Profit or Loss Pre and Post Incorporation – CA Inter Accounting Study Material is designed strictly as per the latest syllabus and exam pattern.

Profit or Loss Pre and Post Incorporation – CA Inter Accounts Study Material

Theory Questions

Question 1.

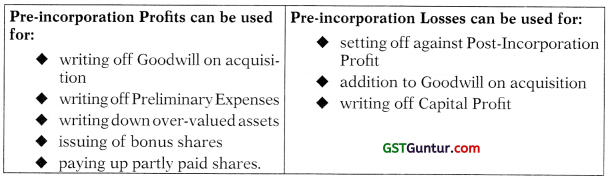

What are the purposes for which Pre-incorporation Profit & Pre-incorporation Losses can be used for? (4 Marks) (Nov. 2016)

Answer:

Purposes for which pre-incorporation profits and pre-incorporation losses can be used are as follows:

Computation Of Ratio

Question 2.

From the following information, calculate the Ratio of Sales in each case separately:

(a)

- Date of acquisition – 1st April, 2015; date of incorporation – 1st July, 2015 and date of closing the books of account – 31st March, every year.

- The sales for the year ending on 31 st March ,2016 were ₹ 24,00,000 of which ₹ 4,80,000 goods were sold during the first six months of the accounting period.

(b)

- The accounts were made up to 31st December, 2015. The company was incorporated on 1st May, 2015 to takeover a business from the preceding 1st January.

- Total sales for the year were ₹ 12,00,000. It is ascertained that the sales for November and December are one and half times the average of those for the year, whilst those for February and April are only half the average.

(c)

- Fema Ltd. was incorporated on 1st July, 2015 to take the existing business of X from 1st April, 2015. Date of closing the books of account – 31st March, 2016.

- Monthly sales in April 2015, February 2016 and March 2016 are double the average monthly sales for remaining months of the year. (RTP)

Answer :

(a) Sales of first 6 months = ₹ 4,80,000. Average sale of first 6 months = ₹ 4,80,000/6 = ₹ 80,000 per month. Pre-incorporation period consist of 3 months (ie., April, May and June). The sales of those 3 months = ₹ 80,000 × 3 = ₹ 2,40,000. Sales of remaining 9 months = ₹ 24,00,000 – ₹ 2,40,000 = ₹ 21,60,000.

Therefore, the ratio of sales = ₹ 2,40,000 : ₹ 21,60,000 or 1 : 9.

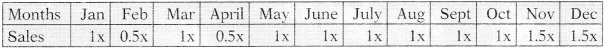

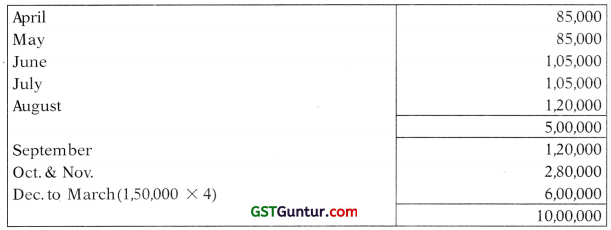

(b) Let the average of monthly sales = x. The sales of different months can be shown as follows:

Date of incorporation is May, 2015 Pre-incorporation period is from January to April i.e. 3x

Post-incorporation period is from May to December i.e. 9x

The ratio of Sales = 3x: 9x or 1:3.

(c) Let the average monthly sales be x. The sales of different months can be shown as follows:

Date of incorporation is 1 July, 2015. Pre-incorporation period is from April to June ie. 4x Post-incorporation period is from July to March i.e. 11x. The ratio of Sales = 4x: 11x or 4 : 11

![]()

Question 3.

M Ltd. was incorporated on 1.8.2016 to takeover the running business of M/s A with assets from 1.4.2016. The accounts of the company were closed on 31.3.2017.

The average monthly sales during the first four months of the year (2016-17) was twice the average monthly sales during each of the remaining eight months.

You are required to compute time ratio and sales ratio for pre and post incorporation periods.

Answer:

Computation of Time ratio:

Pre-incorporation period (1.4.2016 to 1.8.2016) = 4 months

Post-incorporation period (1.8.2016 to 31.3.2017) = 8 months

Time ratio = 4 : 8 or 1 : 2

Computation of Sales ratio:

Average monthly sale before incorporation was twice the average sale per month of the post incorporation period. If weightage for each post-incorporation month is x, then

Weighted sales ratio = 4 × 2x : 8 × 1x = 8x : 8x or 1 : 1

Simple Problems

Question 4.

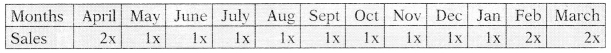

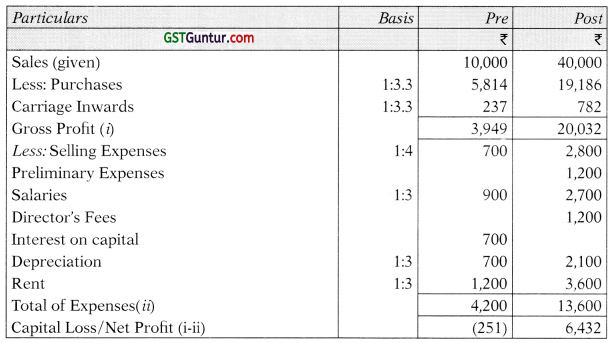

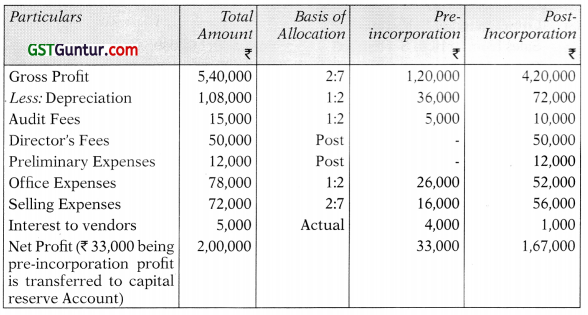

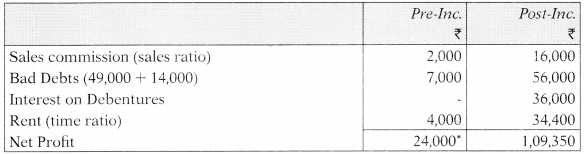

The Business carried on by Kapil under the name ‘K’ was taken over as a running business with effect from 1st April, 2016 by S Ltd., which was incorporated on 1st July, 2016. The same set of books was continued since there was no change in the type of business and the following particulars of profits for the year ended 31st March, 2017 were available.

The purchase price (including carriage inwards) for the post-incorporation period had increased by 10 per cent as compared to pre-incorporation period. No stocks were carried either at the beginning or at the end.

You are required to draw up a statement showing the amount of pre and post-incorporation period profits stating the basis of allocation of expenses. (RTF)

Answer:

Statement showing the computation of profits/losses for pre-incorporation and Post-incorporation period profits for the year ended 31st March, 2017

Working Notes:

- Sales Ratio = 10,000:40,000 = 1 : 4

- Time Ratio = 3 : 9 = 1 : 3

- Purchase Price Ratio

∴ Ratio is 3: 9

But purchase price was 10% higher in the company period

∴ Ratio is 3: 9 + 10%

3:9.9 = 1:3.3.

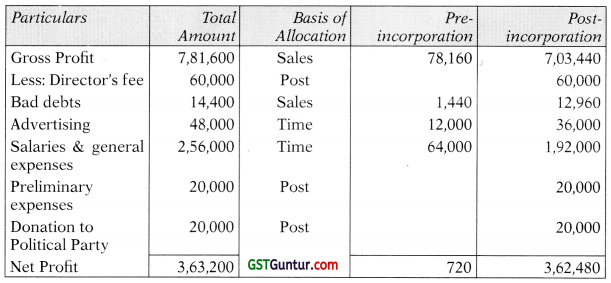

Question 5.

L Ltd. was incorporated on 1st July, 2017 to acquire a running business of F goods with effect from 1st April, 2017. During the year 2017-18, the total sales were ₹ 48,00,000 of which ₹ 9,60,000 were for the first six months. The Gross profit of the company ₹ 7,81,600. The expenses debited to the Profit & Loss Account included:

- Director’s fees ₹ 60,000

- Bad debts ₹ 14,400

- Advertising ₹ 48,000 (under a contract amounting to ₹ 4,000 per month)

- Salaries and General Expenses ₹ 2,56,000

- Preliminary Expenses written off ₹ 20,000

- Donation to a political party given by the company ₹ 20,000.

Prepare a statement showing pre-incorporation and post-incorporation profit for the year ended 31st March, 2018. (RTP)

Answer :

Statement showing the computation of Profits for the pre-incorporation and post-incorporation periods For the year ended 31st March, 2018

Working Notes:

1. Computation of Sales ratio

Thus, Sales Ratio = 1 : 9

2. Computation of Time ratio

1st April, 2017 to 30 June, 2017: 1st July, 2017 to 31st March, 2018 = 3 months: 9 months = 1: 3

Thus, Time Ratio is 1: 3

![]()

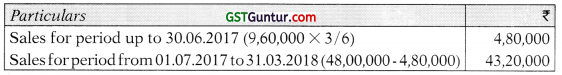

Question 6.

A firm M/s. Alag, which was carrying on business from 1st July, 2010 gets itself incorporated as a company on 1st November, 2010. The first accounts are drawn upto 31st March, 2011. The gross profit for the period is ₹ 56,000. The general expenses are ₹ 14,220; Director’s fee ₹ 12,000 p.a.; Incorporation expenses ₹ 1,500. Rent upto 31st December was ₹ 1,200 p.a. after which it is increased to ₹ 3,000 p.a. Salary of the manager, who upon incorporation of the company was made a director, is ₹ 6,000 p.a. His remuneration thereafter is included in the above figure of fee to the directors.

Give profit and loss account showing pre and post incorporation profit. The net sales are ₹ 8,20,000, the monthly average of which for the first four months is one-half of that of the remaining period. The company earned a uniform profit. Interest and tax may be ignored. (6 Marks) (Nov. 2011)

Answer:

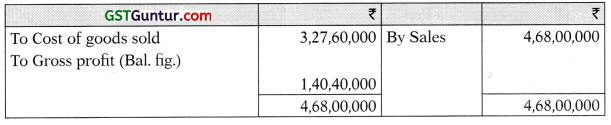

Profit & Loss Account for 9 months ended on 31st March, 2011

Working Notes:

1. Computation of sales ratio

Let the average monthly sales of first four months = 100 and next five months = 200 ”

Total sales of first four months = 100 × 4 = 400 and total sales of next five months = 200 × 5 = 1,000

The ratio of sales = 400: 1,000 =2: 5

2. Allocation of Rent

Till 31st December, 2010, rent was ₹ 1,200p.a. i.e. ₹ 100p.m.So, Pre-incorporation rent = ₹ 100 × 4 months = ₹ 400

Post-incorporation rent = (₹ 100 × 2 months) + (₹ 250 × 3 months) = ₹ 950

Question 7.

The promoters of Glorious Ltd. took over on behalf of the company a running business with effect from 1 st April, 2012. The company got incorporated on 1st August, 2012. The annual accounts were made up to 31st March, 2013 which revealed that the sales for the whole year totalled ₹ 1,600 lakhs out of which sales till 31 st July, 2012 were for ₹ 400 lakhs. Gross profit ratio was 25%.

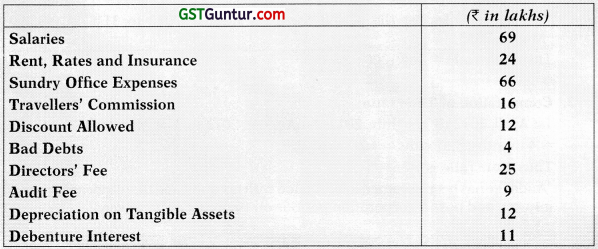

The expenses from 1st April 2012, till 31st March, 2013 were as follows:

Prepare a statement showing the calculation of Profits for the pre-incorporation and post-incorporation periods. (8 Marks) (May 2013)

Answer:

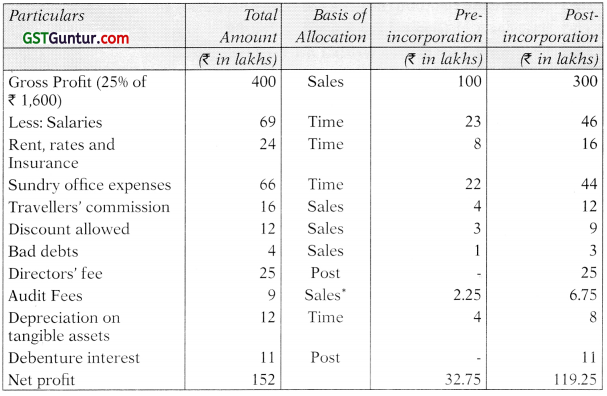

Statement showing the computation of Profits for the pre-incorporation and post-incorporation periods

Working Notes:

1. Computation of Sales ratio

Thus, sale ratio = 400:1200

= 1:3

2. Computation of Time ratio

1st April, 2012 to 31st July, 2012: 1st August, 2012 to 31st March, 2013

= 4 months: 8 months = 1:2

Thus, time ratio is 1:2.

* Audit fee has been assumed to be related with tax audit and therefore apportioned into pre and post-incorporation periods on the basis of turnover.

![]()

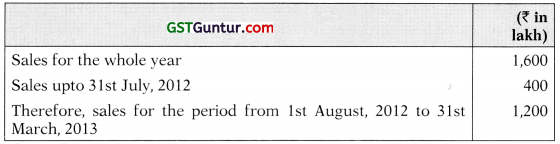

Question 8.

Sneha Ltd. was incorporated on 1st July, 2013 to acquire a running business of Atul Sons with effect from 1st April, 2013. During the year 2013-14, the total sales were ₹ 24,00,000 of which ₹ 4,80,000 were for the first six months. The Gross profit of the company ₹ 3,90,800. The expenses debited to the Profit & Loss Account included:

- Director’s fees ₹ 30,000

- Bad debts ₹ 7,200

- Advertising ₹ 24,000 (under a contract amounting to 12,000 per month)

- Salaries and General Expenses ₹ 1,28,000

- Preliminary Expenses written off ₹ 10,000

- Donation to a political party given by the company ₹ 10,000.

Prepare a statement showing pre-incorporation and post-incorporation profit for the year ended 31st March, 2014. (8 Marks) (May 2014)

Answer :

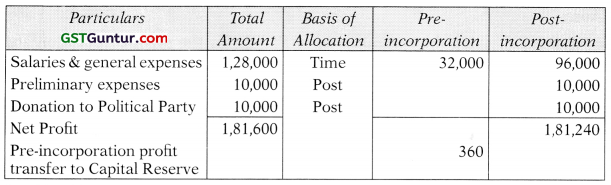

Statement showing the computation of Profits for the pre-incorporation and post-incorporation periods

For the year ended 31st March, 2014

Working Notes:

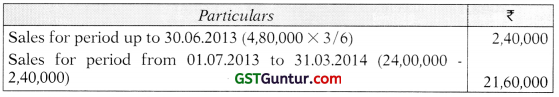

1. Computation of Sales ratio

Thus, Sales Ratio = 1:9

2. Computation of Time ratio

1st April, 2013 to 30 June, 2013: 1st July, 2013 to 31st March, 2014

= 3 months: 9 months =1:3 Thus, Time Ratio is 1: 3

Question 9.

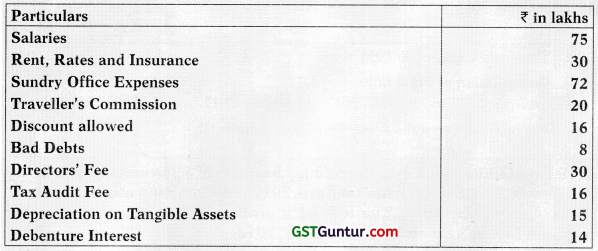

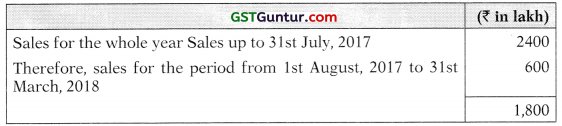

The promoters of Shiva Ltd. took over on behalf of the company a running business with effect from 1st April 2017. The company got incorporated on 1st August, 2017. The annual accounts were made up to 31st March, 2018 which revealed that the sales for the whole year totalled ₹ 2400 lakhs out of which sales till 31st July, 2017 were for ₹ 600 lakhs. Gross profit ratio was 20%.

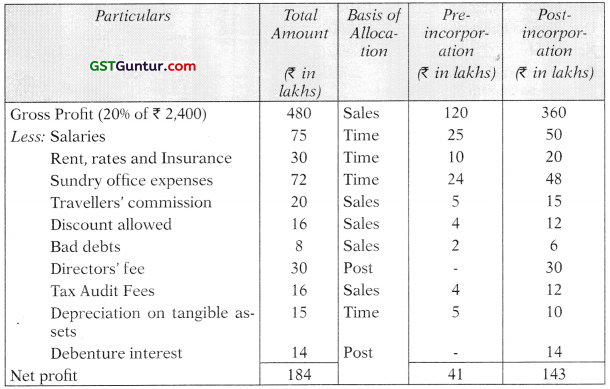

The expenses from 1st April, 2017, till 31st March, 2018 were as follows:

Prepare a statement showing the calculation of profits for the pre-incorporation and Post incorporation periods. (10 Marks) (May 2018)

Answer:

Statement showing the computation of Profits for the pre-incorporation and post-incorporation periods

Working Notes:

1. Computation of Sales ratio

Thus, sale ratio = 600:1800 = 1:3

2. Computation of Time ratio

1st April, 2017 to 31st July, 2017: 1st August, 2017 to 31st March, 2018 = 4 months: 8 months = 1:2, Thus, time ratio is 1 : 2.

![]()

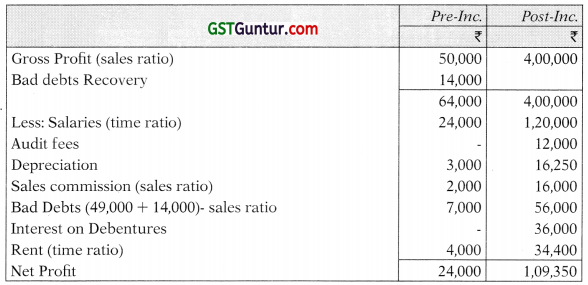

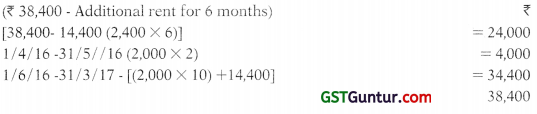

Question 10.

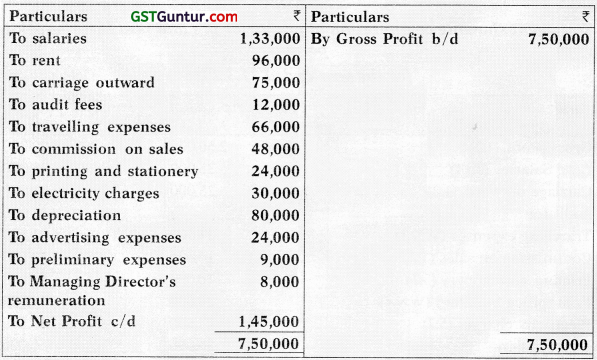

Sun Limited took over the running business of a partnership firm M/s A & N Brothers with effect from 1 st April, 2017. The company was incorporated on 1st September, 2017. The following profit and loss account have been prepared for the year ended 31st March, 2018.

Additional Information:

- Trend of sales during April, 2017 to March, 2018 was as under:

- Sun Limited took over a machine worth ₹ 7,20,000 from A&N Brothers and purchased a new machine on 1st February, 2018 for ₹ 4,80,000. The company decides to provide depreciation @ 10% p.a.

- The company occupied additional space from 1st October, 2017 @ rent of ₹ 6,000 per month.

- Out of travelling expenses, ₹ 30,000 were incurred by office staff while remaining expenses were incurred by salesmen.

- Audit fees pertains to the company.

- Salaries were doubled from the date of incorporation.

You are required to prepare a statement apportioning the expenses between pre and post-incorporation periods and calculate the profit/ (loss) for such periods.

Answer:

Statement showing computation of profits forpre and post incorporation periods for the year ended 31.3.2018

Working Notes:

1. Computation of Time Ratio

Pre-incorporation period = 1st April, 2017 to 31st August, 2017 ie. 5 months

Post-incorporation period is 7 months

Time ratio is 5: 7.

2. Computation of Sales ratio

5,00,000 : 10,00,000 = 1 : 2

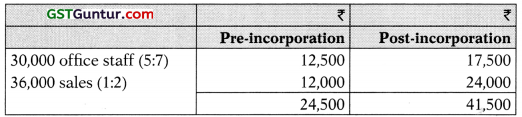

3. Allocation of Travelling expenses

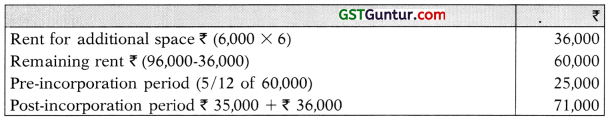

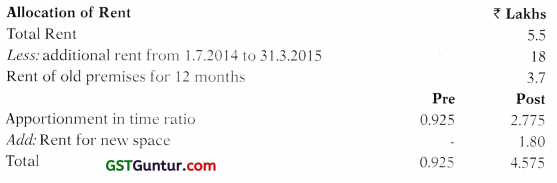

4. Allocation of Rent

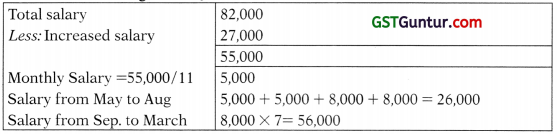

5. Allocation of Salaries

Suppose x for a month in pre-incorporation period then salaries for pre- incorporation period = 5x salaries for post-incorporation period = 2x × 7= 14x

Ratio = 5:14

6. Allocation of Depreciation

![]()

Advanced Problems

Question 11.

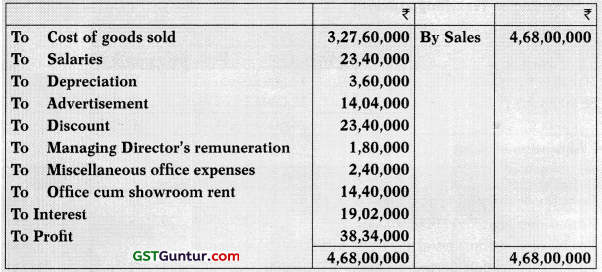

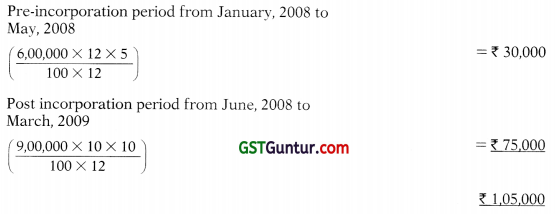

The partnership of Seva Agencies decided to convert the partnership into Private Limited Company named S Pvt. Ltd. with effect from 1st January, 2014. The consideration was agreed at ₹ 2,34,00,000 based on firm’s Balance Sheet as on 31st December, 2013. However, due to some procedural difficulties, the company could be incorporated only on 1st April, 2014. Meanwhile, the business was continued on behalf of the company and the consideration was settled on that day with interest at 12% p.a. The same books of account were continued by the company, which closed its accounts for the first time on 31st March, 2015 and prepared the following summarized Profit and Loss account:

The company’s only borrowing was a loan of ₹ 1,00,00,000 at 12% p.a. to pay the purchase consideration due to the firm and for working capital requirements. The company was able to double the monthly average sales of the firm from 1st April, 2014, but the salaries trebled from the date. It had to occupy additional space from 1st July, 2014 for which rent was ₹ 60,000 per month.

Prepare a statement showing apportionment of costs and revenue between pre-incorporation and post-incorporation periods. (RTP)

Answer:

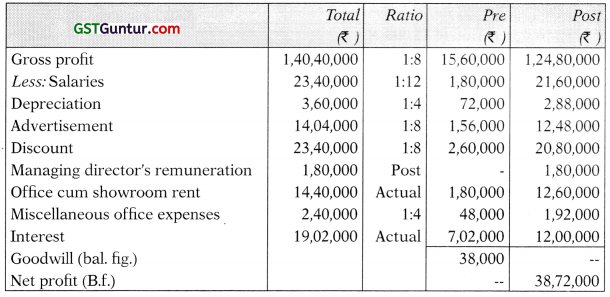

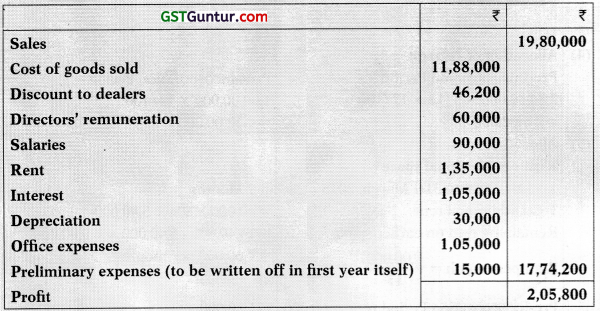

Statement showing computation of profits for pre and post incorporation periods for the year ended 31.3.15 (15 Months)

Working Notes:

(6) Computation of Gross Profit

Trading Account

![]()

Question 12.

The partners of PQ Enterprises decided to convert the partnership firm into a Private Limited Company PQ (P) Ltd. with effect from 1st January, 2015. However, company could be incorporated only on 1st June, 2015. The business was continued on behalf of the company and the consideration of ₹ 6,00,000 was settled on that day along with interest @ 12% per annum. The company availed loan of ₹ 9,00,000 @ 10% per annum on 1st June, 2015 to pay purchase consideration and for working capital. The company closed its accounts for the first time on 31st March, 2016 and presents you the following summarized profit and loss account:

Sales from June, 2015 to December, 2015 were 2/times of the average sales, which further increased to 3/times in January to March quarter, 2016. The company recruited additional work force to expand the business. The salaries from July, 2015 doubled. The company also acquired additional showroom at monthly rent of ₹ 10,000 from July, 2015.

You are required to prepare a statement showing apportionment of cost and revenue between pre-incorporation and post-incorporation periods. Also suggest the purposes for which Pre-incorporation Profit & Pre-incorporation Losses can be used for. (RTP)

Answer:

Profit and Loss Account for 15 months ended 31st March, 2016

Working Notes:

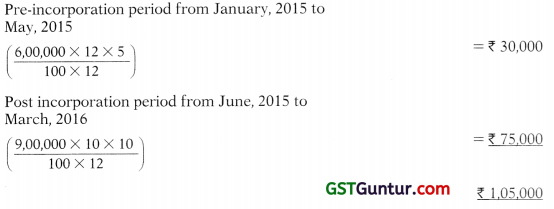

1. Computation of sales ratio

Let the average sales per month in pre-incorporation period be x

Average Sales (Pre-incorporation) = x ₹ 5 = 5x

Sales (Post incorporation) from June to December, 2015 = 21/2 × ₹ 7 = 17.5x

From January to March, 2016 = 31/2 × ₹ 3 = 10.5x

Total Sales 28.0x

Sales ratio of pre-incorporation & post-incorporation is 5x: 28x

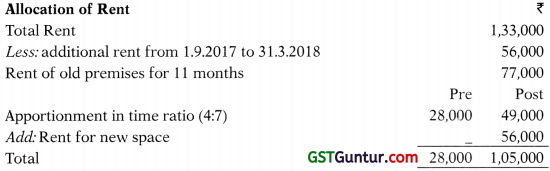

2. Computation of ratio for salaries

Let the average salary be x

Pre-incorporation salary = x ₹ 5 = 5x

Post-incorporation salary

June, 2015 = x

July to March, 2016 = x ₹ 9 X 2 = 18x

19x

Ratio is 5: 19

3. Allocation of Rent

₹

Total rent 1,35,000

Less: Additional rent for 9 months @ ₹ 10,000 p.m. 90,000

4. Allocation of interest

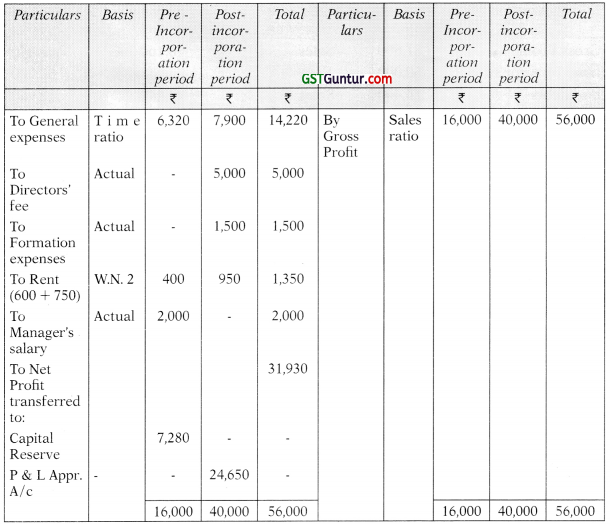

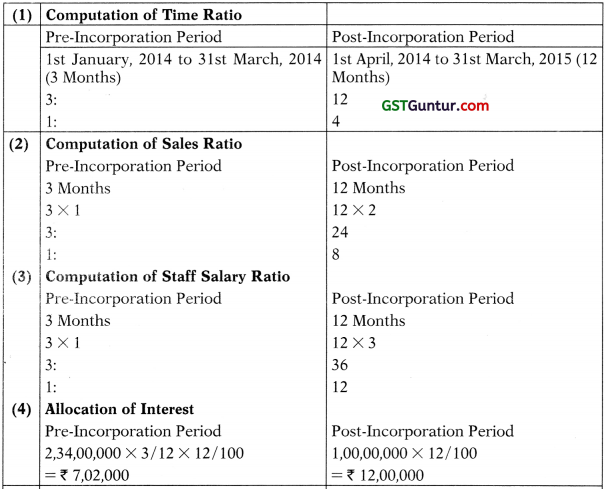

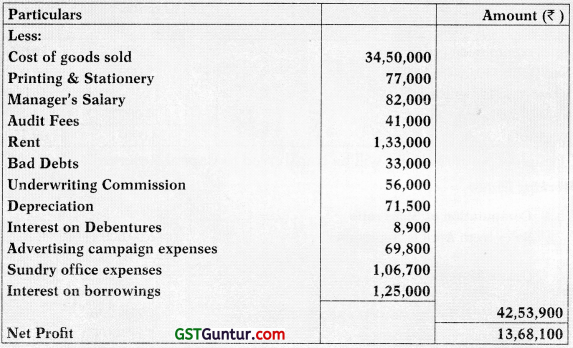

Question 13.

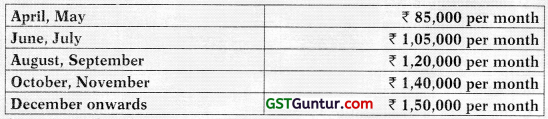

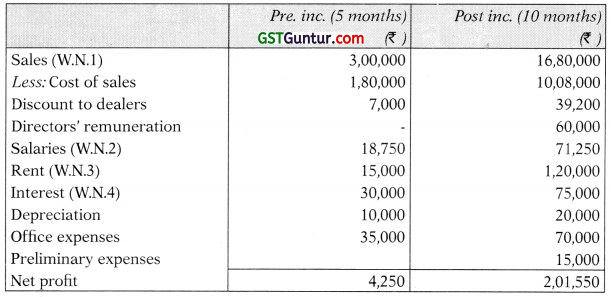

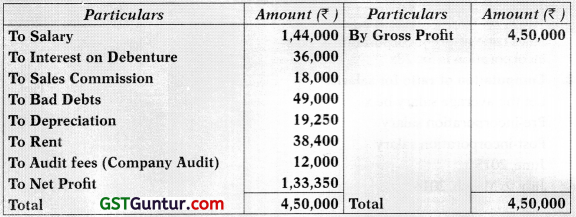

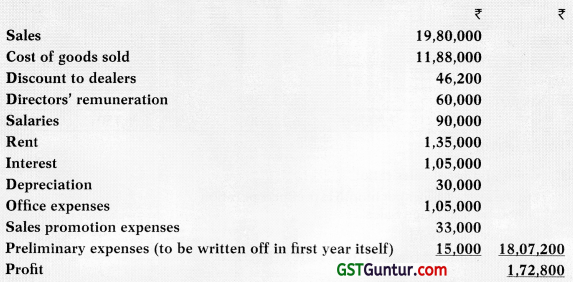

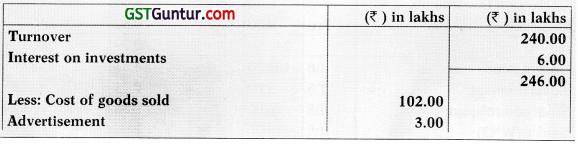

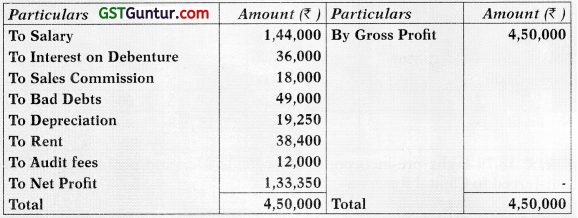

R & S working in partnership, registered a joint stock company under the name of RS Ltd. on May 31st 2017 to take over their existing business. The summarized Profit & Loss A/c as given by RS Ltd. for the year ending 31st March, 2018 is as under:

RS Ltd.

Profit & Loss Account for the year ending March 31, 2018

Prepare a Statement showing allocation of expenses & calculation of pre-incorporation & post-incorporation profits after considering the following information:

- GP ratio was constant throughout the year.

- Depreciation includes ₹ 1,250 for assets acquired in post incorporation period.

- Bad debts recovered amounting to ₹ 14,000 for a sale made in 2014-15 has been deducted from bad debts mentioned above.

- Total sales were ₹ 18,00,000 of which ₹ 6,00,000 were for April to September.

- Happy Ltd. had to occupy additional space from 1st Oct. 2017 for which rent was ₹ 2,400 per month. (RTF)

Answer:

Statement showing computation of profit/losses for pre and post incorporation periods

Working Notes:

- Computation of Sales ratio Sales from April to September = 6,00,000(1,00,000p.m.on average basis)

Oct. to March = ₹ 12,00,000 (2,00,000 p.m. on average basis)

Thus, sales for pre-incorporation = ₹ 2,00,000 period

post-incorporation period = ₹ 16,00,000

Sales are in the ratio of 1:8 - Depreciation of ₹ 18,000 divided in the ratio of 1:5 (time basis) and ₹ 1,250 charged to post incorporation period.

- Bad debt recovery of ₹ 14,000 is allocated in pre-incorporation period, being sale made in 2014-15.

- Rent

![]()

Question 14.

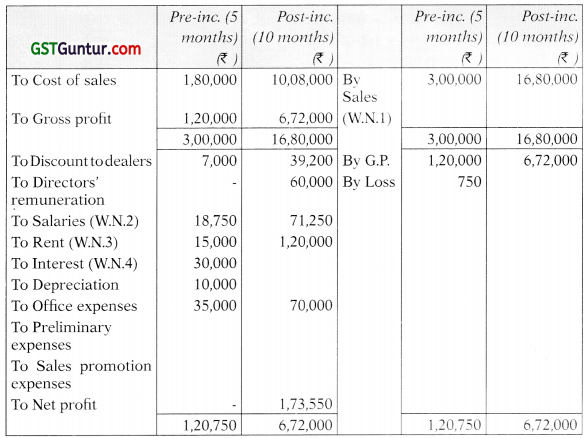

Rama Udyog Limited was incorporated on August 1, 2008. It had acquired a running business of Rama & Co. with effect from April 1, 2008. During the year 2008-09, the total sales were ₹ 36,00,000. The sales per month in the first half year were half of what they were in the later half year. The net profit of the company, ₹ 2,00,000 was worked out after charging the following expenses:

- Depreciation ₹ 1,08,000,

- Audit fees ₹ 15,000,

- Directors’ fees ₹ 50,000,

- Preliminary expenses ₹ 12,000,

- Office expenses ₹ 78,000,

- Selling expenses ₹ 72,000 and

- Interest to vendors upto August 31, 2008 ₹ 5,000.

Please ascertain pre-incorporation and post-incorporation profit for the year ended 31st March, 2009. (6 Marks) (Nov. 2009)

Answer :

Statement showing computation of pre and post incorporation profit for the year ended 31st March, 2009

Working Notes:

1. Computation of Sales ratio

The sales per month in the first half year were half of what they were in the later half year. If in the later half year, sales per month is Re. 1 then it should be 50 paise per month in the first half year. So, sales for the first four months (ie. from 1st April, 2008 to 31st July, 2008) will be 4 × .50 = ₹ 2 and for the last eight months (ie. 221 from 1st August, 2008 to 31st March, 2009) will be (2 × .50 + 6 × 1) = ₹ 7. Thus, sales ratio is 2:7.

2. Computation of Time ratio

1st April, 2008 to 31st July, 2008: 1st August, 2008 to 31st March, 2009 = 4 months: 8 months = 1:2

Thus, time ratio is 1:2.

3. Computation of Gross profit

Gross profit = Net profit + All expenses

= ₹ 2,00,000 + ₹ (1,08,000 + 15,000 + 50,000 + 12,000 + 78,000 + 72,000 + 5,000)

= ₹ 2,00,000 + ₹ 3,40,000 = ₹ 5,40,000.

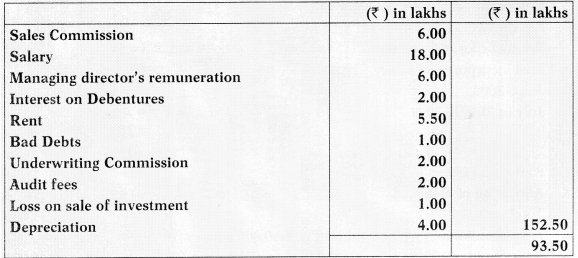

Question 15.

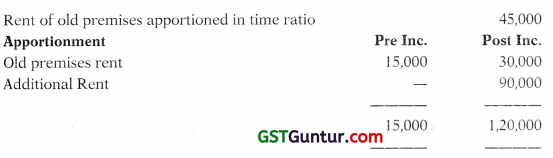

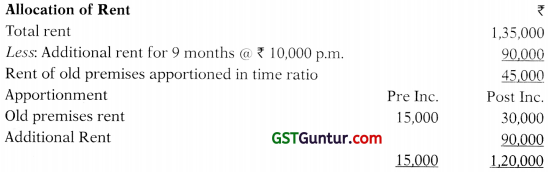

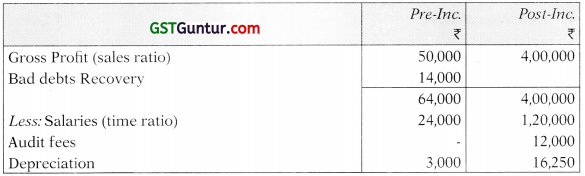

The partners of Shri Enterprises decided to convert the partnership firm into a Private Limited Company Shreya (P) Ltd. with effect from 1st January, 2008. However, company could be incorporated only on 1st June, 2008. The business was continued on behalf of the company and the consideration of ₹ 6,00,000 was settled on that day along with summarized profit and loss account:

Sales from June, 2008 to December, 2008 were 2‘/2 times of the average sales, which further increased to 3’/2 times in January to March quarter, 2009. The company recruited additional work force to expand the business. The salaries from July, 2008 doubled. The company also acquired additional showroom at monthly rent of ₹ 10,000 from July, 2008.

You are required to prepare a Profit and Loss Account showing apportionment of cost and revenue between pre-incorporation and post-incorporation periods. Also suggest how the pre-incorporation profits/losses are to be dealt with. (10 Marks) (Nov. 2010)

Answer:

Profit and Loss Account for 15 months ended 31st March, 2009

Working Notes:

1. Computation of sales ratio:

Let the average sales per month in pre-inoiporatiun period be x Average Sales

(Pre-incorporation) = x × 5 = 5x

Sales (Post-incorporation) from June to December, 2008 = 21/2x × 7 = 17.5x

From January to March. 2009 = 31/2 × 3 = 10.5x

Total Sales 28.0x

Sales ratio of pre-incorporation & post-incorporation is 5x: 28x

2. Computation of ratio for salaries

Let the average salary be x

Pre-incorporation salary x = x × 5 = 5x

Post incorporation salary

June, 2008 = x

July to March, 2009 = x × 9 × 2

= 18x

19x

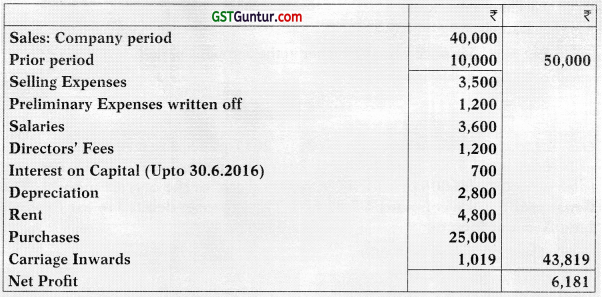

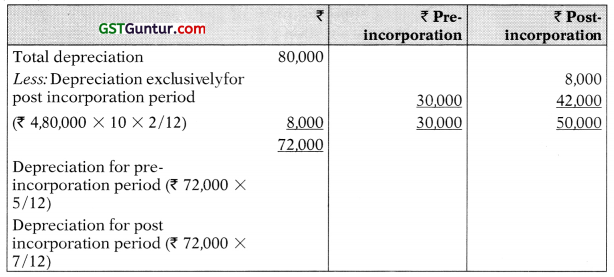

3.

4.

![]()

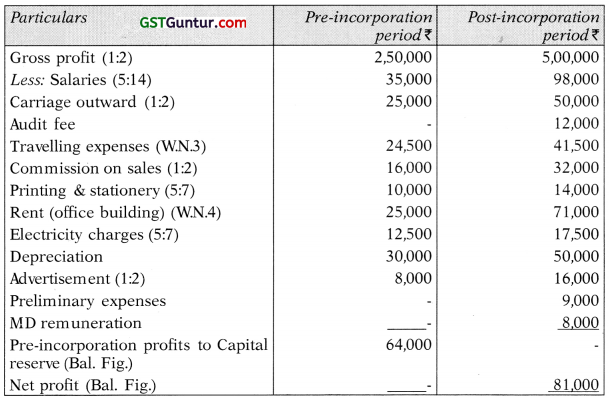

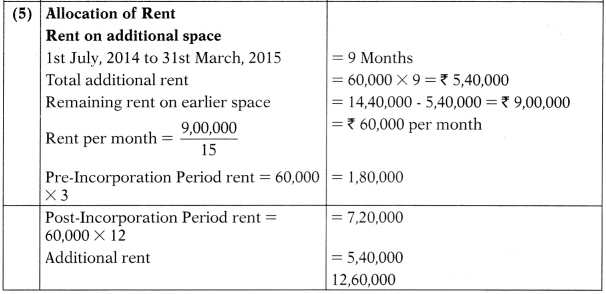

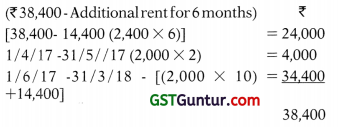

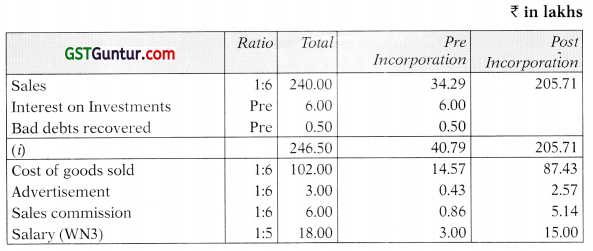

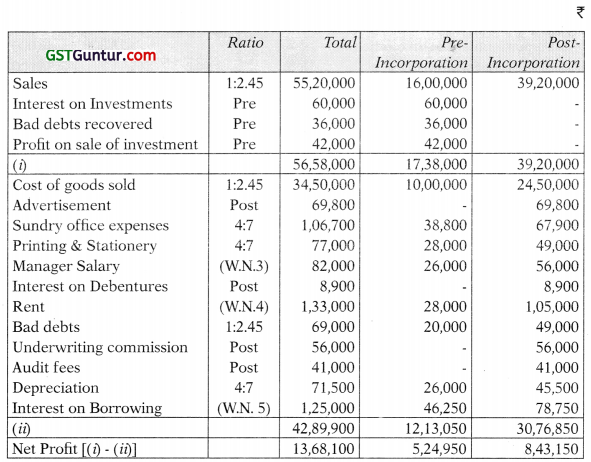

Question 16.

The partners Karnal and Vimal decided to convert their existing partnership business Into a Private Limited Company called M /s. KV Trading Private Ltd. with effect from 1-7-2014.

The same books of account were continued by the company which closed its account for first term on 31-3.2015.

The summarized Profit and Loss Account for the year ended 31-3-2015 is below:

The following additional information was provided:

- The average monthly sales doubled from 1-7-2014. GP ratio was constant.

- All investments were sold on 31-5-2014.

- Average monthly salary doubled from 1-10-2014.

- The company occupied additional space from 1-7-2014 for which rent of ₹ 20,000 per month was incurred.

- Bad debts recovered amounting to ₹ 50,000 for a sale made in 2012, has been deducted from bad debts mentioned above.

- Audit fees pertains to the company.

Prepare a statement apportioning the expenses between pre and post incorporation periods and calculate the Profit/Loss for such periods. Also suggest how the pre-incorporation profits are to be dealt with. (10 Marks) (May 2015)

Answer:

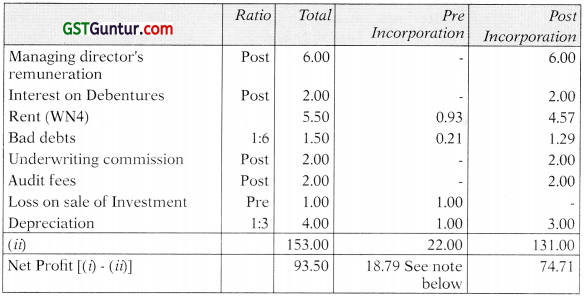

Statement showing computation of profit/loss for pre and post incorporation periods

Noie: ₹ 8.79 lakhs pre-incorporation profit is a capital profit and will be transferred to Capital Reserve.

Working Notes:

1. Computation of Sales Ratio

Let the average sales per month be x

Total sales from 01.04.2014 to 30.06.2014 will be 3x

Average sales per month from 01.07.2014 to 31.03.2015 will be 2x

Total sales from 01.07.2014 to 31.03.2015 will be 2x × 9 = 18x

Ratio of Sales will be 3x: 18x ie. 3:18 or 1:6

2. Computation of time ratio

Ratio 3 Months: 9 Months i.e. 1:3

3. Allocation of Salary

Let the salary per month from 01.04.2014 to 30.09.2014 is x

Salary per month from 01.10.2014 to 31.03.2015 will be 2x

Hence, pre-incorporation salary (01.04.2014 to 30.06.2014) = 3x

Post-incorporation salary from 01.07.2014 to 31.03.2015 = (3x + 12x) i.e.15x

Ratio for division 3x: 15x or 1:5

4.

![]()

Question 17.

Roshani & Reshma working in partnership, registered a joint stock company under the name of Happy Ltd. on May 31st 2016 to take over their existing business. The summarized Profit & Loss A/c as given by Happy Ltd. for the year ending 31st March, 2017 is as under:

Happy Ltd.

Profit & Loss A/c. for the year ending March 31, 2017

Prepare a Statement showing allocation of expenses & calculation of pre-incorporation & post-incorporation profits after considering the following information:

- GP ratio was constant throughout the year.

- Depreciation includes ₹ 1,250 for assets acquired in post incorporation period.

- Bad debts recovered amounting to ₹ 14,000 for a sale made in 2013-14 has been deducted from bad debts mentioned above.

- Total sales were ₹ 18,00,000 of which ₹ 6,00,000 were for April to September.

- Happy Ltd. had to occupy additional space from 1st Oct. 2016 for which rent was ₹ 2,400 per month. (8 Marks) (May 2017)

Answer :

Statement showing computation of profit/losses for pre and post incorporation periods

* Pre-incorporation profit will be transferred to Capital Reserve.

Working Notes:

(i) Computation of Sales ratio

Sales from April to September = ₹ 6,00,000 (1,00,000 p.m. on average basis)

Oct. to March = ₹ 12,00,000 (2,00,000 p.m. on average basis)

Thus, sales for pre-incorporation period = ₹ 2,00,000

post-incorporation period = ₹ 16,00,000

Sales are in the ratio of 1:8

(ii) Depreciation of ₹ 18,000 divided in the ratio of 1:5 (time basis) and ₹ 1,250 charged to post incorporation period.

(iii) Bad debt recovery of ₹ 14,000/- is allocated in pre-incorporation period, being sale made in 2013-14.

(iv) Rent

Question 18.

A partnership firm M/s. Nice Sons was carrying on business from 1st May, 2017. The partners of the firm decided to convert the partnership firm into a private company called Zenith (P) Ltd. with effect from 1st September, 2017. The annual accounts were drawn upto 31st March, 2018. The summarized Profit and Loss Account from 1st May, 2017 to 31st March, 2018 is as follows:

Additional information Provided:

- The company’s only borrowing was a loan of ₹ 15,00,000 at 9% p.a., to pay the purchase consideration due to the firm and for working capital requirements. The loan wras taken on 1st September, 2017.

- The company occupied additional space from 1st September, 2017 for which rent of ₹ 8,000 per month was incurred.

- Audit fee pertains to the company.

- Bad debts recovered amounting to ₹ 36,000 for a sale made in June 2017, has been deducted from bad debts mentioned above.

- All investments were sold in August 2017.

- Zenith (P) Ltd. initiated an advertising campaign on 1st September, 2017, which resulted increase in monthly average sales by 40%.

- The salary of Manager was increased by ₹ 3,000 p.m. from 1st July, 2017.

Prepare a statement showing pre-incorporation and post-incorporation profit for the year ended 31st March, 2018. (8 Marks) (May 2018)

Answer:

Statement showing computation of profit/loss for pre and post incorporation periods

Working Notes:

1. Computation of Sales Ratio

Let the average sales per month be x

Total sales from 01.05.2017 to 31.08.2017 will be 4x

Average sales per month from 01.09.2017 to 31.03.2018 will be 1.4x

Total sales from 01.09.2017 to 31.03.2018 will be 1.4x × 7 =9.8x

Ratio of Sales will be 4x: 9.8x =1:2.45

2. Computation of time Ratio

4 Months: 7 Months i.e. 4:7

3. Allocation of Manager Salary

4.

5. Allocation of Interest

Company’s Borrowing Interest = 3,15,00,000 × 9% × 7/12 = 3,78,750

Interest for Pre-incorporation period = 3,1,25,000 – 78,750 = 3,46,250