Not for Profit Organisation – CA Foundation Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

Not for Profit Organisation – CA Foundation Accounts Study Material

Question 1.

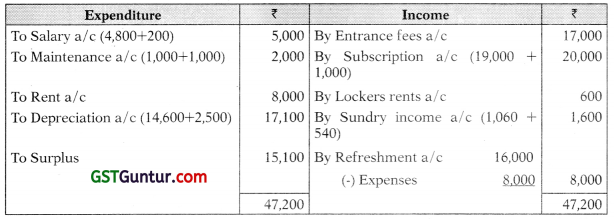

Income and Expenditure A/c.

Answer:

Income and Expenditure A/c:

- Income & Expenditure Account – is just like a profit & Loss account.

- All the Expenses for that year i.e., related to that year, will be debited to it

- All the incomes related to that year will be credited to it.

- If the credit side is more, the balance is known as “Surplus”(Profit)

- If the debit side is more the balance is known as “Deficit” (Loss) which is then

- Transferred (Surplus is credited/Loss is debited) to the capital account of the Association/Trust which is known by different names such as Trust Fund/General Fund/Capital Fund etc.

Question 2.

Receipt and Payment A/c.

Answer:

Receipt and Payment A/c:

- Receipt & Payment Account – is a summarized cash book.

- All receipts in that year may be loan, a capital receipt or an income will be Debited to Receipt & Payment a/c.

- Income received in this year may be related to this year or previous year or next year.

- Similarly all payments made in this year may be for capital expenditure, repayment of loan, revenue expenditure etc. should be credited to Receipt & Payment A/c.

- The revenue expenditure paid in this year, may relate to this year or previous year or next year.

- Balance of this a/c is the closing cash and bank balance and will appear in the balance sheet.

![]()

Question 3.

Entrance Fees.

Answer:

Entrance Fees:

(a) The Associations collect entrance fees/admission fees from the new members at the time of their admission.

(b) It is different from the membership fees/subscriptions, which are received every year and hence treated as revenue income and transferred to Income & Expenditure account.

(c) But the entrance fees is received only once from a member, hence it can be treated as follows:

→ If the amount is just sufficient to recover the expenditure incurred while admitting any member then it will be treated as revenue income and transferred to Income & Expenditure account.

→ Otherwise the entrance fees can be Capitalized & transferred to the Trust Fund Account. OR;

→ Entrance fees may be treated as deferred Income and shown in the Balance Sheet under the head “Entrance Fees Account” & Part-amount can be written off every year by transferring to Income & Expenditure A/c in proportion to the benefit extended to the members, estimated on some suitable basis.

Question 4.

Membership fees.

Answer:

Membership fees:

- These are usually charged yearly from the members hence are treated as revenue income and credited to I&E a/c.

- The amount received should be duly adjusted for outstanding and advances, so as to get the figure of income for the year.

- When number of members and the rate of membership fees/subscription is given then income = number of member x rate per member.

- Outstanding subscription i.e. subscription receivable will be shown on the asset side of balance sheet.

- Advance subscription i.e. unearned subscription will be shown on the liability side of balance sheet.

Question 5.

Donation.

Answer:

Donation:

- Donations are the voluntary contribution provided by the well wishers for general or specific purpose.

- If donations are received for a particular purpose then it will be credited to that particular fund a/c say donation received for construction of building credited to Building fund a/c.

- Otherwise general donations will be credited to Income & Expenditure a/c.

- If question requires capitalisation, but does not specify the fund to which it should be credited, then credit such donation to trust fund a/c.

- Donation may be in kind then stock or fixed asset whatever is received will be debited and the credit will be as explained in above points.

Question 6.

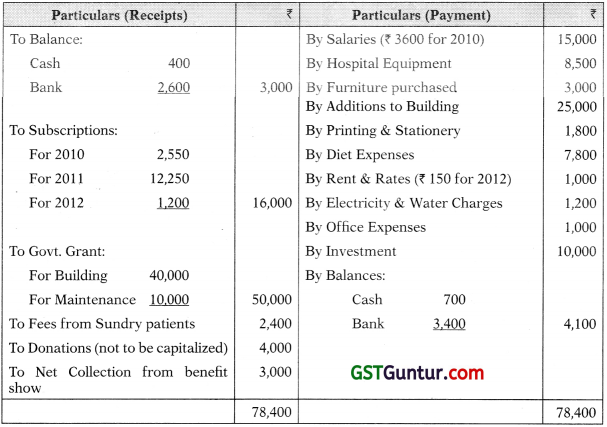

From the following data, prepare an Income and Expenditure Account for the year ended 31st December, 2011 of the Mayura Hospitals.

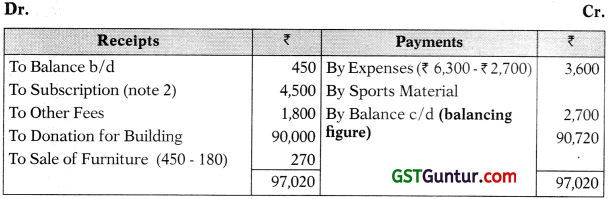

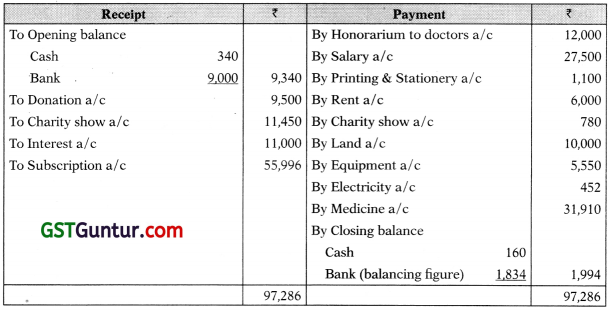

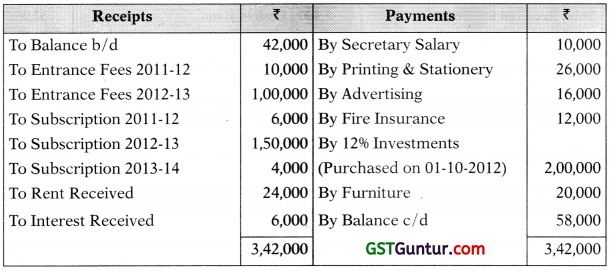

Receipt and Payments Account (For the year ended 31st Dec. 2011)

Additional information:

(i) Subscription in arrears as on 31-12-2010 ₹ 3,200

(ii) Investments in 8% Govt. Securities were made on 1st July, 2011

Solution:

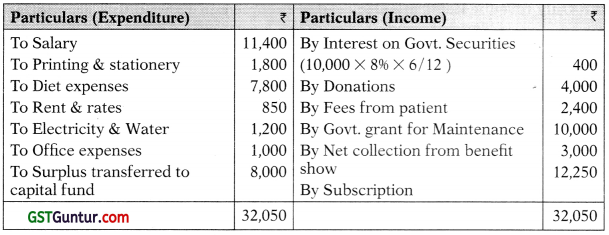

Income and Expenditure Account for the Year Ended 31.12.2011

Working Notes:

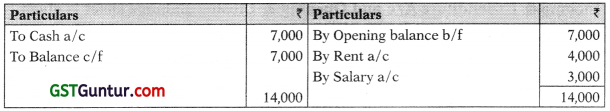

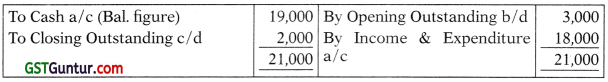

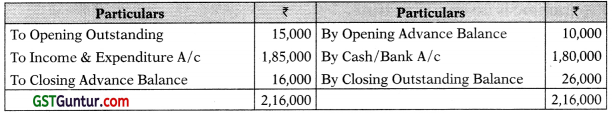

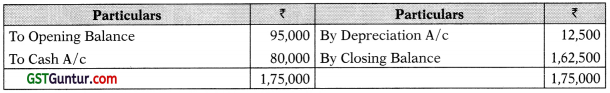

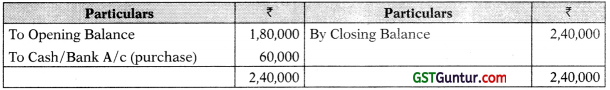

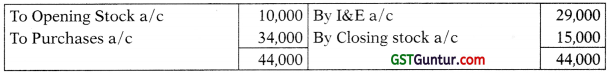

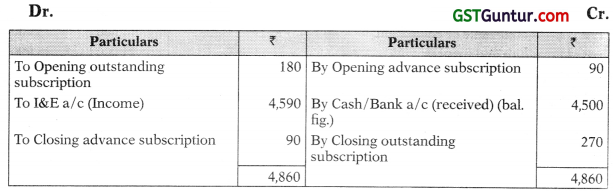

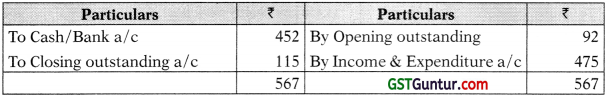

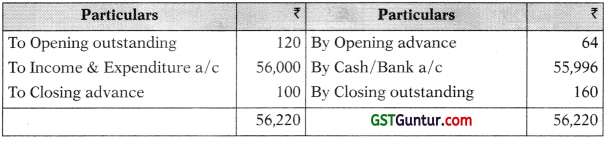

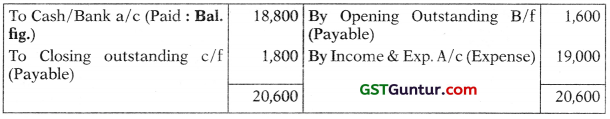

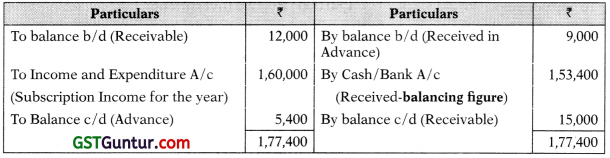

Subscription Account

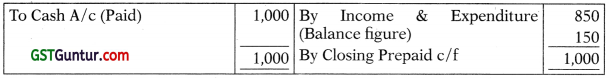

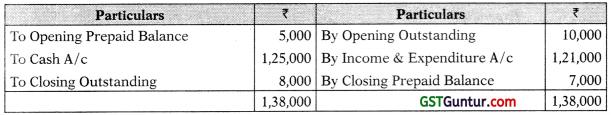

Salary Account

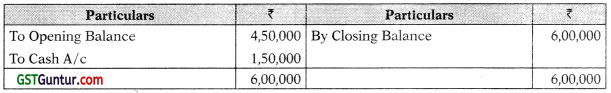

Rent Account

Important Points:

- Govt, grant for Building will be credited to building fund a/c and will appear in Balance sheet.

- Addition to Purchase of Furniture, Equipment, Building and Investment will be debited to respective asset a/ c and will appear in Balance sheet.

![]()

Question 7.

The following informations were obtained from the books of Delhi Club as on 31.3.2011 at the end of the first year of the Club. You are required to prepare Receipts and Payments Account for the year ended 31.3.2011:

(i) Donations received for Building and Library Room ₹ 2,00,000.

(ii) Other revenue receipts:

(iii) Other actual payments:

Donations to the extent of ₹ 25,000 were utilized for the purchase of Library Books, balance was still unutilized. In order to keep it safe, 9% Govt. Bonds of ₹ 1,60,000 were purchased on 31.3.2011. Remaining amount was put in the Bank on 31.3.2011 under the term deposit.

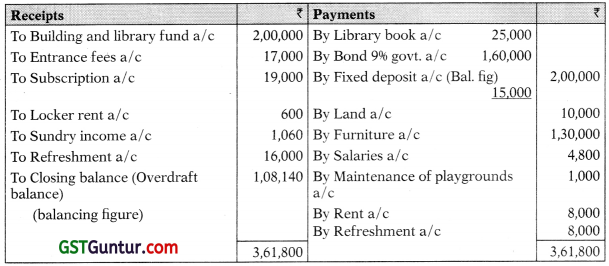

Solution :

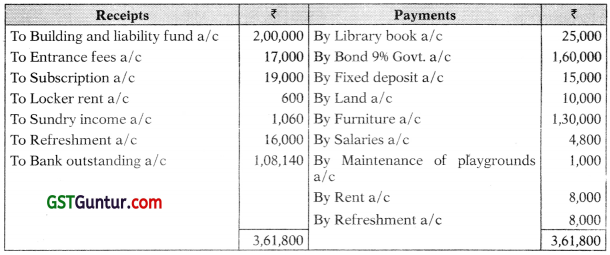

Delhi Club

Receipt and Payments A/c for the year ended 31st March 2011

Question 8.

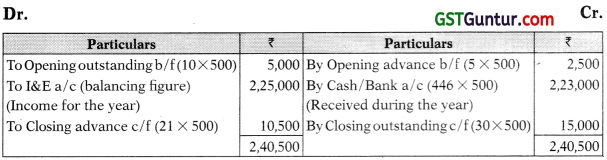

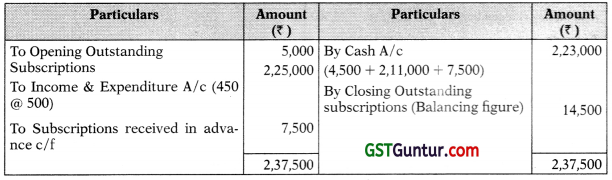

Members of a club, are paying an annual subscription of ₹ 500. On 31st March, 2010, subscriptions in arrears from 10 members and received in advance •from 5 members. Subscriptions received during the year ended 31st March, 2011 from 446 members, including from 21 members for the year 2011-2012. Subscriptions in arrears as on 31st March, 2011 from 30 members. Calculate the amount of subscriptions income for the year ended on 31st March, 2011 by preparing subscriptions a/c.

Solution:

Subscription a/c

Alternatively above figure can be ascertained by preparing a statement.

Question 9.

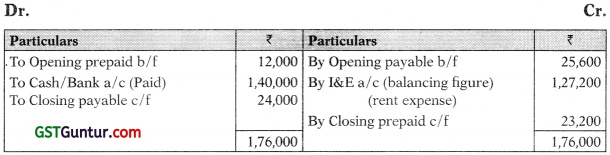

On the basis of the following information related to its many rented premises, calculate the amount that will appear against the item ‘Rent’ in the income and expenditure account for the year ended 31st March, 2011:

| ₹ | |

| Rent prepaid as on 1st April, 2010 | 12,000 |

| Rent payable as on 1st April, 2010 | 25,600 |

| Amount paid for rent during the year ended 31st March, 2011 | 23,200 |

| Rent prepaid as on 31st March, 2011 | 24,000 |

| Rent payable as on 31st March, 2011 | 1,40,000 |

Solution:

Rent a/c

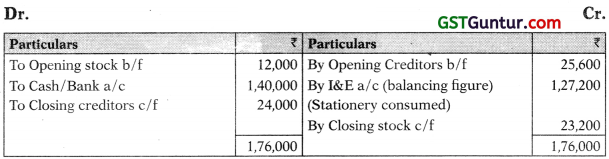

Question 10.

On the basis of the following information, calculate the amount that will appear against the item ‘stationery consumed’ in the income and expenditure account for the year ended 31 st March, 2011:

| ₹ | |

| Stock of stationery as on 1st April, 2010 | 12,000 |

| Creditors for stationery on 1st April, 2010 | 25,600 |

| Amount paid for stationery during the year ended 31st March, 2011 | 1,40,000 |

| Stock of stationery as on 31st March, 2011 | 23,200 |

| Creditors for stationery as on 31st March, 2011 | 24,000 |

Solution:

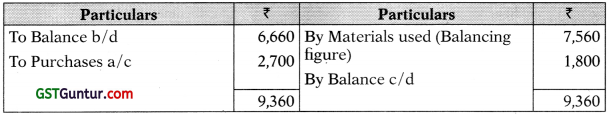

Stationery a/c

Note:

Alternatively you can prepare two accounts as explained below that will also show you amount of stationery purchased.

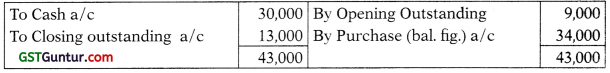

Creditors for Stationery a/c

Stationery Stock a/c

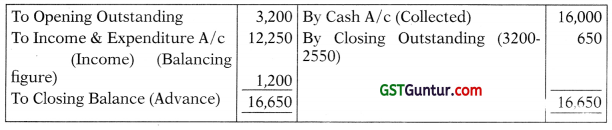

When Opening balance sheet. Receipt & Payment a/c and some information is given.

![]()

Question 11.

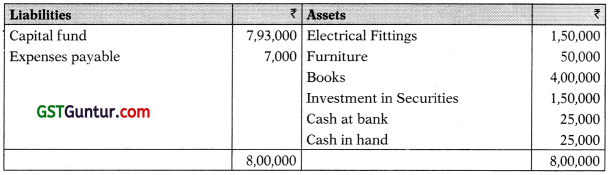

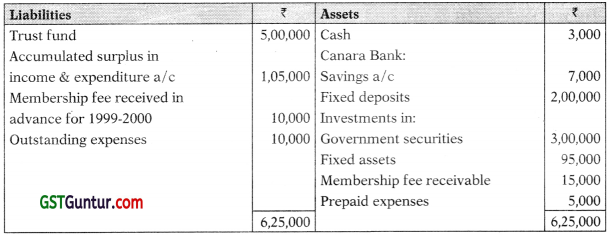

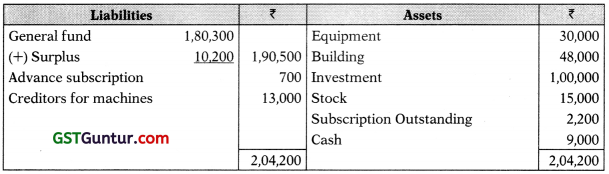

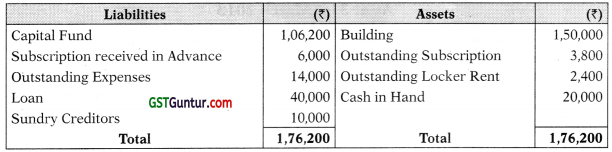

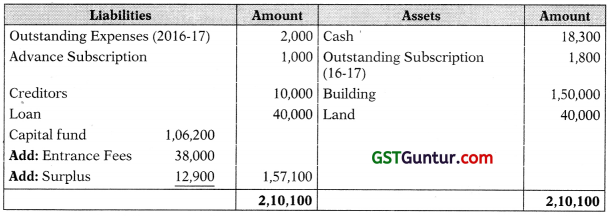

Smith Library Society showed the following position on 31st March 2010:

Balance sheet as on 31st March, 2010

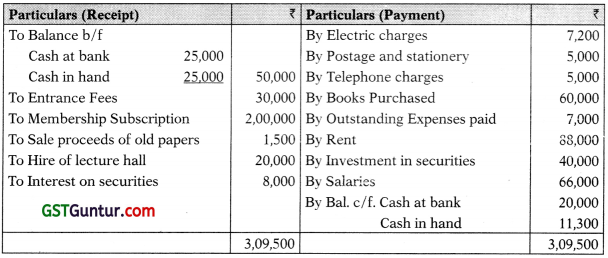

The Receipt and Payment Account for the year ended on 31st March, 2011 is given below

You are required to prepare an Income and Expenditure Account for the year ended 31 st March, 2011 and a Balance Sheet as at 31 st March, 2011 after making the following adjustments:

(a) Membership Subscription included ₹ 10,000 received in advance.

(b) Provide for outstanding rent ₹ 4,000 and salaries ₹ 3,000.

(c) Books to be depreciated @10% including additions. Electrical Fittings and Furniture’s are also to be depreciated at the same rate.

(d) 75% of Entrance Fees is to be capitalised.

(e) Interest on Securities is to be calculated @ 5% p.a. including purchases made on 1.10.2010 for ₹ 40,000.

Solution:

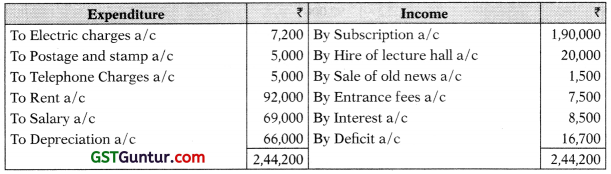

Income and Expenditure Account

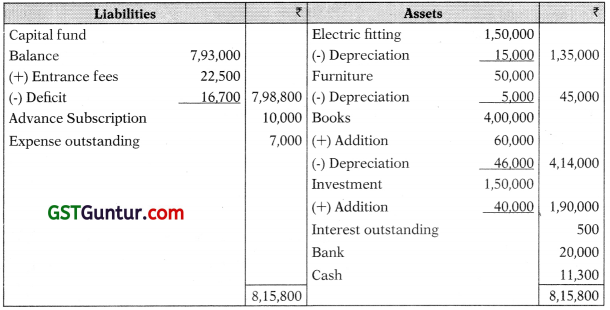

Balance sheet on date 31.3.2011

Working notes:

Expenses outstanding Account

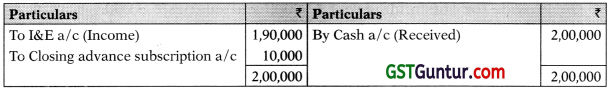

Subscription Account

Rent Account

Salary Account

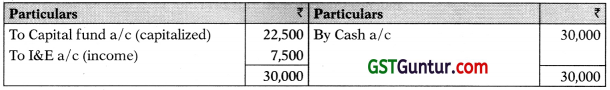

Entrance fees Account

Interest Account

Calculation of interest on investment:

Income & Expenditure A/c and Opening & Closing Balance sheet is given.

Question 12.

Chail Cricket Club gives you the following information:

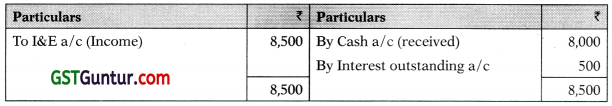

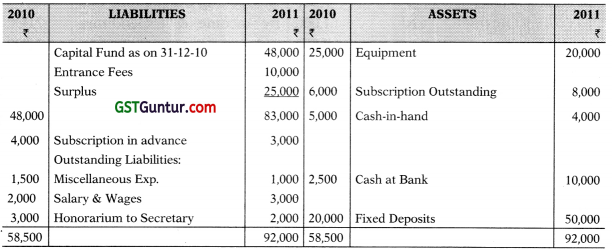

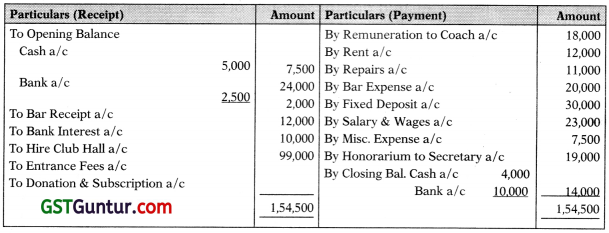

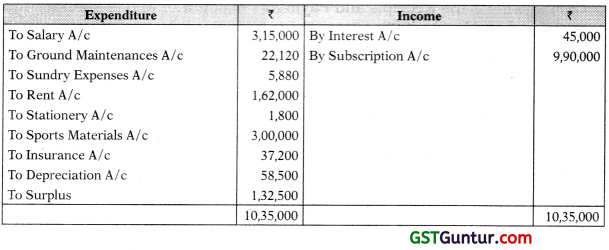

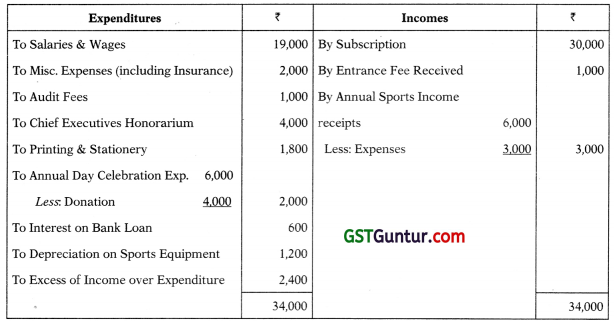

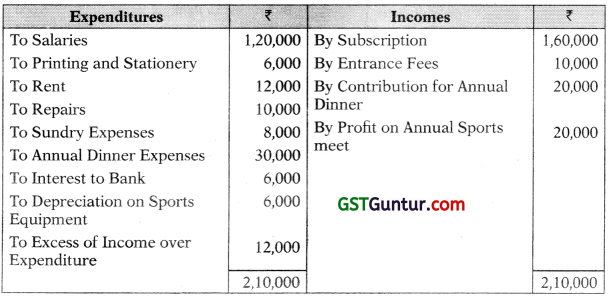

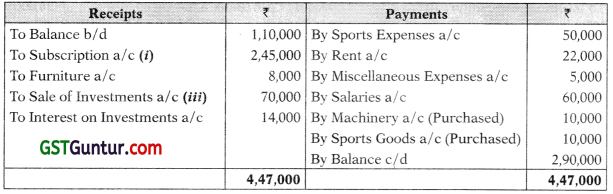

Income & Expenditure Account for the year ended 31st Dec., 2011

Balance Sheet

Prepare the Receipt and Payment Account of the Club for the year ended 31 st Dec. 2011.

Solution:

Important Points:

→ Expenses in which there is no opening or closing adjustment will be equal to payment and will appear as it is in Receipt & Payment a/c.

→ Similarly Income in which there is no opening or closing adjustment will be equal to receipt and will appear as it is in Receipt & Payment a/c.

→ For others figure of receipt or payment will be ascertained by preparing concerned account.

Receipt and Payment Account:

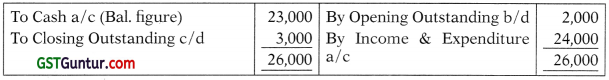

Working note:

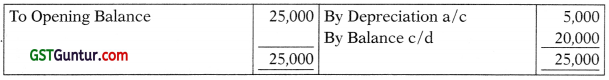

Salary and Wages Account

Miscellaneous Expense Account

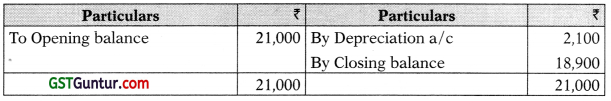

Honorarium To Secretary Account

Equipment Account

Fixed Deposit Account

Subscription Account

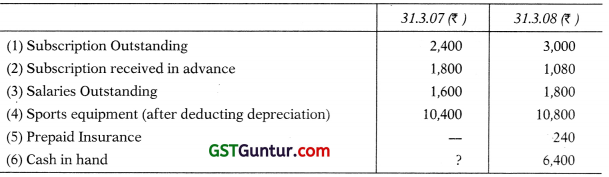

Question 13.

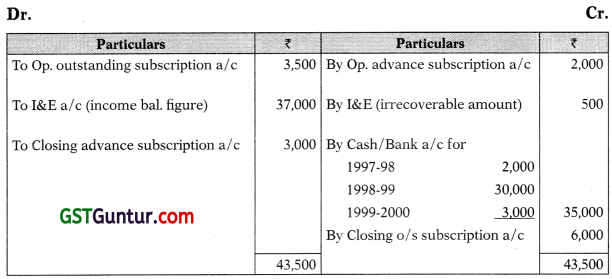

From the following, find out the amount of subscriptions to be included in the income and expenditure account for the year ended 31st March, 1999.

Subscriptions were received during the year 1998-99 as follows:

| ₹ | |

| For the year 1997-98 | 2,000 |

| For the year 1998-1999 | 30,000 |

| For the year 1999-2000 | 3,000 |

Subscriptions outstanding as on 31st March, 1998 were ₹ 3,500 out of which ₹ 500 were considered to be irrecoverable. On the same date, subscription received in advance for 1998-99 were ₹ 2,000. Subscriptions still outstanding as on 31st March, 1999 amounted to ₹ 6,000.

Solution:

Subscription a/c

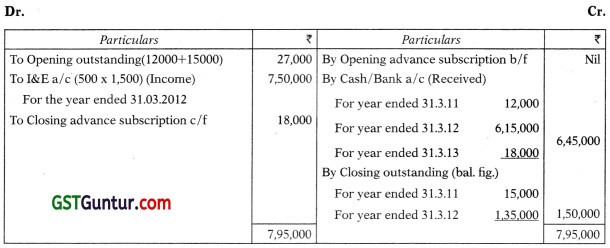

Question 14.

During the year ended 31st March, 2012, Sachin Cricket Club received subscriptions as follows :

| ₹ | |

| For year ending 31st March, 2011 | 12,000 |

| For year ending 31st March, 2012 | 6,15,000 |

| For year ending 31st March, 2013 | 18,000 |

| Total | 6,45,000 |

There are 500 members and annual subscription is ₹ 1,500 per member.

On 31st March, 2012, a sum of ₹ 15,000 was still in arrears for subscriptions for the year ended 31 st March, 2011.

Ascertain the amount of subscriptions that will appear on the credit side of Income and Expenditure Account for the year ended 31st March, 2012. Also show how the items would appear in the Balance Sheet as on 31 st March, 2011 and the Balance Sheet as on 31st March, 2012.

Solution:

Subscription a/c year ended 31.03.2012

Income & Expenditure Account (An extract) of Sachin Cricket Club For the year ended 31st

Balance Sheet of Sachin Cricket Club as on 31st March 2012 (An extract)

Question 15.

On 31 st March, 1999 Writers Club a cultural association had the following assets and liabilities:

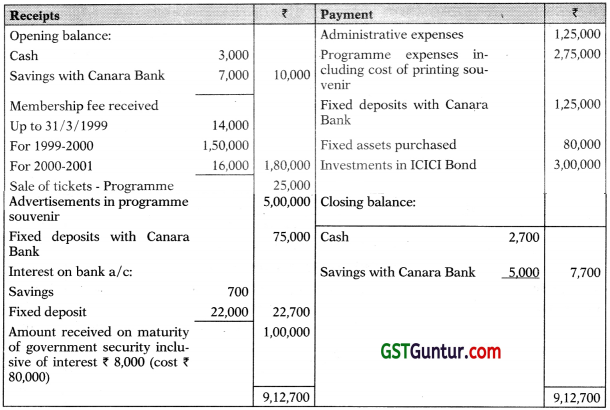

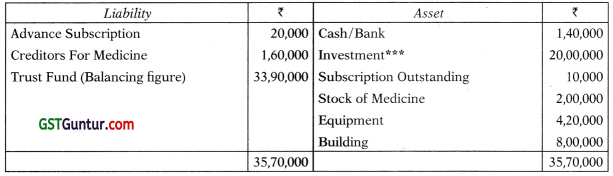

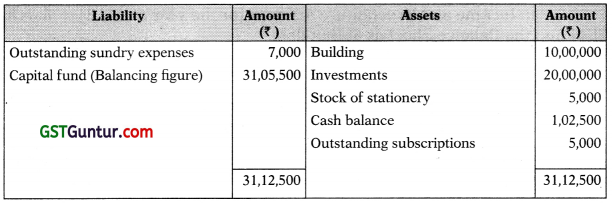

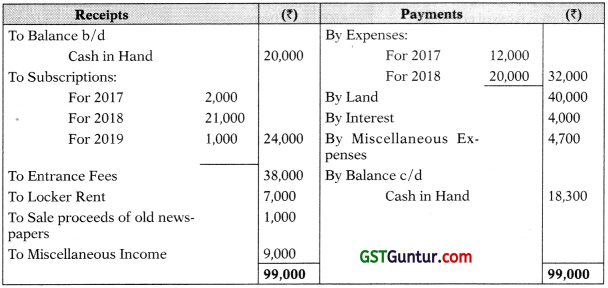

The following is the receipt and payment account for the year ended 31st March, 2000:

The club informs You that:

Membership fee for 1999-2000 due is ₹ 25,000; it includes ₹ 1,000 due from the member who has not yet paid also for 1998-99; provision for irrecoverable membership is to be made in respect of this member.

Income receivable on 31-3-2000 on ICICI bond is ₹ 30,000 and on government securities is ₹ 24,000.

Prepaid expenses on 31-3-2000 amount to ₹ 7,000.

Outstanding expenses on 31-3-2000 amount to ₹ 8,000.

Depreciation provision is to be ₹ 12,500.

Programme is an annual feature.

The club asks you to prepare:

(a) Income and expenditure account for the year ended 31st March, 2000.

(b) Balance sheet as at 31st March, 2000.

Solution:

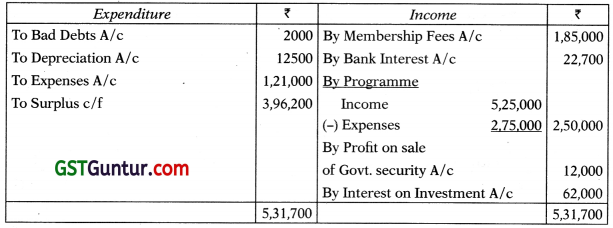

Income & Expenditure A/c

Balance Sheet As On 31.03.2000

Working Notes:

By preparing these accounts we get missing information which may be a transaction (complete the double entry of same) or a balance of that account. Complete accounting for whatever information is available in the question. Then by balancing the account you will get missing information as a balancing information.

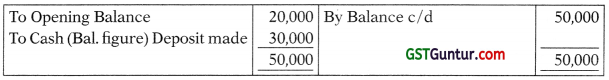

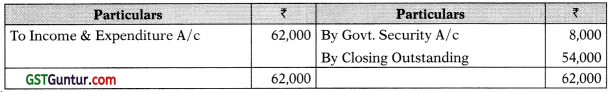

Membership Fees A/c [subscription]:

Expenses A/c

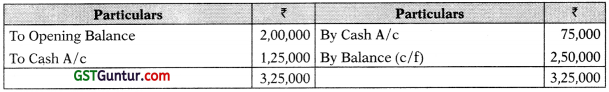

Fixed Deposits A/c

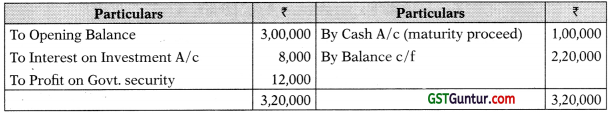

Government Securities A/c

Fixed Asset A/c

Interest On Investment A/c

Question 16.

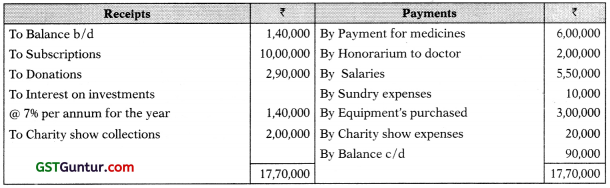

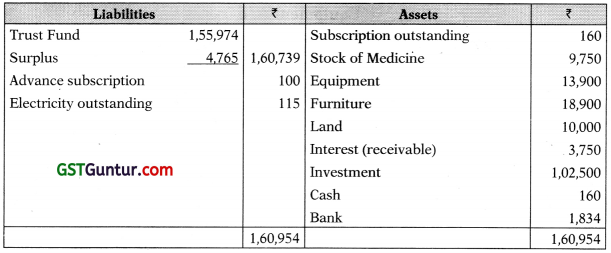

The following is the receipts and payments account of Jyoti Charitable Hospital for the year ended 31st March, 2003:

Additional information:

| On 1.4.2002 (₹) | On 31.3.2003 (₹) | |

| Subscriptions due

Subscriptions received in advance Stock of medicines Creditors for medicines Equipment’s Buildings |

10,000

20,000 2,00,000 1,60,000 4,20,000 8,00,000 |

20,000

10,000 3,0,000 2,40,000 6,00,00 7,60,000 |

You are required to prepare income and expenditure account for the year ended 31st March, 2003 and balance sheet as at that date.

Solution:

Income & Expenditure A/c [P&L A/c]:

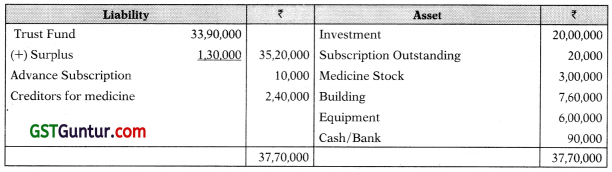

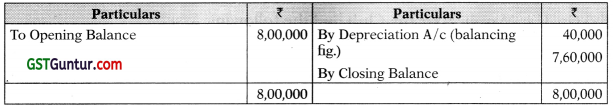

Balance Sheet As On 31.03.2003

Working Notes:

Important Points:

By preparing these accounts we get missing information which may be a transaction (complete the double entry of same) or a balance of that account. Complete accounting for whatever information is available in the question. Then by balancing the account you will get missing information as a balancing information.

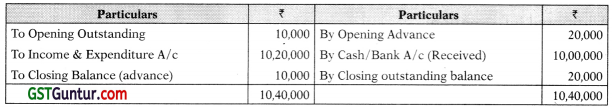

Subscription A/c

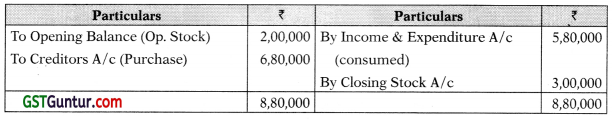

Medicine A/c

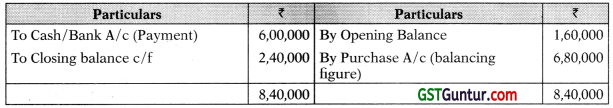

Creditors For Medicane A/c

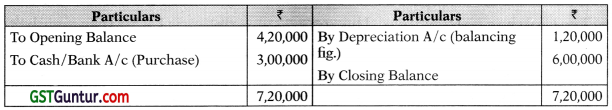

Equipment A/c

Building A/c

Balance Sheet As On 31.03.2002

Investment is calculated from interest Investment = 1,40,000/7 x 100 = 20,00,000

Question 17.

Following is the Receipts and Payments Account of Mayur Club for the year ended 31st March, 2008:

Following additional information is provided to you:

(i) The Club has 220 members. The annual subscription is ₹ 4,500 per member.

(ii) Depreciation to be provided on Furniture at 10% p.a. and on Sports equipment at 15% p.a.

(iii) On 31st March, 2008, stock of sports material in hand (after members use during the year) is valued at ₹ 78,000 and stock of stationery at 7 3,150. Rent for 1 month is outstanding. Unexpired insurance amounts to ₹ 9,600.

(iv) On 31st March, 2007 the Club had the following Assets:

| Furniture | ₹ 2,70,000 |

| Sports equipment | ₹ 0,80,000 |

| Bank fixed deposit | ₹ 4,50,000 |

| Stock of stationery | ₹ 1,500 |

| Stock of sports material | ₹ 73,500 |

| Unexpired insurance | ₹ 8,400 |

| Subscription in arrear | ₹ 22,500 |

Note / There was no liability on 31.3.2007

You are required to prepare:

(i) Income and Expenditure Account; and

(ii) Balance Sheet as at 31st March, 2008.

Solution:

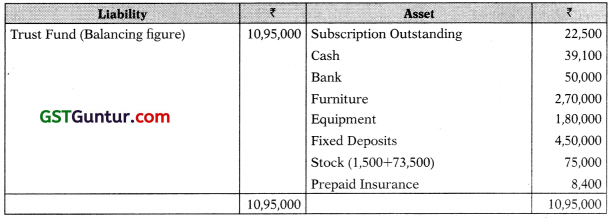

Income & Expenditure A/c

Balance Sheet as on 31.03.2008

Working Notes:

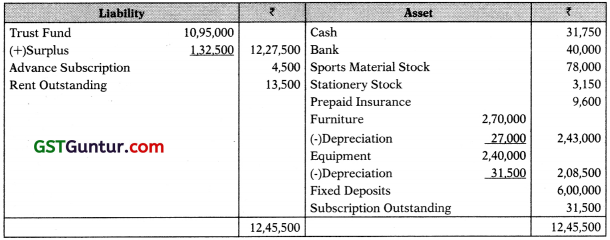

Balance Sheet as on 31.03.2007

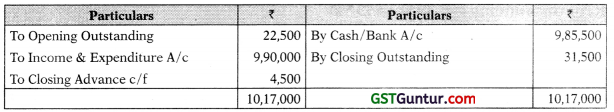

Subscription A/c

Equipment A/c

Fixed Deposits A/c

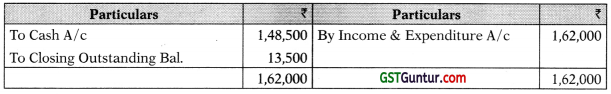

Rent A/c

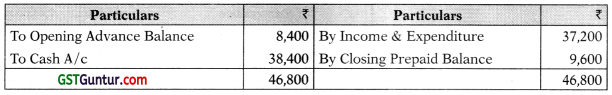

Insurance A/c

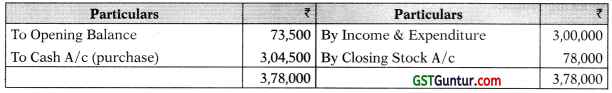

Sports Materials A/c

Stationery A/c

Workings:

Calculation of rent outstanding :

Rent for 1 month is outstanding, which implies that the rent paid is for 11 months.

Rent outstanding = \(\frac { 1,48,500 }{ 11 }\) = 13,500

Question 17.

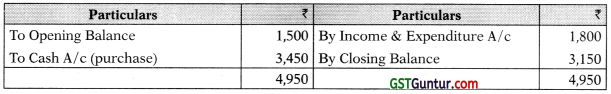

The following is the Receipt and Payment Account of Park View Club in respect of the year ended 31st March, 2011:

Additional information:

(i) There are 450 members each paying an annual subscription of ₹ 500. On 1st April, 2010, outstanding subscription was ₹ 5,000.

(ii) There was an outstanding telephone bill for ₹ 3,500 on 31st March, 2011.

(iii) Outstanding sundry expenses as on 31st March, 2010 totalled ₹ 7,000.

(iv) Stock of stationery:

On 31st March, 2010 ₹ 5,000

On 31st March, 2011 ₹ 9,000

(v) On 31st March, 2010 building stood in the books at ₹ 10,00,000 and it was subject to depreciation @ 5% per annum.

(vi) Investment on 31st March, 2010 stood at ₹ 20,00,000.

(vii) On 31st March, 2011, income accrued on the investments purchased during the year amounted to ₹ 3,750.

Prepare an Income and Expenditure Account for the year ended 31st March, 2011 and the Balance Sheet as at that date.

Solution:

Park View Club

Income and Expenditure Account

for the year ended on 31st March 2011

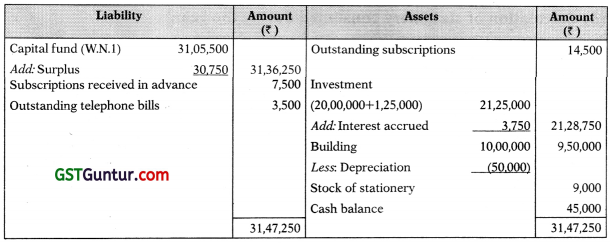

Balance Sheet as at 31st March 2011

Working Notes:

(1) Calculation of Opening Capital Fund

Balance Sheet as at 31st March 2010

(2) Calculation of subscriptions accrued during the year

Subscription A/c

(3) Calculation of stationery consumed during the year

| ₹ | |

| Opening Stock of stationery

Add Purchased Total Less: Closing Stock of stationery Stationery consumed |

5,000

40,000 |

| 45,000

(9,000) |

|

| 36,000 |

Question 18.

The Accountant of Diana Club furnishes you the following Receipts and Payments account for the year ending 30th September, 2003:

Additional Information:

| 01.10.2002 ₹ |

01.10.2002 ₹ |

|

| (i) Subscription due (not received) (ii) Cheques issued, but not presented for payment of printing (iii) Club premises at cost (iv) Depreciation on club premises provided so far (v) Car at cost (vi) Depreciation on car (vii) Value of Bar stock (viii) Amount unpaid for bar purchases |

2,400 180 58,000 37,600 24,380 20,580 1,420 1,180 |

1,960 60 – – – – 1,740 860 |

(ix) Depreciation is to be provided @596 p.a. on the written down value of the club premises and @ 1596 p.a. on car for the whole year.

You are required to prepare an Income and Expenditure account of Diana Club for the year ending 30th September, 2003 and Balance Sheet as on that date.

Solution:

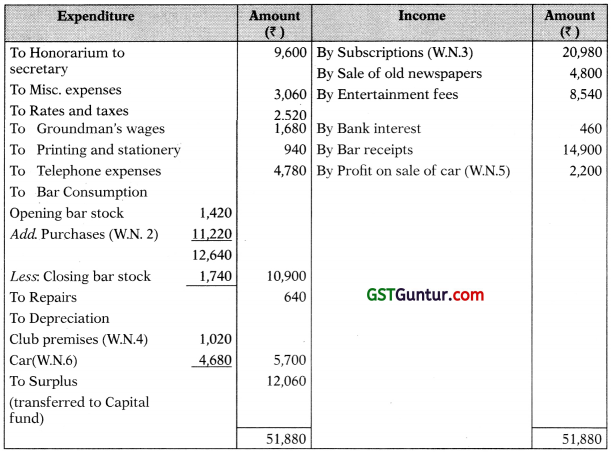

Income and Expenditure Account of Diana Club

for the year ended 30th September, 2003

Balance Sheet of Diana Club as on 30th September, 2003

Working Notes:

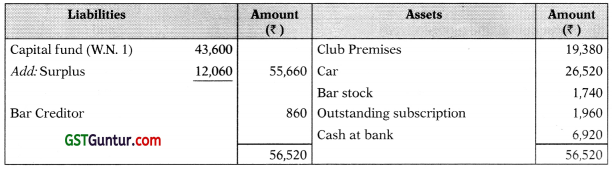

1. Balance Sheet of Diana Club as on 1st October, 2002

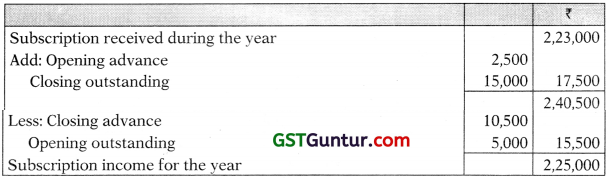

2. Calculation of bar purchases for the year:

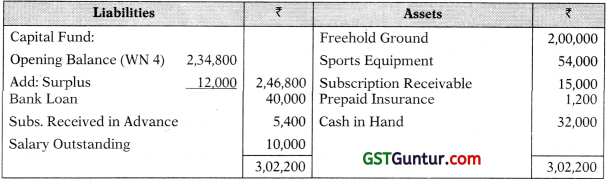

Bar Creditor a/c

| To Cash/Bank A/c (Paid during the year) To Closing outstanding c/f (payable) |

11,540 860 |

By Opening Outstanding b/f (Payable) By Income & Exp. A/c (Purchase: Bal.fig.) |

1,180 11,220 |

| 12,400 | 12,400 |

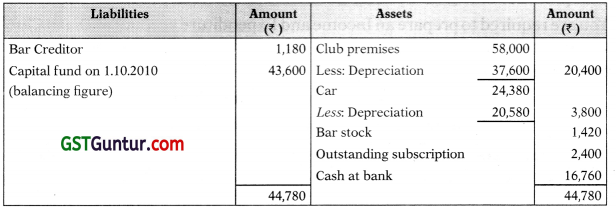

3. Calculation of subscriptions accrued during the year:

Subscription a/c

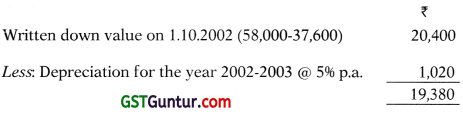

4. Depreciation on club premises and written down value on 30th September, 2003:

5. Calculation of profit on sale of car:

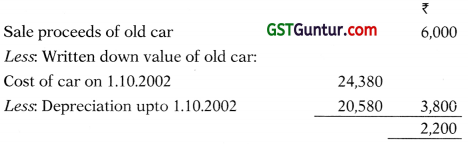

6. Depreciation on car and written down values on 30th September, 2003:

Note:

The opening and closing balance of cash and bank shown in the Receipts and Payments Account (given in the question), include the bank balance as per cash book. Therefore, no adjustment has been made in the above solution on account of cheques issued, but not presented for payment of printing. This is a reconciliation item pending to be recorded by bank.

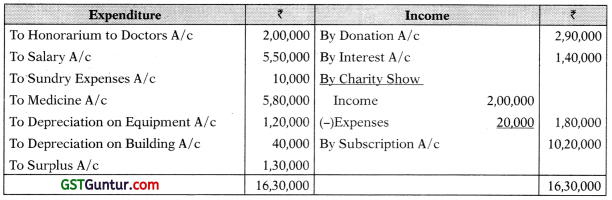

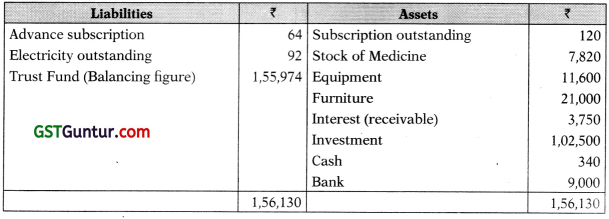

Question 19.

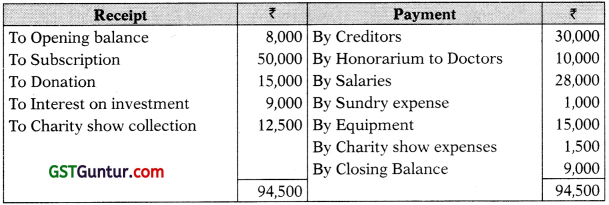

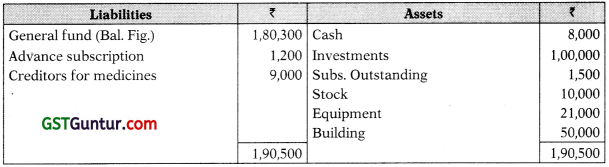

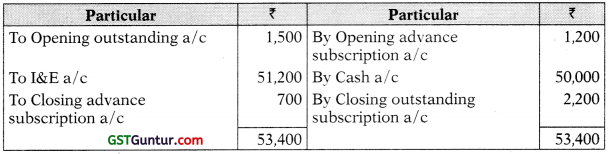

Summary of Receipts and payments of Bombay Medical Aid Society for the year ended 31.12.2000 are as follows:

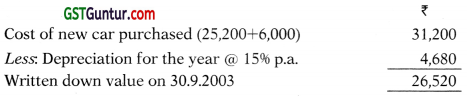

Opening Cash balance in hand ₹ 8,000, Subscription ₹ 50,000, Donation ₹ 15,000, Interest on Investments @ 9% p.a. ₹ 9,000, Payments for medicine supply ₹ 30,000, Honorarium to Doctors ₹ 10,000, Salaries ₹ 28,000, Sundry Expenses ₹ 1,000, Equipment purchase ₹ 15,000, Charity show expenses ₹ 1,500, Charity show collections ₹ 12,500.

Additional information:

| 1.1.2000 | 31.12.2000 | |

| Subscription due Subscription received in advance Stock of medicine Amount due for medicine supply Value of equipment Value of building |

1,500 1,200 10,000 9,000 21,000 50,000 |

2,200 700 15,000 13,000 30,000 48,000 |

You are required to prepare Receipts and Payments Account and Income and Expenditure Account for the year ended 31.12.2000 and Balance Sheet as on 31.12.2000.

Solution:

Income and Expenditure Account

Balance sheet on date 31.12.2000

Receipt and Payment Account

Working note:

Balance sheet on date 1.1.2000

Subscription A/c

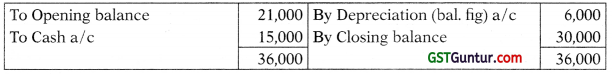

Medicine Expenditure A/c

Creditors for M.S. A/c

Equipment A/c

Building A/c

Amount of Investment = Interest ÷ Rate = 9,000 ÷ 9/100 = 1,00,000.

![]()

Question 20.

The following information’s were obtained from the books of Delhi Club as on 31.3.1998 at the end of the first year of the Club. You are required to prepare Receipts and Payments Account, Income and Expenditure Account for the year ended 31.3.1998 and a Balance Sheet as at 31.3.1998 on mercantile basis:

(i) Donations received for Building and Library Room ₹ 2,00,000.

(ii) Other revenue income and actual receipts:

| Revenue Income ₹ |

Actual Receipts ₹ |

|

| Entrance Fees Subscription Locker Rents Sundry Income Refreshment Account |

17,000 20,000 600 1,600 – |

17,000 19,000 600 1,060 16,000 |

(iii) Other revenue expenditure and actual payments:

| Revenue Expenditure ₹ |

Actual Payments ₹ |

|

| Land (cost ₹ 10,000) Furniture (cost ₹ 1,46,000) Salaries Maintenance of Playgrounds Rent Refreshment Account |

– – 5,000 2,000 8,000 – |

10,000 1,30,000 4,800 1,000 8,000 8,000 |

Donations to the extent of ₹ 25,000 were utilized for the purchase of Library Books, balance was still unutilized. In order to keep it safe, 9% Govt. Bonds of ₹ 1,60,000 were purchased on 31.3.1998. Remaining amount was put in the Bank on 31.3.1998 under the term deposit. Depreciation at 10% p.a. was to be provided for the year on Furniture and Library Books.

Solution:

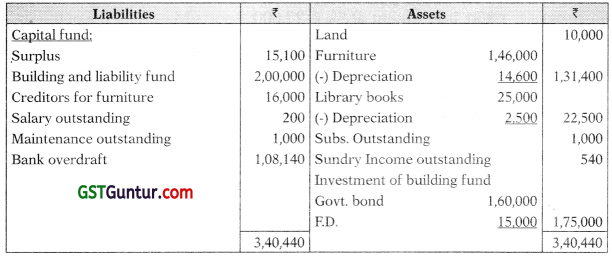

Delhi Club

Income and Expenditure Account for the year ended 31st March 1998

Balance sheet on date 31.3.1998

Receipts and Payments A/c for the year 31st March 1998

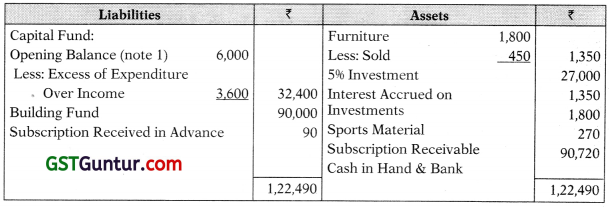

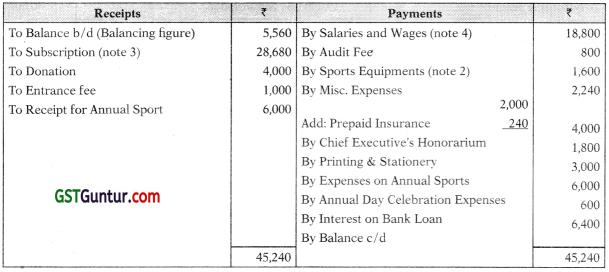

Question 21.

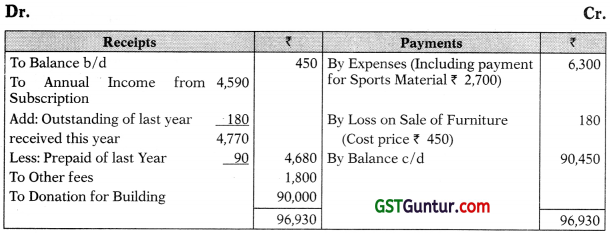

The Receipts and Payments Account of Trustwell Club prepared on 31st March, 2008 is as follows:

Receipts and Payments Account

Additional Information:

Trustwell Club had balances as on 1.4.2007:

Furniture ₹ 1,800; Investment at 5% ₹ 27,000; Sports Materials ₹ 6,660;

Balance as on 31.3.2008: Subscription Receivable ₹ 270; Subscription received in advance ₹ 90; Stock of Sports Material ₹ 1,800.

Do you agree with above Receipts and Payments Account? If not, prepare correct Receipt and Payments Account and Income and Expenditure Account for the year ended 31st March, 2008 and Balance Sheet as on that date.

Solution:

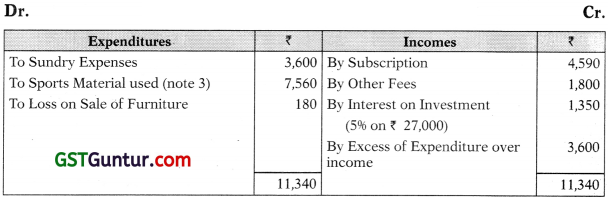

In the books of Trustwell Club

Corrected Receipts & Payments Account

for the year ended 31st March, 2008

Income & Expenditure Account

for the year ended 31st March, 2008

Balance sheet of Trustwell Club as on 31st March, 2008

Working Notes:

1. Balance Sheet of Trustwell Club as on 1st April, 2007

2. Subscription Account

3. Sports Material Stock Account

Question 22.

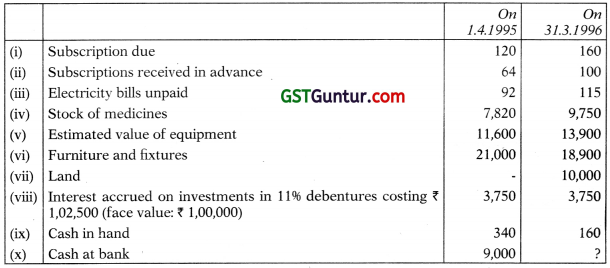

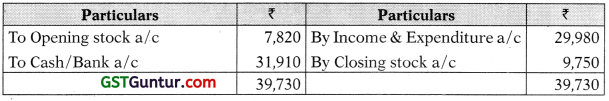

From the following particulars relating to Deena Nath Charitable Hospital, prepare (i) Receipts and Payments Account for the year ended on 31st March, 1996; and (ii) Balance Sheet as on 31st March, 1996:

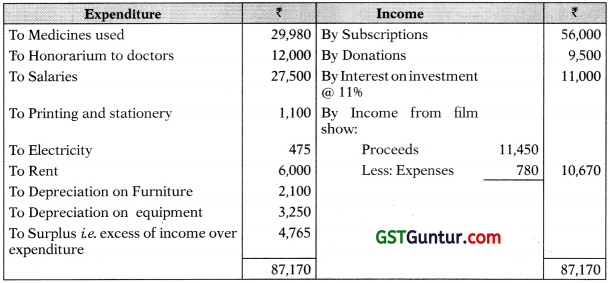

Income and Expenditure Account

For the year ended 31st March, 1996

Additional Information:

Solution:

Receipt & Payment A/c

Balance Sheet as on 31.3.96

Working Notes:

Balance Sheet as on 31.3.95

Medicine A/c

Electricity A/c

Furniture A/c

Equipment A/c

Interest A/c

Subscription A/c

Question 23.

Following is the Income and Expenditure Account of Victoria Club for the year ending 31st March, 2008

Additional Information:

→ The Club owned a sports ground of ₹ 40,000

→ The Club took a loan of ₹ 8,000 from a bank during the year 2006-07, which was not paid in 2007-08.

→ Audit fee of 2007-08 was outstanding, but Audit fees of ₹ 800 for 2006-07 was paid in 2007-08

Prepare Receipts and Payments Account for the year ending 31st March, 2008 and a Balance Sheet as on that date.

Solution:

In the books of Victoria Club

Receipts and Payments Account for the year ended on 31st March, 2008

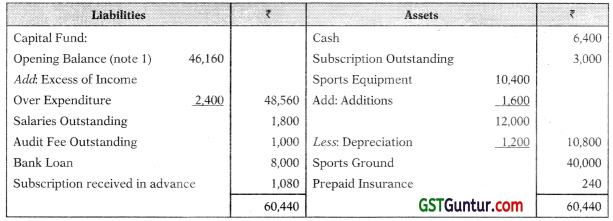

Balance Sheet of Victoria Club

As on 31st March, 2008

Working Notes:

1. Balance Sheet of Victoria Club

as on 31st March, 2007

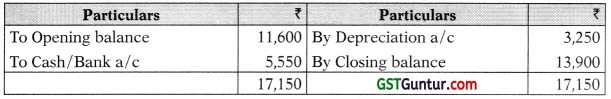

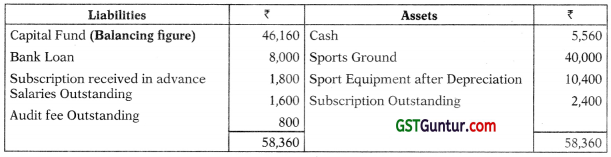

2. Sports Equipment Account

3. Subscription Account

4. Salary & Wages Account

Question 24.

The Income and Expenditure Account of City Sports Club for the year ended 31st March, 2009 was as follows:

The above account had been prepared after the following adjustments:

| ₹ | |

| Subscription outstanding on 31.03.2008 | 12,000 |

| Subscription received in advance on 31.03.2008 | 9,000 |

| Subscription received in advance on 31.03.2009 | 5,400 |

| Subscription outstanding on 31.03.2009 | 15,000 |

Salaries outstanding at the beginning and at the end of the financial year were ₹ 8,000 and ₹ 10,000 respectively. Sundry expenses included prepaid insurance expenses of ₹ 1,200.

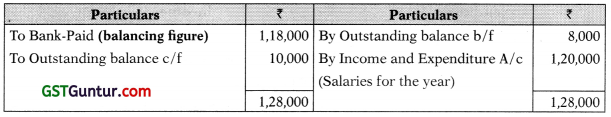

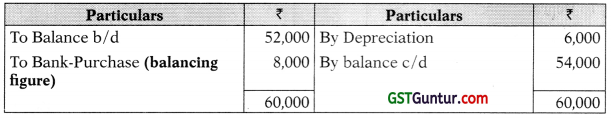

The club owned a freehold ground valued ₹ 2,00,000. The club has sports equipment on 01.04.2008 valued at ₹ 52,000. At the end of the year after depreciation the sports equipment amounted to ₹ 54,000. The club raised a loan of ₹ 40,000 from a bank on 01.01.2008 which was unpaid till 31.03.2009. On 31.03.2009 Cash in hand was ₹ 32,000.

Prepare Receipts and Payments account of the club for the year ended 31 st March, 2009 and Balance Sheet as on that date.

Solution:

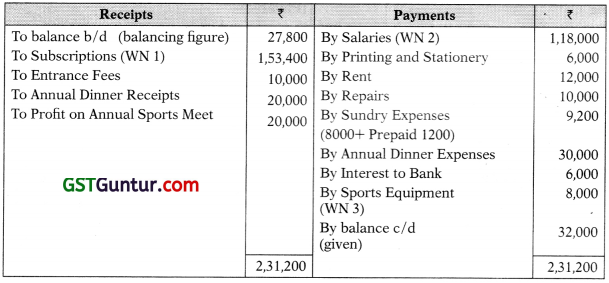

Receipts and Payments Account for the year ended 31.03.2009

Balance Sheet as on 31.03.2009

Working Notes:

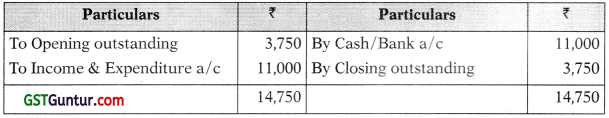

1. Subscription Account

2. Salary Account

3. Sports Equipment Account

4. Balance Sheet as at 01.04.2009

Question 25.

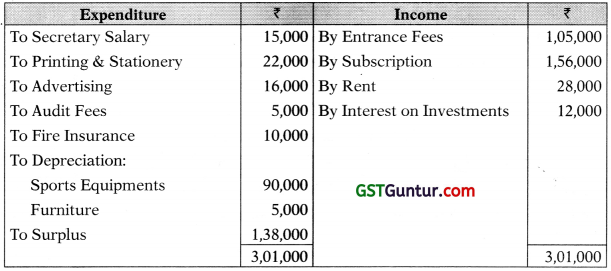

The Receipts and Payments Account, the Income and Expenditure Account and additional information of a sports club for the year ended 31st March, 2013 were as follows:

Receipts & Payments Account

For the year ending on 31st March, 2013

Income & Expenditure Account

For the year ending on 31st March, 2013

Additional Information:

The assets and liabilities as on 31st March, 2012 include club Grounds & Pavilion ₹ 4,40,000, Sports Equipments ₹ 2,50,000, Furniture & Fixtures ₹ 40,000, Subscription in Arrear ₹ 8,000, Subscription received in advance ₹ 2,000 and Creditors for Printing & Stationery ₹ 5,000.

You are required to prepare the Balance Sheet of the Club as on 31st March, 2013.

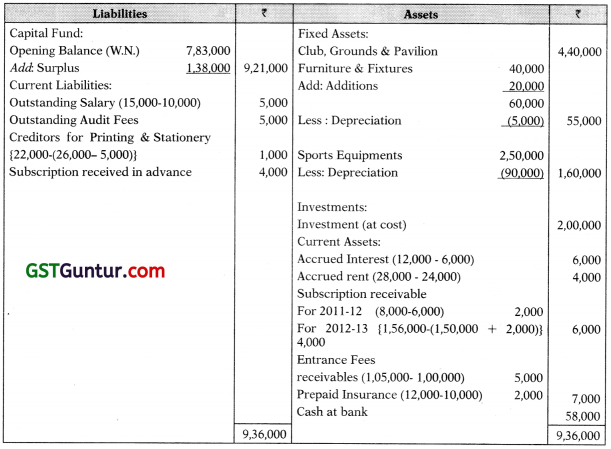

Solution:

Balance Sheet of Sports Club

As at 31st March 2013

Alternatively accounts can be prepared to ascertain the missing figures.

Working Note:

Calculation of Capital Fund as on 1st April, 2012

Balance Sheet of Sports Club

As at 31st March 2012

Question 26.

You are provided with the followings:

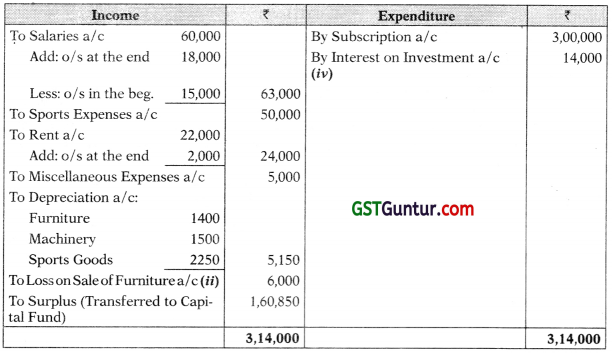

Balance Sheet as on 31st March, 2017

The Receipts and Payments account for the year ended on 31st March, 2018

You are required to prepare Income and Expenditure account for the year ended 31st March, 2018 and a Balance Sheet as at 31st March, 2018 (Workings should form part of your answer).

Solution:

Income & Expenditure A/c

(for the year ending 31st March, 2018)

Working Note:

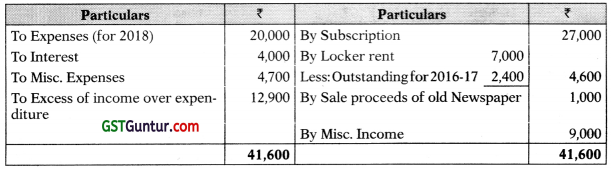

Subscription A/c

Balance Sheet as on 31st March, 2018

Question 27.

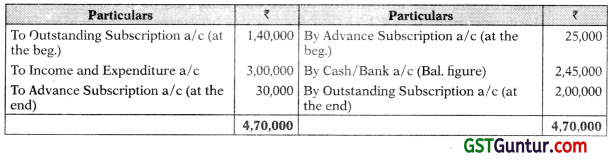

From the following information supplied by M.B.S. Club prepare Receipts and Payments Account and Income and Expenditure Account for the year ended 31st March 2019.

| 01.04.2018 Rs. |

31.03.2019 Rs. |

|

| Outstanding subscription Advance Subscription Outstanding Salaries Cash in Hand and at Bank 10% Investment Furniture Machinery Sports Goods |

1,40,000 25,000 15,000 1,10,000 1,40,000 28,000 10,000 15,000 |

2,00,000 30,000 18,000 ?? 70,000 14,000 20,000 25,000 |

Subscription for the year amount to ₹ 3,00,000. Salaries paid 7 60,000. Face value of the Investment was ₹ 1,75,000, 5096 of the Investment was sold at 8096 of Face Value. Interest on Investments was received ₹ 14,000. Furniture was sold for ₹ 8000 at the beginning of the year. Machinery and Sports Goods purchased and put to use at the last date of the year. Charge depreciation @ 1596 p.a. on Machinery and Sports Goods and @1096 p.a. on Furniture.

Following Expenses were made during the year:

Sports Expenses: ₹ 50,000

Rent: ₹ 24,000 out of which ₹ 2,000 outstanding

Misc. Expenses : ₹ 5,000

Solution:

Receipts & Payments A/c for the year ended 31st March, 2019

Income & Expenditure A/c for the year ended 31st March, 2019

Working Notes:

(i) Subscription Account

(ii) Loss on Sale of Furniture

Cost of Furniture sold = ₹ 28,000 – ₹ 14,000 = ₹ 14,000

Sale value of furniture = ₹ 8,000

Loss on sale of furniture = ₹ 14,000 – ₹ 8,000 = ₹ 6,000

(iii) Sale Value of Investment

= 1,75,000 x 50% = 87,500 (Face value)

= 87,500 x 80% = 70,000

Therefore, No Profit or Loss on Sale of Investment

(iv) Since date of sale of Investment is not given, it has been assumed that the interest received on investments of ₹ 14,000 is the interest of the year.

True or False

Question 1.

Scholarship granted to students out of funds provided by Government will be debited to Income & Expenditure Account.

Answer:

False: The Scholarship granted to students should be deducted from the funds provided by the Government for the same purpose in the Balance Sheet.

Question 2.

Receipts and Payments Account is a summary of all capital receipts and payments.

Answer:

False: Receipts and Payments Account is a summary of all cash or bank receipts and payments whether they are of capital or revenue in nature.

Question 3.

If there appears a sports fund, the expenses incurred on sports activities will be taken to income and expenditure account.

Answer:

False: Expenses incurred on sports activities will be deducted from sports fund only.

Question 4.

Receipts and Payments Account highlights total income and expenditure.

Answer:

False: Receipts and Payments Account is a summary of all cash or bank receipts and payments whether they are of capital or revenue in nature.

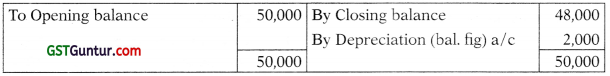

![]()

Question 5.

Only revenue items are disclosed in Income and Expenditure account.

Answer:

True: Income and Expenditure Account is prepared to find out surplus/ deficit. Hence, only revenue items are shown in the Income and Expenditure Account. Thus, capital expenditures are not shown in Income & Expenditure Account.

Question 6.

Fees received for Life Membership is a revenue receipt as it is of recurring nature.

Answer:

False: Life membership fee received for the life membership is a capital receipt because it is of non-recurring nature.