Consolidated Financial Statements – CA Inter Advanced Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Consolidated Financial Statements – CA Inter Advanced Accounting Question Bank

Question 1.

Describe the procedure for computation of Cost of Control while preparing Consolidated Fin, Statements.

Answer:

In preparing CES, the Financial Statements of Parents and Subsidiary should be combined on a line-by-line basis, by adding together like items.

Step 1:

Determine the Cost of Investments in the Subsidiary, as per the Parent’s Financial Statements. Where the Carrying Amount of the Investment in the Subsidiary is different from its cost, the Carrying Amount should be considered.

Step2: .

Compute the Parent’s Portion of Equity of each Subsidiary, at the date on which investment in each Subsidiary is made.

Equity = Residual Interest in the Assets of an Enterprise, after deducting all its Liabilities.

Step 3:

Compute the difference between Step 1 and Step 2. Ascertain Goodwill or Capital Reserve.

If Cost of Investments> Parent’s Portion of Equity, then ‘difference = Goodwill.

If Cost of Investments < Parent’s Portion of Equity, then difference = Capital Reserve.

Step 4:

Eliminate the Cost of Investments & Parent’s Portion of Equity from the addition of line items. Disclose the Goodwill or Capital Reserve in the Consolidated Balance Sheet.

Question 2.

ABC Ltd. acquired 60% stake in XYZ Ltd. for a consideration of ₹ 56 Lakhs. On the date of acquisition, XYZ Ltd. Equity Capital was ₹ 50 Lakhs, Revenue Reserves were ₹ 20 Lakhs and balance in P & L Account was ₹ 15 Lakhs.

(i) Explain the computation of Goodwill/Capital Reserve on consolidation.

(ii) ABC Ltd. showed the investment in Subsidiary at a Carrying Amount of ₹ 52 Lakhs, what will be its impact?

(iii) If the consideration paid for acquiring the 60% stake was ₹ 46 Lakhs, what will be the conclusion?

Answer:

ABC’s Portion of Equity in Pushya Ltd., as on date of acquiring controlling interest = 60% of (Equity Capital + Revenue Reserves + Balance in P & L Account) = 60% × (50 + 20 + 15 Lakhs) = ₹ 51 Lakhs.

The Goodwill/Capital Reserve to be shown in Consolidated BIS, in different situations is explained as under:

| Situation | Cost of Investments (60% in XYZ Ltd.) |

Punarvasu’s Portion of Equity of XYZ Ltd. (as above) | The difference, either Goodwill or Capital Reserve |

| When Purchase Consideration = Carrying Amount = ₹ 56 Lakhs |

₹ 56 Lakhs | ₹ 51 Lakhs | ₹ 5 Lakhs Goodwill |

| When Carrying Amount = ₹ 52 Lakhs | ₹52 Lakhs | ₹ 51 Lakhs | ₹ 1 Lakh Goodwill |

| When Purchase Consideration = Carrying Amount = ₹ 46 Lakhs |

₹ 46 Lakhs | ₹ 51 Lakhs | ₹ 5 Lakhs Capital Reserve |

Question 3.

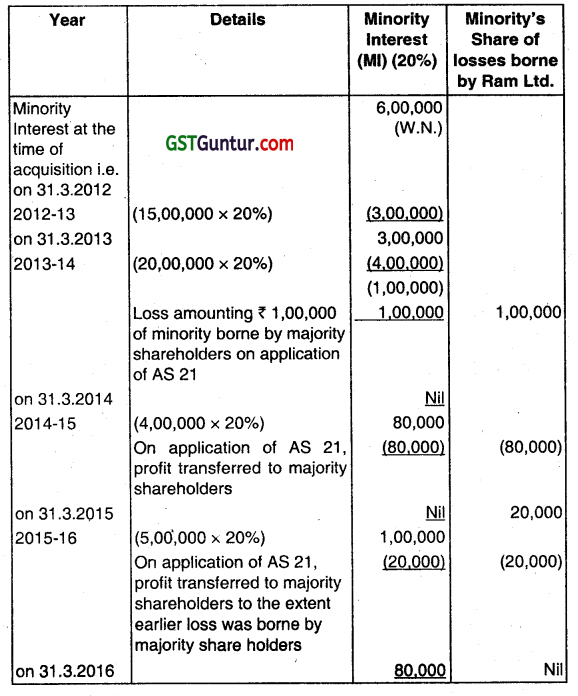

Ram Ltd. holds 80% share in Shyam Ltd., its subsidiary. Share Capital of Shyam Ltd. is ₹ 25,00,000 Lakhs and Reserves being ₹ 5,00,000 on the date of acquisition 31.03.2012.

Following is the results of Shyam Ltd.:

| Year Ended | Profit/(Loss) | Net Worth (₹ In Lakhs) |

| 31 .3.2013 | (15,00,000) | + 15.00 |

| 31.3.2014 | (20,00,000) | (5.00) |

| 31.3.2015 | 4,00,000 | (1.00) |

| 31.3.2016 | 5,00,000 | + ‘4.00 |

Calculate Minority Interest for the period from 2012 to 2016 as per AS -21. (May 2016, 5 marks)

Answer:

As per AS 21 “Consolidated Financial Statements”, the losses applicable to the minority in a consolidated subsidiary may exceed the minority interest in the equity of the subsidiary. The excess, and any further losses applicable to the minority, are adjusted against the majority interest except to the extent that the minority has a binding obligation to, and ¡s able to, make good the losses, If the subsidiary subsequently reports profits, all such profits are allocated to the majority interest until the minority’s share of losses previously absorbed by the majority has been recovered. Accordingly,

Question 4.

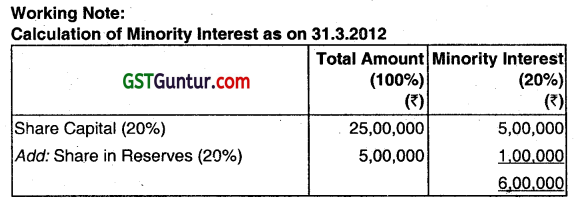

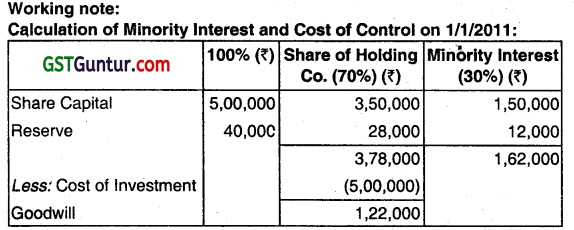

H Ltd. acquire 70% of equity share of S Ltd. as on 1st January 2011 at a cost of ₹ 5,00,000 when S Ltd. had an equity share capital of ₹ 5,00,000 and reserve and surplus of ₹ 40,000. Both the companies follow calendar year as the accounting Year. In the four consecutive years, S Ltd. fared badly and suffered losses of ₹ 1,25,000, ₹ 2,00,000, ₹ 2,50,000, and ₹ 60,000 respectively. Thereafter in 2015, S Ltd. experienced turn around and registered an annual profit of ₹ 25,000. In the next two years i.e. 2016 and 2017, S Ltd. recorded annual profits of ₹ 50,000 and ₹ 75,000 respectively. Show the Minority Interests and Cost of Control at the end of each year for the purpose of consolidation. (May 2019, 10 marks)

Answer:

The losses applicable to the minority in a consolidated subsidiary may exceed the minority interest in the equity of the subsidiary. The excess, and any further losses applicable to the minority, are adjusted against the majority interest except to the extent that the minority has a binding obligation to, and is also to, make good the losses.

If the subsidiary subsequently reports profits, all such profits are allocated to the majority interest until the minority’s share of losses previously absorbed by the majority has been recovered Accordingly.

![]()

Question 5.

Answer the following:

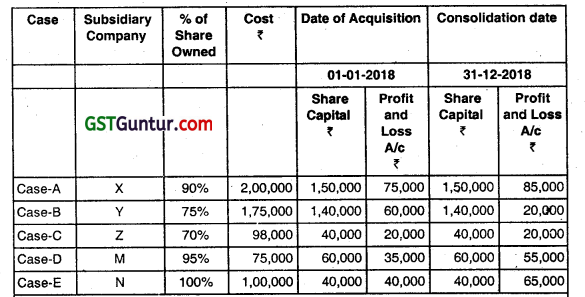

From the following data determine in each case:

Minority Interest at the date of acquisition and at the date of consolidation. (Nov 2019,5 Marks)

Answer:

Minority Interest = Equity attributable to minorities equity is the residual interest in the assets of an enterprise after deducting all its liabilities i.e. in this case, its should be equal to share capital + Profit & Loss A/c

| Minority % Shares Owned [E] | Minority Interest as at the date of acquisition [E] x [A+B] ₹ | Minority interest as at the date of consolidation [E] x [C+D] ₹ | |

| Case A [100- 90] | 10% | 22,500 | 23,500 |

| Case B [100 – 75] | 25% | 50,000 | 40,000 |

| Case C [100 -70] | 30% | 18,000 | 18,000 |

| Case D [100 – 95] | 5% | 4,750 | 5,750 |

| Case E[100 – 100] | NIL | NIL | NIL |

A = Share Capital as on 1.1.2018

B = Profit & Loss account balance as on 1.1.2018

C = Share Capital as on 31.12.2018

D = Profit & Loss account balance as on 31.12.2018.

Question 6.

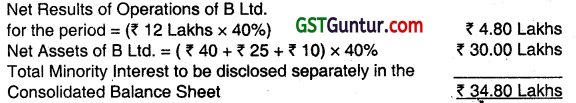

A Ltd. Acquired 60% stake in B Ltd. for a consideration of ₹ 50 Lakhs. On the date of acquisition, B Ltd. Equity Capital was ₹ 40 Lakhs, Revenue Reserves were ₹ 25 Lakhs and balance in P & L Account was ₹ 10 Lakhs During the year, B Ltd. earned a Post Tax Profit of ₹ 12 Lakhs. Compute the Minority Interest.

Answer:

Note: It is assumed that there have been no changes in B Ltd.’s Equity Capital during the period.

Question 7.

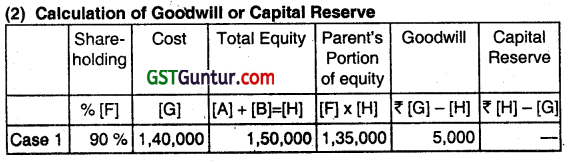

The following data is provided to you:

Determine in each case:

(1) Minority interest at the date of acquisition and at the date of consolidation.

(2) Goodwill or Capital Reserve.

Answer:

(1) Minority Interest = Equity attributable to minorities Equity is the residual interest in the assets of an enterprise after deducting all its liabilities i.e. in this case it should be equal to Sharer Capital + Profit & Loss A/c.

| Minority % Shares Owned [E] | Minority interest as at the date of acquisition [E] × [A+B] ₹ | Minority interest as at the date of consolidation [E] × [C+D] ₹ | |

| Case 1 [100-90] | 10% | 15,000 | 17,000 |

| Case 2 [100-85] | 15% | 19,500 | 18,000 |

| Case 3 [100-80] | 20% | 14,000 | 14,000 |

| Case 4 [100-100] | NIL | NIL | NIL |

A = Share capital on 1.1 .2018

B = Profit & loss account balance on 1.1.2018

C = Share capital on 31 .12.2018

D = Profit & toss account balance on 1.1 .2018

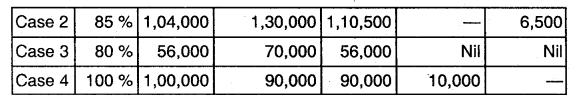

Question 8.

X Ltd. acquired 60% of the Equity Shares and 35% of Preference Shares of Y Ltd. The Balance Sheet of Y Ltd. as on 31st March is as under:

When X Ltd. acquired shares, balances in Reserves of Y Ltd. were as under- (a) Capital Reserve ₹ 40,000, (b) General Reserve ₹ 90,000, (c) Profit & Loss A/c ₹ 1,35,000, (d) Preliminary Expenses ₹ 50,000. Determine Minority Interest.

Answer:

1. Basic Information

| Company Status | Dates | Holding Status |

| Holding Company = X | Acquisition: Not Available | Holding Company = 60% |

| Subsidiary = Y | Consolidation: 31st March | Minority Interest = 40% |

2. Consolidation of Balances

| Particulars | Total | Minority Interest |

| Percentage of Holding | 100% | 40% |

| Equity Share Capital | 7,50,000 | 3,00,000 |

| Preference Share Capital [35 : 65] | 5,00,000 | 3,25,000 |

| Capital Reserve | 75,000 | 30,000 |

| General Reserve | 3,40,000 | 1,36,000 |

| Profit & Loss Account | 85,000 | 34,000 |

| Preliminary Expenses | (50,000) | (20,000) |

| Minority Interest | 8,05,000 |

![]()

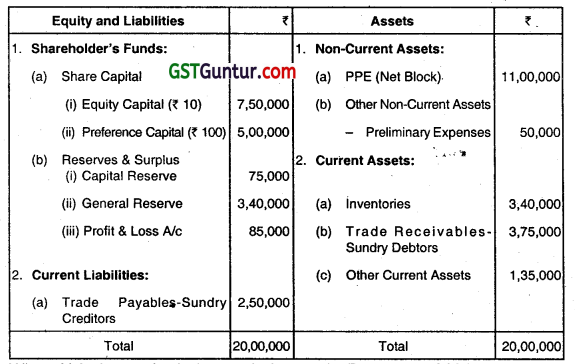

Question 9.

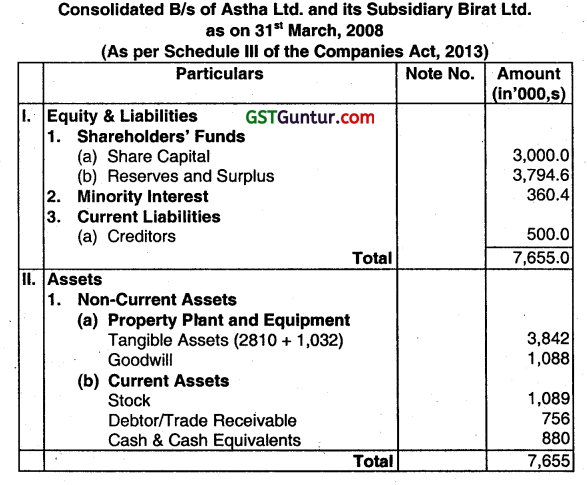

Astha Ltd. Acquired 80% of both classes of shares in Birat Ltd. on 1.4.2007. The draft Balance Sheets of two companies on 31st March, 2008 were as follows:

Note:

Contingent liability-Astha Ltd.: Claim for damages lodged by a contractor against the company pending in a law-suit – ₹ 1,55,000.

Additional Information:

(i) General reserve balance of Birat Ltd. was the same as on 1.4.2007.

(ii) The balance in Profit and Loss A/c of Birat Ltd. on 1.4.2007 was ₹ 3,20,000, out of which dividend of 16% p.a. on the then Equity capital of ₹ 6,00,000 was paid for the year 2006-07.

(iii) The dividend in respect of preference shares of Birat Ltd. for the year 2007-08 was still payable as on 31.3.2008.

(iv) Astha Ltd. credited its Profit and Loss A/c for the dividend received by it from Birat Ltd. for the’ year 2006-07.

(y) Sundry creditors of Astha Ltd. included an amount of ₹ 1,20,000 for purchases from Birat Ltd., on which the later company made a loss of ₹ 10,000.

(vi) Half otthe.above goods were still with the closing stock of Astha Ltd. as at 31.3.2008.

(vii) At the time óf acquisition by Astha Ltd., while determining the price to be paid for the shares in Birat Ltd. it was considered that the value of Plant and Machinery was to be increased by 25% and that of Furniture and Fixtures reduced to 80%. There was no transaction of purchase or sale of these Assets during the year. The Directors wish to give effect to these revaluations in the consolidated Balance Sheet.

(viii) The Directors of Astha Ltd. are of opinion that disclosure of its Contingent liability will seriously prejudice the company’s position in dispute with the contractor.

Prepare consolidated Balance Sheet as at 31st March, 2008, assuming the rate of depreciation charged as 25% p.a. and 10% p.a. on Plant and Machinery and Furniture and Fixtures respectively. Workings should be part of the answer. (May 2008, 16 marks)

Answer:

Contingent liability: Claim against damages lodged by a contractor against Astha Ltd. is pending in a lawsuit ₹ 1,55,000 (W.N.9)

9. Contingent Liability:

As per para 68 of AS 29. ‘Provisions, Contingent Liabilities, and Contingent Assets’, “unless the possibility of any outflow in the settlement is remote, an enterprise should disclose contingent liability at the balance sheet date along with a brief description of the nature of such contingent liability.” and where practicable:

(a) an estimate, of its financial effect.

(b) an indication of the uncertainties.

(c) the possibility of any reimbursement.

Therefore, It would not be correct to ignore the contingent liability.

Question 10.

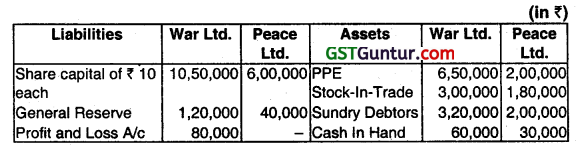

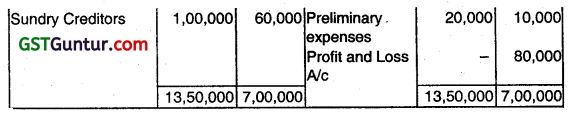

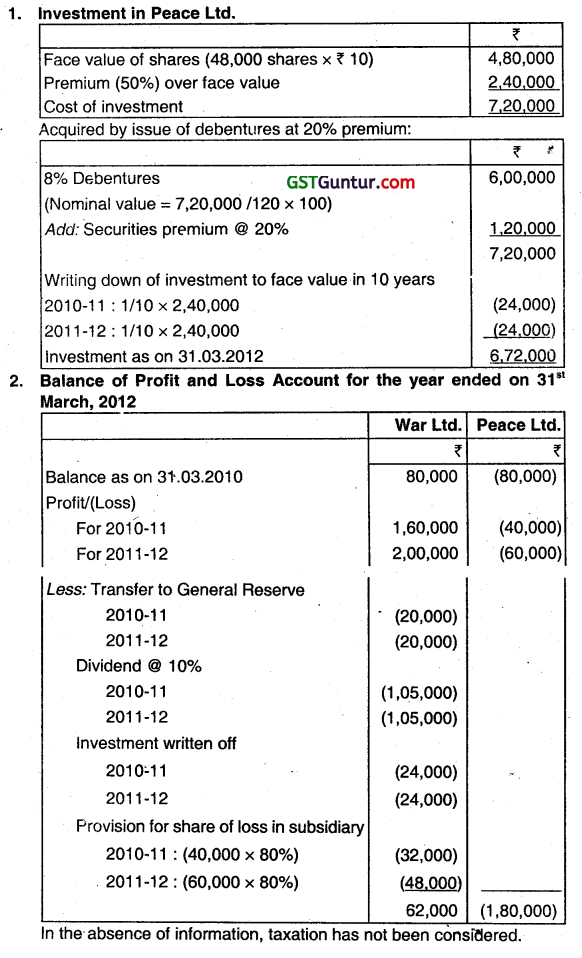

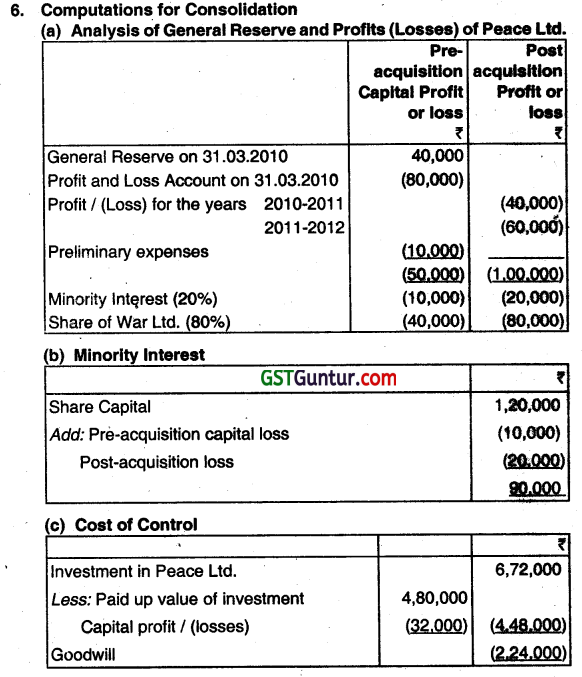

War Limited purchased 48000 shares in Peace Limited on 31st March 2010, at 50% premium over face value by issue of 8% Debentures at 20% premium. The Balance Sheets of War Limited and Peace Limited as on 31 -03-2010, i.e., on the date of purchase were as under:

Particulars of War Limited:

(i) Profits made: 2010-11 ₹ 1,60,000

2011-12 ₹ 2,00,000

(ii) The above profit was made after charging depreciation of ₹ 60,000 and ₹ 40,000 respectively.

(iii) Out of profit shown above, every year ₹ 20,000 had been transferred to General Reserve. ‘

(iv) 10% Dividend had been paid in both the years.

(v) It has been decided to write down investment to face value of shares in 10 years and to provide for share of loss to subsidiary.

(b) Particulars of Peace Limited:

The company incurred losses of ₹ 40,000 and ₹ 60,000 in 2010-2011 and 2011-2012 after charging depreciation of 10% p.a. on the book value of PPE as on 01 -04-201 0. Prepare Consolidated Balance Sheet of War Limited and its subsidiary as at 31 March, 2012 as per requirement of Schedule III. (Nov 2012, 16 marks)

Answer:

Working Notes:

Percentage of shareholding of War Ltd. in Peace Ltd.:

48,000 shares out of 60,000 shares i.e. \(\frac{48,000}{60,000} \times 100 \) = 80%

[Note: AS per para 56 of AS 26 Intangible Assets”, preliminary expenses do not appear in the balance sheet.]

Note:

1. In the absence of information about the movement in individual current assets and current liabilities, balance sheets as on 31.03.2012 have been prepared on the basis of net current assets, Which is the difference of total current assets and total current liabilities. However, reserved Schedule III requires separate disclosure of current liabilities and current assets in the balance sheet.

2. PPE given in the question an assumed to be tangible PPE.

![]()

Question 11.

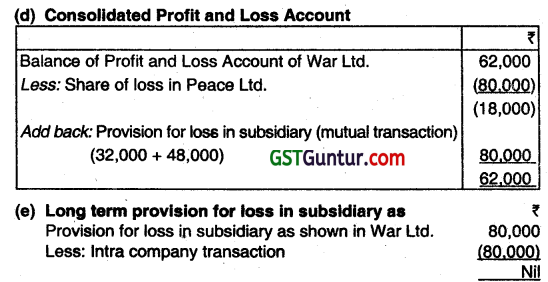

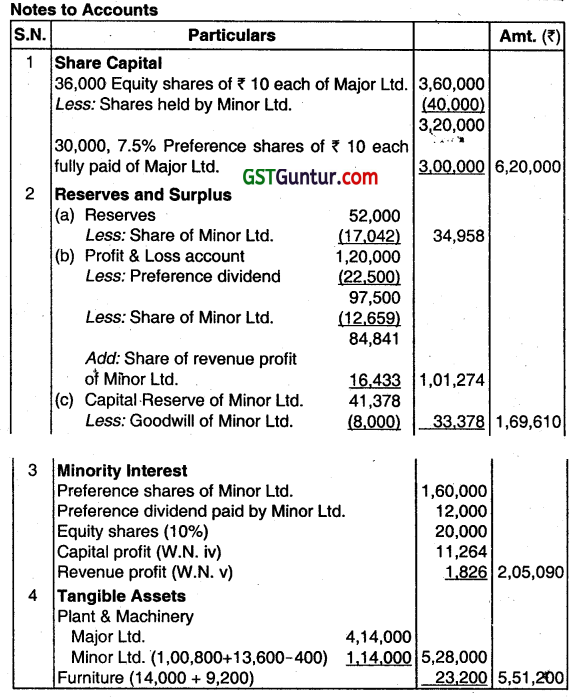

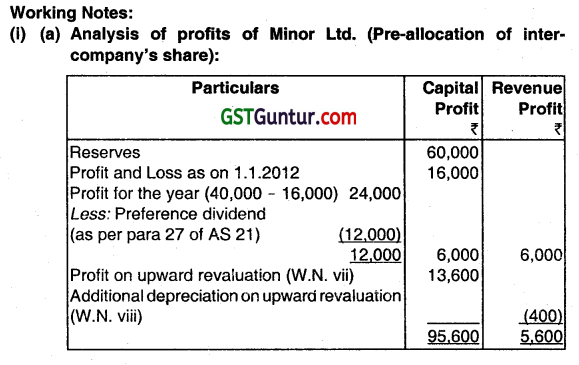

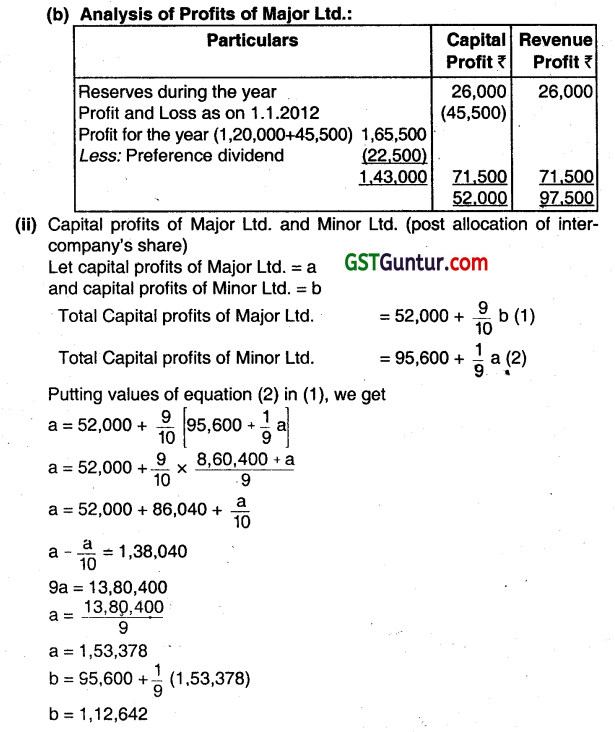

The summarized balance sheets of two companies, Major Ltd. and Minor Ltd. as at 31st December 2012 are given below:

Major Ltd. acquired the shares of Minor Ltd. on 1st July 2012. As on 31st December 2011, the plant & machinery stood in the books at ₹ 1,12,000, the reserve at ₹ 60,000, and the profit and loss account at ₹ 16,000. The plant and machinery was revalued by Major Ltd. on the date of acquisition of shares of Minor Ltd. at ₹ 1,20,000 but no adjustments were made in the books of Minor Ltd.

On 31st December 2011, the debit balance of profit and loss account was ₹ 45,500 in the books of Major Ltd. Both the companies have provided depreciation on all their Property Plant and Equipment at 10% p.a. You are required to prepare a Consolidated Balance Sheet as on 31st December 2012 as per Revised Schedule-III and Supporting Schedule for Computation. (May 2013,16 marks)

Answer:

Question 12.

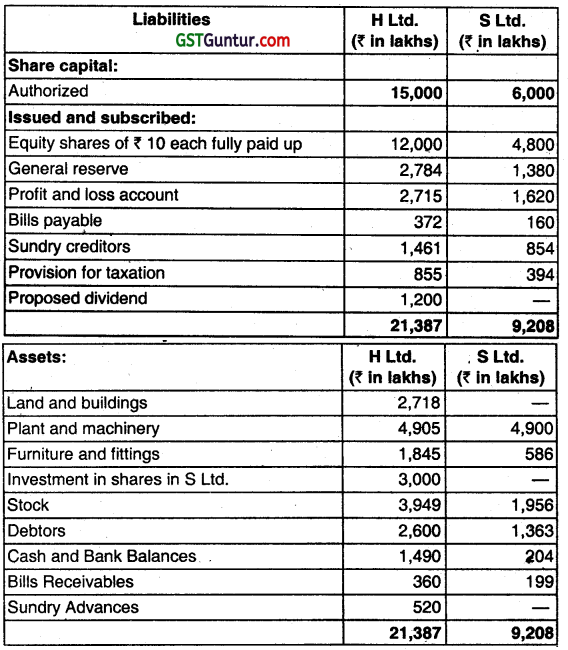

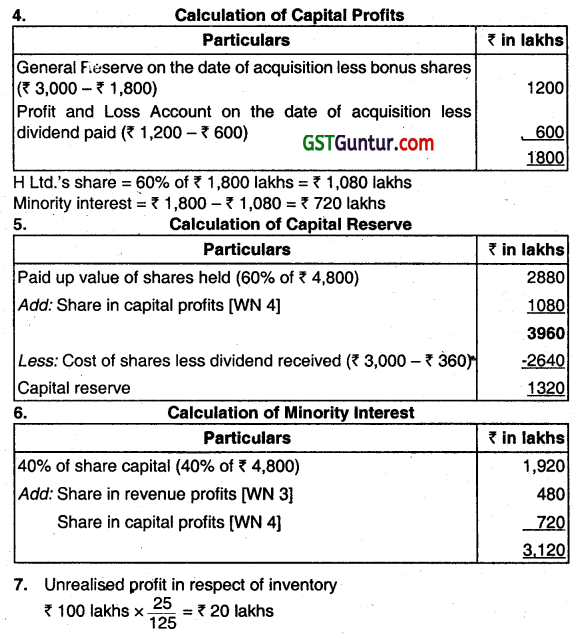

On 31st March, 2016 the balance sheets of H Ltd. and its subsidiary S Ltd. stood as follows:

The following information is also provided to you:

(a) H Ltd. purchased 180 lakhs Shares in S Ltd. on 1st April, 2015 when the balances to General Reserve and Profit and Loss Account of S Ltd. stood at ₹ 3,000 lakhs and ₹ 1,200 lakhs respectively.

(b) On 4th July, 2015 S Ltd. declared a dividend of @ 20% for the year ended 31 March, 2015. H Ltd. credited the dividend received to its profit and loss account.

(C) On 1 November, 2015 S Ltd. Issued, 3 fully paid-up shares for every 5 shares held, as bonus shares, out of balances to its General Reserve as on 31st March, 2015.

(d) On 31st March, 2016 all the bills payable in S Ltd. balance sheet were acceptances in favour of H Ltd. But on that date, H Ltd. held only ₹ 45 lakhs of these acceptances in hand, the rest having been endorsed in favour of its creditors.

(e) On 31st March, 2016 S Ltd.’s stock included goods which it had purchased for 100 Iakhs from H Ltd. which made a profit @ 25% on cost.

Prepare a consolidated balance sheet of H Ltd. and Its subsidiary S Ltd. as at 31st March, 2016. Workings should form part of your answer. (Nov 2016, 16 marks)

Answer:

Note: The question can also be solved by taking ₹ 1,080 lakhs as post-acquisition Profit and Loss balance and ₹ 180 lakhs as post-acquisition General Reserve balance. The final answer will be same.

![]()

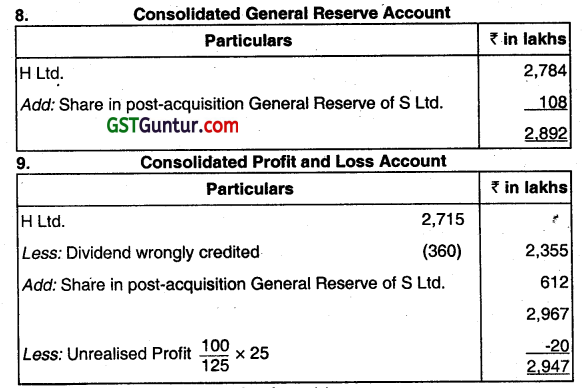

Question 13.

Rohtas Ltd. has a subsidiary company Bee Ltd. and it is preparing Consolidated Financial Statements as on 31st March 2017. On 10th May, 2016, Rohtas Ltd. acquired 40% shares of Amit Ltd. for ₹ 45,00,000. By such an acquisition Rohtas Ltd. can exercise significant influence over Amit Ltd. During the financial year ending on 31st March, 2016, Amit Ltd. earned profits ₹ 11,54,000 and declared a dividend of ₹ 2,48,000 on 1st September, 2016. Amit Ltd. reponed earnings of ₹ 26,26,000 for the financial year ending on 31st March, 2017 and declared dividends of ₹ 9,85,000 on 17th August, 2017. You are required to calculate the carrying amount of investments In Separate Financial Statements of Rohtas Ltd. as on 31st March, 2017 and also in Consolidated Financial Statements of Rohtas Ltd. as on 31st March, 2017. What will be the carrying amount of Investments in Consolidated Financial Statements of Rohtas Ltd. it prepared on 31st August, 2017? (Nov 2017, 5 marks)

Answer:

Working Note:

1. Pre-acquisition Period dividend

= Dividend dedarel Share ot Rohtas Ltd.

= 2,48,000 × 40%

= ₹ 99,200

2. Share of Post acqUisition period Reserves

= Earning of Amit Ltd x Share of Rohtas Ltd.

= 26,26,000 × 40%

= ₹ 10,50,400

(Dividend after balance sheet date is not considered)

3. Dividend Received

= Dividend Declared x Share of Rohtas Ltd.

= 9,85,000 × 40%

= ₹ 3,94,000

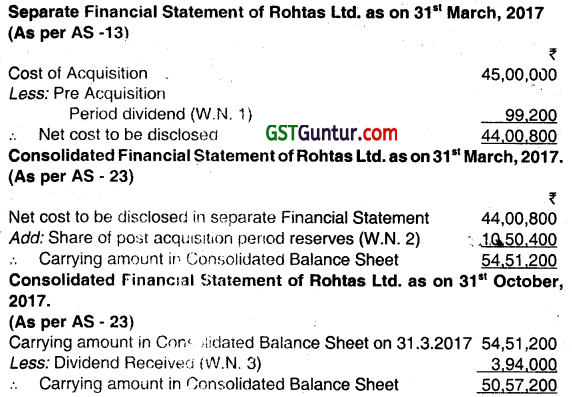

Question 14.

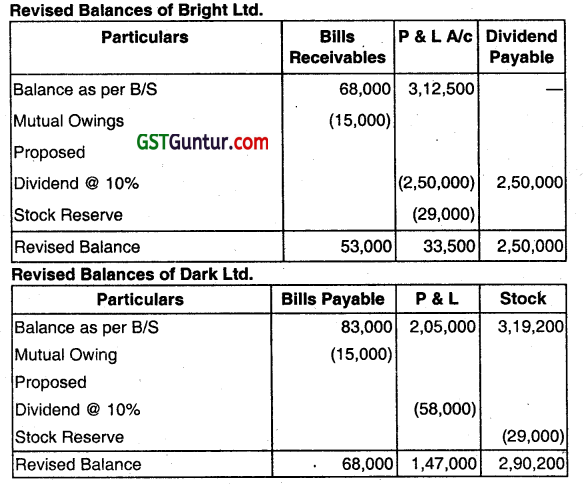

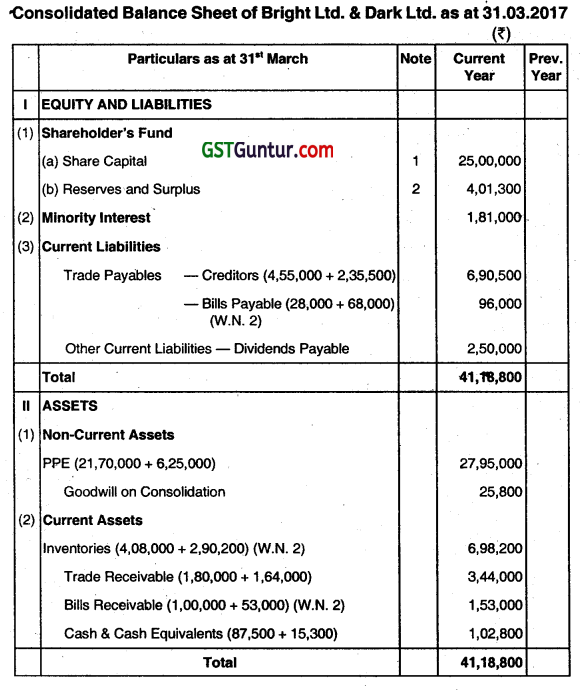

Bright Limited is a company carrying on the business of cotton products and having a subsidiary Dark Ltd. Their balance sheets as on 31st March, 2017 were as under:

Bright Limited has also given the following information:

(i) Bright Limited has acquired the shares in Dark Limited, on two lots on two different dates. The relevant information at the time of acquisition of shares was as under:

| No. of shares acquired | Balance in General Reserve | Balance In Profit & Loss A/c |

| 1st acquisition, 4060 Shares | ₹ 80,000 | ₹ 25,000 |

| 2nd acquisition, 580 Shares | ₹ 85,000 | ₹ 1,02,000 |

(ii) Bills receivables of Bright Limited include ₹ 15,000 being acceptance from Dark Limited.

(iii) Both the companies have declared dividends of 10% for the year ended 31st March,2017, but it has not been provided in the books of account.

(iv) Dark Limited’s inventory includes stock of ₹ 1,45,000 purchased from Bright Limited. Bright Limited sells goods at markup of 25% on its cost. Prepare the Consolidated Balance Sheet of Bright Limited along with ‘Notes to Accounts’ (Nov 2017, 16 marks)

Answer:

Analysis of Reserves of Dark Ltd.

General Reserve Account

Balance as per BIS = 1,20,000

1st Acquisition Bright:

= 80,000

Pre = 70% = 56,000

Pro =10% = 8,000

MI =20% = 16,000

2nd Acquisition = 5,000

Post = 70% = 3,500

Pre =10% = 500

MI =20% = 1,000

Post Acquisition = 35,000

Post = 70% = 24,500

Post = 10% = 3,500

MI =20% = 7,000

Profit and Loss A/c = 1,47,200

1st Acquisition =25,000

Pro =70% = 17,500

Pre =10% = 2,500

MI =20% = 5,000

2nd Acquisition = 77,000

Post = 70% = 53,900

Pre =10% = 7,700

MI =20% =15,400

Post Acquisition = 45,000

Post =70% = 31,500

Post = 10% = 4,500

MI =20% = 9,000

Question 15.

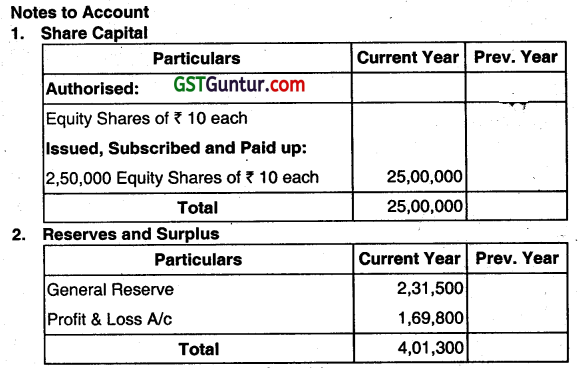

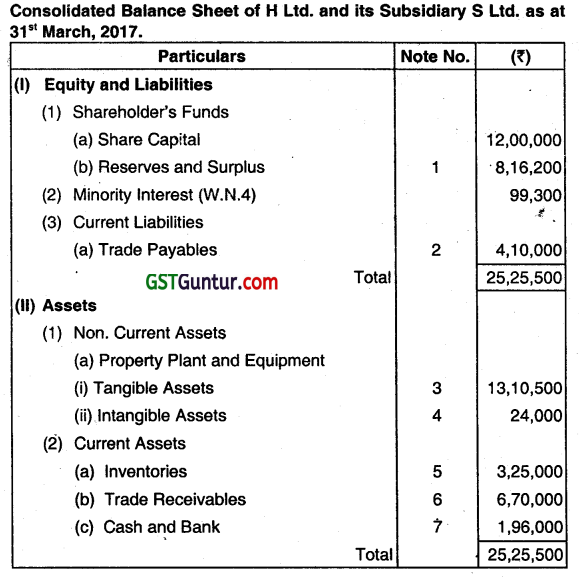

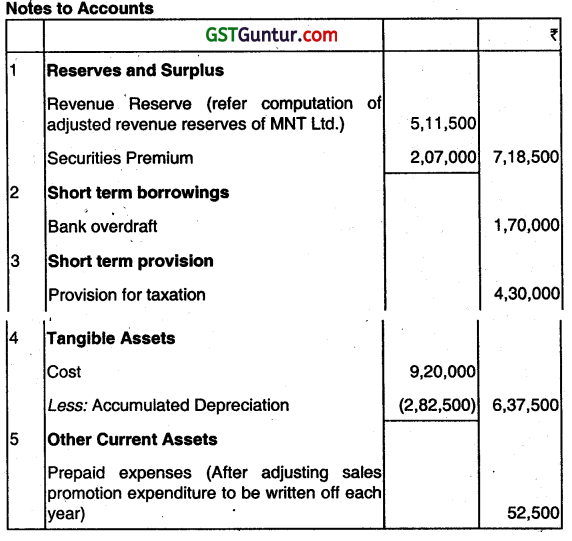

The following summarized Balance Sheets of H Ltd. and its subsidiary S Ltd. were prepared as on 31st March, 2017:

H, Ltd. acquired the 80% shares of S Ltd. on 1st April, 2016. On the date of acquisition, General Reserve and Profit Loss Account of S Ltd. stood at ₹ 50,000 and ₹ 30,000 respectively. Machinery (book value ₹ 2,00,000) and Furniture (book value ₹ 40,000) of S Ltd. were revalued at ₹ 3,00,000 and ₹ 30,000 respectively on 1st April, 2016 for the purpose of fixing the price of its shares (rates of depreciation computed on the basis of useful lives: Machinery 10% and Furniture 15%). Trade Payables of H Ltd. include ₹ 35,000 due to S Ltd. for goods supplied since the acquisition of the shares. These goods are charged at 10%

above cost. The inventories of H Ltd. includes goods costing ₹ 55,000 purchased from S Ltd. You are required to prepare the Consolidated Balance Sheet as at 31st March, 2017. (May 2018, 20 marks)

Answer:

Question 16.

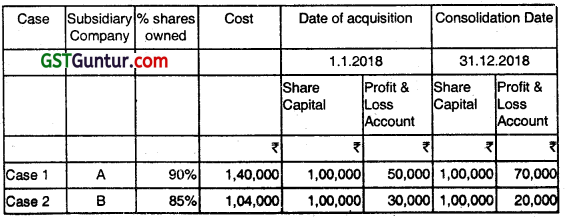

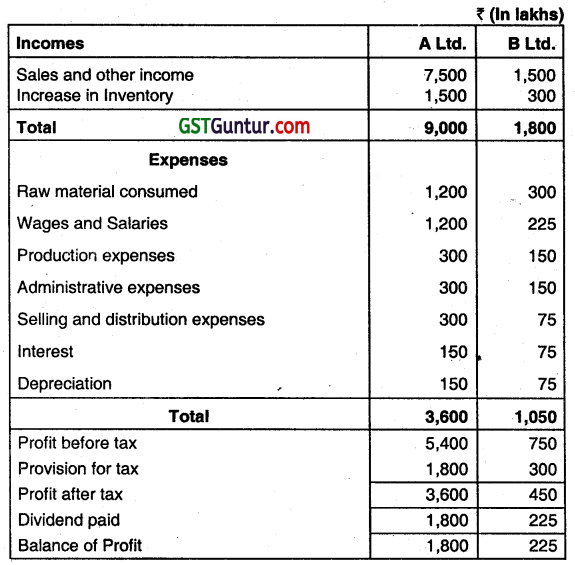

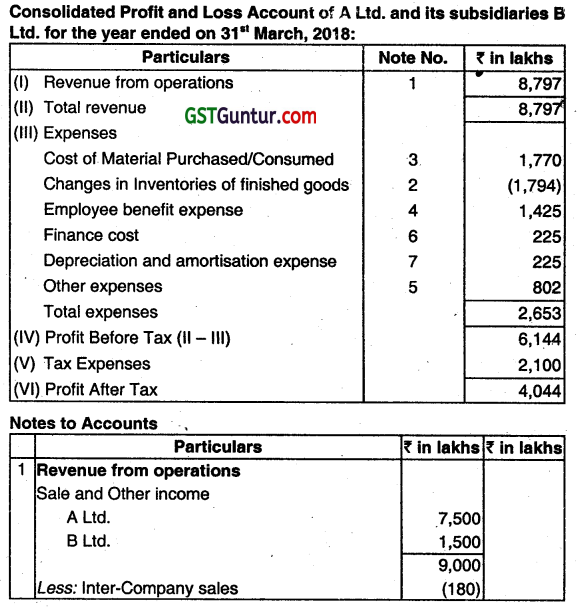

The Profit and Loss Accounts of A Ltd. and its subsidiary B Ltd. for the year ended 31st March, 2018 are given below:

The following information is also given:

(i) A Ltd. sold goods of ₹ 180 Lakhs to B Ltd. at cost plus 25%. (1/6 of such goods were still in inventory of B Ltd. at the end of the year)

(ii) Administrative expenses of B Ltd. include ₹ 8 Lakhs paid to A Ltd. as consultancy tees.

(iii) Selling and distribution expenses of A Ltd. include ₹ 15 Lakhs paid to B Ltd. as commission.

(iv) A Ltd. holds 72% of the Equity Capital of B Ltd. The Equity Capital of B Ltd. prior to 2016-17 is ₹ 1,500 Lakhs Prepare a consolidated Profit and Loss Account for the year ended 31st March, 2018. (Nov 2018, 10 marks)

Answer:

![]()

Question 17.

Consider the following summarized Balance Sheets of subsidiary MNT Ltd.

| Liabilities | 2017-18 Amount In ₹ |

2018-19 Amount In ₹ |

| Share Capital | ||

| Issued and subscribed 7500 Equity Shares of ₹ 100 each | 7,50,000 | 7,50,000 |

| Reserve and Surplus | ||

| Revenue Reserve | 2,14,000 | 5,05,000 |

| Securities Premium | 72,000 | 2,07,000 |

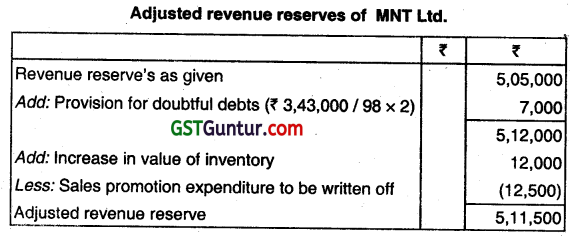

Other Information:

1. MNT Ltd. is a subsidiary of LTC Ltd.

2. LTC Ltd. values inventory on FIFO basis, while MNT Ltd. used a LIFO basis. To bring MNT Ltd.’s inventory values In line with those of LTC Ltd., its value of inventory is required to be reduced by ₹ 5,000 at the end of 2017-2018 and increased by ₹ 12,000 at the end of 2018-2019. (Inventory ot2017-18 has been sold out during the year 2018-19)

3. MNT Ltd. deducts 2% from Trade Receivables as a general provision against doubtful debts.

4. Prepaid expenses in MNT Ltd. include Sales Promotion expenditure carried forward of ₹ 25,000 in 2017-18 and ₹ 12,500 in 2018-19 being part of Initial Sales Promotion expenditure of ₹ 37,500 in 2017-18,

which is being written off over three years. The similar nature of Sales Promotion expenditure of LTC Ltd. has been fully written off in 2017- 18.

Restate the balance sheet of MNT Ltd. as on 31st March, 2019 after considering the above information for the purpose of consolidation. Such restatement is necessary to make the accounting policies adopted by LTC Ltd. and MNT Ltd. uniform. (Nov 2019, 10 marks)

Answer:

Note: Since MNT Ltd. Follows LIFO basis, as given in the question, opening inventory and all of Inventory of 201 7-18 has been sold out in 2018-19. Therefore, reduction in inventory would have been taken care of by sale value. Hence, no adjustment has been made for the same. Restated Balance Sheet of PANT Ltd. as at 31st March, 2019

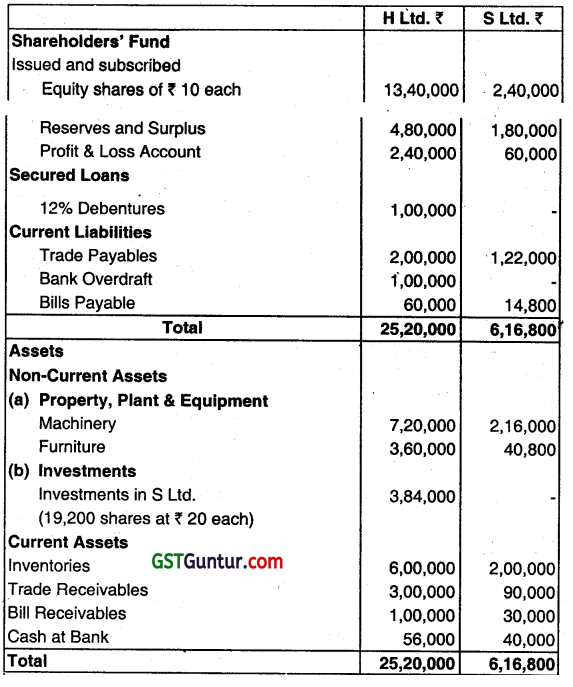

Question 18.

H Limited acquired 64000 Equity Shares of ₹ 10 each in S Ltd. as on 1st October, 2019. The Balance Sheets of the two companies as on 31st March, 2020 were as under:

| Particulars | H Ltd. (₹) | S Ltd. (₹) |

| Equities and Liabilities: | ||

| Equity Share Capital of ₹ 10 each | 20,00,000 | 8,00,000 |

| General Reserve (18April, 2019) | 9,60,000 | 4,20,000 |

| Profit & Loss Account | 2,28,800 | 3,28,000 |

| Preliminary Expenses (1st April, 2019) | – | 20,000 |

| Bank Overdraft | 3,00,000 | |

| Bills Payable | – | 52,000 |

| Trade Payables | 1,66,400 | 80,000 |

| Total | 36,55,200 | 16,60,000 |

| Assets: Land and Building |

7,20,000 | 7,60,000 |

| Plant & Machinery | 9,60,000 | 5,40,000 |

| Investment in Equity Shares of S Ltd. | 12,27,200 | – |

| Inventories | 4,56,000 | 1,68,000 |

| Trade Receivables | 1,76,000 | 1,60,000 |

| Bills Receivable | 59,200 | – |

| Cash in Hand | 56,800 | 32,000 |

| Total | 36,55,200 | 16,60,000 |

Additional Information:

(1) The Profit & Loss Account of S Ltd. showed a balance of ₹ 1,20,000 on 1 April, 2019. S Ltd. paid a dividend of 10% out of the same on 1st November, 2019 for the year 2018-19. The dividend was correctly accounted for by H Ltd.

(2) The Plant & Machinery of S Ltd. which stood at ₹ 6,00,000 on April, 2019 was considered worth ₹ 5,20,000 on the date of acquisition by H Ltd. S Ltd. charges depreciation @ 10% per annum on Plant & Machinery. Prepare consolidated Balance Sheet of H Ltd. and its subsidiary S Ltd. as on 31st March, 2020 as per Schedule III of the Companies Act, 2013. (Nov 2020, 15 marks)

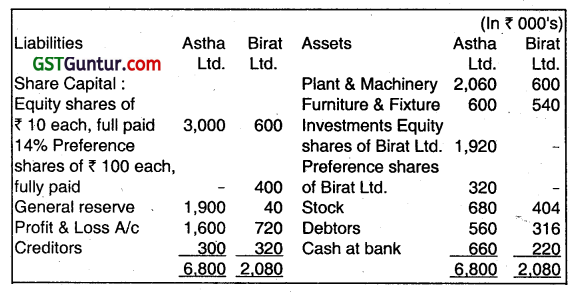

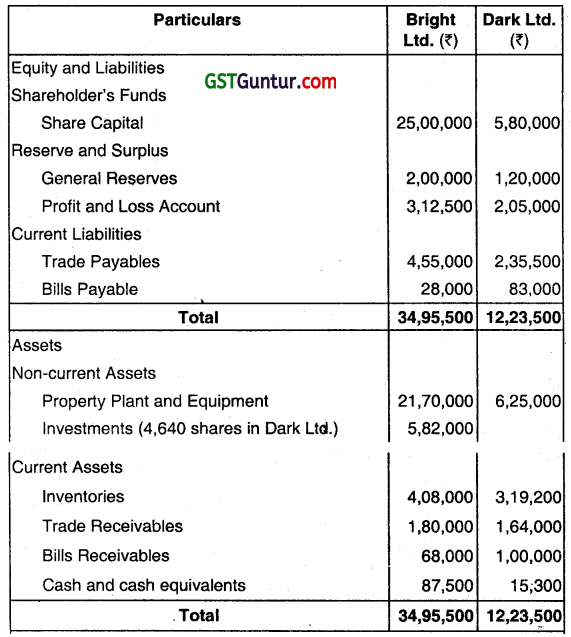

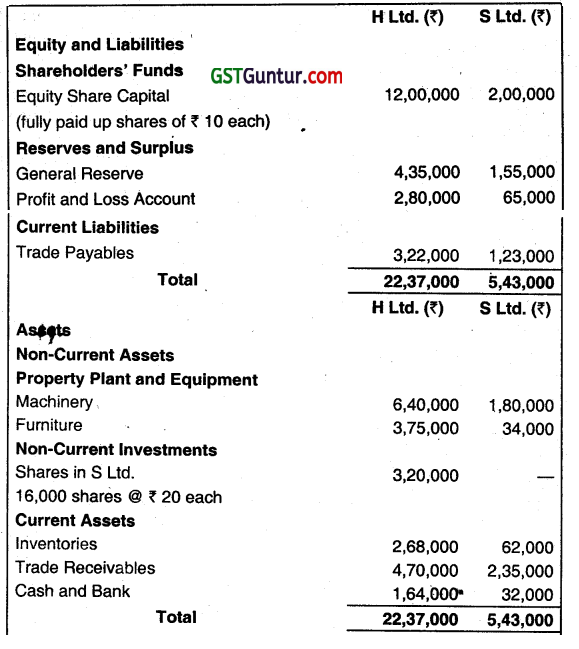

Question 19.

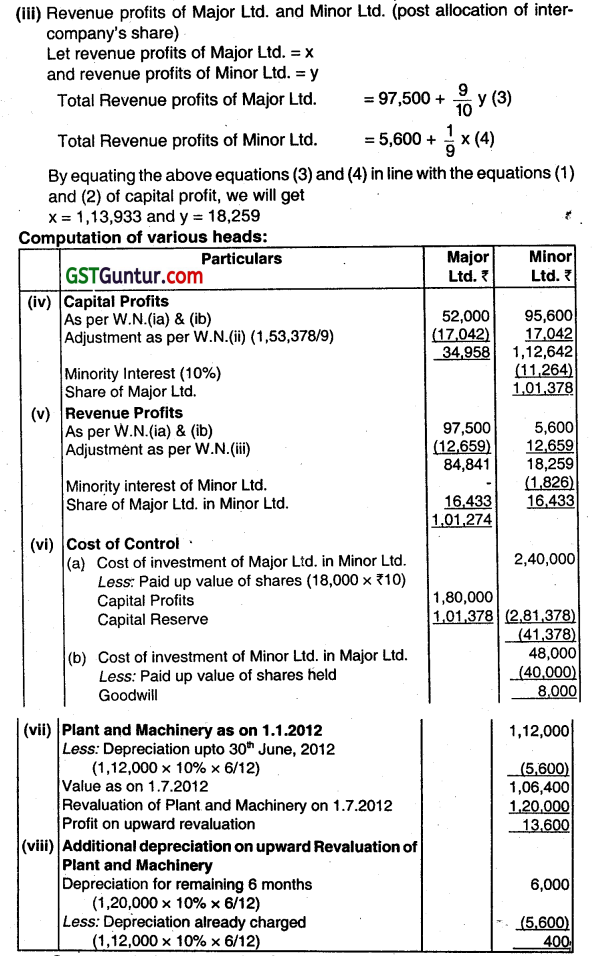

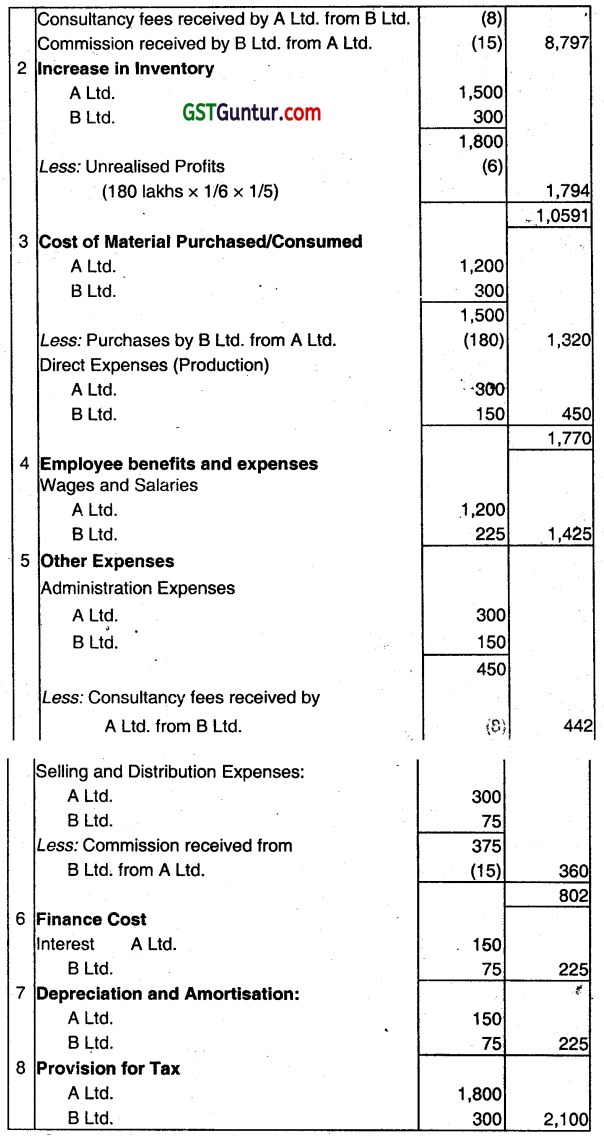

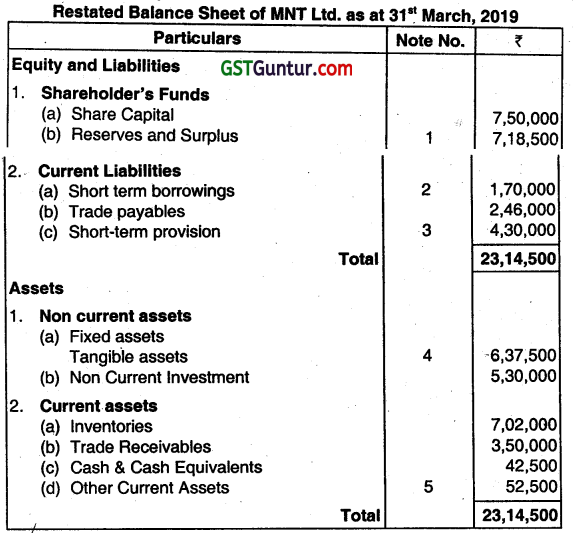

On 31st March, 2020 the summarised Balance Sheets of H Ltd. and its subsidiary S Ltd: stood as follows:

The following information is also provided to you:

(a) H Ltd. purchased 19,200 shares of S Ltd. on 1st April, 2019, when the balances of Reserves & Surplus and Profit & Loss Account of S Ltd. stood at ₹ 60,000 and ₹ 36,000 respectively.

(b) Machinery(Book value ₹ 2,40,000) and Furniture (Book value ₹ 48,000) of S Ltd. were revalued at ₹ 36,00,00 and ₹ 36,000 respectively on 1st April, 2019, for the purpose of fixing the price of its shares. (Rates of depreciation computed on the basis of useful lives:

Machinery 10%, Furniture 15%)

(c) On 31st March, 2020, Bills payable of ₹ 12,000 in S Ltd’s Balance Sheet were accepted in favour of H Ltd. You are required to prepare Consolidated Balance Sheet of H Ltd. and its Subsidiary S Ltd. as at 31st March, 2020. (Jan 2021, 20 marks)

![]()

Question 20.

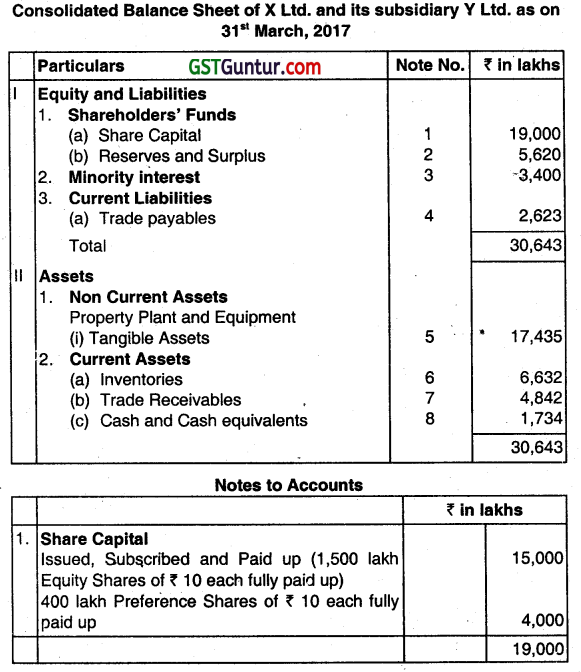

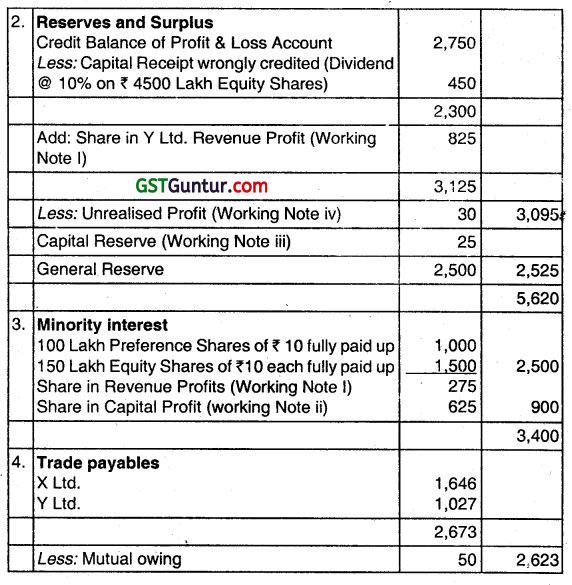

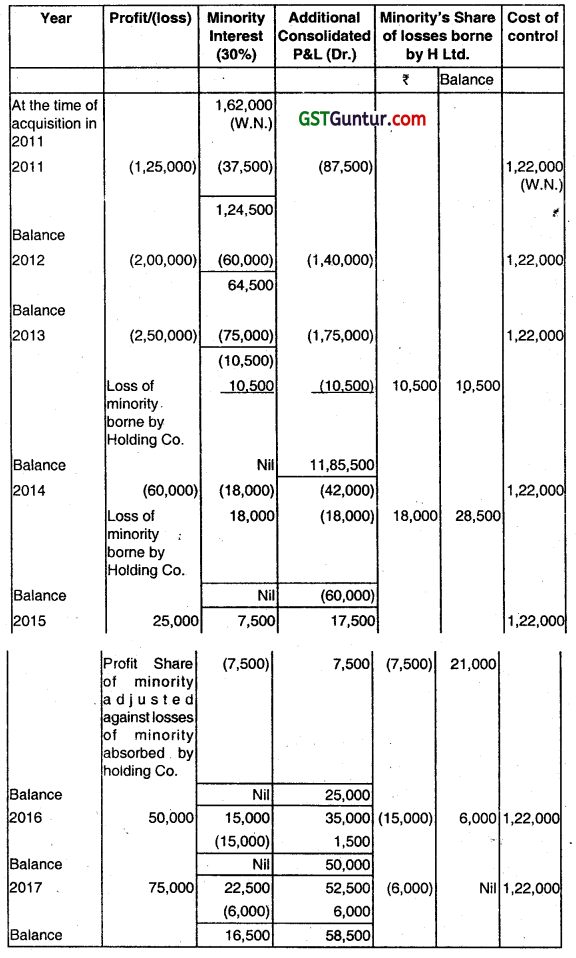

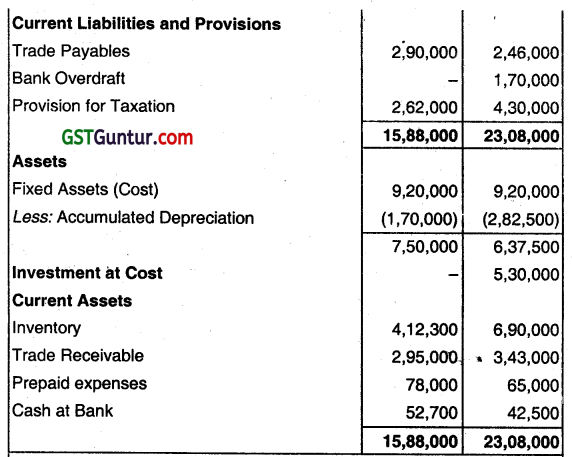

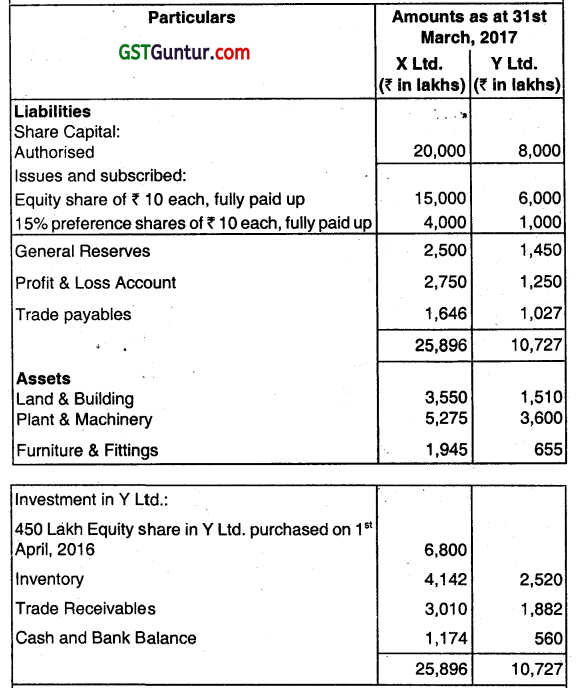

The Summarised Balance Sheet of X Ltd. and its subsidiary Y Ltd. as 31st March, 2017 are as follows:

The following information is also given to you

(a) 10% dividend on Equity shares was declared by V Ltd. on 31st March, 2016 for the year ended 31st March, 2016. X Ltd. credited the dividend received to its Profit & Loss Account.

(b) Credit Balance of Profit & Loss account of Y Ltd. as on 1st April, 2016 was ₹ 650 Lakhs.

(c) General Reserve of V Ltd. stood at same ₹ 1,450 Lakhs as on 1st April, 2016.

(d) Y Ltd.’s Plant & machinery showed a balance of ₹ 4,000 Lakh on 1st April 2016. At the time of purchase of shares in Y Ltd., X Ltd. revalued V’s Ltd. Plant and Machinery upward by ₹ 1,000 Lakh.

(e) Included in Trade Payables of Y Ltd. are ₹ 50 Lakh for goods supplied by X Ltd.

(f) On 31st March, 2017, Y’s ltd. inventory included goods for ₹ 150 lakhs which it had purchased from X Ltd. X Ltd. sold goods to Y Ltd. at cost plus 25%. You are required to prepare a Consolidated Balance Sheet of X Ltd. and its subsidiary Y Ltd. as on 31st March, 2017 giving working notes.

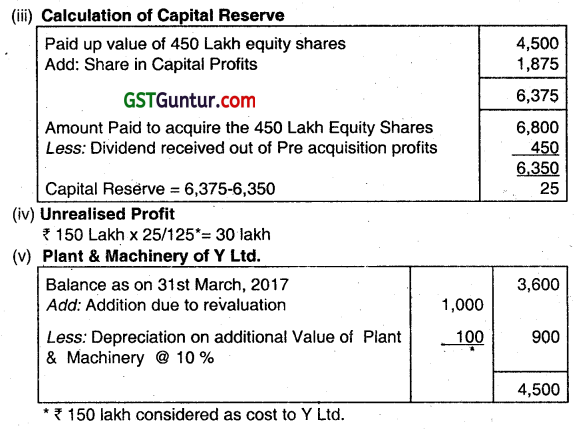

Answer: