Amalgamation, Conversion, and Sale of Partnership Firms – CA Inter Advanced Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Amalgamation, Conversion, and Sale of Partnership Firms – CA Inter Advanced Accounting Question Bank

Question 1.

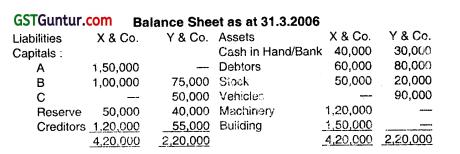

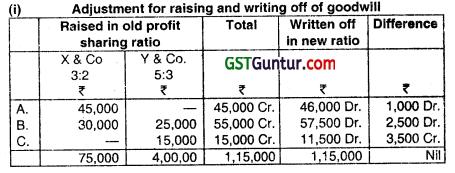

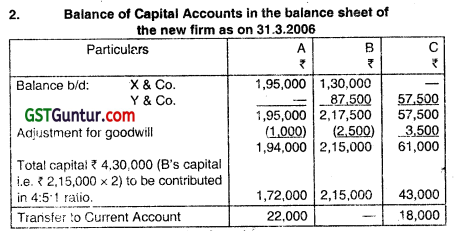

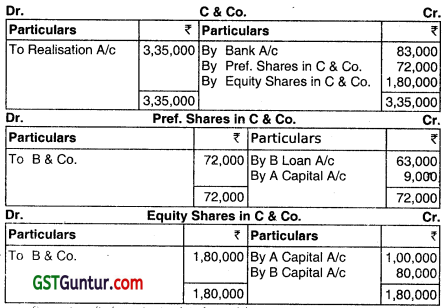

Firm X & Co. consists of partners A and B sharing Profits and Losses in the ratio of 3: 2. The firm Y & Co. consists of partners B and C sharing Profits and Losses in the ratio of 5 : 3. On 31st March 2006 it was decided to amalgamate both the firms and form a new firm XY & Co., wherein A, B and C watch be partners sharing Profits and Losses in the ratio of 4 : 5: 1.

The following were the terms of amalgamation:

(i) Goodwill of X & Co. was valued at ₹ 75,000. GoodMIl of Y & Co. was valued at ₹ 40,000. Goodwill Account not to be opened in the books of the new firm but adjusted through the Capital Accounts of the partners.

(ii) Building, Machinery and Vehicles are to be taken over at ₹ 2,00,000.

₹ 1,00,000 arid ₹ 74,000 respectively.

(iii) Provision for doubtful debts at 5000 in respect of X & Co. and ₹ 4,000 in respect of Y & Co. are to be provided.

You are required to:

(i) Show, how the Goodwill Value is adjusted amongst the partners.

(ii) Prepare the Balance Sheet of XY & Co. as at 31.3.2006 by keeping partners Capita’ in their profit sharing ratio by taking capital of ‘B as the basis. The excess or deficiency to be kept in the respective Partners’ Current Account. (May 2006, 16 marks)

Answer:

Question 2.

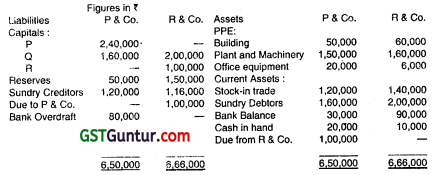

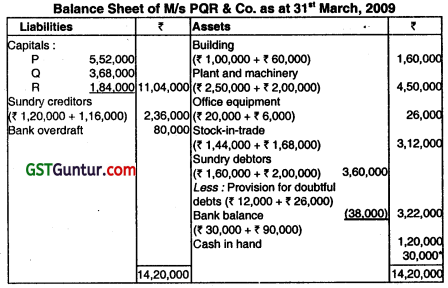

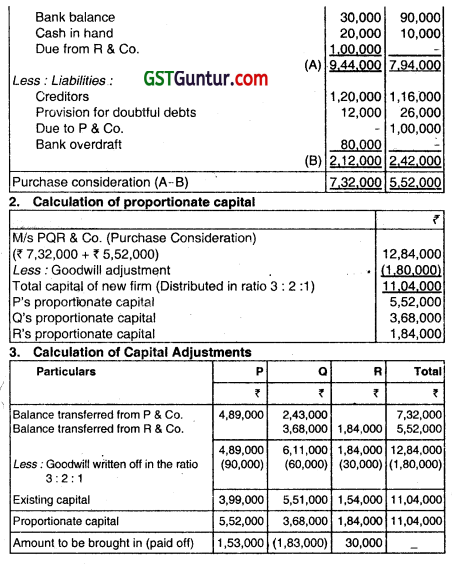

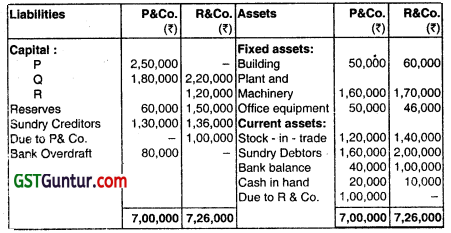

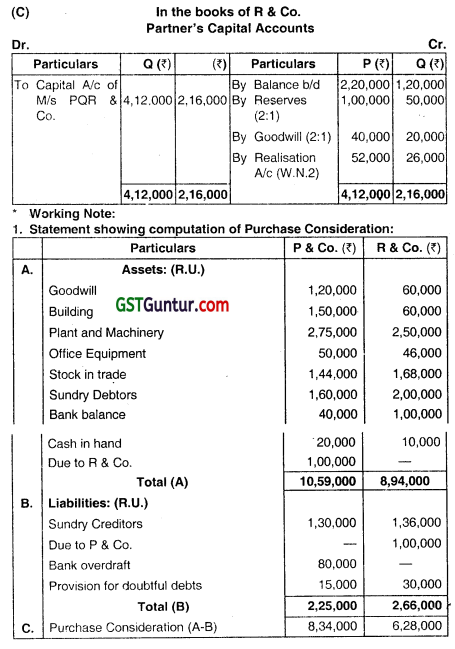

P and Q are partners of P & Co. sharing Profit and Losses in the ratio of 3:1 and Q and R are partners of R & Co., sharing Profits and Losses in the ratio of 2:1. on 31st March 2009, they decide to amalgamate and form new firm MIs. POR & Co., wherein P, Q, and R would be parents Sharing Profits and Losses in the ratio of 3 :2: 1. The Balance Sheets of two firms

on the above date are as under:

The amalgamated firm took over the business on the following terms:

(a) Building of P & Co. was valued at ₹ 1,00,000.

(b) Plant and Machinery of P & Co. was valued at ₹ 2,50,000 and that of R & Co. at ₹ 2,00,000.

(c) All Stock in Trade is to be appreciated by 20%.

(d) Goodwill valued of P & Co. at ₹ 1.20,000 and R & Co. at ₹ 60,000, but the same will not appear In the books of POR & Co.

(e) Partners of new firm will bring the necessary cash to pay other partners to adjust their capitals according to the Profit sharing ratio.

(f) Provisions for doubtful debts has to be carried forward at ₹ 12,000 in respect of debtors of P & Co. and ₹ 26,000 n respect of debtors of R & Co.

You are required to prepare the Balance Sheet of new firm and Capital accounts of the partners in the books of old firms. (May 2010, 16 marks)

Answer:

Question 3.

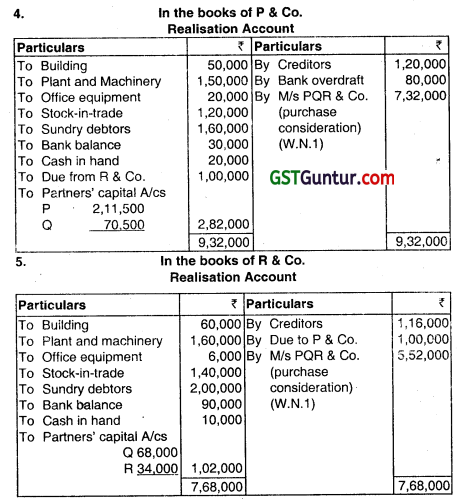

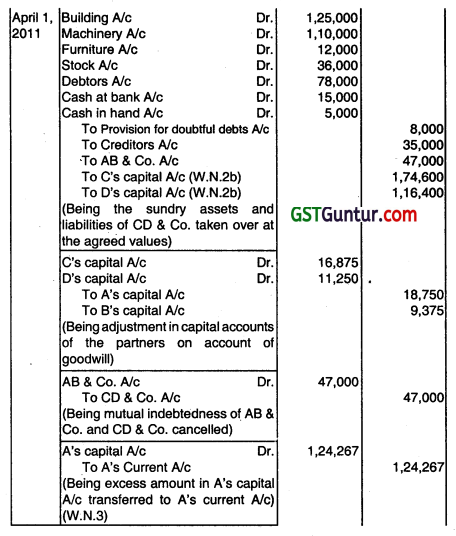

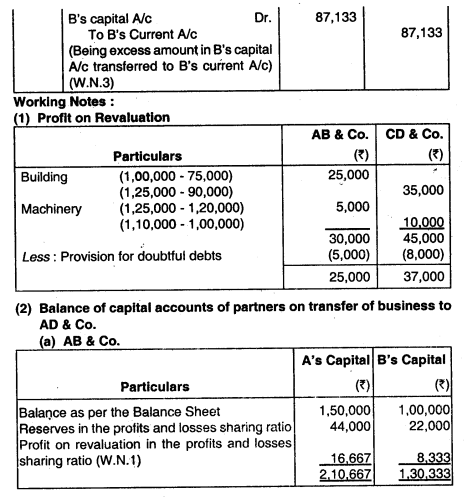

A and B are partners of AB & Co sharing Profits and Losses in the ratio of 2:1 and C and D are partners of CD & Co sharing Profits and Losses in the ratio of 3: 2. On 1st April 2011 they decided to amalgamate and form a new firm M/s. AD & Co wherein all the partners of the both the firm would be partners sharing profits and losses in the ratio of 2: 1 : 3: 2

respectively to A, B, C and D. Their balance sheets on that date were as under:

The amalgamated firm took over the business on the following terms:

(a) Building was taken over at ₹ 1,00,000 and ₹ 1,25,000 of AB & Co. and CD & Co respectively. And Machinery was taken over at ₹ 1.25,000 and ₹ 1,10,000 of AB & Co and CD & Co respectively.

(b) Goodwill of AB & Co was worth ₹ 75000 and that of CD & Co was worth ₹ 50,000. A goodwill account was not to be opened in the books of the new firm, the adjustments being recorded through capital accounts at the partners.

(c) Provision for doubtful debts has to be carried forward at ₹ 5,000 in respect of debtors of AB & Co and ₹ 8,000 in respect of CD & Co.

You are required to:

(i) Compute the adjustments necessary for goodwill

(ii) Pass the Journal Entries in the books of AD & Co assuming that excess) deficit capital (taking D’s Capital as base) with reference to share in profits are to be transferred to current accounts. (May 2011, 16 marks)

Answer:

Question 4.

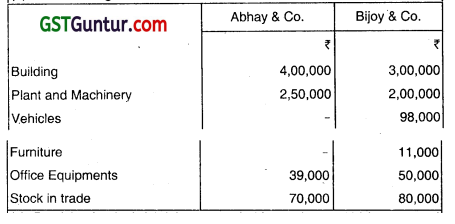

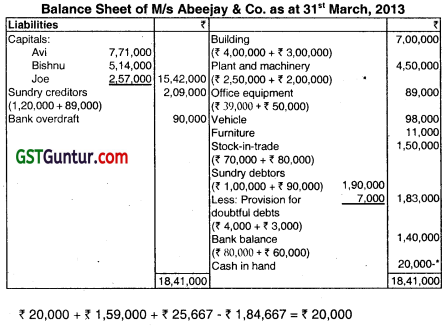

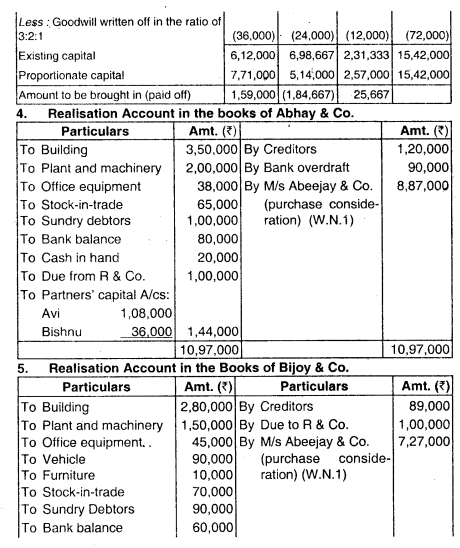

Avi and Bishnu are partners of Abhay & Co. sharing profit and losses in the ratio 3:1 and Gishnu and Joe are partners of Bijoy 8 Co. sharing profit and losses in the ratio 2:1. On 31st March 2013, they decided to amalgamate and form a new firm M/S Abeejay & Co., wherein Avi, Bishnu, and Joe wouLd be partners sharing profit and losses in the ratio 3:2:1. The balance Sheets of the two firms on 31st March 2013 were as under:

The amalgamated firm M/S Abeejay & Co. took over the business on the following terms:

(a) Goodwill of Abhay & Co. was worth ₹ 42,000 and that of Bijoy & Co. ₹ 30,000. A goodwill account was not to be opened in the books of the new firm, the adjustments being recorded through capital accounts of the partners.

(b) The following assets were valued as below:

(c) Provision for doubtful debt was carried forward at ₹ 4000 in respect of Debtors of Abhay & Co. and ₹ 3,000 in respect of Debtors of Bijoy & Co.

(d) Partners of new firm brought necessary cash to pay other partners to adjust their capitals according to the profit-sharing ratio.

You are required to:

(i) Prepare the Balance Sheet of the new firm as on 31st March, 2013.

(ii) Prepare Capital Accounts of the partners in the books of old firms. (Nov 2013, 16 marks)

Answer:

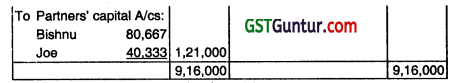

Question 5.

P and Q are partners of P & Co., sharing Profit and Losses in the ratio of 3:1 and Q and R are partners of R & Co,, sharing Profits and Losses in the ratio of 2:1. On 31st March 2015, they decide to amalgamate and form a new firm Ws POR & Co., where in P, Q, and R would be partners sharing profits and losses in the ratio of 3:2:1. The Balance Sheets of two firms on the above date are as under:

The amalgamated firm took over the business on the following terms:

(a) Building of P & Co., was valued at ₹ 1,50,000.

(b) Plant and Machinery of P & Co. was valued at ₹ 2,75,000 and that of R & C’,. at ₹ 2,50,000.

(c) All stock in trade is to be appreciated by 20%.

(d) Goodwill of P & Co. was valued at ₹ 1,20,000 and of R & Co. at ₹ 60,000, but the same will not appear in the books of POR & Co.

(e) Partners of new firm will bring the necessary cash to pay other partners to adjust their capitals according to the profit sharing ratio.

(f) Provisions for doubtful debts has to be carried forward at ₹ 15,000 ¡n respect of debtors of P & Co. and ₹ 30,000 In respect of debtors of R & Co. You are required to prepare the Balance Sheet of new firm and capital accounts of the partners in the books of old firms. (May 2016, 16 marks)

Answer:

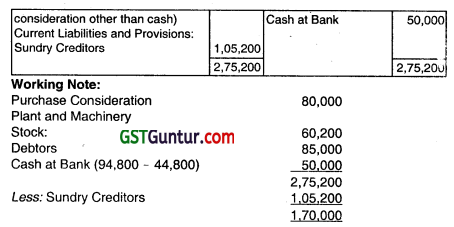

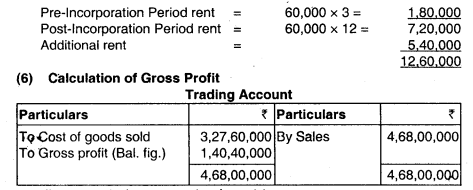

4. Calculation for proportionate Capital:

Total Capital = ₹ 12,82,000

P’s Prop. Capital (12,82,000 × 3/6) = ₹ 6,41.000

Q’s Prop. Capital (12,82,000 × 2/6) = ₹ 4,27,333

A’s Prop. Capital (12,82.000 × 1/6) = ₹ 2,13,667

![]()

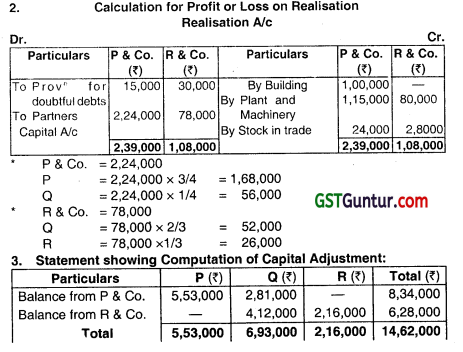

Question 6.

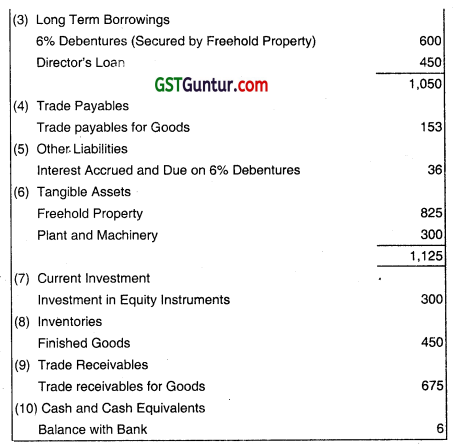

M/s Planet Limited has decided to reconstruct the Balance Street since It has accumulated huge losses. The following is the balance sheet of the company as on 31 March. 2017 before reconstruction:

The Board of Directors of the company decided upon the following scheme of re-construction with the consent of respective shareholders:

(1) Preference Shares are to be written down to ₹ 75 each and Equity Shares to ₹ 2 each.

(2) Preference Shares Dividend in arrears for 3 years to be waived by 2/3rd and for balance 1/3, Equity Shares of 2 each to be allotted.

(3) Debenture holders agreed to take one Freehold Property at its hook value of ₹ 450 lahks in part payment of their holding. Balance Debentures to remain as liability of the company.

(4) Interest accrued and due on Debentures to be paid in cash.

(5) Remaining Freehold Properly to be valued at ₹ 550 lahks,

(6) All investments sold out for ₹ 425 lakh.

(7) 70% of Director’s loan to be waived and for the balance, Equity Shares of ₹ 2 each to be allotted.

(8) 40% of Trade receivables and 80% of Inventories to be written off.

(9) Company’s contractual commitments amounting to? 900 lakh have been settled by paying 8% penalty of contract value.

You are required to:

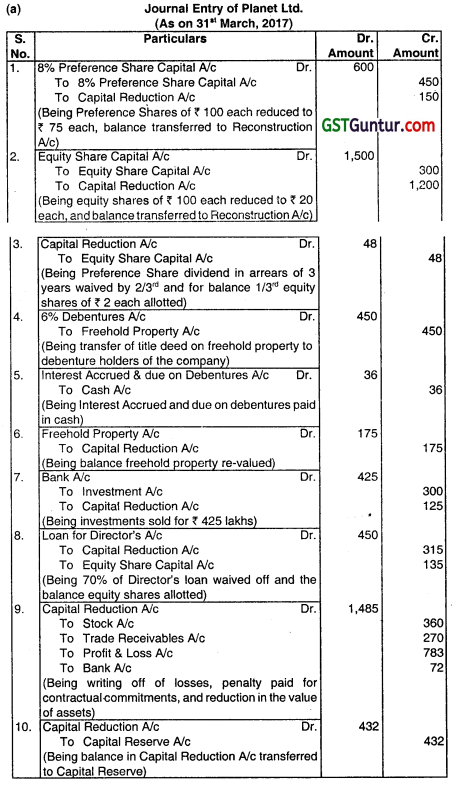

(a) Pass Journal Entries for all the transactions related to internal reconstruction;

(b) Prepare Capital Reduction Account, Bank Account; and

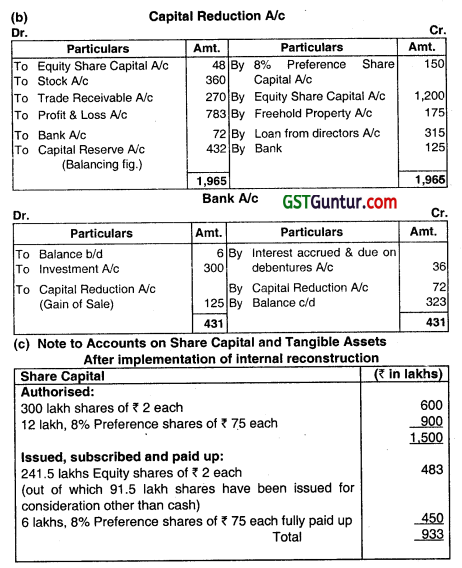

(c) Prepare Notes to Accounts on Share Capital and Tangible Assets, immediately after the implementation of internal reconstruction. (Nov 2017, 16 marks)

Answer:

Note: In place of capital Reduction Account Re-organization or Reconstruction Account may also be used.

Question 7.

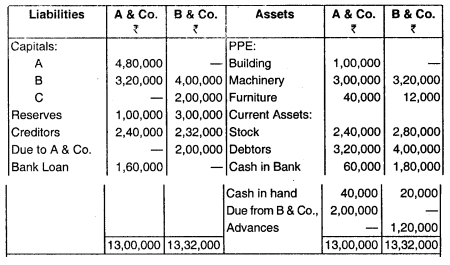

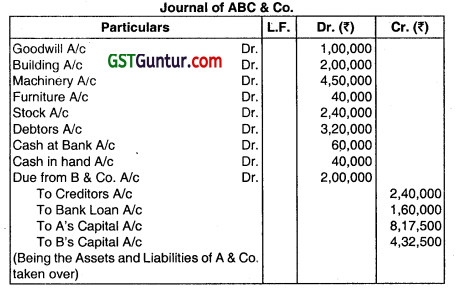

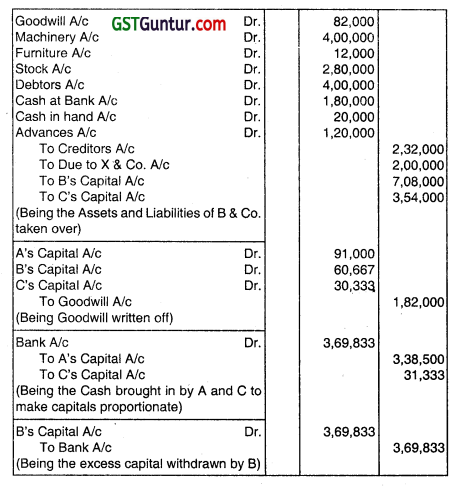

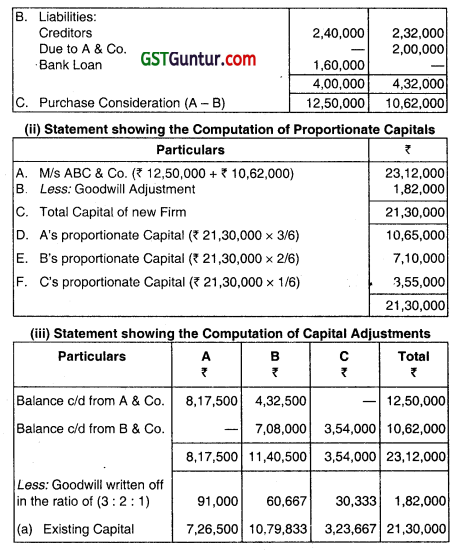

A and B are partners of A and Co, sharing profits and losses in the ratio of 3: 1, and B and C are partners of B & Co., sharing profits and losses in the ratio of 2: 1. On 31st March 2018, they decide to amalgamate and form a new firm M/s ABC & Co., where in A, B, and C would be partners sharing profits and losses in the ratio of 3: 2: 1. The Balance Sheets of two firms on the above date are as under:

The amalgamated firm took over the business on the following terms:

(a) Building of A & Co., was valued at ₹ 2,00,000.

(b) Machinery of A & Co., was valued at ₹ 4.50,000 and that of B & Co. at ₹ 4,00,000.

(c) Goodwill valued A and Co.₹ 1.00,000 and B & Co., ₹ 82,000 but the same will not appear in the books of ABC & Co.,

(d) Partners of the new firm will bring the necessary cash to pay other partners to adjust their capitals according to the profit-sharing ratio.

Required:

Show journal entries in the books of M/s ABC & Co. and Prepare the Balance Sheet as at 31.3.2018.

Answer:

Question 8.

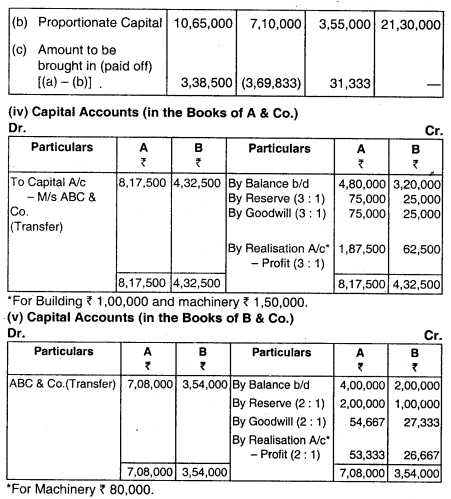

Avirtash, Rohit, and Madwesh were carrying on business in partnership sharing Profits and Losses in the ratio of 5: 4 : 3 respectively. The Trial Balance of the firm as on 31st March 2002 was the following:

Additional Information:

(a) Interest on Capital Accounts at 10% on the amount standing to the credit of partners capital accounts at the beginning of the year was not provided before preparing the above Trial Balance.

(b) On 31st March, 2002 they formed a Private Ltd. Company Anagha (P) Ud. to take over the partnership business.

(c) You are further Informed as under:

(i) Plant and Machinery is to be transferred at ₹ 80,000.

(ii) Equity Shares of 10 each of the company are to be issued to the partners at par in such numbers to ensure that by reason of their shareholdings alone, they will have the same rights of sharing Profits and Losses as they had in the partnership. Balance if any in their Capital Accounts will be settled by giving “2″ Preference Shares at par.

(iii) Before transferring this business, the partners withdrew by cash from partnership the following amounts over and above the drawings as shown in the Trial Balance:

(a) Avinash ₹ 20,000

(b) Rohit ₹ 10,600

(c) Madwesh ₹ 14,200

(iv) All Assets and Liabilities except Plant and Machinery and the Bank Balance are to be transferred at their value in the books of the partnership as at 31st March 2002.

(v) You are required to prepare:

(a) Profit and Loss Adjustment Account for the year ending 31st March 2002.

(b) Capital Accounts showing all the adjustments required to dissolve the partnership.

(c) A statement showing the number of shares of each class to be issued by the company to each of the partners to settle their accounts.

(d) Prepare Balance Sheet of the company Anagha (P) Ltd. as on 31.3.2002 after take over of the business. (Nov 2002, 16 marks)

Answer:

Question 9.

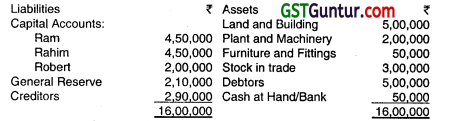

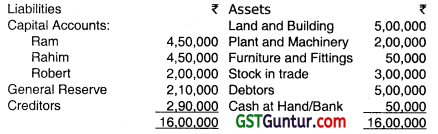

Ram, Rahim, and Robert are partners of the firm RR Traders for the past 5 years. The partners decided to dissolve the firm consequent to the insolvency of partner Robert in October 2002. The Balance Sheet of the firm as on 31.10.2002 is furnished below. They shares profit and losses equally:

The partners Ram and Rahim decided to form a new firm RR Enterprises and take over all the assets and liabilities of the firm at the values given below:

Land and Building ‘₹ 3,50,000

Plant and Machinery ₹ 1,50.000

Furniture and Fittings ‘₹ 20,000

Stock in trade ‘₹ 2,00,000

Debtors include ₹ 3,00,000 lakhs due from SK & Co. owned by Robert. (Nothing is recoverable from the said concern). Other debtors can be recovered fully.

Prepare:

(i) Realisation account, Partners capital account in the books of RR Traders; and

(ii) The Balance Sheet of RR Enterprises (immediately after commencement). (May 2003, 16 marks)

Answer:

Question 10.

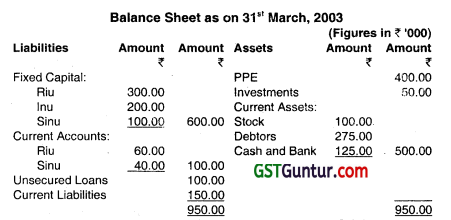

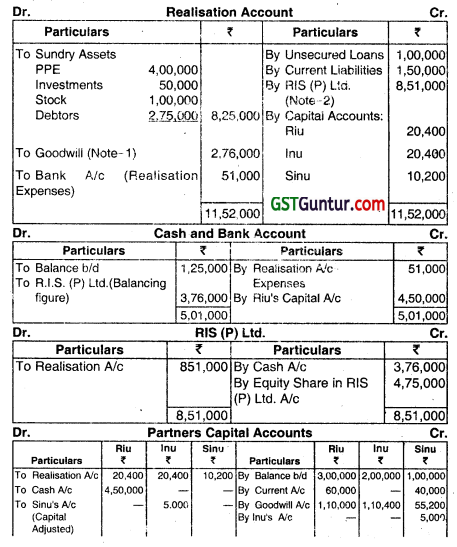

Riu, inu, and Sinu were running Partnership business sharing Profits and Losses in 2 : 2: 1 ratio. Their Balance Sheet as on 31st March 2003 stood as follows:

On 01.04.2003, they agreed to form a New company RIS (P) Ltd. with inu and Sinu each taking up 200 shares of ₹ 10 each, which shall take over the firm as a going concern including Goodwill, but excluding Cash and Bank Balances. The following are also agreed upon:

(a) Goodwill will be valued at 3 years purchases of super profits.

(b) The actual profit for the purpose of Goodwill valuation will be ₹ 2,00,000.

(c) The normal rate of return will be 18% per annum on Fixed Capital.

(d) All other Assets and Liabilities will be taken over at Book values.

(e) The Purchase Consideration will be payable partly in Shares of ₹ 10 each and party in cash. Payment in Cash being to meet the requirement to Discharge Riu, who has agreed to retire.

(f) Inu and Sinu are to acquire Interest in the new company at the ratio 3:2.

(g) Realisation expenses amounted to ₹ 51,000.

You are required to prepare Realisation Account, Cash and Bank Account, RIS (P) Limited Account and Capital Account of Partners. (May 2004, 16 marks)

Answer:

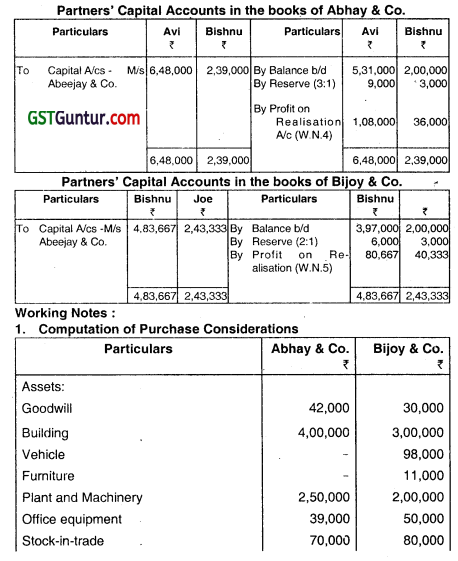

(3) Sharing of shares In New Company received as purchase consideration:

Equity shares of RIS (P) Ltd. have been distributed to inu and Sinu in the ratio of 3:2

![]()

Question 11.

‘X’ and ‘Y’ carrying on business in partnership sharing Profits and Losses equally, wished to dissolve the firm and sell the business to ‘X’ Limited Company on 31 -3 – 2006 when the firms position was as follows:

The arrangement with X Limited Company was as follows:

(i) Land and Building was purchased at 20% more than the book value.

(ii) Furniture and stock were purchased at book values less 15%.

(iii) The goodwill of the time, was valued at ₹ 40,000.

(iv) The firm’s debtors, cash, and creditors were not to be taken over, but the company agreed to collect the book debts of the firm and discharge the creditors of the firm as an agent, for which services, the company was to be paid 5% on all collections from the firm’s debtors and 3% on cash paid to firm’s creditors.

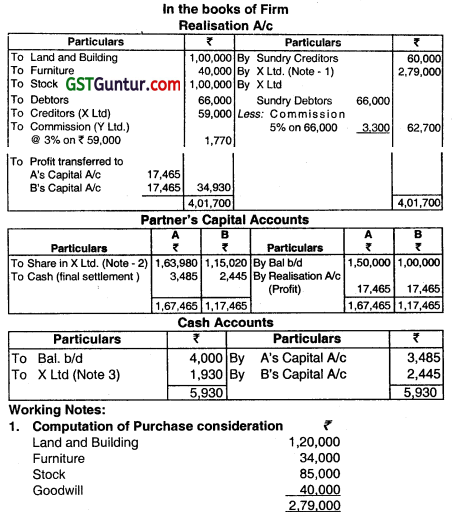

(v) The purchase price was to be discharged by the company in fully paid equity shares of ‘ ₹ 10 each at a premium of ₹ 2 per share. The company collected all the amounts from debtors. The creditors were paid off less by ‘ ₹ 1,000 allowed by them as discount. The company paid the balance due to the vendors in cash. Prepare the Realisation account the Capital accounts of the partners and the Cash account in the books of partnership firm. (Nov 2006, 16 marks)

Answer:

2. The amount of share received trom X Ltd., have been distributed between the two partners A and B in the ratio of their final daim i.e. 1,67, 465: 1,17,465

And, number of shares received from X Ltd.

= \(\frac{2,79,000}{12}=\)

∴ A gets 23,250 × \(\frac{1,67,465}{2,84,930}\) = 13,665 shares

and it value is 13,665 × ₹ 12 = 1,63,980

and B gets 23,250 × \(\frac{1,17,465}{2,84,930}\) = 9,585 shares

and its value is 9,585 × ₹ 12 = ₹ 1,15,020.

Question 12.

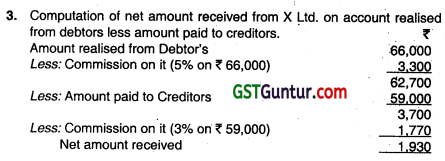

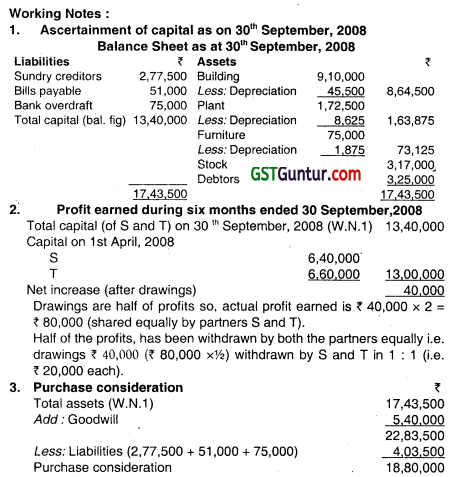

‘S’ and T were carrying on business as equal partner. Their Balance Sheet as on 31st March, 2008 stood as follows:

The operations of the business was carried on till 30th September, 2008. S and T both withdrew in equal amounts half the amount of profits made during the current period of 6 months after 10% per annum had been written oil on Building and Plant and 5% per annum written off on Furniture. During the current period of 6 months, creditors were reduced

by ₹ 50,000, Bills payable by ₹ 11,500 ₹ 75,000.

The Joint Lite policy was surrendered for ₹ 47,500 on 30th September 2008. Stock was valued at ₹ 3,17,000 and debtors at ₹ 3,25,000 on 30th September 2008. The other items remained the same as on 31st March 2008. On 30th September 2008 the firm sold its business to ST Ltd. The value of goodwill was estimated at ₹ 5,40,000 and the remaining assets were valued on the basis of the Balance Sheet as on 30th September, 2008. The ST Ltd. paid the purchase consideration in Equity shares of ₹ 10 each. You are required to prepare a Realization A/c and Capital accounts of the partners. (Nov 2008, 8 marks)

Answer:

Assumption: This solution Is determined on the basis that reduction in bank overdraft is after surrender of Joint Life Policy. Otherwise, the reduction in bank overdraft may be taken as before surrender of Joint Policy. Accordingly, the solution will change.

Question 13.

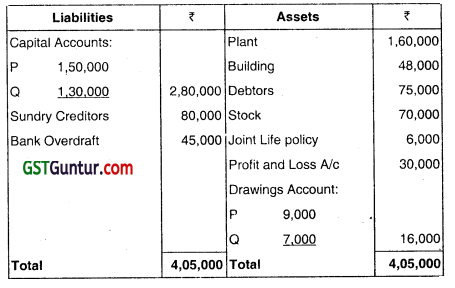

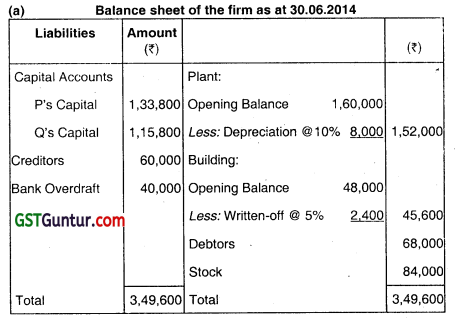

P and Q were carrying on business sharing profits and losses equafly. The firms Balance Sheet as at 31.12.2013 was:

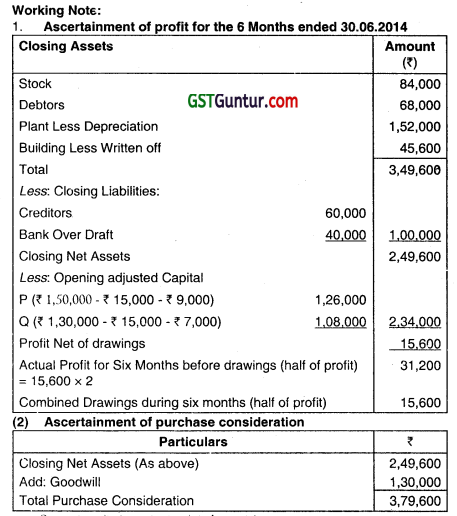

The operations of the business were carried on till 30.06.2014. P and Q both withdrew in equal amounts half the amount of profit made during the current period of six months after charging depreciation at 10% per annum on plant and after writing off 5% on building. During the current period of six months, creditors were reduced by ₹ 20,000 and bank ovetdraft by ₹ 5,000.

The joint-life policy was surrendered for ₹ 6,000 before 30th June 2014. Stock was valued at ₹ 84,000 and debtors at ₹ 68,000 on 30th June 2014. The other items remained the same as at 31.12.2013. On 30.06.2014, the firm sold its business to PQ Ltd. The value of goodwill was estimated at ₹ 1,30,000 and the remaining assets were valued on the basis of the balance sheet as on 30.06.2014. Po Ltd. paid the purchase consideration in equity shares of ₹ 10 each.

You are required to prepare:

(a) Balance sheet of the firm as at 30.06.2014,

(b) Realisation account,

(c) Partners’ Capital Accounts showing the final settlement between them. (Nov 2014, 16 marks)

Answer:

Question 14.

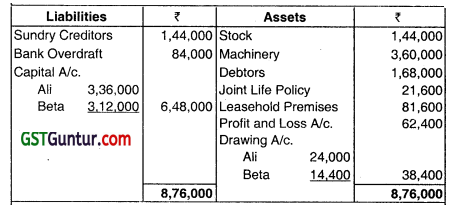

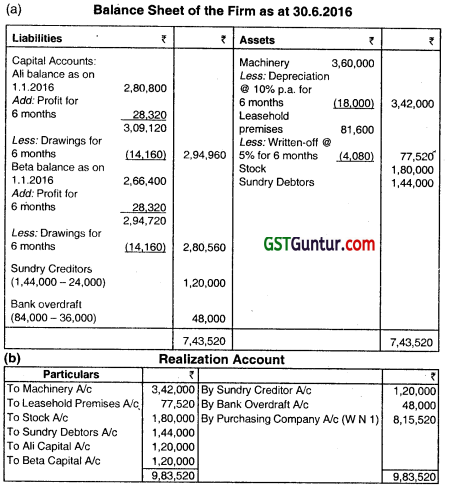

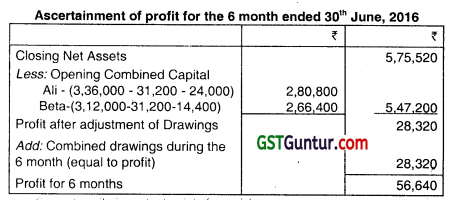

All and Beta were carrying on business, sharing profits and losses equaii

The firm’s balance sheet as at 31-12-2015 was:

The business was carried on till 30-06-2016. The partners withdrew the amounts equal to half the amount of profit made during the period of six months ended on 30-6-2016. in equal proportion. The profit was calculated after charging depreciation at 10% p.a. on machinery and after writing off 5% on leasehold premises. In the half year. sundry creditors were reduced by ₹ 24,000 and bank overdraft by ₹ 36,000.

On 30-6-2016, stock was valued at ₹ 1,80,000 and debtors at ₹ 1,44,000;

the Joint Life Policy had been surrendered for ₹ 21,600 before 30-06-2016 and other items remained the same as at 31-12-2015.

On 30-6-2016, the firm sold the business to a limited company. The value of goodwill was fixed at ₹ 2,40,000 and the rest of the assets were valued on the basis of the balance sheet as at 30-6-2016. The company paid the purchase consideration in equity shares of ₹ 10 each.

You are required to prepare:

(a) Balance Sheet of the firm as at 30-6-2016;

(b) Reaslisation Account; and

(c) Partners’ Capital Account showing the final settlement between them. (May 2017, 16 marks)

Answer:

Question 15.

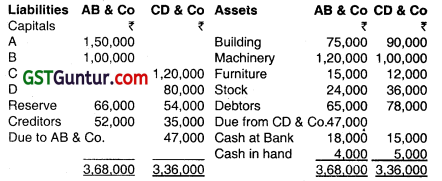

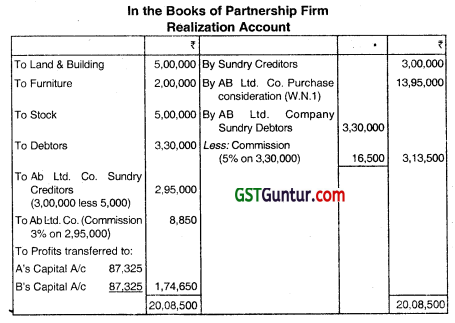

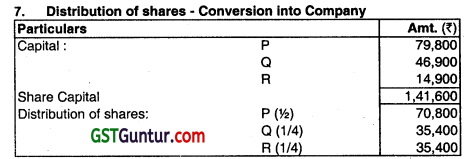

A and B carrying or, business in partnership sharing profits and losses equally, wished to dissolve the firm and sell the business to AB Limited Company on 31.03.2018 when the firm’s position was as follows:

| Liabilities | ₹ | Assets | ₹ |

| A’s Capital | 7,50,000 | Land and Buildings | 5,00,000 |

| B’s Capital | 5,00,000 | Furniture | 2,00,000 |

| Sundry Creditors | 3,00,000 | Stock | 5,00,000 |

| Debtors | 3,30,000 | ||

| Cash | 20,000 | ||

| 15,50,000 | 15,50,000 |

The arrangement with AB Limited Company was as follows:

(i) Land and Buildings was purchased at 20% more than the book value.

(ii) Furniture and stock were purchased at book value less 15%.

(iii) The Goodwill of the firm was valued at ₹ 2,00,000.

(iv) The firm’s debtors, cash and creditors were not to be taken over, but the company agreed to collect the book debts of the firm and discharge the creditors of the firm as an agent, for which services the company was to be paid 5% on all collections from the firm’s

debtors and 3°/o on cash paid to firm’s creditors.

(v) The purchase price was to be discharged by the company in fully paid equity shares of 10 each at a premium of ₹ 2 per share.

The company collected all the amounts from the debtors. The creditors were paid off less by ₹ 5,000 allowed as discount. The company paid the balance due to the vendors in cash.

Prepare tho Realisation A/c, the Capital Accounts of the Partners and the Cash Account in the books of the Partnership firm. (May 2018, 15 marks)

Answer:

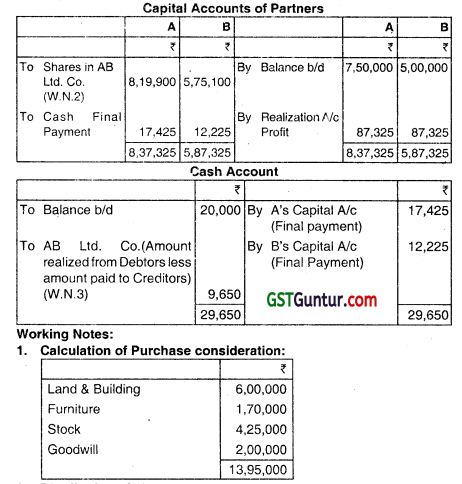

2. Distribution of shares among partners:

The shares received from the company have been distributed between the two partners A & B in me ratio of their final claims i.e. ₹ 8,37,325: 5,87,32 5.

No. of shares received from the company = 13,95,000/12 = 1,16,250.

A gets [(1,16,250 × 8,37.325)/14,24,650] = 68325 shares valued at

68,325 × 12 = 8,19,900. B gets the remaining 47,925 shares valued at ₹ 5,75,100 (47,925 × 12).

3. Calculation of net amount received from AB Ltd. on account of amount realized from debtors less amount paid to Creditors.

Note: In the above situation, shares received from AB Ltd. Company have been distributed between two partners A and B in the ratio of their final daims. Alternatively, shares received from AB Ltd. can be distributed among the partners in their profit sharing ratio i.e. 13,95,000.

x ½ = ₹ 6,97,500 each. In that case, firm will pay cash amounting ₹ 1,39,825 to A and will receive cash ₹ 1,10,175 from B. Partners’ Capital Accounts and Cash Account will, accordingly get changed.

![]()

Question 16.

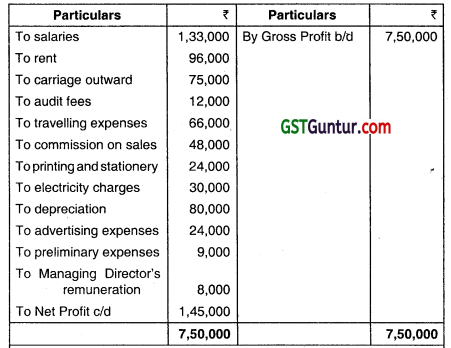

Sun Limited took over the running business of a partnership firm M/s A & N Brothers with effect from 1st April. 2017. The company was incorporated on 1st September 2017. The following profit and loss account has been prepared for the year ended 31st March 2018.

Additional Information:

1. Trend of sales during April, 2017 to March 2018 was as under

| April, May | ₹ 85,000 per month |

| June, July | ₹ 1,05,000 per month |

| August, September | ₹ 1,20,000 per month |

| October, November | ₹ 1,40,000 per month |

| December, onwards | ₹ 1,50000 per month |

2. Sun Limited took over a machine worth ₹ 7,20,000 from A &N Brothers and purchased a new machine on 1st February, 2018 for ₹ 4,80,000. The company decides to provide depreciation @ 10% p.a.

3. The company occupied additional space from 1st October, 2017 @ rent of ₹ 6,000 per month.

4. Out of traveling expenses, ₹ 30,000 were Incurred by office staff while remaining expenses were incurred by salesmen.

5. Audit fees pertains to the company.

6. Salaries were doubled from the date of incorporation.

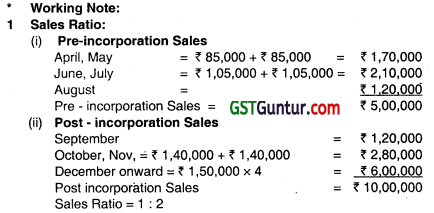

You are required to prepare a statement apportioning the expenses between pre and post-incorporation periods and calculate the profit/loss for such periods. (Nov 2018, 12 marks)

Answer:

2. Apportionment of Salary:

Let the Salary per month from 01.04.2017 to 31st August. 2017 is x Salary per month from 1st Sep to 31st March, 2018 be = 2 × Hence, pre-incorporation Salary (01.04.2017 to 31.08.2017) i.e. for 5 month = 5 ×

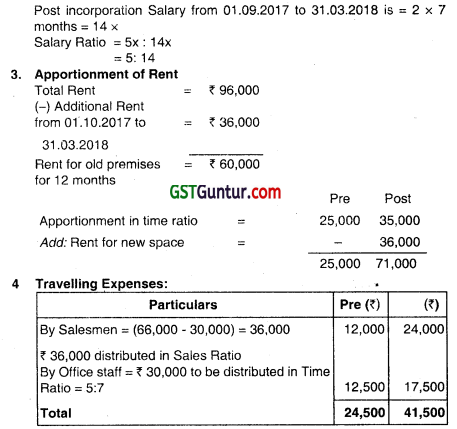

5. Depreciation

Total depreciation = ₹ 80.000

Depreciation on Machine took over A&N Brother = 7,20,000 × 10% = ₹ 72,000 is to be distributed in Time Ratio Depreciation on new purchased Machine;

=4,80,000 × 10% × 2/12= ₹ 8,000

Purchased Machinery is exclusive for post period so allocated to Post incorporated period only.

Question 17.

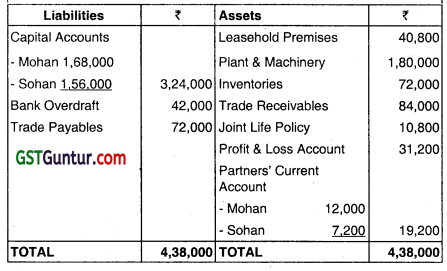

Mohan and Sohan were carrying business in partnership, sharing profit and losses equally. The Balance Sheet of the firm as on 31st March 2019 stood as under:

The business was carried on till 30th September 2019. The partners withdrew the amounts equal to half the amount of profit make during the period of six months ended on 30g’ September 2019 equally. The profit was calculated after charging depreciation @ 5% per annum on Leasehold premises and 10% per annum on Plant & Machinery.

In the halt year, the amounts of Bank Overdraft and Trade Payables stood reduced by ₹ 18,000 and ₹ 12,000 respectively. On 30th September 2019 the inventories were valued at ₹ 90,000 and Trade Receivables at ₹ 72,000. The Joint Ufe Policy had been surrendered for ₹ 10,800 before 30th September. 2019 and all other terms remained the same as at 31st March, 2019.

On 30th September 2019, the firm sold off its business to PKR Limited. The value of Goodwill was fixed at ₹ 1,20,000 and the rest of the assets and liabilities were valued on the basis of their book values as at 30th September. 2019. PKR Ltd. paid the purchase consideration m equity shares of ₹ 10 each

You are requested to prepare the following:

(1) Balance Sheet of the Firm as at 30m September 2019; ‘

(2) Realization Account,

(3) Partners’ Capital Account showing the final settlement between them. (Nov 2020,15 marks)

Question 18.

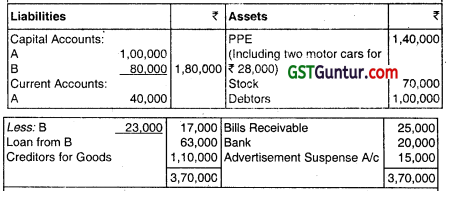

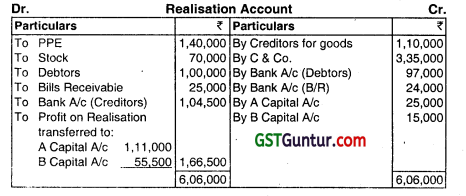

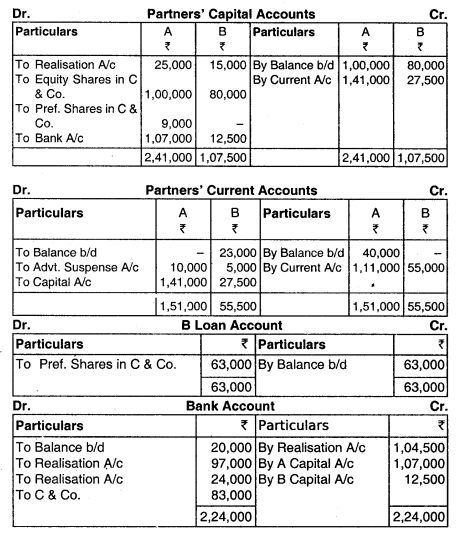

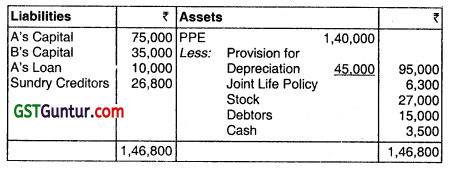

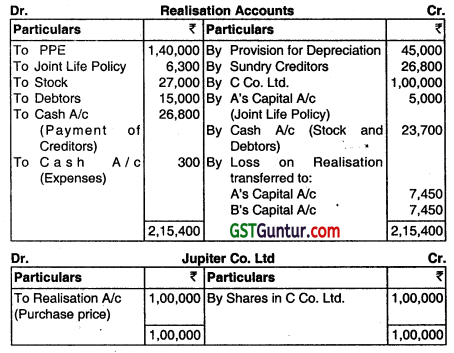

A and B were in partnership sharing profit and losses in the rabo of 2:1. Their summarized Balance Sheet as on 31st March, 2018 was as under:

They decided to dissolve the business and accepted the oiler of C and Co. Ltd. to acquire stocks and PPE excluding two motor cars at a total price of ₹ 3,35,000. The debtors realised ₹ 97,000 and bills receivable, ₹ 24,000.

Creditors for goods allowed a discount of 5%. The purchase consideration was to be discharged by a cash payment of ₹ 83,000 the allotment by the company to the partners of 8,000 preference shares of ₹ 10 each (valued at ₹ 9 each) and the balance by the allotment of ₹ 9,000 ordinary shares of ₹ 10 each. The partners agreed that following should be the basis of

distribution on dissolution of the firm.

(a) A to take over one Motor car at a value of ₹ 25,000 and B the other car at ₹ 15000.

(b) B to accept preference shares for her loan to the firm, the remainder to be taken over by A.

(c) The ordinary shares to be taken over by A and B in proportion of their fixed capitals.

(d) The balance to be settled in cash.

Required: Prepare the necessary accounts to close the books of the firm.

Answer:

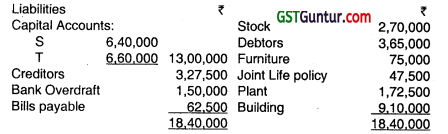

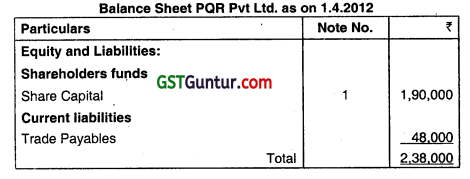

Question 19.

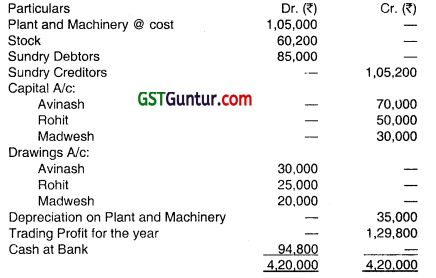

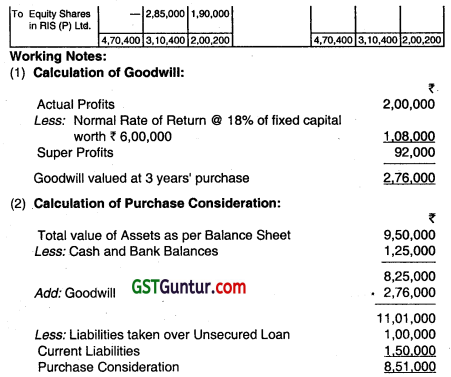

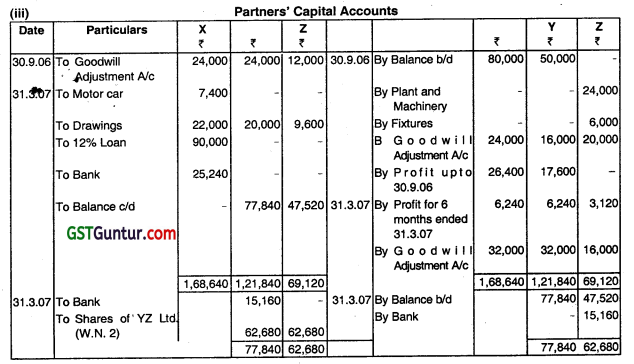

A and B were partners on 31st March 2018 their Balance Sheet was as follows:

On that date, the partners dissolved the firm. Fixed assets were sold to C Co. Ltd., for ₹ 1,00,000 payable in the form of 10,000 shares of ₹ 10 each. A took over joint life policy at an agreed valuation of ₹ 5,000. Stock and debtors realised ₹ 23,700. Expenses came to ₹ 300. A and B agreed to distribute shares in C Co. Ltd., between themselves in the ratio of their final claims. Sundry creditors were paid at book value.

Required: Show the necessary ledger accounts.

Answer:

Notes:

(i) Since there is no enough cash is available, for the balance of As loan account, shares in C Co. Ltd. are given,

(ii) There is no need to establish the ratio of final claim, as the only assets available for closing the capital accounts are’ Shares in the C Co. Ltd.

![]()

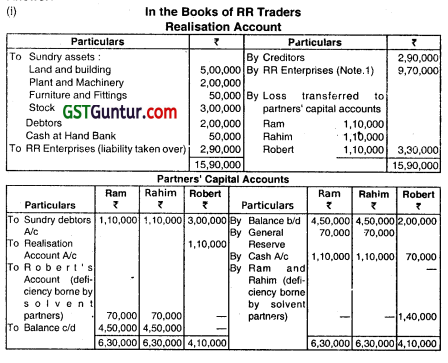

Question 20.

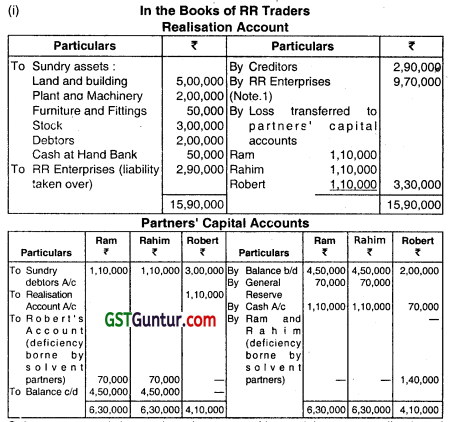

Ram, Rahim, and Robert are partners of the firm RR Traders for the past 5 years. The partners decided to dissolve the firm consequent to insolvency of partner Robert in October 2002. The Balance Sheet of the firm as on 31.10.2002 is furnished below. They share profits and losses equally:

The partners Ram and Rahim decided to form a new firm ‘RR Enterprises and take over all the assets and liabilities of the firm at values given below:

Land and Building ₹ 3,50,000

Plant and Machinery ‘ ₹ 1,50,000

Furniture and Fittings ₹ 20,000

Stock in trade ₹ 2,00,000

Debtors include ₹ 3,00,000 lakhs due from SK & Co. owned by Robert. (Nothing is recoverable from the said concern). Other debtors can be recovered fully.

Prepare:

(i) Reahsat, on account. Partner’s capital account in the books of AR Traders; and

(ii) The Balance Sheet of RR Enterprises (immediately after commencement). (May 2003, 16 marks)

Answer:

Solvent partners bring cash to the extent of loss arising upon realization of assets of the firm as per Garner vs Murray Rule.

Question 21.

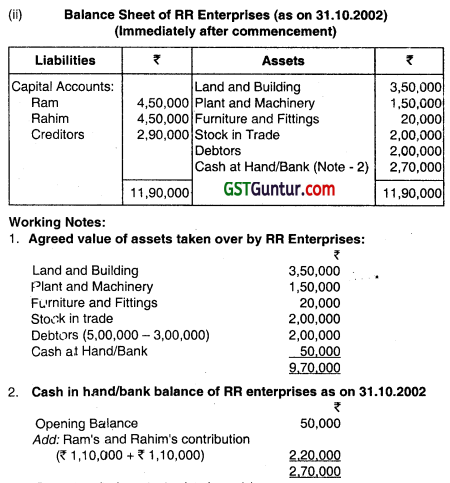

X and Y are partners sharing Profits and Losses in the ratio of 3:2. On 30th September 2006 they admitted Z as a partner. The new Protit sharing ratio agreed was 2:2:1. At the time of admission Z brought in a fixture valued at ₹ 6,000 and a machinery worth ₹ 24,000. No accounting entry was passed for the fixture brought in by partner Z in ‘he books of the firm.

Also at the time of admission, the valuation of goodwill was made. The value of goodwill of X and Y was decided at ₹ 40,000 and value of goodwill of partner Z was fixed at ₹ 20,000. No effect was given to the goodwill value in the books of the firm.

On 31.3.2007. it was decided that partner X would retire and the other partners viz., Y and Z would continue the business of the firm by converting it into a company called YZ Ltd., with equal shareholding in the Company.

The partners agreed as below:

(i) The goodwill of the firm shall be fixed at ₹ 80,000. The necessary effect for goodwill value not recorded earlier shall be given. The present goodwill value being ₹ 80,000 shall be reflected in the books of the company.

(ii) All the Assets and Liabilities of the firm shall be taken over by the company.

(iii) Partner X would take Motor car of the firm at a value of ₹ 7,400.

(iv) A plant owned by the firm is sold for ₹ 6,000.

(v) The Profit of the firm upto 30.9.2006 was ₹ 44,000.

(vi) Partner X agreed to leave ₹ 90,000 as loan with the firm In return for 12% interest per annum.

Following is the Trial Balance of the firm as on 31.3.2007:

Particulars Dr. ₹ Cr. ₹

Capital Account:

X – 80,000

Y – 50,000

Z – 24,000

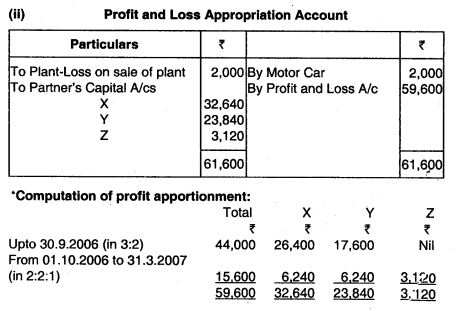

You are required to prepare:

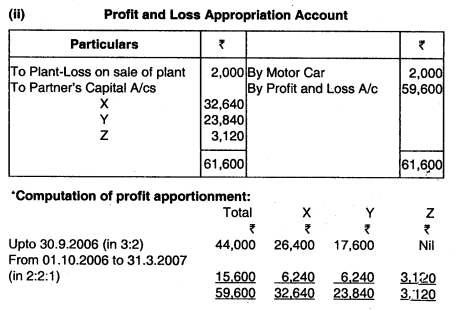

(i) Goodwül Adjustment Account

(ii) Profit and Loss Appropriation Account

(iii) Partners Capital Accounts

(iv) Balance Sheet of YZ Ltd. after Conversion. (Nov 2007, 20 marks)

Answer:

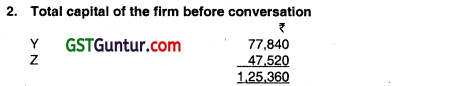

As Y and Z would continue with equal shareholding, hence, share capital

of Y and Z would be ₹ 1,25,360 /2 = ₹ 62,680 each.

Z should bring cash ₹ (62,680 – 47,520) = ₹ 15,160

Y should withdraw cash ₹ (77,840 – 62,680) =₹ 15,160

Question 22.

The partnership of Sakshi Agencies decided to convert the partnership into Private Limited Company named Rameshwar Company Pvt. Ltd. with effect from 1st January 2008. The consideration was agreed at ₹ 2,34,00,000 based on firm’s Balance Sheet as on 31st December 2007.

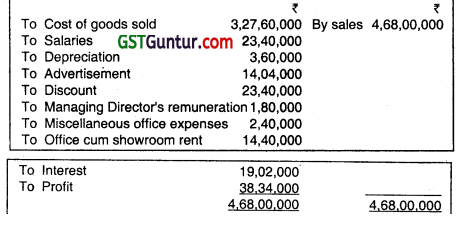

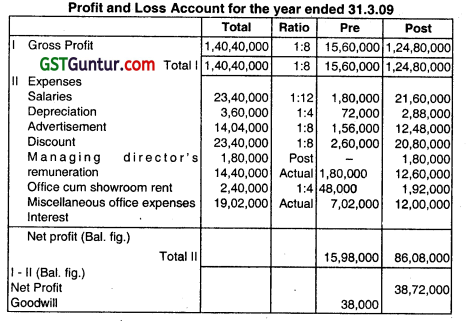

However, due to some procedural difficulties, the company could be incorporated only on 1st April, 2008. Meanwhile, the business was continued on behalf of the company and the consideration was settled on that day with Interest at 12% p.a. The same books of accounts were continued by the company, which closed its accounts for the first time on 31st March 2009 and prepared the following summarised Profit and Loss account:

The companys only borrowing was a loan of ₹ 100,00,000 at 12% p.a. to pay the purchase consideration due to the firm and for working capital requirements. The company was able to double the monthly average sales of the firm from 1st April, 2008, but the salaries trebled from the date. It had to occupy additional space from 1st July, 2008 for which rent was ₹ 60,000 per month. Prepare a Profit and Loss account in columnar form apportioning costs and revenue between the pre-Incorporation and post-Incorporation periods. (May 2009, 8 marks)

Answer:

Question 23.

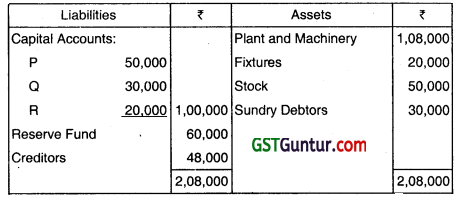

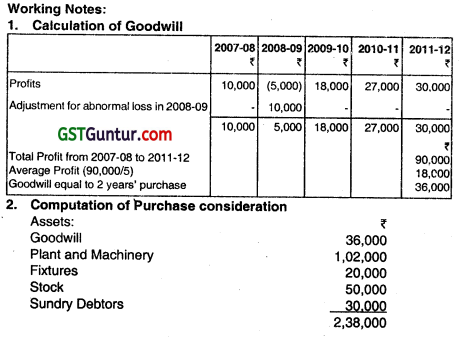

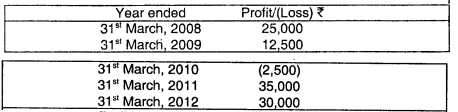

P, Q, and R are partners sharing profits and losses in the ratio 3 :2: 1 after allowing interest on capital @ 9% p.a. Their Balance Sheet as at 31st March 2012 are as follows:

They applied for conversion of the firm into a Private Limited Company named PQR Pvt. Ltd. and the certificate was received on 01-04-2012. They decided to maintain same profit-sharing ratio and to preserve the priority in regard to repayment of capital as far as possible. For that purpose, they Decided to insert a clause of issuance of Preferences shares in Memorandum of Association In addition to issuance of Equity shares of 10 each. On 01-04-2012, the value of goodwill is to be determined on the basis of 2 years purchase of the average profit from the business of the last 5 years.

The particulars of profits are as under:

| ₹ | ||

| Year ended 31.03.2008 | Profit | 10,000 |

| Year end3d 31.03.2009 | Loss | 5,000 |

| Year ended 31.03.2010 | Profit | 18,000 |

| Year ended 31.03.2011 | Profit | 27,000 |

| Year ended 31.03.2012 | Profit | 30,000 |

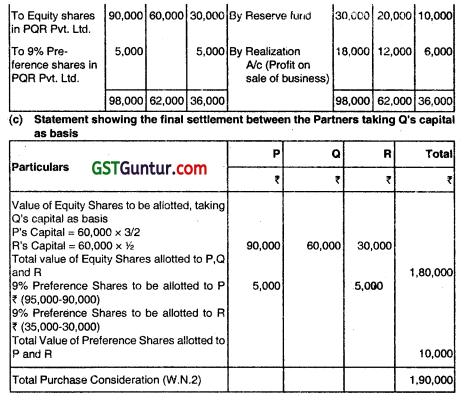

The loss for the year ended 31 -03-2009 was on account of loss by strike to the extent of ₹ 10,000.lt was agreed that rest of the assets are valued on the basis of. the Balance Sheet as at 31-03-2012 except Plant and Machinery which is valued at ₹ 1,02,000. You are required to prepare (a) the Balance Sheet of the Company as at 01-04-2012. (b) Partners’ Capital Account and (c) Statement showing the final settlement between the partners taking Q’s capital as basis. (Nov 2012, 16 marks)

Answer:

Taking Q’s capital as basis, both P and R have ₹ 5,000 each as excess in their capital account balances. Since interest on capital is meant to compensate those wtose capital is in excess of proportionate limits and since in the case of partners it is an appropriation of profit, it will be proper to give 9% preference shares to P and R for ₹ 5,000 each and the remaining

amount 01 ₹ 1,80,000 in the form of Equity Shares to be divided among P, Q and R in the ratio 3:2:1. They will then share the company’s profit in the ratio 3:2:1 after allowing preference dividend.

Note:

The question requires that the profit sharing ratio should be maintained even after conversion of partnership firm Into a company. Further, it also requires that priority in regard to repayment of capital should also be preserved.

Therefore, It is also possible that 9% preference shares equivalent and proportionate to the capital balance 01 partners as on 31.3.2012 may be issued, so that such preference shares earn dividend equivalent to the interest on such capital @ 9%. Further, priority in regard to repayment of capital should be ensured to the extent of preference share capital and dividend thereon.

Thereafter, to maintain the profit sharing ratio, equity share capital may be issued in the ratio of sharing profits and losses. In that case, 1,00,000, 9% Preference shares will be issued to P, Q and R in the proportion of 5:3:2 and Equity shares will be issued to P, Q and R in the proportion of 3:2:1.

Question 24.

The following is the Balance Sheet of M/S. P and Q as on 31st March, 2012:

| liabilities | ₹ | Assets | ₹ |

| Capital Accounts: | Machinery | 54,000 | |

| P | 50,000 | Furniture | 5,000 |

| Q | 30,000 | Investment | 50,000 |

| Reserves | 20,000 | Stock | 20,000 |

| Loan Account of Q | 15,000 | Debtors | 21,000 |

| Creditors | 40,000 | Cash | 5,000 |

| 1,55,000 | 1,55,000 |

It was agreed that Mr. R is to be admitted for a fourth share in the future profits from 1 April, 2012. He is required to contribute cash towards goodwill and ₹ 15,000 towards capital.

The following further information is furnished:

(a) P & Q share the profits in the ratio 3: 2

(b) P was receiving salary of 750 p.m. from the very inception of the firm in 2005 in addition to share of profit.

(c) The future profit ratio between P, Q & R will be 2: 1: 1. P will not get any salary after the admission of R.

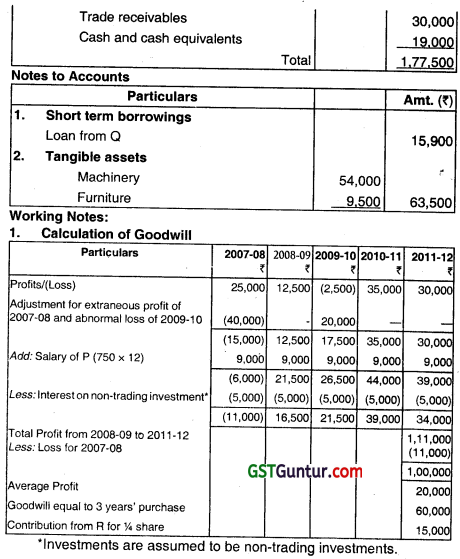

(d) It was agreed that the value of goodwill of the firm shall appear in the books of the firm. The goodwill of the firm shall be determined on the basis of 3 years’ purchase of the average profits from business of the last 5 years. The particulars of the profits are as under:

The above Profits and Losses are after charging the Salary of P. the Profit of the year ended 31st March 2008 included an extraneous profit of ₹ 40,000 and the loss for the year ended 31st March 2010 was on account of loss by strike to the extent of ₹ 20,000.

(e) The cash trading profit for the year ended 31st March 2013 was ₹ 50,000 before depreciation.

(f) The partners had drawn each ₹ 1,000 p.m. as drawings.

(g) The value of other assets and liabilities as on 31st March 2013 were as under:

₹

Machinery (before depreciation) 60,000

Furniture (before depreciation) 10,000

Investment 50,000

Stock 15,000

Debtors 30,000

Creditors 20.000

(h) Provide depreciation @ 10% on Machinery and @ 5% on Furniture on the Closing Balance and interest is accumulated @ 6% on Q’s loan. The loan alongwith interest would be repaid within next 12 months. Investments are held from inception of the firm and interest In received @ 10%p.a.

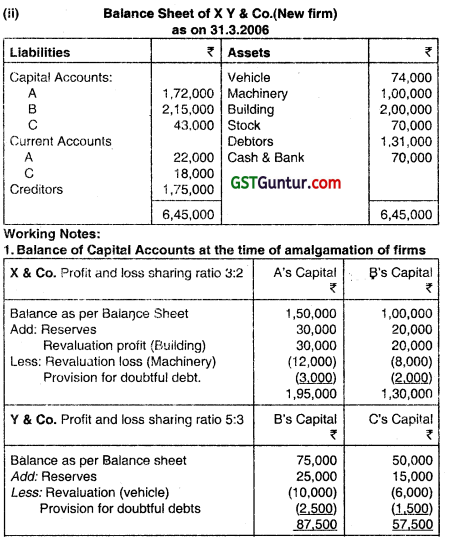

(i) The partners applied for conversion of the firm into a Private Limited Company. Certificate was received on 1st April, 2013. They decided to convert Capital A/cs of the partners into share capital In the ratio of 2 :1: 1 on the basis of total Capital as on 31” March, 2013.

If necessary. partners have to subscribe to fresh capital or withdraw. Prepare the Profit and Loss Account of the firm for the year ended 31st March, 2013 and the Balance Sheet of the Company on 1st April, 2013. (May 2013,16 marks)

Answer:

P and Q should withdraw capital of ₹ 9,000 (₹ 79,800 – ₹ 70,800) and ₹ 11,500 (₹ 46,900 – ₹ 35,400) respectively and R should subscribe shares of ₹ 20,500 (₹ 35,400- ₹ 14,900).

![]()

Question 25.

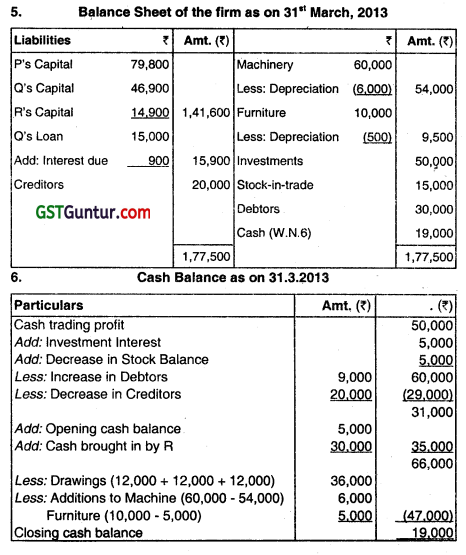

Yash, Tanish, and Ruchika were partners sharing Profit and Loss in ratio of 3:2:1. Balance Sheet of the firm is as follows: ‘

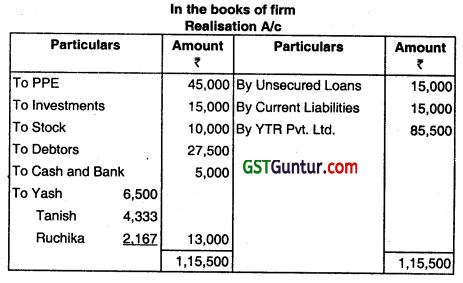

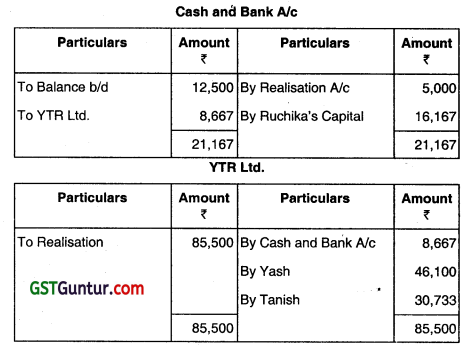

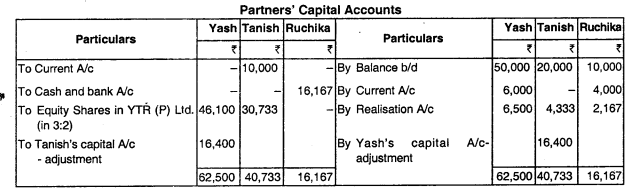

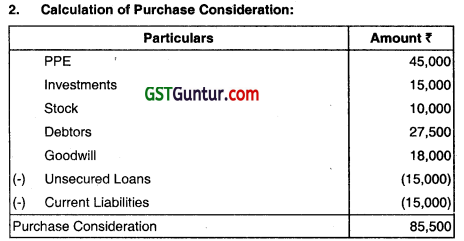

On 1st April 2014 all the partners agreed to form a new company YTR Pvt. Ltd., which shall take over the firm as going concern including goodwill, but excluding cash and bank balances. The following matters were also agreed upon:

(i) Goodwill shall be valued at 3 years’ purchase of super profits.

(ii) Actual profit for the purpose of goodwill valuation will be ₹ 20,000.

(iii) The normal rate of return will be 17.50% per annum of Fixed Capital.

(iv) All other Assets and Liabilities will be taken over at book value.

(v) The purchase consideration will be paid partly in share of ₹ 1 each and partly in cash. Yash and Tan ish to acquire interest in new company in the ratio of 3:2 at tace value. Ruchika agreed to retire after taking her share ¡ri cash.

(vi) Realisatiori expenses amounted to ₹ 5,000. Prepare Realisation Account, Cash and Bank Account, YTR Private Limited Account and Capital Accounts of the partners. (Nov 2015, 16 marks)

Answer:

Working Notes:

Calculation 0f goodwill:

Normal Profit = Capital Investment × Rate of Return

= (50,000 + 20,000 + 10,000) × 17.5%

Normal Profit = ₹ 14,000

Super profit = Actual Profit – Normal Profit

Super Profit = 20,000 – 14,000

= ₹ 6000

Goodwill = Super Profit × No.of year purchase

= 6000 × 3

Good will = ₹ 18,000

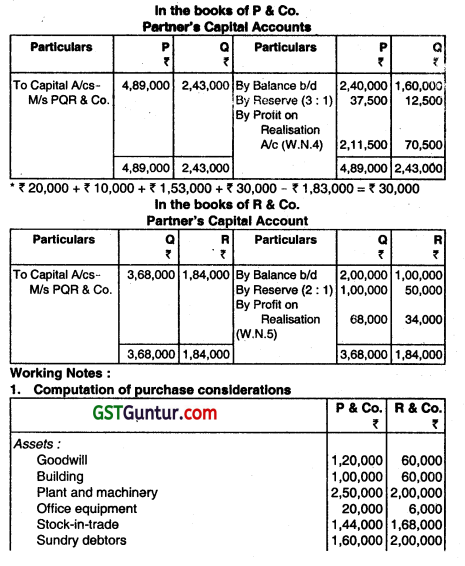

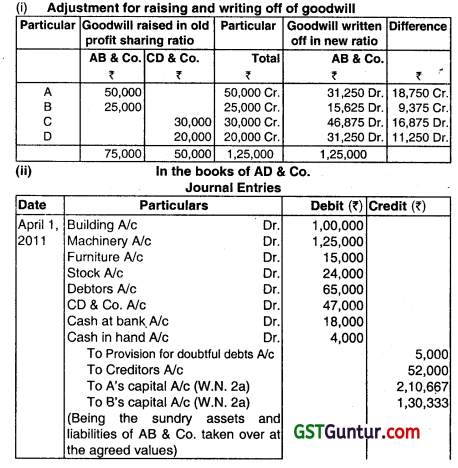

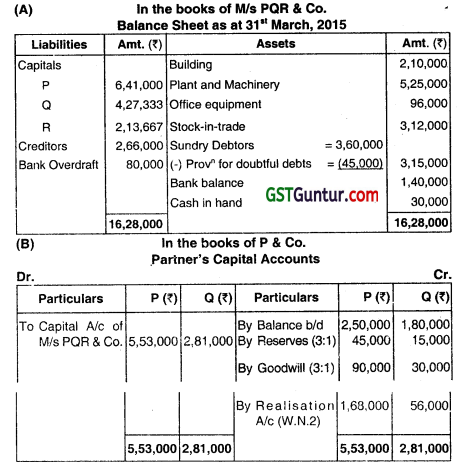

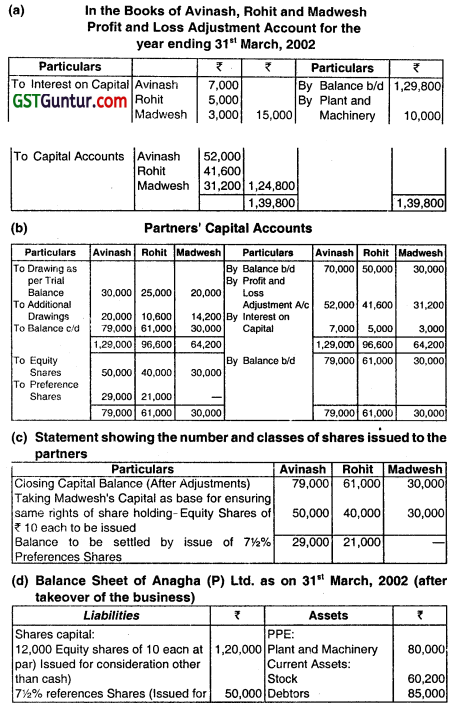

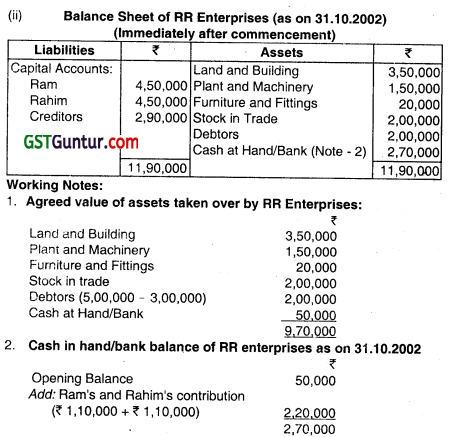

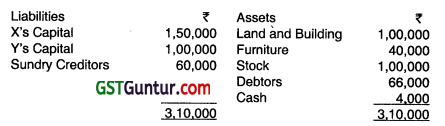

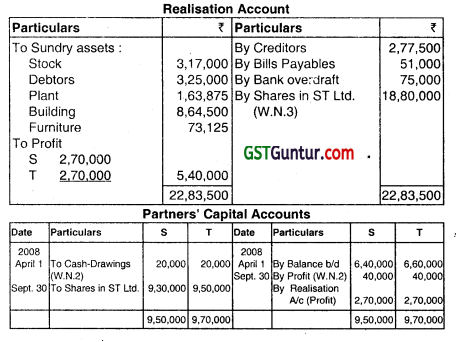

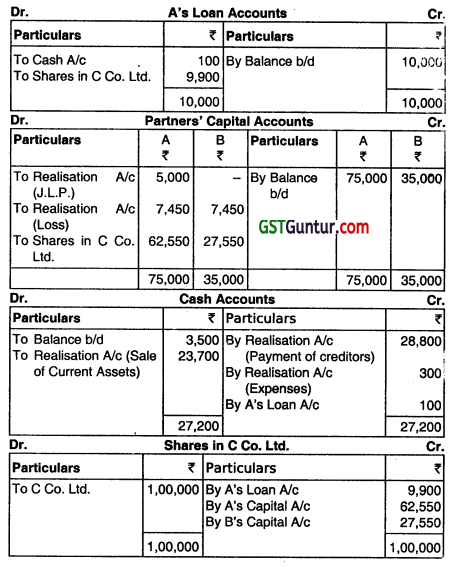

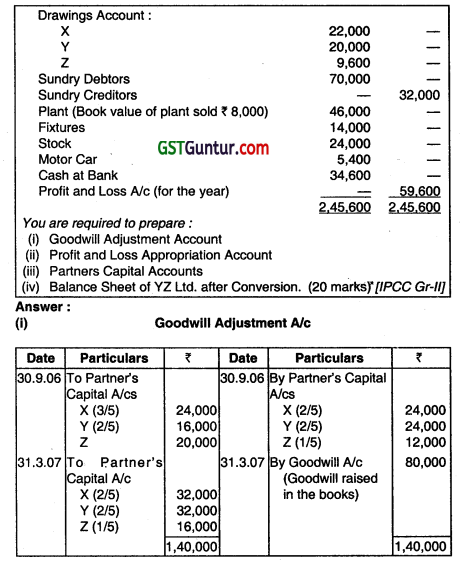

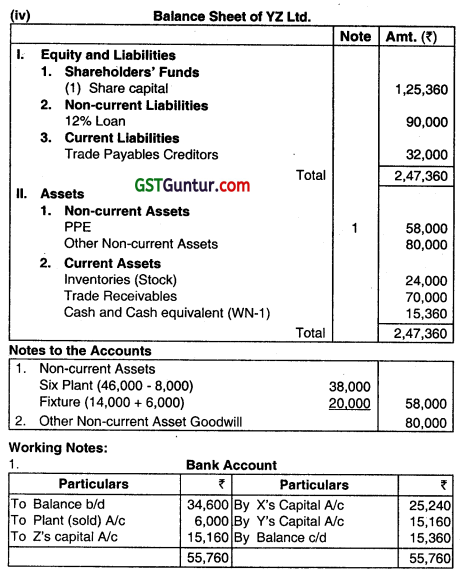

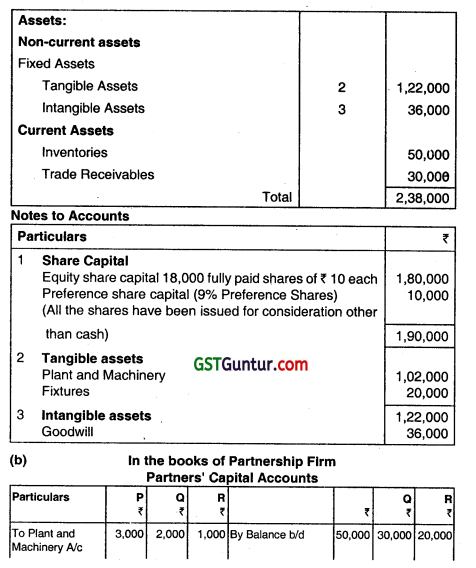

Question 26.

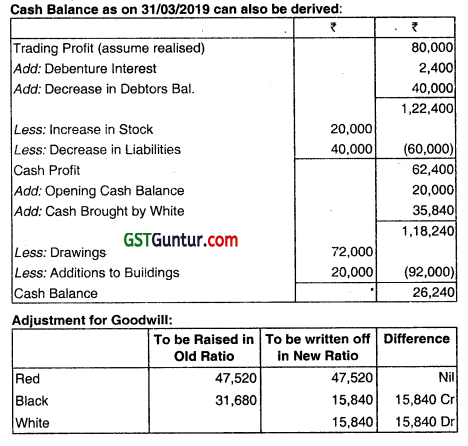

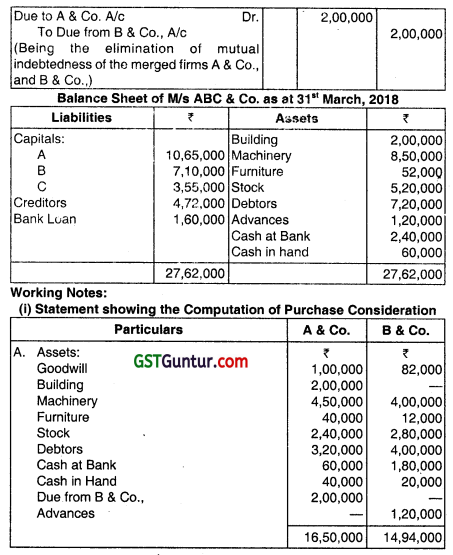

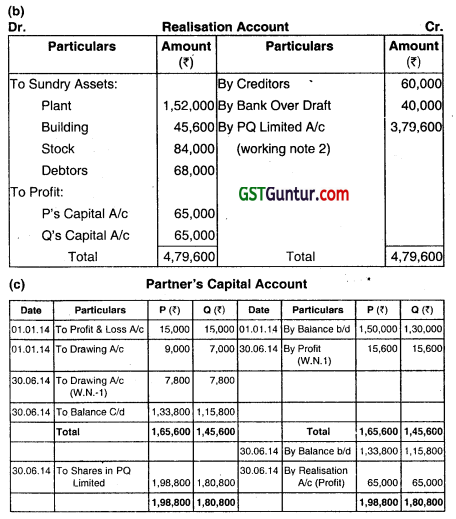

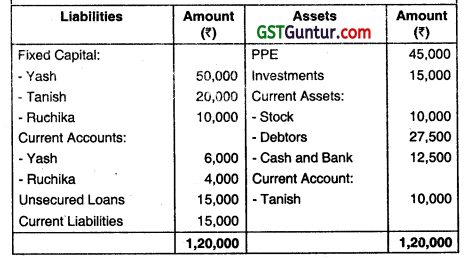

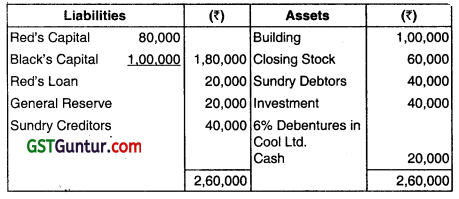

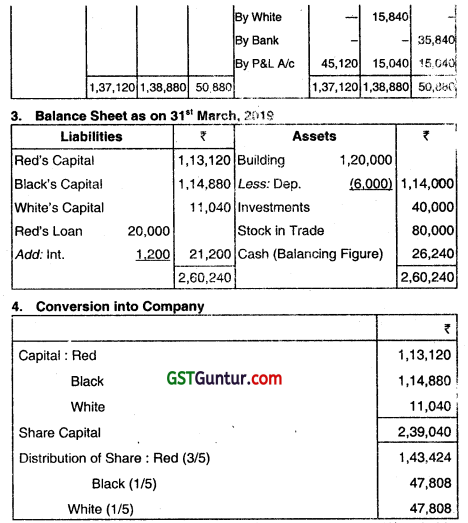

The following is the Balance Sheet of M/s Red and Black as on 31st March 2018:

it was agreed that Mr. White is tobe admitted for a fifth share in the future profits from 1st April, 2018. He Is required to contribute cash towards goodwill and ₹ 20,000 towards capital.

(a) The following further information is furnished:

(i) The Partners Red and Black shared the profits in the ratio of 3:2.

(ii) Mr. Red was receiving a salary ₹ 1,000 p.m. from the very inception of the firm in addition to the share of profit.

(iii) The future profit ratio between Red, Black and White will be 3:1:1. Mr. Red will not get any salary after the admission of Mr. White.

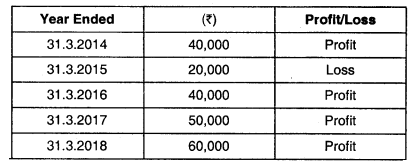

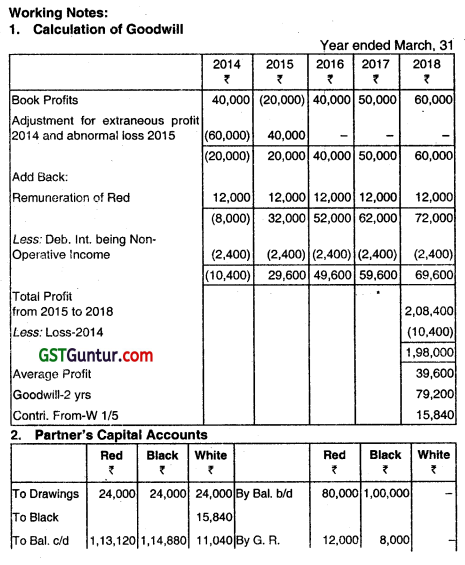

(iv) The goodwill of the firm should be determined on the basis of 2 years’ purchase of the average profits from business of the last 5 years. The particulars of profits/losses are as under:

The above profits and losses are after charging the salary of Mr. Red. The profit of the year ended 31st March, 2014 included an extraneous profit of ₹ 60,000 and the loss of the year ended 31st March. 2015 was on account of loss by strike to the extent of ₹ 40,000.

(v) It was agreed that the value of the goodwill should not appear in the books of the firm.

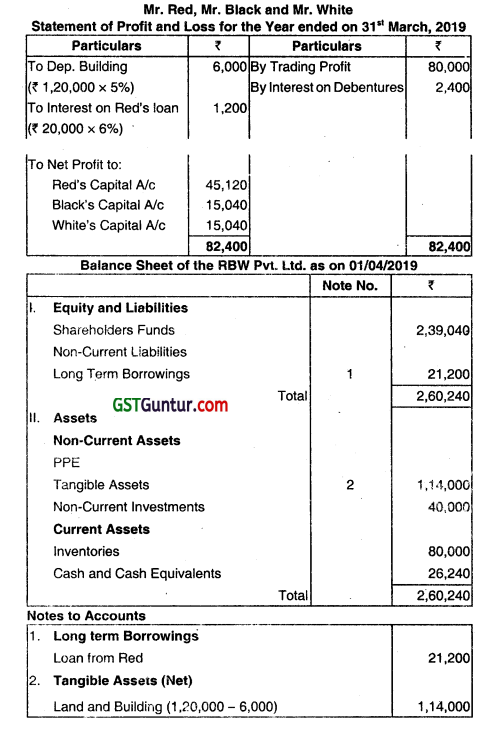

(b) Trading profit for the year ended 31st March, 2019 was ₹ 80,000 (Before charging depreciation)

(c) Each partner had drawn ₹ 2,000 per month as drawing during the year 2018-19.

(d) On 31st March, 2019 the following balances appeared in the books:

Building (Before Depreciation) ₹ 1,20,000

Closing Stock ₹ 80,000

Sundry Debtors NIL

Sundry Creditors NIL

Investment ₹ 40,000

(e) Interest © 6% per annum on Reds loan was not paid during the year.

(f) Interest on Debenture received during the year.

(g) Depreciation is to be provided @ 5% on Closing Balance of Building.

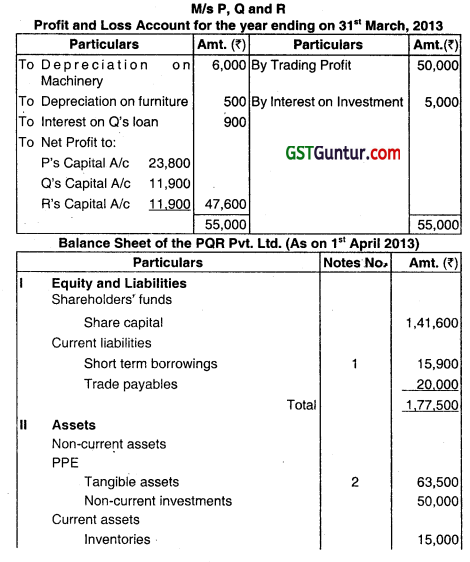

(h) Partners applied for conversion of the firm into a Private Limited Company. i.e. RBW Private Limited. Certificate received on 1.4.2019.

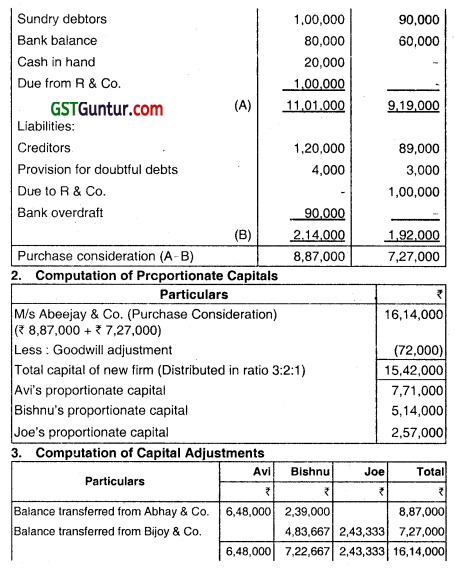

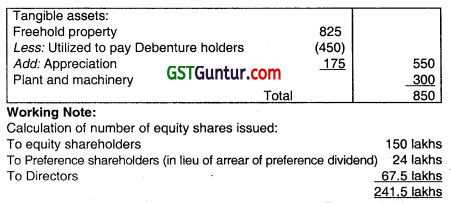

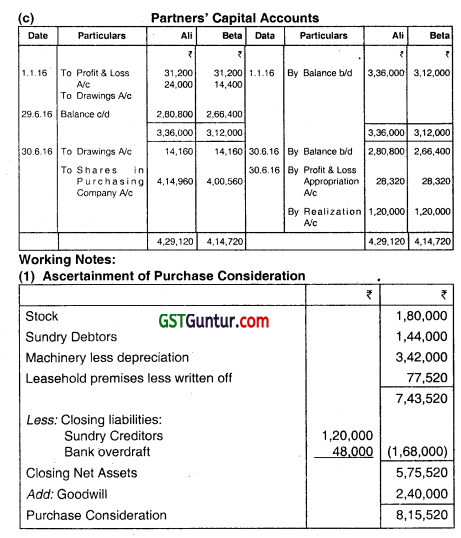

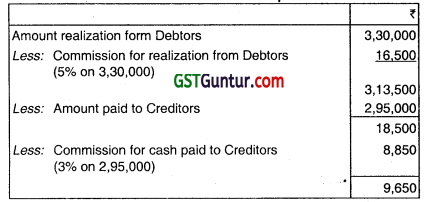

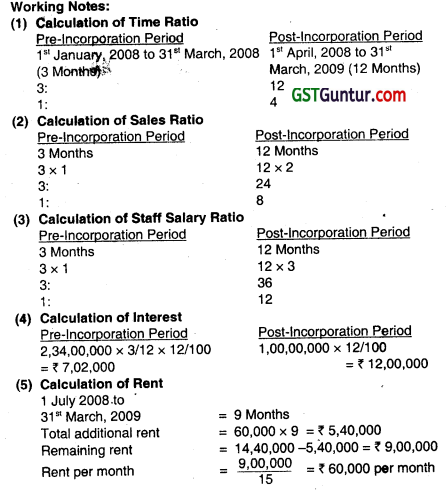

![]()

They decided to convert Capital accounts of the partners into share capital, in the ratio of 3:1:1 (on the basis of total capital as on 31.3.2019). If necessary, partners have to subscribe to fresh capital or withdraw.

You are required to prepare:

(1) Profit & Loss Account for the year ended 31 March, 2019 in the books of M/s Red and Black. .

(2) Balance Sheet as on 1 April, 2019 in the books of RBW Private Limited. (May 2019, 20 marks)

Answer:

Red should subscribe shares of ₹ 30,304 (₹ 1,90,944 – ₹ 1,60,640) and white should subscribe shares of ₹ 36,768 (₹ 63,648 – ₹ 26,880), Black withdraws ₹ 67,072 (₹ 1,30,720 – ₹ 63,648) Subscribing shares to worth ₹ 63,648.