Accounting for Employee Stock Option Plans – CA Inter Advanced Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Accounting for Employee Stock Option Plans – CA Inter Advanced Accounting Study Material

Theory Questions

Question 1.

Explain ‘Employee’s stock option plan. (Nov. 2009) (2 Marks)

Answer:

‘Employee Stock Option Plan’ is a plan in which option is given for a specified period, to employees of a company, which gives such directors, officers or employees the right, but not the obligation, to purchase or subscribe, the shares of the enterprise at a fixed or determinable price.

![]()

Basic Questions On Esop – Expense Computation

Question 2.

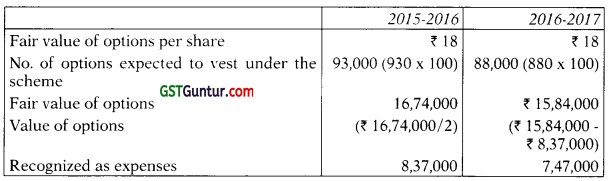

PQ Ltd. grants 100 stock options to each of its 1,000 employees on 1-4-2015, conditional upon the employee remaining in the company for 2 years. The fair value of the option is ₹ 18 on the grant date and the exercise price is ₹ 55 per share. The other information is given as under:

- Number of employees expected to satisfy service condition are 930 in the 1st year and 850 in the 2nd year.

- 40 employees left the company in the 1st year of service and 880 employees have actually completed 2 year vesting period.

You are required to compute ESOP cost to be amortized by PQ Ltd. in the years 2015-2016 and 2016-2017.

Answer:

Calculation of ESOP cost to be amortized

Question 3.

At the beginning of year 1, the enterprise grants 1,000 stock options to each member of its sales team, conditional upon the employees remaining in the employment of the enterprise for three years, and the team selling more than 50,000 units of a particular product over the three-year period. The fair value of the stock options is ₹ 15 per option at the date of grant.

During year 2, the enterprise increases the sales target to 1,00,000 units. By the end of year 3, the enterprise has sold 55,000 units, and the stock options do not vest.

Twelve members of the sales team have remained in service for the three-year period. You are required to examine and give comment in light of the relevant Guidance Note that whether the company should recognise the expenses on the base of options granted or not.

Also state will your answer differ if, instead of modifying the performance target, the enterprise had increased the number of years of service required for the stock options to vest from three years to ten years.

Answer:

Paragraph 19 of the Guidance Note on Share Based Payments

Analysis:

For a performance condition that is not a market condition, the en-terprise to recognize the services received during the vesting period based on the best available estimate of the number of shares or stock options expected to vest and to revise that estimate, if necessary, if subsequent information indicates that the number of shares or stock options expected to vest differs from previous estimates. On vesting date, the enterprise revises the estimate to equal the number of instruments that ultimately vested.

![]()

However, paragraph 24 of the Guidance Note requires, irrespective of any modifications to the terms and conditions on which the instruments were granted, or a cancellation or settlement of that grant of instruments, the enterprise to recognize, as a minimum, the services received, measured at the grant date fair value of the instruments granted, unless those instruments do not vest because of failure to satisfy a vesting condition (other than a market condition) that was specified at grant date.

Furthermore, paragraph 26(c) of the Guidance Note

If the enterprise modifies the vesting conditions in a manner that is not beneficial to the employee, the enterprise does not take the modified vesting conditions into account when applying the requirements for treatment of vesting conditions as specified in Guidance Note.

Conclusion:

Therefore, because the modification to the performance condition made it less likely that the stock options will vest, which was not beneficial to the employee, the enterprise takes no account of the modified performance condition when recognizing the services received. Instead, it continues to recognize the services received over the three-year period based on the original vesting conditions. Hence, the enterprise ultimately recognizes cumulative remuneration expense of ₹ 1,80,000 over the three-year period (12 employees × 1,000 options × ₹ 15).

The same result would have occurred if, instead of modifying the performance target, the enterprise had increased the number of years of service required for the stock options to vest from three years to ten years.

Because such a modification would make it less likely that the options will vest, which would not be beneficial to the employees, the enterprise would take no account of the modified service condition when recognizing the services received. Instead, it would recognize the services received from the twelve employees who remained in service over the original three-year vesting period.

![]()

Basic Questions on Esop – Journal Entries

Question 4.

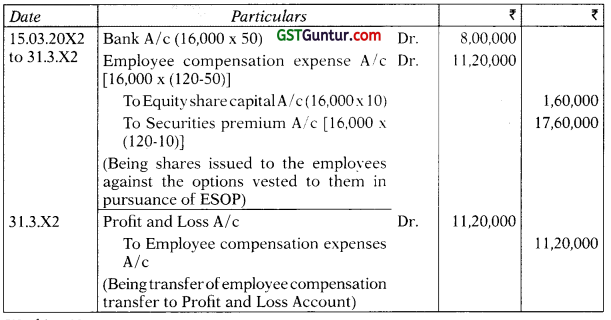

X Co. Ltd. has its share capital divided into equity shares of ₹ 10 each. On 1.1.20X1 it granted 20,000 employees’ stock option at ₹ 50 per share when the market price was ₹ 120 per share. The options were to be exercised between 15th March, 20X2 and 31st March, 20X2. The employees exercised their options for 16,000 shares only and the remaining options lapsed. The company closes its books on 31st March every year. Show Journal entries (with narration) as would appear in the books of the company up to 31st March, 20X2.

Answer:

In the books of X Co. Ltd. Journal Entries

Working Notes:

- No entry is passed when Stock Options are granted to employees. Hence, no entry will be passed on 1st April 20X1;

- Market Price = ₹ 120 per share whereas stock option price = ₹ 50, Hence, the difference ₹ 120 . ₹ 50 = ₹ 70 per share is equivalent to employee cost or employee compensation expense and will be charged to P/L Account as such for the number of options exercised i.e., 16,000 shares.

![]()

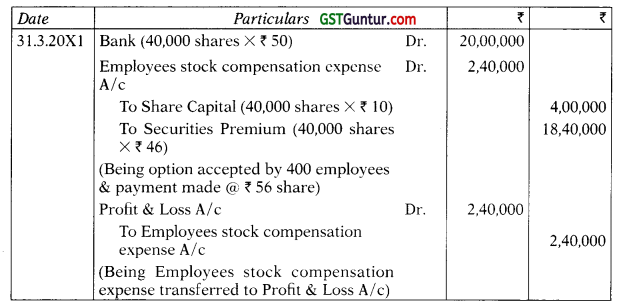

Question 5.

On 1st April, 20X1, a company offered 100 shares to each of its 500 employees at ₹ 50 per share. The employees are given a year to accept the offer. The shares issued under the plan shall be subject to lock-in on transfer for three years from the grant date. The market price of shares of the company on the pant date is ₹ 60 per share. Due to post-vesting restrictions on transfer, the fair value of shares issued under the plan is estimated at ₹ 56 per share.

On 31st March, 20X2, 400 employees accepted the offer and paid ₹ 50 per share purchased. Nominal value of each share is ₹ 10.

Record the issue of share in the books of the company under the aforesaid plan.

Answer:

Fair value of an option = ₹ 56 – ₹ 50 = ₹ 6

Number of shares issued = 400 employees × 100 shares/employee = 40,000 shares

Fair value of ESOP = 40,000 shares × ₹ 6 = ₹ 2,40,000

Vesting period = 1 month

Expenses recognized in 20X1 – X2 = ₹ 2,40,000

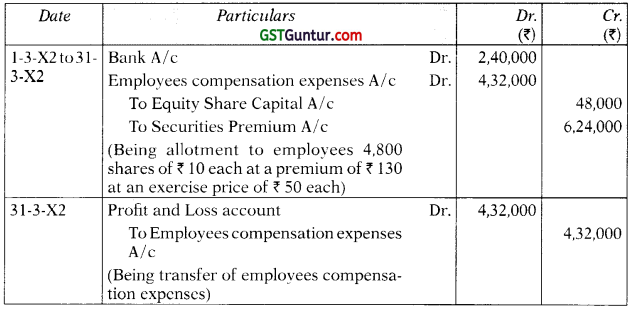

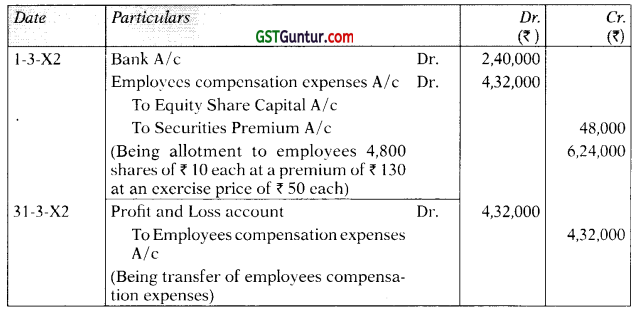

Question 6.

A company has its share capital divided into shares of ₹ 10 each. On 1-1-20X1, it granted 5,000 employees stock options at ₹ 50, when the market price was ₹ 140. The options were to be exercised between 1-3-20X2 to 31-03- 20X2. The employees exercised their options for 4,800 shares only; remaining options lapsed. Pass the necessary journal entries for the year ended 31-3- 20X2, with regard to employees’ stock options.

Answer:

Working Note:

- Employee Compensation Expenses = Discount between Market Price and option price = ₹ 140 – ₹ 50 = ₹ 90 per share = ₹ 90 × 4,800 = ₹ 4,32,000 in total.

- Securities Premium Account = ₹ 50 – ₹ 10 = ₹ 40 per share + ₹ 90 per share on account of discount of option price over market price = ₹ 130 per share = ₹ 130 × 4,800 = ₹ 6,24,000 in total.

![]()

Question 7.

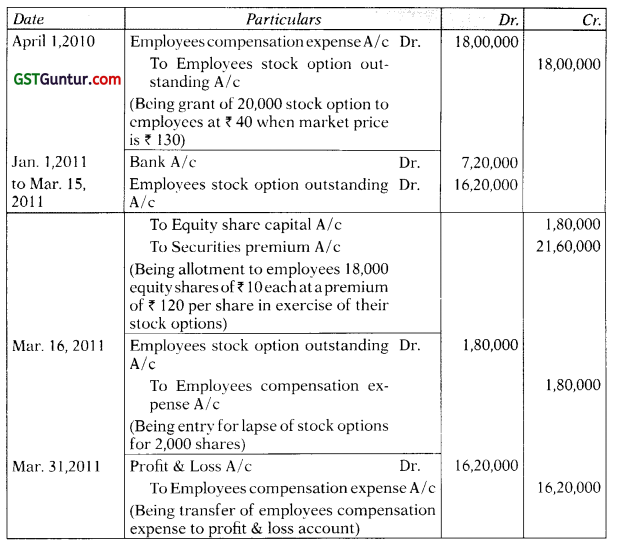

A Company has its share capital divided into shares of ₹ 70 each. On 1st April 2010, it granted 20,000 employees’ stock options at ₹ 40, when the market price was ₹ 730. The options were to be exercised between 1st January 2011 to 15th March 2011. The employees exercised their options for 18,000 shares only; the remaining options lapsed. The company closes its books on 31st March every year. Pass Journal entries with regard to employees’ stock options. (May 2011) (5 Marks)

Answer:

Journal Entries

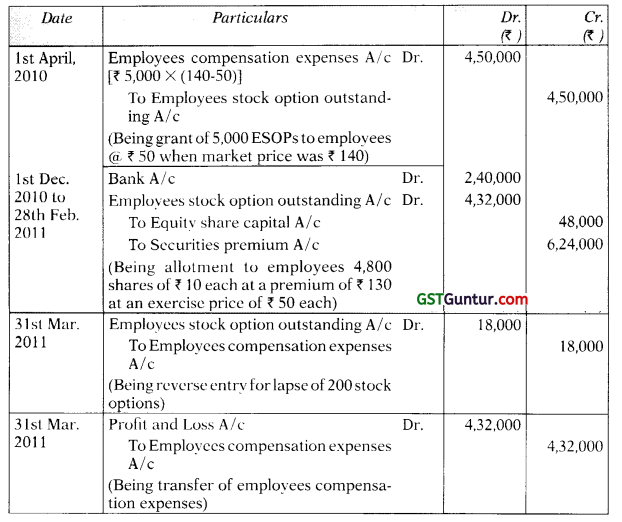

Question 8.

A company has its share capital divided into shares of ₹ 10 each. On 1-4-2010, it granted 5,000 employees stock option at ? 50, when the market price was ₹ 140. The options were to be exercised between 1-12-2010 to 28-22011. The employees exercised their options for 4,800 shares only; remaining options lapsed. Pass the necessary journal entries for the year ended 31-3-2011, with regard to employees’ stock option. (Nov. 2011) (4 Marks)

Answer:

In the books of Company Journal Entries

![]()

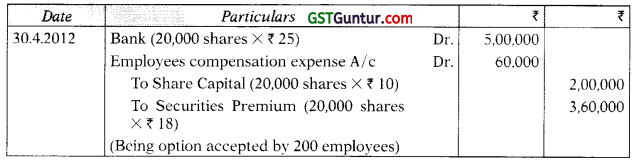

Question 9.

On 1st April, 2012, a company offered 100 shares to each of its 400 employees at ₹ 25 per share. The employees are given a month to accept the shares. The shares issued under the plan shall be subject to lock-in to transfer for three years from the grant date i.e. 30th April, 2012. The market price of shares of the company on the grant date is ₹ 30 per share. Due to post-vesting restrictions on transfer, the fair value of shares issued under the plan is estimated at ₹ 28 per share. (May 2012) (4 Marks)

Answer:

Fair value of an option = ₹ 28 – ₹ 25 = ₹ 3

Number of employees accepting the offer = 400 employees × 50% = 200 employees

Number of shares issued = 200 employees × 100 shares/employee = 20,000 shares

Fair value of ESPP = 20,000 shares × ₹ 3 = ₹ 60,000

Expenses recognized in 2012-13 = ₹ 60,000

Journal Entry

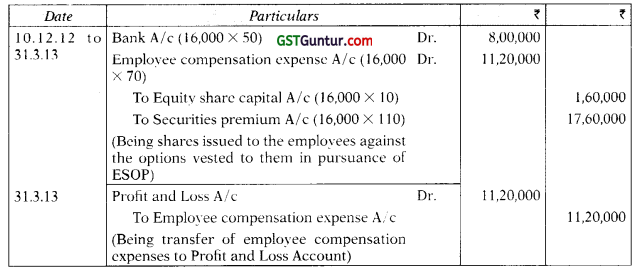

Question 10.

Arihant Limited has its share capital divided into equity shares of ₹ 10 each. On 1-10-2012, it granted 20,000 employees stock option at ₹ 50 per share, when the market price was ₹ 120 per share. The options were to be exercised between 10th December, 2012 and 31st March, 2013. The employees exercised their options for 16,000 shares only and the remaining options lapsed. The company closes its books on 31st March every year. Show Journal Entries (with narration) as would appear in the books of the company upto 31st March, 2013. (May 2013) (4 Marks)

Answer:

Journal Entries in the books of Arihant Ltd.

![]()

Question 11.

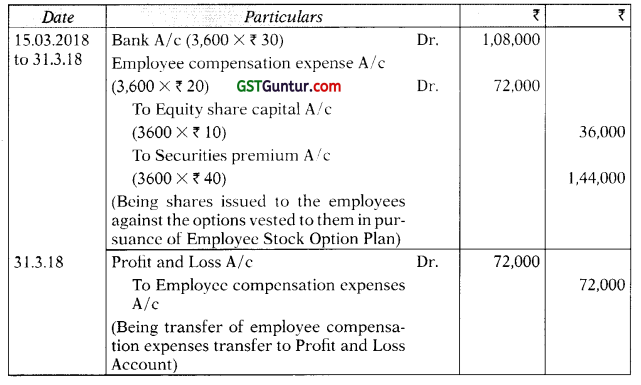

J Ltd. has its share capital divided into equity shares of ₹ 10 each. On 1.1.2018 it granted 5,000 employee stock options at ₹ 30 per share, when the market price was ₹ 50 per share. The options were to be exercised between 15th March, 2018 and 31st March, 2018. The employees exercised their options for 3,600 shares only and the remaining options lapsed. The company closes its books on 31st March every year. You are required to prepare journal entries (with narration) as would appear in the books of the company up to 31st March, 2018.

Answer:

Journal Entries in the books of J Ltd.

Working Notes:

- No entry is passed when stock options are granted to employees. Hence, no entry will be passed on 1st January 2018;

- Market Price = ₹ 50 per share and stock option price = ₹ 30, Hence, the difference ₹ 50 – ₹ 30 = ₹ 20 per share is equivalent to employee cost or employee compensation expense and will be charged to P&L Account as such for the number of options exercised i.c. 3,600 shares.

![]()

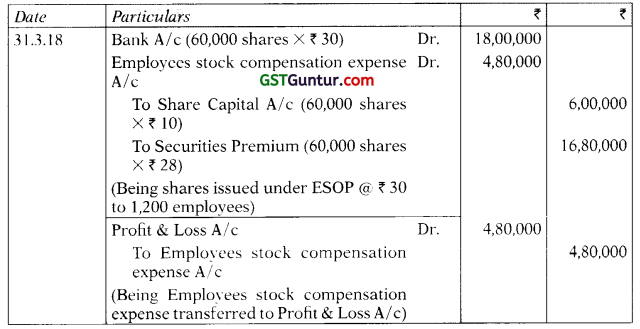

Question 12.

Suvidhi Ltd. offered 50 shares to each of its 1500 employees on 1st April 2017 for ₹ 30. Option would be exercisable within a year it is vested. The shares issued under the plan shall be subject to lock-in on transfer for three years from the grant date. The market price of shares of the company is ₹ 50 per share on grant date. Due to post vesting restrictions on transfer, the fair value of shares issued under the plan is estimated at ₹ 38 per share.

On 31st March, 2018, 1200 employees accepted the offer and paid ₹ 30 per share purchased. Nominal value of each share is ₹ 10.

Record the issue of shares in the books of the company under the aforesaid plan. (May 2018 – New Course) (5 Marks)

Answer:

Journal Entries in the books of Suvidhi Ltd.

Working Note:

Fair value of an option = ₹ 38 – ₹ 30 = ₹ 8

Number of shares issued = 1,200 employees × 50 shares/employee = 60,000 shares

Fair value of ESOP which will be recognized as expenses in the year 2017-2018

= 60,000 shares × ₹ 8 = ₹ 4,80,000

Vesting period = 1 year

Expenses recognized in 2017-2018 = ₹ 4,80,000

![]()

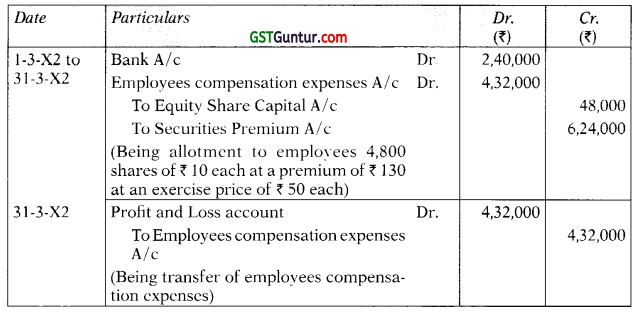

Question 13.

A company has its share capital divided into shares of ₹ 10 each. On 1-1-20X1, it granted 5,000 employees stock options at ₹ 50, when the market price was ₹ 140. The options were to be exercised between 1-3-20X2 to 31-03-20X2. The employees exercised their options for 4,800 shares only; remaining options lapsed. You are required to prepare the necessary journal entries for the year ended 31-3-20X2, with regard to employees’ stock options.

Answer:

In the books of Company Journal Entries

Working Note:

- Employee Compensation Expenses = Discount between Market Price and option price = ₹ 140 – ₹ 50 = ₹ 90 per share = ₹ 90 × 4,800 = ₹ 4,32,000 in total.

- Securities Premium Account = ₹ 50 – ₹ 10 = ₹ 40 per share + ₹ 90 per share on account of discount of option price over market price = ₹ 130 per share = ₹ 130 × 4,800 = ₹ 6,24,000 in total.

![]()

Question 14.

A company has its share capital divided into shares of ₹ 10 each. On 1-1-20X1, it granted 5,000 employees stock options at ₹ 50, when the market price was ₹ 140. The options were to be exercised between 1-3-20X2 to 31-03-20X2. The employees exercised their options for 4,800 shares only; remaining options lapsed. Pass the necessary journal entries for the year ended 31-3-20X2, with regard to employees’ stock options.

Answer:

Journal Entries in the books of company

Working Note:

- Employee Compensation Expenses = Discount between Market Price and option price = ₹ 140 – ₹ 50 = ₹ 90 per share = ₹ 90 × 4,800 = ₹ 4,32,000/- in total.

- Securities Premium Account = ₹ 50 – ₹ 10 = ₹ 40 per share + ₹ 90 per share on account of discount of option price over market price = ₹ 130 per share = ₹ 130 × 4,800 = ₹ 6,24,000/- in total.

![]()

Question 15.

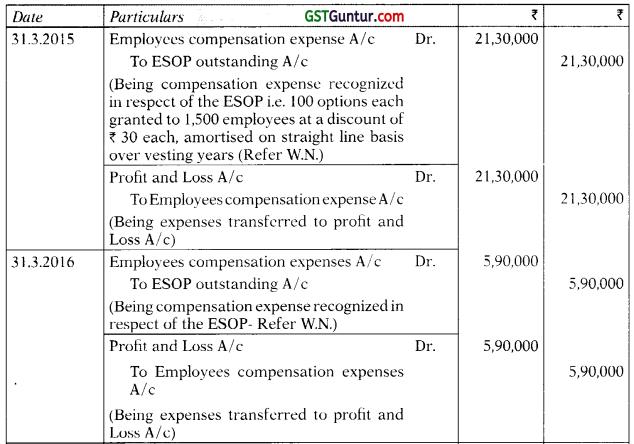

Lucky Ltd. grants 100 stock options to each of its 1,500 employees on 1-4-2014 for ₹ 40, depending upon the employees at the time of vesting of options. Options would be exercisable within a year it is vested. The market price of the share is ₹? 70 each. These options will vest at the end of year 1 if the earning of Lucky Ltd. is 15%, or it will vest at the end of the year 2 if the average earning of two years is 13% or lastly it will vest at the end of the third year if the average earning of 3 years will be 10% 8,000, unvested options lapsed on 31-3-2015. 6,000 unvested options lapsed on 31-3-2016 and finally 4,000 unvested options lapsed on 31-3-2017.

The earnings of Lucky Ltd. for the three financial years ended on 31st March, 2015; 2016 and 2017 are 14%, 10% and 8% respectively.

1,250 employees exercised their vested options within a year and remaining options were unexercised at the end of the contractual life.

You are required to give the necessary journal entries for the above and also prepare the statement showing compensation expense to be recognized at the end of each year. (November 2018 – New Course) (10 Marks)

Answer:

![]()

Working Note:

Statement showing compensation expense to be recognized at the end of:

*It is assumed that each share is of ₹ 10 each and Lucky Ltd. expects all the options to be vested after deducting actual lapses during the year.

Questions On Espp

Question 16.

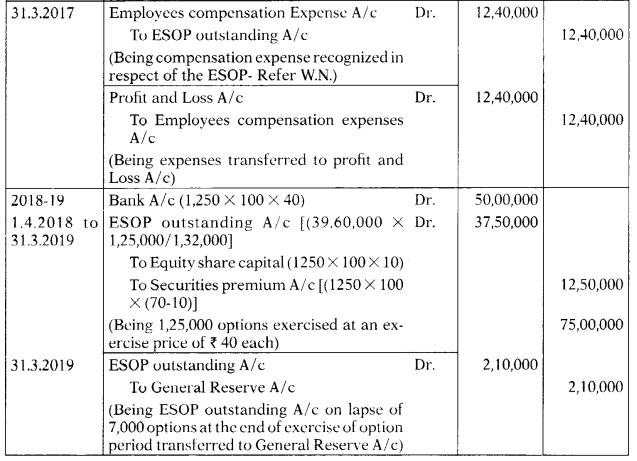

On 1st April, 2013, a company offered 100 shares to each of its 500 employees at ₹ 50 per share. The employees are given a month to accept the offer. The shares issued under the plan shall be subject to lock-in on transfer for three years from the grant date. The market price of shares of the company on the grant date is ₹ 60 per share. Due to post-vesting restrictions on transfer, the fair value of shares issued under the plan is estimated at ₹ 56 per share. On 30th April, 2013,400 employees accepted the offer and paid ₹ 50 per share purchased. Nominal value of each share is ₹ 10.

Record the issue of shares in the books of the company under the aforesaid plan.

Answer:

Fair value of an option = ₹ 56 – ₹ 50 = ₹ 6

Number of shares issued = 400 employees × 100 shares/employee = 40,000 shares

Fair value of ESPP = 40,000 shares × ₹ 6 = ₹ 2,40,000

Vesting period = 1 month

Expenses recognized in 2013-14 = ₹ 2,40,000

Advanced Questions on Esop

Question 17.

The following particulars in respect of stock options granted by a company are available:

| Grant date | April 1,2008 |

| Number of employees covered | 300 |

| Vesting condition: Continuous employment upto 31/03/11 | 100 |

| Nominal value per share (₹) | 10 |

| Exercise price per share (₹) | 40 |

| Fair value of option per share on grant date (₹) | 20 |

| Exercise date | July 31, 2011 |

The number of options to vest per employee shall depend on company’s average annual earning after tax during vesting period as per the table below:

| Average annual earning after tax | Number of options per employee |

| Less than ₹ 100 crores | Nil |

| ₹ 100 crores to less than ? 120 crores | 30 |

| ₹ 120 crores to less than ? 150 crores | 45 |

| Above ₹ 150 crores | 60 |

![]()

Position on 31/03/09

(a) The company expects to earn ₹ 115 crores after tax on an average per year during vesting period.

(b) Number of employees expected to be entitled to option = 280

Position on 31 /03/10

(a) The company expects to earn ₹ 130 crores after tax on an average per year during vesting period.

(b) Number of employees expected to be entitled to option = 270

Position on 31 /03/11

(a) The company earned ₹ 128 crores after tax on an average per year during vesting period.

(b) Number of employees entitled to option = 275

Position on July 31, 2011

Number of employees exercising option = 265

Compute expenses to be recognised in each year and value of options forfeited.

Answer:

(A) Computation of expenses to be recognized in each year

| Year | Calculation | Expense for Period (₹) | Cumulative expense (₹) |

| 2008-09 | (280 × 30) options × ₹ 20 × 1/3 | 56,000 | 56,000 |

| 2009-10 | [(270 × 45) options × ₹ 20 × 2/3] – 56,000 | 1,06,000 | 1,62,000 |

| 2010-11 | [(275 × 45) options × ₹ 20 × 3/3] – 1,62,000 | 85,500 | 2,47,500 |

(B) Value of option forfeited as on July 31, 2011

Fair value of option per share = ₹ 20

Number of shares not subscribed = (275 – 265) × 45 = 450

Value of options forfeited = 450 × ₹ 20 = ₹ 9,000.

![]()

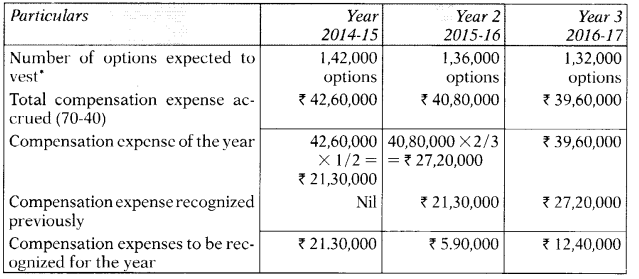

Question 18.

The following particulars in respect of stock options granted by a company are available:

tableee

The options will vest to employees serving continuously for 3 years from vesting date, provided the share price is ₹ 70 or above at the end of 2013-14.

The estimates of number of employees satisfying the condition of continuous employment were 48 on 31 /03/12,47 on 31 / 03/13. The number of employees actually satisfying the condition of continuous employment was 45.

The share price at the end of 2013-14 was ₹ 68.

Compute expenses to recognise in each year and show important accounts in books of the company.

Answer:

The vesting of options is subject to satisfaction of two conditions viz. service condition of continuous employment for 3 years and market condition that the share price at the end of 2013-14 is not less than ₹ 70. Since the share price on 31 /03 /14 was ₹ 68, the actual vesting shall be nil. Despite this, the company should recognise value of option over 3-vear vesting period from 2011-12 to 2013-14.

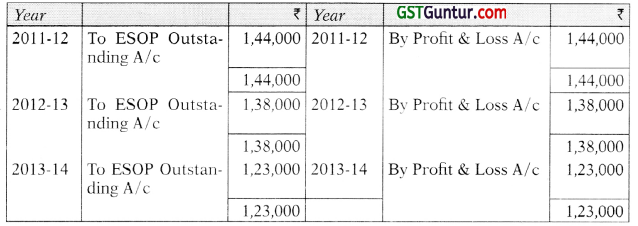

Year 2011-12

Fair value of option per share = ₹ 9

Number of shares expected to vest under the scheme = 48 × 1,000 = 48,000

Fair value = 48,000 × ₹ 9 = ₹ 4,32,000

Expected vesting period = 3 years

Value of option recognised as expense in 2011-12 = ₹ 4,32,000/3 = ₹ 1,44,000

Year 2012-13

Fair value of option per share = ₹ 9

Number of shares expected to vest under the scheme = 47 × 1,000 = 47,000

Fair value = 47,000 × ₹ 9 = 2 4,23,000 Expected vesting period = 3 years

Cumulative value of option to recognise as expense in 2011-12 and 2012-13 = (₹ 4,23,000/3) × 2 = ₹ 2,82,000

Value of option recognised as expense in 2011-12 = ₹ 1,44,000

Value of option recognised as expense in 2012-13 = ₹ 2,82,000 – ₹ 1,44,000 = ₹ 1,38,000

![]()

Year 2013-14

Fair value of option per share = ₹ 9

Number of shares actually vested under the scheme = 45 × 1,000 = 45,000

Fair value = 45,000 × ₹ 9 = 2 4,05,000

Vesting period = 3 years

Cumulative value of option to recognise as expense in 2011-12, 2012-13 and 2013-14 = ₹ 4,05,000

Value of option recognised as expense in 2011-12 and 2012-13 = ₹ 2,82,000

Value of option recognised as expense in 2013-14 =₹ 4,05,000 – ₹ 2,82,000 = ₹ 1,23,000

Employees’ Compensation A/c

ESOP Outstanding A/c

![]()

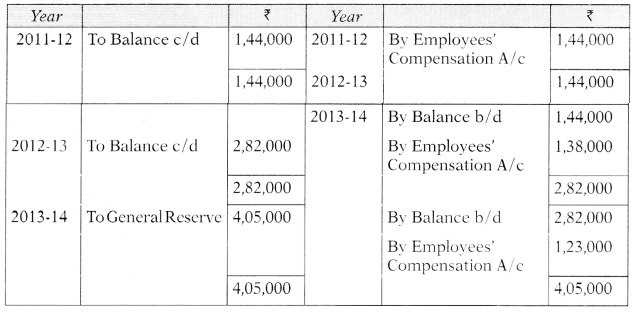

Question 19.

X Ltd. granted 500 stock options to its employees on 1.4.2011 at ₹ 50 per share. The vesting period is 2 years and the maximum exercise period is one year. Market price on that date is ₹ 140 per share. All the options were exercised on 30.06.2014. Pass journal entries giving suitable narrations, if the face value of equity share is t 10 per share. (Nov. 2014) (8 Marks)

Answer:

Journal entries in the books of X Ltd.

Working. Note:

1. Total employees compensation expenses

= 500 × (₹ 140 – ₹ 50) = ₹ 45,000

2. Employees compensation expense has been written off during 21/2 years on straight line basis as under:

Ist Year = ₹ 18,000 (for full year)

IInd Year = ₹ 18,000 (for full year)

IIIrd Year = ₹ 9,000 (for half year)

![]()

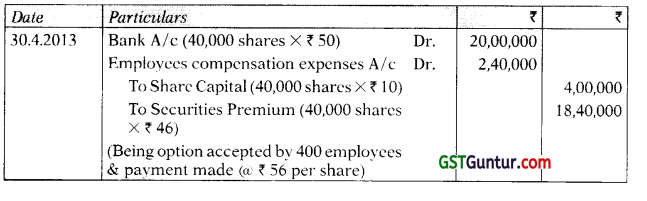

Question 20.

You are provided with the following details in respect of ABC Limited:

- 10,000 equity shares of nominal value of ₹ 10 each (under ESOP) were issued on 31st March, 2014;

- Exercise price of equity shares granted under ESOP was ₹ 160 per share;

- Market price of share was ₹ 400 each on the date of the grant;

- Vesting of shares was in the ratio of 30%, 60% and 100% after 1 year, 2 year and 3 year respectively from the date of grant;

- Vested options can be exercised up to 1 year from the date of vesting;

- The number of shares expired and exercised are as under:

| Years ended | |||

| Particulars | 31.03.2015 | 31.03.2016 | 31.03.2017 |

| Vested Options Lapsed during the year | – | 200 | 600 |

| Unvested Options Lapsed during the year | 400 | 600 | 1,000 |

| Options Exercised during the year | 2,500 | 2,000 | |

From the above details you are required to calculate:

- Employee Compensation Expense for the year ending 31 st March, 2015, 31st March, 2016 and 31st March, 2017

- Balance of Employee Stock Option Outstanding Account as on 31st March, 2015, 31st March, 2016 and 31st March, 2017

Entries relating to ESOP lapsed and options exercised were passed at the end of the respective financial year. (Nov. 2017) (8 Marks)

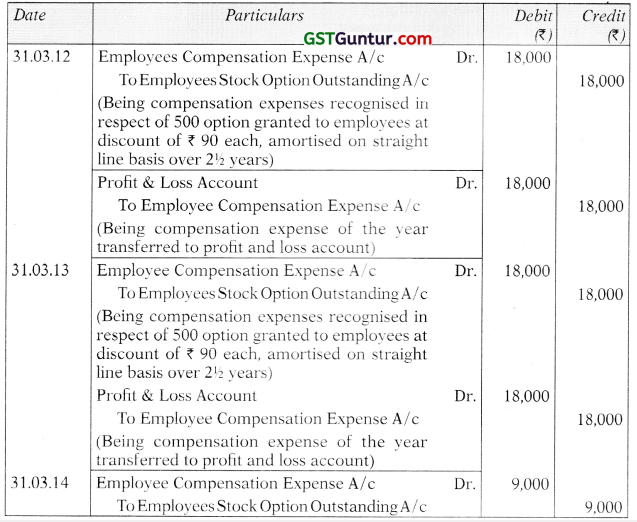

Answer:

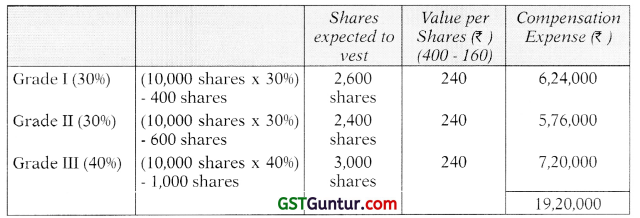

(i) Computation of Employee Compensation Expense (Refer Working Note)

| Vesting Date as on 31st March | Cost to be recognized in the year ending on 31st March | ||

| 2015 | 2016 | 2017 | |

| Grade I (30%) | 6,24,000 | ||

| Grade II (30%) | 2,88,000 | 2,88,000 | |

| Grade III (40%) | 2,40,000 | 2,40,000 | 2,40,000 |

| Cost for the year | 11,52,000 | 5,28,000 | 2,40,000 |

| Cumulative cost | 11,52,000 | 16,80,000 | 19,20,000 |

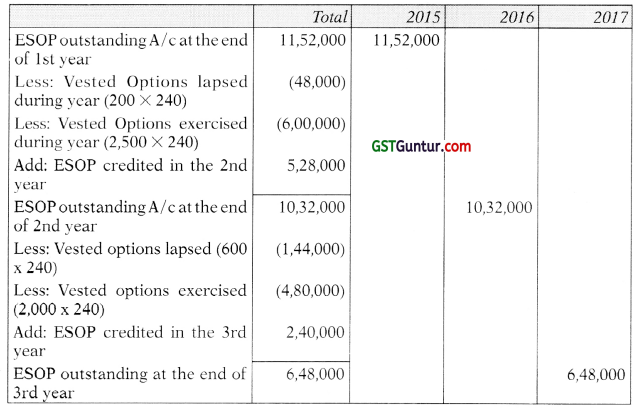

![]()

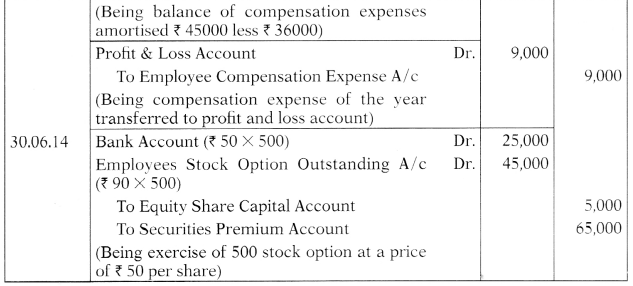

(ii) Balance of ESOP Outstanding Account

Working Note:

Determination of number of options expected to vest under each group

Total compensation expense of ₹ 19,20,000, determined at the grant date, is attributed to 3 years.