Government Audit and Audit of Local Bodies – CA Inter Audit Questions bank is designed strictly as per the latest syllabus and exam pattern.

Government Audit and Audit of Local Bodies – CA Inter Audit Question Bank

Question 1.

State with reasons (in short) whether the following statement Is true or false. ComptroIer and Auditor General of India can be removed by the Prime Minister of India on the recommendation of his Counc of Ministers. (Nov 2009, 2 marks)

Answer:

False:

The Comptroller and Auditor General of India cannot be removed by the Prime Minister of India himself or on the recommendation of his Council of Ministers. He can be removed on the ground of proven misbehaviour Or incapacity, when each House of Parliament decides to do so by majority of not less than 2/3 of the members of the house present and voting.

Question 2.

What is the function of audit while examining various rules, regulations and orders with regard to Audit against Rules & Orders by C & AG? (Nov 2020, 3 marks)

Question 3.

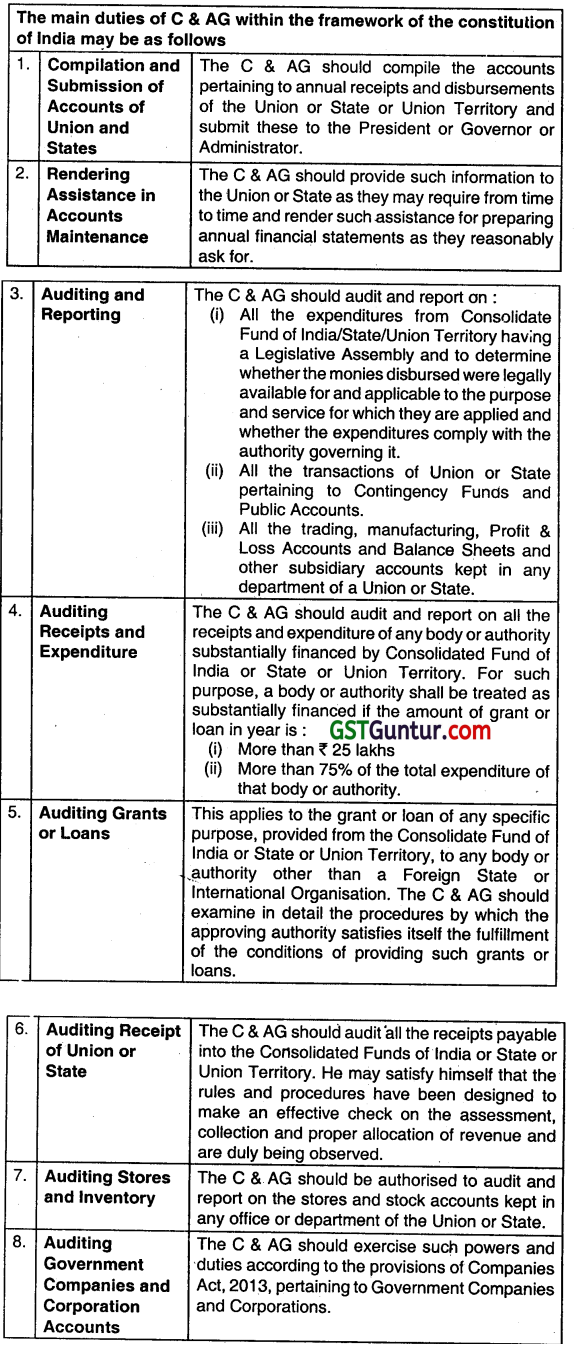

What are the duties of-Comptroller and Auditor General? (Nov 2012, 10 marks)

Answer:

Question 4.

Write short note on the Power of Comptroller and Auditor General of India performance of duties. (Nov 2014, 4 marks)

Answer:

Power of CAG under Sec. 143 of Companies Act, 2013

As per Sec. 143(5)

In the case of a Government Company or any other company owned or controlled, directly or indirectly, by the Central Government, or by any State Government or Government, or partly by the Central Government and partly by one or more State Government, the comptroller and Auditor-General of India shall appoint the auditor under sub-section (5) or sub-section (7) of Sec.1 39 and direct such auditor the manner in which the accounts of the company are required to be audited and thereupon the auditor so appointed shall submIt a copy of the audit report to the Comptroller and Auditor-General of india which, among other things, indude the directions, if any, issued by the Comptroller and Auditor-General of India, the action taken thereon and its impact on the accounts and financial statement of the company.

As per Sec. 143(6)

The Comptroller and Auditor-General of India shall within sixty days from the date of receipt of the audit report under sub-Sec. (5) have a right to:

(a) conduct a supplementary audit of the financial statement of the company by such person o persons as he may authonse in this behalf; and for the purposes of such audit, require information or additional information to be furnished to any person or persons, so authorised, on such matters, by such person or persons, and in such form, as the Comptroller and Auditor-General of India may direct; and

(b) comment upon or supplement such audit report: Provided that any comments given by the Comptroller and Auditor- General of India upon, or supplement to the audit report shall be sent by the company to every person entitled to copies of audited financial statements under sub-Sec. (1) of Sec. 136 and also be placed before the annual general meeting of the company at the same time and in the same manner as the audit report.

As per Sec. 143(7)

Without prejudice to the provisions of this Chapter, the Comptroller and Auditor-General of India may. in case of any company covered under sub-Sec. (5) or sub-Sec. (7) of Sec. 139, if he considers necessary, by an order, cause test audit to be conducted of the accounts of such company and the provisions of Sec. 19A of the Comptroller and Auditor- General’s (Duties, Powers and Conditions of Service) Act, 1971(56 of 1971), shall apply to the report of such test audit.

![]()

Question 5.

Examine with reasons whether the following statements are correct or in correct:

Bhartiya Gas Ltd. a Government Company, the Comptroller and Auditor General of India shall, in respect of a financIal year, appoint an auditor duly qualified to be appointed as an auditor of companies under this Act, within a period of 180 days from the end of the financial year. who shall hold office till the end of the next Financial Year. (May 2019, 2 marks)

Answer:

This Statement ¡s Incorrect:

In case of Bhartiya Gas Ltd. a Government Company, the Comptroller and Auditor – General of India, shall in respect of a fInancial year, appoint an auditor duly qualified to be appointed as an auditor of companies within a period of 180 days from the commencement of the financial year, who shall hold office till the conclusion of the annual general meeting. [Sec. 139(5), of the Companies Act. 2013].

Question 6.

Discuss the power of C & AG in Government audit. (May 2019, 3 marks)

Answer:

Power of C & AG In Government Audit:

- To inspect any office of accounts under the control of the Union or a State Government including office responsible for the creation of the initial or subsidiary accounts.

- To require that any accounts, books, papers and other documents which deal with or are otherwise relevant to the transactions under audit, be sent to specified places.

- To put such questions or make such observations as he may consider necessary to the person in charge of the office and to call for such information as he may require for the preparation of any account or report which is his duty to prepare.

- In carrying out the audit, the C & AG has the power to dspense with any part ol detailed audit of any accounts or class of transactions and to apply such limited checks in relation to such accounts or transactions as he may determine.

Question 7.

Write short note on Audit against Rules and Orders. (May 2008, 5 marks)

Answer:

The auditor has to ensure that the expenditure incurred complies with the relevant provisions of the legal enactment and is according to the financial rules and regulations framed by the competent authority.

Rules and Orders: The rules, regulations and orders against which regularity audit is conducted mainly taU under the following categories:

1. Expenditure from consolidated fund and the contingency fund of India or State.

2. Presentation of claims against Government, withdrawing money from the consolidated fund, Contingency fund and Public Accounts of India/State, and in general the financial rules prescribing the detailed procedure to be followed by Government servants in dealing with Government transactions; and

3. Rules and Orders regulating the conditions of service, Pay arid Allowances and pensions of Government servants. It is the function of the executive Government to frame rules, regulations and orders, which are to be observed by its subordinate authorities.

The function of Audit is to carry out examination of various rules, regulations and orders issued by the executive Authorities to see that:

- They are not inconsistent with any provisions of the Constitution or any laws made there under;

- They are consistent with the essential requirements of audit & accounts as deiermined by the C & AG;

- They do not come n conflict with the orders of, or rules made by any higher authority; and

- In case they have not been separately approved by competent authority, the issuing authority possesses the necessary rule making power.

Question 8.

Write short note on Audit of expenditure in Government audit. (May 2011, 4 marks)

OR

Write short note on Basic standards sel for audit of government expenditure. (Nov 2013, 4 marks)

Answer:

Audit of Government Expenditure:

Audit of expenditure of government organisation or department is conducted by the Comptroller and Auditor General (C & AG) of India. It is a major constituent of the government audit. The basic standards established for expenditure audit are to confirm that there is provision for funds authonsed by the competent authority setting the limits withir. which expenditure can be incurred. These standards are as follows:

1. Audit against Rules and Order: The expenditure incurred complies with the relevant provisions of the law and according to the Financial Rules and Regulation constructed by the competent authority. Such audit is known as Audit against Rules and Orders.

2. Audit of Sanctions: There is either special or general sanction allowed by the competent authority authorising the expenditure. Such an audit is known as audit of sanctions.

3. Audit against Provisions for Funds: There is provision for funds out of which expenditure is ncurred and also it is authorised by the competent authority. Such audit is known as audit against provision for funds.

4. Proprietary Audit: The expenditure has been incurred with due regards to the broad and general principles of the financial propriety. Such audit is known as propriety audit.

5. Performance Audit: Various programmes, schemes and projects in which huge financial expenditures have been incurred or being run economically and are yielding results expected from them. Such audit is known as performance audit.

The propriety audit and performance audit suggest completely, a different approach, adopted by the C & AG as against the regulatory audit.

In propriety audit the C & AG brings out the cases of avoidable, improper or unfruitful expenditure even though the expenditure has been incurred in compliance with the existing rules and regulations.

Performance audit goes even a step ahead and has a quite comprehensive approach as it includes 3 Es. i.e. efficiency, economy and effectiveness.

![]()

Question 9.

What are the focus points in doing propriety audits by C & AG as regards government expenditure? (Nov 2011, 8 marks)

OR

Discuss the Audit against the propriety seeks to ensure that expenditure confirms to certain principles. (Nov 2016, 5 marks)

Answer:

Propriety Audit:

Propriety audit is concerned with a close examination of executive decisions, which have bearing on the financial position, and the profit and loss situation of the company regarding especially the public interest and commonly accepted practices and standards of conduct. While performing a propiety audit, the auditor shouki examine whetherthe propriety standards have been maintained in making payments incurring expenditure or entering into a transaction. In propriety audit, the auditor tries to brng out the cases of avoidable, improper and unfruitful expenditure even though the expenditure has been incurred in compliance with the existing rules and regulations.

It is difficult to frame any precise rules and regulations for regulating the course of audit against propriety. Such purpose of audit depends upon its acceptance on its appeal made to the common sense and straight logic of the auditors and whose financial transaction subject to propriety audit.

However, audit c.de lays down some general principle which have been recognised for long as Financial Propriety Standards. Audit against propriety endeavor to ensure that the expenditure comply to the principle as stated below:

1. The expenditure must not be prima facie more than except in the occasions demanded. Each and every public officer is expected to maintain the same alertness with respect to the expenditure incurred from public amounts as a person of ordinary prudence would do with respect to the expenditure of his own amount.

2. No authority should use its powers of approving expenditure to pass an order which will be directly or Indirectly to its own advantage.

3. Public amounts should not be used in the favour of a particular person or section of the community until and unless:

- The expenditure amount involved is in significant, or

- A claim for the amount could be enforced in the Tribunal of law, or

- The expenditure is n pursuance of a recognised policy or custom, and

- The allowances amount such as travelling allowances, provided to meet expenditure of a particular type, should be regulated that the allowances are not wholly the sources of profit to the recipients.

It may be expressed that the executive departments are responsible for enforcing economy in public expenditure. The function of auditor is to bring into the notice of the proper authorities, the wastage In public administration and the case of avoidable, improper and unfruitful expenditure. The main focus of Propriety Audit is to identity cases of improper, avoidable or Infructuous expenditure even though the expenditure has been incurred in conformity with the existing rules and regulations. This will ensure a reasonably high standard of public financial morality when Auditors look into the wisdom, faithfulness and economy, faithfulness and economy of transactions.

Question 10.

Write short note on Propriety audit. (Nov 2017, 4 marks)

Answer:

Propriety Audit:

Propriety audit is concerned with a close examination of executive decisions, which have bearing on the financial position, and the profit and loss situation of the company regarding especially the public interest and commonly accepted practices and standards of conduct. While performing a propriety audit, the auditor should examine whether the propriety standards have been maintained in making payments incurring expenditure or entering Into a transaction.

In propriety audit, the auditor tries to bring Out the cases of avoidable, improper and unfruitful expenditure even though the expenditure has been incurred in compliance with the existing rules and regulations. It is difficult to frame any precise rules and regulations for regulating the course of audit against propriety. Such purpose of audit depends upon its acceptance on its appeal macia to the common sense and straight logic of the auditors and whose financial transaction subject to propriety audit.

However, audit code lays down some general principle which have been recognised for long as Financial Propriety Standards. Audit against propriety endeavor to en sure that the expenditure comply to the principle as stated below:

1. The expenditure must not be prima facie more than except in the occasions demanded. Each and every public officer Is expected to maintain the same alerinoss with respect to the expenditure incurred from public amounts as a person of ordinary prudence would do with respect to the expenditure of his own amount.

2. No authority should use its powers of approving expenditure to pass an order which will be directly or Indirectly to its own advantage.

3. Public amounts should not be used in the favour of a particular person or section of the community until and unless:

- The expenditure amount Involved is insignificant, or

- A claim for the amount could be enforced in the Tribunal of law, or

- The expenditure is in pursuance of a recognised policy or custom, and

- The allowances amount such as travelling allowances, provided to meet expenditure of a particular type, should be regulated that the allowances are not wholly the sources of profit to the recipients.

It may be expressed that the executive departments are responsible for enforcing economy in public expenditure. The function of auditor Is to bring into the notice of the proper authorities, the wastage in public administration and the case of avoidable, improper and unfruitful expenditure.

The main focus of Propriety Audit is to identity cases of improper, avoidable or infructuous expenditure even though the expenditure has been incurred In conformity with the existing rules and regulalions. This will ensure a reasonably high standard of public financial morality when Auditors look into the wisdom, faithfulness and economy, faithfulness and economy of transactions.

Question 11.

Answer the following:

Write basic standards set for Expenditure Audit of Government. (Nov 2018, 5 marks)

Answer:

The basic Standards set for Expenditure Audit of Government are:

1. That the expenditure incurred conforms to the relevant provisions of the statutory enactment and in accordance with the Financial Rules and Regulations framed by the Competent authority. Such as audit is cafled as the audit against rules and orders.

2. That there is sanction, either special or general, accorded by competent authority authorising the expenditure. Such an audit is called as the audit of sanctions.

3. That there is a provision of funds out of which expenditure can be incurred and the same has been authonsed by competent authority. Such an audit Is called as audit against provision of funds.

4. That the expenditure is incurred with the due regard to broad and general principles of financial propriety. Such an audit is also called as propriety audit.

5. That the various programmes. schemes and protects where large financial expenditure has been incurred are being run economically and are yielding results expected of them. Such an audit is termed as the performance audit.

Question 12.

Write short note on Power of CAG Under Sec. 143 in relation to audit of Government Company. (Nov 2007, 5 marks)

OR

Write short note Powers of C & A.G. In connection with the performance of his duties. (Nov 2009, 5 marks)

Answer:

Power of CAG under Sec. 143 of CompanIes Act, 2013 As per Sec. 143(5) In the case of a Government Company or any other company owned or controlled, directly or indirectly, by the Central Government, or by any State Government or Government, or partly by the Central Government and partly by one or more State Government, the comptroller and Auditor-General of India shall appoint the auditor under sub-section (5) or sub-section (7) of Sec.1 39 and direct such auditor the manner In which the accounts of the company are required to be audited and there upon the auditor so appointed shall submit a copy of the audit report to the Comptroller and Auditor-General of India which, among other things, Indude the directions, if any. issued by the Comptroller and Auditor-General of India, the action taken thereon and its Impact on the accounts and financial statement of the company.

As per Sec. 143(6)

The C & AG of India shall within sixty days from the date of receipt of the audit report under sub-Sec. (5) have a right to:

(a) conduct a supplementary audit of the financial statement of the company by such person or persons as he may authorise in this behalf; and for the purposes of such audit, require information or additional information to be furnished to any person or persons, so authorised, on such matters, by such person or persons, and in such form, as the C & AG of India may direct; and

(b) comment upon or supplement such audit report:

Provided that any comments given by the C & AG of India upon, or supplement to , the audit report shall be sent by the company to every person entitled to copies of audited financial statements under sub-Sec. (1) of Sec. 136 and also be placed before the annual general meeting of the company at the same time and in the same manner as the audit report.

As per Sec. 143(7)

Without prejudice to the provisions of this Chapter. the C & AG of India may. in case of any company covered under sub-Sec. (5) or sub-Sec. (7) of Sec. 139, he considers necessary, by an order, cause test audit to be conducted of the accounts of such company and the provisions of Sec. 19A of the Comptroller and Auditor-Gene rars (Duties. Powers and Conditions of Service) Act, 1971 (56 of 1971), shall apply to the report of such test audit.

Question 13.

State with reasois (in short) whether the following statement is correct or in correct:

C & AG orders to conduct test audit of the accounts of a Government company. (May 2015, 2 marks)

Answer:

Correct:

C & AG can order to conduct test audit of the accounts of a government company and as C & AG conduct the audit of government company.

Question 14.

The audit of receipts of government is not as old as audit of expenditure but with the rapid growth of public enterprises audit of receipts tax or non- tax has come to say. Discuss audit of receipts with respect to Government Audit. (Nov 2020, 4 marks)

Question 15.

Explain the different types of revenue grants which local bodies may receive. (Nov 2020, 3 marks)

![]()

Question 16.

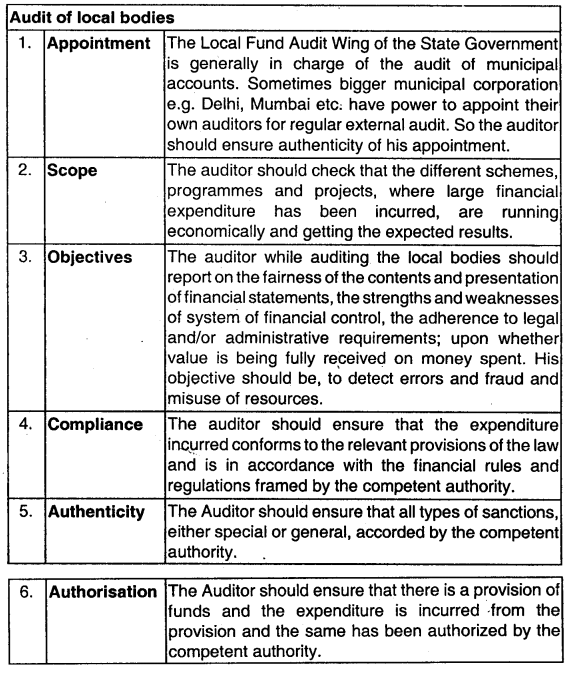

State the important objectives of local body’s audit. (May 2015, May 2017, 4 marks each)

OR

Answer the following:

State the objectives of audit of Local Bodies. (May 2018,5 marks)

Answer:

Objective of Audit of Local Bodies: The external control of municipal expenditure is exercised by the State Governments through the appointment of auditors to examine municipal accounts. The municipal corporations of Delhi. Mumbai and a few others have powers to appoint their own auditors for regular external audit. The important objectives of audit are:

- Reporting on the fairness oÍ the content and presentation of financial statements;

- Reporting upon the strengths and weaknesses of systems of financial control;

- Reporting on the adherence to legal and/or administrative requirements;

- Reporting upon whether value is being fully received on money spent; and

- Detection and prevention of error, fraud and misuse of resources.

Question 17.

Draft an audit programme for conducting audit of accounts of a Local Body. (May 2010, May 2016, 5, 6 marks)

Answer:

Local Bodies

A municipality can be defined as a unit of local self-government in an urban area. By the term local self-government’ is ordinarily understood the administration of a locality – a village, a town, a city or any other area smaller than a state – by a body representing the local inhabitants, possessing fairly large autonomy, raising at least a part of its revenue through local lacation and spending its income on services which are regarded as local and therefore, distinct from state and central services.

Municipal government in India covers five distinct types of urban local authorities, viz., the municipal corporations, the municipal councils, the notified area committees, the town area committees and the cantonment committees.

Question 18.

State the background of local Bodies. Draft an audit programme for audit of local bodIes. (May 2014, 8 marks)

Answer:

As per Sec. 2(45) of the Companies Act, 2013, govenment company means any company in which not less than 51% of the paid up share capital is held by the Central Government or by any State Government or Governments or partly by the Central Government any partly by one or more State Govern iients and includes a company whict is a subsidiary of a

Government Company.

Audit Progranme for Audit of Local Body:

Please refer 2010 – May 51 (a) on page no. 581

Multiple Choice Question

Question 1.

Government audit serves as a ………………… for public accounting of government funds.

(a) mechanism

(b) process

(c) auditing

(d) (a) or (b) above

Answer:

(d) (a) or (b) above

Question 2.

The tunction of Government Audit is discharged by the independent statutory authority of the ………………… through the agency of the Indian Audit and Accounts Department.

(a) Central Government Audit Committee

(b) Central Accounts and Audit Committee

(c) Comptroller and Auditor General

(d) None of the above.

Answer:

(c) Comptroller and Auditor General

Question 3.

The C & AG, Hi the discharge at his functions, watches that the various authorities act in regard to financial matters In accordance with the ………………….., and conform to the rules or orders made there under.

(a) Government Rules

(b) Constitution

(c) Law made by Parliament

(d) (b) and (c)

Answer:

(d) (b) and (c)

Question 4.

Who makes a provision regarding th appointment, salary and duties and powers 0f the C & AG.

(a) Parliament

(b) Constitution

(c) President of India

(d) Supreme Court

Answer:

(b) Constitution

Question 5.

Comptroller and Auditor General is appointed by the

(a) Constitution of India

(b) President of India

(c) Parliament of India

(d) Chief Justice of the Supreme Court

Answer:

(b) President of India

Question 6.

………………… of the Constitution provides that the acoounts of the Union and of the States shall be kept In such form as the president may on the advice of the C & AG prescribe.

(a) Article 149

(b) Article 150

(c) Article 151

(d) Article 155

Answer:

(b) Article 150

Question 7.

Reports of the C & AG relating to the accounts of the Union/State shall be submitted to the President/Governor who shall cause them to be laid before House of Parliament/State Legislature according to …………………… of the Constitution

(a) Artide 149

(b) Article 150

(c) Article 151

(d) Article 158

Answer:

(c) Article 151

Question 8.

Which is not a duties of C & AG?

(a) Audit of Government Companies and Corporations

(b) Compile and Submit Accounts

(c) Preparation of Government Accounts

(d) Audit of Grants or Loan

Answer:

(c) Preparation of Government Accounts

Question 9.

C & AG has not inspect any office of accounts under the control of the Union or a State Government. Is the statement Is: …………………… .

(a) True

(b) False

(c) Partly True

(d) None

Answer:

(b) False

Question 10.

According to , the auditors try to bring out cases of improper, avoidable, or ritructuous expenditure even though the expenditure has been incurred in conformity with the existing rules and regulation.

(a) Performance Audit

(b) Propriety Audit

(c) Audit of Sanction

(d) Audit against Rules and Orders.

Answer:

(b) Propriety Audit

![]()

Question 11.

……………….. is an appraisal of the performance of programmes. schemes, projects with reference to the overall targeted objectives as well as efficiency of the means adopted for the attainment of the objectives.

(a) Effectiveness Audit

(b) Performance Audit

(c) Propriety Audit

(d) Social Audit

Answer:

(a) Effectiveness Audit

Question 12.

Local bodies may receive different types of revenue grants from the state administration except

(a) General purpose grant

(b) Specific purpose grant

(c) Public Grant

(d) Statutory and Compensatory grants

Answer:

(c) Public Grant

Question 13.

Non-Governmental Organisations are generally incorporated as societies under the Societies Registration Act) 1860 or .

(a) Trust under the Indian Trust Act, 1882

(b) Incorporated as a company under Section 8 of the Companies Act, 2013

(c) Under any other taw corresponding to these law enforced In any part of India

(d) Any of the above

Answer:

(d) Any of the above

Question 14.

NGO’s registered under the Companies Act, 2013 must maintain their books of account under the …………………… as required by the provisions of Section 128 of the Act.

(a) Cash basis

(b) Accrual basis

(c) Hybrid basis

(d) Either (a) or (b) basis

Answer:

(b) Accrual basis

Question 15.

The NGOs which are not registered under the Companies Act, 2013 are maintain their accounts ……………….. .

(a) Cash basis

(b) Accrual basis

(c) Hybrid basis

(d) Either (a) or (b) basis

Answer:

(d) Either (a) or (b) basis

Question 16.

Donations and Grants received in the nature of ……………. are in the nature of capital receipts and shown as liabilities in the Balance Sheet.

(a) Government’s Contribution

(b) Doner’s Contribution

(c) Promoter’s Contribution

(d) Financing

Answer:

(c) Promoter’s Contribution

Question 17.

A contribution made towards the capital or corpus of an NGO is known as ……………… .

(a) Capital Fund

(b) Corpus Capital

(c) Corpus Investment

(d) Corpus Contribution

Answer:

(d) Corpus Contribution

Question 18.

NGO receive contributions in Liquid form Statement is

(a) True

(b) False

(c) Partly True

(d) None

Answer:

(b) False

Question 19.

The auditors of NGO registered under Section 8 of the Companies Act, 2013 are appointed by the ………………….. .

(a) Shareholders

(b) Management

(c) Members of the company

(d) State Government/Central Government

Answer:

(c) Members of the company

Question 20.

Audit of Sole Trader is mandatory Statement is

(a) True

(b) False

(c) Partly True

(d) None

Answer:

(b) False

![]()

Question 21.

Who determines the scopeof the audit as well as the conditions under which it will be carried out in case of a audit of a sole proprietary firm.

(a) Sole Proprietor

(b) Management of the Sole Proprietary firm

(c) Members of the BOD

(d) None of the above

Answer:

(a) Sole Proprietor

Question 22.

The auditor to a firm is usually appointed by the partners …………………. .

(a) Any one of the partner

(b) On the basis of a decision taken by them

(c) According to the provision of partnership agreement

(d) Either (b) or (c)

Answer:

(d) Either (b) or (c)

Question 23.

In case of partnership audit ¡s it required to compliance of accounting standard issued by the institute

(a) Yes

(b) No

(c) Partly Yes

(d) None of the above

Answer:

(a) Yes

Question 24.

Accounts of every LLP shall be audited in accordance with ………………….. .

(a) Rule 22 of the Partnership Act,

(b) Rule 22 of LLP, Rules 2009,

(c) Rule 23 of LLP, Rules 2009,

(d) Rule 24 of LLP, Rules 2009,

Answer:

(d) Rule 24 of LLP, Rules 2009,

Question 25.

As per Rule 24 of LLP Rules 2009, specifies the exemption of Audit of Accounts of LLP when

(a) Turnover of LLP does not exceed Rupees Forty Lakh in any financial year.

(b) Contribution does not exceed Rupees Five Lakhs.

(c) Both (a) and (b)

(d) Either (a) or (b)

Answer:

(b) Contribution does not exceed Rupees Five Lakhs.

Question 26.

Every LLP is required to file annual return in ………………… with ROC within …………………… of closer of financial year.

(a) Form 10, 30 days

(b) Form 10, 60 days

(c) Form 11, 3o days

(d) Form 11 ,60 days

Answer:

(d) Form 11 ,60 days

Question 27.

Annual Return of an LLP will be available for public inspection on payment of prescribed fees to Registrar. Statement is

(a) True

(b) False

(c) partly True

(d) None

Answer:

(a) True

Question 28.

In case of LLP, documents or information will be available for Inspection by any person.

(a) Incorporation document

(b) Name of partners and changes, if any, made therein

(c) Statement of Account and Solvency, and Annual Return

(d) Any of the above

Answer:

(d) Any of the above

Question 29.

The fees for such inspection of an LLP is ………………… and fees for certified copy or extract of any document u/s 36 shall be …………………… .

(a) ₹ 50, ₹ 5 per Page

(b) ₹ 50, ₹ 10 perPage

(c) ₹ 100, ₹ 5 per Page

(d) ₹ 100, ₹ 10 per Page

Answer:

(a) ₹ 50, ₹ 5 per Page

Question 30.

In case of LLP auditor nay be appointed by the partner ……………… .

(a) At any time for the first financial year but before the end of first financial year

(b) At least thirty days prior 15 the end of each subsequent year after first financial year.

(c) To fill the casual vacancy caused by removal of auditor

(d) Any of the above

Answer:

(d) Any of the above

![]()

Question 31.

In the case of an audit of a charitable institution regarding Grunts:

(a) Vouching the account received with the relevant correspondence, receipts and minute books

(b) Obtaining a certificate from a responsible official showing the amount of grants received.

(c) Both (a) and (b) both

(d) Eighter (a) or (b)

Answer:

(c) Both (a) and (b) both

Question 32.

Person who obtains or has obtained possession of goods from an owner under the hire-purchase agreement, is known as ……………….. .

(a) Hire

(b) Hirer

(c) Hiree

(d) None

Answer:

(b) Hirer

Question 33.

In a lease agreement, …………………. acquires the right to use an asset for an agreed period of time in consideration of payment of rent to another party called ………………… .

(a) Buyer, Seller

(b) Lessor, Lessee

(c) Lessee, Lessor

(d) None of the above

Answer:

(c) Lessee, Lessor

Question 34.

When under the lease agreement, the legal ownership of the asset remains with the lessee lessor, (the leasing company), but in substance, all the risks and rewards of ownership of the asset are transferred to the lessee, is called …………….. .

(a) Operating Lease

(b) Financing Lease

(c) H.P. Leasing

(d) None of the above

Answer:

(b) Financing Lease

Question 35.

……………………… is an arrangement where in return for rent, the lessor allows

the lessee to use the asset for a certain period.

(a) Operating Lease

(b) Financing Lease

(c) HP Leasing

(d) None of the above

Answer:

(a) Operating Lease

Question 36.

…………………. contains the fundamental law regarding the formation and working of the Co-operative Societies in India and is applicable in many states with or without amendments.

(a) Societies Act, 1872

(b) Co-operative Act, 1872

(c) Co-operative Act, 1872

(d) Co-operative Act, 1912

Answer:

(d) Co-operative Act, 1912

Question 37.

Qualification required for an auditor of Co-operative Societies.

(a) Chartered Accountant within the meaning of the Chartered Accountant Act, 1949

(b) Person holding diploma ¡n Co-operative accounts under State Co-operative Acts,

(c) Person who has served as an auditor in the Co-operative department of a government to act as an auditor.

(d) Any one of the above.

Answer:

(d) Any one of the above.

Question 38.

According to Section 33 of the Central Act, a prescribed percentage of the profits should be transferred to Reserve Fund, before …………………. .

(a) deceleration of profit

(b) distribution of net Income

(c) Publication of gross and net income

(d) distribution as dividends or bonus to members.

Answer:

(d) distribution as dividends or bonus to members.

Question 39.

State Acts allowes a society may use their Reserve Fund in

(a) Invest as per provision of the Act

(b) Use for some public purposes likely to promote the object of the society.

(c) In the business of a society as working capital

(d) In any case of the above.

Answer:

(d) In any case of the above.

Question 40.

Multi-State Co-operative Societies Act, 2002 come into force from

(a) April, 2002

(b) July, 2002

(c) August, 2002

(d) November, 2002

Answer:

(c) August, 2002

![]()

Question 41.

Multi-State Co-operative Societies, 2002 applies, to Co-operative Societies whose objects are:

(a) multi product operations

(b) multi service providing operation

(c) multi district operation

(d) multi state operation.

Answer:

(d) multi state operation.

Question 42.

Multi State Co-operative Society can utilised their fund for any political purpose. Statement is ……………………… .

(a) True

(b) False

(c) Partly True

(d) None

Answer:

(b) False