International Trade – CA Inter Economics Study Material is designed strictly as per the latest syllabus and exam pattern.

International Trade – CA Inter Economics Study Material

Theory Questions

Question 1.

List the point of difference between fixed exchange rate and floating exchange rate. (2 Marks May 2018)

Answer:

Difference between Fixed Exchange Rate and floating Exchange Rate

| Fixed Exchange Rate | Floating Exchange Rate |

| Under fixed exchange rate a country’s central bank and/or government announces or decrees what its currency will be worth in terms of either another country’s currency or a basket of currencies or another measure of value, such as gold. | Under floating exchange rate regime, the equilibrium value of the exchange rate of a country’s currency is market- determined ie. the demand for and supply of currency relative to other currencies determine the exchange rate. |

| In order to maintain the exchange rate at the predetermined level, the central bank intervenes in the foreign exchange market. | There is no interference on the part of the government or the central bank of the country in the determination of exchange rate. Any interference in the foreign exchange market on the part of the government or central bank would be only for moderating the rate of change. |

Question 2.

What do you mean by anti-dumping duties ? (2 Marks May 2018)

Answer:

Anti-dumping duty:lt is an extra import duty that a domestic government imposes on foreign imports that it believes are priced below fair market value causing injury to the competing domestic industry. It is a protectionist tariff equal to the difference between the importing country’s FOB price of the goods at the time of their import and the market value of similar goods in the exporting country.

An anti-dumping duty increases the price of imports and brings it closer to the domestic price and prevents injury to domestic industry due to unfair competition.

![]()

Question 3.

Describe deterrents to Foreign Direct Investment (FDI) in the country. (2 Marks May 2018)

Answer:

- Poor macro-economic environment, such as, infrastructure lags, high rates of inflation and continuing instability, balance of payment deficits, exchange rate volatility, unfavourable tax regime including double tax-ation, small size of market and lack of potential for its growth and poor track-record of investments.

- Unfavourable resource and labour market conditions such as poor natural and human resources, rigidity in the labour market, low literacy, low labour skills, language barriers and high rates of industrial disputes.

- Unfavourable legal and regulatory framework such as absence of well-defined property rights, lack of security to life and property, stringent regulations, cumbersome legal formalities and delays, bureaucracy and corruption and political instability.

- Lack of host country trade openness viz. lack of openness, prevalence of non-tariff barriers, lack of a general spirit of friendliness towards foreign investors, lack of facilities for immigration and employment of foreign technical and administrative personnel.

Question 4.

Describe the objectives of World Trade Organization (WTO). (3 Marks May 2018)

Answer:

The main objectives of World Trade Organization (WTO) are:

- to set and enforce rules for international trade,

- to provide a forum for negotiating and monitoring further trade liber-alization,

- to resolve trade disputes,

- to increase the transparency of decision-making processes,

- to cooperate with other major international economic institutions involved in global economic management and

- to help developing countries to get benefit fully from the global trading system

Question 5.

Examine why General Agreement in Tariff & Trade (GATT) lost its relevance. (2 Marks May 2018)

Answer:

Main reasons because of which the GATT lost its relevance are:

- It was obsolete to the fast evolving contemporary complex world trade scenario characterized by emerging globalization,

- International investments had expanded substantially,

- Intellectual property rights and trade in services were not covered by GATT,

- World merchandise trade increased by leaps and bounds and was beyond its scope,

- The ambiguities in the multilateral system could be heavily exploited,

- Efforts at liberalizing agricultural trade were not successful,

- There were inadequacies in institutional structure and dispute settlement system,

- It was not a treaty and therefore terms of GATT were binding only insofar as they are not incoherent with a nation’s domestic rules.

![]()

Question 6.

How do import tariffs affect International Trade? (2 Marks May 2018)

Answer:

Import tariffs affect International Trade in the following way:

- Tariff barriers create obstacles to international trade, decrease the volume of imports and of international trade.

- The prospect of market access of the exporting country is worsened when an importing country imposes a tariff.

- By making imported goods more expensive, tariffs discourage domestic consumption of imported foreign goods and therefore imports are discouraged.

- Tariffs create trade distortions by disregarding comparative advantage and prevent countries from enjoying gains from trade arising from comparative advantage. Thus, tariffs discourage efficient production in the rest of the world and encourage inefficient production in the home country.

Question 7.

The table given below shows the number of labour hours required to produce Sugar and Rice in two countries X and Y:

| Commodity | Country X | Country Y |

| 1 Unit of Sugar | 2.0 | 5.0 |

| 1 unit of Rice | 4.0 | 2.5 |

(a) Compute the Productivity of labour in both countries in respect of both commodities.

(b) Which country has absolute advantage in production of Sugar?

(c) Which country has absolute advantage in production of Rice? (3 Marks Nov 2018)

Answer:

(a) Productivity of labour = Output ÷ Input of labour hours

| Output of commodity | Units in Country X | Units in Country Y |

| Sugar | 0.5 | 0.20 |

| Rice | 0.25 | 0.40 |

(b) A country has an absolute advantage in producing a good over another country if it requires fewer resources to produce that good. Since one hour of labour time produces 0.5 units of sugar in country X against 0.20 units in country Y, Country X has absolute advantage in production of sugar.

(c) Since one hour of labour time produces 0.40 units of rice in country Y against 0.25 units in country X, Country Y has absolute advantage in production of rice.

Question 8.

Explain with example how Ad Valorem Tariff is levied. (3 Marks Nov 2018)

Answer:

Ad Valorem Tariff: It is a duty or other charges levied on an import item on the basis of its value and not on the basis of its quantity, size, weight, or any other factor. It is levied as a constant percentage of the monetary value of one unit of the imported good. For example, a 30% ad valorem tariff on a computer generates ₹ 30,000 government revenue from tariff on each imported computer priced at ₹ 1,00,000 in the world market. If the price of computer rises to ₹ 2,00,000, then it generates a tariff of ₹ 60,000.

![]()

Question 9.

What are the modes of Foreign Direct Investment (FDI)? (3 Marks Nov 2018)

Answer:

Modes of FDI are:

- Opening of a subsidiary or associate company in a foreign country,

- Equity injection into an overseas company,

- Acquiring a controlling interest in an existing foreign company,

- Mergers and acquisitions (M&A),

- Joint venture with a foreign company,

- Green field investment (establishment of a new overseas affiliate for freshly starting production by a parent company).

Question 10.

The Nominal Exchange rate of India is ₹ 56/1$, Price Index in India is 116 and Price Index in USA is 112. What will be the Real Exchange Rate of India? (2 Marks Nov 2018)

Answer:

Domestic Price Index

Real Exchange rate = \(\frac{\text { Domestic Price Index }}{\text { Foreign Price Index }}\)

= 56 × \(\frac{116}{112}\) = 58

Question 11.

“World Trade Organisation (WTO) has a three-tier system of decision making.” Explain. (2 Marks Nov 2018)

Answer:

World Trade Organization three-tier system of decision making: The WTO’s top level decision-making body is the Ministerial Conference which can take decisions on all matters under any of the multilateral trade agreements. The Ministerial Conference meets at least once every two years. The next level is the General Council which meets several times a year at the Geneva headquarters. The General Council also meets as the Trade Policy Review Body and the Dispute Settlement Body.

At the next level, the Goods Council, Services Council and Intellectual Property (TRIPS) Council report to the General Council. These councils are responsible for overseeing the implementation of the WTO agreements in their respective areas of specialisation. The three also have subsidiary bodies. Numerous specialized committees, working groups and working parties deal with the individual agreements.

Question 12.

Explain ‘depreciation’ and ‘appreciation’ of home currency under float-ing exchange rate. (2 Marks May 2019)

Answer:

In case of floating rate system, home currency depreciates when its value falls with respect to the value of another currency or a basket of other currencies i.e. there is an increase in the home currency price of the foreign currency. For example, if the Rupee dollar exchange rate in the month of January is $ 1 = ₹ 75 and ₹ 78 in June, then the Indian Rupee has depreciated in its value with respect to the US dollar and the value of US dollar has appreciated in terms of the Indian Rupee.

On the contrary, home currency appreciates when its value increases with respect to the value of another currency or a basket of other currencies i.e. there is a decrease in the home currency price of foreign currency. For example, if the Rupee dollar exchange rate in the month of January is $ 1 = ₹ 78 and ₹ 75 in June, then the Indian Rupee has appreciated in its value with respect to the US dollar and the value of US dollar has depreciated in terms of the Indian Rupee.

Question 13.

Explain the classical theory of Comparative Advantage as given by David Ricardo. (3 Marks May 2019)

Answer:

Classical theory of Comparative Advantage as given by David Ricardo: A per David Ricardo the law of comparative advantage states that even if one nation is less efficient than (has an absolute disadvantage with respect to) the other nation in the production of both commodities, there is still scope for mutually beneficial trade.

The first nation should specialize in the production and export of the commodity in which its absolute disadvantage is smaller (this is the commodity of its comparative advantage) and import the commodity in which it’s absolute disadvantage is greater (this is the commodity of its com-parative disadvantage).

Labour differs in its productivity internationally and different goods have different labour requirements, so comparative labour productivity advantage was Ricardo’s predictor of trade.

The theory can be explained with a simple example output per hour of Labour

| Commodity | Country A | Country B |

| Wheat (bushels/hour) | 6 | 1 |

| Cloth (yards/hour) | 4 | 2 |

Country B has absolute disadvantage in the production of both wheat and cloth. However, since B’s labour is only half as productive in cloth but six times less productive in wheat compared to country A, country B has a comparative advantage in cloth. On the other hand, country A has an absolute advantage in both wheat and cloth with respect to the country B, but since its absolute advantage is greater in wheat (6:1) than in cloth (4:2), country A has a com-parative advantage in wheat.

According to the law of comparative advantage, both nations can gain if country A specialises in the production of wheat and exports some of it in exchange for country B’s cloth. Simultaneously, country B should specialise in the production of cloth and export some of it in exchange for country A’s wheat.

If country A could exchange 6W for 6C with country B, then, country A would gain 2C (or save one-half hour of labour time) since the country A could only exchange 6W for 4C domestically. The 6W that the country B receives from the country A would require six hours of labour time to produce in country B.

With trade, country B can instead use these six hours to produce 12C and give up only 6C for 6W from the country A. Thus, the country B would gain 6C or save three hours of labour time and country A would gain 2C. However, the gains of both countries are not equal.

Country A would gain if it could exchange 6W for more than 4C from country B; because 6W for 4C is what it can exchange domestically (both require the same one hour labour time). The more C it gets, the greater would be the gain from trade.

Conversely, in country B, 6W = 12C (in the sense that both require 6 hours to produce). Anything less than 12C that country B must give up to obtain 6W from country A represents a gain from trade for country B. To summarize, country A gains to the extent that it can exchange 6W for more than 4C from the country B. Country B gains to the extent that it can give up less than 12C for 6W from the country A. Thus, the range for mutually advantageous trade is 4C < 6W < 12C.

![]()

Question 14.

How does international trade increase economic efficiency? Explain. (3 Marks May 2019)

Answer:

International trade increase economic efficiency in the following ways:

(1) The wider market made possible owing to trade induces companies to reap the quantitative and qualitative benefits of extended division of labour. As a result, they would enlarge their manufacturing capabilities and benefit from economies of large scale production.

(2) The gains from international trade are reinforced by the increased competition that domestic producers are confronted with on account of internationalization of production and marketing requiring businesses to invariably compete against global businesses. Competition from foreign goods compels manufacturers, especially in developing countries, to enhance competitiveness and profitability by adoption of cost reducing technology and business practices.

Efficient deployment of productive resources to their best uses is a direct economic advantage of foreign trade. Greater efficiency in the use of natural, human, industrial and financial resources ensures productivity gains. Since international trade also tends to decrease the likelihood of domestic monopolies, it is always beneficial to the community.

(3) Trade provides access to new markets and new materials and enables sourcing of inputs and components internationally at competitive prices. Also, international trade enables consumers to have access to wider variety of goods and services that would not otherwise be available. It also enables nations to acquire foreign exchange reserves necessary for imports which are crucial for sustaining their economies.

(4) International trade enhances the extent of market and augments the scope for Mechanization and specialisation.

(5) Exports stimulate economic growth by creating jobs, reducing poverty and augmenting factor incomes and in so doing raising standards of livelihood and overall demand for goods and services.

(6) Employment generating investments, including foreign direct investment, inevitably follow trade.

(7) Opening up of new markets results in broadening of productive base and facilitates export diversification.

(8) Trade also contributes to human resource development, facilitates fundamental and applied research and exchange of know-how and best practices between trade partners.

(9) Trade strengthens bonds between nations by bringing citizens of different countries together in mutually beneficial exchanges and thus promotes harmony and cooperation among nations.

Question 15.

What is meant by ‘Mixed tariffs*? (2 Marks May 2019)

Answer:

Mixed tariffs: Mixed tariffs can be expressed either on the basis of the value of the imported goods (an ad valorem rate) or on the basis of a unit of measure of the imported goods (a specific duty) depending on which generates the most income (or least income at times) for the nation. For example, duty on cotton: 5 per cent ad valorem or ₹ 3,000 per tonne, whichever is higher.

![]()

Question 16.

Using suitable diagram, explain, how the nominal exchange rate between two countries is determined? (3 Marks May 2019)

Answer:

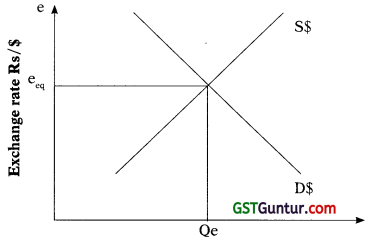

In case of floating exchange rate system, the supply of and demand for foreign exchange in the domestic foreign exchange market determine the external value of the domestic currency, or in other words, a country’s nominal exchange rate. Similar to any standard market, the exchange market also faces a downward-sloping demand curve and an upward-sloping supply curve.

Determination of Nominal Exchange Rate

The equilibrium rate of exchange is determined by the interaction of the supply and demand for a particular foreign currency. In the figure above, the demand curve (D$) and supply curve (S$) of dollars intersect to determine equilibrium exchange rate eeq with Qe as the equilibrium quantity of dollars exchanged.

Question 17.

Distinguish between Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI). ‘ (2 Marks May 2019)

Answer:

Difference between Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI)

| Foreign direct investment {FDI) | Foreign portfolio investment (FPI) |

| Investment involves creation of physical assets. | Investment is only in financial assets |

| Has a long term interest and therefore remain invested for long. | Only short term interest and generally remain invested for short periods. |

| Relatively difficult to withdraw. | Relatively easy to withdraw. |

| Not inclined to be speculative. | Speculative in nature. |

| Often accompanied by technology transfer. | Not accompanied by technology transfer. |

| Direct impact on employment of labour and wages. | No direct impact on employment of labour and wages. |

| Enduring interest in management and control. | No abiding interest in management and control. |

| Securities are held with significant degree of influence by the investor on the management of the enterprise. | Securities are held purely as a financial investment and no significant degree of influence on the management of the enterprise. |

Question 18.

Explain the term ‘Real Exchange Rate’. (2 Marks Nov 2019)

Answer:

Real Exchange Rate (RER): The Real Exchange Rate refers to the relative price of the consumption baskets of two countries, i e. it describes ‘how many’ of a good or service in one country can be traded for ‘one’ of that good or service in a foreign country. Unlike nominal exchange rate which assumes constant prices of goods and services, the real exchange rate incorporates changes in prices.

The real exchange rate therefore is the exchange rate times the relative prices of a market basket of goods in the two countries and is calculated as:

Real exchange rate = Nominal exchange rate × \(\frac{\text { Domestic Price Index }}{\text { Foreign Price Index }}\)

![]()

Question 19.

Explain the key features of modern theory of international trade. (3 Marks Nov 2019, Nov 2020)

Answer:

Modern theory or Heckscher-Ohlin theory: The Heckscher-Ohlin theory of trade, also referred to as Factor-Endowment Theory of Trade or Modern Theory of Trade, emphasises the role of a country’s factor endowments in explaining the basis for its trade. ‘Factor endowment’ refers to the overall availability of usable resources including both natural and man-made means of production.

If two countries have different factor endowments under identical production function and identical preferences, then the difference in factor endowment results in two countries having different factor prices and different cost func-tions. In this model a country’s advantage in production arises solely from its relative factor abundance.

Thus, comparative advantage in cost of production is explained exclusively by the differences in factor endowments of the nations.

According to this theory, international trade is but a special case of inter-regional trade. Different regions have different factor endowments, that is, some regions have abundance of labour, but scarcity of capital; whereas other regions have abundance of capital, but scarcity of labour. Thus, each region is suitable for the production of those goods for whose production it has relatively plentiful supply of the requisite factors.

The theory states that a’country’s exports depend on its resources endowment ie. whether the country is capital-abundant or labour-abundant. A country which is capital-abundant will export capital-in-tensive goods. Likewise, the country which is labour-abundant will export labour-intensive goods.

The Heckscher-Ohlin Trade Theorem establishes that a country tends to spe-cialize in the export of a commodity whose production requires intensive use of its abundant resources and imports a commodity whose production requires intensive use of its scarce resources.

The Factor-Price Equalization Theorem which is a corollary to the Heckscher-Ohlin trade theory states that in the absence of foreign trade, it is quite likely that factor prices are different in different countries. International trade equalizes the absolute and relative returns to homogeneous factors of production and their prices.

This implies that the wages and rents will converge across the countries with free trade, or in other words, trade in goods is a perfect substitute for trade in factors. The Heckscher-Ohlin theorem thus postulates that foreign trade eliminates the factor price differentials.

Question 20.

The price index for exports of Bangladesh In the year 2018-19 (based on 2010-11) was 233.78 and the price index for imports of it was 220.50 (based on 2010-11):

(i) What do these figures mean?

(ii) Calculate the index of terms of trade for Bangladesh.

(iii) How would you interpret the index of terms of trade for Bangladesh? (5 Marks Nov 2019)

Answer:

(i) The figures represent foreign trade price indices which are compiled using prices of specified group of commodities exported from and imported by Bangladesh in the year 2018-19. Both indices have a base year of 2010-11 (=100) and the price changes are measured in relation to that figure.

In the current year, the import price index of 220.50 indicates that there has been a 120.50 per cent increase in price since 2010-11 and export price index shows that there is 133.73 per cent increase in export prices. These indices track the changes in the price which firms and countries receive/pay for products they export/import and can be used for assessing the impact of international trade on the domestic economy.

(ii) Terms of trade for Bangladesh (ToT) is given by:

Terms of Trade \(=\frac{\text { Price Index of Bangladesh export }}{\text { Price Index Bangladesh import }}\) × 100

= \(\frac{233.73}{220.5}\) × 100 = 106

(iii) ‘Terms of trade’ is defined as the ratio between the index of export prices and the index of import prices. It is the relative price of a country’s exports in terms of its imports and can be interpreted as the amount of import goods an economy can purchase per unit of export goods. If the export prices increase more than the import prices, a country has positive terms of trade, because for the same amount of exports, it can purchase more imports.

In the given problem, with a ToT of 106, a unit of exports by Bangladesh will buy six per cent more of imports. In other words, from the sale of home produced goods at higher export prices and the purchase of foreign produced goods at lower prices, trade will result in Bangladesh obtaining a greater volume of imported products for a given volume of the exported product. This indicates increased welfare for Bangladesh.

![]()

Question 21.

How does the WTO agreement ensure market access? (2 Marks Nov 2019)

Answer:

Major points of the WTO agreement aims to increase world trade by en-hancing market access are:

(1) The agreement specifies the conduct of trade without discrimination. The Most-favoured-nation (MFN) principle holds that if a country lowers a trade barrier or opens up a market, it has to do so for the same goods or services from all other WTO members.

(2) The National Treatment Principle requires that a country should not discriminate between its own and foreign products, services or nationals. With respect to internal taxes, internal laws, etc. applied to imports, treatment not less favourable than that which is accorded to like domestic products must be accorded to all other members.

(3) The principle of general prohibition of quantitative restrictions.

(4) By converting all non- tariff barriers into tariffs which are subject to country specific limits.

(5) The imposition of tariffs should be only legitimate measures for the protection of domestic industries, and tariff rates for individual items are being gradually reduced through negotiations ‘on a reciprocal and mutually advantageous’ basis.

(6) In major multilateral agreements like the Agreement on Agriculture (AOA), specific targets have been specified for ensuring market access.

Question 22.

What is meant by ‘Bound tariff? (2 Marks Nov 2019)

Answer:

Bound tariff: It is a tariff which a WTO member binds itself with a legal commitment not to raise it above a certain level. By binding a tariff, often during negotiations, the members agree to limit their right to set tariff levels beyond a certain level. The bound rates are specific to individual products and represent the maximum level of import duty that can be levied on a product imported by that member.

A member is always free to impose a tariff that is lower than the bound level. Once bound, a tariff rate becomes permanent and a member can only increase its level after negotiating with its trading partners and compensating them for possible losses of trade. A bound tariff ensures transparency and predictability in trade.

![]()

Question 23.

Discuss the guiding principle of WTO in relation to trade without dis-crimination. (2 Marks Nov 2020)

Answer:

The guiding principle of WTO in respect of trade without discrimination are:

(1) Most Favoured Nation (MFN) principle: This principle holds that the member countries cannot normally discriminate among their trading partners. Each member treats all the other members equally as “most-favoured” trading partners. If a country grants a special advantage, favour, privilege or immunity to one (such as lowering of customs duty or opening up of market), it has to unconditionally extend the same treatment to all the other WTO members.

(2) The National Treatment Principle (NTP): It mandates that when goods are imported, the imported goods and the locally produced goods and services should be treated equally in respect of internal taxes and internal laws. A member country should not discriminate between its own and foreign products, services or nationals. For instance, once imported apples reach Indian market, they cannot be discriminated against and should be treated at par in respect of marketing opportunities, product visibility or any other aspect with locally produced apples.

Question 24.

Following exchange rate quotations are available for different periods:

(1) The spot exchange rate changes from ₹ 65 per $ to ₹ 68 per $.

(2) The spot exchange rate changes from $ 0.0125 per rupee to $ 0.01625 per rupee.

Required:

(a) Identify the nature of rate quotations in (1) and (2) above.

(b) Identify the base currency and counter currency in (1) and (2) above.

(c) What are possible consequences on exports and imports of (1) and (2) above. (3 Marks Nov 2020)

Answer:

(a) The nature of rate quotations in (1) and (2):

In an exchange rate, two currencies are involved. There are two ways to express nominal exchange rate between two currencies (here US $ and Indian Rupee) namely direct quote and indirect quote.

The nature of rate quotation in [(1) ₹ 65/per $] is direct quote, (also called European Currency Quotation). The exchange rate is quoted in terms of the number of units of a local currency exchangeable for one unit of a foreign currency. For example, 65/US$ means that an amount of 65 is needed to buy one US dollar or 65 will be received while selling one US dollar.

An indirect quote is presented in [(2) $ 0.0125 per Rupee] of the question. In an indirect quote, (also known as American Currency Quotation), the exchange rate is quoted in terms of the number of units of a foreign currency exchangeable for one unit of local currency; for example: $ 0.0125 per rupee. In an indirect quote, domestic currency is the commodity which is being bought and sold.

(b) The base currency and counter currency in (1) and (2):

An exchange rate has two currency components; a ‘base currency’ and a ‘counter currency’. The currency in the numerator always states ‘how much of that currency is required for one unit of the base currency’.

(i) In a direct quotation [in (1) ₹ 65/per $], the foreign currency is the base currency and the domestic currency is the counter currency. So in the given question, US dollar is the base currency and Indian Rupee is the counter currency.

(ii) In an indirect quotation, [in (2) $ 0.0125 per Rupee], the domestic currency is the base currency and the foreign currency is the counter currency. So in the given question, Indian Rupee is the base currency and US dollar is the counter currency.

![]()

(c) The possible consequences on exports and imports of (1) and (2):

When the spot exchange rate changes from ₹ 65/per $ to ₹ 68/per $, it indicates that a person has to exchange a greater amount of Indian Rupees (68) to get the same 1 unit of US dollar. The rupee has become less valuable with respect to the U.S. dollar or Indian Rupee has depreciated in its value. Simultaneously, the dollar has appreciated.

Consequence on exports and imports of (1): Other things remaining the same, when a country’s currency depreciates, foreigners find that its exports are cheaper and the quantity demanded of its export goods will increase. For example a foreigner who spends ten dollars on buying Indian goods will, get goods worth ₹ 680 instead of ₹ 650 prior to depreciation.

On the other hand, the domestic residents find that imports from abroad are more expensive. A resident of India, who wants to import goods worth $1 will have to pay ₹ 68/- instead of ₹ 65/- prior to depreciation. Imports will be discouraged as importers will have to pay more rupees per dollar for importing products.

In short, depreciation of domestic currency lowers the relative price of a country’s exports and raises the relative price of its imports.

Consequence on exports and imports of (2): In this case, Rupee has ap-preciated and dollar has depreciated. Earlier, $ 1.25 would fetch export goods worth ₹ 100/- from India; but after the change $16.25 would be necessary to buy the same amount of goods. Other things remaining the same, when a country’s currency appreciates, it raises the relative price of its exports and lowers the relative price of its imports. In other words, foreigners find their imports from that country (exports from India in the above case) costlier. Therefore quantity demanded of export goods would decrease.

On the other hand, the domestic residents find that imports from abroad are cheaper. Therefore, we may expect an increase in the quantity of imports.

Question 25.

Explain the concept of soft peg and hard peg exchange rate policies. (2 Marks Nov 2020)

Answer:

Soft peg: It refers to an exchange rate policy under which the exchange rate is generally determined by the market, but in case the exchange rate tends to move speedily in one direction, the central bank will intervene in the market.

Hard peg: In case of a hard peg exchange rate policy, the central bank sets a fixed and unchanging value for the exchange rate. Both soft peg and hard peg policy require that the central bank intervenes in the foreign exchange market.

![]()

Question 26.

In which sectors Foreign Investment is prohibited in India? (2 Marks Nov 2020)

Answer:

In India, foreign investment is prohibited in the following sectors:

- Lottery business including Government/private lottery, online lotteries, etc.

- Gambling and betting including casinos etc.

- Chit funds,

- Nidhi company,

- Trading in Transferable Development Rights (TDRs),

- Real Estate Business or Construction of Farm Houses,

- Manufacturing of cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes,

- Activities/sectors not open to private sector investment e.g. atomic energy and railway operations (other than permitted activities).

- Foreign technology collaboration in any form including licensing for franchise, trademark, brand name, management contract is also prohibited for lottery business and gambling and betting activities.

Question 27.

What is meant by ‘Countervailing Duties’?. (2 Marks Nov 2020)

Answer:

Countervailing duties: Countervailing duties are tariffs imposed by an importing country with the aim of off-setting the artificially low prices charged by exporters who enjoy export subsidies and tax concessions offered by the governments in their home country.

If a foreign country does not have a com-parative advantage in a particular product and a government subsidy allows the foreign firm to artificially reduce the export price and be an exporter of the product, then the subsidy generates a distortion from the free-trade allocation of resources.

In such cases, CVD is charged by an importing country to negate such advantage that exporters get from subsidies. This is done to ensure fair and market-oriented pricing of imported products and thereby protecting domestic industries and firms.

Question 28.

Distinguish between ‘direct quote’ and ‘indirect quote’ with reference to express nominal exchange rate between two currencies. (2 Marks Jan 2021)

Answer:

Direct quote: A direct quote is the number of units of a local currency exchangeable for one unit of a foreign currency. The price of 1 dollar may be quoted in terms of how much rupees it takes to buy one dollar.

Indirect quote: An indirect quote is the number of units of a foreign currency exchangeable for one unit of local currency. A quotation in direct form can easily be converted into a quotation in indirect form and vice versa. This is done by taking the reciprocal of the given rate.

Question 29.

Describe the advantages of Floating Exchange Rate. (3 Marks Jan 2021)

Answer:

Advantage of floating exchange rate are:

- A floating exchange rate has the greatest advantage of allowing a Central bank and/or government to persue its own monetary policy.

- Floating exchange rate regime allows exchange rate to be used as a policy tool: for example, policy makers can adjust the nominal exchange rate to influence the competitiveness of the tradable goods sector.

- As there is no obligation or necessary to intervene in the currency markets, the Central bank is not required to maintain a huge foreign exchange reserves.

![]()

Question 30.

Describe the purposes of Trade Barriers in international trade. (2 Marks Jan 2021)

Answer:

Purpose of trade barriers in international trade: Over the past decades significant transformation arc happening in terms of growth as well as trends ol Hows and pattern of global trade. The increasing importance of developing countries has been a salient feature of the shifting global trade patterns. Funda-mental changes are taking place in the way countries associate themselves for International trade and investments.

Trading through regional arrangements which foster closer trade and economic relations is shaping the global trade landscape in an unprecedented way. Trade barriers create obstacles to trade, reduce the prospect of market access, make imported goods more expensive, increase consumption of domestic goods, protect domestic industries, and increase government revenue.

Question 31.

You are given the following information:

| Good M (Mobile Phones) | India (in $) | Japan (in $) | China (in $) |

| Average Cost | 70.5 | 69.4 | 70.9 |

| Price per unit for domestic sales | 71.2 | 71.10 | 70.9 |

| Price charged in Dubai | 71.9 | 70.6 | 70.6 |

(A) Which of the three exporters are engaged in anti-competitive act in the international market while pricing its export of mobile phones to Dubai?

(B) What would be the effect of such pricing on domestic producers of mobile phones? (3 Marks Jan 2021)

Answer:

China and Japan are engaged in anti-competitive act in the international market while pricing its export of mobile phones to Dubai. Both China and Japan are selling at a price which is less than price per unit for domestic sales. The effect of such pricing will be having adverse effect on domestic industry as they will lose competitiveness in their domestic market due to unfair practice of dumping.

Dubai may prove damage to domestic industries and change anti-dumping duties on goods imported from Japan and China so as to raise the price and making it at par with similar goods produced by domestic firms.

![]()

Question 32.

Describe the benefits and costs of FDI to the host country.

Answer:

Advantages of Foreign Direct Investment to the host country are:

- Entry of foreign enterprises fosters competition and generates a competitive environment in the host country.

- International capital allows countries to finance more investment than can be supported by domestic savings.

- FDI can accelerate growth by providing much needed capital, technological know-how and management skill.

- Competition for FDI among national government promotes political and structural reforms.

- FDI also help in creating direct employment opportunities.

- It also promotes relatively higher wages for skilled jobs.

- FDI generally entails people to people relations and is usually considered as a promoter of bilateral and international relations.

- Foreign investment projects also would act as a source of new tax revenue which can be used for development projects.

Costs of Foreign Direct Investment to the host country are:

- FDI are likely to concentrate on capital intensive methods of production and services so they need to hire few workers.

- FDI flows has tendency to move towards regions which is well endowed in natural resources and infrastructure so accentuate regional disparity.

- If foreign corporations are able to secure incentives in the form of tax holidays or similar provisions, the host country loses tax revenue.

- FDI is also held responsible by many for ruthless exploitation of natural resources and the possible environmental damage.

- With substantial FDI in developing countries there is strong possibility of emergence of a dual economy with a developed foreign sector and an underdeveloped domestic sector.

- Foreign entities are usually accused of being anti-ethical as they frequently resort to methods like aggregate advertising and anti-competitive practices which would induce market distortions.

Important Questions

Question 1.

Countries Rose Land and Daisy land have a total of 4,000 hours each of labour available each day to produce shirts and trousers. Both countries use equal number of hours on each good each day. Rose Land produces 800 shirts and 500 trousers per day. Daisy land produces 500 shirts and 250 trousers per day.

In the absence of trade:

1. Which country has absolute advantage in producing

(a) Shirts,

(b) Trousers. –

2. Which country has comparative advantage in producing

(a) Shirts,

(b) Trousers.

Answer:

1. Calculation of absolute advantage:

Goods produced by each country:

| Country | Shirts | Trousers |

| Rose Land | 800 | 500 |

| Daisy Land | 500 ‘ | 250 |

Each country has 4,000 hours of labour and uses 2,000 hours each for both the goods. Therefore, the number of hours spent per unit on each good:

| Country | Shirts | Trousers |

| Rose Land | 2.5 | 4 |

| Daisy Land | 4 | 8 |

Since Rose Land produces both goods in less time, it has absolute ad-vantage in both shirts and trousers.

2. Calculation of comparative advantage:

Rose Land:

Opportunity cost of Shirts = 2.5/4 = 0.625 trousers

Opportunity cost of Trousers = 4/2.5 = 1.6 shirts

Daisy Land:

Opportunity cost of Shirts = 4/8 = 0.5 trousers

Opportunity cost of Trousers = 8/4 = 2 shirts

For producing shirts Daisy Land has comparative advantage and for producing Trousers Rose Land has comparative advantage.

![]()

Question 2.

(a) Labour group in your country oppose the flow of FDI into the country on grounds of perceived inequities consequent on FDI. What are their arguments?

(b) Beth & Sushi! are members of the committee for resolution of the issue cited above. What arguments would they put forth to convince the labour groups with respect to welfare implications for labour that may arise from FDI?

Answer:

(a) Foreign corporates concentrate on capital-intensive methods of pro-duction – so they need to hire only relatively few workers, technology inap-propriate for a labour-abundant country – does not support generation of jobs or address poverty and unemployment help accentuate the already existing income inequalities- jobs that require expertise and entrepreneurial skills for creative decision making may generally be retained in the home country and therefore the host country is left with routine management jobs that demand only lower levels of skills and ability.

The argument of possible human resource development and acquisition of new innovative skills through FDI may not be realized in reality- may resort to anti-ethical, and anti-competitive practices- ‘off -shoring’, or shifting jobs – negative effects on employment potential of home country- continuance of lower labour or environmental standards and ruthless labour and natural resources exploitation.

(b) FDI will – accelerate growth and foster economic development – bring in technological know-how, management skills and marketing methods- generate direct employment in the recipient country. Subsequent FDI as well as domestic investments propelled in the downstream and upstream projects that come up in multitude of other services generate multiplier effects on employment and income – generate indirect employment opportunities – promote relatively higher wages for skilled jobs- more indirect employment will be generated to persons in the lower-end services sector occupations thereby catering to an extent even to the less educated and unskilled engaged in those units.

Better work culture and higher productivity standards- induce productivity related awareness and may also contribute to overall human resources development.