Audit of Co-operative Societies – CA Inter Audit Questions bank is designed strictly as per the latest syllabus and exam pattern.

Audit of Co-operative Societies – CA Inter Audit Question Bank

Question 1.

Write short note on the following:

Restrictions on investments of funds of a central cooperative society. (May 2013, Nov 2016, 4 marks)

Answer:

Restrictions on Investment of Funds of a Central Cooperative Society:

According to Sec. 32 of the Central Act, a Central Cooperative Society may invest its funds only in any one or more of the following:

- In the Central or State Co-operative Bank.

- In any of the securities specified in Sec. 20 of the Indian Trusts Act, 1882.

- In the shares, securities, bonds or debentures of any other society with limited liability.

- In any Co-operative Bank, other than a Central or State Co-operative Bank, as approved by the Registrar on specified terms and conditions.

- In any other moneys permitted by the Central or State Government.

The principal provision relating to the investments of funds of a co-operative society, the Central as well as State Acts does not mention anything about the investment of reserve funds outside the business specifically.

Question 2.

Write short note on the following:

Restriction on shareholding in a Co-operative Society (Nov 2014, 4 marks)

Answer:

As per Sec. 5 of the Co-operative Society Act 1912, no member, other than a Registered society shall:

- Hold more than such portion of the share capital subject to a maximum of twenty percent, as prescribed by the rules, or

- Have or claim any interest in the share of the society exceeding ₹ 1,000.

![]()

Question 3.

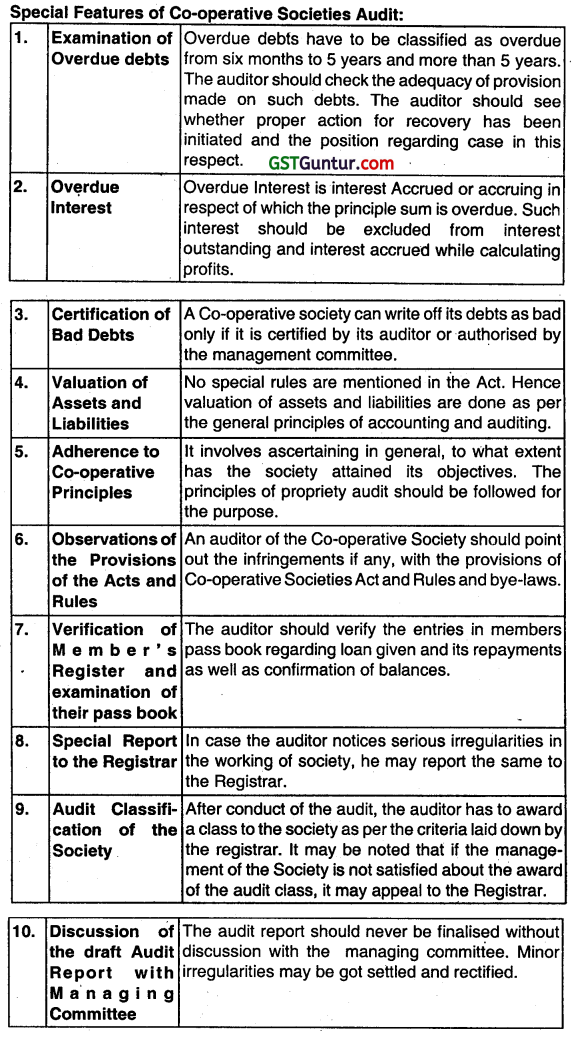

You are appointed as an auditor of a cooperative society. State the special features of the cooperative audit to be borne in mind by the auditor, concerning.

1. Audit classification of society.

2. Discussion of draft audit report with the managing committee. (Nov 2020, 4 marks)

Question 4.

Answer the following:

(b) Mr. M, has served as an auditor in the Co-Operative Department of a Government, is appointed as a statutory auditor by a Co-Operative Society that has receipts of over ₹ 3 crores during the financial year. He is not a Chartered Accountant. Mr. D, Chartered Accountant is appointed to conduct tax audit of the society under section 44AB of the Income Tax Act, 1961. Comment. (May 2018, 5 marks)

Answer:

As per Sec. 17 of the Co-operative Societies Act, 1912, Apart from a Chartered Accountant within the meaning of the Chartered Accountants Act, 1949, persons holding a government diploma in Co-operative accounts or in Co-operation and accountancy and also a person who has served as an auditor in the Co-operative department of a government can act as an auditor.

In this case, Mr. M, who is not a Chartered Accountant, has served as an auditor in the Co-operative Department of a Government, is appointed as a statutory auditor by a Co-operative Society has receipts over ₹ 3 crore during the financial year. So in light of above provisions, the appointment of Mr. M as statutory auditor of a Co-operative Society

is valid in law.

As per Sec. – 44 AB of the Income Tax Act, 1961 any business entity whose gross receipts or turnover exceeds ₹ 1 crore (AY 2021 -22) shall require to get its accounts audited by a Chartered Accountant or a firm of Chartered Accountants. Here, Cooperative Society has gross receipts of ₹ 3 crore which exceeds ₹ 1 crore and it also appoints Mr. D, a CA as auditor so this appointment is also valid.

![]()

Question 5.

Answer the following:

List the special features involved in the audit of a Co-operative Society. (May 2009, 8 marks)

OR

“Examination of overdue debts, audit classification of society, and reporting the infringement of provisions of the Act are the special features of audit of a co-operative society.” Do you agree? (Nov 2010, 6 marks)

Answer:

Question 6.

Answer the following:

Under what circumstances, an auditor is required to submit a special report to the registrar of Co-operative SocIeties ? (Nov 2009, 4 marks)

Answer:

Special Report by Auditor to Registrar äf Co-operative Societies: Under the following circumstances, an auditor has to issue special report to the Registrar of Co-operative Societies (This report should be in addition to the regular report):

1.

- Any member of the managing committee is involved In personal profit-making by using the properties or assets of the society, resulting into the loss to the society.

- Frauds are detected from the society’s transactions.

2. There is mismanagement in the society and the principles of co-operative are not maintained by the management.

3. In the respect of audit of Urban Co-operative Banks, disproportionate advances to vested interest groups. Such as relative of management and deliberate negligence about the recovery thereof. Cases of reckless advancing, where the management Is negligent about taking adequate security and proper safeguards for judging the creditworthiness of the party.

Question 7.

State the requirements regarding the maintenance of books of accounts with respect to a multi-state co-operative society. (May 2011, 4 marks)

Answer:

According to the Multi-State Co-operative Society Rules, 2002 every multi-state co-operative society shall keep books of accounts related to:

- all sum of money received and expended and the matters in respect of which the receipt and expenditure took place.

- all sales and purchases of goods.

- the assets and liabilities of the society.

- in the case of Multi-State Co-operative Society engaged in production, processing, and manufacturing particulars relating to utilization of materials or labour or other terms of cost as may be specified in the bye-laws of such a society.

The following books of accounts may be maintained:

| 1. Cashbook | Maintained to record particulars regarding cash receipts and expenses under suitable heads, with clear distinction between capital and revenue items of receipts and expenses. |

| 2. Stock register | To maintain detailed information as regards receipts, issues, and balances of stock-in-trade, date-wise. In a producer’s co-operative society, perpetual inventory records may be maintained based on an appropriate costing method. |

| 3. Register of assets and investments | To contain detailed particulars regarding the various immovable and movable assets belonging to the society, such as, types of assets, location, date of acquisition, cost, depreciation provided, and so on. |

| 4. Register of fixed deposits | Register of fixed deposits may be maintained giving details as regards the dates of acceptance, maturity, interest accrual, repayment, etc. |

| 5. Register of sureties | Register of Sureties will give particulars about the number of borrowers in respect of which a member has stood surety, and show whether it is within the overall limit of surety-ship that may be given by a member as prescribed by the by-laws. |

| 6. Register of Loan disbursement and recovery | In the case of a cooperative credit society, this Register will provide particulars regarding loans sanctioned by the society, the dates of disbursement, and recovery. |

Question 8.

Write short note on the following:

Aspects to be covered in the books of accounts to be maintained by a multi-state co-operative society. (Nov 2013, Nov 2015, 4 marks)

Answer:

Aspects to be covered In the Books of Accounts to be maintained by a Multi-state Co-operative Society as per Multi-State Co-operative Society Rules, 2002.

- All sum of money received and expended and matters in respect of receipt and expenditure take place.

- All sale and purchases of goods.

- The assets and liabilities.

- In the case of a Multi-state co-operative society engaged in production, processing, and manufacturing in the utilization of materials and labour or other items of cost as may be specified in the bye-laws of such a society.

![]()

Question 9.

Under which circumstances can the Central Government appoint the special auditor of a Multi State Cooperative Society? (Nov 2016, 4 marks)

Answer:

Appointment of Special Auditor of a Multi-State Co-operative Society:

Power of Central Government to direct special audit in certain cases:

As per the Multi-State Co-operative Societies Act, 2002, where the Central Government is of the opinion:

1. that the affairs of any Multi-State Co-operative Society are not being managed in accordance with self-help and mutual did and co-operative principles or Prudent Commercial Practices or with sound business principles; or

2. that any Multi-State Co-operative Society is being managed in a manner likely to cause serious injury or damage to the interests of the trade industry or business to which ¡t pertains; or

3. that the financial position of any Multi-State Co-operative Society in such as to endanger its solvency.

The Central Government may at any time by order direct that a special audit of the Multi-State co-operative society’s accounts for such period or periods as may be specified in the order shall be conducted and appoint either a Chartered Accountant or the Multi-State co-operative society’s auditor himself to conduct the special audit. However, Central Government shall order for special audit only if that Government or the State Government either by itself or both hold fifty-one percent or more of the paid-up share capital in such Multi-State cooperative society.

Question 10.

Answer the following:

Briefly explain the provisions for qualification and appointment of Auditors under the Multi-State Co-operative Societies Act, 2002. (Nov 2018, 5 marks)

Answer:

Qualification of Auditors:

Sec. 72 0f the Multi-State Co-operative Societies Act, 2002 states that a person who is a Chartered Accountant within the meaning of the Chartered Accountants Act, 1949 can only be appointed as auditor of Multi-state Cooperative Society.

However, the following persons are not eligible for appointment as auditors of a Multi-state cooperative society:

- A body corporate

- An officer or employee of the Multi-state cooperative society.

- A person who is a member or who is in the employment, of an officer or employee of the Multi-State Co-operative Society.

- A person who is indebted to the Multi-State Co-operative Society or who has given any guarantee or provided any security in connection with the indebtedness of any third person to the Multi-State Co-operative Society for an amount exceeding one thousand rupees.

If an auditor becomes subject, after his appointment, to any, of the disqualifications specified above, he shall be deemed to have vacated his office as such.

![]()

Appointment of Auditors:

Sec. 70 of the Multi-State Co-operative Societies Act, 2002 provides that the first auditor or auditors of a Multi-State Co-operative Society shall be appointed by the board within one month of the date of registration of society and the auditor or auditors so appointed shall hold office until the conclusion of the first annual general meeting. If the board fails to exercise its powers under this subsection, the Multi-State Co-operative Society in the general meeting may appoint the first auditor or auditors.

The subsequent auditor or auditors are appointed by Multi-State Cooperative Society, at each annual general meeting. The auditor or auditors so appointed shall hold office from the conclusion of that meeting until the conclusion of the next annual general meeting.

Question 11.

Central Govt. holds 55% of the paid-up share Capital in Kisan Credit Cooperative Society, which is incurring huge losses. Advise when the Central Government can direct Special Audit under Section 77 of the Multi-State Co-operative Society Act. (May 2019, 3 marks)

Answer:

As per Sec. 77 the Multi-State Co-operative Societies Act, 2002, the Central Government can direct special audit where the Central Government is of the opinion:

1. That the affairs of any Multi-State Co-operative Society are not being managed in accordance with self-help and mutual deed and co-operative principles or prudent commercial practices or with sound business principles: or

2. That any Multi-State Co-operative Society is being managed in a manner likely to cause serious injury or damage to the interests of the trade industry or business to which it pertains; or

3. That the financial position of any Multi-State co-operative Society is such as to endanger its solvency.