This Annuity – CA Foundation Maths Study Material is designed strictly as per the latest syllabus and exam pattern.

Annuity – CA Foundation Maths Study Material

Definition:

A sequence of payments, generally equal in size, made at equal intervals of times is called an annuity.

Monthly Rent; premiums of LIC; deposit into a recurring account in a bank; equal monthly payments got by a retired government servant as pension and loan instalments to houses or automobiles etc.

Some terms related with annuities

- Periodic Payment: The size of each payment of an annuity is called the periodic payment of the annuity.

- Annual Rent: The sum of all payments of an annuity made in one year is called its annual rent.

- Payment Period/Interval: The duration between two successive payments of an annuity is called the payment period (or payment interval) of the annuity

- Term: The total duration from the beginning time of the first payment period to the end of the last payment period is called the term of the annuity.

- Amount of an Annuity: The total Value of all the payments at the maturity time of an annuity is called the amount (or future value) of the annuity.

- Present Value of an Annuity: Sum of the present values of all the payments of an annuity is called the present value or capital value of the annuity.

Types of Annuities

- Ordinary Annuity: If the payments of an annuity are made at the end of payment interval is called An Ordinary annuity or Regular annuity.

- Annuity Due: If the payments of an annuity are made at the beginning of payment interval is called An Annuity Due or Annuity Immediate.

- Perpetuity: A perpetuity is an annuity whose payments continue forever.

Note. In what is to follow, it is understood that the payment interval coincides with the interest period unless statement to the contrary is made.

![]()

Ordinary Annuity Or Annuity Regular

Definition: Payments of an annuity are made at the end of payment interval.

Type I

(TO Find Amount)

S = A\(\left[\frac{(1+i)^n-1}{r}\right]\) × 100 m

Where S = Amount of an Annuity

A = Value of each instalment

r = rate of interest

m = No. of conversion periods in a year

n = m.t = No. of instalments made in t yrs.

i = \(\frac{r}{100 m}\) = Rate of interest of one conversion Period

Calculator Trick

Step -1 Find (1 + i)n by calculator i.e. Type r ÷ 100 m + 1 Then push × button then push = button (n – 1) times.

Step-II Then – 1

Step – III ÷ r × 100m

Step – IV Then × A push = button (We get the required value of Amount)

Ex-1.

Find the future value of an annuity of ₹ 500 is made annually for 7 years at interest rate of 14% compounded annually. [Given that (1.14)7 = 2.5023]

(a) ₹ 5365.25

(b) ₹ 5265.25

(c) ₹ 5465.25

(d) none

Answer:

option (a) is correct

Calculator Trick

S = \(\left[\frac{(1+i)^n-1}{r}\right]\) × 100 m = ₹ 5365.25

= 500\(\left[\frac{\left(1+\frac{14}{100}\right)^7-1}{14}\right]\) × 100 = ₹ 5365.25

Step I Find \(\left[\frac{(1+i)^n-1}{r}\right]\) As Type 14 ÷ 100 + 1 × Push = button 6 times.

Step – II Type – 1 ÷ 14 then × 100 (Because it is annually)

Step – III Then × 500 = (we get the result)

Ex-2.

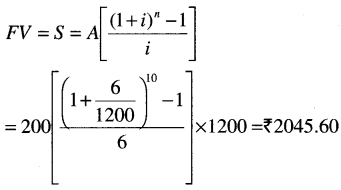

₹ 200 is invested at the end of each month in an account paying interest 6% per year compounded monthly. What is the future value of this annuity after 10th payment? Given that (1,005)10=1.0511

(a) ₹ 2544

(b) ₹ 2144

(c) ₹ 2544

(d) None

Answer:

(a) is correct.

Here A = 200 ; r = 6% compounded monthly

n = 10 = No. of payments.

Calculator Trick

Step-1 Type 6 ÷ 1200 + 1 Then push × button then push = button 9 times.

Step-II Type – 1 Then ÷ 6 × 1200

Step-III Then Type × 200 = buttons we get the required amount.

Note: If (1 + i)n value is given in the question then use given value in the question otherwise answer may vary.

Type – II

To find the Value of EACH INSTALMENT

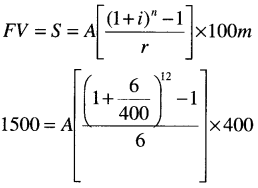

Ex: If a bank pays 6% interest compounded quarterly what equal deposit have to be made at the end of the each quarter for 3 years if you want to have ₹ 1500 at the end of 3 years?

(a) ₹ 117.86

(b) ₹ 115.01

(c) ₹ 150.50

(d) None of these

Answer:

(b) is correct

A = ₹ 150.01

Calculator Trick

Step-I Type 6 ÷ 400 + 1 Then push × button then push = buttons 11 times

Step-II Then push – 1 ÷ 6 × 400 buttons

Step-III Then push M + button to save the typed value.

Step-IV Then type 1500 then ÷ button then push “MRC” button 2 times then push = button.

[we get the required result]

Type-III

(To find Present Value for Ordinary Annuity)

PV = Present value = A\(\left[\frac{1-(1+i)^{-n}}{i}\right]\)

Calculator Trick

Step-I Type (1 + i) value then push= button

Step-II Then push = buttons “n” times

Step-III Push GT button

Step-IV Then type × A (value) then push = button

we get the required result.

Ex- Find the present value of an annuity which pays 200 at the end of each 3 months for 10 years assuming money to be worth 5% converted quarterly?

(a) ₹ 3473.86

(b) ₹ 3108.60

(c) ₹ 6265.38

(d) None of these

Answer:

option (c) is correct

Here A = 200 ; m = 4 ; r = 5% 1/4 yrly.

t = 10 years ⇒ n = mt = 4 × 10 = 40 year PV=?

Calculator Trick

Step-I Type 5 + 400 + 1 then push + button

Step-II Then push = buttons 40 times

Step-III Then Push GT button

Step-IV Then typex 200 = buttons [We get the resulting value]

Type-IV

(To find instalment value if PV is given).

Ex- Mr. A borrows 5,00,000 to buy a house.

If he pays equal instalments for 20 years and 10% interest on outstanding balance what will be the equal annual instalment?

(a) ₹ 58239.84

(b) ₹ 58729.84

(c) ₹ 68729.84

(d) None of these

Answer:

(b) is correct

Here PV = ₹ 5,00,000 ; r = 10% yrly.

t = 20 years

n = 20; A = ?

5,00,000 = A\(\left[\frac{1-\left(1+\frac{10}{100}\right)^{-20}}{0.10}\right]\) = 58729.84

Calculator Trick

Step-I Type 10+ 100 + 1 then push + button

Step-II Push = buttons 20 times

Step-III Then Push GT button

Step-IV Then M+ buttons to save the result.

Step-V Type 5,00,000 then push + button then MRC button 2 time and then = button.

(We get the required result)

![]()

Annuity immediate/Due

Definition: An annuity due is an annuity the first payment of which is made at the beginning of the first payment interval

Type – V

(T0 find Amount)

FV = Amount S = A[\(\left\{\frac{(1+i)^{n+1}-1}{r}\right\}\) × 100m – 1]

Calculator Trick (work as ordinary annuity)

Step-I Type r ÷ 100 m + 1 then pushx button

Step-II Push = buttons n + 1 – 1 = n times then push -1 button then push button then push r value then push × 100m value buttons.

Step-III Push -1 button then × button and then type A value & then push = button (we get the required result)

Previous Year Exam Questions

Question 1.

Mr. X Invests ₹ 10,000 every year starting from today for next 10 years suppose: interest rate is 8% per annum compounded annually. Calculate future value of the annuity: (Given that (1 + 0.08)10 = 2.15892500] [1 Mark, Nov. 2006]

(a) ₹ 156454.88

(b) ₹ 144865.625

(c) ₹ 156554.88

(d) None of these

Answer:

(a) It is Annuity Due Question

A = FV = R[\(\left\{\frac{(1+i)^{n+1}-1}{r}\right\}\) × 100m – 1]

= 10,000[\(\frac{(1+0.08)^{10+1}-1}{8}\) × 100 – 1]

= ₹ 1,56,454.88. [ See Type-V ]

(a) is correct

Question 2.

The present value of an annuity of ₹ 3,000 for 15 years at 4.5% p.a. C.I. is: [Given that (1.045)15 = 1.935282]. [1 Mark, Nov. 2006]

(a) ₹ 23,809.67

(b) ₹ 32,218.67

(c) ₹ 32,908.67

(d) None of these

Answer:

PV = R\(\left[\frac{1-(1+1)^{-n}}{i}\right]\)

= 3000\(\left[\frac{1-(1.045)^{-15}}{0.045}\right]\)

Tricks = ₹ 32,218.67

[See Calculator Tricks in Type III]

Question 3.

A machine can be purchased for ₹ 50,000. Machine will contribute ₹ 12,000 per year for the next five years. Assume borrowing cost is 10% per annum. Determine whether machine should be purchased or not: [1 Mark, Feb. 2007]

(a) Should be purchased

(b) Should not be purchased

(c) Can’t say about purchase

(d) None of the above

Answer:

(b) PV = R\(\left[\frac{1-(1+i)^{-n}}{i}\right]\)

PV = 12000\(\left[\frac{1-(1.10)^{-5}}{0.10}\right]\)

= ₹ 45,489.44

But it costs ₹ 50, 000

It should not be purchased

(b) is correct

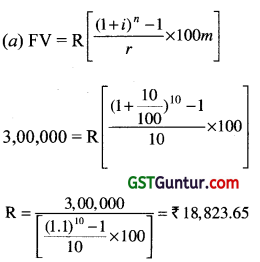

Question 4.

How much amount is required to be invested every year so as to accumulate ₹ 3,00,000 at the end of 10 years, if interest is compounded annually at 10 % ? [Give (1.1)10 = 2.5937] [1 Mark, Feb. 2007]

(a) ₹ 18,823.65

(b) ₹ 18,828.65

(c) ₹ 18,832.65

(d) ₹ 18,882.65

Answer:

(a) is correct

![]()

Question 5.

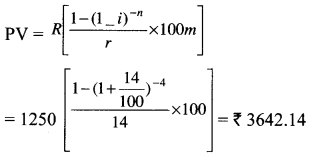

A company is considering proposal of purchasing a machine either by making full payment of ₹ 4,000 or by leasing it for four years at an annual rate of ₹ 1,250. Which course of action is preferable, if the company can borrow money at 14% compounded annually ? [Given: (1.14) = 1.68896] [1 Mark, May 2007]

(a) Leasing is preferable

(b) Should be purchased

(c) No difference

(d) None of these

Answer:

(a) ₹ 4000 = Present value

It is less than real cost price.

Leasing is better

(a) is correct

Tricks : See Quicker BMLRS for CA-Foundation.

Question 6.

Vipul purchases a car for ₹ 5,50,000. He gets a loan of ₹ 5,00,000 at 15% p.a. from a Bank and balance ₹ 50,000 he pays at the time of purchase. He has to pay the whole amount of loan in 12 equal monthly instalments with interest starting from the end of the first month. The money he has to pay at the end of every month is : [Given (1.0125)12 = 1.16075452] [1 Mark, May 2007]

(a) ₹ 45,130.43

(b) ₹ 45,230.43

(c) ₹ 45,330.43

(d) None of these

Answer:

Loan Value = ₹ 5,00,000 = PV

R = Instalment value = ?

PV = R\(\left[\frac{1-(1+i)^{-n}}{i}\right]\)

5,00,000 = R\(\left[\frac{1-\left(1+\frac{15}{1200}\right)^{-12}}{i}\right]\)

R = 45,130.43.

Tricks : [See Page 9.3 Type IV]

Question 7.

A company establishes a sinking fund to provide for the payment of ₹ 2,00,000 debt maturing in 20 years. Contributions to the fund are to be made at the end of every year. Find the amount of each annual deposit if interest is 5% per annum : [1 Mark, Aug. 2007]

(a) ₹ 6,142

(b) ₹ 6,049

(c) ₹ 6,052

(d) 6,159

Answer:

A = ₹ 200,000

200,000 = R\(\left[\frac{(1+5 / 100)^{20}-1}{5} \times 100\right]\)

or R = \(\frac{2,00,000 \times 5}{\left.\left[(1.05)^{20}-1\right)\right] \times 100}\)

= ₹ 6049 (Approx)

Tricks : [See Page 9.5 Type IX]

Question 8.

Raja aged 40 wishes his wife Rani to have ₹ 40 lakhs at his death. If his expectation of life is another 30 years and he starts making equal annual investments commencing now at 3% compound interest p.a. How much should he invest annually? [1 Mark, Nov. 2007]

(a) ₹ 84,077

(b) ₹ 81,628

(c) ₹ 84,449

(d) ₹ 84,

Answer:

(b) is correct.

Calculator Tricks : [See Type IX]

Question 9.

A company may obtain a machine either by leasing it for 5 years (useful life) at an annual rent of ₹ 2,000 or by purchasing the machine for ₹ 8,100. If the company can borrow money at 18% per annum, which alternative is preferable? [1 Mark, Feb. 2008]

(a) Leasing

(b) Purchasing

(c) Can’t say

(d) None of these

Answer:

(a) PV = ₹ 8100 It is an ordinary Annuity

PV = 2000\(\left[\frac{1-\left(1+\frac{8}{100}\right)^{-5}}{18} \times 100\right]\)

= ₹ 6254.34

It is less than ₹ 8100.

(a) is correct

Question 10.

A sinking fund is created for redeeming debentures worth ₹ 5 lacs at the end of 25 years. How much provision needs to be made out of profits each year provided sinking fund investments can earn interest at 4% p.a.?

Answer:

(a) is correct

Tricks: ₹ 5,00,000 = R\(\left[\frac{(1.04)^{25}-1}{0.04}\right]\)

∴ R= 12006.00 approx

Question 11.

Future value of an ordinary annuity : [1 Mark, Dec. 2008]

Answer:

(a) is correct.

It is Formulae.

Question 12.

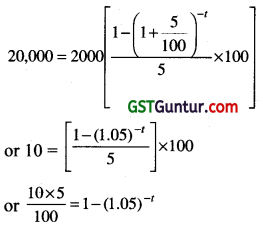

Paul borrowers ₹ 20,000 on condition to repay it with compound interest at 5% p.a. in annual instalment of ₹ 2,000 each. Find the number of years in which the debt would be paid off. [1 Mark, June 2009]

(a) 10 years

(b) 12 years

(c) 14 years

(d) 15years

Answer:

(d) is correct

or 0.5 – 1 = (1.05)-t

or 0.5 – 1 = -(1.05)-t

or (1.05)t = \(\frac{1}{0.5}\) = 2

or t = \(\frac{\log 2}{\log (1.05)}\) = 15 yrs. approx

Tricks : Go by choices

![]()

Question 13.

Find the present value of an annuity of ₹ 1,000 payable at the end of each year for 10 years. If rate of interest is 6% compounding per annum. (given (1.06)-10 = 0.5584): [1 Mark, June 2010]

(a) ₹ 7,360

(b) ₹ 8,360

(c) ₹ 12,000

(d) None of these.

Answer:

(a) is correct

PV = 1000\(\left[\frac{1-(1.06)^{-10}}{0.06}\right]\)

= ₹ 7360 (a) is correct.

Question 14.

The future value of an annuity of ₹ 5,000 is made annually for 8 years at interest rate of 9% compounded annually

[Given that (1.09)8 =1.99256 ________. [1 Mark, Dec. 2010]

(a) ₹ 55,142.22

(b) ₹ 65,142.22

(c) ₹ 65,532.22

(d) ₹ 57,425.22

Answer:

(a) is correct

FV = 5000\(\left[\frac{(1.09)^8-1}{0.09}\right]\) = 55,142.22

(a) is correct

Question 15.

How much amount is required to be invested every year as to accumulate ₹ 6,00,000 at the end of 10th year, if interest is compounded annually at 10% rate of interest? [1 Mark, June 2014]

(a) ₹ 37,467

(b) ₹ 37,476

(c) ₹ 37,647

(d) ₹ 37,674

Answer:

(c) is correct

Let amount invested annually = R

R = \(\frac{6,00,000}{\left[\frac{\left(1+\frac{1}{100}\right)^{10}-1}{10} \times 100\right]}\)

= ₹ 37,647 (approx)

Note : See Quicker BMLRS.

Question 16.

The future value of an annuity of ₹ 1,000 made annually for 5 years at the rate of interest 14% compound annually is: [1 Mark, Dec. 2014]

(a) ₹ 5610

(b) ₹ 6610

(c) ₹ 6160

(d) ₹ 5160

Answer:

(b) FV = 1000\(\left[\frac{\left(1+\frac{14}{100}\right)^5-1}{14} \times 100\right]\)

= ₹ 6610.104 = ₹ 6610

Note: See Annuity in Quicker BMLRS

Question 17.

Suppose your mom decides to gift you ₹ 10,000 every year starting from today for the next sixteen years. You deposit this amount in a bank as and when you receive and get 8.5% per annum interest rate compounded annually. What is the present value of this money: [Given that P (15, 0.085) = 8.304236] [1 Mark, Dec. 2015]

(a) 83,042

(b) 90,100

(c) 93,042

(d) 10,100

Answer:

(c) is correct

PV = 10,000[\(\frac{1-\left(1+\frac{8.5}{100}\right)^{(-16-1)}}{8.5}\) × 100 + 1]

= 10,000(8.304236 + 1)

= ₹ 93,042

Question 18.

The future value of an annuity of ₹ 1500 made annually for 5 years at an interest rate of 10% compounded annually is

[Given that (1.1 )5 = 1.61051] [1 Mark, 2017 June]

(a) 9517.56

(b) 9157.65

(c) 9715.56

(d) 9175.65

Answer:

FV = 1500[\(\frac{\left(1+\frac{10}{100}\right)^5-1}{10}\) × 100]

Use Calculator tricks [See Quicker BMLRS]

= ₹ 9157.65

Question 19.

What sum should be invested at the end of every year so as to accumulate an amount of ₹ 796870 at the end of 10 years at the rate of interest 10% compounded annually, [given that A(10 ; 0.1) = 15.9374]

(a) 40,000

(b) 4,50,000

(c) 4,80,000

(d) 50,000

Answer:

Calculator Tricks: See[Quicker BMLRS] chap. Annuity 796870

R = \(\frac{796870}{\left[\frac{\left(1+\frac{10}{100}\right)^{10}-1}{10} \times 100\right]}\)

= ₹ 50,000

option (d) is correct.

![]()

Question 20.

A person invests ₹ 2,000 at the end of each month @ of interest 6% compounding monthly, find the amount of annuity after the 10th payment is :

Answer:

(a)

FV = 2000[\(\frac{\left(1+\frac{6}{1200}\right)^{10}-1}{6}\) × 1200]

= ₹ 20,456

Calculator Tricks : See calculator tricks in Quicker BMLRS

Type 6 ÷ 1200 +1 then press x button then = button 9 times -1 + 6 x 1200 x 2000 = button ; we will get the required result.