Are you struggling to fulfill the major requirements like paying for a child’s education, planning a wedding, taking care of a medical emergency, etc? If yes, then many lenders such as banks and finance companies offer Gold Loans to support in accomplishing the needs.

Want to know what is meant by Gold Loan, how it works, who is eligible, required documents, check gold loan rate per gram, the Lowest gold loan interest rate 2021, which bank is best for gold loan, etc.? Go through the further modules covered under one roof and get benefited by the loan amount.

- What is Gold Loan?

- Gold Loan Details

- Features of Gold Loan

- Gold Loan Calculator for Eligibility Criteria

- Gold Loan Eligibility Requirements

- Documents Needed To Apply for Loan Against Gold

- How to Apply for a Gold Loan Online?

- Tips to keep in mind before considering a Gold Loan

- Best Comparison of Top Banks Gold Loan Interest Rates To Apply Online

- Lowest Gold Loan Interest Rates as of 24 Nov 2021

- Gold Loan EMI Calculator

- Advantages of Gold Loan

- FAQs on Gold Loan Rate Per Gram

What is Gold Loan?

Gold Loan or loan against gold is a secured loan that permits you to manage immediate funds against your gold jewelry for any personal or business purpose. A few most popular and trusted banks & gold loan companies that offer loans against gold jewels are SBI, HDFC, Yes Bank, Muthoot, and Manappuram.

Gold Loan Details

| Interest Rate | 7.35% p.a. onwards |

| Loan Amount | Up to Rs.1 crore |

| Loan Tenure | Up to 20 years |

| Processing Fee | 0.5% the loan amount + GST onwards |

Features of Gold Loan

We have outlined some of the features of a gold loan. They are as follows

Purpose: You can consider a gold loan as an option for all your financial needs be it education or for medical emergencies, trips for a holiday, etc.

Security: Gold that is pledged with the bank acts as security or collateral against the loan amount disbursed.

Tenure Options: Tenure Ranges from a Minimum of 3 Months to a Maximum of 48 Months.

Fees: Fees applicable on Gold Loan are Processing Fee, Later Payment Charges, Penalty for Non-Payment of Interest, Valuation Fees, etc.

Repayment Options: There are three different options for repayment of a gold loan. They are as under

- Repayment in Equated Monthly Installments (EMI)

- Payment of interest upfront and repayment of the principal loan amount at the end of the loan tenure.

- Payment of interest on a monthly basis and repayment of the principal loan amount at the end of the loan tenure.

Rebates: You can have discount options too on the prevailing interest rates if you repay the interest regularly for the gold borrowed. Rebates can range from 1%-2% off on the original interest rate.

Gold Loan Calculator for Eligibility Criteria

The usage of the gold loan eligibility calculator helps to define the gold loan eligibility by taking several inputs into consideration like loan amount, loan value, loan tenure, gold purity, and gold quantity, among others. It not only allows you to inform whether you can avail of this loan or not yet also gives you a list of eligible gold loan lenders based on your requirement.

Recommended Posts:

Gold Loan Eligibility Requirements

In order to get your gold loan, you need to meet certain eligibility criteria the lender specifies. However, the eligibility criteria for each lender differ from one another. Before applying for a Gold Loan make sure you go through the lender’s website in advance and decide whether you meet the eligibility criteria or not.

| Applicant’s Age | 18 years and above |

| Security to be pledged | Gold Ornaments or Articles |

| Total Gold Carats that can be Pledged | 18 carats or above |

| Other Criteria | Applicant need to be creditworthy |

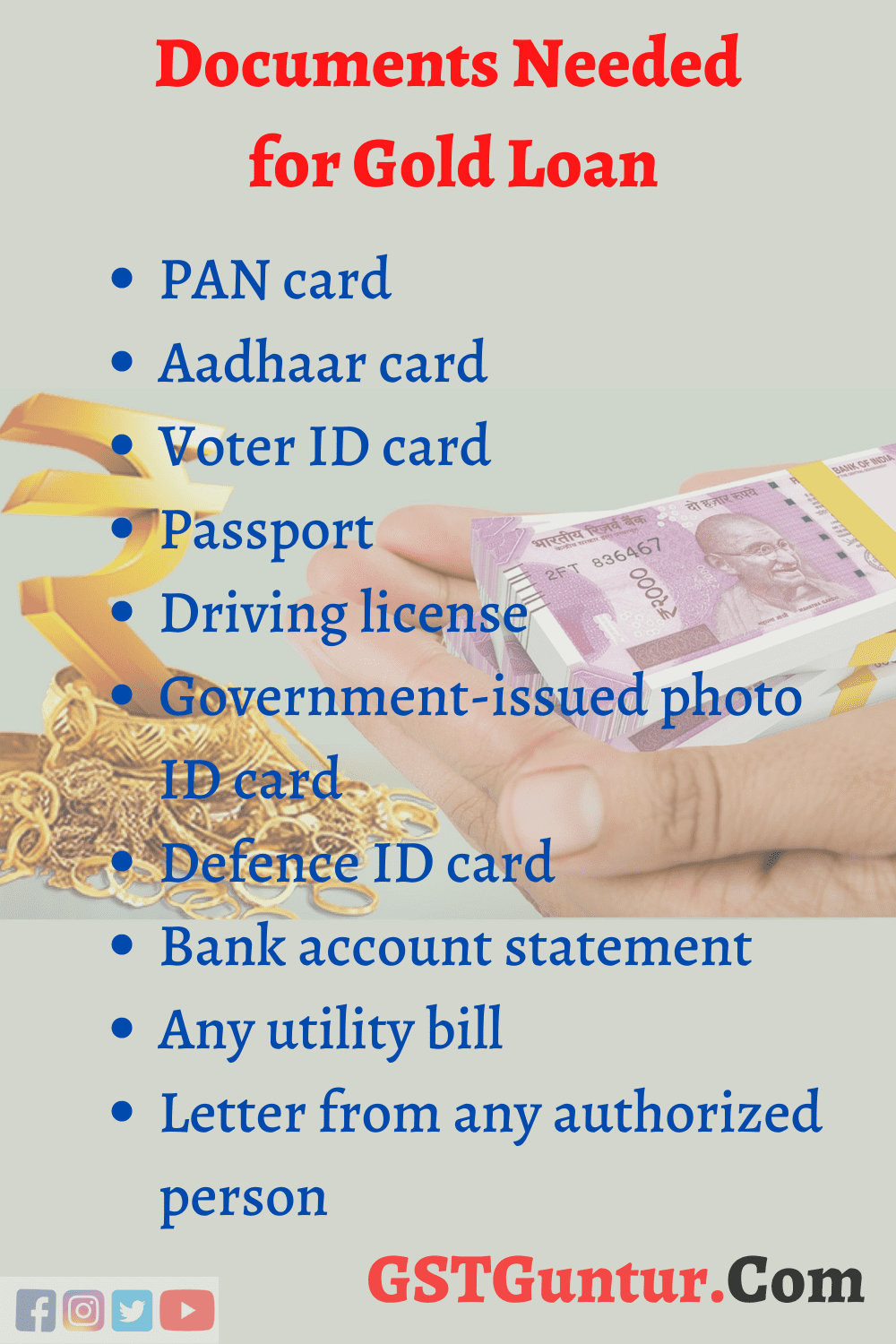

Documents Needed To Apply for Loan Against Gold

The following list is the required KYC documents that you need to submit to get instant approval for this secured Gold loan. The documents that involve are:

Identity proof

- PAN card

- Aadhaar card

- Voter ID card

- Passport

- Driving license

- Government-issued photo ID card

- Defence ID card

Address proof:

- Aadhaar card

- Ration card

- Passport

- Bank account statement

- Voter ID card

- Any utility bill (electricity bill/ water bill/ telephone bill not older than 3 months)

- Letter from any authorized person

You may be asked to submit income proof along with the necessary gold loan documents if the need arises.

How to Apply for a Gold Loan Online?

Follow the below-provided steps to apply for a gold loan online and they are as such

- In order to apply for a gold loan, you need to visit the lender’s website and tap on the loan product you wish to apply for. Later click on the Apply Now Option if it is present on the lender’s website. Later on, fill in the relevant details and submit the application online.

- If you don’t have an option on the lender’s website visit the nearest branch and carry the required documents along with you.

- After submission of the application form lender will cross-check the details. If your loan is approved you will get the loan.

- It is easy to get funds through a gold loan. However, make sure you take the gold loan needed based on your requirements and repayment capacity.

Tips to keep in mind before considering a Gold Loan

Below are the few pointers to be kept in mind while applying for a Gold Loan and they are as under

- Loan Amount: The Loan Amount you receive will depend based on the gold you pledge. In order to have the loan amount you need you need to make sure you have the necessary gold as well as ensure it falls within the amount specified by the lender.

- Rate of Interest: In Comparison to an Unsecured Loan Interest Rates Charged on a Gold Loan is less. However, the interest rate charged depends from lender to lender. You need to compare the interest rates charged by different lenders to decide the best interest rate.

- Applicable Charges: Along with interest rates you need to consider a few other fees like processing fee, documentation fee, appraiser fee, loan overdue fee, etc. All these charges can increase the total cost of a loan.

- Tenure of the Loan: Loan Repayment Tenures can range from 3 to 48 months. Consider your repayment ability and then opt for a gold loan with suitable tenure.

- The credibility of the Lender: Before applying for a gold loan check the credibility of the lender. Keep in mind the safety measures undertaken by the lender in order to keep your assets safe.

- Repayment Schedule: The repayment Schedule for Gold Loans is quite flexible. You can pay in the form of EMIs, Pay the Principal on finishing the policy term, etc. Select the best repayment structure that you are comfortable with and select the lender accordingly.

- Comparison of Loans: Compare all other options such as features, benefits, terms, and conditions offered by various lenders before applying for a loan.

- Eligibility Criteria: Increase your chance of loan application by cross-checking the lender’s eligibility before applying for the loan itself.

Best Comparison of Top Banks Gold Loan Interest Rates To Apply Online

The following table represents the top lenders offered interest rates and loan amounts. Borrowers can do comparisons of banks in terms of rates and loan amount from here and pick one to apply for gold loan online.

| Name of the Bank | Interest Rate | Loan Amount |

| ICICI Gold Loan | 9% p.a. – 19.76% p.a. | Rs.10,000 to Rs.1 crore |

| Axis Bank Gold Loan | 13.50% p.a.to 16.95% p.a. | Rs.25,001 to Rs.25 lakh |

| HDFC Gold Loan | 11% p.a. to 16% p.a. | Rs.10,000 onwards |

| Canara Bank Gold Loan | 7.35% p.a. | Rs.5,000 to Rs.35 lakh |

| Muthoot Gold Loan | 12% p.a. to 26% p.a. | Rs.1,500 onwards |

| SBI Gold Loan | 7.00% p.a. onwards | Rs.20,000 to Rs.50 lakh |

| Kotak Mahindra Gold Loan | 10.00% p.a. – 17.00% p.a. | Rs.20,000 to Rs.1.5 crore |

| IndusInd Bank Gold Loan | 11.50% p.a. – 16.00% p.a. | Up to Rs.10 lakh |

| Manappuram Gold Loan | Up to 29% | As per the requirement of the scheme |

| Bank of Maharashtra Gold Loan | 7.10% p.a. | Up to Rs.20 lakh |

| PNB Gold Loan | 7.70% p.a. to 8.75% p.a. | Rs.25,000 to Rs.10 lakh |

| Bank of Baroda Gold Loan | 9.00% p.a. – 9.15% p.a. | Up to Rs.25 lakh |

*Note: The repayment tenure has been taken as six months and the purity of the gold as 22k.

Lowest Gold Loan Interest Rates as of 24 Nov 2021

| Bank | Interest Rate | Tenure |

|---|---|---|

| Uco Bank | 10.05% to 10.30% | Maximum Tenure 60 months |

| South Indian Bank | 10.25% to 14.15% | Tenure max. upto 48 Months |

| Kotak Mahindra Bank Limited | 10.25% to 24% | Maximum Tenure 60 months |

| Bank Of India | 10.35% to 12.35% | Maximum Tenure 60 months |

| Idfc Bank Limited | 10.49% onwards | Maximum Tenure 60 months |

| Axis Bank | 10.49% to 17.25% | 12 to 60 Months |

| Federal Bank | 10.49% to 17.99% | Maximum Tenure of 48 Months |

| Indusind Bank | 10.49% to 31.50% | Maximum Tenure 60 months |

| Icici Bank Limited | 10.5% to 19% | Maximum Tenure 60 months |

| Bank Of Baroda | 10.50% to 12.50% | Maximum Tenure of 48 Months |

| Dena Bank | 10.50% to 12.50% | Maximum Tenure 36 months |

| Vijaya Bank | 10.50% to 12.50% | Maximum Tenure 60 months |

| Hdfc Bank | 10.50% to 21.00% | The loan is repayable up to 60 months |

| Yes Bank | 10.70% – 19.99% | Maximum Tenure 60 months |

| Indian Overseas Bank | 10.80% | Maximum Tenure 60 months |

| Andhra Bank | 10.90% to 13% | Contact Bank Branch |

| Corporation Bank | 10.90% to 13% | Maximum Tenure 60 months |

| Union Bank Of India | 10.90% to 13% | Maximum Tenure 60 months |

| The Nainital Bank Limited | 10% to 10.50% | Maximum Tenure 60 months |

| Catholic Syrian Bank Limited | 12.00% to 19.00% | Maximum Tenure 60 months |

| Canara Bank | 12.40% to 13.90% | Maximum Tenure of 48 Months |

| Syndicate Bank | 12.40% to 13.90% | Maximum Tenure of 48 Months |

| Karnataka Bank Limited | 12.45% | Tenure max. upto 24 Months |

| Dhanalakshmi Bank | 12.7% to 15.70% | Max. Tenure 60 months |

| Tamilnad Mercantile Bank Limited | 14.05% | Maximum Tenure 60 months |

Gold Loan EMI Calculator

The most important online tool that assists borrowers to estimate the EMI of the gold loan is called the Gold loan EMI Calculator and it works on the desired gold loan requirement, loan tenure, and interest rate. It is the best convenient, hassle-free, and beneficial tool that is available on different online platforms. The following formula is used to calculate the EMI manually and also in the Gold loan EMI calculator for accurate and reliable results:

E = P* r* (1+r)^n / ((1+r)^n – 1)

Where E is the EMI, P is the principal amount, r is the rate of interest, and n is the loan tenure.

Advantages of Gold Loan

Gold Loan offers plenty of benefits and it can be the ultimate solution for all your financial needs. They are as such

- Quick Disbursal of Loans

- Attractive Interest Rates

- There is no need for any EMIs. You can pay the entire loan at the end of your tenure.

- Simple Documentation is enough.

- Your jewelry is in completely safe hands.

FAQs on Gold Loan Rate Per Gram

1. What is a gold loan?

A gold loan is a method of taking financial assistance against your gold jewellery or ornaments like bangles, watches, earrings, necklaces, etc.

2. What will happen if I am unable to repay the loan amount?

If you don’t pay the loan amount within the due date the bank or financial institution will lay a penalty on you. Even after multiple reminders if you don’t pay the loan amount the bank will auction your gold to recover the amount that is due.

3. Do I need to have a guarantor to have a Gold Loan?

You need not have a guarantor to get a Gold Loan in most cases. However, if you want to get a high-value loan you may need a guarantor.

4. Is there an Age Limit to avail a Gold Loan?

Yes, you need to be between the ages of 18 years and above in order to avail a Gold Loan.