Accounting for Reconstruction of Companies – CA Inter Advanced Accounts Question Bank is designed strictly as per the latest syllabus and exam pattern.

Accounting for Reconstruction of Companies – CA Inter Advanced Accounting Question Bank

Question 1.

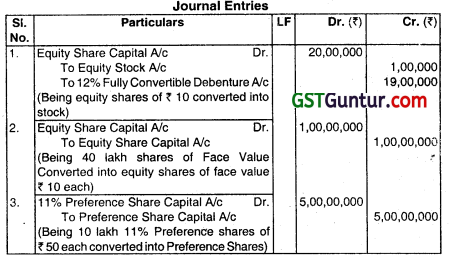

Pass journal entries for the following transactions:

(i) Conversion of 2 lahks fully paid equity shares of ₹ 10 each into stock of ₹ 1,00,000 and balance has 12% fully convertible Debenture.

(ii) Consolidation of 40 lakh fully paid equity shares of ₹ 2.50 each into 10 lakh fully paid equity share of 10 each.

(iii) Sub-division of 10 lahks fully paid 11% preference shares of ₹ 50 each into 50 lakh fully paid 11% preference shares of ₹ 10 each. (Nov 2013, 3 marks)

Answer:

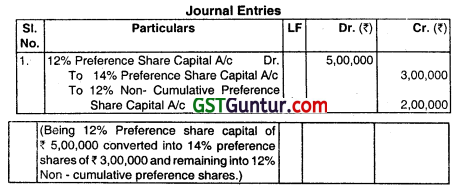

Question 2.

Conversion of 12% preference shares of ₹ 5,00000 into 14% preference shares ₹ 3,00,000 and remaining balance as 12% Non-cumulative preference shares. (Nov 2013, 1 mark)

Answer:

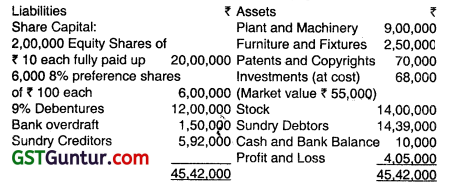

Question 3.

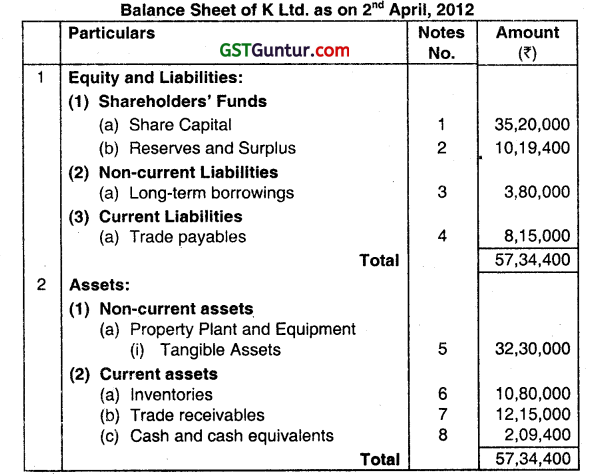

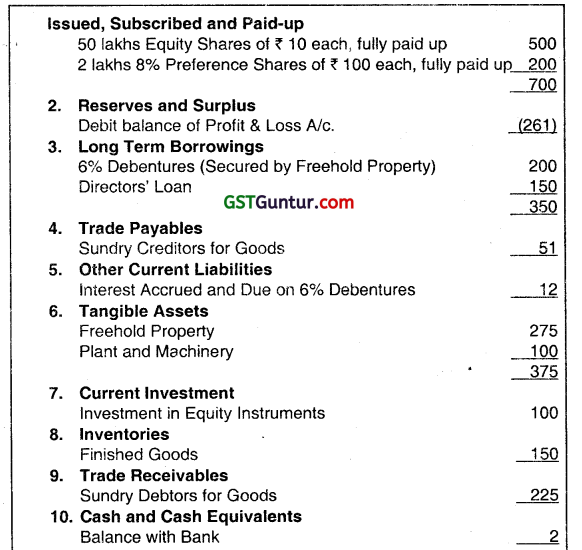

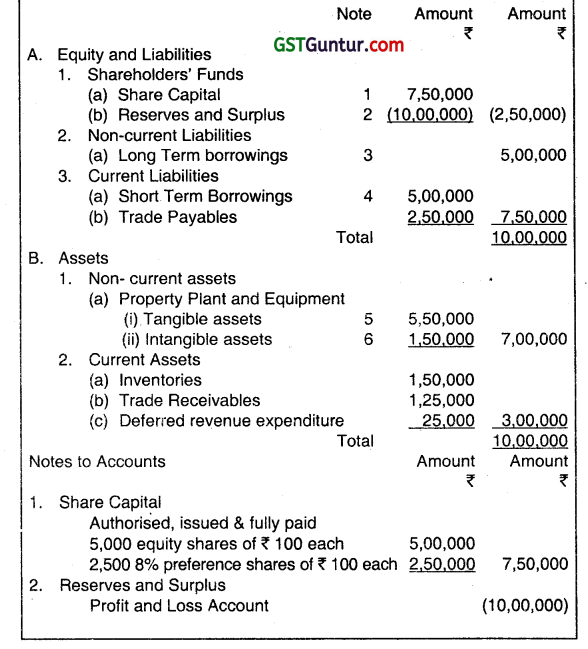

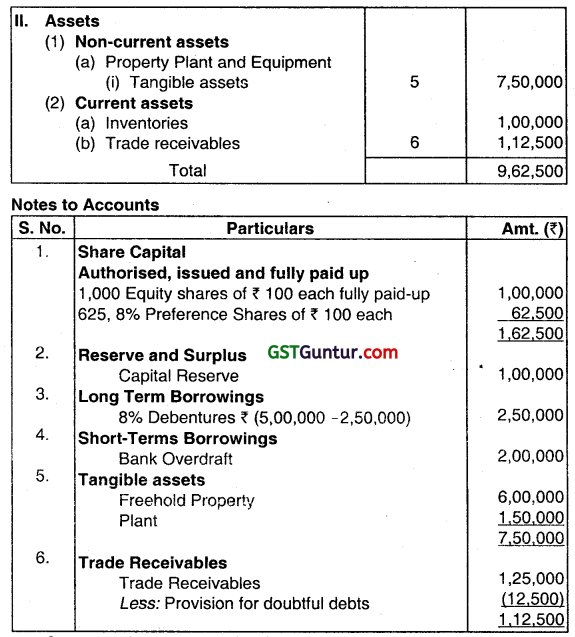

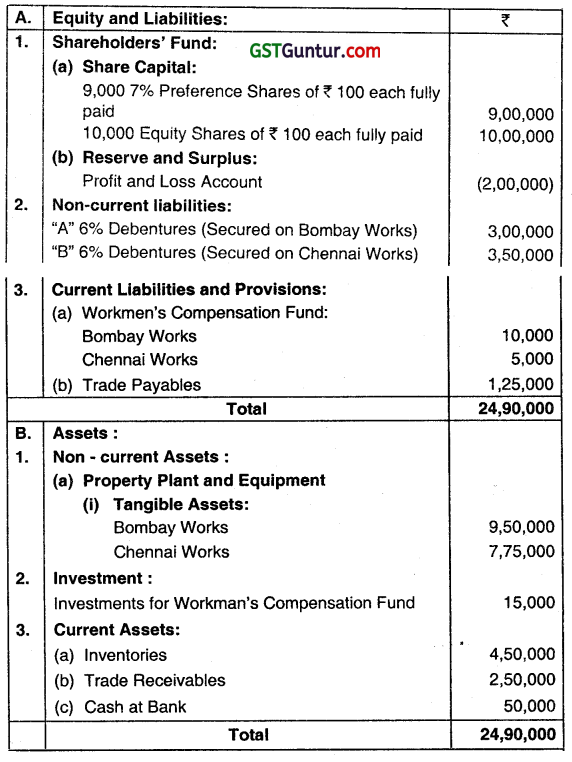

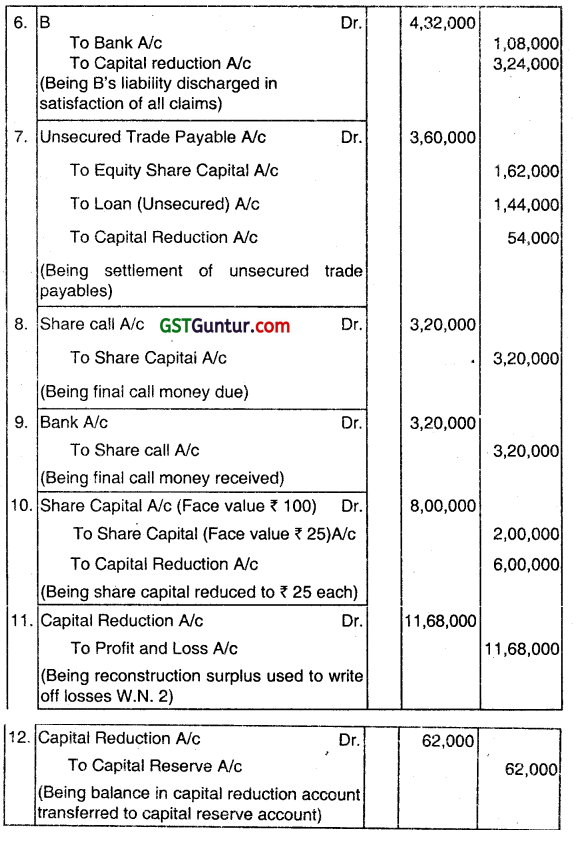

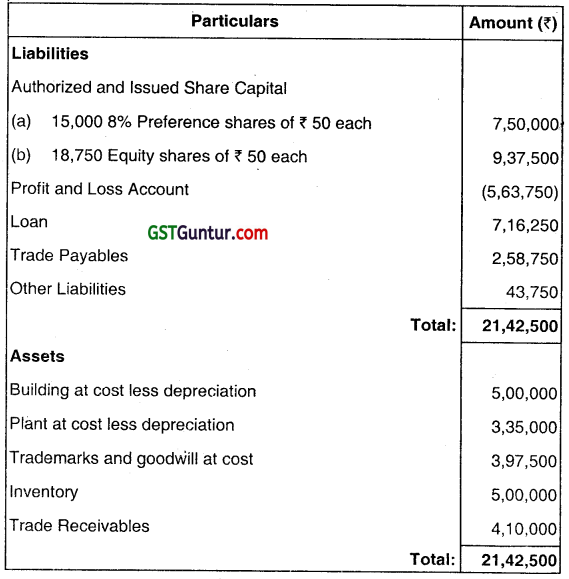

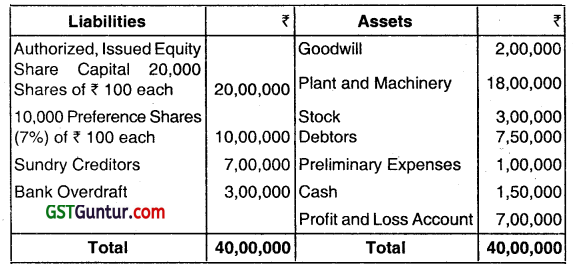

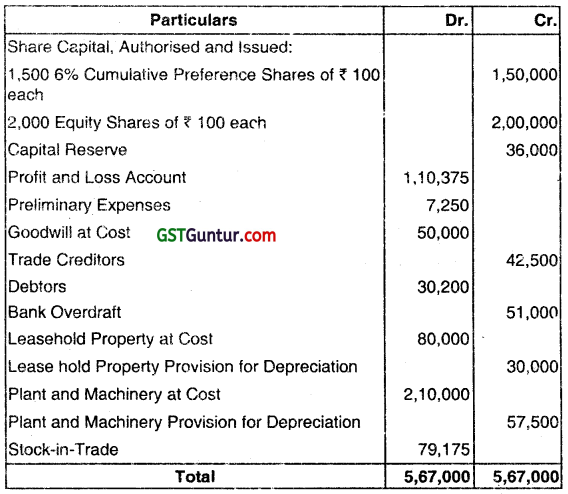

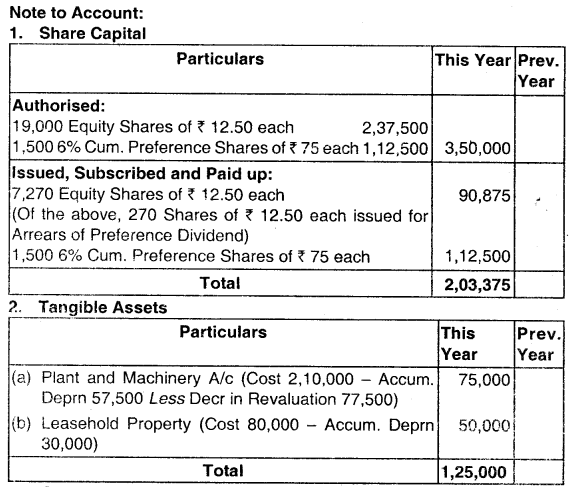

Following is the Balance Sheet of ABC Ltd. as at 31 March 2007:

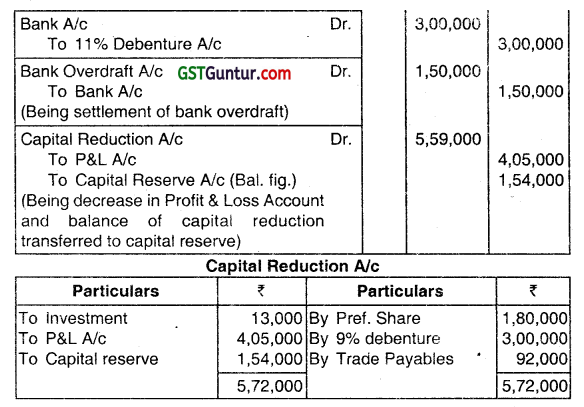

The following scheme of reconstruction was finalized:

(i) Preference shareholders would give up 30% of their Capital in exchange for allotment of 11% Debentures to them.

(ii) Debenture holders having charge on Plant and Machinery would accept Plant and Machinery in full settlement of their dues.

(iii) Stock equal to ₹ 5,00,000 in book value will be taken over by Sundry Creditors in full settlement of their dues.

(iv) Investment value to be reduced to Market price.

(v) The Company would Issue 11% Debentures for ₹ 3,00,000 and augment its working capital requIrement after settlement of bank overdraft. Pass necessary Journal Entries in the books of the company. Prepare Capital reduction account and Balance Sheet of the company after internal reconstruction. (Nov 2007, 16 marks)

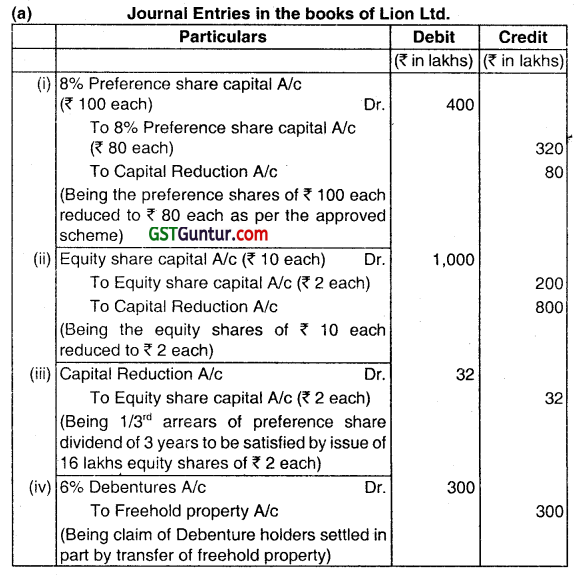

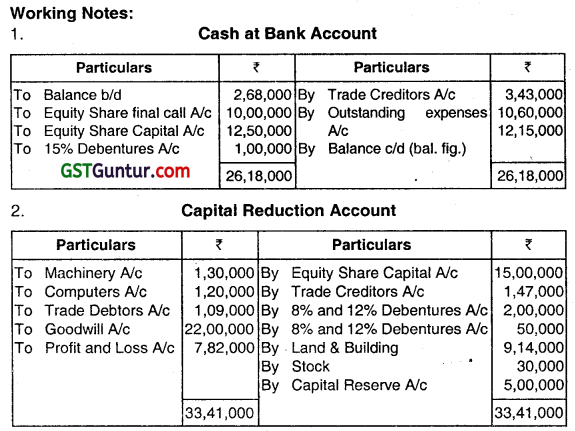

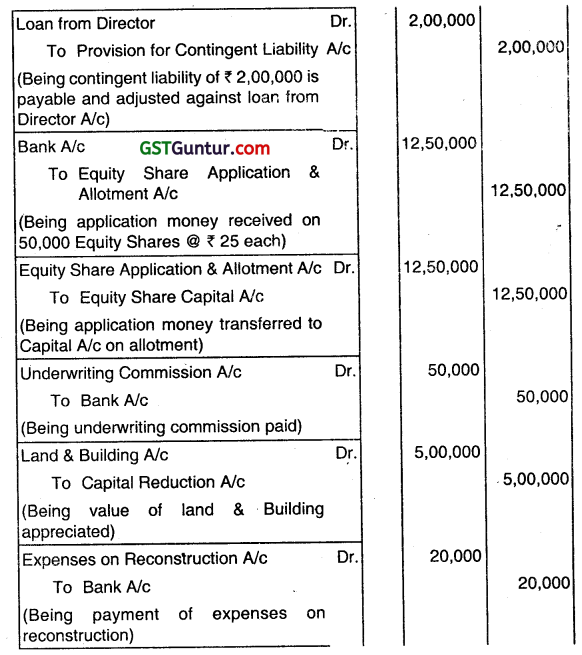

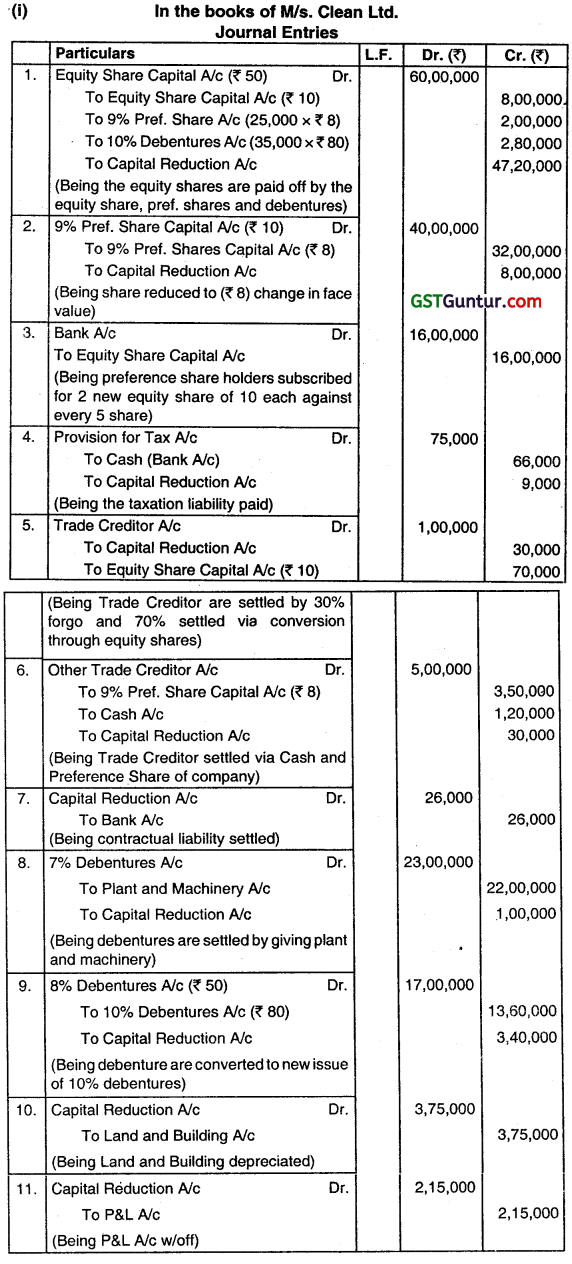

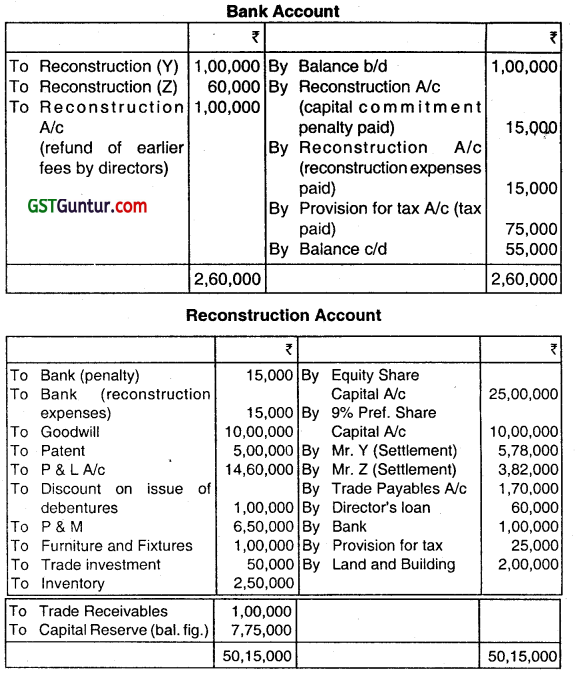

Answer:

![]()

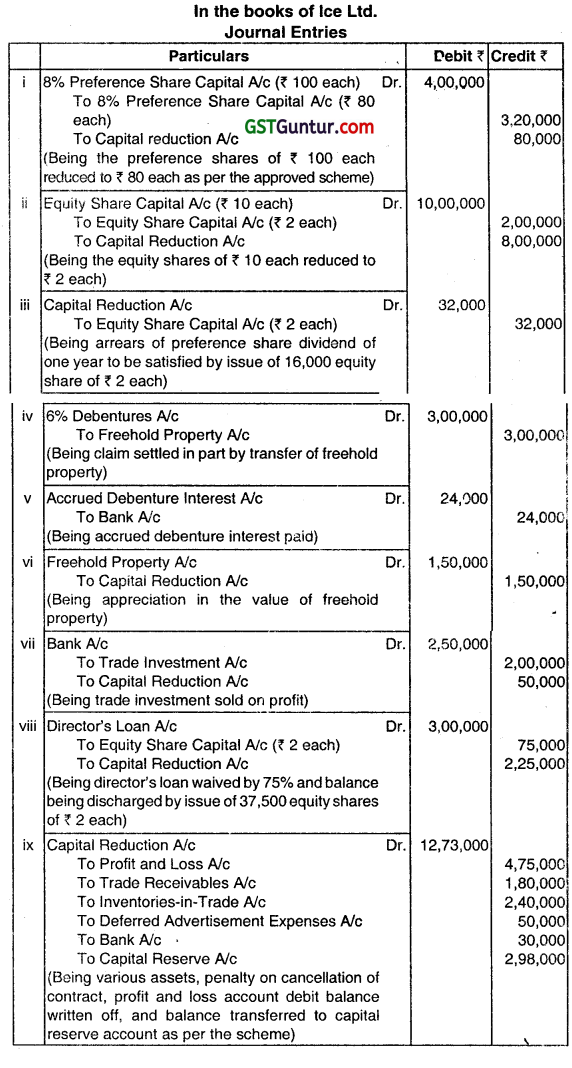

Question 4.

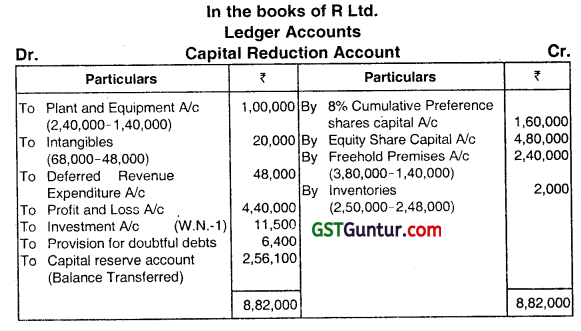

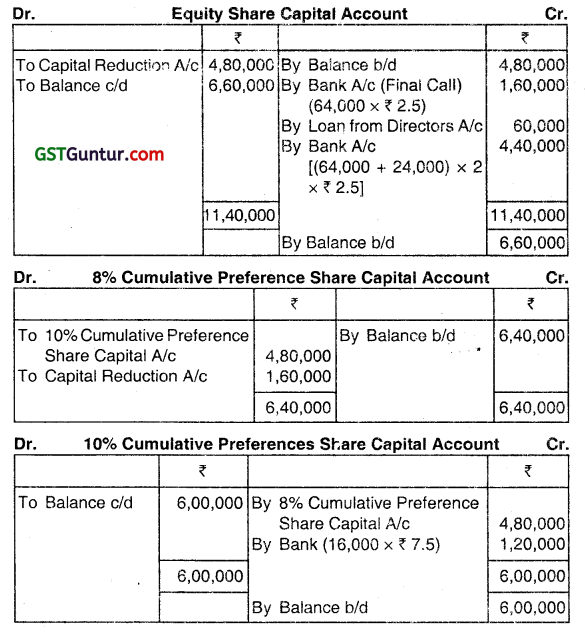

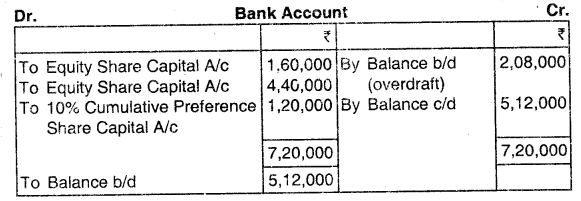

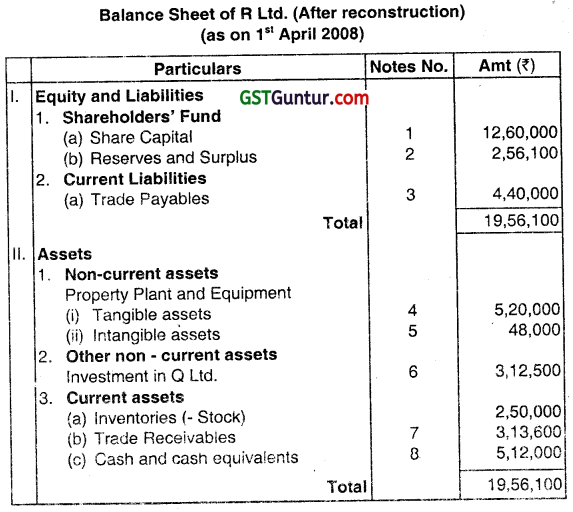

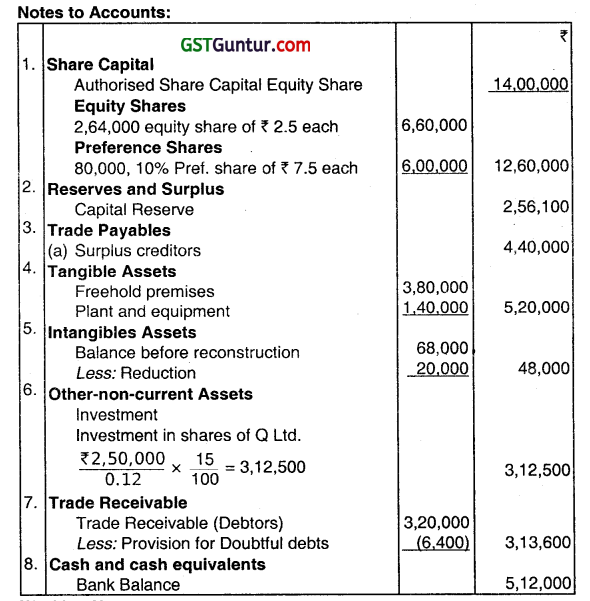

The Balance Sheet of R Ltd., at 31st March. 2008 was as follows:

Note: The arrear of Preference dividends amount to ₹ 51,200.

A scheme of reconstruction was duly approved with effect from 1 April 2008 under the conditions stated below:

(a) The unpaid amount on the Equity shares would be called up.

(b) The Preference shareholders would forego their arrear dividends. In addition, they would accept a reduction of ₹ 2.5 per share. The dividend rate would be enhanced to 10%.

(c) The Equity shareholders would accept a reduction of ₹ 7.5 per share.

(d) R Ltd. holds 21,600 shares in Q Ltd. This represents 15% of the Share capital of that company. Q Ltd. is not a quoted company. The average net profit (after tax) of the company is ₹ 2,50,000. The shares would be valued based on 12% capitalization rate.

(e) A bad debt provision at 2% would be created.

(f)

The other assets would be valued as under: ₹

Intangibles 48,000

Plant 1,40,000

Freehold premises 3,80,000

Stocks 2,50,000

(g) The Profit and Loss account debit balance and the balance standing to the debit of the deferred Revenue Expenditure account would be eliminated.

(h) The directors would have to take equity shares at the new tace value of ₹ 2.5 per share in settlement of their loan.

(i) The Equity shareholders, including the directors, who would receive equity shares in settlement of their loans, would take up two new equity shares for every one held.

(j) The Preference shareholders would take up one new preference share for every four held.

(k) The authorized Share capital would be restated to ₹ 14,00,000.

(l) The new face values of the shares preference and equity will be maintained at their reduced levels.

You are required to prepare:

(i) Necessary Ledger accounts to effect the above; and

(ii) The Balance Sheet of the company after reconstruction. (Nov 2008, 16 marks)

Answer:

Working Note:

1. Reduction in hie value of investment in shares of Q Ltd.

₹ 3,24,000 – ₹ 3,12.500 = ₹ 11,500.

Question 5.

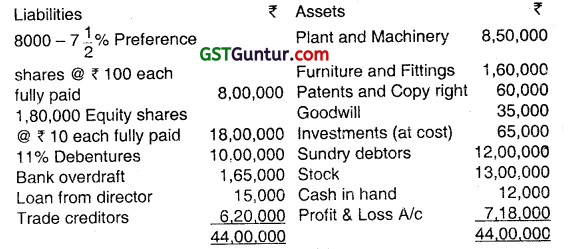

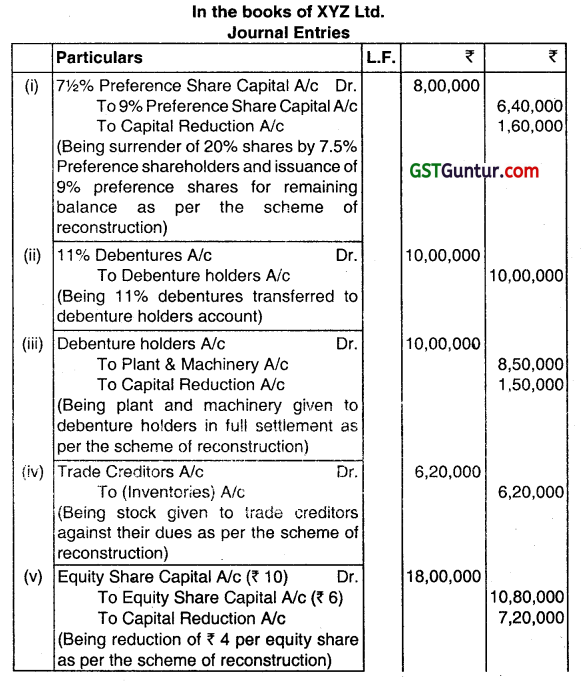

Following is the Balance Sheet of XYZ Ltd. as on 31st March, 2010:

Due to heavy losses and overvaluation of Assets, the following scheme of reconstruction was finalised:

(i) Preference shareholder will surrender their 20% shares and they have been allotted 9% (new) preference shares for remaining amount.

(ii) DehentureholderS having charge on plant and machinery would accept plant and machinery in full settlement.

(iii) Trade creditors accepted to take over the stock upto the value of ₹ 6,20,000.

(iv) Equity shareholders are to accept reduction of ₹ 4 per share.

(v) Investment is to be valued at market price i.e.₹ 60,000.

(vi) Sundry debtors and remaining stock is to be valued at 90% of their book value.

(vii) Directors have to forgo their loan in full.

(viii) Patents and Copy Right and Goodwill have no more value.

Pass necessary Journal entries in the books of XYZ Ltd. assuming that all the legal formalities have beer, completed. Prepare Capital reduction account and Balance Sheet of the company after reduction. (May 2010, 16 marks)

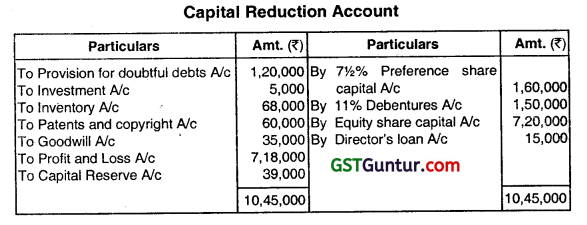

Answer:

Question 6.

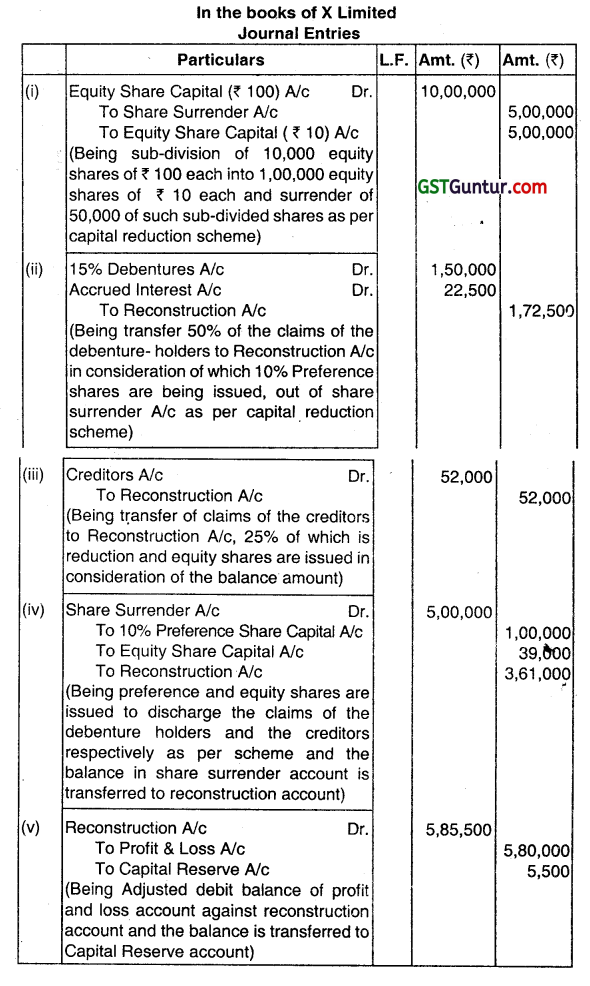

The Balance Sheet of X Limited as on 31st March 2011 was as follows:

It was decided to reconstruct the company for which necessary resolution was passed and sanctions were obtained from the appropriate authorities.

Accordingly, it was decided that:

(i) Each share be sub-divided into 10 fully paid-up equity share of ₹ 10 each,

(ii) After sub-division, each shareholder shaN surrender to the company 50% of his holding for the purpose of reissue to debenture holders and creditors as necessary.

(iii) Out of shares surrendered, 1000 shares of ₹ 10 each shall be converted into 10% Preference Shares of ₹ 10 each fully paid up.

(iv) The claims of the debenture holders shall be reduced by 50%. In consideration of the reduction, the debenture holder shall receive Preference Shares of ₹ 1,00,000 which are converted out of shares surrendered.

(v) Creditors claim shall be reduced by 25%, it is to be settled by the issue of equity shares of 10 each out of shares surrendered.

(vi) Balance of Profit and Loss Account to be written off.

(vii) The shares surrendered and not re-issued shall be cancelled.

Pass Journal Entries giving effect to the above and the resultant Balance Sheet. (May 2011,16 marks)

Answer:

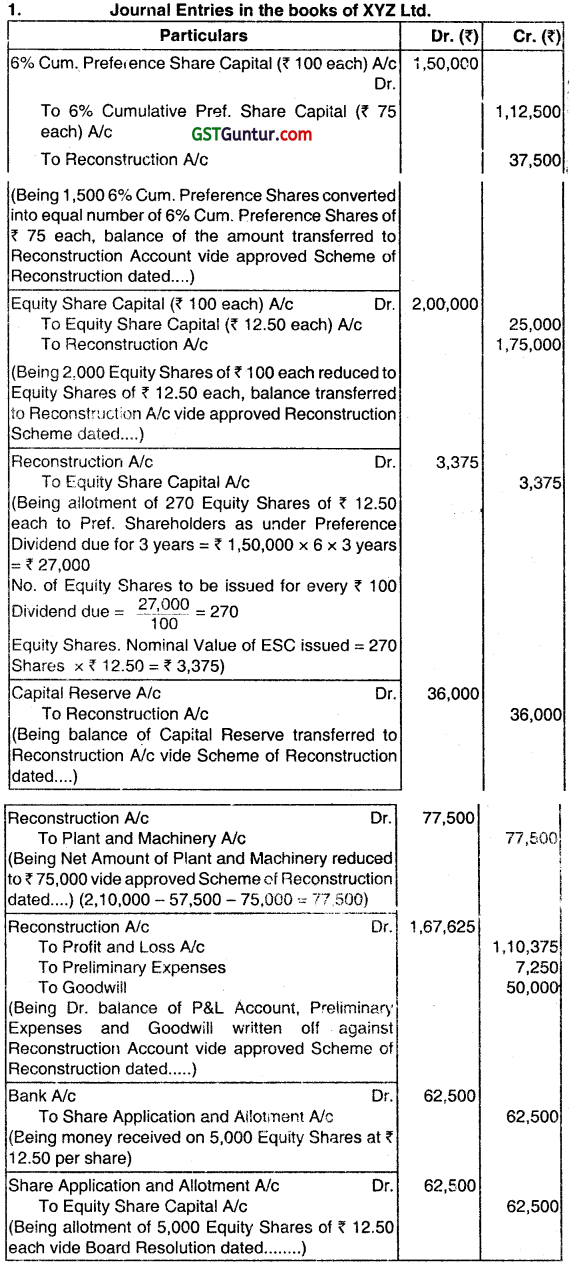

Question 7.

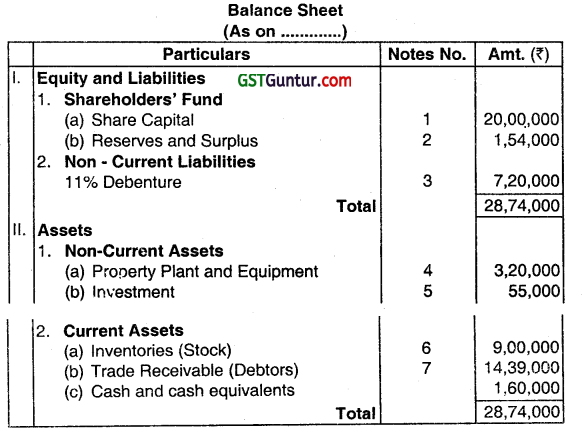

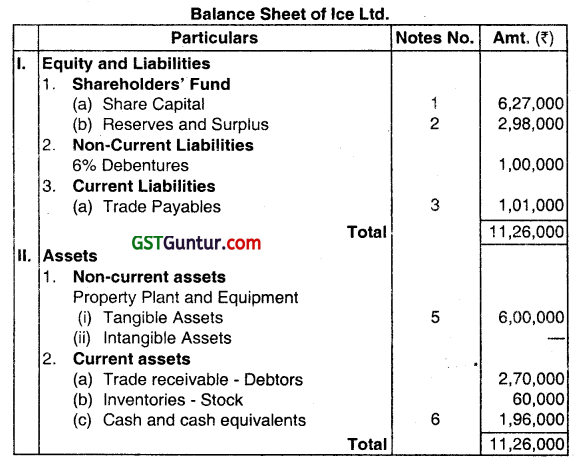

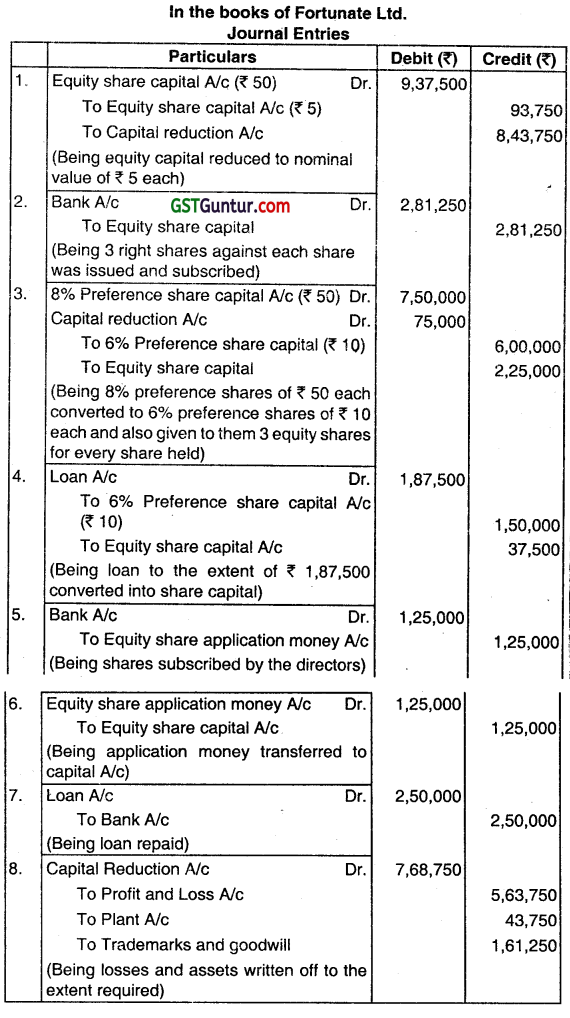

The Balance Sheet of M/s. Ice Ltd. as on 31-3-2011 is given below:

The Board of Directors of the Company decided upon the following scheme of reconstruction with the consent of respective stakeholders:

(i) Preference shares are to be written down to ₹ 80 each and equity shares to 2 each.

(ii) Preference dividend in arrear for 3 years to be waived by 2/3rd and for balance 1/3, equity shares of 2 each to be allotted.

(iii) Debenture holders agreed to take one freehold property at its book value of ₹ 3,00,000 in part payment of their holding. Balance debentures to remain as liability of the company.

(iv) Arrear debenture interest to be paid in cash.

(v) Remaining freehold property to be valued at ₹ 4,00,000

(vi) Investment sold Out for ₹ 2,50000.

(vii) 75% of Director’s loan to be waived and for the balance, equity share of ₹ 2 each to be allotted.

(viii) 40% of sundry debtors, 80% of stock, and 100% of deferred advertisement expenses to be written off.

(ix) Company’s contractual commitments amounting to ₹ 6,00,000 have been settled by paying 5% penalty of contract value.

Show the Journal Entries for giving effect to the internal re-construction and draw the Balance Sheet of the company after effecting the scheme. (Nov 2011, 16 marks)

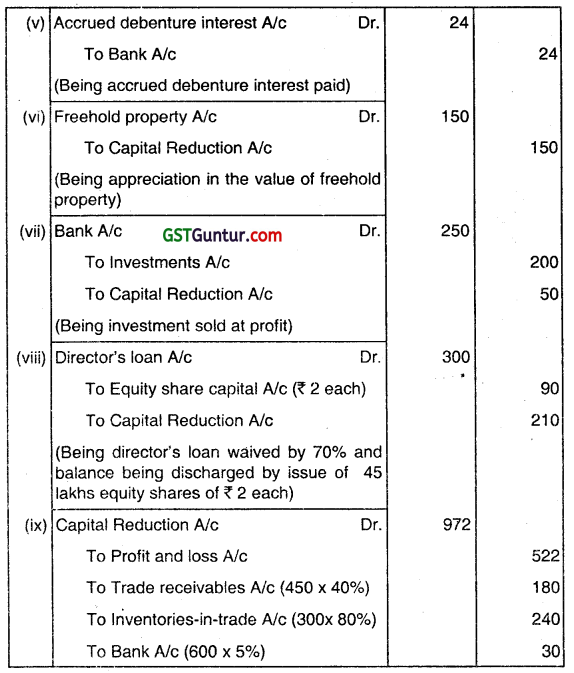

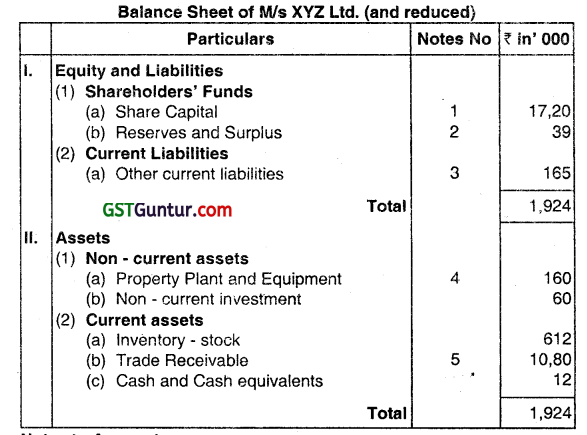

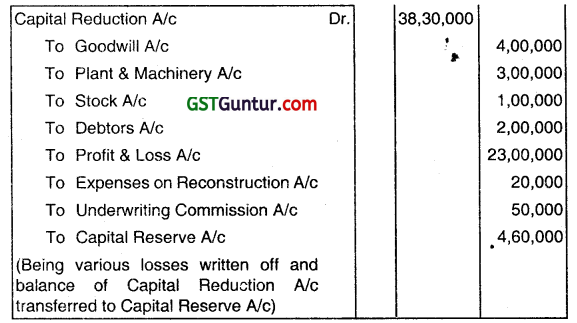

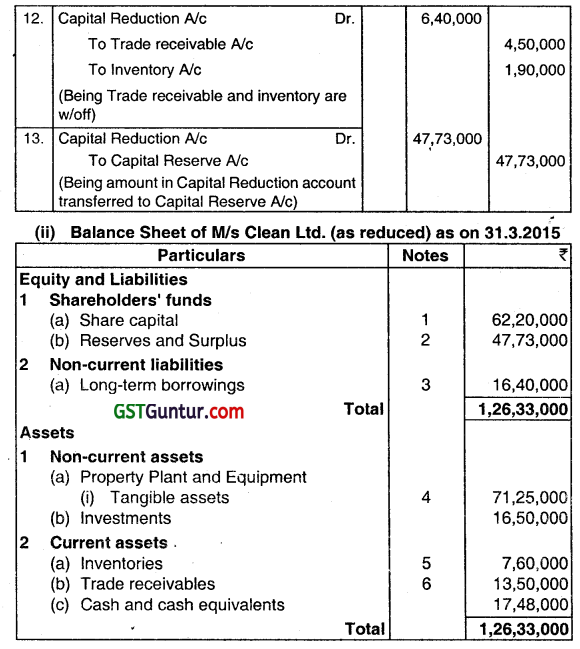

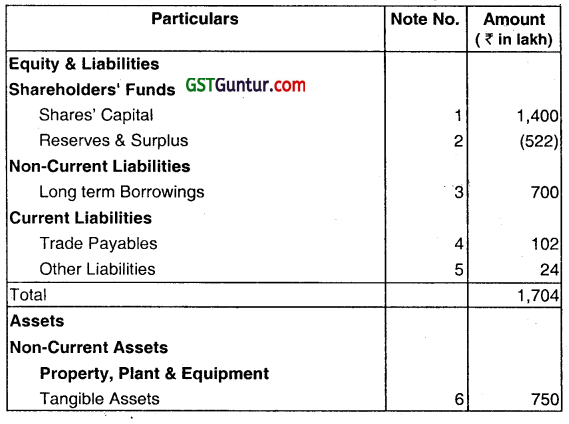

Answer:

![]()

Question 8.

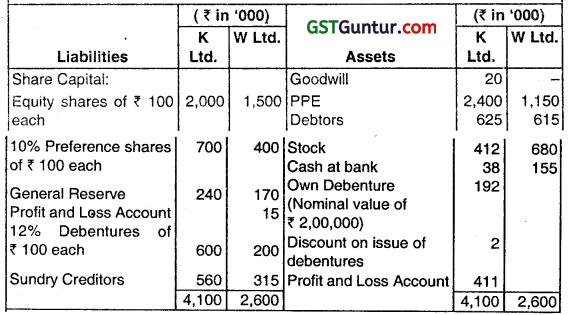

M/s Platinum Limited has decided to reconstruct the Balance Sheet since it has accumulated huge losses. The following is the Balance Sheet of the company as on 31st March 2012 before reconstruction:

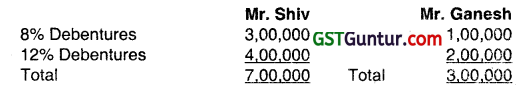

Following is the interest of Mr. Shiv and Mr Ganesh in M/s Platinum Limited:

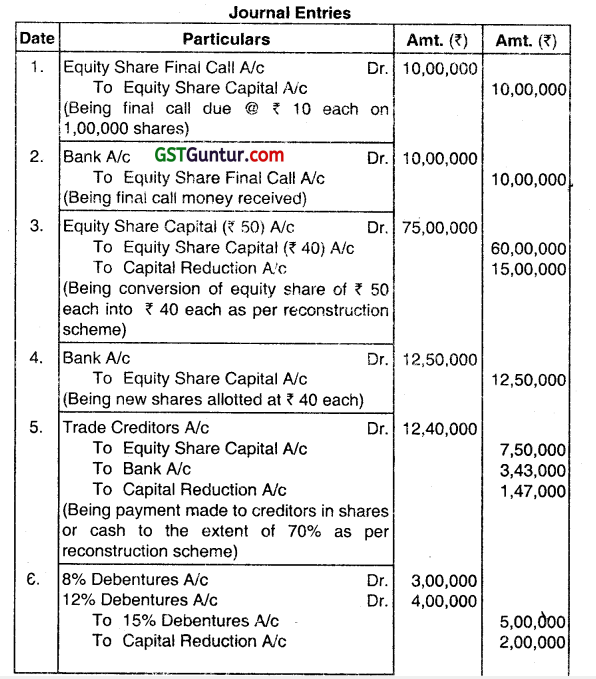

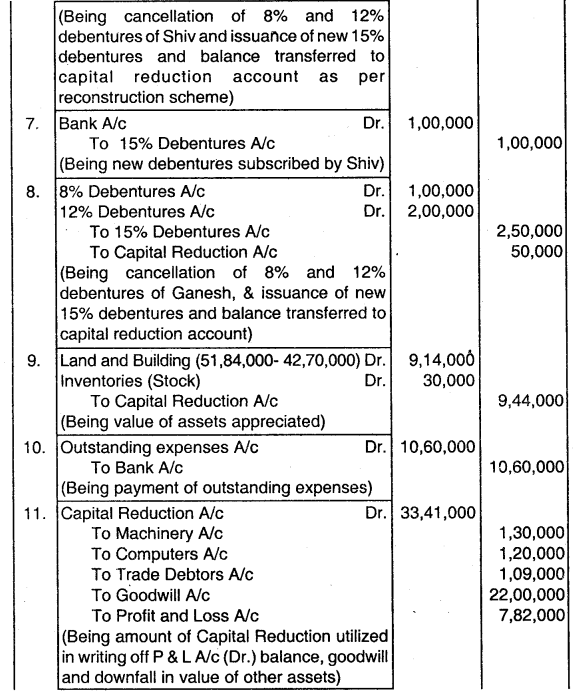

The following scheme of internal reconstruction was framed and implemented, as approved by the court and concerned parties:

1. Uncalled capital is to be called up in full and then all the shares to be converted into Equity Shares of ₹ 40 each.

2. The existing shareholders agree to subscribe in cash, fully paid-up equity shares of 40 each for ₹ 12,50,000.

3. Trade Creditors are given option of either to accept fully paid equity shares of ₹ 40 each for the amount due to them or to accept 70% of the amount due to them in cash in full settlement of their claim. Trade Creditors for ₹ 7,50,000 accept equity shares and rest of them opted for cash towards full and final settlement of their claim.

4. Mr. Shiv agrees to cancel debenture amounting for ₹ 2,00,000 out of total debentures due to him and agree to accept 15% Debentures for the balance amount due. He also agree to subscribe further 15% Debentures in cash amounting to ₹ 1,00,000.

5. Mr. Ganesh agrees to cancel debenture amounting to ₹ 50,000 out of total debentures due to him and agree to accept 15% Debentures for the balance amount due.

6. Land & Building to be revalued at ₹ 51,84,000. Machinery at ₹ 7,20,000, Computers at ₹ 4,00,000, Stock at ₹ 3,50,000 and Trade Debtors at 10% less to as they are appearing in Balance Sheet as above.

7. Outstanding Expenses are fully paid in cash.

8. Goodwill and Profit & Loss A/c will be written off and balance, if any, of Capital Reduction A/c, will be adjusted against Capital Reserve.

You are required to pass necessary Journal Entries for all the above transactions and draft the company’s Balance Sheet Immediately after the reconstruction. (May 2012, 16 marks)

Answer:

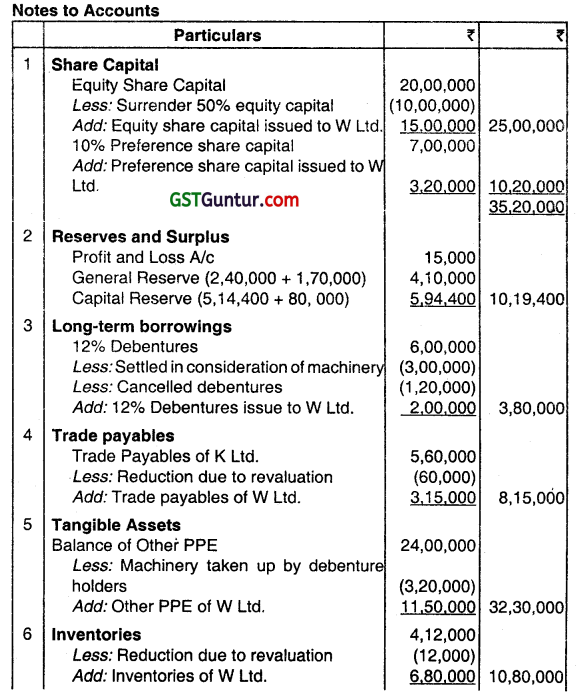

Question 9.

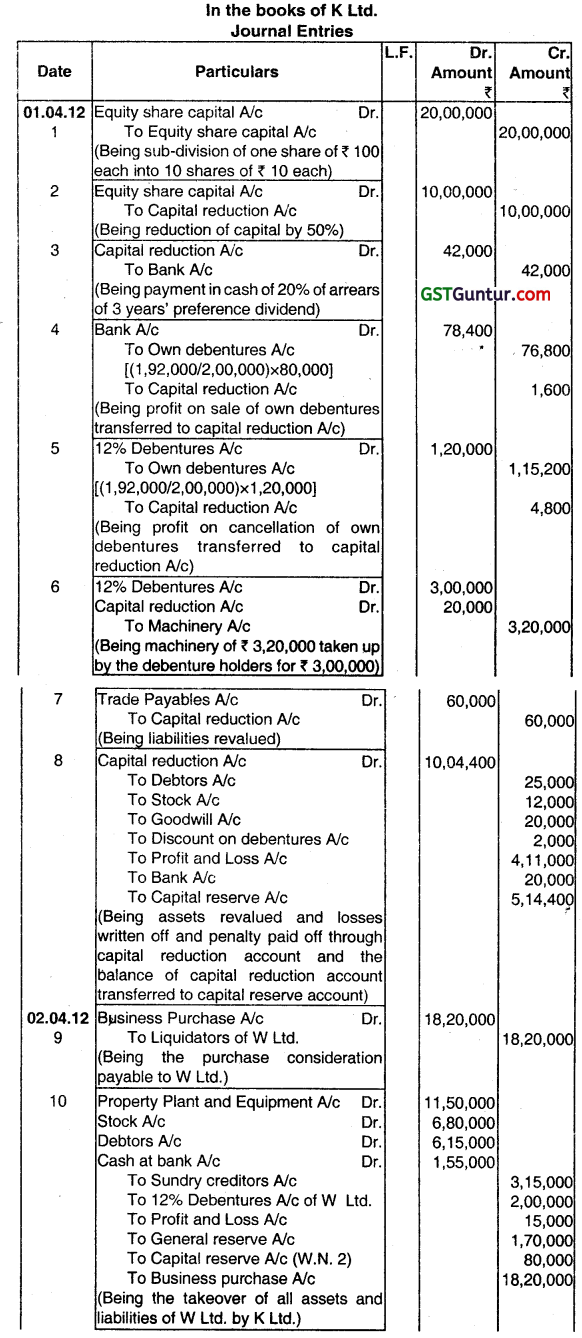

Following are the summarized Balance Sheet of Companies K Ltd. and W Ltd., as at 31.12.2011:

On 01.04.2012. K Ltd. adopted the following scheme of reconstruction:

(i) Each equity share shall be sub-divided into 10 equity shares of ₹ 10 each fully paid up. 50% of the equity share capital would be surrendered to the company.

(ii) Preference dividends are in arrears for 3 years. Preference shareholders agreed to waive 80% of the dividend claim and accept payment for the balance.

(iii) Own debentures of ₹ 80,000 (nominal value) were sold at ₹ 98 cum interest and remaining own debentures were cancelled.

(iv) Debenture holders of ₹ 3,00,000 agreed to accept one machinery of book value of ₹ 3,20,000 in full settlement.

(v) Creditors, Debtors and stock were valued at ₹ 5,00,000, ₹ 6,00,000 and ₹ 4,00,000 respectively. Goodwill, discount on issue of debentures and Profit and Loss account (Dr.) are to be written off.

(vi) The company paid ₹ 20,000 as penalty to avoid capital commitments of ₹ 4,00,000.

On 02.04.2012, a scheme of absorption was adopted, K Ltd. would take over W Ltd. The purchase consideration was fixed as below:

(a) Equity shareholders of W Ltd. will be given 50 equity shares of ₹ 10 each fully paid up, in exchange for every 5 shares held in W Ltd.

(b) Issue of 10% preference shares of ₹ 100 each in the ratio of 4 preference shares of K Ltd. for every 5 preference shares held in W Ltd.

(c) Issue of 12% debentures of ₹ 100 each of K Ltd. for every 12% debentures in W Ltd.

Pass necessary Journal entries ¡n the books of K Ltd. and draw the resultant Balance Sheet as at 2 April 2012. (Nov 2012,16 Marks)

Answer:

Note: In the aforesaid question, summarised balance sheets of K Ltd. and W Ltd. as on 31.12.2011 are given. But the internal reconstruction and amalgamation took place on 1.4.2012 and 2.4.2012 respectively. Since, no information have been provided for the intervening period of 3 months (i.e. from 1.1.2012 to 31.3.2012). the above solution is given assuming this date of summarised balance sheets as 31.3.2012 Instead of 31.12.2011.

Alternatively, the solution may be given on the basis 0131.12.2011. In that case, the only difference will be that dividends on preference shares and interest on debentures for period of 3 months (i.e. from 1.1.2012 to 31.3.2012) will be considered at the time of internal reconstruction.

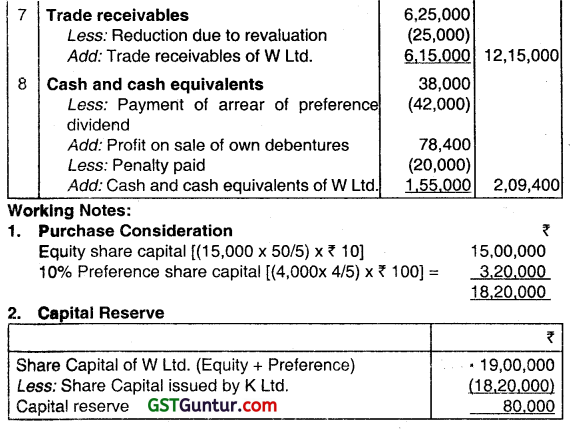

Question 10.

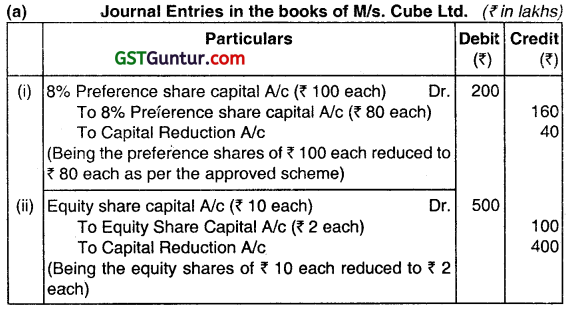

The Balance Sheet of M/s. Cube Limited as on 31-03-2013 is given below:

The Board of Directors of the company decided upon the following scheme of reconstruction with the consent of respective shareholders:

(1) Preference Shares are to be written down to ₹ 80 each and Equity Shares to ₹ 2 each.

(2) Preference Shares Dividend in arrears for 3 years to be waived by 2/3rd and for balance 1/3rd, Equity Shares of ₹ 2 each to be allotted.

(3) Debenture Holders agreed to take one Freehold Property at its book value of ₹ 150 lakh in part payment of their holding. Balance Debentures to remain as liability of the company.

(4) Interest accrued and due on Debentures to be paid in cash.

(5) Remaining Freehold Property to be valued at ₹ 200 lakhs.

(6) All investments sold out for ₹ 125 lakhs.

(7) 70% of Directors’ loan to be waived and for the balance. Equity Shares of ₹ 2 each to be allowed.

(8) 40 % of Sundry Debtors and 80% of Inventories to be written off.

(9) Company’s contractual commitments amounting to ₹ 300 lakhs have boon settled by paying 5% penalty of contract value.

You are required to:

(a) Pass Journal Entries for all the transactions related to internal reconstruction.

(b) Prepare Reconstruction Account and

(c) Prepare notes on Share Capital and Tangible Assets to Balance Sheet, immediately after the implementation of scheme of internal reconstruction. (May 2013, 16 marks)

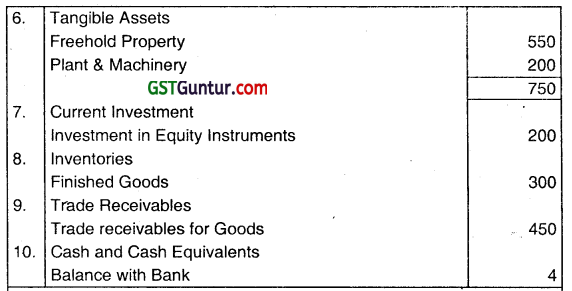

Answer:

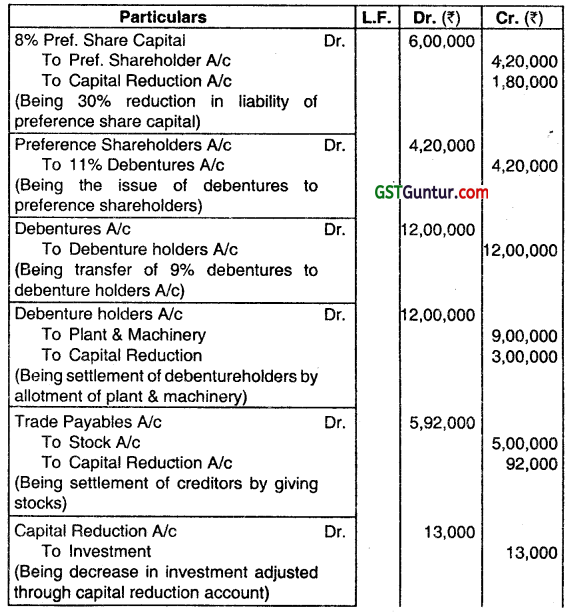

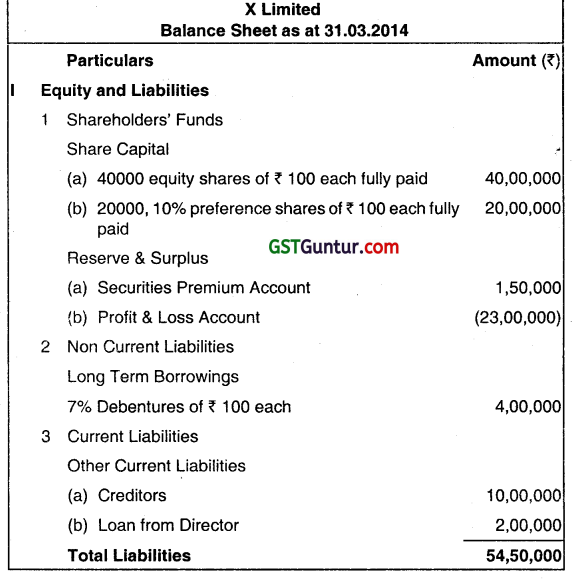

Question 11.

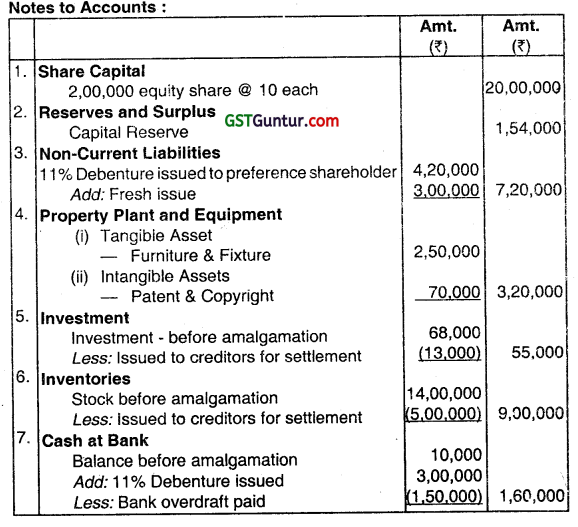

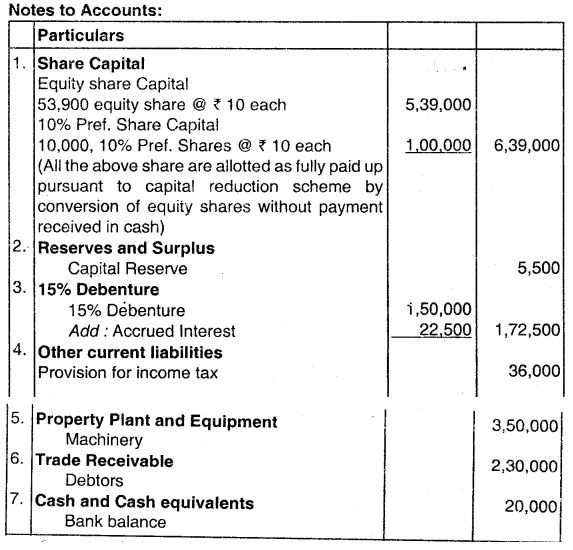

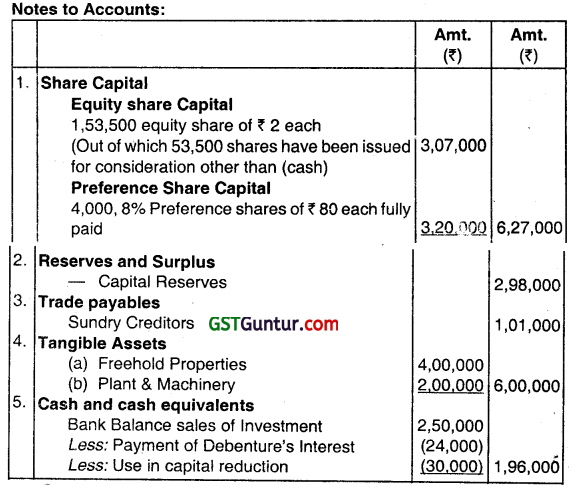

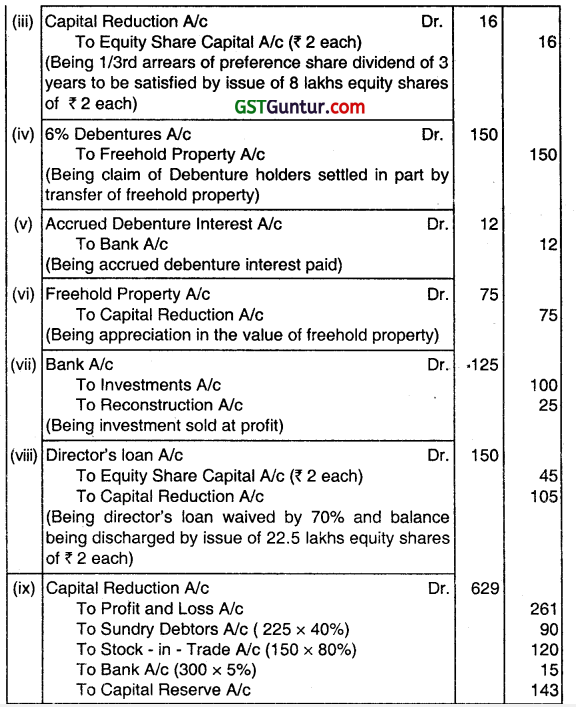

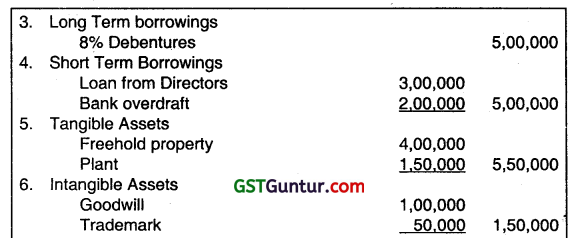

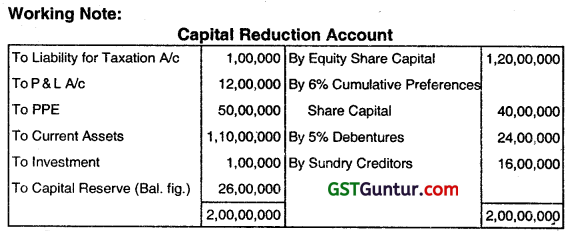

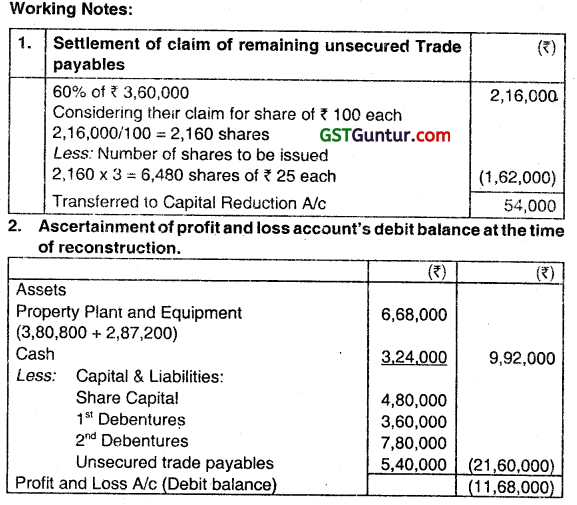

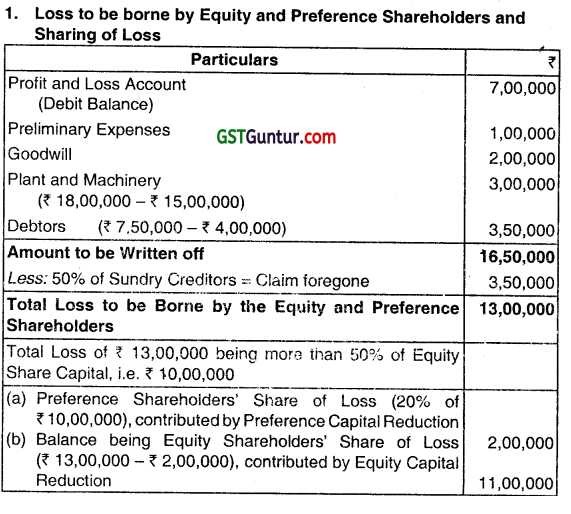

The summarized Balance Sheet of Bad Luck Ltd. as on 31st March. 2013 was as follows:

The following scheme of internal reconstruction was framed, approved by the Court, all the concerned parties and implemented:

(i) The preference shares to be written down to ₹ 25 each and the equity shares to ₹ 20 each. Each class of shares then to be converted into shares of ₹ 1oo each.

(ii) The debenture holders to take over freehold property (book value ₹ 2,00,000) at a valuation of ₹ 2,50,000 in part repayment of their holdings. Remaining freehold property to be revalued at ₹ 6,00,000.

(iii) Loan from directors to be waived off in full.

(iv) Stock of ₹ 50,000 to be written off, ₹12,500 to be provided for bad debts.

(v) Profit and Loss account balance, Trademark, goodwill, and deferred revenue expenditure to be written off.

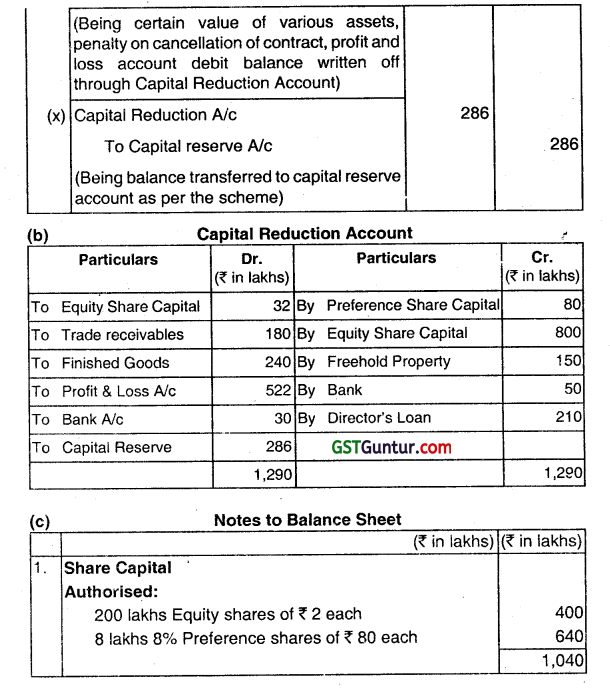

Pass Journal Entries for all the above-mentioned transactions. Also, Prepare Capital Reduction account and company’s Balance Sheet immediately after reconstruction. (May 2013, 16 marks)

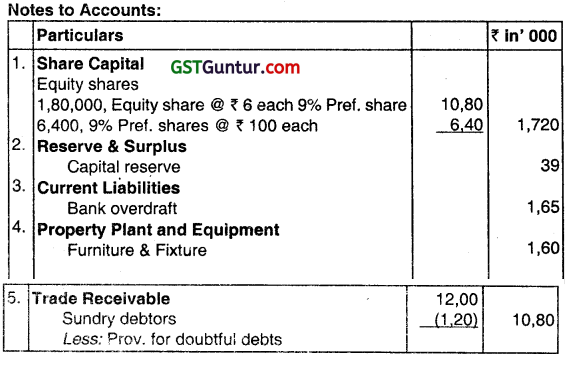

Answer:

![]()

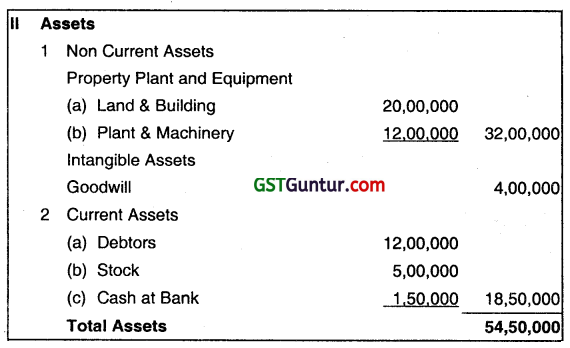

Question 12.

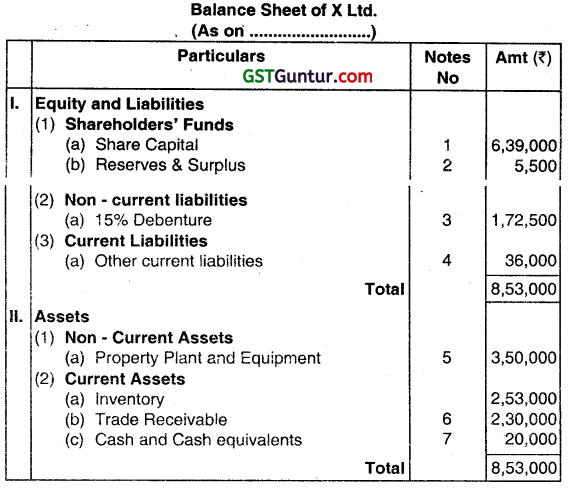

The Balance Sheet of X Ltd. as at 31st March 2014 was as follows:

No Dividend on Preference Shares has been paid for last 5 years. The following scheme of reorganization was duly approved by the Court:

(i) Each equity share to be reduced to ₹ 25.

(ii) Each existing Preference Share to be reduced to ₹ 75 and then exchanged for one new 13% Preference Share of ₹ 50 each and one Equity Share of ₹ 25 each.

(iii) Preference Shareholders have forgone their right for dividend for four years. One year’s dividend at the old rate is, however, payable to them in fully paid equity shares of ₹ 25.

(iv) The Debenture Holders be given the option to either accept 90% of their claims in cash or to convert their claims in full Into new 13% Preference Shares of 50 each issued at par. One-fourth (in value) of the Debenture Holders accepted Preference Shares for their claims. The rest were paid in cash.

(v) Contingent Liability of ₹ 2,00,000 is payable which has been created by wrong action of one Director. He has agreed to compensate this loss Out of the loan given by the Director to the Company.

(vi) Goodwill does not have any value in the present. Decrease the value of Plant & Machinery, Stock, and Debtors by ₹ 300,000; ₹ 1,00,000, and ₹ 2,00,000 respectively. Increase the value of Land & Building to ₹ 25,00,000.

(vii) 50,000 new Equity Shares of ₹ 25 each are to be issued at par payable in full on application. The issue was underwritten for a commission of 4%. Shares were fully taken up.

(viii) Total expenses incurred by the Company in connection with the Scheme excluding Underwriting Commission amounted to ₹ 20,000. Pass necessary Journal Entries to record the above transactions. (Nov 2014, 16 marks)

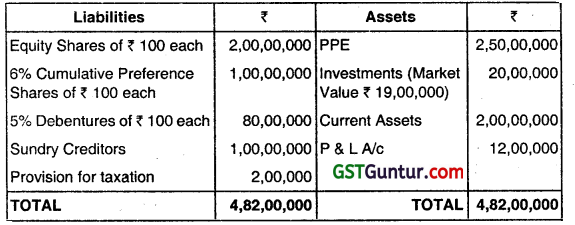

Answer:

Question 13.

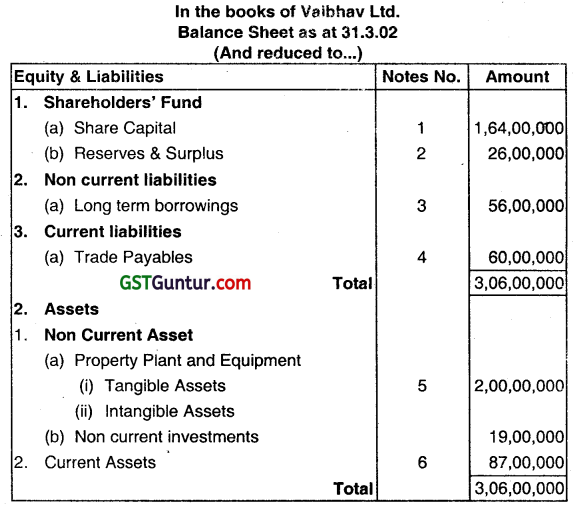

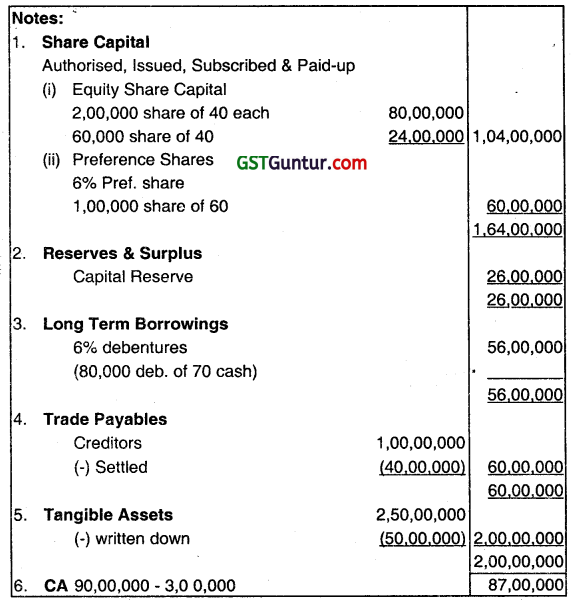

The Balance Sheet of Vaibhav Ltd. as on 31st March 2014 is as follows:

The following scheme of Internal Reconstruction is sanctioned:

(i) All the existing equity shares are reduced to ₹ 40 each.

(ii) All preference shares are reduced to ₹ 60 each.

(iii) The rate of Interest on Debentures is increased to 6%. The Debenture holders surrender their existing debentures of ₹ 1oo each and exchange the same for fresh debentures of ₹ 70 each for every debenture held by them.

(iv) PPE are to be written clown by 20%.

(v) Current assets are to be revalued at ₹ 90,00,000.

(vi) Investments are to be brought to their market value.

(vii) One of the creditors of the company to whom the company owes ₹ 40,00,000 decides to forgo 40% of his claim. The creditor is allotted with 60000 equity shares of ₹ 40 each in full and final settlement of his claim.

(viii) The taxation liability is to be settled at ₹ 3,00,000.

(ix) It is decided to write off the debit balance of Profit & Loss A/c. Pass journal entries and show the Balance Sheet of the company after giving effect to the above. (Nov 2014, 12 marks)

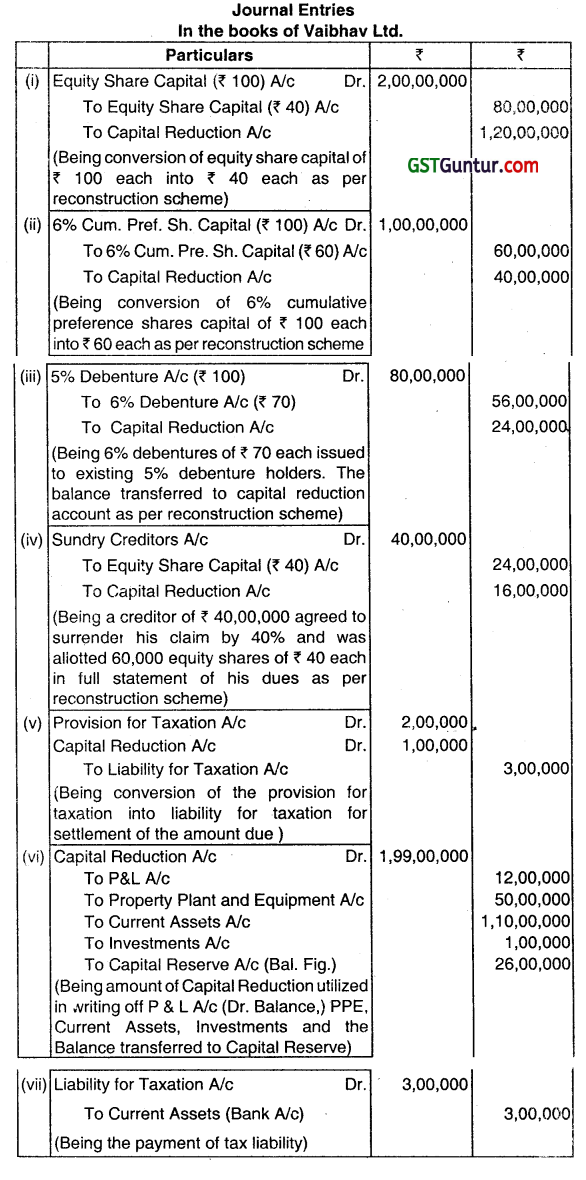

Answer:

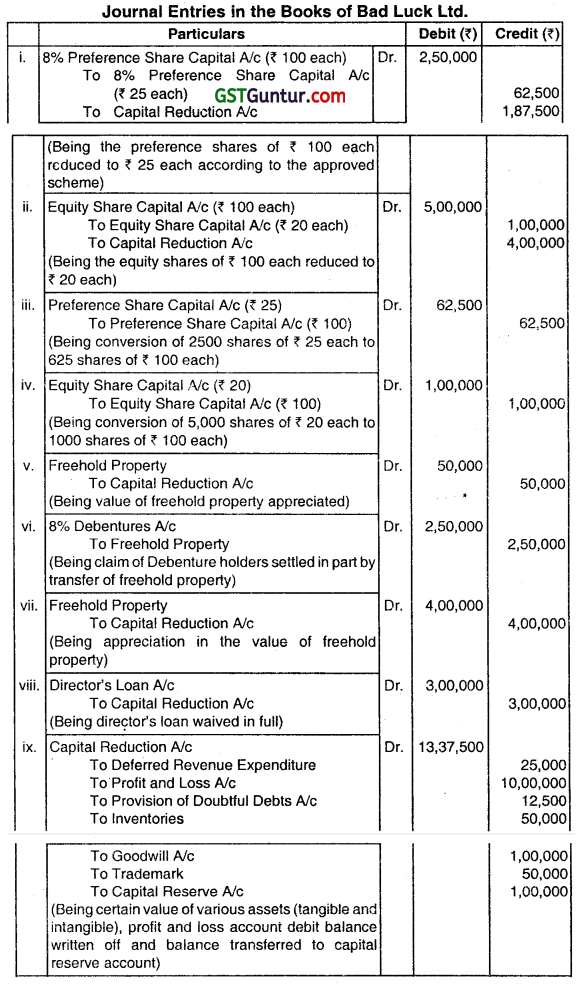

Question 14.

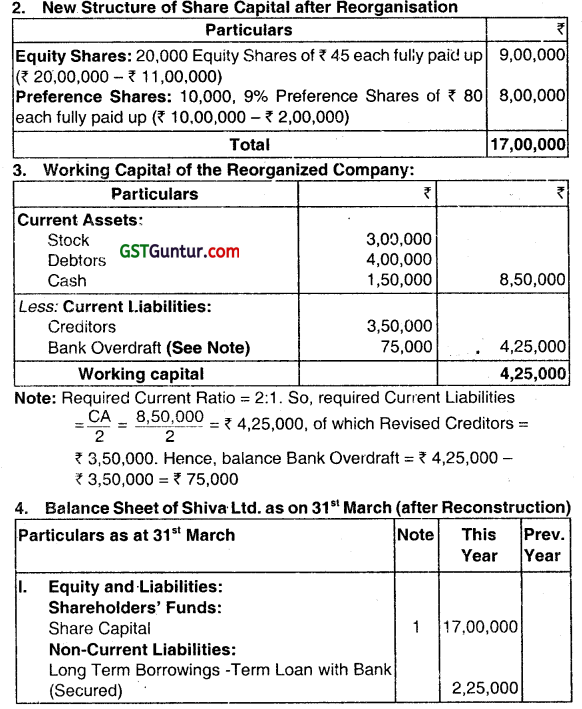

The Balance Sheet of MIs Clean Ltd. as on 31st March 2015 was Summarized as follows:

The Board of Directors of the company decided upon the following scheme of reconstruction duly approved by all concerned parties:

(1) The equity shareholders agreed to receive ri lieu of their present holding of 1 20,000 shares of ₹ 50 each as under

(a) New fully paid equity shares of ₹ 10 each equal to 2/3d of their holding.

(b) 9% preference shares of ₹ 8 each to the extent of 25% of the above new equity share capital.

(c) ₹ 2,80,000, 10% debentures of ₹ 80 each.

(2) The preference shareholders agreed that their ₹ 10 shares should be reduced to ₹ 8 by cancellation of ₹ 2 per share. They also agreed to subscribe for two new equity shares of ₹ 10 each for every five preference shares held.

(3) The taxation liability of the company is settled at ₹ 66,000 and the same is paid immediately.

(4) One of the trade creditors of the company to whom the company owes ₹ 1,00,000 decides to forgo 30% of his claim. He is allotted equity shares of ₹ 10 each in full satisfaction of his balance claim.

(5) Other trade creditors of ₹ 5,00,000 are given option of either to accept fully paid 9% preference shares of ₹ 8 each for the amount due to the or to accept 80% of the amount due to them in cash in full settlement of their claim. Trade creditors for ₹ 3,50,000 accepted preference shares option and rest of them opted for cash towards full settlement of their claim.

(6) Company’s contractual commitments amounting to ₹ 6,50,000 have been settled by paying 4% penalty of contract value.

(7) Debenture holders having charge on plant and machinery accepted plant and machinery in full settlement of their dues.

(8) The rate of Interest on 8% debentures is increased to 10%. The debenture holders surrender their existing debenture of ₹ 50 each and agreed to accept 10% debenture of ₹ 80 each for every two debentures held by them.

(9) The land and building to be depreciated by 5%.

(10) The debit balance of profit and loss account is to be eliminated.

(11) 1/4th of trade receivables and 115 of inventory to be written off. Pass Journal Entries and prepare Balance Sheet after completion of the reconstruction scheme in the books of M/s Clean Ltd. as per Schedule III to the Companies Act, 2013. (Nov 2015, 16 marks)

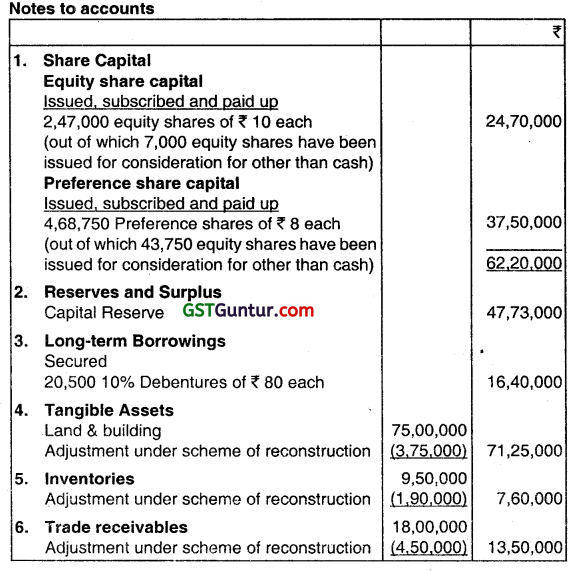

Answer:

![]()

Question 15.

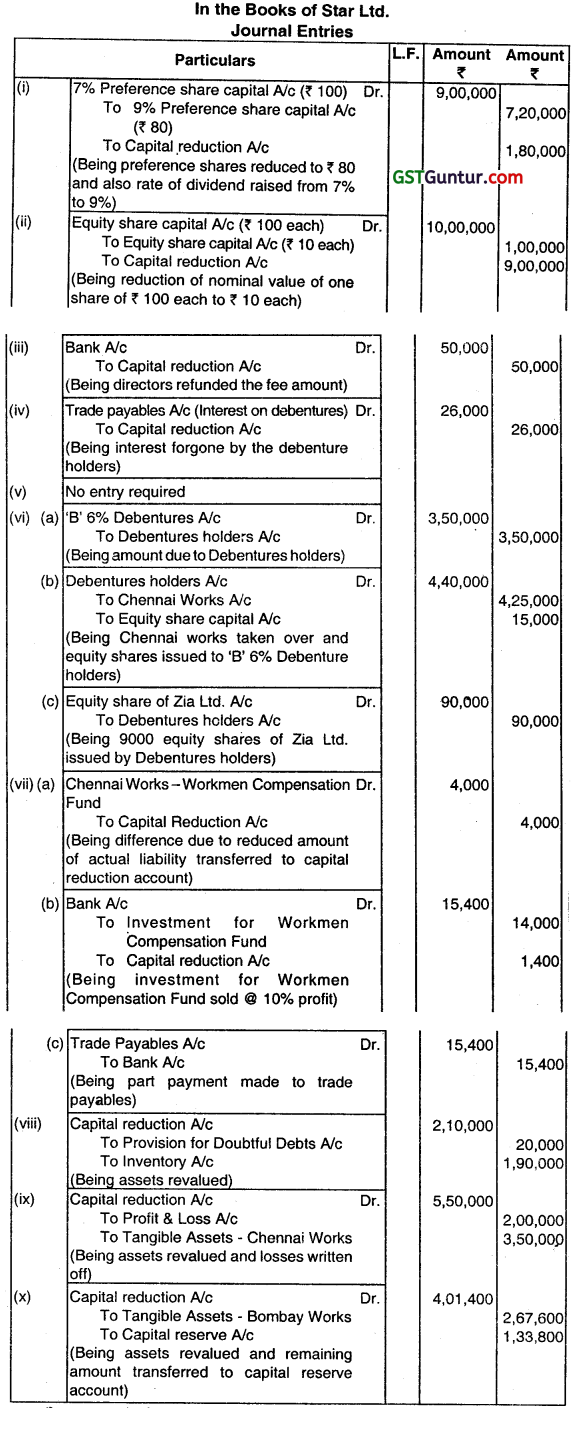

The following is the Balance Sheet of Star Ltd as on 31st March 2015:

A reconstruction scheme was prepared and duly approved. The salient features of the scheme were as follows:

(i) Paid up value of 7% Preference Share to be reduced to ₹ 80, but the rate of dividend being raised to 9%.

(ii) Paid up value of Equity Shares to be reduced to 10.

(iii) The directors to refund ₹ 50,000 of the fees previously received by them.

(iv) Debenture holders forego their interest of ₹ 26,000 which is included among the Sundry Creditors.

(v) The preference shareholders agreed to waive their claims for preference share dividend, which is in arrears for the last three years.

(vi) B 6% Debenture holders agreed to take over the Chennai Works at ₹ 4,25,000 and to accept an allotment of 1.500 equity shares of ₹ 10 each at par, and upon their forming a company called Zia Ltd. (to take over the Chennai Works), they allotted 9,000 equity shares of ₹ 10 each fully paid at par to Star Ltd.

(vii) The Chenriai Worksmen’s compensation fund disclosed that there were actual liabilities of ₹ 1,000 only. As a consequence, the investments of the fund were realized to the extent of the balance. Entire investments were sold at a profit of 10% on book value and the proceeds were utilized for part payment of the creditors.

(viii) Stock was to be written off by ₹ 1,90,000 and a provision for doubtful debts is to be made to the extent of ₹ 20,000.

(ix) Chennai works completely written off.

(x) Any balance of the Capital Reduction Account is to be applied as two-thirds to write off the value of Bombay Works and one-third to Capital Reserve. Pass necessary Journal Entries in the books of Star Ltd. after the scheme has been carried into effect. (Nov 2015, 16 marks)

Answer:

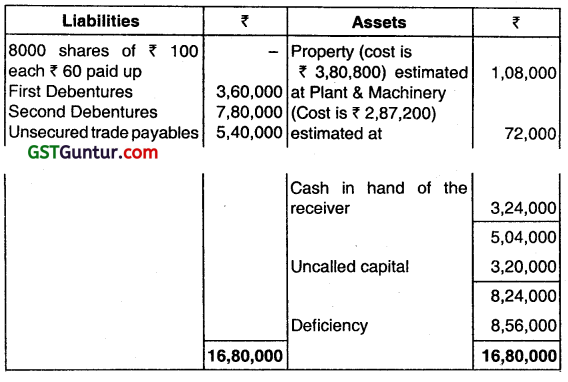

Question 16.

Proficient Infosoft Ltd. is in the hands of a Receiver for Debenture Holders who holds a charge on all assets except uncalled capital. The following statement shows the position as regards creditors as on 30th June 2016:

A holds the first debentures for ₹ 3,60,000 and second debentures for ₹ 3,60,000. He is also an unsecured trade payable for ₹ 1,08,000. B holds second debentures for ₹ 3,60,000 and is an unsecured trade payable for ₹ 72,000. The following scheme of reconstruction is proposed.

(i) A is to cancel ₹ 2,52,000 of the total debt owing to him; to bring ₹ 36,000 in cash and to take first debentures (in cancellation of those already issued to him) for ₹ 6,12,000 in satisfaction of all his claims.

(ii) B to accept ₹ 1,08,000 in cash in satisfaction of all claims by him.

(iii) In full settlement of 60% of the claim, unsecured trade payable (other than A and B) a greed to accept three shares of ₹ 25 each, fully paid against their claim for each ₹ 100.

The balance of 40% is to be postponed and to be payable at the end of three years from the date of Court’s approval of the scheme. The nominal share capital is to be increased accordingly.

(iv) Uncalled capital is to be called up in full and ₹ 75 per share cancelled, thus making the shares of ₹ 25 each. Assuming that the scheme is duly approved by all parties interested and by the Court. give necessary journal entries. (Nov 2016, 16 marks)

Answer:

Question 17.

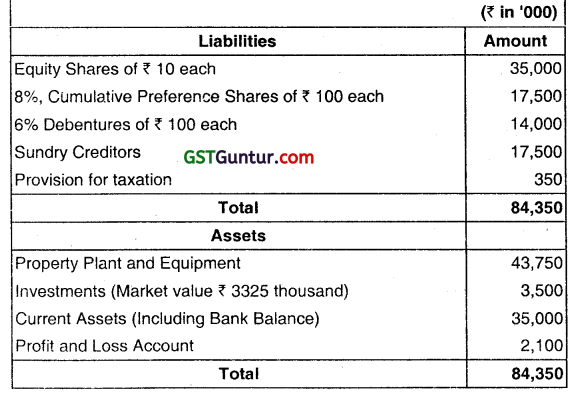

The summarized Balance Sheet of SK Ltd. as on 31st March, 2018 is given below.

The following Scheme of Internal Reconstruction is approved and put into effect on 31st March, 2018.

(i) Investments are to be brought to their market value.

(ii) The Taxation Liability is settled at ₹ 5,25,000 out of current Assets.

(iii) The balance of Profit and Loss Account to be written off.

(iv) All the existing equity shares are reduced to ₹ 4 each.

(v) All preference shares are reduced to ₹ 60 each.

(vi) The rate of interest on debentures is increased to 9%.

The Debenture holders surrender their existing debentures of ₹ 100 each and exchange them for fresh debentures of ₹ 80 each. Each old debenture is exchanged for one new debenture.

(vii) Balance of Current Assets left alter settlement of taxation liability are revalued at ₹ 1,5750,000.

(viii) Property Plant and Equipment are written down to 80%.

(ix) One of the creditors of the Company for ₹ 70,00,000 gives up 50% of his claim. He is allotted 8,75,000 equIty shares of ₹ 4 each in full and final settlement of his claim. Pass Journal entries for the above transactions. (Nov 2018, 10 marks)

Answer:

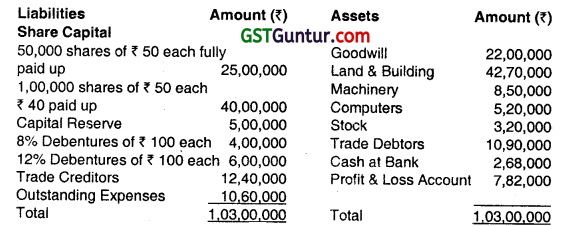

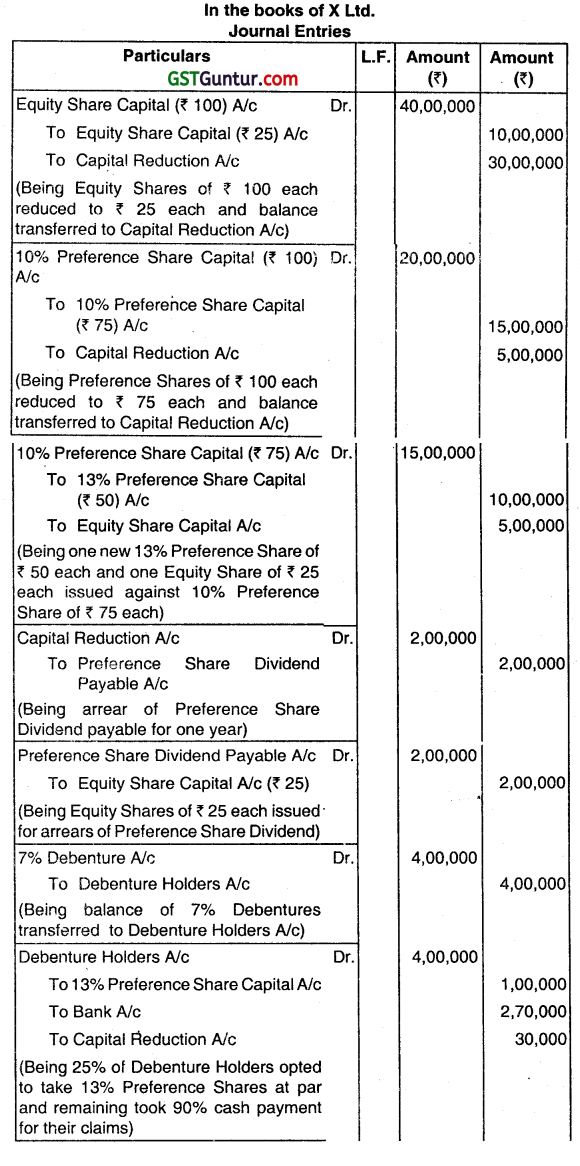

Question 18.

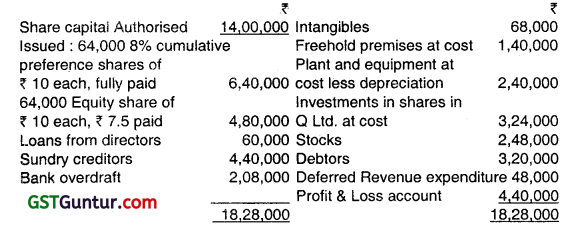

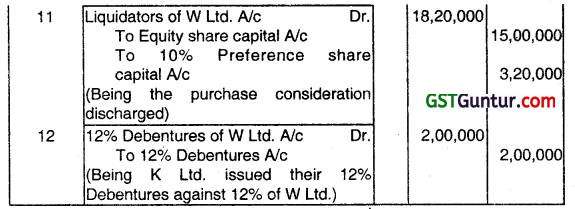

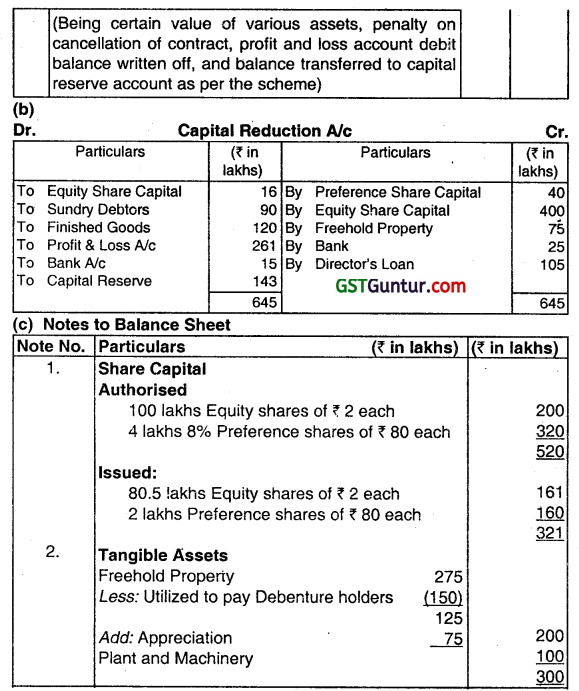

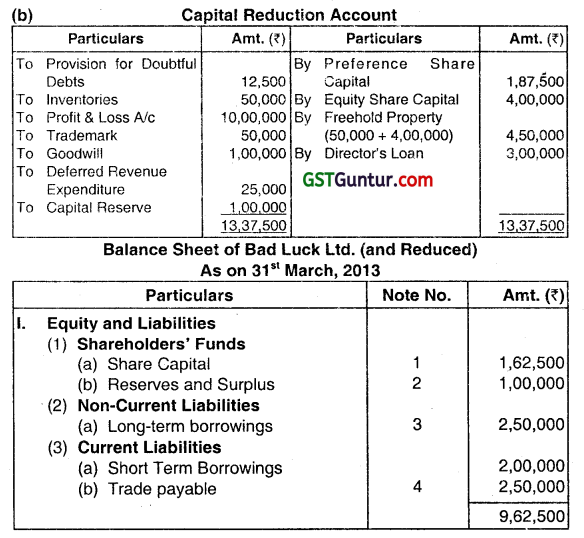

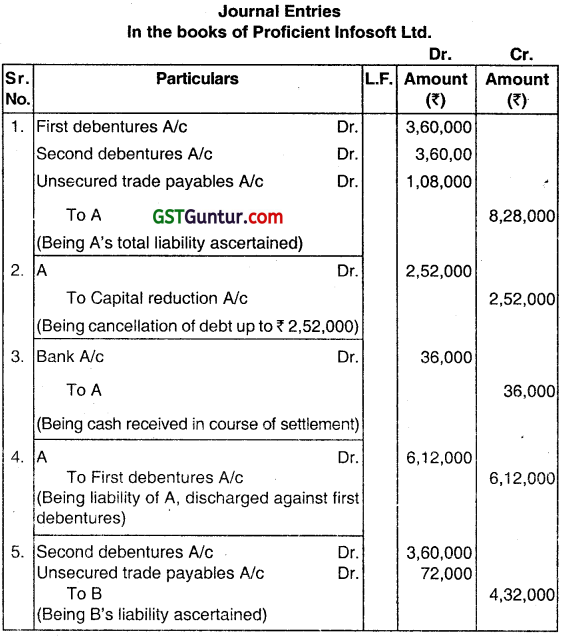

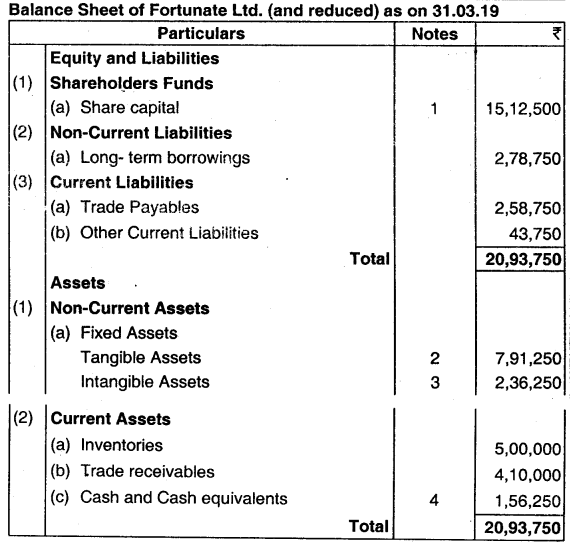

Following is the summarized Balance Sheet of Fortunate Ltd. as on 31st March, 2019.

(Note: Preference shares dividend is in arrear for last five years).

The Company is running with the shortage of working capital and not earnings profits. A scheme of reconstruction has been approved by both the classes of shareholders. The summarized scheme of reconstruction is as follows:

(i) The equity shareholders have agreed that their ₹ 50 shares should be reduced to ₹ 5 by cancellation of ₹ 45.00 per share. They have also agreed to subscribe for three new equity shares of ₹ 5.00 each for each equity share held.

(ii) The preference shareholders have agreed to forego the arrears of dividends and to accept for each ₹ 50 preference share, 4 new 6% preference shares of ₹ 10 each. plus 3 new equity shares of ₹ 5.00 each, all credited as fully paid.

(iii) Lenders to the company for ₹ 1,87,500 have agreed to convert their loan into shares and for this purpose, they will be allotted 15,000 new preference shares of ₹ 10 each and 7,500 new equity shares of ₹ 5.00 each.

(iv) The directors have agreed to subscribe in cash for 25000 new equity shares of ₹ 5.00 each in addition to any shares to be subscribed by them under (i) above.

(v) of the cash received by the issue of new shares, ₹ 2,50,000 ¡s to be used to reduce the loan due by the company.

(vi) The equity share capital cancelled is to be applied:

(a) To write off the debit balance in the Profit and Loss A/c, and

(b) To write off ₹ 43,750 from the value of plant.

Any balance remaining is to be used to write down the value of trademarks and goodwill. The nominal capital as reduced is to be increased to ₹ 8,12,500 for preference share capital and ₹ 9,37,500 for equity share capital. You are required to pass journal entries to show the effect of above scheme and prepare the Balance Sheet of the Company after reconstruction. (Nov 2019,15 marks)

Answer:

![]()

Question 19.

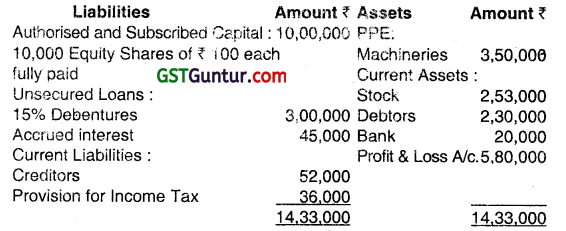

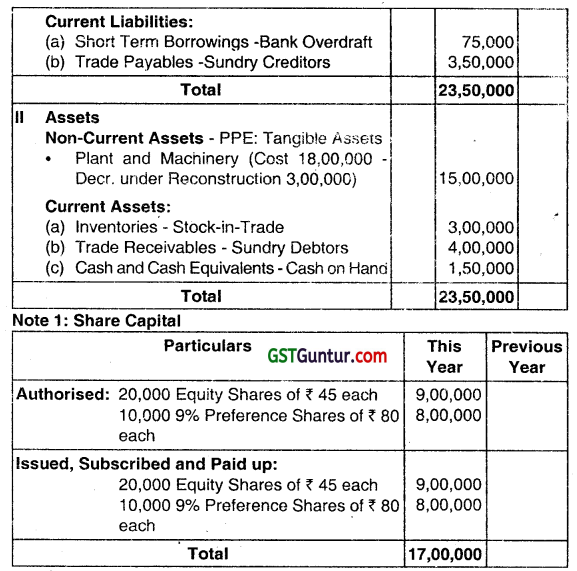

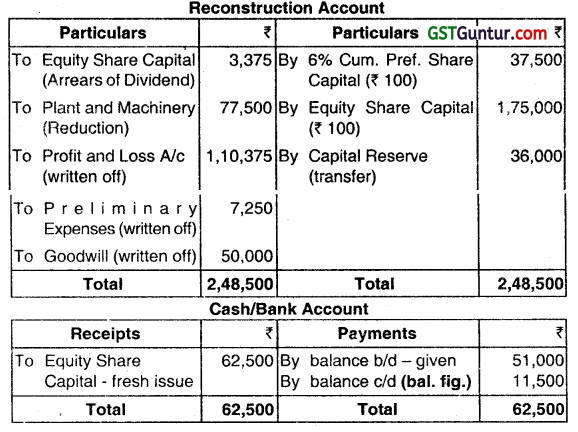

The Balance Sheet of XYZ Ltd. as on 31st March is as under:

Two years’ Preference Dividends are in Arrears. The Company had bad time during the last two years and hopes for better business in future, earning profit and paying dividend, provided the capital base is reduced. An Internal Reconstruction Scheme as follows was agreed to by all concerned:

1. Creditors agreed to forego 50% of the claim.

2. Preference Shareholders withdrew Area Dividend claim. They also agreed to lower their Capital claim by 20% by reducing Nominal Value, in consideration of 9% DMdend effective after reorganization, in case Equity Shareholders’ Loss exceeds 50% on the application of the scheme.

3. Bank agreed to convert Overdraft into Term Loan to the extent required for making Current Ratio equal to 2:1.

4. Revalued figure for Plant and Machinery was accepted as ₹ 15,00,000.

5. Debtors to the extent of ₹ 4,00,000 were considered good.

6. Equity Shares shall be exchanged for same number of Equity Shares, at a revised denomination as required after re-organisation.

Show:

1. Total Loss to be borne by the Equity and Preference Shareholders for the Reorganisation,

2. Share of Loss to the Individual Classes of Shareholders,

3. New Structure of Share Capital after Reorganisation,

4. Working Capital of the Reorganized Company, and

5. A Proforma Balance Sheet after Reorganisation.

Answer:

Note: Two years’ Preference Dividend (Arrears) has been ignored in the computation of Loss to be borne by Equity and Preference Shareholders.

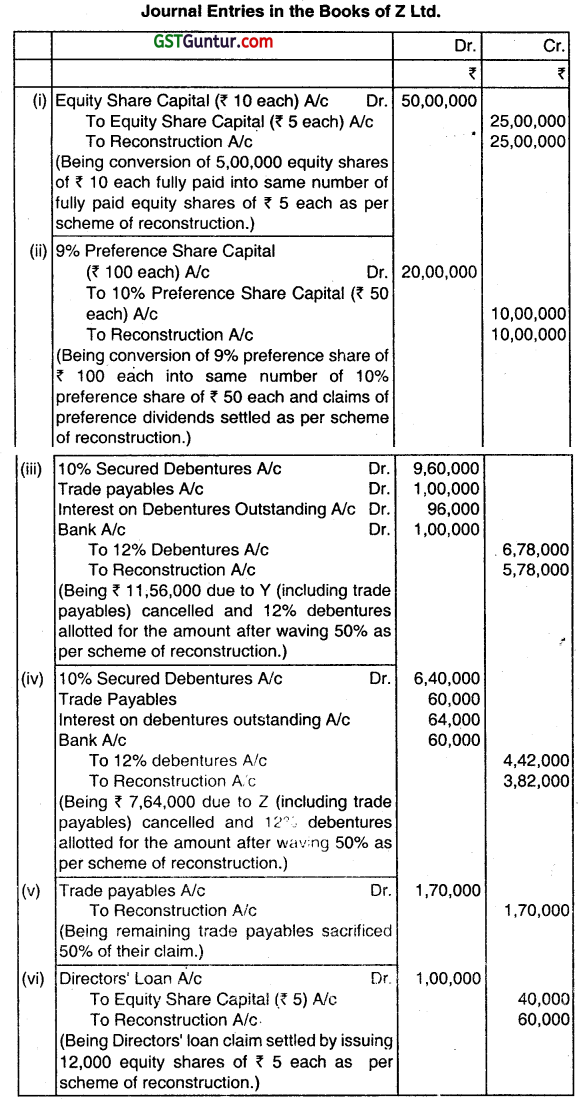

Question 20.

XYZ Ltd. which had experienced trading difficulties decided to reorganise its finances. On 31st March, a Final Trial Balance extracted from the books of the Company showed the following position: (in ₹)

Approval from appropriate authorities was obtained for the following scheme for Reduction of Capital:

1. Preference Shares to be reduced to ₹ 75 per Share and Equity Shares is be reduced to ₹ 12.50 per Share.

2. One ₹ 12.50 Equity Share to be issued for each ₹ 100 of Gross Preference Dividend Arrears, the Preference DMdend had not been paid for three years.

3. The balance in Capital Reserve Account to be utilized.

4. Plant and Machinery to be written down to ₹ 75,000.

5. Profit and Loss Account balance and all Intangible Assets to be written off.

At the same time as the resolution to reduce Capital was passed, another resolution was approved restoring the Total Authorised Capital to ₹ 3,50,000 consisting of 1,500 6% Cumulative Preference Shares of ₹ 75 each and the balance in Equity Shares of ₹ 12.50 each. As soon as the above resolution had been passed, 5,000 Equity Shares were issued at par

for cash payable in full upon application. The same were fully subscribed and paid

You are required:

1. To show the Journal Entries necessary to record the above transaction in the Company’s books, and

2. To prepare the Balance Sheet of the Company, alter completion of th scheme.

Answer:

Note: Since the Scheme involves arrangements with Shareholders only the A/c Head Name Capital Reduction ADcount may be used. AIternuive, the term “Reconstruction” A/c is used in this Illustration.

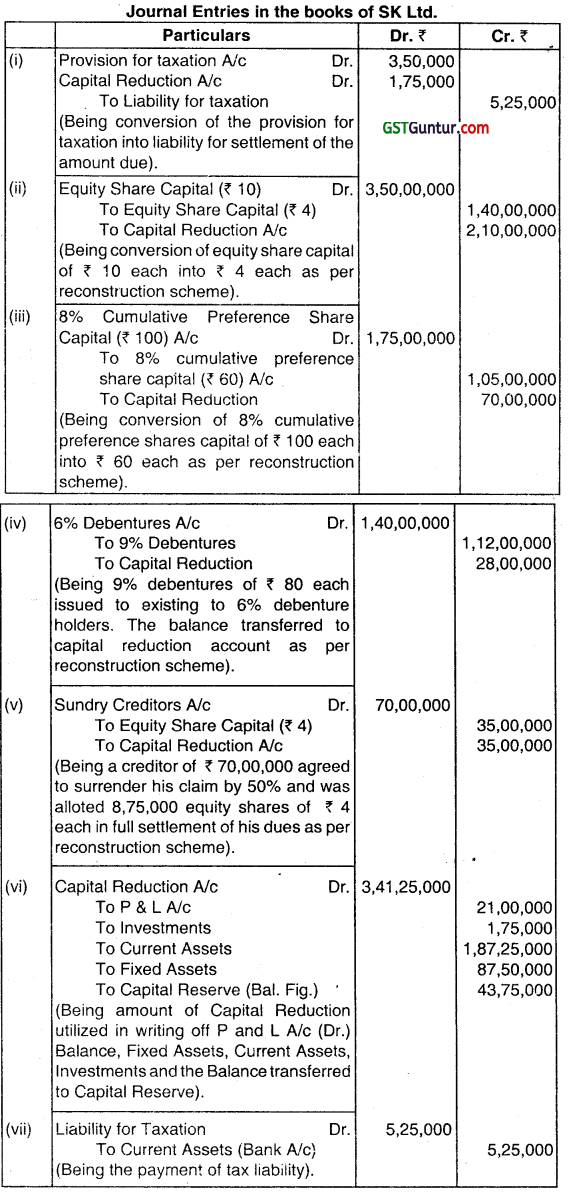

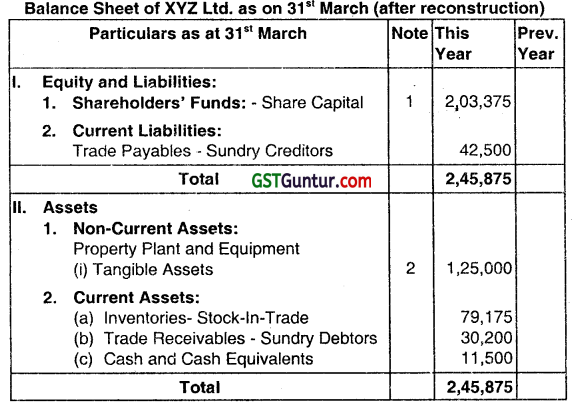

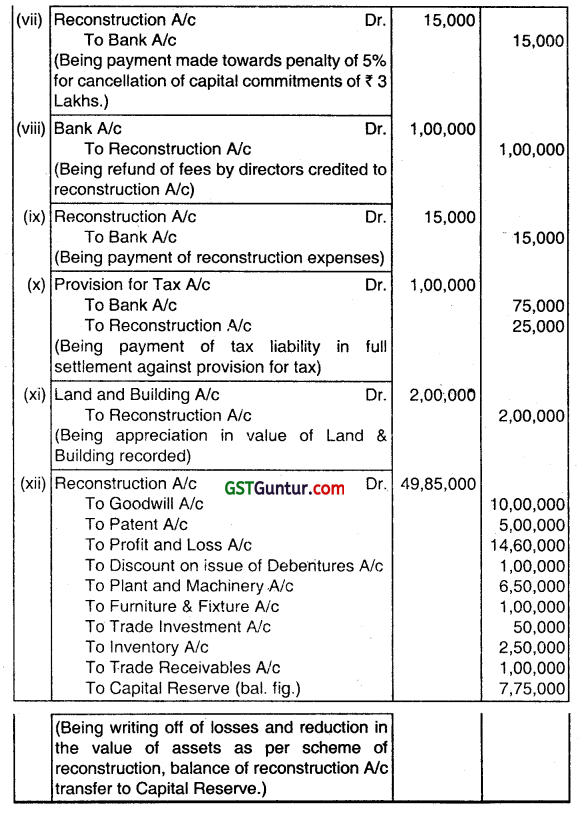

Question 21.

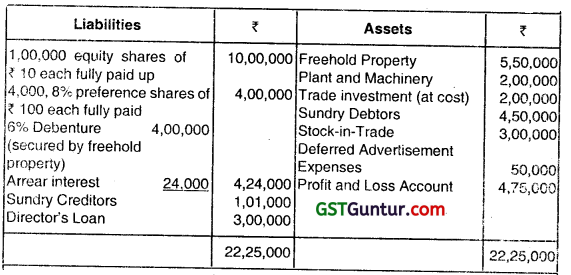

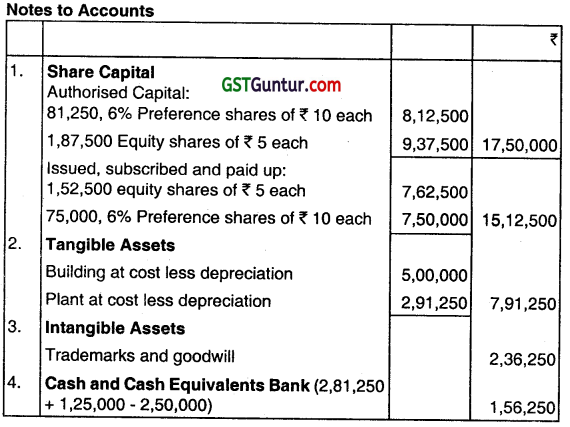

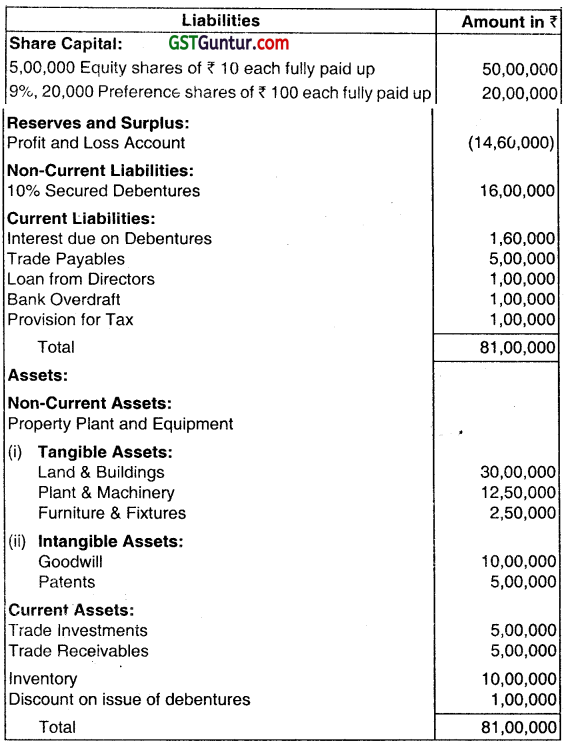

The summarized balance sheet of Z Limited as on 31 March. 2017 is as under:

Note: Preference dividend is In arrears for last 2 years.

Mr. Y holds 60% of debentures and Mr. Z holds 40% of debentures.

Moreover, ₹ 1,00,000 and ₹ 60,000 were also payable to Mr. Y and Mr. Z respectively as trade payable.

The following scheme of reconstruction has been agreed upon and duly approved. The following scheme of reconstruction has been agreed upon and duly approved.

(i) All the equity shares to be converted into fully paid equity shares of ₹ 500 each

(ii) The Preference shares be reduced to 50 each and the preference shareholders agreed to forego their arrears of preference dividends, in consideration of which 9% preference shares are to be converted into 10% preference shares.

(iii) Mr. Y and Mr. Z agreed to cancel 50% each of their respective total debt including interest on debentures. Mr. Y and Mr. Z also agreed to pay ₹ 1,00,000 and ₹ 60,000 respectively in cash and to receive new 12% debentures for the balance amount.

(iv) Persons relating to trade payables, other than Mr. Y and Mr. Z also agreed to forgo their 50% claims.

(v) Directors also waived 60% of their loans and accepted equity shares for the balance.

(vi) Capital commitments of ₹ 3.00 lacs were cancelled on payment of ₹ 15,000 as penalty.

(vii) Directors refunded ₹ 1,00,000 of the fees previously received by them.

(viii) Reconstruction expenses paid ₹ 15,000.

(ix) The taxation liability of the company was settled for ₹ 75,000 and was paid immediately.

(x) The Assets were revalued as under:

Land and Building 32,00,000

Plant and Machinery 6,00,000

Inventory – 7,50,000

Trade Receivables 400,000

Furniture and Fixtures 150,000

Trade Investments 4,50,000

You are required to prepare necessary journal entries for all the above-mentioned transactions Including amounts to be written off of Goodwill, Patents, Loss in Profit and Loss account, and Discount on issue of debentures. And also, prepare Bank Account and Reconstruction Account.

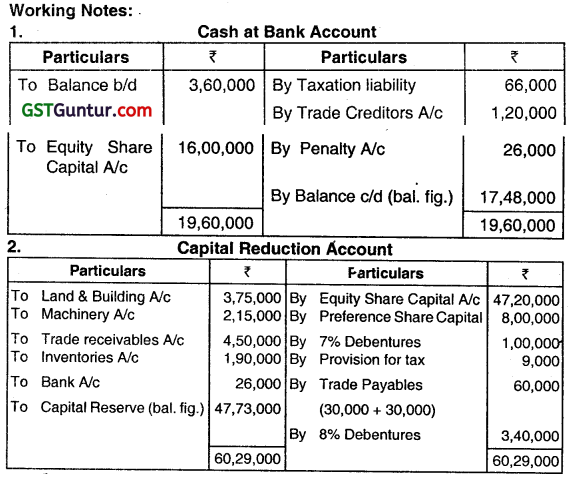

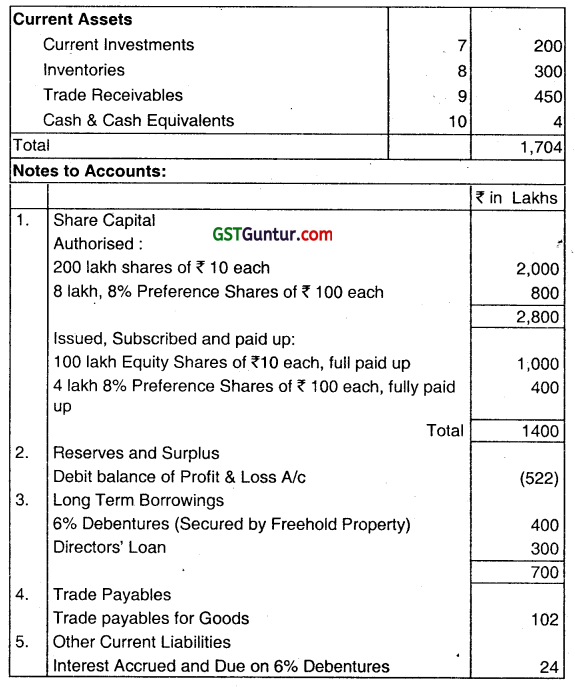

Answer:

![]()

Question 22.

Internal Reconstruction of a Company

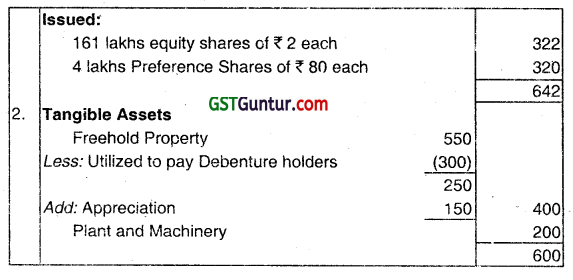

The Balance Sheet of Lion Limited as on 31-03-2018 is given below:

The Board of Directors of the company decided upon the following scheme of reconstruction with the consent of respective shareholders:

(1) Preference Shares are to be written down to ₹ 80 each and Equity Shares to ₹ 2 each.

(2) Preference Shares Dividend ¡n arrears for 3 years to be waived by 2/3rd and for balance 1/3rd, Equity Shares of ₹ 2 each to be allotted.

(3) Debenture holders agreed to take one Freehold Property at its book value of ₹ 300 lakh in part payment of their holding. Balance Debentures to remain as liability of the company.

(4) Interest accrued and due on Debentures to be paid in cash.

(5) Remaining Freehold Property to be valued at ₹ 400 lakh

(6) All investments sold Out for ₹ 250 lakh.

(7) 70% of Directors’ loan to be waived and for the balance, Equity Shares of ₹ 2 each to be allowed.

(8) 40% of Trade receivables and 80% of Inventories to be written off.

(9) Company’s contractual commitments amounting to ₹ 600 lakh have boon settled by paying 5% penalty of contract value.

You are required to:

(a) Pass Journal Entries for all the transactions related to internal reconstruction;

Answer: