Application of Accounting Standards – CA Inter Advanced Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Application of Accounting Standards – CA Inter Advanced Accounting Question Bank

Question 1.

A company entered into an agreement to sell its immovable property to another company for 35 lakhs. The property was shown in the Balance Sheet at 7 lakhs. The agreement to sell was concluded on 15th February, 2008 and sale deed was registered 30th April, 2008. The financial statements for the year 2007-08 were approved by the board on 12th May, 08.

You are required to state, how this transaction would be dealt with in the financial statements for the year ended 31st March, 2008. (Nov 2009, 2 marks)

Answer:

Provision:

According to Para 13 of AS 4 “ContIngencies and Events Occurring after the Balance Sheet Date”, assets and liabilities should be adjusted for events occurring after the balance sheet date that provide additional evidence to assist the estimation of amounts relating to conditions existing at the balance sheet date or that indicate that the fundamental accounting

assumption of going concern ¡s not appropriate.

Analysis and Conclusion:

In the given question, sale of immovable property was carried out before the closure of the books of accounts. This ¡s clearly an event occurring after the balance sheet date but agreement to sell was effected on 15th February 2009 i.e. before the balance sheet date. Registration of the sale deed on 30th April 2009, simply provides additional information relating to the conditions existing at the balance sheet date. Hence, adjustment to assets for sale of immovable property is necessary in the financial statements for the year ended 31st March 2009.

Question 2.

A Company follows April to March as Its Financial Year. The Company recognizes cheques dated 31st March or before, received from customers after balance sheet date, but before approval of Financial statement by debiting cheques in hand A/c and crediting Debtors A/c. The cheques In hand is shown in the Balance Sheet as an item of cash and cash equivalents. All cheques in hand are presented to bank in the month of April and are also realised in the same month in normal course after deposit in the bank. State with reasons, whether the collection of cheques bearing date 31st March or before, but received after Balance Sheet date is an adjusting event and how this fact is to be disclosed by the company? (May 2010, 2 marks)

Answer:

Analysis and Conclusion:

Even if the cheques bear the date 31st March or before, the cheques received after 31 March do not represent any condition existing on the balance sheet date i.e. 31st March. Therefore, the collection of cheques after balance sheet date is not an adjusting event. ‘fleque that are received after the balance sheet date should be accounted for in the period in which they

are received even though the same may be dated 31st March or before as per AS 4 Contingencies and Events Occurring after the Balance Sheet Date”. Moreover, the collection of cheques after balance sheet date does not represent any material change affecting financial position of the enterprise, therefore, no disclosure in the Director’s Report is necessary.

Question 3.

While preparing its final accounts for the year ended 31st March 2010, a company made a provision for bad debts @ 4% of its total debtors (as per trend follows from the previous years). In the first week of March 2010, a debtor- for ₹ 3,00,000 had suffered heavy loss due to an earthquake; the loss was not covered by any insurance policy. In April 2010 the debtor becomes bankrupt. Can the company provide for the full loss arising out of insolvency of the debtor in the final accounts for the year ended 31st March 2010. (Nov 2010, 5 marks)

Answer:

Provision:

According to AS 4 Contingencies and Events Occurring After the Balance Sheet Date’, adjustments to assets and liabilities are required for events occurring after the balance sheet date that provide additional information materially affecting the determination of the amounts relating to conditions existing at the Balance Sheet date.

Analysis and Conclusion:

A debtor for ₹ 3,00,000 suffered heavy loss due to earth quake in the first week of March, 2010 and he became bankrupt in April 2010 (after the balance sheet date). The loss was also rot covered by any insurance policy. Accordingly. full provision for had debts amounting ₹ 3,00,000 should be made, to cover the less arising due to the insolvency of a debtor, in the final

accounts for the year ended 31st Mach, 2010.

![]()

Question 4.

MEC Limited could not recover an amount of 8 lakhs from a debtor. The company is aware that the debtor is in great financial difficulty. The accounts of the company for the year ended 31.3.2011 were finalized by making a provision @ 25% of the amount due from that debtor. In May 2011, the debtor became bankrupt and nothing is recoverable from him. Do you advise the company to provide for the entire loss of 8 lakhs in books of account for the year ended 31.3.2011? (Nov 2011, 4 marks )

Answer:

Provision:

As per AS 4, Contingencies and Events Occurring after the Balance Sheet Date, adjustments to assets and liabilities are required for events occurring after the balance sheet date in such event provides/relates to additional information to the conditions existing at the balance sheet date and is also materially affecting the valuation of assets and liabilities on the

balance sheet date.

Analysis and Conclusion:

As per the information given in the question, the debtor was already in a great financial difficulty at the time of closing of accounts, Bankruptcy of the debtor in May 2011 is only an additional information to the condition existing on the balance sheet date. Also the effect of a debtor becoming bankrupt is material as total amount of 8 lakhs will be a loss to me company. Therefore, the company is advised to provide for the entire amount of ₹ 8 lakhs in the books of account for the year ended 31st March, 2011.

Question 5.

Cashier of A-One Limited embezzled cash amounting to ₹ 6,00,000 during March, 2012. However same comes to the notice of company management during April. 2012 only. Financial statements of the company is not vet approved by the Board of Directors of the company. With the help of; provisions of AS 4 Contingencies and Events Occurring attr the Balance Sheet Date” decide. whether the embezzlement of cash should be adjusted in the books nf accounts for the year cradling March. 2012? What will be your reply if embezzlement of cash comes to the notice of company management only after approval of financial statements by the Board of Directors of she company? (May 2012, 4 marks)

Answer:

Provision:

According to AS 4, assets and liabilities should be adjusted for events occurring after the balance sheet date that provide additional evidence to assist the estimation of amounts relating to conditions existing at the balance sheet date.

Analysis and Conclusion:

1. Though the theft, by the cashier ₹ 6,00,000 was detected after the balance shoot off (before approval of financial statements) e.it is as an additional information materially affecting the determination of the cash amount relating to conditions existing at the balance sheet date.

2. Therefore it is necessary to make the necessary adjustments in the financial statements of the company for the year ended 31st March. 2012 for recognition of the loss amounting ₹ 6,00,000.

3. When embezzlement of cash comes to the notice of company management arty after approval of financial statements by Board of Directors of the company, then the treatment will be done as per the provisions of AS 5. This being extraordinary item should be disclosed in the statement of profit and loss as a part of loss for the year ending March 2013. The nature and the amount of prior period items should be separately disclosed on the statement of profit and loss in a manner that its impact on current profit or loss can be perceived.

Question 6.

Neel Limited has its corporate office in Mumbai and sells its products tc stock Lists all over India. On 31st March, 2013. the company wants to recognize receipt of cheques bearing date 31st March 2013 or before, as ”Cheques in Hand” by reducing trade Receivables”. The “Cheques in Hand” is shown in the Balance Sheet as an item of cash and cash equivalents. All cheques are presented to the bank in the month of April 2013 and are also realized in the same month in normal course after deposit in the bank. State with reasons, whether each of the following is an adjusting event and how this fact Is to be disclosed by the company, with reference In the relevant accounting standard.

(i) Chequis connected by the marketing personnel of the company from the stockists on or before 31st March, 2013.

(ii) Cheques sent by the stockists through courier on or before 31st March, 2013. (May 2013, 4 marks)

Answer:

(i) Cheques collected by the marketing personnel of the company is an adjusting event as the marketing personnel are employees of the company and therefore, are representatives of the company. Handing over of cheques by the stockist to the marketing employees discharges the liability of the stockist. Thus, cheques collected by the marketing personnel of the company on or before 31st March, 2013 require adjustment from the stockists’ accounts i.e. from ‘Trade Receivables A/c’ even though these cheques (dated on or before 31st March, 2013) are presented in the bank in the month of April, 2013 in the normal course.

Therefore, collection of cheques by the marketing personnel is an adjusting event as per AS 4 ‘Contingencies and Events Occurring after the Balance Sheet Date’. Such ‘cheques in hand’ will be shown in the Balance Sheet as ‘Cash and Cash equivalents’ with a disclosure in the Notes to accounts about the accounting policy followed by the company for such cheques.

Question 7.

State with reasons, how the following events would be dealt with in the financial statements of Pradeep Ltd. for the year ended 31st March, 2013:

(i) An agreement to sell a land for 30 lakhs to another company was entered into on 1st March, 2013. The value of land is shown at ₹ 20 lakh in the Balance Sheet as on 31st March, 2012. However, the Sale Deed was registered on 15th April, 2013.

(ii) The negotiation with another company for acquisition of its business was started on 2nd February, 2013. Pradeep Ltd. invested ₹ 40 lakh on 12m April, 2013. (Nov 2013, 5 marks)

Answer:

(i) Provision:

As per AS – 4 “ContingencIes and Events Occurring after the Balance Sheet Date”, assets and liabilities should be adjusted for events occurring after the balance sheet date that provide additional evidence to assist the estimation of amounts relating to conditions existing at the balance sheet date.

Analysis and Conclusion:

In the given situation, sale of land was carried out before the closure of the books of accounts. This is clearly an event occurring after the balance sheet date but agreement to sell was effected on 1st March 2013 i.e. before the balance sheet date. Registration of the sale deed on 15th April, 2013. simply provides additional Information relating to the conditions existing at the balance sheet date. Therefore, adjustment to assets for sale of land is necessary in the financial statements for the year 31st March 2013.

(ii) Provision:

According to AS – 4 “Contingencies and Events Occurring after the Balance Sheet Date”, which do not affect the figures stated in the financial statements would not normally require disclosure in the financial statements, although they may be of such significance that they may require a disclosure in the report of the approving authority to enable users of financial statements to make proper evaluations and decisions.

Analysis and Conclusion:

The investment of 40 lakhs in April 2013 for acquisition of another company is under negotiation stage, and has not been finalized yet. Also it is not affecting the figures stated inthe financial statements of 2012 -13, hence the details of the negotiation should be disclosed in the Directors Report to enable users of financial statements to make proper evaluations and decisions.

Question 8.

With reference to AS 4 Contingencies and events occurring after the balance sheet date, state whether the following events will be treated as contingencies adjusting events or non-adjusting events occurring after balance sheet in case of a company which follows April to March as its financial year.

(i) A major tire has damaged the assets in a factory on 5th April, 5 days after the year-end. However, the assets are fully insured and the books have not been approved by the Directors.

(ii) A suit against the company’s advertisement was tiled by a party on 10th April, 10 days after the year-end claiming damages of ₹ 20 lakhs.

(iii) It sends a proposal to purchase an immovable property for ₹ 30 lakhs in March. The book value in’ the property is ₹ 20 lakhs as on year-end date. However, the deed was registered as on 15th April.

(iv) The terms and conditions for acquisition of business of another company have been decided by March end. But the financial resources were arranged ri April and amount invested was ₹ 40 lakhs.

(v) Theft of cash of ₹ 2 lakhs by the cashier on 31st March but was detected the next day after the financial statements have been approved by the Directors. (May 2016, 5 marks)

Answer:

(i) As per AS-4, the loss due to major fire Is an example of event occurring after balance sheet date. This event does not relate to conditions existed at the balance sheet date. It has not affected financial position as on the balance sheet date and there fore requires no specific adjustments in The financial Statements, However, paragraph 8.6 of AS-4 states that disclosure is generally made of events occurring after balance sheet date i.e. subsequent periods that represent unusual changes affecting the existence or substratum of the enterprise aller the balance sheet date.

In this given case, a major fire has damaged the assets in a factory on 5th April and assets are fully insured so that ¡t may be considered as an event affecting the substratum of the enterprise because asset is insured but the loss due to it may not be fully recovered from insurance company. So that it is considered as non-adjusting events occurring after balance sheet date and should be disclosed in the report of the approving authority.

(ii) As per AS-4, events occurring after balance sheet date are those significant events, both favourable and un favourable that occur between the balance sheet date and the date on which financial statements are approved by board of directors or any other approving authority.

In this case, a suit against company’s advertisement was filed by a party on 10th April, for amount of ₹ 20 Lakhs. Therefore, it does not fit into the definition of a contingency and hence is a non-adjusting event.

(iii) In the given case, proposal for deal of immovable property was sent before the closure of the books of accounts. This is a non-adjusting event as only the proposal was sent and no agreement was effected in the month of March i.e. before the balance sheet date.

(iv) As the term and conditions of acquisition of business of another company had been decided by the end of March, acquisition of business is an adjusting event occurring after the balance sheet date. Adjustment to assets and liabilities is required since the event affects the determination and the condition of the amounts stated in the financial statements for the financial year ended on 31st March.

(v) Since the financial statements have been approved before detection of theft by the cashier of ₹ 2,00,000, it becomes a non-adjusting event and no disclosure is required in the report of the Approving Authority.

![]()

Question 9.

M/s AB Ltd. is in the process of analyzing its account for the year ended 31st March, 2015. The company seeks your advice on the following:

(i) The company’s sale tax assessment for assessment year 2012-13 has been completed on 1 14th February, 2015 with a demand of ₹ 5.40 crore. The company paid the entire due under protest without prejudice to Its right of appeal. The company files its appeal before the appellate authority wherein the grounds of appeal cover tax on additions made in the assessment order for a sum of ₹ 3.70 crore.

(ii) The company has entered Into a wage agreement in May 2015 where by the labour union has accepted a revision ¡n wage from June 2014. The agreement provides that the hike till May 2015 will not be paid to the employees but will be settled to them at the time of retirement. The company agrees to deposit the arrears in Government Bonds by September 2015. (May 2016, 5 marks)

Answer:

(i) This given situation is considered as per provision of AS-4. Contingencies and events occurring after the balance sheet date. As per AS-4 events that occur between balance sheet date and date of approval of financial statement should be disclosed.

In this case, the company is not appealing against addition of ₹ 1.7 crore, the same should be provided for in its accounts for the year ended 31st March. 2015. The amount paid under protest can be kept under the subheading ‘Short-Term Loans and Advances’ and disclosed along with the contingent liability of ₹ 3.70 crore.

(ii) As per AS-4 Contingencies and events occurring after balance sheet date, the events should be disclosed which have effect In the current financial year and such events have occurred during the financial year. The principle of accrual is applied here. As per this principle the income and expenses are realised in books they are earned and incurred but not by receipt and payment. So that in this case wage agreement decided in May 2015 so that it is event occurring after balance sheet date. The arrears for period from June 2014 to March 2015 are required to be provided for in the accounts of the company for the year ended 31st March. 2015.

Question 10.

While preparing its final accounts for the year ended 31st March. 2016. a company made provision for bad debts @ 5% of its total debtors. In the last week of February, 2016 a debtor for ₹ 20 lakhs had suffered heavy loss due to an earthquake; the loss was not covered by any insurance policy. In April, 2016 the debtor became a bankrupt. Can the company provide for the full loss arising out of nsolvericy of the debtor in the final accounts for the year ended 31st March. 2016? Comment with reference to relevant Accounting Standard. (Nov 2016, 5 marks)

Answer:

Provision:

As per para 8 of AS 4 ‘Contingencies and Events Occurring after the Balance Sheet Date Adjustment to assets and liabilities are required for events occurring after the balance sheet date that provide additional information materially affecting the determination of the amounts relating to conditions existing at the balance sheet date.

Analysis & Conclusion:

A debtor for ₹ 20,00000 suffered heavy loss due to earthquake n the last week of February, 2016, which was not covered by insurance. This information was already known to the company. The fact that he become bankrupt in April, 2016 is only an additional information related to the existing condition on the Balance Sheet date. Accordingly, full provision for bad debts amounting ₹ 20,00,000 should be made, to cover the loss arising due to the insolvency of a debtor, in the Final A/c for the year ended 31st March, 2016.

Question 11.

The Board of Directors of M/s. New Graphics Ltd. in its Board Meeting held on 18th April, 2017, considered and approved the Audited Financial results along with Auditors Report for the Financial Year ended 31st March, 2017 and recommended a divided of 2 per equity share (on 2 crore fully paid up equity shares of ₹ 10 each) for the year ended 31st March, 2017 and if

approved by the members at the forthcoming Annual General Meeting of the company on 18th June, 2017, the same will be paid to all the eligible shareholders.

Discuss on the accounting treatment and presentation of the said proposed dividend in the annual accounts of the company for the year ended 31st March, 2017 as per the applicable Accounting Standard and Other Statutory Requirements. (May 2017, 5 marks)

Answer:

As per the amendment in AS 4 “Contingencies and Events Occurring After the Balance Sheet Date” vide Companies (Accounting Standards) Amendments Rules, 2016 the events which take place after the balance sheet date, are sometimes reflected in the financial statements because of statutory requirements or because of their special nature. However, dividends declared after the balance sheet date but before approval of financial statements are not recognized as a liability at the balance sheet date because no statutory obligation exists at that time. Hence. such dividends are disclosed ri the notes to financial statements.

Present Case:

Provision for proposed dividends Is riot required to be made. Such proposed dividends are to be disclosed In trie notes to financial statements. Accordingly, the dividend of ₹ 4 Crores recommended by New Graphics Ltd. In its Board meeting on 18th April. 2017 shall not be accounted for In the books for the year 2016-17 irrespective of the fact that it pertains to the year 2016-17 and will be paid after approval in the Annual General Meeting of the members/ shareholders.

Question 12.

The accounting year of Dee Limited ended on 31st March, 2018 but the accounts were approved on 30th April, 2018. On 15th April, 2018 a fire occurred in the factory and office premises. The loss by fire is of such a magnitude that it was not possible to expect the enterprise Dee Limited to start operation again. State with reasons, whether the loss due to fire is an adjusting or non-adjusting event and how the fact of loss is to be disclosed by the company in the context of the provisions of AS-4 (Revised). (Nov 2018, 5 marks)

Answer:

AS 4 (Revised) “ContingencIes and Events occurring after the Balance Sheet Date,” states that adjustments to assets and liabilities are not appropriate for events occurring after the balance sheet date if such events do not relate to conditions existing at the balance sheet date. However, an event occurring after the balance sheet date should be an adjusting event

even if It does not reflect any condition existing on the balance sheet date if the event is such as to indicate that the fundamental accounting assumption of going concern is no longer appropriate.

Present Case:

A fire occurred in the factory and office premises of an enterprise after 31/03/2018. But before approval of financial statement of 2017-18. The loss on fire is of such a magnitude that it is not reasonable to expect the company to start its operation again. i.e. the going concern assumption is not valid. Since the fire occurred after 31/03/2018, the loss on fire is not a result of any condition existing on 31/0312018. In such a case, the entire accounts need to be prepared on a liquidation basis with adequate disclosures.

Question 13.

State whether the following statement is ‘True’ or False’. Also, give reason for your answer.

As per the provisions of AS-4, a contingency is a condition or situation, the ultimate outcome of which (gain or loss) will be known all’ determined only on the occurrence of one or more uncertain future events. (May 2019, 1 mark)

Answer:

This statement is False As per AS 4, a contingency is a condition or situation the ultimate outcome of which, gain or loss, will be known or determined only on the occurrence, or non-occurrence of one or more uncertain future events.

Question 14.

The financial statements of PQ Ltd. for the year 2017-18 approved by the Board of Directors on 15th July, 2018. The following information was provided:

(i) A suit against the company’s advertisement was filed by a party on 20th April, 2018, claiming damages of ₹ 25 lakhs.

(ii) The terms and conditions for acquisition of business of another company have been decided by March 2018. But the financial resources were arranged in April, 2018 and amount invested was ₹ 50 lakhs.

(iii) Theft of cash of 5 lakhs by the cashier on 31st March, 2018 but was detected on 16th July, 2018.

(iv) Company sends a proposal to sell an immovable property for ₹ 40 lakhs in March, 2018. The book value of the property is ₹ 30 lakhs on 31st March, 2018. However, the deed was registered on 15th April, 2018.

(v) A major fire has damaged the assets in a factory on 5th April, 2018. However, the assets are fully insured.

With reference to AS-4 “Contingencies and events occurring after the balance sheet date”, state whether the above mentioned events will be treated as contingencies, adjusting events or non-adjusting events occurring after the balance sheet date. (May 2019, 5 marks)

Answer:

(i) Suit filed against the company is a contingent liability but it was not existing as on balance sheet date as the suit was filed on 20th April after the balance Sheet date. As per AS 4, ‘Contingencies’ used in the Standard is restricted to conditions or situations at the balance sheet date, the financial effect of which is to be determined by future events which may or may not occur. Hence, I will have no effect on financial statements and will be a non-adjusting event.

(ii) In the given case, terms and conditions for acquisition of business were finalised and carried out before the closure of the books of accounts but transaction for payment of financial resources was effected in April, 2018. This is dearly an event occurring after the balance sheet date. Hence, necessary adjustment 4o assets and liabilities for acquisition of business is necessary In the financial statements for the year ended 31st March 2018.

(iii) Only those significant events which occur between the balance sheet date and the date on which the financial statements are approved, may indicate the need for adjustment to assets and liabilities existing on the balance sheet date or may require disclosure. In the given case, theft of cash was detected on 16th July, 18 after approval of financial statements by the Board of Directors, hence no treatment is required.

(iv) Adjustments to assets and liabilities are not appropriate for events occurring after the balance sheet date, it such events do not relate to conditions existing at the balance sheet date. In the given case, sale of immovable property was under proposal stage (negotiations also not started) on the balance sheet date. Therefore, no adjustment to assets for sale of immovable property is required in the financial statements for the year ended 31st March, 2018.

(v) The condition of fire occurrence was not existing on the balance sheet date. Only the disclosure regarding event of fire and loss being completely insured may be given in the report of approving authority.

![]()

Question 15.

When can an item qualify to be a prior period item as per AS-5? (May 2008, 4 marks)

Answer:

Prior Period Item [Para 16 of AS-5 (Revised)]:

When incomes or expenses arise in the current period as a result of errors or omissions in the preparation of the financial statements of one or more prior periods, the said incomes or expenses must be classified as prior period items. The errors may occur as a result of mathematical mistakes, mistakes in applying accounting policies, misinterpretation of facts or

oversight.

The term does not include other adjustments necessitated by circumstances, which though related to prior periods, are determined In the current period e.g. arrears payable to workers in current period as a result of revision of wages with retrospective effect.

Question 16.

The company finds that the stock sheets of 31.3.2007 did not Include two pages containing details of inventory worth 20 lakhs. State, how will you deal with this matter In the accounts of A Ltd. for the year ended 31st March, 2008 with reference to AS 5. (Nov 2008, 2 marks)

Answer:

Provision:

As per AS -5, Prior Period Items are incomes or expenses which arise in current period as a result of error of omission in the preparation of financial statement of one or more prior periods.

Analysis and Conclusion:

In the above case, 2 pages of stock sheet were missing in financial statements of 2007. Due to this the closing stock of 2007 was shown short by ₹ 20 lakhs as a result of which the opening stock of 2008 was understated resulting into an over-valuation of profit in 2008. In the current year 2008, the prior period item will be adjusted by reducing the profit by ₹ 20 lakhs. Therefore, as per AS-5 a separate disclosure of prior period items should be shown separately in the statement of trading and Profit & Loss A/c in a manner that the impact on the current profit or loss can be perceived.

Question 17.

Explain the provisions of AS-5 regarding accounting treatment of prior period items. (May 2009, 4 marks)

Answer:

As per AS 5, Prior Periods Items are income or expenses, which arise, in the current period as a result of errors or omissions in the preparation of financial statements of one or more prior periods. The term does not Include Other adjustments necessitated by circumstances, which though related to prior periods, are determined in the current period. Example: arrears payable to workers in current period as a result of retrospective revision of wages.

The nature and amount of prior period items should be separately disclosed in the statement of profit and loss in a manner that their impact on current profit or loss can be perceived. As per para 19 of AS 5, prior period items are normally included in determination of net profit or loss for the current profit, they can be added (or deducted as the case may be) from the current profit. An alternative approach is to show such items in the statement of profit or loss after determination of current net profit or loss. In either case, the objective is to indicate the effect of such items on the current profit or loss.

Question 18.

Goods worth 5,00,000 were destroyed due to food in September 2006. A claim was logged with insurance company. But no entry was passed in the books for insurance claim in the financial year 2006-07, in March 2008, the claim was passed and the company received a payment of ₹ 3,50,000 against the claim. Explain the treatment of such receipt in final accounts for the year ended 31st March. 2008. (Nov 2009, 2 marks)

Answer:

According to the provisions, of AS 5 “Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies”, prior period items are incomes or expenses, which arise in the current period as a result of error or omissions in the preparation of financial statements of one or more prior periods. The nature and amount of prior period items should be separately disclosed in the statement of profit and loss.

Present case:

In the given question, it is clearly a case of error in preparation of financial statements for the financial year 2006-07. Therefore claim received in the financial year 2007-08 is a prior period item and should be separately disclosed In the statement of profit and loss for the year ended 31st March 2008.

Question 19.

A company created a provision of ₹ 75,000 for staff welfare while preparing the financial statements for the year 2007-08. On 31st March, in a meeting with staff welfare association, it was decided to increase the amount of provision for staff welfare to ₹ 1,00,000. The accounts were approved by Board of Directors on 15th April, 2008. Explain the treatment of such revision in financial statements for the year ended 31st March 2008. (Nov 2009, 2 marks)

Answer:

Provision:

According the provisions of AS-5, all items of income and expense which are recognised in a period are included in the determination of the net profit or loss for the period, This includes extraordinary items and the effects of changes in accounting estimates. However, the effect of such change in accounting estimate should be classified using the same classification In the statement of profit and loss, as was used previously, for the estimate.

Analysis and Conclusion:

According to AS 5 “Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies, the charge in amount of staff welfare provision amounting ₹ 25,000 is neither a prior period item nor an extraordinary item. li is a change in estimate, which has occurred in the year 2007-2008.

Question 20.

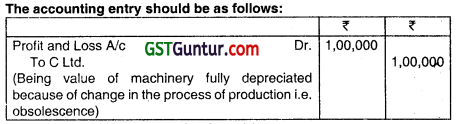

A Ltd. entered into a binding contract with C Ltd. to buy a machine for ₹ 1,00,000. The machine is to be delivered on 15th February, 2009. On 1st January, 09 A Ltd. changed its process of production. The new process will not require the machine ordered and it shall have to be scrapped after delivery. The expected scrap value of the machine is nil. Explain how A Ltd. should recognise the entire transaction in the books of account for the year ended 31st March 2009. (Nov 2009, 2 marks)

Answer:

A Ltd. entered into a binding contract with C Ltd. and therefoíe, it should recognise a liability of ₹ 1,00,000. The entire amount of purchase price of the machine should be recognised in the year ended 31st March 2009 as Loss because future economic benefit from the machine to the enterprise is improbable.

Question 21.

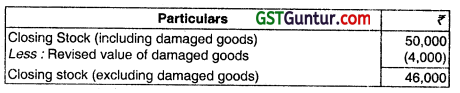

Closing stock for the year ending on 31.3.2010 is ₹ 50,000 which includes stock damaged in a lire in 2008-09. On 31.3.2009 the estimated net realisable value of the damaged stock was ₹ 12,000. The revised estimate of net reasable value included in dosing stock of 2009-10 is ₹ 4,000. Find the value of Closing stock to be shown in Profit and Loss account for the year 2009-10. (May 2010, 2 marks)

Answer:

The fall in estimated net realisable value of damaged stock ₹ 8,000 is the effect of change in accounting estimate. As per AS 5 ‘Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies’, the effect of a change in accounting estimate should be classified using the same class fication in the statement of profit and loss as was used previously for the estimate.

Therefore, the value of closing stock for the year 2009-10 with be as follows:

Question 22.

A company signed an agreement with the employee’s union on 01-09-2010 for revision of wages with retrospective effect from 01-04-2009. This would cost the company an additional liability of ₹ 10 lakhs per annum. Is a disclosure necessary for the amount paid in 2010-11. (May 2011, 4 marks)

Answer:

Provisions:

According to AS 5 (Revised), “Net Profit or Loss for the Period, Prior, period items and Changes in Accounting Policies, when items of income and expense within profit or loss from ordinary activities are of such size, nature or incidence that their disclosure is relevant to explain the performance of the enterprise for the period, the nature and amount of such items should be disclosed separately.

Analysis and Conclusion:

It is given that revision of wages took place on 1st September 2010 with retrospective effect from 1.4.2009. The arrear of wages payable for the period 01.4.2009 to 31.3.2010, cannot be taken as an error or omission in the preparation of financial statement and hence this expenditure cannot be taken as a prior period item. Additional wages liability of ₹ 20 lakhs should be Included in current years’ wages.

1. It may be mentioned that additional wages is an expense arising from the ordinary activities of the company. Although abnormal in amount, such an expense does not qualify as an extraordinary Item.

2. Thus, necessary disclosure should be made for the additional liability amounting ₹ 20 lakhs.

![]()

Question 23.

Tiger Motor Car Limited signed an agreement with its employees union for revision of wages on 01.07.2011. The revision of wages is with retrospective effect from 01.04.2008. The arrear wages up to 31.03.2011 amounts to ₹ 40,00,000 arid that (for the period from 01.04.2011 to 01.07.2011 amount to ₹ 3,50,000. In view of the provisions of AS 5 Net Profit or Loss for the period, Prior Period Items and Changes in Accounting Policies, decide whether a separate disclosure of arrear wages is required while preparing financial statements for the year ending 31.03.2012 (May 2012, 4 marks)

Answer:

Question shows that revision of wages took place in July. 2011 with retrospective effect from 1.4.2008. The arrear wages payable for the period (from 1.4.2008 to 31.3.2011 cannot be taken as an error or omission in the preparation of financial statements and hence this expenditure cannot be taken as a prior period item.

Additional wages liability of ₹ 40,00,000 (from 1.4.2008 to 31 .3.2011) should be included in current year’s wages. It may be considered that additional wages is an expense arising from the ordinary activities of the company. Although abnormal in amount, such an expense does not qualify as an extraordinary item. However, A 5, when items of income and expense within profit or loss from ordinary activities are of such size, nature, or incidence that their disclosure is relevant to explain the performance of the enterprise for the period, the nature and amount of such items should be disclosed separately.

However, wages payable for the current year (from 1.4.2011 to 1.7.2011) amounting ₹ 3,50,000 is not a prior period item hence need not be disclosed separately. This may be shown as current-year wages.

Question 24.

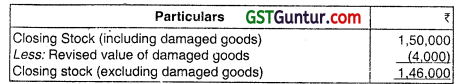

Closing Stock for the year ending on 31st March, 2013 is ₹ 1,50,000 which includes stock damaged in a fire in 2011-12. On 31st March 2012. the estimated net realizable value of the damaged stock was ₹ 12,000. The revised estimate of net realizable value of damaged stock included in closing stock at 2012-13 is ₹ 4000. Find the value of closing stock to be

shown in Profit and Loss Account for the year 2012-13, using provisions of Accounting Standard 5. (May 2013, 5 marks)

Answer:

Provision:

According to AS 5 Net Profit or Loss for the Period, Prior Period Items and Changes In Accounting Policies’, the effect of a change in accounting estimate should be classified using the same classification in the statement of profit and loss as was used previously for the estimate.

It is presumed that the loss by fire in the year ended 31.3.2012, i.e. difference of cost and NRV was shown in the profit and loss account as an extraordinary item. Reduction in estimated net realizable value of damaged stock ₹ 8,000 is the effect of change in accounting estimate.

Analysis and Conclusion:

Thus, in the year 2012-13, revision in accounting estimate should also be classified as extra-ordinary item in the profil and loss account, and closing stock should be shown excluding the value of damaged stock. Value of closing stock for the year 2012-13 will be as follows:

Question 25.

The Accountant of Mobile Limited has sought your opinion with relevant reasons, whether the following transactions will be treated as change in Accounting Policy or not for the year ended 31st March, 2017. Please advise him in the following situations in accordance with the provisions of relevant Accounting Standards:

(i) Provision for doubtful debts was created @ 2% till 31st March 2016. From the Financial year 201 6-2017, the rate of provision has been changed to 3%.

(ii) During the year ended 31st March, 2017, the management has introduced a formal gratuity scheme in place of ad-hoc ex-gratia payments to employees on retirement.

(iii) Till the previous year the furniture was depreciated on straight-line basis over a period of 5 years. From current year, the useful life of furniture has been changed to 3 years.

(iv) Management decided to pay pension to those employees who have retired after completing 5 years of service in the organization. Such employees will get pension of ₹ 20,000 per month. Earlier there was rio such scheme of pension in the organization.

(v) During the year ended 31st March 2017, there was change In cost formula in measuring the cost of inventories. (Nov 2017, 5 marks)

Answer:

AS-5 Changes in Accounting Policies

(i) Creating a provision for doubtful debts is an Accounting Estimate. An Accounting Estimate may have to be revised (a) if there are changes in circumstances on which the estimate was based, or (b) as a result of new information, more experience or subsequent developments. Hence, this is not a change in Accounting Policy.

(ii) Adaptation of an accounting policy for events or transactions that differ in substance from previously occurring events or transactions does not constitute a change in Accounting Policy.

(iii) As per AS 5 & AS 10 PPE, change ¡n the estimate of useful life of fixed assets should be considered as changes Accounting Estimates. Hence, this is not a change in Accounting Policy.

(iv) Adoption of a new Accounting Policy for events or transactions which did not occur previously or that were immaterial does not constitute a change in Accounting Policy.

(v) Change in cost formula in measuring the cost of inventories is a change in Accounting Policy.

Question 26.

M/s POR Ltd. is in the process of finalising its accounts for the year ended 31st March, 2018. The company seeks your advice on the following:

(i) Goods worth ₹ 5,00,000 were destroyed due to flood in September 2015. A claim was lodged with insurance company. But no, entry was passed in the books for insurance claims in the financial year 2015- 16. In March 2018, the claim was passed and the company received a payment of ₹ 3,50,000 against the claim. Explain the treatment of such receipt in final account for the year ended 31st March, 2018.

(ii) Company created a provision for bad and doubtful debts at 2.5% on debtor.., in preparing the financial statements for the year 2017-18.

Subsequently, on a review of the credit period allowed and financial capacity of the customers, the company decides to increase the provision to 8% on debtors as on 31. 03.2018. The accounts were not approved by the Board of Directors till the date of decision. While applying the relevant accounting standard, can this revision be considered as an extraordinary item or prior period item? (May 2018, 5 marks)

Answer:

(i) As per the provisions of AS -5, “Net Profit or Loss for the period, prior period items and changes, In Accounting policies”, prior period items are income or expenses, Which arise, in the current period as a result of error or omissions in the preparation of firtancial statements of one or more prior periods. Further, the nature and amount of prior period items should be separately disclosed in the statement of profit and loss in a manner that their impact on current profit or loss can be perceived.

In the given case, it is clearly a case of error in preparation of financial statements for The year 2015-16, Hence claim received in the financial year 2017-18 is a prior period item and should be separately disclosed in the statement of Profit and Loss.

(ii) As per para 21 of AS 5, “Net Profit or Loss for the period, prior period Items and changes in Accounting policies”, the preparation of financial statements involves making estimates which are based on the circumstances existing at the time when the financial statements are prepared. it may be necessary to revise an estimate in a subsequent period if there is a change in the circumstances on which the estimate was based. Revision of an estimate, by its nature, does not bring the adjustment within definitions of a prior period item or an extraordinary item para 21 of AS 5 (Revised) on Net Profit or Loss for the period, prior period Items, and changes in Accounting Policies).

In the given case, a limited company created 2.5% provision for doubtful debts for the year 2017-18. Subsequently, in 2018 the company revised the estimates based on the changed circumstances and wants to create 8% provision. As per AS -5 (Revised), this change in estimate is neither a prior period item nor an extraordinary item. However, as per para 27 of AS 5 (Revised), a change in accounting estimate which has material effect in the current period, should be disclosed and quantified. Any change in the accounting estimate which is expected to have a material effect in later periods should also be disclosed and quantified.

Question 27.

State whether the following statement is ‘True’ or False’. Also, give reason for your answer.

1. As per the provisions of AS-5, extraordinary items should not be disclosed in the statement of profit arid loss as a part of net profit or loss for the period. (May 2019, 1 mark)

Answer:

This statement is False.

As per AS 5 “Net profit or loss for the period, prior period items and change In accounting policies”. Extraordinary items should be disclosed in the statement of profit and loss as a part of net profit or loss for the period.

![]()

Question 28.

State whether the following items are an example of change in Accounting Policy/Change in Accounting Estimates/Extraordinary items/Prior period items/Ordinary Activity.

(i) Actual bad debts turning out to be more than provisions.

(ii) Change from Cost model to Revaluation model for measurement of carrying amount of PPE.

(iii) Government grant receivable as compensation for expenses incurred in previous accounting period.

(iv) Treating operating ease as finance lease.

(v) Capitalisation of borrowing cost on working capital.

(vi) Legislative changes having long-term retrospective application.

(vii) Change n the method of depreciation from straight line to WDV.

(viii) Government grant becoming refundable.

(ix) Applying 10% depreciation instead of 15% on furniture.

(x) Change in useful life of fixed assets. (Jan 2021, 5 marks)

Question 29.

Explain contract costs as per Accounting Standard -7 related to ‘Construction Contracts’. ( Nov 2009, 2 marks)

Answer:

According to AS 7 “Construction Contracts (revised 2002)”, contract cost should comprise:

- Costs that relate directly to the specific contract;

- Costs that are attributable to contract activity in general and can be allocated to the contract;

- Other costs as are specifically chargeable to the customer under the terms of the contract.

Question 30.

Answer the following:

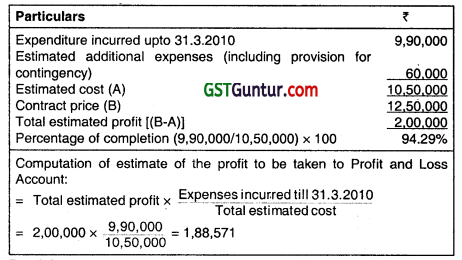

An amount of ₹ 9,90,000 was incurred on a contract work up to 31-3-2010. Certificates have been received to date to the value of ₹ 12,00,000 against which 10,80,000 has been received in cash. The cost of work done but not certified amounted to ₹ 22,500. It is estimated that by spending an additional amount of ₹ 60,000 (including provision for contingencies) the work can be completed in all respects in another two months. The agreed contract price of work is ₹ 12,50,000. Compute a conservative estimate of the profit to be taken to the Profit and Loss Account as per AS-7. (Nov 2010, 4 marks)

Answer:

Computation of Estimated Profit as per AS 7

Provision:

According to AS-7, ‘Construction Contracts’, when the outcome of a construction contract can be estimated reliably, contract revenue and contract costs associated with the construction contract should be recognised as revenue arid expenses respectively by reference to stage of completion of the contract activity at the reporting date.

Analysis and Conclusion:

Therefore estimated profit amounting ₹ 1,88,571 should be recognised as revenue in the statement of profit and loss.

Question 31.

Answer the following:

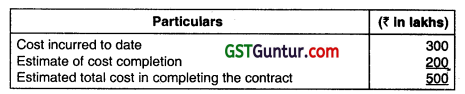

From the following data, show. Profit and Loss A/c (Extract) as would appear in the books of a contractor following Accounting Standard -7:

| (₹ in lakhs) | |

| Contract Price (fixed) | 480.00 |

| Cost incurred to date | 300.00 |

| Estimated cost to complete | 200.00 |

(Nov 2011, 4 marks)

Answer:

Calculation of Estimated Total Cost

Percentage of completion (300/500) x 100 = 60%

Revenue recognized as a percentage to contract price

= 60% of ₹ 480 lakhs = ₹ 288 lakhs

As per para 35 of AS 7 ‘Construction Contracts, when it is probable that total contract costs will exceed total contract reveue, the expected loss should be recognized as an expense immediately. Accordingly, expenses to be recognized in the Profit and Loss Account will be

Question 32.

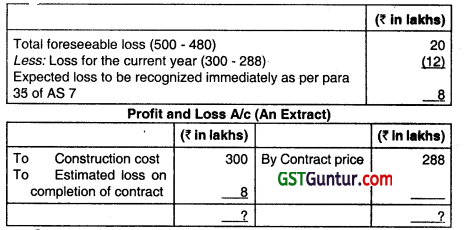

M/s Excellent Construction Company Limited undertook a contract to construct a building for ₹ 3 Crore on 1 ‘ September. 2011. On 31st March, 2012 the company found that it had already spent ₹ 1 Crore 80 Lakhs on the construction. Prudent estimate of additional cost for completion was ₹ 1 Crore 40 Lakhs. What amount should be charged, to revenue in the

final accounts for the year ended on 31 March 2012. as per the provisions of Accounting Standard 7 Construction Contracts (Revised)’? (May 2012, 5 marks)

Answer:

Computation of Estimated Cost of Construction:

Percentage of completion of contract till date to total estimated cost of construction = (1.80/3.20) x 100 = 56.25%

Proportion of total contract price considered as revenue as per AS 7 (Revised) = Contract price x percentage of completion

= 3 crores × 56.25% = 1.6875 crores

Question 33.

M/s. Highway Constructions undertook the construction of a highway on 01.04.2013. The contract was to be completed in 2 years. The contract price was estimated at ₹ 150 crores. Up to 31.03.2014, the company incurred ₹ 120 crores on the construction. The engineers involved in the project estimated that a further ₹ 45 crores would be incurred for completing the work. What amount should be charged to revenue for the year 2013-14 as per the provisions of Accounting Standard 7 Construction Contracts? Show the extract of the Profit & Loss A/c in the books of M/s. Highway Constructions. (May 2014, 5 marks)

Answer:

Question 34.

A construction contractor has a fixed price contract for ₹ 9,000 lacs to build a bridge in 3 years time frame. A summary of some of the financial data is as under:

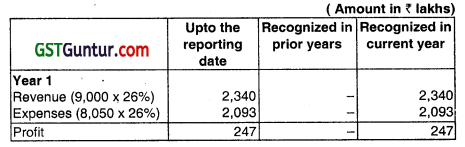

‘Includes ₹ 100 lacs for standard materials stored at the site to be used in year 3 to complete the work. ‘Excludes ₹ 100 lacs for standard material brought forward from year 2. The variation in cost and revenue in year 2 has been approved by customer. Compute year-wise amount of revenue, expenses, contract cost to complete and profit or loss to be recognized in the Statement of Profit and Loss as per AS-7 (revised). (May 2015, 5 marks)

Answer:

The amounts of revenue, expenses and profit recognized in the statement of profit and loss in three years are shown below:

Question 35.

Uday Constructions undertake to construct a bridge for the Government of Uttar Pradesh. The construction commenced during the financial year ending 31.03.2016 and is likely to be completed by the next financial year. The contract is for a fixed price of ₹ 12 crores with an escalation clause. The costs to complete the whole contract are estimated at Z 9.50 crores

of rupees. You are given the following information for the year ended 31.03.2016:

Cost incurred upto 31.03.2016 ₹ 4 crores

Cost estimated to complete the contract ₹ 6 crores

Escalation in cost by 5% and accordingly the contract price is increased by 5%.

You are required to ascertain the state of completion and state the revenbe and profit to be recognized for the year as per AS-7. (May 2016, 5 marks)

Answer:

Stage of completion

Percentage of completion till date to total estimated cost of construction

= (4/10) x 100

= 40%

Revenue and Profit to be recognized for the year ended 31st March, 2016 as per AS-7

Proportion of total contract value recognized as revenue = Contract price × percentage of completion = ₹ 12.60 crore x 40% ₹ 5.04 crore

Profit for the year ended 31st March, 2016 = ₹ 5.04 crore less ₹ 4 crore = 1.04 crore.

![]()

Question 36.

GTI Ltd. negotiates with Bharat Oil Corporation Ltd. (BOCL), for construction of Retail Petrol and Diesel Outlet Stations. Based on proposals submitted to different Regional Offices of BOCL, the final approval for one outlet each in Region X, Region Y, Region Z is awarded to GTI Ltd. A single agreement is entered into between two. The agreement lays down values for each of the three outlets i.e. ₹ 102 Lakhs, ₹ 150 Lakhs,₹ 130 Lakhs for Region X, Region Y., Region Z respectively. Agreement also lays down completion time for each Region. Comment whether GTI Ltd. will treat it as single contract or three separate contracts with reference to AS-7? (Nov 2016, 5 marks)

Answer:

Provision:

As per AS-7 ‘Construction Contracts’ when a contract covers a number of assets, the construction of each asset should be treated as a separate contract when:

- separate proposals have been submitted for each asset;

- each asset has been subject to separate negotiation and the contractor and customer have been able to accept or reject that part of the contract relating to each asset; and

- the costs and revenues of each asset can be identified.

Analysis:

In the given case, GTI Ltd. negotiates with Bharat Oil Corporation Ltd. Separate proposal is submitted for each construction, though a single agreement is entered between the two. Also values for each contract is demanded separately such as ₹ 102 Lakhs,₹ 150 Lakhs, and ₹ 130 Lakhs for Region X, Region Y, and Region Z respectively.

Conclusion:

Thus, GTI Ltd. is required to treat construction of each unit as separate construction contract. Therefore, three separate contract accounts must be recorded and maintained in the books of GTI Ltd. For each contract principles of revenue and cost recognition must be applied separately and net income will be determined for each asset as per AS-7.

Question 37.

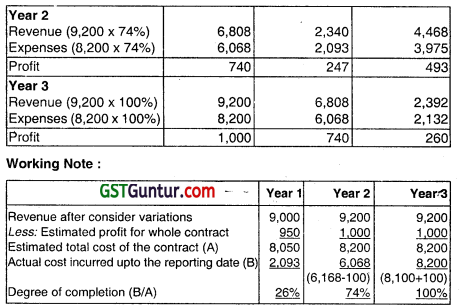

Akar Ltd. signed on 01/04116, a construction contract for 1.50,00.000. Following particulars are extracted in respect of contract, for the period ending 31/03/17.

Materials issued ₹ 75,00,000

Labour charges paid ₹ 36,00,000

Hire charges of plant ₹ 10,00,000

Other contract cost incurred ₹ 15,00,000

Out of material issued, material lying unused at the end of period is ₹ 4,00,000

Labour charges of ₹ 2,00,000 are still outstanding on 31.3.17. It is estimated that by spending further ₹ 33,50,000 the work can be completed in all respect.

You are required to compute profit-loss to be taken to Profit and Loss Account and additional provision for foreseeable loss as per AS-7. (May 2017, 5 marks)

Answer:

Computation of Amount to be charged to P & L and Additional Provision (As per AS-7)

Question 38.

Santa Construction Co. obtained a contract for construction of a dam. The following details are available in records of company for the year ended 31st March 2018:

₹ in lakhs

Total Contract Price 12,000

Work Certified 6,250

Work not certified 1,250

Estimated further cost to completion 8.750

Progress payment received 5,500

Progress payment to be received 1,500

Applying the provisions of Accounting Standard 7 “Accounting for Construction Contracts” you are required to compute:

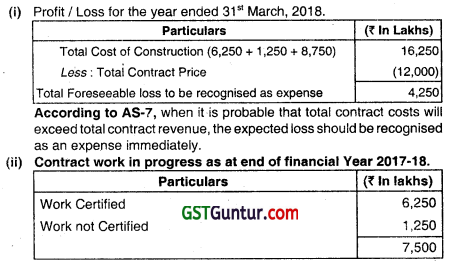

(i) Profit/Loss for the year ended 31st March 2018.

(ii) Contract work in progress as at end of financial year 2017-18.

(iii) Revenue to be recognized out of the total contract value.

(iv) Amount due from/to customers as at the year end. (May 2018, 5 marks)

Answer:

This is 46.15% (7,500/16,250 x 100) of total costs of construction.

(iii) Revenue to be recognised out of the total contract Value 46.15% of ₹ 12,000 Lakhs = ₹ 5,538 Lakhs.

(iv) Amount due from/to customers as at the year end Amount due from / to customers = (Contract Costs + Recognised Profits – Losses) – (Progress Payments Received + Progress Payments to be Received)

= (7,500 + Nil – 4,250) – (5.500 + 1,500) ₹ in Lakhs

= [3,250 – 7,000] ₹ in Lakhs

Amount due to customers = ₹ 3.750 lakhs

The amount of ₹ 3,750 Lakhs will be shown in the balance sheet as liability.

Question 39.

Answer the following questions:

(i) AP Ltd., a construction contractor, undertakes the construction of commercial complex for Kay Ltd. AP Ltd. submitted separate proposals for each of 3 units of commercial complex. A single agreement is entered into between the two parties. The agreement lays down the value of each of the 3 units, i.e. ₹ 50 Lakh. ₹ 60 Lakh and ₹ 75 Lakh respectively. Agreement also lays down the completion time for each unit. Comment, with reference to AS-7, whether AP Ltd., should treat it as a single contract or three separate contracts.

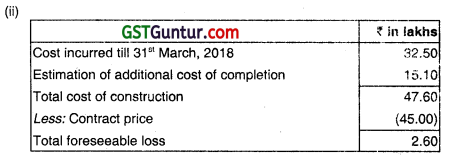

(ii) On 1st December 2017. GR Construction Co. Ltd. undertook a contract to construct a building for ₹ 45 lakhs. On 31st March, 2018. the company found that it had already spent ₹ 32.50 lakhs on the construction. Additional cost of completion Is estimated at ₹ 15.10 lakhs. What amount should be charged to revenue in the final accounts for the year ended 31 March 2018 as per provisions of AS-7? (May 2019, 5 marks)

Answer:

(i) As per AS 7 ‘ConstructIon Contracts’, when a contract covers a number of assets, the construction of each asset should be treated as a separate construction contract when:

(a) separate proposals have been submitted for each asset;

(b) each asset has been subject to separate negotiation and the contractor and customer have been able to accept or reject that part of the contract relating to each asset; and

(c) the costs and revenues of each asset can be identified. Therefore, AP. Ltd. is required to treat construction of each unit as a separate construction contract.

According to AS 7, the amount of ₹ 2.60 lakh is recognised as an expense.

Contract work ¡n progress = \(\frac{₹ 32.50 \text { lakhs } \times 100}{₹ 47.60 \text { lakhs }}\) = 68.28%

Proportion of total contract value recognised as turnover.

= 68.28% of ₹ 45 lakhs

= ₹ 30.726 lakhs

Question 40.

Answer the following:

Rajendra undertook a contract for ₹ 20,00,000 on an arrangement that 80% of the value of work done as certified by the architect of the contractee, should be paid immediately and that the remaining 20% be retained until the Contract was completed. In Year 1st the amounts expended were ₹ 8,60,000, the work was certified for ₹ 8,00,000, and 60% of this was paid as agreed. It was estimated that future expenditure to complete the Contract would be ₹ 10,00,000. In Year 2, the amounts expended were ₹ 4,75,000, Three-fourths of the Contract was certified as done by December 31st and 80% of this was received accordingly.

It was estimated that future expenditure to complete the Contract would be ₹ 4,00,000. In Year 3, the amounts expended were ₹ 3,10,000 and on June whole Contract was completed. Show how Contract revenue would be recognized in the P & L A/c of Mr. Rajendra each year. (Nov 2020, 5 marks)

Question 41.

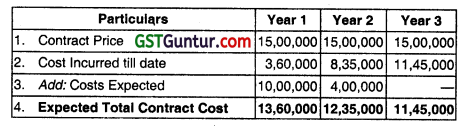

X Undertook a Contract for ₹ 15,00,000 on an arrangement that 80% of the value of work done as certified by the architect of the Contractee, should be paid immediately and that the remaining 20% be retained until the Contract was completed.

In Year 1, the amounts expended were ₹ 3,60,000, the work was certified for ₹ 3,00,000 and 80% of this was paid as agreed. It was estimated that future expenditure to complete the Contract would be ₹ 10,00,000. In Year 2, the amounts expended were ₹ 4,75,000. Three-fourths of the Contract was certified as done by December 31st and 80% of this was received accordingly. It was estimated that future expenditure to complete the Contract would be ₹ 4,00,000. In Year 3, the amounts expended were ₹ 3,10,000 and on June 30th the whole Contract was completed. Show how Contract Revenue would be recognised in the P&L A/c each year.

Answer:

Question 42.

XYZ & Co. a Firm of Contractors, obtained a Contract for Construction of bridges across the river Revathi. The following details are available m the records kept for the year ending 31 March. (information ₹ Lakhs)

| Total Contract Price 1000 | Progress Payment Received 400 |

| Costs incurred till date 605 | Progress Payment to be Received 140 |

| Estimated further Cost to Completion 495 |

The Firm seeks your advice and assistance in the presentation of accounts keeping in view the requirements of AS – 7

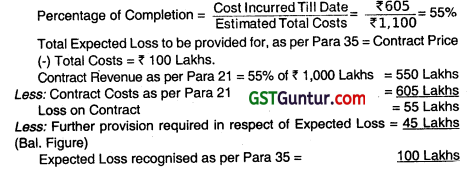

Answer:

Amount due from /to customers = Contract Costs + Recognised Profits (-) Recognised Losses (-) Progress Billings

= 605 + Nil (-) 100 (-) 540 = (35) Lakhs

Amount Due to Customers.

This amount of ₹ 35 Lakhs will be shown in the Balance Sheet as a Liability.

Note: Progress Billings = Payments Received + Payments billed but not received.

Question 43.

XYZ Construction Co. Ltd. undertook a contract on 1st January to construct a building for ₹ 80 Lakhs. The Company found on 31st March that it had already spent ₹ 58,50,000 on the construction. Prudent estimate of additional cost for completion was ₹ 31,50,000.

What amount should be charged to Revenue and what amount of Contract Value to be recognized as Turnover in the accounts for the year ended 31st March as per provisions of AS-7?

Answer:

Estimated Total Contract Costs Cost till date + Further Costs = ₹ 58,50,000 + ₹ 31,50,000 = ₹ 90,00,000

Percentage of Completion = \(\frac{\text { Cost Incurred Tili Date }}{\text { Estimated Total Costs }}=\frac{₹ 58.50}{₹ 90.00}\) = 65%

Total Expected Loss to bo provided oi = Contract Price (-) Total Costs

₹ 80 (-) ₹ 90 = ₹ 10,00,000.

Contract Revenue as per Para 21 = 60% of ₹ 80 Lakhs = ₹ 52,00,000

(Contract Revenue to be recognized)

![]()

Question 44.

XYZ Ltd. undertook a Contract for building a Crane for ₹ 10 Lakhs. As on 31st March of a financial year, it incurred a cost of ₹ 1.50 Lakhs and expects that ₹ 9 Lakhs more will be required for completing the crane it has received so far ₹ 1.20 Lakhs as Progress Payment. Discuss the treatment of the above under AS-7.

Answer:

Percentage of Completion = \(\frac{\text { Cost Incurred Till Date }}{\text { Estimated Total Costs }}=\frac{₹ 1.50}{₹ 10.50}\) = 14.29%

Total Expected Loss to be provided for, as per Para 35= Contract Price (-) Total Costs = ₹ 0.50 Lakhs.

Contract Revenue as per Para 21 = 14.29% of ₹ 10 Lakhs = 1.43 Lakhs

Less: Further provision required in respect of Expected Loss = 0.43 Lakhs (Bal. Figure)

Expected Loss recognised as per Para 35 = 0.50 Lakhs

Amount due from / to customers = Contract Costs + Recognised Profits (-) Recognised Losses (-) Progress Billings

= 1.50 + Nil (-) 0.50 (-) 1.20 = (0.20)

Lakhs Amount Due to Customers.

This amount of ₹ 0.20 Lakhs will be shown in the Balance Sheet as a Liability.

Question 45.

Answer the following:

Y Ltd. used certain resources of X Ltd. In return, X Ltd. receives ₹ 10 lakhs and ₹ 15 lakhs as interest and royalties respectively, from Y Ltd. during the year 2007-08. State on what basis X Ltd. should recognize their revenue, as per AS 9. (Nov 2008, 2 marks)

Answer: –

According to AS-9 on Revenue Recognition, Interest of ₹ 10 lakhs received In the year 2007-08 should be recognized on the time proportion basis taking into account the amount outstanding and the rate applicable; whereas royalty of ₹ 15 lakhs received in the same year should be recognized on accrual basis as per the terms of relevant agreement.

Question 46.

According to Accounting Standard-9, when revenue from sales should be recognised? (May 2010, 2 marks)

Answer:

According to AS 9 ‘Revenue Recognition’, revenue from sales should be recognized only when requirements as to performance are satisfied provided that at the time of performance, it is not unreasonable to expect ultimate collection. These requirements can be given as follows:

(i) The seller of goods has transferred to the buyer the property in the goods for a price or all significant risks and rewards of ownership have been transferred to the buyer and the seller retains no effective control of the goods transferred to a degree usually associated with ownership; and

(ii) No significant uncertainty exists regarding the amount of the consideration that will be derived from the sale of the goods.

Question 47.

Answer the following:

M/s. SEA Ltd. recognized ₹ 5.00 lakhs on accrual basis Income from dividends during the year 2010-11. on shares of the lace value of ₹ 25.00 lakhs held by it in Rock Ltd. as at 3V March, 2011. Rock Ltd. proposed dividend @ 20% on 10m April, 2011. However, dividend was declared on 30th June, 2011. Please state with reference to relevant Accounting

Standard, whether the treatment accorded by SEA Ltd. is in order. (Nov 2011, 4 marks)

Answer:

Provision:

According to para 8.4 of AS-9 “Revenue Recognition, dividends from investments in shares are not recognized in the statement of Profit and Loss until the right to receive dividends is established.

Analysis and Conclusion:

In the given situation the dividend is proposed on 10th April, 2011. while it was declared on 30 June, 2011. Hence, the right to receive dividend is established on 30 June, 2011 only. Therefore, on applying the provisions stated In the standard, income from dividends on shares should be recognized by Sea Ltd. in the financial year 2011-2012 only. Therefore, the recognition of income from dividend of ₹ 5 lakhs. on accrual basis, in the financial year 2010-11 is not in accordance with AS-9.

Question 48.

Answer the following;

(d) M/s. Moon Ltd. sold goods worth ₹ 6,50,000 to Mr. Star. Mr. Star asked for a trade discount amounting to ₹ 53,000 and same was agreed to by M/s. Moon Ltd. The sales was effected and goods were dispatched. On receipt of goods. Mr. Star has found that goods worth ₹ 67,000 are defective. Mr. Star returned defective goods to M/s. Moon Ltd. and made payment due amounting to ₹ 5,30.000. The account art of M/s. Moon Ltd. booked the sale for ₹ 5.30,000. Discuss the contention of the accountant with reference to Accounting Standard (AS) 9. (May 2013, 4 marks)

Answer:

Provisions

As per AS-9, Revenue Recognition, revenue is the gross inflow of cash, receivable or other consideration arising in the course of the ordinary activities of an enterprise from the sale of goods. However, trade discounts and volume rebates given in the ordinary course of business should be deducted in determining revenue. Revenue from sales should be recognized at the time of transfer of significant risks and rewards. the delivery of the sales is not subject to approval from customers, then the transfer of significant risks and rewards would take place when the sale is affected and goods are dispatched.

Analysis and Conclusion:

In the given case, if trade discounts allowed by Mis. Moon Ltd. are given in the ordinary course of business, M/s. Moon Ltd. should record the sales at ₹ 5,97000 (i.e. ₹ 6,50,000 – ₹ 53,000) and goods returned worth ₹ 67,000 are to be recorded ¡n the form of sales return.

However, when trade discounts allowed by M/s. Moon Ltd. is not In the ordinary course of business, M/s. Moon Ltd. should record the sales at gross value of ₹ 6,50,000. Discount of ₹ 53,000 in price and return of goods worth ₹ 67,000 are to be adjusted by suitable provisions. M/s Moon Ltd. might have sent the credit note of ₹ 1,20,000 to Mr. Star to account for these adjustments. In both the cases, the contention of the accountant to book the sales for ₹ 5,30,000 is not correct.

Question 49.

A Ltd. entered into a contract with B Ltd. to desptch goods valuing ₹ 25,000 every month for 4 months upon receipt of entire payment. B Ltd. accordingly made the payment of ₹ 1,00,000 and A Ltd. started despatching the goods. In third month, due to a natural calamity. B Ltd. requested A Ltd. not to despatch goods until further notice though A Ltd. is holding the remaining goods worth ₹ 50,000 ready for despatch. A Ltd. accounted ₹ 50,000 as sales and transferred the balance to Advance Received against Sales. Comment upon the treatment of balance amount with reference to the provisions of Accounting Standard 9. (Nov 2013, 5 marks)

Answer:

Analysis:

According to AS-9, Revenue Recognition, in a transaction involving the sale of goods, performance should be regarded as being achieved when the following conditions are fulfilled:

(i) the seller of goods has transferred to the buyer the property in the goods for a price or all significant risks and rewards of ownership have been transferred to the buyer and the seller retains no effective control of the goods transferred to a degree usually associated with ownership; and

(ii) no significant uncertainty exists regarding the amount of the consideration that will be derived from the sale of the goods.

Conclusion:

In the given problem transfer of property in goods results in or coincides with the transfer of significant risks and rewards of ownership to the buyer. Also, the sale price has been recovered by the seller. Hence, the sale is complete but delivery has been postponed at buyer’s request. A Ltd. should recognize the entire sale of ₹ 1,00,000 (₹ 25,000 × 4) and no part of the same is to be treated as Advance Receipt against Sales.

Question 50.

Santa publishes a monthly magazine on the ir of every month. it sells advertising space in the magazine to advertisers on the terms of 80% sale value payable in advance and the balance within 30 days of the (elease of the publication, The sale of space for the March, 2014 issue was made in February 2014. The magazine was published on its scheduled date. It received ₹ 2,40,000 on 10.3.2014 and ₹ 60,000 on 10.4.2014 for the March 2014 issue. Discuss in the context of AS 9 the amount of revenue to be recognized and the treatment of the amount received from advertisers for the year” ending 31.3.2014. What will be the treatment f the publication is delayed till 2.4.2014? (Nov 2014, 5 marks)

Answer:

According to AS-9, ‘Revenue Recognition’, in a transaction involving the rendering of services, performance should be measured either under the completed service contract method or under the proportionate completion method as the service Is performed, whichever relates the revenue to the work accomplished.

In this case, income accrues when the related advertisement appears before public. The advertisement service would be considered as performed on the day the advertisement is seen by public and hence revenue is recognized on that date, so in this case, it is 15.03.2014, the date of publication of the magazine.

Therefore, ₹ 3,00,000 (₹ 2,40,000 + ₹ 60,000) is recognized as income in March 2014. The terms of payment are not relevant for considering the date on which revenue is to be recognized. ₹ 60,000 is treated as amount due from advertisers as on 31.032014 and ₹ 2,40,000 will be treated as payment received against the sale.

Whereas, if the publication is delayed till 02.04.2014 revenue recognition will also be delayed till the advertisements get published in the magazine. In such case revenue of ₹ 3,00,000 will be recognized for the year ended 31.3.2015 after the magazine is published on 02.04.2014. The amount received from sale of advertising space on 10.03.2014 of ₹ 2,40,000 will be considered as an advance from advertisers as on 31.03.2014.

Question 51.

Answer the following:

Given the following information of M/s. Paper Products Ltd.

(i) Goods of ₹ 60,000 were sold on 20-3-2015 but at the request of the buyer these were delivered on 10-4-2015.

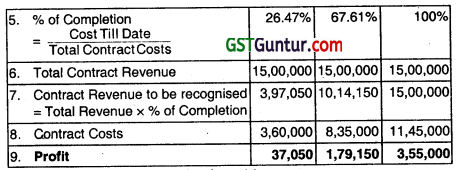

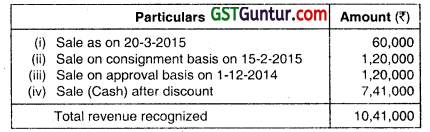

(ii) On 15-1-20 15 goods of ₹ 150,000 were sent on consignment basis of which 20% of the goods unsold are lying with the consignee as on 31-3-2015.

(iii) ₹ 1,20,000 worth of goods were sold on approval basis on 1-12- 2014. The period of approval was 3 months after which they were considered sold. Buyer sent approval for 75% goods up to 31-1-2015 and no approval or disapproval received for the remaining goods till 31-3-2015.

(iv) Apart from the above, the company has made cash sales of ₹ 7,80,000 (gross). Trade discount of 5% was allowed on the cash sales.

You are required to advise the accountant of M/s. Paper Products Ltd., with vahd reasons, the amount to be recognized as revenue in above cases in the context of AS-9 arid also determine the total revenue to be recognized for the year ending 31-3-2015. (May 2015, 4 marks)

Answer:

(i) As per AS-9 “Revenue Recognition”, in a transaction involving the sale goods, performance should be regarded as being achieved when the following conditions are fulfilled:

(a) the seller of goods has transferred to the buyer the property in the goods for a price or an significant risks and rewards of ownership have been transferred to the buyer and the Soller retains no effective control of the goods transferred to a degree usually associated with ownership; and

(b) no significant uncertainty exists regarding the amount of the consideration that will be derived from the sale of the goods. In this transaction, the buyer sold goods of ₹ 60,000 on 20-3-2015 but at the request of the buyer these were delivered on 10-4-2015. As per AS-9, goods sold by company the right becomes to revenue recognised whether, the actual physical delivery of goods taken place or not. So here ₹ 60,000 of revenue is to be recognised as Sales in Trading A/c.

(ii) As per AS-9, if the goods are sent on consignment basis and if the agent sells them to third party then only the revenue is recognised by consignor. So here, goods of ₹ 1,50,000 sent on consignment and only 80% goods were sold. Thus, sales recorded will be only ₹ 1,20,000 In Trading A/c as per AS-9.

(iii) As per AS-9, revenue should be recognised on sale on approval basis as follows:

Revenue shall be recognised if the buyer formally accepted the goods. Revenue shall also be recognised lithe period of rejection has elapsed or where no time has been fixed or a reasonable time has elapsed. Here, total goods worth ₹ 1,20,000 are sold to customers on 1-12- 2014, on approval period of 3 months. Buyer sent approial for 75% goods up to 31-1-2015 and no approval or disapproval received for the remaining goods tIll 31-3-2015. As the approval time is elapsed on 31-3-2015, so all the goods sold on’ 1-12-2014 is to be considered as sales. So, ₹ 1,20,000 to be shown in Trading P&L A/c as sales as on 31- 3-2015.

(iv) Apart, from above the company has made cash sales of ₹ 7,80,000 (gross). Trade discount of 5% aHowed or, cash sales, so sale to be recorded as 7,80,000 – 39,000 = ‘ ₹ 7,41,000.

Calculation for total revenue to be recognised for the year endin9 31-3-2015

![]()

Question 52.

M/s Umang Ltd. sold goods through its agent. As per terms of sales, consideration is payable within one month. In the event of delay in payment, interest is chargeable @ 12% p.a. from the agent. The company has not realized interest from the agent in the past. For the year ended 31st March, 2015 interest due from agent (because of delay in payment) amounts to ₹ 1,72,000. The accountant of M/s Umang Ltd. booked ₹ 1,72,000 as interest income in the year ended 31st March, 2015. Discuss the contention of the accountant with reference to Accounting Standard-9. (Nov 2015, 5 marks)

Answer:

As per AS-9 “Revenue Recognition”, where the ability to assess the ultimate collection with reasonable certainty is lacking at the time of rising any claim, the revenue recognition is postponed to the extent of uncertainty. In such cases, the revenue is recognised only when it is reasonably certain that the ultimate collection will be made.

So in this case M/s Urnang Ltd. never realised interest for the delayed payments made by the agents. Hence. it has to recognize the interest onty If the ultimate collection is certain. The interest income of ₹ 1,72,000 is not be recognised in the year ended 31st March, 2015. So the contention of the accountant is wrong. It should not recognize it as interest income in the books of account for year ended 31st March, 2015.

Question 53.

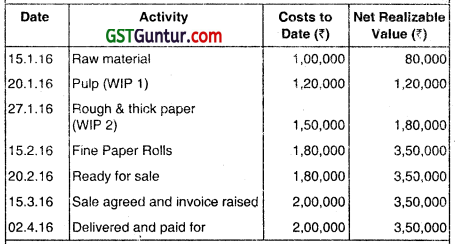

A manufacturing company has the following stages of production and sak in manufacturing Fine paper rolls:

Explain the stage on which you think revenue will be generated and State how much would be net profit for year ending 31-3-16 on this product according to AS-9. (Nov 2016, 5 marks)

Answer:

Provision:

As per AS-9 ‘Revenue Recognition’ revenue in terms of sales could be recognised only when ownership has been passed by the seller to the buyer and there is no uncertainty regarding collection of consideration (sale proceeds) and it is reasonable to expect ultimate collection at the time of performance. Thus, sales will be recognized only when following two conditions are satisfied:

(i) The sate value is tixed and determinable.

(ii) Property 01 the goods is transferred to the customer.

Analysis:

In the given situation, company has sold goods and raised invoice on 15.3.16 and goods are ready for delivery. In that case company is entitled to recognise sale for the year ended 31.3.2016. provided delay in delivery is due to buyer’s request.

Calculation of NP Is as under:

Question 54.

Raj Ltd. entered into an agreement with Heena Ltd. to dispatch goods valuing ₹ 5,00,000 every month for next 6 months on receipt of entire payment. Heena Ltd. accordingly made the entire payment of ₹ 30,00,000 and Raj Ltd. started dispatching the goods. In fourth month, due to fire in premises of Heena Ltd.. Heena Ltd. requested to Raj Ltd. not to dispatch goods untill further notice. Due to this, Raj Ltd. is holding the remaining goods worth ₹ 15,00,000 ready for dispatch. Raj. Ltd. accounted ₹ 15.00,000 as sales and transferred the balance to Advance received against Sales account. Comment upon the above treatment by Raj Ltd. with reference to the provision of AS-9. (May 2017, 5 marks)

Answer:

As per AS-9 “Revenue Recognition”, in a transaction involving the sale of goods, performance should be regarded as being achieved when the following conditions are fulfilled: