Go through this Theoretical Framework – CS Foundation Fundamentals of Accounting and Auditing Notes will help students in revising the entire subject quickly.

Theoretical Framework – CS Foundation Fundamentals of Accounting Notes

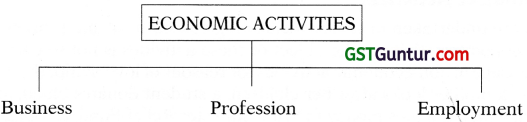

Introduction:

- A description of proper Accounts is also found in “Arthashastra” written by Kautilya.

- Modern day accounting concept was originated by “Luca Pacioli” in Italy.

- Accounting is the process of collecting, recording, summarizing and communicating financial information.

- This financial information is communicated to the users i.e. proprietor, creditors, investors, government etc.

- As per the definition of American Institute of Certified Public M Accountants

- Accounting is “the art of recording, classifying and summarizing in a significant manner and in terms of money, transactions and events which are in part at least, of a financial character and interpreting the results thereof”.

Characteristics (attributes) of Accounting:

(i) Accounting records transactions and events which are of financial nature.

(ii) Accounting is an art.

A subject is an art, if it helps us in attainment of a given objective. The main aim of accounting is to ascertain financial result and hence it is an art.

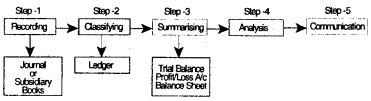

(iii) It involves the following activities: recording, classifying and summarizing

- Recording: Writing down the transactions and events in the book systematically and chronologically.

- Classifying: Process of grouping transactions of similar nature.

- Summarizing: Preparation of reports or results from the classified data.

(iv) Accounting helps in determining the financial position of an enterprise by analysing and interpreting the summarized records and communicating them to users.

(v) Accounting information can be manipulated and thus cannot be considered as the true test of performance.

(vi) It records transactions in terms of money.

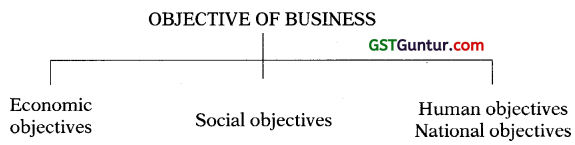

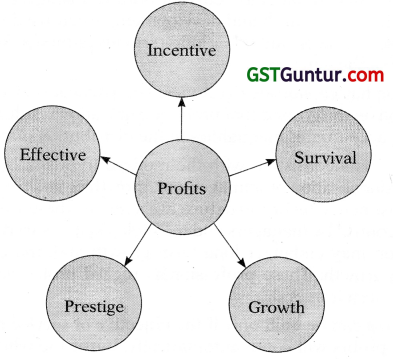

Objectives of Accounting:

- Maintaining accounting records

- Ascertaining profit/loss of the enterprise

- Ascertaining the financial position of the enterprise

- Providing accounting information to the users.

Functions of Accounting:

- Maintaining systematic records

- Protecting and controlling business properties

- Ascertaining the operational profit/loss

- Ascertaining financial position

- Facilitating rational decision making.

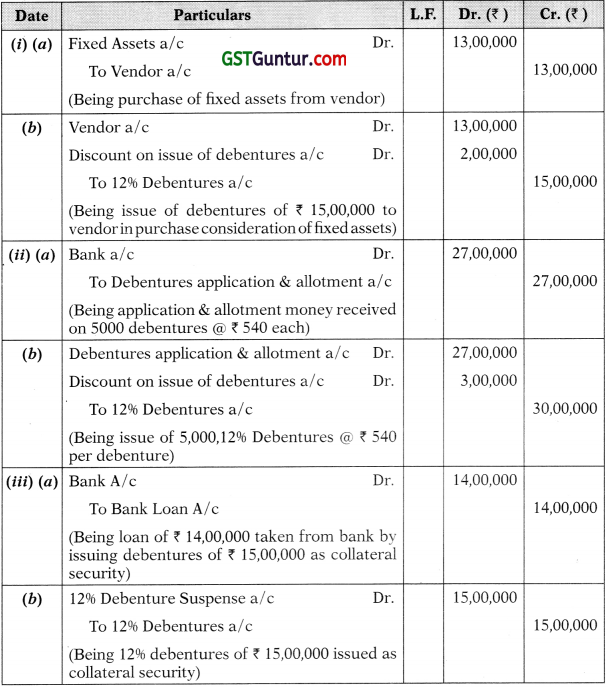

Process of Accounting/Stages of Accounting:

Branches or sub fields of Accounting:

- Financial Accounting: It is concerned with recording of financial data and ascertaining results thereof. It is directed towards preparation of trial balance, P/L A/c and-Balance Sheet.

- Cost Accounting: Accounting for the cost of the product is known as cost accounting. It helps in cost ascertainment and cost control.

- Management Accounting: It helps the management in decision making, increasing efficiency and maximizing profit.

Advantages of Accounting:

- Provides financial information about the business to interested parties

- Helps in comparison of financial results – Comparison of its own results of different years, Comparison of financial results with other firms in the industry.

- Helps in decision making

- Accounting information can be used as an evidence in legal and taxation matter

- Helps in valuation of the business

- Maintenance of business record

- Preparation of financial statements

Disadvantages (Limitations) of Accounting:

- Accounting ignores non monetary transactions

- Accounting information is sometimes based on estimates which may be unrealistic

- Window Dressing may lead to faulty results.

- Accounting ignores the effect of price level changes as the recordings are done at historical costs. Fixed assets are recorded at historical cost.

- Accounting information can be manipulated and thus can not be considered as the true test of performance, i.e. it. may be biased. Money as measurement unit changes in value.

- Accounting information may be biased. Accounting information is not without personal influence or bias of accountant.

Note:

Window Dressing:

The term window dressing means manipulation of accounts in such a way so as to conceal the important facts and show a rosy picture of the financial statements. It is mainly done to attract investors.

Book Keeping:

- Book keeping is a branch of knowledge that educates us how the financial records are maintained. Due to being clerical in nature, it is done by junior employees.

- It is concerned with recording financial data of the business in a significant and orderly manner.

- It is meant to show the effect of all the transactions made during the accounting period on the financial position of the business.

- Book keeping is a clerical work which covers procedural aspects of accounting work and includes record keeping function. It is science and art both.

- Book keeping is mechanical and repetitive.

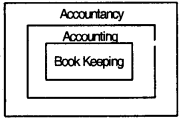

Book Keeping and Accounting:

1. Book keeping and accounting are often used interchangeably but they are different from each other

Book keeping is a part of accounting. Accounting requires more skill, experience and imagination.

2. Book keeping involves only recording of financial data whereas accounting also involves analysing, interpreting and communicating financial information to users.

3. We can say, book keeping is the first stage of accounting or in simple words “Accounting begins where book keeping ends”.

| Basis |

Book Keeping |

Accounting |

| 1. Scope |

Book keeping is concerned with identifying financial transactions, measuring them in money terms, recording and classifying them. |

Accounting is concerned with summarising the recorded transactions, interpreting them and communicating the results. |

| 2. Stage |

It is a primary stage and constitutes the base for accounting. |

It is the secondary stage. It begins where book keeping ends. |

| 3. Performance |

Junior staff performs this function. |

Senior staff performs this function. |

| 4. Nature of Job |

This job is clerical and routine in nature. |

This job is analytical and dynamic in nature. |

| 5. Objective |

The objective of Book keeping is to maintain systematic records of financial transactions. |

The objective of accounting is to ascertain net results of operations and financial position and to communicate information to the interested parties. |

| 6. Structure |

Done in accordance with basic accounting concepts and conventions. |

Method and procedure for analysis and interpretations may vary from firm to firm. |

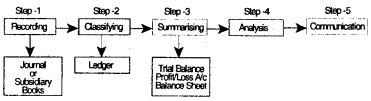

Accountancy:

- Accounting include design of accounting system which book-keepers use.

- This work requires more skill, experience and imagination.

- Accountancy refers to the systematic knowledge of accounting.

- Accountancy is an area of knowledge whereas accounting is a process of recording data.

- The application part of accountancy is known as accounting.

- Relationship between book keeping, accounting and accountancy.

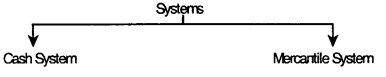

Systems of Accounting:

Cash System:

- Accounting is done not when the transaction takes place but when cash is paid or received.

- No entry is made when a payment or receipt is due.

Example:

If the transaction took place in the previous year but the cash is received in the current year, the recording will be done in the current year.

For example : In case of professionals i.e. doctor, CA, CS etc. In such the financial statements prepared by them for determination of their income is termed as receipt and expenses A/c.

Merits of Cash System:

- This method is less complex as the recording is to be done when cash is received or paid, (concepts of accrued or due not used).

- It is most suited where credit transactions are almost negligible and collections are uncertain and where the organisation is small.

Demerits of Cash System:

- Cash system of accounting violates the matching principle which states that expenses should be matched with their revenues and should be shown in the same year.

- Financial statements prepared under cash system do not show a true and fair view of books of account.

Accrual or Mercantile System of Accounting:

- Under this system, transactions are recorded when they occur and not when cash is realised.

- Accrual system of accounting complies with the matching principle which means it relates the revenue earned to the cost incurred during a given period.

- Mercantile system of accounting is widely used and recognized by the business enterprises.

- Costs which are not charged to income are carried forward and are kept under continuous review.

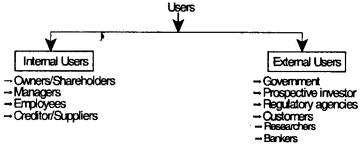

Accounting Information:

- Accounting helps in communicating financial information of the business to the users, hence accounting is known as the language of business.

- Accounting information collects the reports and interprets financial information about the activities of the organisation.

- Example : Organisations have to submit its financial details to the banks for applying for loans or to the government while paying taxes.

- Therefore, accounting is concerned with communicating results of an organisation to its various users.

- Many law requires financial information like income tax, sales tax, department company board etc.

Characteristic of accounting information:

Relevant – The accounting information should be relevant enough to help the users to evaluate the events while taking economic decisions. The relevance of information depends upon the materiality and nature.

Reliable – An information is said to be reliable if it is faithful complete, prudent, free from material errors and non-biased. Thus, the accounting information should be reliable. The key aspects of reliability are:

- faithful representation

- substance overform

- neutrality

- prudence

- ompleteness

1. Comparability – Accounting information should be capable in facilitating comparison of results of different periods of the same enterprise or comparing the results of different enterprises at same time.

2. Understandability – The information should be readily understandable to the users

3. Timeliness – The accounting information should be communicated to its user within an appropriate time period to facilitate quick decision making.

4. Cost Benefit – The benefits of using the accounting information should be more than the cost of preparing it and preparation of that information. It must not be costly and time consuming.

5. Verifiability – The information should be capable of being verified by a person other than the accountant himself.

6. Neutrality – The accounting information should be free from any bias and should not support any particular person or group.

7. Completeness – The information should be complete and contain all necessary information which is required by the users to take their decisions.

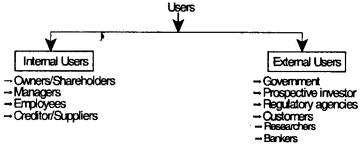

Users of accounting information:

Accountant – Accounting is a clerical work and the person involved in this work is known as an accountant.

Role of Accountant – An accountant performs the following functions:

- Maintenance of books of accounts

- Performing audits (conducted by Chartered Accountant)

(i) Statutory Audit

(ii) Internal Audit

- Performs budgeting – Budgeting means planning of business activities and after the completion of activities comparing the actual results with the planned results to know the variations.

- Handling taxation matters

- Carrying out investigations

- Giving advices to the management

- Any other business work.

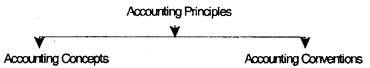

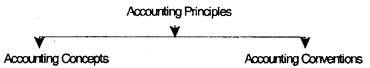

Accounting Principles, Accounting Concepts and Accounting Conventions:

| Accounting Principles |

Accounting Concepts |

Accounting Conventions |

| Scientifically laid down guidelines to establish standard for sound accounting practices and procedure. Accounting principles are a body of doctrines commonly associated with the theory and procedures of accounting, serving as an explanation of current practices and as a guide for selection of conventions or procedures where alternative exists. |

Accounting concepts define the assumption on the basis of which financial statements of an entity are prepared. |

Accounting conventions emerge out of accounting principles which are adopted by the enterprises over a period of time. These are derived by usage and practice.

1. Profit loss and Balance Sheet are prepared according to it. |

Accounting Concepts:

1. Going Concern Concept

It is on this concept that a clear distinction is made between assets and expenditure. This concept assumes that business shall continue for an indefinite period. The proprietor has no intention to close it in the near future and would be able to meet its obligations according to plan.

Due to this concept:

- Assets are valued at cost and then depreciated every year.

- Expenses and incomes are classified into capital and revenue.

2. Business Entity Concept:

- According to this concept, business and its owners are separate entities.

- The owner is treated as the creditor of the company to the extent of capital contributed by him.

- All transactions of the business are recorded in the books of business from the point of view of business.

- This concept keeps the personal affairs of the owner away from the business affairs.

- Income or profit is the property of the business unless distributed among the owners.

3. Money Measurement Concept:

- As per this concept, only those transactions which can be expressed in terms of money can be recorded.

- Transactions and events which cannot be expressed in terms of money, even if they affect the business, are not recorded in the books.

- Income or profit is the property of the business unless distributed among the owners.

Example: Death of the director, disputes within the organisation, strikes, etc. may affect the working and profits of the business, but are not recorded in books of accounts. Measuring unit for money is the currency of the ruling country.

Note:

Entity and money measurement are considered as the basic concepts on which other procedural concepts depend.

4. Cost Concept:

- According to this concept, the value at which the various assets shall be recorded in the books shall be the historical cost or acquisition cost.

- This concept says that the assets shall be recorded at cost at the time of its purchase and its value shall be reduced systematically by charging depreciation.

- This concept helps to keep the statements free from personal bias or judgements.

- This concept is not beneficial for new investors as they are more interested in knowing the present worth of the business rather than its historical cost.

5. Dual Aspect Concept

- According to this concept, every transaction has two aspects, a debit aspect and a credit aspect.

- Due to these two aspects, the total amount debited is always equal to the total amount credited (i.e. total assets are equal to total liabilities).

Note: Concept of Accounting Equation:

Accounting equation is based on the dual aspect concept.

Assets: These are the resources owned by the business.

Liabilities: These are the claims against the assets.

- Liability to owners – capital

- Liability to outsiders – liabilities.

As per the dual aspect concept, at any point of time, total assets of a business are equal to total liabilities.

Hence, based on above, the following equation can be framed :

Assets = Liabilities + Capital

OR

Capital = Asset – Liabilities

Example:

1. Owner contributed ₹ 1,00,000 as cash into the business. The two aspects will be:

(i) Bringing cash in business – increase in asset.

(ii) Owner is treated as a creditor – increase in liability Asset = Capital + Liability

1,00,000 = 1,00,000

(Cash) = (Owner)

2. Purchased furniture on credit from Mr. X for ₹ 30,000.

(i) Purchase of furniture – increase in asset

(ii) Mr. X will become creditor – increase in liability

Assets = Capital+ Liabilities

30,000 = +30,000

(furniture) (Mr. X Creditor)

From, the above it is clear, that every transaction has two aspects and due to this accounting equation always balances.

6. Realisation Concept:

- According to this concept, revenue is recognized only when sale is made.

- This concepts says that any change in the value of an asset is to be recorded only when business realises it.

- This concept prevents business firms from inflating their profits by showing expected incomes, (which have not yet materialised)

- Example: An increase in the value of asset cannot be considered as a profit until and unless the asset is sold and profit is realised.

Note : Going concern + Cost Concept + Realization Concept = Valuation criteria criteria.

7. Accrual Concept:

- It is fundamental to the usefulness of financial accounting information.

- According to this concept, a transaction should be recorded at the time when it takes place and not when the cash is realised.

- Every transaction and event effects, one or more or all the three aspects, assets, liabilities and capital.

- They have their impact on both the Profit & Loss A/c and Balance Sheet.

- This concept implies that income should be measured as a difference between revenue and expenditure.

Example:

Mr. A purchases furniture on 1st January, 2012 of ₹ 1,00,000. The amount is agreed to be paid on 15th April, 2012. Here, although the payment is made in financial year 2012-13 but entry will be done in 2011-12 (i.e. the date of transaction).

8. Accounting Period Concept:

- This is also known as the concept of periodicity.

- According to this principle, the life of an enterprise is broken into smaller periods (generally one year) know as accounting period.

- The main objective of this concept is to know the performance of the enterprise at regular intervals.

- Accounting period is an interval of time at the end of which the income or revenue statement and balance sheet are prepared in order to show the results of the operations.

9. Matching Concept/Revenue match Concept:

- Based on accounting period concept

- As per this concept, expenses of a period should be matched with the revenues of that period.

- It says, the cost incurred to earn the revenue should be recognized as expenses in the period when revenue is recognized.

- Matching principle requires that all revenues earned during an accounting year, whether received or not and all cost incurred, whether paid or not, have to be taken into account while preparing Profit/Loss Account.

- In the same manner all amounts received or paid during the current year but pertaining to the previous year or the next year should be excluded from current year’s revenue and cost.

- The term matching means appropriate association of related revenues and expenses.

Accounting Conventions:

1. Consistency:

- According to this convention, accounting practices once selected and adopted should be applied consistently year after year.

- This convention helps in comparison of financial statements.

- Consistency does not mean that accounting principles once adopted can never be changed. They can be changed, if the change is desirable.

Example:

If a company follows written down value method of depreciation, it shall continue to follow it year after year.

2. Disclosure:

- This is also known as the “Full disclosure” principle.

- According to this convention, all significant information should be fully and fairly disclosed in the financial statements.

- Ensuring this convention increases the relevance and reliability of financial statements. The companies act make ample provision for disclosure of essential information.

3. Conservatism:

- The concept of conservatism states that we should not anticipate a profit but should provide for all possible losses while preparing financial statements.

- It enables the financial statements to show a realistic picture of the state of affairs of the enterprise.

- This convention understates the assets and overestimates the liabilities.

- Financial statement are usually drawn up on a conservative basis.

- Choice between two methods of valuing an asset, the accountant should choose a method which leads to lesser value.

Example:

Valuing stock at lower of cost or market value, making provision for doubtful debts in anticipation of debts becoming bad, are done to comply with the convention of conservatism.

4. Materiality:

- According to the convention of materiality, accountant should record only those items which are material and ignore all insignificant items.

- An item is said to be material if it is likely to influence the decision of the users, (like investors etc.)

Judgement of materiality depends from organisation to organisation and on the basis of professional experience and judgement.

Example

An item of expense of ₹ 1,00,000 may be material for a small organisation but immaterial for a large firm.

Accounting Standards:

- Accounting standards are the written policy documents guiding the measurement, treatment and disclosure of financial transactions.

- Accounting standards are issued by the regulatory body known as the “Institute of Chartered Accountants of India”.

- The Institute of Chartered Accountants of India constituted Accounting Standard Board (ASB) on 21st April, 1977 for making these standards.

- The main objective of setting standards is to bring uniformity and harmony in the financial statements and enabling consistency and comparability in the data established by the enterprise.

Accounting Policies:

1. Accounting policies refers to specific accounting principles and the methods of applying those principles.

2. Accounting policies are based on accounting concepts, principles and conventions.

3. Choice of accounting policy is an important decision and hence, the following basis should be considered while choosing accounting policies:

- Prudence

- Substance over form

- Materiality.

| Accounting Concept |

Accounting Conventions |

| 1. Theoretical idea forming a set of practices |

Method or procedure accepted by general agreement |

| 2. Not based on accounting conventions |

Based on Accounting concept |

| 3. Non internally consistent |

Internally inconsistent |

| 4. Personal judge has no role in adoption |

Personal judgment may play crucial role |

| 5. Established by law |

Established by common accounting practices |

| 6. Uniform |

Not so in conventions |

Note:

Areas where different accounting policies are used:

- Methods of depreciation/depletion/amortization.

- Valuation of inventories

- Treatment of goodwill

- Valuation of investments

- Valuation of fixed assets, etc.

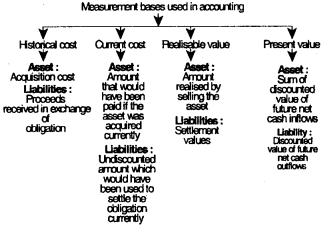

Accounting as a Measurement of Discipline:

1. Measurement means assigning numerical values to specific attributes. In accounting, we take money as a measurement tool.

2. There are three elements of measurement:

- Identification of objects and events

- Selection of standards or scale

- Evaluation of dimensions of measurement standard or scale.

3. Value refers to the benefits to be derived from objects, abilities or ideas.

4. Measurement and valuation do not mean the same thing. Valuation is a part of measurement.

5. Measurement is a broader concept than valuation.

6. Valuation is an economic concept.

7. In Accounting. monetary unit is used to value an object.

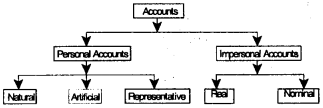

Accounts:

An account is an individual records of a person, firm, thing and item of an income or expense.

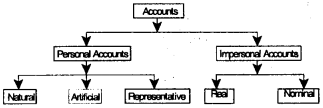

Classification of Accounts:

Personal Accounts:

(i) Natural personal account: It relates to transactions of human beings like Ram, Shyam etc.

(ii) Artificial (legal) personal account: Business entities have a separate identity from that of its owners. These business entities are said to be artificial legal person. For example: companies, clubs, co-operative societies.

(iii) Representative personal accounts: These accounts are not in the name of any person but are represented as personal accounts. For e.g: outstanding liability, prepaid account, capital account, drawings account etc.

Impersonal Accounts:

(i) Real Account: Accounts which relate to the assets of the firm are known as real accounts e.g – Cash A/c, Building A/c, Investment A/c etc.

(ii) Nominal Accounts : Accounts which relate to expenses, losses, gains, revenue etc. are nominal accounts e.g – salary account, interest paid account, dividend-received account etc.

Notes:

1. Real Accounts can be divided into tangible real accounts and intangible real accounts.

- Tangible Real Accounts – Land, building etc.

- Intangible Real Accounts – Goodwill, patent, copyright etc.

2. Bank balance is an asset but bank account is not a real account but a personal account because it is an account of some banking company which is an artificial person.

3. According to Kohler Dictionary for Accounts, an account has been defined as a formal record of a particular type of transaction expressed in money.

Systems of Record Keeping

There are two system of record keeping:

- Single Entry System

- Double Entry System

Single Entry System:

- Under this system some entries are recorded partially and some are entirely eliminated.

- It is also known as accounting from incomplete records.

- This system is economical and time saving but is unscientific and not reliable.

Double Entry System:

(i) Under this system, every transaction has two aspects – debit and credit and at the time of recording a transaction, it is written once on the debit side and again on the credit side of another account.

(ii) This is a system which recognizes and records both aspects of a transaction.

Features of Double Entry System:

- Complete record of transactions

- Recognizes dual aspect of every transaction.

- Under this, one aspect is debited and other is credited.

- The accounts will always balance.

Merits of Double Entry System:

- Keeps complete record of transactions.

- Keeps a check on arithmetical accuracy of accounts. Helps in the preparation of final accounts.

- Chances of frauds and errors are less.

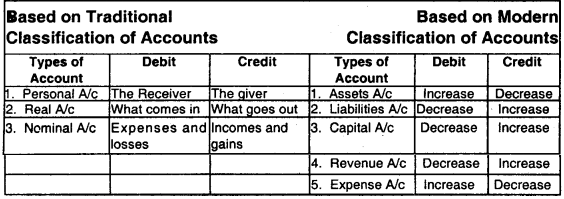

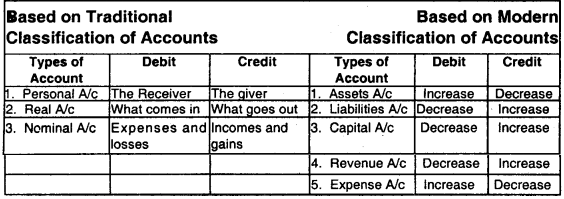

Rules of Accounting

1. Rules of accounting are also known as the rules of debit or credit or Golden Rules of Accounting.

Example:

| Transaction |

Entry |

Type of A/c |

Reason |

| 1. Cash deposited for opening an account |

Bank A/c Dr.

To Cash A/c |

Personal

Real |

Debit the receiver, credit what goes out. |

| 2. Cash withdrawn |

Cash A/c Dr.

To Bank A/c |

Real

Personal |

Debit what comes in, credit the giver |

| 3. Payment of Expenses (Say Rent) |

Rent A/c Dr.

To Bank A/c |

Nominal

Personal |

Debit all expenses and losses, credit the giver |

| 4. Interest allowed by the bank |

Bank A/c Dr.

To Cash A/c

Recevied A/c |

Personal Nominal |

Debit the receiver, credit all incomes and gains |

2. Rules of debit and credit can be explained under:

- Traditional classification of accounts.

- Modern classification of accounts.

Debit and Credit relating to various accounts:

| Personal Accounts |

Debit: The person has become a debtor of company.

Credit: The person has become a creditor of company. |

| Real Accounts |

Debit: Increase in asset, Decrease in liability

Credit: Increase in liability, Decrease in asset |

| Nominal Accounts |

Debit: Expenses or losses

Credit: Incomes or gains |

Accounting Equation:

All business transactions are recorded as having a dual aspect. Thus,

- Total Assets = Total Liabilities, or

- Capital + Liabilities = Assets, or

- Capital = Assets – Liabilities, or

- Assets = (Capital at the begining + Incomes – Expenditures) = Capital at the end.

This equation is known as accounting equation. This is based on the concept that for every debit, there is an equivalent credit.

Bills of Exchange: Negotiable Instrument Act, 1881 : Section 5:

“A bills of exchange is an instrument in writing containing an unconditional order signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain person or to the bearer of the instrument.”

Features of BoE:

- It must be in writing

- It must contain an order to make payment

- It must be unconditional

- Date of payment should be certain

- Must be signed by the drawer

- Must be accepted by the drawee by signing on it

- Amount specified in the bill is payable either on demand or on the expiry of a fixed period.

- Bill is payable either to a certain person or to his order or to the bearer of the bill.

- The amount of bill of exchange must be certain

- It must be stamped as per legal requirements.

Parties to a Bill of Exchange:

- Drawer : Writer of bill of exchange, drawer is entitled to receive money from the drawee.

- Drawee : Acceptor of the bill, drawee is liable to pay money to the creditor/drawer.

- Payee : Payee is the person who receives the payment from the drawee. Usually, drawer and payee are the same person. In the following cases, they are two different persons

- When bill is discounted from bank.

- When bill is endorsed by the drawer to his creditors.

Contents of Bill of exchange:

- Date

- Term/Tenure

- Amount

- Stamp

- Name of Parties

- For value received.

Theoretical Framework MCQ Questions

Question 1.

Double Entry Principle means:

(a) Having debit for every credit and similarly, credit for each debit

(b) Writing all the entries twice in the book

(c) Maintaining the double account for all business transactions

(d) Writing two times the same entry.

Answer:

(a) Having debit for every credit and similarly, credit for each debit

Question 2.

Which of the following is not a function of accounting _________.

(a) Keeping systematic record

(b) Protecting properties of business

(c) Maximising the results

(d) Meeting legal requirements

Answer:

(c) Maximising the results

Question 3.

The system of recording transactions based on dual concept is called _________.

(a) Double account system

(b) Double entry system

(c) Single entry system

(d) Cash system.

Answer:

(b) Double entry system

Question 4.

According to money measurement concept, the following will be recorded in the books of account.

(a) Health of the chairman of the company

(b) Quality control in the business

(c) Value of the building

(d) All of those

Answer:

(c) Value of the building

Question 5.

Which of the following is not dependent on accounting₹

(a) Management accounting

(b) Cost accounting

(c) Financial accounting

(d) Book-keeping.

Answer:

(d) Book-keeping.

Question 6.

Which is not function of accounting₹

(a) Decision making

(b) Measurement

(c) Forecasting

(d) Ledger posting.

Answer:

(d) Ledger posting.

Question 7.

The practice of appending note regarding contingent liabilities in the accounting statements is in pursuant to:

(a) Convention of consistency

(b) Money measurement concept

(c) Convention of disclosure

(d) None of these.

Answer:

(c) Convention of disclosure

Question 8.

The proprietor is treated as a creditor to the extent of his capital, accounting to:

(a) Cost concept

(b) Business entity concept

(c) Going concern concept

(d) All of these.

Answer:

(b) Business entity concept

Question 9.

The accounting equation is based on _________

(a) Going concern concept

(b) Dual aspect concept

(c) Money measurement concept

(d) All of these.

Answer:

(b) Dual aspect concept

Question 10.

Market value of investment is shown as a footnote according to _________.

(a) Convention of disclosure

(b) Convention of consistency

(c) Convention of conservatism

(d) All of these.

Answer:

(a) Convention of disclosure

Question 11.

Making the provision for doubtful debts in anticipation of actual bad debts is on the basis of _________.

(a) Convention of disclosure

(b) Convention of consistency

(c) Convention of conservatism

(d) None of these.

Answer:

(c) Convention of conservatism

Question 12.

Which of the following is accounting equation₹

(a) Capital = Assets + Liabilities

(b) Capital = Assets – Liabilities

(c) Assets = Liabilities – Capital

(d) Liabilities = Assets + capital.

Answer:

(b) Capital = Assets – Liabilities

Question 13.

Recording of capital contributed by the owner as liability ensures the adherence of principle of _________

(a) Double entry

(b) Going concern

(c) Separate entity of business

(d) Materiality.

Answer:

(c) Separate entity of business

Question 14.

Contingent liability is shown in the balance sheet because of _________.

(a) Convention of consistency

(b) Convention of materiality

(c) Convention of disclosure

(d) All of these.

Answer:

(c) Convention of disclosure

Question 15.

Two primary qualitative characteristic of financial statements are _________.

(a) Understandability and materiality

(b) Relevance and reliability

(c) Relevance and understandability

(d) Materiality and reliability.

Answer:

(b) Relevance and reliability

Question 16.

A purchased a car for ₹ 10,00,000, making a down payment of ₹ 1,00,000 and signing a ₹ 9,00,000 bill payable due in 60 days. As a result of this transaction.

(a) Total assets increased by ₹ 10,00,000

(b) Total liabilities increased by ₹ 9,00,000

(c) Total assets increased by ₹ 9,00,000

(d) Total assets increased by ₹ 9,00,000 with corresponding increase in liabilities by ₹ 9,00,000.

Answer:

(d) Total assets increased by ₹ 9,00,000 with corresponding increase in liabilities by ₹ 9,00,000.

Question 17.

On sale of old furniture, owner’s equity would _________.

(a) Increase

(b) Decrease

(c) Remain unchanged

(d) May or may not change.

Answer:

(d) May or may not change.

Question 18.

On 31st Dec, 2006 assets of the business are ₹ 3,00,000 and its capital is ₹ 1,00,000. Its liabilities on that date will be _________.

(a) ₹ 4,00,000

(b) ₹ 2,00,000

(c) ₹ 1,00,000

(d) None of the above.

Answer:

(b) ₹ 2,00,000

Question 19.

Revenue is generally recognized at the point of sale. Which principle is applied.

(a) Consistency

(b) Matching

(c) Revenue recognition

(d) Cost principle.

Answer:

(c) Revenue recognition

Question 20.

Economic life of an enterprise is split into the periodic interval as per _________.

(a) Periodicity

(b) Matching

(c) Going concern

(d) Accrual.

Answer:

(a) Periodicity

Question 21.

A machinery is purchased on 1st April, 2005 for ₹ 10,00,000. Its installation charges were ₹ 1,00,000. But its market value as on 3181 March, 2006 was ₹ 13,00,000. If the company shows the machinery at ₹ 13,00,000 in its B/S, which of the following concepts is not followed by the company?

(a) Cost concept

(b) Matching concept

(c) Realisation concept

(d) Periodicity concept

Answer:

(a) Cost concept

Question 22.

A business man purchased goods for ₹ 30,00,000 and sold 20% of such goods during the accounting year ended 31st March, 2005. The market value of the remaining goods was ₹ 5,00,000. He has not valued the closing stock at market price, he has violated the concept of _________.

(a) Money measurement

(b) Conservatism

(c) Cost

(d) Periodicity.

Answer:

(b) Conservatism

Question 23.

Which of the following is not a subfield of accounting?

(a) Management accounting

(b) Cost accounting

(c) Financial accounting

(d) Book-Keeping.

Answer:

(d) Book-Keeping.

Question 24.

Book- keeping is mainly concerned with _________.

(a) Recording of financial data

(b) Designing the systems in recording, classifying and summarizing the recorded data.

(c) Interpreting the data for internal and external users.

(d) None of the above.

Answer:

(a) Recording of financial data

Question 25.

Users of accounting information include _________.

(a) Creditors

(b) Lenders

(c) Customers

(d) All of the above.

Answer:

(d) All of the above.

Question 26.

Financial statements only consider.

(a) Assets expressed in monetary terms.

(b) Liabilities expressed in monetary terms.

(c) Assets expressed in non-monetary terms.

(d) Assets and liabilities expressed in monetary terms.

Answer:

(d) Assets and liabilities expressed in monetary terms.

Question 27.

_________ is a primary stage.

(a) Accounting

(b) Managing.

(c) Book keeping

(d) Auditing

Answer:

(c) Book keeping

Question 28.

External users of accounting informations are :

(a) Investors and Lenders 1

(b) Management 1

(c) Both (a) & (b)

(d) Owners

Answer:

(a) Investors and Lenders 1

Question 29.

Which method of accounting is commonly adopted by business concerns:

(a) Cash method of accounting

(b) Mercantile method of a accounting

(c) Special method of accounting

(d) Systematic method accounting.

Answer:

(b) Mercantile method of a accounting

Question 30.

The job of accounting is :

(a) Routine in nature

(b) Clerical in nature

(c) Analytical in nature

(d) All of the above.

Answer:

(c) Analytical in nature

Question 31.

Accounting cycle starts with ends with :

(a) Recording of transactions, preparation of final accounts

(b) Recording of transactions, posting them in ledger.

(c) Recording & posting of transaction, preparation of final accounts

(d) None of the above.

Answer:

(a) Recording of transactions, preparation of final accounts

Question 32.

According to Dual aspect concept, which of the following is incorrect:

(a) Increase in one asset & decrease in other asset

(b) Decrease in one liability & increase in other liability

(c) Decrease in both liability & asset

(d) None of the above.

Answer:

(d) None of the above.

Question 33.

Which concept holds that a transaction is recorded at the time when it takes place & not when the settlement takes place :

(a) Verifiable objective concept

(b) Matohing concept

(c) Accrual concept

(d) Revenue recognition concept.

Answer:

(c) Accrual concept

Question 34.

The basic concepts related to P & L Account are _________.

(a) Realization concept

(b) Matching concept

(c) Cost concept

(d) Both (a) and (b) above.

Answer:

(d) Both (a) and (b) above.

Question 35.

The underlying accounting principle (s) necessitating amortization of intangible asset (s) is are _________.

(a) Cost concept

(b) Realization concept

(c) Matching concept

(d) Both (a) and (c) above.

Answer:

(c) Matching concept

Question 36.

The accounting measurement that is not consistent with the going concern concept is:

(a) Historical cost

(b) Realization

(c) The transaction approach

(d) Liquidation value.

Answer:

(d) Liquidation value.

Question 37.

Omission of paise and showing the round figures in financial statements is based on:

(a) Conservatism concept

(b) Consistency concept

(c) Materiality concept

(d) Realization concept.

Answer:

(c) Materiality concept

Question 38.

Accounting does not record non-financial transactions because of:

(a) Entity concept

(b) Accrual concept

(c) Cost concept

(d) Money measurement concept.

Answer:

(d) Money measurement concept.

Question 39.

Mr. Rohit, owner of Rohit Furniture Ltd. owns a personal residence that cost ₹ 6,00,000, but has a market value of ₹ 9,00,000. During preparation of the financial statement for the business, the entire value of property was ignored and was not shown in the financial statements. The principle that was being followed was :

(a) The concept of the business entity

(b) The concept of the cost principle

(c) The concept of going concern principle

(d) The concept of realisation principle.

Answer:

(a) The concept of the business entity

Question 40.

The expenses and incomes pertaining to full trading period are taken to the profit and loss account of a business, irrespective of their payment of receipt. This is in recognition of:

(a) Time period concept

(b) Business entity concept

(c) Going concern concept

(d) Accrual concept

Answer:

(d) Accrual concept

Question 41.

What does ‘AICPA’ stands for:

(a) American Institute of Certified Public Accountants

(b) Anglo Institute of Certified Public Accountants

(c) African Institute of Certified Public Accountants

(d) American Institute of Certified Private Accountants

Answer:

(a) American Institute of Certified Public Accountants

Question 42.

Which organisation defined this statement:

‘The art of recording, classifying and summarizing in a significant manner and in terms of money, transaction and events which are, in part atleast, of a financial character and interpreting the result there of _________.

(a) IASB

(b) ISB

(c) AICPA

(d) None of the above

Answer:

(c) AICPA

Question 43.

“The system of book keeping by double entry is, perhaps the most beautiful one in the wide domain of literature or science. Were it less common, it would be the administration of the learned world” is spoken by:

(a) Luca Pacioli

(b) Edwin T. Freedly

(c) Warren Buffet

(d) Richard Notebaert

Answer:

(b) Edwin T. Freedly

Question 44.

Who originated the double entry system of accounting:

(a) Alfred Marshall

(b) Edwin T. Freedly

(c) Luca Pacioli

(d) Warren Buffet

Answer:

(c) Luca Pacioli

Question 45.

_________ is the process of grouping transaction and entries of the same type at one place.

(a) Analysing

(b) Summarizing

(c) Recording

(d) Classifying

Answer:

(d) Classifying

Question 46.

_________ involves the preparation of reports and statements from the classified data (ledger) understandable and useful to management and other interested parties.

(a) Analysing

(b) Summarizing

(c) Recording

(d) Classifying

Answer:

(b) Summarizing

Question 47.

_________ is the art of interpreting the results of operation to determine the financial position of the enterprise, the progress it has made and how well it is getting along.

(a) Accounting

(b) Costing

(c) Presentation

(d) None of the above

Answer:

(a) Accounting

Question 48.

_________ is done in manner which identifies the different classes and types of transaction.

(a) Identification

(b) Classification

(c) Both (a) & (b)

(d) Recording

Answer:

(d) Recording

Question 49.

The statement prepared by the summarizing process is known as:

(a) Fund Flow Statement

(b) Financial Statement

(c) Cash Flow Statement

(d) None of the above

Answer:

(b) Financial Statement

Question 50.

Which of the following is not a branch of accounting?

(a) Financial Accounting

(b) Cost Accounting

(c) Strategic Accounting

(d) Management Accounting

Answer:

(c) Strategic Accounting

Question 51.

_________ is concerned with record-keeping directed towards the preparation of trial balance, profit and loss account and balance sheet.

(a) Cost Accounting

(b) Financial Accounting

(c) Management Accounting

(d) None of the above

Answer:

(b) Financial Accounting

Question 52.

The main function of Cost Accounting are to:

(a) Ascertain cost

(b) Help management in controlling cost

(c) Help in reduction of cost

(d) All of the above

Answer:

(d) All of the above

Question 53.

Which of the following is not the function of accounting?

(a) Keeping systematic records

(b) Protecting and controlling business properties

(c) Protecting user interest

(d) Facilitating rational decision making

Answer:

(c) Protecting user interest

Question 54.

Which of the following is not the advantage of accounting:

(a) Ascertaining financial position of a business

(b) Comparison of results

(c) Evidence in legal matters

(d) Help in taxation matters

Answer:

(a) Ascertaining financial position of a business

Question 55.

Which of the following is not the limitation of accounting?

(a) Accounts can be manipulated

(b) Provide information to interested parties

(c) Money as a measurement unit changes in value

(d) Fixed Assets are recorded at original cost

Answer:

(b) Provide information to interested parties

Question 56.

_________ is incompatible with the matching principle of income determination.

(a) Cash System of Accounting

(b) Accrual System of Accounting

(c) Both (a) & (b)

(d) None of the above

Answer:

(a) Cash System of Accounting

Question 57.

In which system of accounting “cost are matched against revenue on the basis of relevant time period to determine relevant income”.

(a) Mercantile System of Accounting

(b) Accrual System of Accounting

(c) Cash System of Accounting

(d) Both (a) & (b)

Answer:

(d) Both (a) & (b)

Question 58.

_________ work is clerical in nature.

(a) Summarizing

(b) Analysing

(c) Both (a) & (b)

(d) Book keeping

Answer:

(d) Book keeping

Question 59.

_________ is the science and art of correctly recording in the books of accounts all those business transaction that result in the transfer of money or money’s worth.

(a) Accounting

(b) Auditing

(c) Book keeping

(d) None of the above

Answer:

(c) Book keeping

Question 60.

Which organisation uses cash system of Accounting?

(a) Company

(b) NPO’s

(c) Partnership Firms

(d) None of the above

Answer:

(b) NPO’s

Question 61.

Any cost that appears to have lost its utility or its power to generate future revenue is written off as a _________.

(a) Expenditure

(b) Deferred Expenditure

(c) Loss

(d) None of the above

Answer:

(c) Loss

Question 62.

Primary aim of accounting is:

(a) Providing necessary information to the owners related to their business

(b) To earn profit

(c) Both (a) & (b)

(d) None of the above

Answer:

(a) Providing necessary information to the owners related to their business

Question 63.

_________ ensures the truthfulness of the recorded transaction.

(a) Neutrality

(b) Verifiability

(c) Cost-benefit

(d) Timeliness

Answer:

(b) Verifiability

Question 64.

What are the key aspects of reliability:

(a) Neutrality

(b) Prudence

(c) Completeness

(d) All of the above

Answer:

(d) All of the above

Question 65.

‘Free from Bias’ is the feature of which characteristics of accounting.

(a) Reliability

(b) Relevance

(c) Neutrality

(d) Completeness

Answer:

(c) Neutrality

Question 66.

What is the full form of GAAP:

(a) Generally Accepted Accounting Parts

(b) Generally Accepted Accounting Provisions

(c) Generally Accepted Accounting Principals

(d) Generally Accepted Accounting Principles

Answer:

(d) Generally Accepted Accounting Principles

Question 67.

_________ means the planning of business activities before they occur.

(a) Budget

(b) Policy

(c) Objectives

(d) All of the above

Answer:

(a) Budget

Question 68.

_________ have been defined as “the body of doctrines commonly associated with the theory and procedure of accounting, serving as an explanation of current practices and as a guide for the selection of conventions or procedure where alternative exist.”

(a) Accounting principles

(b) Accounting concept

(c) Accounting convention

(d) None of the above

Answer:

(a) Accounting principles

Question 69.

Death, Dispute, Sentiments etc. are not recorded in the books in which accounting concept is followed. This is as _________.

(a) Cost concept

(b) Relevant match concept

(c) Money measurement concept

(d) Dual aspect concept

Answer:

(c) Money measurement concept

Question 70.

_________ & _________ are independent variables.

(a) Asset, Capital

(b) Capital, Liabilities

(c) Asset, Liabilities

(d) None of the above

Answer:

(c) Asset, Liabilities

Question 71.

_________ concept means that fixed assets are valued on the basis of cost less proper depreciation keeping in mind their expected useful life ignoring fluctuation in the prices of the asset.

(a) Cost

(b) Going concern

(c) Dual aspect

(d) Realisation

Answer:

(a) Cost

Question 72.

_________ concept implies the income measured by the difference between cash received and disbursement:

(a) Matching Revenue

(b) Accrual

(c) Cash

(d) Accounting period

Answer:

(a) Matching Revenue

Question 73.

_________ concept is based on Accounting Period Concept.

(a) Accrual

(b) Going concern

(c) Realisation

(d) Matching Revenue

Answer:

(d) Matching Revenue

Question 74.

_________ denotes custom or tradition or practices based on general agreement between the accounting bodies which guides the accountant while preparing the financial statement.

(a) Convention

(b) Principle

(c) Both (a) & (b)

(d) None of the above

Answer:

(a) Convention

Question 75.

Who defined this statement “An account has been defined as a formal record of a particular type of transaction expressed in money” _________.

(a) Luca Pacioli

(b) Warren Buffet

(c) Philip Kotler

(d) Kohler

Answer:

(d) Kohler

Question 76.

Which of the following is NOT a characteristic of Accounting?

(a) Accounting is an art

(b) It records transactions only in monetary terms

(c) It is concerned with interpretation of results

(d) None of the above

Answer:

(d) None of the above

Question 77.

Which of the following is NOT a branch of Accounting?

(a) Financial Accounting

(b) Cost Accounting

(c) Corporate Accounting

(d) Management Accounting

Answer:

(c) Corporate Accounting

Question 78.

Which of the following is NOT an advantage of Accounting?

(a) Decision making

(b) Helps in taxation matters

(c) Valuation of Business

(d) Increasing the profits and sales

Answer:

(d) Increasing the profits and sales

Question 79.

“Book keeping starts where accounting ends”:

(a) True

(b) Partly True

(c) False

(d) Partly False

Answer:

(c) False

Question 80.

Accrual System of accounts is also called as:

(a) Merchantile system

(b) Hybrid system

(c) Cash system

(d) None of the above

Answer:

(a) Merchantile system

Question 81.

Which of the following is NOT an accounting concept?

(a) Business Entity Concept

(b) Money Measurement Concept

(c) Consistency Concept

(d) Realisation Concept

Answer:

(c) Consistency Concept

Question 82.

Which of the following is NOT an accounting convention?

(a) Disclosure

(b) Consistency

(c) Going Concern

(d) Conservatism

Answer:

(c) Going Concern

Question 83.

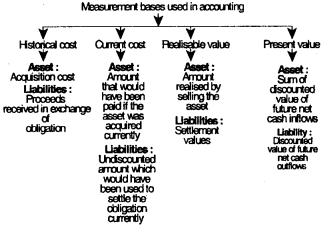

If the transactions are recorded as per the current cost measurement, then the assets are recorded:

(a) At the cost of acquisition

(b) Amount that would be realised by selling the asset

(c) The value of cash required to be paid to acquire the asset

(d) None of the above

Answer:

(c) The value of cash required to be paid to acquire the asset

Question 84.

If the transactions are recorded as per the historical cost measurement, then the assets are recorded at _________.

(a) The value at which they are acquired

(b) The amount required to purchase the asset

(c) The amount that would be realised by selling the asset

(d) None of the above

Answer:

(a) The value at which they are acquired

Question 85.

As per the realisation value measurement base, the liabilities are valued _________.

(a) At the value of amount received in exchange of obligation

(b) At the present value

(c) The amount required to settle the liability

(d) None of the above

Answer:

(c) The amount required to settle the liability

Question 86.

As per the current cost measurement, the liabilities are valued at _________.

(a) Discounted value of cash required to settle the obligation currently ,

(b) Undiscounted value of cash required to settle the obligation currently

(c) At the amount received to settle the obligation –

(d) None of the above

Answer:

(b) Undiscounted value of cash required to settle the obligation currently

Question 87.

As per the present value measurement base, the liabilities are valued at _________.

(a) Sum of present discounted value of future cash outflows

(b) Value of future net cash outflows

(c) At the present settlement value

(d) None of the above

Answer:

(a) Sum of present discounted value of future cash outflows

Question 88.

As per the present value measurement base, the assets are recorded or valued at _________.

(a) Sum of present discounted net cash inflows

(b) Present value of the asset

(c) Cost of acquisition of the asset

(d) All of the above

Answer:

(a) Sum of present discounted net cash inflows

Question 89.

Adjustments of outstanding expenses, accrued income, unexpired income etc. is done to ensure compliance with:

(a) Realisation concept

(b) Cost concept

(c) Revenue match concept

(d) None of the above

Answer:

(c) Revenue match concept

Question 90.

If the proprietor of a business takes goods for his personal use, then which of the following will not be affected:

(a) Assets

(b) Liabilities

(c) Capital

(d) None of the above

Answer:

(b) Liabilities

Question 91.

Which of the following is not a form of personal account?

(a) Natural Personal Account

(b) Artificial Personal Account

(c) Representative Personal Account

(d) Nominal Personal Account

Answer:

(d) Nominal Personal Account

Question 92.

As per the conservatism principle _________.

(a) The accountant should not anticipate income but provide for all losses

(b) The accountant should use a valuation method which leads to taking less value of an asset

(c) Both (a) and (b)

(d) Neither (a) noi (b)

Answer:

(c) Both (a) and (b)

Question 93.

Goodwill, trade marks, patent, rights are examples of:

(a) Personal Account

(b) Real Account

(c) Nominal Account

(d) None of the above

Answer:

(b) Real Account

Question 94.

Profit & Loss Account is prepared because of:

(a) Cost concept

(b) Going concern concept

(c) Dual aspect concept

(d) Accounting period concept

Answer:

(d) Accounting period concept

Question 95.

The assets are recorded as per their book value to ensure compliance with:

(a) Historical cost

(b) Current cost

(c) Present value

(d) None of the above

Answer:

(a) Historical cost

Question 96.

In order to determine whether a transaction or item is material or not, the accountant should consider:

(a) The nature of transaction

(b) The amount of transaction

(c) Both (a) and (b)

(d) Neither (a) nor (b)

Answer:

(c) Both (a) and (b)

Question 97.

Inclusion of personal expenses of using car in the business expenses would violate the concept of:

(a) Separate business entity

(b) Consistency

(c) Going concern

(d) Dual aspect

Answer:

(a) Separate business entity

In accounting for every type of business organization, be it sale trader ship or partnership or joint stock company, business is treated as a separate accounting entity.

Thus, inclusion of personal expenses of using car in the business expenses would violate the concept of Separate Business Entity.

Question 98.

“Assets should be valued at the price paid to acquire them” is based on _________.

(a) Accrual concept

(b) Cost concept

(c) Money Measurement concept

(d) Matching concept

Answer:

(b) Cost concept

According to cost concept: The various assets acquired by a concern or firm should be recorded on the basis of the actual amounts or the price paid to acquire them.

Question 99.

A businessman purchases goods worth ₹ 25,00,000 and sold 80% of such goods during the accounting year ending on 31st March, 2011. The market value of the remaining goods was ₹ 7,50,000. He valued the closing stock @ ₹ 5,00,000 and not at ₹ 7,50,000 due to _________.

(a) Money Measurement concept

(b) Convention of conservatism

(c) Cost concept

(d) Accounting period concept

Answer:

(b) Convention of conservatism

Purchase ₹ 25,00,000; 80% of the goods have been sold. So, cost of goods sold is ₹ 20,00,000 stock remains at cost of ₹ 5,00,000. Since, market value of the stock left is ₹ 7,50,000 which is higher than the cost of stock. So, stock is valued at ₹ 5,00,000.

This is due to conservatism concept as this concept says that accountant should not anticipate income and should provide for all possible losses. The rule of ‘Lower of cost or market value’ for inventory valuation is due to conservatism (Prudence) concept.

Question 100.

Revenue from sale of products is generally accounted in the period in which:

(a) Cash is collected

(b) Sales is made

(c) Products are manufactured

(d) None of the above.

Answer:

(b) Sales is made

According to accrual concept, if any transaction are not settled in cash then it is proper to record the transaction or the event concerned into the books. So, due to Accrual Concept Revenue from the sale of products is recorded in the period in which Sales is made.

Question 101.

Which of the following is not the purpose of accounting?

(a) Providing information about the assets, liabilities and capital of business entity

(b) Maintaining record of business

(c) Providing information about the performance of business

(d) Providing details about the personal assets and liabilities of the owners of business entity.

Answer:

(d) Providing details about the personal assets and liabilities of the owners of business entity.

The purpose of accounting are as follows :

- Maintaining systematic records of business.

- Providing all information about assets, liabilities etc.

- Meeting legal requirements.

- Providing and communicating financial result or performance.

- Facilitating rational decision making.

On considering the purpose of accounting, it is found that ‘Providing details about the personal assets and liabilities of the owner of business entity’ is not purpose of accounting.

Question 102.

Which accounting concept is applicable to record a transaction entered between owner and business?

(a) Productivity

(b) Going concern

(c) Prudence

(d) Business entity

Answer:

(d) Business entity

Business entity concept is applicable to record a transaction entered between owner and business. As according to this concept business is treated as a separate entity from its owner, creditors, managers and others. In accounting, for every type of business organization, be it sole tradership or partnership or joint stock company, business is treated as a separate accounting entity.

Question 103.

Ashok a cloth merchant buys cloth for ₹ 50,000 paying cash ₹ 20,000. What is the amount of expense as per accrual concept?

(a) 50,000

(b) 20,000

(c) 30,000

(d) Nil

Answer:

(a) 50,000

According to accrual concept, all business transaction are recorded when they occur and not when the related payment are received or made. So, here amount of expenses is ₹ 50,000 and not ₹ 20,000.

Question 104.

Which of the following is an accepted method of accounting?

(a) Cash Accounting

(b) Accrual or Mercantile Accounting

(c) Both Accrual Accounting and Cash Accounting

(d) None of the above

Answer:

(b) Accrual or Mercantile Accounting

In cash accounting system, accounting entries are made only when cash is received or paid and no entry is made when a payment or receipt is merely due but in accrual or mercantile accounting system, all transactions are recorded on the basis of amounts having become due for payment or receipt. Since, cash basis accounting ignore accrual concept and revenue match concept.

So, Accrual or Mercantile Accounting system is more acceptable method of accounting. ,

Question 105.

Accounting transactions are recorded in terms of:

(a) Money

(b) Purpose

(c) Characteristics

(d) None of the above

Answer:

(a) Money

According to money measurement concept of accounting, only such transactions and events which can be interpreted in terms of money are recorded. Those transactions which cannot be expressed in money terms do not find place in the books of account though they may be very important for the business.

So, Accounting transactions are recorded in terms of Money.

Question 106.

A businessman purchased goods for ₹ 25,00,000 and sold 70% of such goods during the accounting year ended on 31st March, 2013. The market value of the remaining goods was ₹ 5,00,000. He valued the closing stock at ₹ 5,00,000 and not at ₹ 7,50,000 due to:

(a) Money measurement concept

(b) Conservatism concept

(c) Cost concept

(d) Periodicity concept.

Answer:

(b) Conservatism concept

Purchases ₹ 25,00,000

70% of the goods have been sold

∴ cost of goods sold is ₹ 17,50,000

Stock remaining at cost ₹ 7,50,000

Since, market value of the stock left is ₹ 5,00,000

which is lower than the cost the stock is valued at ₹ 5,00,000.

This is due to conservatism concept as this concept says that accountant should not anticipate income and should provide for all possible losses. The value of “lower of cost or market value” for inventory valuation is due to conservatism (Prudence) concept.

Question 107.

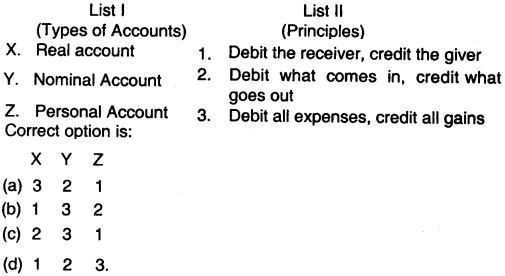

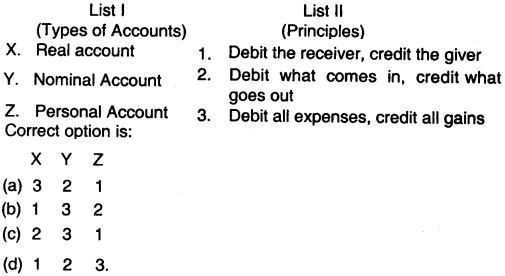

Match List I with List II and select the correct answer using the codes given below the lists.

Answer:

(c) The rules are as follows:

- Real Account : Debit what comes in and credit what goes out

- Nominal Account : Debit all Expenses and losses credit all income & gains

- Personal Account : Debit the receiver credit the giver

Therefore the correct matching is x : 2; y : 3 and z : 1

Question 108.

If capital at the end of the year is ₹ 7,000, capital introduced during the year is ₹ 5,000, drawings during the year are ₹ 8,000, loss incurred during the year is ₹ 10,000, then capital in the beginning would be equal to:

(a) ₹ 12,000

(b) ₹ 16,000

(c) ₹ 20,000

(d) ₹ 30,000.

Answer:

(c) ₹ 20,000

| Capital at end of year |

₹ 7,000 |

| Less: Capital introduced during the year |

5, 000 |

| Add: Drawings made during the year |

8, 000 |

| Add: Loss incurred during the year |

10, 000 |

| Capital at beginning of the year |

20, 000 |

Question 109.

Which one of the following statements is correct?

(a) Capital of the firm is reduced by borrowing

(b) When there is no change in proprietor’s capital, it is an indication of loss in business

(c) Nominal accounts refer to false transactions

(d) Real accounts relate to the assets of a business.

Answer:

(d) Real accounts relate to the assets of a business.

The correct statement is Real accounts relate to the assets of a business both tangible and intangible.

Example : plant & machinery, furniture, goodwill, copyrights, etc.

Question 110.

A concern proposes to discontinue its business from March 2013 and decides to dispose of all its assets within a period of 4 months. The Balance Sheet as on 31st March, 2013 should indicate the assets at their:

(a) Historical cost

(b) Net realisable value

(c) Cost less depreciation

(d) Cost price or market value whichever’is lower

Answer:

(b) Net realisable value

When a concern proposes to discontinue its business operations then balance sheet should indicate assets at their Net Realizable value rather than the Historical Cost.

This is so because the going concern of the organisation is lost.

Question 111.

The convention of conservatism is likely to lead to an in the balance sheet.

(a) Understatement of liabilities

(b) Overstatement of assets

(c) Overstatement of capital

(d) Understatement of assets.

Answer:

(d) Understatement of assets.

The convention of conservatism is likely to lead to an understatement of assets in the Balance Sheet. The concept of conservatism states that an accountant should not anticipate income and should provide for all possible losses. This will lead to understatement of income, wealth and assets.

Question 112.

The rule every transaction affects two or more ledger accounts is based on the concept of _________.

(a) Going concern

(b) Double entry system of book-keeping

(c) Money measurement

(d) Periodicity.

Answer:

(b) Double entry system of book-keeping

Double entry system is based on scientific principles therefore, it is used by most of the business houses. This system recognises the fact that every transaction has two aspects and records both aspects of each and every transaction. Thus, we can say that the rule ‘every transaction affects two or more ledger accounts’ is based on the concept of double entry system of book-keeping.

Question 113.

Which of the following is correct about ‘Accounting Concept’ _________.

(a) Accounting concepts are based on accounting conventions

(b) Accounting concepts are established by common accounting practices

(c) Accounting concepts are methods or procedures accepted by general agreement

(d) Personal judgement has no role in the adoption of accounting concepts.

Answer:

(d) Personal judgement has no role in the adoption of accounting concepts.

Accounting concepts are defined as basic assumptions on the basis of which financial statements of a business entity are prepared. Accounting concepts are used as a foundation for formulating various methods and procedures for recording and presenting the business transactions. In brief we can say that personal judgement has no role in the adoption of accounting concepts.

Question 114.

Which of the following accounting equation is correct:

(a) Capital (₹ 15,000) = Fixed Assets (₹ 12,000) +Cash (₹ 4,000)

(b) Trade payables (₹ 3,000) + Capital (₹ 17,000) + Bills Payable (₹ 4,000) = Fixed Assets (₹ 20,000)

(c) Capital (₹ 15,000) = Cash (₹ 3,000) + Fixed Assets (₹ 9,000)

(d) Trade payables (₹ 8,000) + Capital (₹ 7,000) = Fixed Assets (₹ 8,000) + Cash at Bank (₹ 4,000) + Cash (₹ 3,000).

Answer:

(d) According to accounting equation:

Capital + Trade Liabilities = Assets (or)

Capital + Trade Liabilities = Fixed Assets + Current Assets There, we find that option (D) is right answer because in this equation

Capital (7,000) + Trade Payable (8,000) = ₹ 15,000 is equal to Fixed Assets (8,000) + Cash at Bank (4,000) + Cash (3,000) = ₹ 15,000.

Question 115.

General reserve is created on the basis of convention of:

(a) Conservatism

(b) Uniformity

(c) Materiality

(d) Full disclosure.

Answer:

(a) Conservatism

According to conservatism convention, accountant should not anticipate income and should provide for all possible losses.

Examples:

- Making provisions for Bad Debts

- Making General Reserve

- Valuing the stock at lower of cost or market value

Question 116.

Revaluation account is a:

(a) Nominal account

(b) Real account

(c) Personal account

(d) None of the above.

Answer:

(a) Nominal account

Since Revaluation A/c shows the profit or loss on revaluation, so it is a Nominal Account.

Question 117.

Atul purchased a car for ₹ 5,00,000, by making a down payment of ₹ 1,00,000 and signing a ₹ 4,00,000 bill payable due in 60 days. As a result of this transaction:

(a) Total assets increased by ₹ 5,00,000

(b) Total liabilities increased by ₹ 4,00,000

(c) Total assets increased by ₹ 4,00,000

(d) Total assets increased by ₹ 4,00,000 with a corresponding

Answer:

(d) Total assets increased by ₹ 4,00,000 with a corresponding

On purchase of a Car, total assets of balance sheet will be increased by ₹ 5,00,000 and on making of down payment of ₹ 1,00,000 total assets will decrease by ₹ 1,00,000. The result will be that total assets of B/S will increase by ₹ 4,00,000.

On other hand on signing a B/P of ₹ 4,00,000 liability side of Balance Sheet will be increased by ₹ 4,00,000.

Thus, option (d) is right.

Question 118.

Number of accounting standards presently issued by ICAI and notified by CG _________.

(a) 29

(b) 32

(c) 31

(d) 19

Answer:

(a) 29

Presently these are 32 accounting standards issued by ‘ICAI’ out of which 29 are notified by Central Government.

Question 119.

_________ is an art of recording, classifyIng, summarising transactions and events which are of financial character ¡n terms of money and interpreting the result thereof:

(a) Accountancy

(b) Accounting

(c) Book-Keeping

(d) None of these.

Answer:

(b) Accounting

“Accounting is an art of recording, classifying, summarising transactions and events which are of financial character in terms of money and interpreting the result there of.”

Question 120.

Contingent liability is shown as _________.

(a) Liability

(b) Equity Shareholders fund

(c) Footnote

(d) None of these

Answer:

(c) Footnote

As per Schedule 111 of Companies Act 2013, Contingent liabilities are shown as footnote in the Balance Sheet.

Question 121.

Closing entry means:

(a) All income & expenses

(b) All assets & liabilities

(c) All assets

(d) All liabilities.

Answer:

(b) All assets & liabilities

Closing entry means all assets and liabilities are revalued and closed.

Question 122.

In which of the book cash purchase is recorded?

(a) Cash book

(b) Purchase book

(c) Both (a) and (b)

(d) None of these.

Answer:

(a) Cash book

Cash book is a book of prime entry which records cash and bank transactions includes only cash purchases made.

Question 123.

In case of three column cash book, contra entry is related with:

(a) Cash; Discount

(b) Cash; Bank

(c) Bank; Discount

(d) None of these.

Answer:

(b) Cash; Bank

The entry which involves both cash and bank transactions is called contra entry. These entries are posted on both the sides of cash book one in bank column and the other in cash column.

Question 124.

Which of the following is not considered as an accounting concept?

(a) Conservation

(b) Business Entity

(c) Accrual

(d) Going Concern.

Answer:

(a) Conservation

Accounting concepts are defined as basic assumptions on the basis of which financial statements of a business entity are prepared. Since, conservatism is an accounting convention & not a concept, option (a) is correct.

Question 125.

Which convention implies that the accounting practices should remain same from one year to another year.

(a) Going Concern

(b) Materiality

(c) Accrual

(d) Consistency.

Answer:

(d) According to consistency concept, it is assumed that the accounting practices will be followed continuously over a period of time until & unless there is required a need for change.

Hence, option (d) is correct.

Question 126.

______ and ______ are independent variables.

(a) Asset and Liability

(b) Income and Expenses

(c) Both (a) and (b)

(d) None of these.

(d) None of these.

Answer:

(a) Asset and Liability

Independent variables are those variables which has no effect on each other.

The asset & liability are dependent variables while the income & expenses are independent variables.

Hence, option (a) is correct.

Question 127.

Accounting Transactions are recorded in terms of:

(a) Money

(b) Purpose

(c) Characteristics

(d) None of these.

Answer:

(a) Money

According to money measurement concept, each & every accounting transaction is to be recorded in books of accounts in terms of money.

Hence, option (a) is correct.

Question 128.

Double Entry principle means:

(a) Writing all entries twice in the book

(b) Having debit for every credit and similarly, credit for every debit

(c) Maintaining the double account for each business transactions.

(d) Writing two times the same entry.

Answer:

(b) Having debit for every credit and similarly, credit for every debit

Double entry is a principle in which there is a debit for every credit & similarly a credit for every debit.

Hence, option (b) is correct.

Question 129.

Which one of the following statements is Correct?

(a) Capital of the firm is reduced by borrowing

(b) Nominal accounts refer to false transactions

(c) When there is no change in proprietors capital. it is an indication of loss in business

(d) Real accounts relate to the assets of a business.

Answer:

(d) Real accounts relate to the assets of a business.

Capital of the firm is not reduced by borrowing because both are the different heads of the liabilities side of the balance sheet. Nominal accounts relates with the expenses and incomes, not with false transactions. When there is no change, in proprietor’s capital, it does not mean that it shows a loss, it may be a profit situation in the business.

Thus, option (d) is the correct answer that real account relate to the assets & liabilities of a business.

Question 130.

Which of the following statement is correct?

(a) Assets are equal to liabilities minus capital

(b) Capital is equal to assets minus liabilities

(c) Liabilities are equal to capital plus assets

(d) Capital is equal to assets plus liabilities

Answer:

(b) Capital is equal to assets minus liabilities

According to Accounting Equation.

Capital = Assets – Liabilities.

So, option (b) is correct answer, i.e. Capital is equal to assets minus liabilities.

Question 131.

The convention of conservatism is likely to lead to an __________ in the balance sheet.

(a) Understatement of assets

(b) Overstatement of assets

(c) Overstatement of capital

(d) Understatement of liabilities

Answer:

(a) Understatement of assets