Standard Costing – CA Inter Cost and Management Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Standard Costing – CA Inter Costing Study Material

Standard Costing:

A technique which uses standards for costs and revenues for the purposes of control through variance analysis.

Variance:

A divergence from the pre-determined rates.

Process of Standard Costing:

- Setting standards

- Ascertaining actual costs

- Compare standard cost and actual cost

- Investigate the reasons for variances

- Disposed-off the variance

Types of Variance:

- Controllable variances: Those variances which can be controlled under normal operating conditions if a responsibility centre takes preventive measures and acts prudently.

- Uncontrollable variances: Those variances w’hich occurs due to conditions which are beyond the control of a responsibility centre and cannot be controlled even though all preventive measures are in place.

- Favourable variance: Variances which are profitable for the company. Denoted by capital ‘F’

- Adverse variances: Variances which causes loss to the company. Denoted by capital ‘A’.

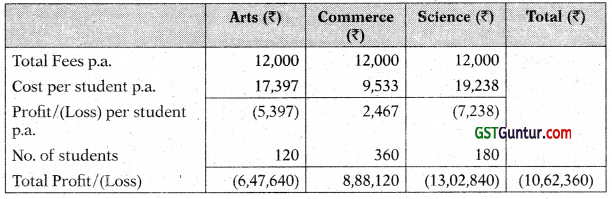

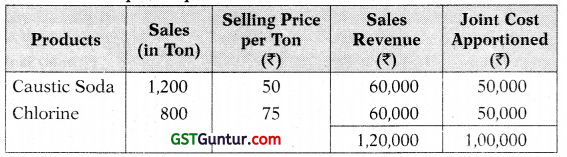

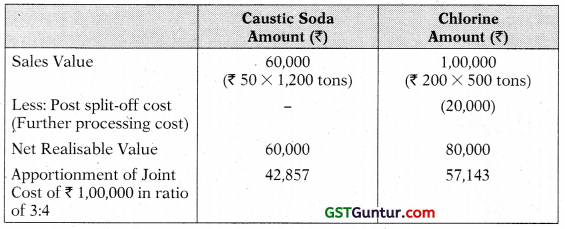

Classification of Variances

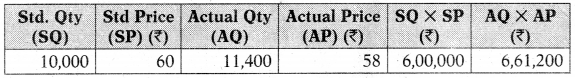

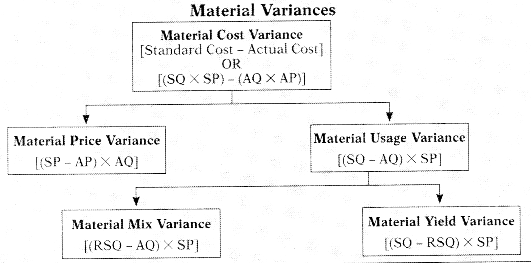

SQ = Standard Quantity of Input for the Actual Output

SP = Standard Price of Material

AQ = Actual Quantity of Input

AP = Actual Price of Material

RSQ = Revised Standard Quantity = Standard Mix for the total Actual Input

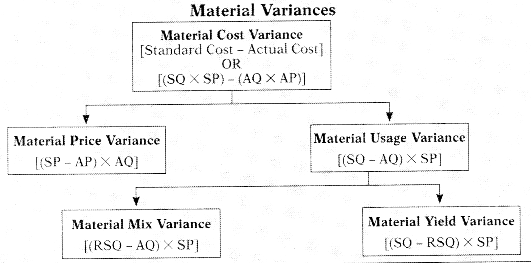

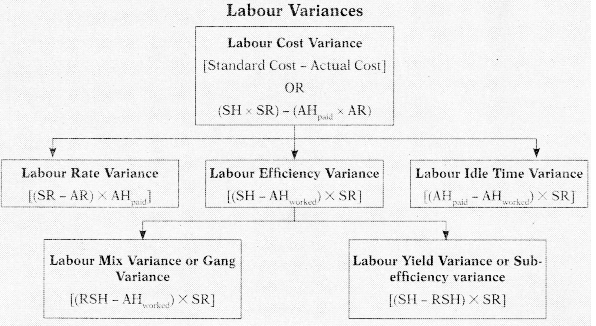

SH = Standard Hours for the Actual Output

SR = Standard Rate of Labour

AHworked = Actual Hours worked

AHpaid = Actual Hours paid

AR = Actual Rate of Labour

RSH = Revised Standard Hours = Standard Mix for the total Actual Hours worked.

Note: AHpaid = AHworked, where hours paid and hours worked is same.

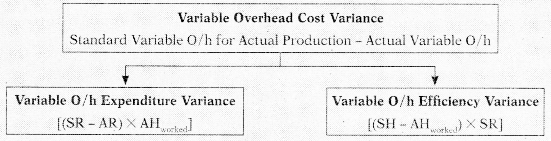

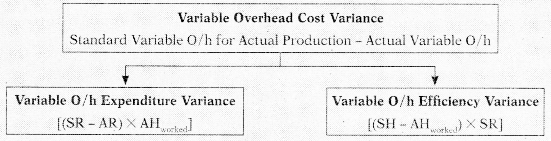

Variable Overheads Variances

SH = Standard Hours for the Actual Output I

SR = Standard Rate of Variable O/h

AHworked = Actual Hours worked

AR = Actual Rate of Variable 0/h

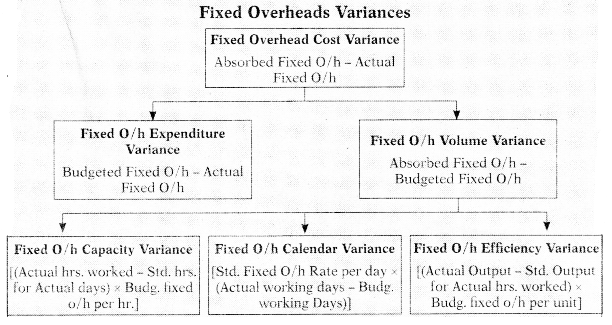

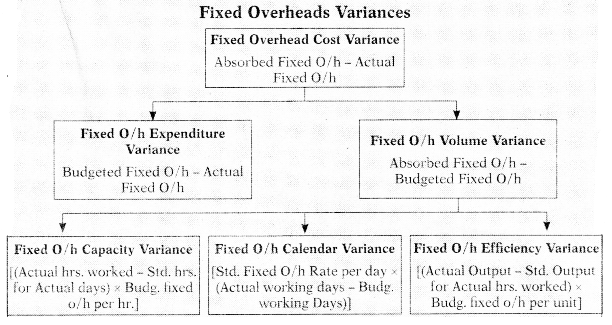

Fixed Overheads Variances

Theory Questions

Question 1.

What are the types of standards?

Answer:

(i) Ideal Standards: These represent the level of performance attainable when prices for material and labour are most favourable, when the highest output is achieved with the best equipment and layout and when the maximum efficiency in utilisation of resources results in maximum output with minimum cost.

(ii) Normal Standards: These are standards that may be achieved under normal operating conditions. The normal activity has been defined as “the number of standard hours which will produce at normal efficiency sufficient good to meet the average sales demand over a term of years”.

(iii) Basic or Bogey Standards: These standards are used only when they are likely to remain constant or unaltered over a long period. According to this standard, a base year is chosen for comparison purposes in the same way as statisticians use price indices. Since basic standards do not represent what should be attained in the present period, current standards should also be prepared if basic standards are used.

(iv) Current Standards: These standards reflect the management’s anticipation of what actual costs will be for the current period. These are the costs which the business will incur if the anticipated prices are paid for the goods and services and the usage corresponds to that believed to be necessary to produce the planned output.

Question 2.

Describe the various steps involved in adopting standard costing system in an organization. [CA Inter Nov. 2015, 4 Marks]

Answer:

The Steps of standard costing is as below:

- Setting of Standards: The first step is to set standards which are to be achieved.

- Ascertainment of actual costs: Actual cost for each component of cost is ascertained from books of account, material invoices, wage sheet, charge slip etc.

- Comparison of actual cost and standard cost: Actual costs are compared with the standards costs and variances are determined.

- Investigation of variances: Variances arises are investigated for further action. Based on this performance is evaluated and appropriate actions are taken.

- Disposition of variances: Variances arise are disposed off by transferring it the relevant accounts (costing profit and loss account) as per the accounting method (plan) adopted.

Question 3.

Discuss the steps involved in setting labour time standards. [CA Inter Dec. 2021, 5 Marks]

Answer:

The following are the steps involved in setting labour standards:

(a) Standardization of product and product study is carried out as explained above.

(b) Labour specification: Types of labour and labour time is specified. Labour time specification is based on past records and it takes into account normal wastage of time.

(c) Standardization of methods: Selection of proper machines to use proper sequence and method of operations.

(d) Manufacturing layout: A plan of operation for each product listing the operations to be performed is prepared.

(e) Time and motion study: It is conducted for selecting the best way of completing the job or motions to be performed by workers and the standard time that an average worker will take for each job. This also takes into account the learning efficiency and learning effect.

(f) Training and trial: Workers are trained to do the work and time spent at the time of trial run is noted down.

Question 4.

Describe three distinct groups of variances that arise in standard costing. [CA Inter May 2018, May 2000, 6 Marks]

Answer:

The three distinct groups of variances that arise in standard costing are:

- Variances of efficiency. These are the variance, which arise due to efficiency or inefficiency in use of material, labour etc.

- Variances of prices and rates: These are the variances, which arise due to changes in procurement price and standard price.

- Variances due to volume: These represent the effect of difference between actual activity and standard level of, activity.

Question 5.

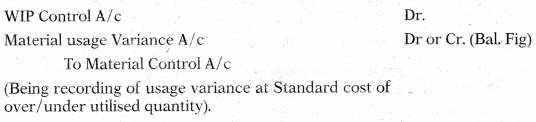

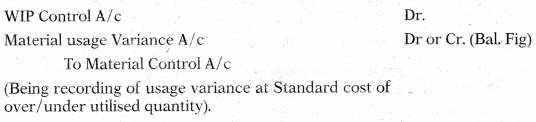

Under the single plan, record the journal entries giving appropriate narration, with indication of amounts of debits or credits alongside the entries, for the following transactions using the respective control A/c.

(i) Material price variance {on purchase of materials)

(ii) Material usage variance (on consumption)

(iii) Labour rate variance. [CA Final Nov. 2006, 6 Marks]

Answer:

Under the single plan, Journal entries are:

(i) Material price variance (on purchase of materials)

(ii) Material usages variance (on consumption)

(iii) Labour Rate Variance:

Question 6.

What are the advantages of Standard Costing? [ICA1 Module]

Answer:

- It serves as a basis for measuring operating performance and cost control.

- It aids in price fixing.

- It facilitates the estimation of the cost of new products with greater accuracy.

- It is also used for the measurement of profit.

- It is useful in planning, budgeting and decision-making.

- It serves as an incentive to the departmental head to achieve the targets set by the company.

Question 7.

What are the criticisms of Standard Costing? [ICAI Module]

Answer:

- Variation in price: One of the main problems faced in the operation of the standard costing system is the precise estimation of likely prices or rate to be paid. The variability of prices is so great that even actual prices are not necessarily adequately representative of cost.

- Varying levels of output: If the standard level of output set for pre-determination of standard costs is not achieved, the standard costs are said to be not realised.

- Attitude of technical people: Technical people are accustomed to think of standards as physical standards and, therefore, they will be misled by standard costs.

- Mix of products: Standard costing presupposes a pre-determined combination of products both in variety and quantity. The mixture of materials used to manufacture the products may vary in the long run.

- Fixation of standards may be costly: It may require high order of skill and competency. Small concerns, therefore, feel difficulty in the operation of such system.

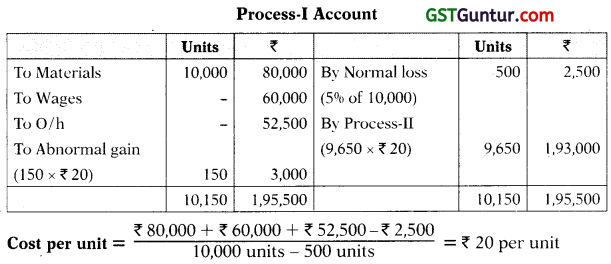

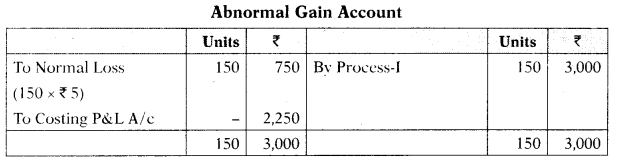

Practical Questions

Question 1.

UV Ltd. presents the following information for November, 2020:

Budgeted, production of product P = 200 units.

Standard consumption of Raw materials = 2 kg. per unit of P.

Standard price of material A = ₹ 6 per kg.

Actually. 230 units of P were produced and material A was purchased at ₹ 8 per kg and consumed at 1.8 kg per unit of P.

Calculate the Material Cost Variances. [CA Inter Nov. 2008, 3 Marks]

Answer:

Actual production of P = 250 units

Standard quantity of material A for actual production (SQ) = 250 units × 2 kg. per unit = 500 kg.

Actual quantity of material A for actual production (AQ) = 250 units × 1.8 kg. per unit = 450 kg.

Standard price per kg. of material A(SP) = ₹ 6

Actual price per kg. of material A(AP) = ₹ 8

1. Total Material Cost Variance = (SP × SQ) – (AP × AQ)

= (₹ 6 × 500 kg.) – (₹ 8 × 450 kg.)

= ₹ 3,000 – ₹ 3,600

= ₹ 600 (A)

2. Material Price Variance

=(SP – AP) × AQ

= (₹ 6 – ₹ 8) × 450 kg.

= 900 (A)

3. Material Usage Variance

= (SQ – AQ) × AP

= (500 kg. – 450 kg.) × ₹ 6

= 300 (F)

Question 2.

Following details relating to product X during the month of April, 2021 are available:

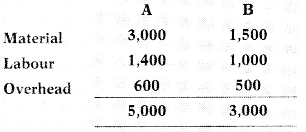

Standard cost per unit of X.

Materials: 50 kg @ 140/kg

Actual production: 100 units

Actual material cost: ₹ 42/kg

Material price variance: ₹ 9,800 (Adverse)

Material usage variance: ₹ 4,000 (Favourable)

Calculate the actual quantity of material used during the month April, 2021. [CA Intel May 2009, 2 Marks]

Answer:

Standard quantity for actual production (SQ) = 5,000 kg.

Standard price per kg. (SP) = ₹ 40

Material Usage Variance = (SQ – AQ) × SP

₹ 4,000 = (5,000 – AQ) × ₹ 40

₹ 4,000/₹ 40 = 5,000 – AQ

100 = 5,000 – AQ

AQ = 5,000 – 100

AQ = 4,900 kgs.

Actual quantity of material used during the month of April = 4,900 kgs.

Question 3.

Following are the details of the product Phomex for the month of April 2021:

Standard quantity of material required per unit – 5 kg

Actual output – 1000 units

Actual cost of materials used – ₹ 7,14,000

Material price variance – ₹ 51,000 (Fav)

Actual price per kg of material is found to be less than standard price per kg of material by ₹ 10.

You are required to calculate:

(i) Actual quantity and Actual price of materials used.

(ii) Material Usage Variance.

(iii) Material Cost Variance. [CA Inter May 2013, 5 Marks]

Answer:

Actual output = 1,000 units

Standard quantity for actual production (SQ) = 1,000 units × 5 kg per unit

= 5,000 kg

Actual cost of material = AQ × AP

= ₹ 7,14,000

Actual price per kg = SP – 10

(i) Actual Quantity and Actual Price of material used

Material Price Variance = (SP – AP) × AQ

₹ 51,000 = [SP – (SP – 10)] × AQ

₹ 51,000 = [SP – SP + 10] × AQ

₹ 51,000/10 = AQ

AQ = 5,100 kgs

Actual cost of material = AQ × AP

₹ 7,14,000 = 5,100 × AP

₹ 7,14,000/5,100 = AP

AP = ₹ 140

Standard price per kg. (SP) = AP + 10

= ₹ 140 + 10

= ₹ 150

(ii) Material Usage Variance = (SQ – AQ) × SP

= (5,000 – 5,100) × ₹ 150

= ₹ 15,000 (A)

(iii) Material Cost Variance = (SP × SQ) – (AP × AQ)

= ₹ 150 × 5,000 – ₹ 140 × 5,100

= ₹ 36,000 (F)

OR

= Material Price Variance + Material Usage Variance

= ₹ 51,000 (F) + ₹ 15,000 (A)

= ₹ 36,000 (F)

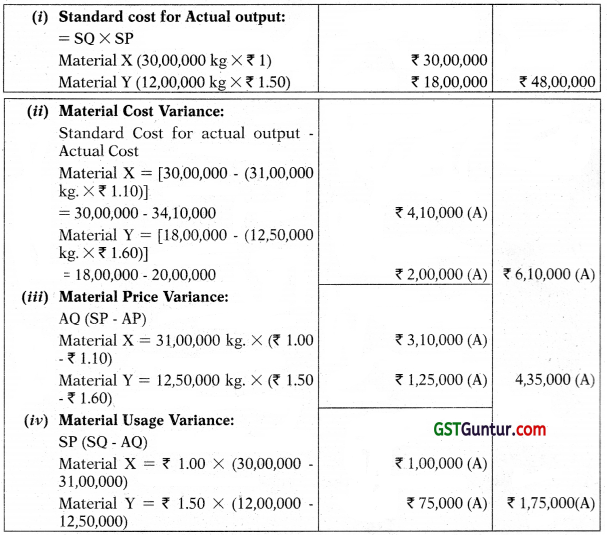

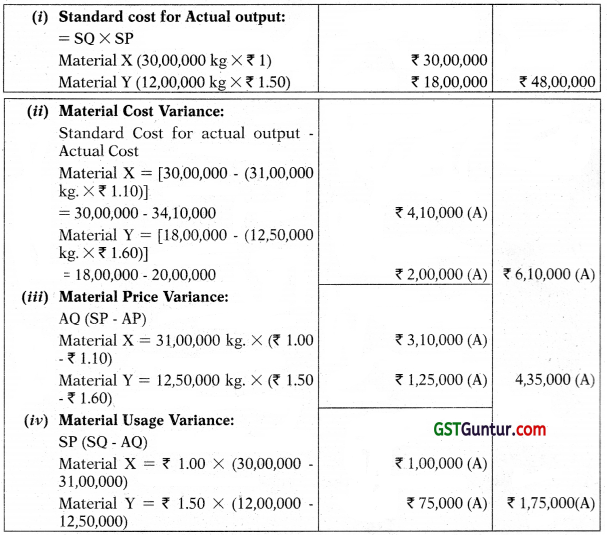

Question 4.

XYZ Limited produces an article and uses a mixture of material X and Y. The standard quantity and price of materials for one unit of output is as under:

| Material |

Quantity |

Price (₹) |

| X |

2000 Kg |

1.00 per kg. |

| Y |

800 Kg |

1.50 per kg. |

During a period, 1500 units were produced. The actual consumption of materials and prices are given below:

| Material |

Quantity |

Price (₹) |

| X |

31,00,000 kg |

1.10 per kg. |

| Y |

12.50,000 kg |

1.60 per kg. |

Calculate:

(i) Standard cost for actual output

(ii) Material cost variance

(iii) Material Price variance

(iv) Material usage variance [CA Inter Nov. 2017, 8 Marks j

Answer:

(i) Standard cost for Actual output:

Standard quantity for actual production (SQ):

Material X = 1,500 units × 2,000 kg = 30,00,000 kg

Material Y = 1,500 units × 800 kg = 12, 00, 000 kg

Question 5.

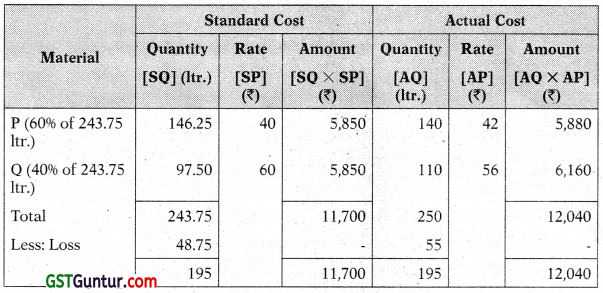

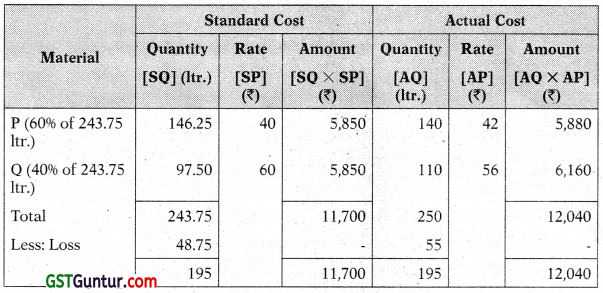

Beta Ltd. is manufacturing Product N. This is manufactured by mixing two materials namely Material P and Material Q. The Standard Cost of Mixture is as under:

Material P 150 Itrs. @ ₹ 40 per 3tr.

Material 0 100 Itrs. @ ₹ 60 per ltr.

Standard loss @ 20% of total input is expected during production.

The cost records for the period exhibit following consumption:

Material P 140 Itrs. @ ₹ 42 per ltr,

Material Q 110 Itrs. @ ₹ 56 per ltr,

Quantity produced was 195 ltrs.

Calculate:

(i) Material Cost Variance

(ii) Material Osage Variance

(iii) Material Price Variance [CA Inter May 2018, 5 Marks]

Answer:

Statement showing computation of Standard Cost/Actual Cost/Revised Actual Quantity

Computation of Variances:

Material Cost Variance = Standard cost – Actual cost

A = ₹ 5,850 – ₹ 5,880 = ₹ 30 (A)

B = ₹ 5,850 – ₹ 6,160 = ₹ 310 (A)

Total = ₹ 340 (A)

Material Usage Variance = SP × (SQ – AQ)

A = 140 × (146.25 ltr. -140 ltr.) = ₹ 250 (F)

B = ₹ 60 × (97.50 ltr. – 110 ltr.) = ₹ 750 (A)

Total = ₹ 500 (A)

Material Price Variance = AQ × (SP – AP)

A – 140 Kg. × (₹ 40 -142) = ₹ 280 (A)

B = 110 Kg. × (₹ 60 – ₹ 56) = ₹ 440 (F)

Total = ₹ 160(F)

Workings:

The good output is 195 ltr. Therefore, the standard quantity of material required for 195 Itr. of output is = 195/80 × 100 = 243.75 ltr.

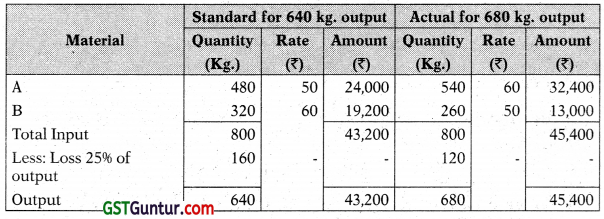

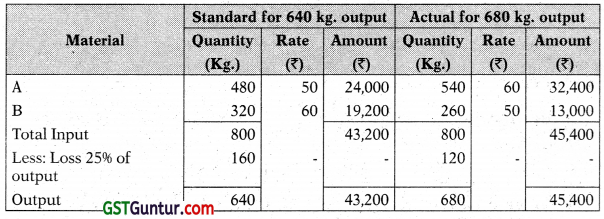

Question 6.

The standard cost of a chemical mixture is as follows:

60% of Material A @ ₹ 50 per kg

40% of Material B @ ₹ 60 per kg

A standard loss of 25% on output is expected in production. The cost records for a period have shown the following usage.

540 kg of Material A @ ₹ 60 per kg

260 kg of Material B @ ₹ 50 per kg

The quantity processed was 680 kilograms of good product.

From the above given information Calculate:

(i) Material Cost Variance

(ii) Material Price Variance

(iii) Material Usage Variance

(iv) Material Mix Variance

(v) Material Yield Variance. [CA Inter Nov. 2019, 10 Marks]

Answer:

Basic Calculation

Standard cost for actual output = ₹ 43,200 × \(\frac{680}{640}\) = ₹ 45,900

Calculation of Variances:

(i) Material Cost Variance = (Std. cost of actual output – Actual cost)

= (SQ × SP) – (AQ – AP)

= ₹ 45 900 – ₹ 45 400

= ₹ 500 (F)

(ii) Material Price Variance (SP – AP) × AQ

Material A = ( 50- 60) × 540 = ₹ 5400 (A)

Material B = (₹ 60 – ₹ 50) × 260 = ₹ 2600 (F)

Total = ₹ 2800 (A)

(iii) Material Usage Variance = (SQ – AQ) × AP

Material A = (480 × \(\frac{680}{640}\) – 540) × ₹ 50 = ₹ 1,500 (A)

Material B = (320 × \(\frac{680}{640}\) – 260) × ₹ 60 = ₹ 4,800 (F)

Total = ₹ 3,300 (F)

(iv) Material Mix Variance = SP × (RSQ – AQ)

Material A = ₹ SO × (480 Kg – 540 Kg) = ₹ 3,000 (A)

Material B = ₹ 60 × (320 Kg. – 260 Kg.) = ₹ 3,600 (F)

Total = ₹ 600 (F)

(v) Material Yield Variance = SP × (SQ – RSQ)

Material A = ₹ 50 × (510 Kg. – 480 Kg) = ₹ 1,500 (F)

Material B = ₹ 60 × (340 Kg. – 320 Kg.) = ₹ 1,200 (F)

Total = ₹ 2,700 (F)

Working: RSQ = Standard mix for the actual input:

Material A = 800 × 60% = 480 Kg.

Material B = 800 × 40% = 320 Kg.

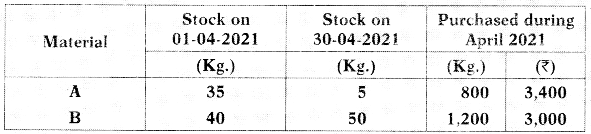

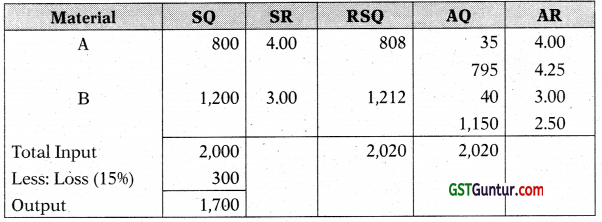

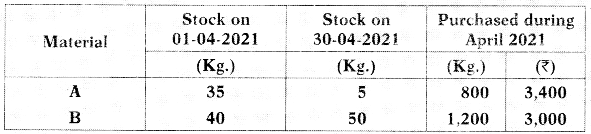

Question 7.

ABC Ltd. produces an article by lending two basic raw materials It operates a standard costing system and the following standards have been set for raw materials:

Opening stock of material is valued at standard price.

Calculate the following variances:

(i) Material price variance

(ii) Material usage variance

(iii) Material yield variance

(iv) Material mix variance

(v) Total Material cost variance [ICAIModule]

Answer:

Actual quantity of material = Opening stock + Purchases – Closing stock

Material A = 35 + 800 – 5 = 830 kg.

Material B = 40 + 1,200 – 50 = 1,190 kg.

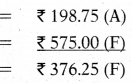

(i) Material price variance = AQ (SP – AP)

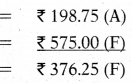

Material A = 795 kg. (₹ 4 – ₹ 4.25) = ₹ 198.75 (A)

Material B = 1,150 kg. (₹ 3 – ₹ 2.50) = ₹ 575.00 (F)

Total = ₹ 376.25 (F)

There will be no price variance in respect of opening stock, since already valued at standard price.

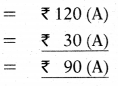

(ii) Material usage variance = SP (SQ – AQ)

Material A = 4 (800 – 830) = ₹ 120 (A)

Material B = 3(1,200 – 1,190) = ₹ 30(A)

Total = ₹ 90(A)

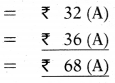

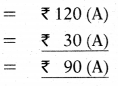

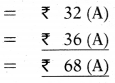

(iii)Material yield variance = SP (SQ – RSQ)

Material A = 4 (800 – 808) = ₹ 32(A)

Material B = 3 (1,200 – 1,212) = ₹ 36(A)

Total = ₹ 68(A)

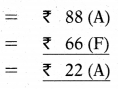

(iv) Material mix variance = SP (RSQ – AQ)

Material A = 4 (808 – 830) = ₹ 88 (A)

Material B = 3(1,212 – 1,190) = ₹ 66(F)

Total = ₹ 22(A)

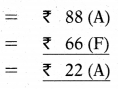

(v) Total material cost variance

= Std. cost for actual output – Actual cost

= (800 × 4 + 1200 × 3) – (35 × 4 + 795 × 4.25 + 40 × 3 + 1,150 × 2.50 )

= 6,800 – 6,513.75

= 286.25 (F)

Question 8.

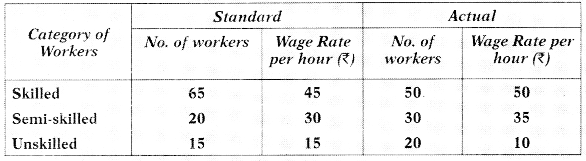

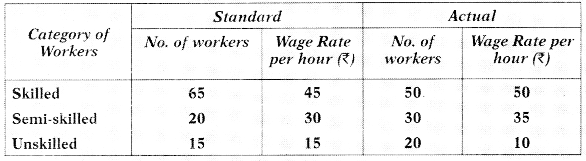

The standard labour employment and the actual labour engaged in a 40 hours week for a job are as under:

Standard output: 2,000 units:

Actual output: 1,800 units

Abnormal Idle time 2 hours in the week

Calculate:

(i) Labour Cost Variance

(ii) Labour Efficiency Variance

(iii) Labour Idle Time Variance. [CA Inter Nov, 2012, 6 Marks]

Answer:

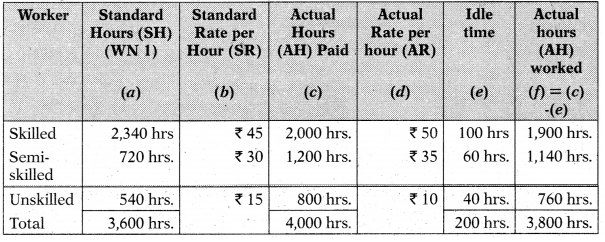

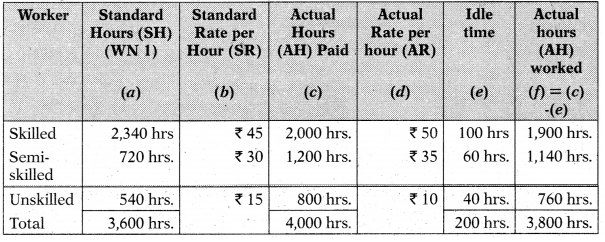

Table Showing Standard & Actual Cost

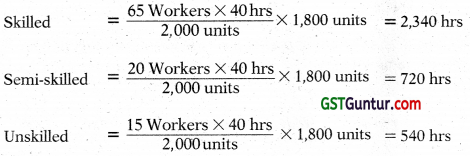

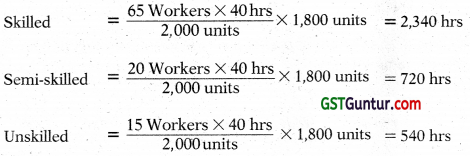

Workings:

(i) Standard Hours (SH) for actual output

(ii) Actual Hours worked:

Skilled = 50 Workers × 40 Hours = 2,000 Hours

Semi-skilled = 30 Workers × 40 Hours = 1,200 Hours

Unskilled’ = 20 Workers × 40 Hours = 800 Hours

Calculation of Variances:

(i) Labour Cost Variance = (SH × SR) – (AH paid × AR)

Skilled worker = (2,340 hrs × ₹ 45) – (2,000 hrs × ₹ 50)

= ₹ 1,05,300 – ₹ 1,00,000 = ₹ 5,300 (F)

Semi-skilled worker Unskilled Worker = (720 hrs × ₹ 30) – (1,200 hrs × ₹ 35)

= ₹ 21,600 – ₹ 42,000

= ₹ 20,400 (A)

Unskilled Worker = (540 hrs × ₹ 15) – (800 hrs × ₹ 10)

= ₹ 8,100 – ₹ 8,000

= ₹100 (F)

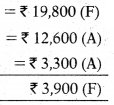

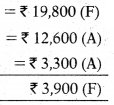

(ii) Labour Efficiency Variance = SR × (SH – AH worked)

Skilled worker = ₹ 45 × (2,340 hrs. – 1,900 hrs.)

= ₹ 19,800 (F)

Semi-skilled worker = ₹ 30 × (720 hrs. – 1,140 hrs.)

= ₹ 12,600 (A)

Unskilled Worker = ₹ 15 × (540hrs. – 760 hrs.)

= ₹ 3,300 (A)

Total = ₹ 13,900 (F)

(iii) Labour Idle Time Variance = SR × Idle-Time (Hrs.)

Skilled worker = ₹ 45 × 100 = 14,500 (A)

Semi-skilled worker = ₹ 30 × 60 hrs = ₹ 1,800 (A)

Unskilled worker = ₹ 15 × 40 hrs = ₹ 600 (A)

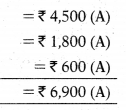

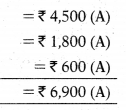

Total = ₹ 6,900 (A)

Question 9.

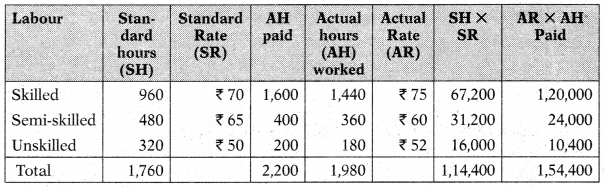

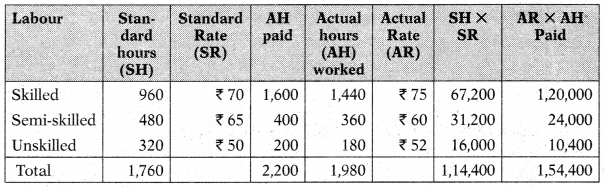

A gang of workers normally consists of 30 skilled workers, 15 semiskilled workers and 10 unskilled workers. The are paid at standard rate per hour as under:

| Skilled |

₹ 70 |

| Semi- skilled |

₹ 65 |

| Unskilled |

₹ 50 |

In a normal working week of 40 hours, the gang is expected to produce 2,000 units of output. During the week ended 31 st March, 2021, the gang consisted of 40 skilled, 10 semi-skilled and 5 unskilled workers. The actual w ages paid were at the rate of ₹ 75, ₹ 60 and ₹ 52 per hour respectively. Four hours were lost due to machine breakdown and 1,600 units were produced.

Calculate the following variances showing clearly adverse (A) or favourable (F)

(i) Labour Cost Variance

(ii) Labour Rate Variance

(iii) Labour Efficiency Variance

(iv) Labour Mix Variance

(v) Labour Idle Time Variance [CA Inter May 2019, 10 Marks]

Answer:

Workings:

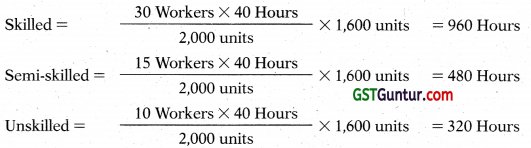

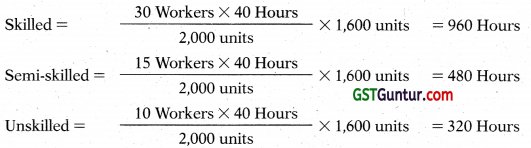

(a) Total Standard Hours for actual output

(b) Actual Hours worked:

Skilled = 40 Workers × 40 Hours

Semi-skilled =10 Workers × 40 Hours

Unskilled = 5 Workers × 40 Hours

(c) Actual Hours paid:

Skilled = 40 Workers × (40 – 4) Hours

Semi-skilled =10 Workers × (40 – 4) Hours =360 Hours

Unskilled = 5 Workers × (40 – 4) Hours =180 Hours

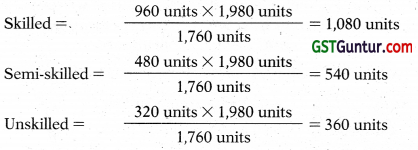

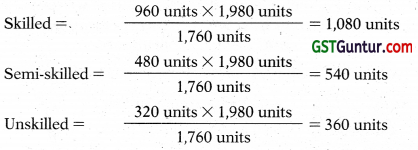

(d) Revised Standard Hours:

(i) Labour Cost Variance

| Types of workers |

(SH × SR) – (AR × AH Paid) |

₹ |

| Skilled |

67,200 – 1,20,000 |

52,800 (A) |

| Semi- Skilled |

31,200 – 24,000 |

7,200 (F) |

| Unskilled |

16,000 – 10,400 |

5,600 (F) |

| Total |

1,14,400 – 1,54,400 |

40,000 (A) |

(ii) Labour Rate Variance

| Types of workers |

AH worked × (SR – AR) |

₹ |

| Skilled |

1,600 hours × (₹ 70.00 – ₹ 75.00) |

8,000 (A) |

| Semi- Skilled |

400 hours × (₹ 65.00 -₹ 60.00) |

2,000 (F) |

| Unskilled |

200 hours × (₹ 50.00 – ₹ 52.00) |

400 (A) |

| Total |

|

6,400 (A) |

(iii) Labour Efficiency Variance

| Types of workers |

SR × (SH – AH Worked) |

₹ |

| Skilled |

₹ 70.00 × (960 hours – 1,440 hours) |

33,600 (A) |

| Semi- Skilled |

₹ 65.00 × (480 hours – 360 hours) |

7,800 (F) |

| Unskilled |

₹ 50.00 × (320 hours – 180 hours) |

7,000 (F) |

| Total |

|

18,800 (A) |

Alternatively labour efficiency can be calculated on basis of labour hours worked

| Types of workers |

SR × (SH – Actual Hours) |

₹ |

| Skilled |

₹ 70.00 × (960 hours – 1,600 hours) |

44,800 (A) |

| Semi- Skilled |

₹ 65.00 × (480 hours – 400 hours) |

5,200 (F) |

| Unskilled |

₹ 50.00 × (320 hours – 200 hours) |

6,000 (F) |

| Total |

|

33,600 (A) |

(iv) Labour Mix Variance

| Types of workers |

SR × (Revised AH Worked – AH Worked) |

₹ |

| Skilled |

₹ 70 × (1,080 hrs. – 1440 hrs.) |

25,200 (A) |

| Semi -Skilled |

₹ 65 × (540 hrs. – 360 hrs.) |

11,700 (F) |

| Unskilled |

₹ 50 × (360 hrs. – 180 Hrs.) |

9,000 (F) |

| Total |

|

4,500 (A) |

(v) Labour Idle Time Variance

| Types of workers |

SR × (AH Worked × AH Paid) |

₹ |

| Skilled |

₹ 70.00 × (1,600 hours – 1,440 hours) |

11,200 (A) |

| Semi- Skilled |

₹ 65.00 × (400 hours – 360 hours) |

2,600 (A) |

| Unskilled |

₹ 50.00 × (200 hours – 180 hours) |

1,000 (A) |

| Total |

|

14,800 (A) |

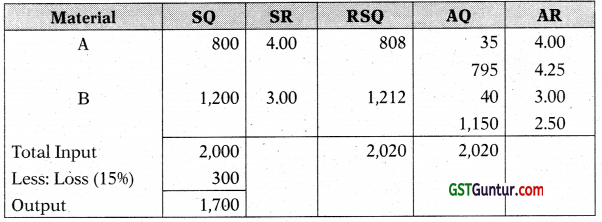

Question 10.

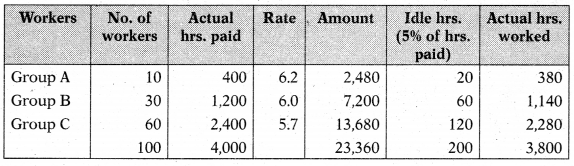

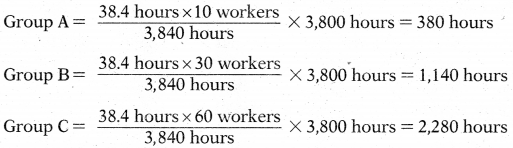

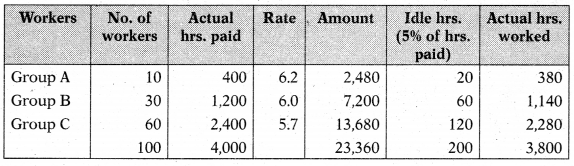

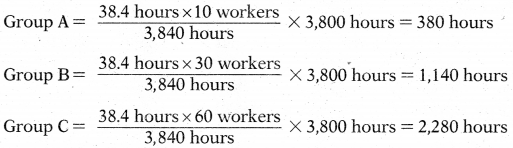

The standard output of a Product ‘DJ’ is 25 units per hour in manufacturing department of a company employing 100 workers. In a 40 hours week, the department produced 960 units of product ‘DJ’ despite 5% of the time paid was lost due to an abnormal reason. The hourly wage rates actually paid were ₹ 6.20, ₹ 6.00 and ₹ 5.70 respectively to Group ‘A’ consisting 10 workers. Group ‘B’ consisting 30 workers and Group ‘C’ consisting 60 workers. The standard wage rate per labour is same for all the workers. Labour Efficiency Variance is given ₹ 240 (F).

You are required to compute:

(i) Total Labour Cost Variance

(ii) Total Labour Rate Variance

(iii) Total Labour Gang Variance

(iv) Total Labour Yield Variance, and

(v) Total Labour Idle Time Variance.

Answer:

1. Total Labour Cost Variance = (SH × SR) – (AH × AR)

= (3,840 × 6) – 23,360

= 320A

2. Total Labour rate Variance = AH paid (SR – AR)

Group A = 400 hours (₹ 6 – ₹ 6.2)

GroupB = 1,200 hours (₹ 6 – ₹ 6)

Group C = 2,400 hours (₹ 6 – ₹ 5.7)

3. Labour Gang Variance = SR (RSH – AH worked)

Group A = ₹ 16 (380 hours – 380 hours) = Nil

Group B = ₹ 6 (1,140 hours – 1,140 hours) = Nil

Group C = ₹ 6 (2,280 hours – 2,280 hours) = Nil

4. Labour Yield Variance =SR (Total SH – Total AHworked)

= ₹ 6 (3,840 hrs. – 3800 hrs.)

= 240F

5. Labour Idle Variance = Total Idle Hrs. × SR

= 200 hrs. × ₹ 6

= ₹ 1,200A

Working Notes:

1. Standard man hours per unit = \(\frac{100 \mathrm{hrs}}{25 \text { units }}\) = 4 hrs. per unit

2. Standard man hours for actual output = 960 units × 4 hrs. = 3,840 hrs.

3. Calculation of Actual Cost:

4. Calculation standard wage rate:

Labour efficiency variance = 240F

Standard hrs for actual production – Actual hrs. × SR = 240F

(3,840 – 3,800) × SR = 240F

Standard Rate (SR) = ₹ 6 per hr.

5. Calculation of Revised Standard Hour (RSH):

Question 11.

The following information is available from the cost records of Vatika & Co. For the month of August, 2020:

| Material purchased |

24,000 kg |

₹ 1,05,600 |

| Material consumed |

22,800 kg |

|

| Actual wages paid for |

5,940 hours |

₹ 29,700 |

| Unit produced |

2160 units |

|

| Standard rates and prices are: |

| Direct material rate is |

₹ 4.00 per kg |

|

| Direct labour rate is |

₹ 4.00 per hr. |

|

| Standard input is |

10 kg. |

for one unit |

| Standard requirement is |

2.5 hours |

per unit |

Calculate all material and labour variances for the month of August, 2020. [CA Inter Nov. 2009, 8 Marks]

Answer:

Material Variance

Actual production = 2,160 units

Standard quantity for actual production (SQ) = 2,160 units × 10 kg. = 21,600 kg.

Actual quantity for actual production (AQ) = 22,800 kg.

Standard price per kg. (SP) = ₹ 4

Actual price per kg. (AP) = 11,05,6004 – 24,000 kg = ₹ 4.40 per

(i) Material Cost Variance = (SQ × SP) – (AQ × AP)

= (2,1600 × ₹ 4) – (22,800 × ₹ 4.40)

= ₹ 13,920 (A)

(ii) Material Price Variance = AQ × (SP – AP)

= 22,800 × (₹ 4 – ₹ 4.40)

= ₹ 9,120 (A)

(iii) Material Usage Variance = SP × (SQ – AQ)

= ₹ 4 × (21,600 – 22,800)

= ₹ 4,800 (A)

Labour Variance

Standard labour hours (SH) = 2,160 units × 2.5 hours per unit

Actual labour hours (AH) = 5,940 hours

Standard rate (SR) = ₹ 4.00 per hour

Actual rate (AR) = \(\frac{₹ 29,700}{5,940 \text { hours }}\) = ₹ 5.00 per hour

(iv) Labour Cost Variance = (SH × SR) – (AH × AR)

= (5,400 × ₹ 4) – (5,940 × ₹ 5)

= ₹ 8,100 (A)

(v) Labour Rate Variance = AH × (SR – AR)

= 5,940 × (₹ 4 – ₹ 5)

= ₹ 5,940 (A)

(vi) Labour Efficiency Variance = SR (SH – AH)

= ₹ 4 × (5,400 – 5,940)

= ₹ 2,160 (A)

Question 12.

JVG Ltd. produces a product and operates a standard costing system and value material and finished goods inventories at standard cost. The information related with the product is as follows:

|

Cost per unit (₹) |

| Direct materials (30 kg at × 350 per kg) |

10,500 |

| Direct labour (5 hours at × 80 per hour) |

400 |

The actual information for the month just ended is as follows:

(a) The budgeted and actual production for the month of September 2021 is 1,000 units.

(b) Direct materials – 5,000 kg at the beginning of the month. The closing balance of direct materials for the month was 10,000 kg. Purchases during the month were made at ₹ 365 per kg. The actual utilization of direct materials was 7,200 kg more than the budgeted quantity.

(c) Direct labour – 5,300 hours were utilised at a cost of ₹ 4,34,600.

You are required to calculate:

(i) Direct Material Price Variance

(ii) Direct Material Usage variance

(iii) Direct Labour Rate Variance

(iv) Direct Labour Efficiency Variance [CA Inter Nov. 2019, RTP]

Answer:

Quantity of material purchased and used.

| No. of units produced |

1,000 units |

| Std. input per unit |

30 kg. |

| Std. quantity (Kg.) |

30,000 kg. |

| Add: Excess usage |

7,200 kg. |

| Actual Quantity |

37,200 kg. |

| Add: Closing Stock |

10,000 kg. |

| Less: Opening stock |

5,000 kg. |

| Quantity of Material purchased |

42,200 kg. |

(i) Direct Material Price Variance = AQ purchased (SP – AP)

= 42,200 kg. × (₹ 350 – ₹ 365) .

= ₹ 6,33,000 (A)

(ii) Direct Material Usage Variance = SP (SQ – AQ)

= ₹ 350 (30,000 kg. – 37,200 kg.)

= ₹ 25,20,000 (A)

(iii) Direct Labour Rate Variance = AH (SR – AR)

= 5,300 hours (₹ 80 – ₹ 82)

= ₹ 10,600 (Adverse)

(iv) Direct Labour Efficiency Variance = SR (SH – AH)

= ₹ 80 (1,000 units × 5 hrs. – 5,300 hrs.)

= ₹ 24,000 (Adverse)

Question 13.

Following information relates to labour of KAY PEE Ltd.:

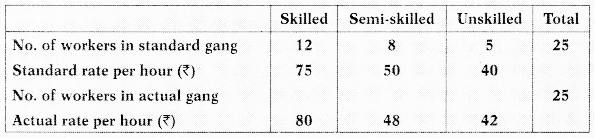

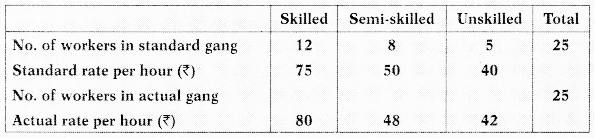

The standard output of gang was 12 units per hour of the product M. The gang was engaged for 200 hours during the month of March 2021 out of which 20 hours were lost due to machine breakdown and 2,295 units of product M were produced. The actual number of skilled workers was 2 times the semi skilled workers. Total labour mix variance was ₹ 10,800 (A).

You are required to calculate the following:

(i) Actual number of workers in each category.

(ii) Labour rate variance.

(iii) Labour yield variance.

(iv) Labour efficiency variance. [CA Inter May 2019, 8 Marks]

Answer:

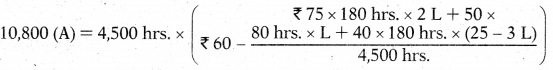

(i) Actual Numbers of Workers in Each Category

Assumed Semi-skilled Workers = L

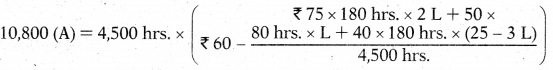

Total Labour Mix Variance

= Total Actual Time Worked (hours) × {Average Standard Rate per hour of Standard Gang Less: Average Standard Rate per hour of Actual Gang*} *on the basis of hours worked

L = 7

Semi-skilled = 7 (as above)

Skilled = 14(twice of 7)

Unskilled = 4(balance out of 25)

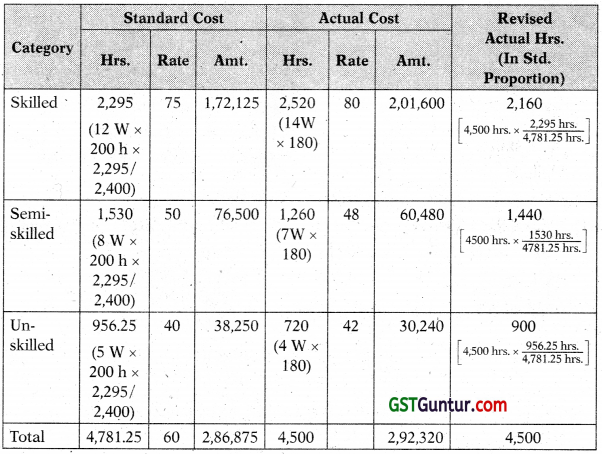

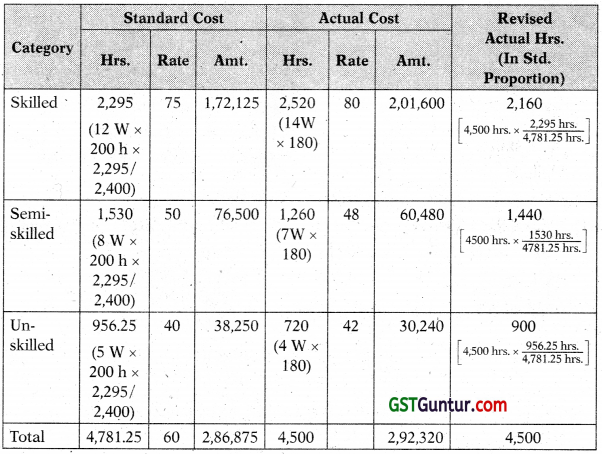

(ii) Labour Rate Variance = Actual Hours Paid × (Standard Rate – Actual Rate)

Skilled Workers = 2,800 hrs. × (₹ 75 – ₹ 80)

= 14,000(A)

Semi-skilled 1,400 hrs. × ( 50 – ₹ 48)

= 2,800(F)

Unskilled Workers 800 hrs. × (₹ 40 – ₹ 42)

= 1,600(A)

Total = 14,000(A) + 2,800(F) + 1,600(A)

= 12,800 (A)

(iii) Labour Yield Variance

= Average Standard Rate per hour of Standard Gang × {Total Standard

Time (hours) Less Total Actual Time Worked (hours)j

= \(\left(\frac{₹ 2,86,875}{4,781.25 \text { hrs. }}\right)\) × (4,781.25 hrs – 4,500 hrs)

= ₹ 16,875 (F)

(iv) Labour Efficiency Variance

= Std. Rate × (Std. Hours – Actual Hours Worked)

= ₹ 75 × (2,295 hrs. – 2,520 hrs.)

= ₹ 16,875 (A).

= ₹ 50 × (1,530 hrs. – 1,260 hrs.)

= ₹ 13,500 (F)

= ₹ 40 × (956.25 hrs. – 720 hrs.)

= ₹ 9,450 (F)

= ₹ 16,875 (A) + ₹ 13,500 (F) + ₹ 9,450 (F)

= ₹ 6,075 (F)

Statement Showing “Standard & Actual Cost”

Question 14.

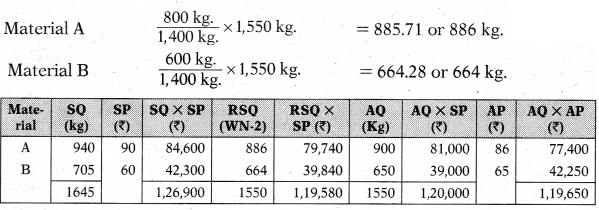

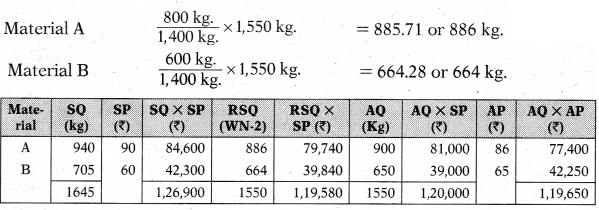

ABC Ltd. had prepared the following estimation for the month of January:

|

Quantity |

Rate (₹) |

Amount (₹) |

| Material-A |

800 kg. |

90.00 |

72,000 |

| Material-B |

600 kg. |

60.00 |

36,000 |

| Skilled labour |

1,000 hours |

75.00 |

75,000 |

| Unskilled labour |

800 hours |

44.00 |

35,200 |

Normal loss was expected to be 10% of total input materials and an idle labour time of 5% of expected labour hours was also estimated.

At the end of the month the following information has been collected from the cost accounting department:

The company has produced 1,480 kg. finished product by using the followings:

|

Quantity |

Rate (₹) |

Amount (₹) |

| Material-A |

900 kg. |

86.00 |

77,400 |

| Material-B |

650 kg. |

65.00 |

42,250 |

| Skilled labour |

1,200 hours |

71.00 |

85,200 |

| Unskilled labour |

860 hours |

46.00 |

39,560 |

You are required to calculate:

(a) Material Cost Variance

(b) Material Price Variance;

(c) Material Mix Variance

(d) Material Yield Variance;

(e) Labour Cost Variance

(f) Labour Efficiency Variance and

(g) Labour Yield Variance. [CA Inter May 2020, RTPJ

Answer:

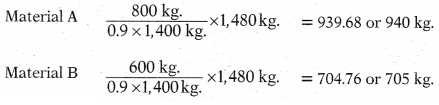

Material Variances:

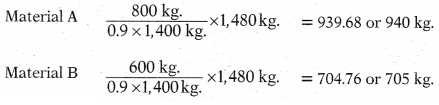

Calculation of Standard Quantity (SQ):

Calculation of Revised Standard Quantity (RSQ):

Calculation of Material variances

(a) Material Cost Variance (A + B) = (SQ × SP) – (AQ × AP)

= 1,26,900 – 1,19,650

= 7,250 (F)

(b) Material Price Variance (A + B) = (AQ × SP) – (AQ × AP)

= 1,20,000 – 1,19,650

= 350 (F)

(c) Material Mix Variance (A + B) = (RSQ × SP) – (AQ × SP)

= 1,19,580 – 1,20,000

= 420(A)

(d) Material Yield Variance (A + B) = (SQ × SP) – (RSQ × SP)

= 1,26,900 – 1,19,580

= 7,320 (F)

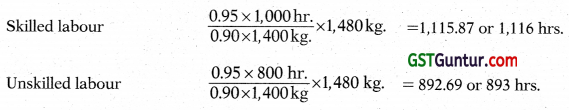

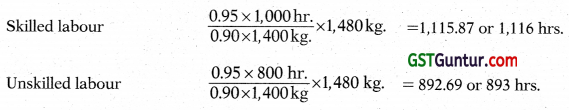

Labour Variances:

Calculation of Standard Hours (SH):

Calculation of Revised Standard Hours (RSH):

Calculation of Material Variances

(e) Labour Cost Variance (SkilLed + Unskilled) = (SH × SR) – (AH × AR)

= 1,22,992 – 1,24,760

= 1,768(A)

(f) Labour Efficiency Variance (Skilled +Unskilled) = (SH × SR) – (AH × SR)

= 1,22,992 – 1,27,840

= 4,848 (A)

(g) Labour Yield Variance (Skilled + Unskilled) = (SH × SR) – (RSH × SR)

= 1,22,992 – 1,26,1041

= 3,1 12 (A)

Question 15.

A manufacturing concern has provided following information related to fixer overheads;

|

Standard |

Actual |

| Output in a month |

5000 units |

4800 units |

| Working days in a month |

25 days |

23 days |

| Fixed overheads |

₹ 5,00,000 |

₹ 4,90,000 |

Compute:

(i) Fixed overhead variance

(ii) Fixed overhead expenditure variance

(iii) Fixed overhead volume variance

(iv) Fixed overhead efficiency variance [CA Into, Nov. 2018, 5 Mm ks]

Answer:

(i) Fixed Overhead Variance =Absorbed fixed overhead – Actual fixed overhead

= [(₹ 5,00,000 × 5,000) × 4,800] – ₹ 4,90,000

= ₹ 10,000 (A)

(ii) Fixed Overhead Expenditure Vari- Budgeted fixed overhead – Actual fixed ance overhead

= ₹ 5,00,000 – ₹ 4,90,000

= ₹ 10,000 (F)

(iii) Fixed Overhead Volume Variance (Actual output – Budgeted output) × Budgeted fixed overhead per unit

= (4,800 units – 5,000 units) × ₹ 5,00,000 5000 units

= ₹ 20,000 (A)

(iv) Fixed Overhead efficiency Variance = Standard fixed overhead – Budgeted fixed overhead for Actual days

= ₹ 4,80,000 – [(× 5,00,000 × 25) × 23]

= 120,000 (F)

Question 16.

AB Ltd. has furnished the following information:

|

Budgeted |

Actual July 2016 |

| Number of working days |

25 |

27 |

| Production (in units) |

20,000 |

22,000 |

| Fixed Overheads |

₹ 30,000 | |

₹ 31,000 |

Budgeted fixed overhead rate is ₹ 1.00 per hour. In July 2021, the actual hours worked were 31,500. In relation to fixed overheads, calculate:

(i) Efficiency Variance

(ii) Capacity Variance

(iii) Calendar Variance

(iv) Volume Variance

(v) Expenditure Variance [CA Inter May 2017, 5 Marks]

Answer:

(i) Efficiency Variance = Budgeted fixed overhead per units × (Actual output – Standard output for actual hours)

= ₹ 1.50 × (22,000 units – 21,000 units)

= ₹ 1,500 (F)

(ii) Capacity Variance = Standard Rate × (Actual Hours – Budgeted Hours for actual days worked)

= ₹ 1.00 (31,500 hours – 32,400 hours)

= ₹ 900 (A)

(iii) Calendar Variance = Standard Fixed Overhead Rate per day × (Actual Working days – Budgeted working days)

= ₹ 1,200 (27 days – 25 days)

= ₹ 2,400 (F)

(iv) Volume Variance = Budgeted fixed overhead per units × (Actual output – Budgeted output)

= ₹ 1.50 (22,000 units – 20,000 units)

= ₹ 3,000 (F)

(v) Expenditure Variance = Budgeted Overheads – Actual Overheads

= ₹ 30,000 – ₹ 31,000

= ₹ 1,000 (A)

Workings:

(1) Budgeted Hours = ₹ 30,000/₹ 1 per hour = 30,000 hours

(2) Standard Fixed Overhead rate per hour (Standard Rate):

= Budgeted fixed overheads/Budgeted Hours = ₹ 30,000/30,000 hrs. = ₹ 1.00

(3) Budgeted fixed overhead per units = 30,000 hours/20,000 units × ₹ 1.00 = ₹ 1.50

(4) Standard hours for Actual Output = 22,000 units × 1.5 hours = 33,000 Hours

(5) Budgeted Overhead per day for budgeted days = 30,000/25 days = ₹ 1,200

(6) Budgeted Hours for Actual days worked = 30,000 hours/25 days × 27 days = 32,400 hours

(7) Standard output for actual hours = (31,500 hours × 20,000 units)/ ₹ 30,000 =21,000 units

Question 17.

A company has normal capacity of 100 machines working 8 hours per day of 25 days in a month. The budgeted fixed overheads of a month are ₹ 1,50,000. The standard time required to manufacture one unit of product is 4 hours. In a particular month the Company worked for 24 days of 750 machine hours per day and produced 4,500 units of the product. The actual fixed overheads incurred were ₹ 1,45,000

Compute:

(i) Efficiency variance

(ii) Capacity variance

(iiii) Calendar variance

(iv) Expenditure variance

(v) Volume variance

(vi) Total fixed overhead variance [CA Inter May 2001, 10 marks]

Answer:

Computation of Variances in relation to Fixed Overheads:

(i) Efficiency Variance = Budgeted fixed overhead per units × (Actual output – Standard output for actual hours)

= ₹ 30 × (4,500 units – 4,500 units)

= Nil

(ii) Capacity Variance = Standard Rate per hour × (Actual Hours – Budgeted Hours for actual days worked)

= ₹ 7.50 (18,000 hours – 19,200 hours)

= ₹ 9,000 (A)

(iii) Calendar Variance = Standard Fixed Overhead Rate per day × (Actual Working days – Budgeted working days)

= ₹ 6,000 (24 days – 25 days)

= ₹ 6,000 (A)

(iv) Exp. Variance = Budgeted Overheads – Actual Overheads

= ₹ 1,50,000 – ₹ 1,45,000 = ₹ 5,000 (F)

(v) Volume Variance = Budgeted fixed overhead per units × (Actual output – Budgeted output)

= ₹ 30 × (4,500 units – 5,000 units)

= ₹ 15,000 (A)

(vi) Total fixed overhead variance = Absorbed fixed overhead – Actual fixed overhead

= ₹ 1,35,000 – ₹ 1,45,000

= ₹ 10,000 (A)

Workings:

(1) Budgeted Units = 20,000 hours/4 units per hour = 5,000 units

(2) Standard Fixed Overhead rate per hour (Standard Rate) = Budgeted fixed overheads/Budgeted Hours = ₹ 1,50,000/20,000 hrs. = ₹ 7.50

(3) Budgeted fixed overhead per units = ₹ 1,50,000/5,000 units = ₹ 30

(4) Absorbed fixed overhead = 4,500 units × ₹ 1,50,000/5,000 units = ₹ 1,35,000

(5) Budgeted Overhead per day for budgeted days = 1,50,000/25 days = ₹ 6,000

(6) Budgeted Hours for Actual days worked = 20,000 hours/25 days × 24 days = 19,200 hours

(7) Standard output for actual hours = (18,000 hours × 5,000 units)/20,000 hours = 4,500 units.

Question 18.

ABC Ltd. has furnished the following information regarding the overheads for the month of June 2020:

(i) Fixed;Overhead:: Cost Variance:y – ₹ 2,800 (Adverse)

(ii) Fixed Overhead Volume Variance – ₹ 2,000 (Adverse)

(iii) Budgeted Hours for June, 2020 – 2,400 hours

(iv) Budgeted Overheads for June, 2020 – ₹ 12,000

(v) Actual rate of recovery of overheads – ₹ 8 Per lioin

From the above given information

Calculate:

(i) Fixed Overhead Expenditure

(ii) Actual Overheads Incurred Variance

(iii) Actual Hours for Actual Production

(iv) Fixed Overhead. Capacity Variance

(v) Standard hours for Actual Production

(vi) Fixed Overhead Efficiency Variance [CA Inter Nov. 2020, 10 Marks]

Answer:

(i) Fixed Overhead Exp. Variance = Fixed Overhead Cost Variance – Fixed Overhead Volume Variance

= ₹ 2,800 (A) – ₹ 2,000 (A)

= ₹ 800 (A)

(ii) Fixed Overhead Cost Variance 2,800 (A) Actual Overheads = Absorbed Fixed Overheads – Actual Fixed Overheads

= ₹ 10,000 – Actual Overheads

= ₹ 12,800

(iii) Actual Hours for Actual Production = ₹ 12,800/₹ 8

= 1,600 hrs.

(iv) Fixed Overhead capacity variance = Budgeted Fixed Overheads for Actual Hours – Budgeted Fixed Overheads

= (₹ 5 × 1600 hrs.) – ₹ 12,000 = ₹ 4,000 (A)

(v) Standard Hrs. for Actual Production = Absorbed Overheads/Std. Rate per hour

= ₹ 10,000/₹ 5 = 2,000 hrs.

(vi) Fixed Overhead Efficiency Var. = Absorbed Fixed Overheads – Budgeted Fixed Overheads for Actual Hours

= ₹ 10,000 – (₹ 5 × 1,600 hrs.)

= ₹ 2,000 (F)

Working Note:

Standard Rate per Hour = ₹ 12,000/2,400 hrs. = ₹ 5

Question 19.

The activity ratio of a concern is 95.6% whereas the capacity ratio is 105%. What is the efficiency ratio? [CA Inter May 2000, 2 Marks]

Answer:

Efficiency ratio = \(\frac{\text { Activity ratio }}{\text { Capacity ratio }}\) × 100

= \(\frac{95.6 \%}{105 \%}\) × 100

= 91.04796

Question 20, A manufacturing firm produces a specific product and adopts standard costing system. The product is produced within a single cost centre.

Following information related to the product are available from the standard cost sheet of me product:

Unit Cost (₹)

Direct material 5 kg @ ₹ 15 per kg 75.00

Direct wages 4 hours @ ₹ 20 per hour 80,00

During the month of October 2021, the firm purchased 3,50,000 kg of material at the rate of ₹ 14 per kg. Production records for the month exhibits the following actual results:

Material used 3,20,000 kg.

Direct wages – 2,20,000 hours ₹ 46,20,000

The production schedule requires completion of 60,000 units in a month. However, the firm produced 62,000 units in the month of October, 2021. There are no opening and closing work-in-progress.

You are required to:

(i) Calculate Material Cost, Price and Usage Variance.

(ii) Calculate Labour Cost, Rate and Efficiency Variance; and

(iii) Calculate the amount ot bonus, as an incentive scheme is in operation in the company u hereby employees are paid a bonus of 50% of direct labour hour saved at standard direct labour hour rate. [CA Inter Nov, 2019, S Marks]

Answer:

(i) Material Cost, Price and Usage Variance:

Material Cost Variance (on the basis of consumed quantity)

= SQ × SP – AQconsumed × AP

= (5 kg. × 62,000 units × ₹ 15) – (3,20,000 kg. × ₹ 14)

= ₹ 46,50,000 – ₹ 44,80,000 = ₹ 1,70,000 (F)

OR

Material Cost Variance (on the basis of purchased quantity)

= SQ × SP – AQPurchase × AP

= 3,10,000 × ₹ 15- 3,50,000 × ₹ 14

= ₹ 2,50,000 (A)

Material Price Variance (on the basis of consumed quantity)

= AQConsumed × SP – AQConsumed × AP

= (3,20,000 kg. × ₹ 15) – (3,20,000 kg. × ₹ 14)

= ₹ 3,20,000 (F)

OR

Material Price Variance (on the basis of purchased quantity)

= (SP – AP) × AQPurchase

= (₹ 15 – ₹ 14) × 3,50,000

= ₹ 3,50,000 (F)

Material Usage Variance

= SP × SQ – SP × AQConsumed

= (₹ 15 × 5 kg. ₹ 62,000 units) – (₹ 15 × 3,20,000 kg.)

= ₹ 46,50,000 – ₹ 48,00,000

= ₹ 1,50,000 (A)

(ii) Labour cost Variance = SH × SR – AH × AR

= 2,48,000 hrs. × ₹ 20 – 2,20,000 hrs. × ₹ 21

= ₹ 49,60,000 – ₹ 46,20,000

= ₹ 3,40,000 (F)

Labour Rate Variance = (SR – AR) × AH

= (₹ 20 – ₹ 21) × 2,20,000

= 2,20,000 (A)

Labour Efficiency Variance = (SH – AH) × SR

= (2,48,000 – 2,20,000) × ₹ 20

= 5,60,000 (F)

(iii)Hours Saved = 2,48,000 – 2,20,000 = 28000 hrs.

Bonus Rate = ₹ 20 × 5096 = ₹ 10

Bonus = 28,000 × ₹ 10 = ₹ 2,80,000

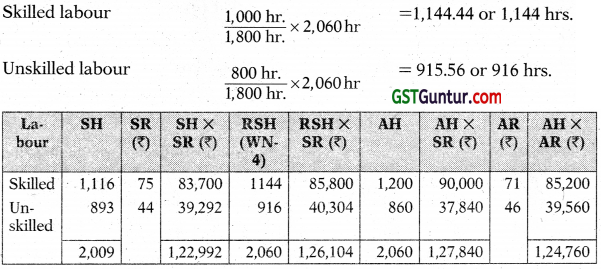

Question 21.

KPR Limited operates a system of standard costing in respect of one of its products which is manufactured within a single cost centre. The Standard Cost Card of a product is as under:

| Standard |

Unit cost (₹) |

| Direct material |

5 kgs @ ₹ 4.20 |

21.00 |

| Direct labour |

3 hours @ ₹ 3.00 |

9,00 |

| Factory overhead |

₹ 1.20 per labour hour |

3.60 |

| Total manufacturing cost |

33.60 |

The production schedule for the month of June, 2021 required completion of 40,000 units. However, 40,960 units were completed during the month without opening and dosing work-inprocess inventories.

Purchases during the month of June, 2021, 2,25,000 kgs of material at the rate of ₹ 4.50 per kg. Production and Sales records for the month showed the following actual results.

| Material used |

2,05,600 kgs. |

| Direct labour 1,21,200 hours; cost incurred |

₹ 3,87,840 |

| Total factory overhead cost incurred |

₹ 1,00,000 |

| Sales |

40,000 units |

Selling price to be so fixed as to allow a mark-up of 20% on selling price.

Required:

(i) Calculate material variances based on consumption of material.

(ii) Calculate labour variances and the total variance for factory overhead.

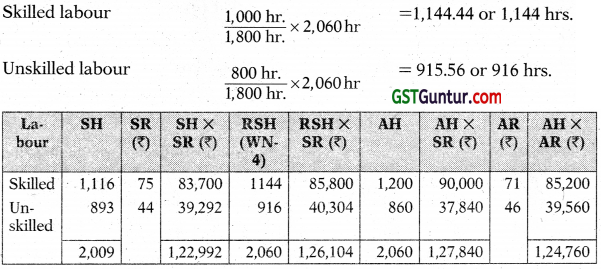

(iii) Prepare Income statement for June, 2021 showing actual gross margin.

(iv) An incentive scheme is in operation in the company whereby employees are paid a bonus of 50% of direct labour hour saved at standard direct labour hour rate. Calculate the Bonus amount. [CA Inter Nov. 2007, 15 Marks]

Answer:

(i) Material variances:

Standard Quantity (SQ) = 40,960 × 5 = 2,04,800 kgs.

Standard Price (SP) = ₹ 4.2

Actual Quantity (AQ) = 2,05,600 kgs.

Actual Price (AP) = ₹ 4.5

(a) Direct material cost variance = (SQ × SP) – (AQ × AP)

= (2,04,800 × 4.2) – (2,05,600 × 4.5)

= 8,60,160 – 9,25,200 – 65,040 (A)

(b) Material price variance = AQ (SP – AP)

= 2,05,600 (4.20 – 4.50)

= 61,680 (A)

(c) Material usages variance = SP (SQ – AQ)

= 4.20 (2,04,800 – 2,05,600)

= 3,360 (A)

(ii) Labour variances and overhead variances:

Standard Hours (SH) = 40,960 × 3 = 1,22,880 hrs.

Standard Rate (SR) = ₹ 3

Actual Hours (AH) = 1,21,200 hrs.

Actual Cost (AH × AR) (given) = ₹ 3,87,840

Actual Rate (AR) = ₹ 3,87,840/1,21,200 hrs. = ₹ 3.2

(a) Labour cost variance = (SH × SR) – (AH × AR)

= (1,22,880 × 3) – 3,87,840

= 19,200 (A)

(b) Labour rate variance = AH (SR – AR)

= 1,21,200 (3 – 3.20)

= 24,240 (A)

(c) Labour efficiency variance = SR (SH – AH)

= 3 (1,22,880 – 1,21,200)

= 5,040 (F)

(d) Total factory overhead variance = Factory overhead absorbed – Factory overhead incurred

= 40,960 × 3 × 1.20 – 1,00,000

= 47,456 (F)

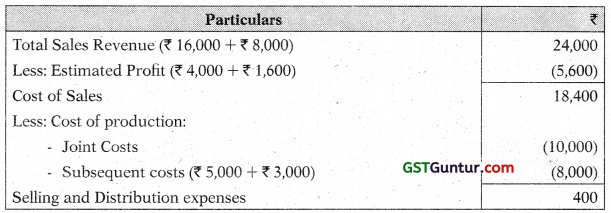

(iii) Calculation of unit selling price

|

₹ |

| Direct material |

21.00 |

| Direct labour |

9.00 |

| Factory overhead |

3.60 |

| Factory cost |

33.60 |

| Margin (25% on factory cost) |

8.40 |

| Selling price |

42.00 |

Income statement

(iv) Labour hour saved

| Labour hour saved |

₹ |

| Standard labour hours (40,960 units × 3 hrs.) |

1,22,380 |

| Actual labour hour worked |

1,21,200 |

| Labour hour saved |

1,680 |

Bonus for saved labour = 1,680 hrs. × ₹ 3 × 50% = ₹ 2,520

Question 22.

BabyMoon Ltd. uses standard costing system in manufacturing one of its product ‘Baby Cap’. The details are as follows:

| Direct Material 1 Meter @ 160 per meter |

₹ 60 |

| Direct Labour 2 hour @ ₹ 20 per hour |

₹ 40 |

| Variable overhead 2 hour @ ₹ 10 per hour |

₹ 20 |

| Total |

₹ 120 |

During the month of August, 10,000 units of ‘Baby Cap’ were manufactured. Details are as follows:

Direct material consumed 11,400 meters @ ₹ 58 per meter

Direct labour Hours ? @ ? ₹ 4,48,800

Variable overhead incurred ₹ 2,24,400

Variable overhead efficiency variance is ₹ 4.000 A. Variable overheads are based on Direct Labour Hours.

You are required to calculate the following Variances:

(a) Material Variances – Material Cost Variance, Material Price Variance and Material Usage Variance.

(b) Variable Overheads variances – Variable overhead Cost Variance, Variable overhead Efficiency Variance and Variable overhead Expenditure Variance.

(c) Labour variances – Labour Cost Variance, Labour Rate Variance and Labour Efficiency Variance. [CA Inter RTP Nov. 2021]

Answer:

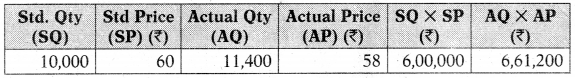

(a) Material Variances

Material Cost Variance = (SQ × SP) – (AQ × AP)

= 6,00,000 – 6,61,200

= ₹ 61,200 (A)

Material Price Variance = AQ (SP – AP)

= 11,400 (60 – 58)

= ₹ 22,800 (F)

Material Usage Variance = SP (SQ – AQ)

= 60 (10,000 – 11,400)

= ₹ 84,000 (A)

(b) Variable Overheads variances Variable overhead cost Variance

= Standard variable overhead – Actual Variable Overhead

= (10,000 units × 2 hours × ₹ 10) – 2,24,400

= ₹ 24,400 (A)

Variable overhead Efficiency Variance = SR (SH – AH)

Let Actual Hours be ‘X’, then:

10 (20,000 – X) = 4,000 (A)

2,00,000 – 10X = – 4,000

X = 2,04,000 × 10

Therefore, Actual Hours (X) = 20,400

Variable overhead Expenditure Variance

= Variable Overhead at Actual Hours – Actual Variable Overheads

= 20,400 × ₹ 10 – 2,24,400 = ₹ 20,400 (A)

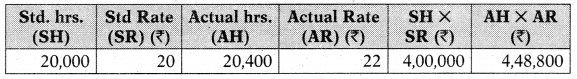

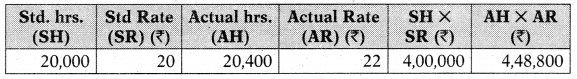

(c) Labour variances

Actual Rate = ₹ 4,48,800 × 20,400 hours = ₹ 22

Labour Cost Variance = (SH × SR) – (AH × AR)

= 4,00,000 – 4,48,800

= ₹ 48,800 (A)

Labour Rate Variance = AH (SR – AR)

= (20 – 22) × 20,400

= ₹ 40,800 (A)

Labour Efficiency Variance = SR (SH – AH)

= (20,000 – 20,400) × 20

= ₹ 8,000 (A)

Question 23.

The following information is available from the cost records of a Company for the month of July, 2021:

| (i) Material purchased |

22,000 pieces |

₹ 90,000 |

| (ii) Material consumed |

21,000 pieces |

|

| (in) Actual wages paid for |

5,150 hours |

₹ 25,750 |

| (iv) Fixed Factory overhead incurred |

|

₹ 46,000 |

| (v) Fixed Factory overhead budgeted |

|

₹ 42,000 |

| (vi) Units produced |

1,900 |

|

| (vii) Standard rates and prices are: |

|

|

| Direct material |

₹ 4.50 per piece |

|

| Standard input |

10 pieces per unit |

|

| Direct labour rate |

₹ 6 per hour |

|

| Standard requirement |

2.5 hours per unit |

|

| Overheads |

₹ 8 per labour hour |

|

You are required to calculate the following variances:

(i) Material price variance

(ii) Material usage variance

(iii) Labour rate variance

(iv) Labour efficiency variance

(v) Fixed overhead expenditure variance

(vi) Fixed overhead efficiency variance

(vii) Fixed overhead capacity variance.

Answer:

(i) Material Price Variance = Actual Quantity × (Std. Price – Actual Price)

= 21,000 pcs × [₹ 4.50 – (₹ 90,000/22,000 pcs.)]

= ₹ 8.591(F)

(ii) Material Usage Variance = Std. price × (Std. Quantity – Actual Quantity)

= ₹ 4.50 × [(1,900 units × 10) – 21,000)]

= ₹ 9,000 (A)

(iii) Labour Rate Variance = Actual Hours × (Std. Rate – Actual Rate)

= 5,150 hours × [ 6 -(? 25,750/5,150 hours)]

= 5,150 (F)

(iv) Labour Efficiency Variance Std. Rate × (Std. Hours – Actual Hours)

= 6 × (1,900 units × 2.5 hours – 5,150 hours)

= 50 × (7,200 hrs. – 7,000 h rs.)

=2,400(A)

(v) Fixed overhead efficiency = Budgeted Overhead – Actual Overhead variance

= 42,000 – 46,000

= 4,000 (A)

(vi) Fixed overhead expenditure = Std. rate per unit (Actual output – Standard variance output for actual hours)

= 20 × [1,900 units – (5,150/2.5 hours)]

= 3,200(A)

(vii) Fixed overhead capacity variance = Std. rate (Actual hours – Budgeted hours)

= 8 (5,150 hours – ₹ 42,000/? 8)

= ₹ 800 (A)

Question 24.

SP Limited produces a product ‘Tempex’ which is sold in a 10 Kg. packet. The standard cost card per packet of ‘Tempex’ are as follows:

|

₹ |

| Direct Materials 8,900 @ ₹ 46 per Kg. |

4,09,400 |

| Direct Labour 7,000 hours @ ₹ 52 per hour |

3,64,000 |

| Variable Overhead incurred |

72,500 |

| Fixed Overhead incurred |

1,92,000 |

Budgeted output for the third quarter of a year was 10,000 Kg. Actual output is 9,000 Kg.

Actual cost for this quarter is as follows:

|

₹ |

| Direct Materials 8,900 Kg @ ₹ 46 per Kg. |

4,09,400 |

| Direct Labour 7,000 hours @ ₹ 52 per hour |

3,64,000 |

| Variable Overhead incurred |

72,500 |

| Fixed Overhead incurred |

1,92,000 |

You are required to calculate:

(i) Material Usage Variance

(ii) Material Price Variance

(iii) Material Cost Variance

(iv) Labour Efficiency Variance

(v) Labour Rate Variance

(vi) Labour Cost Variance

(vii) Variable Overhead Cost Variance

(viii) Fixed Overhead Cost Variance [CA Inter Nov. 2011, Nov. 2013, 8 Marks]

Answer:

Ans.

(i) Material Usage Variance = Std. Price X (Std. Quantity – Actual Quantity)

= ₹ 45 X (9,000 kgs. – 8,900 kgs.)

= ₹ 4,500 (F)

(ii) Material Price Variance = Actual Quantity X (Std. Price – Actual Price)

= 8,900 kgs. X (₹ 45 – ₹ 46)

= ₹ 8,900 (A)

(iii) Material Cost Variance = Std. Material Cost – Actual Material Cost

= (SQ × SP) – (AQ × AP)

= (9,000 kgs. × ₹ 45) – (8,900 kgs. × ₹ 46)

= ₹ 4,05,000 – ₹ 4,09,400

= ₹ 4,400 (A)

(iv) Labour Efficiency Variance = Std. Rate X (Std. Flours – Actual Hours)

= ₹ 50 × (9,000/10 × 8hrs. – 7,000hrs.)

= ₹ 50 × (7,200 hrs. – 7,000 hrs.)

= ₹ 10,000 (F)

(v) Labour Rate Variance = Actual Hours X (Std. Rate – Actual Rate)

= 7,000 hrs. × (₹ 50 – ₹ 52)

= ₹ 14,000 (A)

(vi) Labour Cost Variance = Std, Labour Cost – Actual Labour Cost

= (SH × SR) – (AH × AR)

= (7,200 hrs. × ₹ 50) – (7,000 hrs. × ₹ 52)

= ₹ 3,60,000 – ₹ 3,64,000

= ₹ 4,000 (A)

(vii) Variable Overhead Cost Variance = Std. Variable Cost – Actual Variable Cost

= (7,200 hrs. × ₹ 10) – ₹ 72,500

= ₹ 500 (A)

(viii) Fixed Overhead Cost Variance = Absorbed Fixed Overhead – Actual Fixed Overhead

= (₹ 200/10kgs. ₹ 9,000 kgs.) – 1,92,000

= ₹ 1,80,000 – ₹ 1,92,000

= ₹ 12,000 (A)

Question 25.

The overhead expense budget for a factory producing to a capacity of 200 units per month is as follows:

| Description of overhead |

Fixed cost per unit (₹) |

Variable cost per unit (₹) |

Total cost per unit (₹) |

| Power and fuel |

1,000 |

500 |

1,500 |

| Repair and maintenance |

500 |

250 |

750 |

| Printing and stationary |

500 |

250 |

750 |

| Other overheads |

1,000 |

500 |

1,500 |

|

X 3,000 |

1,500 |

4,500 |

The factory has actually produced only Details of overheads actually incurred have been provided by the accounts department and are as follows:

| Description of overhead |

Actual cost |

| Power and fuel |

₹ 4,00,000 |

| Repair and maintenance |

₹ 2,00,000 |

| Printing and stationary |

₹ 1,75,000 |

| Other overheads |

₹ 3,75,000 |

You are required to calculate the overhead volume variance and tiie overhead expense variances. [ICAI Module]

Answer:

Overheads volume variance (in case of fixed overhead):

Standard fixed overheads per unit (SR): ₹ 3,000 (Given)

Actual production : 100 units

Standard production (capacity) : 200 units

Fixed Overhead Volume Variance = Absorbed overhead – Budgeted Overhead

= (₹ 3,000 × 100 units) – (₹ 3,000 × 200 units)

= ₹ 3,00,000 – ₹ 6,00,000

= ₹ 3,00,000 (Adverse)

Overhead expense variances:

For variable overhead = AQ (SR – AR)

= 100 units (₹ 1,500 – ₹ 1,500) = Nil

For fixed overhead – Budgeted Overhead – Actual Overhead

= (₹ 3,000 × 200 units) – (Total overhead – Variable overhead)

= (₹ 3,000 × 200 units) – (₹ 11,50,000 – ₹ 1,500 × 100 units)

= ₹ 6,00,000 – (₹ 11,50,000 – ₹ 1,50,000)

= ₹ 6,00,000 – ₹ 10,00,000

= ₹ 4,00,000 (Adverse)

Question 26.

Premier Industries has a small factory where 52 workers are employed on an average for 25 days a month and they work 8 hours per day. The normal down time is 15%. The firm has introduced standard costing for cost control. Its monthly budget for November, 2020 shows that the budgeted variable and fixed overhead are ₹ 1,06,080 and ₹ 2,21,000 respectively.

The firm reports the following details of actual performance for November, 2020, after the end of the month:

Actual hours worked 8,100 hrs.

Actual production expressed in standard hours 8,800 hrs.

Actual Variable Overheads Actual Fixed Overheads

You are required to calculate:

(i) Variable Overhead Variances:

(а) Variable overhead expenditure variance.

(b) Variable overhead efficiency variance.

(ii) Fixed Overhead Variances:

(a) Fixed overhead budget variance

(b) Fixed overhead capacity variance.

(c) Fixed overhead efficiency variance.

(iii) Control Ratios:

(a) Capacity ratio.

(b) Efficiency ratio. [CA Inter Jan. 2021, 10 Marks]

Answer:

(i) Variable overheads variance

(a) Variable overhead expenditure variance

= Std. overhead for Actual hours – Actual variable Overhead

= (\(\frac{₹ 1,06,080}{8,840}\) × 8,100) – ₹ 1,02,000

= ₹ 4,800 (A)

(b) Variable overhead efficiency variance

=Std. rate per hour × (Std. hours for actual production – Actual hours)

= \(\frac{1,06,080}{8,840}\) (8,8oo hours – 8,100 hours)

= ₹ 8,400 (F)

(ii) Fixed overhead variances

(a) Fixed overhead budget variance

= Budgeted overhead – Actual overhead

= ₹ 2,21,000 – ₹ 2,00,000

= ₹ 21,000 (F)

(b) Fixed overhead capacity variance

= Std rate × (Actual hours – budgeted hours)

= \(\frac{₹ 2,21,000}{8,840}\) × (8,100 – 8,840)

= ₹ 18,500 (A)

(c) Fixed overhead efficiency variance

= Std rate × (Std hours for actual production – Actual hours)

= \(\frac{₹ 2,21,000}{8,840}\) × (8,800 – 8,100)

= ₹ 17,500 (F)

(iii) Control Ratios

(a) Capacity Ratio

= \(\frac{\text { Actual hours }}{\text { Budgeted hours }}\) × 100

= \(\frac{8,100}{8,840}\) × 100

= 91.63%

(b) Efficiency Ratio

= \(\frac{\text { Standard hours }}{\text { Actual hours }}\) × 100

= \(\frac{8,800}{8,100}\) × 100

= 108.64%

(c) Activity Ratio

= \(\frac{\text { Standard hours }}{\text { Budgted hours }}\) × 100

= \(\frac{8,800}{8,840}\) × 100

= 99.55%

Working: Calculation of budgeted hours

Budgeted hours = (52 × 25 × 8) × 85% = 8,840 hours.

Question 27.

SJ Ltd has furnished the following information:

| Standard overhead absorption rate per unit |

₹ 20 |

| Standard rare per hour |

₹ 4 |

| Budgeted production |

12,000 units |

| Actual production |

15,560 units |

| Actual hours |

74,000 |

Actual overheads were ₹ 2,95,000 out of which ₹ 62,500 fixed. Overheads are based on the following flexible budget

| Production (units) |

8,000 |

10,000 |

14.000 |

| Total Overheads (₹) |

1.80,000 |

2,10,000 |

2.70,000 |

Calculate following overhead variances on the basis of hours:

(i) Variable overhead efficiency variance

(ii) Variance overhead expenditure variance

(iii) Fixed overhead efficiency variance

(iv) Fixed overhead capacity variance. [CA Inter May 2012, May 2015, 8 Marks]

Answer:

(i) Variable Overhead efficiency variance :

= Standard Rate Per Hour × (Std. Hours – Actual Hours)

= ₹ 3 × (77,800 – 74,000)

= ₹ 11.400(F)

(ii) Variable Overhead expenditure variance:

= Actual Hours × (Std. Rate Per Hour – Actual Rate Per Hour)

= 74,000 × (₹ 3 3.1419)

= ₹ 10,500 (A)

(iii) Fixed overhead efficiency variance:

= Std. Rate Per Hour × (Std. Hours – Actual Hours)

= ₹ 1 × (77,800 – 74,000)

= ₹ 3,800 (F)

(iv) Fixed overhead Capacity variance:

= Std. Rate Per Hour × (Actual Hours – Budgeted Hours)

= ₹ 1 × (74,000 – 60,000)

= ₹ 14,000 (F)

Workings:

(a) Variable overhead rate per unit:

= \(\frac{\text { Difference in Total overheads at two levels }}{\text { Difference in production units at two level }}=\frac{₹ 2,10,000-₹ 1,80,000}{10,000 \text { units }-8,000 \text { units }}\)

= ₹ 15 per unit

(b) Fixed overhead = ₹ 2,10,000 – (8,000 × ₹ 15) = ₹ 60,000

(c) Standard Hour Per Unit:

= \(\frac{\text { Standard Overhead Absoption rate }}{\text { Std.Rate per hour }}=\frac{₹ 20}{₹ 4}\) = 5 hours

(d) Standard variable overhead rate per hour:

= \(\frac{\text { Variable overhead per unit }}{\text { Std. hours per unit }}=\frac{₹ 15}{5 \text { hours }}\) = 3

(e) Standard Fixed Overhead Rate Per Hour = ₹ 4 – ₹ 3 = ₹ 1

(f) Actual Variable Overhead = ₹ 2,95,000 – ₹ 62,500

= ₹ 2,32,500

(g) Actual Variable Overhead Per Hour:

= \(\frac{₹ 2,32,500}{74,000 \text { hours }}\) = ₹ 3.1419

(h) Budgeted hours = 12,000 × ₹ 5 = 60,000 hours

(i) Standard Hours for Actual Production = 15,560 × ₹ 5 = 77,800 hours

Question 28.

In a manufacturing company the standard units of production for the year were fixed at 1,20,000 units and overhead expenditures were estimated to be as follows:

|

₹ |

| Fixed |

12,00,000 |

| Semi-variable (60% – Fixed; 40%- Variable) |

1,80,000 |

| Variable |

6,00,000 |

Actual production during the month of April, 2021 was 8,000 units. Each month has 20 working days. During the month there w as one public holiday. The actual overheads were as follows:

|

₹ |

| Fixed |

1,10,000 |

| Semi-variable (60% – Fixed; 40%- Variable) |

19,200 |

| Variable |

48,000 |

You are required to calculate the following variances for the month of April 2021:

(i) Overhead Cost variance

(ii) Fixed Overhead Cost variance

(iii) Variable Overhead Cost variance

(iv) Fixed Overhead Volume variance

(v) Fixed Overhead Expenditure Variance

(vi) Calendar Variance [CA Inter Dec. 2021, 10 Marks]

Answer:

Budgeted fixed o/h per unit = \(\frac{₹ 12,00,000+(60 \% \text { of } 1,80,000)}{1,20,000 \text { units }}\) = ₹ 10.90

Budgeted variable o/h per unit = \(\frac{6,00,000+(40 \% \text { of } 1,80,000)}{1,20,000 \text { units }}\) = ₹ 5.60

Actual fixed overhead = 1,10,000 + (60% of 19,200) = ₹ 1,21,520 (for April, 2021)

Actual variable overhead = 48,000 + (40% of 19,200) – ₹ 55,680.

Budgeted production per month = \(\frac{1,20,000 \text { units }}{12 \text { months }}\) = 10,000 units

(i) Overhead Cost Variance

= Absorbed overheads – Actual Overheads

= [(₹ 10.90 + ₹ 5.60) × 8,000 units] – [₹ 1,21,520 + 55,680]

= ₹ 1,32,000 – ₹ 1,77,200

= ₹ 45,200 (A)

(ii) Fixed overhead Cost Variance

= Absorbed fixed overheads – Actual fixed overhead

= (₹ 10.90 × 8,000 units) – ₹ 1,21,520

= ₹ 87,200 – ₹ 1,21,250

= ₹ 34,320 (A)

(iii) Variable over Cost Variance

= Standard Variable overheads – Actual Variable overheads

= (₹ 5.60 × 8,000 units) – ₹ 55,680

= ₹ 44,800 – ₹ 55,680

= ₹ 10,880 (A)

(iv) Fixed overhead Volume Variance

= Budgeted Fixed overhead per unit × (Actual Output – Budgeted output)

= ₹ 10.90 × (8,000 – 10,000 units)

= ₹ 21,800 (A)

(v) Fixed overhead Expenditure Variance

= Budgeted Fixed overhead per month – Actual Fixed overhead of the month

= (₹ 10.90 × 10,000 units) – ₹ 1,21,520

= ₹ 12,520 (A)

(vi) Calendar Variance

= Budgeted Fixed overhead per day × (Actual days – Budgeted days)

= ₹ 5,450 × (19 – 20)

= ₹ 5,450 (A)

Budgeted Fixed overhead per day = \(\frac{₹ 1,09,000}{20 \text { days }}\) = ₹ 5,450

Question 29.

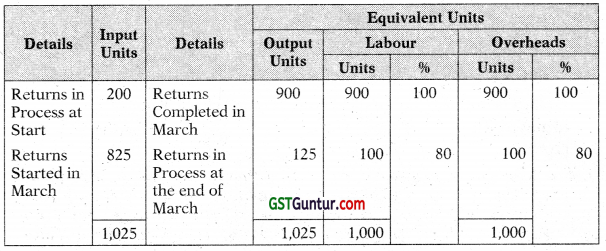

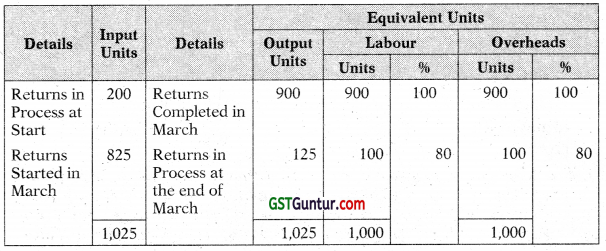

X Associates undertake to prepare income tax returns for individuals for a fee. They use the weighted average method and actual costs for the financial reporting purposes. However, for internal reporting, they use a standard costs system. The standards, based on equivalent performance, have been established as follows:

| Labour per return |

5 hrs @ ₹ 40 per hour |

| Overhead per return |

5 hrs @ ₹ 20 per hour |

For March 2021 performance, budgeted overhead is ₹ 98,000 for standard labour hours allowed. The following additional information pertains to the month of March 2021:

| March 1 |

Return-in-process (25% complete) |

200 No. |

|

Return started in March |

825 Nos. |

| March 31 |

Return-in-process (80% complete) |

125 Nos. |

| Cost Data: |

|

|

| March 1 |

Return-in-process: Labour |

₹ 12,000 |

|

Overheads |

₹ 5,000 |

| March 1 to 31 |

Labour : 4,000 hours |

₹ 1,78,000 |

|

Overheads |

₹ 90,000 |

You are required to compute:

(a) For each element, equivalent units of performance and the actual cost per equivalent unit based on weightage average.

(b) Actual cost of return-in-process on March 31.

(c) The standard cost per return.

(d) The labour rate and labour efficiency variance as well as overhead volume and overhead expenditure variance. [CA Inter May 2016, 8 Marks]

Answer:

(i) Statement Showing Cost Elements Equivalent Units of Performance and the Actual Cost per Equivalent Unit

| Costs: |

₹ |

₹ |

| From previous month |

12,000 |

5,000 |

| During the month |

1,78,000 |

90,000 |

| Total Cost |

1,90,000 |

95,000 |

| Total equivalent units |

1,000 |

1,000 |

| Cost per Equivalent Unit |

190.00 |

95.00 |

(ii) Actual cost of returns in process on March 31:

|

Total (₹) |

| Labour (125 returns ₹ 0.80 × ₹ 190,00) |

19,000 |

| Overhead (125 returns ₹ 0.80 × ₹ 95.00) |

9,500 |

|

28,500 |

(iii) Standard Cost per Return:

|

Total (₹) |

| Labour (5 Hrs × ₹ 40 per hour) |

₹ 200 |

| Overhead (5 Hrs × ₹ 20 per hour) |

₹ 100 |

|

₹ 300 |

(iv) Computation of Variances:

| Statement Showing Output (March only) Element Wise |

Labour |

Overhead |

| Actual performance in March in terms of units equivalent |

1.000 |

1,000 |

| Less: Returns in process at the beginning of March in terms of equivalent units z.e. 25% of returns (200) |

50 |

50 |

|

950 |

950 |

Variance Analysis:

Labour Rate Variance:

= Actual Time × (Standard Rate – Actual Rate)

= Standard Rate × Actual Time – Actual Rate × Actual Time

= ₹ 40 × 4,000 hrs. – ₹ 1,78,000

= ₹ 18,000 (A)

Labour Efficiency Variance:

= Standard Rate × (Standard Time – Actual Time)

= Standard Rate × Standard Time – Standard Rate × Actual Time

= ₹ 40 × (950 units × 5 hrs.) – ₹ 40 × 4,000 hrs.

= ₹ 30.000(F)

Overhead Expenditure or Budgeted Variance:

= Budgeted Overhead – Actual Overhead

= ₹ 98,000 – ₹ 90,000

= ₹ 8,000 (F)

Overhead Volume Variance:

= Recovered/Absorbed Overhead – Budgeted Overhead

= 950 Units × 5 hrs. × ₹ 20 – ₹ 98,000

= ₹ 3,000 (A)

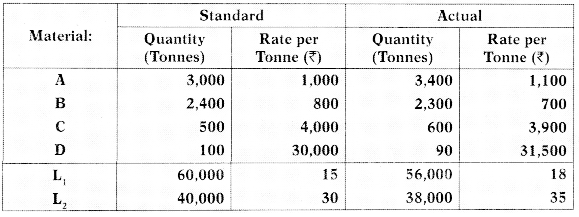

Question 30.

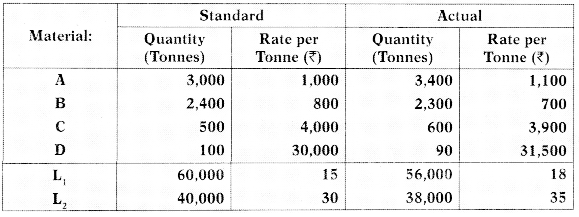

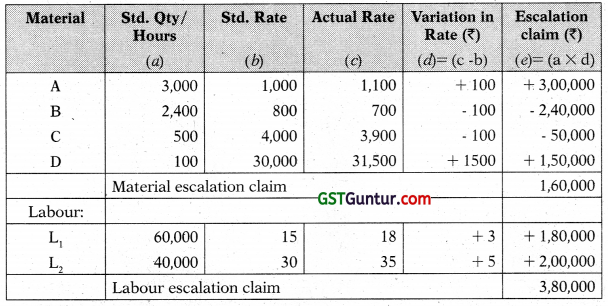

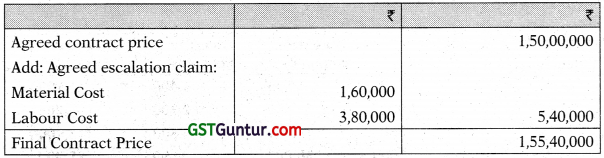

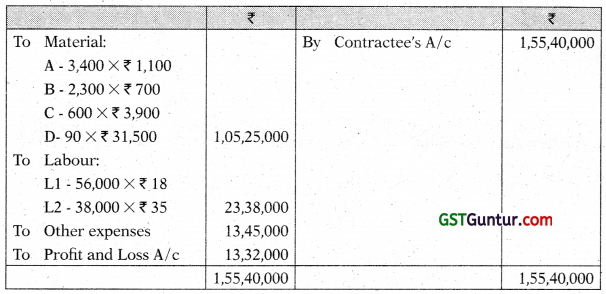

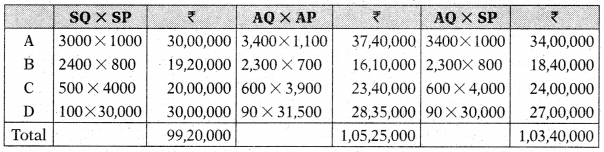

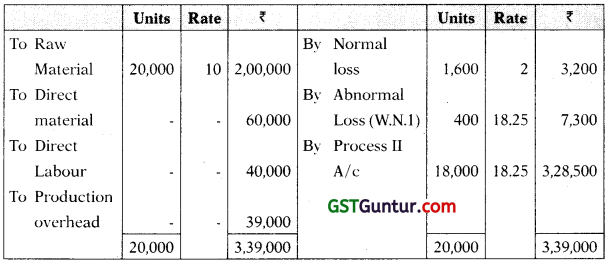

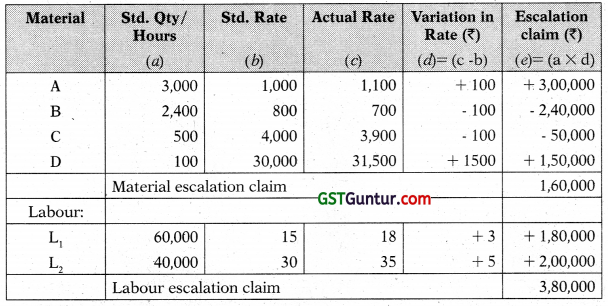

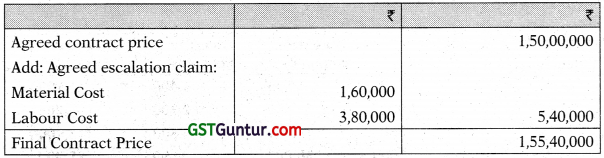

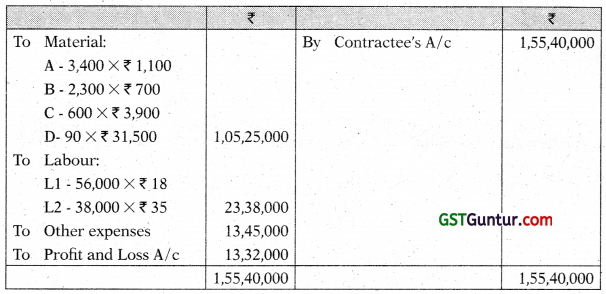

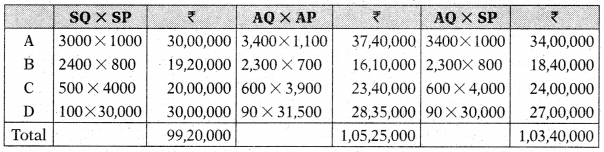

SB Constructions Limited has entered into a big contract at an agreed price of X 1,50,00,000 subject to an escalation clause for material and labour as spent out on the contract and corresponding actuals are as follows:

You are required to:

(i) Give your analysis of admissible escalation claim and determine the final contract price payable.

(ii) Prepare the contract account, if the all expenses other than material and labour related to the contract are ? 13,45,000.

(iii) Calculate the following variances and verify them:

(a) Materia! cost variance

(b) Material price variance

(c) Material usage variance

(d) Labour cost variance

(e) Labour rate variance

(f) Labour efficiency variance [CA Inter May, 2010, 15 Marks]

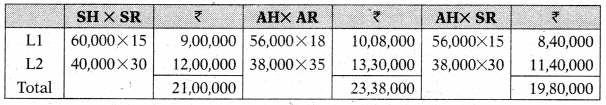

Answer:

(i) Statement showing additional claim due to escalation clause.

Statement showing Final Contract Price

(ii) Contract Account:

(iii) Material Variances:

Material Price Variance (MCV) = (SQ × SP) – (AQ × AP)

= ₹ 99,20,000 – ₹ 1,05,25,000 = ₹ 6,05,000 (AP)

Material Price Variance (MPV) = AQ (SP – AP) or (AQ × SP) – (AQ × AP)

= ₹ 1,03,40,000 – ₹ 1,05,25,000

= ₹ 1,85,000 (A)

Material usage variance (MUV) = (SQ × SP) – (AQ × SP)

= ₹ 99,20,000 – ₹ 1,03,40,000

= ₹ 4,20,000 (A)

Labour Variances

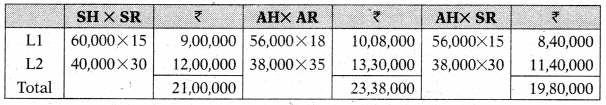

Labour Cost Variance (LCV) = (SH × SR) – (AH × AR)

= ₹ 21,00,000 – ₹ 23,38,000

= ₹ 2,38,000 (A)

Labour Rate Variance (LRV) = (AH × SR) – (AH × AR)

= ₹ 19,80,000 – ₹ 23,38,000

= ₹ 3,58,000 (A)

Labour Rate Variance (LEV) = (SH × SP) – (AH × SP)

= ₹ 21,00,000 – ₹ 19,80,000

= ₹ 1,20,000 (F)