Inventory Valuation – CA Foundation Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

Inventory Valuation – CA Foundation Accounts Study Material

Question 1.

Periodic inventory system

Answer:

Periodic/Physical inventory system

- No records of inventory are maintained.

- Inventory is ascertained by physical counting at the end of the year and then valued.

- It is simple and commonly followed by small organisations.

Unless otherwise specified, we can always assume that inventory/closing stock for annual financial account purposes is ascertained by physical counting and then valuing.

Question 2.

Perpetual inventory system.

Answer:

Perpetual/continuous inventory system:

- Inventory records also known as stores records are maintained in which details of each and every item are kept.

- The records may be in only quantity form or may include value also (known as priced ledger).

- The details of receipt and issue are recorded instantly and balance ascertained.

- Hence balance of all items of inventory are always available. The balance of year end can be used in financial accounting for final accounts.

![]()

Question 3.

Stock taking.

Answer:

Stock taking:

- Stock taking is referred to the process of physical counting/checking of each item of inventory.

- It is a necessary element of inventory control system.

- It can be carried at pre-determined time interval or on a surprise basis i.e. any time without intimating in advance to the stores people.

- All items may be verified together at one time or on few items everyday basis.

- Important and valuable items will be verified more frequently than others.

- In perpetual inventory system also stock taking is carried so as to prove the accuracy of stock records.

- In periodic inventory system stock taking is carried at the year end.

Question 4.

FIFO & LIFO method

Answer:

FIFO & LIFO method:

FIFO (First In First Out) method:

- In FIFO method it is assumed that the lot of material which comes first will be issued first and then the next and so on.

- Therefore the closing stock will be out of the latest (recent) lots and hence the stock will be valued at the rates of this lots.

- Closing stock can be valued from out of the latest (last) lots or by preparing date wise stores ledger, both approaches will give same valuation.

- In case of rising prices, the inventory will be valued at the latest i.e. higher prices and hence profit will be higher and cost of sales will be lower.

- In case of declining prices, the inventory will be valued at the latest i.e. lower prices and hence profit will be lower and cost of sales will be higher.

LIFO (Last In First Out) method:

- In LIFO method it is assumed that the last lot (i.e., the last among the lots available at the time of issue) wall be issued first and then the previous lot and so on.

- Therefore the earlier lots will be in stock and hence the closing stock will be valued at those rates of earliest lots (i.e. oldest lots)

- In case of rising prices, the inventory will be valued at the oldest i e. lower prices and hence profit will be lower and cost of sales will be higher.

- In case of declining prices, the inventory will be valued at the oldest i.e. higher prices and hence profit will be higher and cost of sales will be lower.

- In this method the current (i.e. latest) cost gets charged against current revenue.

- In case of LIFO method the valuation of inventory from earliest lot will be followed only when date wise details of issue are not given.

- But if in the question the details of date-wise issues are given then more correctly the valuation should be made by preparing a date wise stores-Card. Both approaches can give different valuation.

- LIFO as a cost formula is not permitted by revised AS-2.

Question 5.

M/s. Subhalaxmi Traders find out the following historical cost and net realisable value for various types of inventories. Find out value of Closing Stock in accordance with AS-2 (Revised) – Valuation of Inventories issued by ICAI.

| Inventory Categories | 01 | 02 | 03 | 04 | 05 | 06 | |

| Historical Cost | 17,400 | 20,100 | 18,200 | 16,500 | 15,400 | 21,400 | = 1,09,000 |

| Net Realisable Value | 12,200 | 27,400 | 19,100 | 17,200 | 16,800 | 20,900 | = 1,13,600 |

Solution:

As per AS-2 (Revised), valuation of inventories must be at the lower of historical cost and Net Realisable value. Comparison between cost and net realisable value can be done individually on item-by-item basis or in the aggregate i.e. group-wise of similar and interchangeable items.

But comparison by global basis is to be avoided. That is to say, total cost of all dissimilar items with their total net realisable value is not permitted. Hence, as per category-by-category comparison, we can determine value of inventories as under.

| Inventory Categories | Lower of historical cost & net realisable value |

| 01 | 12,200 |

| 02 | 20,100 |

| 03 | 18,200 |

| 04 | 16,500 |

| 05 | 15,400 |

| 06 | 20,900 |

| 1,03,300 |

Thus, Value of closing stock is ₹ 1,03,300.

![]()

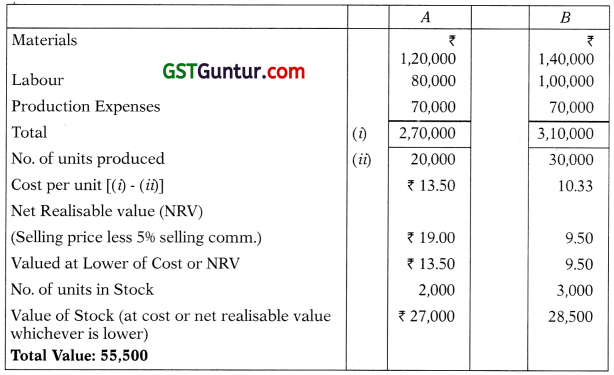

Question 6.

A firm has two products A and B. It analyses its costs for the products as follows:

| A (₹) | B (₹) | |

| Materials | 1,20,000 | 1,40,000 |

| Labour | 80,000 | 1,00,000 |

| Production Expenses | 70,000 | 70,000 |

| Administration Expenses | 50,000 | 50,000 |

| Advertising | 30,000 | 30,000 |

| 3,50,000 | 3,90,000 |

Production was 20,000 units of A and 30,000 units of B. The selling price was ₹ 20 per unit of A but the price of B was only ₹ 10; agents in both cases received commission @ 5% of the selling price. The closing stock was 2,000 units and 3,000 units of A and B respectively. What is the value that should be put on the closing stock?

Solution:

Statement Showing Valuation of Stock as on ……….

Cost of Production

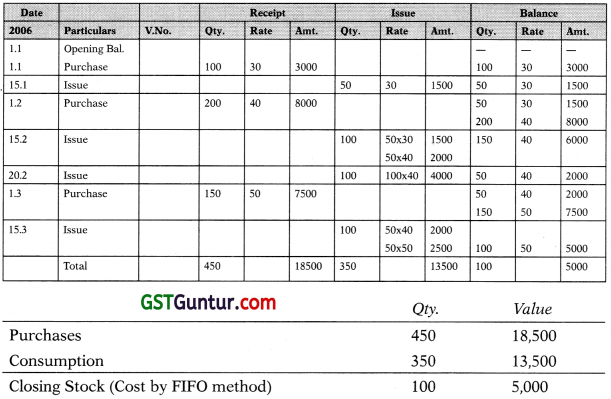

Question 7.

The following are the details of a spare part of Sriram Mills:

| 1-1-06 | Opening Stock | Nil |

| 1-1 | Purchases | 100 units @ ₹ 30 per unit |

| 15-1 | Issued for consumption | 50 units |

| 1-2 | Purchases | 200 units @ ₹ 40 per unit |

| 15-2 | Issued for consumption | 100 units |

| 20-2 | Issued for consumption | 100 units |

| 1-3 | Purchases | 150 units @ ₹ 50 per unit |

| 15-3 | Issued for consumption | 100 units |

Find out the value of stock as on 31-3-06 if the company follows:

1. First in First Out basis

2. Last in First Out basis

3. Weighted Average basis

Solution :

Stores card/Stores ledger

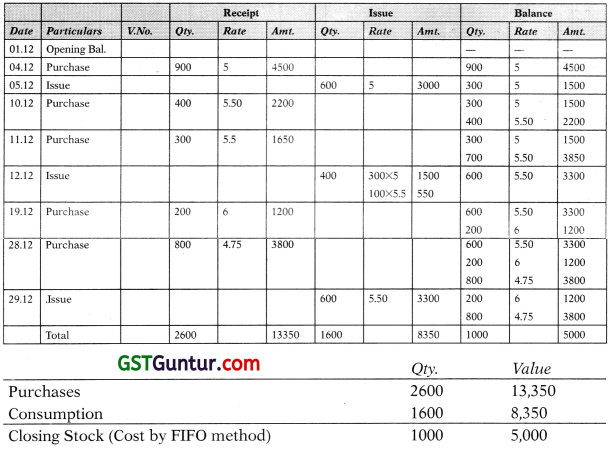

Fifo Method:

Item – Spare parts → Method of Valuation of issues → FIFO

Without making stores card, if we simply value the stock of 100 units from the last lot because the earlier lots have been issued, we get the same valuation 100 units @ ₹ 50/- = ₹ 5,000.

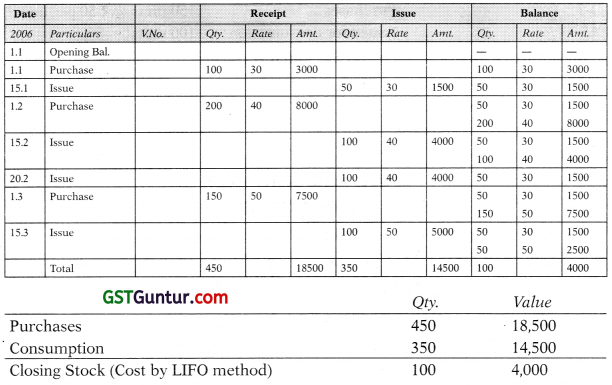

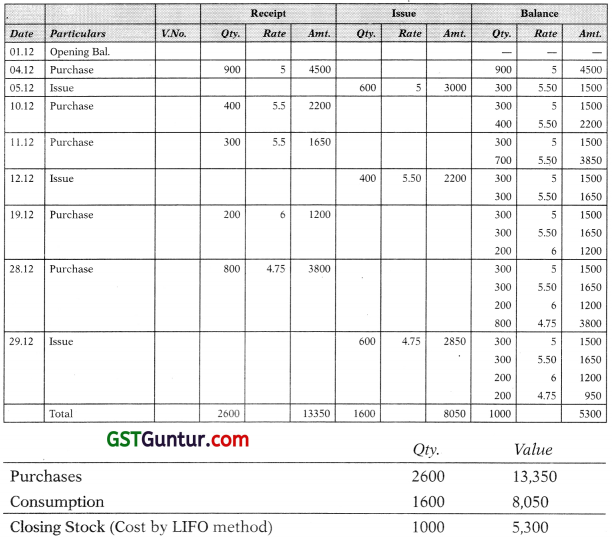

Lifo Method:

Item – Spare parts → Method of Valuation of issues → LIFO

Alternatively:

The shortcut valuation of closing stock by LIFO i.e. without preparing stores card, would have been 100 units @30/- = 3,000. It differs from the above valuation which is more correct if datewise issue is known.

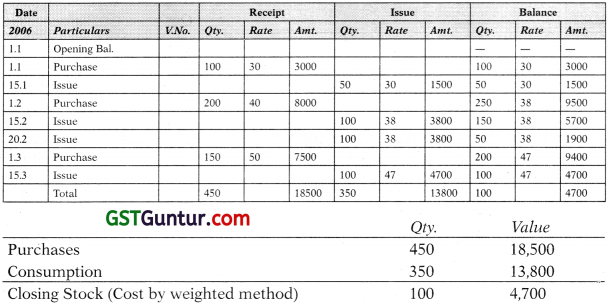

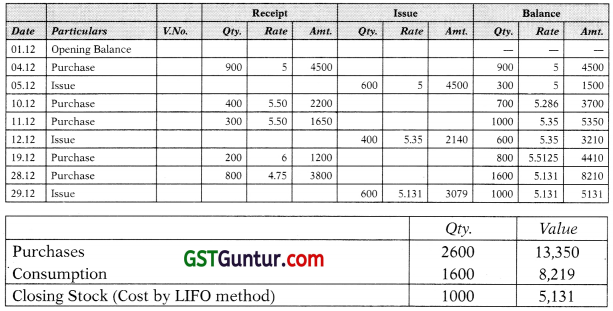

Weighted Average Method:

Item – Spare parts → Method of Valuation of issues → Weighted Average Method

Alternatively periodic weighted average can be applied

say quarterly weighted average = 3000 + 8000 + 7500/100 + 200 + 150 = 41.11

Closing stock = 41.11 x 100 = 4111

| Qty. | Value | |

| Purchases Consumption |

450 350 |

18,500 14,389 |

| Closing Stock (Cost by weighted method) | 100 | 4,111 |

Question 8.

A manufacturer has the following record of purchase of a condenser which he uses while manufacturing radio sets:

Purchases were as follows:

| Date | Quantity (Units) | Price per (Unit) |

| Dec-4 | 900 | 5.00 |

| Dec-10 | 400 | 5.50 |

| Dec-11 | 300 | 5.50 |

| Dec-19 | 200 | 6.00 |

| 2600 | ||

Value the closing stock under different methods

Issues were made as follows

| Date | Quantity (Units) |

| Dec-5 | 600 |

| Dec-12 | 400 |

| Dec-29 | 600 |

Solution:

Fifo Method:

Item – Condenser → Method of Valuation of issues → FIFO

Closing Stock (Cost by FIFO method) 1000 5,000

Without making stores card, if we simply value the stock of 1000 units from the last lots because the earlier lots have been issued, we get the same valuation 800 units @ 4.75/- = ₹ 3,800 and 200 units @ 6/- = ₹ 1,200.

Lifo Method:

Item → Condenser → Method of Valuation of issues → LIFO

The shortcut valuation of closing stock by LIFO i.e. without preparing stores card, would have been 900 units @5 = 4,500 and 100 units @5.50 = 550. It differs from the above, which is more correct if date wise issue is known.

Weighted Average Method:

Item → Condenser → Valuation of Issues → Weighted Average

Alternatively periodic weighted average can be applied. It can be monthly, quarterly etc.

Monthly Weighted Average = \(\frac{5 \times 900+5.5 \times 400+5.5 \times 300+6 \times 200+4.75 \times 800}{900+400+300+200+800}\)

= \(\frac{4500+2200+1650+1200+3800}{2600}=\frac{13350}{2600}\)

= 5135

Therefore closing stock will be 1000 x 5.135 = 5135

| Qty. | Value | |

| Purchases Consumption |

2,600 1,600 |

13,350 8,215 |

| Closing Stock (Cost by LIFO method) | 1,000 | 5,135 |

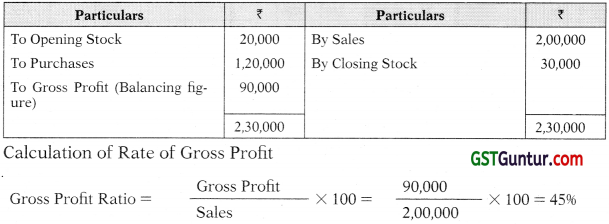

Ascertaining closing stock by preparing trading account.

![]()

Question 9.

From the following particulars for the years 2004 and 2005 determine the value of the closing stock at the end of 2005.

| 2004 ₹ |

2005 ₹ |

|

| Opening Stock Purchases Sales |

20,000 1,20,000 2,00,000 |

30,000 1,90,000 2,40,000 |

Uniform rate of gross profit may be assumed.

At the end of 2005, goods purchased were received, but no entry was made for this credit purchase since invoice was not received. These goods cost ₹ 20,000.

Solution:

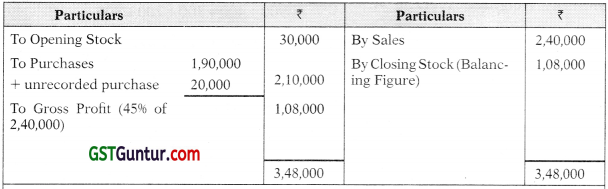

Closing stock of 2005 can be ascertained by preparing Trading a/c but gross profit ratio for 2005 is not given hence the same is ascertained by preparing Trading a/c of 2004. For this remember the closing stock of this year is the opening stock of next year.

Trading Account:

For the year ending 31st December, 2004

Trading Account:

For the year ending 31st December, 2005

Uniform Rate of gross Profit = 45% is taken from 2004. Stock as on 31-12-2005 including goods for which invoice was not accounted is ₹ 1,08,000

Ascertaining Stock, when stock of different date is known (Stock of latter date is known)

Question 10.

X who was closing his books on 31-3-2006 failed to take the actual Stock which he did only on 9th April, 2006, when it was ascertained by him to be worth ₹ 25,000. It was found that sales are entered in the sales book on the same day of dispatch and return inwards in the return book as and when the goods are received back. Purchases are entered in the purchases day book once the invoices are received.

It was found that sales between 31-3-2006 and 9-4-2006 as per the sales day book are ₹ 1,720. Purchases between 31-3-2006 and 9-4-2006 as per purchases day book are ₹ 120, out of these goods amounting to ₹ 50 were not received until after the stock was taken. Goods invoiced during the month of March, 2006 but goods received only on 4th April, 2006 amounted to ₹ 100. Rate of gross profit is 33 1/3% on cost.

Ascertain the value of physical stock as on 31-3-2006.

Solution:

| Stock on 9-4-2006 Add: Cost of goods sold (1720/ 100) x 75 Note: Profit 33 1/3% on cost = 25% on sale Less: Goods purchased and received (120-50) Less: Goods purchased in March but received on 4-4-06 Physical stock on 31-3-06 Add: Stock in transit (purchased but not received till 31-3-06) Closing stock for final a/c. |

25,000 + 1,290- 70 – 100 |

| 26120 + 100 |

|

| 26,220 |

Ascertaining stock, when stock of different date is known (Stock of earlier date is known).

![]()

Question 11.

A trader prepared his accounts on 31st March, each year. Due to some unavoidable reasons, stock taking was done on 15th March, 2006 on which date the total cost of goods in his godown came to ₹ 50,000. The following facts were established between 15th March and 31st March, 2006.

(a) Sales ₹ 41,000 (including cash sales ₹ 10,000)

(b) Purchases ₹ 5,034 (including cash purchases ₹ 1,990)

(c) Sales Returns ₹ 1,000

Goods are sold by the trader at a profit of 209& on sales.

You are required to ascertain the value of stock on hand on 31st March, 2006.

Solution:

Statement showing the Valuation of Stock as on 31st March, 2006:

| A Stock in godown (Physical inventory) as on 15-3-06 B Less: (a) Cost of sales between 15.3 to 31.3 net of return 80% of (₹ 41,000 – ₹ 1,000) C Add: (a) Purchases during the period D Stock as on March 31, 2006 (at cost) |

₹ |

| 50,000 – 32,000 + 5,034 |

|

| 23,034 |

Question 12.

Raj Ltd. prepared their accounts for financial year ended on 31st March 2019. Due to unavoidable circumstances actual stock has been taken on 10th April 2019, when it was ascertained at ₹ 1,25,000. It has been found that;

(i) Sales are entered in the Sales Book on the day of dispatch and return inwards in the Returns Inward Book on the day of the goods received back.

(ii) Purchases are entered in the Purchase Book on the day the Invoices are received.

(iii) Sales between 1st April 2019 to 9th April 2019 amounting to ₹ 20,000 as per Sales Day Book.

(iv) Free samples for business promotion issued during 1st April 2019 to 9th April 2019 amounting to ₹ 4,000 at cost.

(v) Purchases during 1st April 2019 to 9th April 2019 amounting to 110,000 but goods amounts to ₹ 2,000 not received till the date of stock taking.

(vi) Invoices for goods purchased amounting to Rs. 20,000 were entered on 28th March 2019 but the goods were not included in stock.

Rate of Gross Profit is 2596 on cost.

Ascertain the value of Stock as on 31st March 2019.

Solution:

| ₹ | |

| Stock as on 10th April, 2019 Add: Cost of Goods sold (\(\frac { 20,000 }{ 100 }\) x 80) [Note:- Profit 25% on cost = 20% on sale] Add: Free samples distributed Less: Goods purchased & received (10,000 – 2,000) Add: Invoices entered but goods not included in stock |

1,25,000 16,000 4,000 8,000 20,000 |

| Stock as on 31st March, 2019 | 1,57,000 |

True or False

Question 1.

Damaged inventory should be valued at cost or market price, whichever is lower.

Answer:

False: Damaged inventory should be valued at net realizable value only.

![]()

Question 2.

Finished goods are normally valued at cost or market price whichever is higher.

Answer:

False: As per AS-2, finished goods are normally valued at cost or net realizable value whichever is lower.

Question 3.

The inventory under AS-2 is valued on the basis of cost price or current replacement cost, whichever is less.

Answer:

False: As per AS-2, Valuation of Inventories, inventory is valued at the lower of cost and net realizable value.