Shares – CA Foundation Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

Shares – CA Foundation Accounts Study Material

Question 1.

How may a Company utilise its Securities Premium Reserve as per Com-panies Act, 2013₹

Answer:

Issue of shares (at premium) [Section 52]:

A company may utilise its Securities Premium for the following purposes only:

- for issuing fully paid bonus shares.

- for writing off of the preliminary expenses of the Company.

- for writing off of the discount on issue of shares, if any.

- for writing off of expenses, brokerage, commission etc. on issue of shares/debentures.

- for providing premium on redemption of preference shares.

- for buyback of own shares of Company.

Question 2.

Nominal and Registered Capital

Answer:

Nominal or authorised or registered capital:

- It is the sum stated in the memorandum as the capital of the company with which it is to be registered.

- It is the maximum amount, which a company authorised to raise by issuing shares.

- It can be increased as and when decided by the company by following necessary formalities.

![]()

Question 3.

Reserve Capital

Answer:

Reserve capital:

- It is that part of the uncalled capital of the company which can be called up only in the event of winding up.

- The company can determine this by passing special resolution (Section 65 of Companies Act, 2013).

- The company cannot demand the payment of money on the shares to that extent during its lifetime.

- When once the reserve capital has been so created, it cannot be charged or mortgaged as security for any loan raised by the company and it cannot be called up.

- Creating such reserved capital will not require any accounting entry and the capital will continue to be shown as partly paid up in the balance sheet.

- Fact of such reservation should be disclosed in the balance sheet.

- The Reserve capital is different from Capital reserve, which is created out of profits.

Question 4.

Cumulative preference shares.

Answer:

Cumulative preference shares:

- They carry the right to cumulative dividends if the company fails to pay the dividend in a particular year.

- That is if for want of profit dividend is not paid the same gets accumulated and paid as and when company earns.

- All preference shares are always presumed to be cumulative unless the contrary is stated in the terms of issue.

Question 5.

Minimum subscription.

Answer:

Minimum Subscription:

Minimum Subscription means the minimum amount of subscription which a company must receive before it can allot securities to the subscribers.

According to Section 39(1) of the Companies Act, 2013, no allotment of securities shall be made:

- unless the amount stated in the prospectus as the minimum amount has been subscribed;

- the sum payable on application for such amount has been paid to and received by the company.

![]()

Question 6.

Reserve Capital and Capital Reserve.

Answer:

Reserve capital and Capital reserve:

| Basis | Reserve Capital | Capital Reserve |

| 1. Creation | It is created out of uncalled capital. | It is created out of capital profits. |

| 2. Disclosure in Balance Sheet | It is not disclosed in the com-pany’s Balance Sheet | It is disclosed as the first item under the head Reserves and Surplus on the equity andliabil- ities part of the Balance Sheet. |

| 3. Time when it can be used | It can be used only at the time of winding up | It can be used during the life of the company. |

Question 7.

Authorised Capital and Issued Capital.

Answer:

Authorised Capital and Issued Capital:

| Basis of Difference | Authorised Capital | Issued Capital |

| 1. Disclosure in Memorandum of Association | It is the amount stated in the company’s Memorandum of Association. It is the maximum amount that a company can issue under each class of capital. | It is not stated in the Memo-randum of Association of the company. |

| 2. Limits | It is higher than or equal to the issued and subscribed capital. | It cannot exceed authorised capital. |

Question 8.

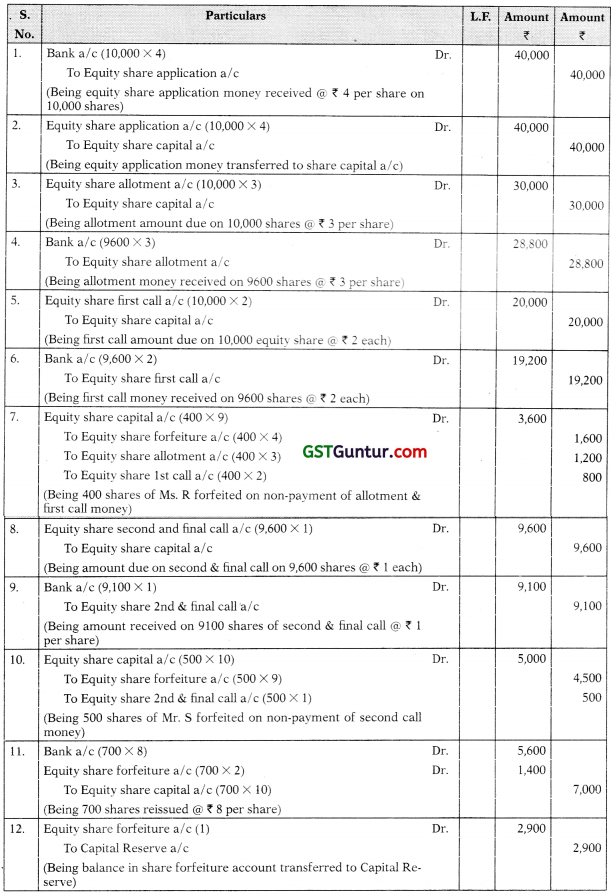

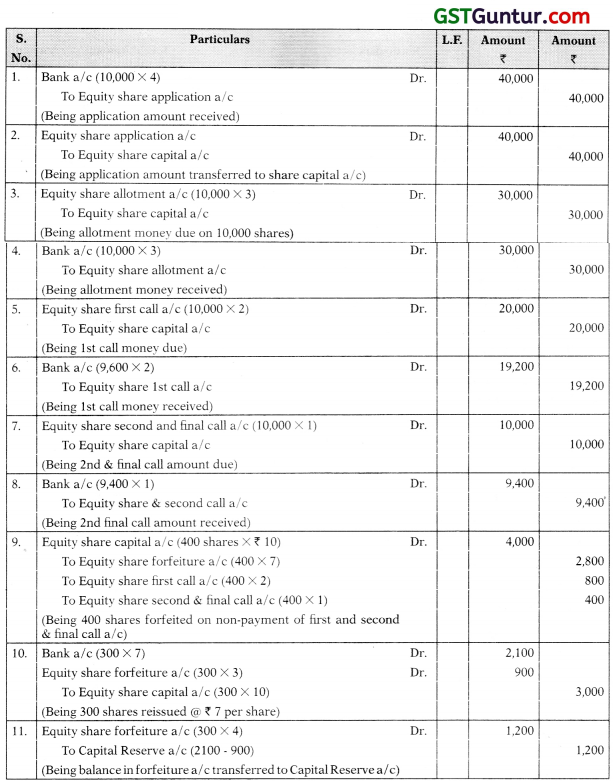

A company issued 10,000 shares of ₹ 10 each in the following manner:

On application – ₹ 4

On allotment – ₹ 3

On first call – ₹ 2

On second & final call – ₹ 1

Ms. R holder of 400 shares failed to pay allotment & first call. Company forfeited his shares & then the 2nd call was made. Mr. S holder of 500 shares failed to pay 2nd & final call. Company forfeited his shares further the company reissued 700 shares (including all shares of Ms. R) @ ₹ 8 per share.

Give necessary journal entries in the books of the company.

Solution:

Journal Entries

(In the books of the Company)

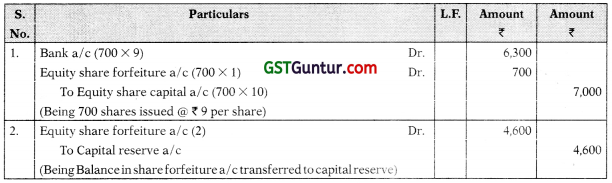

Suppose Company reissued 700 shares @ ₹ 9 per share including all shares of Mr. S. What will be the amount of Capital Reserve?

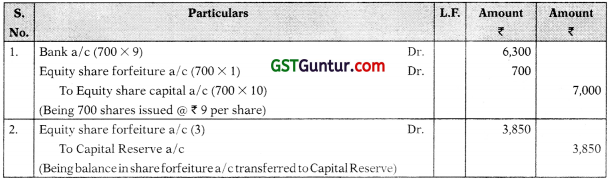

Suppose Company reissued 700 shares @ ₹ 9 per share including 350 shares of R. What will be the amount of Capital Reserve?

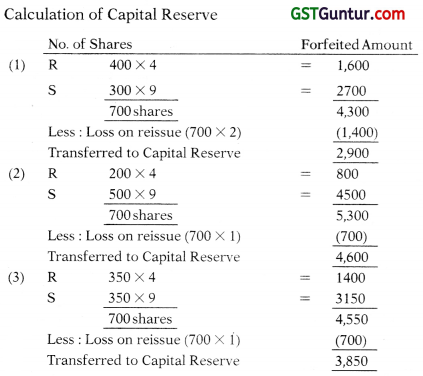

Working Notes:

Question 9.

XYZ Co. issued 10,000 of ₹ 10/- each in the following manner:

₹ 4 Application

₹ 3 Allotment

₹ 2 1st call

₹ 1 2nd call

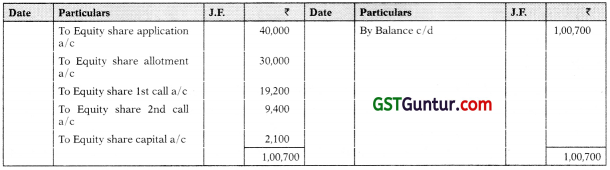

Mr. R holder of 400 shares failed to pay 1st & 2nd call money Mr. S holder of 200 shares failed to pay 2nd call money Company forfeited shares of Mr. R. and subsequently reissued 300 shares out of these @ ₹ 7 per share. Give Balance sheet of the company along with journal entries.

Solution:

Journal Entries

In the books of XYZ Co.

Bank a/c

Balance sheet of XYZ Co. as at

Working Notes:

Question 10.

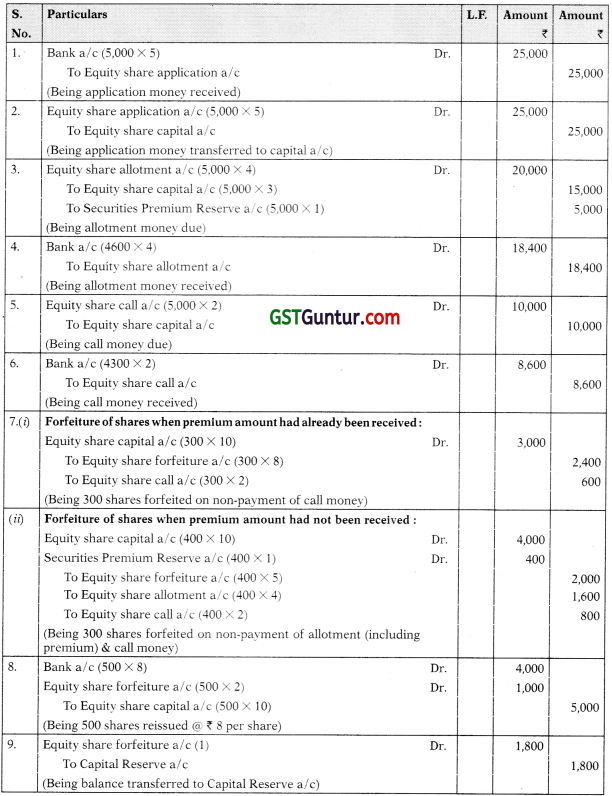

A company issued 5,000 shares of ₹ 10 each @ a premium of ₹ 1 per share. Amount was payable as follows:

Application – 5

Allotment – 3 + 1

Call – 2

Mr. A was unable to pay allotment and call money on 400 shares, whereas as Mr. B holder of 300 shares failed to pay call money. Company forfeited these shares after making call and subsequently company reissued 500 of these shares @ ₹ 8 per share, including all shares of Mr. A. Give journal entries in the books of Company.

Solution:

Journal Entries

In the books of the Company

Working Note:

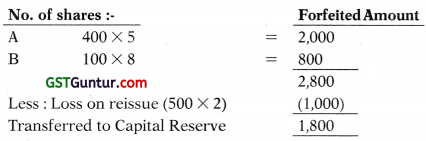

Question 11.

A Company issued 10,000 shares in the following manner:

1st Jan. On application – ₹ 4

1st Apr. On allotment – ₹ 3

1st June On 1st call – ₹ 2

1st July On 2nd call & final call – ₹ 1

Mr. R holder of 300 shares paid his 1st and 2nd call money on his shares at the time of allotment. Whereas, Mr. S holder of 200 shares failed to pay 1st & 2nd call Money upto 31st July i.e. date of closing records. Company decided to allow and charge interest on calls in advance & interest on calls in arrears as per rates specified in Table F on companies Act, 2013. You are required to give necessary journal entries in the books of the company.

Solution:

In the books of Company

Journal Entries

Working Notes:

1. Calculation of Interest on calls in advance of Mr. R.

For 1st call:

\(\frac{(300 \text { shares } \times 2) \times 2 \times 12}{100 \times 12}\) = ₹ 12.00

For 2nd & final call:

\(\frac{(300 \text { shares } \times 1) \times 3 \times 12}{100 \times 12}\) = ₹ 9.00

Total = ₹ 21.00

2. Calculation of Interest on calls in arrear of Mr. S.

For 1st call:

\(\frac{(200 \text { shares } \times 2) \times 2 \times 10}{100 \times 12}\) = ₹ 6.67

For 2nd & final call:

\(\frac{(200 \text { shares } \times 2) \times 1 \times 10}{100 \times 12}\) = ₹ 1.67

Total = ₹ 8.34

![]()

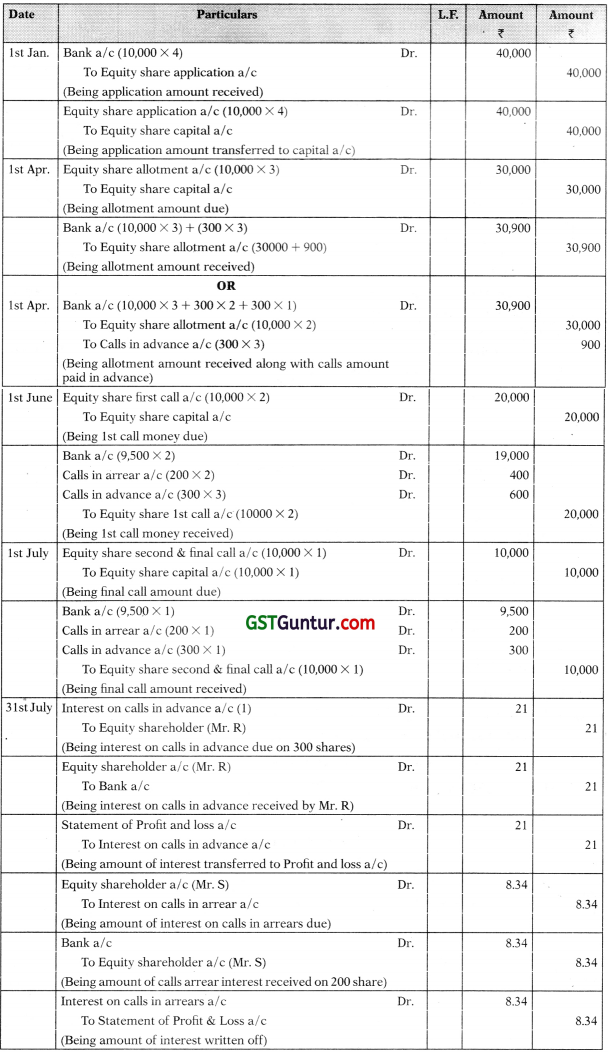

Question 12.

A company purchased some plant of ₹ 2,00,000 from Mr. R. Company decided to issue its shares of ₹ 10 each against purchase considerations. Show the necessary journal entries in the books of companies.

(1) If shares were issued @ ₹ 10 per share.

(2) If shares were issued @ ₹ 12.50 per share.

Solution:

Journal Entries

Question 13.

A Company issued its shares of ₹ 10 each in the following manner:

On application: 3 + 1

On allotment: 2 + 2

On 1st call: 4 + 1

On 2nd call & final call: 1 + 2

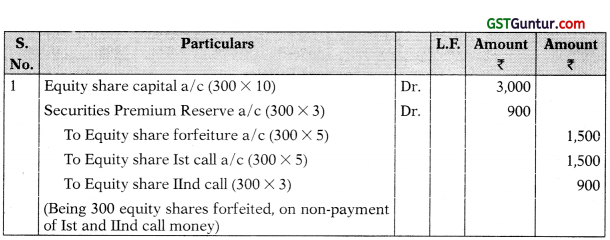

Mr. R holder of 300 shares failed to pay 1st call & 2nd call money. Company forfeited his shares. Give entry for forfeiture.

Solution:

Question 14.

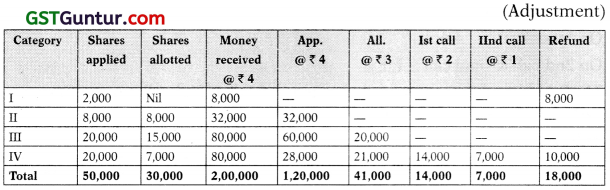

A Company issued 30,000 shares of ₹ 10 each in the following manner:

Application – ₹ 4

Allotment – ₹ 3

1st call – ₹ 2

2nd & final call – ₹ 1

Company received the application of 50,000 shares. Company made allotment of shares in the following manner:

| Category | Share Applied for | Shares Allotted |

| I II III IV |

2,000 8,000 20,000 20,000 |

Nil 8,000 15,000 7,000 |

| 50,000 | 30,000 |

Excess of money on application was to be adjusted upto last call. Give necessary journal entries in the books of Company (if all calls duly received).

Solution:

Analytical table

Journal Entries

In place of Equity share 1st and IInd call, Calls in advance a/c may be credited with ₹ 21, 000.

![]()

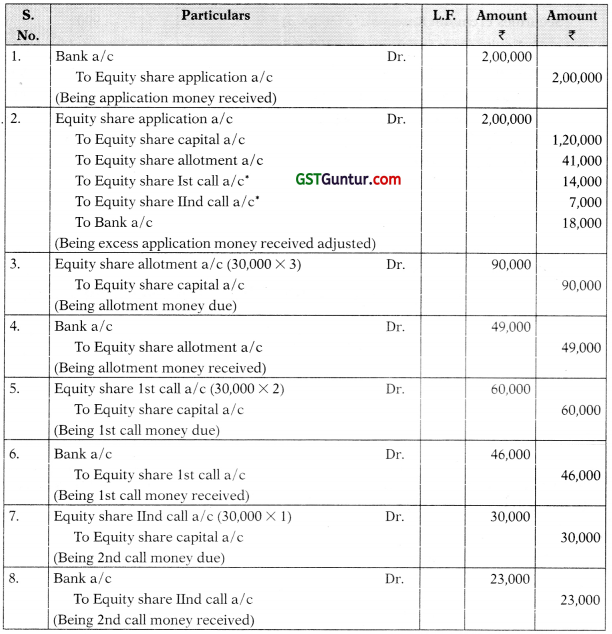

Question 15.

A Company issued 10,000 shares of ₹ 10 each, in the following manner:

Application ₹ 3

Allotment ₹ 4

1st call ₹ 2

2nd call ₹ 1

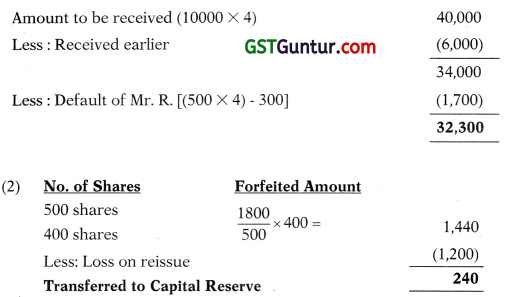

Company received the application for 13,000 shares Company rejected & refunded the amount of applications of 1,000 shares & made the pro rata allotment on remaining applications. Mr. R holder of 500 shares failed to pay any amount after application money. Company forfeited his shares after making last call and subsequently reissued 400 of these shares @ ₹ 7 per share. Give necessary journal entries in the books of the company.

Solution:

In the books of company

Journal Entries

Working Note:

(1) 10,000 shares Allotted – 12,000 shares Applied

Mr. R 500 shares [Allotted] – \(\frac { 12000 }{ 10000 }\) x 500 = 600 shares [Applied]

Application money to be paid = 500 x 3 = ₹ 1500

Application money actually paid = 600 x 3 = ₹ 1800

Excess = 300 (included in allotment money)

∴ Amount received at the time of allotment:

Question 16.

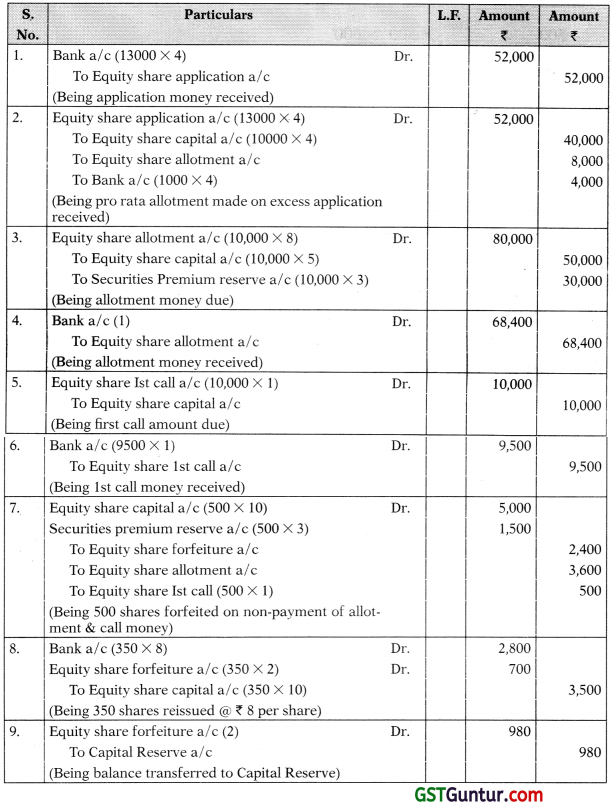

A Company issued 10,000 shares of ₹ 10 each at a premium of ₹ 3 per share in the following manner:

Application ₹ 4

Allotment ₹ 5 + 3

On call ₹ 1

Company received application for 13,000 shares. Company rejected & refunded the amount of application of 1,000 shares and made pro rata on remaining applications. Mr. R holder of 500 shares failed to pay any amount after application money. Company forfeited his shares after making call and subsequently re-issued 350 shares out of them @ ₹ 8 per share. Give necessary journal entries in the books of the Company.

Solution:

Journal Entries

In the books of the Company

Working Note:

Allotted Applied

1. 10,000 – 12,000

500 – \(\frac { 12000 }{ 10000 }\) x 500 = 600

Application money to be paid = 500 x 4 = 2000

Application money actually paid = 600 x 4 = 2400

Excess amount = 2400 – 2000 = 400

(included in allotment)

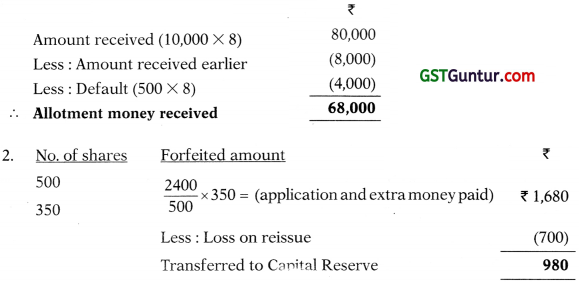

Question 17.

X Co. Ltd. invited applications for 20,000 of its Equity shares of ₹ 10 each at a premium of ₹ 2 per share, payable ₹ 3 on application, ₹ 7 on allotment including premium and the balance on first and final call.

Applications for 25,000 shares were received. It was decided:

(a) to refuse allotment to the applicants for 1,000 shares

(b) to allot in full to applicants for 4,000 shares

(c) to allot the balance of the available shares in pro rata among the other applications, and

(d) to utilise excess application moneys in part payment.

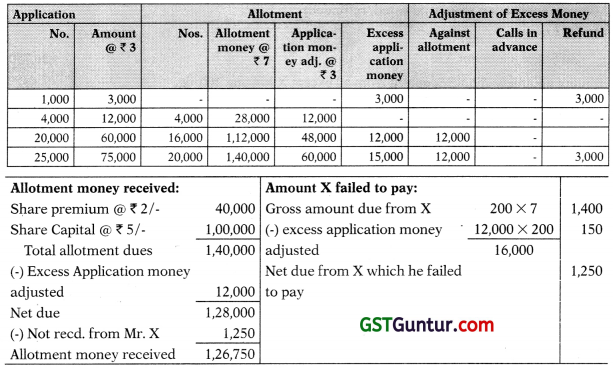

Mr. X holding 200 shares to whom shares had been allotted on pro rata basis failed to pay the amount due on allotment and call and Mr. Y holding 100 shares to whom full allotment was made failed to pay the amount due on call only. These shares were forfeited.

160 forfeited shares of Mr. X and 40 forfeited shares of Mr. Y were re-issued at a discount of Re.1 per share to Mr. Z. Show the necessary Journal Entries including cash in the books of X Co. Ltd.

Solution:

Journal Entries in the Books of X Co. Ltd.

Working Notes:

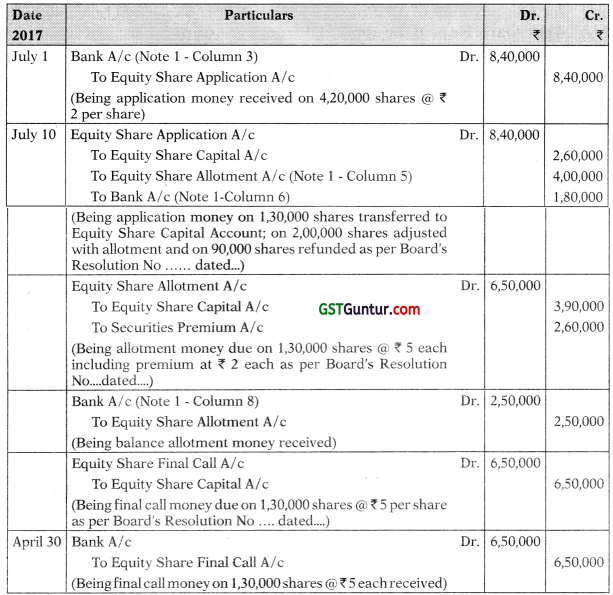

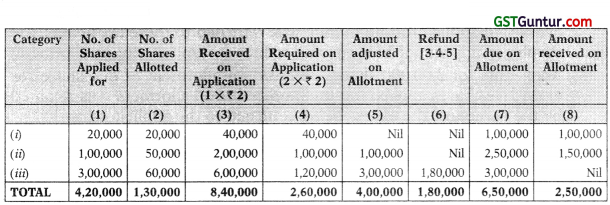

Question 18.

Piyush Limited is a company with an authorized share capital of ₹ 2,00,00,000 in equity shares of ₹ 10 each, of which 15,00,000 shares had been issued and fully paid on 30th June, 2017. The company proposed to make a further issue of 1,30,000 shares of₹ 10 each at a price of ₹12 each, the arrangements for payment being:

- ₹ 2 per share payable on application, to be received by 1st July, 2017

- Allotment to be made on 10th July, 2017 and a further ₹ 5 per share (including the premium) to be payable

- The final call for the balance to be made, and the money received by 30th April, 2018.

Applications were received for 4,20,000 shares and were dealt with as follows:

(1) Applicants for 20,000 shares received allotment in full;

(2) Applicants for 1,00,000 shares received an allotment of one share for every two applied for; no money was returned to these applicants, the surplus on application being used to reduce the amount due on allotment;

(3) Applicants for 3,00,000 shares received an allotment of one share for every five shares applied for; the money due on allotment was retained by the company, the excess being returned to the applicants; and

(4) The money due on final call was received on the due date.

You are required to record these transactions (including cash items) in the journal of Piyush limited.

Solution:

Journal of Piyush Limited

Working Note:

Calculation for Adjustment and Refund

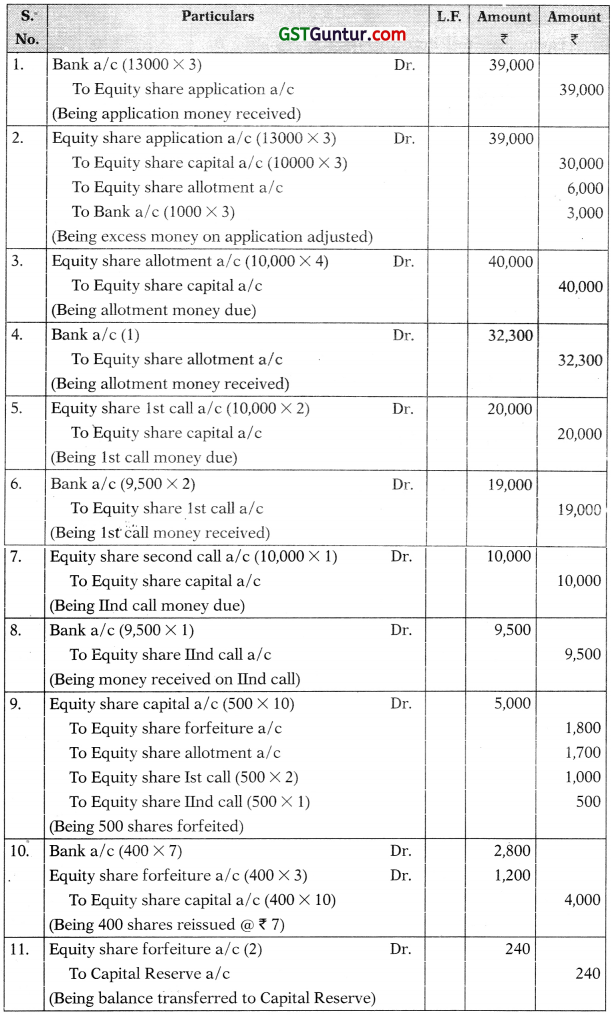

Question 19.

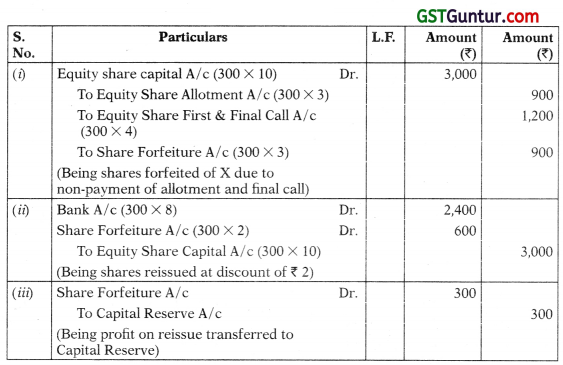

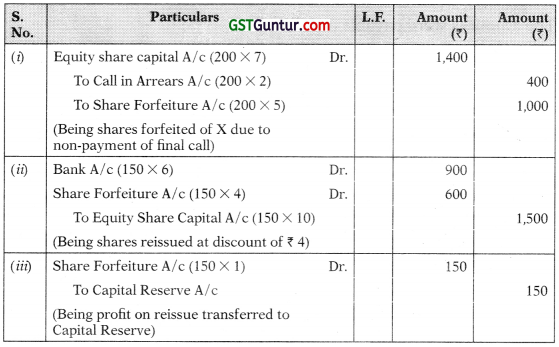

Give necessary journal entries for the forfeiture and re-issue of shares:

(i) X Ltd. forfeited 300 shares of ₹ 10 each fully called up, held by Ramesh for non-payment of allotment money of ₹ 3 per share and final call of ₹ 4 per share. He paid the application money of ₹ 3 per share. These shares were re-issued to Suresh for ₹ 8 per share.

(ii) X Ltd. forfeited 200 shares of₹ 10 each (₹ 7 called up) on which Naresh had paid application and allotment money of ₹ 5 per share. Out of these, 150 shares were re-issued to Mahesh as fully paid up for ₹ 6 per share.

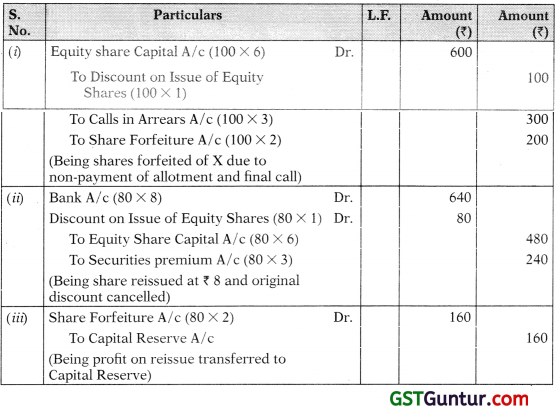

(iii) X Ltd. forfeited 100 shares of ₹ 10 each (₹ 6 called up) issued at a dis¬count of 10% to Dimple on which she paid ₹ 2 per share. Out of these, 80 shares were re-issued to Simple at ₹ 8 per share and called up for ₹ 6 per share.

Solution :

(i) Journal

(ii) Journal

(iii) Journal

Note:

Although this question 6(a)(iii), containing issue of shares at discount, has been asked in the examination but as per Companies Act, 2013, a company cannot issue shares at discount to general public.

![]()

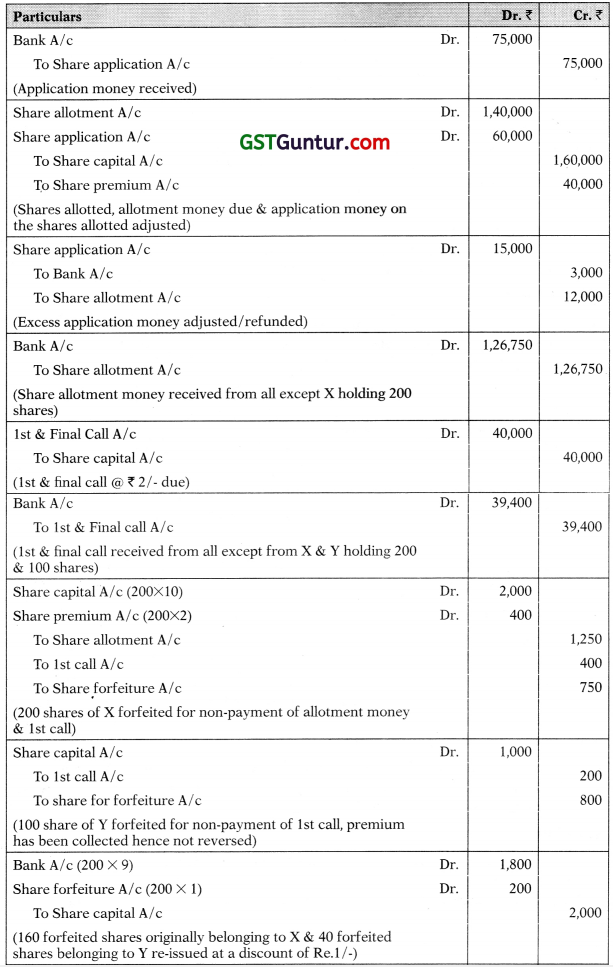

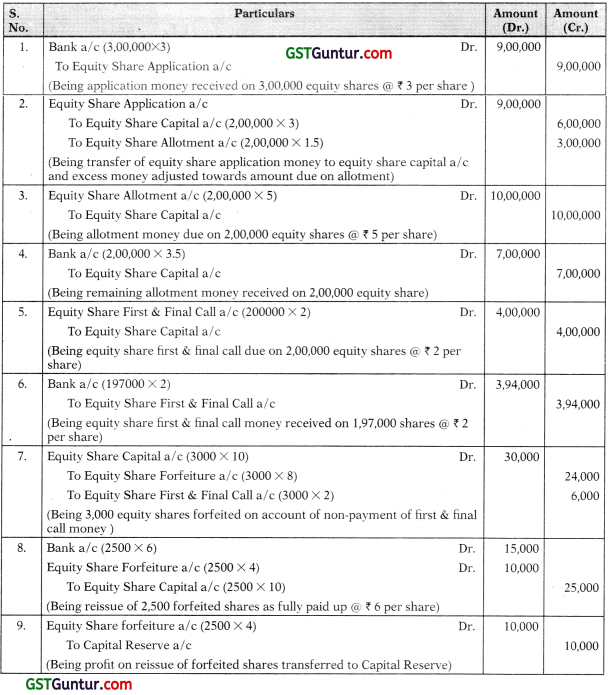

Question 19.

Bhagwati Ltd. invited applications for issuing 2,00,000 equity shares of ₹ 10 each.

The amounts were payable as follows:

On application – ₹ 3 per share

On allotment – ₹ 5 per share

On first and final call – ₹ 2 per share.

Applications were received for 3,00,000 shares and pro rata allotment was made to all the applicants. Money overpaid on application was adjusted towards allotment money. B, who was allotted 3,000 shares, failed to pay the first and final call money. His shares were forfeited. Out of the forfeited shares, 2,500 shares were reissued as fully paid-up (5 ₹ 6 per share.

Pass necessary Journal entries to record the above transactions in the books of Bhagwati Ltd.

Solution:

In the books of Bhagwati Limited:

Journal Entries

True or False

Question 1.

Reserve Capital and Capital Reserve carry the same meaning.

Answer:

False: Reserve Capital refers to that portion of uncalled up share capital which shall not be capable of being called up except in the event of winding up. Capital Reserve is a reserve which is created out of capital profits.

![]()

Question 2.

As per Table F, the Minimum rate of interest that can be charged on calls- in-Arrear and that can be allowed on calls-in-advance are 10% p.m. and 12% p.m. respectively.

Answer:

False: As per Table F, the maximum rate of interest that can be charged on Calls-in-Arrear and that can be allowed on calls-in-advance are 10°o p.a. and 12% p.a. respectively.

Question 3.

Re-issue of forfeited shares is allotment of shares but not a sale.

Answer:

False: A forfeited share is merely a share available to the company for sale and remains vested in the company for that purpose only. Reissue of forfeited shares is not allotment of shares but only a sale as they have already been allotted earlier.