Business is an ocean!!! Everyone wants to start and grow their business. To initiate any type of business we just need enough amount of funding. Sometimes people need some funds to originate home or business then we require a trusted source like banks and leading finance companies. The lender offers Home Loan & Business Loan to achieve dreams.

Avail business loans in India by fulfilling all the eligibility conditions of the bank or lender and step into the new journey of your life. Well, some of the people have queries like Is Getting a business loan can be easy? Is applying for a business loan tricky or not? Can we get a Business Loan at Lowest Interest Rates? and more. To clarify all your doubts, we have come up with this ultimate guide on Business loans.

Look at the whole article & know major details such as What is a business loan, types of business loans, Eligibility, Documents required for commercial loans, business loan interest rate, how to apply loan for your business online, etc.

- What is Business Loan in India?

- Business Loan Details

- Types of Business Loans in India

- Secured Vs Unsecured Business Loans

- Popular Commerical Loan Schemes for Women Entrepreneurs

- Reasons for Applying a Loan for your business

- Business Loan Eligibility

- Factors That Determine Eligibility for Business Loan Are

- Features of Commerical Loan

- Business Loan Benefits

- Compare Lowest Business Loan Interest Rate in India

- How do you get a Business Loan Collateral Free? (Easy Process)

- Details Covered in Business Loan Application Form

- Documents Required for Business Loan Application

- List of Items a Bank (Lender) can request before approving a Business Loan

- Business Loan Fees and Charges

- List of Important Schemes on Business loan by Government of India

- Best Tips to Get Business Loan Sanction with Ease

- FAQs on Collateral Free Loan for Your Business

What is Business Loan in India?

Business Loan is financial support offered by NBFCs and Banks in India. The main objective of these loans is to help the needed lenders to grow their business. The other name for a business loan is commercial loans. Several financial institutions provide term loans and Flexi loans for catering to the company’s needs in terms of growing their business. These loans can be obtained by all types of businesses like proprietorships, privately held companies, partnership firms, self-employed individuals & retailers.

Business Loan Details

| Interest Rate | 14.00% onwards |

| Processing Fee | Upto 3% of the loan amount |

| Loan Tenure | Upto 5 years |

| Lowest EMI per lakh | ₹ 2,327 for 5 years |

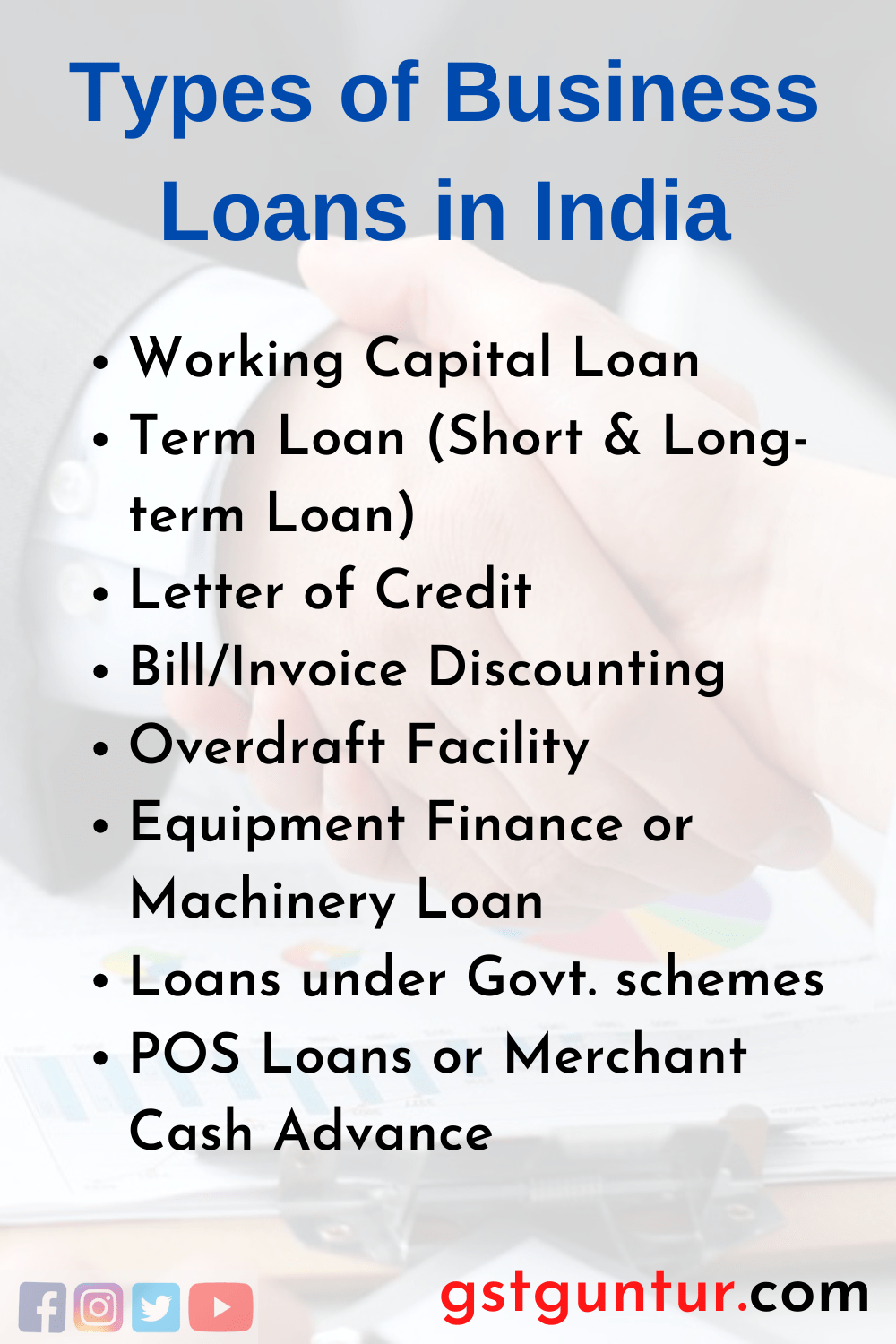

Types of Business Loans in India

Generally, there are 8 business loan types in India that are separated into various categories. They are as such:

- Working Capital Loan

- Term Loan (Short & Long-term Loan)

- Letter of Credit

- Bill/Invoice Discounting

- Overdraft Facility

- Equipment Finance or Machinery Loan

- Loans under Govt. schemes

- POS Loans or Merchant Cash Advance

Business Loan Types – On the basis of Security

Based on the security, business loans are classified into two categories and they are:

(1) Secured Business Loan: This loan is upheld by collateral. Banks or any finance companies offer secured loans at a low-interest rate because they can auction the collateral if any negligence by the borrower while payments.

(2) Unsecured Business Loan: This loan is not financed by any collateral. Borrowers can opt for this loan comparatively at a high-interest rate to the borrowers.

Business Loan Types – On the basis of Tenure

Here, you can see that the Business Loan has been divided into two categories based on tenure. They are as follows:

(1) Working Capital Business Loan: It is granted for driving the daily operations of a business easily. Usually, It is given for the shorter term.

(2) Term Business Loan: It is granted for the extension and expansion of business. It is approximately for a longer-term.

Secured Vs Unsecured Business Loans

Business loans can be given in two ways secured and unsecured loans. When you opt for a business loan by providing any of your own assets like a home or other business etc. to the banks/finance company then it is called a secured loan.

Unsecured business loans are the ones that can opt directly from the banks without any security. The rate of interest for secured loans is lower compared to unsecured loans. In case, your payments are not getting cleared from time to time, then you will need to hand over the asset that you gave as security to the bank/finance companies.

Popular Commerical Loan Schemes for Women Entrepreneurs

A few schemes on business loans for women entrepreneurs are listed here. Check it out and get complete details from the respective lender and start your business.

- Mahila Udyam Nidhi Scheme

- Mahila Samridhi Yojana

- Cent Kalyani from the Central Bank of India

- Stree Shakti Package from the State Bank of India

- Shringaar and Annapurna from the State Bank of India

- Dena Shakti Scheme from Bank of Baroda

- Udyogini Scheme

Reasons for Applying a Loan for your business

- Originate a new Business

- New Business Opportunity

- To purchase Plant and Machinery for your Business

- Renting or buying a place for your Business

- To hire new people

- Improving Services and new technology for Business

- For Business Expansion

- To pay for salaries and wages to current employees

- Purchase of Inventories

- Working Capital Requirement

- Need of Equipment for Business

- Transfer your existing Business Loan due to the lower interest rate offered by the target bank

Business Loan Eligibility

Different banks and finance companies will use different factors to determine the loan amount eligibility of their borrowers. The standard eligibility criteria factors that can be followed by most banks to calculate the business loan eligibility are as follows:

Factors That Determine Eligibility for Business Loan Are

- Age of Business

- Loan Repayment Track Record

- Financials of your Business Entity including its Earnings

- Check Credit Score / Credit Performance Update

- Debt Service Ability of the Borrower

- Financial Ratios of the Entity

- Existing Relationship with the Bank

- Cash flows of the Business

- Additional eligibility condition is a borrower should have a self-owned house or workplace

Features of Commerical Loan

- A few banks need a Guarantor

- Lenders price interest on loans, which can be fixed or floating

- Lenders usually ask for security/collateral against Business Loan

- Multiple repayment options are available

- Most of the bankers/lenders offer Online Application Facility

- Also, some banks offer collateral free business loans for borrowers

- Lenders or Banks verify your loan eligibility before approval of the business loan

Business Loan Benefits

- Quick approval of the loans

- Apply online via a hassle-free process

- Banks offer Customer Oriented Services

- Multiple repayment options

- Attractive Business Loan Interest Rates

- Flexible Business Solutions are provided by banks

- Availability of long Repayment Period

- Include with no hidden fees and charges

- Easy documentation

- Flexible tenure options

Compare Lowest Business Loan Interest Rate in India

In this section, you will get to know the comparison of top banks Business Loan Interest Rates in India as on 15-11-2021.

| Bank | Interest Rate | Tenure | Explore |

|---|---|---|---|

| Union Bank Of India | 10.10% to 13.85% | Maximum 5 years | Explore |

| Bank Of India | 10.20% to 12.95% | Maximum 5 years | Explore |

| South Indian Bank | 10.60% to 12.10% | Contact Bank Branch | Explore |

| Punjab And Sind Bank | 10.65% to 10.90% | Maximum 5 years | Explore |

| Uco Bank | 10.70% to 13.20% | Maximum 5 years | Explore |

| Indian Overseas Bank | 11.20% to 12.20% | Maximum 5 years | Explore |

| Vijaya Bank | 11.25% | Maximum 10 Years | Explore |

| Dhanalakshmi Bank | 11.43% to 13.90% | Max. 5 Years | Explore |

| Karur Vysya Bank | 11.85% | Max. 7 Years | Explore |

| State Bank Of India | 11% to 16.65% | Maximum 5 years | Explore |

| Jammu And Kashmir Bank Limited | 12.05% to 12.55% | Max. 10 Years | Explore |

| Federal Bank | 12.10% to 13.60% | Max. 10 Years | Explore |

| City Union Bank Limited | 12.50% to 13.50% | Max. 5 Years | Explore |

| Bandhan Bank Limited | 12.55% to 16% | Max. 7 Years | Explore |

| Punjab National Bank | 12.60% to 15.60% | Maximum 7 years | Explore |

| Karnataka Bank Limited | 12% to 13% | Max. 5 Years | Explore |

| Indusind Bank | 12% to 23% | Max. 5 Years | Explore |

| United Bank Of India | 13.15% | Maximum 5 years | Explore |

| Central Bank Of India | 13.25% | Maximum 5 years | Explore |

*Note: Above interest rates and other mentioned information are tentative and it can differ from one lender to another based on their norms. Kindly readers are suggested to compare the rates and all tenure before applying or getting a loan from the bank or lender.

How do you get a Business Loan Collateral Free? (Easy Process)

The following are some simple steps that should be followed for getting a business loan:

- Research & Get Knowledge on what factors banks assess you.

- Fix the type of loan or long-term financing you require.

- Choose any leading bank or lender that offers the best & effective features.

- Determine your possibilities of getting approved.

- Finish your documentation that holds paperwork and records that help to approve.

- Fill out the application online or offline.

Details Covered in Business Loan Application Form

Individuals who are applying for Business Loan need to fill up the field covered in the Business Loan Application Form and submit it with the required attachments to get a loan. The following list of details is to be filled up carefully:

- Name of the Entity

- Registered Address of the Entity

- Nature of Business

- Date of Incorporation of the Entity (Sole Proprietorship, Partnership Firm, Private Limited Company, Public Limited Company)

- Name of Proprietors/ Partners/ Promoters

- Credit Facilities ( for both existing and applied for)

- Details of Collateral/ Security (in case of Secured Loan)

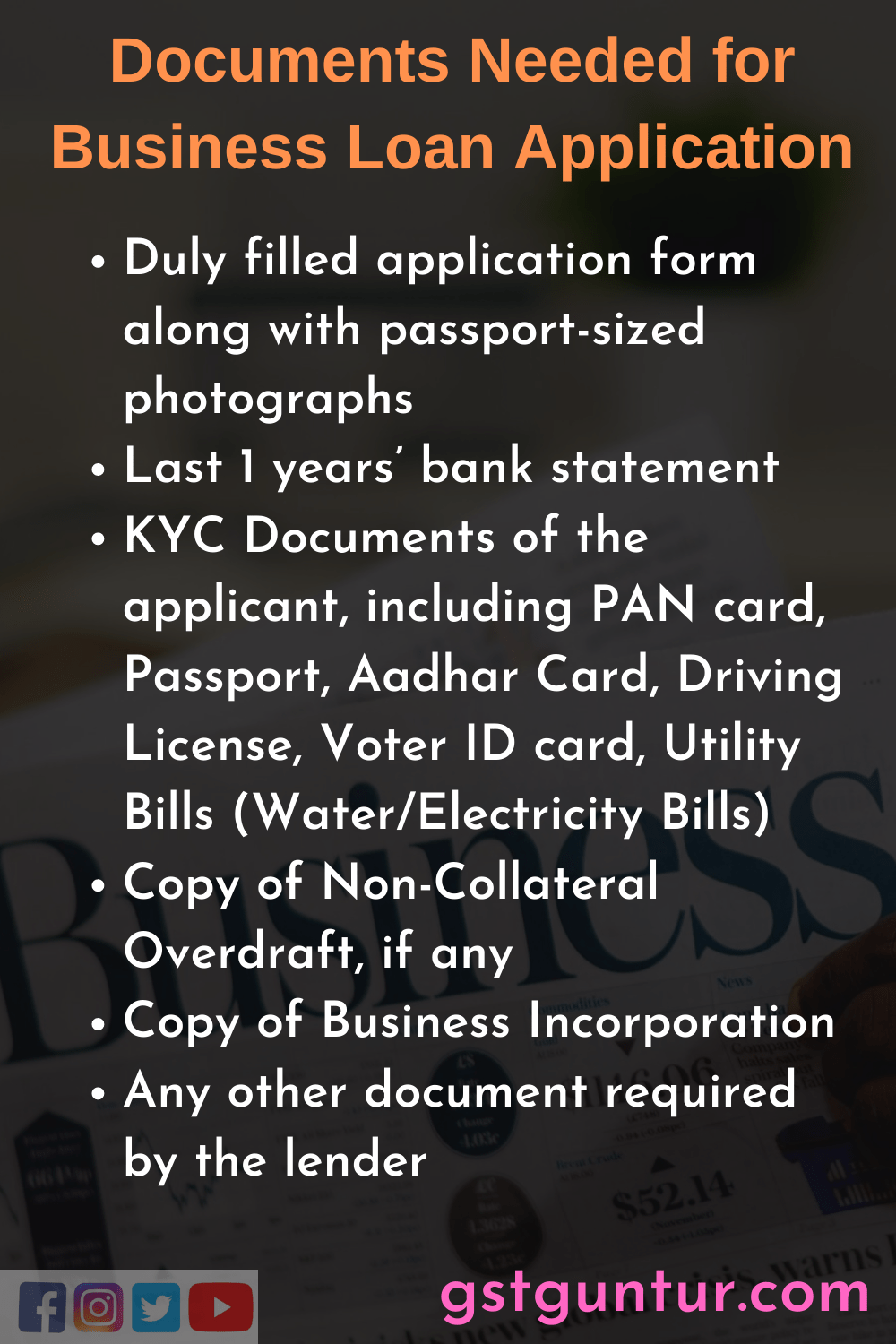

Documents Required for Business Loan Application Submission

When applying for a business loan, you will need to submit the following documents:

- Duly filled application form along with passport-sized photographs

- Last 1 years’ bank statement

- KYC Documents of the applicant, including PAN card, Passport, Aadhar Card, Driving License, Voter ID card, Utility Bills (Water/Electricity Bills)

- Copy of Non-Collateral Overdraft, if any

- Copy of Business Incorporation

- Any other document required by the lender

List of Items a Bank (Lender) can request before approving a Business Loan

- Comprehensive Business Plan

- Mission of Getting Loan

- Financial Details of the Business

- Insurance information

- Audited financial statements for the last 3 years.

- Copy of Income Tax Return (ITR) pertaining to a period of the last 3 years.

- Collateral in case of Secured Loan

- Shops and Establishment certificate

- Excise / Sales Tax registration certificate

- MSE registration certificate, if applicable

- Last one year current account statement

Business Loan Fees and Charges | Business Loan EMI Calculator

A business loan is also known as a commercial loan. The charges and fees of a commercial loan can differ from one bank to another and from type to type. On the basis of the loan amount, interest rate, and repayment tenure only, they can decide the business loan fees and charges.

List of Important Schemes on Business loan by Government of India

- MUDRA Yojana under PMMY

- PMEGP: The Prime Minister Employment Generation Programme

- CLCSS: Credit Linked Capital Subsidy Scheme

- PSB Loans in 59 minutes

- Standup India

- CGTMSE: Credit Guarantee Fund Trust for Micro and Small Enterprises

- Startup India

- PMRY: Prime Minister’s Rojgar Yojana

- Credit Guarantee Scheme

- National Small Industries Corporation (NSIC) Subsidy

Best Tips to Get Business Loan Sanction with Ease

- You have to present the very well-created business plan that should explain why you require the loan and it need to cover minute but necessary information about the business.

- Existing Relationship with the lender is the best opportunity to get loan approval very quickly.

- One of the important aspect is the Continuity of Business. It shows your seriousness towards your business and its growth.

- Having a good credit score is also a strong aspect to approve the business loan.

- If you want a collateral free business loan or with security loan, then should have good credit history and have repaid all the loans in the past well in time then the lender will not mind extending you a business loan on favourable terms.

- A considerable amount of paperwork need to finish well before applying for a business loan. All the documents required for business loan should be ready with you while applying loan for your business.

FAQs on Collateral Free Loan for Your Business

1. Why should you get a business loan?

A business loan will support you financially to accomplish your dream of starting any type of business and running for a long time. These loans are applicable for various business reasons.

- Starting your business

- Running your business

- Expanding your business

2. How much income do you need to get a business loan?

To get a business loan, the required income that the lender can range a minimum annual revenue from $50,000 to $250,000. In case, you are not satisfied with the revenue then look for more options in business loans types like short-term business loans, or other machinery financing support.

3. What credit score you need for a business loan?

Usually, for business loans, the credit scores required are 680 or more for traditional bank or SBA Loans, 630 score for equipment financing or business lines of credit, for short-term business its 600 scores, and for merchant cash advanced its 550 credit score is needed.

4. What is the minimum turnover criteria for a loan to start a business?

The minimum annual turnover requirement is determined by the lender and differs from bank to bank. But, for existing enterprises or businesses clients can apply online for business loans with a minimum turnover of Rs.12 lakh or more.