CA Inter FM ECO Paper May 2022 – CA Inter FM ECO Study Material is designed strictly as per the latest syllabus and exam pattern.

CA Inter FM ECO Question Paper May 2022 Solution

Question 1.

(a) Following are the information and ratios are given for W limited for the year ended 31st March, 2022:

Equity Share Capital of 10 each : ₹ 10 Lakhs

Reserves & Surplus to Shareholder& Fund : 0.50

Sales / Shareholders’ Fund : 1.50

Current Ratio : 2.50

Debtors Turnover Ratio : 6.00

Stock Velocity : 2 Months

Gross Profit Ratio : 20%

Net Working Capital Turnover Ratio : 2.50

You are required to calculate:

(1) Shareholders’ Fund

(2) Stock

(3) Debtors

(4) Current Liabilities

(5) Cash Balance (5 Marks)

Answer:

(1) Shareholders’ Fund = Equity Share Capital + Reserve and Surplus

= ₹ 10 Lakhs + 0.50 Shareholders’ Fund

0.50 Shareholders’Fund = ₹ 10 Lakhs

Shareholders’ Fund = ₹ 10 Lakhs ÷ 0.50 = ₹ 20,00,000

\(\frac{\text { Reserve and Surplus }}{\text { Shareholders’ Fund }} \) = 0.50 or Reserve & Surplus = 0.50 Shareholders’ Fund

(2) Stock = COGS × Stock Velocity /12

= ₹ 24,00,000 × 2 /12 = ₹ 4,00,000

\(\frac{\text { Sales }}{\text { Shareholders Fund }}\) = 1.50 or Sales = 1.50 Shareholders’ Fund

Sales = 1.50 × ₹ 20,00,000 = ₹ 30,00,000

COGS = Sales – Gross Profit

= ₹ 30,00,000 – 20% = ₹ 24,00,000

(3) Debtors = Annual Credit Sales -P Debtors Turnover Ratio

= ₹ 30,00,000 ÷ 6 = ₹ 5,00,000

(4) Current Liabilities

Current Ratio = CA ÷ CL = 2.50

Current Assets = 2.50 CL

\(\frac{\text { Sales }}{\text { Net Working Capital }}\) = 2.50

Net Working Capital = Sales ÷ 2.50 = ₹ 30,00,000 ÷ 2.50 = ₹ 12,00,000

CA – CL = ₹ 12,00,000

2.5 CL – CL = ₹ 12,00,000

Current Liabilities = ₹ 12,00,000 ÷ 1.5 = ₹ 8,00,000

(5) Cash Balance = Current Asset – Debtors – Stock

= ₹ 20,00,000 – ₹ 5,00,000 – ₹ 4,00,000

= ₹ 11,00,000

Current Asset = 2.5 CL

= 2.5 × 8,00,000 = ₹ 20,00,000

![]()

(b) Balance sheet of X Ltd. for the year ended 31st March, 2022 is given below: (₹ in lakhs)

| Liabilities | Amount | Amount | |

| Equity Shares ₹ 10 each | 200 | Fixed Assets | 500 |

| Retained Earnings | 200 | Raw Materials | 150 |

| 11% Debentures | 300 | WIP | 100 |

| Public Deposits (Short-term) | 100 | Finished Goods | 50 |

| Trade Creditors | 80 | Debtors | 125 |

| Bills Payable | 100 | Cash and Bank | 55 |

| 980 | 980 |

Calculate the amount of maximum permissible bank finance under three methods as per Tandon Committee lending norms.

Total core current assets are assumed to be ₹ 30 Lakhs. (5 Marks)

Answer:

Calculation of MPBF:

Method 1 = 75% (CA – CL) = 15% (480 – 280) = ₹ 150 Lakhs

Method 2 = (75% CA) – CL = (75% 480) – 280 = ₹ 80 lakhs

Method 3 = (75% CA other than core CA) – CL

= 75% (480 -30) – 280 = ₹ 57.50 Lakhs

Current Assets = Raw Materials + WIP + Finished Goods + Debtors + Cash and Bank

= 150 + 100 + 50 + 125 + 55 = ₹ 480Lakhs

Current Liabilities = Public deposit (Short.term) + Trade Creditors + Bills Payable

= 100 + 80 + 100 = ₹ 280 Lakhs

![]()

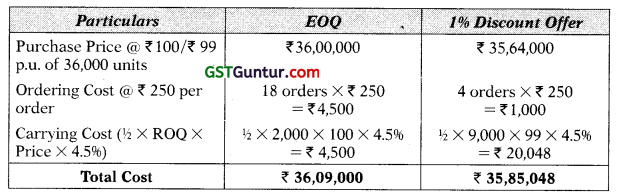

(c) A company requires 36,000 units of a product per year at a cost of ₹ 100 per unit. Ordering cost per order is ₹ 250 and the carrying cost is 4.5% per year of the inventory cost. Normal lead time is 25 days and safety stock is Nil. Assume 360 working days in a year.

(а) Calculate the Reorder Inventory Level.

(b) Calculate the Economic Order Quantity (EOQ).

(c) If the Supplier offers 1% quantity discount for purchase in lots of 9,000 units or more, should the company accept the proposal? (5 Marks)

Answer:

(a) Reorder Inventory Level = (Average Consumption × Average Lead Time) + Safety Stock

= [(36,000 ÷ 360) × 25 days] + Nil

= 2,500 units

(b) EOQ = \(\sqrt{\frac{2 \mathrm{AO}}{\mathrm{C}}}\) = \(\sqrt{\frac{2 \times 36,000 \times 250}{100 \times 4.5 \%}}\) = 2,000 units

(c) Statement of Evaluation of 1% Discount Offer

Advise: Company should accept 1% discount offer (Net saving by acceptance is ₹ 23,952).

(d) P Ltd. is considering a project with the following details: (5 Marks)

| Initial Project Cost | ₹ 1,00,000 | |||

| Annual Cash Inflow (₹) | 1 | 2 | 3 | 4 |

| 30,000 | 40,000 | 50,000 | 60,000 | |

| Project Life (years) | 4 | |||

| Cost of Capital | 10% | |||

(a) MEASURE the sensitivity of the project to change in Initial Project Cost and Annual Cash Inflows (considering each factor at a time) such that NPV become zero.

(b) IDENTIFY which of the two factors; the project is most sensitive to affect the acceptability of the project?

| Years | 1 | 2 | 3 | 4 | 5 |

| PVIF0.10,t | 0.909 | 0.826 | 0.751 | 0.683 | 0.621 |

Answer:

Current Net Present value (NPV)

| Years | Particulars | ₹ | PVIF @ 10% | PV |

| 0 | Initial outflows | (1,00,000) | 1.000 | (1,00,000) |

| 1 | Annual Cash Inflows | 30,000 | 0.909 | 27,270 |

| 2 | Annual Cash Inflows | 40,000 | 0.826 | 33,040 |

| 3 | Annual Cash Inflows | 50,000 | 0.751 | 37,550 |

| 4 | Annual Cash Inflows | 60,000 | 0.683 | 40,980 |

| NPV | 38,840 | |||

(a) Measurement of Sensitivity:

(i) Sensitivity Analysis w.r.t. Initial Project Cost:

NPV of the project would be zero when the cost of the project is increased by ₹ 38,840

∴ Percentage change in the cost = (38,840 ÷ 1,00,000) × 100 = 38.84%

(ii) Sensitivity Analysis w.r.t. Annual Cash Flows:

NPV of the project would be zero when the PV of annual cash inflows is decreased by ₹ 3 8,840

∴ Percentage change in the annual cash inflows = (38,840 ÷ 1,38,840) × 100 = 27.97%

(b) The Annual cash inflows is the most sensitive as only a change beyond 27.97% in savings makes the project unacceptable.

![]()

Question 2.

Details of a company for the year ended 31st March, 2022 are given below: (10 Marks)

Sales : ₹ 86,00,000

Profit Volume (P/V) Ratio : 35%

Fixed Cost excluding interest expenses : ₹ 10,00,000

10% Debt : ₹ 55,00,000

Equity Share Capital of ₹ 10 each : ₹ 75,00,000

Income Tax Rate : 40%

Required:

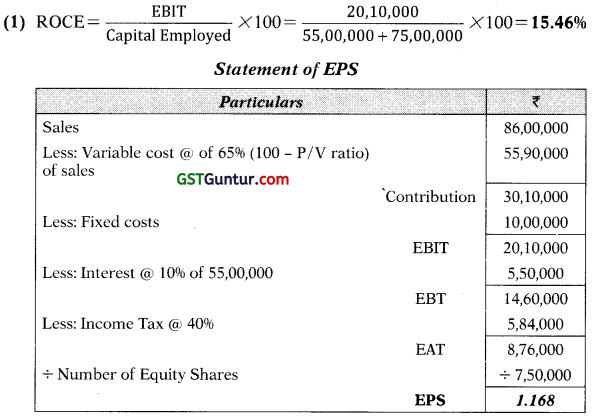

(1) Determine company’s Return on Capital Employed (Pre-tax) and EPS.

(2) Does the company have a favourable financial leverage?

(3) Calculate operating and combined leverage of the company.

(4) Calculate percentage change in EBIT, if sales increases by 10%.

(5) At what level of sales, the Earning Before Tax (EBT) of the company will be equal to zero?

Answer:

(2) ROCE is 15.46% and Interest on debt is 10%, hence, it has a favourable financial leverage.

(3) Calculation of Operating and Combined leverages:

Operating Leverage = \(\frac{\text { Contribution }}{\text { EBIT }}\) = \(\frac{30,10,000}{20,10,000}\) = 1.497

Combined Leverage = \(\frac{\text { Contribution }}{\text { EBT }}\) = \(\frac{30,10,000}{14,60,000}\) = 2.062

(4) Operating leverage is 1.497. So if sales is increased by 10% then EBIT will be increased by 1.497 × 10 i.e. 14.97% (approx.)

(5) EBT = Sales – Variable cost – Fixed cost – Interest

Nil = Sales – 65% sales – 10,00,000 – 5,50,000

35% of sales = 15,50,000

Sales = ₹ 44,28,571

![]()

Question 3.

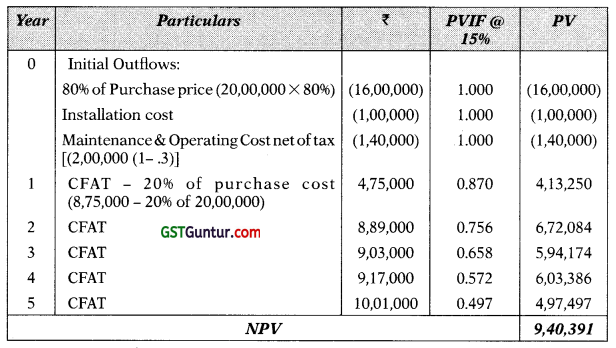

Alpha Limited is a manufacturer of computers. It wants to introduce artificial intelligence while making computers. The estimated annual saving from introduction of the Artificial Intelligence (AI) is as follows: (10 Marks)

- Reduction of five employees with annual salaries of ₹ 3,00,000 each.

- Reduction of ₹ 3,00,000 in production delays caused by inventory problem;

- Reduction in lost sales ₹ 2,50,000; and

- Gain due to timely billing ₹ 2,00,000

The purchase price of the system for installation of artificial intelligence is ₹ 20,00,000 and installation cost is ₹ 1,00,000. 80% of the purchase price will be paid in the year of purchase and remaining will be paid in next year.

The estimated life of the system is 5 years and it will be depreciated on a straight-line basis.

However, the operation of the new system requires two computer specialists with annual salaries of ₹ 5,00,000 per person.

In addition to above, annual maintenance and operating cost for five years are as below:

(Amount in ₹)

| Year | 1 | 2 | 3 | 4 | 5 |

| Maintenance & Operating Cost | 2,00,000 | 1,80,000 | 1,60,000 | 1,40,000 | 1,20,000 |

Maintenance and Operating Cost are payable in advance.

The company’s tax rate is 30% and its required rate of return is 15%.

| Year | 1 | 2 | 3 | 4 | 5 |

| PVIF0.10,t | 0.909 | 0.826 | 0.751 | 0.683 | 0.621 |

| PVIF0.12,t | 0.893 | 0.797 | 0.712 | 0.636 | 0.567 |

| PVIF0.15,t | 0.870 | 0.756 | 0.658 | 0.572 | 0.497 |

Evaluate the project by using Net Present Value and Profitability Index.

Answer:

(1) Net Present value (NPV)

Advice: Accept the proposal having positive NPV.

(2) Profitability Index = PV of Inflows ÷ PV of Outflows

= 27,80,391 ÷ 18,40,000 = 1.51

Advice: Accept the proposal having PI higher than 1.

Working Note:

Statement of CFAT

![]()

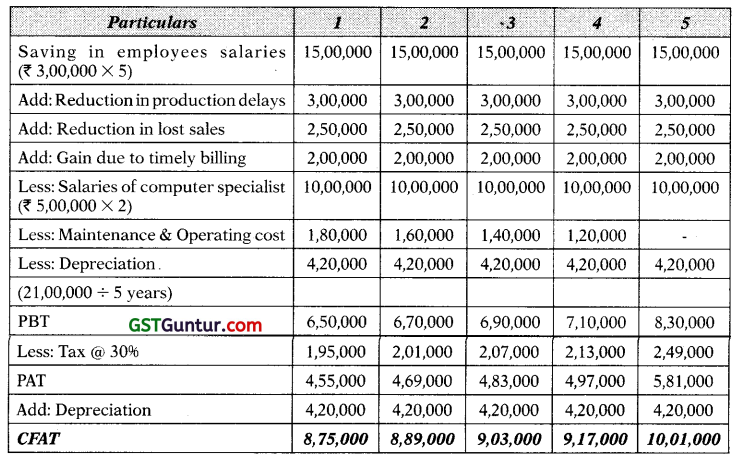

Question 4.

The particulars relating to Raj Ltd. for the year ended 31st March, 2022 are given as follows:

| Output (units at normal capacity) | 1,00,000 |

| Selling price per unit | ₹ 40 |

| Variable cost per unit | ₹ 20 |

| Fixed cost | ₹ 10,00,000 |

The capital structure of the company as on 31st March, 2022 is as follows:

| Particulars | Amount in ₹ |

| Equity Share Capital (1,00,000 shares of ₹ 10 each) | 10,00,000 |

| Reserves and Surplus | 5,00,000 |

| Current Liabilities | 5,00,000 |

| Total | 20,00,000 |

Raj Ltd. has decided to undertake an expansion project to use the market potential that will involve ₹ 20,00,000. The company expects an increase in output by 50%. Fixed cost will be increased by ₹ 5,00,000 and variable cost per unit will be increased by 15%. The additional output can be sold at the existing selling price without any adverse impact on the market.

The following alternative schemes for financing the proposed expansion program are planned:

| Amount in ₹ | ||

| Alternative | Equity Shares | |

| 1 | 5,00,000 | Balance |

| 2 | 10,00,000 | Balance 1 |

| 3 | 14,00,000 | Balance |

Slab wise interest rate for fund borrowed is as given follows:

| Fund Limit | Applicable Interest Rate |

| Upto ₹ 5,00,000 | 10% |

| Over ₹ 5,00,000 and upto ₹ 10,00,000 | 15% |

| Over ₹ 10,00,000 | 20% |

Current market price per share is 200.

Find out which of the abovementioned alternatives would you recommend for raj Ltd. with reference to the EPS, assuming a corporate tax rate is 40%? (10 Marks)

Answer:

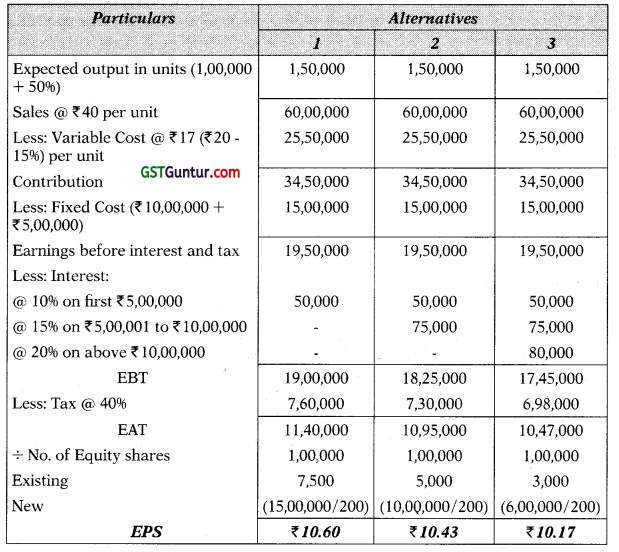

Statement of EPS

Decision: The earning per share is higher in alternative I ie. if the company finance the project by raising debt of ₹ 5,00,000 & issue equity shares of ₹ 15,00,000. Therefore, the company should choose this alternative to finance the project.

![]()

Question 5.

A company issues:

15% convertible debentures of ₹ 100 each at par with a maturity period of 6 years. On maturity, each debenture will be converted into 2 equity shares of the company. The risk-free rate of return is 10%, market risk premium is 18% and beta of the company is 1.25. The company has paid dividend of ₹ 12.76 per share. Five year ago, it paid dividend of ₹ 10 per share. Flotation cost is 5% of issue amount.

5% preference shares of ₹ 100 each at premium of 10%. These shares are redeemable after 10 years at par. Flotation cost is 6% of issue amount.

Assuming corporate tax rate is 40%.

(a) Calculate the cost of convertible debentures using the approximation method.

(b) Use YTM method to calculate cost of preference shares. (10 Marks)

Answer:

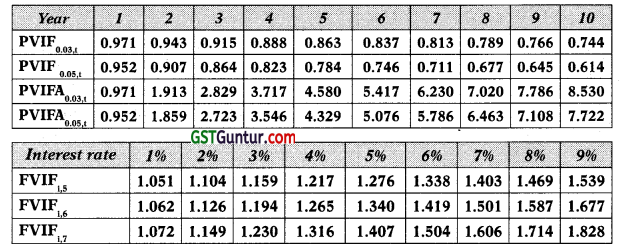

(a) Calculation of cost of Convertible Debentures using Approximation method:

= 13.24%

Working Notes:

Determination of Redemption value:

Higher of

(i) The cash value of debentures = ₹ 100

(ii) Value of equity shares = 2 shares × ₹ 48.72 (1 + 0.05)6 = ₹ 130.58

₹ 130 will be taken as redemption value as it is higher than the cash option and attractive to the investors.

Calculation of Value of Share today:

P0 = \(\frac{D_1}{\mathrm{~K}_{\mathrm{e}}-\mathrm{g}}\) = \(\frac{12.76(1+0.05)}{32.50 \%-5 \%}\) = ₹ 48.72

Ke = Rf + β (Rm – Rf) = 10% + 1.25 × 18% = 32.50%

g = \(\sqrt[5]{\frac{12.76}{10.00}}\) = 5% or

g = 12.76 ÷ 10.00 = 1.276 (5% for 5 year; given in interest rate table)

![]()

(b) Calculation of Cost of Preference shares using YTM method:

Calculation of NPV at two discount rates:

IRR/Kd = LR + \(\frac{\mathrm{NPV}_L}{\mathrm{NPV}_L-\mathrm{NPV}_H}\) × (H – L) = 3% + \(\frac{13.65}{13.65-(-3.39)}\) × (5% – 3%)

= 4.60%

Working Note:

Net Proceeds = Issue Price – Flotation Cost

= (100 + 10% Premium) – 6% = ₹ 103.40

Question 6.

(a) Identify the limitations of Internal Rate of Return. (4 Marks)

Answer:

Followings are the limitations of IRR:

(a) The calculation process is tedious if there is more than one cash outflow interspersed between the cash inflows; there can be multiple IRR, the interpretation of which is difficult.

(b) The IRR approach creates a peculiar situation if we compare two projects with different inflow/outflow patterns.

(c) It is assumed that under this method all the future cash inflows of a proposal are reinvested at a rate equal to the IRR. It ignores a firm’s ability to reinvest in portfolio of different rates.

(d) If mutually exclusive projects are considered as investment options which have considerably different cash outlays. A project with a larger fund commitment but lower IRR contributes more in terms of absolute NPV and increases the shareholders’ wealth. In such situation decisions based only on IRR criterion may not be correct.

![]()

(b) Briefly explain the assumptions of the Walter’s Model. (4 Marks)

Answer:

Followings are the assumptions of Walter’s Model:

(a) All investment proposals of the firm are to be financed through retained earnings only.

(b) ‘ r’ rate of return & ‘Ke’ cost of capital are constant.

(c) Perfect capital markets: The firm operates in a market in which all investors are rational and information is freely available to all.

(d) No taxes or no tax discrimination between dividend income and capital appreciation (capital gain). It means there is no difference in taxation of dividend income or capital gain. This assumption is necessary for the universal applicability of the theory, since, the tax rates may be different in different countries.

(e No flotation or transaction cost: Similarly, these costs may differ country to country or market to market.

(f) The firm has perpetual life

![]()

(c) State advantages of “Wealth Maximization” goals in Financial Management (2 Marks)

OR

Distinguish between American Depository Receipts and Global Depository Receipts. (2 Marks)

Answer:

Followings are the advantages of ‘Wealth Maximization’:

(a) Emphasizes the long-term gains

(b) Recognises risk or uncertainty

(c) Recognises the timing of returns id) Considers shareholders’ return.

Or

Answer:

American Depository Receipts (ADRs): These are securities offered by non-US companies who want to list on any of the US exchange. Each ADR represents a certain number of a company’s regular shares. ADRs allow US investors to buy shares of these companies without the costs of investing directly in a foreign stock, exchange.

The Indian companies have preferred the GDRs to ADRs because the US market exposes them to a higher level of responsibility than a European listing in the areas of disclosure, costs, liabilities and timing. The regulations are somewhat more stringent and onerous, even for companies already listed and held by retail investors in their home country. The most onerous aspect of a US listing for the companies is to provide full, half yearly and quarterly accounts in accordance with, or at least reconciled with US GAAPs.

Global Depository Receipts (GDRs): These are negotiable certificates held in the bank of one country representing a specific number of shares of a stock traded on the exchange of another country. These financial instruments are used by companies to raise capital in either dollars or Euros. These are mainly traded in European countries and particularly in London.

![]()

Question 7.

(a) Following information, relating to a particular financial year, are given as under: (3 Marks)

| ₹ in Crores | |

| Sales | 3,500 |

| Intermediate Consumption | 400 |

| Closing Stock | 300 |

| Opening Stock | 200 |

| Net Indirect Tax | 600 |

| Mixed Income | 200 |

| Consumption of Fixed Capital | 400 |

| Compensation of Employees | 400 |

Compute:

(a) GVAMP

(b) NDPMP

(c) Operating Surplus

Answer:

(a) GVAMP = Value of output- Intermediate consumption

= Sales + Change in stock – Intermediate consumption

= 3,500 + (300 – 200) – 400 = 3,200 Crores

(b) NDPMP = GVAMP – Consumption of Fixed Capital

= 3,200 – 400 = 2,800 Crores

(c) NDPFC 2,200 = Compensation of Employees + Operating Surplus + Mixed Income 400 + Operating Surplus + 200

Operating Surplus = 1,600 Crores

NDPFC = NDPMP – Net Indirect Tax

= 2,800 – 600 = 2,200 Crores

![]()

(b) State the features of Foreign Portfolio Investment. (3 Marks)

Answer:

Foreign Portfolio Investment (FPI) is not concerned with either manufacture of goods or with provision of services. Such investors also do not have any intention of exercising voting power or controlling or managing the affairs of the company in whose securities they invest.

The singular intention of a foreign portfolio investor is to earn a remunerative return through investment in foreign securities and is primarily concerned about the safety of their capital, the likelihood of appreciation in its value, and the return generated. Logically, portfolio capital moves to a recipient country which has revealed its potential for higher returns and profitability.

Following international standards, portfolio investments are characterised by lower stake in companies with their total stake in a firm at below 10 per cent. It is also noteworthy that unlike the FDIs, these investments are typically of short term nature, and therefore, are not intended to enhance the productive capacity of an economy by the creation of capital assets.

Portfolio investors will evaluate, on a separate basis, the prospects of each independent unit in which they might invest and may often shift their capital with changes in these prospects. Therefore, portfolio investments are, to a large extent, expected to be speculative. Once investor confidence is shaken, such capital has a tendency to speedily shift from one country to another, occasionally creating financial crisis for the host country.

![]()

(c) Comment on the role of Government intervention for equitable distribution. (2 Marks)

Answer:

One of the most important activities of the government is to redistribute incomes so that there is equity and fairness in the society. Equity can be brought about by redistribution of endowments with which the economic agents enter the market.

Some common policy interventions include: progressive income tax, targeted budgetary allocations, unemployment compensation, transfer payments, subsidies, social security schemes, job reservations, land reforms, gender sensitive budgeting etc. Government also intervenes to combat black economy and market distortions associated with a parallel black economy. Government intervention in a market that reduces efficiency while increasing equity is often justified because equity is greatly appreciated by society.

(d) Describe the precautionary motive for money. (2 Marks)

Answer:

Many unforeseen and unpredictable contingencies involving money payments occur in our day to day life. Individuals as well as businesses keep a portion of their income to finance such unanticipated expenditures. The amount of money demanded under the precautionary motive depends on the size of income, prevailing economic as well as political conditions and personal characteristics of the individual such as optimism/pessimism, farsightedness etc. Keynes regarded the precautionary balances just as balances under transactions motive as income elastic and by itself not very sensitive to rate of interest.

![]()

Question 8.

(a)(i) Differentiate between Non-Discretionary and Discretionary Fiscal Policy. (3 Marks)

Ans.

Non-discretionary fiscal policy or automatic stabilizers are part of the structure of the economy and are ‘built-in’ fiscal mechanisms that operate automatically to reduce the expansions and contractions of the business cycle. Changes in fiscal policy do not always require explicit action by government. In most economies, changes in the level of taxation and level of government spending tend to occur automatically.

These are dependent on and are determined by the level of aggregate production and income, such that the instability caused by business cycle is automatically dampened without any need for discretionary policy action. Any government programme that automatically tends to reduce fluctuations in GDP is called an automatic stabilizer.

However, automatic stabilizers that depend on the level of economic activity alone would not be sufficient to correct instabilities. The government needs to resort to discretionary fiscal policies. Discretionary fiscal policy for stabilization refers to deliberate policy actions on the part of government to change the levels of expenditure, taxes to influence the level of national output, employ-ment and prices. Governments influence the economy by changing the level and types of taxes, the extent and composition of spending, and the quantity and form of borrowing.

![]()

(a) (ii) Write a brief note on Countervailing Duties. (2 Marks)

Answer:

Countervailing duties are tariffs that aim to offset the artificially low prices charged by exporters who enjoy export subsidies and tax concessions offered by the governments in their home country. If a foreign country does not have a comparative advantage in a particular good and a government subsidy allows the foreign firm to be an exporter of the product, then the subsidy generates a distortion from the free-trade allocation of resources.

In such cases, CVD is charged in an importing country to negate the advantage that exporters get from subsidies to ensure fair and market oriented pricing of imported products and thereby protecting domestic industries and firms. For example, in 2016, in order to protect its domestic industry, India imposed 12.5% countervailing duty on Gold jewellery imports from ASEAN.

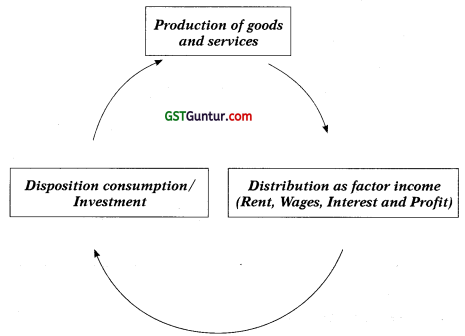

(b )(i) Explain the ‘Circular Flow of Income’. (3 Marks)

Answer:

Circular flow of income refers to the continuous circulation of production, income generation and expenditure involving different sectors of the economy. There are three different interlinked phases in a circular flow of income,

namely: production, distribution and disposition as can be seen from the following figure.

Circular Flow of Income

- In the production phase, firms produce goods and services with the help of factor services.

- In the income or distribution phase, the flow of factor incomes in the form of rent, wages, interest and profits from firms to the households occurs.

- In the expenditure or disposition phase, the income received by different factors of production is spent on consumption goods and services and investment goods. This expenditure leads to further production of goods and services and sustains the circular flow.

These processes of production, distribution and disposition keep going on simultaneously and enable us to look at national income from three different angles namely: as a flow of production or value added, as a flow of income and as a flow of expenditure. Each of these different ways of looking at national income suggests a different method of calculation and requires a different set of data. The details in respect of what is measured and what data are required for all three methods mentioned above are given in the following table.

![]()

(b) (ii) What will be the total money credit created by the commercial banking system for an initial deposit of ₹ 500 if the required reserve ratio is 0.04, 0.06 and 0.10 per cent respectively. Compute credit multiplier. (2 Marks)

Answer:

(a) Credit Multiplier = \(\frac{1}{\text { Required Reserved Ratio }}\)

Required Reserved Ratio

For RRR 0.04 Credit Multiplier = \(\frac{1}{\text { Required Reserved Ratio }}\) = 1/0.04 = 25

For RRR 0.06 Credit Multiplier = \(\frac{1}{\text { Required Reserved Ratio }}\) = 1/0.06 = 16.67

For RRR 0.10 Credit Multiplier = \(\frac{1}{\text { Required Reserved Ratio }}\) = 1/0.10 = 10

(b) Credit Creation = Initial deposits × Credit Multiplier

For RRR 0.04

Credit Creation = 500 × 25 — 12,500

For RRR 0.06

Credit Creation = 500 × 16.67 = 8,333

For RRR 0.10

Credit Creation = 500 × 10 = 5,000

![]()

Question 9.

(a) (i) Explain ‘Global Public goods’ with examples. (3 Marks)

Answer:

There are several public goods benefits of which accrue to everyone in the world. These goods have widespread impact on different countries and regions, population groups and generations. These are goods whose impacts are indivisibly spread throughout the entire globe.

The WHO delineates two categories of global public goods namely, final public goods which are ‘outcomes’, (e.g. the eradication of polio) and intermediate public goods, which contribute to the provision of final public goods, (e.g. International Health Regulations aimed at stopping the cross-border movement of communicable diseases and thus reducing cross-border health risks).

Similarly, the World Bank identifies five areas of global public goods which it seeks to address: namely, the environmental commons (including the prevention of climate change and biodiversity), communicable diseases (including HIV /AIDS, tuberculosis, malaria and avian influenza), international trade, international financial architecture, and global knowledge for development. The distinctive characteristic of global public goods is that there is no mechanism (either market or government) to ensure an efficient outcome.

(a) (ii) What is Aggregate Demand Function? (2 Marks)

Answer:

In a simple two-sector economy Aggregate Demand (AD) or aggregate expenditure consists of only two components:

(i) Aggregate demand for consumer goods (C), and

(ii) Aggregate demand for investment goods (I)

AD = C + I

Of the two components, consumption expenditure accounts for the highest proportion of the GDP. In a simple economy, the variable I is assumed to be determined exogenously and constant in the short run. Therefore, the short- run aggregate demand function can be written as:

AD = C + I (constant investment)

We can infer that, in the short run, AD depends largely on the aggregate consumption expenditure.

![]()

(b) (i) Calculate the volume of Transaction:

Price = 105

Velocity of money = 4.2

Money supply = 4500 billion

What will be the outcome if volume of transaction increases to 240? (3 Marks)

Answer:

MV = PT,

(a) 4500 × 4.2 = 105 × T

T = 180

MV = PT,

(b) M × 4.2 = 105 × 240

M = 6,000 billion

(b) (ii) What do you mean by ‘Bound Tariff’? Explain.

Answer:

A bound tariff is a tariff which a WTO member binds itself with a legal commitment not to raise it above a certain level. By binding a tariff, often during negotiations, the members agree to limit their right to set tariff levels beyond a certain level. The bound rates are specific to individual products and represent the maximum level of import duty that can be levied on a product imported by that member.

A member is always free to impose a tariff that is lower than the bound level. Once bound, a tariff rate becomes permanent and a member can only increase its level after negotiating with its trading partners and compensating them for possible losses of trade. A bound tariff ensures transparency and predictability.

![]()

Question 10.

(a) (i) What are the common objectives of fiscal policy? (3 Marks)

Answer:

Most common objectives of fiscal policy are:

(a) Achievement and maintenance of full employment,

(b) Maintenance of price stability,

(c) Acceleration of the rate of economic development, and

(d) Equitable distribution of income and wealth.

(a) (ii) State the nature of the monetary policy for the following actions taken by the RBI of the country: (2 Marks)

(A) Reduction in the cash reserve ratio.

(B) Selling of securities in the open market.

(C) Increase of repo rate by 50 base point.

(D) Increase in the supply of currency and coins.

Answer:

| Action taken by RBI | Nature of Monetary policy | |

| (A) | Reduction in the cash reserve ratio | Expansionary policy |

| (B) | Selling of securities in the open market | Contractionary policy |

| (C) | Increase of repo rate by 50 base point | Contractionary policy |

| (D) | Increase in the supply of currency and coins | Expansionary policy |

![]()

(b) (i) Calculate, Multiplier and Marginal Propensity of Consume (MPC) with the help of following information: (3 Marks)

| Particulars | 2020 – 2021 (₹ in Crore) | 2021 – 2022 (₹ in Crore) |

| Investment | 1600 | 2000 |

| National income | 5000 | 6600 |

Answer:

Investment multiplier (k) = ∆Y/∆I = 1600/400 = 4

∆Y/∆I = \(\frac{1}{1-\mathrm{MPC}}\) = 4

4 – 4MPC = 1

MPC = 0.75

(b) (ii) Explain ‘Sanitary and Phytosanitary (SPS) Measures’. (2 Marks)

Answer:

SPS measures are applied to protect human, animal or plant life from risks arising from additives, pests, contaminants, toxins or disease-causing organisms and to protect biodiversity. These include ban or prohibition of import of certain goods, all measures governing quality and hygienic requirements, production processes, and associated compliance assessments. For example; prohibition of import of poultry from countries affected by avian flu, meat and poultry processing standards to reduce pathogens, residue limits for pesticides in foods etc.

![]()

Question 11.

(a) (i) The monetary authority of an economy has provided the following data: (3 Marks)

| Particulars | ₹ in Crores |

| Note in Circulation | 2,42,09,645 |

| Rupee Coin in Circulation | 3,25,572 |

| Small Coins in Circulation | 7,434 |

| Post Office Savings Bank Deposits | 14,17,868 |

| Cash in Hand with banks | 9,75,635 |

| Deposit Money of the Public | 1,77,61,992 |

| Demand Deposited with Bank | 1,73,76,925 |

| Other Deposits with Reserve Bank | 3,85,074 |

| Total Post Office Deposits | 1,48,966 |

| Time Deposits with Banks | 17,86,969 |

You are required to calculate (i) M1; and (ii) M2.

Answer:

M1 = (Notes in Circulation + Circulation of Rupee Coin + Circulation of Small Coins – Cash on Hand with Banks) + Deposit Money of the Public

= (2,42,09,645 + 3,25,572 + 7,434 – 9,75,635) + 1,77,61,992

= 4,13,29,008 Crores

M2 = M1+ Post Office Saving Bank Deposits

= 4,13,29,008 + 1,48,966

= 4,14,77,974 Crores

![]()

(a) (ii) Identify the market outcomes for each of the following situations: (2 Marks)

(A) Playing of loud music at night in inability to sleep.

(B) Wearing of mask during Covid-19 pandemic.

Answer:

| Situations | Market Outcomes | |

| (A) | Playing of loud music at night in inability to sleep | Negative consumption externalities |

| (B) | Wearing of mask during Covid-19 pandemic | Positive consumption externalities |

![]()

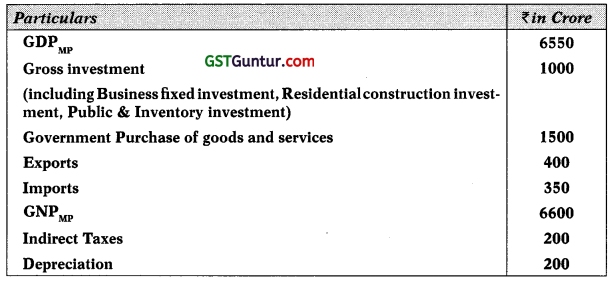

(b) (i) Following information, relating to an economy of a country, for the current year are as under: (3 Marks)

Find out:

(A) Private Final Consumption Expenditure

(B) Net Factor Income from Abroad

(C) NNPFC or National Income

Answer:

(A) GDPMP = C + I + G + X – M

6,550 = C + 1000 + 1,500 + 400 – 350

C = 4,000 Crores

(B) GNPMP = GDPMP + NFIA

6,600 = 6,550 + NFIA

NFIA = 50 Crores

(C) NNPFC (NI) = GNPMP – Depreciation

= 6,600 – 200

= 6,400 Crores

![]()

(b) (ii) Explain briefly two key concepts of ‘New Trade Theory’ that gives advantages to countries that import goods to compete with the home country. (2 Marks)

Or

Explain ‘Embargos; (2 Marks)

Answer:

According to NTT, two key concepts give advantages to countries that import goods to compete with products from the home country:

(a) Economies of Scale: As a firm produces more of a product its cost per unit keeps going down. So if the firm serves domestic as well as foreign market instead of just one, it can reap the benefit of large scale of production consequently the profits are likely to be higher.

(b) Network effects are the way one person’s value of a good or service is affected by the value of that good or service to others. The value of the product or service is enhanced as the number of individuals using it increases. This is also referred to as the ‘bandwagon effect’. Consumers like more choices, but they also want products and services with high utility, and the network effect offers increased utility from these products over others. A good example will be Mobile App such as Whats App and software like Microsoft Windows.

Or

An embargo is a total ban imposed by government on import or export of some or all commodities to particular country or regions for a specified or indefinite period. This may be done due to political reasons or for other reasons such as health, religious sentiments. This is the most extreme form of trade barrier.