Buyback of Securities and Equity Shares with Differential Rights – CA Inter Advanced Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Buyback of Securities and Equity Shares with Differential Rights – CA Inter Advanced Accounting Question Bank

Question 1.

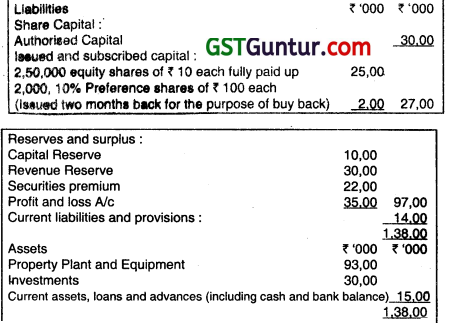

Dee Limited furnishes the following Balance Sheet as at 31st March, 2008:

The company passed a resolution to buy back 20% of its equity capital @ ₹ 50 per share. For this purpose, It sold all of Its investments for ₹ 22,00,000. You are required to pass necessary journal entries and prepare the Balance Sheet. (Nov 2009, 8 marks)

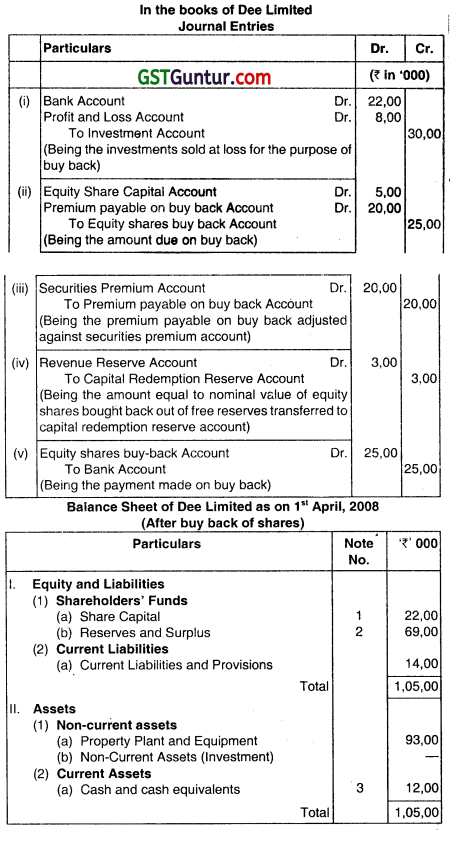

Answer:

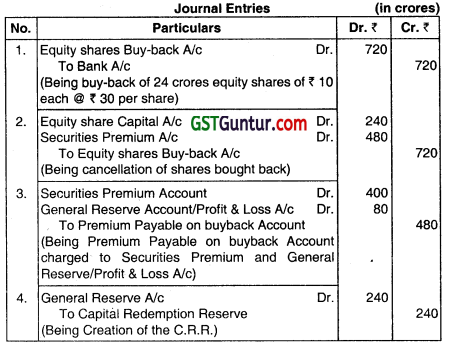

Question 2.

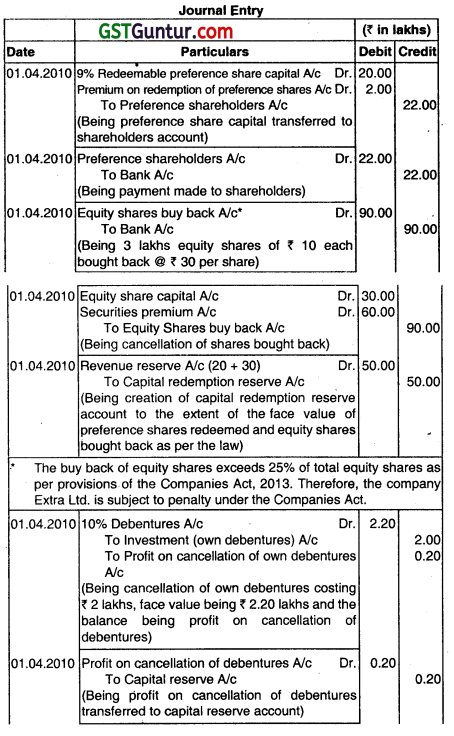

Extra Ltd. furnishes you with the following Balance Sheet as on 31st March 2010: (₹ in lakh)

(i) The company redeemed the preference shares at a premium 0f 10% on 1st April 2010.

(ii) It also bought back 3 lakhs equity shares of ₹ 10 each at ₹ 30 per share.

The payment foe the above were made out of huge bank balances, which appeared as a part of the current assets.

(iii) Included in its investment were investments in own debentures costing ₹ 2 lakhs (face value ₹ 220 lakhs). These debentures were cancelled on 1st April 2010.

(iv) The company had 1,00,000 equity stock options outstanding on the above-mentioned date, to the employees at ₹ 20 when the market price was ₹ 30. (This was included under Current liabilities). On 1.04.2010 employees exercised their options for 50,000 shares.

(v) Pass the Journal Entries to record the above.

(vi) Prepare Balance Sheet as at 01.04.2010. (Nov 2010, 16 marks)

Answer:

Question 3.

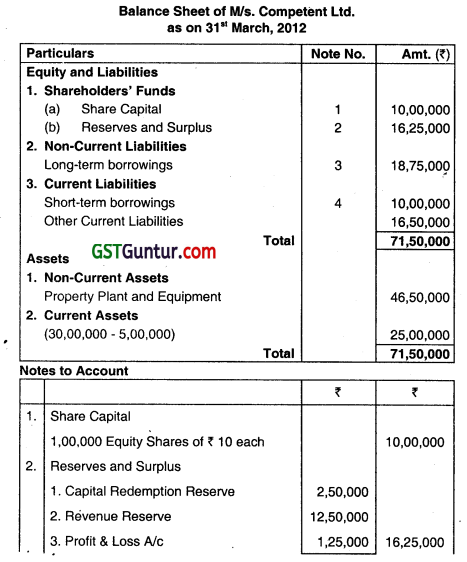

Following is the Balance Sheet of MIs Competent Limited as on 31st March, 2012:

| Liabilities | ₹ | Assets | ₹ |

| Equity Shares of ₹ 10 each fully paid | 12,50,000 | PPE | 46,50,000 |

| Revenue Reserve | 15,00,000 | Current Assets | 30,00,000 |

| Securities Premium | 2,50,000 | ||

| Profit & Loss Account | 1,25,000 | ||

| Secured Loans: 12% Debentures |

18,75,000 | ||

| Unsecured Loans | 10,00,000 | ||

| Current Liabilities | 16,50,000 | ||

| Total | 76,50,000 | Total | 76,50,000 |

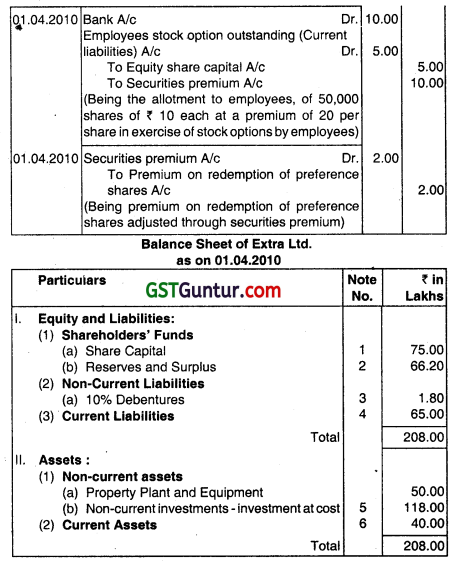

The company wants to buy back 25,000 equIty shares of ₹ 10 each, on 1st April, 2012, at ₹ 20 per share. Buy back of shares is duly authorized by its articles and necessary resolution passed by the company towards this.

The payment for buy back of shares will be made by the company out of sufficient bank balance available as a part of Current Assets. Comment with your calculations, whether buy back of shares by company is with in the provisions of the Companies Act, 2013. If yes, pass necessary journal entries towards buy back of shares and prepare Balance Sheet after buy back of shares. (May 2012, 8 marks)

Answer:

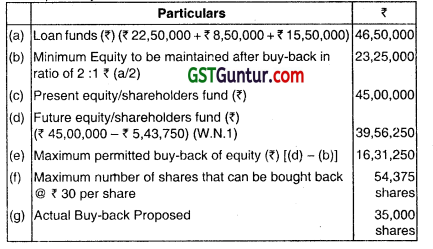

Determination of buyback of maximum number of shares as per the Companies Act, 2013

1. Shares Outstanding

| Particulars | (Shares) |

| Number of shares outstanding | 1,25,000 |

| 25% of the shares outstanding | 31,250 |

2. Resources Allocation

| Particulars | |

| Paid-up capital (₹) | 12,50,000 |

| Free reserves (₹)(15,00,000 + 2,50,000 + 1,25,000) | 18,75,000 |

| Shareholders’ funds (₹) | 31,25,000 |

| 25% of Shareholders’ fund (₹) | 7,81,250 |

| Buyback price per share | ₹ 20 |

| Number of shares that can be bought back (shares) | 39,063 |

3. Debt Equity Ratio Test

| Particulars | ₹ |

| (a) Loan funds (18,75,000 + 10,00.000 + 16,50,000) | 45,25,000 |

| (b) Minimum equity to be maintained after buyback in the ratio of 2: 1 | 22,62,500 |

| (c) Present equity/shareholders fund (₹) | 31,25,000 |

| (d) Future equity/shareholders fund (₹)(31,25,000-2,87,500) Maximum permitted buyback (d – b) |

28,37,500 5,75,000 |

| (e) Maximum number of shares that can be bought back @ | 28,750 |

| ₹ 20/ share | Shares |

Statement determining the maximum number of shares to be bought back

| Particulars | Number of shares |

| Shares Outstanding Test | 31,250 |

| Resources Test | 39,063 |

| Debt Equity Ratio Test | 43,125 |

| Maximum number of shares that can be bought back [least of the above] | 31,250 |

Company qualifies all tests for buyback of shares and came to the conclusion that it can buy maximum 31,250 shares on 1st April 2012. Whereas company wants to buy back only 25,000 equity shares @ ₹ 20. Hence, buy-back of 25.000 shares, as desired by the company is within the provisions of the Companies Act, 2013.

Note: Revenue reserve account. Securities Premium Account and Profit and Loss Account are considered as tree reserves in total.

![]()

Question 4.

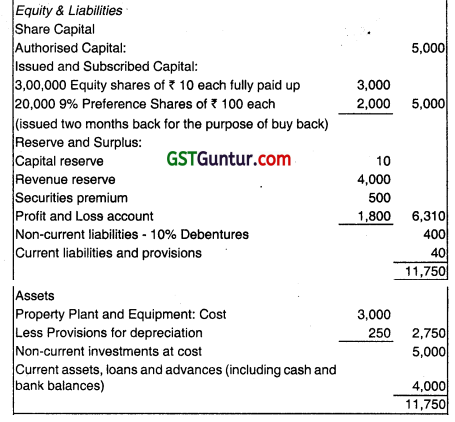

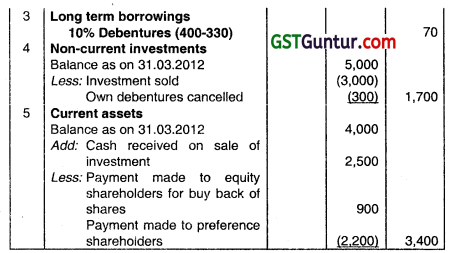

M Ltd. furnishes the following summarized Balance Sheet as at 31st “March, 2012:

₹ In 000 ₹ in ‘000

(1) The company passed a resolution to buy back 20% of its equity capital @ ₹ 15 per share. For this purpose, it sold its investments of ₹ 30 lakhs for ₹ 25 lakhs.

(2) The company redeemed the preference shares at a premium of 10% on 1st April, 2012.

(3) Included in its investments were ‘Investments in own debentures’ costing ₹ 3 lakhs (lace value ₹ 3.30 lakhs). These debentures were cancelled on 1st April, 2012. You are required to pass necessary Journal entries and prepare the Balance Sheet on 01.04.2012. (Nov 2012, 12 marks)

Answer:

Note: In the given solution, it is assumed that buy-back of shares has been done out of the proceeds of issue of preference shares, therefore, no amount is transferred to capital redemption reserve for buy-back. However, if it is assumed that buy-back is from sale of investments and not from the proceeds of issue of preference shares, then, amount of revenue reserves transferred to capital redemption reserve will be ₹ 2,600 instead of ₹ 2,000.

Question 5.

Give four conditions to be fruit ifled by a Joint Stock Company to buy back its equity Shares. (May 2014, 4 marks)

Answer:

As per Section 68(2) of the Companies Act, 2013, joint stock company has to fulfill the following conditions to buy back its own equity share:

- The buyback is authorised by its articles.

- A special resolution has been passed in general meeting of the company authorising the buyback.

- The buy back does not exceed 25% of the total paid-up capital and free reserves of the company. Provided the buyback must not exceed 25% of its total paid-up equity capital in that financial year.

- The ratio of debt owed by the company is not more than twice the capital and its free reserves after such buyback.

Question 6.

Followings the summarized Balance Sheet of M/s Complicated Ltd. as on 31st March 2016:

| Liabilities | Amount (₹) |

| Equity shares of ₹ 10 each fully paid up | 12,50,000 |

| Bonus shares | 1,00,000 |

| Share option outstanding Account | 4,00,000 |

| Revenue Reserve | 15,00,000 |

| Securities Premium | 2,50,000 |

| Profit & Loss Account | 1,25,000 |

| Capital Reserve | 1,00,000 |

| Revaluation Reserve | 1,00,000 |

| Unpaid dividends | 1,00,000 |

| 12% Debentures (Secured) | 18,75,000 |

| Advance from related parties (Unsecured) | 10,00,000 |

| Current maturities of long-term borrowings | 16,50,000 |

| Application money received for allotment due for refund | 2,00,000 |

| 86,50,000 |

| Assets | Amount (₹) |

| Property Plant and Equipment Current Assets |

46,50,000 40,00,000 |

| 86,50,000 |

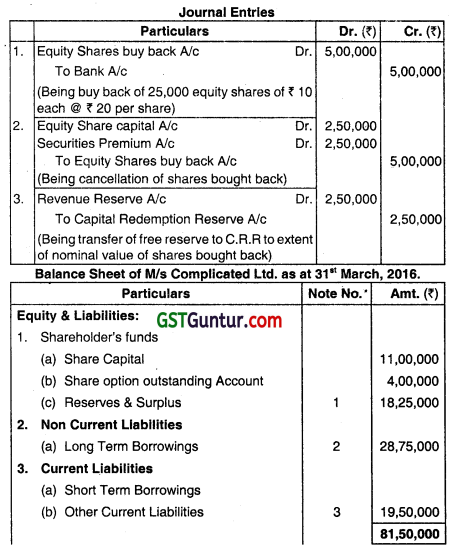

The Company wants to buy back 25000 equity shares of ₹ 10 each, on 1st April 2016 at ₹ 20 per share. Buyback of shares is duly authorised by its Articles and necessary resolution has been passed by the Company towards this. The payment for buyback of shares will be made by the Corn pany out of sufficient bank balance available shown as part of Current Assets.

Comment with your calculations, whether buyback of shares by the Company is within the provisions of the Companies Act, 2013. It yes, pass necessary journal entries towards buy back of shares and prepare the Balance Sheet after buyback of shares. (May 2016, 12 marks)

Answer:

Determination of Buyback of maximum no. of shares as per the Companies Act, 2013

1. Shares Outstanding Test:

| Particulars | (Shares) |

| Number of shares outstanding ( ₹12,50,000 +₹ 1 ,00,00)/₹ 10 | 1,35,000 |

| 25°c of the shares outstanding | 33,750 |

2. Resources Test: Maximum permitted limit 25% of Equity paid-up capital + Free reserves

| Particulars | Amount |

| Paid-up capital (₹) | ₹ 13,50,000 |

| Free reserves (₹) (15,00.000 + 2,50,000 + 1,25,000) | ₹ 18,75,000 |

| Shareholders funds (₹) | ₹ 32,25,000 |

| 25% of Shareholder’s fund (₹) | ₹ 8,06,250 |

| Buyback price per share | ₹ 20 |

| Number of shares that can be bought back (shares) | 40,312 |

| Actual Number of shares for buyback | 25,000 |

3. Debt Equity Ratio Test:

| Particulars | Amount (₹) |

| Should be 2: 1 (a) Loan funds (given) (18,75,000 + 10,00,000) |

28,75,000 |

| (b) Minimum equity to be maintained after buyback (2:1) (a ÷2) | 14,37,500 |

| (c) Present equity/shareholder’s fund | 32,25,000 |

| (d) Permissible dilution (a – b) | 17,87,500 |

| (e) Buyback price | ₹ 20 |

| (f) Maximum permitted buyback of Equity (d) ÷ [(e) + FV] | 89,375 Shares |

Summary statement determining the maximum number of shares to be bought back:

| Particulars | Number of shares |

| Shares Outstanding Test | 33,750 |

| Resources Test | 40,312 |

| Debt Equity Ratio Test | 89,375 |

| Maximum number of shares that can be bought back [least of the above] | 33,750 |

Company qualities all tests for buy-back of shares and conclusion is that it can buy maximum 33,750 shares on 1st April, 2016. However, company wants to buy-back only 25,000 equity shares @ ₹ 20. Therefore, buy-back of 25,000 shares, as desired by the company is within the provisions of the Companies Act, 2013.

Note:

1. Share option outstanding account is a provision created for the purpose of employee stock option plan so that it is not considered for calculating total paid-up share capital.

2. Advance from related parties (Unsecured) are taken as long term borrowings and all the Property Plant and Equipment are considered as tangible property plant and equipment in absence of information.

![]()

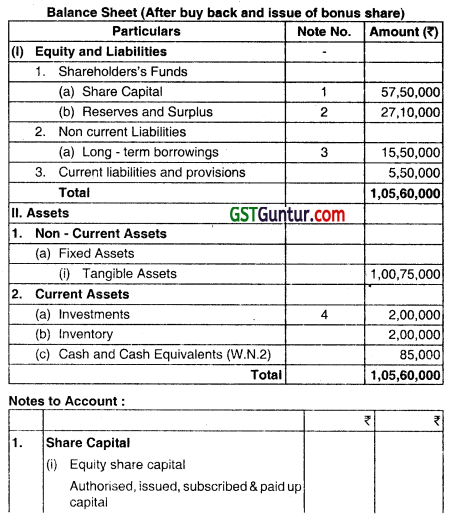

Question 7.

The following is the Summarized Balance Sheet of M/s. Vriddhi Infra Ltd. as on 31 March. 2016:

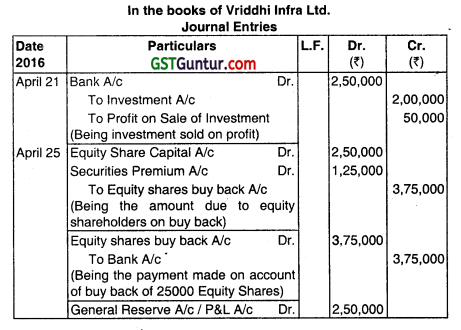

On 21st April 2016 the Company announced the buyback of 25,000 of its equity shares @ ₹ 15 per share. For this purpose, it sold all its investments for ₹ 2.50 lakhs. On 25th April 2016, the company achieved the target of buyback.

On 1st May, 2016 the company Issued one fully paid-up share of ₹ 10 each by way of bonus for every five equity shares held by the equity shareholders. You are requested to pass necessary Journal Entries for the above transactions. All necessary workings should form part of your answer. (2016 – Nov,6 marks)

Answer:

It is assumed that there is bank overdraft amounting ₹ 85,000 [(40,000 + 2,53,000) less ₹ 3,75,000]

Working Note:

Amount of bonus shares = [(1,00,000 – 25,000) × \(\frac{1}{5}\)] × 10

= 15,000 × ₹10 = ₹ 1,50,000.

Question 8.

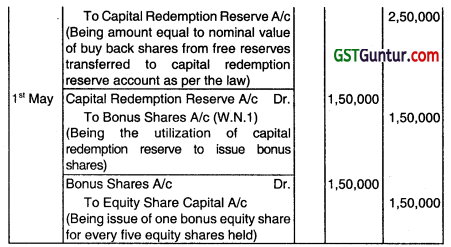

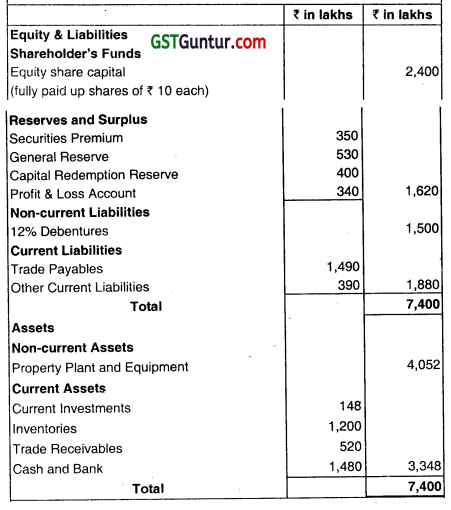

SMM Ltd. has the following capital structure as on 31st March 2017: ₹ in crores

The company has offered a buyback price of ₹ 30 per equity share. You are required to calculate maximum permissible number of equity shares that can be bought back in both situations and also required to pass necessary jumbal Entries. (May 2017,8 marks)

Answer:

Thus, SMM Ltd can buy back 24 crores shares in Situation – I but it cannot buy back shares In Situation – II.

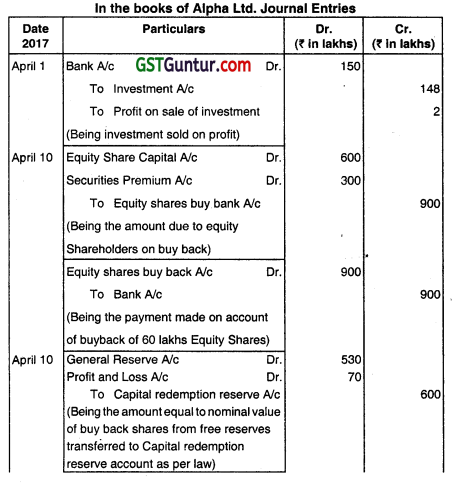

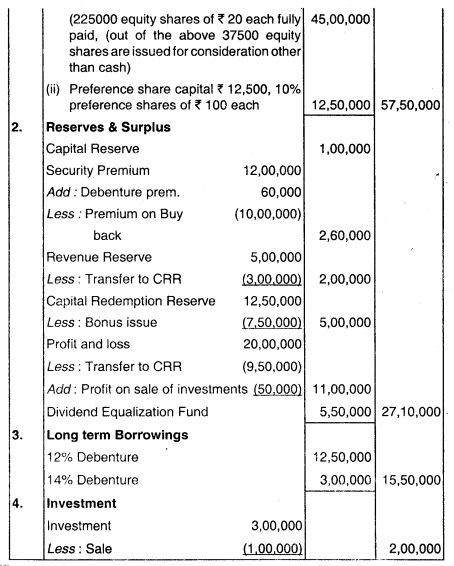

Question 9.

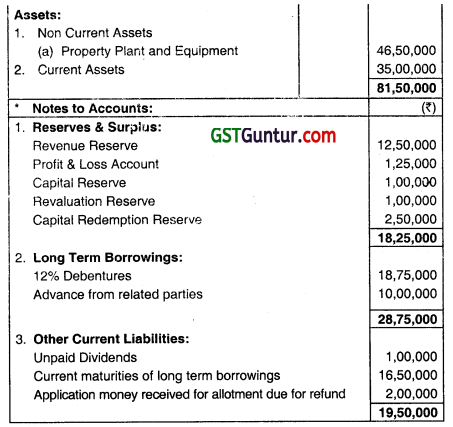

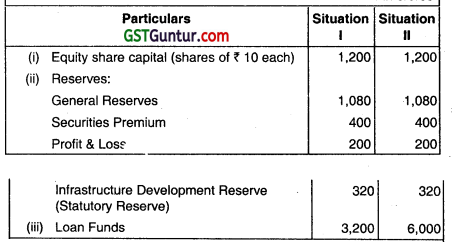

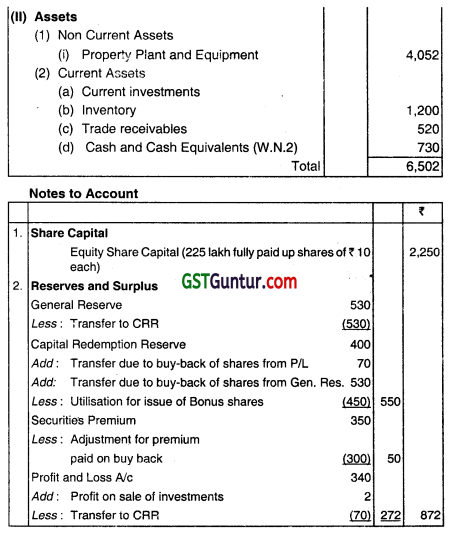

Alpha Ltd punishes the following summarized Balance Sheet as at 31st March 2017:

(i) On 1st April 2017. the company announced buy-back of 25% of its equity shares @ ₹ 15 per share. For this purpose, it sold all its investments for ₹ 150 Lakhs.

(ii) On 10th April, 2017 the company achieved the target of buy-back.

(iii) On 30th April, 2017, the company issued one fully paid-up equity share of ₹ 10 each by way of bonus for every four equity shares held by the equity shareholders by capitalization of Capital Redemption Reserve. You are required to pass necessary journal entries and prepare the Balance Sheet of Alpha Ltd. after bonus issue. (May 2018, 10 marks)

Answer:

Working Notes:

1. Amount of bonus shares = 25% of (2,400 – 600) Iakhs = ₹ 450 lakhs

2. Cash at bank after issue of bonus shares

Note: In the given case, it is possible to adjust transfer to capital redemption reserve account or capitalization of bonus shares from any other free reserves or Securities Premium (to the extent available) also.

![]()

Question 10.

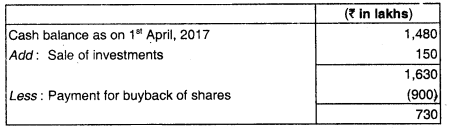

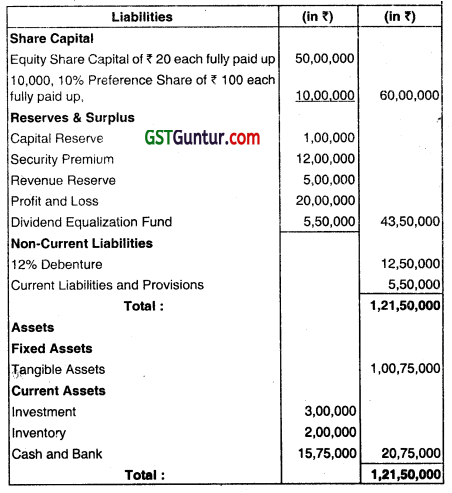

Following is the summarized Balance Sheet of Super Ltd. as on 31st March, 2018.

Super Limited wants to buy back 35,000 equity shares of ₹ 10 each full paid up on 1st April, 2018 at ₹ 30 per share. Buy Back of shares is fully authorised by its articles and necessary resolutions have been passed by the company towards this. The payment for buyback of shares will be made by the company out of sufficient bank balance available as part of the Current Assets. Comment with calculations, whether the Buy Back of shares by the company is within the provisions of the Companies Act. 2013. (May 2019, 10 marks)

Answer:

Determination of Buy-back of maximum number of shares as per the Companies Act, 2013.

1. Shares outstanding Test:

| Particulars | Shares |

| Number of shares outstanding | 1,70,000 |

| 25% of the shares outstanding | 42,500 |

2. Resources Test: Maximum permitted limit 25% of Equity paid-up capital + Free Reserves

3. Debt Equity Ratio Test: Loans cannot be in excess of twice the Equity Funds post Buy-back;

Summary statement determining maximum numbers of shares to be bought back.

| Particulars | Number of shares |

| Shares outstanding Test | 42,500 |

| Resources Test | 37,500 |

| Debt Equity ratio Test | 54,375 |

| Maximum No. of shares can be bought back (least) | 37,500 |

Company qualified all tests for buy-back of shares and come to the conclusion that it can buy maximum 37,500 shares on 1st April, 2018. However, company wants to buy back only 35,000 shares @ 30. Therefore, buy-back of 35,000 shares, as desired by the company is within the provisions of the Companies Act, 2013.

Working Note:

1. Amount transfer to CAR and maximum equity lo be bought back will be calculated by simultaneous equation method. Suppose, amount transferred to CRR account is ‘x’ an’d maximum permitted buy-back of equity is ‘y’

(₹ 45,00,000 – x) – ₹ 23,25,000 = y ……………….. (1)

(\(\frac{y}{230} \times ₹ 10\)) = x or 3x = y ……………….. (2)

So, putting value of y in equation No. (2)

3x = y

3x = (₹ 45,00,000 – x) – ₹ 23,25000

3x = ₹ 21,75,000 – x

x = ₹ 5,43,750

So. y=3x

= 3(₹ 5,43,750)

y = 16,31,250

Question 11.

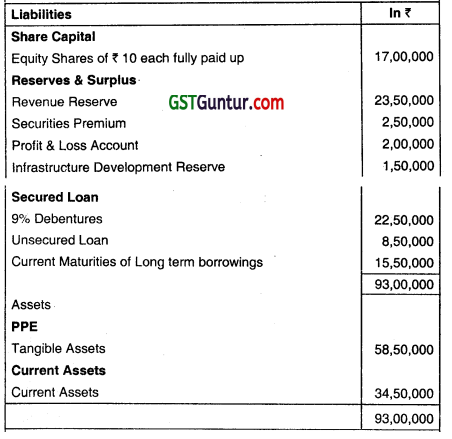

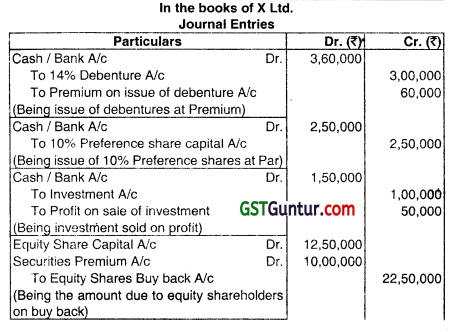

X Ltd. furnishes the following summarized Balance Sheet as at 31 -03- 2018.

The shareholders adopted the resoluhon on the date of the above-mentioned Balance Sheet to:

1. Buyback 25% of the paid-up capital and it was decided to oiler a price of 20% over market price. The prevailing market value of the company’s share is ₹ 30 per share.

2. To finance the buyback of share company;

(a) Issue 3000, 14% debenture of ₹ 100 each at a premium of 20%.

(b) Issue 2500, 10% preference share of ₹ 100 each.

3. Sell investment worth ₹ 1,00,000 for ₹ 1,50,000.

4. Maintain a balance of ₹ 2,00,000 in Revenue Reserve.

5. Later the company issue three fully paid-up equity share of ₹ 20 each by way of bonus share for every 15 equity share held by the equity shareholder. You are required to pass the necessary journal entries to record the above transactions and prepare Balance Sheet after buyback. (Nov 2019,15 marks)

Answer:

Note: For transferring amount equal to nominal value of buyback shares from free reserves to capital redemption reserve account, as given In the question the amount of ₹ 2,00,000 required to be maintained in revenue reserve account. So ₹ 3,00,000 utilised from revenue reserve account and ₹ 9,50,000 utilised from profit and loss account for the purpose of transfer to CRR.

Working Notes:

1. Number of equity shares

= 2,50,000 – 62,500 (buy back) + 37,500 (Bonus shares)

= 2,25,000 Shares

2. Cash/Bank after issue of bonus share:

Question 12.

Answer the following:

The Directors of Umang Ltd. passed a resolution to buy back 5,00,000 numbers of its fully paid equity shares of ₹ 10 each at ₹ 15 per share. This buyback is in compliance with the provisions of the Companies Act, 2013 For this purpose, the company.

(i) Sold its investments of ₹ 30,00,000 for ₹ 25,00,000.

(ii) Issued 20,000, 12% preference shares of ₹ 100 each at par, the entire amount being payable with application.

(iii) Used ₹ 15,00,000 of its Securities Premium Account apart from its adequate balance in General Reserve to fulfill the legal requirements regarding buy-back.

(iv) The company has necessary cash balance for the payment to shareholders. You are required to pass necessary Journal Entries (including narration) regarding buy-back of shares in the books of Umang Ltd. (Jan 2021, 5 marks)

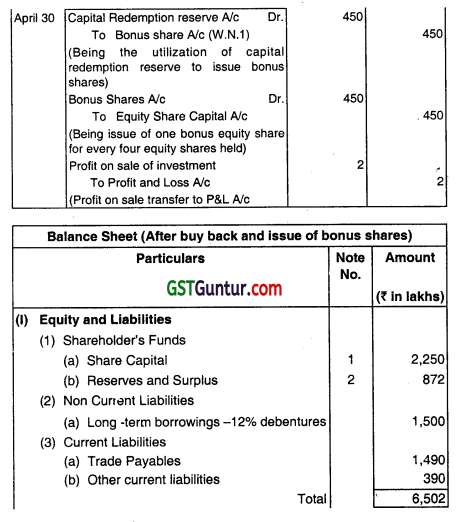

Question 13.

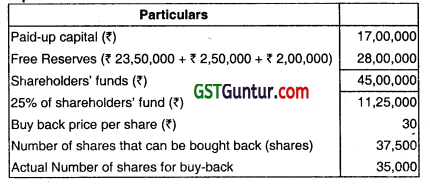

Explain the meaning of equity shares with differential rights. Can preference shares be also issued with differential rights?

Answer:

Equity shares with Differential Rights means the share with dissimilar rights as to dividends, voting or otherwise. No; the preference shares cannot be issued with differential rights.

![]()

Question 14.

E F, G, and H hold Equity Capital in Alpha Co. in the proportion of 30:30:20:20. S, T,U, and V hold preference share capital in the proportion of 40:30:10:20. If the paid-up capital of the company is ₹ 120 Lakh and Preference share capital is ₹ 60 Lakh. You are required to calculate their voting rights in case of resolution of winding up of the company.

Answer:

E, F, G, and H hold Equity capital Is held by in the proportion of 30:30:20:20, and S, T, U, and V hold preference share capital in the proportion of 40:30:10:20. As the paid-up equity share capital of the company is ₹ 120 Lakhs and Preference share capital is ₹ 60 Lakhs & (2:1), then relative weights in the voting right of equity shareholders and preference shareholders will be 2/3 and 1/3. The respective voting right of various shareholders will be

E = 213×30/100 = 3/15

F = 2/3×30/100 = 3115

G = 2/3×20/100 = 2115

H = 2/3×20/100 = 2115

S = 1/3×40/100 = 2115

T = 1/3×30/100 = 1/10

U = 1/3×10/100 = 1/30

V = 1/3×20/100 = 1/15

Question 15.

Answer the following:

Equity capital is held by LM.N and O in the proportion of 30: 40: 20:10. A, B, C, and D hold Preference share capital in the proportion of 40: 30:10: 20. If The paid up Equity Share capital of the company is ₹ 60 lakhs and Preference share capital is ₹ 30 lakhs, find the voting rights of shareholders (in percentage) in case of resolution of winding up of the company. (Nov 2018, 5 marks)

Answer:

L, M, N, and O hold Equity Capital is held by in the proportion of 30: 40: 20:10 and A, B, C, and D hold preference share capital in the proportion of 40: 30:10: 20. As the paid-up equity share capital of the company is ₹ 60 lakhs and preference share capital is 30 lakhs (2: 1), then relative weights in the voting right of equity shareholders and preference shareholders will be 2/3 and 1/3. The respective voting rights of various shareholders will be:

L= 213 × 30/100= 3/15 =20%

M = 2/3 × 40/100 = 4/15 = 26.67%

N= 213 × 20/100= 2/15 =1333%

O = 2/3 × 10/100 = 1/15 =6.67%

A = 1/3 × 40/100 = 4/30 = 13.33%

B= 113 × 30/100 = 3/30 =10%

C = 1/3 × 10/100 = 1/30 = 3.33%

D = 1/3 × 20/100= 2/30 = 6.67%