Nature, Objective, and Scope of Audit – CA Inter Audit Questions bank is designed strictly as per the latest syllabus and exam pattern.

Nature, Objective, and Scope of Audit – CA Inter Audit Question Bank

Question 1.

State with reasons (in short) whether the following statement is True or False:

The auditor compares entries In the books of accounts with vouchers and if two agrees, his work is done. (May 2010, 2 marks)

Answer:

False:

The totaling of entries in the books with vouchers shows fairness of financials statements. But auditor has to determine reliability of annual statement of accounts along with the truth and fairness.

Question 2.

State with reasons (in short) whether the following statement Is correct or incorrect:

The basic objective of audit does not change with reference to nature, size or form of an entity. (May 2015, 2 marks)

Answer:

Correct:

The meaning and nature of audit does not change with the nature or size of entity, audit is examination of true and fair view of statement of any entity Irrespective of its size and legal structure as defined in definition of audit.

Question 3.

In auditing, the auditor checks the specific assertions of the items appearing in the financial statements and opines about the overall assertions they signify. Explain specific assertions and overall assertions in this context. (May 2009,10 marks)

Answer:

Auditor checks specific assertions that the items of financial statements misleaded and also gives his opinion in the form of overall assertion In respect of financial statements taken as a whole.

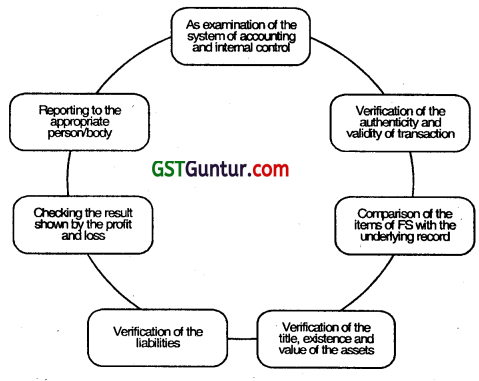

The specific assertions are:

| 1. Existence | An asset or liability exists at a given date. |

| 2. Rights and Obligations | An asset is a right of an entity and a liability is an obligation of the entity at a given date. |

| 3. Occurrence | A transaction or event took place which pertains to the entity. |

| 4. Completeness | There are no unrecorded assets, liabilities or transactions. |

| 5. Valuation | An assets or liability is recorded at an appropriate carrying value. |

| 6. Measurement | A transaction is recorded In the proper amount and revenue or expense is allocated to proper period. |

| 7. Presentation and Disclosure | An item is disclosed, classified, and described in accordance with the acceptable accounting policies and, when applicable, legal requirements. |

The overall assertion opined by the auditor about the financial statements are:

- The profit and loss account gives a true and fair view of the results – profit or loss for the period ended on the last date of the accounting period.

- The balance sheet gives a true and fair view of the financial status or financial position of the entity as on the last date of the accounting period.

![]()

Question 4.

Discuss the types of audits required under law. (Nov 2011, 5 marks)

Answer:

Legally audit is not compulsory for all the types of business organization Institution. Thus It may be divided in two broad categories:

1. Statutory/Mandatory Audit

2. Voluntary/independent Audit

1. Statutory Audit: It is an audit which is conducted under the control of law as under

| Enterprise | Governing Statute |

| Companies | Companies Act, 2013 |

| Co-operative Societies | Multi-state Co-operative Societies Act |

| Banking Cos | Banking Regulation Act, 1949, Banking Laws (Amendment) Act, 2017 |

| Insurance Co’s | Insurance Act and Companies Act |

| Electricity Co’s | The Electricity Act, 2003 |

| Public Charitable Trust | Indian Trust Act and also state enactments |

2. Voluntary Audit: It is a purely optional audit and at the discretion of the governing body. Examples of enterprises of voluntary natures are individuals, private trust, partnership firms etc.

Question 5.

The chief utility of audit lies In refillable financial statements on the basis of which the state of affairs may be easy to understand. Apart from this obvious utility, there are other advantages of audit. Some or all of these are of considerable value even to those enterprises and organizations where audit is not compulsory. Explain.

Answer:

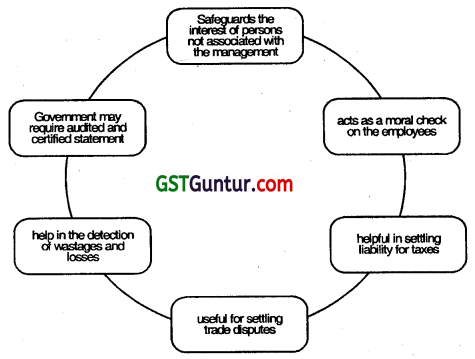

The chief utility of audit lies in reliable financial statements on the basis of which the state of affairs may be easy to understand. Apart from this obvious

utility, there are other advantages of audit. Some or all of these are of considerable value even to those enterprises and organizations where audit is not compulsory, these advantages are given below:

(a) It safeguards the financial interest of persons who are not associated with the management of the entity, whether they are partners or shareholders, bankers, Fl’s, public at large etc.

(b) It acts as a moral check on the employees from committing clefalcations or embezzlement.

(c) Audited statements of account are helpful in settling liability for taxes, negotiating loans and for determining the purchase consideration for a business.

(d) These are also useful for settling trade disputes for higher wages or bonus as well as daims in respect of damage suffered by property, by fire or some other calamity.

(e) An audit cari also help in the detection of wastages and losses to show the different ways by which these might be checked, especially those that occur due to the absence or inadequacy of internal checks or Internal control measures.

(f) Audit ascertains whether the necessary books of account and allied records have been properly kept and helps the client in making good deficiencies or Inadequacies In this respect.

(g) As an appraisal function, audit reviews the existence and operations of various controls in the organisations and reports weaknesses, in adequacies. etc., in them.

(h) Audited accounts are of great help in the settlement of accounts at the time of admission or death of partner.

(i) Government may require audited and certified statement before it gives assistance or issues a license for a particular trade.

Question 6.

State with reasons (in short) whether the following statement s True or False:

“Auditoc is not an Insurer”. (Nov 2008, 2 marks)

Answer:

True:

SA – 200 i.e. “Overall objectives of the independent Auditor and the Conduct of an audit ¡n accordance with standards of Auditing,” states that auditor’s opinion is not an assurance as to the future viability of the enterpnse or the efficiency or effectiveness with which the management has conducted the affairs of the enterprise. The auditor does not Insures the

interest of users of accounts but only states his opinion after taking all reasonable care and skill, that the statements show a true and fair picture. The ultimate responsibility is of the management. The audit of financial statements does not relieve management of its responsibilities.

According to Companies Act 2013:

The financial statements shall give a true and fair view of the state of affairs of the company or companies as at the end of the financial year (Sec. 129(1) of 2013 Act).

The auditor’s report shall state that:

to the best of his information and knowledge, the said accounts, financial statements give a true and fair view of the state of the company’s affairs as at the end of its financial year and the profit or loss and cash flow for the year and such other matters as may be prescribed (Sec. 143(2)01 the 2013 Act].

The aforesaid definition is very authoritative. It makes clear that the basic objective of auditing. i.e., expression of opinion on financial statements does not change with reference to nature, size or form of an entity. The definition given above is restrictive since it covers financial information aspect only.

However, the scope of auditing is not restricted to financial information only, but, today it extends to variety of non-financial areas as well. That is how various expressions like marketing audit, personnel audit, efficiency audit, production audit, etc. came into existence. But here we should study only financial audit unless and until otherwise specified.

![]()

Question 7.

Discuss limitations of audit. (May 2011,8 marks)

Answer:

Inherent limitations of Audit:

As per SA-200, Overall Objectives of the Independent Auditor and the conduct of Audit in accordance with standards of auditing, the purpose of an audit is to enhance the degree of confidence of intended users in the financial statements. This is achieved by the expression of an opinion by the auditor on whether the financial statements are prepared, in all material

respects, in accordance with an applicable financial reporting framework.

In the case of most general purpose frameworks, that opinion is on whether the financial statements are presented dairy, In all material respects, or give a true and fair view in accordance with the framework. An audit conducted In accordance wish SAs and relevant ethical requirements enables the auditor to form that opinion.

The auditor is not expected to, and cannot, reduce audit risk to zero and cannot, therefore, obtain absolute assurance that the financial statements are tree from material misstatement due to fraud or error. This is because there are inherent limitations of an audit, which result in most of the audit evidence on which the auditor draws conclusions and bases the auditor’s opinion being persuasive rather than conclusive.

The Inherent limitations of an audit ailse from:

1. The Nature of Financial Reporting

The preparation of financial statements involves judgment by management in applying the requirements of the entity’s applicable financial reporting framework to the facts and circumstances of the entity. In addition, many financial statement items involve subjective decisions or assessments or a degree of uncertainty, and there may be a range of acceptable interpretations or judgments that may be made. Consequently, some financial statement items are subject to an inherent level of variability which cannot be eliminated by the application of additional auditing procedures.

2. Non-Co- operation by Management

There is the possibility that management or others may not provide, intentionally or unintentionally, the complete information that is relevant to the preparation and presentation of the financial statements or that has been requested by the auditor. Accordingly, the auditor cannot be certain of the completeness of information, even though the auditor has performed audit procedures to obtain assurance that all relevant information has been obtained.

3. Fraud may involve sophisticated and carefully organised schemes designed to conceal it:

Therefore, audit procedures used to gather audit evidence may be ineffective for detecting an Intentional misstatement that involves, for example, collusion to fatsity documentation which may cause the auditor to believe that audit evidence is valid when it is not. The auditor is neither trained as nor expected to be an expert in the authentication of documents.

4. Timeliness of Financial Reporting and the Balance between Benefit and Cost:

The matter of difficulty, time, or cost involved is not in itself a valid basis for the auditor to omit an audit procedure for which there is no alternative or to be satisfied with audit evidence that is less than persuasive. Appropriate planning assists in making sufficient time and resources available for the conduct of the audit. Notwithstanding this, the relevance of information, and thereby its value, tends to diminish over time, and there is a balance to be struck between the reliability of information and its cost.

There is an expectation by users of financial statements that the auditor will form an opinion on the financial statements within ti reasonable period of time and at a reasonable cost, recognising that it is impracticable to address all Information that may exist or to pursue every matter exhaustively on the assumption that information is n error or fraudulent

until proved otherwise.

5. Risk of failure of Internal Control:

Any system of internal check/control may become ineffective due to collusion among employees for doing fraud and fraud committed by top management itself.

6. Management’s Fraud:

Risk of auditor not detecting a material misstatement resulting from management’s fraud is greater than that of an employee’s fraud because those charged with governance and management are often in a position that assumes their integrity and enables them to override the internal control procedures. For example- it a director of a company orders verbally the assistant not to record the sales made to particular party and to show the goods, sold as inventory, he is overriding the internally established procedure (Internal control).

Question 8.

Discuss the following:

The discipline of behavioural science is closely linked with the subject of auditing. (Nov 2013, 5 marks)

Answer:

Auditing is very much a discipline which Involves review of various assertions both financial as well as non-financial as regards his truthfulness. So audit can be performed in a better way only If the person also possesses a good knowledge about other disciplines.

The discipline of behavioural science is closely linked with subject of auditing. While carrying out audit activity an auditor is required to obtain information and explanations from the client’s staff and he has also to interact with the client’s staff in analysing the financial figures. So, the knowledge of human behaviour is very essential for an auditor. Thus knowledge of dealing with human being Is Indeed very essential for an auditor in order to discharge his duties.

Question 9.

Discuss the following:

Indicate the factors which make it appropriate for an auditor to send a new Engagement Letter for a recurring audit. (Nov 2014, 5 marks)

Answer:

Factors whet make It appropriate for an auditor to send a new Engagement Letter for a recurring audit Any indication that the entity misunderstands the objective and scope of the audit.

- Any revised or special terms of the audit engagement.

- A recent change of senior management.

- A significant change in ownership.

- A significant change in nature or size of the Entity’s business.

- A change in legal or regulatory requirements.

- A change in the financial reporting framework adopted in the preparation of the financial statements.

- A change in other reporting requirements.

Question 10.

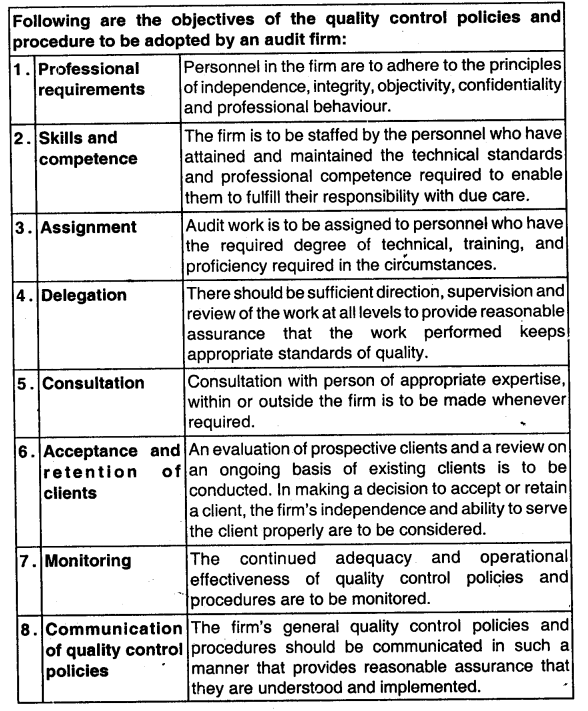

Write short note on the Quality control for audit work at firm level. (Nov 2007, 5 marks)

Answer:

Under SA – 220, Quality Control for an audit of Financial Statement, an audit firm should implement quality control policies and procedures designed to ensure that all audits are conducted in accordance with Standard of Audit.

Question 11.

What is the Importance of having the accounts audited by an independent auditor? (May 2008, 5 marks)

or

Advantages of Independent Audit. (May 2015, 5 marks)

Answer:

independent Audit

1. Meaning

independence implies that the judgment of a person is not subordinate to the wishes or directions of another person who might have engaged him or to his own self-interest.

2. Nature

independence is a condition of mind and personal character and should not be confused with the superficial and visible standards of Independence. which are imposed by law.

3. Visibility

Independence of the auditor should not only exist but should also appear to so exist to 311 reasonable persons. The relationship maintained by the auditor shall be such that no reasonable man can doubt his objectivity and integrity. There is a collective aspect of independence that is important to the accounting professional as a whole.

The advantages of an Independent Audit are:

1. Protection of interest

It safeguards the financial interest of persons who are not associated with the management of the organization whether they are partners of shareholders.

2. Moral check

it acts as a moral check on the employees from committing defalcations.

3. Tax liability

Audited statements of account are helpful In settling liability for taxes.

4. Credit negotiation

Financiers and bankers use audited financial statements In evaluating the edit worthiness of individuals in negotiating loans.

5. Trade dispute settlement

Audited statements are useful in settling the trade disputes for higher wages, oc bonus, etc.

6. Control over Inefficiency

It helps in detection of wastages and losses and also helps in recommending ways to correct it.

7. Funds-in-trust

It is an agency, which ensures that persons acting for others have properly accounted for the amounts collected by them.

8. Arbitration

It is helpful in settling disputes by arbitration.

9. Appraisal

Audit reviews the existence and operations of various controls in the organization and reports in adequacies, weaknesses, etc in them. Management can take suitable action based on the reports.

10. Assistance to the government

Government may require audited and certified statements before it gives assistance o issues a license for a particular trade.

![]()

Question 12.

independence of mind and independence in appearance are Interlinked perspectives of independence of auditors. Explain. (May 2019, 3 marks)

Answer:

Independence of Mind and Independence in appearance are interlinked perspectives of Independence of auditors. Independence implies that the judgment of a person is not subordinate to the wishes or directions of another person who might have engaged him or to his own self-interest.

Independence Is a condition of mind and personal character and should not be confused with the superficial and visible standards of independence. which are imposed by law.

The Code of Ethics for Professional Accountants Issued by International Federation of Accountants (IFAC) defines the term Independence as follows.

Independence Is:

Independence of Mind:

The state of mind that permits the provision of an opinion without being affected by influences allowing an individual to act with integrity and exercise objectivity and professional skepticism; and.

Independence In Appearance:

The avoidance of tacts and circumstances that are so significant that a third party would reasonably conclude an auditor’s integrity, objectivity, or professional skepticism had been compromised.

Question 13.

The auditor shall plan and perform an audit with professional skepticism recognizing that circumstances may exist that cause the financial statement to be materially misstated. Discuss any four examples of professional skepticism. (Nov 2019,4 marks)

Answer:

The auditor shall plan and perform an audit with professional skepticism recognising that circumstances may exist that cause the financial statements to be materially misstated.

The following are the examples that professional skepticism Includes being alert to,

- Audit evidence that contradicts other audit evidence obtained.

- Information that brings into question the reliability of documents and responses to inquiries to be used as audit evidence.

- Conditions that may indicate possible fraud.

- Circumstances that suggest the need for audit procedures in addition to those required by the SAs.

- Maintaining professional skepticism throughout the audit is necessary if the auditor is to reduce the risk of:

- Overlooking unusual circumstances.

- Overgeneralizing when drawing conclusions from audit observations.

- Using inappropriate assumptions ¡n determining the nature, timing, and extent of the audit procedures and evaluating the results thereof.

Question 14.

Briefly explain the policies and procedures of assembling the final audit file on a timely basis after the date of auditor’s report under SQC-1. (Nov 2019, 3 marks)

Answer:

The auditor shall assemble the audit documentation in an audit tile and complete the administration process of assembling the final audit tile on a timely basis after the date of the auditor’s report.

SQC 1 “Quality Control for firms that perform Audits and Review of Historicøl Financial Information, and Other Assurance and related services”, requires firms to establish policies and procedures for the timely completion of the assembly of audit files. An appropriate time limit within which to complete the assembly of the final audit files is ordinarily not more than 60 days after the date of the auditor’s report.

The completion of the assembly of the final audit file after the date of the auditor’s report is an administrative process that does not involve the performance of new audit procedures or the drawing of new conclusions. Changes may, however, be made to the audit documentation during the final assembly process, if they are administrative in nature.

Examples of such change Include;

– Deleting or discarding superseded documentation.

– Sorting, collating, and cross-referencing working papers.

– Signing off on completion checklists relating to the file assembly process.

– Documenting audit evidence that the auditor has obtained, discussed, and agreed with the relevant members of the engagement team before the date of the auditor’s report.

After the assembly of the final audit file has been completed, the auditor shall not delete, or discard, audit documentation of any nature before the end of its retention period. SQC-1 requires firms to establish policies and procedures for the retention of engagement documentation. The retention period for audit engagements ordinarily is no shorter than 7 years from the date of the auditor’s report, or. it later, the date of the group auditor’s report.

Question 15.

Explain the fundamental principles of professional ethics relevant to the auditor when conducting an audit of financial statements in accordance with Code of Ethics issued by ICAI. (Jan 2021, 4 marks)

Question 16.

Write short note on Independence of an Auditor.

Answer:

Independence implies that the judgement of a person is not subordinate to the wishes or directions of another person who might have engaged him or to his own self-interest. Independence is a condition of mind and personal character and should not be confused with the superficial and visible standards of independence, Which are Imposed by law.

Independence of the auditor should not only exist but should also appear to so exist to all reasonable persons. The relationship maintained by the auditor shall be such that no reasonable man can doubt his objectivity and integrity. There is a collective aspect of independence that is important to the accounting professional as a whole.

Question 17.

Describe a set of instructions, which an auditor has to give to his client before the start of actual audit. (Nov 2009, 4 marks)

Answer:

Set of lntruçtion, which an auditor has to give to his client before the audit. known as letter of engagement.

Letter of Engagement:

Meaning

A letter of engagement refers to a letter written by the auditor to his client n order to avoid any misunderstanding between them.

Purpose of the SA – 210, Agreeing the terms of Audit Engagements:

Normally the objective and scope of an audit and auditors duty and obligations are laid down in the applicable statute like Companies Act, 2013; RBI regulation for bank; or regulations and pronouncements of the Institute of Chartered Accountants of India (ICAI). In such a case explaining the terms of audit engagement by a letter by the auditor to the client is only informative.

The purpose mentioned in SA – 210 is to establish standard on:

1. Agreeing with the terms of engagement with the client, and

2. How the auditor should respond if the client requests for changes in terms of engagement.

This letter should be sent before starting the audit. It should mention the following:

1. Objective of the audit of financial statements.

2. Responsibility of management regarding the following:

- Financial statements are proposed on going concern basis.

- Selection of accounting policies.

- Consistently following the accounting policies.

- Maintenance of adequate accounting records.

- Written representation by the management.

- Arrangement concerning the involvement of Internal auditors and the other staff of the client.

3. The scope of the audit including reference to applicable laws and regulations and pronouncements of ICAI.

4. Test nature of audit, frauds & errors may remain undetected.

5. Unrestricted access to records.

6. The fact that audit process may be subjected to a peer review under the Chartered Accountants Act, 1949.

Following Instructions are given by the auditor to the client before the start of audit

- The accounts should be totaLed up and trial instructions are balanced and final accounts be kept ready.

- Vouchers should be serially arranged.

- A schedule of trade receivables and trade payables should be prepared.

- Schedule of outstanding expenses, prepaid expenses and accrued income to be kept ready.

- A list of bad arid doubtful debts should be prepared.

- A schedule of investments should be prepared.

- Certified list of goods returned to be prepared.

- Statement of permanent capital expenditure to be prepared.

- Schedule of deferred revenue expenditures to be prepared.

- Names and addresses of managers and other officers should be kept ready.

![]()

Question 18.

CA Ra, an engagement partner wants to take decision, regarding acceptance and continuance of an audit engagement. Wtiich informations, he should obtain before accepting an engagement? (May 2019, 3 marks)

Answer:

SQC-1 requires the firm to obtain information before accepting an engagement. Information such as the following assists the engagement partner in determining whether the decisions regarding the acceptance and continuance of audit engagements are appropriate:

1. The integrity of the principal owners, key management and those charged with governance of the entity:

2. Whether the engagement team is competent to perform the audit engagement and has the necessary capabilities, including time and resources:

3. Whether the firm and the engagement team can comply with relevant ethical requirements: and.

4. Significant matters that have arisen during the current or previous audit engagement, and their implications for continuing the relationship.

Question 19.

Examine with reasons whether the following statements are correct or Incorrect. Even if law or regulation prescribes sufficient details of the terms of the audit engagement the auditor should record them in a written agreement. (Nov 2020, 2 marks)

Question 20.

R & M Company, a firm of Chartered Accountants, was appointed as statutory auditors of XYZ Company Ltd. Draft an engagement letter accepting the appointment as auditors. (Nov 2010, 8 marks)

Answer:

Engagement Letter for accepting the appointment as an Auditor: As per the SA 210, Agreeing the Terms of Audit Engagements.

Draft of Engagement Letter:

To the Board of Directors of ABC Limited You have requested that we audit the financial statements of ABC Company Limited, which comprise the Balance Sheet as at March 31, 2011. and the Statement of Profit & Loss, and Cash Flow Statement for the year then ended, and a summary of significant accounting policies and other explanatory information.

We are pleased to confirm our acceptance and our understanding of this audit engagement by means of this letter. Our audit will be conducted with the objective of our expressing an opinion on the financial statements.

We will conduct our audit in accordance with Standards on Auditing (SAs), issued by the Institute of Chartered Accountants of India (ICAI). Those Standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are tree from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures In

the financial statements.

The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. An audit also indudes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

Because of the inherent limitations of an audit, together with the inherent limitations of internal control, there Is an unavoidable risk that some material misstatements may not be detected, even though the audit is properly planned and performed in accordance with SAS.

In making our risk assessments, we consider internal control relevant to the entity’s preparation of the financial statements in order to design audit procedures that are appropriate In the circumstances, but not for the purpose 0f expressing an opinion on the effectiveness of the entity’s internal control.

However, we will communicate to you in writing concerning any significant deficiencies in internal control relevant to the audit of the financial statements that we have identified during the audit.

Our audit will be conducted on the basis of acknowledgment provided by management or appropriate governance body.

1. For the preparation of financial statements that give a true and fair view in accordance with the Financial Reporting Standards. This includes:

the responsibility for the preparation of financial statements on a going concern basis. the responsibility for selection and consistent application of appropriate accounting policies, including implementation of applicable accounting standards along with proper explanation relating to any material departures from those accounting standards the responsibility for making judgments and estimates that are reasonable and prudent so as to give a true and fair view of the state of affairs of the entity at the end of the financial year and of the profit or loss of the entity for that period.

2. For such internal control as management determines, it is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error; and

3. To provide us with:

(i) Access, at all times, to all information, including the books, accounts, vouchers arid other records and documentation, of the Company, whether kept at the head office of the company or elsewhere, of which management Is aware that is relevant to the preparation of the financial statements such as records, documentation, and other matters;

(ii) Additional information that we may request from management for the purpose of the audit: and

(iii) Unrestricted access to persons within the entity from whom we determine it necessary to obtain audit evidence. This includes our entitlement to require from the officers of the Company such information and explanations as we may think necessary for the performance of our duties as auditor.

As part of our audit process, we will request from management and, where appropriate, those charged with governance, written confirmation concerning representations made to us in connection with the audit.

We also wish to invite your attention to the fact that our audit process is subject to ‘peer review’ under the Chartered Accountants Act, 1949 to be conducted by an Independent reviewer. The reviewer may inspect, examine or take abstracts of our working papers during the course of the peer review. We look forward to full cooperation from your staff during our audit.

The form and content of our report may need to be amended in the light of our audit findings. Please sign and return the attached copy of this letter to indicate your acknowledgment of, and agreement with, the arrangements for our audit of the financial statements Including our respective responsibilities.

XYZ & Co.

Chartered Accountants

Firm’s Registration No.

……………………….

(Signature)

(Name of the Member)

(Partner or Proprietor)

Date:

Place:

Acknowledged on behalf of ABC Ud. by

………………………………..

(Signature)

Name and Designation

Date

![]()

Question 21.

it is not mandatory to send a new engagement letter in recurring audit, but sometimes it becomes mandatory to send new Ietter. Explain those situations where new engagement letter is to be sent. (Nov 2011,5 marks)

OR

Discuss the following:

Indicate the factors which make it appropriate for an auditor to send a new Engagement Letter for a recurring audit. (Nov 2014, 5 marks)

Answer:

As per SA -210 i.e. “Agreeing on the terms of Audit Engagement, In case of a recurring audit, the auditor should consider:

1. Whether circumstances require the terms of engagement to be revised, and

2. Whether there is a need to remind the check of the existing terms of engagement.

In following circumstances, the auditor may think it appropriate to send a new engagement letter to client:

- Any indication that the client misunderstood the objective and scope of audit

- Any revised and special terms of the engagement

- Any recent change in board of directors, and senior managements.

- New legal requirements, or pronouncements of the Institute of Chartered Accountants of India (ICAI)

- Significant change in client’s business.

Change in terms of engagement:

- If a change is related to information that is Incorrect or otherwise unsatisfactory the auditor should not agree to changed terms of engagement.

- If the auditor is unable to agree to change the engagement then he should withdraw from it.

Question 22.

Discuss the following:

(c) V’ an auditor decides not to send a new audit engagement letter to G Ltd. every year. Whether he is right in his approach? State the circumstances where sending new engagement letter, would be appropriate. (Nov 2015, 5 marks)

Answer:

As per SA-210, Agreeing the terms of Audit Engagements, the auditor shall assess whether circumstances require the terms of audit engagement to be revised and whether there Is a need to remind the entity of the existing terms. It is not necessary to issue audit engagement letter each, ear for repetitive audits. Here ‘P’ an auditor decides not to send a new engagement letter to G Ltd. every year. So, the approach of the auditor is correct and appropriate.

The following are the circumstances where Issue of the fresh engagement letter becomes mandatory:

- When it appears that the client has misunderstood the objective and scope of audit. In such case issue of engagement letter becomes necessary.

- Where there has been change in management, board, or ownership. so that it is felt that it is pertinent to remind them of the engagement terms again.

- Where any revision by way of addition, deletion, or modifications had been contemplated in the engagement letter originally issued.

- Where significant changes had occurred in nature, volume of the business transactions of the client which warrant the scope and terms of engagement to be altered to be In tune with them.

- Where there has been necessity to modify audit approach to be in line with the pronouncements of ICAI, the Companies Act, and the like.

Question 23.

X, a Chartered Accountant was engaged by POR & Co. Ltd. for auditing their accounts. He sent his letter of engagement to the Board of Directors. which was accepted by the Compañy. In the course of audit of the company, the auditor was unable to obtain appropriate sufficient audit evidence regarding receivables. The client requested for a change in the

terms of engagement. Offer your comments In this regard. (Nov 2009, 5 marks)

Answer:

A letter of engagement refers to a letter written by the auditor to his client in order to avoid any misunderstanding between them as to the scope and objective of an audit.

Change In terms of engagement.

In the following circumstances, the auditor may think it appropriate to send a new engagement letter to client.

1. Any indication that the client misunderstood the objective and scope of audit.

2. Any revised and special terms of engagement.

3. Any recent change in board of directors and senior management.

4. New Legal requirements or pronouncement of ICAI.

5. Significant change in clients business

It should be kept In mind that

1. When the terms of engagement change both the auditor and the client should agree an new terms.

2. The auditor should not agree to change in terms where there is no reasonable justification for doing so.

Thus, as per the case In question, the auditor should not agree to change the terms of engagement as the auditor was unable to obtain sufficient evidence regarding receivable.

Question 24.

State with reasons (in short) whether the following: statement is True or False:

Procedural error arises as a result of transactions having been recorded in a fundamentally incorrect manner. (May 2008, 2 marks)

Answer:

False:

When transactions are recorded in fundamentally incorrect manner it is known as Error of Principle. For e.g. a distinction not being made between capital and revenue income or expenditure. Procedural errors arse due to adoption of wrong accounting procedures.

Question 25.

State with reasons (in short) whether the following statement is True or False:

The principle of confidentiality precludes auditor to disclose the information about the client to third party at all circumstances without any exception. (May 2009, 2 marks)

Answer:

False:

The principle of confidentiality is one of the basic principles of auditing. Audito- is generally not expected to disclose the information of his client to others. He can disclose the information to others only when (a) permitted by his client, or (b)as per any statutory obligation dictated by any law.

![]()

Question 26.

Distinguish between Auditing and Investigation. (Nov 2012, 8 marks)

Answer:

Both involve a systematic and critical examination of the available evidence, Yet these are quite distinct from each other which is as follows:

| Basis of Difference | Auditing | Investigation |

| 1. Meaning | Auditing relates to the independent examination of financial information of any entity when such an examination is conducted with a view to express an opinion. | Investigation relates to the systematic, critical and special examination of the records of the business for a specific purpose. |

| 2. Scope | Audit covers all factual assertions In the financial statements to ascertain their truth and fairness. | Scope is limited as regards the period or area to be covered. |

| 3. Object | The object of an audit is to critically examine the financial statements and report on the truth & fairness of assertions. | Investigation aims at ascertaining certain facts such as fraud, tax liability, value of shares etc. |

| 4. Coverage | Auditing is a routine exercise for generally an accounting year. | Investigation may spread over a period longer than one year. |

| 5. Purpose | To enhance the degree of confidence of intended users in the financial statements. | To establish a fact or assessing a particular situation. |

| 6. Appointment | Auditor may be appointed by the owners or shareholders. | Investigators may be appointed by the owners or management or even third parties. |

| 7. Procedure | The audit is conducted in accordance with the Generally Accepted Auditing Procedure. | Investigation involves an extended auditing procedure. |

| 8. Approach | Auditor is skeptical and not suspicious. | Investigator starts his work with suspicion & collects evidence to either confirm or dispel that suspicion. |

| 9. Evidence | Audit evidence is persuasive. | Investigator relies on conclusive. |

| 10. Extent of checking | Test checking or sample checking is allowed. | In investigation particularly to detect frauds, test checking may not be advisable. It may be necessary to check 100%. |

| 11. Report | Auditor reports to the owners e.g. shareholders. | Investigator reports to the person on whose behalf he has undertaken the investigation. |

Question 27.

State with reasons (in short) whether the following statement is correct or incorrect. Specific disclosure is required of the fundamental accounting assumptions followed in the financial statements. (May 2014, 2 marks)

Answer:

Incorrect:

As per AS- 1 Disclosure of Accounting Policies, it the company Of firm does not follow the fundamental accounting assumptions viz., going concern, accrual, consistency then disclosures in the financial statements are required. If they follow the fundamental accounting assumptions then disdosures are not required.

Question 28.

State with reasons (in short) whether the following statements are correct or incorrect.

Errors of commission’ is where a transaction has been omitted either wholly or partially. (May 2014, 2 marks)

Answer:

Incorrect:

When wrong amount is entered either in the subsidiary books or in ledger accounts or when totals are wrongly made or when a wrong account is involved or when amount is posted on the wrong side, It is a case of error of commission.

Question 29.

Write short note on the Self-revealing errors and four Illustrations thereof. (Nov 2014, 4 marks)

Answer:

Self-revealing errors: These are such errors the existence of which becomes apparent in the process of compilation of accounts. A few illustrations of such errors are given hereunder, showing how they become apparent.

| 1. Omission to post a part of a journal entry to the ledger. | Trial balance does not tally. |

| 2. Wrong totaling of the Purchase Register. | Control Account (e.g., the Sundry Creditors Account) balances and the aggregate of the balances in the personal ledger will disagree. |

| 3. A failure to record in the cash book amounts paid into or withdrawn from the bank. | Bank reconciliation statement will show up error. |

| 4. A mistake in recording amount received from X in the account of Y. | Statements of account of parties will reveal mistake. |

From the above, It Is clear that certain apparent errors balance almost automatically by double entry accounting procedure and by following established practices that lie within the accounting system but not being generally considered to be a part of it. like bank reconciliation or sending monthly statements of account for confirmation.

Question 30.

Describe the guiding principles which the auditor should take into account which serves as the safeguards to eliminate the threats to independence. (Nov 2020, 4 marks)

![]()

Multiple Choice Question

Question 1.

Audit is …………………… examination of financial information.

(a) Dependent

(b) Independent

(c) Interdependent

(d) Intra dependent

Answer:

(b) Independent

Question 2.

The Objective of an audit is to ………………………. .

(a) Find errors

(b) Give report on any fraud

(c) Express an opinion on the financial statement

(d) Any of them

Answer:

(c) Express an opinion on the financial statement

Question 3.

Audit is an independent examination of …………………… information of any entity.

(a) Statutory

(b) Financial

(c) Financial as well as non-financial

(d) All of them

Answer:

(b) Financial

Question 4.

Audit is an independent examination of financial information of any entity.

(a) that entity must be profit oriented

(b) that may profit oriented or not

(c) Irrespective of its size or legal form

(d) (b) and (c)

Answer:

(d) (b) and (c)

Question 5.

Audit ensures that the entries in the books are

(a) adequately supported by sufficient documents

(b) adequately supported by sufficient evidence

(c) adequately supported by vouchers

(d) adequately supported by sufficient and appropriate evidence.

Answer:

(d) adequately supported by sufficient and appropriate evidence.

![]()

Question 6.

The word “Audltlng has been derived from Latin word

(a) Auditor

(b) Audience

(c) Auditstro

(d) Audiherence

Answer:

(b) Audiere

Question 7.

Auditing’ word has been derived from Latin word “Audiere which means

(a) to check

(b) to verify

(c) to hear

(d) to comply.

Answer:

(c) to hear

Question 8.

Overall Objectives of the Independent Auditor describe under.

(a) SA-200

(b) SA – 205

(c) SA-500

(d) SA-700

Answer:

(a) SA-200

Question 9.

Objective of the auditor

(a) To obtain reasonable assurance

(b) To report on the financial statements and communicate as required by the SAs.

(c) To ensure the financial statement as a whole are free from material misstatement

(d) All of them.

Answer:

(d) All of them.

Question 10.

Audit should be organised to cover adequately ……………………. of the enterprise relevant to the financial statements being audited.

(a) some aspects

(b) only financial aspects

(c) nonfinancial aspects

(d) all aspects.

Answer:

(d) all aspects.

Question 11.

Auditor assesses the reliability and sufficiency of the information contained in the accounting records and other source data by:

(a) making a study and evaluation of accounting systems and internal control

(b) carrying out other tests, enquiries, and verification as appropriate in a particular circumstances

(c) (a) or (b)

(d) (a) and (b).

Answer:

(d) (a) and (b).

Question 12.

Aspects to be covered in Audit

(a) An examination of system of accounting and internal control

(b) Veriftcation of the authenticity and validity of transaction including all assets and liabilities

(c) Checking the result shown by the financial statement and report it to the appropriate body

(d) All of them.

Answer:

(d) All of them.

Question 13.

Audit of a corporate body, auditor should confirming the compliance of

(a) Management’s requirements

(b) Non Statutory requirements

(c) Statutory requirements

(d) None of them.

Answer:

(b) Non Statutory requirements

![]()

Question 14.

Audit is ……………………… for all types of business organisation or institutions.

(a) Legally obligatory

(b) Not legally obligatory

(c) Voluntary

(d) None of them

Answer:

(b) Not legally obligatory

Question 15.

Organizations which require audit under law.

(a) Companies governed by the Companies Act.

(b) Banking Companies

(c) Statutory bodies required by their regulators or by Specific Act

(d) All of them

Answer:

(d) All of them

Question 16.

Exception of voluntary category of audit

(a) Proprietary entries

(b) HUF entries

(c) Companies from under companies law

(d) Partnership firms.

Answer:

(c) Companies from under companies law

Question 17.

An audit that is taken up between two annual audits is called

(a) Statutory Audit

(b) Vohintary Audit

(c) Interim Audit

(d) Internal Audit

Answer:

(c) Interim Audit

Question 18.

When the auditor’s staff is engaged continuously m checking the accounts of the client throughout the financial period/whole year is called

(a) Statutory Audit

(b) Interim Audit

(c) Concurrent Audit

(d) Continuous Audit

Answer:

(d) Continuous Audit

Question 19.

A comprehensive, continuous and systematic examination of all transactions by a person other than those involved in operation is called.

(a) Statutory Audit

(b) Interim Audit

(c) Concurrent Audit

(d) Continuous Audit

Answer:

(c) Concurrent Audit

Question 20.

Concurrent Audit ensure

(a) Accuracy

(b) authenticity and due compliance

(c) procedures and guidelines

(d) all of them.

Answer:

(d) all of them.

![]()

Question 21.

………………………. is a management process tool towards the establishment of sound internal functions and effective control systems.

(a) Statutory Audit

(b) Internal Audit

(c) Interim Audit

(d) Concurrent Audit

Answer:

(d) Concurrent Audit

Question 22.

Audit which commences after the books has been closed at the end of the accounting period and thereafter is carried on continuously until completed.

(a) Continuous Audit

(b) Internal Audit

(c) Final or Annual Audit

(d) Concurrent Audit

Answer:

(c) Final or Annual Audit

Question 23.

Advantages of audit excludes

(a) It safeguards the hnancial interest of person who are associated

(b) It safeguards the financial interest of person who are not associated

(c) It acts as a moral check on the employees.

(d) It helps in the detection of wastages and losses.

Answer:

(a) It safeguards the hnancial interest of person who are associated

Question 24.

Audit of financial statement is beneficial:

(a) For settlement of accounts at the time of admission or death of partners

(b) Help in detection of wastages and losses

(c) Help in settlement of liabilities for taxes

(d) All of them.

Answer:

(d) All of them.

Question 25.

The auditor is not expected to, and cannot, reduse audit risk to zero because there are some inherent limitation of an audit. This statement is stated under.

(a) SA 200

(b) SA 300

(c) SA 500

(d) SA 700

Answer:

(a) SA 200

Question 26.

Some practical and legal limitations on the auditors ability to obtain audit evidence Includes:

(a) An Audit is not an official investigation into alleged wrongdoing

(b) Fraud may involve sophisticated and carefully organised scheme

(c) Possibility that management or other may not provide, Intentionally or unintentionally, the complete information relevant for preparation and presentation of financial statement

(d) Any of them.

Answer:

(d) Any of them.

Question 27.

Auditing involves review of various assertion ………………….. with a view to prove the veracity of such assertions and expression of opinion by auditor on the same.

(a) financial terms

(b) nonfinancial terms

(c) both financial and non-financial term

(d) None of them.

Answer:

(c) both financial and non financial term

Question 28.

International Federation of Accountants (IFAC) was set up In ……………………… .

(a) 1970

(b) 1977

(c) 1987

(d) 1997

Answer:

(b) 1977

Question 29.

International Federation of Accountants was set up with a view to

(a) establish uniform accounting rules and regulation

(b) establish uniform accounting standards

(c) bringing same accounting methods and procedure for all countries

(d) bringing harmony in the profession of accountancy on an international scale.

Answer:

(d) bringing harmony in the profession of accountancy on an international scale.

Question 30.

ICAI is a member of

(a) IFAC

(b) IAASB

(c) IMF

(d) SEBI

Answer:

(a) IFAC

![]()

Question 31.

…………………….. apply in the audit of historical financial information.

(a) Standards on Auditing (SAS)

(b) Standards on Review Engagements (SREs)

(c) Standards on Assurance Engagements (SAEs)

(d) Standards on Related Services

Answer:

(a) Standards on Auditing (SAS)

Question 32.

…………………………. apply in the review of historical financial information

(a) Standards on Auditing (SAs)

(b) Standards on Review Engagements (SAEs)

(c) Standards on Assurance Engagements (SAEs)

(d) Standards on Related Services

Answer:

(b) Standards on Review Engagements (SAEs)

Question 33.

…………………… apply to engagements to apply agreed-upon procedures to information and other related services engagements such as compilation engagements.

(a) Standards on Auditing (SM)

(b) Standards on Review Engagements (SREs)

(c) Standards on Assurance Engagements (SAEs)

(d) Standards on Related Services

Answer:

(d) Standards on Related Services

Question 34.

……………………… apply in assurance engagements, dealing with subject matters other than historical financial information

(a) Standards on Auditing (SAs)

(b) Standards on Review Engagements (SAEs)

(c) Standards on Assurance Engagements (SAEs)

(d) Standards on Related Services

Answer:

(c) Standards on Assurance Engagements (SAEs)

Question 35.

Guidance Notes are ……………………… in nature.

(a) Mandatory

(b) Recommendatory

(c) Statutory

(d) All of them.

Answer:

(b) Recommendatory

Question 36.

An auditor must be honest that is, he must not certify what he does not believe to be true and must take reasonable care and skill before he believes that what he certifies is true. Stated by

(a) Justice kindley In Federal General Bank Case

(b) Justice Kindley in London Federal Bank Case

(c) Justice Kindley in London and General Bank Case

(d) None of them.

Answer:

(c) Justice Kindley in London and General Bank Case

Question 37.

Quality Control System of a firm should includes policies and procedures of

(a) Ethical requirements

(b) Engagement performance

(c) Leadership responsibilities for quality

(d) All of them.

Answer:

(d) All of them.

![]()

Question 38.

As per SA – Engaged partner shall take responsibility for the overall quality on each audit engagement to which that partner is assigned”.

(a) SA 200

(b) SA 220

(c) SA 300

(d) SA 320

Answer:

(b) SA 220

Question 39.

Which of the fundamental principles of professional ethics relevant to the auditor when conducting an audit.

(a) Integrity and objectivity

(b) Confidentiality and professional behaviour

(c) Professional competence and due care

(d) All of them.

Answer:

(d) All of them.

Question 40.

………………………….. refers to an attitude that includes a questioning mind.

While conducting the audit.

(a) Professional misconduct

(b) Professional behaviour

(c) Professional Skepticism

(d) Professional ethics

Answer:

(c) Professional Skepticism

Question 41.

“Agreeing the Terms of Audit Engagements”, preconditions for an audit may be defined as the use by management is defined under

(a) SA 200

(b) SA 210

(c) SA 220

(d) SA 300

Answer:

(b) SA 210

Question 42.

Audit engagement letter is sent by …………………… to his ………………….. .

(a) Client, auditor

(b) Shareholder, auditor

(c) Auditor, Client

(d) Auditor, government

Answer:

(c) Auditor, Client

Question 43.

ICAI has issued SA 210 “Agreeing the Terms of Audit engagement” in the interest of

(a) both the auditor and the client

(b) both the auditor and government

(c) only auditor

(d) only client

Answer:

(a) both the auditor and the client

Question 44.

Letter of engagement is issued so that

(a) Possibility of understanding Increases to a great extent

(b) Possibility of understanding reduces to a great extent

(c) Possibility of misunderstanding is reduced to great extent

(d) None of them.

Answer:

(c) Possibility of misunderstanding is reduced to great extent

Question 45.

The appointment of the auditor in partnership firm Is normally government by

(a) Partners

(b) Management of the firm

(c) Partnership Deed

(d) Governing Council.

Answer:

(c) Partnership Deed

![]()

Question 46.

According to SA 210 Agreeing the Terms of Audit Engagement” the auditor shall agree the terms of audit engagement with …………………… as appropriate.

(a) Management or those charge with governance (TCWG)

(b) Management or shareholders

(c) Management or auditor

(d) Auditor or those charge with governance.

Answer:

(a) Management or those charge with governance (TCWG)

Question 47.

The agreed terms of the audit engagement shall include:

(a) The objective and scope of the audit of the financial statement

(b) The responsibilities of auditor and management

(c) Identification of the applicable financial reporting framework for the preparation of the financial statements.

(d) All of above.

Answer:

(d) All of above.

Question 48.

In case of recurring audit of a firm by the same auditor

(a) requires fresh letter of engagement

(b) requires revised letter of engagement

(c) does not requires any letter of engagement

(d) does not requires any letter of engagement until and unless there is any type of change

Answer:

(d) does not requires any letter of engagement until and unless there is any type of change

Question 49.

Factor(s) that may make It appropriate to revise the terms of the audit engagement are:

(a) Any indication that the entity misunderstands the objective and scope of the audit

(b) A recent change of senior management or change in ownership

(c) A change in legal or regulatory requirement

(d) Any of them.

Answer:

(d) Any of them.

Question 50.

If management or TCWG impose limitation on the scope such that auditor believes limitation would result in auditor discLaiming an opinion

(a) the auditor shall accept such a limited engagement

(b) the auditor shall not accept such a limited engagement

(c) the auditor quit his assignment

(d) any of them.

Answer:

(d) any of them.