mandatory for obtaining the GST Registration?

Yes, PAN is mandatory for GST Registration.

5. What is the Validity of GST Registration?

There is no expiry date for GST Registration. Thus it will be valid as long as it is not canceled, suspended, or surrendered.