Final Accounts – CA Foundation Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

Final Accounts – CA Foundation Accounts Study Material

Question 1.

Discuss the limitations which must be kept in mind while evaluating the Financial Statements.

Answer:

Limitations of Financial Statements:

The following are the limitations of financial statements:

1. Historical Cost:

The financial statements are prepared on the basis of historical cost, i.e. current market value of the fixed asset is not taken into consideration. The value of the fixed asset continues to decrease with the passage of time, but the effect of these subsequent changes in price is not taken into account. The Balance Sheet loses its significance since it does not take into consideration the economic realities of the business organization. Thus, heavy reliance on historical cost makes the financial statements misleading & irrelevant for decision making.

2. Perpetual Continuity & Periodical Account:

Financial statements are prepared at the end of the year but the accounting records are maintained on the going concern assumption (i.e. the business shall continue to exist forever). As a result, many items of capital expenditure are distributed over a number of beneficial years arbitrarily which may lead to incorrect preparation of financial statements.

3. Strengths & Weaknesses:

The assets which can be expressed in terms of money are recorded in the financial statements of a company. The strengths & weaknesses of the business are not taken into consideration while preparing the Balance Sheet.

For example: services, skills & loyalty of the employees are also important for the business, but these are not shown in the Balance Sheet. Thus, it should be kept in mind while judging the company’s financial position, that many non-monetary strengths will not be reflected in the Balance Sheet.

4. Intangible assets:

A company may have a number of intangible assets that are not recorded in its financial statements, but the expenditure made in regard to those assets are charged to expense. This policy can drastically affect the reliability of the financial statements of a company.

5. Window Dressing:

There is a possibility of fabrication of the financial statements by the management of the company. In such a case, financial statements may not provide true & fair view of the financial position of the company.

6. Different Accounting Policies:

The financial statements of different companies are not always comparable, because the entities use different accounting policies. For example: One company may charge depreciation on straight line method & another on written down value method. When different methods are adopted by different companies for the treatment of a particular item, the results of comparison between such enterprises shall be misleading.

![]()

Question 2.

Trading account.

Answer:

Trading account:

- Trading account shows the profit/loss made on a gross basis that is including only the direct cost of the goods.

- In trading a/c, we credit the trading income like sale and

- Debit the cost of goods sold (opening stock + purchases (-) closing stock).

- Alternatively Opening Stock & purchases is debited & Closing stock is credited to trading account.

- Other direct expenses related to purchase or manufacture of goods like carriage inward, wages, etc. are also debited here.

- Purchase return & Sales returns will be deducted/adjusted from the purchases & sales respectively.

- The balance is known as the gross profit or gross loss, which is transferred to profit and loss a/c.

- Non-corporate entities usually prepares trading a/c so as to know the gross margin available in its sale.

- But at corporate level usually it is not prepared. In those cases the items of trading account gets incorporated in profit & loss account.

Question 3.

Profit and loss account.

Answer:

Profit and loss account:

- It shows the performance of the entity i.e. profit earned or loss suffered considering all indirect expenses and incomes.

- Gross profit or gross loss from trading account is transferred to P&L a/c.

- Other incomes like discount, interest, etc. are credited.

- Administrative expense, selling and distribution expense, financial expense, income tax, losses, etc. are debited to it.

- The net profit/net loss is transferred to P&L appropriation a/c (if made) otherwise to capital a/c.

- If trading a/c is not prepared then in place of gross profit/gross loss all items of trading a/c will come in P&L a/c itself

Although not necessary, but usually full profit/loss is transferred to proprietor,/ partners capital account, hence profit & loss account does not appear in balance sheet.

Question 4.

Balance sheet.

Answer:

Balance sheet:

- Balance sheet shows the financial position of the entity as at a particular point of time.

- It shows what and how much entity owns (i.e. its assets) and how much it owes to others (i.e. its liabilities), the balance (i.e. asset – liability) is the owners equity.

- It is not an account, hence does not have debit and credit side.

- On one side assets like fixed assets (building, machinery, furniture, etc.), current assets (like stock, debtors, cash bank balance, advances prepaid and investments, if any) are shown.

- On the other side in addition to owner’s capital and reserves, the outside liabilities like loans taken, creditors, expenses payable etc. are shown.

- The two sides total must be same.

- On the asset side of balance sheet we start with most permanent to least permanent i.e. fixed assets, investments and then current assets.

- It is known as permanency preference. In case of manufacturer/trader this sequence is followed hence student will see this in all the chapters.

- When asset side starts with most liquid asset to least liquid like cash bank balance and ends with fixed assets is known as liquidity preference generally followed by institutions like banks.

- Liability side is mostly same in all cases we have first owner capital and reserves, then loans and thereafter current liabilities and provisions.

Balance sheet is a point of time statement, when stated as at 31.3.2006 it means as at close of that date ie. after considering all transactions of that day. Even though balance sheet does not have debit and credit side, student should remember that asset side represent debit and capital and liability side represent credit. It will help in correctly preparing final accounts.

In General Mercantile/accrual system is followed, as it is the proper and complete system to measure the performance of entity. In your syllabus every where this is considered. Under this system, incomes are recognized when these are earned irrespective of whether amount is received or not. Similarly expenses are recognized when these are incurred or accrued irrespective of whether amount is paid or not. As a result we have to make adjustment for expenses outstanding (payable), prepaid, income outstanding (receivable) and advance-received etc.

![]()

Question 5.

Manufacturing A/c.

Answer:

Manufacturing account:

- A manufacturing concern may prepare Manufacturing a/c to ascertain cost of goods manufactured.

- Raw material consumed (Op. stock + Purchases – Closing stock), carriage inward, wages, power,

- depreciation of factory building, machinery, etc. and other manufacturing (factory) expense are debited to it.

- Opening WIP stock is debited and closing WIP stock credited.

- Balance is the cost of goods manufactured and is then transferred to trading account.

- When manufacturing a/c is not prepared, these items will come in trading a/c. Sometimes depreciation a/c may be directly taken to P&L a/c instead of trading a/c.

- Manufacturing a/c is also a period statement.

A manufacturer is one who purchases raw material and process it into finished goods with the help of labour and machines at his factory and sells the finished goods. Whereas a trader purchases goods and sells it as it is.

Question 6.

Trial balance.

Answer:

Trial balance:

- Trial balance is a statement containing the balances of all accounts as at the end of certain period usually classified into debit and credit.

- The total of debit and credit side must tally because whole accounting is done by double entry principle, otherwise it indicates arithmetical inaccuracies.

- It has balance of expenses, incomes, assets and liabilities.

- With the help of trial balance and adjustments the final accounts are prepared.

- All expenses and incomes will go into Manufacturing, Trading, P&L and P&L app. a/c depending upon its nature and all assets and liabilities will go into balance sheet.

Question 7.

Provision & Reserve.

Answer:

Provision and Reserve:

1. Provision means

- “any amount written off or retained by way of providing for depreciation, renewal or diminution in value of assets, or

- retained by way of providing for any known liability of which the amount cannot be determined with substantial accuracy”.

2. Provision is a present liability which by its nature requires a significant amount of estimation.

3. The following are examples of amount retained in the business out of earning for different purposes that are described as provisions.

- Amount provided for meeting claims /liabilities which are admissible in principle but the amount whereof has not been ascertained.

- Amount provided for payment of taxes still to be assessed.

- Amount set aside for writing off bad debts or for discounts.

4. The term ‘reserve’ is not defined in Part-III of Schedule VI except negatively in the sense that profit retained in the business not having any of the attributes of a ‘provision’ is to be treated as a reserve.

5. Also provisions in excess of the amount considered necessary for the purposes these were originally made, are to be considered as reserves.

6. It is thus evident that provisions are a charge against profits, while reserve is an appropriation of profits.

7. Reserve are accumulated profits hence part of owners equity, provision are in the nature of liability due to outsiders.

8. Provision will be debited to P&L a/c and reserve to P&L appropriation A/c when created.

![]()

Question 8.

Capital reserve & Revenue reserve.

Answer:

Capital reserve and Revenue reserve:

→ Capital reserve is any reserve, which is not free for distribution as dividend.

→ Revenue reserve shall mean any reserve other than capital reserve.

→ Following are the examples of capital reserve.

Profit/Reserve which are credited to capital reserve account

- Profit prior to incorporation (as per GAAP)

- Profit on re-issue of forfeited shares

- Debenture premium (as per GAAP)

- Profit on redemption of debenture/shares (as per GAAP)

- Profit on buyback of shares (as per GAAP)

- Profit on acquisition of business (as per AS-14)

- Balance of reconstruction account (as per GAAP).

→ Profit of capital nature not distributable but kept in separate accounts

- Share premium/Securities premium a/c

- Capital redemption reserve/share buyback reserve a/c

- Revaluation reserve (as per AS-10)

→ Reserve which are not distributable for the time being (Created under the provisions of Income-tax Act)

- Investment allowance reserve

- Export allowance reserve

- Shipping reserve

- Export project reserve

→ Free reserves/Revenue reserve is a reserve, which is available for distribution as dividend like:

- Profit & loss account balance

- General reserve

- Dividend equalisation reserve

- Profit on disposal of fixed assets/investments.

Question 9.

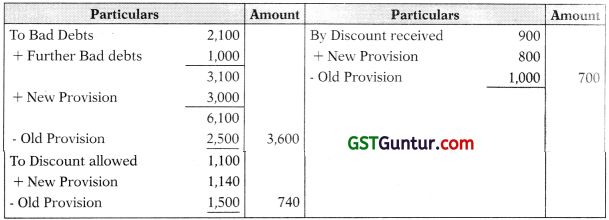

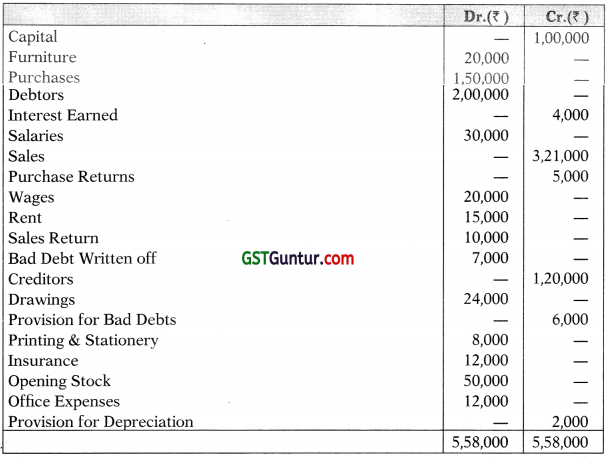

| Particulars | (Dr.) Balance | (Cr.) Balance |

| Bad Debts | 2,100 | |

| Discount Allowed | 1,100 | |

| Discount Received | 900 | |

| Debtors | 53,000 | |

| Creditors | 40,000 | |

| Provision for Bad Debts | 2,500 | |

| Provision for Discount allowed | 1,500 | |

| Provision for Discount received | 1,000 |

Additional information

a. There was a further bad debt of ₹ 1,000.

b. During the year sales of ₹ 8,000 omitted to be recorded.

c. Make a Provision for bad debts @ 5% on debtors.

d. Make a Provision for discount @ 2%.

Show the extract of Profit & Loss Account & Balance Sheet for the above adjustments.

Solution:

Profit and Loss Account (Extract)

Balance Sheet (Extract)

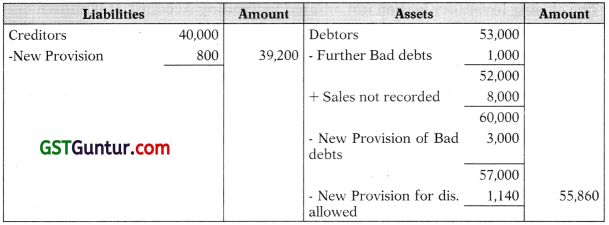

Question 10.

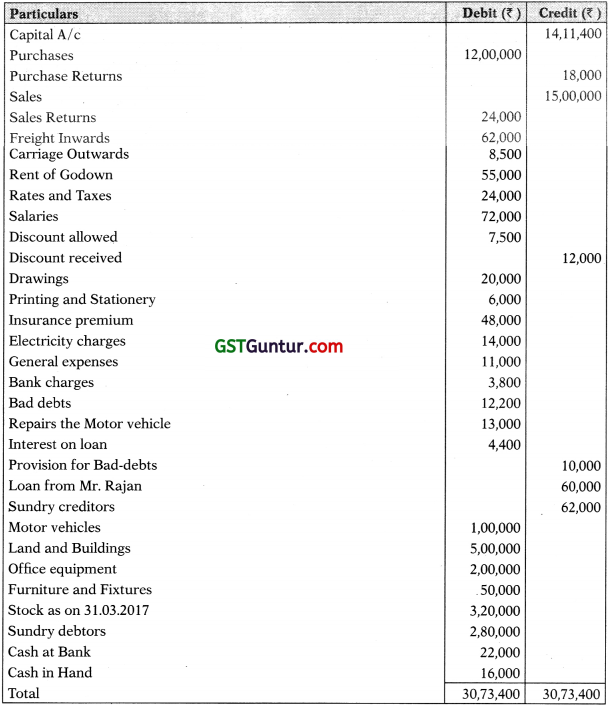

Below is the trial balance of Shah as on December 31, 2005 :

Additional information:

1. Rates have been prepaid to the extent of ₹ 175.

2. Bad debts ₹ 500 have to written off. A provision for doubtful debts @ 5% on debtors is necessary.

3. Building has to be depreciated at 2% and Furniture @ 10%.

4. The manager is entitled to a commission of 5% of net profits before charging such commission.

Solution:

Trading and Profit and Loss Account of Shah

for the Year ended on December 31, 2005

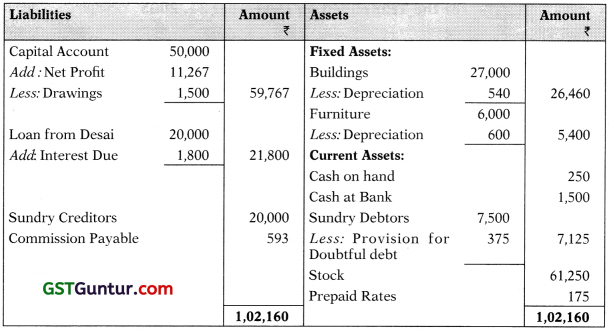

20,900 less ₹ 9,040 (the total of all expenses so far), Manager is entitled to 5% of this figure.

(1) The trial balance gives “Adjusted Purchases”. It means that the opening stock has already been transferred to the Purchases Account and thus been closed. Further, entry for closing stock has already been passed by debiting the Closing Stock Account and crediting Purchases Account. That is why closing stock appears inside the trial balance. It will now be shown in the Balance Sheet and not in the Trading Account since purchases already stand reduced.

(2) There is a Loan of Desai @ 9% taken in 2004 i.e. in last accounting year. As per mercantile system interest up to 31.12.04 must have been provided in the last years a/c itself. The trial balance makes no mention of any interest being paid to him. Hence, interest @ 9% must be provided for the whole of current year only.

Balance Sheet of Shah as on December 31, 2005

Question 11.

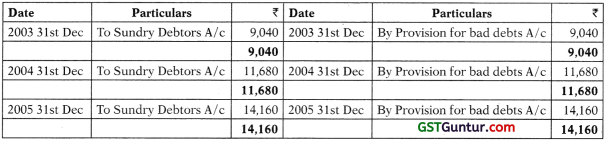

On 1-1-2003 M/s A & Co. had a provision for bad debts of ₹ 10,880.

The bad debts during the year 2003 amounted to ₹ 9,040.

The debtors as at 31-12-2003 were ₹ 2,24,000.

Provision for bad debts @ 5% is maintained by the business.

Bad debts during 2004 and 2005 were ₹ 11,680 and t 14,160 respectively.

The sundry debtors as at 31-12-04 and 31-12-05 were ₹ 2,88,000 and ₹ 1,36,000 respectively.

Prepare necessary Ledger Accounts in the books of M/s. A & Co. Also show how these would appear in the Profit and Loss Account and Balance Sheet for the years 2003 to 2005.

Solution:

Bad Debts A/c

Provision for bad debts A/c

Extract of P&L Account for the year ended on 31-12-2003

Question 12.

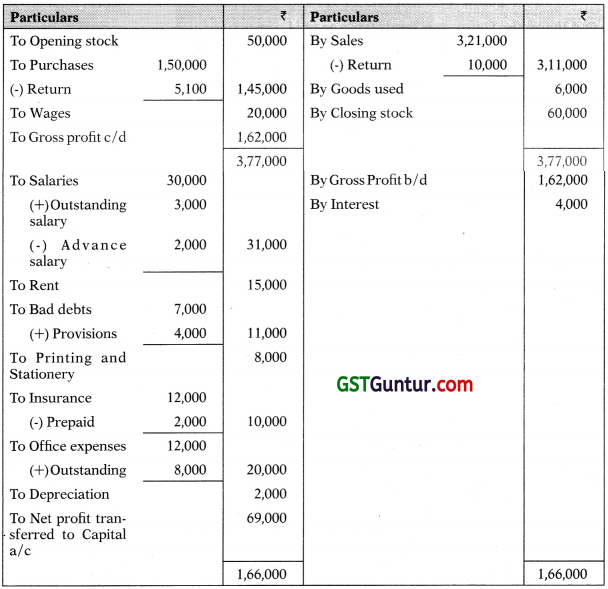

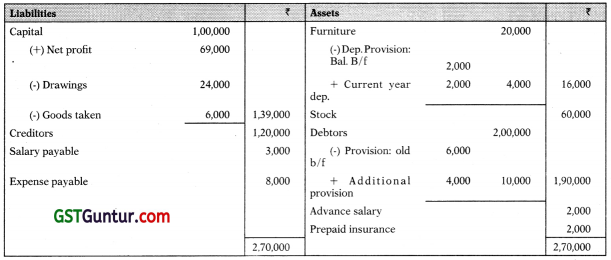

From the following Trial Balance of Hari and additional information prepare Trading and Profit & Loss Account for the year ended 31st March, 2006 and a Balance Sheet as on that date:

Trial Balance as at 31st March, 2006

Additional Information:

(1) Depreciate Furniture by 10% on original cost;

(2) A provision for Doubtful Debts is to be created to the extent of 5% on Sundry Debtors;

(3) Salaries for the month of March, 2006 amounting to ₹ 3,000 were unpaid which must be provided for. However salaries included ₹ 2,000 paid in advance;

(4) Insurance amounting to ₹ 2,000 is prepaid;

(5) Provide for outstanding office expenses ₹ 8,000;

(6) Stock used for private purpose ₹ 6,000;

(7) Closing Stock-in-Trade ₹ 60,000.

Solution:

M/s Hari

Trading and Profit and Loss Account for the year ended on 31.3.2006

M/s Hari

Balance Sheet as on 31.3.2006

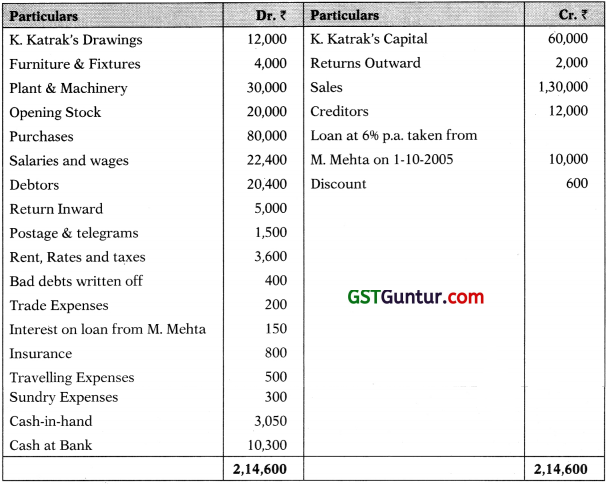

Adjustment Entries

Transfer Entries/Book Closing Entries

![]()

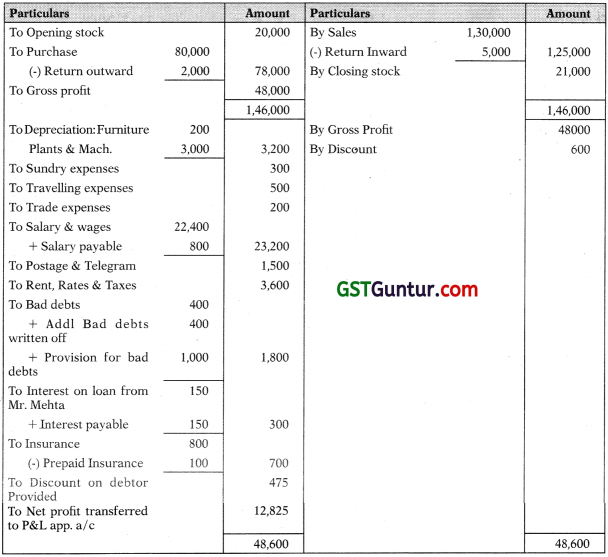

Question 13.

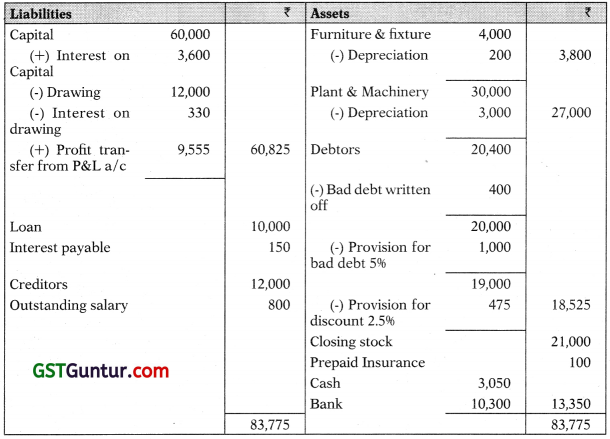

From the following Trial Balance of K. Katrak as on 31-3-2006. Prepare Trading Account, Profit and Loss Account for the year ended 31-3-2006, and a Balance Sheet as on that date after making necessary adjustments:

Trial Balance

Adjustments:

(1) Closing stock was valued at ₹ 21,000.

(2) Of the debtors ₹ 400 are bad and should be written off. Create a reserve for bad debts at 5% on Sundry Debtors and a reserve for discount on Debtors at 2.5%.

(3) Salaries ₹ 800 for March,06 were not paid.

(4) Interest on Capital is to be calculated at 6% p.a. and on drawings ₹ 330.

(5) Prepaid Insurance amounted to ₹ 100.

(6) Depreciate Furniture & Fixture by 5% and plant and machinery by 10%.

Solution :

M/S K. Katrak

Trading and Profit & loss Account for the year ended on 31.03.06

Profit & loss Appropriation Account

→ Interest on capital, interest on drawing, salary/ commission etc. to owners and transfer to reserves etc. is taken in P&L appropriation a/c.

→ Loan from Mr. Mehta has been taken 6 month ago for which the interest accrued is ₹ 300 out of which ₹ 150 has already been paid and accounted balance ₹ 150 is payable and is accounted now.

Balance sheet as at 31.03.06

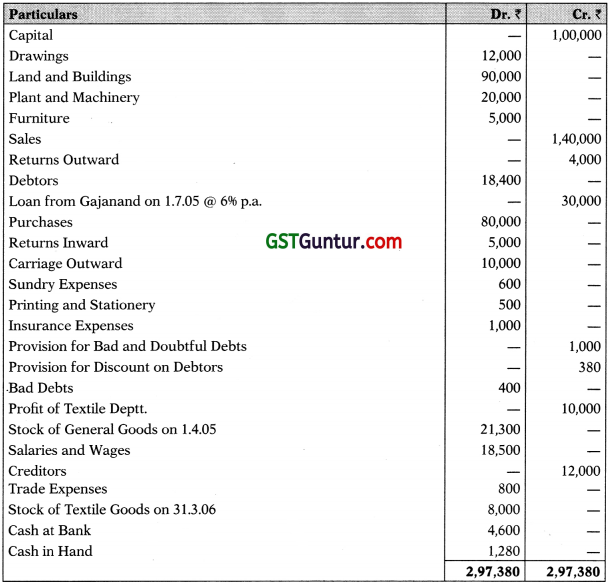

Question 14.

From the following trial balance and information, prepare Trading and Profit and Loss Account of Mr. Rishabh for the year ended 31st March, 2006 and a Balance Sheet as on that date:

Additional Information:

(i) Stock of General goods on 31.3.06 valued at ₹ 27,300.

(ii) Fire occurred on 23rd March, 2006 and ₹ 10,000 worth of general goods were destroyed. The Insurance Company accepted claim for ₹ 6,000 only and paid the claim money on 10th April, 2006.

(iii) Bad Debts amounting to ₹ 400 are to be written off. Provision for Bad and Doubtful debts is to be made at 5% and for discount at 2% on debtors Make a provision of 2% on creditors for discount.

(iv) Received ₹ 6,000 worth of goods on 27th March, 2006 but the invoice of purchase was not recorded in Purchase Book.

(v) Rishabh took away goods worth ₹ 2,000 for personal use but no record was made thereof.

(vi) Charge depreciation at 296 on Land and Buildings, 2096 on Plant and Machinery and 596 on Furniture.

(vii) Insurance prepaid amounts to ₹ 200.

Solution:

M/s. Rishabh

Trading and P&L a/c for the year ended on 31st March, 2006

M/s. Rishabh

Balance Sheet as on 31st March, 2006

Final Accounts of Partnership Firm.

Question 15.

From the under mentioned Trial Balance of X and Y as on 31st December, 2005, prepare a Trading Account, Profit and Loss Account for the year ended 31-12-2005 and a Balance Sheet as on that date:

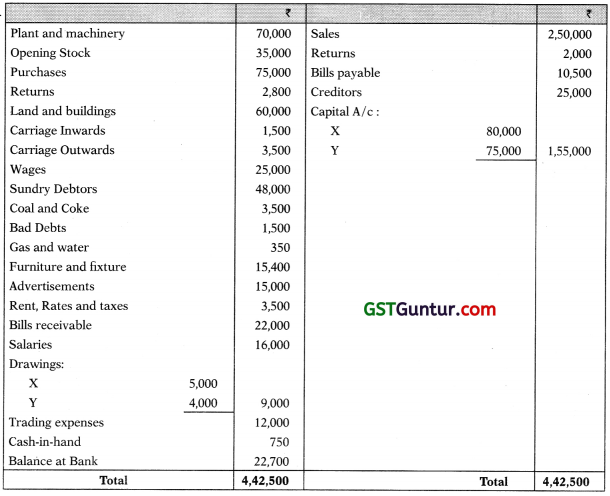

Trial Balance

The following additional information is supplied:

(a) The partners share profits and losses as X = 4/5 and Y = 1/5;

(b) Depreciate Plant and Machinery by 10%;

(c) Bad Debts reserve to be raised to 2.5% on sundry debtors;

(d) Interest on capital is to be provided at 5% p.a. and on drawings at 6% p.a.

(assumed to be drawn on 30th June, 2005);

(e) Salaries include ₹ 3,000 drawn equally by the partners;

(f) Advertisement expenses to be written off against revenue over 5 years;

(g) Outstanding liabilities to be provided: for wages ₹ 2,000; salaries ₹ 3,000;

(h) Partners are allowed an annual salary of ₹ 3,000 each;

(i) 50% of the net distributable profits are transferred to Reserve Fund;

(j) Closing Stock ₹ 10,000.

Solution:

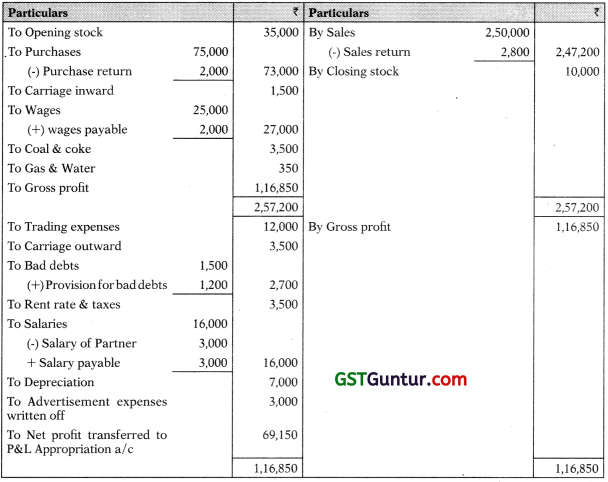

Trading and Profit and loss Account for the year ended on 31.12.05

Profit & loss Appropriation Account

Balance sheet as on 31.12.05

Manufacturing Account.

Question 16.

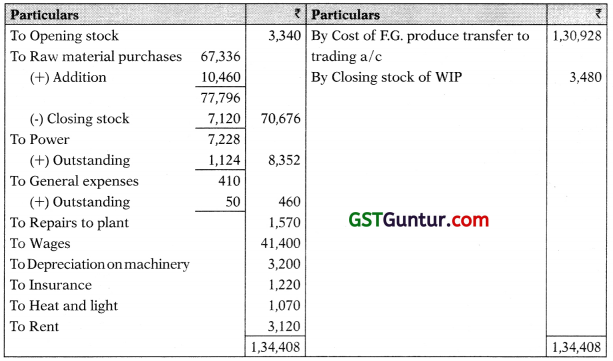

Prepare Manufacturing, Trading and Profit and Loss account for the year ended on 31st December, 2005 and Balance Sheet as at that date of Shri S. Singh, manufacturers, from the following Trial Balance & information.

Trial Balance as at 31st December, 2005

Additional Information:

Stock on 31st December, 1998 were:

- Raw-materials ₹ 7,120

- Work-in-progress ₹ 3,480

- Finished goods ₹ 19,300

- Packing materials ₹ 250

The following liabilities are to be provided for:

- Factory power ₹ 1,124

- Rent & Rates ₹ 772

- Light & Heat ₹ 320

- General expenses – Factory ₹ 50

- General expenses – Office ₹ 80

Insurance prepaid ₹ 340

Provide depreciation at 10% p.a. on Plant and machinery and 5% p.a. on furniture. Increase Bad debts provision by ₹ 1,000.

Five sixth of Rent & Rates, Light & Heat, and Insurance are to be allocated to the Factory and one sixth to the office.

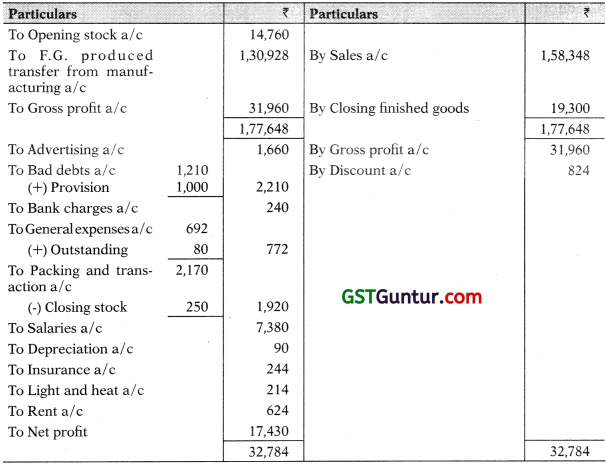

Solution:

M/s. S. Singh

Manufacturing Account for the year ended on 31st December, 1998

Trading and P&L a/c for the year ended on 31st December, 1998

Balance Sheet as on 31st December, 1998

Question 17.

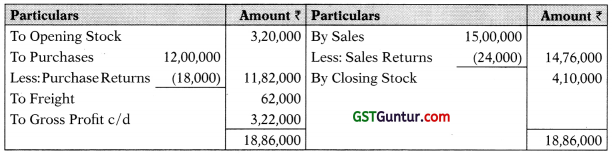

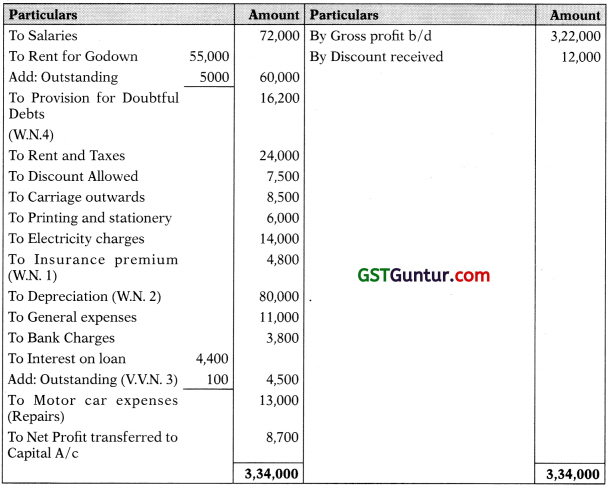

The following are the balances extracted from the books of Shri Raghuram as on 31.03.2018, who carries on business under the name and style of M/s Raghuram and Associates at Chennai:

Prepare Trading and Profit and Loss Account for the year ended 31.03.2018 and the Balance Sheet as at that date after making provision for the following:

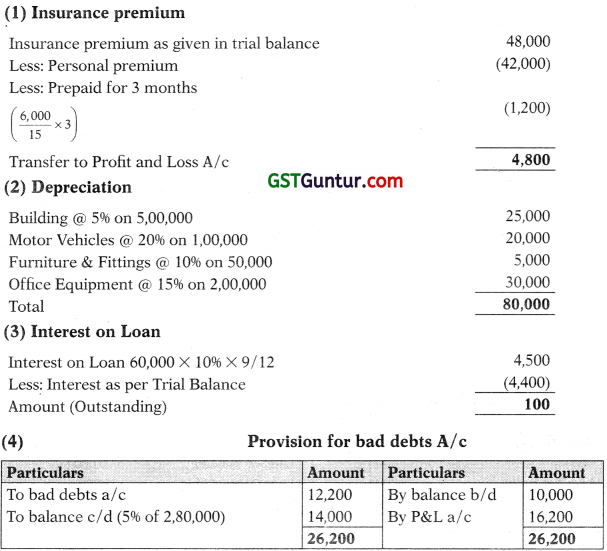

(a) Depreciate Building by 5%, Furniture and Fixtures by 10%, Office Equipment by 15% and Motor Car by 20%.

(b) Value of stock at the close of the year was ₹ 4,10,000.

(c) One month rent for godown is outstanding.

(d) Interest on loan from Rajan is payable @10% per annum. This loan was taken on 01.07.2017

(e) Reserve for bad debts is to be maintained at 5% of Sundry debtors

(f) Insurance premium includes ₹ 42,000 paid towards proprietor’s life insurance policy and the balance of the insurance charges cover the period from 01.04.2017 to 30.06.2018.

Solution:

M/s Raghuram & Associates

Trading Account for the year ended on 31st March 2018

M/s Raghuram & Associates

Profit and Loss Account for the year ended on 31st March 2018

Balance Sheet of M/s Raghuram & Associates as at 31st March 2018

Working Notes:

![]()

Question 18.

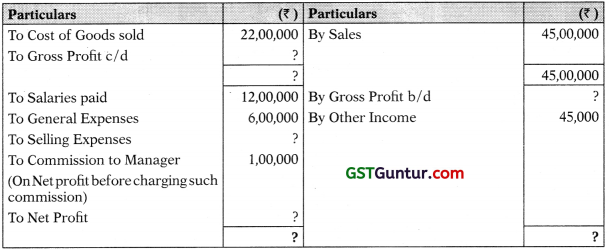

Mr. Fazhil is a proprietor in business of trading. An abstract of his Trading and P&L Account is as follows :

Trading and P&L A/c for the year ended on 31st March, 2018

Selling expenses amount to 1% of total Sales.

You are required to compute the missing figure.

Solution :

Trading & Profit & Loss A/c

(for the year ending on 31st March, 2018)

Question 19.

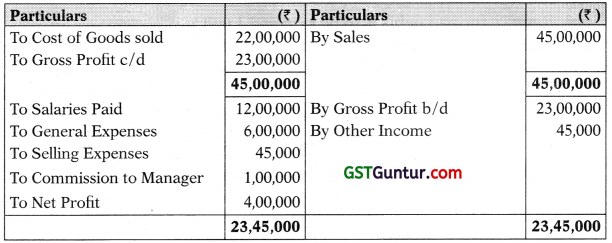

Following particulars are extracted from the books of Mr. Sandeep for the year ended 31st December, 2018.

Other information :

(i) Closing stock was valued at ₹ 4,500

(ii) Salary of Rs. 100 and Tax of ₹ 200 are outstanding whereas insurance . ₹ 50 is prepaid.

(iii) Commission received in advance is ₹ 100

(iv) Interest accrued on investment is ₹ 210

(v) Interest on overdraft is unpaid ₹ 300

(vi) Reserve for bad debts is to be kept at ₹ 1,000

(vii) Depreciation on furniture is to be charged @ 10%

You are required to prepare the final accounts after making above adjustments.

Solution:

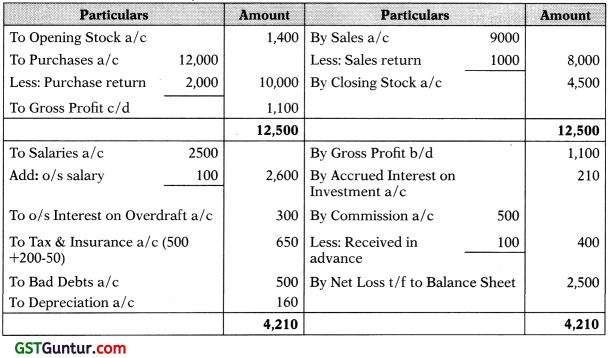

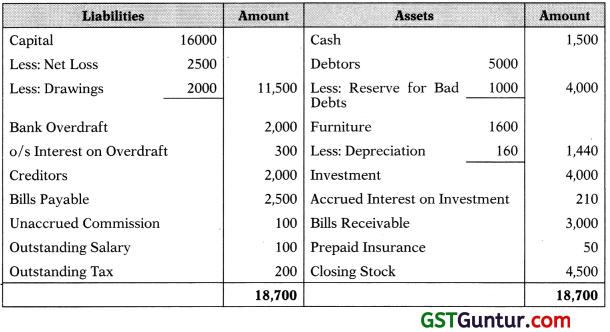

Trading & Profit & Loss A/c

for the year ended 31st Dec. 2018

Balance Sheet as at 31st Dec., 2018

True or False

Question 1.

Profit and loss account shows the financial position of the concern.

Answer:

False: Profit and loss account shows the profit or loss of a concern for a particular accounting period.

Question 2.

Profit and loss account is a point statement whereas a balance sheet is a period statement.

Answer:

False: A profit and loss account is a period statement and a balance sheet is a point statement.

Question 3.

The provision for discount on debtors is calculated before deducting the provision for doubtful debts from debtors

Answer:

False: The provision for discount on debtors is calculated after deducting the provision for doubtful debts from debtors

Question 4.

The gain from sale of capital assets need not be added to revenue to ascertain the net operating profit of a business.

Answer:

True: The profit on sale of capital assets should not be added to ascertain the net operating profit of a business.

![]()

Question 5.

Under the ‘liquidity approach’ assets which are most liquid are presented at the bottom of the balance sheet.

Answer:

False: Under the ‘liquidity approach’ assets which are most liquid are presented first, like, cash & cash equivalents.

Question 6.

The proprietor of a shop feels that he has made a loss due to closing stock being zero.

Answer:

False: Only closing stock is not taken in the calculation of the profits of a business.

Question 7.

Closing stock will never appear in the trial balance.

Answer:

False: Closing stock may appear in the trial balance if an adjusting entn relating to closing stock has already been passed and adjusted purchases are given in trial balance.

Question 8.

If Closing Stock appears in the Trial Balance:

The closing inventory is then not entered in Trading Account. It is shown only in the balance sheet.

Answer:

True: If closing stock appears in the Trial balance it indicates that it is already been adjusted with the purchase and will be shown in the Balance Sheet only.