Depreciation – CA Foundation Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

Depreciation – CA Foundation Accounts Study Material

Question 1.

Meaning of depreciation.

Answer:

Meaning of depreciation:

An expenditure which results into enduring benefit (long-term benefit) are treated as capital expenditure/fixed assets. Fixed assets are those assets which are held for use in the business and not for sale or consumption in the course of production.

Fixed assets which have a limited useful life are known as depreciable assets like, building, plant and machinery, etc. land is a non-depreciable asset. Revenue expenses are charged to the years P&L a/c similarly depreciable fixed assets should be charged over (written off) over its useful life.

This process of systematically allocating depreciable amount (cost less estimated scrap value) to the P&L accounts over its useful life is known as depreciation accounting. Amortization of assets which has specific life like patents etc. is also included in it.

1. Depreciation is the reduction in the value of fixed assets due to:

- its use,

- passage of time and

- obsolescence.

2. Depreciation is the apportionment of cost of asset net of estimated scrap value over its estimated useful life.

Question 2.

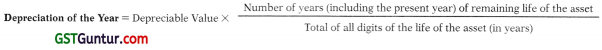

Sum of Years of Digits Method.

Answer:

Sum of Years of Digits Method:

In this method the depreciation is calculated in the ratio of the remaining life of the asset in the beginning of that year to the sum of digits of the life remaining for all the year.

Question 3.

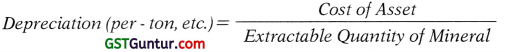

Depletion method

Answer:

Depletion method:

- This method is followed in case of exhaustive (wasting) assets example mines.

- For charging depreciation on such item the life of the Asset (lease period) is not very important because it can be used (i.e, Mineral can be extracted) only till it contains minerals.

- As soon as the mineral is exhausted the mine becomes useless.

- Therefore depreciation is calculated in proportion of the mineral extracted in a particular year to the total extractable mineral contained in it.

Question 4.

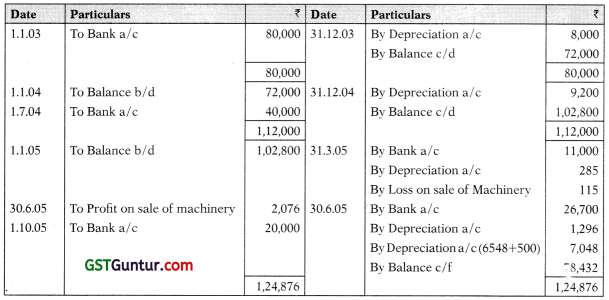

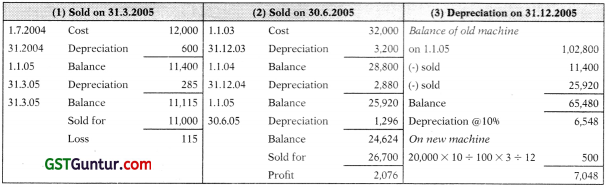

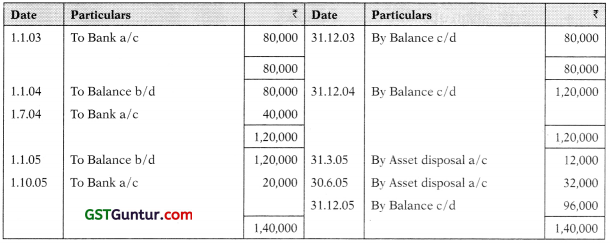

On 1.1.03 machinery was purchased for ₹ 80,000. On 1.7.04 addition were made to the amount of ₹ 40,000. On 31.3.05 machine purchased on 1.7.04 costing ₹ 12,000 was sold for ₹ 11,000 & on 30.6.05 machinery purchased on 1.1.03 costing ₹ 32,000 was sold for ₹ 26,700. On 1.10.05 addition were made to the amount of ₹ 20,000. Show Machinery a/c & Depreciation a/c for 3 years 2003, 04, 05. Depreciate Machinery at 10% p.a. by W.D.V. method.

Solution:

Machinery A/c (W.D.V. 10%)

Depreciation a/c

Working notes

Depreciation : Calculation by SLM and Accounting by credit to Asset a/c.

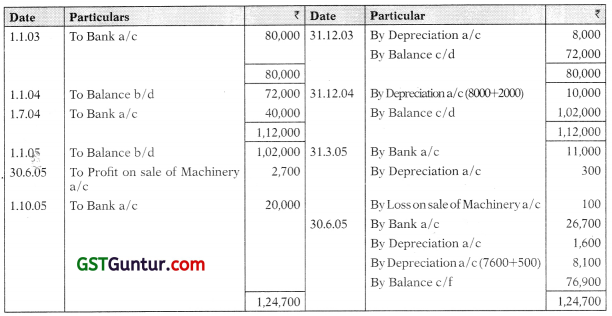

Question 5.

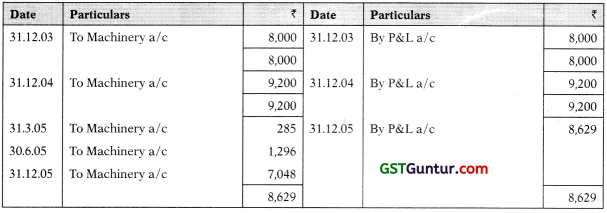

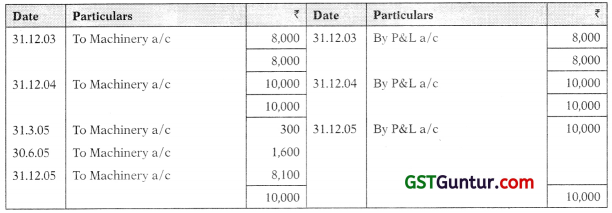

On 1.1.03 machinery was purchased for ₹ 80,000. On 1.7.04 addition were made to the amount of ₹ 40,000. On 31.3.05 machine purchased on 1.7.04 costing ₹ 12,000 was sold for ₹ 11,000 & on 30.6.05 machinery purchased on 1.1.03 costing ₹ 32,000 was sold for ₹ 26,700. On 1.10.05 addition were made to the amount of ₹ 20,000. Show Machinery a/c & Depreciation a/c for 3 years 2003, 04, 05. Depreciate Machinery at 10% p.a. by S.L.M.

Solution:

Machinery A/c (SLM 10%)

Depreciation a/c

Working notes

Depreciation : Calculation by WDV and Accounting by credit to Depreciation Provision a/c.

![]()

Question 6.

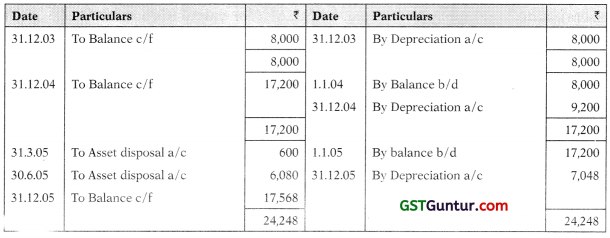

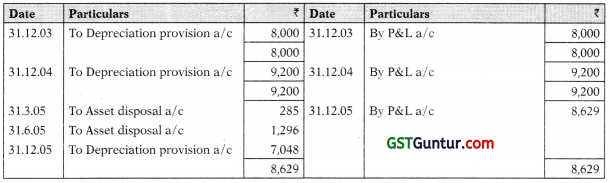

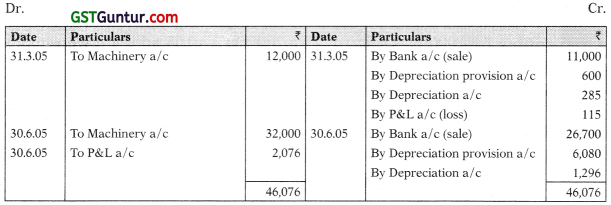

On 1.1.03 machinery was purchased for ₹ 80,000. On 1.7.04 addition were made to the amount of ₹ 40,000. On 31.3.05 machine purchased on 1.7.04 costing ₹ 12,000 was sold for t 11,000 & on 30.6.05 machinery purchased on 1.1.03 costing t 32,000 was sold for ₹ 26,700. On 1.10.05 addition were made to the amount of ₹ 20,000. Show Machinery a/c, Depreciation provision a/c and Asset disposal a/c for 3 years 2003, 04, 05. Depreciate Machinery at 1096 p.a. by W.D.V. method.

Solution:

Machinery Account

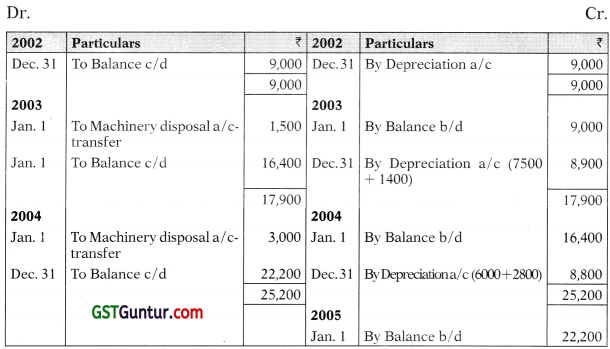

Provision for Depreciation Account (WDV 10%)

Depreciation a/c

Asset Disposal Account

Depreciation upto the date of disposal is directly credited to asset disposal a/c alternatively it can be routed through depreciation provision a/c.

Similarly asset sold can be accounted through asset Disposal account in earlier Question also.

Depreciation : Calculation by SLM and Accounting by credit to Depreciation Provision a/c.

Question 7.

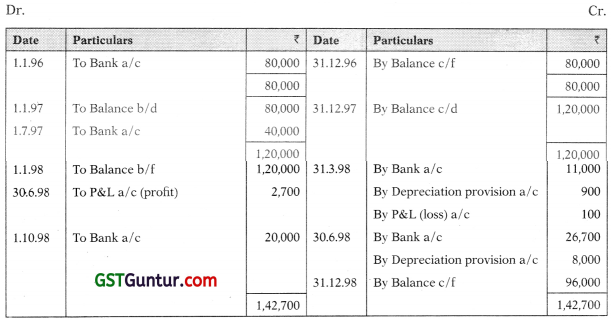

On 1.1.96 machinery was purchased for ₹ 80,000. On 1.7.97 addition were made to the amount of ₹ 40,000. On 31.3.98 machine purchased on 1.7.97 costing ₹ 12,000 was sold for ₹ 11,000 & on 30.6.98 machinery purchased on 1.1.96 costing ₹ 32,000 was sold for ₹ 26,700. On 1.10.98 addition were made to the amount of ₹ 20,000.

Show Machinery a/c & Depreciation provision a/c for 3 years 96, 97, 98. Depreciate Machinery at 10% p.a. by S.L.M.

Solution:

Machinery Account

Alternatively sale of asset can be routed through asset disposal a/c as done in earlier question.

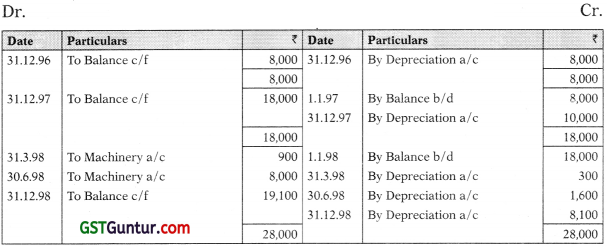

Provision for Depreciation Account (SLM 10%)

Depreciation a/c

Question 8.

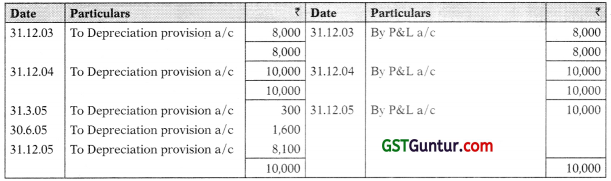

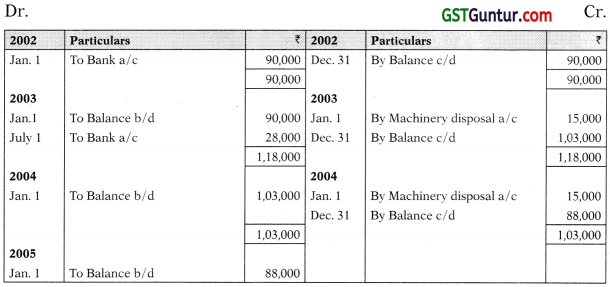

On 1st January, 2002 Hari Om purchased 6 machines for ₹ 15,000 each. His accounting year ends on 31st December. Depreciation at the rate of 10% on initial cost has been charged to profit and loss account and credited to a separate depreciation provision account.

On 1st January, 2003 one machine was sold for ₹ 12,500 and on 1st January, 2004 a second machine was sold for ₹ 12,500. An improved model which cost ₹ 28,000 was purchased on 1st July, 2003. The same rate of depreciation was decided for the new machine was well. You are required to show:

1. The asset account

2. The asset disposal account

3. The depreciation provision account.

Solution:

Ledger of Hari Om

Machinery Account

Note: The balance in the asset account at any time represents the cost of assets retained by the firm.

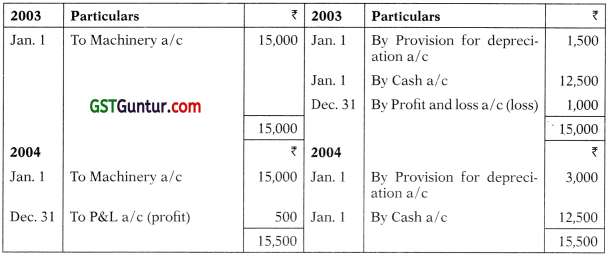

Machinery Disposal Account

Note: Machinery disposal account is not a continuous account like machinery account. It must be prepared separately for each year.

Provision for Depreciation Account (SLM 10%)

Note : The balance in the provision account at any time shows the balance of accumulated depreciation in respect of retained assets.

| Working of depreciation

(1) On ₹ 75,000 (₹ 90,000 – ₹ 15,000) @ 10% per annum On ₹ 28,000 @ 10% p.a. for 6 months Depreciation for the year 2003 (2) On ₹ 60,000 (₹ 75,000 – ₹ 15,000) @ 10% p.a. On ₹ 28,000 @ 10% p.a. for one year Depreciation for the year 2004 |

₹

7,500 1,400 |

| 8,900 | |

| 6,000 2,800 |

|

| 8,8000 |

![]()

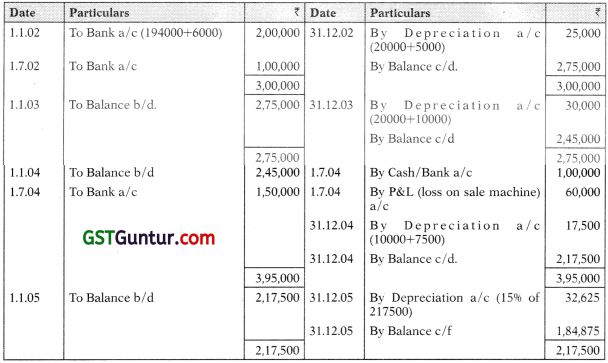

Question 9.

A purchased on 1st January, 2002 certain machinery for ₹ 1,94,000 and spent ₹ 6,000 on its erection. On 1st July, 2002 additional machinery costing ₹ 1,00,000 was purchased. On 1st July, 2004 the machinery purchased on 1st January, 2002 having become obsolete was auctioned for ₹ 1,00,000 and on the same date new machinery was purchased at a cost of ₹ 1,50,000.

Depreciation was provided for annually on 31st December at the rate of 10% per annum on the original cost of the machinery. No depreciation need be provided when a machinery is sold or auctioned, for that part of the year in which sale or auction took place. But for the above, depreciation shall be provided on time basis. In 2005, however, A changed this method of providing depreciation and adopted the method of writing off 15% p.a. on the written down value on the balance as appeared in machinery account on 1-1-2005.

Show the machinery account for the calendar years 2002 to 2005. (certain matter is underlined by the author for the attention of the student which indicates the prospective change)

Solution:

Machinery A/c

New method to be applied on the balance appearing as on 1.1.2005 as given in the question in the last sentence, as prospective change.

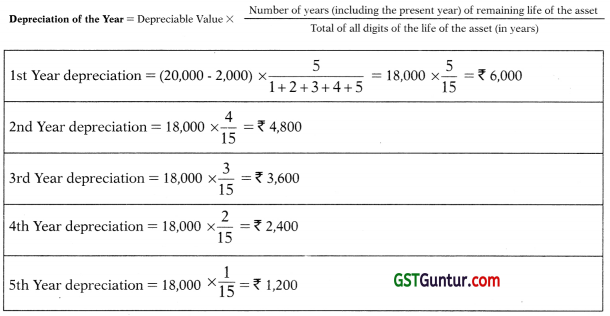

Question 10.

Cost of Machine = ₹ 20,000

Scrap Value = ₹ 2,000

Estimated life = 5 years

Calculate depreciation of all the years on the basis of Sum of Years of Digits Method.

Solution:

Question 11.

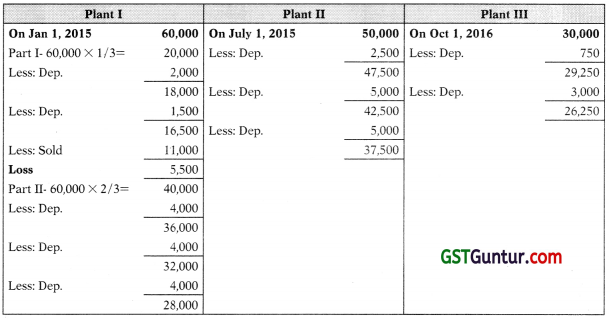

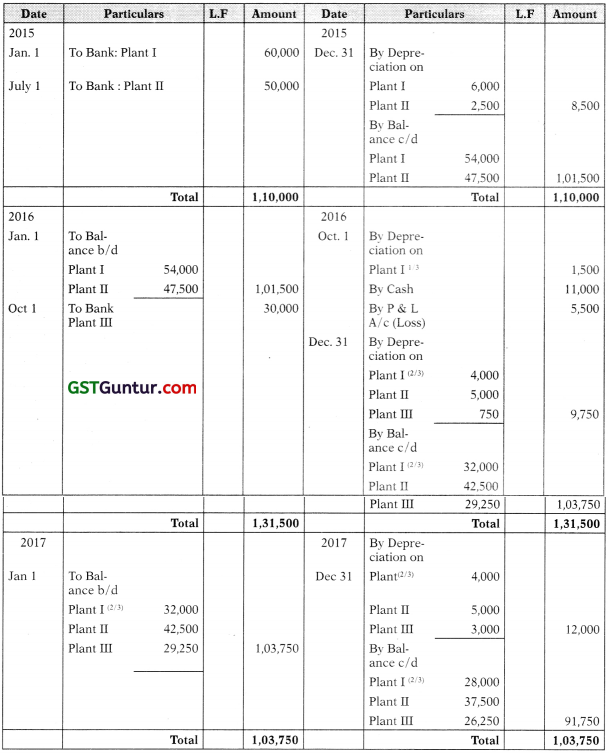

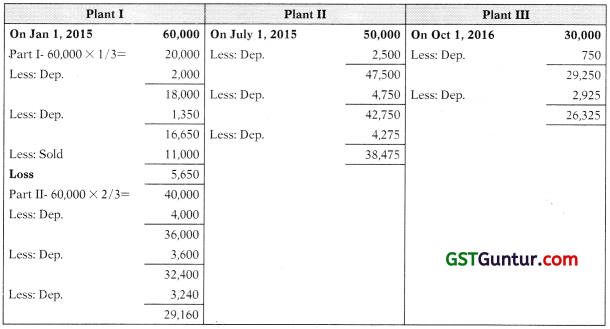

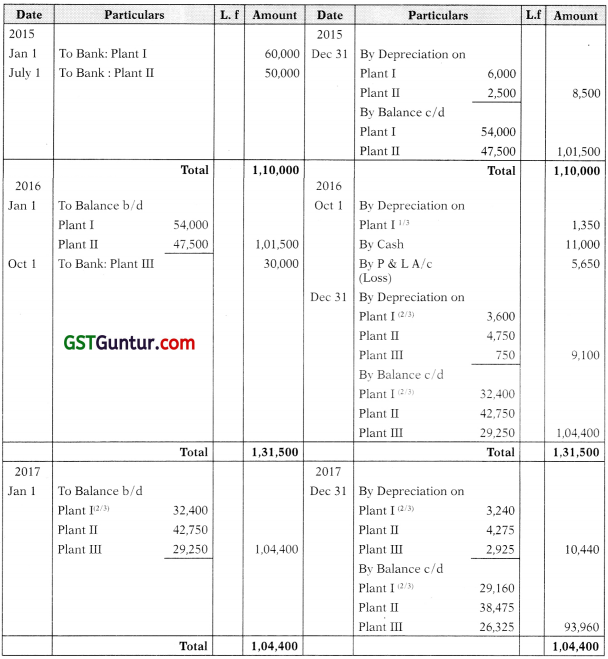

Mr. A purchased a Plant costing 160,000 on 1 st January, 2015. He purchased another Plant for ₹ 50,000 on 1st July in the same year. On 1st October 2016, he sold 1/3rd part of 1st Plant for ₹ 11,000 and purchased another Plant for ₹ 30,000 on the same date. Prepare Plant A/c for three years in the following cases:

Case I- If rate of depreciation is 10% p.a. on SLM

Case II- If rate of depreciation is 10% p.a. on WDV

Solution:

Case I:

Working Note:

Plant Account:

Case II:

Working Note:

Plant Account:

Question 12.

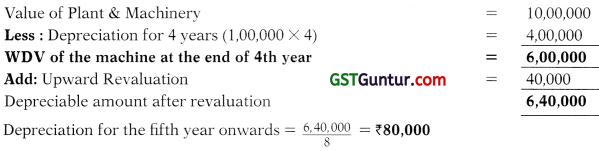

A Plant & Machinery costing ₹10,00,000 is depreciated on straight line assuming 10 year working life and zero residual value, for four years. At the end of the fourth year, the machinery was revalued upwards by ₹ 40,000. The remaining useful life was reassessed at 8 years. Calculate Depreciation for the fifth year.

Solution:

Depreciation per year = \(\frac{10,00,000}{10}\) = ₹ 1,00,000

Question 13.

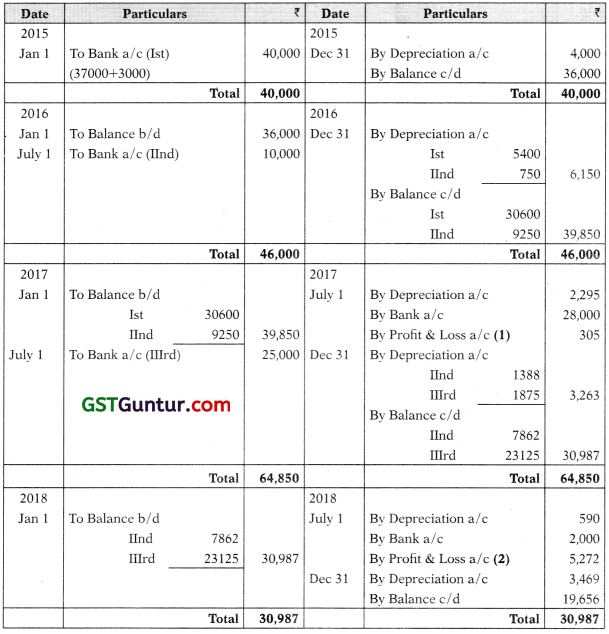

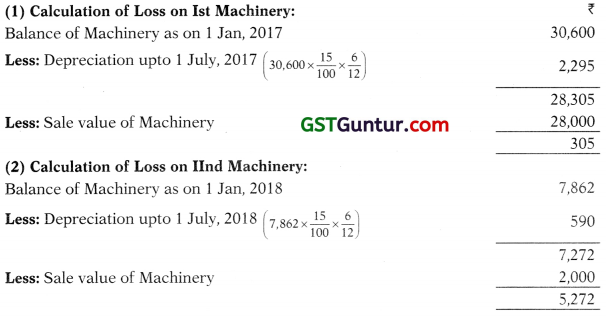

A Firm purchased an old Machinery for ₹ 37,000 on 1st January, 2015 and spent ₹ 3,000 on its overhauling. On 1st July 2016, another machine was purchased for ₹ 10,000. On 1st July 2017, the machinery which was purchased on 1st January 2015, was sold for ₹ 28,000 and the same day a new machinery costing ₹ 25,000 was purchased. On 1st July, 2018, the machine which was purchased on 1st July, 2016 was sold for ₹ 2,000.

Depreciation is charged @10% per annum on straight line method. The firm changed the method and adopted diminishing balance method with effect from 1st January, 2016 and the rate was increased to 15% per annum. The books are closed on 31st December every year.

Prepare Machinery account for four years from 1st January, 2015.

Solution:

Machinery Account

Working Notes:

True or False

Question 1.

Land is also a depreciable asset.

Answer:

False: Land is not a depreciable asset because it does not qualify for depreciation as per AS-10.

Question 2.

Depreciation is a cash expenditure like other normal expenses.

Answer:

False: Depreciation is a non-cash expenditure because it does not involve any cash outflow.

Question 3.

Depreciation is an amortised expenditure.

Answer:

True: Depreciation is charged on value of fixed asset over its useful life. So, by way of depreciation any capital expenditure is amortised over its useful life.

![]()

Question 4.

Depreciation cannot be provided in case of loss, in a financial year.

Answer:

False: Depreciation is a charge against profit so it has to be provided for whether there is a profit or loss in a financial year of the business.

Question 5.

Depreciable amount refers to the difference between historical cost and the market value of an asset.

Answer:

False: Depreciable amount refers to historical cost less salvage value.

Question 6.

Depreciation is a non-cash expense and does not result in any cash outflow.

Answer:

True: Depreciation is a non cash expense and there is no outflow of cash in the business.