Consolidated Financial Statements – CA Inter Advanced Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Consolidated Financial Statements – CA Inter Advanced Accounting Study Material

Question 1.

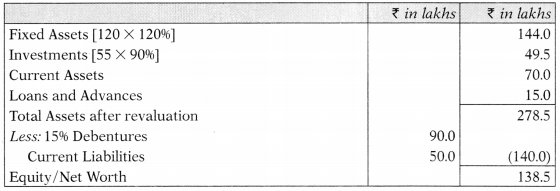

E Ltd. acquires 70% of equity shares of Z Ltd. as on 31st March, 2017 at a cost of ₹ 70 lakhs. The following information is available from the balance sheet of Z Ltd. as on 31st March, 2017:

| ₹ in lakhs | |

| Fixed Assets | 120 |

| Investments | 55 |

| Current Assets | 70 |

| Loans & Advances | 15 |

| 15% Debentures | 90 |

| Current Liabilities | 50 |

The following revaluations have been agreed upon (not included in the above figures):

Fixed Assets Up by 20%

Investments Down by 10%

Z Ltd. declared and paid dividend @ 20% on its equity shares as on 31st March, 2017. E Ltd. purchased the shares of Zed Ltd. @ ₹ 20 per share.

Calculate the amount of goodwill/capital reserve on acquisition of shares of Z Ltd.

Answer:

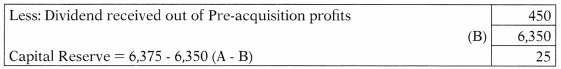

Revalued net assets of Z Ltd. as on 31st March, 2017

W Note :

Total Cost of 70% Equity of Z Ltd. ₹ 70 lakhs

÷ Purchase Price of each share ₹ 20

⇒ Number of shares purchased [70 lakhs/₹ 20] 3.5 lakhs

Dividend @ 20 % ie. ₹ 2 per share ₹ 7 lakhs

Also, dividend received is for pre-acquisition period, which has been reduced from the cost of investment as per AS-13.

Question 2.

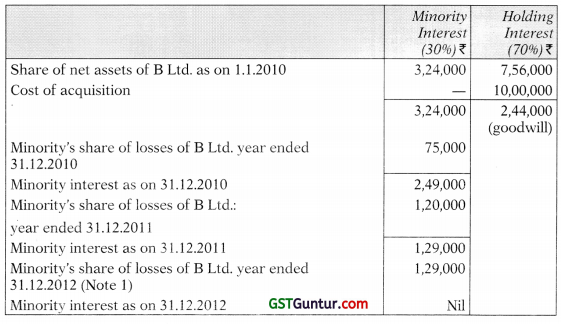

A Ltd. acquired 70% of equity shares of B Ltd. as on 1st January, 2010 at a cost of ₹ 10,00,000 when B Ltd. had an equity share capital of ₹ 10,00,000 and reserves and surplus of ₹ 80,000. Both the companies follow calendar year as the accounting year. In the four consecutive years, B Ltd. fared badly and suffered losses of ₹ 2,50,000,4,00,000, ₹ 5,00,000 and ₹ 1,20,000 respectively. Thereafter in 2014, B Ltd. experienced turnaround and registered an annual profit of ₹ 50,000. In the next two years i.e. 2015 and 2016, B Ltd. recorded annual profits of ₹ 1,00,000 and ₹ 1,50,000 respectively.

Show the minority interests and cost of control at the end of each year for the purpose of consolidation.

Answer:

Note 1. In the year 2012, the minority’s share of losses actually comes to ₹ 1,50,000. But since minority interest as on 31.12.2011 was less than the share of loss, the excess of loss of ₹ 21,000 is to be added to A Ltd.’s share of losses.

Note 2: For the year 2013, the entire loss of B Ltd. is to be adjusted against A Ltd.’s profits for the purpose of consolidation. Therefore, upto 2013, the minority’s share of B Ltd.’s losses of ₹ 57,000 are to be borne by A Ltd. Thereafter, the entire profits of B Ltd. will be allocated to A Ltd. unless the minority’s share of losses previously absorbed 57,000) has been recovered. Such recovery is fully made in 2016 and therefore minority interest of ₹ 33,000 is shown after adjusting fully the share of losses of minority previously absorbed by A Ltd.

![]()

Question 3.

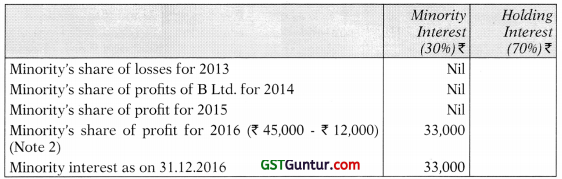

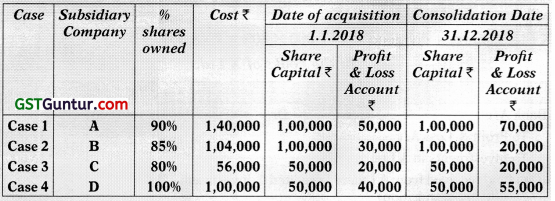

From the following data, determine the amount of holding company’s profit in the consolidated Balance Sheet assuming holding company’s own Profit & Loss Account to be ₹ 2,00,000 in each case:

Answer:

The balance in the Profit & Loss Account on the date of acquisition (1.1.2018) is Capital profit, as such the balance of Consolidated Profit & Loss Account shall be equal to Holding Co.’s profit.

On 31.12.2018 in each case the following amount shall be added or deducted from the balance of holding Co.’s Profit & Loss account.

| % Share holding (1) |

P & L as on 31.12.2018 (2) |

P & L as on consolidation date (3) |

P & L post acquisition (3 – 2) = 4 |

Amount to be added/ (deducted) from holding’s P & L (4 X 1) |

|

| 1 | 90% | 50,000 | 70,000 | 20,000 | 18,000 |

| 2 | 85% | 30,000 | 20,000 | (10,000) | (8,500) |

| 3 | 8096 | 20,000 | 20,000 | Nil | Nil |

| 4 | 100% | 40,000 | 55,000 | 15,000 | 15,000 |

Question 4.

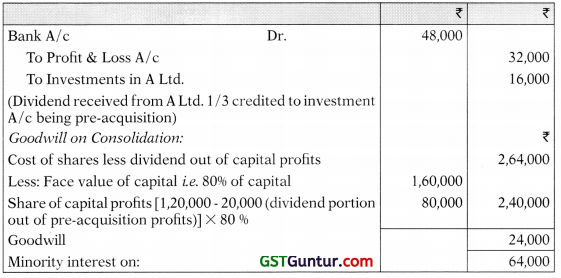

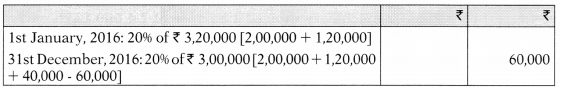

X Ltd. purchased 80% shares of A Ltd. on 1st January, 2016 for ₹ 2,80,000. The issued capital of A Ltd., on 1st January, 2016 was ₹ 2,00,000 and the balance in the Profit & Loss Account was ₹ 1,20,000.

During the year ended 31 st December, 2016, A Ltd. earned a profit of ₹ 40,000 and at year end, declared and paid a dividend of ₹ 60,000.

Show by an entry how the dividend should be recorded in the books of X Ltd.

You are required to compute amount of minority interest as on 1st January, 2016 and 31st December, 2016?

Answer:

Total dividend paid = ₹ 60,000

Out of post-acquisition profit = ₹ 40,000

Out of pre-acquisition profit = ₹ 20,000

Hence, 2/3rd of dividend received by X will be credited to P & L and l/3rd will be credited to Investment.

X Ltd.’s share of dividend = ₹ 60,000 × 80% = ₹ 48,000

In the books of X Ltd.

![]()

Question 5.

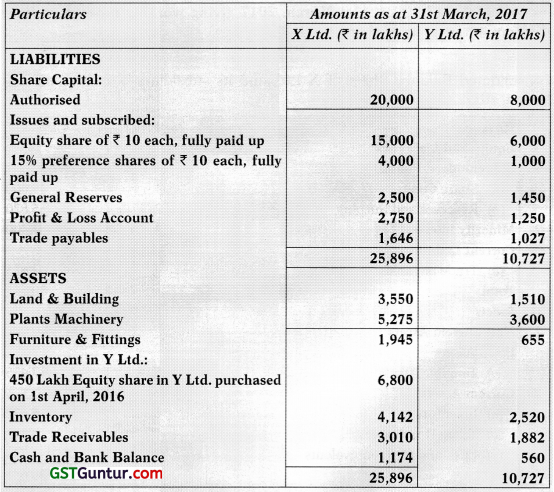

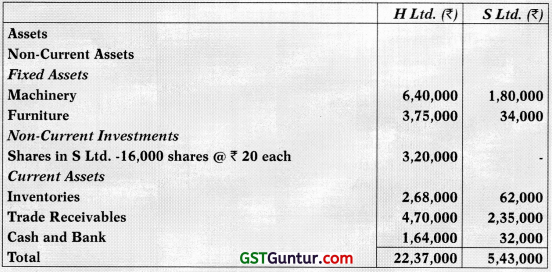

The Summarised Balance Sheet of X Ltd. and its subsidiary Y Ltd. as on 31st March, 2017 areas follows:

The following information is also given to you

(a) 10% dividend on Equity shares was declared by Y Ltd. on 31st March, 2016 for the year ended 31st March, 2016. X Ltd. credited the dividend received to its Profit & Loss Account.

(b) Credit Balance of Profit & Loss account of Y Ltd. as on 1st April, 2016 was ₹ 650 Lakhs.

(c) General Reserve of Y Ltd. stood at same ₹ 1,450 Lakhs as on 1st April, 2016.

(d) Y Ltd.’s Plant & machinery showed a balance of ₹ 4,000 Lakh on 1st April 2016. At the time of purchase of shares in Y Ltd., X Ltd. revalued Y’s Ltd. Plant & Machinery upward by ₹ 1,000 Lakh.

(e) Included in Trade Payables of Y Ltd. are ₹ 50 Lakh for goods supplied by X Ltd.

(f) On 31st March, 2017, Y’s Ltd. inventory included goods for ₹ 150 lakhs which it had purchased from X Ltd. X Ltd. sold goods to Y Ltd. at cost plus 25%.

You are required to prepare a Consolidated Balance Sheet of X Ltd. and its subsidiary Y Ltd. as on 31st March, 2017 giving working notes. (Ignoring dividend on preference shares).

Answer:

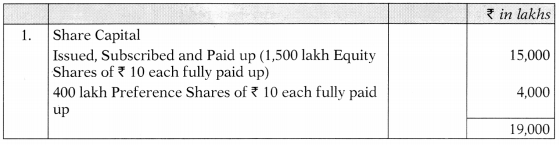

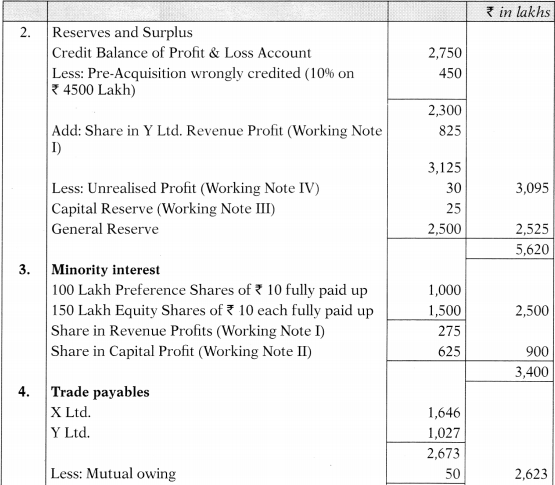

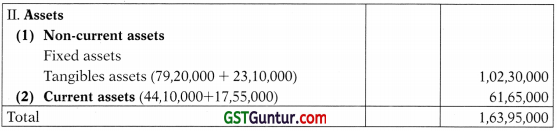

Consolidated Balance Sheet of X Ltd. and its subsidiary Y Ltd. as on 31st March, 2017.

Notes to Accounts

Working Notes

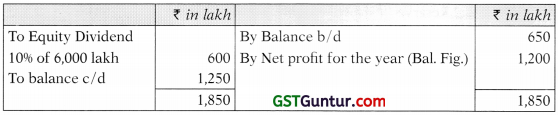

(i) Calculation of Post-Acquisition Profits

Y’s Ltd. Profit & Loss Account

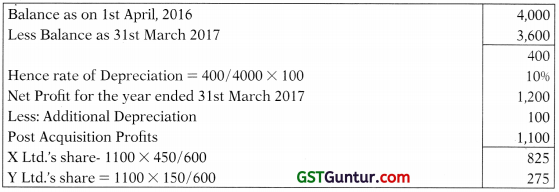

Depreciation provided on Plant & Machinery

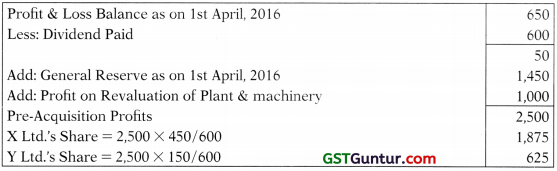

(ii) Calculation of Pre – Acquisition Profits

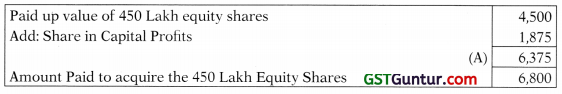

(iii) Calculation of Capital Reserve

(iv) Unrealised Profit

₹ 150 Lakh × 25/125 = 30 lakh

(v) Plant & Machinery of YLtd.

![]()

Question 6.

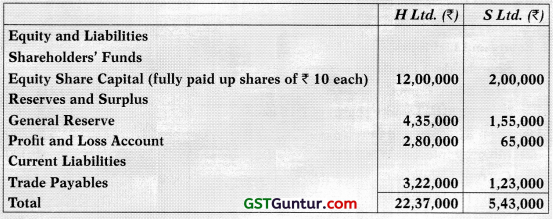

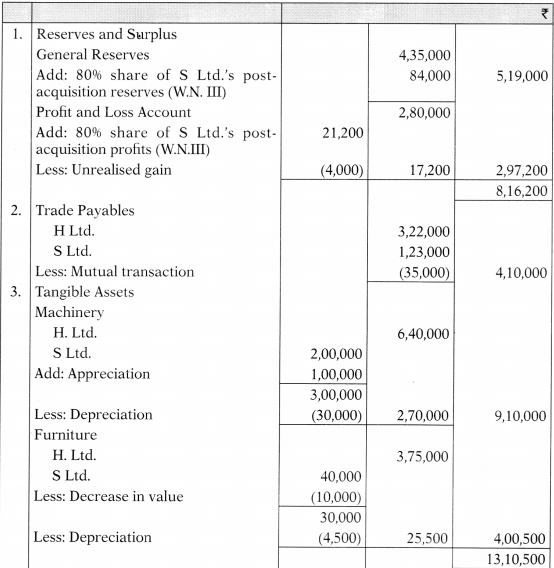

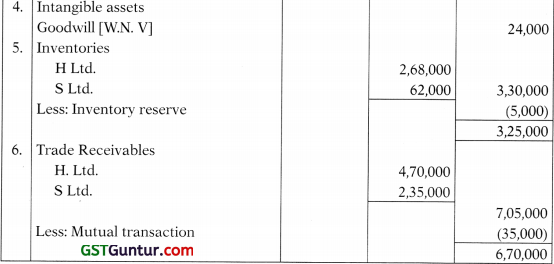

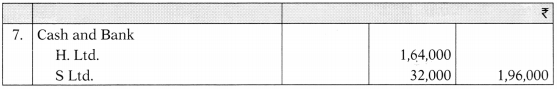

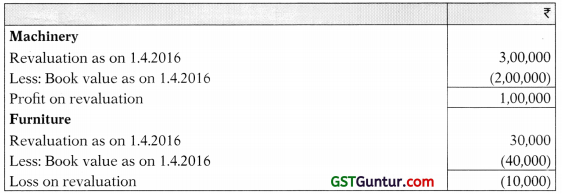

The following summarised Balance Sheets of H Ltd. and its subsidiary S Ltd. were prepared as on 31st March, 2017:

H Ltd. acquired the 80% shares of S. Ltd. on 1st April, 2016. On the date of acquisition, General Reserve and Profit Loss Account of S Ltd. stood at ₹ 50,000 and ₹ 30,000 respectively.

Machinery (hook value ₹ 2,00,000) and Furniture (book value ₹ 40,000) of S Ltd. were revalued at ₹ 3,00,000 and ? 30,000 respectively on 1 st April, 2016 for the purpose of fixing the price of its shares (rates of depreciation computed on the basis of useful lives: Machinery 10% and Furniture 15%). Trade Payables of H Ltd. include ?

35,000 due to S Ltd. for goods supplied since the acquisition of the shares. These goods are charged at 10% above cost. The inventories of H Ltd. includes goods costing ₹ 55,000 purchased from S Ltd.

You are required to prepare the Consolidated Balance Sheet as at 31st March, 2017. (May 2018 – New Course) (20 Marks)

Answer:

Consolidated Balance Sheet of H Ltd. and its Subsidiary S Ltd. as at 31st March, 2017

Notes to Accounts

Working Notes:

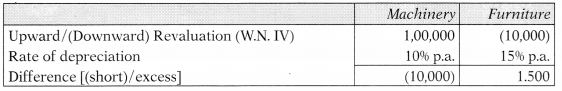

I. Profit or loss on revaluation of assets

II. Calculation of short/excess depreciation

III. Analysis of profits of S Ltd. as on 31.03.2017

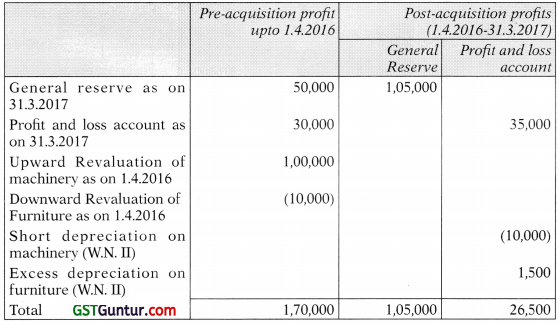

IV. Minority Interest

V Cost of Controls Goodwill

![]()

Question 7.

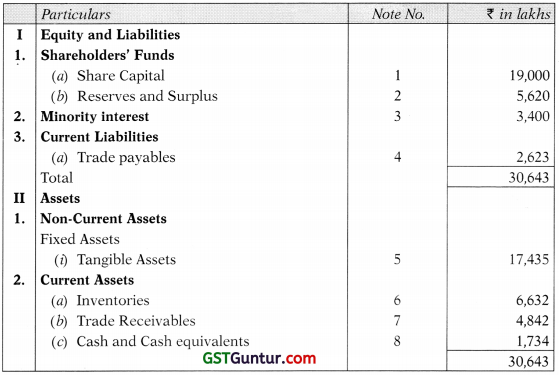

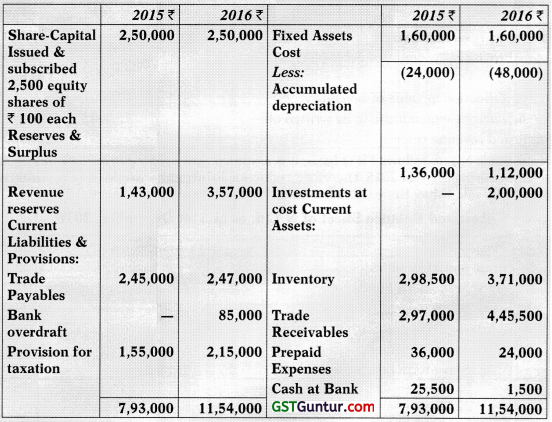

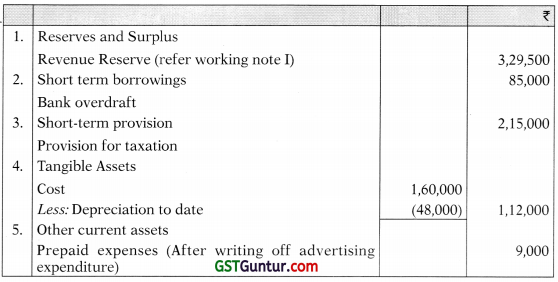

Consider the following summarized balance sheets of subsidiary N Ltd.:

Also consider the following information:

- N Ltd. is a subsidiary of S Ltd. Both the companies follow calendar year as the accounting year.

- S Ltd. values inventory on LIFO basis while N Ltd. used FIFO basis. To bring N Ltd.’s values in line with those of S Ltd. its value of inventory is required to be reduced by ₹ 6,000 at the end of 2015 and ₹ 17,000 at the end of 2016.

- N Ltd. deducts 1 % from Trade Receivables as a general provision against doubtful debts.

- Prepaid expenses in N Ltd. include advertising expenditure carried forward of ₹ 30,000 in 2015 and ₹ 15,000 in 2016, being part of initial advertising expenditure of ₹ 45,000 in 2015 which is being written off over three years. Similar amount of advertising expenditure of S Ltd. has been fully written off in 2015.

You are required to restate the balance sheet of N Ltd. as on 31st December,

2016 after considering the above information, for the purpose of consolidation.

Make the necessary restatement which is necessary to make the accounting

policies adopted by S Ltd. and N Ltd. uniform.

Answer:

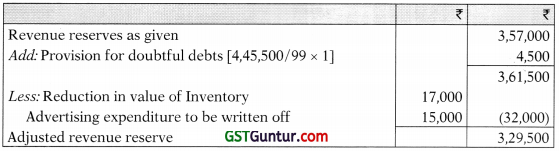

Working Note I

Computation of Adjusted revenue reserves of N Ltd.

Note: Since N Ltd. follows FIFO basis, it is assumed that opening inventory has been sold out during the year 2015. Therefore, reduction in inventory would have been taken care of by sale value. Hence no adjustment has been made for the same.

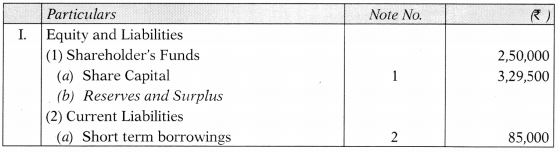

Restated Balance Sheet of N Ltd. as at 31st December, 2016

Notes to Accounts

![]()

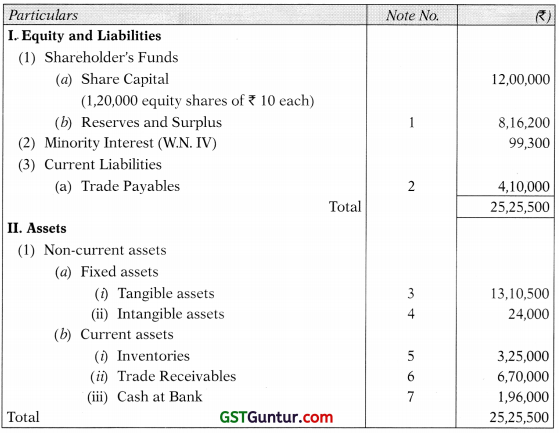

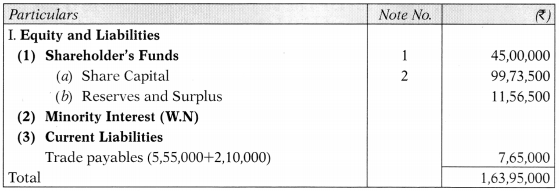

Question 8.

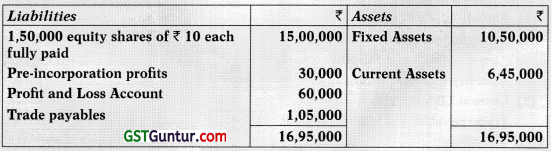

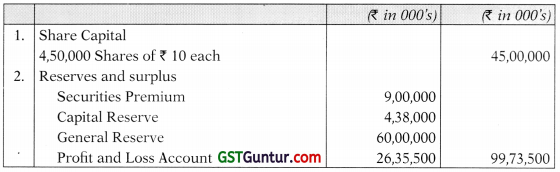

On 31st March, 2011, P Ltd. acquired 1,05,000 shares of Q Ltd. for ₹ 12,00,000. The Balance Sheet of Q Ltd. on that date was as under:

On 31st March, 2017 the summarized Balance Sheets of two companies were as follows:

Directors of Q Ltd. made bonus issue on 31st March, 2017 In the ratio of one equity share of 10 each fully paid for every two equity shares held on that date.

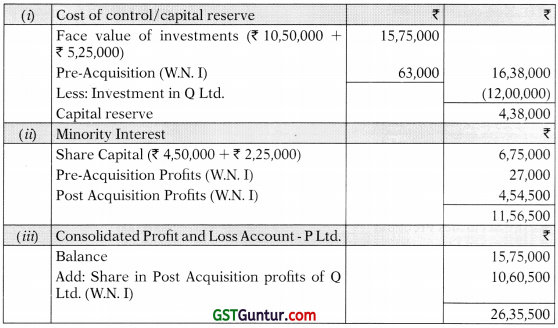

Calculate as on 31st March, 2017 (i) Cost of Control/Capital Reserve; (ii) Minority Interest; (iii) Consolidated Profit and Loss Account In each of the following cases:

(i) Before Issue of bonus shares.

(ii) Immediately after issue of bonus shares.

It may be assumed that bonus shares were issued out of post-acquisition profits by using General Reserve.

Prepare a Consolidated Balance Sheet after the bonus issue. –

Answer:

Consolidated Balance Sheet of P Ltd. and its subsidia, Q Ltd. as on 31st March, 2017

Notes to Accounts

Shareholding pattern

(i) Before issue of bonus shares

(ii) Immediately after issue of bonus shares

Working Note I:

Analysis of Profits of Q Ltd.

Note: Share of P Ltd. in General reserve has been adjusted in Consolidated Profit and Loss Account.

![]()

Question 9.

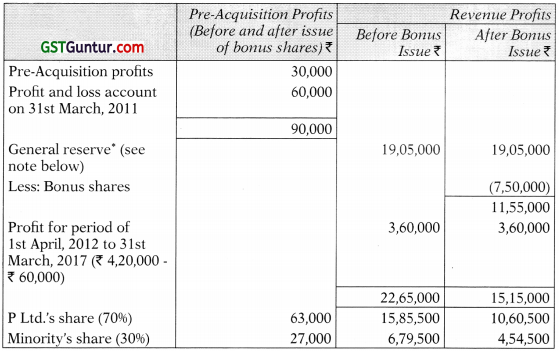

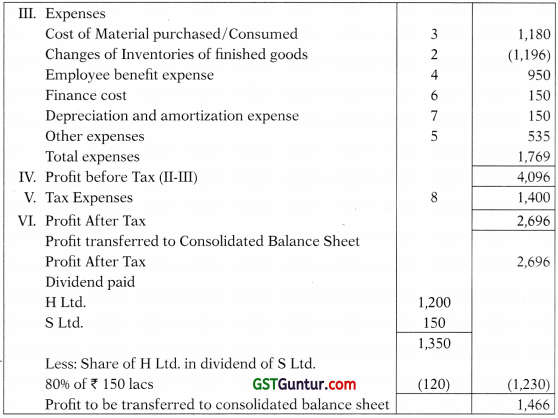

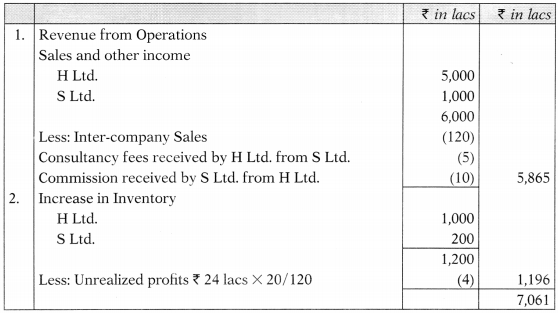

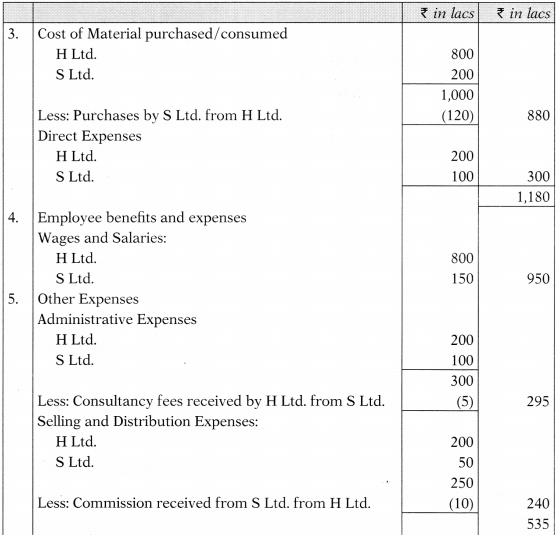

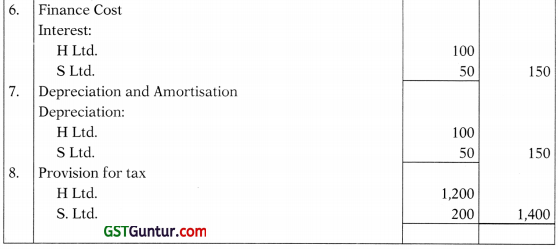

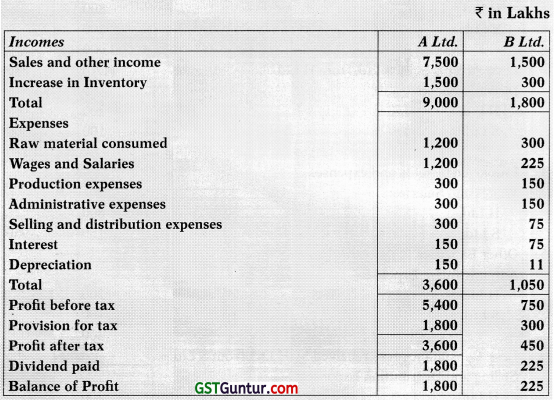

Given below are the Profit & Loss Accounts of H Ltd. and its subsidiary Ltd. for the year ended 31st March, 2017:

Other Information:

H Ltd. sold goods to S Ltd. of ₹ 120 lacs at cost plus 20%. Inventory of S Ltd. includes such goods valuing ₹ 24 lacs. Administrative expenses of S Ltd. include ₹ 5 lacs paid to H Ltd. as consultancy fees. Selling and distribution expenses of H Ltd. include ₹ 10 lacs paid to S Ltd. as commission.

H Ltd. holds 80% of equity share capital of ₹ 1,000 lacs in S Ltd. prior to 2015-2016. H Ltd. took credit to its Profit and Loss Account, the proportionate amount of dividend declared and paid by S Ltd. for the year 2015-2016.

You are required to prepare a consolidated profit and loss account of H Ltd. and its subsidiary S Ltd. for the year ended on 31st March, 2017.

Answer:

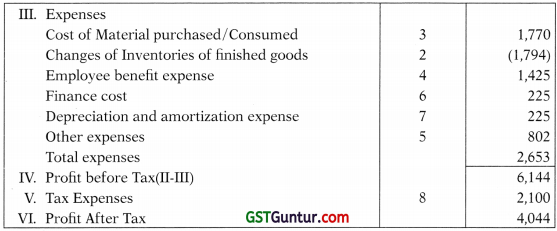

Consolidated Profit & Loss Account of H Ltd. and its subsidiary S Ltd. for the year ended on 31st March, 2017

Notes to Accounts

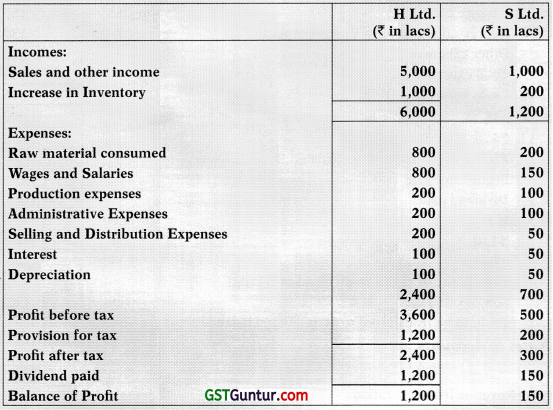

Question 10.

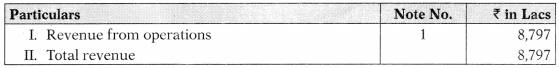

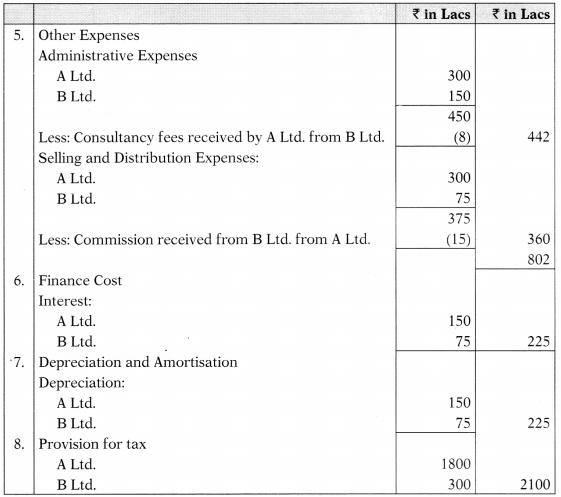

The Profit and Loss Accounts of A Ltd. and its subsidiary B Ltd. for the year ended 31st March, 2018 are given below:

The following information is also given:

- A Ltd. sold goods of ₹ 180 Lakhs to B Ltd. at cost plus 25%. (1/6 of such goods were still in inventory of B Ltd. at the end of the year)

- Administrative expenses of B Ltd. include ₹ 8 Lakhs paid to A Ltd. as consultancy fees.

- Selling and distribution expenses of A Ltd. include ₹ 15 Lakhs paid to B Ltd. as commission.

- A Ltd. holds 72% of the Equity Capital of B Ltd. The Equity Capital of B Ltd. prior to 2016-17 is ₹ 1,500 lakhs

Prepare a consolidated Profit and Loss Account for the year ended 31 st March, 2018. (November 2018 – New Course) (10 Marks)

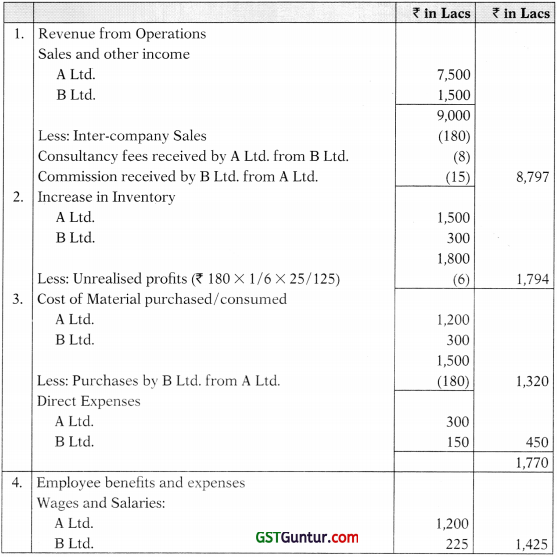

Answer:

Consolidated Profit & Loss Account of A Ltd. and its subsidiary B Ltd. for the year ended on 31st March, 2018

Notes to Accounts

Assumption: It is assumed that dividend adjustment has not be done in sales & other income of A Ltd. i.e. dividend received from B Ltd. is not included in other income of A Ltd.