Audit Report – CA Inter Audit Questions bank is designed strictly as per the latest syllabus and exam pattern.

Audit Report – CA Inter Audit Question Bank

Question 1.

When does an auditor issue an unqualified opinion ard what does it indicate? (May 2008, 4 marks)

Answer:

An unqualified report or clean audit report ¡s issued when the auditor has no reservation in respect of matters contained in the financial statements. He is satisfied in all material respects with al the points required to be stated in his report and states them in affirmative, adding no reservation anywhere In the audit report:

An unqualified Audit Report shall state that:

The financial statements give a true and fair view of the state of affairs and profit and loss account during the period.

A clean report is issued, if, the auditor is satisfied that:

- The financial Information has been prepared using acceptable accounting policies and they are applied consistently.

- The financial information complies with relevant regulations and statutory requirements.

- There is adequate disclosure of all material matters relevant to the proper presentation of the financial information, subject to statutory requirements, where applicable.

Question 2.

‘An auditor Is required to make specific evaluations while forming an opinion in an audit report State them. (Nov 2018,5 marks)

Answer:

An auditor is required to make following specific evaluations while forming an opinion in an audit report.

- The financial statements adequately disclose the significant accounting policies selected and applied:

- The accounting policies selected and applied are consistent with the applicable financial reporting framework and are appropriate:

- The accounting estimates made by management are reasonable;

- The information presented in the financial statements are relevant, reliable, comparable, and understandable;

- The financial statements provide adequate disclosures to enable the intended users to understand the effect of material transactions and events on the information conveyed in the financial statements; and

- The terminology used in the financial statements, including the title of each financial statement, is appropriate.

Question 3.

Comment on the following situation:

Sri Limited charged depreciation on its plant and machinery comprised in PPE at rates different from what had been specified in Schedule II to the Companies Act. 2013. The auditor insisted that the rates of depreciation adopted should be mentioned In the notes to the account, else, he would make qualification in his audit report. The Management of the company contended that there is no impact on profits due to its omission to disclose the fact and hence on considerations of the principle of materiality, the auditor is wrong in mentioning this omission in his report by way of qualification. (May 2009, 8 marks)

Answer:

1. It is permissible for the business entity to charge depreciation on its assets at rate different from Schedule li rates provided those rates are higher than the schedule rates based on technical estimation or otherwise allowed under Sec. 123 of the Act.

2. If the rates adopted are different from the principal rates specified in the schedule, the same need to be disclosed in the notes to the accounting.

3. If there is a non-disclosure of rates, then it Is a violation of AS-1 which requires the accounting policies to be disclosed in the accounts, and also the Schedule II requirement which too requires such disclosure.

4. The auditor hence, is right in his approach to qualify the same in his report.

5. The materiality of an item is not always measured in terms of quantitative factors alone.

6. The qualitative factors also affect the judgment of auditors In opining the true and fair view of accounts.

7. The contention of the management that it does not meddle with the profit is not founded.

8. When the management does not correct the situation. the auditor Is justified in qualifying his audit report.

![]()

Question 4.

Differentiate between ‘Qualified report’ and ‘Adverse report’. (May 2010, 5 marks)

Answer:

The distinction between a Qualified report and an Adverse report:

| Basic | Qualified Opinion | Adverse Opinion |

| 1. Effect on Materiality | A qualified opinion should be expressed when the auditor concludes that an unqualified opinion cannot be expressed but that the effect of any disagreement with management is not so material and pervasive as to require. an adverse opinion or limitation on scope Is not so material and pervasive as to require a disclaimer of opinion. | An adverse opinion should be expressed when the effect of a disagreement is so material and pervasive to the financial statements that the auditor concludes that a qualification of the report is not adequate, to disclose the misleading or incomplete nature of the financial statements. |

| 2. True end Fair View | In qualified report the auditor’s reservation is generally written as “subject to or except for, we report that the Balance Sheet shows a true and fair view’. | In case of adverse report. the auditor states that the financial statements do not present a true and fair view of the state of affairs and working results”. |

| 3. Opinion | In the qualified report, the auditor gives an opinion subject to certain reservations. | In the case of an adverse report, the auditor concludes that on the basis of his examination, he is not satisfied with the affirmation made in the financial statements. |

Question 5.

State any six basic elements of the Auditor’s Report. (Nov 2012, 6 marks)

Answer:

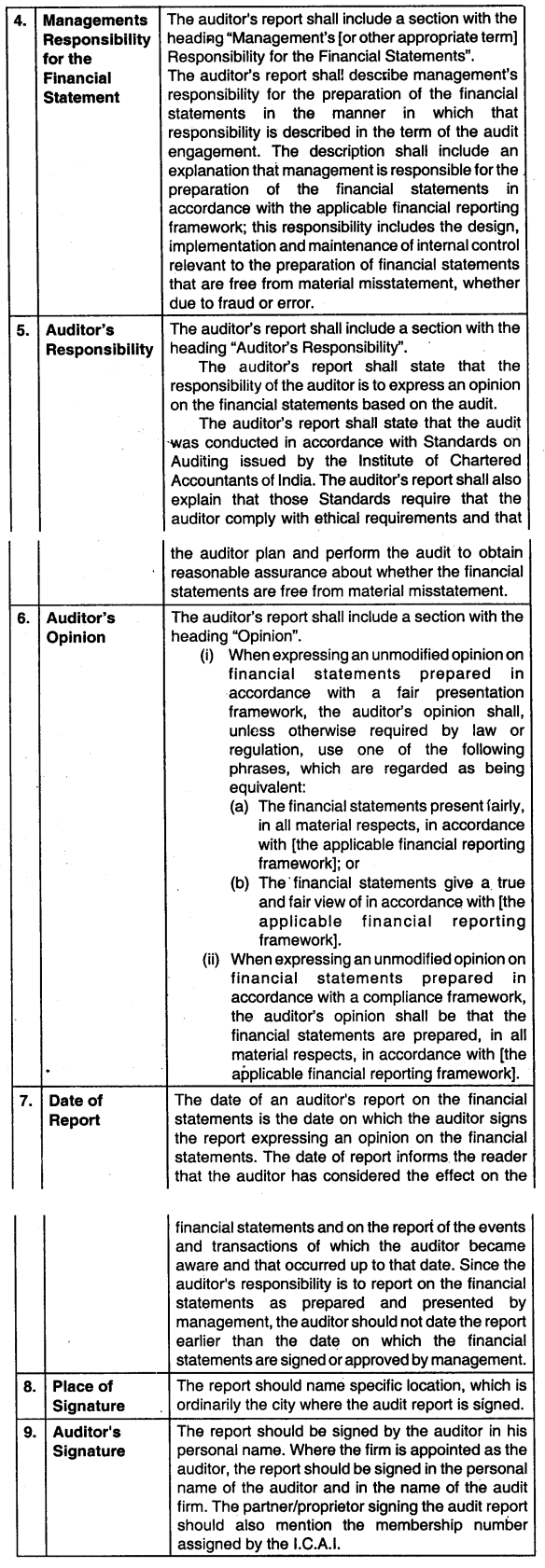

| The basic elements of the Auditor’s Report are: | |

| 1. Title | The Auditor’s Report should have an appropriate title. i.e as Auditors Report.” so that it can be easily distinguished from other reports. |

| 2. Addressee | The auditors report should be appropriately addressed as required by the circumstances of the engagement and applicable laws and regulations. Ordinarily, the auditor’s report Is addressed to the authority, appointing the auditor. |

| 3. Opening or Introductory Paragraph | The auditor’s report should identify the Mandal statements of the entity that have been audited, including the date of and period covered by the financial statements. The report should include a statement that the financial statements are the responsibility of the entity’s management and a statement that the responsibility of the auditor is to express an opinion on the financial statements based on the audit. |

Question 6.

Write short note on the following:

Introductory Paragraph in the Auditor’s Report. (May 2014, 4 marks)

Answer:

Introductory paragraph an the Auditor’s Report:

The report should identify the financial statements of entity that have been audited, including the date of and period covered by financial statements. It should include statement that financial statements are the responsibility of the entity’s management and a statement that the responsibility of auditor is to express an opinion on financial statement.

An illustration of these matters in an introductory paragraph is:

“We have audited the attached balance sheet of ……………………. (Name) as at 31st March 2014 and also the profit and loss account for the year ended on That date thereto our responsibility is to express an opinion on these financial statements based on our audit.

Question 7.

Examine with reasons (in short) whether the following statement Is correct or incorrect:

(h) The statutory auditor of ABC Ltd. is of the opinion that communicating key audit matters in the auditor’s report constitutes a substitute for disclosure In the financial statements. (May 2018, 2 marks)

Answer:

Incorrect:

Communicating key audit matters in the auditor’s report is in the context of the auditor having formed an opinion on the financial statements as a whole. Communicating key audit matters in the auditor’s report is not a substitute for disclosures in the financial statements that the applicable financial reporting framework requires management to make, or that are otherwise necessary to achieve fair presentation.

Question 8.

Examine with reasons (in short) whether the following statements are correct or incorrect:

(h) Any partner of an LLP, who is appointed as an auditor of a company, can sign the audit report. (Nov 2018, 2 marks)

(j) An auditor should issue a disclaimer of opinion when there is difference of opinion between him and the management on a particular point. (Nov 2018, 2 marks)

Answer:

(h) Incorrect:

As per Sec. 141(2) of the Companies Act, 2013, where a firm including a Limited Liability Partnership (LLP) is appointed as an auditor of a company, only the partners who are chartered Accountants shall be authorized to act and sign on behalf of the firm.

(J) Incorrect:

The auditor shall disclaim an opinion when the auditor is unable to obtain sufficient appropriate audit evidence on which to base the opinion, and the auditor concludes that the possible effects on the financial statement of undetected misstatements, if any, could be both material and pervasive.

![]()

Question 9.

Examine with reasons whether the following statements are correct or incorrect:

Where the firm is appointed as an auditor of the entity the audit report is signed only in the name of audit firm. (May 2019, 2 marks)

Answer:

This Statement Is Incorrect

It Is clarified that in India, the reports are not issued f signed on in the firm’s name, rather they are Issued/signed on the behalf of the firm by the sole practitioner, proprietor or a partner of the firm, as the case may be, in his individual name.

Question 10.

State the matters to be specified in the Auditor’s Report in terms of provisions of Sec. 143 (2) of the Companies Act, 2013. (Nov 2014, 6 marks)

Answer:

According to Sec. 143(2) of the Companies Act, 2013

The auditor shall make a report to the members of the company on the accounts examined by him and on every financial statements which are required by or under this Act to be laid before the company In general meeting arid the report shall after taking into account the provisions of this Act, the accounting and auditing standards and matters which are required to be included in the audit report under the provisions of this Act or any rules made thereunder or under any order made under subsection (11) and to the best of his information and knowledge, the said accounts, financial statements give a true and fair view of the state of the company’s affairs as at the end of its financial year and profit or loss and cash flow for the year and such other matters as may be prescribed.

Question 11.

Write short note on the following:

Disclaimer of Opinion. (Nov 2008, Nov 2010, 5, 5 marks)

Answer:

Disclaimer of Opinion: As per SA – 500 on “Audit Evidence”, the auditor must collect sufficient and appropriate audit evidence, on the basis of which he draws his conclusion to form an opinion, on the financial statements. But, if the auditor fails to obtain sufficient information to form an overall opinion on the matter contained in the financial statements, he issues a disclaimer of opinion.

The reasons due to which the auditor Is not able to collect the audit evidence are:

1. Scope of audit is restricted,

2. The auditor may not have access to the books of accounts, e.g:

- Books of A/c’s of the company seized by IT authorities,

- Sometimes inventory verifications at locations outside the city-bound the scope of duties of the auditor.

In such a case, the auditor must state In his audit report that:

He is unable to express an opinion because he has not been able to obtain sufficient and appropriate audit evidence to form an opinion.

Question 12.

State with reasons (in short) whether the following statement is True or False:

Disclaimer of opinion is issued when an auditor confronts a different standard by management In respect of a material issue which auditor does not approve of. (May 2009, 2 marks)

Answer:

False:

Disclaimer of opinion is Issued when the auditor is unable to frame an opinion in view of certain reasons such as non-availability of information, non-performance of procedure, lack of clarity in information, etc. Where the auditor is positively in disagreement with management on certain issues he would issue qualified report.

Question 13.

State with reasons (in short) whether the following statement is true or false. The Auditor disagreed with the management with regard to the acceptability of the Accounting Policies and the inadequacy of disclosures in the financial statòments and Issued a disclaimer. (Nov 2009, 2 marks)

Answer:

False:

If the auditor disagrees with the management in the matters relating to the acceptability of Accounting policies selected and in adequacy of the disclosures in the financial statements, he should issue a qualified report or express an adverse opinion and not a disclaimer.

Question 14.

(a) State the circumstances which could lead to any of the following in an Auditor’s Report:

(i) A modification of opinion

(ii) Disclaimer of opinion

(iii) Adverse opinion

(iv) Qualified opinion (May 2013, 4 x 2 = 8 marks)

Answer:

(i) A Modification of Opinion:

The auditor shall modify the opinion in the auditor’s report when:

(a) The auditor concludes that, based on the audit evidence obtained, the financial statements as a whole are not free from material misstatement; or

(b) The auditor is unable to obtain sufficient appropriate audit evidence to conclude that the financial statements as a whole are free from material misstatement.

(ii) Disclaimer of opinion: As per SA – 500, the auditor must collect sufficient & appropriate audit evidence, on the basis of which he draws his conclusion to form an opinion, on the financial statements. But, If the auditor fails to obtain sufficient information to form an overall opinion on the matter contained in the financial statements, he issues a disclaimer ot opinion.

The reasons due to which the auditor Is not able to collect the audit evidence are:

(a) Scope of audit is restricted,

(b) The auditor may not have access to the books of accounts, e.g:

(a) books of Afcs of the company seized by IT authorities,

(b) Sometimes inventory verifications at locations outside the city-bound the scope of duties of the auditor.

In such a case, the auditor must state in his audit report that:

He is unable to express an opinion because he has not been able to obtain sufficient and appropriate audit evidence to form an opinion.

(iii) Adverse Opinion: An adverse audit report is issued if the auditor is of the opinion that based on his examination he does not agree with the affirmation made in the financial statements.

In such case, the reservations or objections of the auditor are so material that he feels that the overall view of the accounts as presented would be a serious distortion. He must state the reasons for such a type of report.

(iv) Qualified Opinion: The auditor shall express a qualified opinion when:

(a) The auditor, having obtained sufficient appropriate audit evidence, concludes that misstatements, individually or in the aggregate, are material, but not pervasive, to the financial statements; or

(b) The auditor is unable to obtain sufficient appropriate audit evidence on which to base the opinion, but the auditor concludes that the possible effects on the financial statements of undetected misstatements, If any, could be material but not pervasive.

Question 15.

State with reasons (we short) whether the following statement s correct or incorrect:

The Auditor shall express an unqualified opinion if the Auditor is unable to obtain sufficient audit evidence regarding the opening balances. (Nov 2014, 2 marks)

Answer:

Incorrect:

When auditor is unable to obtain sufficient audit evidence regarding the opening balances he shall express a qualified opinion.

Question 16.

State with reasons (In short) whether the following statement is correct or incorrect: The auditor shall not modify the opnion in the auditor’s report. (May 2015, 2 marks)

Answer:

Incorrect:

The auditor can modify the opinion in the auditor’s report if there is material misstatement in the financial statements or if he is not able to obtain sufficient and appropriate audit evidences.

![]()

Question 17.

State with reasons (in short) whether the following statement ¡s correct or incorrect:

An auditor issues unqualified opinion when he concludes that the financial statements give true and fair view. (Nov 2016, 2 marks)

Answer:

Correct:

An unqualified report oc clean audit report is issued when the auditor has no reservations in respect of matters contained In the financial statements. He is satisfied in all material respects with all the points required to be stated in his report and states them in affirmative, adding no reservation anywhere in the audit report shall state that. The financial statements give a true and fair view of the state of affairs and profit and loss account during the period.

Question 18.

State with reasons (In short) whether the following statement is correct or incorrect:

If financial statements are misstated, and in the auditor’s judgement such misstatement Is material and pervasive, he should issue a qualified opinion. (May 2017, 2 marks)

Answer:

Incorrect:

As per SA-705, Modifications to the Opinion In the Independent Auditor’s Report auditor expresses qualified opinion when he concludes that there is a material misstatement in the financial statement but it is not so pervasive so as to require an adverse opinion.

Question 19.

Discuss the following:

What are the circumstances that may result in other than an unqualified opinion on the Financial Statements by an auditor? (Nov 2017, 5 marks)

Answer

Circumstances that may result in other than an unqualified opinion:

Limitation on scope: If, after accepting the engagement, the auditor becomes aware that management has imposed a limitation on the scope of the audit that the auditor considers likely to result in the need to express a qualified opinion or to disclaim an opinion on the Financial Statements, the auditor shall request that management remove the limitation.

If management refuses to remove the limitation, the auditor shall communicate the matter to those charged with Governance and determine whether It is possible to perform alternative procedures to obtain sufficient appropriate audit evidence.

If the auditor Is unable to obtain sufficient appropriate audit evidence, the auditor shall determine the ImplIcation as follows:

1. If the auditor concludes that the possible effects on the Financial Statements of undetected misstatements, if any, could be material but not pervasive, the auditor shall qualify the opinions; or

2. If the auditor concludes that the possible effects on the Financial Statements of undetected misstatements, if any, could be both material and pervasive so that a qualification of the opinion would be in adequates to communicate the gravity of the situation, the auditor shall:

- resign from the audit, where practicable and not prohibited by law or regulation; or

- if resignation from the audit before Issuing me auditor’s report is not practicable or possible, disclaim an opinion on the Financial Statement.

If the auditor resigns as contemplated by above paragraph, before resigning the auditor shall communicate to those charged with (governance any matters regarding misstatements identified during the audit that would have given rise to a modification of the opinion.

Disagreement with management: The auditor may disagree with management about matters such as the acceptability of accounting policies selected. The method of their application, or the adequacy of disclosures in the Financial Statement. If such disagreements are material to the Financial Statement, the auditor shoul1 express a qualified or an adverse opinion.

Other considerations relating to the adverse opinion or disclaimer of opinion: When the auditor considers it necessary to express an adverse opinion or disclaim an opinion on the Financial Statement as a whole, the auditor’s report shall not also include an unmodified opinion with respect to the same financial reporting framework on a single Financial Statement or one or more specific elements, accounts or items of a Financial Statement.

Question 20.

What an auditor should state In “Basis for opinion” section of auditor’s report and when the auditor modifies the opinion on the financial statements, what amendments he should make in this section? (Jan 2021, 4 marks)

Question 21.

Define Emphasis of Matter Paragraph and how it should be disclosed in the independent Auditor’s Report? (May 2018, 5 marks)

Answer:

Emphasis of Matter Paragraph:

A paragraph included in the auditor’s report that refers to a matter appropriately presented or disclosed in the financial statements that, in the auditor’s judgement. ts of such importance that it is fundamental to users’ understanding of the financial statements.

Emphasis of Matter Paragraphs In the Independent Auditor’s Report:

If the auditor considers it necessary to draw users’ attention to a matter presented or disclosed In the financial statements that, in the auditor’s judgement, is of such importance that it is fundamental to users’ understanding of the financial statements, the auditor shall include an emphasis of Matter Paragraph in the auditor’s report provided:

(a) The auditor would not be required to modify the opinion in accordance with SA – 705 (Revised) as a result of the matter, and

(b) Wien SA – 701 applies, the mailer has not been determined to be a key audit matter to be communicated in the auditors report.

Question 22.

How would an auditor determine Key Audit Matters as per SA- 701. “Communicating Key Audit Matters in the Independent Auditor’s Report”? (Nov 2020, 3 marks)

Question 23.

Explain whether the following statements are correct or Incorrect, with reasons/explanations! examples:

Communicating Key Audit Matters is a substitute for the auditor expressing a modified audit opinion when required by the circumstances of a specific audit engagement in accordance with SA 705. (Jan 2021,2 marks)

![]()

Question 24.

Explain clearly the purpose of communicating key audit matters.

Answer:

Purpose of Communicating Key Audft Matters

As per SA – 701, “Communicating Key Audit Matters In the Auditor’s Report”, the purpose of communicating key audit matters is to enhance the communicative value of the auditor’s report by providing greater transparency about the audit, that was performed. Communicating key audit matters provides additional information to Intended users of the financial statements to assist them in understanding those matters that, in the auditor’s professional judgment, were of most Significance in the audit of the financial statements of the current period. Communicating key audit matters may also assist intended users in understanding the entity and areas of significant management judgment In the audited financial statements.

Question 25.

State with reasons (in short) whether the following statement is True or False:

SA – 710 on comparatives Is applicable to corresponding previous years’ figures and not to comparative Financial statements. (May 2009, 2 marks)

Answer:

True:

As per SA – 710, “Comparatives” wIth reference to financial statement presentation Includes the corresponding previous year figures and are intended to be read on relation to the amounts and other disclosures relating to the current period.

Question 26.

The extent of audit procedure performed on the corresponding figure is less compared to audit of current period figures, and reporting. Justify the statement with regard to Audltos duties for reporting of comparatives under SA – 710. (May 2010, 5 marks)

Answer:

Comparatives:

According to SA – 710 on “Comparatives Information Corresponding Figures and Comparative Financial Statements, the following are the broad principles” The auditor should obtain sufficient appropriate audit evidence that the corresponding figures meet the requirements of the relevant financial reporting framework.

The auditor should determine whether the comparatives comply, In all material respects, with the financial reporting framework relevant to the financial statements being audited.

When the comparatives are presented as corresponding figures, the auditor’s report should not specifically identify comparables because the auditor’s opinion is on the current period financial statements as a whole, including the corresponding figures.

When the auditor’s report on the prior period, as previously issued, included a qualified opinion, disclaimer of opinion, or adverse opinion and the matter which gave rise to the modification in the audit report is

(i) unresolved and results in a modification of the auditor’s report regarding the current period figures, the auditor’s report should also be modified regarding the corresponding figures or

(ii) unresolved, but does not result in a modification of the auditor’s report regarding the current period figures, the auditor’s report should be modified regarding the corresponding figures.

‘ When the prior period financial statements are not audited, the incoming auditor should state in the auditor’s report that the corresponding figures are unaudited. In case of material misstatement of prior period detected subsequently, the auditor should examine that appropriate disclosures have been made, if appropriate disclosures have not been made, the auditor should Issue a modified report on the current report financial modified with respect to the corresponding figures included therein.

Question 27.

When corresponding figures are presented, the auditors’ opinion shall not refer to the corresponding figures. Discuss the exceptions of the above statement when the prior period financial statements are audited. (Nov 2019, 4 marks)

Answer:

When corresponding figures are presented, the auditors’ opinion shall not refer to the corresponding figures. Following are the exceptions to the above statement when prior period financial statements are audited:

It the auditor’s report on the prior period, as previously issued, included a qualified opinion, a disclaimer of opinion, or an adverse opinion, and the matter which give rise to the modification Is unresolved, the auditor shall modify the auditor’s opinion on the current period’s financial statements.

In the basis for Modification paragraph In the auditor’s report, the auditor shall either:

(a) Refer to both the current period’s figures and the corresponding figures in the description of the matter giving rise to the modification when the effects or possible effects of the matter on the current period’s figures are material: or

(b) In other cases, explain that the audit opinion has been modified because of the effects or possible effects of the unresolved matter on the comparability of the current period’s figures and corresponding figures.

If the auditor obtains audit evidence that a material misstatement exists in the prior period financial statements on which an unmodified opinion has been previously Issued, the auditor shall verify whether the misstatement has been dealt with as required under the applicable financial reporting framework and if that is not the case, the auditor shall express a qualified opinion or an adverse opinion in the auditor’s report on the current period financial statements, modified with respect to the corresponding figures included therein.

Multiple Choice Question

Question 1.

Main objective of the auditor is

(a) Communicate key Audit matters in the Independent Auditor’s Report

(b) Forming an opinion and reporting on financial statements.

(c) To, express clearly an appropriately modified opinion

(d) All of the above.

Answer:

(d) All of the above.

Question 2.

Management is responsible for

(a) The preparation of the financial statements.

(b) The necessary internal controls

(c) The appointment of the Statutory Auditor

(d) (a) and (b).

Answer:

(d) (a) and (b).

Question 3.

The purpose of an audit is to

(a) Produce error-free financial statement

(b) Fulfill the requirements of the Companies Act,

(c) Enhance the degree of confidence of intended users of the financial statements.

(d) Any of the above.

Answer:

(c) Enhance the degree of confidence of intended users of the financial statements.

Question 4.

The main user of audit reports are, except

(a) Shareholders

(b) Management

(c) Members

(d) Any stakeholders of the company.

Answer:

(b) Management

![]()

Question 5.

“Forming an Opinion and Reporting on Financial Statements” is described under

(a) 400

(b) 500

(c) 650

(d) 700

Answer:

(d) 700

Question 6.

In order to form an opinion and conclusion shall take into account.

(a) Whether sufficient appropriate audit evidence has been obtained.

(b) Whether uncorrected misstatements are material. individually or in aggregate

(c) The evaluations

(d) All of the above.

Answer:

(d) All of the above.

Question 7.

Auditor’s evaluation shall include consideration of the ………………. aspects of the entity’s accounting practices, including indicators of possible bias in management’s judgments.

(a) Quantitative

(b) Qualitative

(c) Quantitative and Qualitative

(d) Statutory

Answer:

(b) Qualitative

Question 8.

Auditor shall modify the opinion ¡n the auditor’s report in accordance with

(a) SA – 700

(b) SA – 703

(c) SA – 704

(d) SA – 705

Answer:

(d) SA – 705

Question 9.

The auditor shall express an …………………. when the auditor condudes that the financial statements are prepared, in all material respects, in accordance with the applicable financial reporting framework.

(a) Modified opinIon

(b) Unmodified opinion

(c) Qualified opinion

(d) Adverse opinion

Answer:

(b) Unmodified opinion

Question 10.

Auditor’s report is normally addressed to those for whom report is prepared, often either to the shareholders or ……………………… of the entity whose financial statements are being audited.

(a) Management

(b) Those Charge with governance

(c) Managing Director

(d) Nora of the above.

Answer:

(b) Those Charge with governance

![]()

Question 11.

If the concept of going concern Is applicable, the auditor shall report is accordance with …………………… .

(a) SA – 430

(b) SA – 500

(c) SA – 535

(d) SA – 570

Answer:

(d) SA – 570

Question 12.

In the case of an audit of financial statement of listed entities, the auditor shall communicate key audit matters in the auditor’s report in accordance with ……………. .

(a) SA – 570

(b) SA – 630

(c) SA – 700

(d) SA – 701

Answer:

(d) SA – 701

Question 13.

The auditor shall include a section in his report with a heading Responsibilities of Management for the Financial Statement as explained in ………………… .

(a) SA – 200

(b) SA – 500

(c) SA – 505

(d) SA -701

Answer:

(a) SA – 200

Question 14.

…………………… require the auditor to agree managements responsibilities is an engagement letter or other suitable form of written agreements.

(a) SA- 200

(b) SA-210

(c) SA- 230

(d) SA- 701

Answer:

(b) SA-210

Question 15.

SA-700 requires the use of specific headings, which intended to assist In making auditor’s reports that refers to audits that have in conducted in accordance with SA’s more recognizable. Which of the following is that specific heading:

(a) Key audit matters

(b) Basis of opinion

(c) Date

(d) All of the above

Answer:

(d) All of the above

Question 16.

The opinion section of the auditor’s report shall:

(a) State that the financial statements have been audited

(b) Identify the title of each statement comprising the financial statement

(c) Identify the entity whose financial statements have been audited

(d) All of the above.

Answer:

(d) All of the above.

![]()

Question 17.

In order to form the opinion, the auditor shall conclude as to whether the auditor has obtained ……………….. about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error.

(a) Reasonable assurance

(b) Limited assurance

(c) Absolute assurance

(d) None of the above

Answer:

(a) Reasonable assurance

Question 18.

The auditor shall express ……………….. opinion when the auditor, having obtained sufficient appropriate audit evidence, concludes that misstatements, individuality or In the aggregate, are both material and pervasive to the financial statements.

(a) Unqualified

(b) Qualified

(c) Adverse

(d) Disclaimer

Answer:

(c) Adverse

Question 19.

Which of the following is not a type of modified opinion:

(a) Qualified opinion

(b) Adverse opinion

(c) Disclaimer opinion

(d) None of the above.

Answer:

(d) None of the above.

Question 20.

Communicating key audit matters in the auditor’s report constitutes a substitute for disclosure in the financial statements.

(a) Correct

(b) Incorrect

(c) Partially correct

(d) None of the above

Answer:

(b) Incorrect

Question 21.

The auditor shall modify the opinion in the auditor’s report when:

(a) The auditor concludes that, based on the audit evidence obtained, the financial statements as a whole are not tree from material misstatements

(b) The auditor ¡s unable to obtain sufficient appropriate audit evidence to conclude that the financial statements as a whole are free from material misstatement.

(c) (a) or (b)

(d) Both (a) and (b)

Answer:

(c) (a) or (b)

![]()

Question 22.

The auditor, having obtained sufficient appropriate audit evidence, concludes that misstatements are material, but not -pervasive, such audit opinion is known as ……………….. .

(a) Unqualified opinion

(b) Qualified opinion

(c) Adverse opinion

(d) Disclaimer of opinion

Answer:

(b) Qualified opinion

Question 23.

The auditor shall express an …………………….. when the auditor, having obtained sufficient appropriate audit evidence, concludes that misstatements, individually or in the aggregate, are both material and pervasive.

(a) Unqualified opinion

(b) Qualified opinion

(c) Adverse opinion

(d) Disclaimer of opinion

Answer:

(c) Adverse opinion

Question 24.

The auditor shall express …………………. written he is unable to obtain sufficient appropriate audit evidence and he concludes that the possible effects on the financial statements of undetected misstatements could be both material and pervasive.

(a) Unqualified opinion

(b) Qualified opinion

(c) Adverse opinion

(d) Disclaimer of opinion

Answer:

(d) Disclaimer of opinion

Question 25.

“Emphasis of Matter Paragraphs and Other Matter Paragraphs In The Independent Auditor’s Report described under ………………………… .

(a) SA – 700

(b) SA – 701

(c) SA – 705

(d) SA – 706

Answer:

(d) SA – 706

Question 26.

If the auditor considers it necessary to draw users attention, auditor shall include an Emphasis of matter paragraph in the auditor’s report provided:

(a) The auditor would not be required to modify the opinion In accordance with SA 705 (Revised) as a result of the matter

(b) When SA – 701 applies, the matter has not been determined to be a key audit matter to be communicated in the auditor’s report.

(c) (a) or (b)

(d) Both (a) and (b)

Answer:

(d) Both (a) and (b)

![]()

Question 27.

Communicating Key Audit Matters in the Auditor’s Report’, describes under

(a) 601

(b) 700

(c) 701

(d) 705

Answer:

(c) 701

Question 28.

AS per SA-701, the objectives of the auditor are to ……………. and, having formed an opinion on the financial statements, communicate those matters by describing them in the auditors report.

(a) Determine audit evidence

(b) Determine key audit matters

(c) Conduct audit of relevant areas

(d) Conduct investigation of certain areas

Answer:

(b) Determine key audit matters

Question 29.

Auditor shall determine, from the matters communicated with …………………. those matters that required significant’ auditor attention in performing the audit.

(a) Management

(b) Those Charge with Government

(c) Central Government

(d) Shareholders

Answer:

(b) Those Charge with Government

Question 30.

Comparative Information define as

(a) The amount and disclosures including in the financial statements in respect of the financial period in accordance with the applicable financial System”.

(b) The amounts and disclosures including In the financial statements In respect of one or more prior periods in accordance with the applicable financial reporting framework”.

(c) The amount and disclosures included in the financial statements in respect of the current financial period in accordance with the financial reporting framework

(d) None of the above.

Answer:

(b) The amounts and disclosures including In the financial statements In respect of one or more prior periods in accordance with the applicable financial reporting framework”.

Question 31.

When auditor’s opinion on prior period financial statements differs from the opinion the auditor previously expressed, the auditor shall disclose the substantive reasons for the different opinion In an other matter paragraph in accordance with ………………… .

(a) SA – 700

(b) SA – 701

(c) SA – 705

(d) SA – 706

Answer:

(d) SA – 706