Non-Banking Financial Companies – CA Inter Advanced Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Non-Banking Financial Companies – CA Inter Advanced Accounting Question Bank

Question 1.

Answer the following:

Explain the criterion of income recognition in the case of Non Banking Financial Companies. (Nov 2019, 5 marks)

Answer:

The criterion of income recognition In the case of Non-Banking Financial Companies.

1. The income recognition shall be based on recognised accounting principles.

2. Income including interest discount or any other charges on NPA shall be recognised only when it is actually realised. Any such income recognised before the asset became non-performing and remaining unrealised shall be reversed.

3. In respect of hire purchase assets, where instalments are overdue for more than 12 months, income shall be recognised only when hire charges are actually received. Any such Income taken to the credit of profit and loss account before the asset became nonperforming and remaining unrealised, shall be reversed.

4. In respect of lease assets, where lease rentals are overdue for more than 12 months, the income shall be recognised only when lease rentals are actually received. The net lease rentals taken to the credit of the profit and loss account before the asset became non-performing and remaining unrealised shall be reversed. For the purpose of this paragraph, ‘net lease rentals’ mean gross lease rentals as adjusted by the lease adjustment account debited/credited to the profit and loss account and as reduced by depreciation at the rate applicable under schedule XIV of the Companies Act, 1956 (1 0f 1956)/2013.

Question 2.

Write short note on the following:

(d) Non – performing assets ii the context of NBFC. (May 2009, 4 marks)

Answer:

Non-performing asset means:

(a) as asset, in respect of which, interest has remained overdue for a period of six months or more;

(b) a term loan inclusive of unpaid interest, when the instalment is overdue for a period of six months or more or on which interest amount remained overdue for a period of six months or more;

(c) a demand or call loan, which remained overdue for a period of six months or more from the date of demand or call or on which Interest amount remained overdue for a period of six months or more;

(d) a bill which remains overdue for a period of six months or more; “

(e) the interest in respect of a debt or the income on receivables under the head other current assets in the nature of short-term loans/advances, which facility remained overdue for a period of six months or more;

(f) any dues on account of sale of assets or services rendered or reimbursement of expenses incurred, which remained overdue for a period of six months or more;

Note: As per Non-Banking Financial Company – Systemically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016, the above six months criteria for the assets covered under (a) to (f) is 4 months for the financial year ending March 31st, 2017; and from next year ending March 31st’, 2018 and thereafter it will be 3 months.

It implies that as per Non-Banking Financial Company – Non- Systemically Important Non-Deposit Taking Company (Reserve Bank) Directions, 2016, the criteria is 6 months only.

(g) the lease rental and hire purchase instalment, which has become overdue for a period of twelve months or more;

Note: The above twelve months criteria for the assets covered under (g) is 6 months for the financial year ending March 31st, 2017 and from next year ending March 31st, 2018, and thereafter it will be 3 months.

(h) in respect of loans, advances, and other credit facilities (including bills purchased and discounted), the balance outstanding under the credit facilities (including accrued interest) made available to the same borrower/beneficiary when any of the above credit facilities becomes non-performing assets: Provided that in the case of lease and hire purchase transactions, a non-banking financial company may classify each such account on the basis of its record of recovery.

![]()

Question 3.

PGL Finance Ltd. is a non-banking financial company. The following information is provided by the company regarding its outstanding amounts, ₹ 600 Lakhs, of which instalments are overdue on 300 accounts for last two months (amount overdue ₹ 150 Lakhs), on 48 accounts for three months (amount overdue ₹ 64 Lakhs), on 20 accounts for more than 30 months (amount overdue ₹ 120 Lakhs) and in 4 accounts for more than three years (amount overdue ₹ 60 Lakhs – already identified as sub-standard asset) and one account of ₹ 40 Lakhs which has been identified as non-recoverable by the management.

Out of 20 accounts overdue for more than 30 months, 16 accounts are already identified ea sub-standard (amount ₹ 28 Lakhs) for more than fourteen months and others are Identified as sub-standard asset for a period of less than fourteen months. Classify the assets of the company in line with Non-Banking Financial Company-Systematically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016. (Nov 2020, 5 marks)

Question 4.

Write short note on the following:

(a) Capital adequacy ratio for Non-Banking Financial Companies (NBFC) (Nov 2009, 4 marks)

Answer:

Every Non-Banking Financial Companies (NBFC) is required to maintain the capital adequacy ratio at a minimum of 15% of its aggregate risk-weighted assets.

The aggregate of the capital of Tier II at any point of time shall not exceed 100% of Tier-I capital.

Calculation of capital adequacy ratio is to be done as follows:

CAR = \(\frac{\text { Capital Employed }}{\text { Risk-Weighted Assets }} \times 100 \)

Where:

Capital Employed = Capital Tier I + Capital Tier II

Question 5.

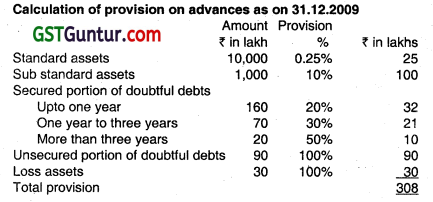

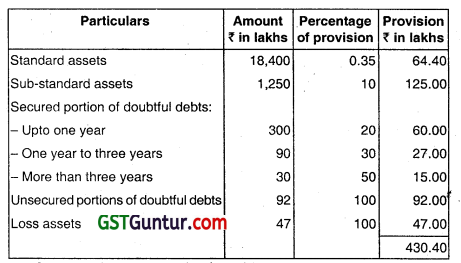

While closing its books of account as on 31.12.2009 a non-banking finance company (NBFC) has its advances classified as under:

| ₹ in lakhs | |

| Standard assets | 10,000 |

| Sub-standard assets | 1,000 |

| Secured portion of doubtful debts | |

| – Up to one year | 160 |

| – One year to three years | 70 |

| – More than three years | 20 |

| Unsecured portion of doubtful debts | 90 |

| Loss assets | 30 |

Calculate the provision to be made against advances by NBFC as per prudential norms. (May 2010, 4 marks)

Answer:

Question 6.

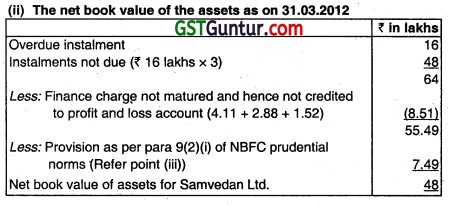

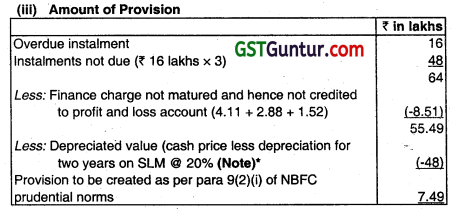

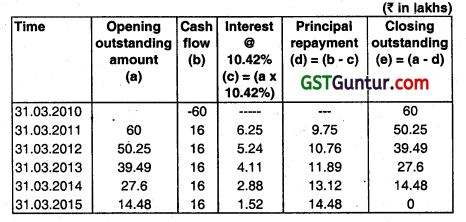

Samvedan Limited is a non-banking finance company. It accepts public deposit and also deals in hire purchase business. It provides you with the following information regarding major hire purchase deals as on 31-03- 2010. Few machines were sold on hire purchase basis. The hire purchase price was set as ₹ 100 lakhs as against the cash price of ₹ 80 lakhs. The amount was payable as ₹ 20 lakhs down payment and balance in 5 equal instalments. The hire vendor collected first instalment as on 31-03-2011 but could not collect the second instalment which was due on 31-03-2012. The company was finalising accounts for the year ending 31-03-2012. Till 15-05-2012. the date on which the Board of Directors signed the accounts, the second instalment was not collected. Presume IRR to be 10.42%.

Required:

(i) What should be the principal outstanding on 1-4-2011? Should the company recognize finance charge for the year 2011-12 as income?

(ii) What should be the net book value of assets as on 31 -03-12 so far Samvedan Ltd. is concerned as per NBFC prudential norms requirement for provisioning?

(iii) What should be the amount of provision to be made as per prudential norms for NBFC laid down by RBI? (Nov 2012, May 2015, 10 marks)

Answer:

(i) Since the hire-purchaser paid the first Instalment due on 31.03.2011, the notional principal outstanding on 01.04.2011 was ₹ 50.25 lakhs (refer W.N.). In the year ended 31.03.2012, the instalment due of ₹ 16 lakhs has not been received. However, it was due on 31.03.2012 i.e. on the balance sheet date, and therefore, it will be classified as standard asset. Samvedan Ltd. will recognise ₹ 5.24 lakhs as interest income included in that due instalment as this should be treated as finance charge.

[Note: As per NBFC prudential norms laid down by the RBI]

Since, the Instalment of ₹ 16 Lakhs not paid, was due on 31.03.2012 only, the asset Is classified as standard asset. Therefore, no additional provision has been made for it.

Working Notes:

It is necessary to segregate the instalments into principal outstanding and interest components by using I.R.A. @ 10.42%.

Question 7.

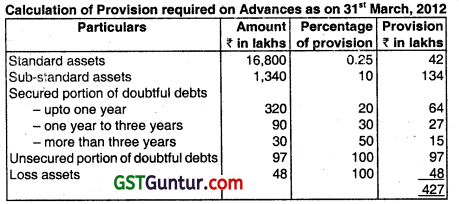

(a) While closing its books of account on 31st March, 2012 a non-banking finance company has is advances classified as follows:

| Particulars | ₹ in Lakhs |

| Standard Assets | 16,800 |

| Sub-Standard Assets | 1,340 |

| Secured portion of doubtful debts: | |

| – Up to one year | 320 |

| – One year to three years | 90 |

| – More than three years | 30 |

| Unsecured portion of doubtful debts | 97 |

| Loss Assets | 48 |

Calculate the amount of provision, which must be made against the advances. (May 2013, 4 marks)

Answer:

Question 8.

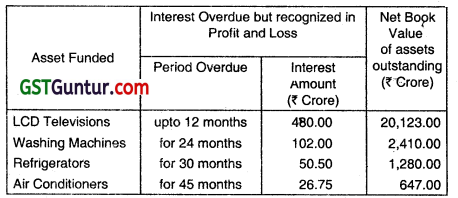

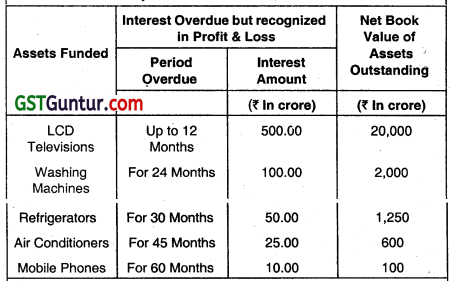

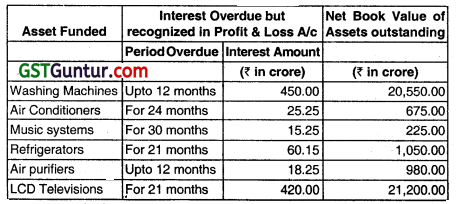

Peoples Financiers Ltd. is an NBFC providing Hire Purchase Solutions for acquiring consumer durables. The following information is extracted from its books for year ended 31st March,

You are required to calculate the amount of provision to be made. (May 2014, 4 marks)

Answer:

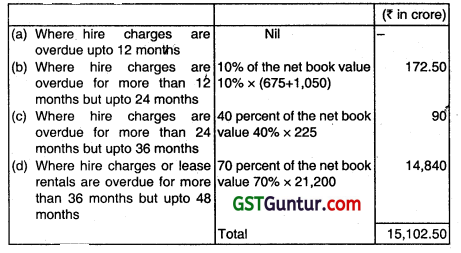

On the basis of the given information, regarding of hire purchase and leased assets, additional provisions shall be made as under.

| (₹ in crore) | ||

| (a) Where hire charges are overdue up to 12 months | Nil | – |

| (b) Where hire charges are overdue for more than 12 months but up to 24 months | 10% of the net book value 10% × 2,410 | 241 |

| (c) Where hire charges are overdue for more than 24 months but up to 36 months | 40% of the net book value 40% × 1,280 | 512 |

| (d) Where hire charges for more than 36 months but up to 48 months | 70% of the net book value 70% × 647 | 452.90 |

| Total | 1,205.90 |

Question 9.

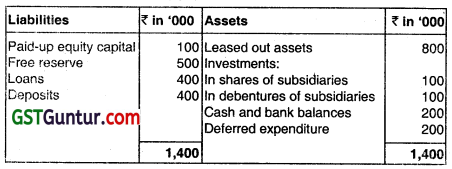

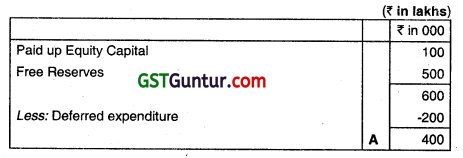

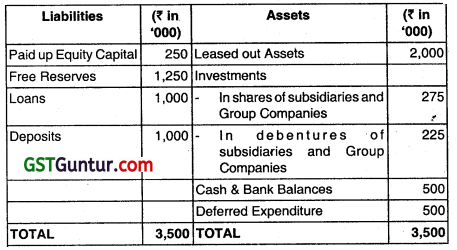

Glory Finance Ltd. is a non-banking finance company. The extracts of its balance sheet are given below:

Compute “Net Owned Fund of Glory Ltd. as per NBFC systematically important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016 (Nov 2016, 4 marks)

Answer:

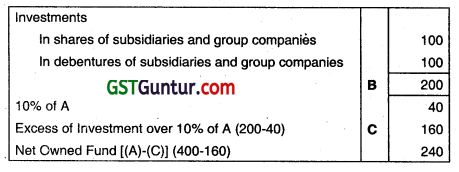

Question 10.

Abhiram Limited is a non-banking finance company. It accepts public deposits and also deals in hire purchase business of trucks. As on 31st March, 2014, few trucks were sold on hire purchase basis. The hire purchase price was set as ₹ 400 lakhs as against the cash price of ₹ 350 lakhs. The amount was payable as ₹ 50 lakhs down payment and the balance in 5 equal instalments.

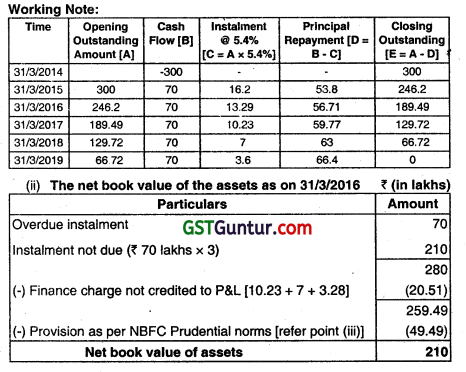

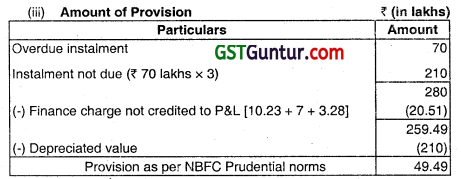

The hire vendor collected the first instalment as on 31.03-2015, but could not collect the second instalment which was due on 31-03-2016. Till 15-05-2016, the date on which the Board of Directors signed the accounts, the second instalment was not collected. Presume IRR to be 5.4%. Depreciation Is to be charged at 20% per annum.

You are required to answer the following:

(i) What should be the principal outstanding as on 01 -04-2015? Should the company recognize finance charges for the year 2015-16 as income?

(ii) What should be the net book value of assets as on 31-03-2016 so far Abhiram Ltd. is concerned as per NBFC prudential norms requirement for provisioning?

(iii) What should be the amount of provision to be made as per prudential norms foc NBFC laid down by RBI? (May 2017,8 marks)

Answer:

(i) Since the hire-purchaser paid the first lnstalment due on 31/312015, the notional principal outstanding on 1/412015 was ₹ 246.2 lakhs. In the year ended 3113/2016, the instalment due of ₹ 70 lakhs has not been received. However. it was due oIl 31/3/2016 i.e. on the balance sheet date arid therefore It will be classified as standard asset. Abhiram Ltd. will recognise ₹ 13.29 lakhs as interest income included in that due irstalment as this should be treated as finance charge.

![]()

Question 11.

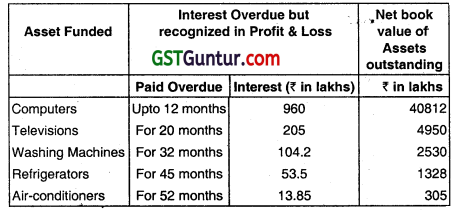

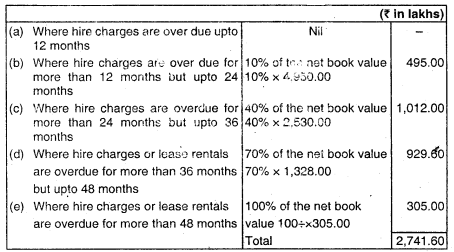

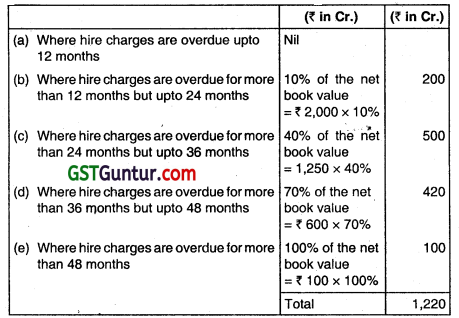

ABC Financiers Ltd. is an NBFC providing Hire Purchase solutions for acquiring consumer durables. The following information is extracted from its books for the year ending 31st March, 2017:

You are required to calculate the amount of provision to be made. (May 2018, 5 marks)

Answer:

On the basis of Information given, in respect of hire purchase and eased assets, addition& provision shall be made as follows:

Question 12.

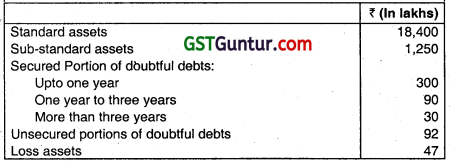

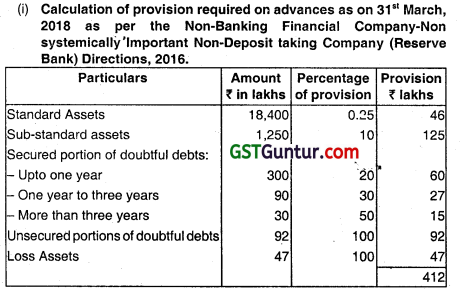

While closing its books of accounts on 31st March 2018, a Non-Banking Finance Company has its advances classified as follows:

Calculate the amount of provision which must be made against the Advances as per —

(i) The Non-banking Finanaal Company – Non-systematically Important Non Deposit taking Company (Reserve Bank) Directions, 2016; and

(ii) Non-banking Financial Company – Systematically Important Non Deposit taking Company (Reserve Bank) Directions, 2016. (Nov 2018, 10 marks)

Answer:

(ii) Calculation of provision required on advances as on 31st March, 2018 as per the Non-Banking Financial Company-Systemically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016.

Question 13.

Babu Bhai Financiers Ltd. is an NBFC providing Hire Purchase Solutions for acquiring consumer durables. The following information is extracted from its books for the year ended 31st March, 2018:

You are required to calculate the amount of provision to be made. (May 2019, 5 marks)

Answer:

On the basis of the information given, in respect of hire purchase and leased assets, additional provision shall be made as under:

Question 14.

Vikas Finance Ltd. is a Non-Banking Finance Company. The extracts of is Balance Sheet are as under:

You are requested to compute the Net Owned Funds of Vikas Finance Ltd. as per Non-Banking Finance Company – Systematically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions, 2016. (Nov 2020, 5 marks)

Question 15.

Universal Financers Ltd. is a Non-Banking Financial Company. It provides you the following information regarding its advances of ₹ 440 lakhs, of which instalments are overdue on:

550 accounts for last 3 months (amount overdue ₹ 105 lakhs)

75 accounts for 4 months (amount overdue ₹ 64 lakhs)

25 accounts for more than 30 months (amount overdue ₹ 66 lakhs)

15 accounts already identified as substandard for more than 3 years (unsecured) (amount overdue ₹ 82 lakhs)

8 accounts of ₹ 33 lakhs have been identified as non-recoverable by the management. (out of 25 accounts overdue for more than 30 months, 17 accounts are already identified as substandard for more than 12 months (amount overdue ₹ 19 lakhs) and others are identified as substandard asset for a period of less than 12 months.

Classify the assets of the company in line with the Non-Banking Financial Company-Systemically Important Non-Deposit taking Company, and Deposit taking Company (Reserve Bank) Directions, 2016. (Jan 2021, 5 marks)

![]()

Question 16.

Lokraj Financiers Ltd. is an NBFC providing Hire Purchase Solutions for acquiring consumer durables. The following information is extracted from its books for the year ended 31st March, 2017:

Answer:

On the basis of the information given, in respect of hire purchase and leased assets, additional provision shall be made as under: