Cultivation of crops is very difficult as it includes massive expenses & hard work. For farmers in India, it is very hard to cultivate crops without enough financial support. At times, they suffer so much to repay their debts. To be an Indian, we all know that how much they struggle to fill other citizens’ stomachs and save their lives. To support all agriculturists in India, banks and other private and public lenders offer Agricultural Loan Subsidy in India.

Know more about Agriculture loans such as what does agriculture loans mean, how many types of loans and schemes are offered, rate of interest, Top lenders, advantages, eligibility criteria, steps to apply online for agriculture loans, repayment period, top-best banks agricultural loan interest rates & processing fees, etc.

- What is meant by Agricultural Loan?

- Types of Agriculture Loan

- Some Other Types of Loans in Agriculture

- List of Various Agriculture Loan Schemes

- Purposes of Agriculture Loan India

- Features of Agriculture Loan

- Eligibility Criteria for Agricultural Loan

- Documents Required To Apply Online for Agricultural Loan

- How to Apply for an Agriculture Loan Online?

- Agricultural Loan Interest Rate 2021

- Top Lenders Interest Rate Details for Agriculture Loan

- Compare Agriculture Loan Interest Rates of Different Banks in India

- Agriculture Loan Fees and Charges

- Agricultural Loan in India by Banks

- Providers of Agricultural Loans in India

- Agriculture Loan Repayment Tenure

- Advantages of Agricultural Loan

- Major Aspects to Consider While Applying for the Agriculture Loan

- Highlights of Union Budget 2020-2021 Allocation to Agriculture

- FAQs on Agriculture Loan Subsidy 2021

What is meant by Agricultural Loan?

An Agricultural or Agriculture Loan is a credit facility or financial support for the farmers to meet the farming, cultivation, irrigation, and working capital requirements for agriculture and other agri-associated activities. Also, it is availed by a farmer to finance seasonal agricultural services or associated activities such as animal farming, pisciculture, or the purchase of land or agricultural tools. Moreover, agriculture loan subsidy assists farmers to purchase major inputs like fertilizers, seeds, insecticides, etc., and to employ labour for cultivating & harvesting crops.

Types of Agriculture Loan

The following list is the types of agriculture loans that you can opt to fulfill your requirements in the agriculture sector:

- Crop loans: To grow different crops or development of crops.

- Land Purchase Loan: It is offered for small, marginal, and landless farmers or labourers to buy agricultural land.

- Warehousing Loan: Banks offer this loan for the storage of farm or agriculture commodities for non-perishable commodities.

- Land Development Loan: It helps farmers in developing existing land such as land leveling, reclamation of soil, and any other soil conservation measures, etc.

- Farm Ownership Loans: By these types of loans farmers can purchase agriculture or farming machinery, livestock, tractors, etc.

- For Purchase of Vehicles: Purchase of vehicles for use in their farm management activities.

- Farm Operating Loans: This loan is offered for day-to-day necessities or expansion requirements.

- Purchase of draft animals and animal-drawn vehicles: A loan is given for the purchase of draft animals, animal-drawn carts, for transport of agriculture inputs & farm produce, and other such purposes.

Some Other Types of Loans in Agriculture

Here we are providing the additional types of agriculture loan names in an image format for easy sharing to others:

List of Various Agriculture Loan Schemes

- Agriculture Gold Loan Scheme: It is used to reach the agricultural credit needs for both crop production as well as cash credit for allied agricultural activities & investment credit quickly.

- Farm Mechanization Scheme: For buying agriculture equipment, small and large farming machinery, tractors, etc. we decide to opt for this loan. Also, it is extended for buying of modern tractors and matching implements/equipment, purchase of new power tillers, purchase of new/used tractors with matching implements, purchase of agricultural machinery, and repairs of tractors.

- Minor Irrigation Scheme: These loans provided for the Purchase of pump sets, digging new wells (open/ bore wells), repairs to wells, deepening existing wells, setting lift irrigation, buying sprinkler sets/ drip irrigation sets/ solar pumps/windmills, etc.

- Kisan Credit Card Scheme: The famous framer’s loan scheme that issues a credit card called “Kisan Credit Card” through which they can draw a cash loan for crop production as well as other such urgent needs within the card limit.

- Kisan Shakti Yojana: It offers personal loans including repayment of debt to moneylenders.

- Dairy Plus Scheme: Given for establishment of the dairy farm including the purchase of milk animals, construction of shed, buying milking machine and other dairy equipment.

- Broiler Plus Scheme: Given for construction of poultry shed, the establishment of broiler poultry farm, feeding room, etc.

- Financing of Combine Harvesters: A loan is offered for one farmer or group of farmers for buying combine harvesters, heavy harvesting machines.

- Horticulture Credit: Loans are offered for the development of fruit orchards, such as mango, chikoo, grapes, pomegranate, apple, etc., and marketing of such produce, also for green house development and polyhouse.

Purposes of Agriculture Loan India

The following are some of the purposes of Agriculture Loan in India:

- Buying an Agricultural Land

- To reach operating costs

- Purchasing farming and fertilization machinery

- Horticulture projects

- Establishing dairy units

- Building irrigation channels

- For seasonal requirements

- To cover storage/ warehouse expenses

- Buying cattle and livestock

- Working capital requirements

- Establishment of poultry units

- Funding for marketing expenses

- For fish farming

Features of Agriculture Loan

- Various Types of Agriculture Loan

- Minimal Documentation

- Flexible Loan Repayment Term

- No Hidden Charges

- Quick Processing

- Competitive Interest Rate Charged

- End-use Flexibility

- Collateral Optional

Recommended Loan Pages:

Eligibility Criteria for Agricultural Loan

Every banker or financial company has its own set of eligibility guidelines that you should satisfy before applying for an Agricultural Loan. Here, we have discussed a few standard eligibility conditions for your reference. They are as below

| Who is Eligible? |

|

| Residential Status | Resident Indian |

| Eligibility Age | 18-70 years |

| Land Ownership | Generally, should own a piece of agricultural land or have access to agricultural land for specified purposes |

*Note: Above table represents the general eligibility rules to get an agricultural loan in India. Other eligibility requirements are also applied for some lenders and they differ from lender to lender. Kindly, check the eligibility by contacting the particular lender before applying for an Agricultural loan.*

Documents Required To Apply Online for Agricultural Loan

Provided documents are the important & basic ones to get the loan for agriculture in India

- Any one of valid Identity Proof from Voter ID Card, Aadhaar Card, Ration Card, PAN Card, Passport, Driving License

- Any one of valid Address Proof that includes Lease deed, Rent Agreement, Passport, Driving License, Ration Card, recent utility bill (not more than 3 months old), Bank Statement

- Security Post Dated Cheques (PDCs) or other collateral (as applicable)

- Land ownership/cultivation documents as stipulated by the lender

How to Apply for an Agriculture Loan Online?

If you have decided to get an agriculture loan in India, make sure to research deeply about all aspects of the loan via online options and then apply for the agricultural loan. Follow the given steps carefully and apply online or offline for an agriculture loan provided by the lender.

- Firstly, visit the lender’s official website and check the eligibility criteria to apply for the loan.

- If you meet the loan eligibility navigate to the respective website, click on ‘Apply Now’, enter the required details in the application form

- Next, upload the necessary documents onto the website.

- Submit the online application form of the agricultural loan and know the loan amount you are eligible for.

- The respective lender will verify your documents and application form to approve it.

- If it gets approved by the lender or banker, the loan amount will be disbursed into your account.

Agricultural Loan Interest Rate 2021

The interest rate on agriculture loans always varies from lender to lender as per their rules. A few of the important circumstances in the decision of interest rates are the type of loan applied for, the income of the applicant, repayment capacity, and past credit history of the applicant.

The following table summarizes the interest rate and processing fee of agricultural loans that start from:

| Interest rate | 7% p.a. onwards |

| Processing fee | 0% to 4% of the loan amount |

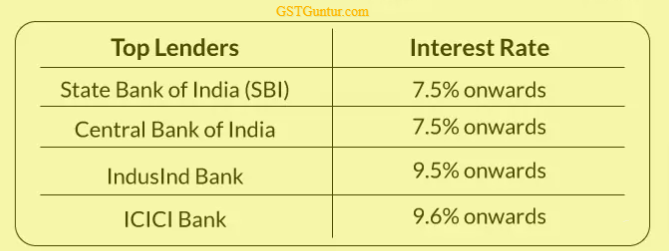

Top Lenders Interest Rate Details for Agriculture Loan

Compare Agriculture Loan Interest Rates of Different Banks in India

| Bank | Interest Rate | Processing Fee |

| State Bank of India | 7.25% p.a. onwards | 0% p.a. to 1.25% p.a. of the loan amount |

| ICICI Bank | 9.6% p.a. onwards | 0.5% p.a. to 4% p.a. of the loan amount |

| IDBI Bank | 7% p.a. onwards | At the discretion of the bank |

| IndusInd Bank | 10% p.a. onwards | 1.25% of the loan amount + GST |

| Central Bank of India | Up to 13.25% p.a. | At the discretion of the bank |

| Karur Vysya Bank | 8.30% p.a. onwards | At the discretion of the bank |

*Note: Above provided data about the agricultural loan interest rates and processing fees of different banks in India is tentative. Please go through the complete details of the rate of interest for an agricultural loan from the bank’s official site and then apply for the loan.*

Agriculture Loan Fees and Charges

The following are some of the Fees and Charges for an agricultural loan 2021. Take a look at them before applying the loans for farmers:

- Processing fee – A one-time processing fee will be deducted from the borrower’s sanctioned loan amount before it is disbursed.

- Foreclosure charges – Will be levied if the borrower prepays their loans and closes their loan account before the completion of the loan repayment term.

- Documentation charges – Will be charged as applicable.

- Late payment charges – If the EMI is not paid as per the schedule specified by the lender, late payment charges will be levied.

- Valuation charges – Will be charged if the applicant’s residential or commercial property undergoes valuation.

- Stamp duty charges – Will be charged at actuals or as per the applicable state laws.

- Bounce charges – Will be charged if the repayment cheque bounces.

*Note: Above mentioned charges are not be levied by all lenders. Furthermore, you may need to pay other charges according to your lender’s terms and conditions.

Agricultural Loan in India by Banks

Here is the list of banks in India that provide loans for agricultural purposes and help farmers to grow various food items.

| Andhra Pradesh Grameena Vikas Bank | Andhra Pragathi Grameena Bank | Arunachal Pradesh Rural Bank |

| Assam Gramin Vikash Bank | Axis Bank | Bangiya Gramin Vikash Bank |

| Bank Of Baroda | Bank Of Maharashtra | Baroda Gujarat Gramin Bank |

| Baroda Rajasthan Kshethriya Gramin Bank | Baroda Up Bank | Central Bank Of India |

| Chhattisgarh Rajya Gramin Bank | Dakshin Bihar Gramin Bank | Gramin Bank Of Aryavart |

| Hdfc Bank | Himachal Pradesh Gramin Bank | Icici Bank |

| Jammu And Kashmir Grameen Bank | Karnataka Vikas Grameena Bank | Kerala Gramin Bank |

| Kotak Mahindra Bank | Langpi Dehangi Rural Bank | Madhya Pradesh Gramin Bank |

| Madhyanchal Gramin Bank | Maharashtra Gramin Bank | Meghalaya Rural Bank |

| Mizoram Rural Bank | Nagaland Rural Bank | Odisha Gramya Bank |

| Pragathi Krishna Gramin Bank | Puduvai Bharathiar Grama Bank | Punjab Gramin Bank |

| Punjab National Bank | Rajasthan Marudhara Gramin Bank | Sarva Haryana Gramin Bank |

| State Bank Of India | Tamil Nadu Grama Bank | Telangana Grameena Bank |

| Tripura Gramin Bank | Union Bank Of India | Utkal Grameen Bank |

| Uttar Bihar Gramin Bank | Uttarakhand Gramin Bank | Vidharbha Konkan Gramin Bank |

Providers of Agricultural Loans in India

The following table shows the most common providers of Agricultural loans in India along with important Agricultural loan types that are offered:

| Name of the Lender | Major Types of Agricultural Loans Offered |

| State Bank of India (SBI) |

|

| ICICI Bank |

|

| Central Bank of India |

|

| Union Bank |

|

| Axis Bank |

|

| National Bank or Agriculture and Rural Development (NABARD) |

|

Agriculture Loan Repayment Tenure

For agricultural loans, if cash credit then the repayment tenure is generally less than 1 year and for long-term loans, it varies from 3 to 9 years. The repayment tenure of agriculture loans differs from lender to lender. Also, there are flexible monthly, half-yearly, and yearly installments repaying options that are available to repay the loan amount. These options can be selected on the basis of your income and repayment capacity.

Advantages of Agricultural Loan

- You can get the agricultural loan with minimum documentation.

- The special rate of interest starts right from 7.50% p.a. Perhaps lower for stipulated Government-backed schemes

- Flexible repayment tenure.

- Based on the applicant’s profile and the quantum of loans applied for, you can get unsecured agricultural loans from some lenders.

- Possible to use the loan amount for various purposes varying from short-term seasonal farm activities to long-term financing in farm machinery.

Major Aspects to Consider While Applying for the Agriculture Loan

- Make sure to satisfy all the eligibility conditions of the specific agricultural loan and check the purpose of the loan that you are opting for.

- Do gather all the necessary documents to get the loan.

- Be attentive in paying your ongoing loan EMIs and credit card dues on time to maintain good repayment history which gives you a high credit score.

- Don’t take a step forward to make multiple loan applications at a time, as it shows you as credit-hungry.

- Make sure to handle a healthy mix of credit ie., the amount of unsecured and secured loans obtained by you.

- Maintain a low Fixed Obligation to Income Ratio (FOIR). In short, your continuous EMIs should not form a notable proportion of your monthly income.

Highlights of Union Budget 2020-2021 Allocation to Agriculture

The Announcement of Rs. 1.42 crore was allocated to the Ministry of Agriculture and Farmer’s Welfare was given by the Finance Minister, Nirmala Sitharaman in the Union Budget of 2020-21. This amount was allocated regarding the following proposals:

- A fixed Agricultural credit target of Rs. 15 lakh crore for 2020-21.

- Self Help Groups (SHGs ) run village storage scheme will be launched.

- The Antyodaya Scheme will help Self Help Groups for women.

- “Kisan Rail” and “Krishi Udaan” will be launched by Indian Railways and Civil Aviation, respectively to facilitate the national cold supply chain for perishables.

- PM KUSUM to cover 20 lakh farmers for standalone solar pumps and a further 15 lakh for grid-connected pumps.

- To increase coverage of artificial insemination to 70%.

- Creation of efficient warehouses on PPP mode with the help of viability gap funding.

- Milk processing capacity to be doubled by 2025.

- e-NWR will be integrated with e-NAM.

- Fish production target of 200 tonnes by 2022-23.

- Fishery extension through 3477 Sagar Mitras and 500 fish FPOs.

- To raise fishery exports to Rs. 1 lakh crore by 2024-25.

FAQs on Agriculture Loan Subsidy 2021

1. Which bank is best for agriculture loan?

Here is the list of the best banks that offer Agriculture Loans in India:

- ICICI Bank (Agri Term Loan)

- Central Bank of India (Cent Kisan Tatkal Scheme)

- IndusInd Bank (Crop Loan)

- HDFC Bank (Retail Agri Loans)

2. Who is eligible for an Agriculture loan?

The eligible candidates to apply for an agriculture loan are Farmers, Dairy Owners, Horticulturists, and any Orchard owners whose age should be preferred for most of the lenders are within 24 to 65 years of age.

3. What are the types of agriculture loans?

The list of lender offered types of Agriculture loan schemes is as follows:

- Kisan Credit Card.

- Crop Loan.

- Multipurpose Gold Loan.

- Tractor Loan.

- Agriculture gold loan scheme.

- Combine Harvestor Loan.

- Drip Irrigation Loan.

- Horticulture Credit

- Dairy Loan.

- Poultry Loan.

4. How much loan can I get for agricultural land?

The maximum amount of loan is Rs. 40 lakh. But the maximum amount of loan is limited to 3 times on his existing annual income from agricultural land and other certified/approved source or 75% of the purchase value or valuation of the land whichever is less.