Buyback of Securities and Equity Shares with Differential Rights – CA Inter Advanced Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Buyback of Securities and Equity Shares with Differential Rights – CA Inter Advanced Accounting Study Material

Theory Questions

Question 1.

State the conditions of issuance of Sweat Equity Shares by Joint Stock Companies. (Nov. 2012) (4 Marks)

Answer:

A company may issue sweat equity shares of a class of shares already issued, if the following conditions are fulfilled:

(i) the issue of sweat equity shares is authorised by a special resolution passed by the company in the general meeting.

(ii) the resolution specifies the number of shares, current market price, the consideration if any, and the class or classes of directors or employees to whom such equity shares are to be issued.

(iii) not less than one year has, at the time of the issue, elapsed since the date on which the company was entitled to commence business.

(iv) the sweat equity shares of company, whose equity shares are listed on a recognised stock exchange, are issued in accordance with the regulations made by the Securities and Exchange Board of India (SEBI) in this behalf. But in the case of company whose equity shares are not listed on any recognised stock exchange, the sweat equity shares are issued in accordance with the guidelines as may be prescribed.

![]()

Question 2.

Give four conditions to be fulfilled by a Joint Stock Company to buy back its equity Shares. (May 2014) (4 Marks)

Answer:

As per section 77A of the Companies Act, 1956, a joint stock company has to fulfil the following conditions to buy back its own equity shares:

- Buy back is authorized by its articles.

- A special resolution has been passed in general meeting of the shareholders of the company, authorizing the buy back.

- The buy back does not exceed 25% of the total paid up capital and free reserves of the company.

- All the shares proposed for buy back are fully paid up.

- The ratio of the debts owed by the Company is not more than twice the capital and its free reserves after such buy back.

- The buy back of listed shares is in accordance with the regulation of SEBI.

- The buy back is made out of free reserves (which includes securities premium) or out of the proceeds of a fresh issue of any shares or other specified securities.

- The buy back is completed within 12 months of the passing of the special resolution or resolution passed by the Board.

- Before making such buy back, a listed company has to the with the Registrar of the Companies and SEBI a declaration of solvency in the prescribed form.

![]()

Questions Without 3 Test

Question 3.

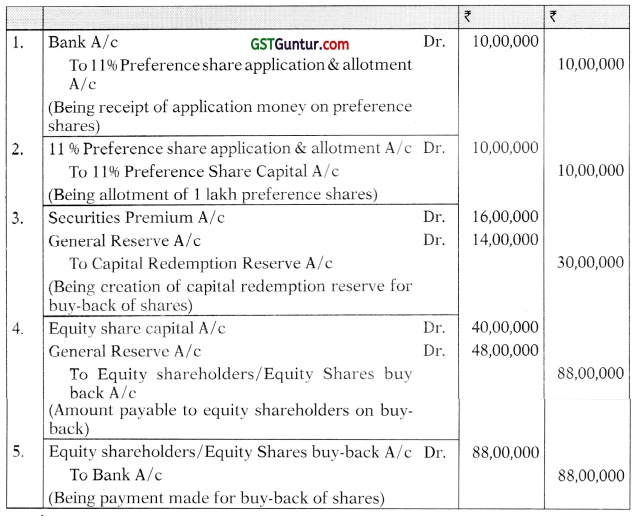

U Ltd. (a listed company) resolves to buy back 4 lakhs of its fully paid equity shares of ₹ 10 each at ₹ 22 per share from the open market. For the purpose, it issues 1 lakh 11% preference shares of ₹ 10 each at par, the entire amount being payable with applications. The company uses ₹ 16 lakhs of its balance in Securities Premium Account apart from its adequate balance in General Reserve to fulfil the legal requirements regarding buy-back. Give necessary journal entries to record the above transactions.

Answer:

Journal Entries (In the Books of U Ltd.)

Working Note:

Amount to be transferred to Capital Redemption Reserve account (CRR)

| ₹ | |

| Face value of shares bought back (4,00,000 shares × ₹ 10) | 40,00,000 |

| Less: Nominal value of Preference Shares issued for such buy-back (1,00,000 shares × ₹ 10) | (10,00,000) |

| Amount transferred to Capital Redemption Reserve Account | 30,00,000 |

![]()

Question 4.

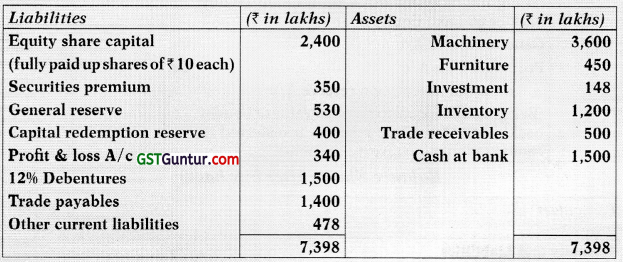

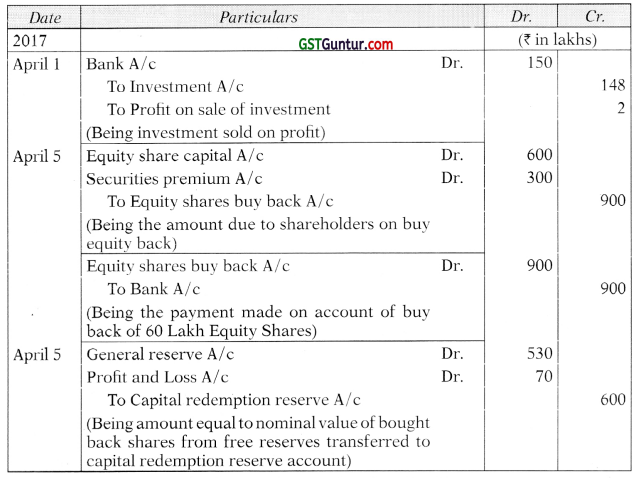

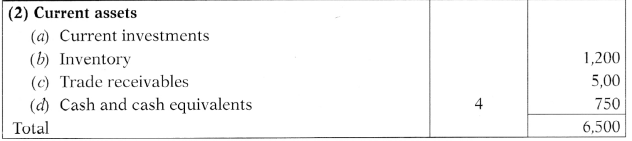

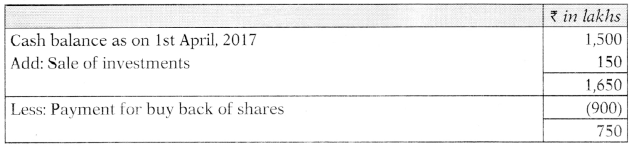

A Limited furnishes the following summarized Balance Sheet as at 31st March, 2017:

On 1st April, 2017, the company announced the buy back of 25% of its equity shares @ ₹ 15 per share. For this purpose, it sold all of its investments for ₹ 150 lakhs.

On 5th April, 2017, the company achieved the target of buy back.

You are required to:

(1) Pass necessary journal entries for the buy-back.

(2) Prepare Balance Sheet of A Limited after buy-back of the shares.

Answer:

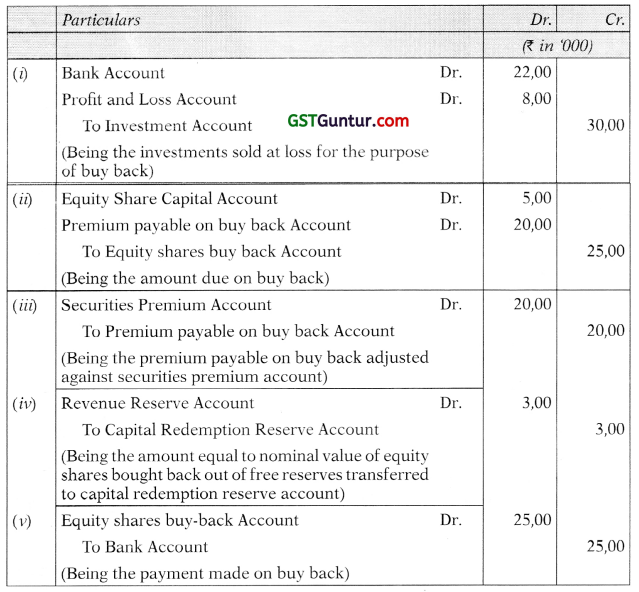

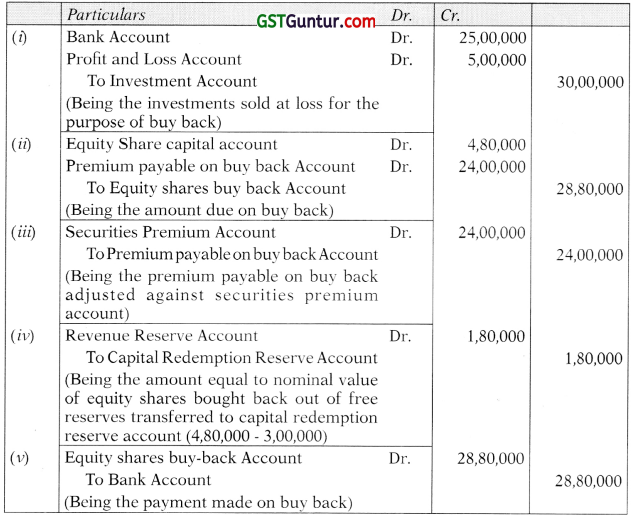

Journal Entries

(In the books of A Limited)

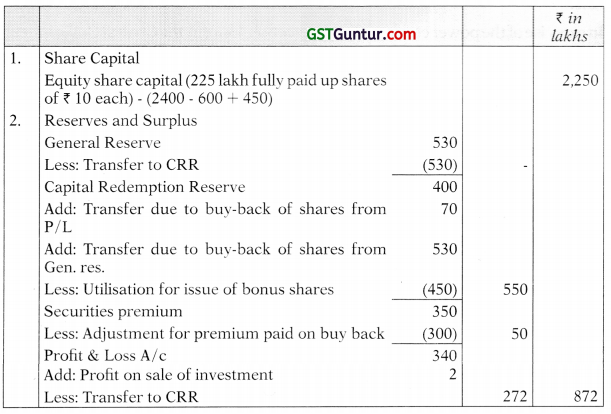

Balance Sheet (After buy back)

Notes to Accounts

4. Cash at bank after buy-back

![]()

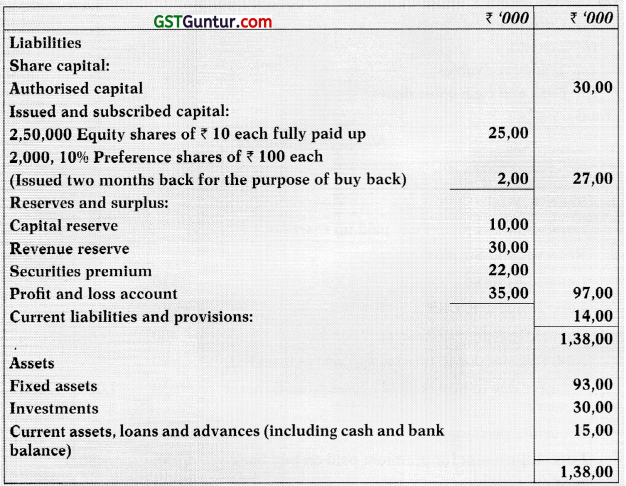

Question 5.

Dee Limited furnishes the following Balance Sheet as at 31st March,

The company passed a resolution to buy back 20% of its equity capital @ ₹ 50 per share. For this purpose, it sold all of its investment for ₹ 22,00,000.

You are required to pass necessary journal entries and prepare the Balance Sheet. (Nov. 2009) (8 Marks)

Answer:

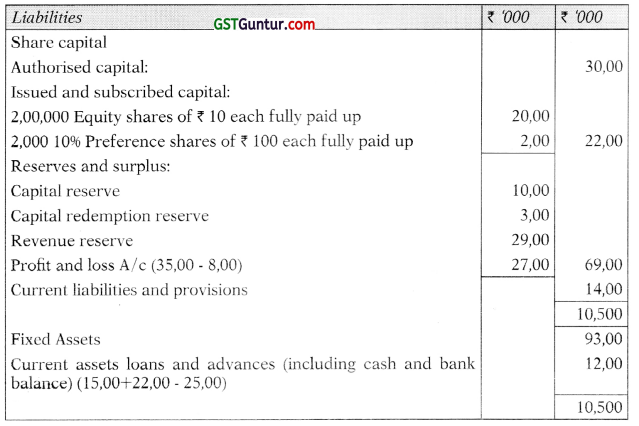

Journal Entries

(In the books of A Limited)

Balance Sheet of Dee Limited as on 1st April, 2008

(After buy back of shares)

![]()

Question 6.

Following is the summarized Balance Sheet of C Ltd. as on 31st March, 2016:

The Company wants to buy back 25,000 equity shares of ₹ 10 each, on 1st April, 2016 at ₹ 20 per share. Buy back of shares is duly authorized by its Articles and necessary resolution has been passed by the Company towards this. The buy-back of shares by the Company is also within the provisions of the Companies Act, 2013. The payment for buy back of shares will be made by the Company out of sufficient bank balance available shown as part of Current Assets.

You are required to prepare the necessary journal entries towards buy back of shares and prepare the Balance Sheet after buy back of shares.

Answer:

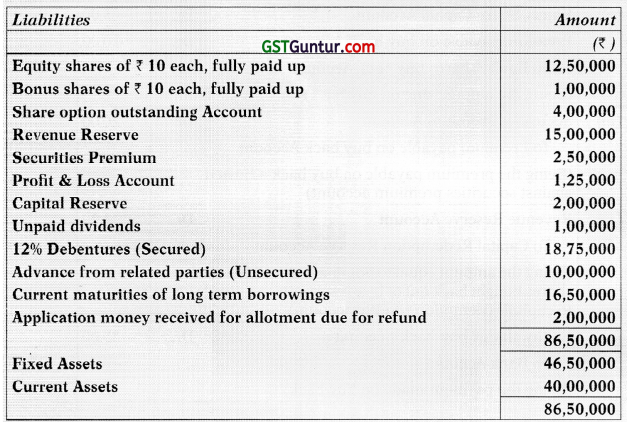

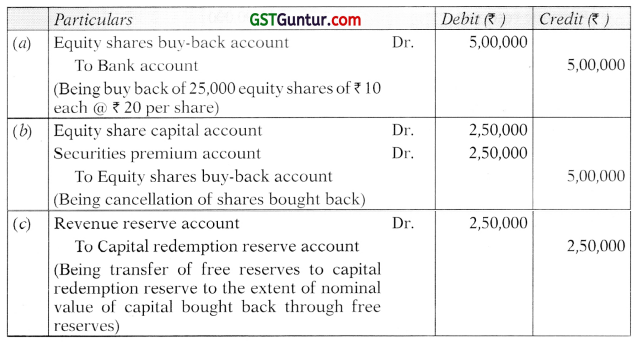

Journal Entries for buy-back of shares (In the books of C Ltd.)

Balance Sheet of C Ltd. as on 1st April, 2016

Notes to Accounts

![]()

Question 7.

The following summarized Balance Sheet P Limited (a non-listed company) furnishes as at 31st March, 2017:

On 1st April, 2017, the company passed a resolution to buy back 20% of its equity capital @ ₹ 60 per share. For this purpose, it sold all of its investment for ₹ 25,00,000.

The company achieved its target of buy-back. You are required to:

(a) Give necessary journal entries and

(b) Give the Balance Sheet of the company after buy back of shares. (RTP)

Answer:

Journal Entries

(In the books of P Limited)

Balance Sheet of P Limited as on 1st April, 2017(After buy back of shares)

Notes to Accounts

![]()

Question 8.

Following is the summarized Balance Sheet of C Ltd. as on 31st March, 2016 :

The Company wants to buy back 25,000 equity shares of ₹ 10 each, on 1st April, 2016 at ₹ 20 per share. Buy back of shares is duly authorized by its Articles and necessary resolution has been passed by the Company towards this. The buy-back of shares by the Company is also within the provisions of the Companies Act, 2013. The payment for buy back of shares will be made by the Company out of sufficient bank balance available shown as part of Current Assets.

You are required to prepare the necessary journal entries towards buy back of shares and prepare the Balance Sheet after buy back of shares.

Answer:

Journal Entries for buy-back of shares

(In the books of C Ltd.)

Balance Sheet of C Ltd. as on 1st April, 2016

Notes to Accounts

![]()

Questions With 3 Test

Question 9.

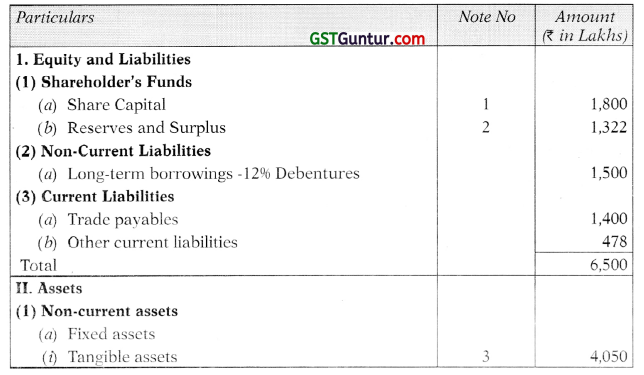

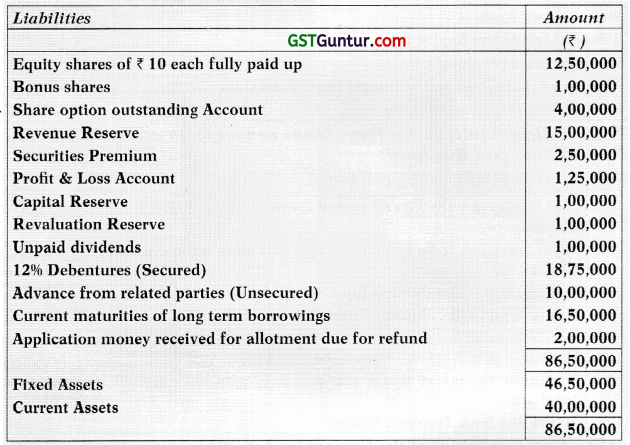

Following Is the summarized Balance Sheet of Complicated Ltd. as on 31st March, 2016:

The Company wants to buy back 25000 equity shares of ₹ 10 each, on 1st April, 2016 at ₹ 20 per share. Buy back of shares is duly authorised by Its Articles and necessary resolution has been passed by the Company towards this. The payment for buy back of shares will be made by the Company out of sufficient bank balance available shown as part of Curreni Assets.

Comment with your calculations, whether buy back of shares by the Company is within the provisions of the Companies Act, 2013. If yes, pass necessary journal entries towards buy back of shares and prepare the Balance Sheet after buy back of shares. (May 2016) (12 Marks)

Answer:

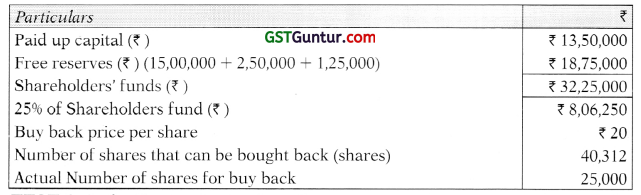

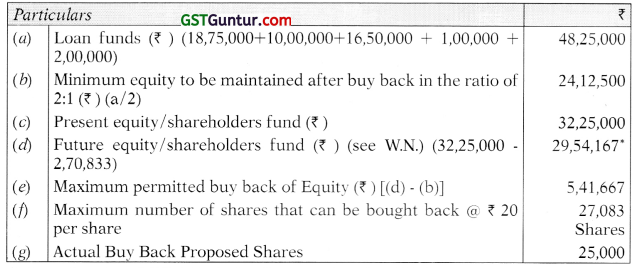

(a) Determination of Buy back of maximum No. of shares as per the Companies Act, 2013

TEST 1. Shares Outstanding Test

| Particulars | (Shares) |

| Number of shares outstanding (₹ 12,50,000 + ₹ 1,00,000)/₹ 10 | 1,35,000 |

| 25% of the shares outstanding | 33,750 |

TEST 2. Resources Test: (Maximum permitted limit 25% of Equity paid up capital + Free Reserves)

TEST 3. Debt Equity Ratio Test: (Loans cannot be in excess of twice the Equity Funds post Buy Back)

*Note: Section 68(2)(d) of the Companies Act, 2013

The ratio of debt owed by the company should not be more than twice the capital and its free reserves after such buy-back.

Section 69(1)

On buy-back of shares out of free reserves a sum equal to the nominal value of the share bought back shall be transferred to Capital Redemption Reserve (CRR).

Section 69(2)

Utilization of CRR is restricted to fully paying up unissued shares of the Company which are to be issued as fully paid-up bonus shares only. It means CRR is not available for distribution as dividend. Hence, CRR is not a free reserve. Therefore, for calculation of future equity i.e. share capital and free reserves, amount transferred to CRR on buy-back has to be excluded from the present equity.

![]()

Working Note:

Amount transferred to CRR and maximum equity to be bought back will be calculated by simultaneous equation method.

Suppose amount transferred to CRR account is ‘x’ and maximum permitted buy-back of equity is ‘y’.

Then

(₹ 32,25,000 – x) – ₹ 24,12,500 = y ………………… (1)

(\(\frac{y}{20}\) × 10) = x

Or 2x = y …………………. (2)

by solving the above equation we get x = ₹ 2,70,833 and y = ₹ 5,41,667

Statement showing maximum number of shares to be bought back

| Particulars | Number of shares |

| Shares Outstanding Test | 33,750 |

| Resources Test | 40,312 |

| Debt Equity Ratio Test | 27,083 |

| Maximum number of shares that can be bought back [least of the above] | 27,083 |

Company qualifies all tests for buy-back of shares and conclusion is that it can buy maximum 27,083 shares on 1st April, 2016.

However, company wants to buy-back only 25,000 equity shares @ ₹ 20. Therefore, buy-back of 25,000 shares, as desired by the company is within the provisions of the Companies Act, 2013.

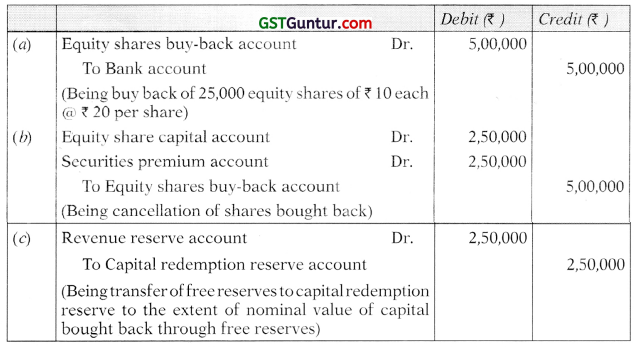

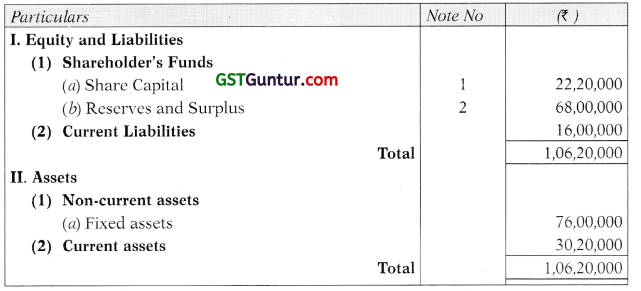

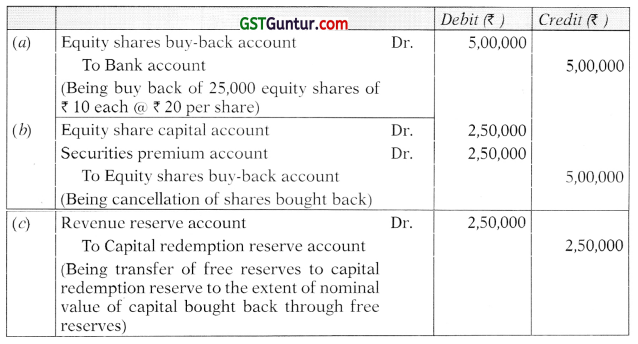

Journal Entries for buy-back of shares

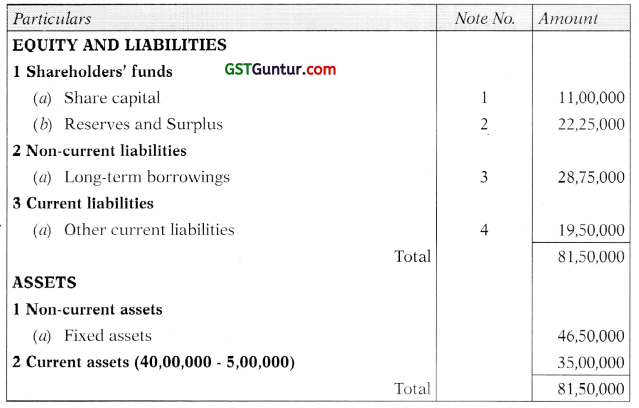

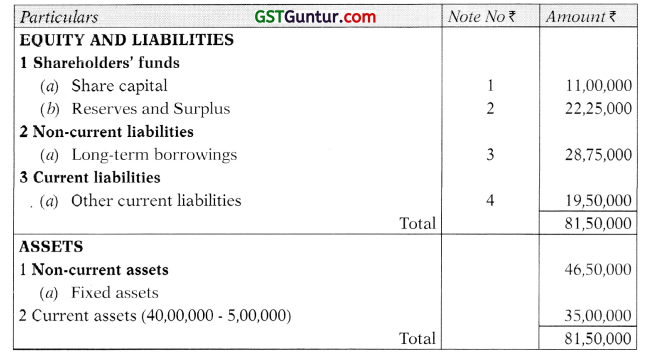

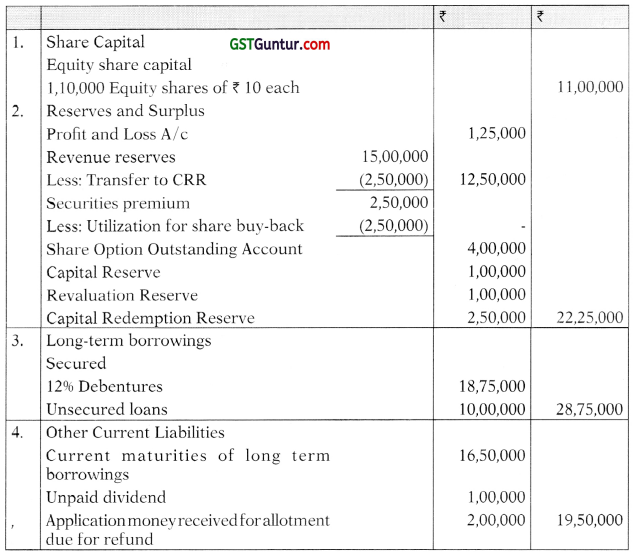

Balance Sheet of Complicated Ltd. as on 1st April, 2016

| Particulars | Note No. | Amount ₹ |

| EQUITY AND LIABILITIES | ||

| 1. Shareholders’ funds | ||

| (a) Share capital | 1 | 11,00,000 |

| (b) Reserves and Surplus | 2 | 22,25,000 |

| 2. Non-current liabilities | ||

| (a) Long-term borrowings | 3 | 28,75,000 |

| 3. Current liabilities | ||

| (a) Other current liabilities | 4 | 19,50,000 |

| Total | 81,50,000 | |

| ASSETS | ||

| 1. Non-current assets | ||

| (a) Fixed assets | 46,50,000 | |

| 2. Current assets (40,00,000 – 5,00,000) | 35,00,000 | |

| Total | 81,50,000 |

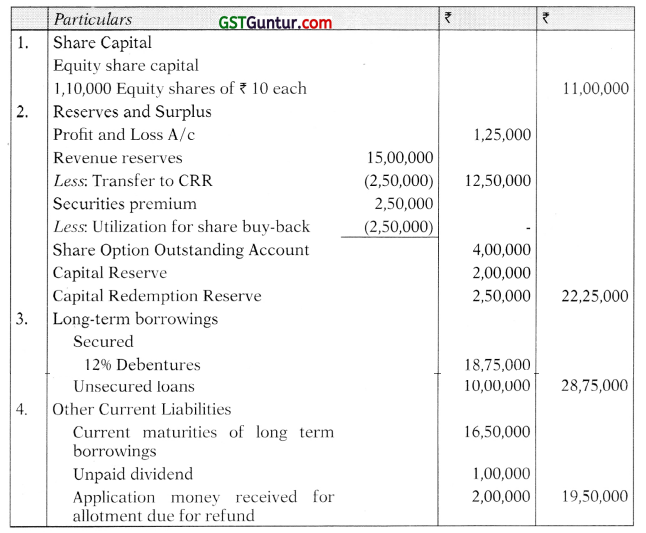

Notes to Accounts

![]()

Question 10.

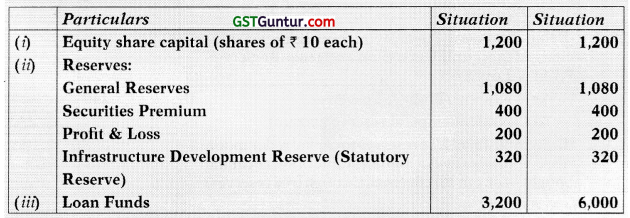

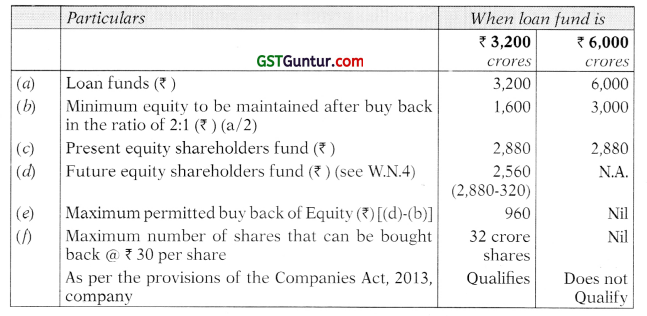

SMMLtd. has the following capital structure as on 31st March, 2017: ₹ in crore

The company has offered buy back price of ₹ 30 per equity share. You are required to calculate maximum permissible number of equity shares that can be bought back in both situations and also required to pass necessary Journal Entries. (May 2017) – (8 Marks)

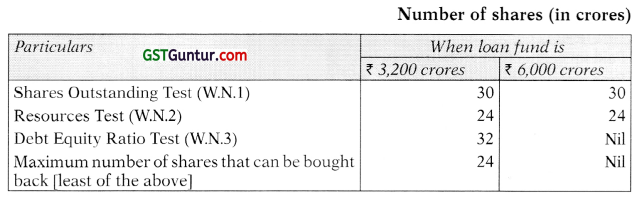

Answer:

Statement showing maximum number of shares to be bought back

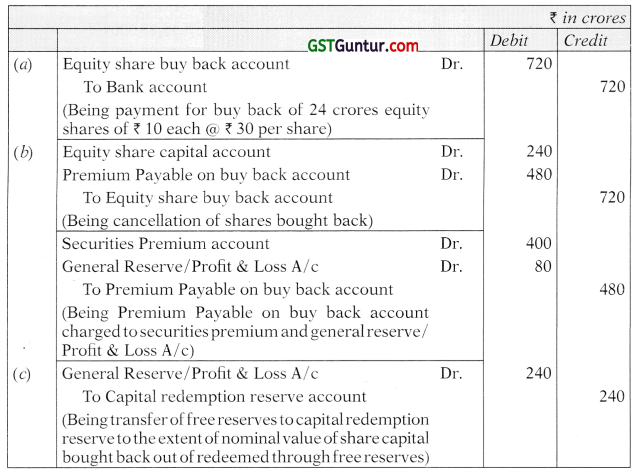

Journal Entries for the Buy Back

(applicable only when loan fund is ₹ 3,200 crores)

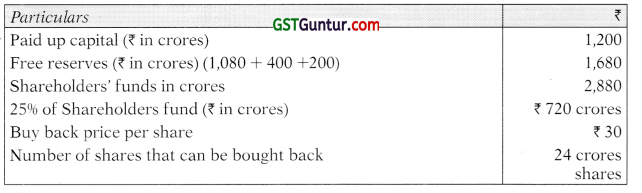

Working Notes:

TEST 1. Shares Outstanding Test

| Particulars | (Shares in crores) |

| Number of shares outstanding | 120 |

| 25% of the shares outstanding | 30 |

TEST 2. Resources Test

TEST 3. Debt Equity Ratio Test: (Loans cannot be in excess of twice the Equity Funds post Buy Back)

Mix Questions (Buy Back; Redemption 0f Preference Shares; Redemption 0f Debentures; Esop’s; Bonus)

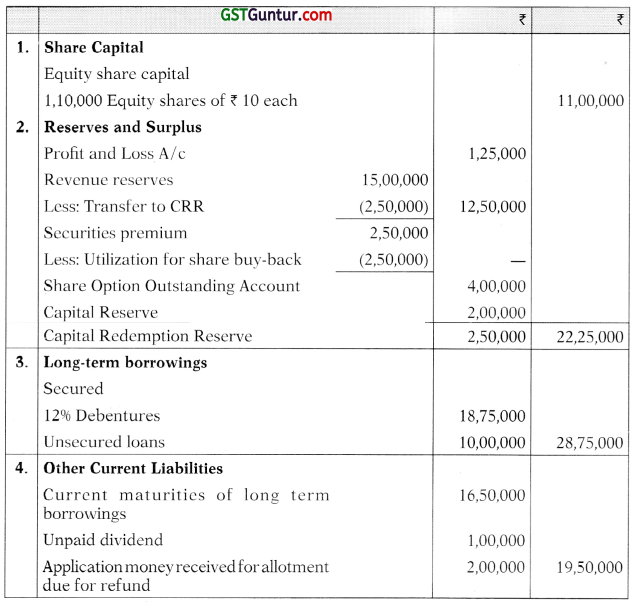

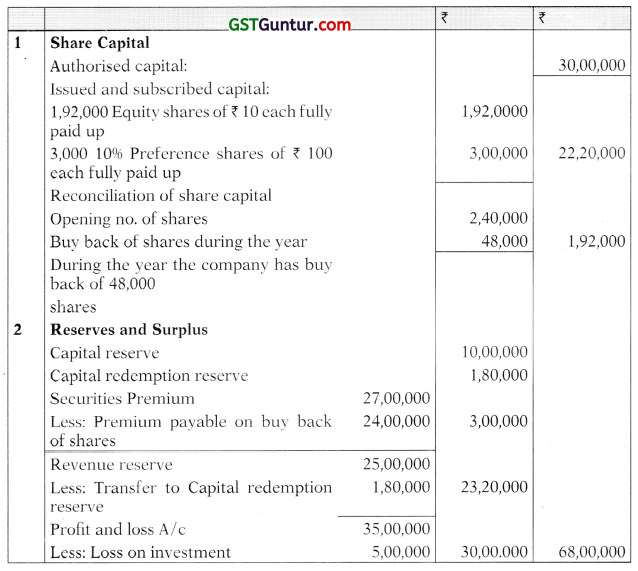

![]()

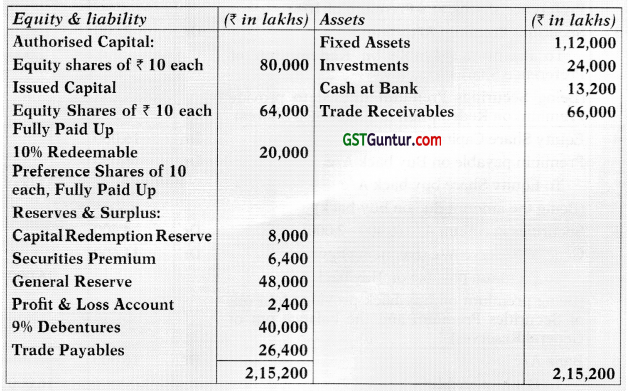

Question 11.

The following was the balance sheet of M Ltd. as on 31 st March, 2016

On 1st April, 2016 the Company redeemed all its Preference Shares at a Premium of 10% and bought back 25% of its Equity Shares at ₹ 20 per Share. In order to make Cash available, the Company sold all the Investments for ₹ 25,200 Lakhs and raised a Bank Loan amounting to ₹ 16,000 lakh on the Security of the Company’s Plant.

Give the necessary Journal Entries considering that the buy back is authorised by the articles of company and necessary resolution is passed by the company for this. The amount of Securities premium will be utilized to the maximum extents allowed by law.

Answer:

Journal entries

(In the books of M Ltd.)

![]()

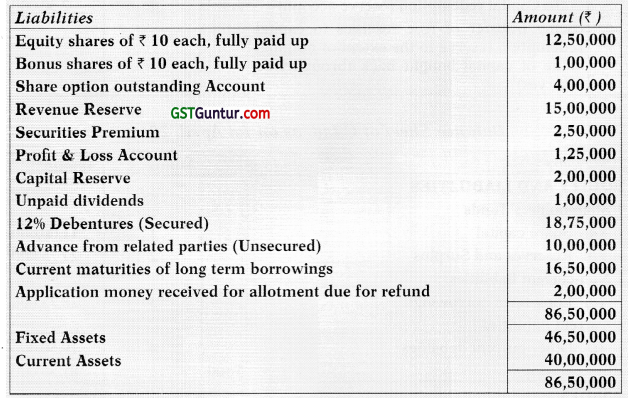

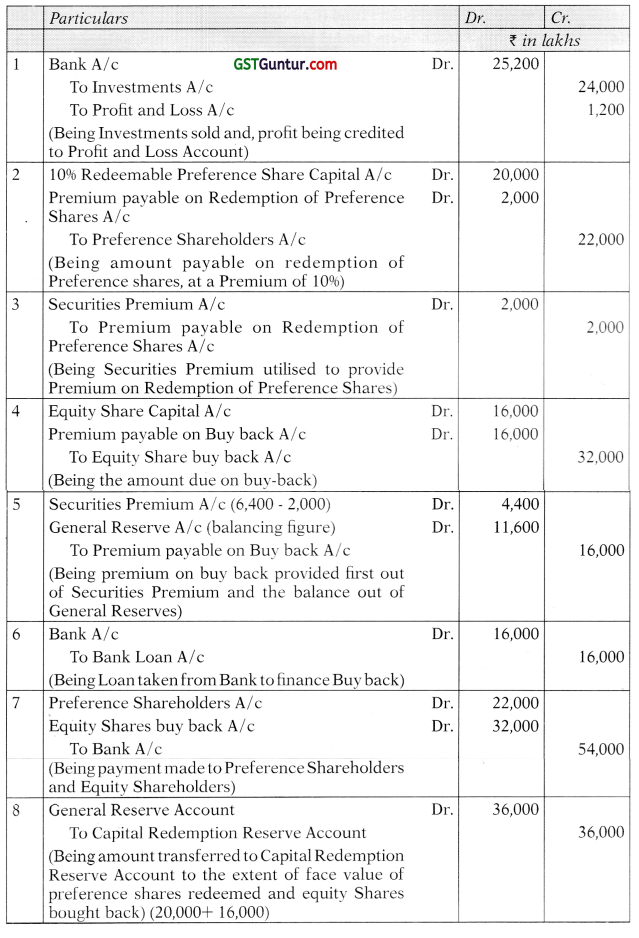

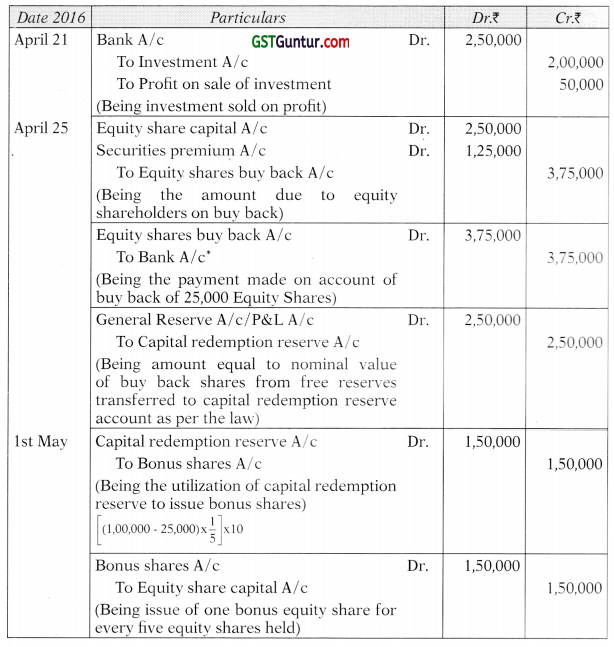

Question 12.

The following is the Summarized Balance Sheet of M/s. Vriddhi Infra Ltd. as on 31st March, 2016:

On 21st April, 2016 the Company announced the buy back of 25,000 of its equity shares @ ₹ 15 per share. For this purpose, it sold all its investment for ₹ 2.50 lakhs.

On 25th April, 2016, the company achieved the target of buy back. On 1st May, 2016 the company issued one fully paid up share of ? 10 each by way of bonus for every five equity shares held by the equity shareholders.

You are requested to pass necessary Journal Entries for the above transactions. All necessary workings should form part of your answer. (Nov. 2016) (6 Marks)

Answer:

In the books of Vriddhi Infra Ltd.

Journal Entries

* It is assumed that, there is bank overdraft amounting ₹ 85,000 [(40,000 + 2,50,000) less ₹ 3,75,000]

![]()

Question 13.

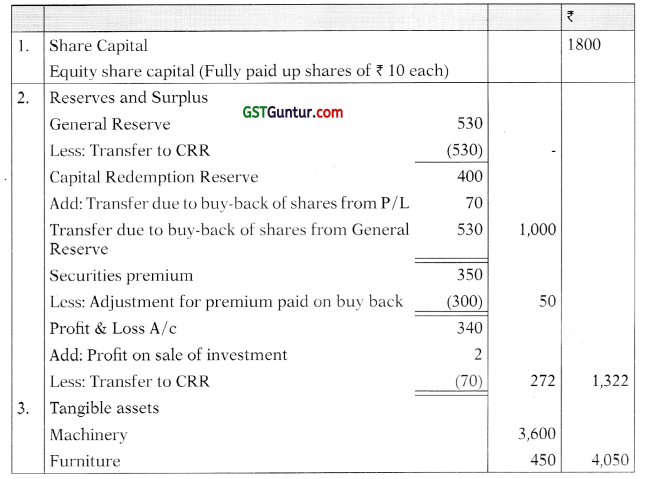

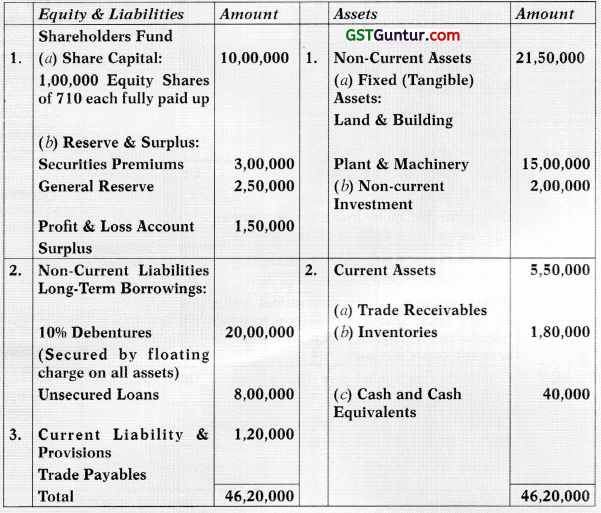

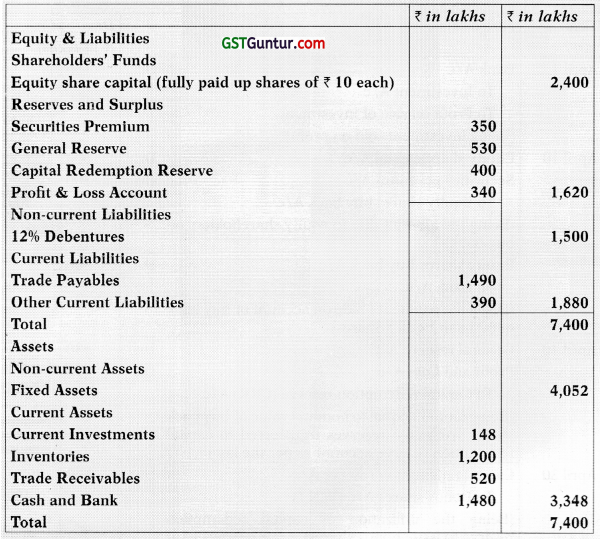

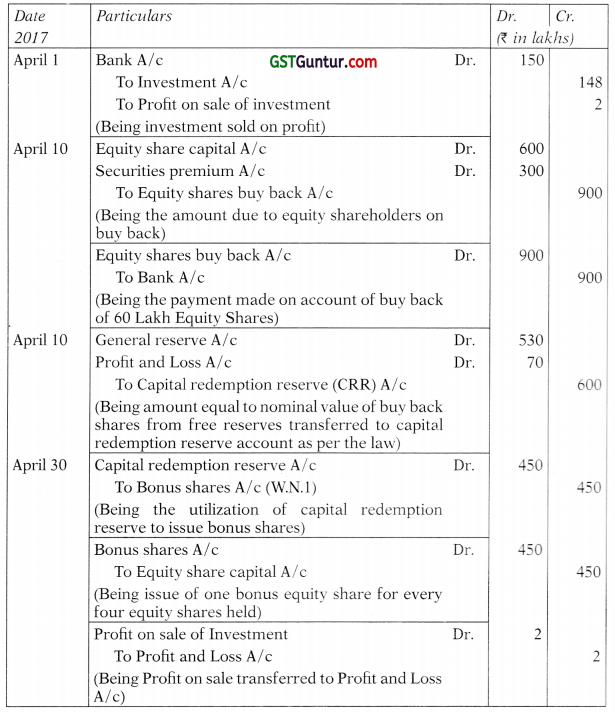

Alpha Ltd. furnishes the following summarized Balance Sheet as at 31st March, 2017:

- On 1st April, 2017, the company announced buy-back of 25% of its equity shares @ ₹ 5 per share. For this purpose, it sold all its investment for ₹ 150 lakhs.

- On 10th April, 2017 the company achieved the target of buy-back.

- On 30th April, 2017, the company issued one fully paid up equity share of ₹ 10 each by way of bonus for every four equity shares held by the equity shareholders by capitalization of Capital Redemption Reserve.

You are required to pass necessary journal entries and prepare the Balance Sheet of Alpha Ltd. after bonus issue. (May 2018 – New Course) (10 Marks)

Answer:

Journal Entries

(In the books of Alpha Limited)

Note : For transferring amount equal to nominal value of buy back shares from free reserves to capital redemption reserve account, the amount of ₹ 340 lakhs from P & L A/c and the balance from general reserve may also be utilized. The combination of different set of amounts (from General Reserve and Profit and Loss Account) aggregating ₹ 600 lakhs may also be considered for the purpose of transfer to CRR.

![]()

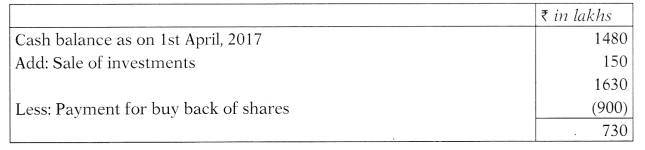

Balance Sheet (After buy back and issue of bonus shares)

Notes to Accounts

3. Cash at bank after issue of bonus shares

![]()

Equity Shares With Differential Rights

Theory Questions

Question 14.

Explain the meaning of equity shares with differential rights. Can preference shares be also issued with differential rights?

Answer:

Equity shares with Differential Rights means the share with dissimilar rights as to dividend, voting or otherwise. No; the preference shares cannot be issued with differential rights.

Question 15.

Explain the conditions under Companies (Share Capital and Debentures) Rules, 2014, to deal with equity shares with differential rights.

Answer:

In exercise of th e power conferred under Section 43 (a)(ii), the Central Government announced Rule 4 under Companies (Share Capital and Debentures) Rules, 2014, to deal with equity shares with differential rights.

The rules lay down the following conditions to be compulsorily complied with:

(a) The articles of association of the company authorizes the issue of shares with differential rights;

(b) The issue of shares is authorized by an ordinary resolution passed at a general meeting of the shareholders:

Provided that where the equity shares of a company are listed on a recognized stock exchange, the issue of such shares shall be approved by the shareholders through postal ballot;

(c) The shares with differential rights shall not exceed twenty-six per cent of the total post-issue paid up equity share capital including equity shares with differential rights issued at any point of time;

(d) The company having consistent track record of distributable profits for the last three years;

(e) The company has not defaulted in filing financial statements and annual returns for three financial years immediately preceding the financial year in which it is decided to issue such shares;

(f) The company has no subsisting default in the payment of a declared dividend to its shareholders or repayment of its matured deposits or redemption of its preference shares or debentures that have become due for redemption or payment of interest on such deposits or debentures or payment of dividend;

(g) The company has not defaulted in payment of the dividend on preference shares or repayment of any term loan from a public financial institution or State level financial institution or scheduled Bank that has become repayable or interest payable thereon or dues with respect to statutory payments relating to its employees to any authority or default in crediting the amount in Investor Education and Protection Fund to the Central Government;

(h) The company has not been penalized by Court or Tribunal during the last three years of any offence under the Reserve Bank of India Act, 1934, the Securities and Exchange Board of India Act, 1992, the Securities Contracts (Regulation) Act, 1956, the Foreign Exchange Management Act, 1999 or any other special Act, under which such companies being regulated by sectoral regulators.

![]()

Practical Question

Question 16.

E, F, G and H hold Equity Capital in Alpha Co. in the proportion of 30:30:20:20. S, T, U and V hold preference share capital in the proportion of 40:30:10:20. If the paid up capital of the company is ₹ 120 Lakh and Preference share capital is ₹ 60 Lakh. You are required to calculate their voting rights in case of resolution of winding up of the company.

Answer:

E, F, G and H hold Equity capital is held by in the proportion of 30:30:20:20 and S, T, U and V hold preference share capital in the proportion of 40:30:10:20. As the paid up equity share capital of the company is ₹ 120 Lakhs and Preference share capital is ₹ 60 Lakhs & (2:1), then relative weights in the voting right of equity shareholders and preference shareholders will be 2/3 and 1/3. The respective voting right of various shareholders will be

E = = 2/3 × 30/100 = = 3/15

F = = 2/3 × 30/100 = = 3/15

G = = 2/3 × 20/100 = = 2/15

H = = 2/3 × 20/100 = = 2/15

S = = 1/3 × 40/100 = = 2/15

T = = 1/3 × 30/100 = = 1/10

U = = 1/3 × 10/100 = = 1/30

V = = 1/3 × 20/100 = = 1/15