CA Inter FM ECO Paper Nov 2022 – CA Inter FM ECO Study Material is designed strictly as per the latest syllabus and exam pattern.

CA Inter FM ECO Question Paper Nov 2022 Solution

Question 1.

(a) K Ltd. has a Quarterly cash outflow of ₹ 9,00,000 arising uniformly during the Quarter. The company has an Investment portfolio of Marketable Securities. It plans to meet the demands for cash by periodically selling marketable securities. The marketable securities are generating a return of 12% p.a. Transaction cost of converting investments to cash is ₹ 60. The company uses Baumol model to find out the optimal transaction size for converting marketable securities into cash. (5 Marks)

Consider 360 days in a year.

You are required to calculate:

(a) Company’s average cash balance,

(b) Number of conversions each year and

(c) Time interval between two conversions.

Answer:

(a) Average cash balance = 1/2 of ₹ 60,000 = ₹30,000

(b) Number or conversions p.a. = \(\frac{\text { Annual Cash Requirement }}{\text { Optimal Transaction Size }}\) = \(\frac{9,00,000 \times 4}{60,000}\)

= 60 conversions per annum

(c) Time interval between two conversions

= \(\frac{360}{\text { No. of Conversions }}\) = \(\frac{360}{60}\) = 6 Days

![]()

(b) The following figure are related to the trading activities of M Ltd. (5 Marks)

Total assets – ₹ 10,00,000

Debt to total assets – 50%

Interest cost – 10% per year

Direct Cost – 10 times of the interest cost

Operating Exp. – ₹ 1,00,000

The goods are sold to customers at a margin of 50% on the direct cost Tax Rate is 30%. You are required to calculate:

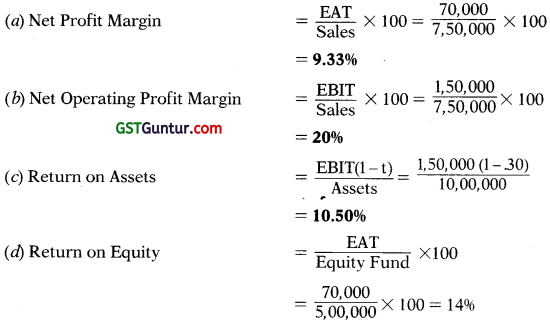

(a) Net profit margin

(b) Net operating profit margin

(c) Return on assets

(d) Return on owner’s equity

Answer:

Working Notes:

(1) Debt = 50% of ₹ 10,00,000 = ₹ 5,00,000

(2) Interest = 10% of ₹ 5,00,000 = ₹ 50,000

(3) Direct cost = 10 times of ₹ 50,000 = ₹ 5,00,000

(4) Sales = Direct cost + 50% ₹ 5,00,000 + 50% = ₹ 7,50,000

(5) Equity Fund = Total Assets – Debt = ₹ 10,00,000 – ₹ 5,00,000 = ₹ 5,00,000

(6) The Net Profit is calculated as follows:

![]()

(c) The following is the extract of the Balance Sheet of M/s KD Ltd.:

| Particulars | ₹ |

| Ordinary shares (Face Value ₹ 10 per share) | 5,00,000 |

| Share Premium | 1,00,000 |

| Retained Profits | 6,00,000 |

| 8% Preference Shares (Face Value ₹ 25 per share) | 4,00,000 |

| 12% Debentures (Face value ₹ 100 each) | 6,00,000 |

| 22,00,000 |

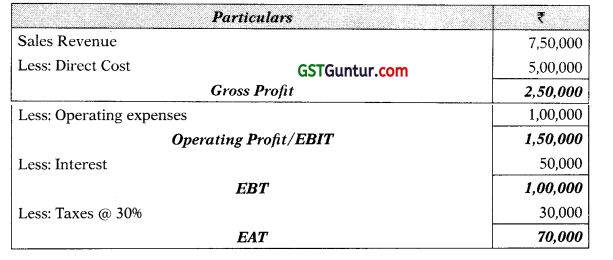

The ordinary shares are currently priced at ₹ 39 ex-dividend and preference share is priced at ₹ 18 Cum-dividend. The debentures are selling at 120 percent ex-interest. The applicable tax rate to D Ltd. is 30 percent. KD Ltd.’s cost of equity has been estimated at 19 percent. Calculate the WACC (weighted average cost of capital) of KD Ltd. on the basis of market value. (5 Marks)

Answer:

Statement of WACC (Market Value Weights)

WACC (K0) = 0.1509 or 15.09%

Working Notes:

(1) Calculation of Market Value:

Total Market value of Equity and Retained earnings:

= (₹ 5,00,000 ÷ ₹10) × ₹ 39 = ₹ 19,50,000

Market Value of Equity = ₹ 19,50,000 × 5/12 = ₹ 8,12,500

Market Value of Retained earnings = ₹ 19,50,000 × 7/12 = ₹ 11,37,500

Market Value of Debentures = (₹ 6,00,000 ÷ ₹ 100) × ₹ 120

= ₹ 7,20,000

Market Value of Preference Shares = (₹ 4,00,000 ÷ ₹ 25) × ₹16*

= ₹ 2,56,000

’Market value of 1 Preference Share ex-dividend is used i.e. ₹ 16 (₹18 – 8% of ₹ 25).

(2) Calculation of Kr:

Kr = Ke = 19%

(3) Calculation of Kd:

Kr = \(\frac{\mathrm{I}(1-t)}{N P}\) × 100 = \(\frac{12 \% \text { of } 100(1-0.3)}{120}\) × 100 = 7%

(4) Calculation of Kp:

Kp = \(\frac{P D}{N P}\) × 100 = \(\frac{8 \% \text { of } 25}{16}\) × 100 = 8%

![]()

(d) Determine the risk adjusted net present value of the following projects: (5 Marks)

| Particulars | A | B | C |

| Net cash outlays (₹) | 70,000 | 1,20,000 | 2,20,000 |

| Project life | 5 Years | 5 Years | 5 Years |

| Annual Cash inflow (₹) | 30,000 | 42,000 | 70,000 |

| Coefficient of variation | 2.2 | 1.6 | 1.2 |

The Company selects the risk-adjusted rate of discount on the basis of the coefficient of variation:

| Coefficient of Variation | Applicable Risk-Adjusted Discount (i) | PVIFA (i, 5) |

| 0 | 10% | 3.791 |

| 0.4 | 12% | 3.605 |

| 0.8 | 14% | 3.433 |

| 1.2 | 16% | 3.274 |

| 1.6 | 18% | 3.127 |

| 2 | 22% | 2.864 |

| >2.0 | 25% | 2.689 |

Which project should be selected by the company based on Risk Adjusted NPV?

Answer:

Statement Showing the Determination of the Risk Adjusted Net Present Value

Decision: Company should select Project B having highest Risk-adjusted NPV.

![]()

Question 2.

The following information is available for SS Ltd. (10 Marks)

Profit volume (PV) ratio – 30%

Operating leverage – 2.00

Financial leverage – 1.50

Loan – ₹ 1,25,000

Post-tax interest rate – 5.6%

Tax rate – 30%

Market Price per share (MPS) – ₹ 140

Price Earnings Ratio (PER) – 10

You are required to

(1) Prepare the Profit-Loss statement of SS Ltd. and

(2) Find out the number of equity shares.

Answer:

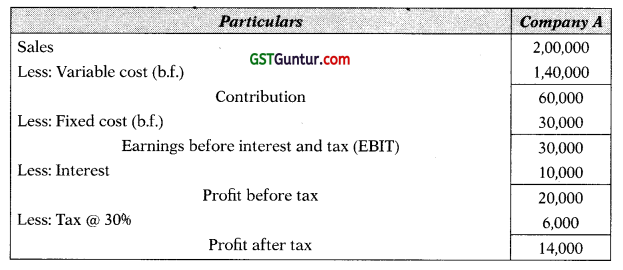

(1) Profit-Loss Statement

(2) Number of Equity Shares = PAT/EPS = ₹ 14,000/₹ 14 = 1,000 Shares

Working Notes:

(a) Financial Leverage = EBIT/(EBIT – Interest)

EBIT/(EBIT – ₹ 10,000) = 1.5

EBIT = 1.5 EBIT – ₹ 15,000

EBIT = ₹ 30,000

Interest = Loan × Pre-tax interest rate

= ₹ 1,25,000 × 8% [5.6% ÷ (1 – 0.3)]

= ₹ 10,000

(b) Operating Leverage = Contribution/EBIT

= Contribution/30,000 = 2.00

Contribution = ₹ 60,000

(c) Sales = Contribution/PV Ratio

= ₹ 60,000/0.30 = ₹ 2,00,000

(d) EPS = MPS/PE Ratio

= ₹ 140/10 times = ₹ 14

![]()

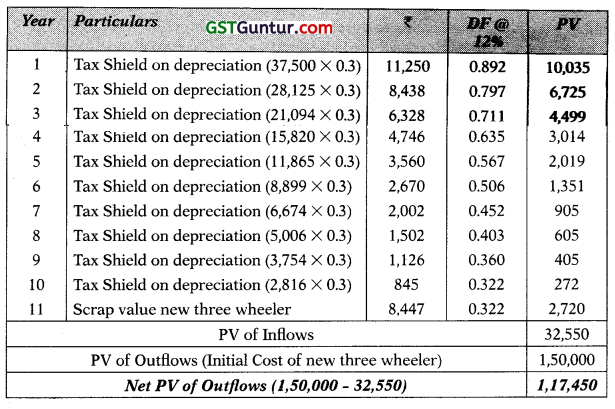

Question 3.

A firm is in need of a small vehicle to make deliveries. It is intending to choose between two options. One option is to buy a new three wheeler that would cost ₹ 1,50,000 and will remain in service for 10 years. (10 Marks)

The other alternative is to buy a second hand vehicle for ₹ 80,000 that could remain in service for 5 years. Thereafter the firm, can buy another second hand vehicle for ₹ 60,000 that will last for another 5 years.

The scrap value of the discarded vehicle will be equal to it written down value (WDV). The firm pays 30% tax and is allowed to claim depreciation on vehicles @ 25% on WDV basis. The cost of capital of the firm is 12%.

You are required to advise the best option.

Given:

| t | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| PVIF(t, 12%) | 0.892 | 0.797 | 0.711 | 0.635 | 0.567 | 0.506 | 0.452 | 0.403 | 0.360 | 0.322 |

Answer:

Statement of PV of outflow under Option 1

Statement of PV of outflow under Option 2

Advise: Select option 2 having lower Net PV of Outflows.

![]()

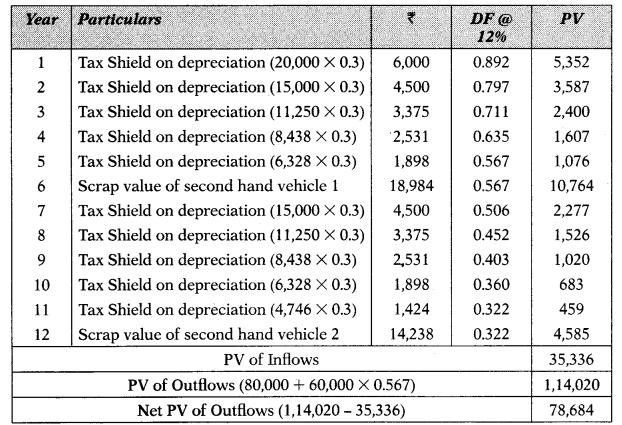

Question 4.

A hospital is considering to purchase a diagnostic machine costing ₹ 80,000. The projected life of the machine is 8 years and has an expected salvage value of ₹ 6,000 at the end of 8 years. The annual operating cost of the machine is ₹ 7,500. It is expected to generate revenues of ₹ 40,000 per year for eight years. Presently, the hospital is outsourcing the diagnostic work and is earning commission income of ₹ 12,000 per annum. Consider tax rate of 30% Discounting Rate as 10%. (10 Marks)

Advise: Whether it would be profitable for the hospital to purchase the machine?

Give your recommendation as per Net Present Value method and Present Value Index method under below mentioned two situations:

(i) If Commission income of ₹ 12,000 p.a. is before taxes.

(ii) If Commission income of ₹ 12,000 p.a. is net of taxes.

Given:

| t | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| PVIF (t, 10%) | 0.909 | 0.826 | 0.751 | 0.683 | 0.621 | 0.564 | 0.513 | 0.467 |

Answer:

(i) Net Present Value and Present Value Index when commission income is before tax:

Net Present Value

| Year | Particulars | ₹ | DF @ 10% | DCF |

| 0 | Initial Outflows | (80,000) | 1.000 | (80,000) |

| 1-8 | Cash Flow After Tax | 17,125 | 5.334 | 91,345 |

| 8 | Salvage | 6,000 | 0.467 | 2,802 |

| NPV | 14,147 | |||

Profitability Index = \(\frac{\text { PV of Inflows }}{\text { PV of Outflows }}\) = \(\frac{94,147}{80,000}\) = 1.18

Advise: Since the net present value (NPV) is positive and profitability index is also greater than 1, it is profitable for the hospital to purchase the machine.

(ii) Net Present Value and Present Value Index when commission income is before tax:

Net Present Value

| Year | Particulars | ₹ | DF @ 10% | DCF |

| 0 | Initial Outflows | (80,000) | 1.000 | (80,000) |

| 1-8 | Cash Flow After Tax | 13,525 | 5.334 | 72,142 |

| 8 | Salvage | 6,000 | 0.467 | 2,802 |

| NPV | (5,056) | |||

Profitability Index = \(\frac{\text { PV of Inflows }}{\text { PV of Outflows }}\) = \(\frac{74,944}{80,000}\) = 0.94

Advise: Since the net present value (NPV) is negative and profitability index is also lower than 1, it is not profitable for the hospital to purchase the machine.

Working Notes:

Calculation of CFAT:

![]()

Question 5.

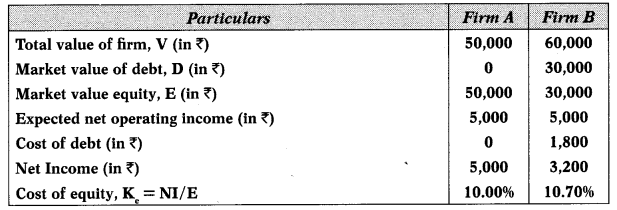

(a) The following are the costs and values for the firms A and B according to the traditional approach.

(i) Compute the Equilibrium value for Firms A and B in accordance with the MM approach. Assume that (a) taxes do not exist and (b) the equilibrium value of Ke is 9.09%.

(ii) Compute Value of Equity and Cost of Equity for both the firms. (4 Marks)

Answer:

(i) Equilibrium value of Firm A (Unlevered)

= Net operating income ÷ Ke

= ₹ 5,000 ÷ 9.0996 = ₹ 55,006

Equilibrium value of Firm B (Levered)

= Value of Firm A (Unlevered)

= ₹ 55,006

(ii) Value of Equity Firm A = ₹ 55,006

Cost of Equity Firm A = 9.09%

Value of Equity Firm B = Value of Firm B – Value of debt

= ₹ 55,006 – ₹ 30,000 = ₹ 25,006

Cost of Equity Firm B = NI/E

= ₹ 3,200 ÷ ₹ 25,006 = ₹ 12.80%

![]()

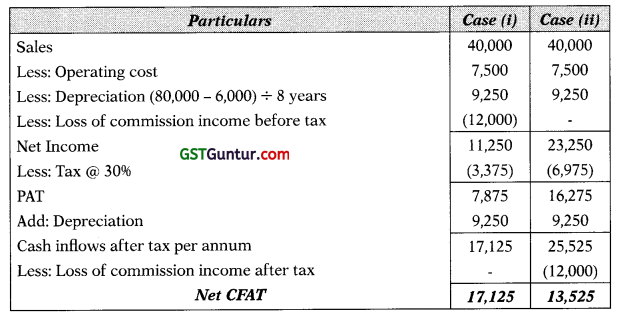

(b) MR Ltd. is having the following capital structure, which is considered to be optimum as on 31.03.2022. (6 Marks)

The earnings per share (EPS) of the company were ₹ 2.50 in 2021 and the expected growth in equity dividend is 10% per year. The next year’s dividend per share (DPS) is 50% EPS of the year 2021. The current market price per share (MPS) is ₹ 25.00. The 15% new debentures can be issued by the company. The company’s debentures are currently selling at ₹ 96 per debenture. The new 12% Pref. Share can be sold at a net price of ₹ 91.50 (face value ₹ 100 each). The applicable tax rate is 30%.

You are required to calculate:

(i) After tax cost of

(a) New debt,

(b) New pref. share capital and

(c) Equity shares assuming that new equity shares come from retained earnings.

(ii) Marginal cost of capital.

(iii) How much can be spent for capital investment before sale of new equity shares assuming that retained earnings for next year investment is 50% of 2021 ?

Answer:

(i) (a) After tax cost of new debt

Kd = \(\frac{\mathrm{I}(1-\mathrm{t})}{\mathrm{NP}}\) × 100 = \(\frac{15(1-0.30)}{96}\) × 100 = 10.94%

(b) After tax cost of new preference shares

Kd = \(\frac{\mathrm{PD}}{\mathrm{NP}}\) × 100 = \(\frac{12}{91.50}\) × 100 = 13.11%

(c) Cost of new equity or cost of retained earnings

Kd = \(\frac{\mathrm{D}_1}{\mathrm{P}_0}\) + g = \(\frac{2.50 \times 50 \%}{25}\) + 0.10 = 15%

(ii) Marginal cost of capital:

KdWd + KpWp + KrWr = 10.94% × .15 + 13.11% × .05 + 15% × .80= 14.30%

(iii) The company can pay the following amount before issue of new shares: Equity (retained earnings in this case) = 80% of the total capital

Therefore, investment before new issue = \(\frac{62,500}{80 \%}\) = ₹ 78,125

Retained earnings = ₹ 2.50 × 50% × 50,000 shares

= ₹ 62,500

![]()

Question 6.

(a) These bonds are issued by non-US Banks and non-US corporation in US. What this bond is called and what are the other features of this Bond? (4 Marks)

Answer:

This bond is called as Yankee Bond. Following are the other features of this bond:

(a) These bonds are denominated in dollars

(b) Bonds issued by non-US banks and non-US corporations

(c) Bonds are issued in USA

(d) Bonds are to be registered in SEC (Securities and Exchange Commission)

(e) Bonds are issued in tranches

(f) Time taken can be up to 14 weeks

(g) Interest rate is dollar LIBOR (London Interbank Offered Rate)

(b) Elucidate the fundamental tasks of treasury department of firm. (4 Marks)

Answer:

Fundamental tasks of treasury department of firm are:

(1) Cash Management: It involves efficient cash collection process and managing payment of cash both inside the organisation and to third parties.

(2) Currency Management: The treasury department manages the foreign currency risk exposure of the company.

(3) Fund Management: Treasury department is responsible for planning and sourcing the company’s short, medium and long-term cash needs. They also facilitate temporary investment of surplus funds by mapping the time gap between funds inflow and outflow.

(4) Banking: It is important that a company maintains a good relationship with its bankers. Treasury department carry out negotiations with bankers with respect to interest rates, foreign exchange rates etc. and act as the initial point of contact with them. Short-term finance can come in the form of bank loans or through the sale of commercial paper in the money market.

(5) Corporate Finance: Treasury department is involved with both acquisition and divestment activities within the group. In addition, it will often have responsibility for investor relations.

![]()

(c) The firm has more capital than its requirement. What is this situation called? Give two consequences of it. (2 Marks)

Answer:

Such situation is called as over capitalization. It is a situation where a firm has more capital than it needs or in other words assets are worth less than its issued share capital, and earnings are insufficient to pay dividend and interest.

Consequences of Over-Capitalisation:

(a) Considerable reduction in the rate of dividend and interest payments.

(b) Reduction in the market price of shares.

(c) Resorting to “window dressing”.

(d) Some companies may opt for reorganization. However, sometimes the matter gets worse and the company ’may go into liquidation.

OR

What are the important factors considered for deciding the source and quantum of capital? (2 Marks)

Answer:

Funds procured from different sources have different characteristics in terms of risk, cost and control. The cost of funds should be at the minimum level for that a proper balancing of risk and control factors must be carried out. Another key consideration in choosing the source of new business finance is to strike a balance between equity and debt to ensure the funding structure suits the business.

![]()

Question 7.

(a) The equilibrium level of income (Y) of an economy is ₹ 2,000 crores. The autonomous consumption expenditure (a) is equal to ₹ 100 crores and investment expenditure (I) is ₹ 500 crores. (3 Marks)

You are required to calculate:

(a) Consumption expenditure at equilibrium level of National Income.

(b) Marginal Propensity to Consume (MPC) and Marginal Propensity to Save (MPS).

(c) Equilibrium level of income if saving function is S = – 10 + 0.2Y.

Answer:

(a) Y = C + I

2,000 crores = C + 500 crores

C = 1,500 crores =

(b) C = a + bY

1,500 crores = 100 crores + b × 2,000 crores

1,400 crores = b × 2,000 crores

b(MPC) = 1,400/2,000 = 0.70

MPS = 1 – b

= 1 – 0.70 = 0.30

(c) S = I

-10 + 0.8 Y = 500

0.8 Y = 500 + 10 = 510

Y = 510/0.8 = 1,020 crores

![]()

(b) What are the two forms, through which foreign capital may flow into an economy, as an investment? (2 Marks)

Answer:

The two forms, through which foreign capital may flow into an economy, as an investment are:

- Foreign portfolio investment (FPI) in bonds, stocks and securities, and

- Foreign direct investment (FDI) in industrial, commercial and similar other enterprises.

(c) Define ‘Money Multiplier’. Use of e-wallets is increasing at fast pace now-a-days. How this enhanced use of e-wallets is affecting money multiplier and money supply? (3 Marks)

Answer:

Money Multiplier (m) = Money supply ÷ Monetary base

Money multiplier m is defined as a ratio that relates the changes in the money supply to a given change in the monetary base. It denotes by how much the money supply will change for a given change in high-powered money. The multiplier indicates what multiple of the monetary base is transformed into money supply.

E-wallets (like: Paytm, G-Pay, Phone Pay etc.) is increasing at fast pace now- a-days. Enhanced use of e-wallets is affecting money multiplier and money supply positively. People hold less cash and more deposits, thus reducing the currency-deposit ratio; increasing the money multiplier causing the money supply to increase.

![]()

(d) What is the different between price ceiling and price floor? (2 Marks)

Answer:

When prices of certain essential commodities rise excessively, government may resort to controls in the form of price ceilings (also called maximum price) for making a resource or commodity available to all at reasonable prices. For example: maximum prices of food grains and essential items are set by government during times of scarcity. A price ceiling which is set below the prevailing market clearing price will generate excess demand over supply.

Whereas price floor is a minimum price buyers are required to pay. When price floors are set above market clearing price, suppliers are encouraged to over-supply and there would be an excess of supply over demand.

Question 8.

(a) (i) The Rupee dollar exchange rate for two different periods of a particular financial year are as follows: (3 Marks)

(a) In the month of January it is $ 1 = ₹ 65; and

(b) In the month of April it is $ 1 = ₹ 70

Answer the following:

(1) What does this indicate?

(2) Who will be benefited, either residents of India or foreigners?

(3) Explain the impact of exchange fluctuations in terms of appreciation of currency on inflation.

Answer:

(1) In April, you will have to exchange a greater amount of Indian Rupees (₹ 70) to get the same 1 US dollar. As such, the value of the Indian Rupee has gone down or Indian Rupee has depreciated in its value. Rupee depreciation here means that the rupee has become less valuable with respect to the U.S. dollar.

(2) When a country’s currency depreciates, foreigners find that its exports are cheaper and domestic residents find that imports from abroad are more expensive. Hence, foreigners will be benefited.

(3) An appreciation may cause reduction in the levels of inflation because imports are cheaper. Lower price of imported capital goods, components and raw materials lead to decrease in cost of production which reflects on decrease in prices.

![]()

(a) (ii) One of the biggest problem with using discretionary policy to counteract fluctuation is the different types of lags involved in fiscal policy action. What are these lags? (2 Marks)

Answer:

One of the biggest problems with using discretionary fiscal policy to counteract fluctuations is the different types of lags involved in fiscal policy action. There are significant lags are:

(a) Recognition lag: The economy is a complex phenomenon and the state of the macro economic variables is usually not easily comprehensible. Just as in the case of any other policy, the government must first recognize the need for a policy change.

(b) Decision lag: Once the need for intervention is recognized, the government has to evaluate the possible alternative policies. Delays are likely to occur to decide on the most appropriate policy.

(c) Implementation lag: Even when appropriate policy measures are decided on, there are possible delays in bringing in legislation and implementing them.

(d) Impact lag: Impact lag occurs when the outcomes of a policy are not visible for some time.

(b) (i) The following data is available for a company: (3 Marks)

| Particulars | Amount (in ₹ Crore) |

| Gross Value Added (GVAMP) | 2,750 |

| Sales | 3,450 |

| Closing Stock | 750 |

| Interest | 200 |

| Opening Stock | 900 |

| Net Indirect taxes | 550 |

| Rent | 310 |

| Mixed income | 380 |

| Compensation to employees | 600 |

| Consumption of fixed capital ‘ | 320 |

Based on the above information, compute the following:

(a) Amount of Intermediates Consumption.

(b) Net Domestic Product at Factor Cost (NDPFC).

(c) Profit of the company.

Answer:

(a) GVAMp = Sales + Change in stocks (Closing – Opening) – Intermediate consumption

2,750 = 3,450 + (750 – 900) – Intermediate consumption

Intermediate consumption = 3,450 – 150 – 2,750 = 550 crores

(b) NDPFC = GVAMP – Net indirect tax – Depreciation

= 2,750 – 550 – 320 = 1,880 crores

(c) GVAMP = Compensation of employees + Rent + Interest + Profit + Mixed income + NIT

2,750 = 600 + 310 + 200 + Profit + 380 + 550 Profit

= 2,750 – 2,040 = 710 crores

![]()

(b) (ii) Explain briefly the Deflationary Gap. (2 Marks)

Answer:

Deflationary Gap is the amount by which actual aggregate demand falls short of aggregate supply at level of full employment. It is called deflationary because it leads to a fall in the price level. Deflationary gap causes deflation and decreases wages and price level in the economy.

Question 9.

(a) (i) Explain the operation of Cash Reserve Ratio. (3 Marks)

Answer:

Cash Reserve Ratio (CRR) refers to the fraction of the total net demand and time liabilities (NDTL) of a scheduled commercial bank in India which it should maintain as cash deposit with the Reserve Bank. The RBI may set the ratio in keeping with the broad objective of maintaining monetary stability in the economy. This requirement applies uniformly to all scheduled banks in the country irrespective of its size or financial position. Non-Bank Financial Institution (NBFIs) are outside the purview of this reserve requirement.

(a) (ii) “Net Exports” can be negative or positive. How is it significant for the economy of a country? (2 Marks)

Answer:

Net exports are the difference between exports and imports of a country during the accounting year. It can be positive or negative.

The net export variable is very important in the computation of a country’s GDP. A trade surplus is added to the country’s GDP. Net exports can also serve as a measure of financial health for a country. A country with a high export value generates income from other countries.

![]()

(b) (i) Tariffs are basically taxes or duties on goods and services which are imported or exported. Briefly explain Preferential, Applied and Escalated tariff. (3 Marks)

Answer:

Tariffs, also known as customs duties, are basically taxes or duties imposed on goods and services which are imported or exported. It is defined as a financial charge in the form of a tax, imposed at the border on goods going from one customs territory to another.

Preferential Tariff: Nearly all countries are part of at least one preferential trade agreement, under which they promise to give another country’s products lower tariffs than their MFN rate. These agreements are reciprocal. A lower tariff is charged from goods imported from a country which is given preferential treatment. Examples are preferential duties in the EU region under which a good coming into one EU country to another is charged zero tariffs.

Applied Tariffs: An ‘applied tariff’ is the duty that is actually charged on imports on a most-favoured nation (MFN) basis. A WTO member can have an applied tariff for a product that differs from the bound tariff for that product as long as the applied level is not higher than the bound level.

Escalated Tariff: It refers to the system wherein the nominal tariff rates on imports of manufactured goods are higher than the nominal tariff rates on intermediate inputs and raw materials, i.e. the tariff on a product increases as that product moves through the value-added chain. For example a four per cent tariff on iron ore or iron ingots and twelve percent tariff on steel pipes.

This type of tariff is discriminatory as it protects manufacturing industries in importing countries and dampens the attempts of developing manufacturing industries of exporting countries. This has special relevance to trade between developed countries and developing countries. Developing countries are thus forced to continue to be suppliers of raw materials without much value addition.

![]()

(b) (ii) Write down the name of fiscal function of the Government in Eco-nomic System, for the following cases: (2 Marks)

(a) Government imposes higher taxes on tobacco products in Union Budget.

(b) Government scheme providing free ration to BPL families.

(c) Government providing subsidy to farmers in purchasing of Urea for agricultural purpose.

(d) Increase in Government expenditure in the time of recession.

Answer:

(a) Allocation function

(b) Allocation function

(c) Redistribution function

(d) Stabilization function

Question 10.

(a) (i) Discuss with example the following types of foreign Direct Investment. (3 Marks)

(a) Horizontal Direct Foreign Investment

(b) Vertical Direct Foreign Investment

(c) Two-way Direct Foreign Investment

Answer:

(a) A Horizontal Direct Foreign Investment is said to take place when the investor establishes the same type of business operation in a foreign country as it operates in its home country, for example, a cell phone service provider based in the United States moving to India to provide the same service.

(b) A Vertical Direct Foreign Investment is one under which the investor establishes or acquires a business activity in a foreign country which is different from the investor’s main business activity yet in some way supplements its major activity.

(c) Two-way Direct Foreign Investments another category of investments which are reciprocal investments between countries that occur when some industries are more advanced in one nation (for example, the computer industry in the United States), while other industries are more efficient in other nations (such as the automobile industry in Japan).

![]()

(a) (ii) Mention the name of the externalities (along with reason in brief) covered in the following acts: (2 Marks)

(a) A Road Construction Company provides training to its employees to learn latest technology for durable road construction.

(b) People taking COVID Booster Dose happily.

Answer:

(a) Positive production externalities: The firm generates positive benefits on other firms by providing training to its employees, when other firms hire such workers as they change their jobs.

(b) Positive consumption externalities: When people took COVID Booster Dose happily and get immunized against COVID, they would confer a social benefit to others as well by preventing others from getting infected.

(b) (i) What do you understand by “Liquidity Adjustment Facility (LAF)”? (3 Marks)

Answer:

From June 2000, the RBI has introduced Liquidity Adjustment Facility (LAF). The Liquidity Adjustment Facility (LAF) is a facility extended by the Reserve Bank of India to the scheduled commercial banks (excluding RRBs) and primary dealers to avail of liquidity in case of requirement (or park excess funds with the RBI in case of excess liquidity) on an overnight basis against the collateral of government securities including state government securities.

The introduction of LAF is an important landmark since it triggered a rapid transformation in the monetary policy operating environment in India. As a key element in the operating framework of the RBI, its objective is to assist banks to adjust their day-to-day mismatches in liquidity. Currently, the RBI provides financial accommodation to the commercial banks through repos/ reverse repos under the Liquidity Adjustment Facility (LAF).

![]()

(b) (ii) Markets are amazingly competent in organizing the activities of an economy as they are generally efficient and capable of achieving optimal allocation of resources. However, market failure occurs. Discuss briefly any two reasons leading to market failure. (2 Marks)

Answer:

The general belief is that markets are amazingly competent in organizing the activities of an economy as they are generally efficient and capable of achieving optimal allocation of resources. However, there are exceptions to this. Under certain circumstances, ‘market failure’ occurs, i.e. the market fails to allocate resources efficiently and therefore, market outcomes become inefficient.

There are four major reasons for market failure. They are:

(a) Market power,

(b) Externalities,

(c) Public goods, and

(d) Incomplete information.

Question 11.

(a) (i) How are the following transactions treated in National Income Calculation? (3 Marks)

(a) B sold a used car to C and receive ? 80,000. How much of the sale proceeds will be included in National Income calculation?

(b) Fees paid to real estate agents and lawyers.

(c) Electric power sold to a consumer household.

Answer:

(a) No impact as transactions of second hand goods are not part of national income.

(b) Yes, this amount will be included in national as it is the income of real estate agents and lawyers.

(c) Electric power sold to a consumer household will be included in national income because its a part of private final consumption expenditure.

![]()

(a) (ii) What are the Guiding principles of World Trade Organization (WTO)? (2 Marks)

Answer:

- Trade without discrimination

- The National Treatment Principle (NTP)

- Free trade

- Predictability

- Principle of general prohibition of quantitative restrictions

- Greater competitiveness

- Tariffs as legitimate measures for the protection of domestic industries

- Transparency in Decision Making

- Progressive Liberalization

- Market Access

- Special privileges to less developed countries

- Protection of Health & Environment

- A transparent, effective and verifiable dispute settlement mechanism.

(b) (i) Discuss with examples the major aspects of market failures. (2 Marks)

Answer:

The pertinent question here is why do markets fail? There are four major reasons for market failure. They are:

(1) Market power:

Market power or monopoly power is the ability of a firm to profitably raise the market price of a good or service over its marginal cost. Firms that have market power are price makers and therefore, can charge a price that gives them positive economic profits. Excessive market power causes the single producer or a small number of producers to produce and sell less output than would be produced in a competitive market. Market power can cause markets to be inefficient because it keeps price higher and output lower than the outcome of equilibrium of supply and demand.

(2) Externalities:

However, sometimes, the actions of either consumers or producers result in costs or benefits that do not reflect as part of the market price. Such costs or benefits which are not accounted for by the market price are called externalities because they are “external” to the market. In other words, there is an externality when a consumption or production activity has an indirect effect on other’s consumption or production activities and such effects are not reflected directly in market prices.

![]()

(3) Public goods:

A public good (also referred to as collective consumption good or social good) is defined as one which all enjoy in common in the sense that each individual’s consumption of such a good leads to no subtraction from any other individuals’ consumption of that good. Because of the peculiar characteristics of public goods such as indivisibility, non-excludability and non-rivalry, competitive private markets will fail to generate economically efficient outputs of public goods.

(4) Incomplete information:

Information failure is widespread in numerous market exchanges. When this happens misallocation of scarce resources takes place and equilibrium price and quantity is not established through price mechanism. This results in market failure.

(b) (ii) Briefly explain the concept of “Liquidity Trap”. (2 Marks)

OR

Why empirical analysis of money supply is important? (2 Marks)

Answer:

A liquidity trap is a situation, described in Keynesian economics, in which, after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash rather than holding a debt which yields so low a rate of interest.

OR

Empirical analysis of money supply is important for two reasons:

(1) It facilitates analysis of monetary developments in order to provide a deeper understanding of the causes of money growth.

![]()

(2) It is essential from a monetary policy perspective as it provides a framework to evaluate whether the stock of money in the economy is consistent with the standards for price stability and to understand the nature of deviations from this standard.

The central banks all over the world adopt monetary policy to stabilise price level and GDP growth by directly controlling the supply of money. This is achieved mainly by managing the quantity of monetary base. The success of monetary policy depends to a large extent on the controllability of money supply and the monetary base.