Financing Decisions-Leverages – CA Inter FM Notes is designed strictly as per the latest syllabus and exam pattern.

Financing Decisions-Leverages – CA Inter FM Notes

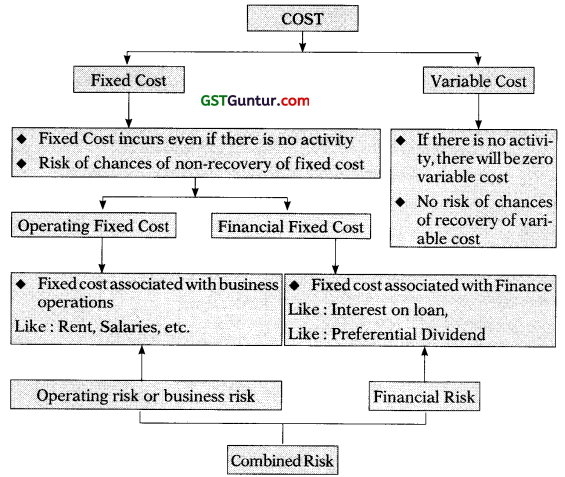

1. Types of Cost and Risk:

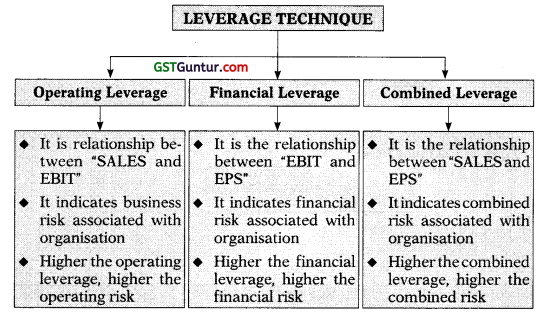

2. Leverage Technique: Leverage is the technique which is used to evaluate risk associated with any business organisation. The term Leverage in general refers to a relationship between two interrelated variables. In financial analysis it represents the influence of one financial variable over some other related financial variable. These financial variables may be costs, output, sales revenue, Earnings Before Interest and Tax (EBIT), Earning per share (EPS) etc.

![]()

3. Types of Leverages:

Understanding of Various Leverage

![]()

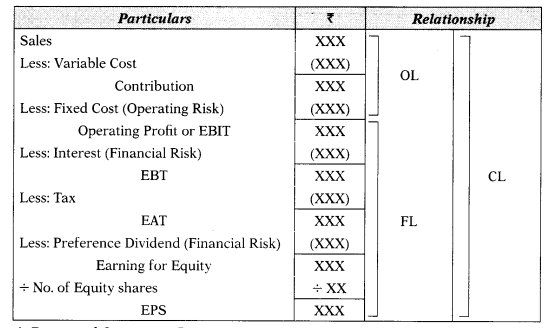

4. Degree of Operating Leverage or Operating Leverage: Operating leverage is used to measure operating or business risk associated with any business organisation, DOL indicates % change in EBIT occurs due to a given % change in Sales.

- If OL is 2.5 times, 196 increase in sales would result in 2.596 increase in EBIT.

Formulae:

Formula 1 : Operating Leverage = \(\frac{\text { Contribution }}{\text { EBIT }}\)

Formula 2 : Operating Leverage = \(\frac{\% \text { Change in EBIT }}{\%_0 \text { Change in Sales }}\)

Formula 3 : Operating Leverage = \(\frac{\text { Combined Leverage }}{\text { Financial Leverage }}\)

Formula 4 : Operating Leverage = \(\frac{1}{\text { MOS Sale Proportion }}\)

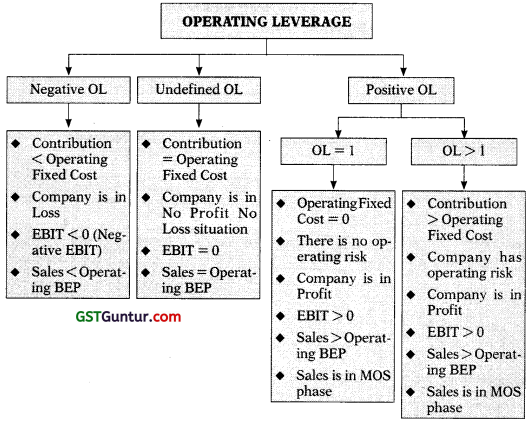

5. Operating Leverage Different Cases:

Note:

- OL can never be between 0 and 1.

- Higher the fixed cost, higher the BEP, Higher the OL and higher the operating risk.

- No operating fixed cost means no operating risk.

- Higher the proportion of MOS, lower the OL and lower operating risk.

![]()

6. Degree of Financial Leverage or Financial Leverage: Financial leverage is used to measure financial risk associated with any business organisation. DFL indicates % change in EPS occurs due to a given % change in EBIT.

- If FL is 5 times, 1% increase in EBIT would result in 596 increase in EPS.

Formulae:

Formula 1 : Financial Leverage = \(\frac{\text { EBIT }}{\text { EBT }-\frac{\text { PD }}{1-T}}\)

Formula 2 : Financial Leverage = \(\frac{\% \text { Change in EPS }}{\% \text { Change in EBIT }}\)

Formula 3 : Financial Leverage = \(\frac{\text { Combined Leverage }}{\text { Operating Leverage }}\)

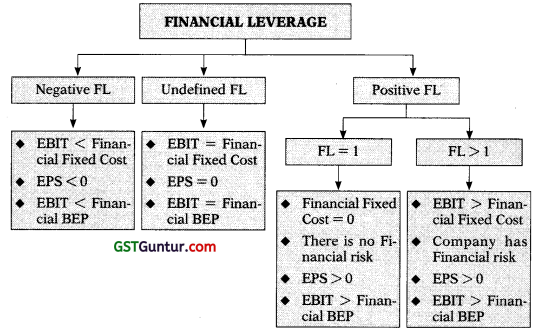

7. Financial Leverage Different Cases:

Note:

- FL can never be between 0 and 1.

- Higher the Financial fixed cost (interest and preference dividend), higher the Financial BEP, Higher the FL and higher the Financial risk.

- No Financial fixed cost means no Financial risk.

![]()

8. Degree of Combined Leverage or Combined Leverage: Combined leverage is used to measure combined risk associated with any business organisation. DCL indicates % change in EPS occurs due to a given % change in Sales.

- If CL is 2 times, 1% increase in Sales would result in 2% increase in EPS.

Formulae:

Contribution

Formula 1 : Combined Leverage = \(\frac{\text { EBIT }}{\text { EBT }-\frac{\text { PD }}{1-T}}\)

Formula 2 : Combined Leverage = \(\frac{\% \text { Change in EPS }}{\% \text { Change in Sales }}\)

Formula 3 : Combined Leverage = OL × FL

![]()

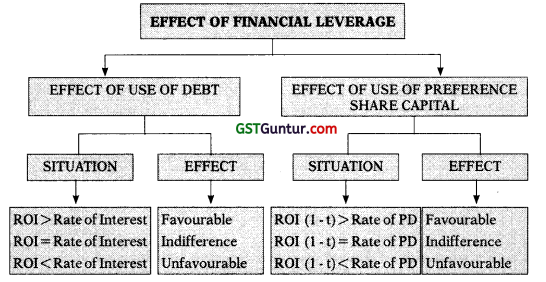

9. Effect of Financial Leverage on Equity Investors: