Rectification of Errors – CA Foundation Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

Rectification of Errors – CA Foundation Accounts Study Material

Question 1.

What are the types of errors & their effects on agreement of trial balance?

Answer:

Classification of Errors (types of errors) and its effect on agreement of Trial Balance:

1. Errors of Principle:

- That means there is error in applying some accounting principle.

- Such errors will not affect the agreement of trial balance i.e. these are double sided error.

Example – Treating a revenue expense as capital expenditure or vice versa or the recording of sale of a fixed asset as ordinary sale.

2. Clerical Errors:

- These are the errors committed in applying the accounting procedure.

- Such errors may or may not affect the agreement of trial balance.

These can be further classified as follows:

(a) Errors of Omission:

(i) Omitting an entry completely from the subsidiary book. Full omission hence Trial Balance will agree.

Example : Sale of ₹ 5,000 to A on 30.3.06 is not recorded.

(ii) Omitting to post the ledger account from the subsidiary books.

Partial omission hence Trial Balance will not agree.

Example : A sale entry of ₹ 10,000 not posted to A’s a/c.

(b) Errors of Commission:

(i) Writing wrong amount in the Subsidiary book. Trial Balance will agree.

Example: A purchase of ₹ 5,000 from ‘X’ is entered in purchase book as ₹ 500

(ii) Posting the wrong account in the ledger. Trial Balance will agree.

Example: From Sales book A’s account is debited by ₹ 8000 instead of B’s account.

(iii) Wrong casting of subsidiary books.

Example: Total of Bills Receivable book is taken as ₹ 1,05,000 instead of ₹ 1,00,500

(iv) Posting the wrong amount in the ledger.

Example: From Sales Return book A’s account is credited by ₹ 8,000 instead of ₹ 8,800

(v) Posting an amount on the wrong side of an account.

Example: From Sales Book L’s account is credited

(vi) Wrong balancing of an account.

Example: Balance of Furniture account is taken as ₹ 7,000 instead of ₹ 3,000

Note: In case of errors described in (iii) to (vi) above, Trial Balance will not agree.

(c) Compensating Errors:

Two or more mistakes which compensate the effect of each other on trial balance & hence Trial Balance will agree.

Example: Excess debit ₹ 1,000 to Furniture a/c & Excess credit of ₹ 1,000 to Sales a/c.

![]()

Question 2.

Suspense Account

Answer:

Suspense Account:

→ When trial balance does not tally, the difference is put to an account named as Suspense a/c. Difference is:

- debited (if debit side of trial balance is short) or

- credited (if credit side of trial balance is short) to Suspense a/c

→ Thus with the help of suspense a/c trial balance is artificially tallied.

→ While passing rectification entry for one sided errors, the one effect Dr. or Cr. will go into the a/c in which mistake is committed & the other effect will be given to Suspense a/c.

→ When all such one sided errors are rectified the Suspense a/c will become Nil

→ While rectifying double sided errors, suspense account will not get affected.

Question 3.

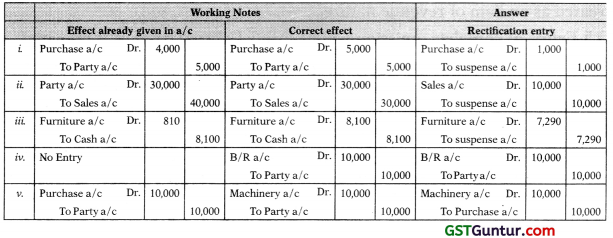

Ganesh drew a Trial Balance of his operations for the year ended 31.03.2006. There was a difference in the Trial Balance which he closed with a Suspense Account. On a scrutiny by the Auditors, the following errors were found:

(i) Purchases day book for the month of April, was undercast by ₹ 1000

(ii) Sales day book of October, was overcast by ₹ 10,000

(iii) A furniture purchased for ₹ 8,100 was entered in the Furniture Account as ₹ 810.

(iv) A bill for ₹ 10,000 drawn by Ganesh was not entered in the Bills Receivable Book.

(v) A machinery purchased for ₹ 10,000 was entered in the purchased day book.

Pass necessary Journal Entries to rectify the same and ascertain the difference in the Trial Balance that was shown under the Suspense Account in respect of the above items.

Solution:

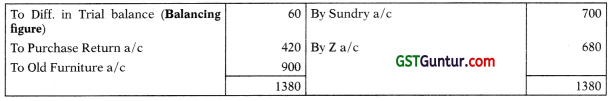

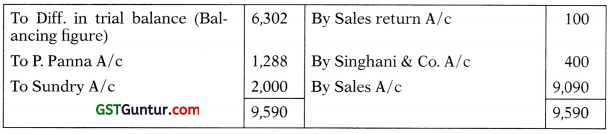

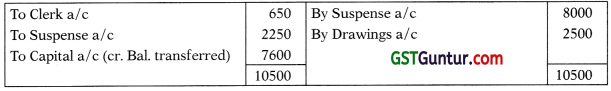

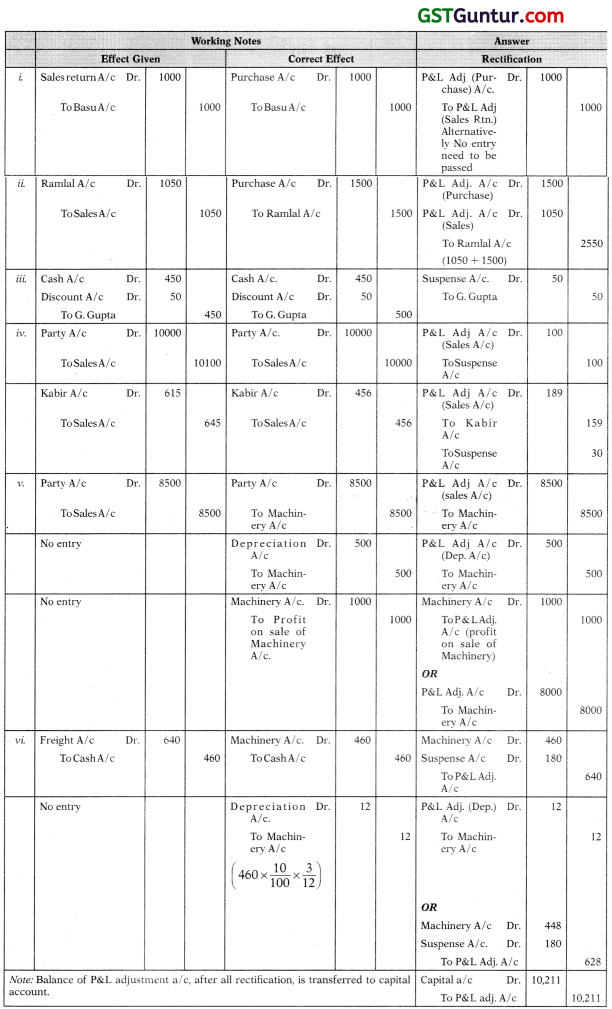

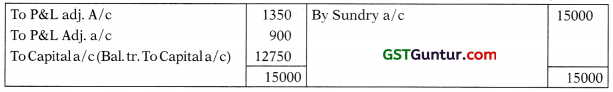

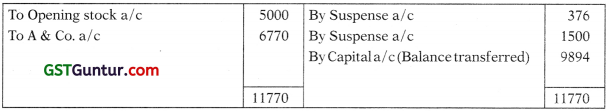

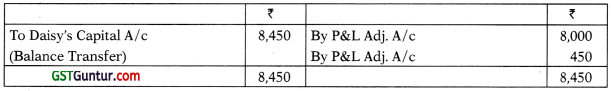

Suspense Account

Comment:

→ Debit side of Trial balance was short by ₹ 18,290. Trial balance was temporarily tallied by putting that diff. to debit of suspense a/c. Now after rectification the suspense a/c has become nil that means trial balance is now tallied.

→ (iv) & (v) are double sided error, hence their rectification does not involve suspense a/c but (i), (ii) & (iii) are one sided error, hence their rectification involves suspense a/c.

→ (v) is Error of Principle, (iv) is Errors of Full omission and (i), (ii) & (iii) . are Error of commission.

Question 4.

The accountant of X prepared the Trial Balance for the year ended 31st March, 2006. But there was a difference and the accountant put the difference in Suspense Account. Rectify the following errors found and prepare the Suspense Account:

1. The total of the Returns outward book, ₹ 420 has not been posted in the ledger.

2. Purchase of ₹ 350 from Y has been entered in the sales book. However Y’s a/c has been correctly entered.

3. A sale of t 390 to Z has been credited to his account as ₹ 290.

4. Old furniture sold for ₹ 5,400 had been entered as ₹ 4,500 in sales account.

5. Goods taken by proprietor, ₹ 500 have not been entered in the books at all.

Solution:

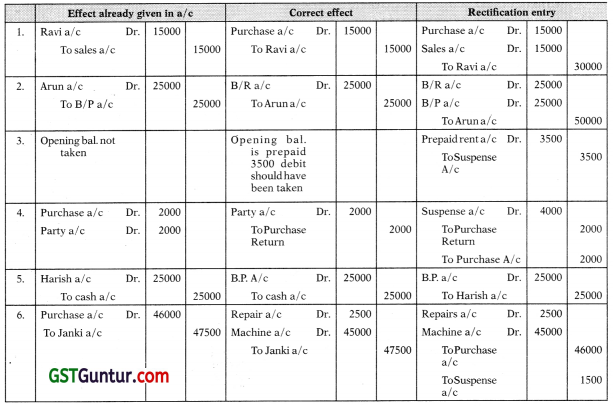

Suspense Account

Comment:

- Debit side of Trial balance was short by ₹ 60.

- (5) is double sided error, hence their rectification does not involve suspense. a/c but (1), (2), (3) & (4) are one sided error, hence their rectification involves suspense a/c.

- (4) is Error of Principle as well as Error of commission, (5) is Errors of Full omission, (1) is Errors of Partial omission and (2), & (3) are Error of commission.

![]()

Question 5.

A book-keeper finds the difference in the Trial Balance amounting to ₹ 1,000 and puts it in the Suspense Account. Later on he detects the following errors.

1. Purchased goods from Ravi ₹ 15,000 but entered into Sales Book.

2. Received one bill for ₹ 25,000 from Arun but recorded in Bills Payable Book.

3. An item of ₹ 3,500 relating to prepaid rent account was omitted to be brought forward.

4. An item of ₹ 2,000 in respect of purchase returns, had been wrongly entered in the purchase book, party a/c was correctly posted.

5. ₹ 25,000 paid to Hari against our acceptance were debited to Harish Account.

6. Bills received from Janki for repairs done to Machine ₹ 2,500 and Machine supplied for ₹ 45,000 were entered in the Purchase Book as ₹ 46,000. Janki a/c was credited with t 47,500.

Give rectifying journal entries with full narration and prepare Suspense Account.

Solution:

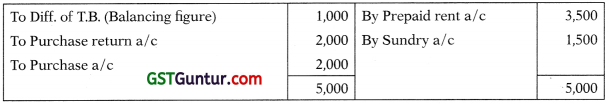

Suspense Account

Comment:

- Debit side of Trial balance was short by ₹ 1000 Amt. of diff. was given but side was not given.

- (1), (2) & (5) are double sided error, hence their rectification does not involve suspense a/c but (3), (4), & (6) are one sided error, hence their rectification involves suspense a/c.

- (6) is Error of Principle as well as Error of commission, (3) is Error of Partial omission, and (1), (2), (4) & (5) are Error of commission.

Question 6.

The trial balance of a firm is out. The following errors were found sub-sequently, to have been committed. Pass journal entries to correct them, and ascertain the difference in the Trial Balance.

(a) An amount of ₹ 100 was received from D. Das on 31st December, 2005, but had been entered in the Cash Book on 3rd January, 2006.

(b) The Returns Inwards Books for December has been cast ₹ 100 short.

(c) The purchase of an office table costing ₹ 300 had been passed through the Purchase Day Book.

(d) ₹ 375 paid for wages to workmen for making show cases had been charged to wages account.

(e) A purchase of ₹ 671 had been posted to the debit of the creditor’s account as ₹ 617. The creditor is P. Panna & Co.

(f) A cheque for ₹ 200 received from P.C Joshi has been dishonoured on maturity and was passed to the debit of Allowances Account.

(g) Goods amounting to ₹ 100 had been returned by a customer and were taken into stock but no entry in respect thereof was made in the books.

(h) ₹ 2,000 paid for the purchase of a motor-cycle for Mr. Dutt (a partner) had been charged to Miscellaneous Expenses Account.

(i) A sale of ₹ 200 to Singhani & Co. was credited to their account.

(j) A sale of ₹ 1,000 had been passed through the Purchase Day Book. The customer’s account has, however, been correctly debited.

(k) While carrying forward the total of the sales book from one page to the next, the amount was written as ₹ 1,76,658 instead of ₹ 1,67,568.

Solution:

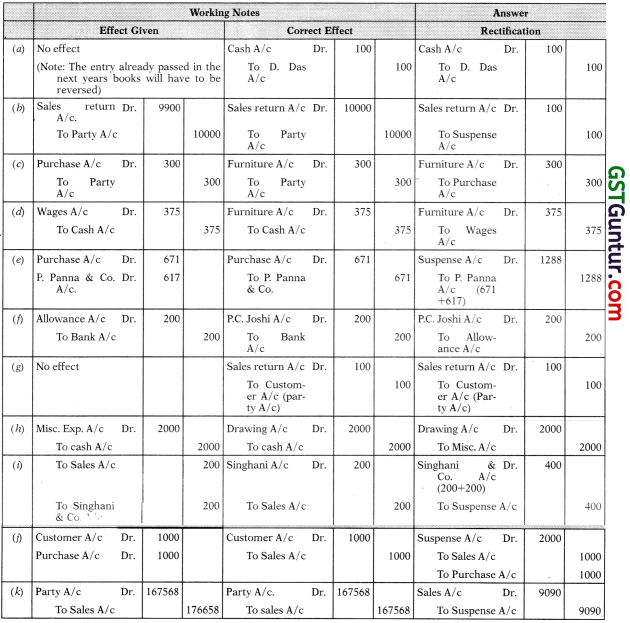

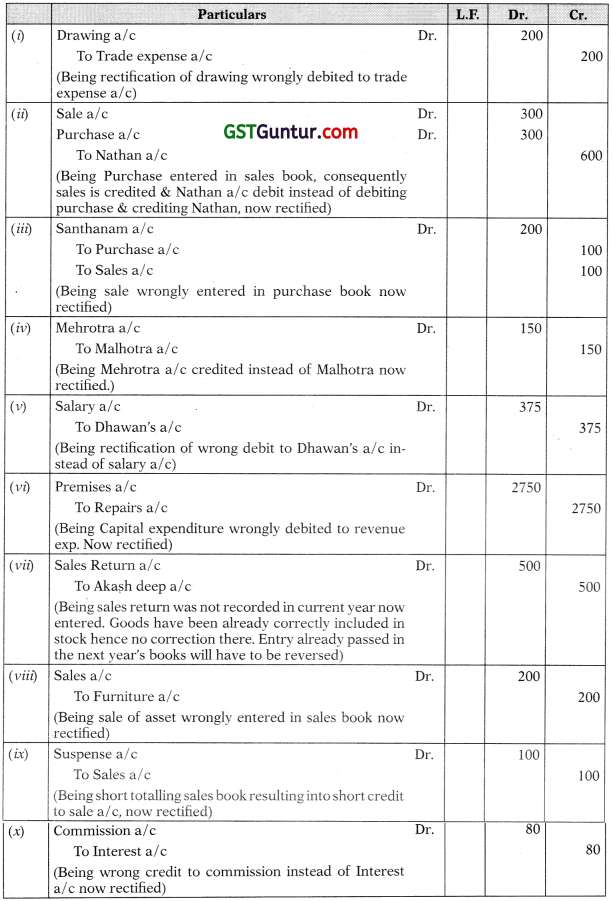

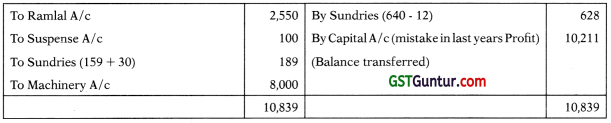

Suspense Account

Comment:

- Debit side of Trial balance was short by ₹ 6302/-

- (a), (c), (d), (f), (g) & (h) are double sided error, hence their rectification does not involve suspense a/ c but (b), (e), (i), (j) & (k) are one sided error, hence their rectification involves suspense a/c.

- (d) & (h) are Error of Principle, (g) is Errors of Full omission, and (a), (b), (c) , (e), (f), (i), (j) & (k) are Error of commission.

![]()

Question 7.

Pass necessary journal entries to rectify the following errors:

(i) An amount of ₹ 200 withdrawn by the proprietor for his personal use has been debited to trade expenses account.

(ii) A purchase of goods from Nathan amounting to ₹ 300 has been wrongly entered through the sales-book.

(iii) A credit sale of ₹ 100 to Santhanam has been wrongly passed through the purchases-book.

(iv) ₹ 150 received from Malhotra have been credited to Mehrotra.

(v) ₹ 375 paid on account of salary to the cashier Dhawan stands debited to his personal account.

(vi) A contractor’s bill for extension of premises amounting to ₹ 2,750 has been debited to building repairs account.

(vii) On 25th June, goods of the value of ₹ 500 were returned by Akash Deep and were taken into stock but the returns were entered in the books under date 3rd July, ie., after the expiration of the financial year on 30th June.

(viii) A bill of ₹ 200 for old office furniture sold to Sethi were entered in the sales-day-book.

(ix) The periodical total of the sales-book was cast short by ₹ 100.

(x) An amount of ₹ 80 received on account of interest was credited to commission account.

Solution:

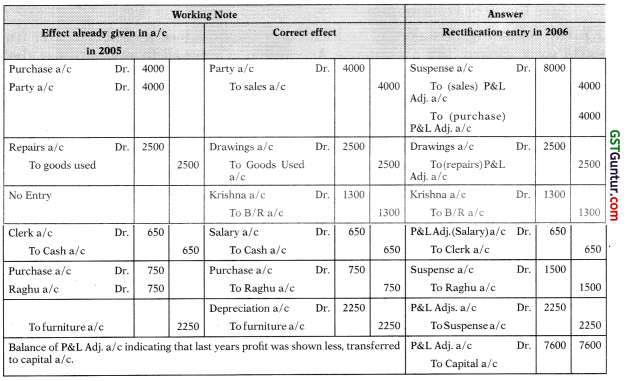

Rectification of Entry in same Year

Comment:

- Credit side of Trial balance was short by ₹100/-

- (i) to (viii) & (x) are double sided error, hence their rectification does not involve suspense a/c but (ix) is one sided error, hence their rectification involves suspense a/c.

- (i), (vi), (viii) is Error of Principle, and (ii) to (v), (vii), (ix) & (x) are Error of commission.

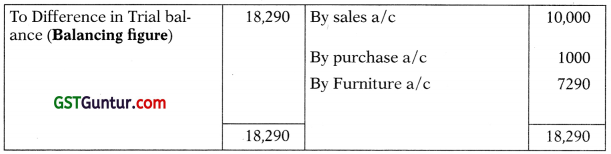

Question 8.

A book-keeper while preparing his trial balance finds that the debit exceeds by ₹ 7,250. Being required to prepare the final account for the year 2005, he places the difference to a Suspense Account. In the next year i.e. 2006 the following mistakes were discovered:

(a) A sale of ₹ 4,000 has been passed through the Purchase Day-book. The entry in customer’s account has been correctly recorded.

(b) Goods worth ₹ 2,500 taken away by the proprietor for his use has been debited to Repairs Account.

(c) A Bill receivable for ₹ 1,300 received from Krishna has been dishonoured on maturity but no entry passed.

(d) Salary ₹ 650 paid to a clerk has been debited to his Personal Account.

(e) A Purchase of ₹ 750 from Raghubir has been debited to his account. Purchases Account has been correctly debited.

(f) A sum of ₹ 2,250 written off as depreciation on furniture has not been debited to Depreciation Account.

Draft the Journal entries for rectifying the above mistakes and prepare Suspense Account.

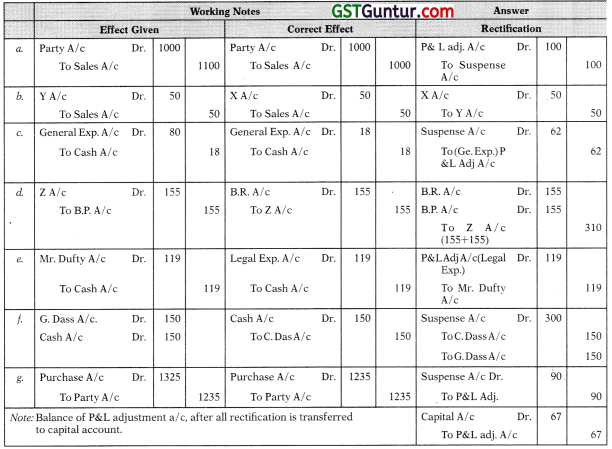

Solution:

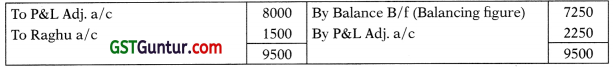

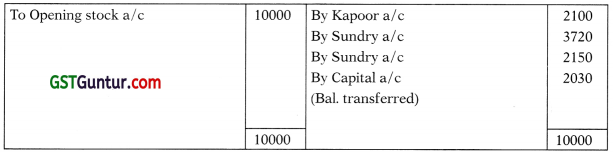

Rectification in Subsequent Year

Suspense Account:

P & L Adjustment Account:

Comment:

- Balance in suspense a/c indicates that in last year’s Trial balance, Credit side was short by ₹ 7250.

- As the rectification is being carried out in the next years books of account, the Profit & Loss adjustment account is debited/credited in place of income & expenses account.

- The credit balance of ₹ 7,600 in. Profit & Loss adjustment account indicates that in last year less profit was shown.

- (b), (c) & (d) is double sided error, hence their rectification does not involve suspense a/c but (a), (e) & (f) are one sided error, hence their rectification involves suspense a/c.

- (b) is Error of Principle, (c) is Error of Full omission and (a), (d), (e) & (f) are Error of commission.

![]()

Question 8.

The following mistakes were located in the books of a concern after its books were closed and a suspense Account was opened in order to get the Trial Balance agreed.

(a) Sales Day Book was over cast by ₹ 100.

(b) A sales of ₹ 50 to X was wrongly debited to the account of Y.

(c) General Expenses of ₹ 18 was posted in the General Ledger at ₹ 80.

(d) A bill receivable for ₹ 155 was passed through Bills payable Day Book – This bill was given by Z.

(e) Legal expenses ₹ 119 paid to Mr. Dufty was debited to his personal account.

(f) Cash received from C. Dass was debited to G. Dass ₹ 150.

(g) While carrying forward the total of one page of the Purchases Book to the next the amount of ₹ 1235 was written as ₹ 1325.

Find out the nature and amount of the Suspense Account and pass entries for the rectification of the above errors in the subsequent year’s books.

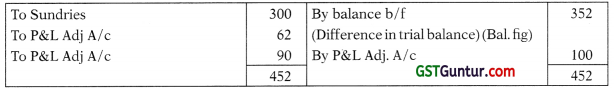

Solution:

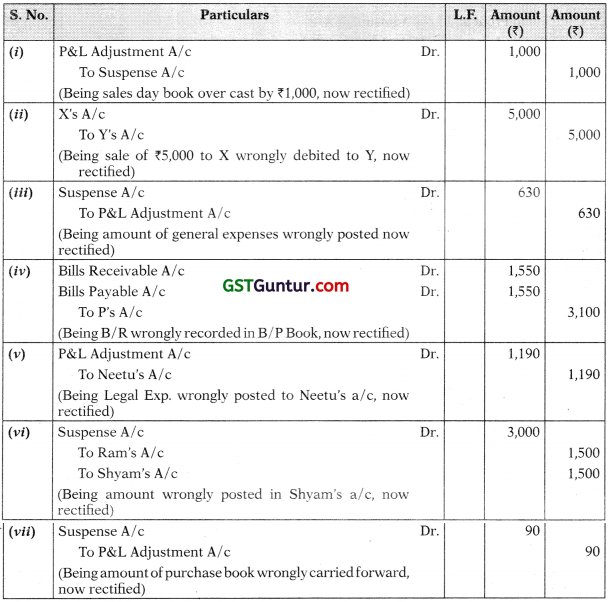

Rectification in Subsequent Year:

Suspense Account:

P&L Adjustment Account:

Note: Debit balance ₹ 67 indicates that last year’s profit was shown excess.

Comment:

- Balance in suspense a/c indicates that in last year’s Trial balance, Credit side was short by ₹ 352

- As the rectification is being carried out in the next years books of account, the Profit & Loss adjustment account is debited/credited in place of income & expenses account.

- The debit balance of ₹ 67 in Profit & Loss adjustment account indicates that in last year excess profit was shown.

- (b), (d) & (e) is double sided error, hence their rectification does not involve suspense a/c but (a), (c), (f) & (g) are one sided error, hence their rectification involves suspense a/c.

- All errors are Error of commission although error (e) can also be considered as Error of Principle.

Question 9.

In 2006 Sen found accidentally that his books for 2005 contained some errors. The errors were:

i. An invoice for ₹ 1,000 for goods purchased from Basu was entered in Sales Returns Book.

ii. Goods bought on credit from Ramlal for ₹ 1,500 were entered in the Sales Book as ₹ 1,050.

iii. A Cash Discount of ₹ 50 allowed to G. Gupta remained un-posted to his account.

iv. The Sales Book for the month of April was overcast by ₹ 100. It was also found that a sale of ₹ 456 to Kabir was entered in the Sales Book as ₹ 645 from where he was debited by ₹ 615.

v. A machine purchased on 1st January, 2003 for 110,000 (on which ₹ 2,000 depreciation had been written off for the two years 2003 and 2004) had been sold on 1st July, 2005 for ₹ 8,500 but the sale was entered in the Sales Day Book.

vi. ₹ 460 paid for freight on machinery purchased on Oct. 1,2005 was debited to Freight Account as ₹ 640. Give journal entries to rectify the errors. Your entries must not affect current year’s profit or loss. Have you any comments to offer?

Solution:

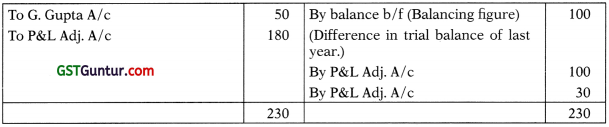

Rectification in Subsequent Year:

P&L Adjustment Account:

Suspense Account

Comment:

- Balance in suspense a/c indicates that in last year’s Trial balance, Credit side was short by ₹ 100.

- As the rectification is being carried out in the next years books of account, the Profit & Loss adjustment account is debited/credited in place of income & expenses account.

- The debit balance of Profit & Loss adjustment account indicates that in last year profit was shown excess by ₹ 10,211.

- (i), (ii) & (v) are double sided error, hence their rectification does not involve suspense a/c but (iii), (iv) & (vi) are one sided error, hence their rectification involves suspense a/ c.

- (v) is Error of Principle, (vi) is Error of Principle as well as error of commission, (iii) is Error of Partial omission and (i), (ii) & (iv) are Error of commission.

![]()

Question 10.

Nitish closes his books on 31st December. In 2005, his books showed a difference which he transferred to the debit of his Capital Account and prepared the Profit and Loss Account and Balance Sheet after doing so he found that the under mentioned errors had been committed in 2005.

(i) A machine, book value ₹ 8200 was sold on credit to Mehtani for ₹ 7500. The amount was posted to the credit of Mehta.

(ii) A cheque for ₹ 2,100 was received from Kapoor and was correctly dealt with. It was, however, returned dishonoured and was then posted to the debit of Trade Expenses A/c.

(iii) The closing stock sheets for 2005 were found to be totalled ₹ 10,000 in excess.

(iv) The income tax paid on behalf of the proprietor, ₹ 2370 was debited to Income Tax Account as ₹ 3720.

(v) A steel cupboard was purchased for ₹ 1,250, it was debited to General Expenses Account as ₹ 2150. Give journal entries to carry out the corrections required. How much was the difference in the books on December 31, 2005?

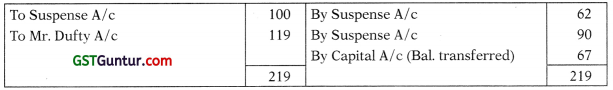

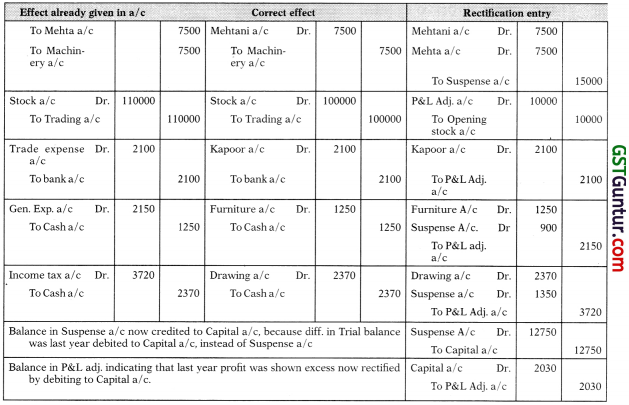

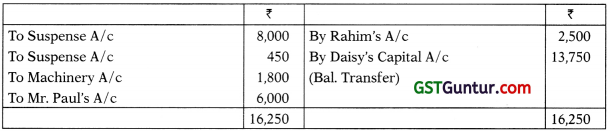

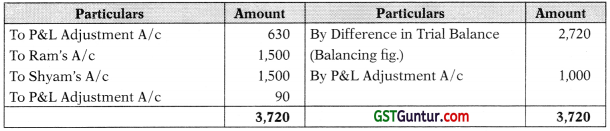

Solution:

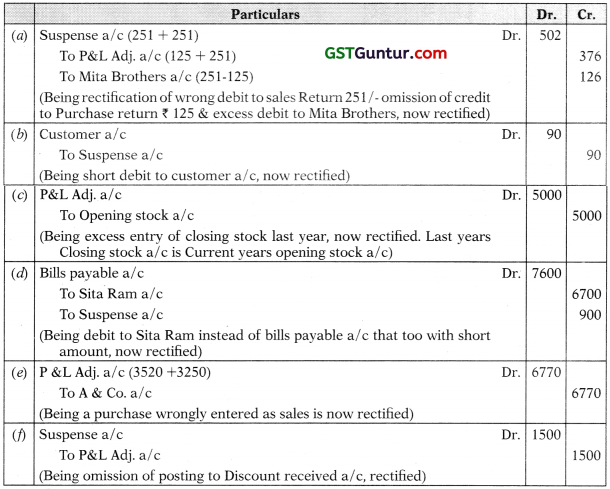

Suspense Account:

P&L Adjustment Account:

Comment:

- Last year difference in Trial balance was transferred (debited) to Capital a/c. Hence suspense a/c does not have it as opening balance. Therefore after rectification instead of suspense a/c getting closed, it is showing balance ₹ 12,750 which is transferred (credited) to capital a/c so that last years debit to capital a/c gets nullified.

- The debit balance of Profit & Loss adjustment account indicates that in last year profit was shown excess by ₹ 2,030.

- (ii) & (iii) are double sided error, hence their rectification does not involve suspense a/c but (i), (iv) & (v) are one sided error, hence their rectification involves suspense a/c.

- (iv) & (v) are Error of Principle as well as error of commission, and (i), (ii) & (iii) are Error of commission.

Question 11.

The books of account of B. Quick for the year ending 31st March, 2005 were closed with a difference in books carried forward. The following errors were detected subsequently:

(a) Goods ₹ 125 returned to Mita Bros, were recorded in the Returns Inward Book as ₹ 251 and from there it was posted to the debit of Mita Bros. Account.

(b) A credit sale of ₹ 760 was wrongly posted as ₹ 670 to the customer account in the Sales ledger.

(c) Closing Stock was overstated by ₹ 5,000 being casting error in the schedule of inventory.

(d) Paid acceptance to Bala Ram for ₹ 7,600 was posted to the debit of Sita Ram as ₹ 6,700.

(e) Goods purchased from A & Co. ₹ 3,250 entered in the Sales Day Book for ₹ 3,520.

(f) ₹ 1,500 being the total of the discount column on the credit side of the Cash Book was not posted. Pass rectification entries in the next year.

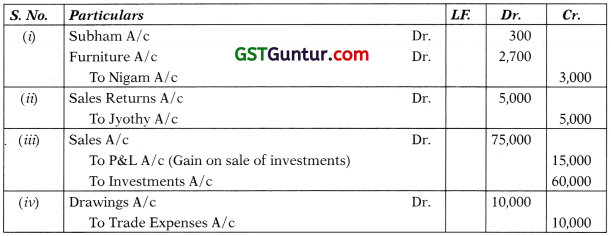

Solution:

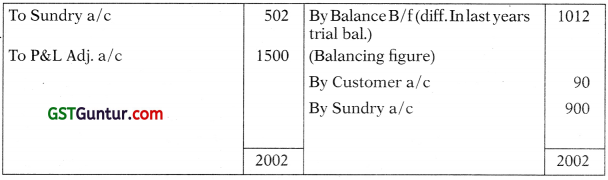

Rectification in Subsequent year:

Suspense Account:

P&L Adjustment Account:

Comment:

- Balance in suspense a/c indicates that in last year’s Trial balance, Credit side was short by ₹ 1012.

- The debit balance of Profit & Loss adjustment account indicates that in last year profit was shown excess by ₹ 9,894.

- (c) & (e) are double sided error, hence their rectification does not involve suspense a/’c but (a), (b), (d) & (f) are one sided error, hence their rectification involves suspense a/c.

- (f) is error of Partial omission, and (a) to (e) are Error of commission.

![]()

Question 12.

Give journal entries (narrations not required) to rectify the following:

(i) Purchase of Furniture on credit from Nigam for 3,000 posted to Subham account as ₹ 300.

(ii) A Sales Return of ₹ 5,000 to Jyothy was not entered in the financial accounts though it was duly taken in the stock book.

(iii) Investments were sold for ₹ 75,000 at a profit of ₹ 15,000 and passed through Sales account.

(iv) An amount of t 10,000 withdrawn by the proprietor (Darshan) for his personal use has been debited to Trade Expenses account.

Solution:

Journal Entries:

Question 12.

Miss Daisy was unable to agree the Trial Balance last year and wrote off the difference to the profit and loss account of that year. On verifying the old books by a Chartered Accountant next year, the following mistakes were found:

(i) Purchase account was undercast by ₹ 8,000.

(ii) Sale of goods to Mr. Rahim for ₹ 2,500 was omitted to be recorded.

(iii) Receipt of cash from Mr. Asok was posted to the account of Mr. Anbu ₹ 1.200.

(iv) Amount of ₹ 4,167 of sales was wrongly posted as ₹ 4,617.

(v) Repairs to Machinery was debited to Machinery Account ₹ 1,800.

(vi) A credit purchase of goods from Mr. Paul for ₹ 3,000 entered as sale.

Solution:

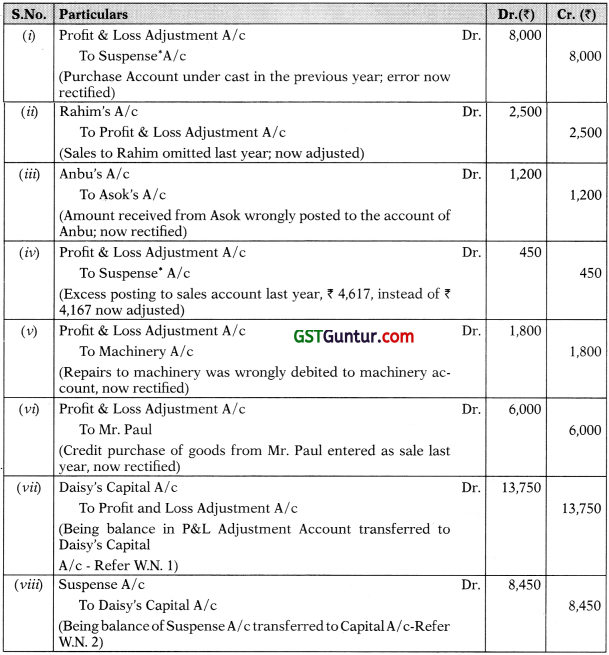

Journal Entries in the books of Miss Daisy:

Considering that the difference was posted to Suspense account.

Working Notes:

1. Profit and Loss Adjustment Account:

2. Suspense Account:

Question 14.

The following mistakes were located in the books of a concern after its books were closed and a Suspense Account was opened in order to get the Trial Balance agreed:

(i) Sales Day Book was overcast by ₹ 1,000.

(ii) A sale of ₹ 5,000 to X was wrongly debited to the Account of Y.

(iii) General expenses of ₹ 180 were posted in the General Ledger as ₹ 810.

(iv) A Bill Receivable for 11,550 was passed through Bills Payable Book. The Bill was given by P.

(v) Legal expenses ₹ 1,190 Paid to Mrs. Neetu was debited to her personal account.

(vi) Cash received from Ram was debited to Shyam ₹ 1,500.

(vii) While carrying forward the total of one page of the Purchases Book to the next, the amount of ₹ 1,235 was written as ₹ 1,325.

Find out the nature and amount of the Suspense Account and pass entries (including narration) for the rectification of the above errors in the subsequent year’s books. Solution:

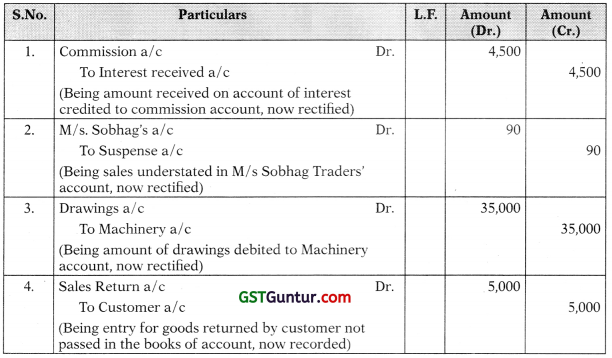

Journal Entries:

Suspense Account:

Question 15.

Give journal entries (with narrations) to rectify the following errors located in the books of a Trader after preparing the Trial Balance :

(i) An amount of ₹ 4,500 received on account of Interest was credited to Commission account.

(ii) A sale of ₹ 2,760 was posted from Sales Book to the Debit of M/s Sobhag Traders at ₹ 2,670.

(iii) ₹ 35,000 paid for purchase of Air conditioner for the personal use of proprietor debited to Machinery a/c.

(iv) Goods returned by customer for ₹ 5,000. The same have been taken into stock but no entry passed in the books of accounts.

Solution:

In the Books of Trader

Rectification Journal Entries

True or False

Question 1.

Rectifying errors in subsequent accounting period always affect the profit or loss of that period.

Answer:

False: Rectifying errors in subsequent accounting period related to Personal & Real Accounts will not affect the profit of that period.

Question 2.

Errors of principle involves an incorrect allocation of expenditure or receipt between capital and revenue.

Answer:

True: Recording the transaction in an incorrect fundamental manner is an error of principle.

Question 3.

Wrong casting of subsidiary books does not affect the trial balance.

Answer:

False: Wrong casting of subsidiary books affects the trial balance because wrong total will be posted to its account and then to the trial balance.

![]()

Question 4.

If the amount is posted in the wrong account or it is written on the wrong f side of an account, it is called an error of commission.

Answer:

True: Error of commission is an error on account of wrong posting, wrong balancing, wrong carry forward, wrong totalling etc.

Question 5.

Under or over-casting of a subsidiary book is an example of error of commission.

Answer:

True: Error of commission is an error on account of wrong posting, wrong balancing, wrong carry forward, wrong totalling etc.

Question 6.

Any type of error affects the agreement of trial balance.

Answer:

False: Every error does not affect the agreement of trial balance because Errors of Principle, Compensating errors etc. do not affect the agreement of trial balance.

Question 7.

Purchase of office furniture has been debited to general expenses account. It is a compensating error.

Answer:

False: It is an error of principle because here an item of capital nature is treated as an item of revenue nature.

Question 8.

Errors of complete omission will be located, if trial balance is prepared.

Answer:

False: Errors of Complete omission cannot be located because both debit and credit aspects of an entry are not recorded and hence it will not affect trial balance.

Question 9.

Errors of principle will affect trial balance.

Answer:

False: Errors of principle will not affect trial balance because both the aspects (debit & credit) of a transaction are recorded with correct figures.

![]()

Question 10.

Error of carry-forward of totals of purchase journal affects two accounts.

Answer:

False: It will affect one account i.e. purchases account so it will affect the total of trial balance.

Question 11.

If the effect of errors committed cancel out, the errors will be called compensating errors and the trial balance will disagree.

Answer:

False: If the effect of errors committed cancel out, the errors will be called compensating errors and the trial balance will agree.

Question 12.

If the amount is posted in the wrong account or it is written on the wrong side of the account, it is called error of principle.

Answer:

False: Amount posted in the wrong account or on the wrong side of the account is an error of commission.