Audit Strategy, Audit Planning and Audit Programme – CA Inter Audit Questions bank is designed strictly as per the latest syllabus and exam pattern.

Audit Strategy, Audit Planning and Audit Programme – CA Inter Audit Question Bank

Question 1.

Comment on the following in relation to SAs:

Auditor shall establish an overall strategy that sets the scope, timing and directions of the audit, and that guides the development of the audit plan. (May 2011, 5 marks)

Answer:

Establishment of overall strategy for development of audit plan:

1. According to SA 300, “Planning an Audit of Financial Statements” the auditor shall establish an overall audit strategy that sets the scope, timing and directions of the audit, and that guides the development of the audit plan.

2. In establishing the overall audit strategy, the auditor shall:

- Identify the characteristics of the engagement that define its scope;

- Ascertain the reporting objectives of the engagement to plan the timing of the audit and the nature of the communications required;

- Consider the factors that, in the auditor’s professional judgment, are significant in directing the engagement team’s efforts;

- Consider the results of preliminary engagement activities and, where applicable, whether knowledge gained on other engagements performed by the engagement partner for the entity is relevant; and

- Ascertain the nature, timing and extent of resources necessary to perform the engagement.

Question 2.

Discuss the following:

An adequate planning benefits the audit of financial statements.’ Discuss. (Nov 2018, 5 marks)

Answer:

Planning an audit involves establishing the overall audit strategy for the engagenent and developng an audit plan. An adequate planning benefits the audit of financial statements in several ways, including the following:

- Helping the auditor to devote appropriate attention to important areas of the audit.

- Helping the auditor identify and resolve potential problems on a timely basis.

- Helping the auditor properly organize and manage the audit engagement so that it is performed in an effective and efficient manner.

- Assisting In the selection of engagement team members with appropriate levels of capabilities and competence to respond to anticipated risks and the proper assignment of work to them.

- Facilitating the direction and supervision of engagement team members and the review of their work.

- Assisting where applicable, in the coordination of work done by auditors of components and experts.

Question 3.

“Planning is not a discrete phase of an audit, but rather a continual and iterative process,” Discuss. (Nov 2018, 5 marks)

Answer:

Planning is not a discrete phase of an audit, but rather a continual and iterative process that often begins shortly after (or in connection with) the completion of the previous audit and continues until the completion of the current audit engagement. Planning, however, includes consideration of the timing of certain activities and audit procedures that need to be completed

prior to the performance of further audit procedures. For example, planning includes the need to consider, prior to the auditor’s identification and assessment of the risks of material misstatement, such matters as:

1. The analytical procedures to be applied as risk assessment procedure.

2. Obtaining a general understanding of the legal and regulatory framework applicable to the entity and how the entity is complying with that framework.

3. The determination of materiality.

4. The involvement of experts.

5. The performance of other risk assessment procedures.

![]()

Question 4.

Examine with reasons whether the following statements are correct or incorrect. The audit plan is more detailed than the overall audit strategy. (Nov 2020, 2 marks)

Question 5.

Describe how the process of establishing the overall audit strategy assists the auditor in marshalling his human resources. (May 2019, 4 marks)

Answer:

The process of establishing the overall audit strategy assists the auditor to determine, In marshalling his human resources in the following way:

1. The resources to deploy for specific audit area, such as the use of appropriately experienced team members for high-risk areas or the involvement of experts on complex matters:

2. The amount of resources to allocate to specific audit areas, such as the number of team members assigned to observe the inventory count at material locations, the extent of review of other auditors’ work in the case of group audits, or the audit budget In hours to allocate to high-risk areas;

3. When these resources are to be deployed, such as whether at an interim audit stage or at key cut-oil dates: and

4. How such resources are managed. directed and supervised such as when team briefing and debriefing meetings are expected to be held, how engagement partner and manager reviews are expected to take place and whether to complete engagement quality control reviews.

Question 6.

In establishing overall audit strategy, the auditor shall ascertain the reporting objectives of the engagement to plan the timing of the audit and the nature of the communications required. Elucidate those cases by which auditor can ascertain the reporting objectives of the engagement. (Nov 2019, 4 marks)

Answer:

In establishing overall audit strategy, the auditor shall ascertain the reporting objectives of the engagement to plan the timing of the audit and the nature of the communications required. Following are some cases by which the auditor can ascertain the reporting objectives of the engagement.

- The entity’s timetable for reporting, such as at interim and final stages.

- The organization of meetings with management and those charged with governance to discuss the nature, timing and extent of the audit work.

- The discussion with management and those charged with governance regarding the expected type and timing of reports to be issued and other communications, both written and oral, including the auditor’s report, management letters and communications to those charged with governance.

- The discussion with management regarding the expected communications on the status of audit work throughout the engagement.

Question 7.

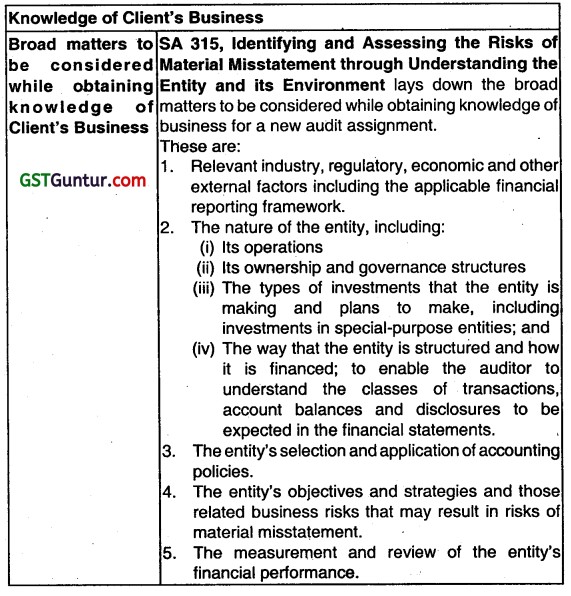

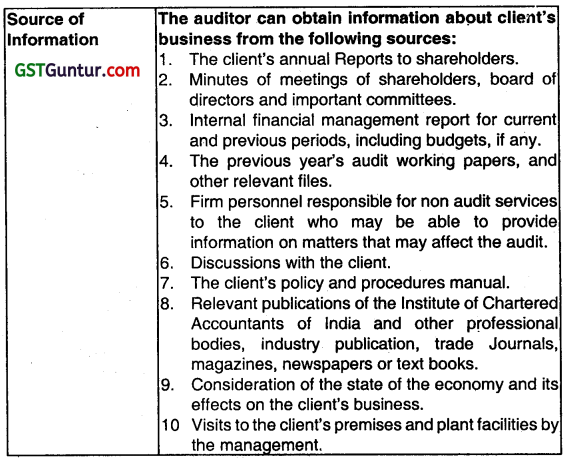

Write short note on the Knowledge of Client’s business (May 2009, 5 marks)

Answer:

Question 8.

M & Co. was appointed as auditor of IGI Ltd. As an auditor what are the factors that would be considered in the development of overall audit plan? (May 2018, 5 marks)

Answer:

Factors to be considered In the development of overall audit plan:

- The terms of his engagement and statutory responsibilities.

- Nature and timing of reports.

- Applicable legal or statutory requirements.

- Accounting policies adopted by the client.

- Effect of new accounting or auditing pronouncements on the audit.

- Identification of significant audit areas.

- Setting of materiality levels for audit purposes.

- The degree of reliance on accounting system and internal control.

- Possible rotation of emphasis on specific audit areas.

- The nature and extent of audit evidence to be obtained.

- The work of internal auditors and the extent of their involvement.

- The involvement of other auditors.

- The involvement of experts.

- The allocation of work between joint auditors.

- Establishing and coordinating staffing requirements.

Question 9.

Examine with reason (in short) whether the following statement is correct or incorrect:

A well-designed and drafted audit plan and audit strategy which takes care of all the uncertainties and conditions, need not be changed during the course of audit. (Nov 2018, 2 marks)

Answer:

Incorrect:

The auditor shall update and change the overall audit strategy and the audit plan as necessary during the course of the audit. As a result of unexpected events, changes in conditions, or the audit evidence obtained from the results of audit procedures, the auditor may need to modify the overall audit strategy and audit plan and thereby the resulting planned nature, timing and extent of further audit procedures, based on the revised consideration of assessed risks.

Question 10.

The auditor shall update and change the overall audit strategy and the audit plan as necessary during the course of the audit. Explain

Answer:

The auditor shall update and change the overall audit strategy and the audit plan as necessary during the course of the audit. As a result of unexpected events, changes in conditions, or the audit evidence obtained from the results of audit procedures, the auditor may need to modify the overall audit strategy and audit plan and thereby the resulting planned

nature, timing and extent of further audit procedures, based on the revised consideration of assessed risks. This may be the case when information comes to the auditor’s attention that differs significantly from the information available when the auditor planned the audit procedures. For example, audit evidence obtained through the performance of substantive procedures may contradict the audit evidence obtained through tests of controls.

Question 11.

The auditor shall document the overall audit strategy, the audit plan and any significant changes made during the audit engagement to the overall audit strategy or the audit plan, and the reasons for such changes. Explain

Answer:

The auditor shall document:

(a) the overall audit strategy;

(b) the audit plan; and

(c) any significant changes made during the audit engagement to the overall audit strategy or the audit plan, and the reasons for such changes.

The documentation of the overall audit strategy is a record of the key decisions considered necessary to properly plan the audit and to communicate significant matters to the engagement team.

For example, the auditor may summarize the overall audit strategy in the form of a memorandum that contains key decisions regarding the overall scope, timing and conduct of the audit.

The documentation of the audit plan is a record of the planned nature, timing and extent of risk assessment procedures and further audit procedures at the assertion level in response to the assessed risks. It also serves as a record of the proper planning of the audit procedures that can be reviewed and approved prior to their performance. The auditor may use standard audit programs and/or audit completion checklists, tailored as needed to reflect the particular engagement circumstances.

A record of the significant changes to the overall audit strategy and the audit plan, and resulting changes to the planned nature, timing and extent of audit procedures, explains why the significant changes were made, and the overall strategy and audit plan finally adopted for the audit. It also reflects the appropriate response to the significant changes occurring during the audit.

For instance-

The following things should form part of auditor’s documentation:

- A summary of discussions with the entity’s key decision-makers

- Documentation of audit committee pre-approval of services, where required

- Audit documentation access letters

- Other communications or agreements with management or those charged with governance regarding the scope, or changes in scope, of our services

- auditor’s report on the entity’s financial statements.

- Other reports as specified in the engagement agreement (e.g., debt covenant compliance letter)

Question 12.

Write short note on Disadvantages of the use of an audit programme. (May 2012, 4 marks)

Short Notes

Answer:

Disadvantages of Audit Programme

| 1. Mechanical Task | Auditor’s work becomes mechanical and he may lose interest and initiative. |

| 2. Rigidity | Audit programmes may become rigid and inflexible. Staff members may limit themselves to the pre-determined programme. |

| 3. Security | It creates false sense of security among staff that everything is taken care of by the audit programme. They may fail to apply their mind in certain circumstances. |

| 4. Lack of Initiative | Audit programme restricts the independent judgement and initiative of the staff. Talented and efficient audit staff may become frustrated. |

| 5. Efficiency | inefficient staff may defend deficiencies in their work on the ground that audit programme contained no such instruction. |

Question 13.

Discuss the following:

Despite of several disadvantages, audit programme is required to start an audit. (Nov 2013, 5 marks)

Answer:

Despite several disadvantages, audit programme is required to start an audit due to the following reasons:

| 1. Set of instructions | Audit programme specifies the extent and manner of checking and verification to be carried out for accounting records. It instructs the assistants and staff in knowing how much is to be checked and in what manner. |

| 2. Checklist | It serves as a ready checklist of audit procedures to be performed. |

| 3. Avoids overlapping | Work is carried out in a planned and phased manner. So chances of overlapping or ignoring certain aspects are avoided. |

| 4. Job allocation | Audit programme helps in selection of assistants for job on the basis of their capability. |

| 5. Accountability | Since assistants put their signature on programme, it is possible to fix responsibility for work done and the work may be traced back to the assistants. |

| 6. Supervision | Audit programmes enable to supervise and control the work done by the assistants. |

| 7. Future planning | It is useful in carrying out the current audit and provides basis for planning the programme for future. |

| 8. Defence against negligence | As the audit programme Is a record of work done, it may be used as a defence against negligence. |

| 9. Basis for opinion | Audit programme provides a sound basis for the expression of Auditor’s opinion. |

| 10. Work review | Audit programme helps to know the progress of the work at any point of time. |

Question 14.

Discuss the following:

How does an audit programme help to plan and perform the audit? (2016 – May 5 marks)

Answer:

Audit programme is a list of examination and verification steps to be applied. It is a detailed plan of applying the audit procedure for accomplishing the audit objectives.

The audit programme shall help to plan and perform the audit In following ways:

- An audit programme provides the assistant carrying out the audit with total and clear set of instructions of the work generally to be done.

- The audit programme shall provide a perspective of the work to be performed.

- With the help of audit programme selection of assistants under a proper framed programme the risk s significance and the audit can be performed systematically.

- The assistants, by putting their signature on a programme accept the responsibility for work.

- With help of audit programme principal can control the progress of the various audits in hand by examination of audit programmes.

- A properly drawn-up audit programme serves as evidence in the event of a charge of negligence being brought against the auditor.

- An audit programme specifies the procedures to be checked during the audit.

- As audit work is split into various elements of procedures to be performed. The audit programme act as a guiding chart list during the performance of audit.

![]()

Question 15.

List out the points that should be kept in mind by the auditor for the purpose of constructing an audit programme. (May 2019, 3 marks)

Answer:

For the purpose of an audit programme construction, the following points should be kept in mind:

- The auditor should stay within the scope and limitations of the assignment.

- He should determine the evidence reasonably available and identify the best evidence for deriving the necessary satisfaction.

- He should apply only those steps and procedures which are useful in accomplishing the verification purpose in the specific situation.

- He should consider all the possibilities of error.

- He should coordinate the procedures to be applied to related items.

Question 16

Examine with reasons whether the following statement is cofrect or incorrect.

(b) Under a properly framed audit programme by the auditor, the danger is significantly less and audit can proceed systematically. (Nov 2019, 2 marks)

Answer:

Correct:

One of the ‘advantages of a properly framed audit programme, is that the danger is significantly less an1 the audit can proceed systematically.

Question 17.

Discuss the Points to be considered by auditor for the purpose of constructing an audit programme. (Nov 2019, 4 marks)

Answer:

For the purpose of audit programme construction, the following points should be kept in mind:

- Stay within the scope and limitations of the assignment.

- Determine the evidence reasonably available and identify the best evidence for deriving the necessary satisfaction.

- Apply only those steps and procedures which are useful ¡n accomplishing the verification purpose in the specific situation.

- Consider all possibilities of error.

- Coordinate the procedures to be applied to related items.

Question 18.

Examine with reasons whether the following statements are correct or incorrect. It is not necessary for the auditor to periodically review the audit programme. (Nov 2020, 2 marks)

Question 19.

State with reasons (in short) whether the following statement is True or False:

When inherent and control risks are low, an auditor can accept a lower detection risk. (May 2008, 2 marks)

Answer:

False:

SA-320 on “Materiality in Planning and Performing an Audit” states that the auditor obtains reasonable assurance by obtaining sufficient appropriate audit evidence to reduce audit risk to an acceptably low level. After the auditor assesses the inherent and control risks, he should consider the level of detection risk that he is prepared to accept and based upon his judgment, select appropriate substantive audit procedures. l the auditor does not perform any substantive procedures, detection risk, that is, the risk that the auditor will fail to detect a misstatement, will be high. The auditor reduces detection risk by performing substantive procedures – the more extensive the procedures performed, the lower the detection risk.

Question 20.

Explain concept of materiality and factors which act as guiding factors to this concept. (Nov 2000, 6 marks)

Answer:

As per SA 320, “Materiality in Planning and Performing an Audit,” material items are, items the knowledge of which would influence the decision of the user of the financial statements. As per International Auditing Guideline – 25, materiality is the magnitude or nature of a misstatement (including an omission) of financial information either individually or in the aggregate that, in the light of the surrounding circumstances, makes it probable that the judgement of a reasonable person relying on the information would hence been influenced or his decisions affected as a result of the misstatement.

The concept of materiality is fundamental to the process of

1. Recognition

2. Aggregation

3. Classification

4. Presentation of the financial statement.

Materiality should be considered by the Auditor when

1. Determining the nature, timing, and extent of Audit procedures.

2. Evaluating the effect of misstatement.

There is an inverse relationship between materiality and Audit Risk. The Auditor takes this inverse relationship into account when determining the nature, timing, and extent of audit procedure.

Factors to be considered for determining materiality.

- The materiality depends on the regulatory or legal considerations.

- Materiality is not often reckoned with respect to quantitative details above. It has qualitative dimensions as well.

- Even insignificant items in terms of quality may be material in special circumstances.

- Item of materiality may be determined individually or in aggregate.

- An item whose impact is insignificant at present, but in future, it may be significant, maybe material item.

Question 21.

Write short notes on the Audit Planning and Materiality (May 2013, 4 marks)

Answer:

Audit Planning and Materiality:

The information is material if its misstatement could influence the decision of users taken on the basis of such financial information. It depends on the size and nature of item, judged in the certain cases of misstatement.

When planning the audit, the auditor considers what would make the financial information materially misstated. The auditors preliminary assessment of materiality related to specific account balances etc. helps the auditor to select audit procedures that in combination can be expected to support the audit opinion at an acceptably low degree of audit risk.

SA-320 on Materiality In Planning and Performing an Audit requires that an auditor should consider materiality and its relationship with audit risk. The auditor’s assessment of materiality regarding various aspects such as specific account balances and classes of transactions helps him to decide such questions as what items are to be examined, which methods are to followed etc. This basically ‘eads him to decide and plan out and select the audit procedure.

Question 22.

State the factors which are to be considered in determining materiality. (Nov 2015, 4 marks)

Answer:

Factors Considered ¡n Determining Materiality:

- The elements of financial statements (for e.g. assets, liabilities, equity, revenue, exp.).

- Whether there are items on which attention of users of the particular entity’s financial statements tend to be focused (for e.g. for the purpose of evaluating financial performance users may tend to focus on profit, revenue or net assets).

- The nature of the entity, where the entity is at in its life cycle, and the industry and economic environment in which entity operates.

- The entity’s ownership structure and the way it ¡s financed (for e.g. if an entity is financed solely by debt rather then equity, users may put more emphasis on assets and claims on them, than on entity’s earnings.

Relevant Information Regarding Concept of Materiality

Accounting Standard 1 defines material items as relatively important and relevant items, i.e. “items the knowledge of which would influence the decisions of the users of the financial statements”.

Whether or not the knowledge of an item would influence the decisions of the users of the financial statements is dependent on the particular facts and circumstances of each case. It is not possible to lay down precisely either in terms of specific account or in terms of amounts the items which could be considered as material in all circumstances.

Materiality is a relative term and what may be material in one circumstance may not be material in another. Therefore, the decision to judge the materiality of the item whether in the aggregation of items, presentation or classification of items shall depend upon the judgment of preparers of the account in the circumstances of the particular case. In many cases percentage comparison may be useful ¡n indicating the materiality of an item.

As per SA 320, this percentage criteria for determining materiality levels is known as Benchmarking. e.g., Part II of Schedule III to the Companies Act, 2013 requires that any expense exceeding one per cent of the total revenue of the company or ₹ 1,00,000 whichever is higher, shall be disclosed by way of notes as additional information and shall not be combined with any other item to be shown under miscellaneous expenses.

Actually, the detailed disclosure requirements of Schedule III to the Companies Act, 2013 seek to ensure that the financial statements disclose all material items so as to give a true and fair view of the state of affairs of the company.

Question 23.

Explain whether the following statements are correct or incorrect, with reasons/explanations) examples:

Determining materiality involves the exercise of professional judgement. (Jan 2021,2 marks)

Answer:

True:

Audit procedures are two – Compliance and Substantive. To apply these procedure auditor uses some specific methods known as audit techniques.

Question 24.

Mention, any four, areas where surprise check can significantly improve the effectiveness of an audit. (May 2008, 4 marks)

Answer:

Surprise checks are mainly intended to ascertain whether the system of internal control is operating effectively and whether the accounting and other records are prepared concurrently and kept up-to-date. The areas over which the surprise checks should be employed would depend upon the circumstances of each audit but should normally include the following areas:

- Verification of cash and investments.

- Test verification of stores and stocks and the records relating there.

- Verification of books of prime entry.

- Verification of statutory registers.

Surpriee checks are a part of normal audits. If the surprise check reveals a weakness ¡n the system of internal control or any fraud or error or the fact that any book or register has not been properly maintained or kept up-to-date, the auditor should communicate the same to the management and ensure that action is taken on the matters communicated by him.

![]()

Question 25.

State with reasons (in short) whether the following statement is True or False:

Auditing in-depth implies that the auditor vouches almost all transactions in a manner that the chances of not checking any transaction are left at minimum. (May 2009, 2 marks)

Answer:

False:

Auditing in depth does not mean the 100% vouching, it is checking selected transactions from beginning to end to understand the entire system within which the transaction passes through.

Question 26.

Write short note on “Audit Techniques”. (May 2012, 4 marks)

Answer:

Meaning: Audit technique refers to the methods and means employed by the auditor for collection and evaluation of audit evidence in different auditing situations Audit techniques may vary according to nature of preposition to be tested. Audit techniques are generally interdependent. A combination of techniques is applied in a particular procedure like in

verification of assets, audit techniques are physical examination confirmation from 3 parties. The techniques to be adopted vary with the time/period of auditing.

They may vary from organisation to organisation depending upon the nature of business, number of transactions etc.

Techniques of Audit :

The important audit techniques are –

- Vouching

- Physical examination

- Confirmation

- Inquiry

- Scanning

- Reconciliation

- Flow Charting

- Electronic data processing records

Question 27.

Discuss the following:

Is surprised checks desirable in audit, if so give important recommendations. (May 2013, 5 marks)

Answer:

- One of the most important parts of audit is the surprise check, the results of these checks are very helpful to the auditor as they help in deciding the scope of audit and also the reports.

- The effectiveness of the audit is improved by the element of surprise. This element is also incorporated in audit programmes.

- The element of surprise in an audit may be both ¡n relation to the time of audit, that ¡s selection of date, when the auditor will visit the clients office for audit and selection of the areas of audit.

- Auditor’s visits for a surprise check in order to know whether the internal control system is working effectively or not and whether all accounting and other records are kept up to the date as per the statutory regulation.

- These checks and surprise visits can bring good moral check on the client’s staff.

- Surprise checks also help in determining the errors and frauds.

- Surprise checks are very helpful for the organization having weak internal control system, very large and diversified.

- Extent of the check will depend upon the auditor.

- The consequences of the surprise check should be communicated to the management. This is done to overcome the weakness.

- The auditor gets satisfied only when proper actions are taken by the management on the matters communicated by him.

Question 28.

What is continuous audit and what are the precautions which should be taken to avoid the disadvantages 0f continuous audit? (May 2013, 8 marks)

Answer:

Continuous Audit

| Meaning of Continuous Audit | When auditor’s assistants are involved continuously in checking the accounts of the client during the whole year round or when the staff attends audit work at intervals, during the financial period, it is called a continuous audit. It is suitable in cases where the final accounts are desired to be presented soon after the close of the financial year or where the internal check is weak. |

| Features | 1. A continuous audit is one which involves detailed examinations of transactions and accounts by the audit staff continuously throughout the year or at regular intervals say fortnightly, monthly or quarterly. 2. At the year end the auditor takes up an examination of financial accounts. 3. It enables completion of audit at the quickest possible time after the closing of accounts. 4. It is also known as detailed audit or running audit. |

| Advantages | 1. Immediate detection of errors and frauds: Management can exercise a strict control over the accounts due to immediate detection of errors and frauds. 2. Deterrent: The frequent attendance of the audit staff deters persons from committing fraud. 3. Up-to-date accounts: The accounting staff of the client is motivated to keep the books of account up to date. 4. Early final audit: The final audit can be completed sooner than what would be otherwise. 5. Knowledge of client’s affairs: The auditor can obtain a more detailed knowledge of the client’s affairs which enables him to discharge his duties more efficiently. 6. Detailed coverage: All aspects of verification are carried out in detail as compared to fina! audit and or when test checks are applied. 7. Staff planning: Work scheduling can be done effectively and staff can be sent regularly by proper planning. 8. Interim reporting: Interim financial statements can be prepared easily and in a timely manner. |

Disadvantages

- Failure to keep track: Since work is carried out in several instalments, the audit staff may fail to keep tracks of things which they had not checked on their last or earlier visit. As a result, some of the transactions may escape audit scrutiny.

- Tampering: The client’s staff may alter the entries in the books of account after checking there of.

- Uneconomic: It is uneconomic for a small-sized concern as a great deal of time is wasted each time in preparing for the audit.

- InterruptIon of work: The presence of addict staff at regular intervals may affect the regular workflow of the client.

- Boredom: Routine checking on a continuous basis may become mechanical.

- Time-consuming: Since all transactions are verified, continuous audits will be time-consuming.

- No guarantee for fraud detection: A complete verification of all transactions in detail, does not guarantee detection of all errors and frauds. Some material misstatements may still exist.

Question 29.

State with reasons (in short) whether the following statement is correct or incorrect.

There is no difference in terms uAudit Procedure” anti-Audit Technique”. (May 2014, 2 marks)

Answer:

Incorrect:

Audit procedure is a way of performing Audit, while Audit technique is a method for Performing Audit Procedure.

Question 30.

State with reasons (in short) whether the following statement is correct or incorrect:

Scrutiny of Bank Reconciliation statement is one of the audit techniques. (May 2015, 2 marks)

Answer:

Correct:

The scrutiny of bank reconciliation statement is one of the audit techniques.

![]()

Question 31.

State the precautions to be taken to avoid the disadvantage of a continuous audit. (Nov 2015, 4 marks)

Answer:

The disadvantage of the continuous audit can be avoided by following precautions:

- During the course of each audit, the auditor should complete his work upto a definite stage so as to avoid loose ends.

- At the end of each visit, important balances should be noted down and the same should be compared at the time of the next visit.

- The visits should be at irregular intervals of time so that the dent’s staff may not know in advance the exact date when the audit would be resumed and thus, may be able to prepare themselves in advance for the same.

- The nominal accounts should be checked only at the time of final closing.

- The client’s staff should be instructed not to alter or correct audit figures. The auditor should also device a special form of ticks (identification marks) for being placed against figures which have been altered and neither its purpose nor significance should be disclosed to the client’s staff.

Question 32.

‘Write short note on the Surprise checks (Nov 2015, 4 marks)

Answer: –

Surprise checks:

Surprise checks are a part of normal audit procedures. An element of surprise can significantly improve the audit effectiveness. Wherever practical, an element of surprise should be incorporated in the audit procedures. The element of surprise in an audit may be both In regard to the time of audit, i.e. selection of date, when the auditor will visit the client’s office for audit and selection of areas of audit.

Surprise checks are mainly intended to ascertain whether the internal control system is working effectively and whether the accounting and other records are kept up to date as per the statutory regulations.

Surprise checks can exercise good moral check on the client’s staff. It helps in determining whether errors or frauds exists and if they exist, brings the matter promptly to the management’s attention, so that corrective action can be taken at the earliest. Surprise checks are very effective in verification of cash and inventories and investments, test checking of stock, verification of accounting records, statutory registers and internal control system. The frequency of surprise checks may be determined by the auditor in the circumstances of each audit but should normally be at least once in the course of an audit.

Multiple Choice Question

Question 1.

Formulating audit plan, laying down two things, one is a ‘broad framework for conducting the work and the second

(a) ‘method’ to ensure control over the quality of work’.

(b) ‘method to ensure control over the auditor’s work’.

(c) ‘method to ensure control over the clean’s work’.

(d) None of the above.

Answer:

(a) ‘method’ to ensure control over the quality of work.

Question 2.

Auditor should plan his work to enable him to conduct an effective audit in …………………. and ………………….. .

(a) a organised, systematic way.

(b) a timely, efficient manner.

(c) an efficient, timely manner.

(d) a systematic, proper way.

Answer:

(c) an efficient, timely manner.

Question 3.

Audit Planning covers

(a) acquiring knowledge of the client’s accounting systems, policies and internal control procedures.

(b) establishing the expected degree of reliance to be place on internal control.

(c) determining and programming the nature, timing and extent of the audit procedures to be performed and coordinating the work to be performed.

(d) All of them.

Answer:

(d) All of them.

![]()

Question 4.

Planning an Audit of financial statement described under.

(a) SA -200

(b) SA-220

(c) SA – 300

(d) SA-310.

Answer:

(c) SA – 300

Question 5.

Strategy which sets the scope, timing and direction of the audit, and guides the development of the more detailed audit plan is known as

(a) Planning strate’

(b) Planning and execution strategy.

(c) Overall audit strategy.

(d) Ove rail investigation strategy.

Answer:

(c) Overall audit strategy.

Question 6.

Auditor should establish overall audit strategy by.

(a) identifying the characteristic of the audit engagement and ascertaining the reporting objective,

(b) Evaluate the professional judgement required and directing the engagement team’s efforts.

(c) Ascertain the nature, timing and extent of resources necessary to perform the engagement.

(d) All of them.

Answer:

(d) All of them.

Question 7.

Overall Audit Strategy and Audit Plan are closely.

(a) intra related.

(b) interrelated.

(c) inversely related.

(d) interchangeable.

Answer:

(b) interrelated.

Question 8.

The nature, timing and extent of planned risk assessment procedures as determined under

(a) SA – 300

(b) SA-310

(c) SA-315

(d) SA-318.

Answer:

(c) SA-315

Question 9.

Audit Plan is more comprehensive than

(a) Audit procedure

(b) Audit forecasting

(c) Audit Strategy

(d) Overall audit strategy.

Answer:

(d) Overall audit strategy.

Question 10.

Identifying and Assessing the risk of material misstatement through understanding the Entity and its Environment describe under

(a) SA-300

(b) SA-310

(c) SA-315

(d) SA-318.

Answer:

(c) SA-315

Question 11.

Planning is not a discrete phase of an audit, but rather a continual and iterative process.

The Statement is

(a) True

(b) Wrong

(c) Partially wrong

(d) Absolutely wrong.

Answer:

(a) True

![]()

Question 12.

Overall audit strategy and audit plan remain the responsibility.

(a) auditor’s

(b) management’s

(c) TCWG’S

(d) client’s

Answer:

(a) auditor’s

Question 13.

The auditor shall …………….. the overall audit strategy and the audit plan during the course of the audit if necessary

(a) not update and change

(b) update and change

(c) update but not change

(d) replace.

Answer:

(b) update and change

Question 14.

The nature, timing and extent of the direction and supervision of engagement team members and review of their work vary depending on the factor(s)

(a) The area of the audit

(b) The size and complexity of the entity

(c) The assessed risks of material misstatement

(d) All of them.

Answer:

(d) All of them.

Question 15.

The auditor shall document the …………….. and any significant changes made during the audit engagement to the overall audit strategy and the audit plan and the reason for such change.

(a) Overall audit strategy and audit plan

(b) Overall audit strategy

(c) Audit Plan

(d) Strategic Planing.

Answer:

(a) Overall audit strategy and audit plan

Question 16.

The documentation of overall audit strategy is a record of the …………………. necessary for proper planning of audit.

(a) Key strategies

(b) Key planning

(c) Key decisions

(d) Key observations.

Answer:

(c) Key decisions

Question 17.

An audit programme is a detailed plan of applying the …………………… in the given circumstances with instructions for the appropriate techniques to be a doped for accomplishing.

The audit objectives.

(a) Audit Planning

(b) Audit Control

(c) Audit Coordination

(d) Audit Procedures.

Answer:

(d) Audit Procedures.

Question 18.

Audit Programme is universal for all types of business.

(a) True

(b) Wrong

(c) Partially True

(d) None.

Answer:

(b) Wrong

Question 19.

Audit programme consists of a series of ………………. procedures to be applied for the purpose of obtaining sufficient evidence for conducting the audit

(a) Planning,

(b) Planning and execution

(c) Verification

(d) Authentication.

Answer:

(c) Verification

Question 20.

Audit Programme requires a

(a) Continuous follow up

(b) Periodic Change

(c) Periodic Review

(d) All of them.

Answer:

(c) Periodic Review

![]()

Question 21.

Point(s) should be kept in mind while constructing the Audit Programme.

(a) Consider all possibilities of error.

(b) Stay within the scope and limitations of the assignment.

(c) Apply only those steps and procedures which are useful in accomplishing the verification purpose in the specific situation.

(d) All of them.

Answer:

(d) All of them.

Question 22.

………………. may be defined as the information used by the auditor In arriving at the conclusions on which the auditor’s opinion is based.

(a) Audit Plan

(b) Audit Programme

(c) Audit Evidence

(d) Audit System.

Answer:

(c) Audit Evidence

Question 23.

……………………….. is the very basis for formulation of opinion and an audit ………………… is designed to provide for that by prescribing procedures and techniques.

(a) Audit Plan, Programme

(b) Audit Programme, Planning

(c) Audit Plan, Evidence

(d) Evidence, Programme.

Answer:

(d) Evidence, Programme.

Question 24.

An audit picks up evidence from a variety of fields except.

(a) Documentary examination

(b) Memorandum and Article of Association

(c) Physical examination and Arithmetical calculations of third parties

(d) Statements and explanations of third parties.

Answer:

(b) Memorandum and Article of Association

Question 25.

Audit Programme provides the assistant carrying out the audit with total and clear set of instructions of the work generally to be done.

(a) True

(b) False

(c) Partially True

(d) None.

Answer:

(a) True

Question 26.

…………………… helps in selection of assistants for the jobs on the basis of capability becomes earlier when the work Is rationally planned, defined and segregated.

(a) Audit Plan

(b) Audit Working Paper

(c) Audit – Note

(d) Audit Programme.

Answer:

(d) Audit Programme.

Question 27.

……………………… serves as a guide for audits to be carried out in the succeeding year.

(a) Audit Plan

(b) Audit Working Paper

(c) Audit Note

(d) Audit Programme.

Answer:

(d) Audit Programme.

Question 28.

A hard and fast audit Programme may kill the initiative of efficient and enterprising assistants. This statement is

(a) True

(b) False

(c) Partially True

(d) None.

Answer:

(a) True

Question 29.

………………………. is an important consideration for an auditor to evaluate whether the inancial statements reflect a true and fair view or not.

(a) Audit Plan

(b) Audit Programme

(c) Materiality

(d) Audit evidence.

Answer:

(c) Materiality

Question 30.

Materiality in Planning and Performing an Audit defines under

(a) SA-300

(b) SA-315

(c) SA – 320

(d) SA-318.

Answer:

(c) SA – 320

![]()

Question 31.

SA – 320 requires that an auditor should consider …………………… and its relationship with …………………. while conducting the audit.

(a) materiality audit evidence

(b) materiality, audit risk

(c) audit risk, materiality

(d) audit risk, audit evidence.

Answer:

(b) materiality, audit risk

Question 32.

Auditor’s assessment of materiality and audit risk …………………. at the time of initially planning of the audit as against at the time of evaluating the result of audit procedures.

(a) must be same

(b) maybe different

(c) absolutely different

(d) None of them.

Answer:

(b) maybe different

Question 33.

When establishing the overall audit strategy, the auditor shall determine materiality for the financial statement ……………………. .

(a) in part

(b) as a whole

(c) as universal

(d) None of them.

Answer:

(b) as a whole

Question 34.

Amount set by the auditor at less than materiality for the financial statements as a whole to reduce to an appropriately low level the probability that the aggregate of uncorrected and undetected misstatements exceeds materiality for the financial statements as a whole is known as

(a) Materiality

(b) Performance Materiality

(c) Overall audit Plan

(d) Overall audit Procedures.

Answer:

(b) Performance Materiality

Question 35.

Determining materiality involves the exercise of …………………… .

(a) professional ethics

(b) professional performance

(c) professional observation

(d) professional judgement.

Answer:

(d) professional judgement.

Question 36.

Factor that may not affect the identification of an appropriate benchmark.

(a) The elements of the financial statements –

(b) Some items on which the attention of the users of the particular entity’s financial statements tends to be focused. ,

(c) Management’s behaviours in the entity

(d) The nature of the entity, wtere the entity is at in its life cycle, and the industry and economic environment in which the entity operates.

Answer:

(c) Management’s behaviours in the entity

![]()

Question 37.

‘Revision of Materiality level is required as the and progresses’. Statement is

(a) True

(b) False

(c) Partially True

(d) None.

Answer:

(a) True

Question 38.

Audit documentation regarding materiality include:

(a) Materiality for the financial statements as a whole and any revision thereon.

(b) Performance materiality

(c) Materiality level or levels for particular classes of transactions, account balance or disclosures.

(d) All of them.

Answer:

(d) All of them.