Audit Documentation and Audit Evidence – CA Inter Audit Questions bank is designed strictly as per the latest syllabus and exam pattern.

Audit Documentation and Audit Evidence – CA Inter Audit Question Bank

Question 1.

Comment on the following situation/statement:

M/s. Health Zone, a partnership firm, running a nursing home have decided to discontinue you as an auditor for the next year and requests you to hand over all the relevant working papers of the previous year. (Nov 2007, 6 marks)

Answer:

Audit Working Paper: Ownership and custody

Facts: According to SA-230 “Audit Documentation”, the working papers are the property of the auditor, the auditor may, at his discretion make portion of or extracts from his working papers available to the client.

Analysis: In the given case M/s Health Zone, a partnership firm owning a nursing home have requested the Auditor to hand over all relevant working papers of the previous year. The working paper being properly of auditor he is under no obligation to hand them over to M/s Health Zone. However, the auditor may at his discretion, make proportions of working paper available to M/s Health Zone.

Question 2.

What does SA 230 say about utility, ownership, custody and retention of working papers? (May 2008, 4 marks)

Answer:

Audit Working Paper

| Basic Requirements | Working paper should: 1. be designed arid properly organized to meet the auditor’s need in the circumstance of each audit. 2. facilitate the delegation of work. 3. be sufficiently complete and detailed to obtain an overall understanding. 4. record the audit plan, audit procedures etc. |

| Working Papers are classified into | 1. Permanent audit files: Are those which are of continuing importance and will be required in future audits. They only need to be updated from time to time. 2. Current audit files: Contain the information relating to audit of a single period. |

| Ownership and Custody of working | 1. Working papers are the property of the auditor. 2. He may, at his discretion, make portions of it papers available to his client. 3. The auditor is entitled to retain them (Chantrey Martin and Co. V. Martin) |

Question 3.

State with reasons (in short) whether the following statement is True or False:

Audit Working Papers to be kept at least for 3 (three) years. (Nov 2008, 2 marks)

OR

State with reasons (in short) whether the following statement is correct or incorrect:

Working papers are property of client, as it contains client’s informations. (Nov 2015,2 marks)

Answer:

False:

As per SA-230, “Audit Documentation” “Documentation” refers to the working papers prepared or obtained by the auditor and retained by him, in connection with the performance of his audit. This audit ig standard states that the working papers are the property of auditor aix’ he has to retain them for a period of 7 years.

![]()

Question 4.

Write short note on the Audit Working Papers. (May 2010, 5 marks)

Answer:

Audit Working Papers

| Meaning | As per SA-230 “i.e. Audit Documentation”, (Revised) the audit working papers refer to the documents proposed or obtained by the auditor and retained by him in connection with the performance of his audit. |

| Provides for | Working papers should provide for: 1. Means of controlling current audit work. 2. Supervision and review of the audit work. 3. Evidence to support the auditor’s opinion. 4. Information about the business being audited, including the recent history. |

Question 5.

R.K. & Company are the auditors of PQR Company Ltd. The Managing Director of the Company demands copies of the working papers from the auditors. Are the auditors bound to oblige the Managing Director? (Nov 2000, 4 marks)

Answer:

Working Papers: Ownership and Custody Facts: According to SA-230 “Audit Documentation”, the wording papers are the property of the auditor, the auditor may, at his discretion make portion of or extracts from his working papers available to the client The auditor is entitled to retain them. (Chantrey Martin and Co. Vs Martin)

Analysis: In the given case the managing director of the company has demanded copies of the working papers from the auditor. He has no right to obtain copies of the working papers from the auditor because they are the property of the auditor. But the auditor may at his discretion make portions of or extracts from the working paper to the managing director of R K & Company.

Inference: The auditor is not bound to oblige the managing director by supplying copies of the audit working papers.

Question 6.

Comment on the following in relation to SAs:

“Audit documentation serves a number of additional purposes”. (May 2011, 5 marks)

Answer:

Audit Documentation

According to SA 230 on “Audit Documentation”, audit documents once collected serves a number of additional purposes.

These purposes are as follows:

- Enabling the conduct of quality control reviews and inspections.

- Enabling the conduct of external inspections in accordance with applicable legal regulatory or other requirements.

- Enabling the engagement team to be accountable for its work.

- Retaining a record of matters of continuing significance to future audits.

- Assisting the engagement team to plan and perform the audit.

- Assisting members of the engagement team responsible for supervision to direct and supervise the audit work and to discharge their review responsibilities in accordance with SA 220 “Quality Control for an Audit of Financial Statements”.

Question 7.

Write short note on the Importance of working papers. (Nov 2011, 4 marks)

OR

Write short note on the following: Importance of audit working papers. (Nov 2013, 4 marks)

OR

Write short note on the Importance of working papers (May 2015, 4 marks)

Answer:

Importance of Working Papers

- It provides guidance to the audit staff with regard to the manner of checking the schedules.

- The auditor is able to fix responsibility on the staff member who signs each schedule checked by him.

- It acts as evidence in the Tribunal of law when a charge of negligence is brought against the auditor.

- It acts as the process of planning for the auditor so that he can estimate the time that may be required for checking the schedules.

- It is useful in recording and demonstrating the audit work from one year to another.

- Working papers are necessary to draw conclusion from the evidence obtained.

- It standardizes the documentation to improve the efficiency of the audit.

- It facilitates to delegate the work as a means to control its quality.

- Helps in fixing responsibility on the staff member who signs each schedule checked by him.

Therefore, the auditor should adopt reasonable procedures br custody and confidentiality of his working papers and should retain them for a period of time sufficient to meet the needs of his practice and satisfy any pertinent legal or professional requirements of record retention.

Question 8.

What are the audit working papers? Discuss various contents of current file. (Nov 2012, 8 marks)

Answer:

Audit Working Papers:

| Basic Requirements | Working paper should: 1. be designed arid properly organized to meet the auditor’s need in the circumstance of each audit. 2. facilitate the delegation of work. 3. be sufficiently complete and detailed to obtain an overall understanding. 4. record the audit plan, audit procedures etc. |

| Working Papers are classified into | 1. Permanent audit files: Are those which are of continuing importance and will be required in future audits. They only need to be updated from time to time. 2. Current audit files: Contain the information relating to audit of a single period. |

| Ownership and Custody of working | 1. Working papers are the property of the auditor. 2. He may, at his discretion, make portions of it papers available to his client. 3. The auditor is entitled to retain them (Chantrey Martin and Co. V. Martin) |

Current Audit Files: In the current audit fifes those audit working papers are kept which contain the information relating to audit of a single period. It records nature, timing, and extent of audit procedures performed and results of such procedures.

The Current Audit File normally Includes:

- Correspondence relating to acceptance of annual reappointment.

- Analysis of transactions and balances.

- Evidence of planning process of the audit and audit programme.

- Evidence that assistanrs work are supervised and reviewed.

- Extracts of important matters related to minutes of Board Meetings and General Meetings which are relevant to audit.

- Copies of communication with other auditor’s, experts, and other third parties.

- Letters of representation or confirmation received from the client.

- Auditor’s conclusions on significant aspects of audit, Including how exceptions and unusual matters, if any, disclosed by the auditor’s procedures were resolved or treated.

- Copies of financial information being reported on and the related audit reports.

- Record of the nature, timing arid extent of auditing procedures performed and the result thereof.

- Management representations on material matters.

- Working paper acts as evidence in the Tribunal of law when a charge of negligence is brought against the auditor.

![]()

Question 9.

Write short note on the Auditors lien. (Nov 2012, 4 marks)

Answer:

Auditor’s lien

| Meaning | Any person having the lawful possession of somebody else’s property on which he has worked may retain the property for non-payment of his dues, on account of the work done on the property. |

| Auditor’s lien | Auditor can exercise hen on books and documents placed at has possession by the client for non-payment of fees, for work done on the books and documents. |

| Conditions for Exercising Lien by the Auditor | It can be done on the following conditions: 1. Documents retained must belong to the client who owes the money. 2. Documents must have come into possession of the auditor on the authority of the client. They must not have been received through irregular or illegal means. 3. The auditor can retain the documents only if he has done work on the documents assigned to him. 4. Such documents can be retained which are connected with the work on which lees have not been paid. |

| Is lien possible in case of Company | 1. Under Sec. 128(1) of the Act, 2013 books of accounts of a company must be kept at the registered office. 2. However, Board can pass a resolution and hand over the books of account to the auditor and makes the necessary notification to the Registrar. 3. However, as per Sec. 128, he must provide reasonable facility for inspection of the books of account by directors and others authorised to inspect under the Act. |

| Lien on working papers | Lien is exercised in respect of client’s property. His working papers being his own property, the question of Lien on them does not arise. |

Question 10.

Discuss with reference to SAs:

Factors affecting form, contents, and extent of audit. (May 2013, 5 marks)

OR

The form, contents, and extent of audit documents depend on certain factors. Explain with reference to SA 230. (Nov 2015,4 marks)

Answer:

As per SA-230 on “Audit Documentation”, the team, content, and extent of audit documentation depend on the following factors:

- The size and complexity of the entity.

- The nature of the audit procedures to be performed.

- The identified risks of material misstatement.

- The significance of the audit evidence obtained.

- The nature and extent of exceptions Identified.

- The need to document a conclusion or the basis for a conclusion not readily determinable from the documentation of the work performed or audit evidence obtained.

- The audit methodology and tools used.

Question 11.

Audit documentation serves a number of purposes. Explain with reference to SA-230. (May 2015, 6 marks)

Answer:

Purposes of Audit Documentation: As per SA 230:

- It helps f or assisting the engagement team to plan and perform the audit.

- It helps for assisting members of the engagement team responsible for supervision to direct and supervise the audit work and to discharge their review responsibilities.

- Documentation enables the engagement team to be accountable for its work.

- It helps to retain a record of matters of continuing significance to future audits.

- it enables the conduct of quality control reviews and inspections.

Question 12.

Audit documentation serves a number of purposes. Explain with reference to SA-230. (May 2015,6 marks)

Answer;

Purposes of Audit Documentation: As per SA 230:

- It helps for assisting the engagement team to plan and perform the audit.

- It helps for assisting members of the engagement team responsible for supervision to direct and supervise the audit work and to discharge their review responsibilities.

- Documentation enables the engagement team to be accountable for its work.

- It helps to retain a record of matters of continuing significance to future audits.

- It enables the conduct of quality control reviews and inspections.

- It enables the conduct of external inspections In accordance with applicable legal, regulatory or other requirements.

- Working Papers are necessary to record and demonstrate the audit work from one year to another.

- It draws conclusions from the evidence obtained.

- Working Papers are necessary to standardize the audit procedures to improve the efficiency of the audits.

- It facilitates the delegation of work as a means to quality control of work performed.

- Working Papers provide guidance to the audit staff with regard to the manner of checking the schedules.

- Working Papers act as evidence in a court of law when a charge of negligence is brought against the auditor.

Question 13.

State with reasons (In short) whether the following statement Is correct or incorrect:

The auditor’s right of lien is unconditional. (Nov 2016, 2 marks)

Answer:

Incorrect:

The auditor can exercise his lien on cliental books and records subject to the following conditions:

- The document must be of the client who owes the money.

- Documents must have come into auditor’s possession with the client’s authority.

- Some work must have been done and fees for work performed must be outstanding.

Question 14.

Examine with reasons (in short) whether the following statements are correct or incorrect:

(c) The Audit Engagement documentations should ordinarily be retained by the auditor for minimum of six years from the date of the auditor’s report or is later, the date of the group auditor’s report, whichever is later. (May 2018, 2 marks)

Answer:

Incorrect:

In specific cases of audit engagements, the retention period for audit engagement documents shall be not shorter than seven years from the date of the auditor’s report, or it later, the date of the group auditor’s report.

Question 15.

CompIetion Memorandum” is helpful as part of the audit documentation. Explain. (May 2019, 3 marks)

Answer:

As per SA 230, ‘Audit Documentation’, the auditor may consider It helpful to prepare and retain as a part of the audit documentation a completion

memorandum (i.e. a summary) that describes –

– the significant matters identified during the audit., and

– how they were addressed.

Such a summary may facilitate effective and efficient review and inspection of the audit documentation, particularly for large and complex audits. Further, the preparation of such a completion memorandum may assist auditor’s consideration of the significant matters. It may also help the auditor to consider whether there is any individual relevant SA objective that the auditor cannot achieve that would prevent the auditor from achieving the overall objectives of the auditor.

Question 16.

State with reasons (in short) whether the following statement is True or False:

One of the techniques used for gathering evidence is substantial review. (Nov 2007, 2 marks)

Answer:

Correct:

For collection and accumulation of audit evidence, certain methods and means are available and these are known as audit techniques. Some of the techniques commonly adopted by the auditors are Posting Checking. Casting Checking, Physical Examination and count, confirmation, Inquiry, Year-end Scrutiny, Re-computation, Tracing In subsequent periods. Bank reconciliation. Substantial review is examination of accounts having large amounts, value, and importance. Substantial review can be used for gathering evidence.

Question 17.

State with reasons (in short) whether the following statement is True or False:

Compliance procedures are tests designed to obtain audit evidence as to completeness, accuracy, and validity of the data produced by accounting system. (May 2008, 2 marks)

Answer:

False:

Compliance procedures are the tests designed to obtain reasonable assurance that those internal controls on which audit reliance s to be placed are in effect. On the other hand. Substantive procedures are tests designed to obtain audit evidence as to completeness, accuracy, and validity of the data produced by accounting system.

![]()

Question 18.

What are the various assertions an auditor is concerned with while obtaining audit evidence from substantive procedure? (May 2008, 6 marks)

Answer:

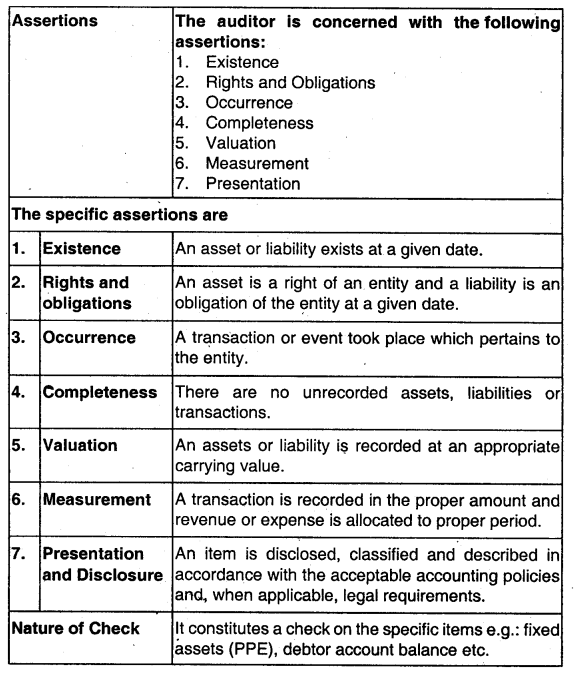

Substantive Procedures are tests designed to obtain evidence as to the completeness, accuracy, and validity of data produced by accounting system.

They are of two types:

1. Test of details of transactions and balances.

2. Analysis of significant ratios and trends including the resulting investigation of unusual fluctuations and items.

In obtaining evidence from substantive procedures, the auditor Is concerned with the following assertions:

| 1. Existence | An asset or liability exists at a given date. |

| 2. Rights and Obligations | An asset is a right of an entity and a liability is an obligation of the entity at a given date. |

| 3. Occurrence | A transaction or event took place which pertains to the entity. |

| 4. Completeness | There are no unrecorded assets, liabilities or transactions. |

| 5. Valuation | An assets or liability Is recorded at an appropriate carrying value. |

| 6. Measurement | A transaction is recorded in the proper amount and revenue or expense is allocated to proper period. |

| 7. Presentation and Disclosure | An Item is disclosed, classified and described in accordance with these acceptable accounting policies and, when applicable, legal requirements. |

Question 19.

Write short note on the Reliability of Audit Evidence. (May 2008, Nov 2011,5 marks)

OR

Discuss the following:

The reliability of audit evidence is influenced by its source, nature, and circumstances under which it is obtained. (Nov 2013, 5 marks)

Answer:

Reliability of Audit Evidence:

SA 500 on “Audit Evidence” provides that the reliability of information to be used as audit evidence and therefore of the audit evidence itself is influenced by its source and its nature and the circumstances under which it is obtained, including the controls over its preparation and maintenance where relevant.

Therefore, generalizations about the reliability of various kinds of audit evidence are subject to Important exceptions. Even when information to be used as audit evidence is obtained from sources external to the entity. circumstances may exist that could affect its reliability.

The reliability of audit evidence Is influenced by

- Its source i.e. internal and external.

- Its nature i.e. visual, documentary or oral.

- Circumstances under which it is obtained.

- Consistency of evidence obtained from different sources or nature.

- Nature of assertion obtained and its materiality.

Generalizations useful in assessing reliability of audit evidence

- External evidence (e.g.: confirmation received from third party) is more reliable than internal evidence.

- Internal evidence is more reliable when related internal control is satisfactory.

- Evidence In the form of documents and written representations are usually more reliable than oral representation.

- Evidence obtained by the auditor himself is more reliable than that obtained through the entity.

![]()

Question 20.

Distinguish between Internal evidence and External evidence. (Nov 2008, 4 marks)

Answer:

| Basis | Internal Evidence | External Evidence |

| 1. Meaning | Internal evidence is one that has been created, used, and retained within the client’s organization. | External evidence is one, which originates outside the client’s organization. |

| 2. Use for accounting | These may not always constitute a direct accounting source document. | These documents are generally proposed in the ordinary course of business activities and form part of its records whether of accounting or non-accounting nature. |

| 3. Auditor’s role | It is provided to the auditor by the sources internal to the organization. | It is obtained directly by the auditor. |

| 4. Reliability | It is not as reliable as external evidence. | It is considered more reliable than internal evidence. |

| 5. Example | Sales invoice duplicate copy, inventory report, wage sheets, etc. | Payee’s receipt, bank statement, cancelled cheques, etc. |

Question 21.

State with reasons (in short) whether the following statement is True or False:

Taking management representation Is a convenient, economical, and equally acceptable auditing method even where the direct access by auditor to audit evidence is possible. (May 2009, 2 marks)

Answer:

False:

It is possible for auditor to check the Transaction by himself through direct access, it es not fair for him to merely rely the management representation as prime audit evidence.

Question 22.

Write short note on the following:

Substantive Procedures (May 2010, Nov 2014, 5, 4 marks)

Answer:

Substantive Procedures

| Meaning | Substantive tests seek to provide evidence as to the completeness, accuracy and validity of an amount or account balance. |

| Purpose | The auditor carries out substantive tests on all aspects of the financial statements, to obtain sufficient, relevant and reliable evidence on which to base his opinion. |

Types They are of two types:

1. Tests of details of transactions and balances, i.e. vouching an verification and,

2. Analysis of significant ratios and trends Including the resulting investigation oF unusual fluctuations and items.

Examples: Substantive tests are conducted in areas, which are not subject to internal control and are hence judgment & in nature. e.g. valuation of stock, provision for doubtful debts etc.

Question 23.

What do you mean by the term ‘Sufficient Appropriate Audit Evidence’? State various factors that help the auditor to ascertain as to what is sufficient appropriate audit evidence. (Nov 2010,6 marks)

Answer:

Sufficient appropriate audit evidence:

Meaning: As per SA 200 he auditor should obtain sufficient appropriate audit evidence through performance of compliance and substantive procedures to enable him to draw reasonable conclusions therefrom on which to base his opinion on ttle financial information.

SA 500 on ‘Audit again elaborates this concept. As per this standard sufficiency and appropriateness are interrelated and apply to evidence obtained from both compliance and substantive procedures.

Sufficiency means the quantum of audit evidence obtained whereas appropriateness is related to its relevance and reliability. Generally, the auditor finds it necessary to rely on audit evidence which is persuasive rather than conclusive. Auditor may often seek evidence from different sources or of different nature to support the same assertions.

Various factors which help the auditor to ascertain sufficient aid appropriate audit evidence: These are the factors which Influence the auditor’s judgment as to what is sufficient and appropriate audit evidence:

- The materiality of the item.

- The type of information available.

- The trend indicated by accounting ratios and analysis.

- The experience gained during previous audits.

- The results of auditing procedures, including fraud and errors which may have been found.

- Degree of risk of misstatements which may be affected by factors such as the nature of items, adequacy of internal control, nature and size of businesses camped out by the entity, situations which may exert an influence on management and the financial position of the entity.

The auditor obtains the evidence through compliance procedures and substantive procedures to satisfy assertions contained in the financial statements.

![]()

Question 24.

Explain various methods to obtain audit evidence. (May 2011, 8 marks)

OR

Write short note on the Methods to obtain audit evidence. (May 2015, 4 marks)

OR

Mr. A was appointed statutory auditor of P Ltd., but he was not able to gather the sufficient audit evidences. Discuss how he should proceed to gather more audit evidences. (Nov 2015, 6 marks)

Answer

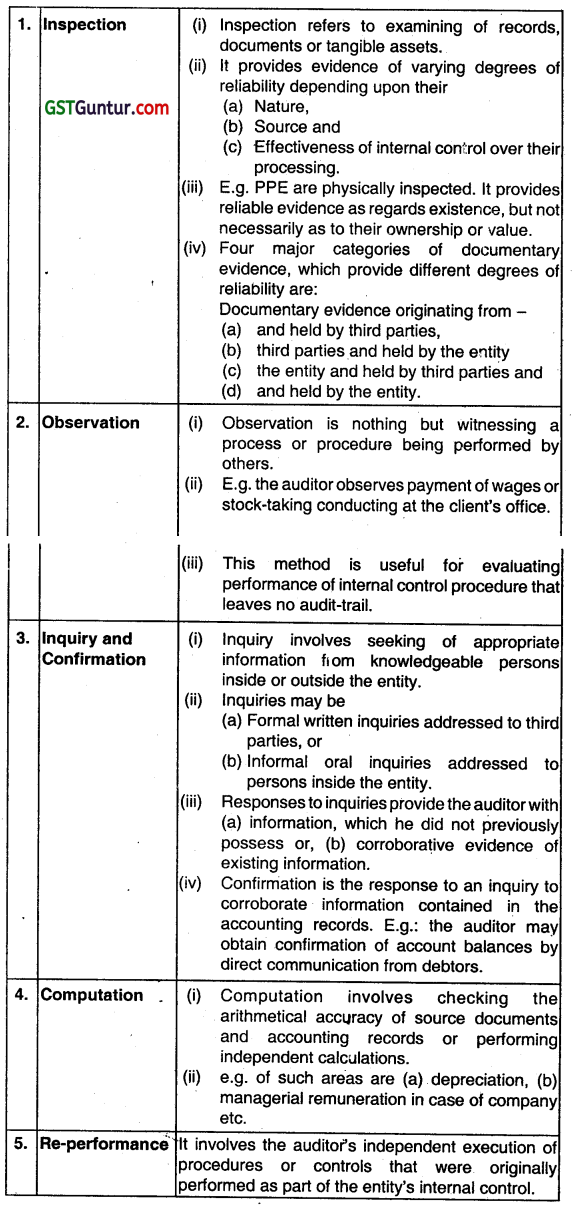

The auditor obtains evidence in performing compliance and substantiative procedures by one or more of the following methods:

1. Inspection.

2. Observation.

3. inquiry and confirmation.

4. Computation

Question 25.

Discuss the following:

Inquiry is one of the audit procedures to obtain audit evidence. (May 2013, 5 marks)

Answer:

inquiry and Confirmation:

1. Inquiry involves seeking of appropriate information from knowledgeable persons inside or outside the entity.

2. Inquiries may be

(a) Formal written inquiries addressed to third parties, or

(b) Informai oral inquines addressed to persons inside the entity.

3. Responses to inquiries provide the auditor with

(a) information, which he did not previously possess or,

(b) corroborative evidence of existing information.

4. Confirmation is the response to an inquiry to corroborate information contained in the accounting records. E.g. the auditor may obtain confirmation of account balances by direct communication from debtors.

Although corroboration of evidence obtained through inquiry is often of particular importance, in the case of inquiries about management intent, the information available to support management’s intent may be limited. In these cases, understanding management’s past history of carrying out its stated intentions, management’s stated reasons for choosing a particular course of action, and management’s ability to pursue a specific course of action may provide relevant information to corroborate the evidence obtained through inquiry.

In respect of some matters, the auditor may consider it necessary to obtain written representations from management and where appropriate, those charged with governance to confirm responses to oral inquiries.

Question 26.

Comment on the following:

Compliance procedures are tests designed to obtain audit evidence as to completeness, accuracy and validity of data produced by accounting systems. (May 2013, 2 marks)

Answer:

As per AS-240 compliance procedure Is one of the techniques adopted in obtaining audit evidence. These tests are conducted by the auditors to obtain reasonable assurance that the internal control system on which reliance is to be placed are effective. Since it constitutes a check on internal control system, therefore, it is a part of internal control system.

Question 27.

State with reasons (in short) whether the following statement is correct or incorrect:

Substantive procedures do not test the balances of accounts. (May 2016, 2 marks)

Answer:

incorrect:

Substantive audit procedure seeks to provide evidence as to accuracy of an amount and balance of account in financial statements.

Question 28.

State with reasons (in short) whether the following statement is correct or incorrect:

One of the techniques used for gathering evidence is substantial review. (Nov 2016, 2 marks)

Answer:

Correct:

For collection and accumulation of audit evidence, certain methods and means are available and these are known as audit techniques. Some of the techniques commonly adopted by the auditors are Posting Checking, Casting Checking, Physical Examination and count, confirmation, Inquiry, Year-end Scrutiny, Re-computation, Tracing in subsequent periods, Bank reconciliation. Substantial review is examination of accounts having large amounts, value and importance. Substantial review can be used for gathering evidence.

![]()

Question 29.

Write short note on the Management representation (Nov 2016, 4 marks)

Answer:

Management Representations

Meaning

According to SA-580 (Revised) on written Representation, Management representation means written or oral confirmations made by the management in relation to the matters of the financial statements.

Prepared by

Management Representation can either

(i) be sent by the management itself on its own, or

(ii) it may be outlined by the auditor and subsequently acknowledged and confirmed by the management.

Other Formalities

It must be properly dated and signed by a competent authority. It must be addressed to the auditor.

As Evidence

Management Representation is a good evidence for the auditor and hence it is documented as working papers.

Auditors Duty

It is auditors duty to obtain written representation that management has disclosed to the auditor about all known actual or possible non-compliance with laws and regulations whose effects should be considered while preparing financial statements.

Basic elements of Management Representation Letter

As per SA 580 Written RepresentatIon”, some of the basic elements of a Management Representation letter are:

- It is a written statement by management provided to the auditor to confirm certain matters or to support other audit evidence.

- It does not include financial statements, the assertions therein, or supporting books and records.

- Auditor shall request management to provide a written representation that it has fulfilled its responsibility regarding preparation of the financial statements In accordance with the applicable financial reporting framework, including where relevant their lair presentation, as set Out in the terms of the audit engagement.

- The written representations shall be for all financial statements and period(s) referred to in the auditor’s report.

Question 30.

Answer the question:

With reference to SA 500, MAudit Evidence”, discuss the different sources and their reliability, of audit evidence. (May 2017, 6 marks)

Answer:

Sources of Audit Evidence:

1. InternaI Evidence:

Internal evidences are those evidences which originates, used, and retained in the clients organisation. It is provided to the Auditor by the sources internal to the organisation.

Example: Employees Wage sheet. Sales invoice. Counter foils of Receipts, Purchase requisition, Minutes book etc.

2. External Evidence:

External evidences are those evidences which originates outside the client’s organisation. It Is generally prepared in the ordinary course of business activities and may be sometimes obtained directly by the auditor.

Example: Purchase invoice, Bank statement confirmation of balances of Debtors, Creditors, Borrowers, etc.

Reliability of Audit Evidence:

Reliability of SA 500 on “Audit Evidence provides that the Audit Evidence reliability of information to be used as audit evidence and therefore of the audit evidence itself is influenced by its source and its nature and the circumstances under which it is obtained, including the controls over its preparation and maintenance where relevant.

Therefore, generalizations about the reliability of various kinds of audit evidence are subject to important exceptions. Even when information to be used as audit evidence is obtained from sources external to the entity, circumstances may exist that could affect its reliability.

The reliability of audit evidence is influenced by

- Its source i.e. internal and external.

- Its nature ie. visual, documentary or oral.

- Circumstances under which it is obtained.

- Consistency of evidence obtained from different sources or nature.

- Nature of assertion obtained and its materiality.

Generalizations useful in assessing reliability of audit evidence

- External evidence (e.g.: confirmation received from third party) is more reliable than internal evidence.

- Internal evidence is more reliable when related internal control is satisfactory.

- Evidence in the form of documents and written representations are usually more reliable than oral representation.

- Evidence obtained by the auditor himself is more reliable Than that obtained through the entity.

Question 31.

Discuss the Various points which auditor needs to consider in determining whether it is appropriate to use audit evidence about operating effectiveness of controls obtained in previous audits, and if so. the length of the time period that may elapsed before retesting. (Nov 2019, 4 marks)

Answer:

In determining whether It is appropriate to use audit evidence about the operating effectiveness of controls obtained In previous audits, and, If so, the length of the time period that may elapse before retesting a control, the auditor needs to consider the following points:

- The effectiveness of other elements of Internal control, including the control environment, the entity’s monitoring of controls, and the entity’s risk assessment process;

- The risks arising from the characteristics of the control, including whether it is manual, or automated;

- The effectiveness of general IT – Controls;

- The effectiveness of the control and its application by the entity, including the nature and extent of deviations in the application of the control note in previous audits, and whether there have been personnel changes that significantly affect the application of the control;

- Whether the lack of a change in a particulars control poses a risk due to changing circumstances; and

- The risks of material misstatement and the extent of reliance on the control.

Question 32.

Discuss the audit procedure to be considered by an auditor while performing analytical procedures to obtain audit evidence as to overall reasonableness of purchase quantity and price. (Nov 2019, 3 marks)

Answer:

Audit procedure to be considered by an auditor while performing analytical procedure to obtain audit evidence as to overall reasonableness of purchase quantity and price may include:

1. Consumption Analysis:

Auditor should scrutinize raw materials consumed as per manufacturing account and compare the same with previous years with closing stock and ask for the reasons from management ¡f any significant variations found.

2. Stock Composition Analysis:

Auditor to collect the reports from management for composition of stock i.e. raw materials as a percentage of total stock and compare the same with previous years and ask for reasons from management In case of significant variations.

3. Ratios:

Auditor should compare the creditor’s turnover ratios and stock turnover ratios of the current year with previous years.

4. Auditor should review quantitative reconciliation of dosing stocks with opening stock, purchases, and consumption.

![]()

Question 33.

Explain whether the following statements are correct or incorrect, with reasons/explanations examples:

Sufficiency is the measure of the quantity of audit evidence. (Jan 2021, 2 marks)

Question 34.

Examine with reasons whether the following statements are correct or incorrect:

A positive Confirmation request Is a request where the confirming party responds only if it disagrees with the information provided in the request. (May 2019, 2 marks)

Answer:

This Statement is Inconnect

A positive confirmation request is a request that the confirming party respond directly to the auditor indicating whether the confirming party agrees or disagrees with the information in the request, or providing the requested information.

Question 35.

Explain the concept of True and Fair’ view. (2012 – Nov 6 marks)

OR

Discuss the following:

What constitutes true and fair view Is a matter of auditor’s judgment, but some specific points must be seen by the auditor to ensure true and fair view. (Nov 2016, 4 marks)

OR

What constitutes a ‘true and fair’ view, is the matter of an auditor’s judgment in the particular circumstances of a case. In order to ensure true and fair view, auditor has to review certain points. Mention any such 5 (five) points in brief. (May 2018, 5 marks)

Answer:

Concept of “True and Fair”: A fundamental concept in auditing is the concept of true and fair audit report. The statutory auditor of a company has to express the opinion in his report on the true and fair character of the balance sheet and the result shown by the profit and loss account.

This requires that the auditor should examine the accounts with a view to verify that all assets, liabilities, income and expenses are stated as amounts which are in accordance with accounting principles and policies which are relevant and no material amount, item, or transaction has been omitted.

1. According to Sec. 129 of the Companies Act, 2013, as amended by the Companies (Amendment) Act, 2017, the financial statements shall give a true and fair view of the state of affairs of the company or companies, comply with the accounting standards notified under Sec. 133 of the Companies Act, 2013 and shall be in the form or forms as may be provided for different classes or classes of companies in Schedule III:

Provided that the items contained in such financial statements shall be in accordance with the accounting standards;

Provided further that nothing contained in this sub-Sec. shall apply to any insurance oc banking company or any company engaged in the generation or Supply of electricity, or to any other class of company for which a form of financial statement has been specified in or under the Act governing such class of company:

Provided also that the financial statements shall not be treated as not disclosing a true and fair view of the state of affairs 0f the company, merely by reason 01 the fact that they do not disclose-

(a) in the case of a company engaged in the generation or supply of electricity, any matters which are not required to be disclosed by the Electricity Act, 2003;

(b) in the case of an insurance company, any matters which are not required to be disclosed by the Insurance Act. 1938, or the Insurance Regulatory and Development Authority Act, 1999;

(c) in the case of a banking company, any matters which are not required to be disclosed by the Banking Regulation Act, 1949;

(d) in the case of a company governed by any other law for the time being in force, any matters which are not required to be disclosed by that law.

2. At every annual general meeting of a company, the Board of Directors of the company shall lay before such meeting financial statements for the financial year.

3. If a company has one or more subsidiaries or associate companies it shall, in addition to financial statements provided under sub-Sec. (2), prepare a consolidated financìal statement of the company and of all the subsidiaries and associate companies in the same form and manner as that of its own and in accordance with applicable accounting standards which shall also be laid before the annual general meeting of the company along with the laying of Its financial statement under sub- Sec. (2):

Provided that the company sh&I also attach along with its financial statement, a separate statement containing the salient features of the financial statement of its subsidiary or subsidiaries and associate company or companies in such form as is prescribed under Rule 5 of the Companies (Accounts) Rules, 2014.

Provided further that the Central Government may provide for the consolidation of accounts of companies in such manner as is prescribed under Rule 6 of the Companies (Accounts) Rules, 2014. [As amended by Companies Act, 2017].

4. The provisions of this Act applicable to the preparation, adoption, and audit of the financial statements of a holding company shall, mutatis mutandls, apply to the consolidated financial statements referred to in sub-Sec. (3).

5. Without prejudice to sub-Sec. (1), where the financial statements of a company do not comply with the accounting standards referred to in sub-Sec. (1), the company shall disclose in its financial statements, the deviation from the accounting standards, the reasons for such deviation, and the financial effects. it any, arising out of such deviation.

6. The Central Government may, on Its own or on an application by a class or classes of companies, by notification, exempt any class or classes of companies from complying with any of the requirements of this section or the rules made thereunder. it is considered necessary to grant such exemption in the public interest and any such exemption may be granted either unconditionally or subject to such conditions as may be specified in the notification.

7. If a company contravenes the provisions of this section, the managing director, the whole-time director in charge of finance, the Chief Financial Officer or any other person charged by the Board with the duty of complying with the requirements of this section and in the absence of any of the officers mentioned above, all the directors shall be punishable with imprisonment for a term which may extend to one year or with fine which shall not be less than fifty thousand rupees but which may extend to live lakh rupees, or with both.

In the relation of audit of a company, the accounts of a company shall be deemed as not disclosing a true and fair view, if they do not disclose any matters which are required to be disclosed by virtue of provisions of Schedule III to that Act, or by virtue of a notification or an order of the Central Government modifying the disclosure requirements. So, the auditor will have to see that the accounts are drawn up in conformity with the provisions of Schedule III of the Companies Act. 2013 and whether they contain all the matters required to be disclosed therein. In case of companies which are governed by special Acts, the auditor should see whether the disclosure requirements of the governing Act are complied with. It must be noted that the disclosure requirements laid down by the law are the minimum requirements.

Thus to ensure true and fair view, an euditor bas to see:

- that the assets are neither undervalued oc overvalued, according to the applicable accounting principles;

- no material asset is omitted;

- the charge. if any, on assets are disclosed;

- material liabilities should not be omitted;

- the profit and loss account and balance sheet discloses all the matters required to be disclosed;

- Accounting policies have been followed consistently; and

- all unusual, exceptional or non-recurring items have been disclosed separately.

![]()

Question 36.

Casting or totaling is an important tool of audit for an Auditor. (2014 – Nov 4 marks)

Answer:

Casting and totaling Is an important audit of normal audit procedure.

As In casting totaling the total of the particular account is done so That any error in totaling is detected it helps the auditor to given opinion on true and fair view of financial statement. So that casting and totaling is an Important audit technique to help the auditor.

Question 37.

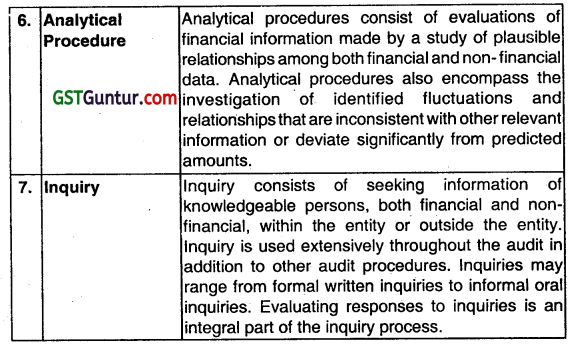

Write short note on the Contents of Audit Notebook. (May 2008, 5 marks)

Answer:

Question 38.

What are the significant matters observed dunng the course of audit, a record of which should be kept in the Audit Note Book? (May 2016, 6 marks)

Answer:

Following are the significant matters observed during the course of audit, e record of which should be kept In audit note book.

(i) General Information which contains following:

- Nature of the business carried on.

- Important provisions affecting its functioning like memorandum and Articles of Association, Partnership deed etc.

- Structure of the financial and administrative organisation.

- List of the books of account.

- Name of principal officers, their duties, and responsibilities.

- Particulars of the system of accounts and internal control which are in operation.

- Particulars of the accounting and financial policies followed.

- Important contracts to which the client is a party e.g. collaboration contracts, Royalty contracts, etc.

(ii) Current Information contains the following:

- Audit queries not cleared immediately, e.g. missing receipts, vouchers etc.

- Mistakes or irregularities observed during the course of audit e.g. failure to comply with requirements of the Companies Act, or the provisions of the memorandum or Articles, change in the basis of valuation of finished stock and WIP or in computation of depreciation, failure to provide adequate depreciation, etc.

- Unsatisfactory bookkeeping arrangements, costing method Internal or financial administration or organisation.

- Important Information about the company which is not apparent from the accounts.

- Special points requiring consideration at the time of verification of final accounts.

- Important matters for future reference.

Question 39.

Explain the following in brief:

Precautions to be taken in applying test check technique. (Nov 2007, 6 marks)

Answer:

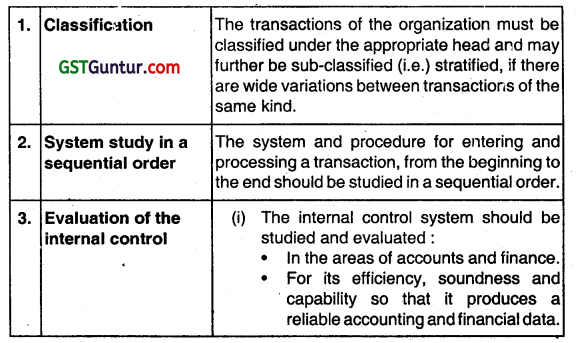

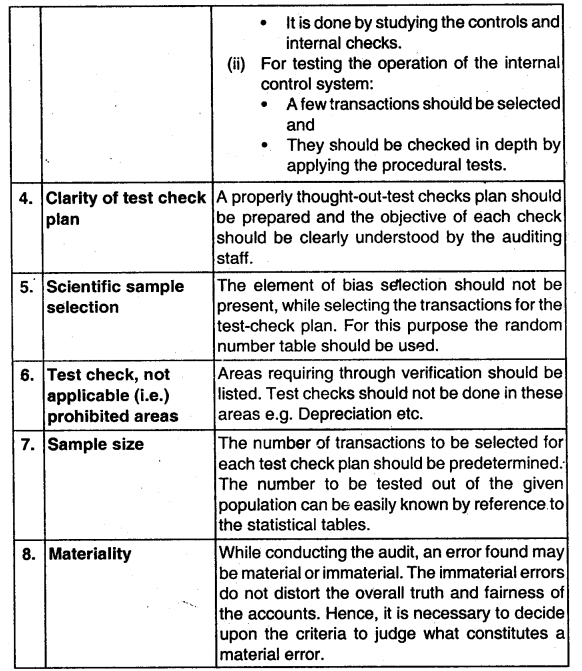

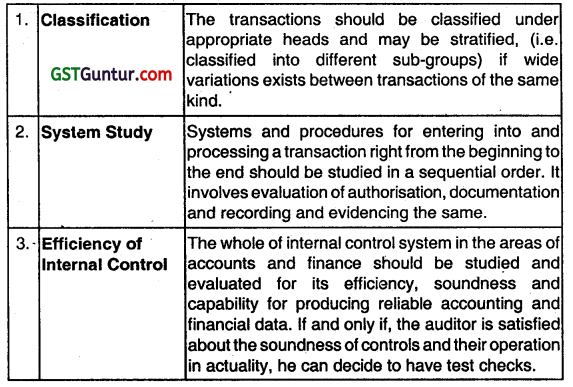

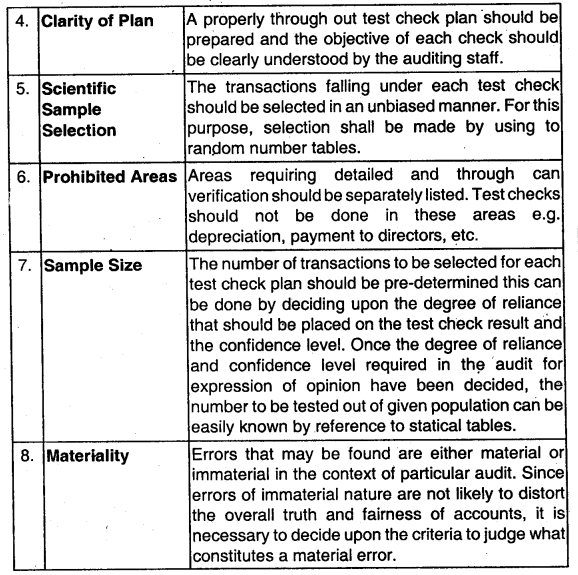

Precautions: Test checking technique is an accepted auditing procedure and is generalized in case of large business organizations flaying many homogeneous transactions. The precautions to be taken are:

Question 40.

You are the auditor of a company. What precautions you will suggest in adopting test checking tedinique for audit work? (May 2014, 8 marks)

OR

What precautions should be taken by an auditor while applying test check techniques? (May 2016,4 marks)

Answer:

Test checking technique is an accepted auditing procedure and is generally used in cases of large business organizations having many homogeneous reactions.

The precautions to be taken by the auditor in test checking are as follows:

Multiple Choice Question

Question 1.

Audit Documentation describes under

(a) SA 200

(b) SA 215

(c) SA 220

(d) SA 230.

Answer:

(d) SA 230.

Question 2.

Audit Documentation also known as

(a) Audit Notes

(b) Audit NoteBook

(c) Working Papers

(d) Audit Evidence Book.

Answer:

(c) Working Papers

Question 3.

Audit documentation refers to the record of audit procedures performed. relevant ……………………….. and conclusions the auditor reached.

(a) Audit planning

(b) Audit evidence

(c) Audit procedures

(d) All of them.

Answer:

(b) Audit evidence

![]()

Question 4.

Audit Documentation provides evidence that the audit was planned and performed in accordance with

(a) SAs

(b) Applicable legal and regulatory requirement

(c) (a) or (b)

(d) (a) and (b).

Answer:

(d) (a) and (b).

Question 5.

Which is not a purpose of Audit documentation.

(a) Assisting the engagement team to plan and perform the audit.

(b) Assisting the management to form the letter of engagement.

(c) Enabling the engagement team to be accountable for its work.

(d) Enabling the conduct of quality control reviews and inspections.

Answer:

(b) Assisting the management to form the letter of engagement.

Question 6.

Content and Extent of Audit Documentation does not depend on the factor.

(a) The size and complexity of the entity,

(b) The identified risks of material misstatement.

(c) The significance of audit evidence obtained and the nature and extent of exceptions Identified.

(d) The requirements under Investigation.

Answer:

(d) The requirements under Investigation.

Question 7.

Audit file may be defined as one or more folders or storage media, ………………. , containing the records that comprise the audit documentation for a specific engagement.

(a) in physical form

(b) In electronic form

(c) (a) or (b)

(d) (a) and (b).

Answer:

(d) (a) and (b).

Question 8.

Appropriate time limit within which to complete the assembly of the final audit file is ordinarily …………………. after the date of audit report.

(a) Less than 60 days

(b) More than 60 days

(c) Not more than 60 days

(d) Less than 90 days.

Answer:

(c) Not more than 60 days

Question 9.

Retention period for audit engagement documents ordinarily is …………………. from the date of the auditor’s report.

(a) not less than 7 years

(b) not less than 5 years

(c) less than 7 years

(d) less than 5 years.

Answer:

(a) not less than 7 years

Question 10.

The retention period for audit engagements ordinarily is no shorter than seven years from the date of the

(a) Auditor’s report

(b) Group Auditor’s report

(c) Auditor’s report or if later, the date of the group auditor’s report.

(d) All of the above.

Answer:

(c) Auditor’s report or if later, the date of the group auditor’s report.

Question 11.

Audit Documentation Summary is also known as

(a) Audit Summary

(b) Audit File

(c) Audit Working Paper

(d) Completion Memorandum.

Answer:

(d) Completion Memorandum.

Question 12.

Audit Documentation Summary describes

(a) the significant matters identified during the audit.

(b) how they were addressed.

(c) the important conclusions concluded by the auditor.

(d) (a) and (b).

Answer:

(d) (a) and (b).

Question 13.

Audit Documentation Summary helps

(a) effective and efficient review and inspection of audit documentation

for large and complex audit

(b) to assist auditor’s consideration of the significant matters

(c) to consider whether there is any individual relevant SA objectives that the auditor cannot achieve.

(d) All of the above.

Answer:

(d) All of the above.

Question 14.

In general audit documentation is the property of the

(a) Client

(b) TCWG

(c) Auditor

(d) Legal Agencies.

Answer:

(c) Auditor

![]()

Question 15.

Auditor may at his discretion make portions of, or extract from, audit documentation available to clients, provided

(a) such disclosure does not undermine the validity of the work performed.

(b) In the case of assurance engagements, the independence of the auditor or his personnel.

(c) (a) and (b)

(d) (a) or (b).

Answer:

(d) (a) or (b).

Question 16.

Auditing is a

(a) Hypothetical process.

(b) Identification process

(c) Investigation process

(d) Logical process.

Answer:

(d) Logical process.

Question 17.

An auditor is called upon to assess the actualities of the situation, review the statements of accounts and give …………………… about the truth and fairness of such accounts.

(a) a conclusion

(b) a general opinion

(c) a opinion

(d) an expert opinion.

Answer:

(b) a general opinion

Question 18.

…………………. may be defined as the information used by the auditor in arriving at conclusions on which the auditor’s opinion ¡s based.

(a) Engagement letter

(b) Audit documents

(c) Audit Note Book

(d) Audit evidence.

Answer:

(d) Audit evidence.

Question 19.

Audit evidences are the evidence collected by the

(a) Accountant at the beginning of audit

(b) Accountant during the audit

(c) Auditor during the audit

(d) Auditor at the time of concluding the audit.

Answer:

(c) Auditor during the audit

Question 20.

Audit evidence is necessary to support the ……………………….. .

(a) auditor’s conclusion

(b) auditor’s investigations

(c) auditor’s opinion

(d) auditor’s opinion and report.

Answer:

(d) auditor’s opinion and report.

Question 21.

Auditor should obtain sufficient and appropriate audit evidence

(a) To prepare audit report

(b) To reduce audit risk

(c) To facilitate audit work.

Answer:

(b) To reduce audit risk

Question 22.

The sufficiency and appropriateness of audit evidence are

(a) Interdependent

(b) Dependent

(c) inter related

(d) Intrarelated.

Answer:

(c) inter related

Question 23.

Audit risk and quantity of audit evidence is

(a) Directly related

(b) Indirectly related

(c) Interdependent

(d) Not related.

Answer:

(a) Directly related

Question 24.

Auditor’s judgement as to sufficiency may be affected by the factors such as

(a) Size and characteristics of the population

(b) Materiality

(c) Risk of nlaterial misstatement

(d) All of the above.

Answer:

(d) All of the above.

![]()

Question 25.

Audit Evidence includes

(a) Confirmation from third party

(b) Analysts reports

(c) Comparable data about competitors

(d) Any of them.

Answer:

(d) Any of them.

Question 26.

…………………. also refers to the amount or amounts set by the auditor at less than the materiality level or levels for particular class of transactions, account balances or disclosures.

(a) Audit Trial

(b) Over all audit procedure

(c) Materiality

(d) Performance Materiality.

Answer:

(c) Materiality

Question 27.

…………………. consists of looking at a process or procedure being performed by the others.

(a) Inspection

(b) Observation

(c) Reperformance

(d) Analytical procedures.

Answer:

(b) Observation

Question 28.

………………….. procedures also are used to obtain audit evidence about the absence of certain conditions.

(a) Observations

(b) External Confirmation

(c) Analytical procedures

(d) Recalculation.

Answer:

(b) External Confirmation

Question 29.

…………………… consists of checking the mathematical accuracy of documents or records.

(a) Observation

(b) External Confirmation

(c) Recalculation

(d) Re-performance.

Answer:

(c) Recalculation

Question 30.

……………………. involves the auditor’s independent execution of procedures or control that were originally performed as part of the entity’s internal control.

(a) Analytical Procedure

(b) External Confirmation

(c) Recalculation

(d) Re – Performance.

Answer:

(d) Re – Performance.

![]()

Question 31.

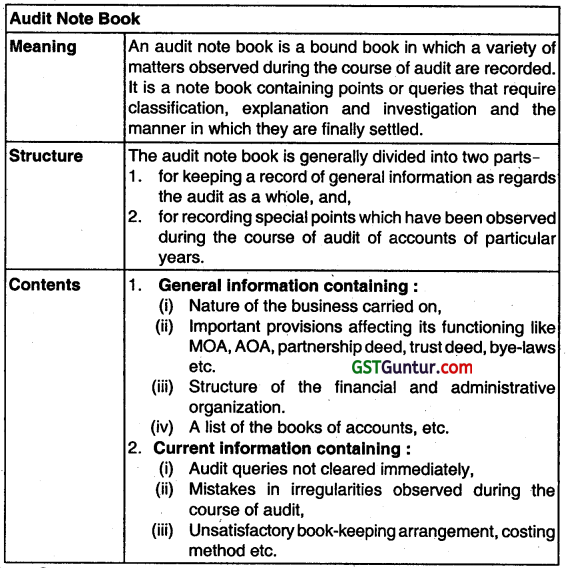

………………… consist of evaluatioftof financial information made by a study of plausible relationships among both financial and non financial data.

(a) Analytical Procedure

(b) External Confirmation

(c) Recalculation

(d) Inquiry.

Answer:

(a) Analytical Procedure

Question 32.

……………….. consists of seeking information of knowledgeable persons. both financial and non tlnancaal, within the entity or outside the entity

(a) Analytical Procedure

(b) Recalculation

(C) Re – Performance

(d) Inquiry.

Answer:

(d) Inquiry.

Question 33.

…………………. defined as audit procedure designed to evaluate the operating effectiveness of control in preventing or detecting and correcting, material misstatements at the assertion level.

(a) Audit Process

(b) Audit Procedures

(c) Audit Control

(d) Test of Controls.

Answer:

(d) Test of Controls.

Question 34.

The auditor shall test controls, for which the auditor intends to rely on those controls in order to provide an appropriate basis for the auditors intended reliance.

(a) for the particular tine

(b) throughout the period

(c) for a point of time

(d) (a) or (b).

Answer:

(d) (a) or (b).

Question 35.

Audit evidence pertaining may be sufficient for the auditors purpose.

(a) Only for a particular period

(b) For a period of time

(c) Only to a point of time

(d) (a) or (b).

Answer:

(c) Only to a point of time

Question 36.

When the auditor has determined that an assessed risk of material misstatement at the assertion level is a significant risk, the auditor shall perform ………………….. that are specifically responsive to that risk.

(a) Audit Procedure

(b) Compliance Procedures

(c) Substantive Procedures

(d) Overall Audit Procedures.

Answer:

(c) Substantive Procedures

Question 37.

Evidence which originate within the organisation being audited is ………………….. .

(a) Confined Evidence

(b) Extraordinary Evidence

(c) Internal Evidence

(d) External Evidence.

Answer:

(c) Internal Evidence

Question 38.

Purchase invoice, supplier’s challan, debit notes and credit notes, quotations are the example of

(a) Confined Evidence

(b) Extraordinary Evidence

(c) Internal Evidence

(d) External Evidence.

Answer:

(d) External Evidence.

![]()

Question 39.

On the basis of nature, Audit Evidence may be

(a) Visual

(b) Oral

(c) Documentary

(d) Any of them.

Answer:

(d) Any of them.

Question 40.

………………. deals with the logical connection with, or bearing upon, the purpose of the audit procedure and, where appropriate, the assertion under consideration.

(a) Realiability

(b) Relevance

(c) Reliance

(d) Relativity.

Answer:

(b) Relevance

Question 41.

Reliability of Audit Evidence increases when

(a) Obtain from independent sources

(b) Obtained in documentary form

(c) Obtained directly by the auditor

(d) Any of them.

Answer:

(d) Any of them.

Question 42.

Written representations may be defined as a written statement by ……………………. provided to the ………………………. to confirm certain matters or to support other audit evidence.

(a) auditor, management

(b) management. TCWG

(c) TCWG, management

(d) management, auditor.

Answer:

(d) management, auditor.

Question 43.

Written representation includes financial statements, the assertions therein, or supporting books and records. The Statement is

(a) True

(b) False

(c) Partically True

(d) None.

Answer:

(b) False

Question 44.

………………. are necessary information that the auditor requires in connection with the audit of the entity’s financial statement

(a) Audit Evidence

(b) Audit Inquiry

(c) Auditor’s representation

(d) Written representation.

Answer:

(d) Written representation.

Question 45.

Is written representations act as a audit evidence

(a) Yes

(b) No

(c) Partically True

(d) None of the above.

Answer:

(a) Yes

Question 46.

The objectives of the auditor is/are.

(a) To obtain written representations

(b) To support other evidence

(c) To respond appropriately

(d) All of them.

Answer:

(d) All of them.

![]()

Question 47.

Written representations are requested by the …………………. from

(a) management, auditor

(b) auditor, management

(c) TCWG, management

(d) auditor, TCWG

Answer:

(d) auditor, TCWG

Question 48.

The Auditor may also ask management to reconfirm its acknowledgment and understanding of those responsibilities is written representations. Statement is

(a) True

(b) Partially True

(c) False

(d) None.

Answer:

(a) True

Question 49.

Objective of auditor to obtain sufficient appropriate audit evidence regarding

(a) Existence and condition of inventory

(b) Completeness of litigation and claims lnvoMng the entity.

(c) Presentation and disclosure of segment information In accordance with the applicable financial reporting framework.

(d) All of the above.

Answer:

(d) All of the above.

Question 50.

Physical inventory counting is essential part of an audit process.

(a) Correct

(b) Partially Correct

(c) Wrong

(d) None.

Answer:

(a) Correct

Question 51.

Attendance of an auditor at Physical Inventory Counting involves, inspecting the inventory to ascertain Its existence and evaluate its condition, and

(a) Performing investigation

(b) Performing test counts

(c) Performing compliance test

(d) Any of them.

Answer:

(b) Performing test counts

![]()

Question 52.

If the auditor is unable to attend physical inventory counting due to unforeseen circumstances, the auditor shall

(a) make an alternative arrangement.

(b) leave the s&d audit

(c) conclude the audit report without verifying the inventory count

(d) make or observe some physical counts on an alternative date, and perform audit procedures on intervening transaction.

Answer:

(d) make or observe some physical counts on an alternative date, and perform audit procedures on intervening transaction.

Question 53.

The auditor shall design and perform audit procedures in order to identity litigation and claims involving the entity which may give rise to a risk of material misstatement including

(a) Reviewing legal expense accounts.

(b) Reviewing minutes of meetings of TCWG and correspondence between the entity and its external legal counsel.

(c) Inquiry of management including in-house legal counsel.

(d) All of them.

Answer:

(d) All of them.

Question 54.

If law, regulation or the respective legal professional body prohibits the entity external legal counsel from communicating directly with the auditor, the auditor shall then adopi

(a) Investigation procedure

(b) Management audit procedure

(c) Alternative audit procedure

(d) Overall audit procedure.

Answer:

(c) Alternative audit procedure

Question 55.

An audit evidence obtained as a direct written response to the auditor from a third. party, in paper form, or by electronic or other medium is known as

(a) External audit

(b) External Investigation

(c) External confirmation

(d) External Procedures.

Answer:

(c) External confirmation

Question 56.

A request that the confirming party respond directly to the auditor only if the confirming party disagrees with the Infomation provided In the request is called

(a) Positive confirmation request

(b) Negative confirmation request

(c) Non-response

(d) Exception.

Answer:

(b) Negative confirmation request

Question 57.

A failure of the confirming party to respond, or fully respond, to a positive confirmation request, or a confirmation request returned undelivered, Is known as

(a) Positive confirmation request

(b) Negative confirmation request

(c) Non-response

(d) Exception.

Answer:

(c) Non response

![]()

Question 58.

Using external confirmation procedures the auditor shall maintain control over external confirmation requests, includes

(a) Determining the information to be confirmed or requested and selecting the appropriate confirming party.

(b) Sending the requests, including follow-up requests when applicable to the confirming party.

(C) (a) or (b)

(d) (a) and (b)

Answer:

(d) (a) and (b)

Question 59.

Factor not to be consider when designing confirmation request

(a) Specific identified risks of material misstatement, including

(b) Defining audit plan and preparing audit procedures

(c) The layout and presentation of confirmation request

(d) Prior experience on the audit or similar engagements.

Answer:

(b) Defining audit plan and preparing audit procedures

Question 60.

Initial audit engagement is required when

(a) The financial statements for the prior period were not audited.

(b) The financial statements for the period were audited by a predecessor auditor

(c) (a) or (b)

(d) (a) and (b)

Answer:

(c) (a) or (b)

Question 61.

In conducting an initial engagement the objective of the auditor with respect to opening balances is to obtain sufficient appropriate audit evidence about whether

(a) Opening balance contain misstatements that materially affect the current periods financial statements

(b) Appropriate accounting policies reflected In the opening balances have been consistently applied in the current periods financial statement.

(c) (a) or (b)

(d) (a) and (b).

Answer:

(d) (a) and (b).

![]()

Question 62.

A Person or other entity that has control oc significant influence, directly or indirecly through one or more intermediaries, over the reporting entity, is known as

(a) Associates

(b) Co-owner

(c) Third Party

(d) Related Party.

Answer:

(d) Related Party.

Question 63.

Related parties may operate through an extensive and complex range of relationship and structures, with a. corresponding increase in the ……………….. of related party transactions

(a) understanding

(b) clarity

(c) complexity

(d) reliability

Answer:

(c) complexity

Question 64.

The auditor has a responsibility to perform audit procedures to identity, assess and respond to the risk of ………………… arising from the entity’s failure to appropriately account for related party relationships, transactions or balances.

(a) matenal misstatement

(b) material facts and figures

(c) material evidences

(d) audit evidences

Answer:

(a) matenal misstatement

![]()

Question 65.

An understanding of the entity’s related party relationships and transactions is relevant to the auditor’s evaluation of whether fraud risk factors are present required by ……………. .

(a) SA-200

(b) SA-215

(c) SA-230

(d) SA-240

Answer:

(d) SA-240

Question 66.

In the related parties transactions, the potential effects of inherent limitations on the auditor’s ability to detect material misstatements are greater for the reason:

(a) Management may be unaware of the existence of all related party relationships.

(b) Related party relationship may piesent a greater opportunity for collusion, concealment or manipulation by management

(c) Only (a)

(d) Both (a) and (b).

Answer:

(d) Both (a) and (b).

Question 67.

The concept of true and fair is a …………….. concept In auditing.

(a) Basic

(b) General

(c) Fundamental

(d) None.

Answer:

(c) Fundamental

Question 68.

“Fonmng an opinion and Reporting on financial statemenr describes as per .

(a) SA -300

(b) SA-315

(c) SA -700

(d) SA-715

Answer:

(c) SA -700

Question 69.

To ensure ‘tnje and fair’ an auditor has to see except.

(a) that the assets are neither undervalued or overvalued, according to the applicable accounting principles.

(b) no material assets is omitted and if there is any change then disclosed

(c) Audited Financial Statements of the previous periods

(d) all unusual, exceptional or nonrecurring items have been disclosed separately.

Answer:

(c) Audited Financial Statements of the previous periods

Question 70.

Event occurring between the date of the financial statements and the date of auditor’ report is known as

(a) Extra events

(b) Extraordinary events

(c) Subsequent events

(d) Conclusive events.

Answer:

(c) Subsequent events

Question 71.

The auditor shall take into account the auditor’s risk assessment regarding subsequent events indudes

(a) Obtaining an understanding of procedures

(b) Inquiring of management

(c) Reading minutes and interim financial statements

(d) All of the above.

Answer:

(d) All of the above.

![]()

Question 72.

Financial Statements are prepared on the assumption

(a) Going Concern

(b) Consistency

(c) Accrual

(d) Cost Concept

Answer:

(a) Going Concern

Question 73.

The going concern concept assumes that

(a) The entity continue running until the end of accounting period

(b) The entity continue running for foreseeable future

(c) The entity will close Its operation after certain period

(d) The entity cant be liquidated.

Answer:

(b) The entity continue running for foreseeable future

Question 74.

The potential effects of inherent limitations on the auditor’s ability to detect matenal misstatements are greater toi’ future events or conditions that may cause an entity to cease to continue as a going concern, descnbe under

(a) SA-200

(b) SA-210

(c) SA-215

(d) SA-230.

Answer:

(a) SA-200

Question 75.

Events or conditions that may cost significant doubt on the entity’s ability to continue as a going concern.

(a) indications of withdrawal of financial support by creditor’s and Adverse Key IRahos

(b) Loss of Key management without replacement

(c) Non- compliance with capital and other statutory or regulatory requirements, such as solvency or liquidity requirements for financial institutions.

(d) Any of the above.

Answer:

(d) Any of the above.