Investment Decisions – CA Inter FM Notes is designed strictly as per the latest syllabus and exam pattern.

Investment Decisions – CA Inter FM Notes

1. Capital Budgeting Decisions: Capital budgeting decision refers to the de-cision in respect of purchase or sale of fixed assets and long term investment.

2. Capital Budgeting: Capital budgeting refers to application of appropriate capital budgeting technique (one or more) to evaluate any capital budgeting proposal and take capital budgeting decision.

3. Importance of Capital Budgeting Decisions:

- Involvement of Substantial Expenditure

- Long Term Effect/Growth

- Involvement of High Risk

- Irreversibility

- Complex Decisions

![]()

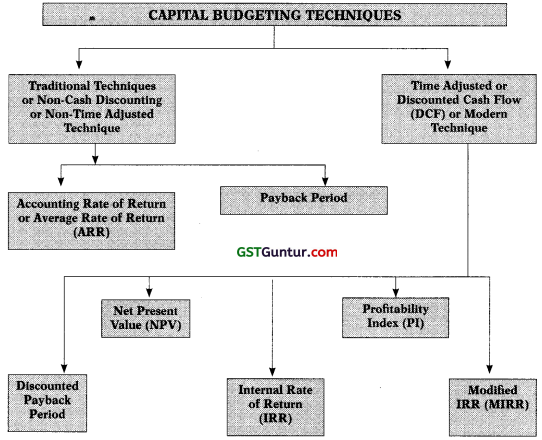

4. Capital Budgeting Techniques:

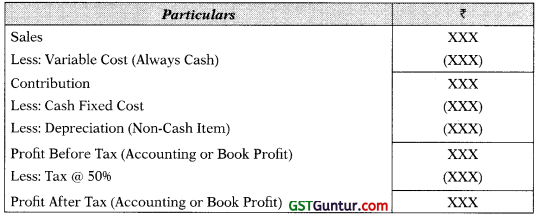

5. Book Profit VS Cash Flow:

Book Profit: It is also known as accounting profit.

Cash Flow: It is focused on cash inflow and outflow and ignore all non-cash activities

Proforma Book Profit and Cash Flow After Tax

Cash Flow After Tax (CFAT):

- CFAT = PAT + Depreciation

- CFAT = Cash Receipt Before Tax (1 – t) + Depreciation × t

- CFAT = Cash Receipt Before Tax (1 – t) + Tax Shield on Dep.

- CFAT = Cash Receipt Before Tax – Tax on PBT

![]()

6. Cash Flow & Discounted Cash Flow (DCF):

Cash Flow : Cash flow without considering time value of money.

Discounted Cash Flow : Cash flow after considering time value of money.

Discounted Cash Flow (Formulae):

Year 1 = \(\frac{\mathrm{C}_1}{1+\mathrm{k}}\) or C1 × PVIF or DF for year 1

Year 2 = \(\frac{\mathrm{C}_2}{(1+\mathrm{k})^2}\) or C2 × PVIF or DF for year 2

Sum of Discounted Cash Flow (In Case of Equal Inflow Formula):

Σ Discounted Cash Flow = Uniform Cash Flow × PVIFA or Sum of DF

Note:

- ARR Technique is based on Accounting/Book Profit

- Payback Period is based on Cash Flow (Non-Discounted)

- Discounted Payback, NPV, PI and IRR Techniques are based on Dis-counted Cash Flow

- MIRR technique if based on Future/Compounded Cash Flow

- Discounted Cash Flow is also known as Present Value of Cash Flow

7. Accounting /Average Rate of Return (ARR): ARR is the rate of return in terms of average book profit on investment. It can be calculated by using one of the following three methods:

Formula 1: ARR (Total Investment Basis) \(=\frac{\text { Average Profit p.a. }}{\text { Initial Investment }}\) × 100

Formula 2: ARR (Average Investment Basis) = \(=\frac{\text { Average Profit p.a. }}{\text { Average Investment }}\) × 100

Formula 3: ARR (Annual Basis):

Step 1: Calculate Annual Rate of Return =

![]()

Step 2: Calculate Average Rate of Return of Annual ARR in Step 1

Note:

- Average Investment = Vi X (Initial Investment + Salvage) + Additional Working Capital (If Any)

Or - Average Investment = (b X Depreciable Investment) + Salvage + Addi-tional Working Capital

![]()

8. Payback Period (Traditional) It is refers to the period within which entire amount of investment is expected to be recovered in form of Cash.

Situation 1: Uniform Cash Receipts:

Payback Period \(=\frac{\text { Initial Investment }}{\text { Annual Cash Inflow }}\)

Situation 2: Unequal Cash Receipts:

Step 1: Calculate Cumulative Cash Inflow

Step 2: Calculate Payback Period

9. Discounted Payback Period: It is refers to the period within which entire amount of investment is expected to be recovered in form of Discounted Cash.

Step 1: Calculate Cumulative Discounted Cash Inflow

Step 2: Calculate Discounted Payback Period

10. Net Present Value (NPV): The net present value of a project is the amount, in current value of amount, the investment earns after paying cost of capital in each period.

NPV = PV of Inflow – PV of Outflow/Initial Investment Or

NPV = (PI – 1) × PV of Outflow/Initial Investment

11. Profitability Index (PI)/Desirability Factor (DF)/Present Value Index Method:

PI = PV of Inflow ÷ PV of Outflow/Initial investment Or

PI = 1 + \(\frac{\text { NPV }}{\text { Initial Investment } / \text { PV of Outflow }}\)

Note: PI technique is useful:

- In case of Capital Rationing with indivisible projects

- In case of equal NPV under mutually exclusive projects

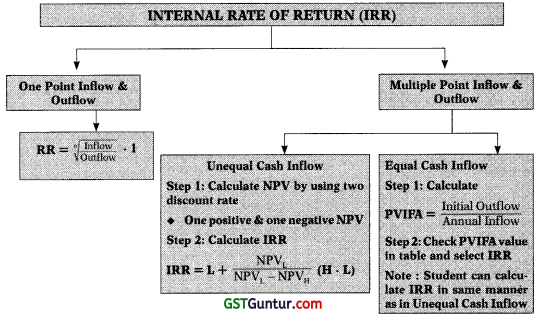

12. Internal Rate of Return (IRR): Internal rate of return refers to the actual rate of return generated by the project. Internal rate of return for an investment proposal is the discount rate that equates the present value of the expected cash inflows with the initial cash outflow.

Situation 1: One Point Inflow & Outflow:

IRR \(=\sqrt[n]{\frac{\text { Inflow }}{\text { Outflow }}}\) – 1

Situation 2: Multiple Point Inflow (Unequal Cash) & Outflow:

Step 1: Calculate one positive and one negative NPV by using random discount rate

Step 2: Calculate IRR: IRR = L + \(\frac{\mathrm{NPV}_{\mathrm{L}}}{\mathrm{NPV}_{\mathrm{L}}-\mathrm{NPV}_{\mathrm{H}}}\)(H – L)

Where,

L = Lower Discount Rate

H = Higher Discount Rate

NPVL = NPV at Lower Discount Rate

NPVH = NPV at Higher Discount Rate

Situation 3: ‘ Multiple Point Inflow (Equal Cash) & Outflow:

Step 1: Calculate PVIFA at IRR: PVIFAIRR \(=\frac{\text { Initial Investment }}{\text { Annual Cash Inflow }}\)

Step 2: ‘ Calculate IRR on the basis of PVIFA table:

(a) If matched in table : Matched PVIFA rate is IRR

(b) If not matched then have to use interpolation: IRR = L + \(\frac{\text { PVIFA }_{\mathrm{L}}-\text { PVIFA }_{\mathrm{IRR}}}{\text { PVIFA }_{\mathrm{L}}-\text { PVIF }_{\mathrm{H}}}\)(H – L)

13. Modified Internal Rate of Return (MIRR) The MIRR is obtained by as-suming a single outflow in the zero year and the terminal cash inflow.

Step 1: Calculate cumulative compounded value of intermediate cash inflow by using cost of capital as rate of compounding.

Step 2: Calculate MIRR : MIRR \(=\sqrt[n]{\frac{\text { Cumulative Compounded Value }}{\text { Initial Investment }}}\) – 1

![]()

14. Replacement Decision: Decision in respect of replacement of an existing working machine with new one having higher production capacity or lower operating cost or both.

Step 1: Calculate Initial Outflow:

| Particulars | ₹ |

| Purchase Cost of New Machine

Less: Sale Value of Old Machine Less: Tax Saving on Loss on Sale of Old Machine Add: Tax Payment on Profit on Sale of Old Machine Add: Increase In Working Capital Less: Decrease in Working Capital |

XXX

(XXX) (XXX) XXX XXX (XXX) |

| Initial Outflow | XXX |

Step 2: Calculate Incremental CFAT.

Step 3: Calculate Incremental Terminal Value (net of tax).

Step 4: Calculate Incremental NPV and Take Replacement Decision.

15. Capital Rationing: Capital rationing refers to the process of selection of optimal combination of projects out of many subject to availability of funds.

Situation 1 : Projects are Divisible:

Step 1 : Calculate PI of all the available projects

Step 2 : Give Rank to all projects on the basis of PI

Step 3 : Select Projects on the basis of Rank

Situation 2 : Projects are Indivisible:

Step 1 : Calculate all possible combinations

Step 2 : Select combination of projects having higher combined NPV

16. Unequal Life of Projects: In case of comparison between two projects having different life we can solve the problem by using Equivalent Annualized Criterion:

Step 1 : Calculate NPV of the projects or PV of outflow of the projects.

Step 2 : Calculate Equivalent Annualized NPV or Outflow:

Equivalent Annualised NPV or Outflow \(=\frac{\text { NPV or PV of Outflow }}{\text { PVIFA }}\)

Step 3 : Select the proposal having higher annualised NPV or Lower annualised outflow.

Note: Such problems can also be solved by using Common Life/Replacement Chain Method

17. Decision Under Various Techniques

| Techniques | Yes | No |

| ARR | ARR ≥ Desired Return | ARR < Desired Return |

| Traditional Payback | Payback ≤ Desired Payback | Payback > Desired Payback |

| Discounted Payback | Payback ≤ Desired Payback | Payback > Desired Payback |

| NPV | NPV ≥ 0 | NPV < 0 |

| PI | PI ≥ 1 | PI< 1 |

| IRR | IRR ≥ Cost of Capital | IRR < Cost of Capital |

| MIRR | MIRR ≥ Cost of Capital | MIRR < Cost of Capital |

18. Special Points:

- Sunk Cost and Allocated Overheads are irrelevant in Capital Budgeting.

- Opportunity Cost is considered in Capital Budgeting.

- Working Capital introduced at the beginning of project (cash outflow) and recover (cash inflow) at the end of the project life.

- Running Cost: Always Cash Cost.

- Operating Cost: Variable Cost plus Fixed Cost (Including Depreciation) subject to operating cost must be > Depreciation.

- Depreciation : Only as per Tax is relevant.

- If nothing is specified: Depreciation as per books is assumed to be de-preciation as per tax and Losses can be carry forwarded for tax benefit.