Looking for the financial support to accomplish your goal of studying higher education in India or Abroad? Then, opting for the Education Loan is the best way to reach your aims. Confused about what is meant by an education loan and how it works? Don’t worry this article will help you completely right from What is student education loan to Tips to apply for Education Loan online in India.

Gather all the details like Processing Fee, Benefits & Features of an Education Loan, facts about student loan, etc from the below modules and choose your desired course to get an education loan.

- What is Education Loan?

- Education Loan Eligibility Criteria

- Different Types of Education Loans in India

- How to Apply for Student Education Loan in India?

- Top Education Loan Offers 2021

- List of Education Loan Required Documents

- Requirements to Apply for Student Loan Online in India

- Education Loan Lowest Interest Rate Banks in India

- Unknown Facts About Education Loan

- Education Loan Features and Benefits

- List of Expenses Covered under Education Loan

- FAQs on Education Loan Details in India

What is Education Loan?

Education Loan is financial assistance that can be offered by lenders/leading banks to deserving and meritorious students for pursuing higher studies in India and abroad. Student Loan or Study Loan are the other terms for education loan. Education loans or other loans are available at fixed interest rates and students can apply for study loans online in India at a pace and avail benefits and features happily.

Education loan Interest rates start from 6.75% p.a. with loan tenures of up to 15 years.

Education Loan Eligibility Criteria

| Particulars | Eligibility |

| Nationality | Indian |

| Age | Minimum- 18 years Maximum- 35 years |

| Academic record | Proven- good |

| Qualification | Pursuing graduate/postgraduate degree or a PG diploma. |

| Income source | Parents/Guardians |

| Income | Stable |

| University Applied to | Recognized – In India/Abroad |

| Admission Status | Confirmed |

| Security | Tangible collateral or guarantor- depending on the loan amount and income source. |

Different Types of Education Loans in India

Irrespective of the courses you choose, there are two great categories of student education loans based on location:

- Domestic Education Loan – For educational courses within the geographical limits of the country.

- Study Abroad Education Loan – For educational courses outside the geographical boundaries of the country.

Furthermore, based on some other categories also the education loans are divided. These include the following:

Based on the education courses:

- Higher Education Loan

- Diploma Studies Loan

- Loans for Professional Courses

Based on the security of collaterals and/or guarantee:

- Secured Loans

- Unsecured Loans

Some other study loans in India are:

- Undergraduate Education Loan

- Professional / Graduate Education Loan

- Career Education Loan

- Loans for Parents

How to Apply for Student Education Loan in India?

You can find various methods to apply for a student education loan and they are as follows:

1. Apply Online: One of the simple and easiest approaches is applying for an education loan online. There are two ways to apply online for a study loan in India. First is the straightforward application form ie., filling the online form and submitting the form with the attachments of needed documents. The second is applying at banks or lender places by providing all the necessary details and the lender will then be in contact with you to explain the terms of the loan before proceeding with the application.

2. Offline:

- Visit a Branch: By visiting your nearest branch with the necessary documents, you can apply for a student loan. Also, you may discuss the terms of the loan with an agent, fill the form, and apply in person.

- Call the Lender: Else, you may call the lender or request a call back by showing your interest. You can then discuss the loan terms and continue with the education loan application process.

3. Virtual Assistant: By the Virtual Assistant method also you can clear all your queries and request assistance with the application procedure to get an education loan.

Recommended Posts:

Top Education Loan Offers 2021

| Name of Bank | Interest Rate (p.a.) | Loan Amount | Processing Fees |

|---|---|---|---|

| PNB | 6.90% to 9.55% | Up to 15 Lakhs | 1% of the loan amount |

| SBI | 6.85% to 8.65% | Up to Rs.1.5 crore | Rs.10,000 + tax |

| Axis | 13.70% to 15.20% | Up to 75 Lakh | Nil to Rs.15,000 + tax |

| Bank of Baroda | 6.75% to 9.85% | Up to 4 Lakh and above | 1% of the loan amount up to Rs.10,000 |

| HDFC | 9.45% to 13.34% | Max Apr | Up to 1.5% of loan amount + tax |

| Tata Capital | 10.99% onwards | Up to 30 Lakh | Up to 2.75% of loan amount + tax |

| Union Bank of India | 8.80% to 10.05% | Need-based finance | Nil for Indian students 0.50% of loan amount + GST for NRI students |

| Bank of India | 6.85% to 9.35% | For courses in India: Up to Rs.10 lakh For courses abroad: Up to Rs.20 lakh | Nil for courses in India Rs.5,000 + other fees for study abroad |

| Kotak Mahindra Bank | Up to 16% | For courses in India: Up to Rs.10 lakh For courses abroad: Up to Rs.20 lakh | Contact the bank |

| ICICI Bank | 10.50% onwards | For courses in India: Up to Rs.50 lakh For courses abroad: Up to Rs.1 crore | Contact the bank |

| Federal Bank | 10.05% onwards | For courses in India: Up to Rs.10 lakh For courses abroad: Up to Rs.20 lakh | Contact the bank |

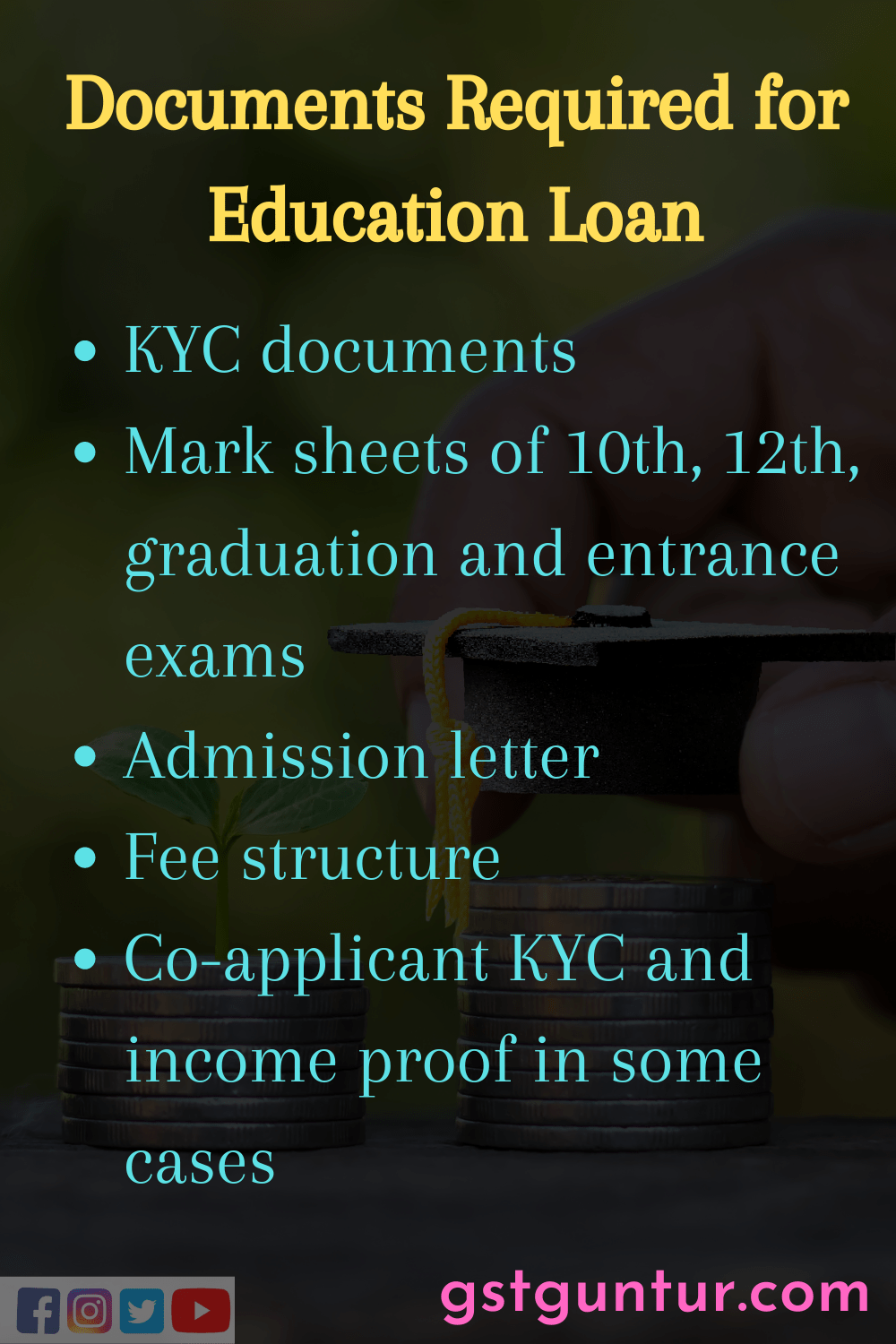

List of Education Loan Required Documents

The following list will help you get ready to apply for an education loan. This list of documents is often asked by most lenders.

- Admission letter from the educational institution

- Marksheets (previous education – school/college)

- Age proof

- ID proof

- Address proof

- Signature proof

- Salary slips

- Recent bank account statements

- ITR with the Income computation

- Audited balance sheet

- Recent bank statements

- Proof of turnover (service tax return/sales receipt)

- Completed application form with signature

- Latest passport size photographs

- Appropriate Visa for studies abroad

*Note: Document charges may be gathered by the lender.

Requirements to Apply for Student Loan Online in India

A few important requirements that should meet while taking a loan are listed as follows:

- The foremost factors are the fees of the course to be pursued and the applicant’s annual family income.

- One of the parents or sibling, or spouse should be a co-applicant.

- No need for a guarantor or security for Loans below Rs. 4 lakhs.

- Must need a third-party guarantor for loans above Rs.4 lakhs.

- Collateral is required for a loan amount of more than Rs.7.5 lakh.

- In case the student is pursuing abroad, then he/she should look for part-time jobs or sponsorship as the loan amount itself is not sufficient.

- For studying abroad, Insurance is necessary.

- Repayment of loans: The repayment process should instantly start after 6 months to 1 year of completion of the course, though it can be prolonged to 5 to 7 years.

- If it is non-repayment, the student’s own credit history, as well as his co-applicants history, gets hit.

- Interest rates for education loans: In India, interest rates for education loans vary according to banks. However, it can be anywhere between 12.00 % and 16.00 %, which of course depends on the bank’s base lending rate and other factors. The base lending rate for banks in India, as directed by the RBI, is around 9- 10%.

Education Loan Lowest Interest Rate Banks in India

| Bank | Interest Rate | Tenure |

|---|---|---|

| Axis Bank | Please contact the bank branch | Contact Bank Branch |

| Hdfc Bank | Please contact the bank branch | Contact Bank Branch |

| Punjab National Bank | 8.45% to 10.95% | In 15 years after the Holiday | Moratorium Period |

| Andhra Bank | 8.70% to 10.65% | In 5 to 7 years after the Holiday | Moratorium Period |

| Allahabad Bank | 8.95% to 10.60% | In 15 years after the Holiday | Moratorium Period |

| Bank Of Baroda | 9.35% to 10.85% | In 5 to 7 years after the Holiday | Moratorium Period |

| Idbi Bank | 9.45% to 10.45% | In 10 to 15 years after the Holiday | Moratorium Period |

| Vijaya Bank | 9.45% to 10.65% | In 15 years after the Holiday | Moratorium Period |

| Oriental Bank Of Commerce | 9.70% to 12.70% | In 15 years after the Holiday | Moratorium Period |

| Central Bank Of India | 9.90% to 10.40% | In 10 to 15 years after the Holiday | Moratorium Period |

| Canara Bank | 9.95% to 10.45% | In 10 to 15 years after the Holiday | Moratorium Period |

| Dena Bank | 10.20% | In 15 years after the Holiday | Moratorium Period |

| Jammu And Kashmir Bank Limited | 10.20% to 10.95% | In 5 to 7 years after the Holiday | Moratorium Period |

| Bank Of India | 10.20% to 11% | In 5 to 7 years after the Holiday | Moratorium Period |

| Bank Of Maharashtra | 10.25% to 10.75% | In 5 to 7 years after the Holiday | Moratorium Period |

| Punjab And Sind Bank | 10.25% to 10.75% | In 15 years after the Holiday | Moratorium Period |

| Corporation Bank | 10.25% to 11.10% | Contact Bank Branch |

| Syndicate Bank | 10.25% to 11.50% | In 5 to 7 years after the Holiday | Moratorium Period |

| Indian Overseas Bank | 10.25% to 11.55% | In 5 to 7 years after the Holiday | Moratorium Period |

| Uco Bank | 10.60% to 11% | In 15 years after the Holiday | Moratorium Period |

| Federal Bank | 10.65% to 14% | Contact Bank Branch |

| Karnataka Bank Limited | 10.85% to 12.95% | In 5 to 7 years after the Holiday | Moratorium Period |

| United Bank Of India | 10.95% to 11.00% | In 15 years after the Holiday | Moratorium Period |

| State Bank Of India | 10% to 10.75% | In 15 years after the Holiday | Moratorium Period |

| Bharatiya Mahila Bank Limited | 10% to 10.75% | In 15 years after the Holiday | Moratorium Period |

*Note: The Interest Rates are Tentative and listed in our knowledge. They may vary at times based on the bank terms and conditions so take a look at them before applying for education loans.

Unknown Facts About Education Loan

- On education loans, the bank charges simple interest at the time of course period that turns into lower EMIs in the future.

- No prepayment penalty can be charged in education loans which means in case you close your loans prior its maturity. Hence, you will not be charged with any penalty.

- Directly, sanctioned education loan amount paid to college or university as per the given fee structure.

- If you repay the loan without any default or delay them it aids in increasing a good credit score for the student, Check CIBIL Score Free from here.

- Parents can claim tax benefits under Section 80E of the Income Tax Act. They can claim deduction towards interest paid on the loan and not on the principal repayment for 8 years. Also, there is no maximum cap on such tax benefit it implies one can claim the entire interest amount paid from his/ her taxable income.

Education Loan Features and Benefits

- Grants financial support to achieve the deserving and meritorious students’ higher education dream.

- Education Loans can be sanctioned for various available courses at attractive interest rates.

- When it comes to education loans for female candidates, it offers numerous discounts or lower interest rates.

- Usually, Banks offer below Rs.4 lakh of Education loans without any security or guarantor.

- Without any upper limit under Section 80E of the Income Tax Act of India, 1961, the interest disbursed on the loan can be claimed as a deduction.

- Government sponsors subsidy schemes to assist students from the economically backward sections of society to avail the benefits of education loans.

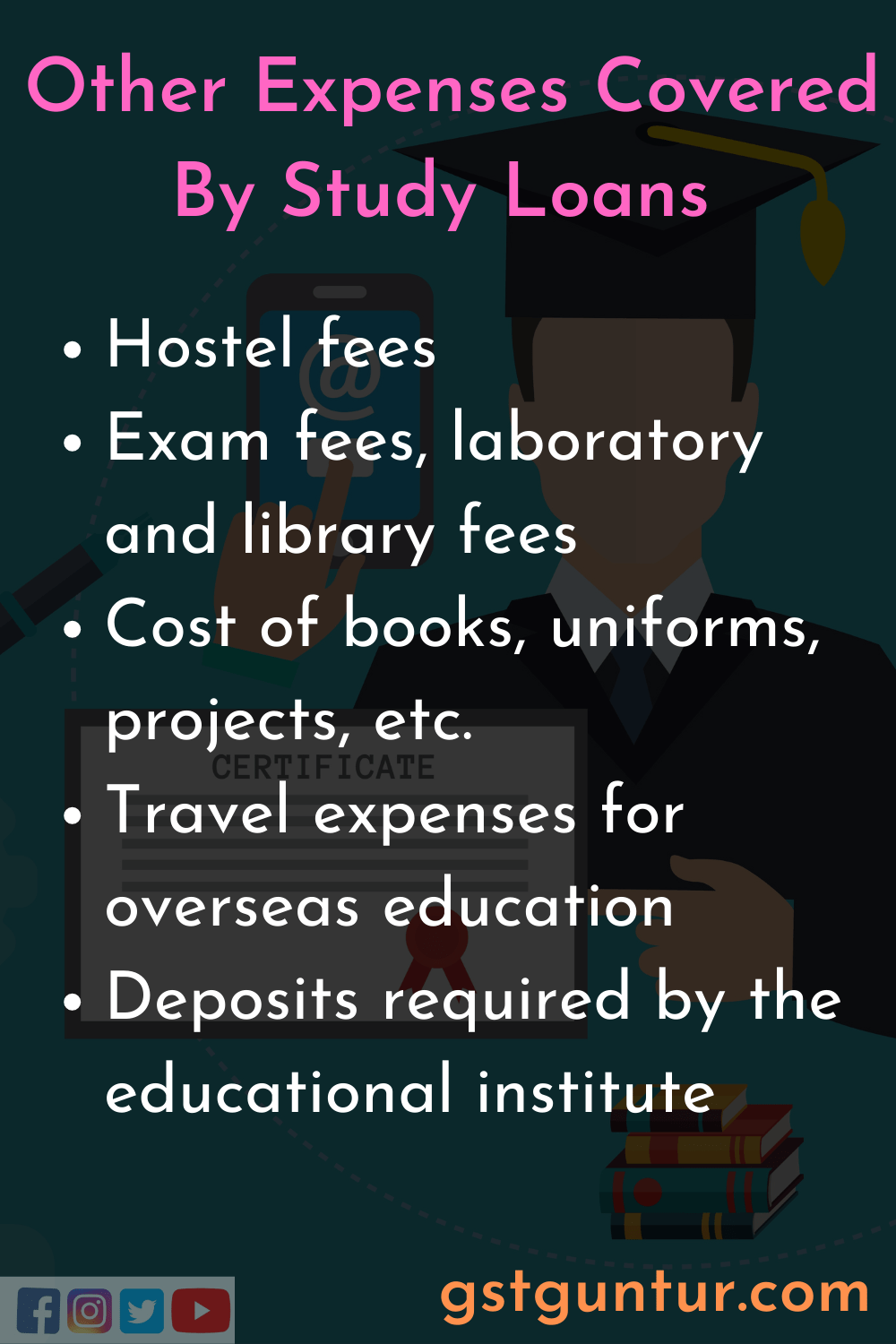

List of Expenses Covered under Education Loan

- Provide enough amount of fees that are structured as per the educational institutes.

- Insurance premium for student borrowers, if applicable.

- Examination/Library/Laboratory fee.

- Purchase of books/equipment/instruments/uniforms (total expense should not exceed 20% of total loan).

- Travel expenses/passage money for studies abroad.

- Caution deposit, building fund/refundable deposit supported by institution bills/receipts (total expense should not exceed 10% of total loan).

- Purchase of computer at an affordable cost, if needed to complete the course (total expense should not exceed 20% of total loan).

- While estimating loan required, scholarships, fee waiver, etc., if any available to the student borrower.

- Other expenses needed to achieve the course, such as study tours, project work, thesis, etc. (total expense should not exceed 20% of total loan).

FAQs on Education Loan Details in India

1. What are the types of courses covered under the study loan?

Study loans can be taken for a full-time, part-time, or vocational course of graduation or post-graduation in the fields of engineering, medical, architecture, hotel, management, etc.

2. What are the benefits of the Income-tax Act?

Section 80E of the I-T Act allows for a deduction on the interest paid on the repayment of the study loan. This deduction is allowed for a maximum of 8 years. You can deduct the entire interest amount paid from your taxable income and the first amount doesn’t qualify for any tax deduction.

3. What is Education Loan EMI Calculator?

A smart tool that calculates your monthly EMI amount payable to the banker/lender is called the Education loan EMI calculator. In the EMI calculator, you just have to enter the values like Principal amount (P), Time duration (N), and Rate of interest ® to find out the EMI and understand your finances prior.

4. What are the factors that lenders consider for loan approval?

The following factors are considered by the lender while approving a loan:

- The amount you require

- Selected course and institute

- Family assets

- Your academic performance

- Repayment capacity of your family

- Annual income