AS 2: Valuation of Inventories – CA Inter Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

AS 2: Valuation of Inventories – CA Inter Accounts Study Material

Definition (Based On Para No. 3)

Question 1.

Alpha Ltd. sells beer to customers; some of the customers consume the beer in the bars run by Alpha Limited. While leaving the bars, the consumers leave the empty bottles in the bars and the company takes possession of these empty bottles. The company has laid down a detailed internal record procedure for accounting for these empty bottles which are sold by the company by calling for tenders. Keeping this in view:

(i) Decide whether the inventory of empty bottles is an asset of the company;

(ii) If so, whether the inventory of empty bottles existing as on the date of Balance Sheet is to be considered as inventories of the company and valued as per AS 2 or to be treated as scrap and shown at realizable value with corresponding credit to ‘Other Income’? (5 Marks) (May 2014)

Answer:

(i) Analysis:

Tangible objects or intangible rights carrying probable future benefits, owned by an enterprise are called assets. The company sells these empty bottles by calling tenders.

It means further benefits are accrued on its sale.

Conclusion:

Therefore, empty bottles are assets for the company.

(ii) Analysis:

As per AS 2 ‘Valuation of Inventories’, inventories are assets held for sale in the ordinary course of business. Inventory of empty bottles existing on the Balance Sheet date is the inventory and Alpha Ltd. has detailed controlled recording and accounting procedure which duly signify its materiality.

Conclusion:

Inventory of empty bottles cannot be considered as scrap and should be valued as inventory in accordance with AS 2.

![]()

Scope (Based On Para Nos. 1 And 2)

Question 2.

A private limited company manufacturing fancy terry towels had valued its closing inventory of inventories of finished goods at the realisable value, inclusive of profit and the export cash incentives. Firm contracts had been received and goods were packed for export, but the ownership in these goods had not been transferred to the foreign buyers.

Comment on the valuation of the inventories by the company. (5 Marks) (May 2018)

Answer:

Accounting Standard 2 ‘Valuation of Inventories’ states that inventories should be value dat lower of historical cost and net realizable value. The standard states, ‘at certain stages in specific industries, such as when agricultural crops have been harvested or mineral ores have been extracted, performance may be substantially complete prior to the execution of the transaction generating .revenue. In such cases, when sale is assured under forward contract or a government guarantee or when market exists and there is a negligible risk of failure to sell, the goods are often valued at net realisable value at certain stages of production.’

Analysis:

Terry Towels do not fall in the category of agricultural crops or mineral ores. Accordingly, taking into account the facts stated, the closing inventory of finished goods (Fancy terry towel) should have been valued at lower of cost and net realisable value and not at net realisable value. Further, export incentives are recorded only in the year the export sale takes place.

Conclusion:

The policy adopted by the company for valuing its closing inventory of inventories of finished goods is not correct.

![]()

Cost (Based On Para Nos. 6 To 13)

Question 3.

‘In determining the cost of inventories, it is appropriate to exclude certain costs and recognize them as expenses in the period in which they are incurred’. Provide examples of such costs as per AS 2 ‘Valuation of Inventories’. (5 Marks) (November 2012)

Answer:

As per AS 2 ‘Valuation of Inventories’, certain costs are excluded from the cost of the inventories and are recognised as expenses in the period in which incurred. Examples of such costs are:

(a) abnormal amount of wasted materials, labour, or other production costs;

(b) storage costs, unless those costs are necessary in the production process prior to a further production stage;

(c) administrative overheads that do not contribute to bringing the inventories to their present location and condition; and

(d) selling and distribution costs.

Question 4.

The company X Ltd., has to pay for delay in cotton clearing charges. The company up to 31.3.2010 has included such charges in the valuation of closing stock. This being in the nature of interest, X Ltd. decided to exclude such charges from closing stock for the year 2010-11. This would result in decrease in profit by ₹ 5 lakhs. Comment.

Answer:

As per para 12 of AS 2 (revised}, interest and other borrowing costs are usually considered as not relating to bringing the inventories to their present location and condition and are therefore, usually not included in the cost of inventories.

Analysis:

X Ltd. was in practice to charge the cost for delay in cotton clearing in the closing stock. As X Ltd. decided to change this valuation procedure of closing stock, this treatment will be considered as a change in accounting policy and such fact to be disclosed as per AS 1.

Conclusion:

Any change in amount mentioned in financial statement, which will affect the financial position of the company should be disclosed properly as per AS 1, AS 2 and AS 5.

A note should be given in the annual accounts that, had the company followed earlier system of valuation of closing stock, the profit before tax would have been higher by ₹ 5 lakhs.

![]()

Question 5.

In a production process, normal waste is 5% of input. 5,000 MT of input were put in process resulting in wastage of 300 MT. Cost per MT of input is ₹ 1,000. The entire quantity of waste is on stock at the year end. State with reference to Accounting Standard, how will you value the inventories in this case?

Answer:

Ax per para 13 of AS 2 (Revised), abnormal amounts of wasted materials, labour and other production costs are excluded from cost of inventories and such costs are recognized as expenses in the period in which they are incurred.

Analysis:

In this case, normal waste is 250 MT and abnormal waste is 50 MT.

Conclusion:

The cost of 250 MT will be included in determining the cost of inventories (finished goods) at the year end. The cost of abnormal waste amounting to ₹ 50,000 (50 MT × ₹ 1,000) will be charged to the profit and loss statement.

Question 6.

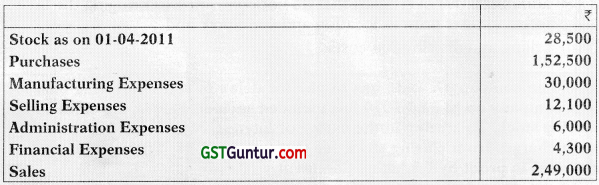

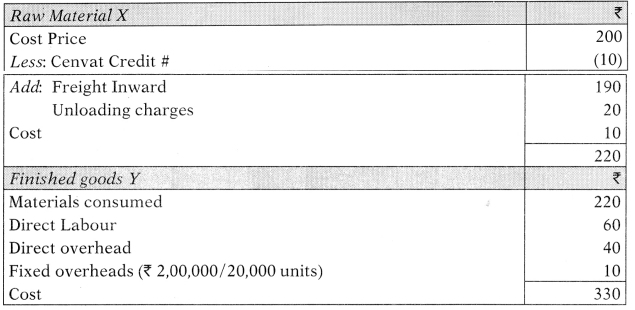

From the following information, ascertain the value of stock as on 31st March, 2012

At the time of valuing stock as on 31st March, 2011, a sum of ₹ 3,500 was written off on a particular item, which was originally purchased for ₹ 10,000 and was sold during the year for ₹ 9,000. Barring the transaction relating to this item, the gross profit earned during the year was 20% on sales. (5 Marks) (November 2012)

Answer:

Statement showing stock valuation as on 31.3.2012

![]()

Question 7.

Capital Cables Ltd., has a normal wastage of 4% in the production process. During the year 2013-14 the Company used 12,000 MT of raw material costing ₹ 150 per MT.

At the end of the year 630 MT of wastage was in stock. The accountant wants to know how this wastage is to be treated in the books.

Explain in the context of AS 2 the treatment of abnormal loss and abnormal loss and also find out the amount of abnormal loss if any. (5 Marks) (November 2014)

Answer:

As per AS 2 (Revised) ‘Valuation of Inventories’, abnormal amounts of wasted materials, labour and other production costs are excluded from cost of inventories and such costs are recognized as expenses in the period in which they are incurred.

The normal loss will be included in determining the cost of inventories (finished goods) at the year end.

Amount of Abnormal Loss:

Macrial used – 12,000 MT @ ₹ 150 = ₹ 1 8,00,000

Normal Loss (12,000 MT 4%) – 480 MT

Net quantity of material – 11,520 MT

Abnormal Loss in quantity – 150 MT

Abnormal Loss – ₹ 23,437.50

[150 units @ ₹ 156.25 (₹ 18,00,000/11,520)]

Amount ₹ 23,437.50 will be charged to the Profit and Loss statement.

![]()

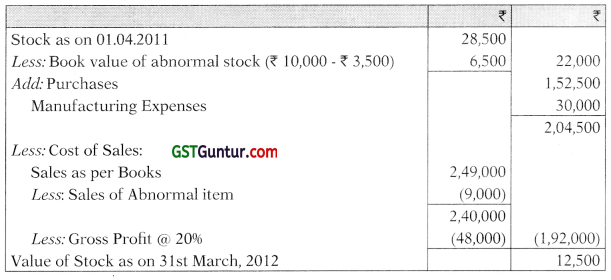

Question 8.

Z Limited ordered 13,000 kg. of chemicals at ₹ 90 per kg. The purchase price includes excise duty of ₹ 5 per kg, in respect of which full CENVAT credit is admissible. Further, State VAT is leviable at ₹ 2.5 per kg on purchase price. Freight incurred amounted to ₹ 30,000.

Normal transit loss is 4%. The company actually received 12,400 kg and consumed 10,000 kg. The company has received trade discount amounting to ₹ 1 per kg. The chemicals were delivered in containers. The containers were not reusable, hence sold for ₹ 500. The administrative expenses incurred to bring the chemicals were ₹ 10,000.

Compute the value of inventory and allocate the material cost as per AS-2. (5 Marks) (May 2016)

Answer:

Statement showing Inventory valuation

# This is now covered in GST. But the answer would remain same.

Statement showing allocation of material cost

Note:

Containers are used for delivery of the chemicals and are not reusable. Cost of these containers is treated as selling and distribution expense. The sale value of these containers will be credited to Profit and Loss Account and shall not be considered for the purpose of valuation of inventory.

![]()

Measurement Of Inventories (Based On Para Nos. 5 And 24)

Question 9.

Raw materials inventory of a company includes certain material purchased at ₹ 100 per kg. The price of the material is on decline and replacement cost of the inventory at the year end is ₹ 75 per kg. It is possible to convert the material into finished product at conversion cost of ₹ 125.

Decide whether to make the product or not to make the product, if selling price is (i) ₹ 175 and (ii) ₹ 225. Also find out the value of inventory in each case. (5 Marks) (May 2010)

Answer:

As per para 24 of AS 2 ‘Valuation of Inventories’, materiab and other supplies held for use in the production of inventories are not written down below cost if the finished products in which they will be incorporated are expected to be sold at or above cost. However, when there has been a decline in the price of materials and it is estimated that the cost of the finished products will exceed net realizable value, the materials are written down to net realisable value. In such circumstances, the replacement cost of the materials may be the best available measure of their net realisable value.

(i) When selling price is ₹ 175

Incremental Profit = ₹ 175 – ₹ 125 = ₹ 50

Current price of the material = ₹ 75

Therefore, it is better not to make the product. Raw material inventory would be valued at net realisable value i.e. ₹ 75 because the selling price of the finished product is less than ₹ 225 (100+125) per kg.

(ii) When selling price is ₹ 225

Incremental Profit = ₹ 225 – ₹ 125 = ₹ 100

Current price of the raw material = ₹ 75.

Therefore, it is better to make the product.

Raw material inventory would be valued at ₹ 100 per kg because the selling price of the finished product is not less than ₹ 225.

![]()

Question 10.

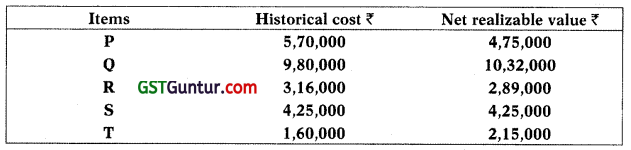

Best Ltd. deals In five products, P, 0, R, S and T which are neither similar nor inter-changeable. At the time of closing of its accounts for the year ending 31st March 2011, the historical cost and net realizable value of the items of the closing stock are determined as follows:

What will be the value of closing stock for the year ending 31st March, 2011 as per AS 2 ‘Valuation of Inventories’? (5 Marks) (May 2011)

Answer:

As per para 5 of AS 2 ‘Valuation of Inventories’ inventories should be valued at the lower of cost and net realizable value. Inventories should be written down to net realizable value on an item-by-item basis.

Valuation of inventory for the year ending 31st March 2011

Question 11.

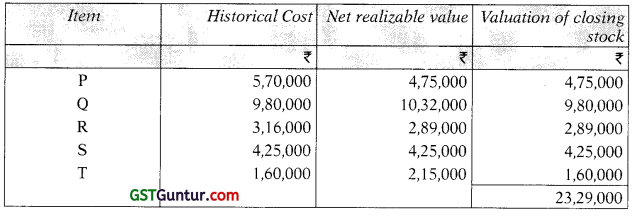

On 31st March 2013 a business firm finds that cost of a partly finished unit on that date is ₹ 530. The unit can be finished in 2013-14 by an additional expenditure of ₹ 310. The finished unit can be sold for ₹ 750 subject to payment of 4% brokerage on selling price. The firm seeks your advice regarding: –

(i) the amount at which the unfinished unit should be valued as at 31st March, 2013 for preparation of final accounts and

(ii) the desirability or otherwise of producing the finished unit. (5 Marks)(May 2013)

Answer:

Valuation of WIP:

Incremental cost ₹ 310 (cost to complete) is less than incremental revenue ₹ 720 (₹ 750 – ₹ 30). The enterprise will therefore decide to finish the unit for sale at ₹ 750.

![]()

Question 12.

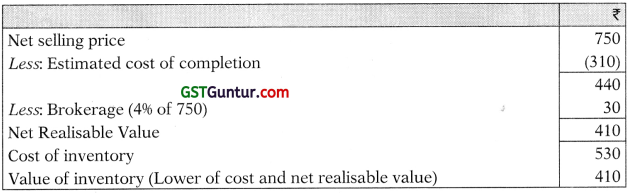

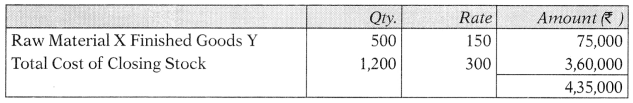

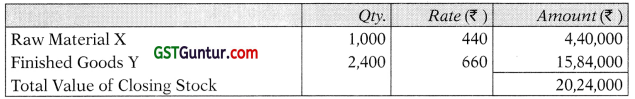

Calculate the value of raw materials and closing stock based on the following information:

Total Fixed overhead for the year was ₹ 2,00,000 on normal capacity of 20,000 units.

Calculate the value of the closing stock, when

(i) Net Realizable Value of the Finished Goods Y is ₹ 400.

(ii) Net Realizable Value of the Finished Goods Y is ₹ 300. (5 Marks) (May 2014)

Answer:

Working Notes:

![]()

# (Now covered in GST) – Treatment still remains the same

Situation (i)

When Net Realisable Value of the Finished Goods Y is ₹ 400

NRV is greater than the cost of Finished Goods Y i.e. ₹ 330

Hence, Raw Material and Finished Goods are to be valued at cost

Value of Closing Stock:

Situation (ii)

When Net Realisable Value of the Finished Goods Y is ₹ 300

NRV is less than the cost of Finished Goods Y i.e. ₹ 330

Hence, Raw Material is to be valued at replacement cost and

Finished Goods are to be valued at NRV since NRV is less than the cost

Value of Closing Stock:

![]()

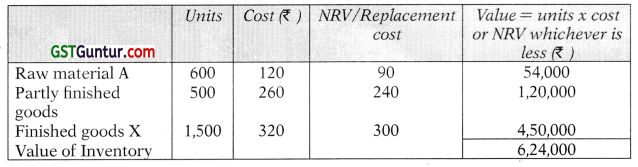

Question 13.

Mr. Mehul gives the following information relating to items forming part of inventory as on 31-3-2015. His factory produces Product X using Raw material A.

(i) 600 units of Raw material A (purchased @ ₹ 120). Replacement cost of raw material A as on 31-3-2015 is ₹ 90 per unit.

(ii) 500 units of partly finished goods in the process of producing X and cost incurred till date ₹ 260 per unit. These units can be finished next year by incurring additional cost of ₹ 60 per unit.

(iii) 1500 units of finished Product X and total cost incurred ₹ 320 per unit. Expected selling price of Product X is ₹ 300 per unit.

Determine how each item of inventory will be valued as on 31-3-2015. Also calculate the value of total inventory as on 31-3-2015. (5 Marks) (May 2015)

Answer:

As- per AS 2 ‘Valuation of Inventories’, materials and other supplies held for use in the production of inventories are not written down below cost if the finished products in which they will be incorporated are expected to be sold at cost or above cost. However, when there has been a decline in the price of materials and it is estimated that the cost of the finished products will exceed net realizable value, the materials are written down to net realizable value.

Analysis:

The replacement cost of the materials may be the best available measure of their net realizable value. In the given case, selling price of product X is ₹ 300 and total cost per unit for production is ₹ 320.

Conclusion:

The valuation will be done as under:

- 600 units of raw material will be written down to replacement cost as market value of finished product is less than its cost, hence valued at ₹ 90 per unit.

- 500 units of partly finished goods will be valued at 240 per unit i.e. lower of cost ₹ 320 (₹ 260 + additional cost ₹ 60) or Net estimated selling price ₹ 240 (Estimated selling price ₹ 300 per unit less additional cost of ₹ 60).

- 1500 units of finished product X will be valued at NRV of ₹ 300 per unit since it is lower than cost ₹ 320 of product X

Valuation of Inventory

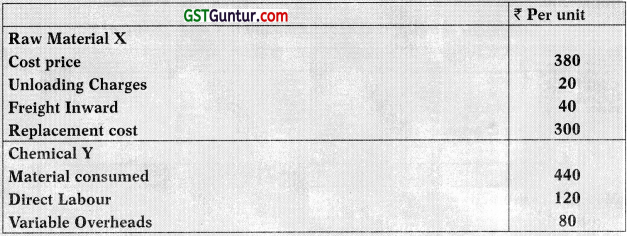

Question 14.

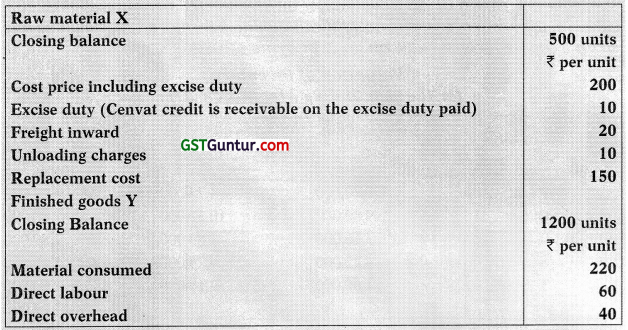

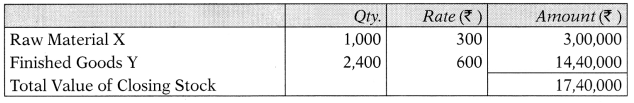

A Limited is engaged in manufacturing of Chemical Y for which Raw Material X is required. The company provides you following information for the year ended 31st March, 2017.

Additional Information:

(i) Total fixed overhead for the year was ₹ 4,00,000 on normal capacity of 20,000 units.

(ii) Closing .balance of Raw Material X was 1,000 units and Chemical Y was 2,400 units.

You are required to calculate the total value of closing stock of Raw Material X and Chemical Y according to AS 2, when

(a) Net realizable value of Chemical Y is ₹ 800 per unit

(b) Net realizable value of Chemical Y is ₹ 600 per unit (5 Marks) (November 2017)

Answer:

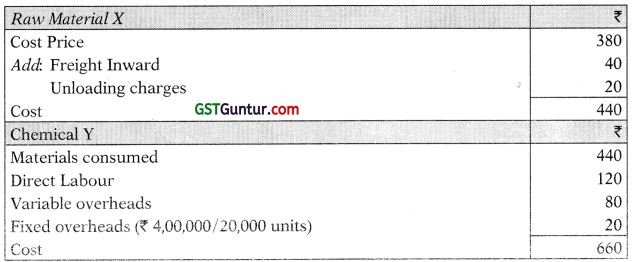

(a) When Net Realizable Value of the Chemical Y is ₹ 800 per unit

NRV is greater than the cost of Finished Goods Y i.e. ₹ 660 (Refer W.N.)

Hence, Raw Material and Finished Goods are to be valued at cost.

Value of Closing Stock:

![]()

(b) When Net Realizable Value of the Chemical Y is ₹ 600 per unit

NRV is less than the cost of Finished Goods Y i.e. ₹ 660. Hence, Raw Material is to be valued at replacement cost and Finished Goods are to be valued at NRV since NRV is less than the cost.

Value of Closing Stock:

Working Note:

Statement showing cost of Raw material X and Chemical Y

Net Realisable Value (Based On Para NOS, 20 To 23 And 25)

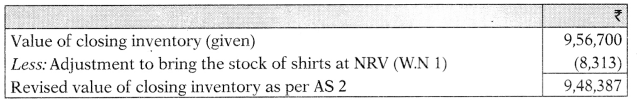

Question 15.

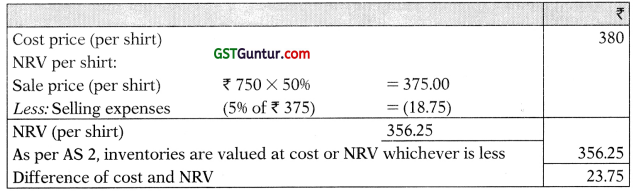

The dosing inventory at cost of XYZ Ltd. amounted to ₹ 9,56,700. 350 Shirts, which had cost ₹ 380 each and normally sold for ₹ 750 each are included in this amount of ₹ 9,56,700. Owing to a defect in manufacture, they were all sold after the Balance Sheet date at 50% of their normal price. Selling expenses amounted to 5% of the proceeds. What should be the closing inventory value? (5 Marks) (May 2013)

Answer:

Value of closing inventory

Working Notes :

1. Valuation of Shirts as per AS 2

Therefore, value of inventory of shirts to be reduced by ₹ 8,313 (₹ 23.75 × 350 shirts)

General Questions

Question 16.

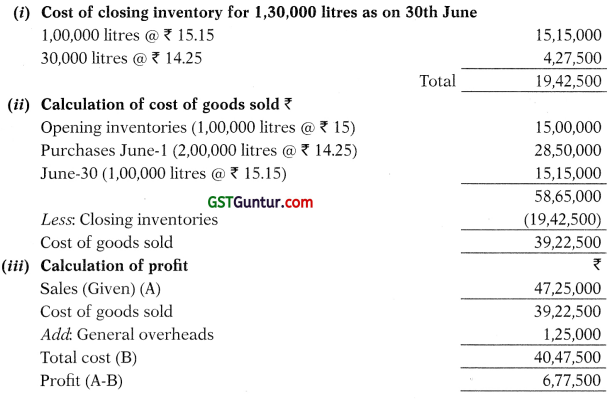

HP is a leading distributor of petrol. A detail inventory of petrol in hand is taken when the books are closed at the end of each month. At the end of month following information is available:

Sales – ₹ 47,25,000

General overheads cost – ₹ 1,25,000

Inventory at beginning – 1,00,000 litres @15 per litre

Purchases

June 1 two lakh litres @ 14.25

June 30 one lakh litres @ 15.15

Closing inventory 1.30 lakh litres

Compute the following by the FIFO as per AS 2:

(i) B. Value of Inventory on June, 30.

(ii) Amount of cost of goods sold for June.

(iii) Profit/Loss for the month of June. (5 Marks) (November 2010)

Answer:

![]()

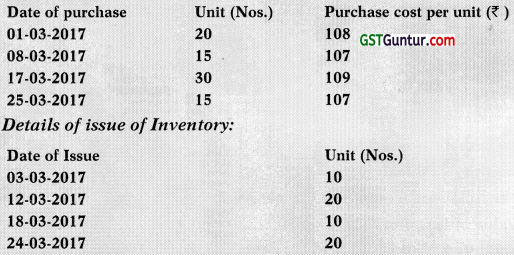

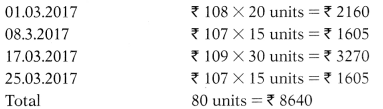

Question 17.

On the basis of information given below, find the value of inventory (by periodic inventory method) as per AS 2, to be considered while preparing the Balance Sheet as on 31st March, 2017 on weighted Average Basis.

Details of Purchases:

Net realizable value of inventory as on 31st March, 2017 is ₹ 107.75 per unit. You are required to compute the value of Inventory as per AS 2.

Answer:

Net Realisable Value of Inventory as on 31st March, 2017

= ₹ 107.75 × 20 units = ₹ 2,155

Value of inventory as per Weighted Average basis

Total units purchased and total cost:

Weighted Average Cost = ₹ 8640/80 units = ₹ 108

Total cost = ₹ 108 × 20 units = ₹ 2,160

Value of inventory to be considered while preparing Balance Sheet as on 31st March, 2017 is, Cost or Net Realisable value whichever is lower i.e. ₹ 2,155