Do you wanna take a Personal Loan for your financial needs and stuck up on where to start with? Then, halt your search as our article will shed some light on you regarding What is a Personal Loan, Top Personal Loan Offering Bank Schemes & Offers, Eligibility Criteria to avail a Personal Loan, Documents Required. Go through the later sections to know the further details such as Processing Fee, Benefits & Features of a Personal Loan, Risks Associated with a Personal Loan, etc.

- What is a Personal Loan?

- Personal Loan Details

- Top Personal Loan Schemes and Offers

- How to Apply for a Personal Loan?

- Risks Associated with Personal Loan

- KYC Documents Needed for Personal Loan

- Income Documents Needed for Personal Loan

- Personal Loan at Lower Interest Rate 10 Nov 2021

- Tips to Keep in mind while applying for a Personal Loan

- Benefits & Features of Personal Loan

- FAQs on Personal Loan

What is a Personal Loan?

A Personal Loan is a kind of unsecured loan offered by banks without any security or collateral for all your financial needs. Usually, Personal Loans are available at fixed interest rates and the processing is fast compared to any other loans such as home loans, education loans, gold loans, etc.

Personal Loan Details

| Interest Rate | 8.95% p.a. onwards |

| Loan Amount | Up to Rs.50 lakh |

| Loan Tenure | Up to 5 years |

| Processing Fee | 0% – 3% of the loan amount + GST |

Top Personal Loan Schemes and Offers

| Bank | Best For | Key Highlights |

|---|---|---|

| ICICI Bank Personal Loan | Low-interest rates and Available internationally |

|

| Rupee Cooperative Bank Personal Loan | Fast and easy loan applications are available. |

|

| Saptagiri Grameena Bank Personal Loan | Low Interest Rates |

|

| Sardar Bhiladwala Pardi Pepls Co Bk Personal Loan | Affordable and competitive interest rates |

|

| Malwa Gramin Bank Personal Loan | Maximum Loan Amount |

|

| Kalyan Janata Sahakari Bank Personal Loan | Fast & easy processing of personal loan applications |

|

| Nasik Merchants Cooperative Bank Personal Loan | Low and Attractive Interest Rates |

|

| Sarva UP Gramin Bank Personal Loan | The approval procedure is simple. |

|

| Oriental Bank of Commerce Personal Loan | Approval of personal loans is done quickly. |

|

| State Bank of Mysore Personal Loan | Indian households can fulfill all their financial requirements. |

|

| State Bank of Travancore Personal Loan | numerous loan repayment options available and The loan application is processed in a timely manner. |

|

| Tamilnad Mercantile Bank Personal Loan | Low Rate Interest |

|

| The Greater Bombay Cooperative Bank Personal Loan | Free Loan Approval Process |

|

| The Nainital Bank Personal Loan | Low Interest Rate and Fast Processing |

|

| The Surath Peoples Cooperative Bank Personal Loan | Approval of the loan is quick |

|

| The Zoroastrian Cooperative Bank Personal Loan | Low Interest Rates |

|

| Tripura Gramin Bank Personal Loan | Low Interest Rates |

|

| Ujjivan Small Finance Bank Personal Loan | Flexible loan amount |

|

| United Bank of India Personal Loan | Low Interest rates |

|

| Utkarsh Small Finance Bank Personal Loan | Quick loan authorization |

|

| Shikshak Sahakari Bank Personal Loan | Impressive and competitive interest rates |

|

| Uttar Bihar Gramin Bank Personal Loan | Competitive interest rates |

|

| The Mapusa Urban Coop Bank of Goa Ltd Personal Loan | Huge Amount With Low Interest Rates |

|

| The Cosmos Co Operative Bank Personal Loan | Approval With in 3 days. |

|

| Sutlej Kshetriya Gramin Bank Personal Loan | Processing personal loan applications are quick and simple. |

|

| The A.P. Mahesh Cooperative Urban Bank Personal Loan | The loan application is processed quickly. |

|

| Zila Sahakari Bank Personal Loan | Regular employees of the Government of India |

|

| Vanachal Gramin Bank Personal Loan | Interest rates which are both attractive and competitive |

|

| NKGSB Cooperative Bank Personal Loan | Interest rates that are both attractive and competitive |

|

| Nutan Sahakari Bank Personal Loan | easy and fast, quickly approved. |

|

| State Bank of Hyderabad Personal Loan | High Rate of Interest, Fast Disbursal |

|

| Vijaya Bank Personal Loan | High Loan Amount and Fast Disbursal |

|

| South Indian Bank Personal Loan | High Rate of Interest, Easy To Apply |

|

| Nagpur Nagarik Sahakari Bank Personal Loan | Easy and fast processing of the personal loan that the person applies for. |

|

| Nagaland Rural Bank Personal Loan | Easy processing |

|

| Meghalaya Rural Bank Personal Loan | Processing price is extremely low, and there are no extra expenses |

|

| Kaveri Grameena Bank Personal Loan | very attractive and competitive interest rates |

|

| Indian Mercantile Cooperative Bank Personal Loan | Personal loan applications are processed efficiently and simply. |

|

| IndusInd Bank Personal Loan | Rates that are competitive |

|

| Jammu And Kashmir Bank Personal Loan | Low Interest Rates ( Depends on Cibil Score) |

|

| Karur Vysya Bank Personal Loan | Quick Approval of Loan |

|

| Karnataka Bank Personal Loan | High Loan Amount With Low Interest Rates |

|

| Langpi Dehangi Rural Bank Personal Loan | Flexible Interest Rates |

|

| Mahanagar Cooperative Bank Personal Loan | Provides Attractive Interest Rates. |

|

| IDFC Bank Personal Loan | low-interest rates and versatile and adaptable payback terms. |

|

| Janakalyan Sahakari Bank Personal Loan | Reasonable interest rate, Processing expense is low |

|

| Janata Sahakari Bank Personal Loan | quick and uncomplicated process of a personal loan. |

|

| Fincare Small Finance Bank Personal Loan | Approval Of Personal Loans Online With Minimum Documents |

|

| Dena Gujarat Gramin Bank Personal Loan | Impressive Rate Of Interest |

|

| Bank of Baroda Personal Loan | No strict Credit limits |

|

| City Union Bank Personal Loan | For any type of Personal Loan |

|

| Equitas Small Finance Bank Personal Loan | Fast and Easy Processing of the personal loan application |

|

| Dombivli Nagari Sahakari Bank Personal Loan | Any individual can have the opportunity to have this bank loan |

|

| New India Cooperative Bank Personal Loan | Repayment Term is Quite Flexible |

|

| Narmada Jhabua Gramin Bank Personal Loan | Loans are approved quickly. |

|

| Punjab And Sind Bank Personal Loan | PSB provides personal loans at a very affordable rate of interest |

|

| Odisha Gramya Bank Personal Loan | Personal loan applications are processed quickly and easily |

|

| Manipur Rural Bank Personal Loan | Less processing fee with fast processing |

|

| Pallavan Grama Bank Personal Loan | Easy documentation process |

|

| Nagar Urban Co Operative Bank Personal Loan | Simple and fast loan processing, Best for personal requirements. |

|

| Kashi Gomti Samyut Gramin Bank Personal Loan | Interest rates that are both attractive and competitive. |

|

| Apna Sahakari Bank Limited Personal Loan | Easy and speedy processing of your loan application |

|

| Andhra Pradesh Grameena Vikas Bank Personal Loan | You Can Spend It On Educational Purposes Or Build A House And Even For A Vacation If You Like. |

|

| Allahabad Bank Personal Loan | Minimum Interest Rate |

|

| Arunachal Pradesh Rural Bank Personal Loan | The interest rate is competitive and reasonable. Documentation is kept to a minimum. |

|

| Sarva Haryana Gramin Bank Personal Loan |

|

|

| State Bank of Patiala Personal Loan | Loan approval is quite quick |

|

| Saraswat Cooperative Bank Personal Loan | Fixed-Rate of Interest and Flexibility in repayment tenure |

|

| State Bank of India Personal Loan | Multiple Personal Loans and can fulfill your financial needs with a loan |

|

| Sangli Urban Co Op Bank Ltd Sangli Personal Loan | bank offers many discounts and special schemes |

|

| Puduvai Bharathiar Grama Bank Personal Loan | Minimal Documentation and Simple Process |

|

| Prathama Bank Personal Loan | The processing requires very little documentation. It provides very fast approval. |

|

| Saurashtra Gramin Bank Personal Loan | Provides you with fast & easy processing of personal loan application |

|

| Solapur Janata Sahakari Bank Personal Loan | The loan approval is quite quick. |

|

| Maharashtra Gramin Bank Personal Loan | Personal loan applications methods are quick and straightforward. |

|

| Laxmi Vilas Bank Personal Loan | Superfast approval for a personal loan |

|

| Madhyanchal Gramin Bank Personal Loan | Quick loan approval |

|

| Mizoram Rural Bank Personal Loan | Approval of a loan promptly |

|

| Syndicate Bank Personal Loan | personal loans are easy to apply |

|

| Kotak Mahindra Bank Personal Loan | A quick disbursement, with money in your account within two days |

|

| North East Small Finance Bank Personal Loan | You can get options to repay multiple loans. |

|

| Paschim Banga Gramin Bank Personal Loan | Approval of the loan within 24 hours |

|

| Rajkot Nagrik Sahakari Bank Personal Loan | Loans are approved quickly. |

|

| Punjab National Bank Personal Loan | Lowest Interest Rates |

|

| Rajarambapu Sahakari Bank Personal Loan | – | – |

| The Akola Janata Commercial Cooperative Bank | – | – |

| Telangana Grameena Bank Personal Loan | The loan approval is quite quick. |

|

| Suryoday Small Finance Bank Personal Loan | Higher interest rates |

|

| State Bank of Bikaner and Jaipur Personal Loan | The bank has effortless and fast personal loan application’s processing. |

|

| Yes Bank Personal Loan | Very Good Interest Rate |

|

| Uttarakhand Gramin Bank Personal Loan | The Bank Does Not Require A Guarantor. Interest Rates That Are Both Attractive And Competitive |

|

| Uttar Banga Kshetriya Gramin Bank Personal Loan | Applications for Personal Loans Are Processed Quickly And Easily. |

|

| UCO Bank Personal Loan | There Are Many Repayment Options. Quick And Hassle-Free Process Of The Loan Application. Loan Approval Does Not Take Much Time |

|

| TJSB Sahakari Bank Personal Loan | Quick And Easy Processing Of The Loan Sanction Form. Loan Approval Does Not Take Much Time. |

|

| Himachal Pradesh Gramin Bank Personal Loan | Customer Care Services. Lowest Interest Rates. Provide You With The Best Options for A Personal Loan |

|

| The Goa Urban Co Op Bank Personal Loan | Fast & Easy Processing Of Personal Loan Applications, Quick loan approval. |

|

| The Jalgaon People’s Cooperative Bank | Multiple Loan Repayment Options and Quick loan approval. |

|

| The Karad Urban Cooperative Bank Personal Loan | The Goal Of A Karad Urban Cooperative Bank Personal Loan Is To Meet A Variety Of Financial Needs |

|

| The Mehsana Urban Cooperative Bank Personal Loan | Approval for The Loan Application Is Quick. Personal Loan Application Is Fast And Easy Processing Which Makes It More Convenient For Individuals. |

|

| The Shamrao Vithal Cooperative Bank Personal Loan | Highest Interest Rates. |

|

| The Thane Bharat Sahakari Bank Personal Loan | Lowest Conceivable Interest Rates |

|

| Corporation Bank Personal Loan | Mainly for Personal Expenses |

|

| G P Parsik Bank Personal Loan | Low Rate of Interest |

|

| Dhanalakshmi Bank Personal Loan | Easy documentation |

|

| Citizen Credit Cooperative Bank Personal Loan | Personal Loan Applications Are Mostly Processed Quickly And Easily. |

|

| Federal Bank Personal Loan | Simple Documentation |

|

| Ellaquai Dehati Bank Personal Loan | Lowest Interest Rates |

|

| Chaitanya Godavari Grameena Bank Personal Loan | Interest Rates That Are Both Attractive And Competitive. The Rapid Acceptance Of Loans |

|

| Capital Small Finance Bank Personal Loan | Quick Loan Acceptance, Impressive And Active Rate Of Interest |

|

| Utkal Grameen Bank Personal Loan | Personal Loan Application Is Processed Quickly And Easily, Making It More Convenient For Consumers. |

|

| Union Bank of India Personal Loan | Variety Of Loan Repayment Choices Available, Approved Quickly And Easily |

|

| Bank of India Personal Loan | Lowest Interest Rates |

|

| Bangiya Gramin Vikash Bank Personal Loan | Open To Both Professional And Self-Employed People. |

|

|

||

| Karnataka Vikas Grameena Bank Personal Loan | Quick Loan Approval |

|

| AU Small Finance Bank Personal Loan | Low-Interest Rate |

|

| Bandhan Bank Personal Loan | Quick Disbursal |

|

| Baroda Rajasthan Kshetriya Gramin Bank Personal Loan | Interest Rates are Attractive and Competitive |

|

| Bassein Catholic Cooperative Bank Personal Loan | Fastest Loan Approval |

|

| Bharati Sahakari Bank Personal Loan | Quick and Responsive, Faster Loan Approval |

|

| Catholic Syrian Bank Personal Loan | Lowest Interest Rate and Quick Loan Approval |

|

| Canara Bank Personal Loan | Quick Loan Approval |

|

| Chhattisgarh Rajya Gramin Bank Personal Loan | Quick Loan Approval |

|

| Indian Overseas Bank Personal Loan | For Various Personal Financial Commitments |

|

| Janalaxmi Coop Bank Personal Loan | Quickly Approves The Loan, Provides Competitive And Attractive Interest Rates. |

|

| Kalupur Commercial Cooperative Bank Personal Loan | Attractive in comparative interest rates. High chances of quick loan approval |

|

| Export-Import Bank of India Personal Loan | Personal Loan Applications Are Processed Efficiently And Quickly. A Higher Interest Rate May Be Charged. |

|

| Jalgaon Janata Sahakari Bank Personal Loan | Minimum Loan Amount |

|

| Jammu And Kashmir Grameen Bank Personal Loan | Application for personal loans is easy and fast. Interest rates that are both attractive and competitive |

|

| Jharkhand Gramin Bank Personal Loan | Can Avail loan in Simple 3 Easy Steps |

|

| Gramin Bank of Aryavart Personal Loan | Quick Disbursal |

|

| DCB Bank Personal Loan | Helps People To Satisfy Their Necessities. |

|

| Indian Bank Personal Loan | The flexibility of Loan Amount |

|

| Kapol Cooperative Bank Personal Loan | Processed Immediately and Effortlessly. |

|

| Central Madhya Pradesh Gramin Bank Personal Loan | Quick Disbursal |

|

| Bihar Gramin Bank Personal Loan | Low Interest Rates. A couple of loan reimbursement alternatives |

|

| IDBI Bank Personal Loan | Low Interest Rates and Customizable Repayment Schedule |

|

| Citibank Personal Loan | Low-Interest Rate |

|

| HDFC Personal Loan | Self-Employed Professional |

|

| Kotak Mahindra Personal Loan | Quick Turnaround Time |

|

| Tata Capital Personal Loan | Flexible Interest Rates |

|

| Standard Chartered Personal Loan | Short-term Requirement |

|

| ICICI Bank Personal Loan | Quick Disbursal |

|

| IDFC First Personal Loan | Top-Up Loans |

|

| Fullerton India Personal Loan | Quick Approval |

|

| SBI Personal Loan | Different Income Categories |

|

| IIFL Personal Loan | Easy Eligibility Checks |

|

| HDBFS Personal Loan | Special Offers |

|

| PNB Personal Loan | Affordable Interest Rates |

|

*Note: Above Listed Data on Interest Rates is True to our Knowledge. However, it can vary go through the terms and conditions before confirming.*

How to Apply for a Personal Loan?

The Application Process for a Personal Loan is convenient and straightforward. Follow the Simple Steps listed below and Apply for a Personal Loan Online. They are as under

- Firstly, evaluate your needs so that you can know the loan amount you need.

- Check the Eligibility Conditions of the Bank and decide whether you meet them or not.

- Know the personal interest rate offered by the bank and use a personal loan EMI Calculator to decide how much your monthly outgo will be.

- If you are already an existing customer of the bank apply for the loan using the bank’s mobile baking app or through the internet banking feature. if you are new to the bank download the application from the bank’s official website or visit a branch and get the application form.

- Provide the required KYC Documents along with the Application Form and check the Processing Fee.

- Once you submit them bank will verify the documents and sanction the loan after approving the amount after you meet the eligibility. Next, you need to sign the agreement and the Standing Instruction Request/ECS Forms.

- Once you are done with the process funds will be disbursed into your account.

Do Check: HDFC Bank Personal Loan

Risks Associated with Personal Loan

- In case if you don’t repay your loan on time the bank may sue you and take you to court since you are not backed by any security.

- In case if you want to pay the personal loan too early there are chances of high penalization.

- Don’t get into a fake loan agreement by seeing a false advertisement.

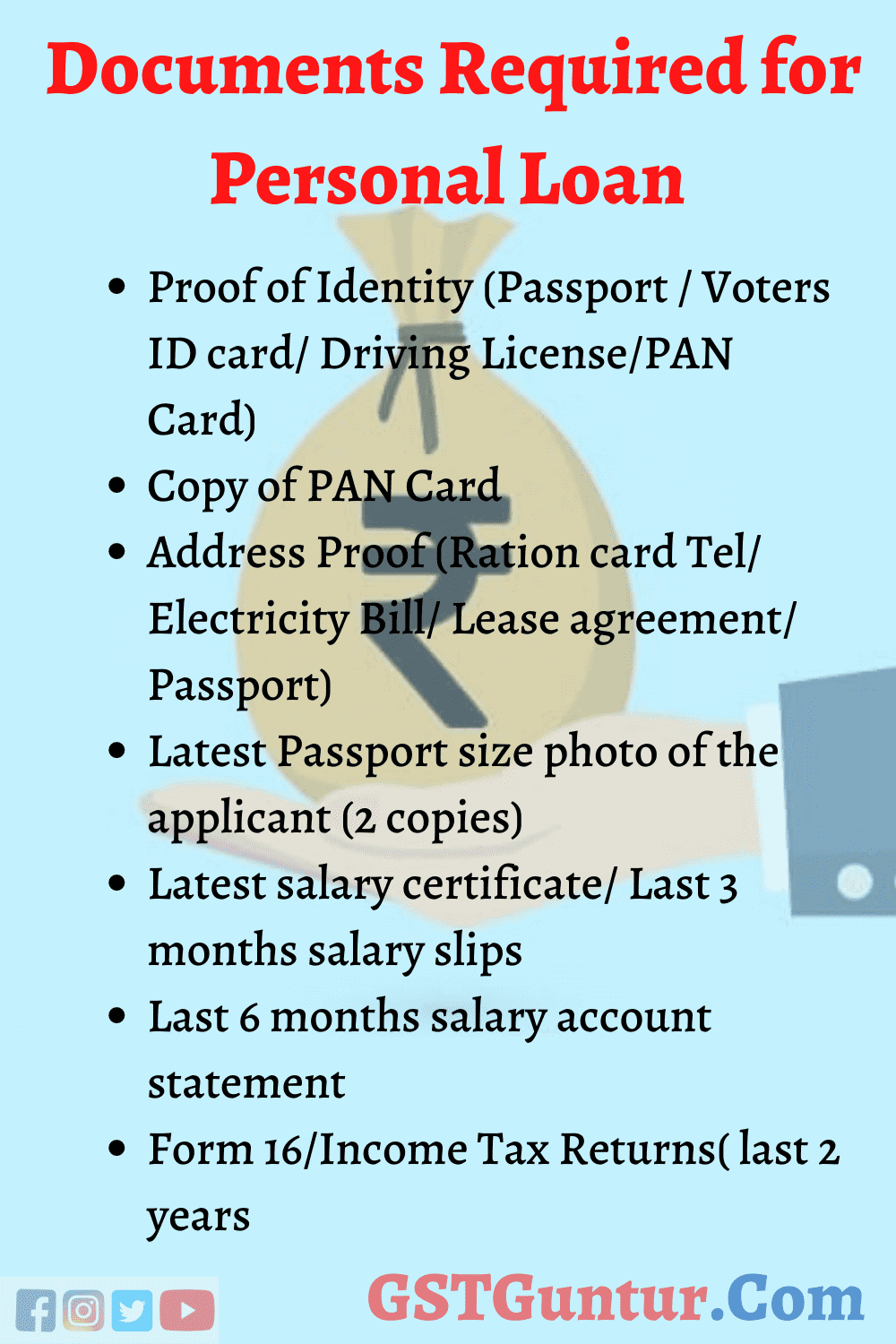

KYC Documents Needed for Personal Loan

Following are the KYC Documents Needed for Personal Loan. They are along the lines

- Proof of Identity (Passport / Voters ID card/ Driving License/PAN Card)

- Copy of PAN Card

- Address Proof (Ration card Tel/ Electricity Bill/ Lease agreement/ Passport)

- Latest Passport size photo of the applicant (2 copies)

Income Documents Needed for Personal Loan

You need to keep the following Income Related Documents Handy before applying for a Personal Loan as you might need them. They are as follows

- Latest salary certificate/ Last 3 months salary slips

- Last 6 months salary account statement

- Form 16/Income Tax Returns( last 2 years)

Personal Loan at Lower Interest Rate 10 Nov 2021

| Bank | Interest Rate | Tenure |

|---|---|---|

| South Indian Bank | 10.90% – 15.00% | Tenure max. upto 48 Months |

| Oriental Bank Of Commerce | 11.20% to 12.95% | Maximum Tenure 60 months |

| UCO Bank | 11.35% to 11.60% | Maximum Tenure 60 months |

| Central Bank Of India | 11.40% | Maximum Tenure of 48 Months |

| Kotak Mahindra Bank Limited | 11.5% to 24% | Maximum Tenure 60 months |

| Andhra Bank | 11.50% to 13% | Contact Bank Branch |

| Icici Bank Limited | 11.59% to 22.00% | Maximum Tenure 60 months |

| Dhanalakshmi Bank | 11.68% to 15.65% | Max. Tenure 60 months |

| Indian Overseas Bank | 11.80% | Maximum Tenure 60 months |

| Punjab National Bank | 11.90% to 14.90% | Contact Bank Branch |

| Yes Bank | 11.99% – 20.00% | Maximum Tenure 60 months |

| Indusind Bank | 11% to 30.50% | Maximum Tenure 60 months |

| Catholic Syrian Bank Limited | 12.00% to 19.00% | Maximum Tenure 60 months |

| Idbi Bank | 12.20% | Maximum Tenure 60 months |

| State Bank Of India | 12.45% | Maximum Tenure of 48 Months |

| Bharatiya Mahila Bank Limited | 12.45% | Maximum Tenure of 48 Months |

| State Bank Of Mysore | 12.45% | Maximum Tenure of 48 Months |

| State Bank Of Hyderabad | 12.45% | Maximum Tenure of 48 Months |

| State Bank Of Patiala | 12.45% | Maximum Tenure of 48 Months |

| State Bank Of Travancore | 12.45% | Maximum Tenure of 48 Months |

| State Bank Of Bikaner And Jaipur | 12.45% | Maximum Tenure of 48 Months |

| Vijaya Bank | 12.50% to 13.50% | Maximum Tenure 60 months |

| Bank Of Maharashtra | 12.75% | Maximum Tenure 36 months |

| Corporation Bank | 12.75% to 13.75% | Maximum Tenure 60 months |

| Punjab And Sind Bank | 12.75% to 14% | Maximum Tenure 60 months |

*Note: Above is the banks that provide Lower Interest Rates on Personal Loan effect to 10th November 2021. Kindly check them before applying for personal loans as they may vary at times based on terms and conditions.*

Tips to Keep in mind while applying for a Personal Loan

Follow the simple steps listed below before applying for a personal loan. They are as under

- The first and foremost step is to try for a bank where you have a relationship such as a salary account, home loan, car loan, etc. so that KYC Process will be much easier and faster.

- Later compare the personal loan interest rates, processing fees, penalty for pre-payment/foreclosure, etc. as all these add up to your cost. Banks that offer lower interest rates will charge a higher processing charge or penalty for foreclosure.

- Maintain a good credit score so as to improve your chances of loan requests getting approved. This is one of the conditions along with other conditions of loan application reviewing.

- Make sure you repay the loans on time as they would improve your chances of securing the loan.

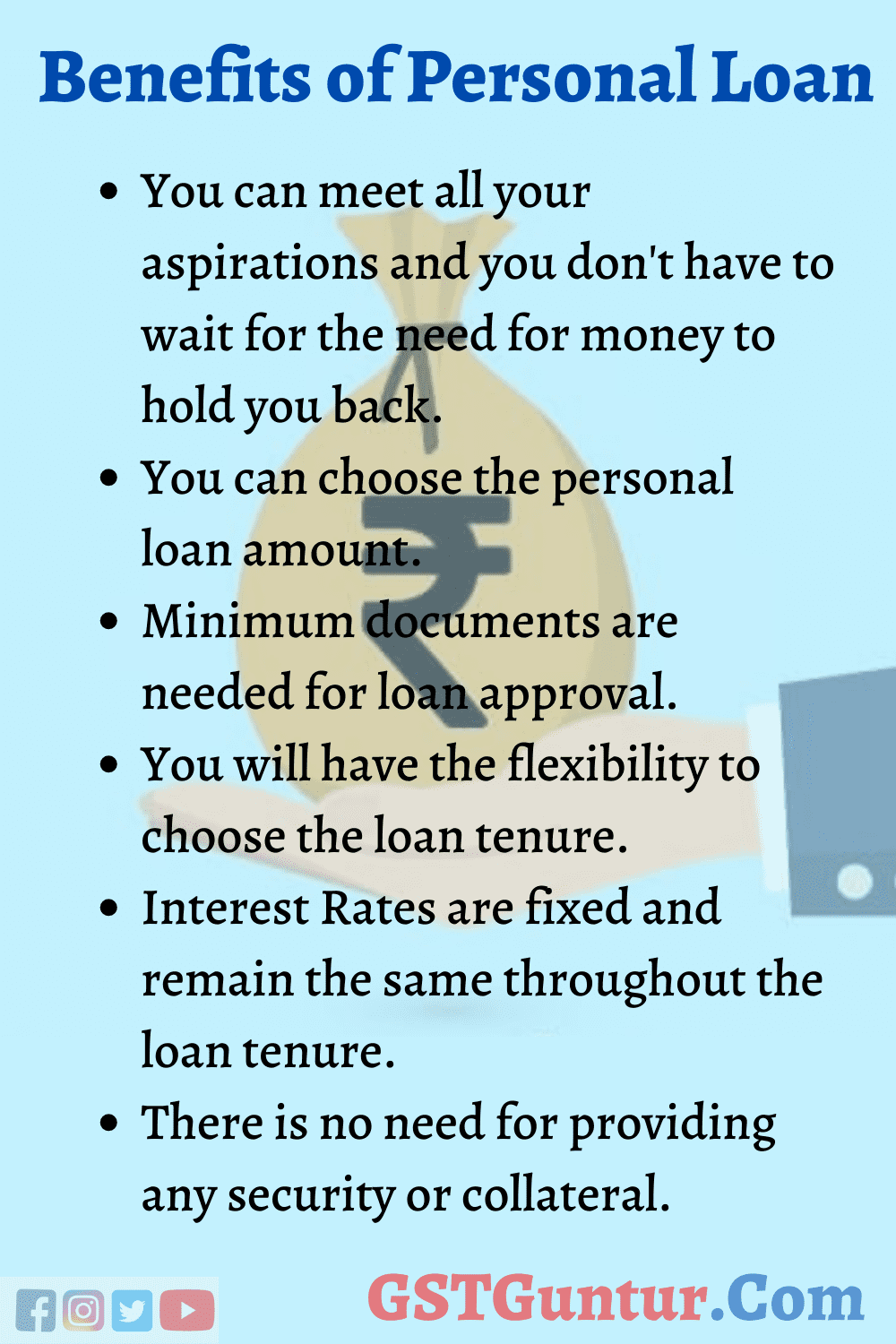

Benefits & Features of Personal Loan

There are several perks of choosing a Personal Loan as we have outlined some of them for your idea. They are as follows

- You can meet all your aspirations and you don’t have to wait for the need for money to hold you back.

- You can choose the personal loan amount.

- Minimum documents are needed for loan approval.

- You will have the flexibility to choose the loan tenure.

- Interest Rates are fixed and remain the same throughout the loan tenure.

- There is no need for providing any security or collateral.

FAQs on Personal Loan

1. What is meant by a Personal Loan?

A Personal Loan is a type of unsecured loan that you can borrow from any financial institution or bank for all your financial needs.

2. What are the Documents Required for Applying for a Personal Loan?

Below is the list of minimum documents needed while applying for a Personal Loan and they are as follows

- Proof of Identity (Passport / Voters ID card/ Driving License/PAN Card)

- Copy of PAN Card

- Address Proof (Ration card Tel/ Electricity Bill/ Lease agreement/ Passport)

- Latest Passport size photo of the applicant (2 copies)

3. Does a personal loan offer tax benefits?

No Personal Loans are not eligible for tax benefits unlike home loans or some secured Business Loans.

4. What can a Personal Loan be used for?

You can use the Personal Loan for any of your needs and there is no restriction on what the money should be used for.