Accounting Standards – CA Inter Advanced Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Accounting Standards – CA Inter Advanced Accounting Study Material

AS 4

Contingencies And Events Occurring After Balance Sheet Date

Adjustment Events (Based On Para Nos. 3, 8.1 And 8.2)

Question 1.

A company entered into an agreement to sell its immovable property to another company for 35 lakhs. The property was shown in the Balance Sheet at ₹ 7 lakhs. The agreement to sell was concluded on 15th February, 2008 and sale deed was registered on 30th April, 2008. The financial statements for the year 2007-08 were approved by the board on 12th May, 2008.

You are required to state, how this transaction would be dealt with in the financial statements for the year ended 31st March, 2008. (Nov. 2009) (2 Marks)

Answer:

According to para 13 of AS 4 “Contingencies and Events Occurring After the Balance Sheet Date”, assets and liabilities should be adjusted for events occurring after the balance sheet date that provide additional evidence to assist the estimation of amounts relating to conditions existing at the balance sheet date.

Analysis:

In the above case, sale of immovable property was carried out before the closure of the books of account. This is clearly an event occurring after the balance sheet date but agreement to sell was affected on 15th February 2009 i.e. before the balance sheet date.

Registration of the sale deed on 30th April, 2009, simply provides additional information relating to the conditions existing at the balance sheet date.

Conclusion:

Thus, adjustment to assets for sale of immovable property is necessary in the financial statements for the year ended 31st March, 2009.

Question 2.

While preparing its final accounts for the year ended 31st March 2010, a company made a provision for bad debts @ 4% of its total debtors (as per trend follows from the previous years). In the first week of March 2010, a debtor for ₹ 3,00,000 had suffered heavy loss due to an earthquake; the loss was not covered by any insurance policy. In April, 2010 the debtor became a bankrupt. Can the company provide for the full loss arising out of insolvency of the debtor in the final accounts for the year ended 31st March, 2010? (Nov. 2010) (5 Marks)

Answer:

As per para 8 of AS 4 ‘Contingencies and Events Occurring After the Balance Sheet Date’ adjustment to assets and liabilities are required for events occurring after the balance sheet date that provide additional information materially affecting the determination of the amounts relating to conditions existing at the Balance Sheet date.

Analysis:

A debtor for ₹ 3,00,000 suffered heavy loss due to earthquake in the first week of March, 2010 and he became bankrupt in April, 2010 (after the balance sheet date). The loss was also not covered by any insurance policy.

Conclusion:

Therefore, full provision for bad debts amounting ₹ 3,00,000 should be made, to cover the loss arising due to the insolvency of a debtor, in the final accounts for the year ended 31st March, 2010.

![]()

Question 3.

MEC Limited could not recover an amount of ₹ 8 lakhs from a debtor. The company is aware that the debtor is in great financial difficulty. The accounts of the company for the year ended 31-3-2011 were finalized by making a provision @ 25% of the amount due from that debtor. In May 2011, the debtor became bankrupt and nothing is recoverable from him. Do you advise the company to provide for the entire loss of ₹ 8 lakhs in books of account for the year ended 31-3-2011? (Nov. 2011) (4 Marks)

Answer:

As per para 8 of AS 4, ‘Contingencies and Events Occurring After the Balance Sheet Date’, adjustments to assets and liabilities are required for events occurring after the balance sheet date if such event provides/relates to additional information to the conditions existing at the balance sheet date and is also materially affecting the valuation of assets and liabilities on the balance sheet date.

Analysis:

As per the information given in the question, the debtor was already in a great financial difficulty at the time of closing of accounts. Bankruptcy of the debtor in May 2011 is only an additional information to the condition existing on the balance sheet date. Also, the effect of a debtor becoming bankrupt is material as total amount of ₹ 8 lakhs will be a loss to the company.

Conclusion:

Thus, the company is should provide for the entire amount of ₹ 8 lakhs in the books of account for the year ended 31st March, 2011.

Question 4.

Cashier of A-One Limited embezzled cash amounting to ₹ 6,00,000 during March, 2012. However same comes to the notice of Company management during April, 2012 only financial statements of the company are not yet approved by the Board of Directors of the company. With the help of provisions of AS 4 “Contingencies and Events Occurring after the Balance Sheet Date” decide, whether the embezzlement of cash should be adjusted in the books of account for the year ending March, 2012?

What will be your reply, if embezzlement of cash comes to the notice of company management only after approval of financial statements by the Boar Directors of the company? (May 2012) (4 Marks)

Answer:

As per para no. 13 of AS 4, assets and liabilities should be adjusted for events occurring after the balance sheet date that provide additional evidence to assist the estimation of amounts relating to conditions existing at the balance sheet date.

Analysis:

Though the theft, by the cashier ₹ 6,00,000, was detected after the balance sheet date (before approval of financial statements) but it is an additional information materially affecting the determination of the cash amount relating to conditions existing at the balance sheet date.

Conclusion:

Therefore, it is necessary to make the necessary adjustments in the financial statements of the company for the year ended 31st March, 2012 for recognition of the loss amounting ₹ 6,00,000.

![]()

Question 5.

In its Final Accounts for the year ended 31st March, 2014, Z Ltd. made a provision of 3% of its total debtors. On 10th March, 2014, a debtor of ₹ 5 lakhs suffered a heavy loss and became insolvent in April 2014. The loss was not insured.

State giving reasons, if the company may provide for the full loss in its accounts for the year ended 31st March, 2014. (May 2014) (5 Marks)

Answer:

According to para 8.2 of Accounting Standard 4 “Contingencies and Events Occurring after the Balance Sheet Date”, adjustments to assets and liabilities are required for events occurring after the balance sheet date that provide additional information materially affecting the determination of the amounts relating to conditions existing at the balance sheet date.

Analysis:

In the above case, though the debtor became insolvent after balance sheet date, yet he had suffered heavy loss (not covered by the insurance), before the balance sheet date and this loss was the cause of the insolvency of the debtor.

Conclusion:

Thus, the company must make full provision for bad debts amounting X 5 lakhs in its final accounts for the year ended 31st March, 2014.

Question 6.

While preparing its final accounts for the year ended 31st March, 2016, a company made provision for bad debts @ 5% of its total debtors. In the last week of February, 2016, a debtor for ₹ 20 lakhs had suffered heavy loss due to an earthquake; the loss was not covered by any insurance policy. In April, 2016 the debtor became a bankrupt. Can the company provide for the full loss arising out of insolvency of the debtor in the final accounts for the year ended 31st March, 2016?

Comment with reference to relevant Accounting Standard. (Nov. 2016) (5 Marks)

Answer:

As per AS 4 ‘Contingencies and Events Occurring After the Balance Sheet Date adjustment to assets and liabilities are required for events occurring after the balance sheet date that provide additional information materially affecting the determination of the amounts relating to conditions existing at the Balance Sheet date.

Analysis:

A debtor for ₹ 20,00,000 suffered heavy loss due to earthquake in the last week of February, 2016 which was not covered by insurance. This information with its implications was already known to the company. The fact that he became bankrupt in April, 2016 (after the balance sheet date) is only an additional information related to the condition existing on the balance sheet date. However, bankruptcy of debtors is an adjusting event.

Conclusion:

Thus, full provision for bad debts amounting ₹ 20,00,000 should be made, to cover the loss arising due to the insolvency of a debtor, in the final accounts for the year ended 31st March 2016.

Since the company has already made 5% provision of its total debtors, additional provision amounting ₹ 19,00,000 shall be made (20,00,000 x 95%).

Non-Adjusting Events (Based On Para Nos. 3, 8.1, 8.3 And 8.4)

Question 7.

A company deals in petroleum products. The sale price of petrol is fixed by the government. After the Balance Sheet date, but before the finalization of the company’s accounts, the government unexpectedly increased the price retrospectively. Can the company account for additional revenue at the close of the year? Discuss in line with provisions of AS 4. (RTP)

Answer:

Analysis:

According to para 8 of AS 4, the unexpected increase in sale price of petrol by the government after the balance sheet date cannot be regarded as an event occurring after the Balance Sheet date, which requires an adjustment at the Balance Sheet date, since it does not represent a condition present at the balance sheet date.

Conclusion:

The revenue should be recognized only in the subsequent year with proper disclosures.

Question 8.

With reference to AS 4 “Contingencies and Events Occurring after the Balance Sheet Date”, state whether the following events will be treated as contingencies, adjusting events or non-adjusting events occurring after balance sheet date in case of a company which follows April to March as its financial year.

(i) A major fire has damaged the assets in a factory on 5th April, 5 days after the year end. However, the assets are fully insured and the books have not been approved by the Directors.

(ii) A suit against the company’s advertisement was filed by a party on 10th April, 10 days after the year end claiming damages of ₹ 20 lakhs. (RTP)

Answer:

Accordingto AS 4 on ‘Contingencies and Events Occurring after the Balance Sheet Date’, adjustments to assets and liabilities are required for events occurring after the balance sheet date that provide additional information materially affecting the determination of the amounts relating to conditions existing at the balance sheet date. However, adjustments to assets and liabilities are not appropriate for events occurring after the balance sheet date, if such events do not relate to conditions existing at the balance sheet date. “Contingencies”used in the Standard is restricted to conditions or situations at the balance sheet date, the financial effect of which is to be determined by future events which may or may not occur.

(i) Analysis:

Fire has occurred after the balance sheet date and also the loss is totally insured.

Conclusion:

Therefore, the event becomes immaterial and the event is non-adjusting in nature.

(ii) Analysis:

The contingency is restricted to conditions existing at the balance sheet date. However, in the given case, suit was filed against the company’s advertisement by a party on 10th April for amount of ₹ 20 lakhs.

Conclusion:

Therefore, it does not fit into the definition of a contingency and hence is a non-adjusting event.

![]()

Question 9.

A Company follows April to March as its financial year. The Company recognizes cheques dated 31st March or before, received from customers after balance sheet date, but before approval of financial statement by debiting ‘Cheques in hand account’ and crediting ‘Debtors account’. The ‘cheques in hand’ is shown in the Balance Sheet as an item of cash and cash equivalents. All cheques in hand are presented to bank in the month of April and are also realised in the same month in normal course after deposit in the bank. State with reasons, whether the collection of cheques bearing date 31st March or before, but received after Balance Sheet date is an adjusting event and how this fact is to be disclosed by the company? (May 2010) (2 Marks)

Answer:

Analysis:

Even if the cheques bear the date 31st March or before, the cheques received after 31st March do not represent any condition existing on the balance sheet date i.e. 31st March.

Conclusion:

Thus, the collection of cheques after balance sheet date is not an adjusting event.

Question 10.

With reference to AS 4 “Contingencies and Events Occurring after the Balance Sheet Date”, identify whether the following events will be treated as contingencies, adjusting events or non-adjusting events occurring after balance sheet date in case of a company which follows April to March as its financial year.

(i) A major fire has damaged the assets in a factory on 5th April, 5 days after the year end. However, the assets are fully insured and the books have not been approved by the Directors.

(ii) A suit against the company’s advertisement was filed by a party on 10th April, 10 days after the year end claiming damages of ₹ 20 lakhs. (RTP)

Answer:

According to AS 4 on ‘Contingencies and Events Occurring after the Balance Sheet Date’, adjustments to assets and liabilities are required for events occurring after the balance sheet date that provide additional information materially affecting the determination of the amounts relating to conditions existing at the balance sheet date. However, adjustments to assets and liabilities are not appropriate for events occurring after the balance sheet date, if such events do not relate to conditions existing at the balance sheet date. “Contingencies ” used in the Standard is restricted to conditions or situations at the balance sheet date, the financial effect of which is to be determined by future events which may or may not occur.

(i) Analysis:

Fire has occurred after the balance sheet date and also the loss is totally insured.

Conclusion:

Therefore, the event becomes immaterial and the event is non-adjusting in nature.

(ii) Analysis:

The contingency is restricted to conditions existing at the balance sheet date. However, in the given case, suit was filed against the company’s advertisement by a party on 10th April for amount of ₹ 20 lakhs.

Conclusion:

Therefore, it does not fit into the definition of a contingency and hence is a non-adjusting event.

Events After Approval Of Financial Statements (Based On Para No. 3)

Question 11.

A Limited Company dosed its accounting year on 30.6.2017 and the accounts for that period were considered and approved by the board of directors on 20th August, 2017. The company was engaged in laying pipe line for an oil company deep beneath the earth. While doing the boring work on 1.9.2017 it had met a rocky surface for which it was estimated that there would be an extra cost to the tune of 80 lakhs. You are required to state with reasons, how the event would be dealt with in the financial statements for the year ended 30.6.2017.

Answer:

AS 4 (Revised) on Contingencies and Events Occurring after the Balance Sheet Date defines ‘events occurring after the balance sheet date’ as ‘significant events, both favourable and unfavourable, that occur between the balance sheet date and the date on which financial statements are approved by the Board of Directors in the case of a company’.

Analysis:

In the above case the incidence, which was expected to push up cost, became evident after the date of approval of the accounts.

Conclusion:

Therefore, it is not an ‘event occurring after the balance sheet date’. However, this may be mentioned in the Report of Approving Authority.

Question 12.

During the year 2015-16, R Ltd. was sued by a competitor for ₹ 15 lakhs for infringement of a trademark. Based on the advice of the company’s legal counsel, R Ltd. provided for a sum of ₹ 10 lakhs in its financial statements for the year ended 31st March, 2016. On 18th May, 2016, the Court decided in favour of the party alleging infringement of the trademark and ordered R Ltd. to pay the aggrieved party a sum of ₹ 14 lakhs. The financial statements were prepared by the company’s management on 30th April, 2016, and approved by the board on 30th May 2016.

Answer:

As per AS 4 (Revised), adjustments to assets and liabilities are required for events occurring after the balance sheet date that provide additional information materially affecting the determination of the amounts relating to conditions existing at the balance sheet date.

Analysis:

In the given case, since R Ltd. was sued by a competitor for infringement of a trademark during the year 2015-16 for which the provision was also made by it, the decision of the Court on 18th May, 2016, for payment of the penalty will constitute as an adjusting event because it is an event occurred before approval of the financial statements.

Conclusion:

Therefore, R Ltd. should adjust the provision upward by ₹ 4 lakhs to reflect the award decreed by the Court to be paid by them to its competitor.

![]()

Mix Questions

Question 13.

Neel Limited has its corporate office in Mumbai and sells its products to stockists all over India. On 31st March, 2013, the company wants to recognize receipt of cheques bearing date 31st March, 2013 or before, as “Cheques in Hand” by reducing “Trade Receivables”. The “Cheques in Hand” ¡s shown in the Balance Sheet as an item of cash and cash equivalents. All cheques are presented to the bank in the month of April 2013 and are also realized in the same month in normal course after deposit in the bank. State with reasons, whether each of the following Is an adjusting event and how this fact is to be

disclosed by the company, with reference to the relevant accounting standard.

(i) Cheques collected by the marketing personnel of the company from the stockists on or before 31st March, 2013.

(ii) Cheques sent by the stockists through courier on or before 31st March,

2013. (May 2013) (4 Marks)

Answer:

(i) Analysis:

Cheques collected by the marketing personnel of the company is an adjusting event as the marketing personnel are employees of the company and therefore, are representatives of the company. Handing over of cheques by the stockist to the marketing employees discharges the liability of the stockist. Therefore, cheques collected by the marketing personnel of the company on or before 31st March, 2013 require ad-justment from the stockists’ accounts i.e. from ‘Trade Receivables A/c’ even though these cheques (dated on or before 31st March, 2013) are presented in the bank in the month of April, 2013 in the normal course.

Conclusion:

Hence, collection of cheques by the marketing personnel is an adjusting event as per AS 4 ‘Contingencies and Events Occurring after the Balance Sheet Date’. Such ‘cheques in hand’ will be shown in the Balance Sheet as ‘Cash and Cash equivalents’ with a disclosure in the Notes to accounts about the accounting policy followed by the company for such cheques.

(ii) Analysis:

Even if the cheques bear the date 31st March or before and are sent by the stockists through courier on or before 31st March, 2013, it is presumed that the cheques will be received after 31st March. Collection of cheques after 31 st March, 2013 does not represent any condition existing on the balance sheet date i.e. 31st March.

Conclusion:

Thus, the collection of cheques after balance sheet date is not an adjusting event. Cheques that are received after the balance sheet date should be accounted for in the period in which they are received even though the same may be dated 31st March or before as per AS 4. Moreover, the collection of cheques after balance sheet date does not represent any material change affecting financial position of the enterprise, so no disclosure in the Director’s Report is necessary.

Question 14.

State with reasons, how the following events would be dealt with in the financial statements of Pradeep Ltd. for the year ended 31st March, 2013:

(i) An agreement to sell a land for 30 lakh to another company was entered into on 1st March, 2013. The value of land is shown at ₹ 20 lakh in the Balance Sheet as on 31st March, 2012. However, the Sale Deed was registered on 15th April, 2013.

(ii) The negotiation with another company for acquisition of its business was started on 2nd February, 2013. Pradeep Ltd. invested ₹ 40 lakh on 12th April, 2013. (Nov. 2013) (4 Marks)

Answer:

(i) Analysis:

In the given case, sale of immovable property was carried out before the closure of the books of account. This is clearly an event occurring after the balance sheet date hut agreement to sell was effected on 1st March, 2013 i.e. before the balance sheet date. Registration of the sale deed on 15th April, 2013, simply provides additional information relating to the conditions existing at the balance sheet date.

Conclusion:

Therefore, adjustment to assets for sale of land is necessary in the financial statements of Pradeep Ltd. for the year ended 31st March, 2013.

(ii) Analysis:

The acquisition of another company is an event occurring after the balance sheet date. However, no adjustment to assets and liabilities is required as the event does not affect the determination and the condition of the amounts stated in the financial statements for the year ended 31 st March, 2013.

Conclusion:

The investment of ₹ 40 lakhs in April, 2013 in the acquisition of another company should be disclosed in the report of the Board of Directors to enable users of financial statements to make proper evaluations and decisions.

Question 15.

With reference to AS 4 “Contingencies and events occurring after the balance sheet date”, state whether the following events will be treated as contingencies, adjusting events or non-adjusting events occurring after balance sheet date in case of a company which follows April to March as its financial year.

(i) A major fire has damaged the assets in a factory on 5th April, 5 days after the year end. However, the assets are fully insured and the books have not been approved by the Directors.

(ii) A suit against the company’s advertisement was filed by a party on 10th April, 10 days after the year end claiming damages of ₹ 20 lakhs.

(iii) It sends a proposal to purchase an immovable property for ₹ 30 lakhs in March. The book value of the property is ₹ 20 lakhs as on year end date. However, the deed was registered as on 15th April.

(iv) The terms and conditions for acquisition of business of another company have been decided by March end. But the financial resources were arranged in April and amount invested was ₹ 40 lakhs.

(v) Theft of cash of ₹ 2 lakhs by the cashier on 31 st March but was detected the next day after the financial statements have been approved by the Directors. (May 2016) (5 Marks)

Answer:

(i) Analysis:

Fire has occurred after the balance sheet date and also the loss is totally insured.

Conclusion:

Thus, the event becomes immaterial and the event is non-adjusting in nature.

(ii) Analysis:

The contingency is restricted to conditions existing at the balance sheet date. However, in the given case, suit was hied against the company’s advertisement by a party on 10th April for amount of t 20 lakhs.

Conclusion:

Thus, it does not fit into the definition of a contingency and hence is a non-adjusting event.

(iii) Analysis:

In the given case, proposal for deal of immovable property was sent before the closure of the books of account.

Conclusion:

This is a non-adjusting event as only the proposal was sent and no agreement was effected in the month of March i.e. before the balance sheet date.

(iv) Analysis and conclusion:

As the term and conditions of acquisition of business of another com-pany had been decided by the end of March, acquisition of business is an adjusting event occurring after the balance sheet date.

Adjustment to assets and liabilities is required since the event affects the determination and the condition of the amounts stated in the financial statements for the financial year ended on 31st

March.

(v) Analysis and conclusion:

Since the financial statements have been approved before detection of theft by the cashier of ₹ 2,00,000, it becomes a non-adjusting event and no disclosure is required in the report of the Approving Authority.

![]()

Dividends (Based On Para No. 8.5)

Question 16.

The Board of Directors of M/s. New Graphics Ltd. in Its Board Meeting held on 18th April, 2017, considered and approved the Audited Financial results along with Auditors Report for the Financial Year ended 31st March, 2017 and recommended a dividend of 2 per equity share (on 2 crore fully paid up equity shares of 10 each) for the year ended 31st March, 2017 and if approved by the members at the forthcoming Annual General Meeting of the company on 18th June, 2017, the same will be paid to all the eligible shareholders.

Discuss on the accounting treatment and presentation of the said proposed dividend in the annual accounts of the company for the year ended 31st March, 2017 as per the applicable Accounting Standard and other Statutory Requirements. (May 2017) (5 Marks)

Answer:

Analysis:

Dividends declared after the balance sheet date but before approval of financial statements are not recognized as a liability at the balance sheet date because no statutory obligation exists at that time. Hence such dividends are disclosed in the notes to financial statements.

No, provision for proposed dividends is not required to be made. Such proposed dividends are to be disclosed in the notes to financial statements.

Conclusion:

Accordingly, the dividend of ₹ 4 crores recommended by New Graphics Ltd. in its Board meeting on 18th April, 2017 shall not be accounted for in the books for the year 2016-17 irrespective of the fact that it pertains to the year 2016-17 and will be paid after approval in the Annual General Meeting of the members/shareholders.

Going Concern (Based On Para No. 8.6)

Question 17.

An earthquake destroyed a major warehouse of P Ltd. on 30.4.2014. The accounting year of the company ended on 31.3.2014. The accounts were approved on 30.6.2014. The loss from earthquake is estimated at ₹ 25 lakhs. State with reasons, whether the loss due to earthquake is an adjusting or non-adjusting event and how the fact of loss is to be disclosed by the company. (RTP)

Answer:

Para 8.3 of AS 4 Contingencies and Events Occurring after the Balance Sheet Date states that adjustments to assets and liabilüies are not appropriate for events occurring after the balance sheet date, if such events do not relate to conditions existing at the balance sheet date.

Analysis:

The destruction of warehouse due to earthquake did not exist on the balance sheet date i.e. 3 1.3.2014. Therefore, loss occurred due to earthquake is not to bë recognised in the financial year 2013-14.

However, according to para 8.6 of the standard, unusual changes affecting the existence or substratum of the enterprise after the balance sheet date may indicate a need to consider the use of fundamental accounting assumption of going concern in the preparation of the financial statements. As per the information given in the question, the earthquake has caused major destruction.

Conclusion:

Therefore, fundamental accounting assumption of going concern is impacted. Hence, the fact of earthquake together with an estimated loss of ₹ 25 lakhs should be disclosed in the Report of the Directors for the financial year 2013-14.

Question 18.

The accounting year of Dee Limited ended on 31st March, 2018 but the accounts were approved on 30th April, 2018. On 15th April, 2018 a fire occurred in the factory and office premises. The loss by fire is of such a magnitude that it was not possible to expect the enterprise Dee Limited to start operation again.

State with reasons, whether the loss due to fire is an adjusting or non- adjusting event and how the fact of loss is to be disclosed by the company in the context of the provisions of AS 4 (Revised). (Nov. 2018) (5 Marks)

Answer:

As per AS 4 (Revised) “Contingencies and Events occurring after the Balance Sheet Date”, an event occurring after the balance sheet date should be an adjusting event even if it does not reflect any condition existing on the balance sheet date, if the event is such as to indicate that the fundamental accounting assumption of going concern is no longer appropriate.

Analysis:

The fire occurred in the factory and office premises of an enterprise after 31st March, 2018 but before approval of financial statement of 30.4.2018. The loss by fire is of such a magnitude that it is not reasonable to expect the Dee Ltd. to start operations again, i.e., the going concern assumption is not valid. Since the fire occurred after 31/03/18, the loss on fire is not a result of any condition existing on 31/03 /18.

Conclusion:

Loss due to fire is an adjusting event the entire accounts need to be prepared on a liquidation basis with adequate disclosures by the company by way of note in its financial statements as under:

Draft Notes to Account:

“Major fire occurred in the factory and office premises on 15th April, 2018 which has made impossible for the enterprise to start operations again.

Therefore, the financial statements have been prepared on liquidation basis.”

AS 5

Net Profit Or Loss For The Period, Prior Period

Items And Changes In Accounting Policies

Extraordinary Items (Based On Para Nos. 4 And 8 To 11)

Question 1.

B Ltd. has a vacant land measuring 20,000 sq. mts., which it had no intention to use in the future. The Company decided to sell the land to tide over its liquidity problems and made a profit of ₹ 10 Lakhs by selling the said land. Moreover, there was a fire in the factory and a part of the unused factory shed valued at ₹ 8 Lakhs was destroyed. The loss from fire was set off against the profit from sale of land and profit of ₹ 2 lakhs was disclosed as net profit from sale of assets.

You are required to examine the treatment and disclosure done by the company and advise the company in line with AS 5. (RTP)

Answer:

As per AS 5 “Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies” Extraordinary items should be disclosed in the statement of profit and loss as a part of net profit or loss for the period. The nature and the amount of each extraordinary item should be separately disclosed in the statement of profit and loss in a manner that its impact on current profit or loss can be perceived.

Analysis:

In the above case the selling of land to tide over liquidation problems as well as fire in the Factory does not constitute ordinary activities of the Company. These items are distinct from the ordinary activities of the business. Both the events are material in nature and expected not to recur frequently or regularly.

Thus, these are Extraordinary Items.

Conclusion:

Thus, disclosing net profits by setting off fire losses against profit from sale of land is not correct. The profit on sale of land, and loss due to fire should be disclosed separately in the statement of profit and loss.

Exceptional Items (Based On Para Nos. 12 To 14)

Question 2.

A company signed an agreement with the employees’ union on 01-092010 for revision of wages with retrospective effect from 01-04-2009. This would cost the company an additional liability of ₹ 10 lakhs per annum. Is a disclosure necessary for the amount paid in 2010-11? (May 2011) (4 Marks)

Answer:

As per AS 5 (Revised), “Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies”, when items of income and expense within profit or loss from ordinary activities are of such size, nature or incidence that their disclosure is relevant to explain the performance of the enterprise for the period, the nature and amount of such items should be disclosed separately.

Analysis:

The revision of wages took place on 1st September, 2010 with retrospective effect from 1.4.2009. The arrear of wages payable for the period 01.4.2009 to 31.3.2010, cannot be taken as an error or omission in the preparation of financial statement and hence this expenditure cannot be taken as a prior period item. Additional wages liability of ₹ 20 lakhs should be included in current years’ wages.

Conclusion:

Additional wages are an expense arising from the ordinary activities of the company. Although abnormal in amount, such an expense does not qualify as an extraordinary item.

Accordingly, necessary disclosure should be made for the additional liability amounting ₹ 20 lakhs.

![]()

Question 3.

Tiger Motor Car Limited signed an agreement with its employee’s union for revision of wages on 01.07.2011. The revision of wages is with retrospective effect from 01.04.2008. The arrear wages up to 31.3.2011 amounts to ₹ 40,00,000 and that for the period from 01.04.2011 to 01.07.2011 amount to ₹ 3,50,000. In view of the provisions of AS 5 “Net Profit or Loss for the period, Prior Period Items and Changes in Accounting Policies”, decide whether a separate disclosure of arrear wages is required while preparing financial statements for the year ending 31.3.2012. (May 2012) (4 Marks)

Answer:

As per para no. 12 of AS 5, when items of income and expense within profit or loss from ordinary activities are of such size, nature or incidence that their disclosure is relevant to explain the performance of the enterprise for the period, the nature and amount of such items should be disclosed separately.

Analysis:

The revision of wages took place in July, 2011 with retrospective effect from 1.4.2008. The arrear wages payable for the period from 1.4.2008 to 31.3.2011 cannot be taken as an error or omission in the preparation of financial statements and hence this expenditure cannot be taken as a prior period item.

Additional wages liability of ₹ 40,00,000 (from 1.4.2008 to 31.3.2011) should be included in current year’s wages.

Conclusion:

Additional wages are an expense arising from the ordinary activities of the company. Although abnormal in amount, such an expense does not qualify as an extraordinary item. However, wages payable for the current year (from 1.4.2011 to 1.7.2011) amounting ₹ 3,50,000 is not a prior period item hence need not be disclosed separately. This may be shown as current year wages.

Prior Period Items (Based On Para Nos. 4 And 15 To 19)

Question 4.

The company finds that the inventory sheets of 31.3.2013 did not include two pages containing details of inventory worth ₹ 20 lakhs.

State, how you will deal with the above matter in the accounts of B Ltd. for the year ended 31st March, 2014 with reference to Accounting Standards. (RTP)

Answer:

Paragraph 4 of Accounting Standard 5 on “Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies”, defines Prior Period items as “income or expenses which arise in the current period as a result of errors or omissions in the preparation of the financial statements of one or more prior periods”.

Analysis and conclusion:

Rectification of error in inventory valuation is a prior period item vide provisions of AS 5. ₹ 20 lakhs must be added to the opening inventory of 1/4/2013. It is also necessary to show ₹ 20 lakhs as a prior period adjustment in the Profit and loss Account.

Separate disclosure of this item as a prior period item is required as per Para 15 of AS 5.

Question 5.

Goods of ₹ 5,00,000 were destroyed due to flood in September, 2015. A claim was lodged with insurance company, but no entry was passed in the books for insurance claim.

In March, 2018, the claim was passed and the company received a payment of ₹ 3,50,000 against the claim. Explain the treatment of such receipt in final accounts for the year ended 31st March, 2018. (RTP)

Answer:

As per the provisions of AS 5 “Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies”, prior period items are income or expenses, which arise, in the current period as a result of error or omissions in the preparation of financial statements of one or more prior periods. Further, the nature and amount of prior period items should be separately disclosed in the statement of profit and loss in a manner that their impact on current profit or loss can be perceived.

Analysis and conclusion:

In the above case, it is clearly a case of error in preparation of financial statements for the year 2015-16. Hence, claim received in the financial year 2017-18 is a prior period item and should be separately disclosed in the statement of Profit and Loss.

Changes In Accounting Policies (Based On Para Nos. 4 And 28 To 33)

Question 6.

G Ltd. had to pay delayed cotton clearing charges over and above the negotiated price for taking delayed delivery of cotton from the supplier’s godown. Upto 2010-11, the company has regularly included such charges in the valuation of closing stock. This charge, being in the nature of interest, the company has decided to exclude it from closing stock valuation. This would result in decrease of profit by ₹ 8.60 lakhs. What will be its treatment in the financial statements for the year ended 31st March, 2012? (RTP)

Answer:

AS 5 (Revised) “Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies”states that a change in an accounting policy should be made only if:

(a) It is required by statute, or

(b) for compliance with an accounting standard, or

(c) if it is considered that the change would result in a more appropriate presentation of the financial statements of an enterprise.

Analysis:

The change in the method of stock valuation is justified in view of the fact that the change is in line with the recommendations of AS 2 (Revised) ‘Valuation of Inventories’ and would result in more appropriate preparation of the financial statements.

Conclusion:

Accordingly, cost formula used for inventory valuation will exclude the delayed clearing charges being in the nature of interest. Due to change in the cost formula, the value of inventory and resulting profit will decrease by ₹ 8.60 lakhs. Appropriate disclosures should be made in the financial statements for this change.

Question 7.

X Limited was making provisions up to 31-3-2012 for non-moving inventories based on no issues for the last 12 months. Based on a technical evaluation the company wants to make provisions during the year 31 -03-2013 in the following manner:

Total value of inventory ₹ 3 crores.

Provision required based on 12 months ₹ 8 lakhs.

Provision required based on technical evaluation ₹ 7.50 lakhs.

Does this amount to change in accounting policy?

Can the company change the method of provision? (RTP)

Answer:

As per AS 5, due to uncertainties inherent in business activities, many financial statement items cannot be measured with precision but can only be estimated. The estimation process involves judgments based on the latest information available. An estimate may have to be revised if changes occur regarding the circumstances on which the estimate was based, or as a result of new information, more experience or subsequent developments.

Analysis and conclusion:

Basis of provisioning whether on no issues or on technical evaluation is the basis of making estimates and cannot be considered as Accounting Policy. The basis of change in provisioning is a guideline and the better way of estimating the provision for non-moving inventory on account of change. Hence, it is not a change in accounting policy. Accounting policy is the valuation of inventory on cost or on net realizable value or on lower of cost or net realizable value. Any interchange of this valuation base would have constituted change in accounting policy.

![]()

Question 8.

Explain whether the following will constitute a change in accounting policy or not as per AS 5.

(i) Introduction of a formal retirement gratuity scheme by an employer in place of ad hoc ex-gratia payments to employees on retirement.

(ii) Management decided to pay pension to those employees who have retired after completing 5 years of service in the organisation. Such employees will get pension of ₹ 20,000 per month. Earlier there was no such scheme of pension in the organization? (RTP)

Answer:

As per para 31 of AS 5 ‘Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies’, the adoption of an accounting policy for events or transactions that differ in substance from previously occurring events or transactions, will not be considered as a change in accounting policy.

Analysis and conclusion:

(i) Accordingly, introduction of a formal retirement gratuity scheme by an employer in place of ad hoc ex-gratia payments to employees on retirement is not a change in an accounting policy.

(ii) Also, the adoption of a new accounting policy for events or transactions which did not occur previously or that were immaterial will not be treated as a change in an accounting policy.

Question 9.

The Accountant of Mobile Limited has sought your opinion with relevant reasons, whether the following transactions will be treated as change in Accounting Policy or not for the year ended 31st March, 2017. Please advise him in the following situations in accordance with the provisions of relevant Accounting Standard:

(i) Provision for doubtful debts was created @ 2% till 31st March, 2016. From the Financial year 2016-17, the rate of provision has been changed to 3%.

(ii) During the year ended 31st March, 2017, the management has introduced a formal gratuity scheme in place of ad-hoc ex-gratia payments to employees on retirement.

(iii) Till the previous year the furniture was depreciated on straight line basis over a period of 5 years. From current year, the useful life of furniture has been changed to 3 years.

(iv) Management decided to pay pension to those employees who have retired after completing 5 years of service in the organization. Such employees will get pension of 20,000 per month. Earlier there was no such scheme of pension in the organization.

(v) During the year ended 31st March, 2017, there was change in cost formula in measuring the cost of inventories. (Nov. 2017) (5 Marks)

Answer:

(i) Analysis:

In the given case, Mobile limited created 2% provision for doubtful debts till 31st March, 2016. Subsequently in 2016-17, the company revised the estimates based on the changed circumstances and wants to create 3% provision.

Conclusion:

Therefore, change in rate of provision of doubtful debt is change in estimate and is not change in accounting policy. This change will affect only current year.

As per AS 5, the adoption of an accounting policy for events or transactions that differ in substance from previously occurring events or transactions, will not be considered as a change in accounting policy.

Analysis and conclusion:

Introduction of a formal retirement gratuity scheme by an employer in place of ad hoc ex-gratia payments to employees on retirement is a transaction which is substantially different from the previous policy, will not be treated as change in an accounting policy.

(iii) Analysis and conclusion:

Change in useful life of furniture from 5 years to 3 years is a change in estimate and is not a change in accounting policy.

(iv) Analysis:

Adoption of a new accounting policy for events or transactions which did not occur previously should not be treated as a change in an accounting policy.

Conclusion:

Thus, introduction of new pension scheme is not a change in accounting policy.

(v) Analysis and conclusion:

Change in cost formula used in measurement of cost of inventories is a change in accounting policy.

Changes In Accounting Estimates (Based On Para Nos. 20 To 27)

Question 10.

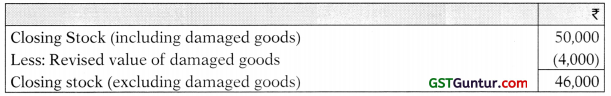

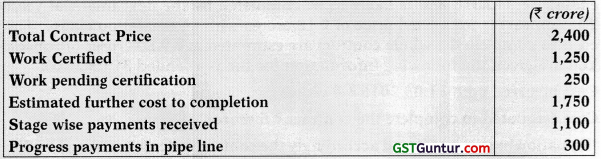

Closing stock for the year ending on 31.3.2010 is ₹ 50,000 which includes stock damaged in a fire in 2008-09. On 31.3.2009, the estimated net realisable value of the damaged stock was ₹ 12,000. The revised estimate of net realisable value of damaged goods amounting ₹ 4,000 has been included in closing stock of ₹ 50,000 as on 31.3.2010.

Find the value of closing stock to be shown in Profit and Loss account for the year 2009-10. (Nov. 2009) (2 Marks)

Answer:

As per AS 5 ‘Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies the effect of a change in accounting estimate should be classified using the same classification in the statement of profit and loss as was used previously for the estimate.

Analysis:

The fall in estimated net realisable value of damaged stock ₹ 8,000 is the effect of change in accounting estimate.

Conclusion:

Thus, the value of closing stock for the year 2009-10 will be as follows:

![]()

Question 11.

Closing stock for the year ending on 31.3.2010 is ₹ 50,000 which includes stock damaged in a fire in 2008-09. On 31.3.2009, the estimated net realisable value of the damaged stock was ₹ 12,000. The revised estimate of net realisable value of damaged goods amounting ₹ 4,000 has been included in closing stock of ₹ 50,000 as on 31.3.2010.

Find the value of closing stock to be shown in Profit and Loss account for the year 2009-10.

(May 2010) (2 Marks)

Answer:

As per AS 5 ‘Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies the effect of a change in accounting estimate should be classified using the same classification in the statement of profit and loss as was used previously for the estimate.

Analysis:

The fall in estimated net realisable value of damaged stock ₹ 8,000 is the effect of change in accounting estimate.

Conclusion:

Thus, the value of closing stock for the year 2009-10 will be as follows:

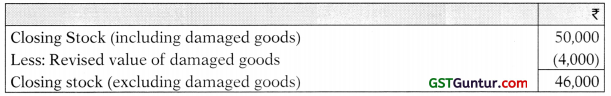

Question 12.

Closing Stock for the year ending on 31st March, 2013 is ₹ 1,50,000 which includes stock damaged in a fire in 2011 -12. On 31 st March, 2012, the estimated net realizable value of the damaged stock was ₹ 12,000. The revised estimate of net realizable value of damaged stock included in closing stock at 2012-13 is ₹ 4,000. Find the value of closing stock to be shown in Profit and Loss Account for the year 2012-13, using provisions of Accounting Standard 5. (May 2013) (5 Marks)

Answer:

As per para 25 of AS 5 ‘Net Profit or Loss the Period, Prior Period Items and Changes in Accounting Policies’, the effect of a change in accounting estimate should be classified using the same classification in the statement of profit and loss as was used previously for the estimate.

Analysis:

The fall in estimated net realisable value of damaged stock ₹ 8,000 is the effect of change in accounting estimate. It is presumed that the loss by fire in the year ended 31.3.2012, i.e. difference of cost and NRV was shown in the profit and loss account as an extraordinary item.

Conclusion:

Therefore, in the year 2012-13, revision in accounting estimate should also be classified as extraordinary item in the profit and loss account and closing stock should be shown excluding the value of damaged stock.

Value of closing stock for the year 2012-13 will be as follows:

Question 13.

HIL Ltd. was making provision for non-moving stocks based on no issues having occurred for the last 12 months upto 31.03.2017. The company now wants to make provision based on technical evaluation during the year ending 31.03.2018.

Total value of stock ₹ 120 lakhs

Provision required based on technical evaluation ₹ 3.00 lakhs.

Provision required based on 12 months no issues ₹ 4.00 lakhs.

You are requested to discuss the following points in the light of Accounting Standard (AS)-1:

(i) Does this amount to change in accounting policy?

(ii) Can the company change the method of accounting? (Nov. 2018) (5 Marks)

Answer:

Analysis:

The decision of making provision for non-moving inventories on the basis of technical evaluation does not amount to change in accounting policy. Accounting policy of a company may require that provision for non-moving inventories should be made but the basis for making provision will not constitute accounting policy. The method of estimating the amount of provision may be changed in case a more prudent estimate can be made.

In the given case, considering the total value of inventory, the change in the amount of required provision of non-moving inventory from ₹ 4 lakhs to ₹ 3 lakhs are also not material.

The disclosure can be made for such change in the notes to the accounts for the year 2017-18 as under:

“The company has provided for non-moving inventories on the basis of technical evaluation unlike preceding years. Had the same method been followed as in the previous year, the profit for the year and the value of net assets at the end of the year would have been lower by ₹ 1 lakh.”

Mix Questions [Prior Period Items; Changes In Accounting Polices; Changes In Accounting Estimates; Extraordinary Items; Exceptional Items]

Question 14.

(i) Goods worth ₹ 5,00,000 were destroyed due to flood in September, 2006. A claim was lodged with insurance company. But no entry was passed in the books for insurance claim in the financial year 2006-07. In March, 2008, the claim was passed and the company received a payment of ₹ 3,50,000 against the claim. Explain the treatment of such receipt in final accounts for the year ended 31st March, 2008.

(ii) A company created a provision of ₹ 75,000 for staff welfare while pre-paring the financial statements for the year 2007-08. On 31st March, in a meeting with staff welfare association, it was decided to increase the amount of provision for staff welfare to ₹ 1,00,000. The accounts were approved by Board of Directors on 15th April, 2008.

Explain the treatment of such revision in financial statements for the year ended 31st March, 2008.

(Nov. 2009) (2 × 2 = 4 Marks)

Answer:

(i) As per the provisions, of AS 5 “Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies”, prior period items are income or expenses, which arise in the current period as a result of error or omissions in the preparation of financial statements of one or more prior periods. Further, the nature and amount of prior period items should be separately disclosed in the statement of profit and loss.

Analysis and conclusion:

It is clearly a case of error in preparation of financial statements for the financial year 2006-07. Hence claim received in the financial year 2007-08 is a prior period item and should be separately disclosed in the statement of profit and loss for the year ended 31st March, 2008.

(ii) As per AS 5, normally, all items of income and expense which are rec-ognised in a period are included in the determination of the net profit or loss for the period. This includes extraordinary items and the effects of changes in accounting estimates. However, the effect of such change in accounting estimate should be classified using the same classification in the statement of profit and loss, as was used previously, for the estimate.

Analysis and conclusion:

The change in amount of staff welfare provision amounting ₹ 25,000 is neither a prior period item nor an extraordinary item. It is a change in estimate, which has been occurred in the year 2007-2008.

![]()

Question 15.

Give two examples on each of the following items:

(i) Change in Accounting Policy

(ii) Change in Accounting Estimate

(iii) Extraordinary Items

(iv) Prior Period Items. (Nov. 2012) (4 Marks)

Answer:

(i) Examples of Changes in Accounting Policy:

(a) Change of depreciation method from WD V to SLM and vice-versa.

(b) Change in cost formula in measuring the cost of inventories.

(ii) Examples of Changes in Accounting Estimates:

(a) Change in estimate of provision for doubtful debts on sundry debtors.

(b) Change in estimate of useful life of fixed assets.

(iii) Examples of Extraordinary items:

(a) Loss due to earthquakes/fire/strike

(b) Attachment of property of the enterprise by government

(iv) Examples of Prior period items:

(a) Applying incorrect rate of depreciation in one or more prior pe-riods.

(b) Omission to account for income or expenditure in one or more prior periods.

Question 16.

Give two examples of each of the following items:

(i) Change in Accounting Policy

(ii) Change in Accounting Estimate

(iii) Extraordinary Items

(iv) Prior Period Item (Nov. 2014) (4 Marks)

Answer:

(i) Examples of Changes in Accounting Policy:

(a) Change of depreciation method from WD V to SLM and vice-versa.

(b) Change in cost formula in measuring the cost of inventories.

(ii) Examples of Changes in Accounting Estimates:

(a) Change in estimate of provision for doubtful debts on sundry debtors.

(b) Change in estimate of useful life of fixed assets.

(iii) Examples of Extraordinary items:

(a) Loss due to earthquakes/fire/strike

(b) Attachment of property of the enterprise by government

(iv) Examples of Prior period items:

(a) Applying incorrect rate of depreciation in one or more prior pe-riods.

(b) Omission to account for income or expenditure in one or more prior periods.

Question 17.

PQR Ltd. is in the process of finalizing its accounts for the year ended 31st March, 2018. The company seeks your advice on the following:

(i) Goods worth ₹ 5,00,000 were destroyed due to flood in September, 2015. A claim was lodged with insurance company. But no entry was passed in the books for insurance claim in the financial year 2015-16. In March, 2018, the claim was passed and the company received a payment of ₹ 3,50,000 against the claim. Explain the treatment of such receipt in final account for the year ended 31st March, 2018.

(ii) Company created a provision for bad and doubtful debts at 2.5% on debtors in preparing the financial statements for the year 2017-18. Subsequently, on a review of the credit period allowed and financial capacity of the customers, the company decides to increase the provision to 8% on debtors as on 31.03.2018. The accounts were not approved by the Board of Directors till the date of decision. While applying the relevant accounting standard, can this revision be considered as an extraordinary item or prior period item? (May 2018) (5 Marks)

Answer:

(i) As per the provisions of AS 5 “Net Profit or Loss for the Period, Prior Period Items and Changes in Accounting Policies”, prior period items are income or expenses, which arise, in the current period as a result of error or omissions in the preparation of financial statements of one or more prior periods. Further, the nature and amount of prior period items should he separately disclosed in the statement of profit and loss in a manner that their impact on current profit or loss can be perceived.

Analysis:

It is clearly a case of error/omission in preparation of financial statements for the year 2015-16.

Conclusion:

Hence, claim received in the financial year 2017-18 is a prior period item and should be separately disclosed in the statement of Profit and Loss.

(ii) Analysis:

The company created 2.5% provision for doubtful debts for the year 2017-18. Subsequently, the company revised the estimates based on the changed circumstances and wants to create 8% provision.

Conclusion:

As per AS 5, the revision in rate of provision for doubtful debts will be considered as change in estimate and is neither a prior period item nor an extraordinary item.

The effect of such change should be shown in the profit and loss account for the year ending 31st March, 2018.

As 7

Construction Contracts

Combining And Segmenting Construction Contracts (Based On Para Nos. 6 To 9)

Question 1.

GTI Ltd. negotiates with Bharat Oil Corporation Ltd. (BOCL), for construction of ‘Retail Petrol & Diesel Outlet Stations’. Based on proposals submitted to different Regional Offices of BOCL, the final approval for one outlet each in Region X, Region Y, Region Z is awarded to GTI Ltd. A single agreement is entered into between two. The agreement lays down values for each of the three outlets i.e. ₹ 102 lacs, ₹ 150 lacs, ₹ 130 lacs for Region X, Region Y, Region Z respectively. Agreement also lays down completion time for each Region.

Comment whether GTI Ltd. will treat it as single contract or three separate contracts with reference to AS-7? (Nov 2016) (5 Marks)

Answer:

As per AS 7 ‘Construction Contracts’, when a contract covers number of assets, the construction of each asset should be treated as a separate construction contract when:

(a) separate proposals have been submitted for each asset;

(b) each asset has been subject to separate negotiation and the contractor and customer have been able to accept or reject that part of the contract relating to each asset; and

(c) the costs and revenues of each asset can be identified.

Analysis : In the given case, each outlet is submitted as a separate proposal to different Zonal Offices, which can be separately negotiated, and costs and revenues thereof can be separately identified. Hence, each asset will be treated as a ‘single contract’ even if there is one single agreement for contracts.

Conclusion : Therefore, three separate contract accounts must be recorded and maintained in the books of GTI Ltd. For each contract, principles of revenue and cost recognition must be applied separately and net income will be determined for each asset as per AS 7.

Contract Revenue (Based On Para Nos. 10 To 14)

Question 2.

Mr. ‘M’ as a contractor has just entered into a contract with a local municipal body for building a flyover. As per the contract terms, Mr. ‘M’ will receive an additional ₹ 2 crore if the construction of the flyover were to be finished within a period of two years of the commencement of the contract. Mr. ‘M’ wants to recognize this revenue since in the past he has been able to meet similar targets very easily.

Is Mr. ‘M’ correct in his proposal? Discuss.

Answer:

According to para 14 of AS 7 (Revised) ‘Construction Contracts’, incentive payments are additional amounts payable to the contractor if specified performance standards are met or exceeded. For example, a contract may allow for an incentive payment to the contractor for early completion of the contract. Incentive payments are included in contract revenue when:

- the contract is sufficiently advanced that it is probable that the specified performance standards will be met or exceeded; and

- the amount of the incentive payment can be measured reliably.

Analysis & Conclusion : In the given problem, the contract has not even begun and hence the contractor (Mr. M) should not recognize any revenue of this contract.

Contract Costs (Based On Para Nos. 15 To 20)

Question 3.

Explain contract costs as per Accounting Standard 7 related to ‘Construction Contracts’. {Nov 2009) (2 Marks)

Answer:

As per para 15 of AS 7 ‘Construction Contracts (revised 2002)’, contract cost should comprise:

(a) costs that relate directly to the specific contract;

(b) costs that are attributable to contract activity in general and can be allocated to the contract; and

(c) such other costs as are specifically chargeable to the customer under the terms of the contract

Recognition Of Contract Revenue And Expenses (Based On Para Nos. 21 To 34)

Question 4.

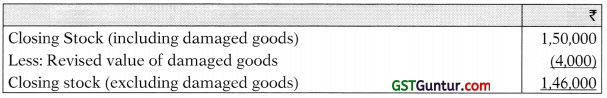

M/s Excellent Construction Company Limited under took a contract to construct a building for ₹ 3 crore on 1st September, 2011. On 31st March, 2012 the company found that it had already spent ₹ 1 crore 80 lakhs on the construction. Prudent estimate of additional cost for completion was ₹ 1 crore 40 lakhs. What amount should be charged, to revenue in the final accounts for the year ended on 31st March, 2012, as per the provisions of Accounting Standard 7 ‘Construction Contracts (Revised)’?

(May 2012) (5 Marks)

Answer:

Computation of Estimated Cost of Construction

Percentage of completion of contract till date to total estimated cost of construction

= ₹ (1.80/3.20) × 100 = 56.2596

Proportion of total contract value recognised as revenue as per AS 7 (Revised) = Contract price x percentage of completion = ₹ 3 crores × 56.25% = ₹ 1.6875 crores

Question 5.

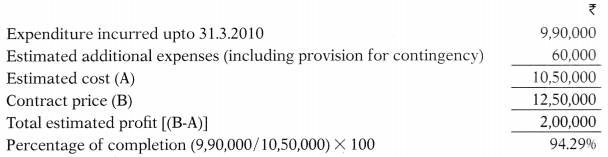

An amount of ₹ 9,90,000 was incurred on a contract work upto 31-3-2010. Certificates have been received to date to the value of ₹ 12,00,000 against which ₹ 10,80,000 has been received in cash. The cost of work done but not certified amounted to ₹ 22,500. It is estimated that by spending an additional amount of ₹ 60,000 (including provision for contingencies) the work can be completed in all respects in another two months. The agreed contract price of work is ₹ 12,50,000. Compute a conservative estimate of the profit to be taken to the Profit and Loss Account as per AS 7. (Nov. 2010) (4 Marks)

Answer:

Analysis Computation of estimate of profit as per AS 7

Computation of estimate of the profit to be taken to Profit and Loss Account:

According to para 21 of AS 7 ‘Construction Contracts’, when the outcome of a construction contract can be estimated reliably, contract revenue and contract costs associated with the construction contract should be recognised as revenue and expenses respectively by reference to stage of completion of the contract activity at the reporting date.

Conclusion: Thus estimated profit amounting ₹ 1,88,571 should be recognised as revenue in the statement of profit and loss.

![]()

Question 6.

Uday Constructions undertake to construct abridge for the Government of Uttar Pradesh. The construction commenced during the financial year ending 31.03.2016 and is likely to be completed by the next financial year. The contract is for a fixed price of ₹ 12 crores with an escalation clause. The costs to complete the whole contract are estimated at ₹ 9.50 crores of rupees. You are-given the following information for the year ended 31.03.2016:

Cost incurred upto 31.03.2016 ₹ 4 crores

Cost estimated to complete the contract ₹ 6 crores

Escalation in cost by 5% and accordingly the contract price is increased by 5%.

You are required to ascertain the state of completion and state the revenue and profit to be recognized for the year as per AS-7. (May 2016) (5 Marks)

Answer:

Stage of completion

Percentage of completion till date to total estimated cost of construction

= (4/10) × 100 = 40%

Revenue and Profit to be recognized for the year ended 31st March, 2016 as per AS 7

Proportion of total contract value recognized as revenue = Contract price x percentage of completion

= ₹ 12.60 crore × 40% = ₹ 5.04 crore

Profit for the year ended 31st March, 2016 = ₹ 5.04 crore less ₹ 4 crore = 1.04 crore

Recognition Of Expected Losses (Based On Para Nos. 35 And 36)

Question 7.

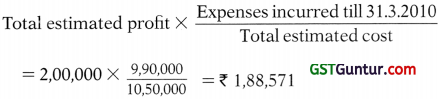

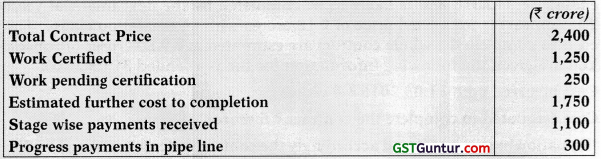

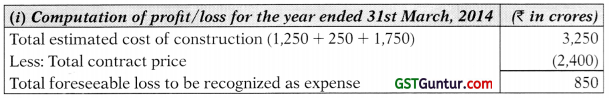

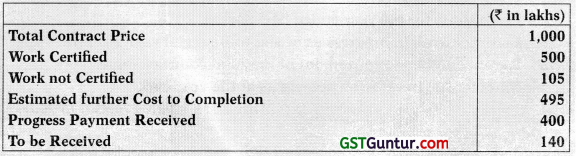

P & Sons Ltd. are Heavy Engineering contractors specializing in construction of dams. From the records of the company, the following data is available pertaining to year ended on 31st March, 2014. Using this data and applying the relevant Accounting Standard you are required to:

(i) Compute the amount of profit/loss for the year ended 31st March, 2014.

(ii) Arrive at the contract work in progress (cost incurred till date) as at the end of financial year 2013-14.

(iii) Determine the amount of revenue to be recognized out of the total contract value.

Answer:

According to para 35 of AS 7 (Revised 2002) ‘Construction Contracts’, when it is probable that total contract costs will exceed total contract revenue, the expected loss should be recognized as an expense immediately.

(iii) Proportion of total contract value recognised as revenue

Percentage of completion of contract to total estimated cost of construction

= (1,500/3,250) × 100 = 46.15%

Revenue to be recognized till date = 46.15% of ₹ 2,400 crores = ₹ 1,107.60 crores.

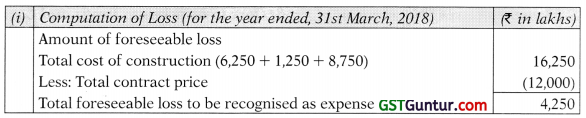

Question 8.

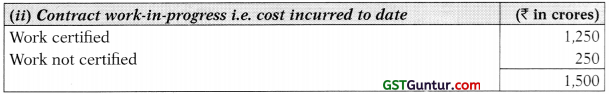

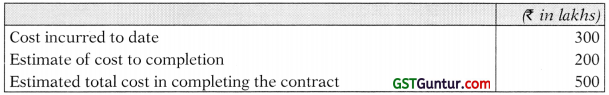

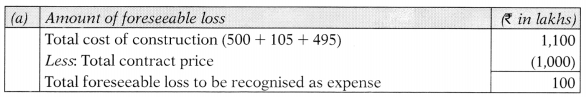

From the following data, show Profit and Loss A/c (Extract) as would appear in the books of a contractor following Accounting Standard 7:

(Nov 2011) (4 Marks)

Answer:

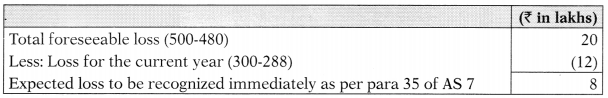

Analysis:

Computation of Estimated Total Cost

Percentage of completion (300/500) × 100 = 60%

Revenue recognised as a percentage to contract price

= 60% of ₹ 480 lakhs = ₹ 288 lakhs

As per para 35 of AS 7 ‘Construction Contracts’, when it is probable that total contract costs will exceed total contract revenue, the expected loss shoidd be recognised as an expense immediately.

Conclusion : Accordingly, expenses to be recognized in the Profit and Loss Account will be computed as under :

Profit and Loss A/c (An Extract)

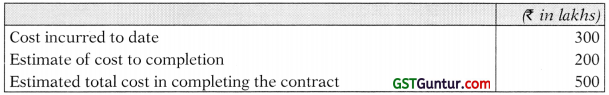

Question 9.

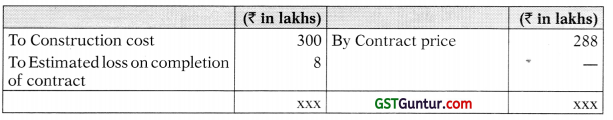

M/s Highway. Constructions undertook the construction of a highway on 01.04.2013. The contract was to be completed in 2 years. The contract price was estimated at ₹ 150 crores. Up to 31.03.2014 the company incurred ₹ 120 crores on the construction. The engineers involved in the project estimated that a further ₹ 45 crores would be incurred for completing the work.

What amount should be charged to revenue for the year 2013-14 as per the provisions of Accounting Standard 7 ‘Construction Contracts’? Show the extract of the Profit & Loss A/c in the books of M/s. Highway Constructions. (May 2014) (5 Marks)

Answer:

Statement showing computation of amount to be reorgnised as Revetiue as per AS 7

Profit and Loss Account (Extract)

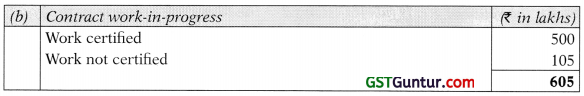

Question 10.

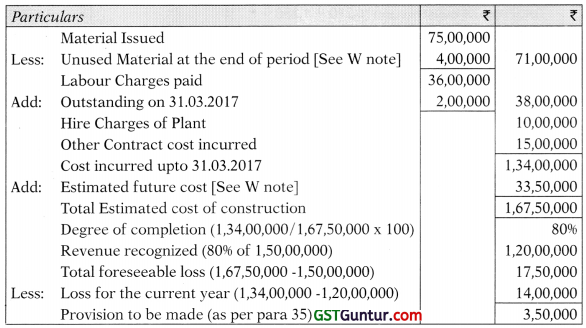

Akar Ltd. Signed on 01/04/16, a construction contract for ₹ 1,50,00,000. Following particulars are extracted in respect of contract, for the period ending 31/03/17.

- Materials issued ₹ 75,00,000

- Labour charges paid ₹ 36,00,000

- Hire charges of plant ₹ 10,00,000

- Other contract cost incurred ₹ 15,00,000

- Out of material issued, material lying unused at the end of period is ₹ 4,00,000

- Labour charges of ₹ 2,00,000 are still outstanding on 31.3.17.

- It is estimated that by spending further ₹ 33,50,000 the work can be completed in all respect.

You are required to compute profit/loss to be taken to Profit & Loss Account and additional provision for foreseeable loss as per AS 7. (May 2017) (5 Marks)

Answer:

Statement showing the amount of profit/loss to be taken to Profit and Loss Account

W note : Unused material amounting ₹ 4,00,000 is considered to be included in amount of ₹ 33,50,000 (estimated future cost).

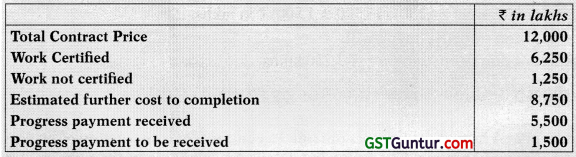

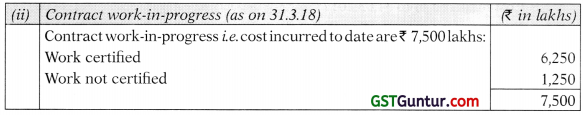

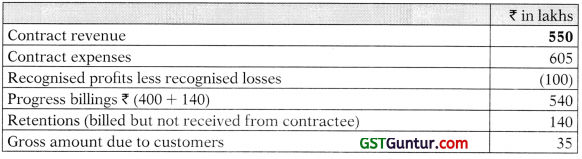

Question 11.

Sarita Construction Co. obtained a contract for construction of a dam. The following details are available in records of company for the year ended 31st March, 2018:

Applying the provisions of Accounting Standard 7 ‘Accounting for Construction Contracts’ you are required to compute:

(i) Profit/Loss for the year ended 31st March, 2018.

(ii) Contract work in progress as at end of financial year 2017-18.

(iii) Revenue to be recognized out of the total contract value.

(iv) Amount due from/to customers as at the year end. (May 2018 – New Course) (5 Marks)

Answer:

According to AS 7, when it is probable that total contract costs will exceed total contract revenue, the expected loss should be recognised as an expense immediately.

Loss for the year ended, 31 st March, 2018 amounting ₹ 4,250 will be recognized.

(iii) Revenue to be recognised

Cost incurred till 31.3.18 is 46.15% (7,500/16,250 × 100) of total costs of construction.

Proportion of total contract value recognised as revenue:

46.15% of ₹ 12,000 lakhs = ₹ 5,538 lakhs

(iv) Amount due from/to customers at year end

(Contract costs + Recognised profits – Recognised Losses) – (Progress payments received + Progress payments to be received)

= (7,500 + Nil – 4,250) – (5,500 + 1,500) ₹ in lakhs

= [3,250 – 7,000] 7 in lakhs

Amount due to customers = ₹ 3,750 lakhs

Disclosure (Based On Para Nos. 38 To 43)

Question 12.

A firm of contractors obtained a contract for construction of bridges across river Yamuna. The following details are available in the records kept for the year ended 31st March, 2017.

The firm seeks your advice and assistance in the presentation of accounts keeping in view the requirements of AS 7 issued by your institute.

Answer:

According AS 7, when it is probable that total contract costs will exceed total contract revenue, the expected loss should be recognised as an expense immediately.

This is 55% (605/1,100 × 100) of total costs of construction.

(c) Proportion of total contract value recognised as revenue:

55% of ₹ 1,000 lakhs = ₹ 550 lakhs

(d) Amount due from/to customers = (Contract costs + Recognised profits – Recognised Losses) – (Progress payments received + Progress payments to be received)

= (605 + Nil – 100) – (400 + 140) ₹ in lakhs

= [505 – 540]₹ in lakhs

Amount due to customers = ₹ 35 lakhs

The amount of ₹ 35 lakhs will be shown in the balance sheet as liability.

(e) The relevant disclosures under AS 7 are given below:

As 9

Revenue Recognition

Sale Of Goods (Based On Para Nos. 6 And 11)

Question 1.

According to Accounting Standard 9, when revenue from sales should be recognised? (May 2010) (2 Marks)

Answer:

As per para 11 of AS 9 ‘Revenue Recognition’, revenue from sales should be recognised only when requirements as to performance are satisfied provided that at the time of performance it is not unreasonable to expect ultimate collection. These requirements can be given as follows:

- the seller of goods has transferred to the buyer the property in the goods for a price or all significant risks and rewards of ownership have been transferred to the buyer and the seller retains no effective control of the goods transferred to a degree usually associated with ownership; and

- no significant uncertainty exists regarding the amount of the consideration that will be derived from the sale of the goods.

![]()

Question 2.

M/s. Moon Ltd. sold goods worth ₹ 6,50,000 to Mr. Star. Mr. Star asked for a trade discount amounting to ₹ 53,000 and same was agreed to by M/s. Moon Ltd. The sale was effected and goods were dispatched. On receipt of goods, Mr. Star has found that goods worth ₹ 67,000 are defective. Mr. Star returned defective goods to M/s. Moon Ltd. and made payment due amounting to ₹ 5,30,000. The accountant of M/s. Moon Ltd. booked the sale for ₹ 5,30,000. Discuss the contention of the accountant with reference to Accounting Standard (AS) 9. (May 2013) (4 Marks)

Answer:

As per AS 9 Revenue Recognition’, revenue is the gross inflow of cash, receivable or other consideration arising in the course of the ordinary activities of an enterprise from the sale of goods. However, trade discounts and volume rebates given in the ordinary course of business should be deducted in determining revenue. Revenue from sales should be recognized at the time of transfer of significant risks and rewards. If the delivery of the sales is not subject to approval from customers, then the transfer of significant risks and rewards would take place when the sale is affected and goods are dispatched.

Analysis : In the given case, if trade discounts allowed by M/s. Moon Ltd. are given in the ordinary course of business, M/s. Moon Ltd. should record the sales at ₹ 5,97,000 (ie. ₹ 6,50,000 – ₹ 53,000) and goods returned worth ₹ 67,000 are to be recorded in the form of sales return. However, when trade discount allowed by M/s. Moon Ltd. is not in the ordinary course of business, M/s. Moon Ltd. should record the sales at gross value of ₹ 6,50,000. Discount of ₹ 53,000 in price and return of goods worth ₹ 67,000 are to be adjusted by suitable provisions. M/s Moon Ltd. might have sent the credit note of ₹ 1,20,000 to Mr. Star to account for these adjustments.

Conclusion : In both the cases, the contention of the accountant to book the sales for ₹ 5,30,000 is not correct.

Question 3.

A Ltd. entered into a contract with B Ltd. to despatch goods valuing ₹ 25,000 every month for 4 months upon receipt of entire payment. B Ltd. accordingly made the payment of ₹ 1,00,000 and A Ltd. started despatching the goods. In third month, due to a natural calamity, B Ltd. requested A Ltd. not to despatch goods until further notice though A Ltd. is holding the remaining goods worth ₹ 50,000 ready for despatch. A Ltd. accounted ₹ 50,000 as sales and transferred the balance to Advance Received against Sales. Comment upon the treatment of balance amount with reference to the provisions of Accounting Standard 9. (Nov 2013) (5 Marks)

Answer:

As per para 11 of AS 9 ‘Revenue Recognition’, in a transaction involving the sale of goods, performance should he regarded as being achieved when the following conditions are fulfilled:

- the seller of goods has transferred to the buyer the property in the goods for a price or all significant risks and rewards of ownership have been transferred to the buyer and the seller retains no effective control of the goods transferred to a degree usually associated with ownership; and

- no significant uncertainty exists regarding the amount of the consideration that will be derived from the sale of the goods.

Analysis: In the given case, transfer of property in goods results in or coincides with the transfer of significant risks and rewards of ownership to the buyer. Also, the sale price has been recovered by the seller. Hence, the sale is complete but delivery has been postponed at buyer’s request.

Conclusion : A Ltd. should recognize the entire sale of ₹ 1,00,000 (₹ 25,000 × 4) and no part of the same is to be treated as Advance Receipt against Sales.

Question 4.

Given the following information of M/s. Paper Products Ltd.

(i) Goods of ₹ 60,000 were sold on 2Question 3-2015 but at the request of the buyer these were delivered on 10-4-2015.

(ii) On 15-1-2015 goods of ₹ 1,50,000 were sent on consignment basis of which 20% of the goods unsold are lying with the consignee as on 313-2015.

(iii) ₹ 1,20,000 worth of goods were sold on approval basis on 1-12-2014. The period of approval was 3 months after which they were considered sold. Buyer sent approval for 75% goods up to 31-1-2015 and no approval or disapproval received for the remaining goods till 31-3-2015.

(iv) Apart from the above, the company has made cash sales of ₹ 7,80,000 (gross). Trade discount of 5% was allowed on the cash sales.

You are required to advise the accountant of M/s. Paper Products Ltd., with valid reasons, the amount to be recognized as revenue in above cases in the context of AS-9 and also determine the total revenue to be recognized for the year ending 31-3-2015. (May 2015) (4 Marks)

Answer:

As per Para 11 of AS 9 ‘Revenue Recognition’, in a transaction involving the sale of goods, performance should be regarded as being achieved when the following conditions are fulfilled:

- the seller of goods has transferred to the buyer the property in the goods for a price or all significant risks and rewards of ownership have been transferred to the buyer and the seller retains no effective control of the goods transferred to a degree usually associated with ownership; and

- no significant uncertainty exists regarding the amount of the consideration that will be derived from the sale of the goods.

Analysis & Conclusion :

In case (i):

Analysis : The sale is complete but delivery has been postponed at buyer’s request.

Conclusion : M/s Paper Products Ltd. should recognize the entire sale of ₹ 60,000 for the year ended 31st March, 2015.

In case (ii):

Analysis: 20% goods lying unsold with consignee should be treated as closing inventory and sales should be recognized for ₹ 1,20,000 (80% of ₹ 1,50,000).

Conclusion : In case of consignment sale revenue should not be recognized until the goods are sold to a third party.

In case (iii):

Analysis : In case of goods sold on approval basis, revenue should not be recognized until the goods have been formally accepted by the buyer or the buyer has done an act adopting the transaction or the time period for rejection has elapsed or where no time has been fixed, a reasonable time has elapsed.

Conclusion: Therefore, in case (iii) revenue should be recognized for the total sales amounting ₹ 1,20,000 as the time period for rejecting the goods had expired.

In case (iv):

Analysis : Trade discounts given should be deducted in determining revenue.

Conclusion : Thus ₹ 39,000 should be deducted from the amount of turnover of ₹ 7,80,000 for the purpose of recognition of revenue. Thus, revenue should be ₹ 7,41,000.

Thus total revenue amounting ₹ 10,41,000 (60,000 + 1,20,000 + 1,20,000 + 7,41,000) will be recognized for the year ended 31st March, 2015 in the books of M/ s Paper Products Ltd.

![]()

Question 5.

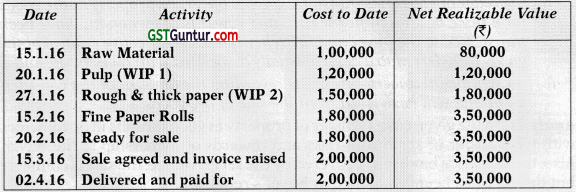

A manufacturing company has the following stages of production and sale in manufacturing Fine paper rolls:

Explain the stage on which you think revenue will be generated and state how much would be net profit for year ending 31.3.16 on this product according to AS-9. (Nov 2016) (5 Marks)

Answer: