Banking Companies – CA Inter Advanced Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Banking Companies – CA Inter Advanced Accounting Study Material

Theory Questions

Question 1.

Mention the condition when a cash credit overdraft account is treated as ‘out of order’. (May 2010) (2 Marks)

Answer:

A cash credit overdraft account is treated as NPA if it remains out of order for a period of more than 90 days. An account is treated as ‘out of order’ if any of the following conditions is satisfied:

(a) The outstanding balance remains continuously in excess of the sanctioned limit/drawing power.

(b) Though the outstanding balance is less than the sanctioned limit /drawing power:

- there are no credits continuously for more than 90 days as on the date of balance sheet; or

- credits during the aforesaid period are not enough to cover the interest debited during the same period.

(c) Further any amount due to the bank under any credit facility is ‘overdue’ if it is not paid on the due date fixed by the bank.

![]()

Question 2.

Write short note on classification of advances in case of Banking Company. (May 2016) – (4 Marks)

Answer:

Banks are required to classify their advances into four broad groups:

(i) Standard Assets – Standard assets are those which do not disclose any problems and which do not carry more than normal risk attached to the business. Such an asset is not a NPA (Non-performing asset).

(ii) Sub standard Assets – Sub-standard asset is one which has been classified as NPA for a period not exceeding 12 months. In other words, such

an asset will have well defined credit weaknesses that jeopardize the liquidation of the debt and are characterized by the distinct possibility that the bank will sustain some loss, if deficiencies are not corrected.

(iii) Doubtful Assets – A doubtful asset is one which has remained sub-standard for a period of at least 12 months. A loan classified as doubtful has all the weaknesses inherent in assets that were classified as sub-standard with added characteristic that the weaknesses make collection or liquidation in full, on the basis of currently known facts, conditions and values, highly questionable and improbable.

(iv) Loss Assets – A loss asset is one where loss has been identified by the bank or internal or external auditors or the RBI inspectors but the amount has not been written off, wholly or partly. In other words such assets are considered uncollectable or if collected of such low value that their being shown as bankable assets is not warranted even though there may be some salvage or recoverable value.

The classification of advances should be done taking into account

- Degree of well defined credit weakness and

- Extent of dependence on collateral security for the recovery of dues.

This classification is meant for the purpose of computing the amount of provision to be made in respect of advances.

![]()

Tier I and II Capital

Question 3.

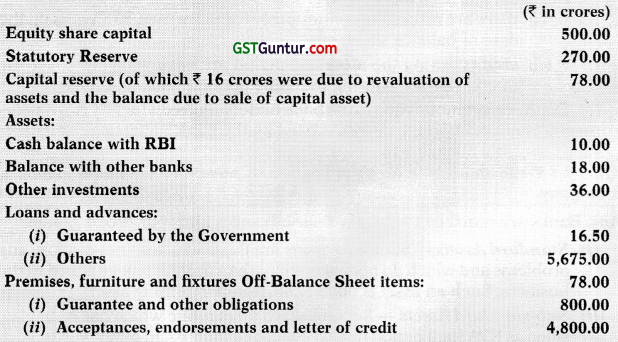

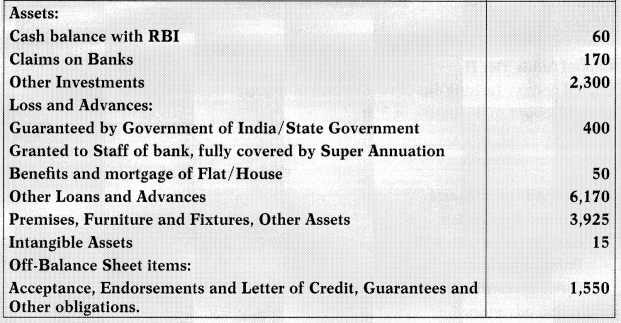

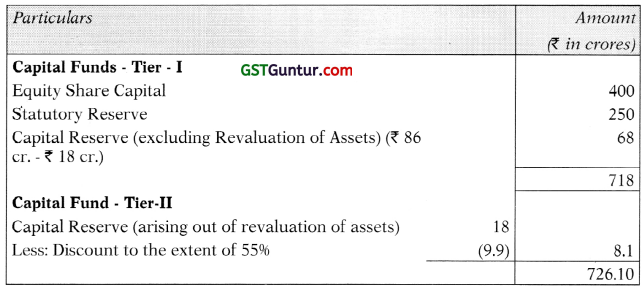

A Commercial Bank has the following capital funds and assets. Segregate the capital funds into Tier I and Tier II capitals. Find out the risk adjusted asset and risk weighted assets ratio. (Nov. 2010) (8 Marks)

Answer:

Risk Weighted Assets Ratio:

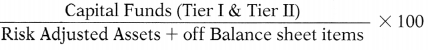

\(\frac{\text { Capital fund } \times 100}{\text { Risk adjusted assets }}\)

(824.8/11,392.60) × 100 = 7.24%

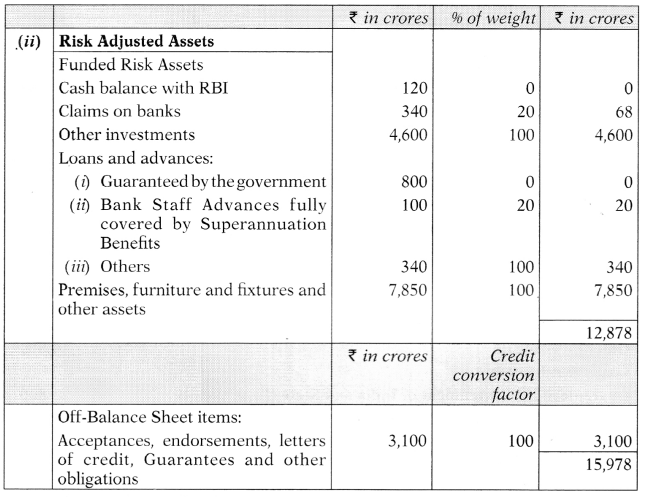

![]()

Question 4.

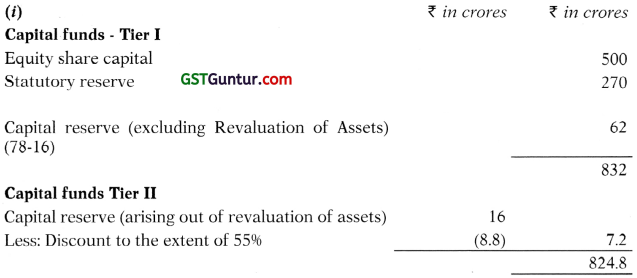

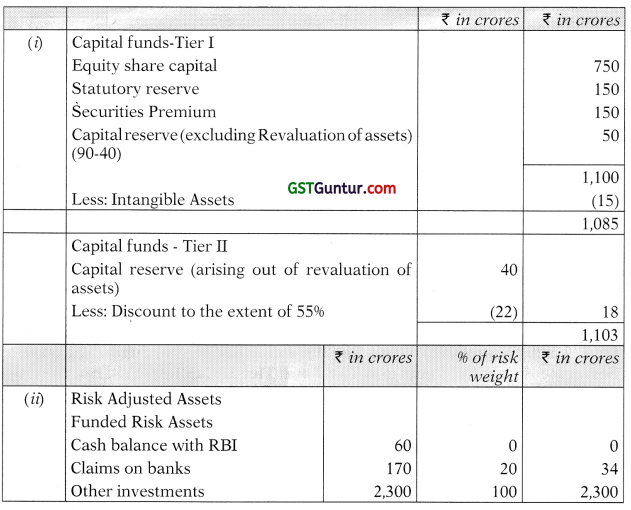

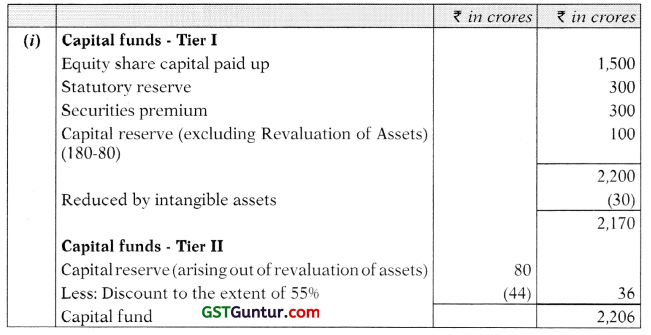

A Commercial Bank has the following capital funds and assets. Segregate the capital funds into Tier-I and Tier-II Capitals. Find out the risk- adjusted and risk weighted assets and capital adequacy ratio: (May 2012) (8 Marks)

Answer:

Capital Adequacy Ratio = \(\frac{\text { Capital fund }}{\text { Risk adjusted assets }}\) × 100

= \(\frac{₹ 1,103 \text { crores } \times 100}{₹ 13,989 \text { crores }}\) = 7.89%

![]()

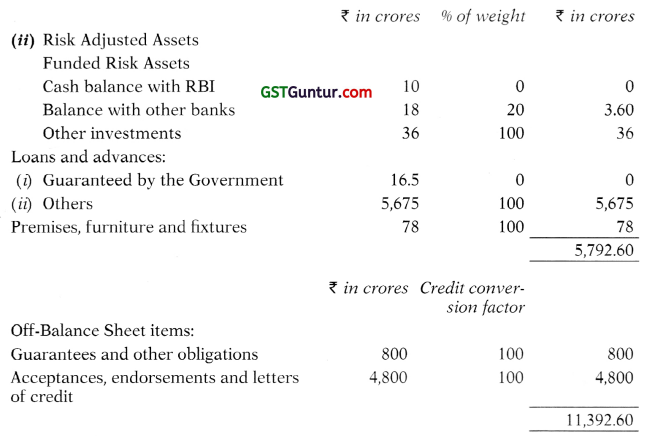

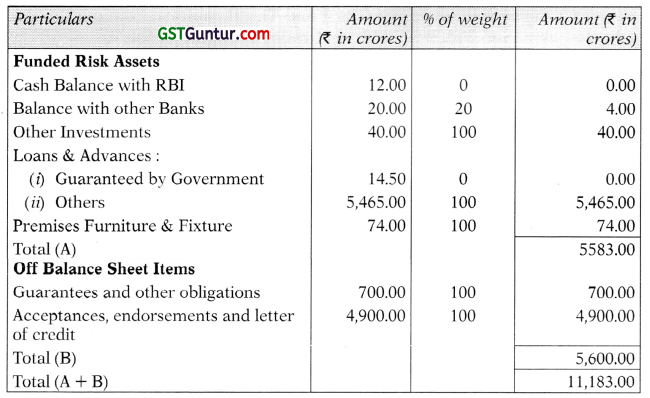

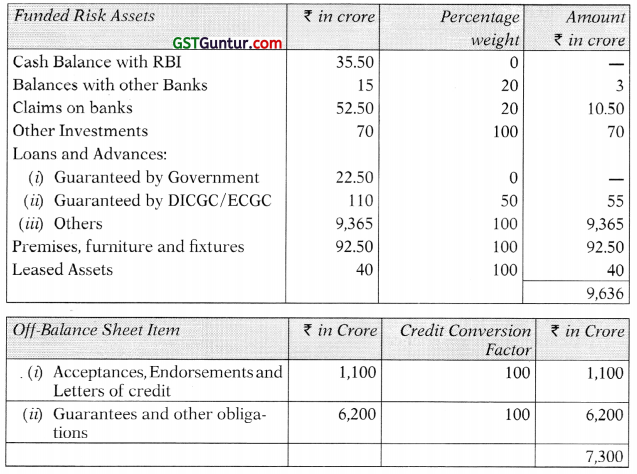

Question 5.

A commercial bank has the allowing capital funds and assets. Segregate the capital funds into Tier I and Tier II capitals. Find out the risk adjusted asset and risk weighted asset ratio. State your observation on the risk weighted asset ratio. (Nov. 2014) (8 Marks)

Answer:

Computation of Tier I and Tier II Capital Fund

Risk Adjusted Assets

Risk Weighted Assets Ratio:

\(\frac{\text { Capital fund } \times 100}{\text { Risk adjusted assets }}\)

= (726.10/11,183) × 100

= 6.49%

At present capital adequacy ratio as per RBI norms is 9%. Therefore, Bank has to improve the ratio by introducing further Tier-I capital or by reducing risk adjusted assets.

![]()

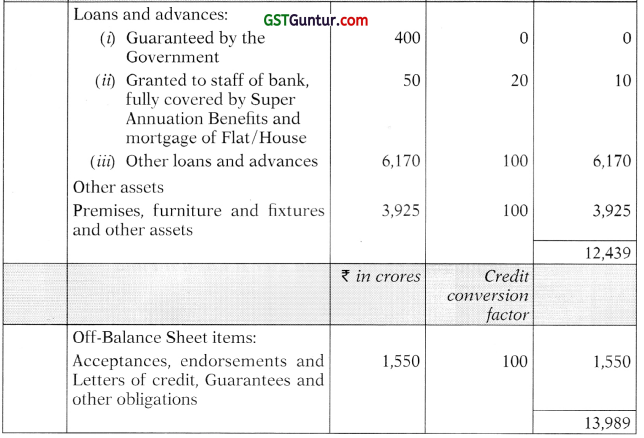

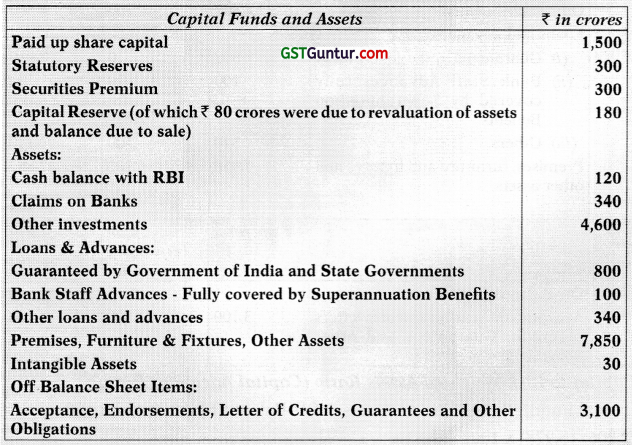

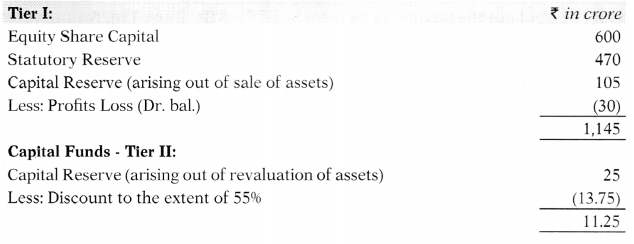

Question 6.

A commercial bank has the following capital funds and assets. You are required to segregate the capital funds into Tier-I and Tier-II capitals and also find out the risk adjusted assets and capital adequacy ratio. (May 2017) (8 Marks)

Answer:

Capital to Risk Weighted Assets Ratio (Capital Adequacy Ratio):

Capital Fund/(Risk Adjusted Assets + Off-Balance Sheet items) × 100

(2,206/15,978) × 100 = 13.8196

![]()

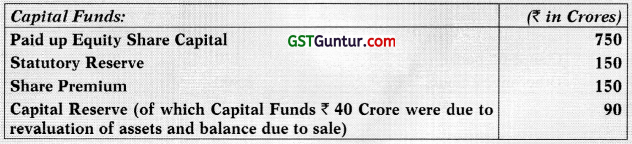

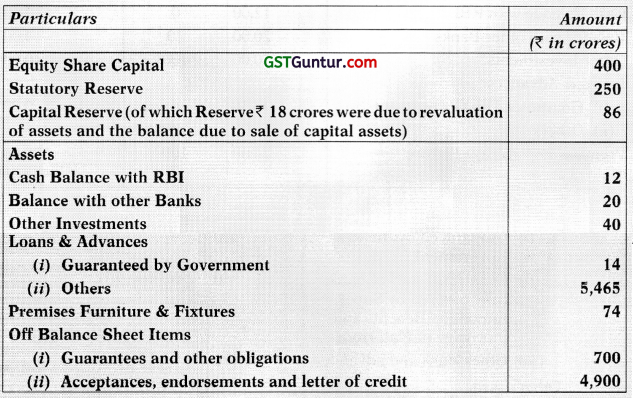

Question 7.

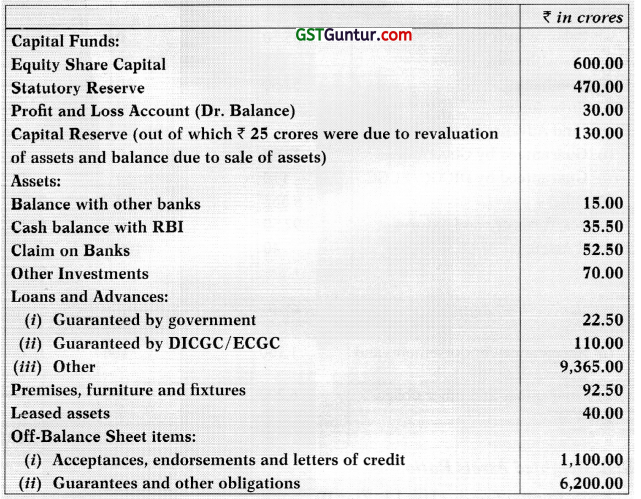

Astha Bank has the following Capital Funds and Assets as at 31st March, 2018:

You are required to:

(i) Segregate the capital funds into Tier I and Tier II capitals.

(ii) Find out the risk-adjusted assets and risk weighted assets ratio. (May 2018 – New Course) (10 Marks)

Answer:

(i) Capital Funds-

(ii) Risk Adjusted Assets

Risk Weighted Assets Ratio:

= (1,145+11.25)/(9,636 +7,300)

= (1,156.25/16.936) × 100 = 6.83% (rounded off)

![]()

Interest Recognition

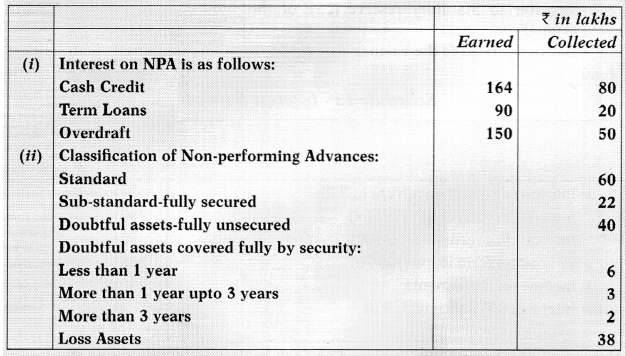

Question 8.

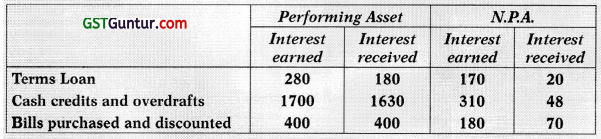

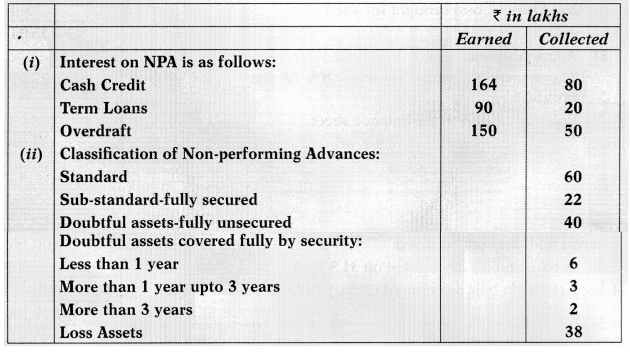

Find out the income to be recognised by ABC Bank Ltd. for the year ended 31st March, 2014 in respect of interest on advances [₹ in Lakhs] as detailed below: (Nov. 2014) (4 Marks)

Answer:

Note : Interest on Performing assets to be recognised on accrual basis, but interest on Non-Performing assets should be recognised on cash basis.

Classification Of Advances

Question 9.

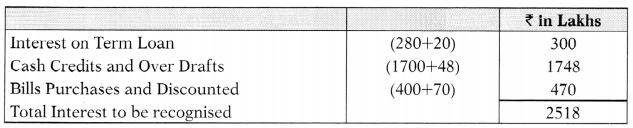

The outstanding amount (funded as well as unfunded) as on 31st March, 20X1 was: ₹ 10,000. The realizable value of security of the same was ₹ 8,000.

Period for which the advance has remained in ‘doubtful’ category as on 31st March, 20X1 was: 2.5 years.

Answer:

Provisioning requirement:

Provisioning for Advances (Without Ecgc and Dicgc Cover)

Question 10.

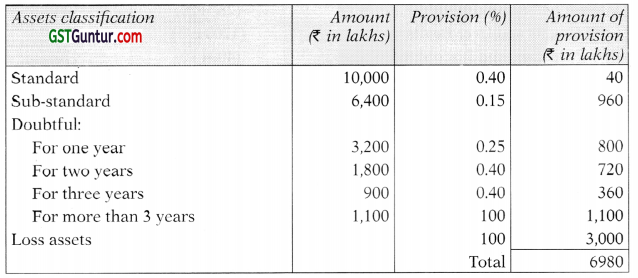

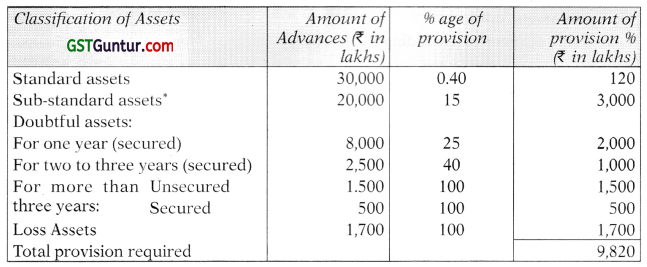

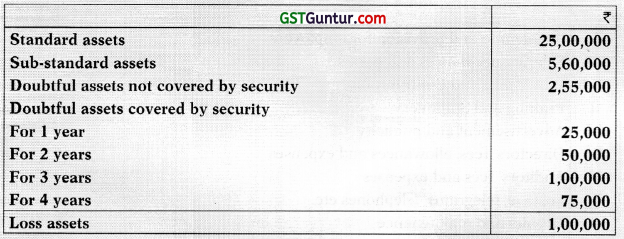

From the following information of details of advances of Zenith Bank Ltd., calculate the amount of provisions to be made in Profit and Loss Account for the year ended on 31-3-2010: (Nov. 2010) (5 Marks)

Answer:

Statement showing provisions

Note: It is assumed that sub-standard assets and all doubtful assets are fully secured.

![]()

Question 11.

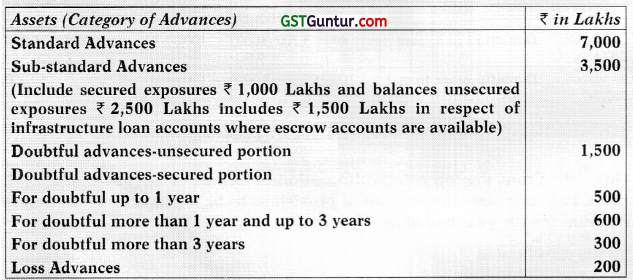

From the following information, compute the amount of provisions to be made in the Profit and Loss Account of a Commercial Bank for the year ending on 31-03-2012. (May 2012) (5 Marks)

Answer:

Statement showing the amount of provisions

![]()

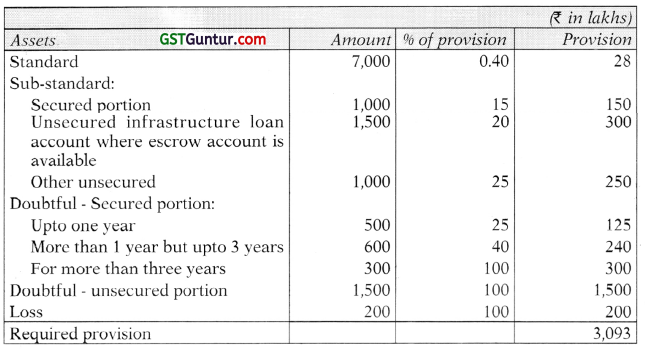

Question 12.

From the following information of STP Bank Ltd. pertaining to the financial year 2012-13, compute the provisions to be made in the Profit and Loss Account: (Nov. 2013) (4 Marks)

Answer:

Statement showing amount of provision

Provisioning for Advances (With Ecgc and Dicgc Cover)

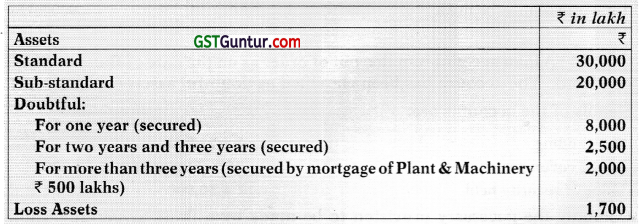

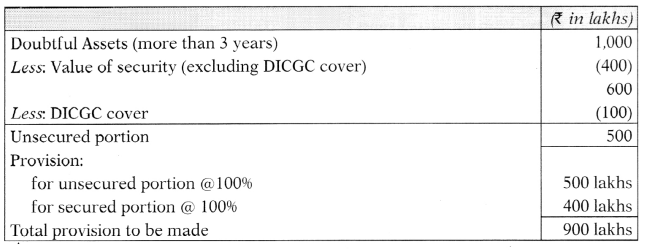

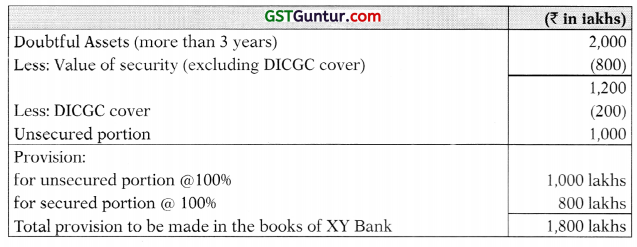

Question 13.

In ABC Bank, the doubtful assets (more than 3 years) as on 31.3.20X1 is ₹ 1,000 lakhs. The value of security (including DICGC 100% cover of ₹ 100 lakhs) is ascertained at ₹ 500 lakhs. How much provision must be made in the books of the Bank towards doubtful assets?

Answer:

![]()

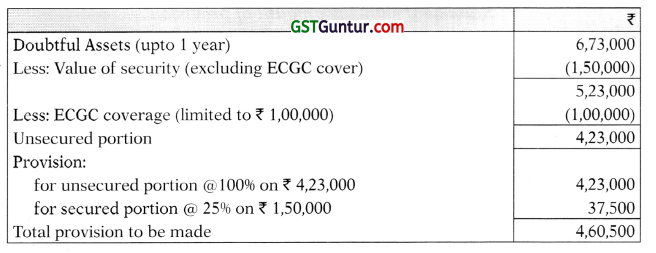

Question 14.

A loan account remains out of order as on the date of Balance Sheet of a Bank. The account has been classified as doubtful assets (up to 1 year).

Details of the accounts are:

Outstanding – ₹ 6,73,000

ECGC coverage – 25% (Limited to ₹ 1,00,000)

Value of security held – ₹ 1,50,000

Compute the necessary provision to be made by a Bank as per applicable rates. (Nov. 2012) (5 Marks)

Answer:

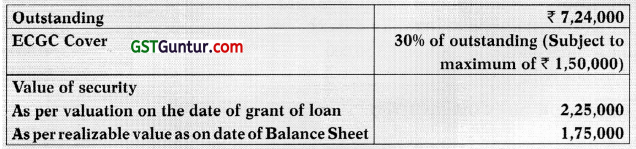

Question 15.

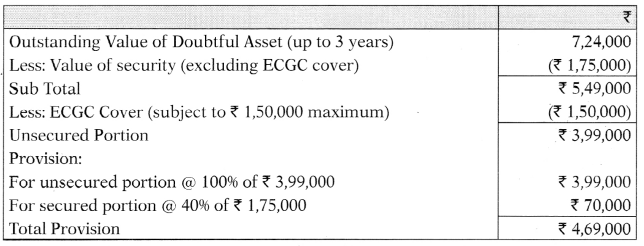

A loan account remains out of order as on the date of Balance Sheet of a Bank. The account has been classified as doubtful assets (up to 3 years). i Detail of the account is:

Compute the necessary provision to be made by bank as per applicable rate. (May 2014) (4 Marks)

Answer:

Computation of provision to be made by a Bank

![]()

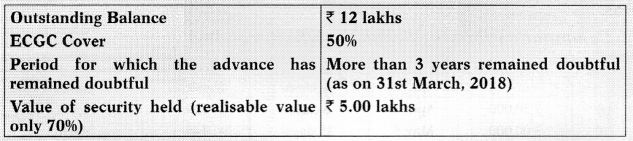

Question 16.

You are required to calculate provisions as per applicable rules. (May 2018) (4 Marks)

Answer:

Provision required to be made as on 31.3.2018

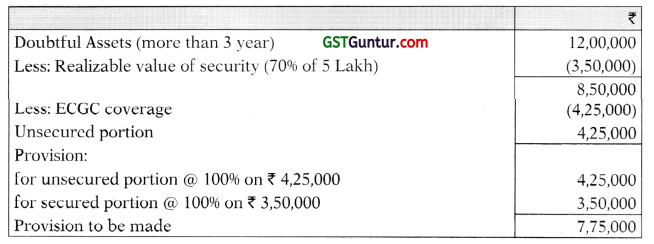

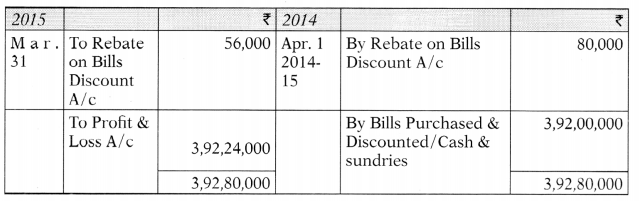

Rebate On Bills Discounted

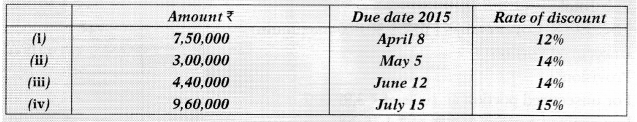

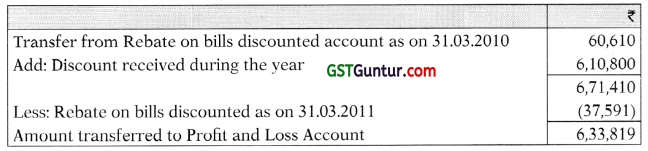

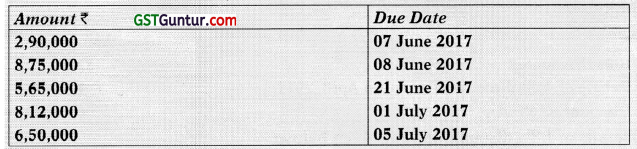

Question 17.

The following facts have been taken out from the records of C Bank Ltd. as on 31st March, 2015:

An analysis of the bills discounted is as follows:

You are required to:

(i) Calculate Rebate on Bill Discounted as on 31st March, 2015.

(ii) The amount of discount to be credited to the profit and loss account.

Answer:

(i) Computation showing Rebate on bills discounted

(ii) Amount of discount [to be credited to the Profit and Loss Account]

![]()

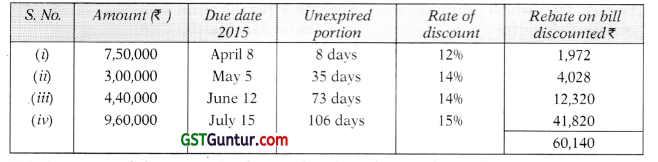

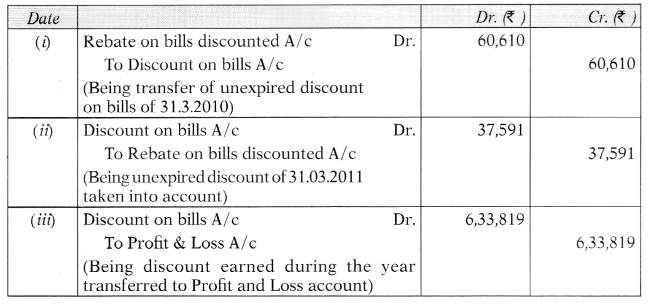

Question 18.

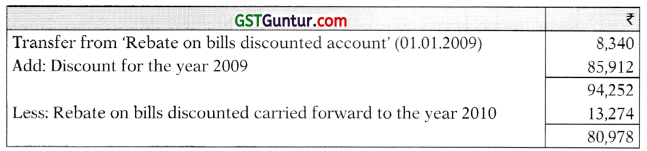

Given below is an extract from the that balance of T.K. Bank Limited as on 31st December, 2009:

An analysis of the bills discounted is shown below:

Show the workings, how the relevant items will appear in the bank’s Profit and Loss account as on 31st December, 2009 and in bank’s Balance Sheet as on 31st December, 2009. (May 2010) (8 Marks)

Answer:

Profit & Loss Account (extract) for the period ending 31.12.2009

Balance Sheet (Extract) as on 31.12.2009

Statement of rebate on bills discounted as on 31.12.2009

![]()

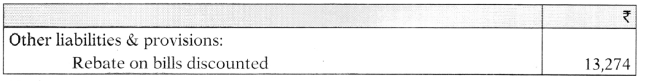

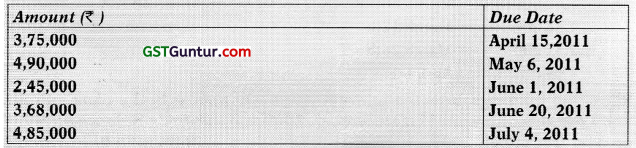

Question 19.

The following particulars are extracted from the records of M/s. Engco Bank Limited for the year ended 31st March, 2011:

An analysis of the bills discounted is a follows:

The rate of discount is 12% per annum. You are required to:

- Calculate rebate on bills discounted as on 31st March, 2011.

- Determine the amount of discount to be credited to the profit and loss account for the year ended 31st March, 2011.

- Show the necessary journal entries in the books of M/s. Engco Bank Ltd. as on 31st March, 2011. (Nov. 2011) (8 Marks)

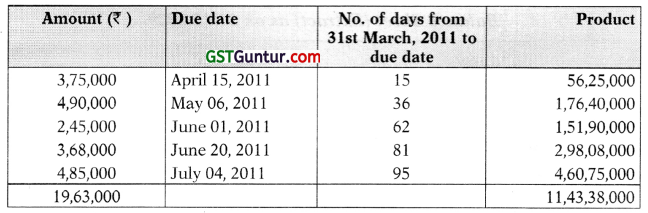

Answer:

(i) Computation showing Rebate on Bills Discounted as on 31st March, 2011

Amount of rebate on bills = ₹ 11,43,38,000 x 1296 × 1/365 = ₹ 37,591 (approx.)

Note: Alternatively rebate on each bill can be calculated individually.

(ii) Amount of discount (to be credited to the Profit and Loss Account for the year ended 31st March, 2011)

In the books of Engco Bank Ltd. Journal Entries

![]()

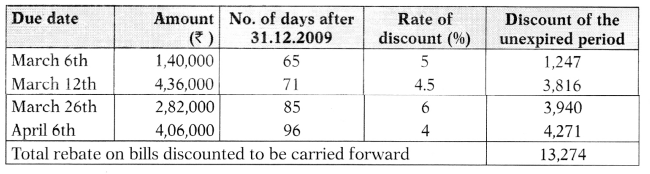

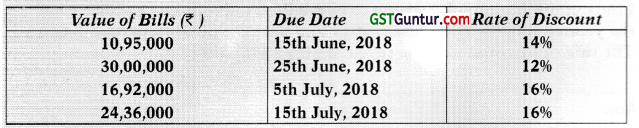

Question 20.

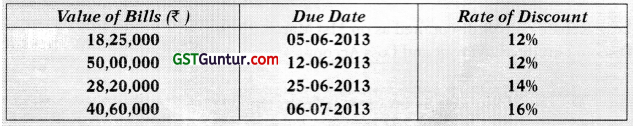

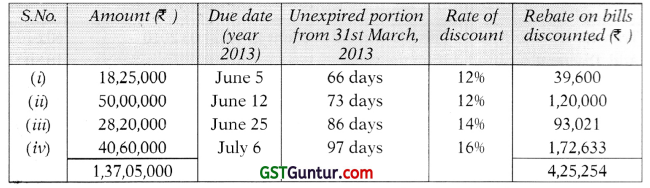

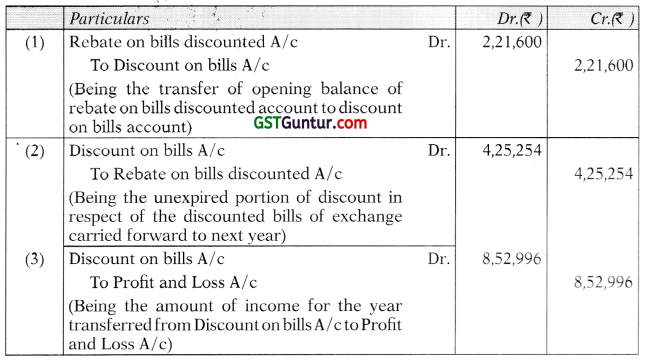

The following information is available in the books of X Bank Limited as on 31st March, 2013:

Bills discounted – ₹ 1,37,05,000

Rebate on bills discounted (as on 1-4-2012) – ₹ 2,21,600

Discount received – ₹ 10,56,650

Details of bills discounted are as follows:

Calculate the rebate on bills discounted as on 31-3-2013 and give necessary Journal Entries in the books of X Bank Ltd. as on 31st March, 2013. (May 2013) (8 Marks)

Answer:

Computation showing of Rebate on bills discounted

Journal Entries in the books of X Bank Ltd.

Working Note:

Amount of discount (to be credited to the Profit and Loss Account)

![]()

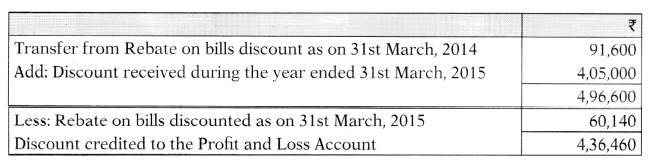

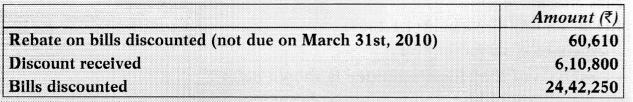

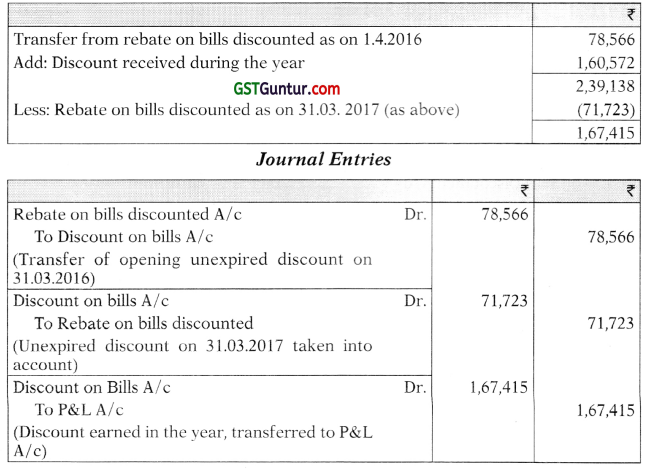

Question 21.

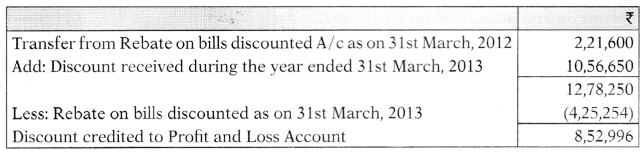

The following is an extract from the trial balance of Novel Bank Limited as on 31st March, 2017:

Rebate on bills discounted as on 1st April 2016 – ₹ 78,566 (Cr. bal.)

Discount Received – ₹ 1,60,572 (Cr. bal.)

An analysis of bills discounted is as follows:

Find out the amount of discount to be credited to Profit and Loss Account for the year ending on 31st March, 2017 and pass the necessary journal entries. The rate of discount shall be taken at 10% per annum. (Nov. 2017) (6 Marks)

Answer:

Computation showing Rebate on bill (discounted as on 31-3-2017)

Amount of discount (to be credited to the profit and loss account)

![]()

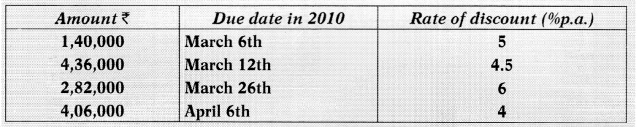

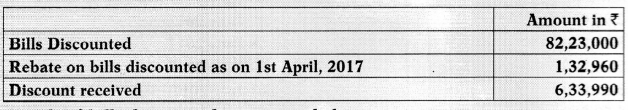

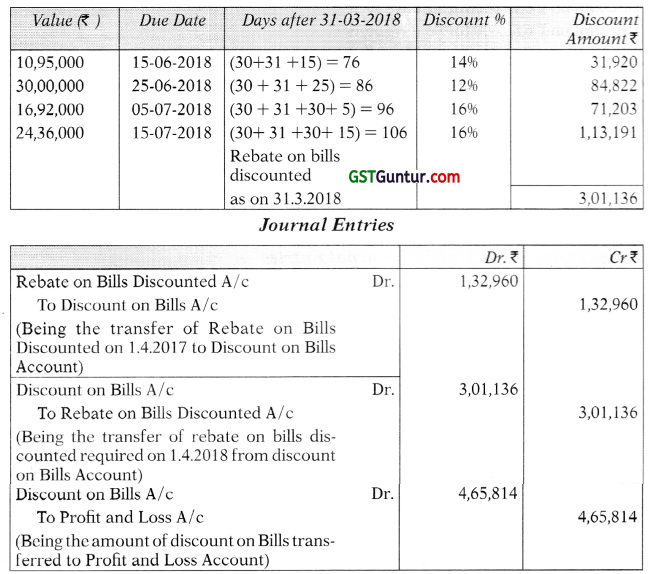

Question 22.

Forward Bank Ltd. furnishes the following information as on 31st March, 2018.

Details of bills discounted is as given below:

(i) Calculate the rebate on bills discounted as on 31st March, 2018.

(ii) Pass necessary Journal Entries. (Nov. 2018 – New Course) (5 Marks)

Answer:

Computation showing Rebate on Bill discounted (as on 31-3-2018)

Working Note:

Amount of discount (to be credited to the Profit and Loss Account)

![]()

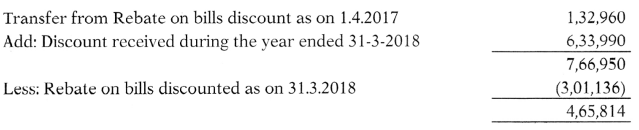

Bills for Collection

Question 23.

On 01.04.20X1 bills for collection was 7 lacs. During 20X1-X2 bills received for collection amounted to 64.5 lacs. Bills collected were 47 lacs. Bills dishonoured was 5.5 lacs. Prepare Bills for collection (Assets) and Bills for Collection (Liabilities) Accounts.

Answer:

Bills for Collection (Assets) Account

Bills for Collection (Liabilities) Account

Acceptances, Endorsements and Other Obligations

Question 24.

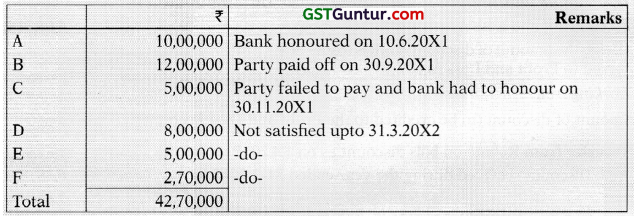

From the following details prepare ‘Acceptances, Endorsements and other Obligation A/c’ as would appear in the General Ledger.

On 1.4.20X1 Acceptances not yet satisfied stood at ₹ 22,30,000. Out of which ₹ 20 lacs were subsequently paid off by clients and bank had to honour the rest. A scrutiny of the Acceptance Register (for transactions during the year) revealed the following:

Client Acceptances/Guarantees

Answer:

Acceptances, Endorsements and other Obligation Account (in general ledger)

![]()

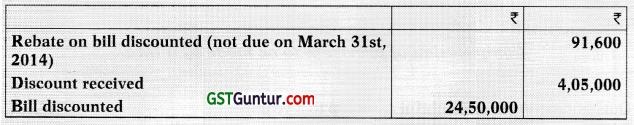

Mix Question (Rebate On Bills Discounted; Bills For Collection; Acceptances, Endorsements And Other Obligations)

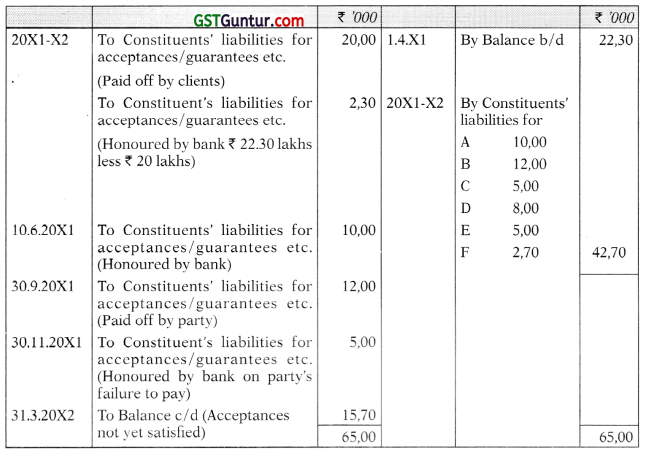

Question 25.

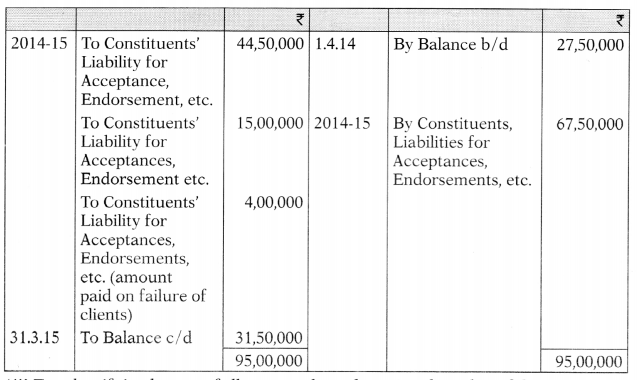

(a) Following facts have been taken out from the records of M/s. Sneha Bank Ltd. in respect of the year ending March 31, 2015:

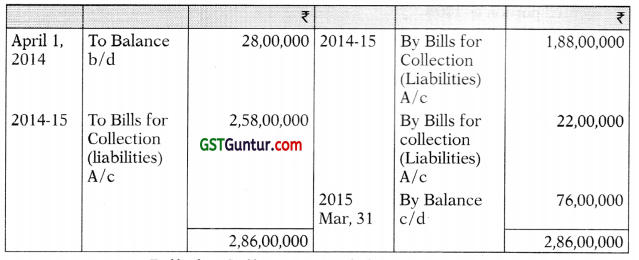

(i) On 1-4-2014 Bills for collection were ₹ 10,15,000. During 2014-15 bills received for collection amounted to ₹ 89,75,000, bills collected were ₹ 64,50,000 and bills dishonoured and returned were ₹ 11,25,000. Prepare Bills for collection (Assets) Account and bills for Collection (Liability) Account.

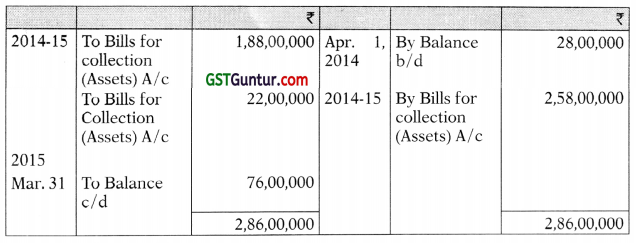

(ii) On 1 -4-2014, Acceptance, Endorsement, etc. not yet satisfied amounted to ₹ 27,50,000. During the year under question, Acceptances, Endorsements, Guarantees etc., amounted to ₹ 67,50,000. Bank honoured acceptances to the extent of ₹ 44,50,000 and client paid of ₹ 15,00,000 against the guaranteed liability. Clients failed to pay ₹ 4,00,000 which the Bank had to pay.

Prepare the ‘Acceptances, Endorsements and other obligations Account’ as it would appear in the General Ledger.

(iii) It is found from the books, that a loan of ₹ 50,00,000 was advanced on 30.09.2014 @ 14% p.a. Interest payable half yearly; but the loan was outstanding as on 31.3.2015 without any payment recorded in the meantime, either towards principal or towards interest. The security for the loan was ₹ 1,00,000 fully paid shares of ₹ 100 each (the market value was ₹ 98 per share as per the Stock Exchange information as on 30th September, 2014). But due to fluctuations, the price fell to ₹ 45 per share in January, 2015. On 31-3-2015, the price as per Stock Exchange rate was ₹ 85 per share.

State how would you classify the loan as secured/unsecured in the Balance Sheet of the Company.

(iv) The following balances are extracted from the Trial Balance as on 31.3.2015:

It is ascertained that the proportionate discounts not yet earned for bills to mature in 2014-15 amount to ₹ 24,000. Prepare ledger accounts.

(b) From the following information of M/s. XY Bank Ltd. for the year ended 31st March, 2014, compute the provisions to be made in the Bank’s Books for Doubtful Assets: (May 2015)

Answer:

(a)(i) Bills for Collection (Assets) A/c

(ii) In the general ledger

Acceptances, Endorsement & other Obligation Account

(iii) For classifying loans as fully secured or otherwise, the value of the security as on the last date of the year is considered. The value of the security is ₹ 85,00,000 covering the loan and the interest due comfortably. Hence, it is to be treated as good and fully secured.

![]()

(iv) Rebate on Bills Discounted Account

(b) Computation of provision in the books of XY Bank Ltd.

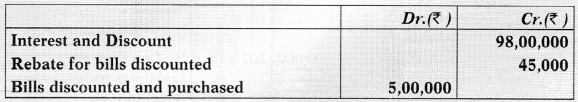

Question 26.

From the following facts drawn from the records of Honest Bank for the year ended 31st March, 2015, prepare the accounts as mentioned below:

(i) 1-4-2014 Bills for Collection were ₹ 28,00,000. During 2014-15, bills received for collection were ₹ 2,58,00,000. Bills collected were ₹ 1,88,00,000. Bills dishonoured and returned were ₹ 22,00,000. Prepare Bills for Collection (Assets) Account and Bills for Collection (Liability) Account.

(ii) On 1st April, 2014, Acceptance, Endorsement etc. not yet satisfied amounted to ₹ 58,00,000. During the year, Acceptances, Endorsements, Guarantees etc. were ₹ 1,76,00,000. The Bank honoured acceptances of ₹ 1,00,00,000 and a client paid ₹ 40,00,000 against guaranteed liabilities. The Bank paid ₹ 4,00,000 which clients failed to pay.

Prepare ‘Acceptances, Endorsements and Other Obligations Account’ in the General Ledger.

(iii) A loan of ₹ 24,00,000 advanced by the Bank on 30th August, 2014 @10 per annum, whose interest is payable half-yearly. The loan was outstanding as on 31st March, 2015. Nothing was paid either towards Principal or Interest of this loan. The security for the loan was 40,000 fully paid shares of ₹ 100 each. The shares were quoted on the stock exchange on 30th September, 2014 at t 90 per share. Due to fluctuations, the price felt to ₹ 50 per share in January, 2015. On 31st March, 2015 the share price quoted on the stock exchange was ₹ 96 per share. State giving reasons, whether the loan would be classified as secured or unsecured in the Balance Sheet of the Company as on 31st March, 2015.

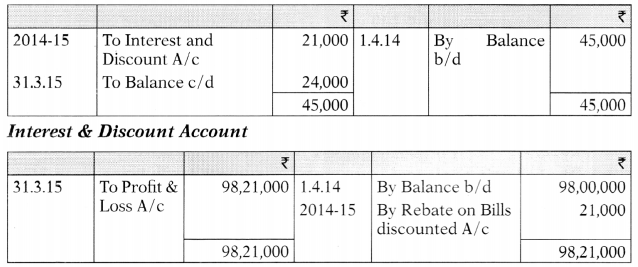

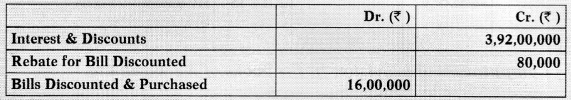

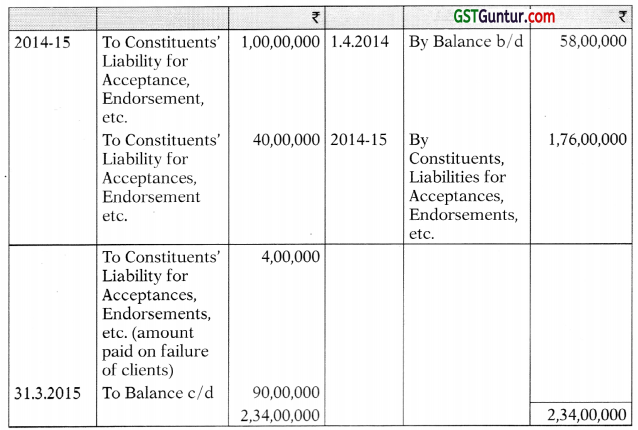

(iv) The following balances were taken from the Trial Balance as on 31st March, 2015.

Proportianate discounts not yet earned for Bills to mature in 2015-2016 were ₹ 56,000. Prepare the following Accounts:

(a) Rebate on Bills Account

(b) Interest and Discount Account. (Nov. 2016) (10 Marks)

Answer:

(i) Bills for Collection (Assets) A/c

Bills for Collection (Liabilities) Account

(ii) In the General Ledger

Acceptances, Endorsement & other Obligations Account

(iii) For classifying loans as fully secured or otherwise, the value of the security as on the last date of the year is considered. The value of the security is ₹ 38,40,000 (40,000 shares ₹ ₹ 96 per share) covering the loan and the interest due comfortably. Hence it is to be treated as good and fully secured loan.

(iv) Rebate on Bills Discounted Account

Interest & Discount Account

![]()

Final Accounts – P&L

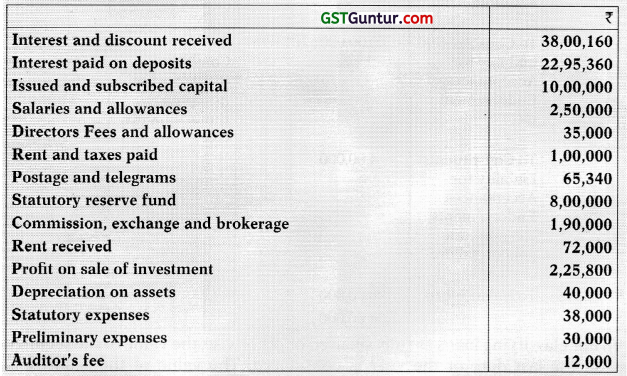

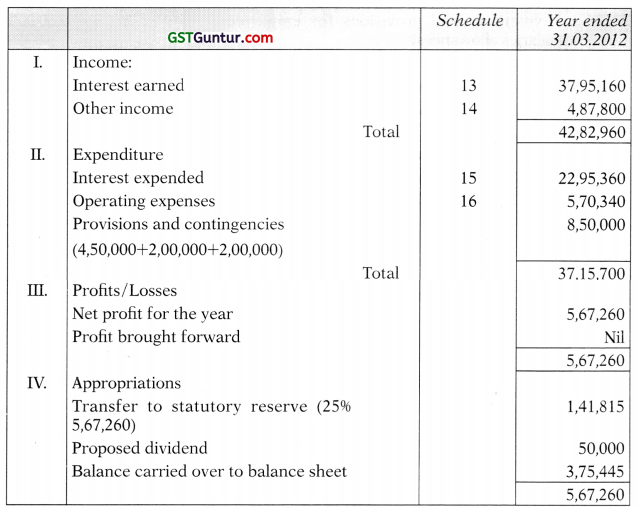

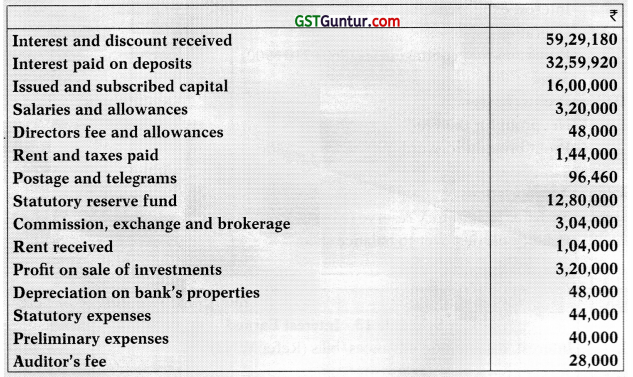

Question 27.

The following figures are extracted from the books of XYZ Bank Ltd. as on 31-03-20X2:

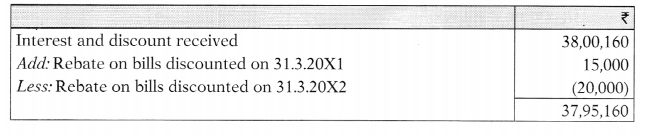

The following further information is given:

- A customer to whom a sum of ₹ 10 lakhs was advanced has become insolvent and it is expected only 55% can be recovered from his estate.

- There was also other debts for which a provisions of ₹ 2,00,000 was found necessary.

- Rebate on bill discounted on 31-03-20X1 was ₹ 15,000 and on 31-03- 20X2 was ₹ 20,000.

- Income tax of ₹ 2,00,000 is to be provided.

The directors desire to declare 5% dividend.

Prepare the Profit and Loss account of XYZ Bank Ltd. for the year ended 31-03-20X2 and also show, how the Profit and Loss account will appear in the Balance Sheet if the Profit and Loss account opening balance was NIL as on 31-03-20X1

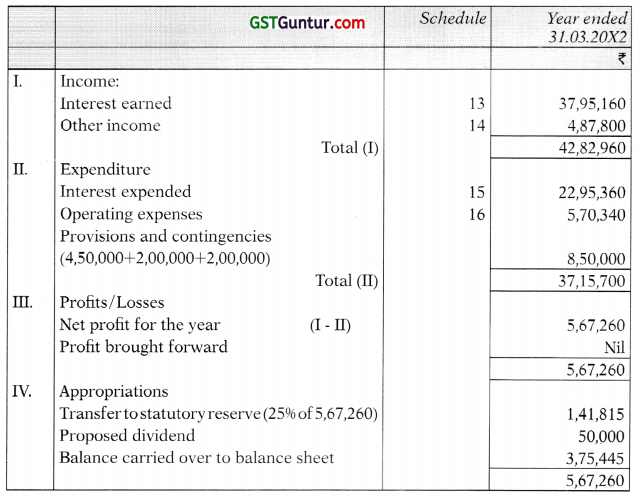

Answer:

XYZ Bank Limited

Profit and Loss Account for the year ended 31st March, 20X2

Profit & Loss Account balance of ₹ 3,75,445 will appear under the head ‘Reserves and Surplus’ in Schedule 2 of the Balance Sheet.

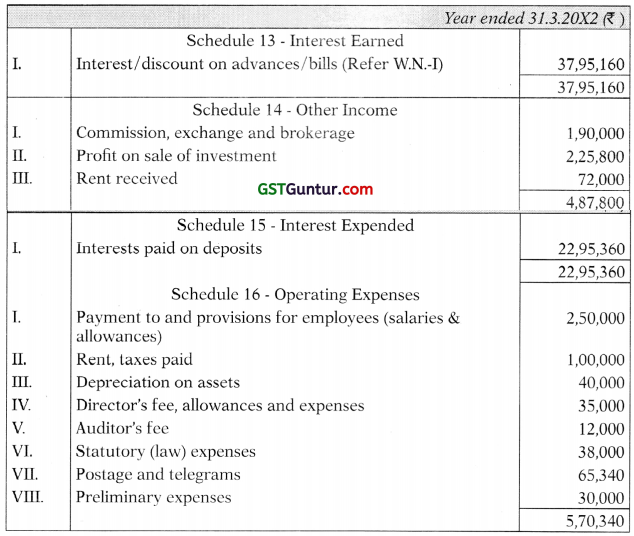

SCHEDULES:

Working Mote I:

![]()

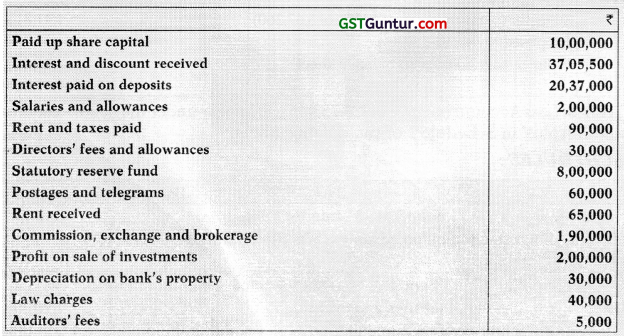

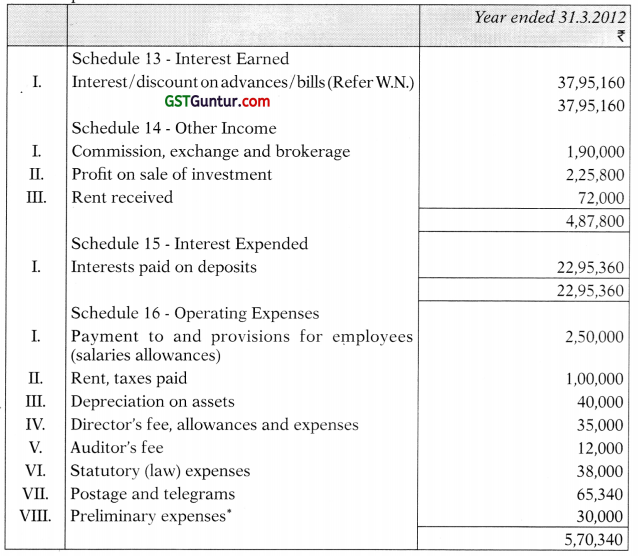

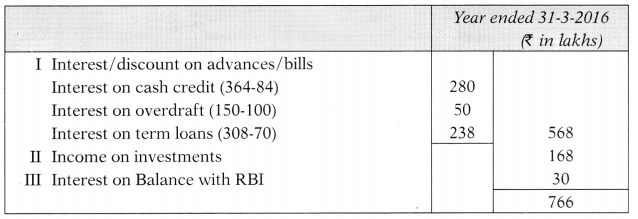

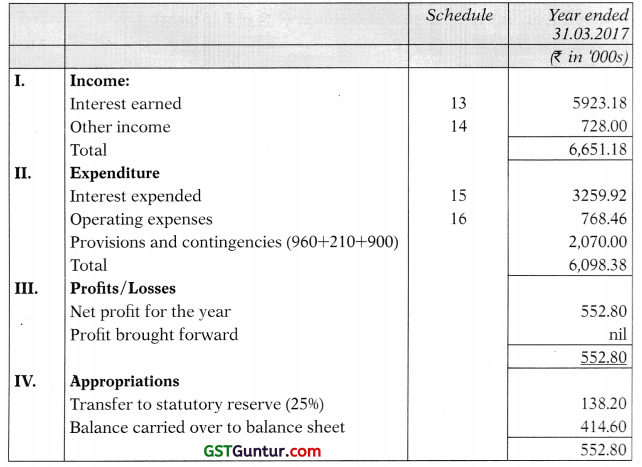

Question 28.

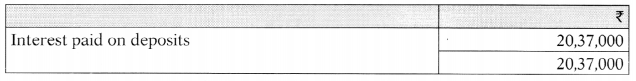

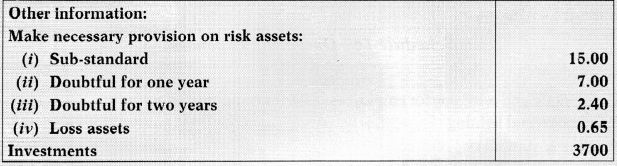

The following figures have been taken from the books of XYZ Bank Limited as on 31st March, 2014:

The following additional information is given to you:

- One customer to whom a sum of ₹ 10 lakhs was advanced, has become insolvent and it is expected that only 50% of the amount will be recovered from his estate.

- Auditors find that a provision of ₹ 1.5 lakhs is necessary against other debts.

- Rebate on bills discounted on 31st March, 2013 was ₹ 12,000 and on 31st March, 2014 was ₹ 16,000.

- Provide ₹ 6,50,000 for income tax.

- The Board of Directors decides to declare dividend @ 10% after transfer of 25% of the year’s profit to Statutory Reserve.

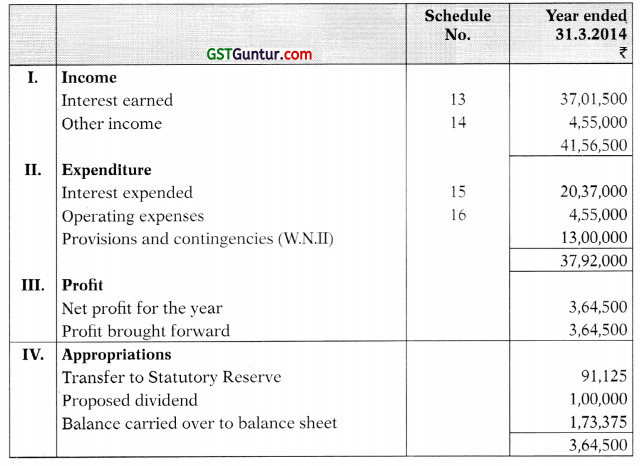

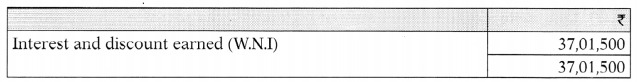

You are required to prepare Profit and Loss Account of the bank with all the necessary schedules for the year ended 31st March, 2014. Ignore figures for the previous year and corporate dividend tax.

Answer:

XYZ Bank Limited

Profit and Loss account for the year ended 31st March, 2014

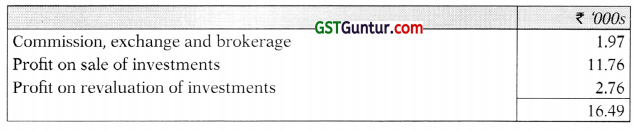

Schedule 13 – Interest earned

Schedule 14 – Other Income

Schedule 15-Interest Expended

Schedule 16-Operating Expenses

Working Notes:

![]()

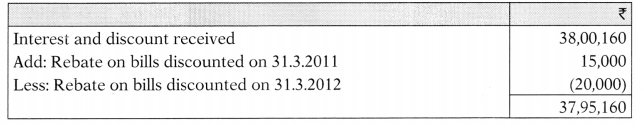

Question 29.

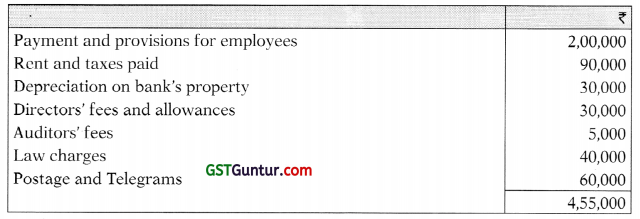

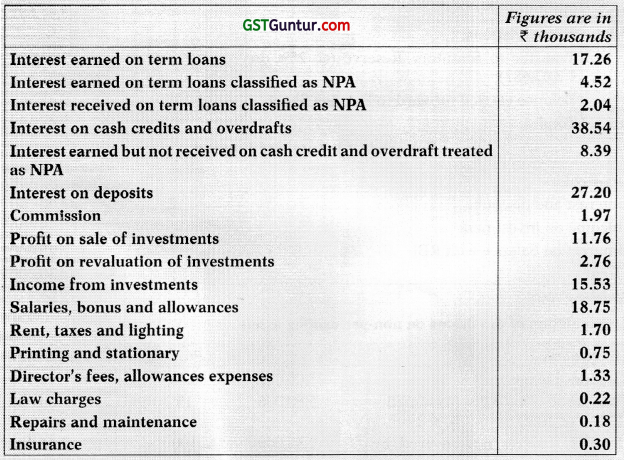

From the following information of ABC Bank Limited, Prepare Profit and Loss Account for the year ended 31st March, 2018:

Other Information:

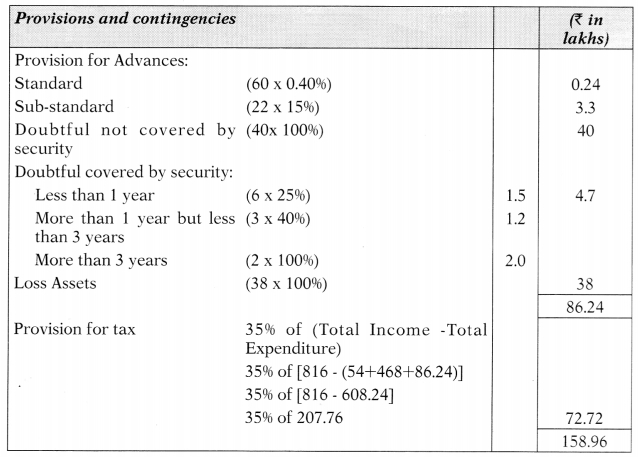

(iii) Provide 35% of the profits towards provision for taxation.

(iv) Transfer 25% of the profit to Statutory Reserves.

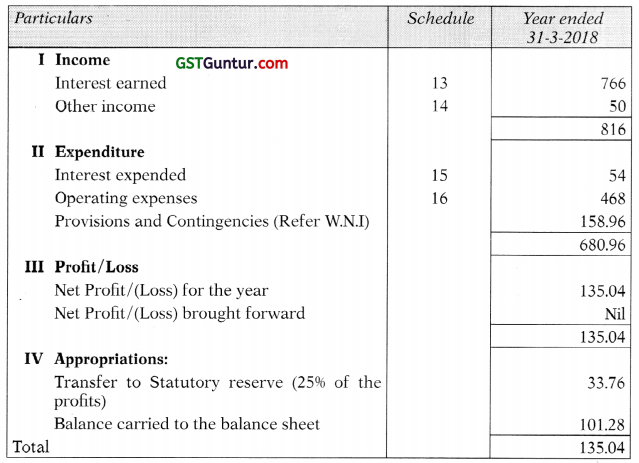

Answer:

ABC Bank Limited Profit and Loss Account

For the year ended 31st March, 2018

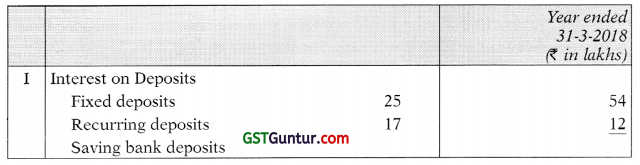

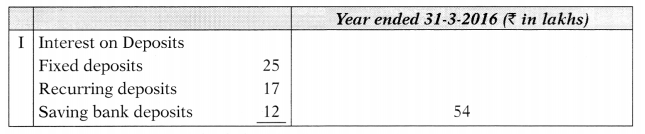

Schedule 13 – Interest Earned

Note: Interest on NPA is recognized on cash basis, hence difference of accrued interest not received have been reduced from the total accrued interest.

Schedule 14 – Other Income

Schedule 15 – Interest Expended

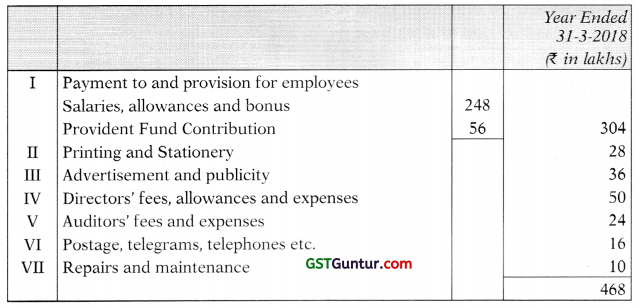

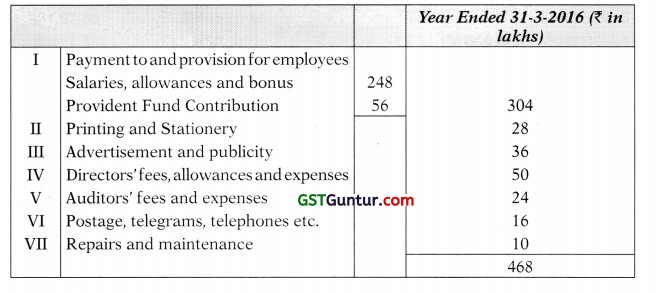

Schedule 16 – Operating Expenses

Working Note:

![]()

Question 30.

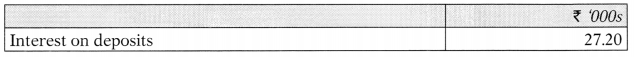

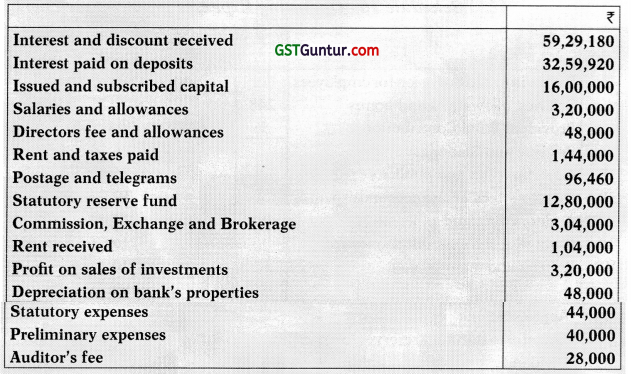

From the following information, you are required to prepare Profit and Loss Account of Zee Bank Ltd., for the year ending 31st March, 2009:

Additional information:

(a) Rebate on bills discounted to be provided for? 15,000

(b) Classification of advances:

(c) Make tax provision @ 35%

(d) Profit and Loss A/c (Cr.) ₹ 40,000. (Nov. 2009) (8 Marks)

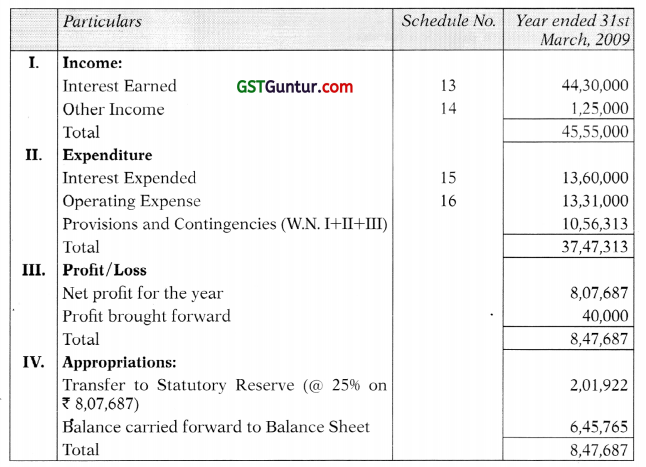

Answer:

Form B’

Zee Bank Ltd.

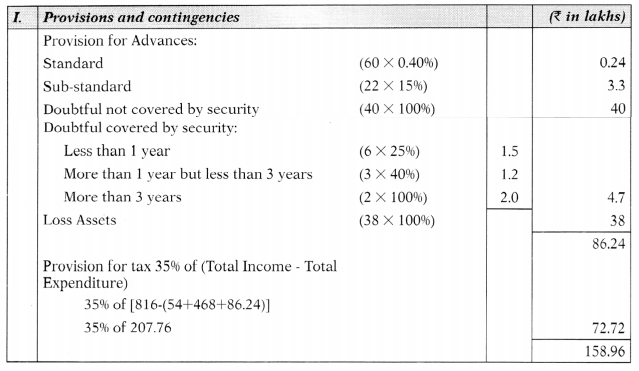

Profit & Loss Account for the year ended 31st March, 2009

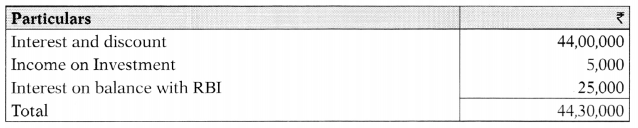

Schedule 13: Interest Earned

Working Notes:

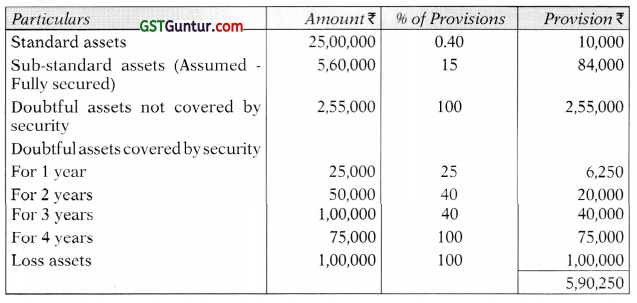

I. Calculation of provisions on non-performing assets

II. Calculation of provision for tax

Tax = 35% of [Total income – Total expenditure (excluding tax)].

Tax = 35% of [₹ 44,30,000 + ₹ 1,25,000 – (₹ 13,60,000 + ₹ 13,31,000 + ₹ 5,90,250 + ₹ 15,000)]

Tax = ₹ 451063

III. Total amount of provisions and contingencies

= Provision for non-performing assets + Provision for tax + Rebate on bills discounted

= ₹ 5,90,250 + ₹ 4,51,063 + ₹ 15,000

= ₹ 10,56,313

![]()

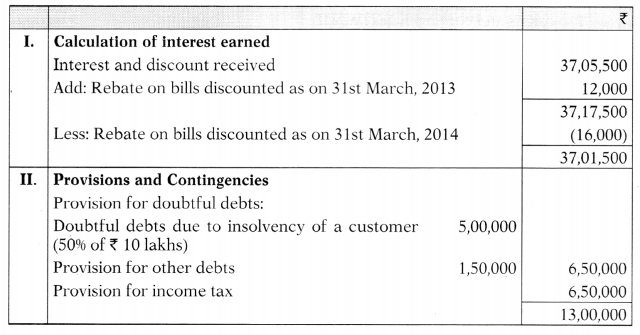

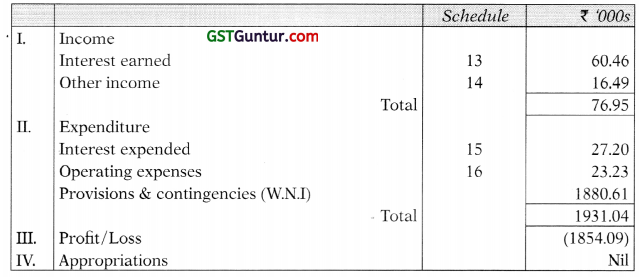

Question 31.

From the following information prepare the Profit & Loss Account of Jawahar Bank Limited for the year ended 31st March, 2011. Also give necessary Schedules.

Bank should not keep more than 25% of its investments as ‘held-for-maturity’ investment. The market value of its best 75% investments is ₹ 9,00,000 as on 31st March, 2011. (May 2011) (16 Marks)

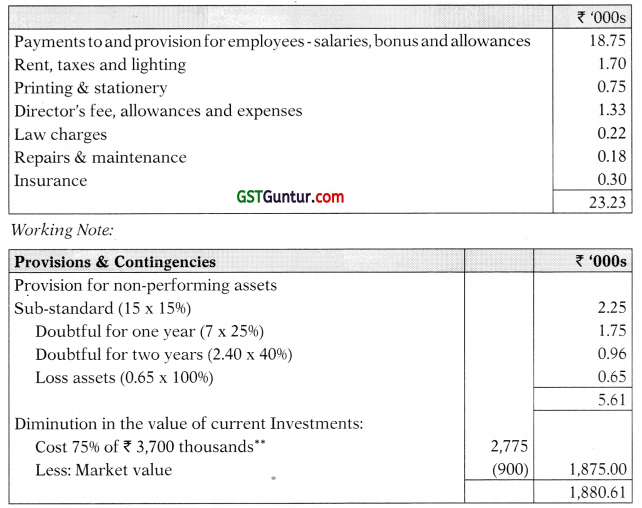

Answer:

Jawahar Bank Limited

Profit & Loss Account for the year ended 31st March, 2011

Schedule 13 – Interest Earned

Schedule 14 – Other Income

Schedule 15 – Interest Expended

Schedule 16 – Operating Expenses

** Note 25% of investments classified as held for maturity’ need not be marked to market as per RBI Guidelines. However, the remaining 75% investments have been marked to market according to RBI Guidelines.

![]()

Question 32.

The following figures are extracted from the books of KLM Bank Ltd. as on 31-03-2012:

The following further information is given:

- A customer to whom a sum of ₹ 10 lakhs was advanced has become insolvent and it is expected only 55% can be recovered from his estate.

- There was also other debts for which a provisions of ₹ 2,00,000 was found necessary.

- Rebate on bill discounted on 31-03-2011 was ₹ 15,000 and on 31-032012 was ₹ 20,000.

- Income tax of ₹ 2,00,000 is to be provided.

The directors desire to declare 5% dividend.

Prepare the Profit and Loss account of KLM Bank Ltd. for the year ended 31-03-2012 and also show, how the Profit and Loss account will appear in the Balance Sheet if the Profit and Loss account opening balance was NIL as on 31-03-2011. (Nov. 2012) (8 Marks)

Answer:

KLM Bank Limited

Profit and Loss Account for the year ended 31st March, 2012

Note: Profit & Loss Account balance of ₹ 3,75,445 will appear under the head ‘Reserves and Surplus’ in Schedule 2 of the Balance Sheet.

Working Note:

![]()

Question 33.

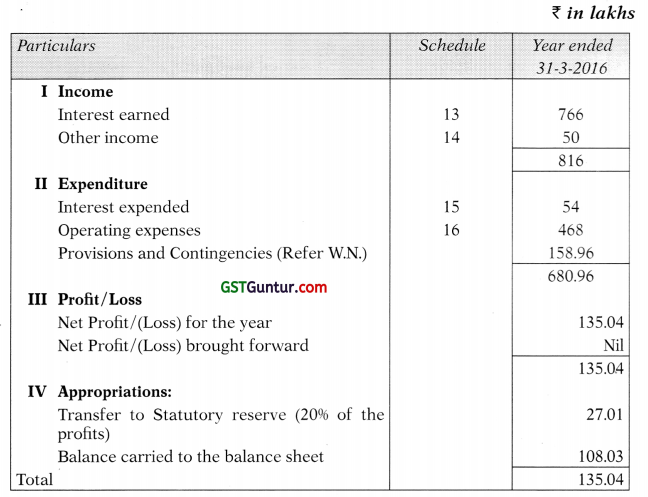

From the following information of Wealth Bank Limited, Prepare Profit and Loss Account for the year ended 31st March, 2016:

Other Information:

(iii) Investments : Bank should not keep more than 25% of its investment as ‘held-for-maturity’ investment; the market value of its rest 75% investment is ₹ 3,95,00,000 as on 31.03.2016.

(iv) Provide 35% of the profits towards provision for taxation.

(v) Transfer 20% of the profit to Statutory Reserves. (May 2016) (10 Marks)

Answer:

Wealth Bank Limited Profit and Loss Account

For the year ended 31st March, 2016

Schedule 13 – Interest Earned

Schedule 14 – Other Income

Schedule 15 – Interest Expended

Schedule 16 – Operating Expenses

Working Note:

Note:

1. Cost of investment is missing in the question. Therefore, it is assumed that cost of 75% of the investments, other than the investments held for maturity, is same as its market value. Hence no diminution in the value is provided for in the given solution.

![]()

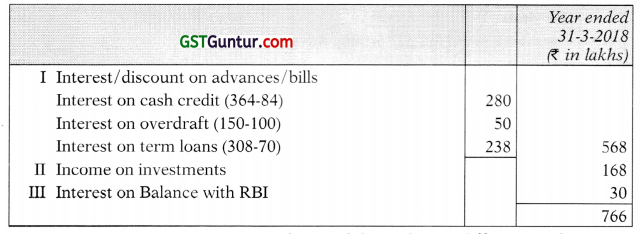

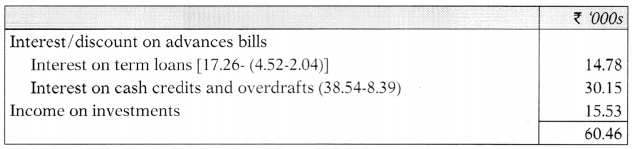

Question 34.

The following are the figures extracted from the books of National Bank Limited as on 31-3-2018.

The following further information is given:

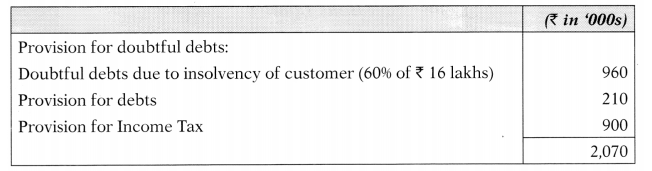

- A customer to whom a sum of ₹ 16 lakhs has been advanced has become insolvent and it is expected only 40% can be recovered from his estate.

- There were also other debts for which a provision of ₹ 2,10,000 was found necessary by the auditors.

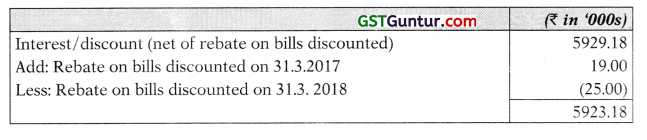

- Rebate on bills discounted on 31-3-2017 was ₹ 19,000 and on 31-3-2018 was ₹ 25,000.

- Preliminary expenses are to be fully written off during the year.

- Provide ₹ 9,00,000 for Income-tax.

- Profit and loss account opening balance was Nil as on 31 -3-2017.

- The directors desire to declare 10% dividend after transfer of 25% of the year’s profit to statutory reserve.

You are required to prepare profit & loss Account of the National Bank Ltd. with all the necessary schedules for the year ended 31st March 2018. Ignore figures for the Previous year and corporate dividend tax. (May 2018) (8 Marks)

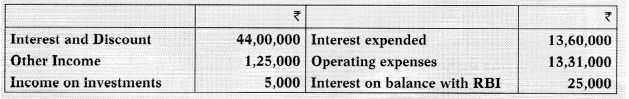

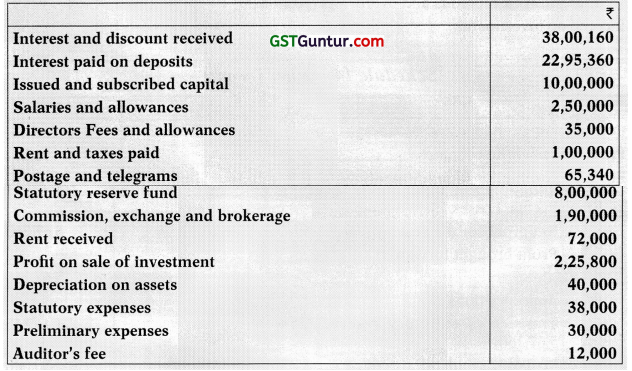

Answer:

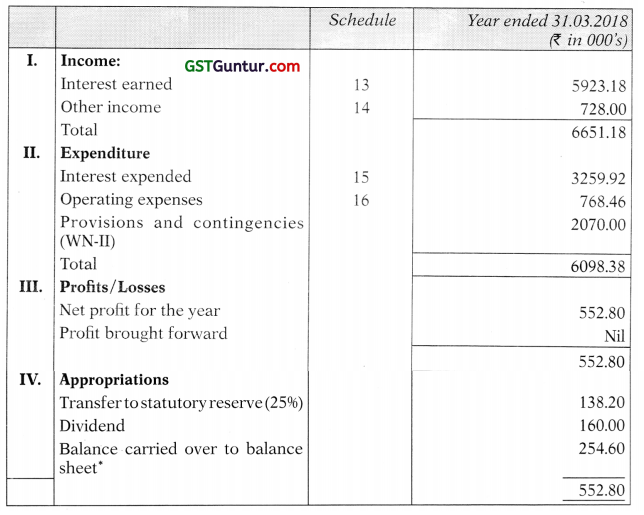

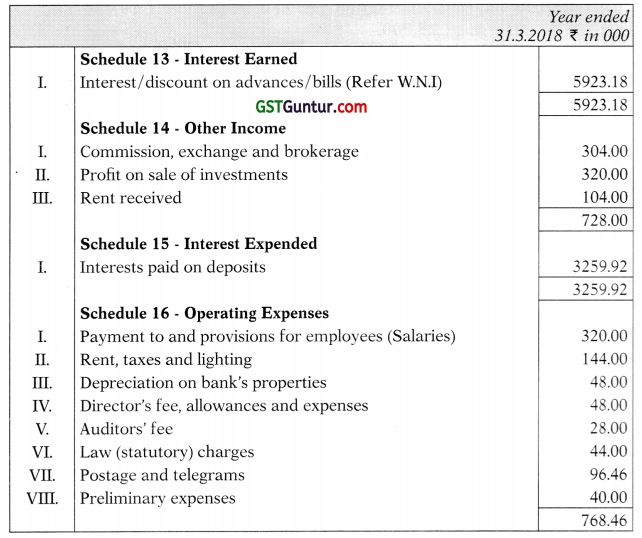

National Bank Limited

Profit and Loss Account for the year ended 31st March, 2018

Note: The Profit & Loss Account balance of ₹ 254.60 thousand will appear in the Balance Sheet under Schedule 2 ‘Reserves and Surplus’.

Working Notes:

I.

II. Provisions and Contingencies

![]()

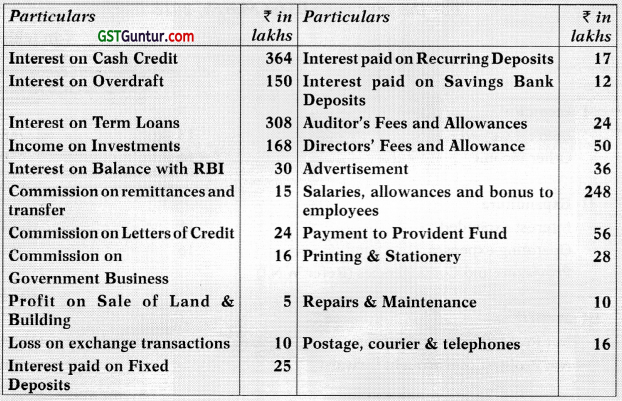

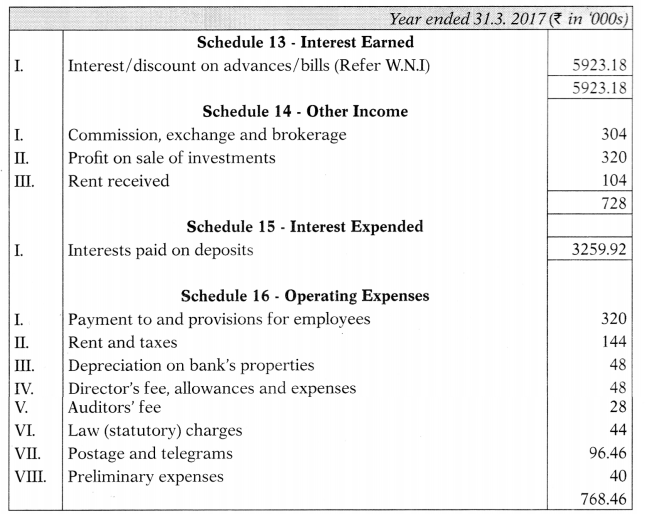

Question 35.

The following are the figures extracted from the books of PQR Bank Limited as on 31.3.2017.

The following further information is given:

- A customer to whom a sum of ₹ 16 lakhs has been advanced has become insolvent and it is expected only 40% can be recovered from his estate.

- There were also other debts for which a provision of ₹ 2,10,000 was found necessary by the auditors.

- Rebate on bills discounted on 31.3.2016 was ₹ 19,000 and on 31.3.2017 was ₹ 25,000.

- Preliminary expenses are to be fully written off during the year.

- Provide ₹ 9,00,000 for Income-tax.

- Profit and Loss account opening balance was Nil as on 31.3.2016.

You are required to Prepare the Profit and Loss account of PQR Bank Limited for the year ended 31.3.2017.

Answer:

PQR Bank Limited

Profit and Loss Account for the year ended 31st March, 2017

Working Note:

![]()

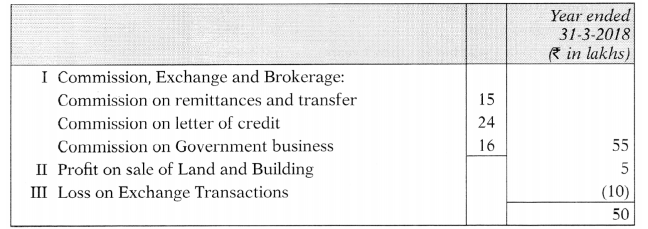

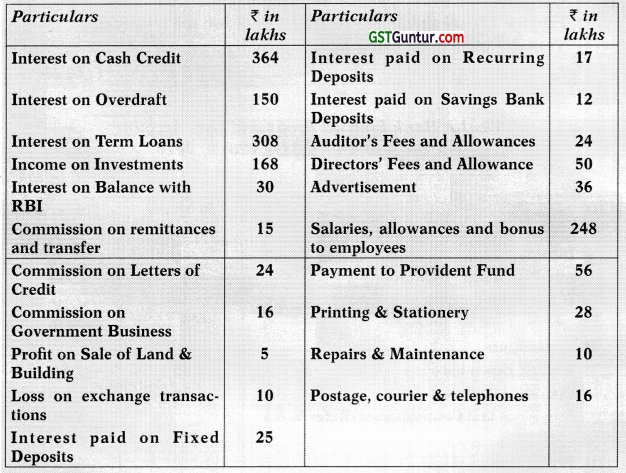

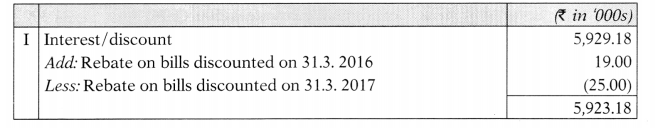

Final Accounts – Balance Sheet

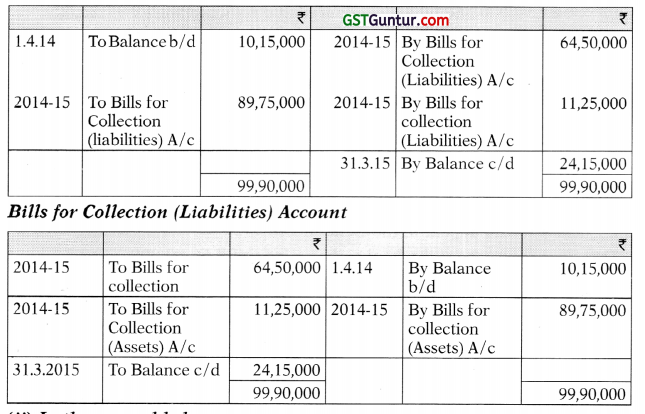

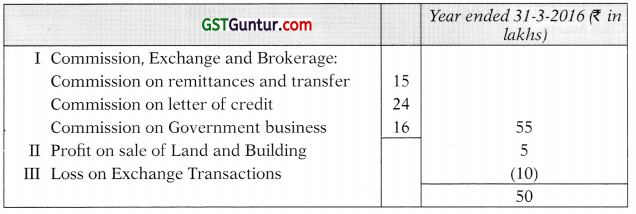

Question 36.

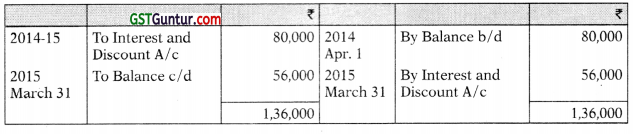

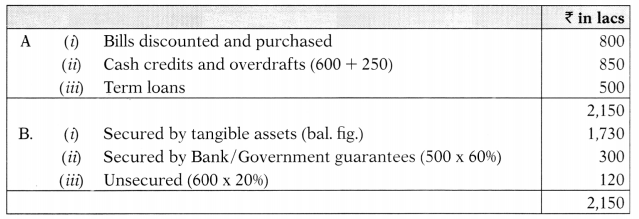

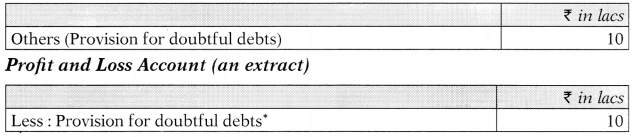

How will you disclose the following Ledger balances in the Final accounts of DVD bank:

Additional information:

- Included in the current accounts ledger are accounts overdrawn to the extent of ₹ 250 lacs.

- One of the cash credit account of ₹ 10 lacs (including interest ₹ 1 lac) is doubtful.

- 60% of term loans are secured by government guarantees, 20% of cash credits are unsecured, other portion is secured by tangible assets. (May 2010) (4 Marks)

Answer:

Relevant Schedules

Schedule 3: Deposits

Schedule 9: Advances

![]()

Schedule 5: Other Liabilities & Provisions

*Note: It is assumed that the cash credit has been in the ‘doubtful’ category for more than three years.