Miscellaneous Audit – CA Inter Audit Questions bank is designed strictly as per the latest syllabus and exam pattern.

Miscellaneous Audit – CA Inter Audit Question Bank

Question 1.

What are the advantages of Audit to sole traders?

Answer:

Advantages of Audit to Sole Trader

Audit of sole traders’ accounts has the following advantages:

| 1. Moral Check | it act as a moral check on the employees from committing defalcations. |

| 2. Tax Liability | Audited statements of accounts are helpful in setting liability or taxes. |

| 3. Credit Negotiation | Financers and Bankers use audited financial statements in evaluating the creditworthiness of individuals in negotiating loans. It is also useful for determining the purchase consideration for a business. |

| 4. Trade Dispute Statement | Audited statements are also useful for setting trade disputes for higher wages or bonus as well as claims in respect of damages suffered by property due to some other calamity. |

| 5. Control Over Inefficiency | It also helps in the detection of wastages and losses and shows the different ways by which these might be checked especially those that occur due to the absence or Inadequacy of internal checks or internal control measures. |

| 6. Arbitration | Audited financial statements are useful In settling disputes by arbitration. |

| 7. Appraisal | Audit reviews the existence and operations of various controls in the organisation and reports in adequacies, weakness etc. in them. The trader can take suitable action based on the reports. |

| 8. Assistance to Government | Government may require audited and certified statements before it gives assistance or issues a license for a particular trade. |

Question 2.

Enumerate the salient features of audit of sole traders’ Accounts.

Answer:

The Salient Features of Audit of Sote Trader Accounts

1. A sole trader ¡s under no legal obligation to get his accounts audited except under Income Tax Act 1961 but it Is only subject to the satisfaction of certain conditions such as tax audit u/s 44AB. Some sole trader, get their financial statement audited due to regulatory requirements, such as stock brokers or on a specific instructions of the bank for approval of loans, etc. otherwise it is not compulsory.

2. The scope of audit arid the conditions under which It is carried out can be determined by the sole trader himself.

3. A sole trader may decide for a partial audit i.e. the audit would be carried out in respect of only a part of the books of accounts.

4. In order to prevent misunderstanding a written letter of appointment should be obtained by the sole trader. The letter must define clearly the scope of audit work.

Question 3.

Mention important points which auditors will consider while conducting audit of accounts of a partnership firm. (May 2013, May 2016,8, 6 marks)

Answer:

The special points to be looked Into auditing the books of a Partnership Firm may be as follows:

| Areas to be covered | Auditors Duty |

| 1. Appointment Letter | Ensure that the appointment letter, signed by a partner, duly authorised, clearly specifies the nature and scope of audit considered by the partners particularly the limitation, if any, under which the auditor functions. |

| 2. Partnership Deed | Inspect the partnership deed duly signed by all the partners and its registration with the Registrar of Firms. Also determine from the partnership deed. the capital contribution, profit sharing ratio, interest on capital, powers and responsibilities of the partners etc. |

| 3. Minutes Book | Peruse the minutes book, If any, maintained to record the policy decision undertaken by the partners especially the minutes pertaining to authorisation of extraordinary and capital expenditure, raising of loans, purchase of assets, extraordinary contracts entered into and other matter which are not routine in nature. |

| 4. Agreement | Verify whether the business in which the partnership is involved is authorised by the partnership agreement, or by any extension or modification of that agreed to subsequently. |

| 5. Books of Accounts | Investigate whether the books of account are reasonable and considered adequate pertaining to the nature of partners business. |

| 6. Interest | Verify whether the interest of non partner has suffered unreasonably by an activity Involved In the partnership which it was not authorised to do under partnership deed or by violating any pervasion in the partnership agreement. |

| 7. Provision for Tax | Ensure that a provision for tax of the firm payable by the partnership has been made in the accounts prior to arrival at the amount of profit divisible among the partners. Also check various requirements of the legislation applicable to the partnership firm such as Sec. 44 (AB) of the Income tax Act, 1961 have been complied with. |

| 8. Profit Sharing | Verify that the profits or Ios3es are distributed among the partners in the profit-sharing ratio as agreed. |

Question 4.

What are the advantages of the audit of the accounts of a partnership firm? (May 2015,6 marks)

Answer:

On broad considerations, the advantages of audit of accounts of a Partnership could be stated as follows

| 1. Account Settlement | Audited accounts provide a convenient and reliable means of settling accounts between the partners and thereby the possibility of occurrence of a dispute among them is mitigated. On this consideration, it ¡s usually provided in and accepted by the partners shall be binding upon them unless some manifest error is brought to light within a specified period subsequent to the accounts having been signed. |

| 2. Retirement or Death | On the retirement or death of a partner, audited accounts, which have been accepted by the partners constitute a reliable evidence for computing the amounts due to the retiring partner or to the representative of the deceased partner in respect of his share of capital, profits and goodwill. |

| 3. Tax Liability | The accounts of a partnership, which have been audited, are generally accepted by the Income Tax Department as the basis for computing the assessable income of the partners and also for the settlement of their liability in respect of Wealth Tax. |

| 4. Reliable | Audited statement of accounts are relied upon by the banks when advancing loans, as well as by prospective purchasers of the business, as evidence of the profitability of the concern and its financial position. |

| 5. Admission of New Partner | Audited statements of account can be helpful in the negotiations to admit a person as a partner, especially when they are available for a number of past years. |

| 6. Moral Chock on Partners | An audit is an effective safeguard against any undue advantage being taken by a working partner or partners, especially in the case of those partners who are not actively associated with the working of the firm. |

| 7. Sale of Business | Audited Accounts can be relied upon by Banks when advancing loans, as well as by prospective customers. |

Question 5.

Examine with reasons whether the following statements are correct or incorrect:

The accounts of every LLP shall be audited in accordance with rule 24 of LLP Rules 2009. (May 2019, 2 marks)

Answer:

This Statement is Correct

The accounts of every LLP shall be audited ¡n accordance with Rule 24 of LLP Rules, 2009.

![]()

Question 6.

There are certain points which are required to consider specially in the audit of accounts of a partnership. Discuss any three points briefly. (Nov 2019, 3 marks)

Answer:

The following are certain points that are required to be considered especially In the audit of accounts of a partnership:

1. Confirm that the letter of appointment, signed by a partner, duly authorized, dearly states the nature and scope of audit contemplated by the partners, especially the limitation, if any, under which the auditor shall have to function.

2. Studying the minute book, if any, maintained to record the policy decision taken by partners specialty the minutes relating to authorisation of extraordinary and capital expenditure, raising of loans; purchase of assets; extraordinary contracts entered Into and other such matters as are not of a routine nature.

3. Verifying that the business in which the partnership is engaged is authorised by the partnership agreement, or by any extension or modification thereof agreed to subsequently.

4. Examining whether books of account appear to be reasonable and are considered adequate in relation to the nature of the business of the partnership.

5. Verifying generally that the interest of no partner has suffered pre-judicially by an activity engaged in by the partnership which, it was not authorized to do under the partnership deed or by any violation of a provision in the partnership agreements.

6. Confirming that a provision for the firm’s tax payable by the partnership has been made in the accounts before arriving at the amount of profit divisible among the partners.

7. Verifying that the profits and losses have been divided among the partners wi their agreed profit-sharing ratio.

Question 7.

Examine with reasons whether the following statements are correct or incorrect. Every LLP is required to submit Statement of Account and Solvency in Form 8, which shall be filed within a period of sixty days from the end of three months of the financial year to Which the Statement of Account and Solvency relates. (Nov 2020, 2 marks)

Question 8.

How will you vouch/verify the following Investments income in the case of charitable institutions (May 2017, 4 marks)

Answer

Investment income Is case of charitable Institutions:

- Verify whether purchase and sale of any investments have been properly authorised.

- Verify Bankers certificate for the lodgement of all securities on the last day of accounting year.

- Affirm strongly the amount received with the interest and dividend, counterfoils and computation of Interest on securities for sale or purchase of investment. Ensure that appropriate dividend is received, also compare the dividend received with the investment list to confirm that dividend has been received with respect to all investments.

- 4. Ensure that appropriate dividend is received, also compare the dividend received with the investment list to confirm that dividend has been received with respect to all investment.

Question 9.

In the case of audit of a charitable institution, what attentions should be paid by auditor regarding audit of expenditure items? (Nov 2019, 4 marks)

Answer:

In the case of audit of a charitable institution, following attentions should be paid by auditor regarding audit of expendIture Items.

1. Vouching payment of grants, also verifying that the grants have been paid only for a charitable purpose or purposes tailing within the preview of the objects for which the charitable institution has been set up and that no trustee, director or member of the Managing Committee has benefitted there from either directly or indirectly.

2. Verifying the schedules of securities held, as well as inventories of properties both movable and immovable by inspecting the securities and title deeds of property and by physical ventilation of the movable properties on a test basis.

3. Verifying cash and bank balances.

4. Ascertaining that any funds contributed for a special purpose have been utilised for the purpose.

Question 10.

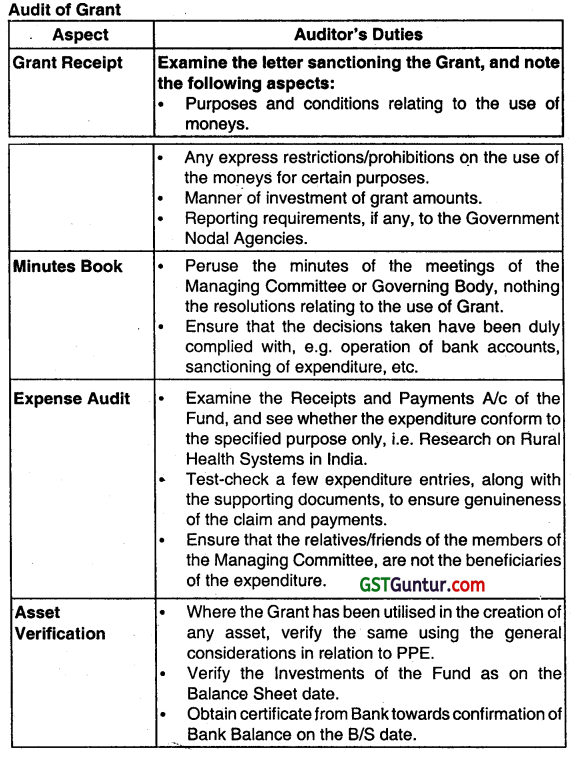

National Collage, an ‘institution managed by a trust, has received a grant of 2.40 crore from Government nodal agencies for funding a project of research on rural health systems In India. Draft an audit programme for auditing this fund in the accounts of the college. (May 2017, 6 marks)

Answer:

Question 11.

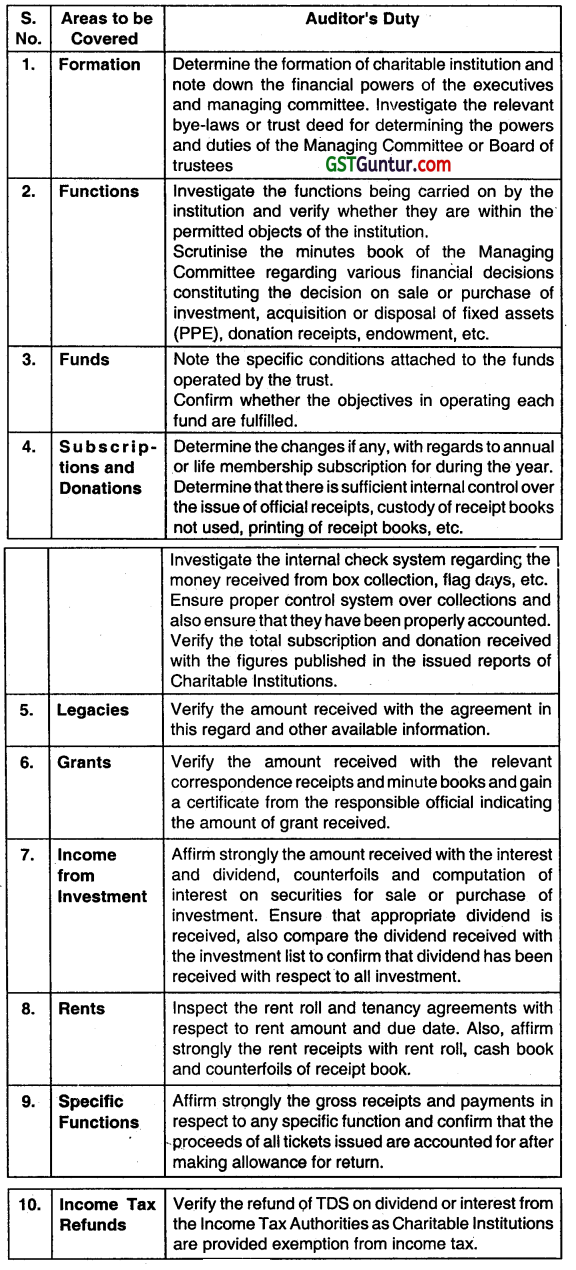

What are the important matters requiring the attention of the auditor in the audit of a charitable institution?

Answer:

Charitable Institution.

The important matters requiring the attention of the auditor in the audit of a Charitable Institution may be as follows:

Question 12.

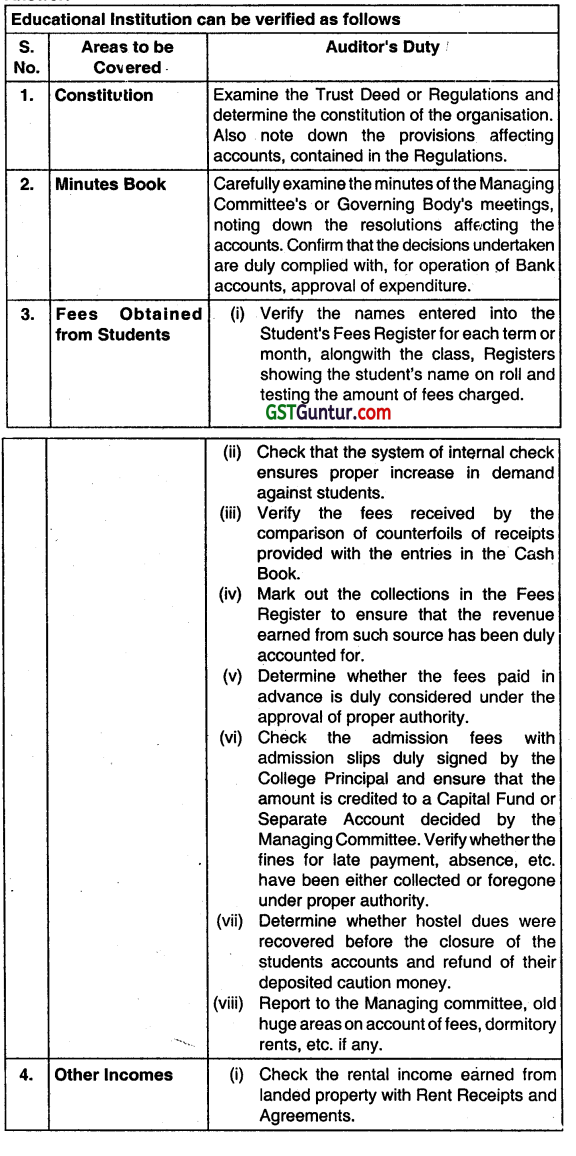

Mention the eight important points which an auditor will consider while conducting the audit of educational institutions. (May 2012, Nov 2014, 8 marks each)

Answer:

![]()

Question 13.

What steps would you take into consideration in Auditing the receipts from patients of a Hospital? (Nov 2008, 6 marks)

Answer:

An auditor should take the following steps In Auditing the receipts from patients of a hospital.

- Ascertain the legal status of the hospital.

- Examine the minutes book of meetings of Board of Trustee/Governing body! BOB! Managing Committee.

- Obtain a list of books of account and that of other registers and records relevant for the checking of receipts from patients.

- Examine the previous audit reports and note the qualifications and other observations related to receipts from patients.

- Vouch the register of patients and bills issued to them.

- Examine the internal check system regarding the receipts (whether they are in cash or cheque). Examine whether the OPD slips! admission slips issued to patients are pre numbered and are properly accounted.

- Check a sample of bHls where concessional treatment is given by sending out confirmations and requests as per SA – 505 (old AAS – 30) to large companies and government departments whose employees are treated free of cost and employer is billed directly by the hospital.

- Calculate occupancy ratio of man days, cost of various tests and Income realized therefrom for comparing them With the preceding year’s trends and ratios.

Question 14.

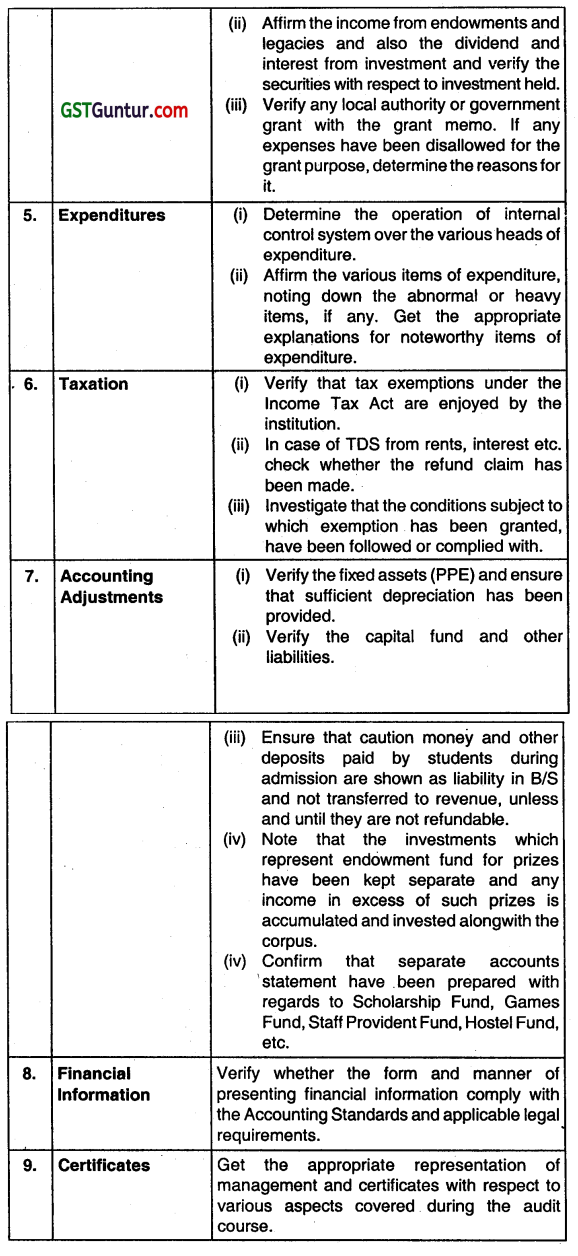

Mention any 8 special points which you as an auditor would look Into while auditing the books of accounts of Hospital (May 2011, May 2014, Nov 2012, 8 marks each)

Answer:

Question 15.

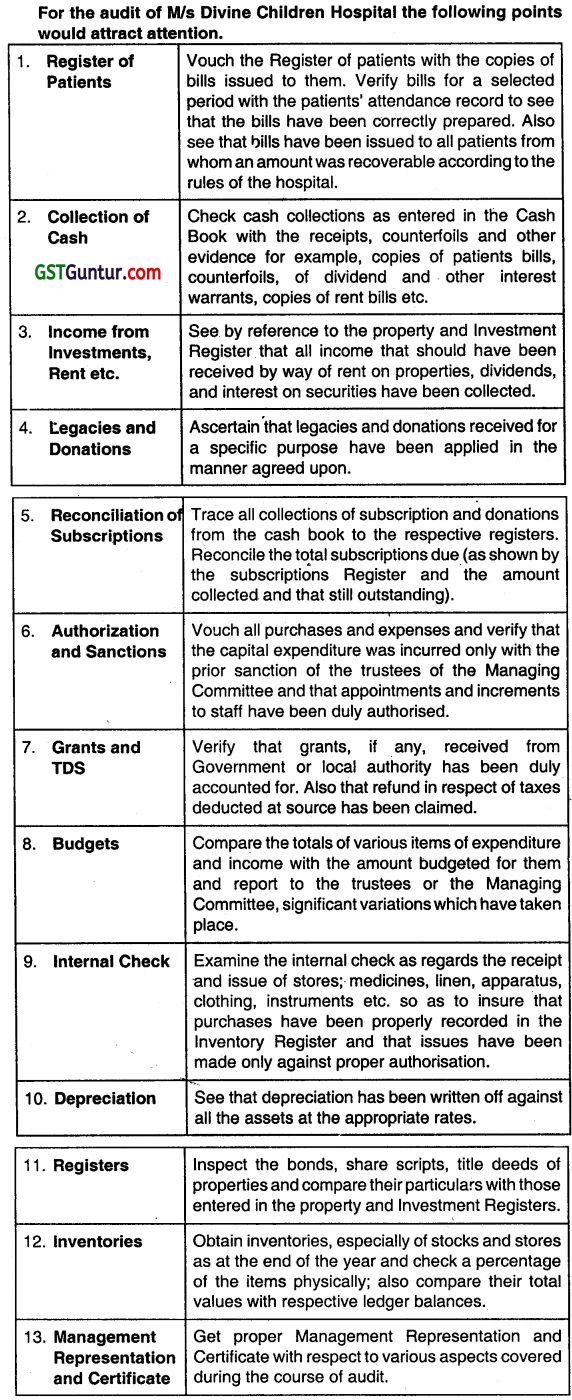

You have been appointed auditor of M/s. Divine Children Hospital. Discuss any four important points that would attract your attention while audit. (Nov 2019, 4 marks)

Answer:

Question 16.

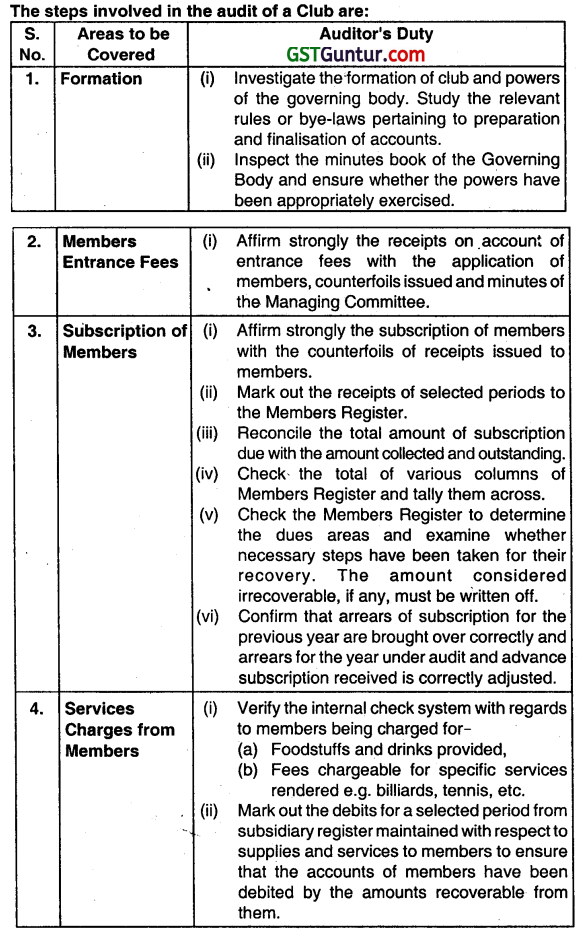

Mention briefly important points which an auditor will consider while conducting the audit of a club? (Nov 2010, Nov 2011, 8 marks each)

Answer:

Question 17.

You have been appointed as internal auditor of ‘City Club’ in Delhi. The receipts of the club were 50 lakhs during the previous year ending 2019- 20. You are required to mention special points of consideration while auditing such receipts of the club. (Jan 2021, 4 marks)

![]()

Question 18.

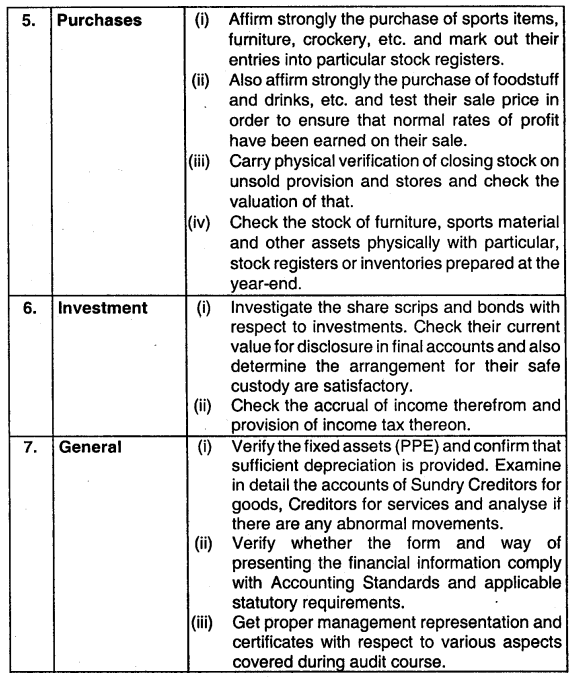

Mention any 8 special points which you as an auditor would look into while auditing the books of accounts of: Cinema (May 2011, 8 marks)

Answer:

Question 19.

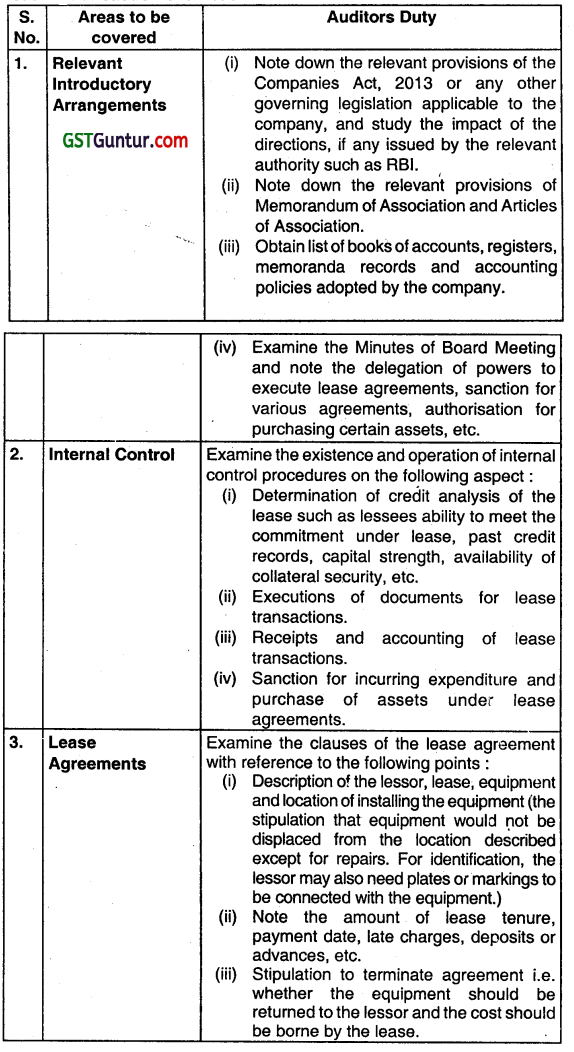

What procedure may be adopted by an auditor, while auditing leasing transactions entered into by the leasing company? (Nov 2013, 8 marks)

Answer:

The consideration to be kept in mind while conducting audit of the leasing transaction of a Leasing Company is as follows:

Question 20.

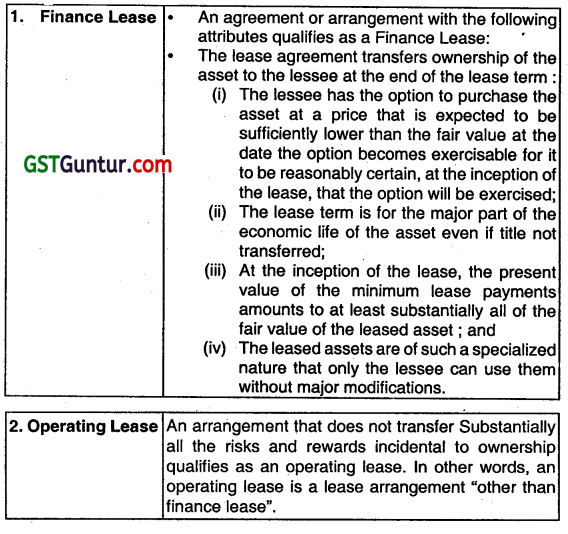

Define the different types of lease agreements as per Accounting Standard/Ind-AS. (May 2019, 4 marks)

Answer:

As per AS -19/ Ind – AS 17, lease agreements could be of 2 types:

1. Finance Lease

2. Operating Lease

![]()

Question 21.

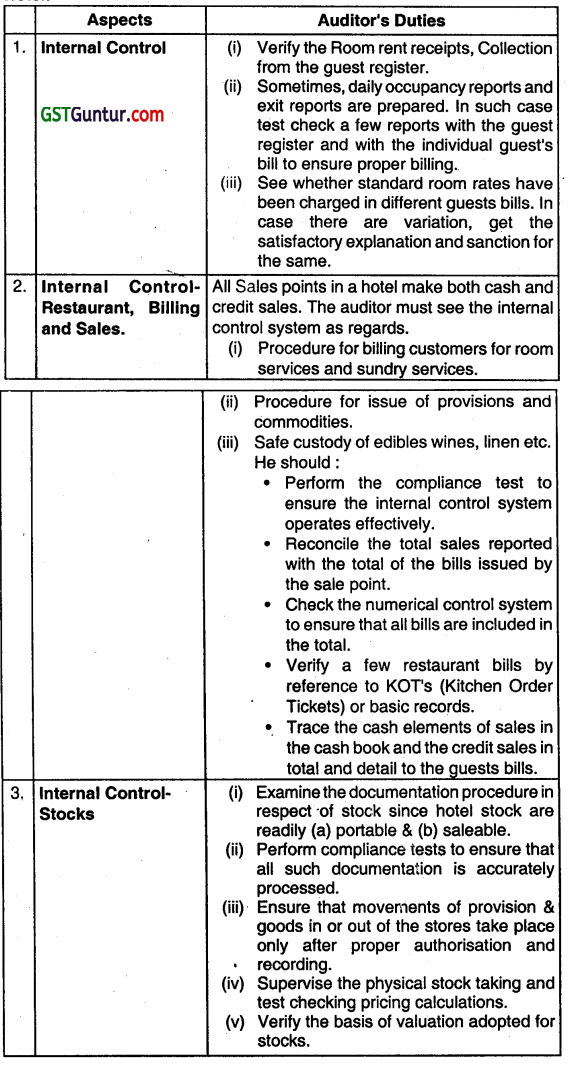

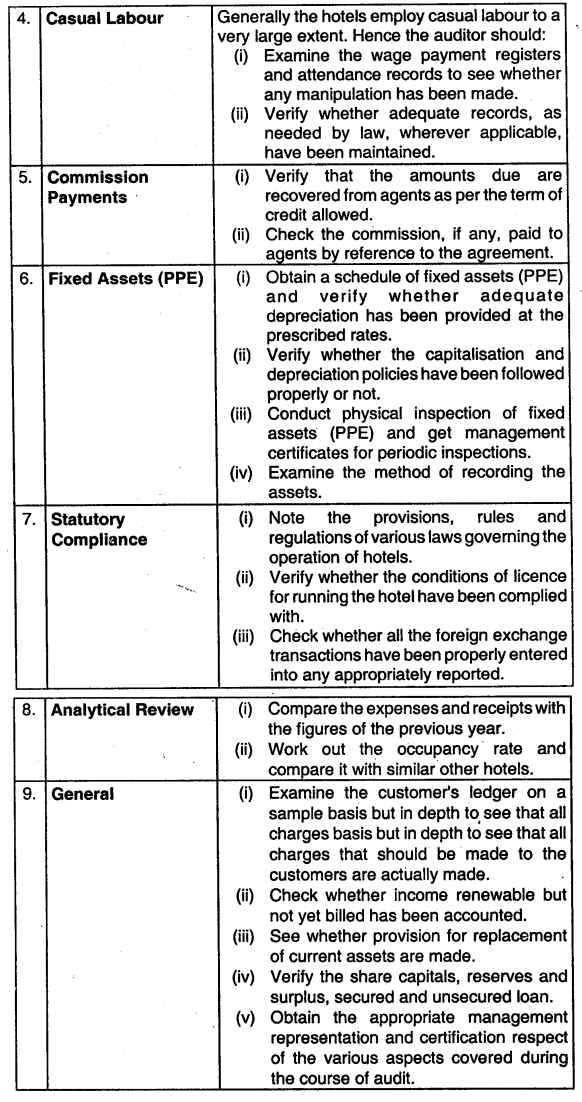

What are the six important points that will attract your attention in the case of audit of a Hotel? (Nov 2009, 5 marks)

Answer:

The following matters deserve the auditor’s attention in the audit of a Hotel: