Accounting for Employee Stock Option Plan – CA Inter Advanced Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Accounting for Employee Stock Option Plan – CA Inter Advanced Accounting Question Bank

Question 1.

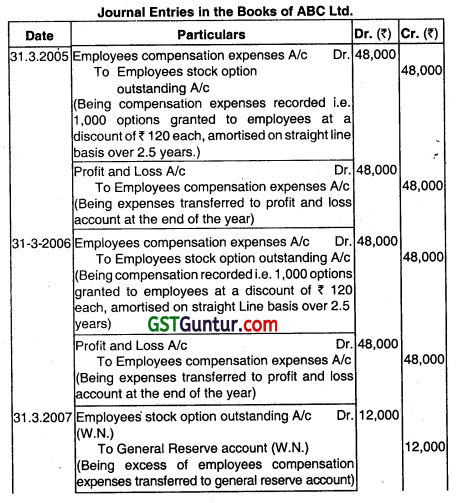

ABC Ltd. grants 1,000 employees stock options on 1.4.2004 at ₹ 40, when the market price is ₹ 160. The vesting period is 2½ years and the maximum exercise period is one year. 300 unvested options lapse on 1.5.2006. 600 options are exercised on 30.6.2007. 1oo vested options lapse at the end of the exercise period. Pass Journal Entries giving suitable narrations. (May 2018, 10 marks)

Answer:

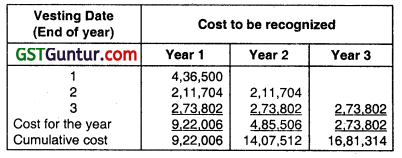

Working Note:

As on 31.3.2007 the actual forfeitures of ABC Ltd. and adjustment regarding it, are as follows, as 700 employees’ stock options have been completed 2.5 years, vesting period. The recognized expenses during the year is negative i.e

No. of options vested 84,000 (700 × ₹ 120) Amount (₹)

Less: Expenses recorded 96,000 (₹ 48,000 + ₹ 48,000)

Excess of expenses being transferred of general reserve 12,000

Note: The Nominal value per share is assumed ₹ 10.

Question 2.

Answer the following:

Explain Emloyee’s stock option plan. (Nov 2009, 2 marks)

Answer:

‘Employee Stock Option Plan is a plan in which option is given for a specified period, to employees of a company, which gives such directors, officers employees the night, but not the obligation, to purchase or subscribe, the shares of the enterprise at a fixed or determinable price which is generally lower than the prevailing market price of its shares.

Question 3.

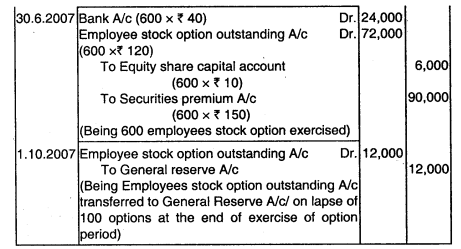

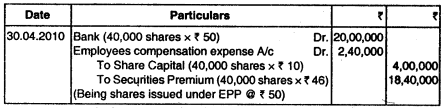

On 1st April 2012. a company offered 100 shares to each of its 400 employees at ₹ 25 per share. The employees are given a month to accept the shares. The shares issued under the plan shall be subject to lock-in to transfer for three years from the grant date i.e. 30th April, 2012. The market price of shares of the company on the grant date is ₹ 30 per share. Due to

post-vesting restrictions on transfer, the fair value of shares issued under the plan is estimated at ₹ 28 per share. Up to 30th April 2012, 50% of employees accepted the offer and paid ₹ 25 per share purchased. Nominal value of each share is ₹ 10. Record the issue of shares in the books of the company under the aforesaid plan. (May 2012, 4 marks)

Answer:

Fair value of an option = ₹ 28 – ₹ 25 = 3

Number of employees accepting the offer = 400 employee x 50% = 200 employees

Number of shares issued = 200 employees x 1oo shares/employee = 20,000 shares

Fair value of ESPP = 20,000 shares × ₹ 3 = ₹ 60,000

Expenses recognized in 2012-13 = ₹ 60,000

Question 4.

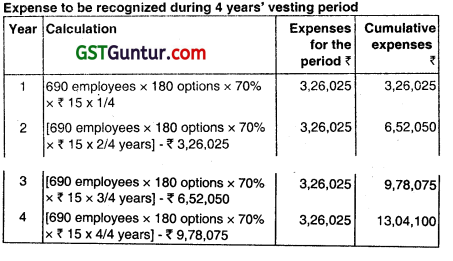

Goodluck Limited grants 180 share options to each of its 690 employees. Each grant containing conditions on the employees working for Goodluck Ltd. over the next 4 years. Goodluck Ltd. has November 2, 2012, estimated that the fair value option is 15. Goodluck Ltd. also estìmatedthat 30% of employees will leave during four year period and hence forfeit their rights to the share option. li the above expectations are correct, what amount of expenses to be recognized during vesting period? (Nov 2012, 4 marks)

Answer:

Total amount of the expenses to be recognized during 4 years vesting period will be ₹ 13,04,100.

![]()

Question 5.

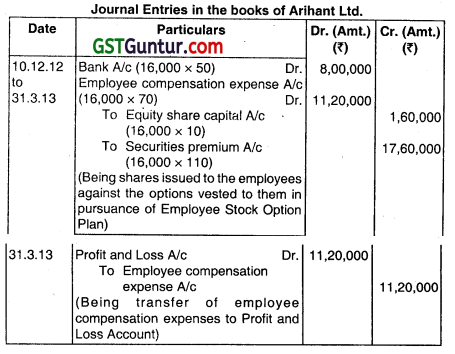

Arihant Limited has its share capital divided into equity shares of ₹ 10 each. On 1-10-2012, it granted 20000 employees stock options at ₹ 50 per share, when the market price was ₹ 120 per share. The options were to be exercised between 10th December 2012 and 31st March 2013. The employees exercised their options for 16,000 shares only and the remaining options lapsed. The company closes its books on 31st March every year. Show Journal Entries (with narration) as would appear in the books of the company up to 31st March 2013. (May 2013, 4 marks)

Answer:

Question 6.

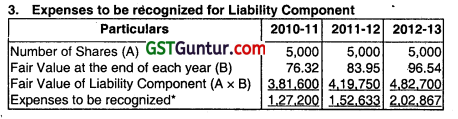

Kush Ltd. announced a Share-Based Payment Plan for its employees who have completed 3 years of continuous service, on 1st of April, 2010. The plan is subject to a 3 year vesting period. The following information is supplied to you in this regard:

(i) The eligible employees can either have the option to claim the difference between the exercise price of 144 per share and the market price in respect of the share on vesting date in respect of 5,000 shares or such employees are entitled to subscribe to 6,000 shares at the exercise price.

(ii) Any shares subscribed to by the employees shall carry a 3-year lock-in restriction. All shares carry face Value of 10.

(iii) The Current Fair Value of the shares at (ii) above Is 60 and that in respect of freely tradeable shares is higher by 20%.

(iv) The Fair Value of the shares not subjected to lock in restriction at the end of each year increases by a given % from its preceding value as under:

Year 2010-11 Year 2011-12 Year 2012-13 % of Increase 6 10 15

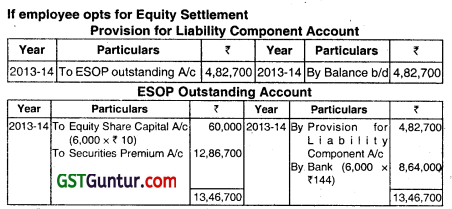

You are required to draw up the following accounts under both options:

(I) Employee Compensation Account

(II) Provision for Liability Component Account

(III) ESOP Outstanding Account (Nov 2023, 10 marks)

Answer:

Working Notes:

1. Computation of Fair Values

Fair value of shares subject to lock-in as on 1” AprIl, 2010 ₹ 60.00

% of increase in fair value of shares not subjected to Lock in 20%

Fair Value as on 1 April, 2010 of Shares not subjected to lock in (60 + 20%) ₹ 72.00

% increase over previous value in respect of Fair Value on 31.03.2011 6%

Fair value of shares not subjected to lock in restriction on 31.03.2011(72 + 6%) ₹ 76.32

% increase over previous value In respect of Fair Value on 31.03.2012 10%

Fair Value of Shares not subjected to lock in restriction on 31.03.2012 (76.32 + 10%) ₹ 83.95

@ increase over previous value in respect of Fair Value on 31.03.2013 15%

Fair Value of Shares not subjected to Lock in restriction on 31.03.2013(83.95+ 15%) ₹ 96.54

2. Expense to be recognized In respect of Equity Component

Fair Value under Equity Settlement Option (6,000 × ₹ 60) 3,60,000

Less: Fair Value under Cash Settlement (Liability Component) 3,60.000

option (5,000 × ₹ 72)

Equity Component Nil

Expenses to be recognized each year for Equity Component Nil

3. Expenses to be recognized for Liability Component

Question 7.

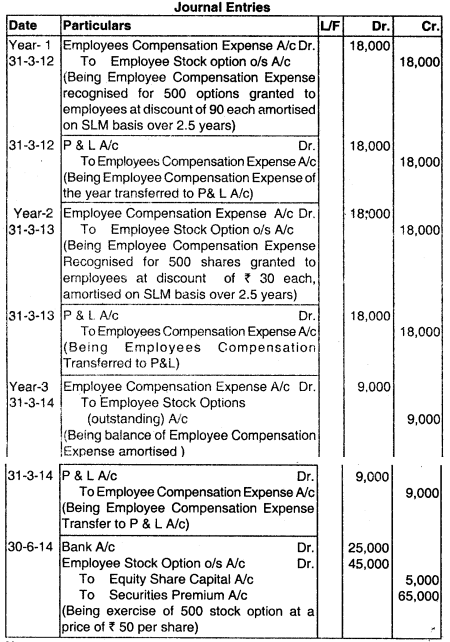

X Ltd. granted 500 stock options to its employees on 1.4.2011 at ₹ 50 per share. The vesting period is 2½ years and the maximum exercise period is one year. Market price on that date is ₹ 140 per share. All the options were exercised on 30,06.2014. Pass journal entries giving suitable narrations. if the face value of equity shares is ₹ 10 per share. (Nov 2014, 8 marks)

Answer:

Calculation of expense to be recognized:

(a) Fair value of option per share = MPS on grant date = ₹ 140

(-) Exercise price = ₹ (50) = ₹ 90

(b) No. of shares given = 500 shares

(c) Fair value of option to be recognized as expense in 2.5 years on straight-line basis = 500 × ₹ 90 = ₹ 45,000

(d) Expense to be recognized:

for 1st year (2011-12) (for full year) = ₹ 18,000

for 2nd year (2012-13) (for full year) = ₹ 18,000

for 3rd year (2013-14) (for half year) = ₹ 9,000

Note:

1. Total employees corn person expense = 500 x (₹ 140 – ₹ 50) = ₹ 45,000

2. Employees’ compensation expense has been written off during 2 years on straight-line basis as under:

1st Year = ₹ 18,000 (for full year)

2nd Year = ₹ 18,000 (for full year)

3rd Year = ₹ 9,000 (for half year)

![]()

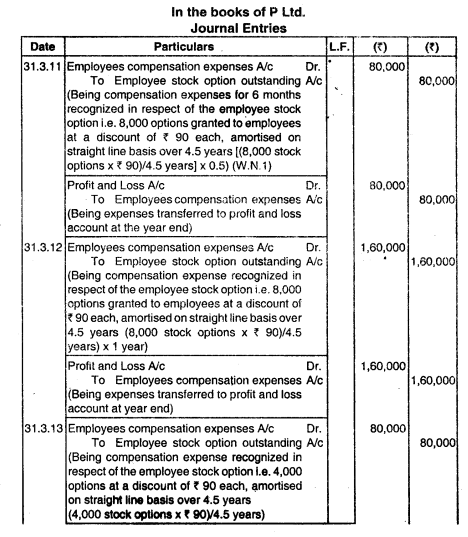

Question 8.

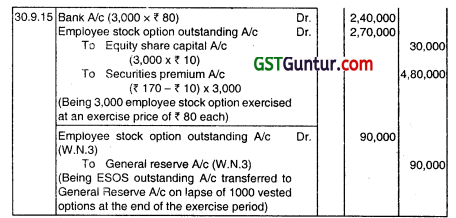

P. Ltd. granted option to 8000 equity shares on 1st October 2010 at ₹ 80 when the market price was ₹ 170. The vesting period is 4.5 years. 4000 unvested options lapsed on 1st December. 2012. 3000 options are exercised on 30th September 2015 and 1000 vested options Lapsed at the end of the exercise period. Pass Journal Entries for above transactions.

(Nov 2015, 8 marks)

Answer:

Working Notes:

1. Fair value = ₹ 170 – ₹ 80 = ₹ 90

2. At 1.12.12, 4,000 unvested option lapsed on which till date expenses recognized to be transferred to general reserve = ₹ (80,000 + 160,000) × 4,000/8,000 = ₹ 1,20,000

3. Expenses charged on seated options lapsed transferred to general reserve = 1,000 × ₹ 90 = ₹ 90,000

Note: The Nominal Value of share is taken as ₹ 10 in the above answer.

Question 9.

Answer the following:

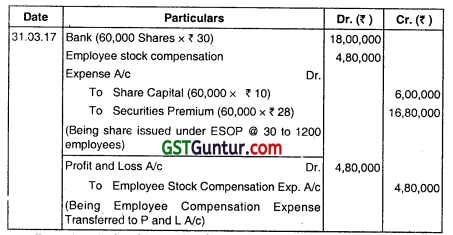

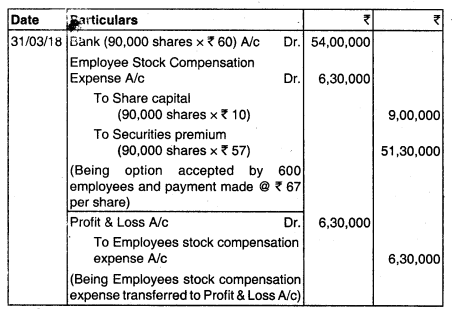

(a) Suvidhi Ltd. offered 50 shares to each of its 1500 employees on 1st April, 2017 for ₹ 30. Option would be exercisable within a year it is vested. The share issued under the plan shall be subject to lock-in on transfer for three years from the grant date The market price of shares of the company is ₹ 50 per share on grant date. Due to post-vesting restrictions on transfer, the fair value of shares issued under the plan is estimated at ₹ 38 per share.

On 31st March 2018, 1200 employees accepted the offer and paid ₹ 30 per share purchased. Nominal value of each share is ₹ 10. Record the issue of share in the books of the company under the aforesaid plan. (May 2018, 5 marks)

Answer:

Fair value of an option ₹ 38 – ₹ 30= 8.

Number of shares issued = 1,200 employees x 50 shares /employee = 60,000 Shares

Fair value of ESOP = 60,000 Shares x ₹ 8 = ₹ 4,80,000

Vesting period = 1 Year.

Expenses recognised in 201 7-18 = ₹ 4,80,000

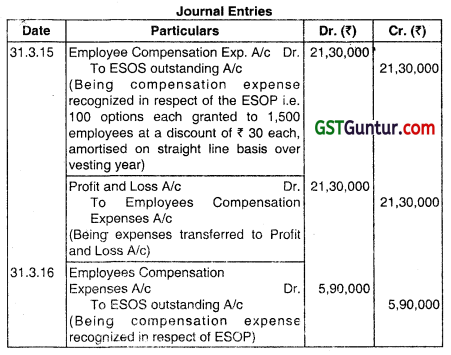

Question 10.

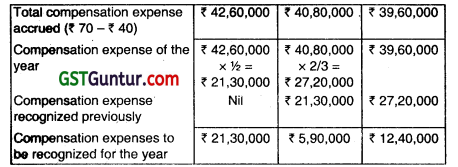

Lucky Ltd. grants 100 stock options to each of its 1 ,500 employees on 1 -4- 2014 for ₹ 40, depending upon the employees at the time of vesting of options, Options would be exercisable within a year it is vested. The market price of The share is ₹ 70 each. These options will vest at the end of year 1 if the earning of Lucky Ltd. is 15%, ont will vest at the end of the year 2 it the average earning of two years is 13% or lastly It will vest at the end of the third year if the average earning of 3 years will be 10% 8,000 unvested options lapsed on 31-3-2015.6,000 unvested options lapsed on 31- 03-2016 and finally 4000 unvested options ‘lapsed on 31-3-2017.

The earnings of Lucky Ltd. for the three financial years ended on 31st March, 2015.16; and 2017 are 14%, 10% and 8% respectively. 1,250 employees exercised their vested options within a year and remaining options were unexercised at the end of the contractual life. You are required to give the necessary journal entries for the above and also prepare the statement showing compensation expense to be recognized at the end of each year. (Nov 2018, 10 marks)

Answer:

Question 10.

Answer the following:

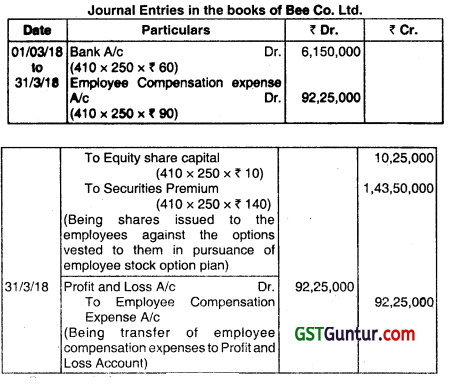

Bee Co. Ltd. has its share capital divided into Equity Shares of ₹ 10 each. On 1st April 2017, the company offered 250 shares to each of its 520 employees at ₹ 60 per share, when the market price was ₹ 150 per share. The options were to be exercised between 01-03-2018 to 31-03-2018. 410 employees accepted the offer and paid 60 per share purchased arid the remaining options lapsed. The company closes its books on 31st March every year. You are required to show Journal Entries (with narrations) as would appear in the books of Bee Co. Ltd. for the year ended 31st March 2018 with regard to employees’ stock options. (May 2019, 5 marks)

Answer:

Question 11.

Sun Ltd. grants 1oo stock options to each of its 1200 employees on 01.04.2016 for ₹ 30, depending upon the employees at the time off vesting of options. Options would be exercisable within a year it is vested. The market price of the share is ₹ 60 each. These options will vest at the end of the year 1 lithe earning of Sun Ltd. Is 16% or It will vest at the end of year 2 if the average earning of two years is 13%, or lastly, It will vest at the end of the third year, if the average earning of 3 years is 10%. 6000 unvested options lapsed on 31.03.2017. 5000 unvested options lapsed on 31.03.2018 and finally 4000 unvested options lapsed on 31.03.2019.

The earnings of Sun Ltd. for the three financial years ended on 31st March 2017. 2018 and 2019 are 15%. 10% and 6%. respectively. 1000 employees exercised their vested options within a year and remaining options were unexercised at the end of the contractual life. You are requested to give the necessary journal entries for the above and prepare the statement showing compensation expenses to be recognized at the end of the year. (Nov 2020, 10 marks)

Question 12.

Answer the following:

Raja Ltd. has its share capital divided into equity shares of ₹ 1o each. On 01-08-2019. it granted 2,500 employees stock options at 50 per share, when the market price was 140 per share. The options were to be exercised between 1-102019 to 31 03-2020. The employees exercised their options for 2,400 share only and the remaining options lapsed. Raja Ltd. closes its books of accounts on 31st March, every year You are to required to pass the necessary Journal Entries (including narration) for the year ended 31-03-2020, with regard to employees’ stock options and give working notes also. (Jan 2021, 5 marks)

![]()

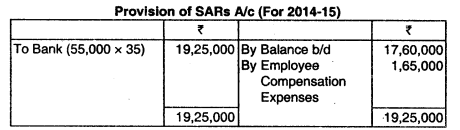

Question 13.

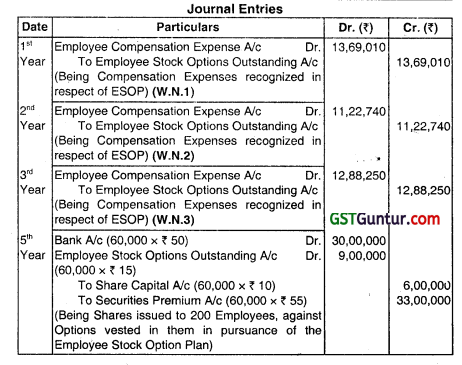

At the beginning of Year 1 an Enterprise grants 300 Options to each of its 1,000 Employees. The Contractual Life (Comprising the Vesting Period and the Exercise Period) of options granted is 6 years. The oilier relevant terms of the grant are as below:

Vesting Period 3 years

Exercise Period 3 year

Expected Lite 5 years

Exercise Price ₹ 50

Market Price ₹ 50

Expected Forfeitures per year 3%

The Fair Value of Options, calculated using an Option Pricing Model, is ₹ 15 per Option. Actual Forfeitures during Year 1 are 5% and at the end of Year 1, the Enterprise still expects that Actual Forfeitures would average 3% per year over the 3-year vesting period. During Year 2, however, the Management decides that the rate of forfeitures is likely to continue to increase, and the excepted Forfeiture Rate for the entire period is changed to 6% per year. It is also assumed that 840 Employees have actually completed 3 years vesting period.

200 Employees exercise their rights to obtain Shares vested in their in pursuance of the ESOP at the end of Year 5, and 600 Emptoyeesexenise their rights at the end of Year 6. Rights of 40 Employees expire unexercised at the end of the Contractual Life of the Option, i.e. at the end of Year 6. Face Value of One Share of the Enterprise is ₹ 10. Give accounting entries.

Answer:

Basic Computations

1. For Year 1: (Considering Expected Forfeiture Rate of 3%, balance Options expected = 97%)

| No. of Options expected to vest = 300 option x 1,000 × 97% × 97% × 97% = | 2,73,802 Options |

| Fair Value of Options expected to vest = 2,73.802 Option × ₹ 15 | ₹ 41,07,030 |

| As the Enterprise expects Actual Forfeitures to average 3% per year over the 3-year Vesting Period, Employee Compensation Expenses to be recognized for Year 1 = ₹ 41,07.030 ÷ 3 | ₹ 13,69,010 |

2. For Year 2: (Considering Revised Expected Forfeiture Rate of 6%, balance Options expected = 94%)

| Revised No. of Options expected to vest = 300 Employees x 1,000 × 94% × 94% × 94% = |

2,49,175 Options |

| Revised Fair Value of Options expected to vest = 249,175 × ₹ 15 | ₹ 37,37,625 |

| Revised Cumulative Exps at the end of Year 2 = Revised Fair Value 37; 37,625 × 2/3rd |

₹ 24,91,750 |

| Less: Expenses already recognized in Year 1 | ₹ 13,69,010 |

| Balance Employee Compensation Expense to be recognized in Year 2 | ₹ 11,22,740 |

3. For Year 3:

| No. of Options actually vested = 840 Employees × 300 = | 2,52,000 Options |

| Fair Value of Options actually vested = 2,52000 × ₹ 15 | 37,80,000 |

| Less: Expenses already recognized in Years 1 and 2 13,69,010 + 11,22,740 | ₹ 24,91,750 |

| Balance Employee Compensation Expense to be recognized in Year 3 | ₹ 12,88250 |

Question 14.

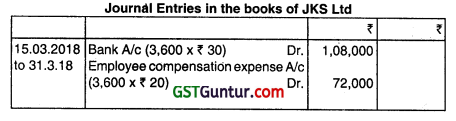

JKS Ltd. has its share capital divided into equity shares of ₹ 10 each. On 1.1.2018 it granted 5,000 employee stock options at ₹ 30 per share, when the market price was ₹ 50 per share. The options were to be exercised between 15th March 2018 and 31 March 2018. The employees exercised their options for 3,600 shares only and the remaining options lapsed. The company closes its books on 31st March every year. You are required to prepare journal entries (with narration) as would appear in the books of the company up to 31st March, 2018.

Answer:

Working Notes:

1. No entry is passed when stock options are granted to employees. Hence, no entry will be passed on 1st January 2018;

2. Market Price = ₹ 50 per share and as stock options price = ₹ 30, Hence, the difference ₹ 50 – ₹ 30 = ₹ 20 per share is equivalent to employee cost or employee compensation expense and will be charged to P &L Account as such for the number of options exercised i.e. 3.600 shares.

Question 15.

At the beginning of year 1 the enterprise grants 1,000 stock options to each member of its sales team, conditional upon the employees remaining in the employment of the enterprise for three years. and the team selling more than 50,000 units of a particular product over the three-year period. The fair value of the stock options is ₹ 15 per option at the date of grant.

During year 2, the enterprise increases the sales target to 1,00,000 units. By the end of year 3, the enterprise has sold 55,000 units, and the stock options do not vest.

Twelve members of the sales team have remained in service for the three-year period. You are required to examine and give comments in light of the relevant Guidance Note that whether the company shouLd recognise the expenses on the basis of options granted or not.

Also, state will your answer differ if, instead of modifying the performance target, the enterprise had increased the number of years of service required for the stock options to vest from three years to ten years.

Answer:

Paragraph 19 of the Guidance Note on Share-Based Payments requires, for a performance condition that is not a market condition, the enterprise to recognize the services received during The vesting period based on the best available estimate of the number of shares or stock options expected to vest and to revise that estimate, it necessary, if subsequent information indicates that the number of shares or stock options expected to vest differs from previous estimates. On vesting date, the enterprise revises the estimate to equal the number of instruments that ultimately vested.

However, paragraph 24 of the Guidance Note requires, irrespective of any modifications to the terms and conditions on which the Instruments were granted, or a cancellation or settlement of that grant of instruments, the enterprise to recognize, as a minimum, the services received, measured at the grant date fair value of the instruments granted, unless those instruments do not vest because of failure to satisfy a vesting condition (other than a market condition) that was specified at grant date.

Furthermore, paragraph 26(c) of the Guidance Note specifies that, if the enterprise modifies the vesting conditions in a manner that is not beneficial to the employee, the enterprise does not take the modified vesting conditions into account when applying the requirements for treatment of vesting conditions as specified in Guidance Note.

Therefore, because the modification to the performance condition made it less likely that the stock options will vest, which was not beneficial to the employee, the enterprise takes no account of the modified performance condition when recognizing the services received. Instead, it continues to recognize the services received over the three-year period based on the original vesting conditions. Hence, the enterprise ultimately recognizes cumulative remuneration expense of ₹ 1,80,000 over the three-year period (12 employees x 1,000 options x ₹ 15).

The same result would have occurred if, instead of modifying the performance target, the enterprise had increased the number of years of science required for the stock options to vest from three years to ten years. Because such a modification would make it less likely that the options will vest. which would not be beneficial to the employees, the enterprise would

take no account of the modified service condition when recognizing the services received. Instead, it would recognize the services received from the twelve employees who remained in service over the original three-year vesting period.

![]()

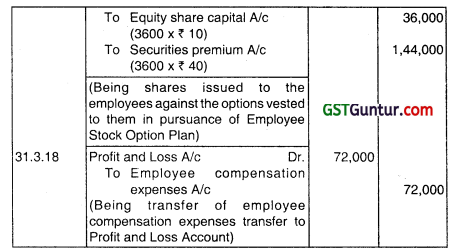

Question 16.

Employee Stock Option Plans

A company has its share capital divided Into shares of ₹ 10 each. On 1-1-2011, it granted 7,500 employees stock options at ₹ 50, when the market price was ₹ 140. The options were to be exercised between 1-3-2012 to 31-03-2012. The employees exercised their options for 7,200 shares only; the remaining options lapsed. Pass the necessary journal entries for the year ended 31.3.2012, with regard to employees’ stock options.

Answer:

Working Notes:

1. Employee Compensation Expenses = Discount between Market Price and option price = ₹ 140- ₹ 50 = ₹ 90 per share = ₹ 90 x 7,200 = ₹ 6,48.000 in total.

2. Securities Premium Account = ₹ 50 – ₹ 10 = ₹ 40 per share + 90 per share on account of discount of option price over market price = ₹ 130 per share = ₹ 130 x 7,200= ₹ 9,36,000 in total.

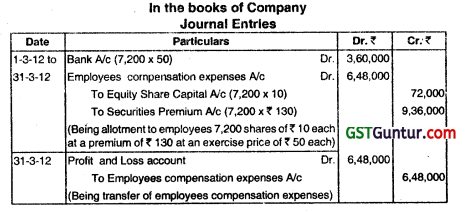

Question 17.

Softex Ltd. announced a Stock Appreciation Right (SAR) on 01-04-07 for each of its employees. The scheme gives the employees the right to claim cash payment equivalent to an excess of market price of company shares in exercise date over the exercise price of ₹ 125 per share in respect of 1oo shares, subject to a condition of Continuous employment f 3 years

The SAR is exercisable after 31-03-2010 but before 30-06- 10.

The fair value of SAR was ₹ 21 in 2007-08, ₹ 23 in 2008 – 09, and ₹ 24 in 2009-10. In 2007-08 the company estimated that 2% of its employees shall leave the company annually. This was revised to 3% in 2008-09. Actually, 15 employees left the company in 2007-08. 10 left in 2008-09 and 8 left in 2009-10. The SAR therefore actually vested in 492 employees on

30-06-2010; when SAR was exercised the intrinsic value was ₹ 25 per share. Show the provision for SAR account by fair value method. Is this provision a liability or equity? (Nov 2010, 16 marks)

Answer:

Note: The Provision for Stock Appreciation Rights (SARa) is a liability. Therefore SARs are settled through cash payment equivalent to an excess of market price of company’s shares over the exercise price on exercise date.

Working Notes:

Year 2007-08

Number of employees to whom SARa were announced (492+15+10+8) = 525 employees

Number of SARs expected to vest = (525 × 0.98 × 0.98 × 0.98) × 100 = 49.413 SARs.

expected to lies years 2007-08 and 2008-09. It can also be worked out by rounding oft the number of employees.

Fair value of SARs = 49,413 SARs x 21 = 10,37,673

Vesting period 3 years

Value of SARa recognized as expense in year 2007 – 08 = 10,37.673 /3

years = 3,45,891.

Question 18.

On 1st April 2010, A company offered 100 shares to each of Its 500 employees at ₹ 50 per share. The employees are given a month to decide whether or not to accept the offer. The shares issued under the plan (EPF’ shall be subject to lock-in on transfers for three years from grant date. The market price of shares of the company on the grant date is ₹ 60 per share.

Due to post-vesting restrictions on trarsfer, the fair value of shares issued under the plan is estimated at ₹ 56 per share. On 30th April. 2010, 400 employees accepted the offer and paid ₹ 50 per share purchased Nominal value of each share is ₹ 10. Record the issue of shares in the book of the company under the a fore said plan. (Nov 2011, 5 marks)

Answer:

Fair value on EPP = ₹ 56 – ₹ 50 = 6

Number of shares Issued = 400 employee 100 shares employee= 40,000 shares

Fair value of EPP which will be recognized as expenses in the year 2010-11 = 40,000

Shares x ₹ 6 = 2,40,000

Vesting period = 1 month

Expenses recognized in 2010-11 = ₹ 2,40,000

Question 19.

On 1st April 2012, A company offered 100 shares to each of its employees at ₹ 40 per share. The employees are given a month to decide whether or not to accept the offer. The shares issued under this plan will be subject to each in transfer for three years from the grant date. The market price on the grant date is ₹ 50 per share. However, the fair value of shares issued

under this plan is estimated at ₹ 48 per share. On 30-04-2012, 400 employees accepted the offer and paid ₹ 40 per share. Nominal value of each share is ₹ 10. Record the issue of shares in the books, of the company under the aforesaid plan. (May 2013, 4 marks)

OR

On 1st April 2018, XYZ Ltd., offered 150 shares to each o its 750 employees at ₹ 60 per share. The employees are given a year to accept the offer. The shares issued under the plan shall be subject to lock-in period on transfer ‘or three years from the grant date. The market price of shares of the company on the grant date is ₹ 72 per share. Due to post- vesting restrictions on transfer, the fair value of shares issued under the plan Is estimated at ₹ 67 per share.

On 31st March 2019, 600 employees accepted the offer and paid 60 per share purchased. Nominal value of each share is ₹ 10. You are required to record the issue of shares in the books of the XYZ Ltd., under the aforesaid pIan. (Nov 2019, 5 marks)

Answer:

Fair value of an option = ₹ 67 – ₹ 60 = 7

Number of shares issued = 600 employees × 150 shares/employee = 90,000 shares

Fair value of ESOP = 90,000 shares × ₹ 7 = ₹ 6,30,000

Vesting Period = 1 month

Expenses recognised in 2018-19 = ₹ 6,30,000

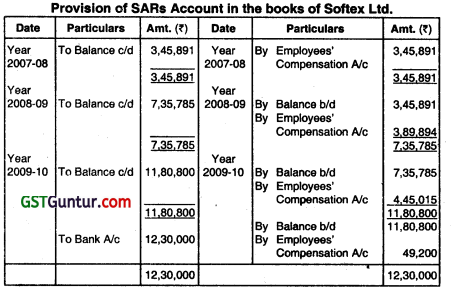

Question 20.

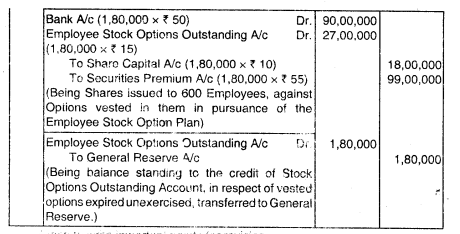

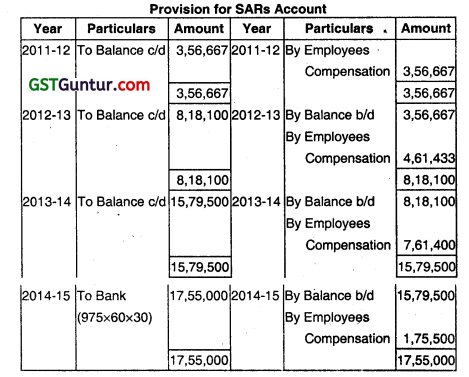

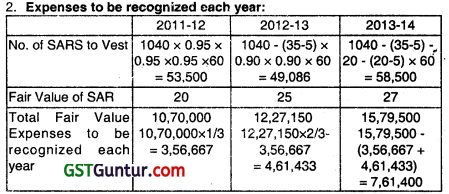

Quittle Ltd. announced a Stock Appreciation Rights (SAR) Scheme to its employees on 1st April, 2011. The salient features of the scheme is given below:

(1) The scheme will be applicable to employees who have completed three years of continuous service with the company.

(2) Each eligible employee can claim cash payment amounting to the excess of Market Price of the company’s shares on exercise date over exercise price in respect of 60 (sixty) shares.

(3) The exercise price is fixed at ₹ 75 per share.

(4) The option to exercise the SAR is open from 1st April 2014 for 45 days and the same vested on 975 employees.

(5) The intrinsic value of the company’s share on date of closing (15th May 2014) was ₹ 30 per share.

(6) The fair value of the SAR was ₹ 20 in 2011-12; ₹ 25 in 2012-13 and ₹ 27 in 2013-14.

(7) In 2011-12 the expected rate of employee attrition was 5% which rete was doubted in the next year.

(8) Actual attrition year-wise was as under:

2011-12 35 employees of which 5 had served the company for less than 3 years.

2012-13 30 employees of which 20 employees served for more than 3 years.

2013-14 20 employees of which 5 employees served for less than 3 years.

You are required to show the Provision for Stock Appreciation Rights Account by Fair Value Method. (May 2014, 8 marks)

Answer:

Working Notes:

1. No.of eligible employees = 975+35+5+20+20 – 5 = 1,040

3. Expenses to be recognized In the year 2014-15.

Total intrinsic Value of SARs less expense recognized till date.

= (975 × 60 × 30) – 15,79,500 = 1,75,500

![]()

Question 21.

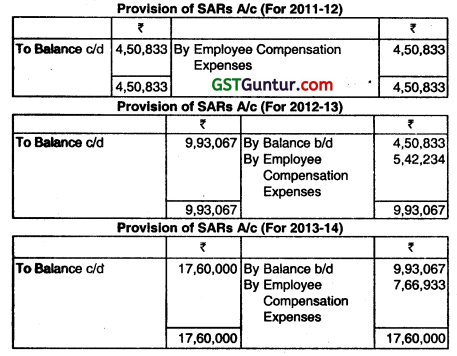

A company announced a Stock Appreciation Right (SAR) on 01/04/2011 for each of its 600 employees. The scheme gives the employees the right to claim cash payment equivalent to excess on market price of company’s shares, on exercise date, over the exercise price ₹ 30 per share in respect of 100 shares, subject to the condition of continuous employment of 3 years. The SAR is exercisable after 31/03/14 but before 30/06/14.

| Particulars | 2011-12 | 2012-13 | 2013-14 |

| Fair value of SAR | 25 25 3% |

25 15 5% |

32 10 – |

| Actual no. of employees left | |||

| Company estimation |

Conany estimation for left employee

On 30/06/20 14 when SAR was exercised, the intrinsic value per share was ₹ 35 per share.

Show Provision for SAR account by fair value method. (Nov 2015, 8 marks)

Answer:

Note:

The solution given below is by rounding off the number of employees and then the number of SARs has been calculated.

Working Notes:

Year 2011 – 12

Number of employees to whom SARs were announced = 600 employees

Total number of employees after three years, on the basis of the estimation in 2011-12 = [(600 -25) × .97 × .97) = 541 employees (approx.)

Total estimated SARs, to be vested at the arid of the vesting period = 541 employees x loo SARs = 54,100 SARs

Fair value of SARs = 54,100 SARs × ₹ 25 = ₹ 13,52,500

Vesting period =3 years

Value of SARs to be recognized as an expense in 2011-12 = ₹ 13,52,500/3

years = ₹ 4,50,833

Year 2012-13

Total number of employees after three years, on the basis of the estimation in 2012-13 = [(600 -25 – 15) × 0.95] = 532 employees

Total estimated SARs, to be vested at the end of the vesting period = 532 employees x 100 SARs = 53,200 SARs

Fair value of SARs = 53,200 SARs × ₹ 28 = ₹ 14,89,600

Vesting period 3 years and No. of years expired 2 years

Cumulative value ol SARa to recognize as expense = 14,89,600/3 × 2 = ₹ 9,93,067

Value of SARs to be recognized as an expense in 2012-13 = ₹ 9,93,067 – ₹ 4,50,833 =₹ 5,42,234

Year 2013-14

Fair value of SARs = ₹ 32

SARs actually vested = (600 -25- 15 -10) employees × 100 SARs

550 employees × 100 = 55,000 SAPs

Fair value = 55,000 SARs × 32 = ₹ 17,60,000

Cumulative value to be recognized = ₹ 17,60,000

Value of SARs to be recognized as an expense = ₹ 17,60,000 – ₹ 9,93,067 = ₹ 7,66,933

Year 2014-15

Cash payment of SARs = 55,000 SARs × ₹’ 35= ₹ 19,25,000

Value of SARs to be recognized as an expense in 2014-15 = ₹’ 19,25,000 – ₹’ 17.60,000 = ₹ 1,65,000.

![]()

Question 22.

On 1st April 2015. Krishna Limited offered 50 shares to each of Its 1000 employees at ₹ 50 per share. The employees are given a month time to decide whether or not to accept the otter. The shares issued under the plan (ESPP) shall be subject to lock-in transfer for three years from grant date.

Other information:

(1) The market price of shares of the company on the grant date is ₹ 60 per share.

(2) Due to post-vesting restrictions on transfer, the fair value of shares issued under the plan is estimated at ₹ 56 per share.

(3) On 30th April 2015. 800 employees accepted the offer and paid ₹ 50 per share purchased.

(4) The nominal value of each share is ₹ 10 each.

You are required to record the issue of shares in the books of the company under aforesaid plan. (2016 May, 4 marks)

Answer:

Fair Value of ESPP = (800 × 50) × (56 – 50) = 2,40,000

Vesting Period = one month

Expenses recognised = 2,40,000

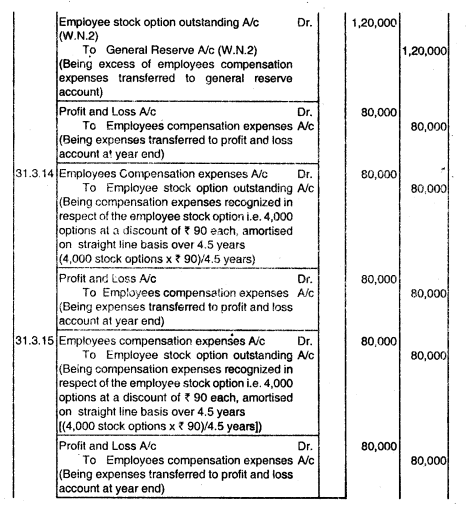

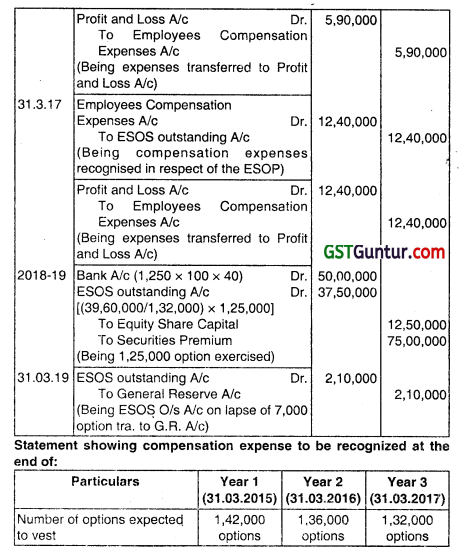

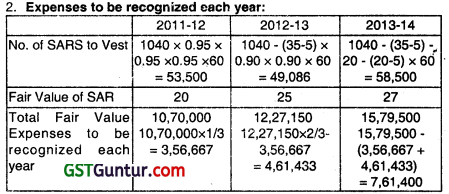

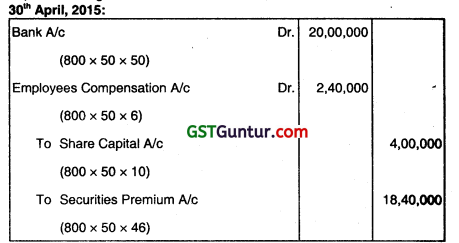

Question 23.

At the beginning of year 1, an enterprise grants 300 options to each of its 1,000 employees. The contractual life of option granted is 6 years. Other relevant information is as follows:

Vesting Period 3 years

Exercise Period 3 years

Expected Life 5 years

Exercise Price ₹ 50

Market Price ₹ 50

Expected forfeitures per year 3%

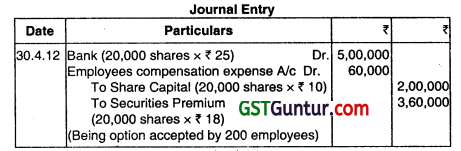

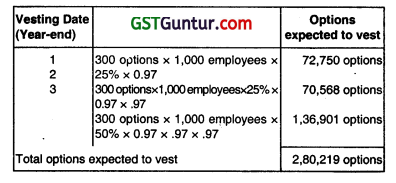

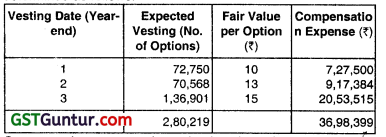

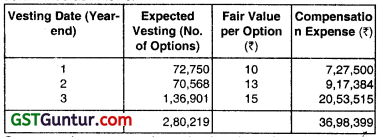

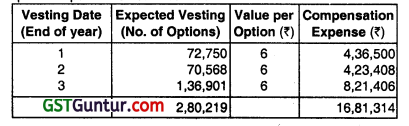

The option granted vest according to a graded schedule of 25% at the end of the year 1, 25% at the end of the year 2, and the remaining 50% at the end of the year 3. You are required to calculate total compensation expenses for the options expected to vest and cost and cumulative cost to be recognised at the end of all the 3 years assuming that expected forfeiture rate does not change during the vesting period when,

(i) The fair value of these options, computed based on their respective expected lives, are ₹ 10. ₹ 13,₹ 15 per options, respectively.

(ii) The intrinsic value of the options at the grant date is ₹ 6 per options. (2016 – Nov, 10 marks)

Answer:

(a)

(i) Based on Fair Value Method

1. Since the options granted have a graded vesting schedule, the enterprise segregates the total plan into different groups. depending upon the vesting dates and treats each of these groups as a separate plan.

![]()

2. The enterprise determines the number of options expected to vest under each group as below:

3. Total compensation expense for the options expected to vest is determined as follows:

4. Compensation expense, determined as above, is recognized over the respective vesting periods. Total compensation expense of ₹36,98,399, determined at the grant date, is attributed to the years 1, 2, and 3 as below:

(ii) Based on Intrinsic Value Method in case of intrinsic value method, total compensation expense for the options expected to vest would be:

The compensation expense of ₹ 16,81,314, determined at the grant date, would be attributed to the years 1, 2, and 3 as below: