Audit of Statement of P&L Account Items – CA Inter Audit Questions bank is designed strictly as per the latest syllabus and exam pattern.

Audit of Statement of P&L Account Items – CA Inter Audit Question Bank

Question 1.

How would you vouch/verify the following. Goods sent out on Sale or Return Basis. (Nov 2009, Nov 2016, 5, 4 marks)

Answer:

Goods Sent out on Sale or Return Basis can be verified as follows

| Documents to be vouched | Aspects to be verified |

| 1. Sale or Return Day Book | (i) Examine the sale or return day book for the manner of accounting. (ii) Check actual movement of goods from Despatch register/Goods outward register. (iii) Note the period of approval in the case of different goods/customers. (iv) Verity whether goods returned have been properly reversed In the day book. |

| 2. Order book or Confirmation Book | (i) Examine this register to verify sale confirmed by customers and goods held by customers at their end as sale or return stock. |

| 3. Sales Register | Ensure that sales have been recognised whenever: (i) approval is received from the party, (ii) goods are appropriated by the party. (iii) period of approval has expired and goods have not been returned. |

| 4. Stock Registers and Statements | (i) Ensure that closing stock Includes good lying with customers and period of approval has not expired. (ii) Ensure that goods validly returned by customers are duly accounted in stack. |

Question 2.

Write short note on Verification of credit salesa. (Nov 2010, 4 marks)

Answer:

Verification of the credit saIes : The credit sales should be verified by reference to copies of invoices issued to customers and, in the process.

The Auditor should consider the following points:

1. The credit sales should be verified by reference to copies of invoices issued to customers and in the process, attention should be paid to the following matters:

- that each item of sales relates to the period of account under audit.

- that the goods are those that are normally dealt in by the concern.

- that the sale price has been correctly arrived at and the copy of the requisition slip issued by the Sales Department and the copy of the Despatch Notes showing the date and mode of despatch of goods are attached with the invoice.

- that the amount of the Invoice has been adjusted in an appropriate account, and

- that the sale has been authorised by a responsible official and in token thereof he has initialed the invoice also that any alteration In the invoice has been attested by the same person.

2. If any additional charges are recovered along with the sale price, these should be credited to separate accounts, appropriately headed, and not to the sales account.

3. When a trade discount is allowed, the amount thereof should be deducted from the sale price. When any special trade discount has been allowed, the reason thereof should be ascertained.

4. Small concerns generally do not have well-organized sales and dispatch departments. In such cases, fo verifying sales the auditor should trace a small preparation of sales invoice into the stock book, especially of goods sold at the beginning and at the close of the year.

5. The sale of goods on hire-purchase basis or goods sent out on sale or return basis or on consignment basis should be separately recorded.

6. When credit sales are not adjusted in the account at the time they are made but at the time sale proceeds are collected, there can be no guarantee that any amount collected in such sales has not been misappropriated. The auditor should, therefore, draw the attention of the management to the risk involved in adopting such practice.

![]()

Question 3.

How will you vouch and verily the following? Profit or loss arising on sale of plots held by real estate dealer. (Nov 2013, 4 marks)

Answer

Profit or Loss arising on sale of plots – held by Real Estate Dealer.

| Document to be vouched | Aspects to b. verified |

| 1. Minutes book or Resolutions | Check requisite sanction for sale for assets, manner of sale, the party to whom it should be sold, consideration etc. |

| 2. Correspondence, agreements etc. | (i) As certain the sale proceeds through proper evidence, e.g. correspondence, agreement to sell etc. (ii) Confirm whether the proceeds are at reasonable market value. |

| 3. Receipt voucher and Bank Statement | (i) Check that the amount shown as received is the actual sales price of the asset less any expenditure incurred has been deducted. (ii) Trace the receipt of sale consideration Into the bank statements. |

| 4. General Ledger | Ensure credit to asset account and not to sales account. |

| 5. Journal Voucher | (i) Ensure capital-revenue distinction in case of profits arising from disposal. (ii) Enswe appropriate accounting treatment in case the asset had been revalued earlier using a revaluation reserve. |

Question 4.

Discuss the audit procedures generally required to be undertaken by the auditor while auditing Goods sent out on Sale or Return Basis. (Nov 2020, 3 Marks)

Question 5.

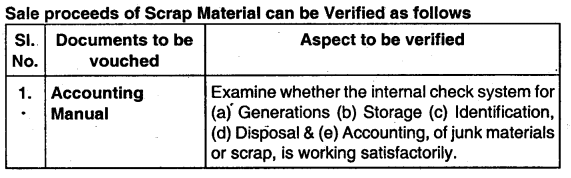

How would you vouch/verify the following? Sale of Scrap. (May 2008, 5 marks)

Answer:

Question 6.

How would you vouch/verify the following? Insurance Claim. (Nov 2008, May 2015, 5, 4 marks)

Answer:

Insurance Claim can be verified as follows

| Documents to be Vouched | Aspects to be verified |

| 1. Copy of Insurance Claim | Insurance claim may be in respect of fixed assets (PPE) or current assets. Examine a copy of the insurance claim lodged with the insurance company while vouching the receipts of insurance claim. |

| 2. Correspondence | Check the correspondence with the insurance company and the insurance agent. |

| 3. Counter foils of Receipts. | Check the counter toils of the receipts issued to the insurance company. |

| 4. Adjustment | The auditor should determine the adjustment of the amount received in excess or short of the value of the actual loss as per the insurance policy. |

| 5. Certificate/ port | Verity the copy of certificate/report containing full particulars of the amount of loss. |

| 6. Treatment | The accounting treatment of the amount received should be seen particularly to ensure that revenue is credited with the appropriate amount and that in respect of claim against an asset, the profit & loss a/c is debited with the shortfall of the claim admitted against the book value. |

| 7. Profit & Loss Account | When the claim was lodged in the previous year but no entries were passed, entries in the profit & loss account should be appropriately described. |

Question 7.

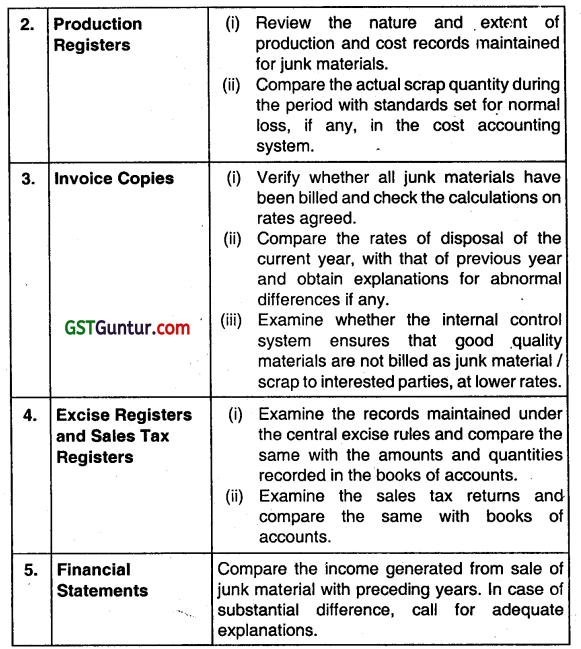

Write short note on Audit of sale of Investments. (Nov 2011, 4 Marks)

Answer:

Question 8.

How will you vouch/verify the following? Rental Receipts (May 2015, 4 marks)

Answer:

Rental Receipts can be verified as follows:

| Documents to be vouched | Aspects to be verified |

| 1. Statement of Rental Receipt | In case, where tenants or properties are numerous, the auditor should obtain statement of Rental Receipts, prepared tenant-wise or property-wise or combination of both. |

| 2. Carbon Copies of Rent Receipts | Trace the rent receipt amounts into the Collection Register, Cash Book and/or Bank statement based on the carbon copies of receipts issued. |

| 3. Agreement | Note the following aspects from the tenancy agreement- (i) Period of tenancy; (ii) Amount of rent payable; (iii) Details of amount payable e.g. maintenance charges etc. |

| 4. Account of Collecting Agent | The auditor should scrutinize the account of collecting agent where amount is collected by such agent. |

| 5. TDS Certificate | (i) The auditor should see whether TDS Certificates are property received and kept in sale custody. (ii) Verify whether any tax has been deducted to source u/s 194 – I from rental income. |

![]()

Question 9.

How will you vouch/verify the following:

Refund of General Insurance premium paid. (Nov 2015, 4 marks)

Answer:

| Documents to be vouched | Aspects to be verified |

| 1. Insurance File | 1. To ascertain the nature of General Insurance Premium refunded. 2. To verify the nature and reason for the refund, which may be either of the following: (i) Earlier provisional payment of premium, or (ii) Acceptance of policy at a part amount, or (iii) Cancellation of a policy at a later date. 3. To scrutinize correspondence between the Insurance Company and the client. |

| 2. Refund Advice | The auditor should examine the covering letter or refund advice sent by the Insurance Company, and ascertain the actual amount of refund. |

| 3. Receipt | The auditor should verify the nature of receipt sent. Sometimes the Insurance Company may issue the refund, only if a stamped receipt is sent in advance. |

| 4. Insurance Policy | The auditor should examine the Insurance Policy or Cover Note to find out the amount of premium. |

| 5. Bank Statement | The auditor should trace the receipt amount in the Pay-in-Slip Counter toils and Bank Statement |

| 6. Financial Statement | The auditor should ensure that the proper treatment in books of account are done or not. |

Question 10.

How will you vouch/verify the following:

Sale Proceeds of junk material (Nov 2015, 4 marks)

Answer:

Sale Proceeds of Junk Material:

The auditor should review the internal control on junk materials, as regards its generation, storage and disposal and see whether it was properly followed at every stage or not.

The auditor should ascertain whether the organization is maintaining reasonable records for the sate and disposal of junk materials.

The auditor should review the production and cost records for determination of the extent of junk materials that may arise in a given period.

The auditor should compare the income from the sale of junk materials with the corresponding figures of the preceding three years.

The auditor should check the rates at which different types of junk materials have been sold and compare the same with the rates that prevailed In the preceding year.

The auditor should see that junk materials sold have been billed and check the calculations on the Invoices.

The auditor should ensure that there exists a proper procedure to identify the scrap material and good quality material is not mixed up with it.

The auditor should make an overall assessment of the value of the realisation from the sale of scrap materials as to its reasonableness.

Question 11.

Write short note on “Recognition of interest on deposits”. (May 2016, 4 marks)

Answer:

Recognition of Interest on deposits:

- Deposits are the advances taken by the company on which they shall pay a certain amount of interest.

- The interest on deposits are the income for the company and shall be disclosed in P&L A/c.

- The interest income on deposits shall be recognized as and when the right to receive the income is established as per AS-9 Revenue Recognition.

- Interest on deposits shall be recognized in financial statements and the auditor shall check that the director’s or board’s report shall states that there is no default in payment of deposits.

- The auditor shall checks the documents related to deposits and checks its existence.

Question 12.

How will you vouch/verify the following? Royalties received (Nov 2016, 4 marks)

Answer:

Vouching/Veriflcation of Ro alties Received

| Documents to be vouched | Aspects to be verified |

| 1. Agreement deed or contract | The auditor should see the relevant agreement deed contract to study the terms of contract governing both the parties, particularly: (i) Rate of Royalty (ii) Mode of Calculation (iii) Due date |

| 2. Periodical Statement | The auditor should check the periodical statements from the payer (publisher or lessee) in order to verity royalty due. |

| 3. Acknowledgment Statement | The auditor should examine the acknowledgment issued. |

| 4. Cash Book | The auditor should verify the entry of royalty in cash book. |

| 5. Nominal Account | The auditor should ensure correctness of posting In nominal account. |

| 6. Records of Earlier Royalty Receipts | If there is any deduction on account of recoupment of royalty for the past period the records of earlier royalty receipt must be seen to ensure that amount of deduction is as per the contract. |

| 7. Adjustment Entry | The auditor should also verity the adjustment regarding royalty due but not received. |

Question 13.

(c) As statutory auditor of the company, list out audit procedures required to be undertaken for the following:

(i) Interest income from fixed deposits. (May 2018, 4 marks)

(ii) Dividend income. (May 2018, 2 marks)

(iii) Gain/(loss on sale of investment in Mutual funds. (May 2018, 2 marks)

Also indicate disclosure requirements of above as per Companies Act, 2013. (May 2018, 2 marks)

Answer:

(i) Interest Income from fixed deposits:

For verifying interest income on fixed deposits following audit procedures need to be followed:

Obtain a listing of fixed deposits opened during the period under audit along with the applicable interest rate and the number of days for which the deposit was outstanding during the period. Verily the arithmetical accuracy of the interest calculation made by the entity by multiplying the deposit amount with the applicable rate and number of days during the period under audit.

For deposits still outstanding as at the period-end, trace the same to the direct confirmation obtained from the respective bank financial institution.

Obtain a confirmation of interest income from the bank and verify that the interest income as per bank reconciles to the calculation shared by the entity. Also, obtain a copy of from 26 AS (TDS withholding by the bank/financial institution) and reconcile the interest reflected there into the calculation shared by client.

(ii) Dividend income:

For dividend Income following audit procedure need to be followed for dividends, verify that the same are recognised in the statement of profit and loss only when the entity’s right to receive payment of the dividend is established, provided It is probable that the economic benefits associated with the dividend will flow to the entity and the amount of the dividend can be measured reliably.

(iii) Gain/(loss) on sale of investment in Mutual Funds:

Verify that Gainf(loss) on sale of investment in mutual funds is recorded as other income only on transfer of title from the entity and is determined as the difference between the redemption price and carrying value of the investments. For the purpose, obtain the mutual fund statement and trace the gain loss as recorded In the books of account to the gain loss as reflected in the statement.

Disclosure Requirements:

Ensure whether the following disclosures as required under md AS compliant Schedule III to the Companies Act, 2013 have been made:

Whether ‘other Income’ has been classified as:

- Interest Income

- Dividend income

- Other non-operating income (net of expenses directly attributable to such income).

![]()

Question 14.

Examine with reasons whether the following statements are correct or incorrect.

Dividends are recognized n the statement of profit and loss only when the amount of dividend can be measured reliably. (Nov 2020, 2 marks)

Question 15.

ABC Limited appointed XYZ & Company, Chartered Accountants, as a Statutory Auditor of the Company for the year 2019-20. CA X, partner of XYZ & Company, was looking after the audit of other income of the company which consists of interest income on fixed deposits. As a Statutory Auditor how would CA X verify interest income on fixed deposits for the year 2019-20? (Nov 2020, 4 marks)

Question 16.

As a Statutory Auditor of the company list out audit procedure required to be undertaken for the recognition of following other income:

i. Interest income from fixed deposit

ii. Dividend income

iii. Gain/(loss) on sale of investment in mutual funds. (Jan 2021, 3 marks)

Question 17.

How would you vouchIverify the following? Customs Duty (Nov 2008, 5 marks)

Answer:

Customs Duty: Custon,s duty is paid through clearing agent. Their bills and receipted bills of entry are available for vouching. If accounts are voluminous then current a/c is maintained with custom authorities. From time to time a lump sum money is advanced against which custom duty is met. For this.

statement of account would be available and spot money receipts are issued by customs authorities. In case of dispute In respect of the amount charged, the auditor must go through the related correspondence and orders along with refunds granted for adjustments in the accounts. Heavy demurrage charges Is a matter for special inquiry by the auditor.

Clearing agent will forward to the company the original receipts for the following charges:

- Customs duties

- Port charges

- Their bills for services

- Claim for refund

- Claim against loss or damage etc.

- Particulars of goods should be scrutinized to find out the portion capitalized and that treated as revenue.

- In case of duty drawback, the auditor should see that the refund of duty has been claimed.

| Documents to be vouched | Aspects to be verified |

| 1. Bills of Entry | It is a document issued by the custom authorities for the duty paid, bill submitted and advice received from the clearing agent. Verify to ascertain actual import of goods and other pertinent details relating to the consignment. |

| 2. Receipt for Payment of Custom Duty | Vouch the payment made based on the challan receipt, Examine the ager.rs bill g, case the customs duty is paid through clearing and forwarding agent. |

| 3. Provisional Assessment and Other Orders | In case of dispute as to amount payable, verify the provisional amount paid in line of the final amount. Also verify the final amount determined as payable. In case the provisional payment was more than the actual amount verity the refund/adjustment of such excess amount. |

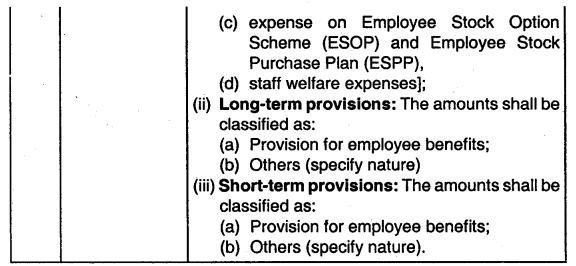

Question 18.

What points shall an auditor keep in mind while auditing an account of Bought Ledger having a debit balance? (Nov 2010, 4 marks)

Answer:

Auditing an account of Bought Ledger:

The basic structure of every account in the Bought Ledger is opening balance, credits on account of goods purchased and debits raised in respect of returns, allowances and discount receivable, advances paid against goods, payments and transfers.

An account in the Bought Ledger may be in debit. The balance may represent the amount receivable on account of goods returned, rebate allowed by the supplier or advance paid against an order.

The auditor should confirm that the advance against the order had been paid in pursuance of a recognised trade practice, also that subsequently goods have been received against the advance or will be received, for such an advance may represent a disguised loan to accommodate a business associate.

The book balance also may represent the cost of goods purchased wrongly debited to the account of the supplier, instead of the Purchase Account.

For the above case, auditor should be ascertained:

(i) That the book balance is good and recoverable and If it is not considered recoverable, a provision against the same has been made. The book balances should be appropriately dassified for purposes of disclosure In the Balance Sheet.

(ii) If the debit balance represents a loan to a director or officer of the company, either jointly or severally with another person or it is a debit due by a firm or a private company in which the director is a partner or a member, the same should be separately disclosed in the Balance Sheet in accordance with the provisions contained in Schedule III to

the Act.

The maximum account due from the directors or other officers of the company at any time during the year and debts due from companies under the same management should also be disclosed along with the names of the companies (Schedule III to the Companies Act, 2013).

![]()

Question 19.

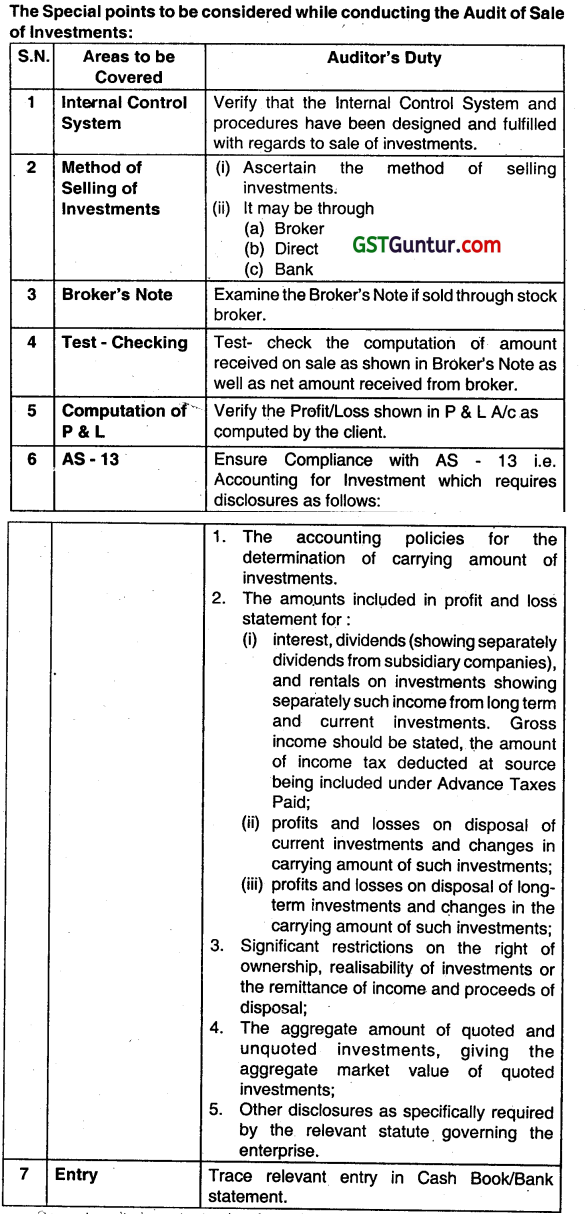

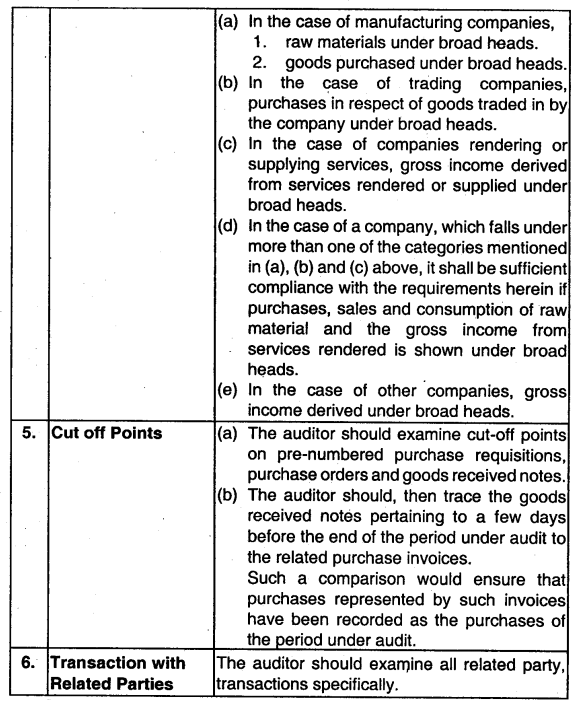

How will you vouch/verify the following? Purchase with invoice (May 2013, 4 marks)

Answer:

Vouching of purchases transactions:

Auditor should vouch credit purchases in the following ways:

Question 20.

While auditing purchases which types of analytical procedures will be performed by the auditor to obtain audit evidence as to overall reasonableness of purchase quantity and price. (2019 – May,4 marks)

Answer:

While auditing purchases the following types of analytical procedures will be performed by the auditor to obtain audit evidence as to overall reasonableness of purchase quantity and price.

1. Consumption Analysis Auditor should scrutinize raw material consumed as per manufacturing account and compare the same with previous years with closing stock and ask for the reasons from management if any significant variations found.

2. Stock Composition Auditor to collect the reports from Analysis management for composition of stock i.e. raw materials as a percentage of total stock and compare the same with previous year and ask for reasons from management in case of significant variations.

3. Ratio

Auditor should compare the creditors turnover ratios and stock turnover ratios of the current year with previous years. Auditor should review quantitative reconciliation of closing stocks with opening stock, purchases and consumption.

Question 21.

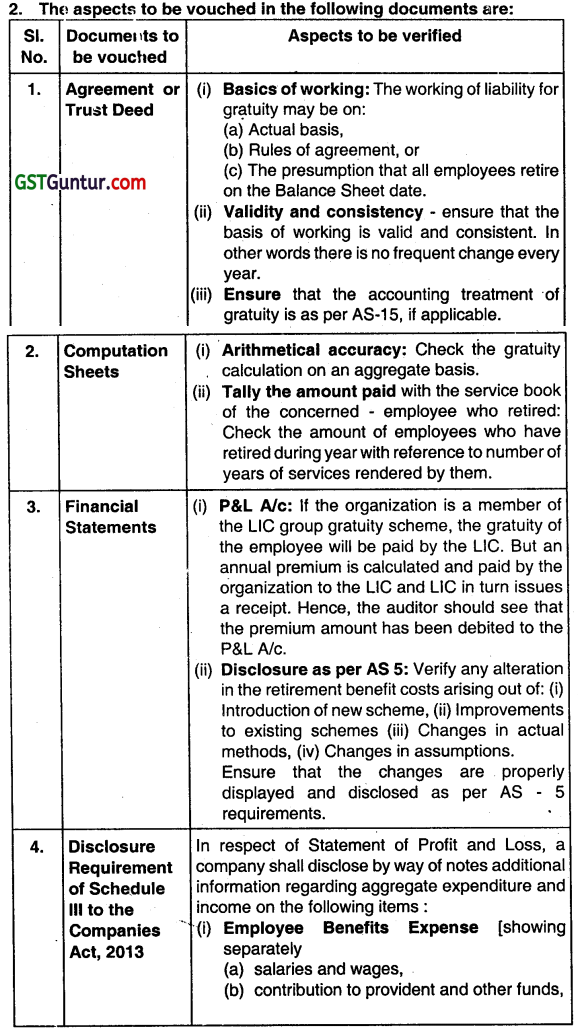

How would you vouch/verify the following? Payment of Retirement Gratuity to employees. (Nov 2007, 5 marks)

OR

How will you verify/vouch the retirement gratuity to employees? (May 2012, Nov 2014, 6, 4 marks)

Answer:

1. The auditor should see whether the organization follows:

(i) The Gratuity Act, 1972, or

(ii) It has its own Gratuity Rules.

Question 22.

How would you vouch/verify the following:

Production Incentives paid to workers. (May 2009, 5 marks)

Answer:

Production Incentives paid to workers

The auditor should verify the following aspects:

| Documents to be Vouched | Aspects to be Verified |

| 1. P&L A/c | Trace the total production incentive paid to workers from P&L Account to prime records/division-wise/dept-wise records. |

| 2. Details of Incentive Scheme | Get the details of incentive scheme from the management and see that It is approved and updated by a competent authority. |

| 3. Details of Actual | Check the production figures from independent Production sources and should correlate them with the incentive payment working computed by the accounts department. |

| 4. Payment List and Slips | Check list of payments and also acquitted disbursement slips of select department slips nods for scrutiny of various data generated In the fields for their accuracy and completeness. |

| 5. Analytical Procedure | Make an overall analytical procedure of ensuring the expense booked is commensurate in quantum with statistical data on production and strength of workers. |

Question 23.

How will you vouch and verify the following? Remuneration paid to directors. (Nov 2013, 4 marks)

OR

Write short note on Remuneration paid to directors in case of a Public United Company. (Nov 2015, 4 marks)

Answer:

Remuneration Paid to Directors

1. A director is not the servant of the company but he is the incharge and controls the affairs of the company. He has no implied right to remuneration for his services as director. Specific provisions for providing for their remuneration can be made through.

- The articles or

- The shareholders may resolve in the general meeting.

2. The remuneration can be paid by way of

- Fees for meetings,

- Monthly, quarterly, annual salary for’ whole-time director or

- For a director who is not a whole-time director by the approval of the Central Government.

Question 24.

state the disclosure requirements in respect of Statement of Protect and Loss as per Schedule III of Companies Act, 2013, in case of Employee benefits expenses. (Nov 2016, 4 marks)

Answer:

Requirement of Disclosure under Schedule III of the Companies Act, 2013 regarding expenses

Requirements as stated in Schedule III to the Companies Act, 2013, related to disclosure of expenses in case of Companies are as follows:

(i) A Company shall disclose aggregate 01 the following expenses separately on the face of the Statement of Profit and Loss:

Item IV.

Expenses:

- Cost of Materials Consumed

- Purchases of Stock-in-trade

- Changes in Inventories of Finished Goods, Work-In-progress and Stock-in-trade:

- Employee Benefits Expense

- Finance Costs

- Depreciation and amortization expense

- Other Expenses

(ii) A Company shall disclose separately by way of notes on the face of the Statement of Profit and Loss additional information regarding aggregate expenses as under:

- Consumption of stores and spare parts;

- Power and fuel;

- Rent;

- Repairs to buildings;

- Repairs to machinery;

- Insurance;

- Rates and taxes, excluding, taxes on income;

- Miscellaneous expenses

![]()

Question 25.

While reviewing Employee benefits expenses of a company, how you as an auditor you will evaluate its hiring, appraisal and retirement process? (May 2019, 3 marks)

Answer:

For the purpose of evaluations hiring, appraisal and retirement process of Employee benefits expenses the following reviews shaM be made:

1. An auditor should test the controls the entity has set around employee benefit payment process to determine how strong and reliable they are. If they are strong, the auditor can minimize the amount of transaction testing. Common internal controls over the employee benefit payment cycle includes maintaining of attendance records, employee master, authorization, and approval of monthly payroll processing and disbursement. Computation of employee deductions like payroll taxes, accrual of other benefits like gratuity, leave encashment, bonus etc.

2. The auditor then selects a random sample of transactions and examines the related appointment letters, appraisal letters, attendance records, HR policies, employee master, etc.

3. Performing substantive audit procedure is must Substantive analytical procedure will consist of monthly expense reasonability, comparison with previous accounting period, any analysis auditor may find relevant, and most important of all setting an expectation in relation to the expense incurred during the period under audit and compare that with the clients business operations overall trends in the Industry.

Question 26.

Define depreciation and discuss various purposes of providing depreciation. (2011 – May 8 marks)

OR

Discuss on the following:

Purposes of providing depreciation. (Nov 2012, Nov 2014, 5 marks)

Question 27.

Write short note The purpose of providing depreciation. (May 2017, 4 marks)

Answer:

Definition of Depreciation: According to AS -10, Property, Plant and Equipment, Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.

Further as per AS-10:

Each part of an item of property, plant, and equipment with a cost that Is significant in relation to the total cost of the item should be depreciated separately.

An enterprise allocates the amount initially recognized in respect of an item of property, plant, and equipment to its significant parts and depreciates each such part separately.

For example, it may be appropriate to depreciate separately the airframe and engines of an aircraft, whether owned or subject to a finance lease.

A significant part et an item of property, plant and equipment may have a useful life and a depreciation method that are the same as the useful life and the depreciation method of another significant part of that same item. Such parts may be grouped n determining the depreciation charge.

To the extent that an enterprise depreciates separately some parts of an item of property, plant and equipment, it also depreciates separately the remainder of the item. The remainder consists of the parts of the item that are Individually not significant. If an enterprise has varying expectations for these parts, approximation techniques may be necessary to depreciate the remainder in a manner that faithfully represents the consumption pattern and/or useful life of its parts.

An enterprise may choose to depreciate separately the parts of an item that do not have a cost that is significant in relation to the total cost of the item.

The depreciation charged for each period should be recognised in the statement et profit and loss unless It is Included in the carrying amount of another asset.

The depreciation charged for a period is usually recognised in the statement of profit and loss. However, sometimes, the future economic benefits embodied ¡n an asset are absorbed in producing other assets.

In this case, the depreciation charge constitutes pad of the cost of the other asset and is included in its carrying amount. For example, the depreciation of manufacturing plant and equipment is included In the costs of conversion of inventories. Similarly, the depreciation of property, plant and equipment used for development activities may be included in the cost of an Intangible asset recognized in accordance with AS 26, Intangible Assets.

The main purpose of providing deprecIation are stated as under:

1. To keep intact the amount of capital invested In PPE: This purpose can be attained by retaining the amount of depredation charged in the Statement of P & L A/c in the business.

2. To ascertain the accurate production cost: Since the value of PPE depletes gradually by consumption during the production process, it is essential to charge such consumption of value in the accounts for determining the true cost of production.

3. For determining the Profit or Loss for the year: Depreciation is an expense representing the loss in the value of fixed asset (PPE) arising on account of the use and other factors like efflux of time. Therefore, it is charged to statement of P& L A/c for determining the profit or loss made during a year.

4. For – presenting true and fair value of the business assets in the Financial Statement: Since the original cost of a fixed asset (PPE) decreases gradually due to its uses and other factors, therefore, it is in appropriate to continue to carry such asset at its original cost. Thus, the depreciation amount charged In Statement of P & L A/c representing the loss in the value of the assets should be deducted from the original cost on cumulative basis in order to reflect the true and fair value of the fixed asset PPE in the Financial Statement.

Question 28.

Comment on the following:

A company can consider an useful hie of the asset longer than the one prescribed by Schedule II of the Companies Act, 2013. [Modified] (May 2013, 2 marks)

Answer:

For prescribed class of company, longer useful life can be permitted It justification thereof Is given fo other companies longer useful life is not permissible.

Question 29.

is there any statutory necessity to make disclosure of depreciation in company’s accounts? (Nov 2016, 6 marks)

Answer:

Schedule III General Considerations for Preparation of Balance Sheet and Statement of Profit and Loss of a Company”, to the Companies Act, 2013 requires Separate disclosure of depreciation charged and impairment losses or reversals along with a reconciliation of the gross and net carrying amounts of each class of assets at the beginning and end of the reporting period showing additions disposals, acquisitions through business combinations and other adjustments. Thus there is a statutory necessity to make disclosure of depreciation in Company’s Accounts.

![]()

Question 30.

Mention any five attributes to be considered by an auditor while verifying for depreciation and amortisation expenses. (May 2018, 5 marks)

Answer:

Auditor needs to consider the following attributes while verifying for depreciation and amortisation Expenses:

- Obtain the understanding of entity’s accounting policies related to depreciation and amortization.

Ensure the company policy for charging depreciation, and amortisation is as per the relevant provisions of Companies Act. applicable accounting standards. - Whether the depreciation has been calculated after making adjustment of residual value from the cost of the assets.

- Whether depreciation and amortization charges are valid.

- Whether depreciation and amortization charges are accurately calculated and recorded.

- Whether all depreciation and amortization charges are recorded in the appropriate period.

- Ensure the parts (components) of each Item of property, plant and equipment that are to be depreciated separately has been properly identified.

- Whether the most appropriate depreciation method for each separately depreciable component has been used.

Question 31.

Depreciation and amortisation expenses generally constitute an entitys significant part of overall expenses and have direct impact on the profit/loss of the entity. What are the attributes, the Auditor needs to consider while verifying Depreciation and amortisation expenses. (Jan 2021, 4 marks)

Question 32.

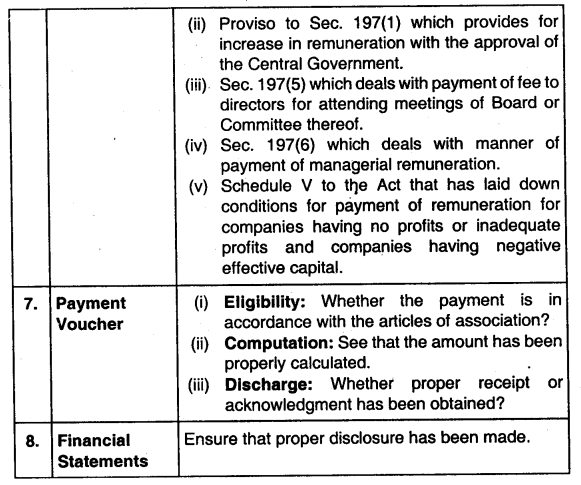

How would you vouch/verify the following? Advertisement Expenses. (May 2008, Nov 2013, May 2014, 5 marks each)

Answer:

Advertisement Expenses

Advertisement is necessary for various purposes and there are several advertisement media.

Question 33.

Comment on the following situation:

XVZ Ltd. Co. gave a donation of ₹ 50,000 each to a Charitable Society running a school and a trust set up for the service of Blinds during financial year ending on 31st March, 2009. The average net profits of the company for the last three years were ₹ 15 lakhs. (Nov 2009, 8 marks)

Answer:

Donations to Charitable Institutions

According to Sec. 181 of the Companies Act1 2013, the Board of Directors of a company may contribute to bona fide charitable and other funds with prior permission of the company in general meeting for such contribution in case any amount the aggregate of which, in any financial year. exceeds five percent of its average net profits for the three immediately preceding financial years.

Facts: In the said case, the company has given donations of fifty thousand rupees each to the two charitable organizations which amounts to one lakh rupees. Assuming that the charitable organisations are not related to the business of the company, the average profits of the last three years is fifteen lakh rupees and the five percent of this works out to seventy-five thousand rupees. So, the maximum of donation could be seventy-five thousand rupees only. For excess of twenty-five thousand rupees the company is required to take prior permission in general meeting which is not been taken.

Conclusion: Alter paying donations of one lakh rupees which is more than seventy-five thousand rupees, the Board has contravened the provisions of Sec. 181 of the Companies Act, 2013. Hence, the auditor should qualify his audit report accordingly.

Question 34.

Comment on the following:

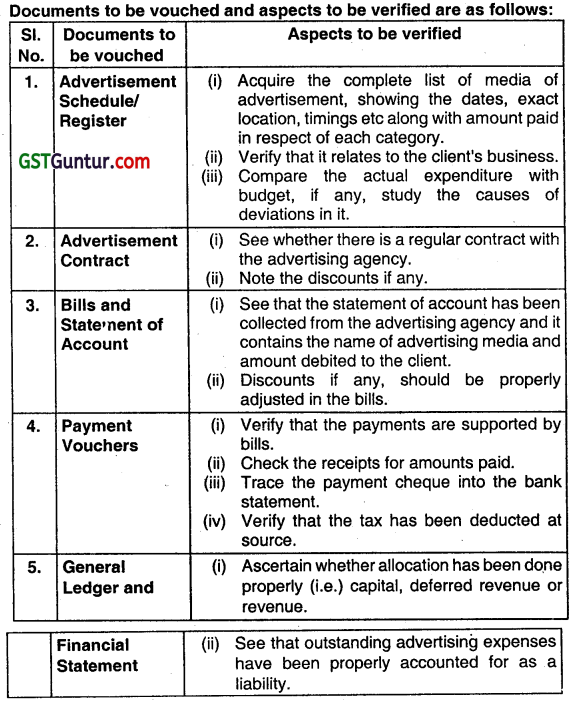

Vouching of payment of taxes. (Nov 2011,5 marks)

OR

How will you vouch/verify the following:

Payment of Taxes (Nov 2015, 4 marks)

Answer:

Vouching of Payment of Taxes:

It is presumed that Income-tax payment is the organization’s tax liability. TDS recovery and remittance is not considered herein.

![]()

Question 35.

Explain, what are the factors to be considered while VouchIng of traveling expenses? ( Nov 2012, 8 marks)

Answer:

Vouching of Traveling Expenses

| Documents to be Vouched | Aspects to be Verified |

| 1. Authorisation | Ensure that all payments with respect of travel have been authorized/sanctioned by proper official. |

| 2. Reasonableness of Payment | Check reasonableness of payments as per clients’ internal rules and regulations and its controls. |

| 3. Bills | Vouch copies of the air/railways tickets hotel bills, and restaurant bills. |

| 4. Permission of RBI | Check whether permission of RBI has been obtained for expenditure In foreign currency. |

| 5. Reasonableness of Sundry Expense | Ensure reasonableness of sundry expenses such as daily allowance, conveyance and tips etc. |

| 6. Entry in Bank Statement | Trace relevant entry in bank statement, if paid in cheque. |

| 7. Accounting Entry | Check posting in traveling expenses account. |

| 8. Analytical Review | Compare amount of traveling expenses with the previous year’s figures and require into abnormal changes, it any. |

Question 36.

Comment on the following:

PQR Ltd. Includes underwriting commission and stamp duty as preliminary expenses. ( May 2013, 2 marks)

Answer:

Preliminary expenses are the expenses incurred by the promoters on behalf of the proposed company before incorporation of a company. Underwriting expenses are incurred for issue of shares and debentures after incorporation of a company. Hence, PQR Ltd. should include stamp duty but exclude underwriting commission.

Question 37.

State with reasons (in short) whether the following statement is correct or incorrect. ABC Ltd., a government company came into existence in year 2012, donated ₹ 50,000 to a political party. (May 2014, 2 marks)

Answer:

Incorrect:

No, Government Company cannot give donations to political party as per Sec. 182 of Companies Act, 2013.

Question 38.

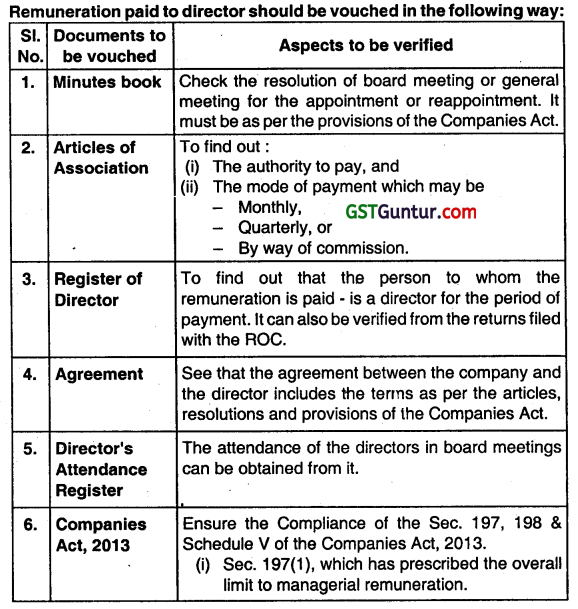

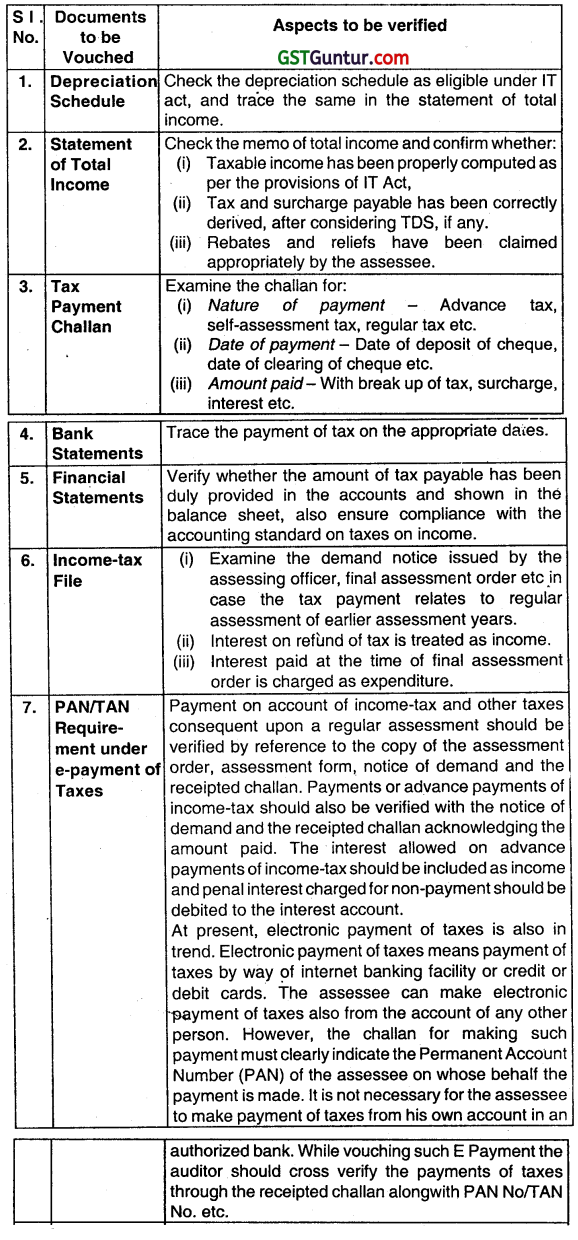

How will you vouch/verify the following? Repair to assets (May 2015, 4 marks)

Answer:

![]()

Question 39.

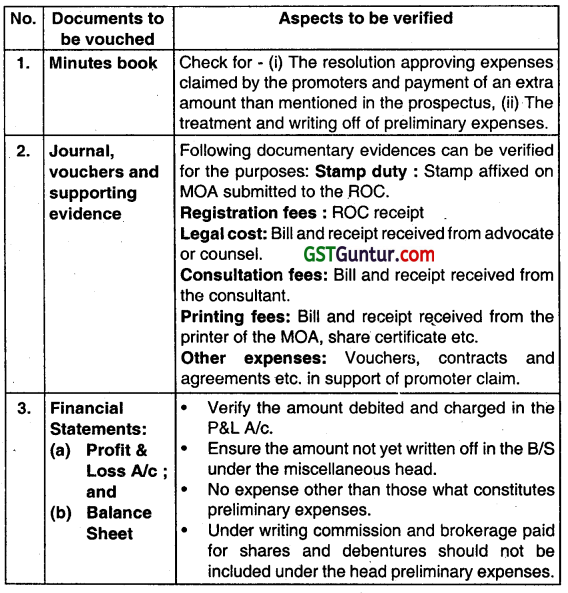

How you will vouch/verify the following? Preliminary expenses (May 2016, 4 marks)

Answer:

Preliminary Expense:

The expenses incidental to forming and saving capital for a proposed company are known as preliminary expenses. The prospectus, Memorandum of Association, Article of Association are source documents which inform the prospective investors about the preliminary expenses. The related matters are decided in the meetings of the board, shareholders etc. The bills and receipts of each Ítem of preliminary expenses act as documentary evidence. Lastly, no expenses other than preliminary expenses should be booked under this. Auditor should examine Compliance with AS -26 with respect to accounting treatment of preliminary expense.

Question 40.

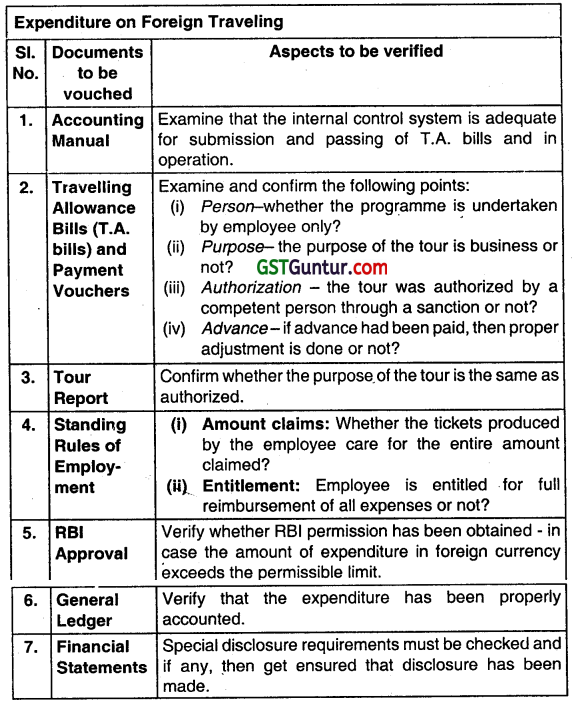

How will you vouch/verify the following? Foreign Travel Expenses (Nov 2016, 4 marks)

Answer:

Question 41.

‘While the auditor may choose to analyse the monthly trends for expenses like rent, power, and fuel but for other expenses, an auditor generally prefers to verify other attributes.” Mention those attributes. (Nov 2016, 5 marks)

Answer:

While the auditor may choose to analyse the monthly trends for expenses like rent, power, and fuel an auditor generally prefers to vouch for other expenses to verify following attributes:

- Whether the expenditure pertained to current period under audit.

- Whether the expenditure qualified as a revenue and not capital expenditure;

- Whether the expenditure had a valid supporting like travel tickets, insurance policy, third party invoice, etc;

- Whether the expenditure has been classified under the correct expense head;

- Whether the expenditure was authorized as per the delegation of authority matrix;

- Whether the expenditure was in relation to the entity’s business and not a personal expenditure.

Question 42.

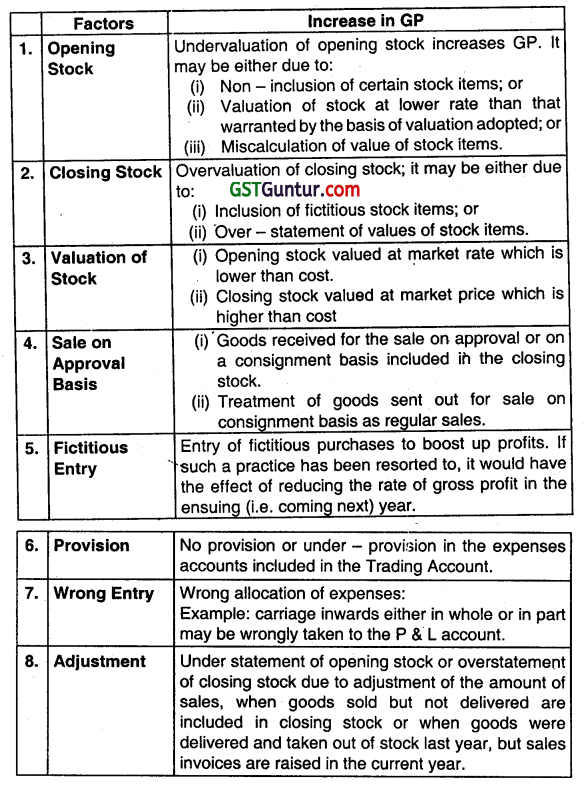

Give various factors which result In increase in gross profit. (May 2011, 8 marks)

Answer:

![]()

Question 43.

As the statutory auditor of A Ltd.. you have observed that the gross profit of the company has decreased in comparison to last years. Mention the possible factors which may be responsible for decrease in gross profit. (Nov 2015, 6 marks)

OR

Discuss the following:

in the course of audit of Steadfast Ltd.1a manufacturing company, you find that there is a sharp fafl in the rate or gross profit in comparison to the previous year. State the steps you would take to verify the same. (May 2017, 5 marks)

Answer:

As a statutory auditor of A Ltd. if there Is decrease in GP as compared to previous year then we have to consider following factors.

Question 44.

Expenses which are essential of a revenue nature if incurred for creating an asset or adding to its value for achieving higher productivity are regarded as expenses of a capital nature. Describe any five such expenses. (May 2018, 5 marks)

Answer:

Expenses which are essential of a revenue nature, ¡f incurred for creating an asset or adding to its value foc achieving higher productivity, are also regarded as expenditures of a capital nature.

Following are examples of such capital expenditure:

(i) Material and Wages:

Capital expenditure when expanded on the construction of a building or erection of machinery;

(ii) Legal Expenses:

Capital expenditure when incurred in connection with the purchase of land or building;

(iii) Freight :

Capital expenditure when incurred in respect of purchase of plant and machinery;

(iv) Repair:

Major repairs of a fixed asset (PPE) that increases its prociuctMty;

(v) Wages:

Wages paid on installation costs incurred in Plant & machinery;

(vi) Interest:

Interest incurred during the eligible period as defined under Ind AS 23 i.e. during the period of construction of the asset.

Question 45.

Write short note on Scrutiny of General Ledger. (Nov 2016, 4 marks)

Answer:

Audit of General Ledger:

The Auditor should consider the following points while conducting the audit of General Ledger:

| 1. Structure | The general ledger includes all the balances of the P&L A/c & BIS. its examination, therefore, should be carried out with great deal of care m as much as it is the final review of balances which on inclusion in final accounts, cumulatively reflect the financial position of the concern. |

| 2. Posting | Entries in the general ledger are posted in summary from the cash book, journals and from other subsidiary books like sales & purchase books etc. The auditor before starting its examination must ensure that all the posting in the various accounts have been verified, total have been checked and the final balance have been linked. |

| 3. Observance of Accounting Principles | It should be ascertained that balances in all the income & expenditure account have been adjusted: (i) According to standard accounting practices (ii) On a consideration of legal provisions which are applicable to the concern. |

| 4. Comparison | Wherever practicable, balances in general ledger should be traced simultaneously on into the trial balance, the grouping schedules and final accounts. The corresponding balances in the previous years final accounts also should be compared. |

| 5. Consistency | It should be confirmed that the accounts have been kept according to Accepted Accounting Principles & the Balance Sheet and the Profit & Loss Account have been drawn up on the same basis as In the previous year. It requires that any Items shown in the Profit & Loss Account, affected by any change on the basis of accounting, the account involved should be disclosed. |

Question 46.

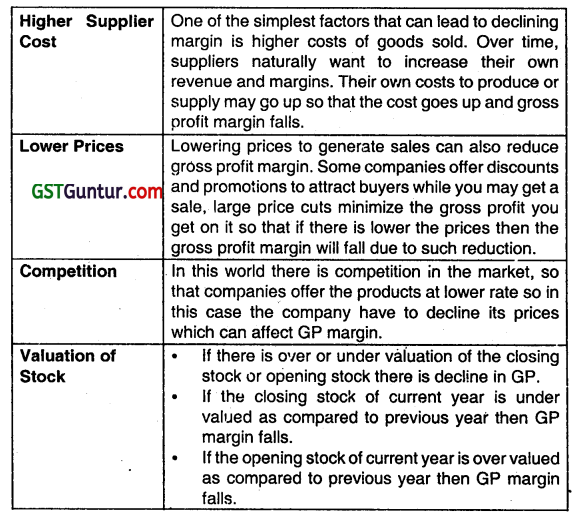

Write short note on “Cut-off Procedure”. (Nov 2007, May 2011, 4 marks each)

OR

Write short note on uCut.off arrangements. (Nov 2009, May 2014,5 marks each)

Answer:

Cut-off Procedure is the procedure adopted by the management for ensuring that the transactions of one period are distinct from those at the beginning of the next following period. The cut-off procedure is very noteworthy in order to ensure that the revenue and expenditure of one year are not getting recorded n the following year since they will distort the true and fair view of the accounts.

Such a procedure is applied to ensure that:

1. The goods purchased, the property in which has passed to the client, have been intact included in the Inventories, and liability has been provided for in case of credit purchase.

2. The goods sold have been excluded from the Inventories and the credit has been taken for sales, if the sales value is to be received, the concerned party has been debited.

3. The proper procedure has been followed for the adjustment of the inventories to take Into account the movements to and from the stock which have taken place between the stock-taking date and the BIS date where the stock has been taken on a date other than the B/S date.

![]()

Multiple Choice Question

Question 1.

Auditors need to obtain adequate understanding about the organization and its revenue centers except:

(a) To identify the control points over sales.

(b) Tests the controls the entity ‘has set up for the sales cycle to determine how strong and reliable they are. If they are strong, the auditor can reduce the amount of transactions testing he must do.

(c) Select a random sample of transactions and examines the related customer purchase orders, invoices, and customer statements, it the control being tested is numbered sales invoices.

(d) None of the above

Answer:

(d) None of the above

Question 2.

An auditor should verity that following disclosures are required under md AS except regarding sales:

(a) Whether revenue from operation is disclosed separately in the notes as revenue arising from:

Sales of Products

Sales of Services

Other operating revenues.

(b) Ensure that the brokerage and discount on sales has not been disclosed.

(c) Whether disclosure of sales In respect of each class of goods has been made.

(d) Whether the transactions with related parties are appropriately disclosed in notes to accounts.

Answer:

(b) Ensure that the brokerage and discount on sales has not been disclosed.

Question 3.

Dividends are recognised in the Statement of profit and loss only when:

(a) the amount of the dividend can be measured reliably

(b) the entity’s right to receive payment of the dividend is established

(c) it is probable that the economic benefits associated with the dividend will flow to entity

(d) Any of the above

Answer:

(d) Any of the above

Question 4.

Which is the following is not an example of revenue expenditure?

(a) Development expenditure of Land

(b) Salaries and wages

(c) Repairs and maintenance of fixed assets

(d) Legal and professional expenses.

Answer:

(a) Development expenditure of Land

Question 5.

Cut-off testing is performed during audit of sales to address the following Income statement assertion:

(a) Occurrence

(b) Measurement

(c) Completeness

(d) All of the above

Answer:

(c) Completeness

![]()

Question 6.

Wages paid to workers would always quality as:

(a) Revenue Expenditure

(b) Capital Expenditure

(c) Revenue or Capital expenditure depending upon facts and circumstances

(d) None.

Answer:

(c) Revenue or Capital expenditure depending upon facts and circumstances

Question 7.

Auditor should verify the disclosure requirements under Ind AS compliant Schedule III of the Companies Act, 2013 have been made except:

(a) Whether purchase of stock-in-trade has been specifically disclosed.

(b) Whether changes in inventories of finished goods, stock-in-trade, and work-in-progress has been specifically disclosed.

(c) Whether the transactions with related parties are appropriately disclosed in notes to accounts.

(d) None of the above

Answer:

(d) None of the above

Question 8.

Auditor should ensure the required disclosure as per and AS regarding the classification of employee benefit expense, except:

(a) Salaries and wages

(b) Staff welfare expenses

(c) Contribution to provident and other funds

(d) None

Answer:

(d) None

Question 9.

Auditor needs to consider the following attributes with an exception while verifying the depreciation expenses.

(a) Ensure the company policy for charging depredation and amortisation.

(b) Whether the depreciation and amortization charges are invalid.

(c) Whether the depreciation has been calculated after making adjustment of residual value from the cost of the assets.

(d) Whether the most appropriate depreciation method for each

separately depreciable component has been used.

Answer:

(b) Whether the depreciation and amortisation charges are invalid.

Question 10.

Profit and Loss Account will be debited regarding depreciation is:

(a) Depreciation

(b) Depreciation expenses

(c) Net Asset Value

(d) Book Value

Answer:

(b) Depreciation expenses

Question 11.

Auditor should adopt – the audit procedure for insurance Expenses”

(a) Obtain a summary of insurance policies taken along with their validity period,

(b) Verify If the expense has been correctly classified between prepaid and expense for the period based on number of days.

(c) Both (a) and (b)

(d) None

Answer:

(c) Both (a) and (b)

![]()

Question 12.

Audit procedure required by an auditor except:

(a) Obtain a month-wise expense schedule along with the rent agreement.

(b) Specific consideration should be given to escalation dause in the agreement to verify if the rent was to be increased/adjusted during the period under audit.

(c) Verity it the agreement is in the name of the entity and whether the expense pertains to premises used for running the business operation of the entity.

(d) None of the above.

Answer:

(d) None of the above.