Redemption of Debentures – CA Inter Accounts Study Material is designed strictly as per the latest syllabus and exam pattern.

Redemption of Debentures – CA Inter Accounts Study Material

Important Notes:

- In every question where a mention is given w.r.t. D.R.R. we need to create 25% DRR on 18 day of the year

- Sinking Fund Investment is now called D.R. Fund Investments.

- Own Debentures concept has been deleted.

- Circumulative fund concept deleted. (Only non-circumulative concept is therefor exams) Thus, interest on fund invest forward to P&L A/c.

- Profit on cancellation of debentures will be transferred to P&L A/c.

- Premium on redemption of debentures transfered to P&L DR Fund

- Gain on sale of investments will be transfered to P&L.

Theory Questions

Question 1.

Noida Toll Bridge Corporation Ltd. (an infrastructure Company) issued 100 lakhs 10% Debentures of ₹ 100 each on 1st April, 2013 due for redemption on 31st March, 2014 at 10% Premium. How much minimum amount should be credited to Debenture Redemption Reserve as per the MCA clarification? Also state the amount required to be deposited/invested in the year of redemption. Record necessary entries for redemption of debentures. (RTP)

Answer:

According to Section 117C of Companies Act, where a company issues debenture after the commencement of this Act, it shall create a debenture redemption reserve for the redemption of such debentures, to which adequate amounts shall be credited, out of its profits every year until such debentures are redeemed.

Ministry of Corporate Affairs has made a clarification on adequacy of Debenture Redemption Reserve (DRR) vide Circular No. 04/2013, dated 11 February, 2013.

As per this clarification, adequacy of Debenture Redemption Reserve (DRR) for debentures issued by companies including manufacturing and infrastructure companies is 25% of the value of debentures issued through public issue. Therefore, minimum amount of DRR will be ₹ 25 crores i.e. 25% of 100 crores in the case of Noida Toll Bridge Corporation Ltd.

Further, every company required to create/maintain DRR shall before the 30th day of April of each year, deposit or invest, as the case may be, a sum which shall not be less than fifteen percent of the amount of its debentures maturing during the year ending on the 31 st day of March next following in any one or more of the following methods, namely:

(a) in deposits with any scheduled bank, free from charge or lien;

(b) in unencumbered securities of the Central Government or of any State Government;

(c) in unencumbered securities mentioned in clauses (a) to (d) and (ee) of section 20 of the Indian Trusts Act, 1882;

(d) in unencumbered bonds issued by any other company which is notified under clause (/) of section 20 of the Indian Trusts Act, 1882;

Accordingly, Noida Toll Bridge Corporation Ltd., have to deposit/invest ₹ 15 crores (100 × 15%) in any of the abovementioned categories.

![]()

Question 2.

Comment on adequacy of Debenture Redemption Reserve (DRR) w.r.t. following: Debentures issued by-

(i) All India Financial Institutions regulated by Reserve Bank of India and Banking Companies.

(ii) For other Financial Institutions within the meaning given in the Companies Act.

(iii) For debentures issued by NBFCs registered with the RBI.

(iv) For debentures issued by other companies including manufacturing and infrastructure companies. (4 Marks) (May 2015)

Answer:

| S.No. | Particulars | Adequacy of Debenture Redemption Reserve (DRR) |

| (i) | For debentures issued by All India Financial Institutions (AIFIs) regulated by Reserve Bank of India. | No DRR is required |

| (ii) | For other Financial Institutions (FIs) within the meaning given in the Companies Act. | 25% of the value of debentures issued through public issue.

No DRR is required in the case of privately placed debentures. |

| (iii) | For debentures issued by NBFCs registered with the RBI. | 25% of the value of debentures issued through public issue. No DRR is required in the case of privately placed debentures. |

| (iv) | For debentures issued by other companies including manufacturing and infrastructure companies. | For listed companies 25% of the value of debentures issued through public issue.

Also 25% DRR is required in the case of private placement of the value of debentures. |

![]()

Question 3.

Mention the ways by which Redeemable Debentures may be redeemed under the Companies Act, 2013. (4 Marks) (May 2016)

Answer:

Redemption of debentures must be done according to the terms of issue of debentures and any deviation will be treated as a default by the company.

Redemption by paying off the debt on account of debentures issued can be done in one of the following four methods viz

(a) By payment in lump sum at the end of a specified period of time;

(b) By payment in annual instalments;

(c) By purchasing its own debentures in the open market.

(d) By conversion into shares in full or in part depending on the terms of issue.

Question 4.

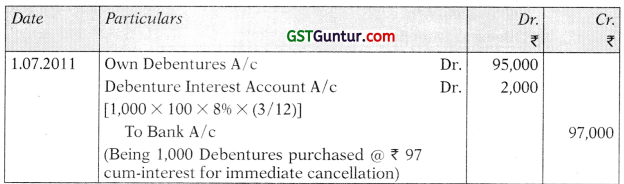

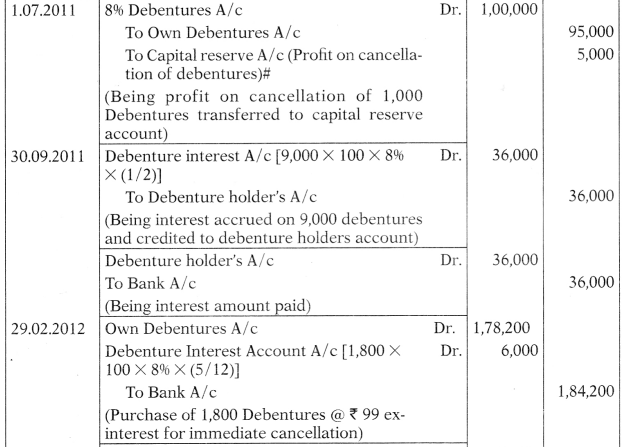

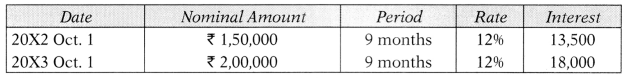

Himalayas Ltd. had ₹ 10,00,000, 8% Debentures of ₹ 100 each as on 31st March, 2011. The company purchased in the open market following debentures for immediate cancellation:

On 01-07-2011 – 1,000 debentures @ ₹ 97 (cum-interest)

On 29-02-2012 – 1,800 debentures @ ₹ 99 (ex-interest)

Debenture interest due date is 30th September and 31st March.

Give Journal Entries in the books of the company for the year ended 31st March, 2012. (8 Marks) (Nov. 2012)

Answer:

Journal Entries

![]()

Open Market Purchase – Own Debentures Only

Question 5.

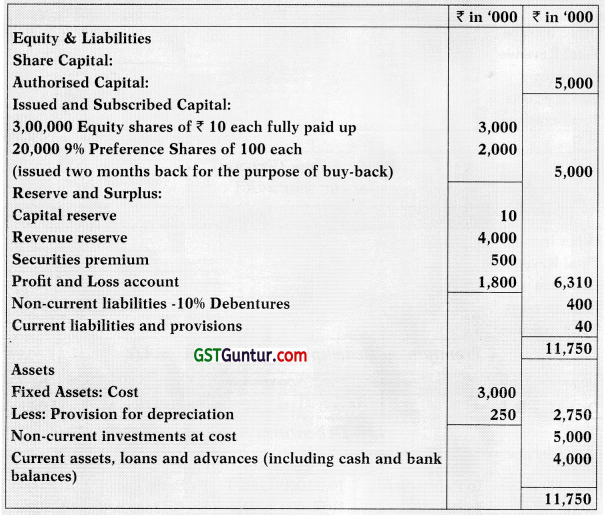

- X Ltd. has issued 10,000 12% Debentures of ₹ 700 each on 1-1-20X1. These debentures are redeemable after 3 years at a premium of ₹ 5 per debenture. Interest is payable annually.

- On October 1, 20X2, it buys 1,500 debentures from the market at ₹ 98 per debenture. These are sold away on June 30, 20X3 at ₹ 705 per debenture.

- On January 1, 20X3 it buys 1,000 debentures at ₹ 104 per debenture from the open market. These are cancelled on April 1, 20X3.

- On October 1, 20X3 it buys 2,000 debentures at ₹ 106 per debenture from the open market. These debentures along with other debentures are redeemed on 31st December, 20X3.

Prepare the relevant Ledger Accounts showing the above transactions. Workings should form part of your answer. Also show the extracts of statement of profit & loss own Debenture Account for the year 20X1, 20X2, 20X3.

(Note : This concept has been deleted for Nov. 2019 attempt. Please wait for clarification for May 2020 attempt. Thus, the section has been retained.)

Answer:

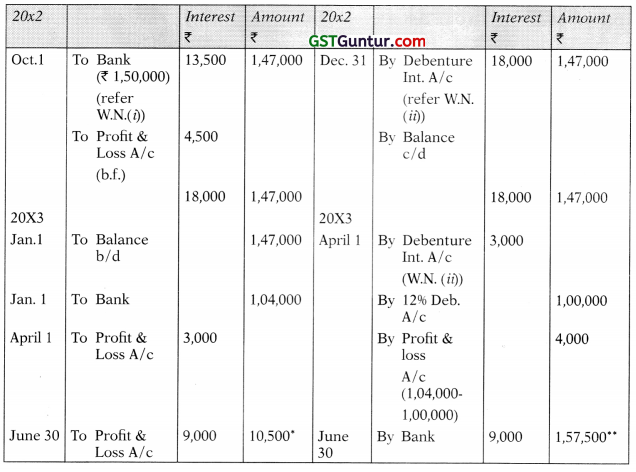

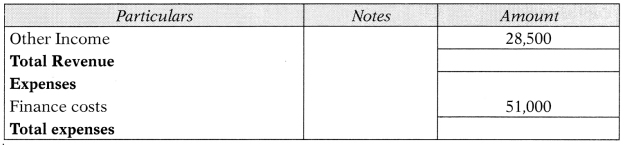

Own Debentures A/c

* 1,57,500 – 1,47,000

** 1,500 × 105

Assumption:

All transactions are ex-interest.

Debenture Interest A/c

* (10,000- 1,000 – 2,000) × 100

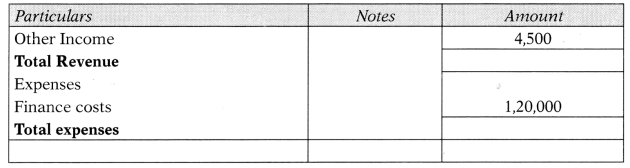

Profit & Loss (Extract) for the year 20X1

Profit & Loss (Extract) for the year 20X2

Profit & Loss (Extract) for the year 20X3

Premium on Redemption of Debentures A/c

12% Debentures A/c

Working Notes

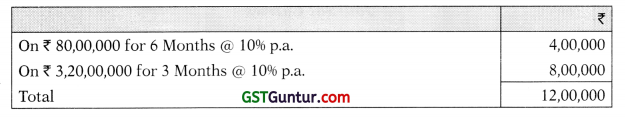

(i) Interest paid on purchase of own debentures:

(ii) Interest credited to Interest on Own Debenture A/c

![]()

Question 6.

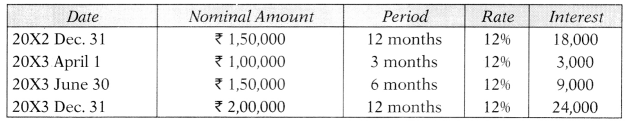

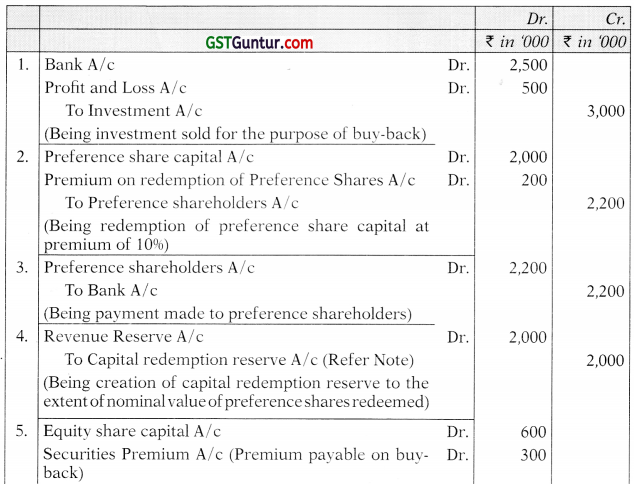

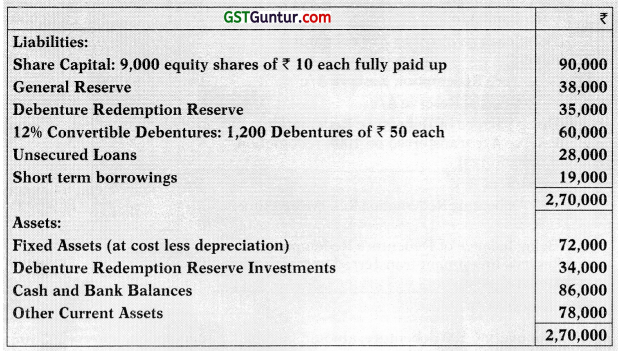

M Ltd. furnishes the following summarized Balance Sheet as at 31st March, 2012:

- The company passed a resolution to buy-back 20% of its equity capital @ ₹ 15 per share. For this purpose, it sold its investments of ₹ 30 lakhs for ₹ 25 lakhs.

- The company redeemed the preference shares at a premium of 10% on 1st April, 2012.

- Included in its investments were ‘Investments in own debentures’ costing ₹ 3 lakhs (face value ₹ 3.30 lakhs). These debentures were cancelled on 1st April, 2012.

You are required to pass necessary Journal entries and prepare the Balance Sheet on 01.04.2012. (12 Marks) (Nov. 2012)

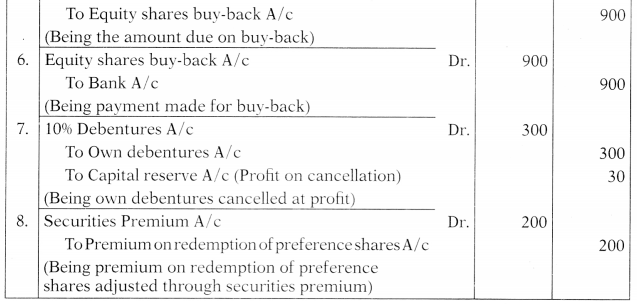

Answer:

Journal Entries

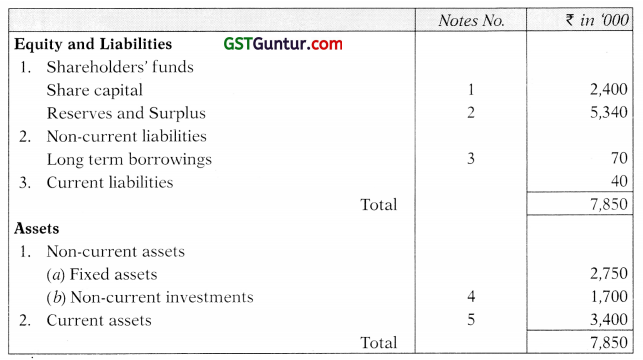

Balance Sheet as on 1st April, 2012

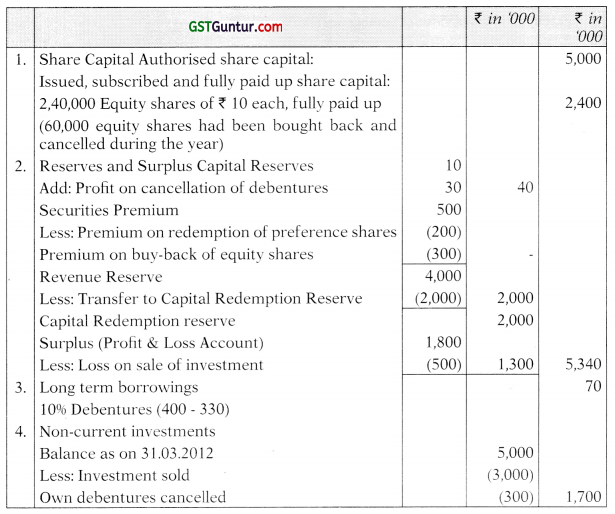

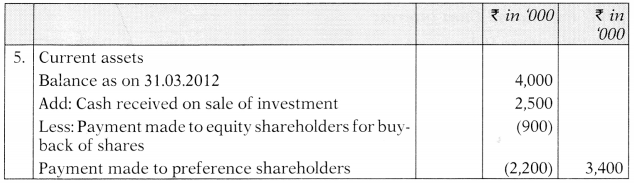

Notes to Accounts

Assumption:

The buy-back of shares has been done out of the proceeds of issue of preference shares, therefore, no amount is transferred to capital redemption reserve for buy-back.

![]()

Question 7.

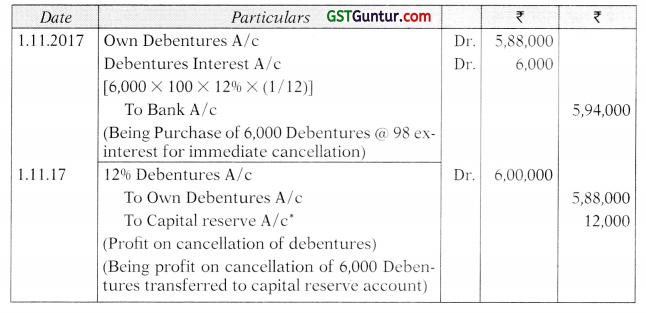

Gurudev Limited purchases for immediate cancellation 6,000 of its own 12% debentures of ₹ 100 each on 1st November, 2017. The dates of interest being 31st March, and 30th September. Pass necessary journal entries relating to the cancellation if: (4 Marks) (May 2018)

(i) Debentures are purchased at ₹ 98 ex-interest.

(ii) Debentures are purchased at ₹ 98 cum-interest.

Answer:

Journal Entries

(i) If Purchased Ex-interest

(ii) If Put chased Cum interest

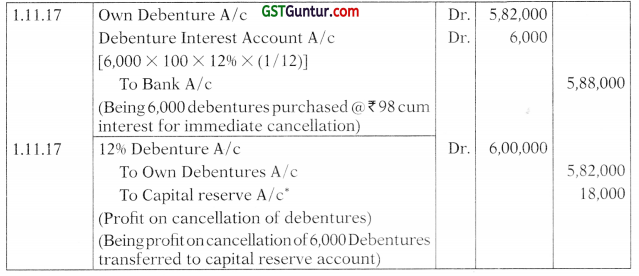

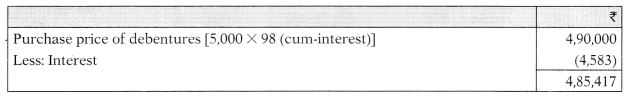

Question 8.

Rama Limited issued 8% Debentures of ₹ 3,00,000 in earlier year on which interest is payable half yearly on 31st March and 30th September. The company has power to purchase its own debentures in the open market for cancellation thereof. The following purchases were made during the financial year 2009-10 and cancellation made on 31st March, 2010:

(a) On 1st April, ₹ 50,000 nominal value debentures purchased for ₹ 49,450, ex-interest.

(b) On 1st September, ₹ 30,000 nominal value debentures purchased for ₹ 30,250 cum-interest.

Show the Journal Entries (without narrations) for the transactions held in the year 2009-10. (2 Marks) (Nov. 2010)

Answer:

Journal Entries

![]()

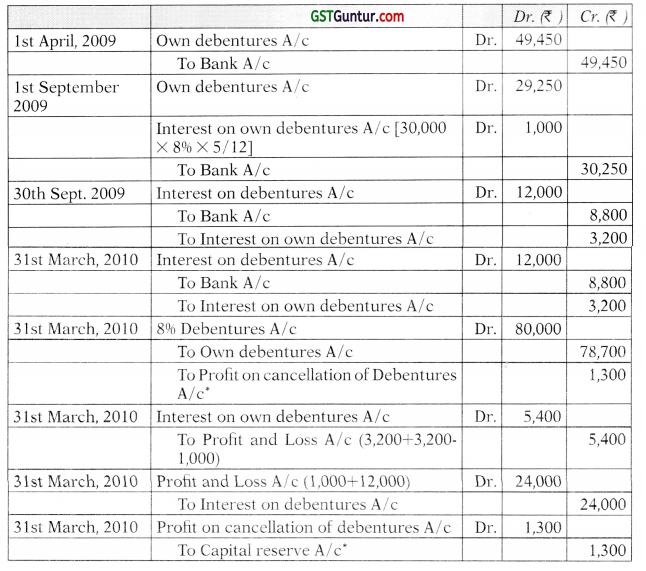

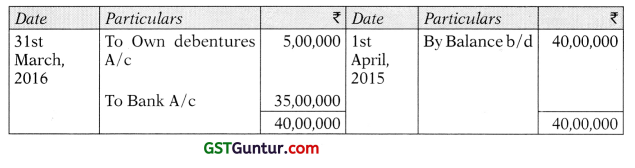

Question 9.

On 1 st April, 2010, A Ltd. had outstanding in its books 1,00,000 Debentures of f 100 each, interest @ 12% per annum. The interest on debentures was paid half-yearly on 30th September and 31st March of every year. On 31st May, 2010 the company purchased 30,000 Debentures of its own @ ₹ 98 (ex-interest) per debenture. The company cancelled the debentures so purchased on 31st March, 2011.

Pass the necessary Journal Entries to record the above transactions for the year ended 31st March, 2011. (5 Marks) (Nov. 2011)

Answer:

In the books of ‘A’ Limited

Journal Entries

![]()

Outside Investments Only

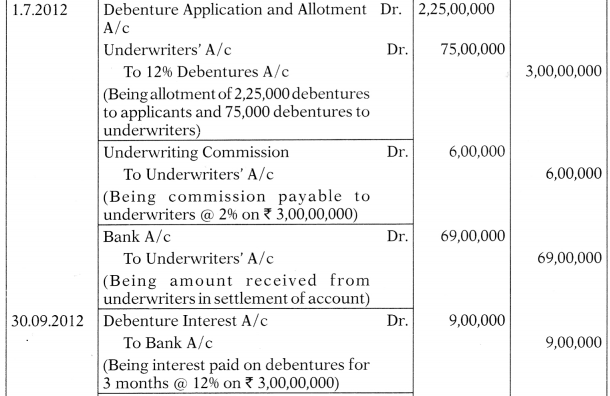

Question 10.

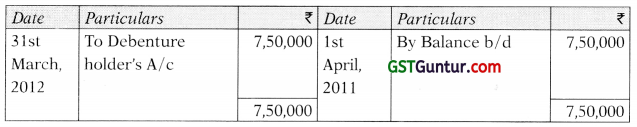

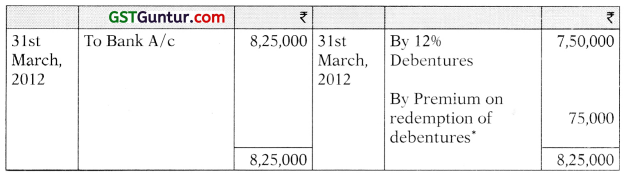

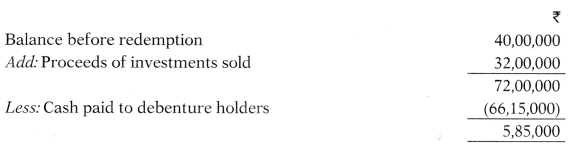

The following balances appeared in the books of Paradise Ltd on 1 -4-2011:

(i) 12% Debentures ₹ 7,50,000

(ii) Balance of Sinking Fund ₹ 6,00,000

(iii) Sinking Fund Investment ₹ 6,00,000 represented by 10% ₹ 6,50,000 secured bonds of Government of India.

Annual contribution to the Sinking Fund was ₹ 1,20,000 made on 31st March each year. On 31-3-2012, balance at bank was ₹ 3,00,000 before receipt of interest. The company sold the investment at 90%, for redemption of debentures at a premium of 10% on the above date.

You are required to prepare the following accounts for the year ended 31st March, 2012: (8 Marks) (May 12)

(1) Debentures Account

(2) Sinking Fund Account*

(3) Sinking Fund Investment Account**

(4) Bank Account

(5) Debenture Holders Account

Answer:

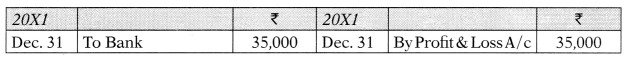

12% Debentures A/c

Sinking Fund A/c

Sinking Fund Investment A/c (10% Secured Bonds of Govt.)

Bank A/c

‘The Oues, is based on cumulative concept. Had it been solved as per non-cumulative concept if would have been transfer to Profit & Loss A/c.

Debenture holders A/c

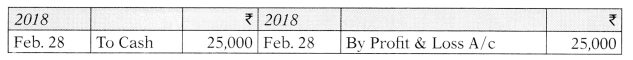

Question 11.

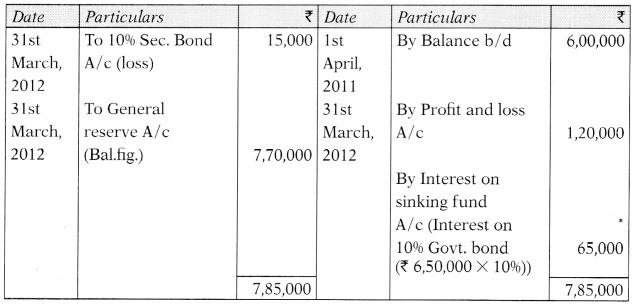

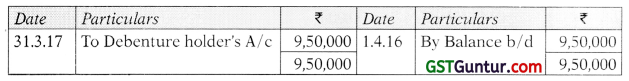

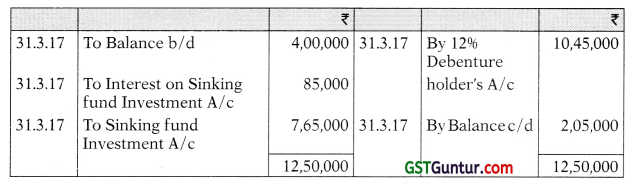

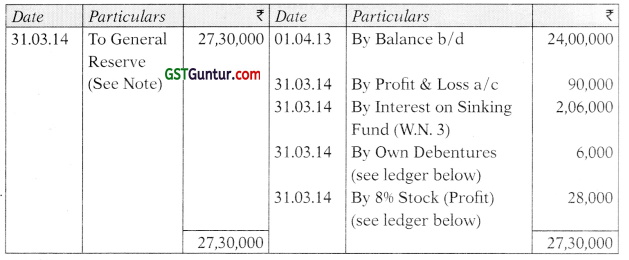

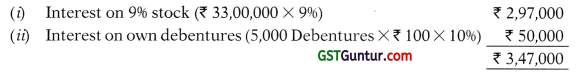

The following balances appeared in the books of Heaven Ltd. on 1st April, 2016:

- 12% Debentures ₹ 9,50,000;

- Balance of Sinking Fund ₹ 8,00,000

- Sinking Fund Investment ₹ 8,00,000 represented by 10% ₹ 8,50,000 Secured Bonds of Government of India.

Annual contribution to the Sinking Fund was ₹ 1,50,000 made on 31st March every year. On 31st March, 2017, balance at bank was ₹ 4,00,000 before receipt of interest. The company sold the 90% face value of its investments, for redemption of debentures, at a premium of 10% on the above date.

You are required to prepare the following accounts for the year ended on 31st March, 2017: (8 Marks) (Nov. 2017)

(a) Debentures Account;

(b) Sinking Fund Account;

(c) Sinking Fund Investment Account;

(d) Bank Account; and

(e) Debenture Holders Account.

Answer:

Debentures A/c

Sinking Fund A/c

Sinking Fund Investment A/c (10% Secured Bonds of Govt.)

Bank A/c

Debenture holders’ A/c

![]()

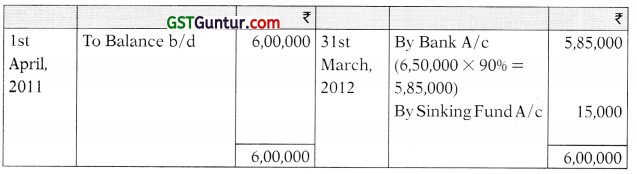

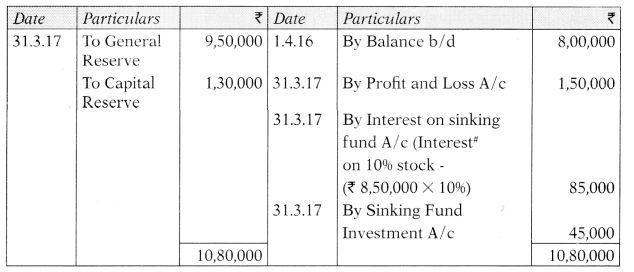

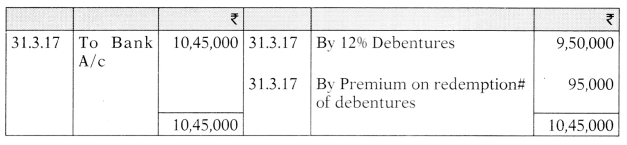

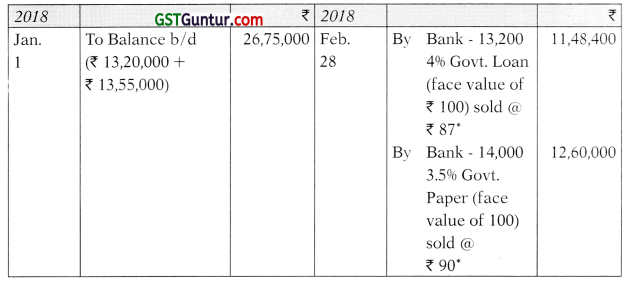

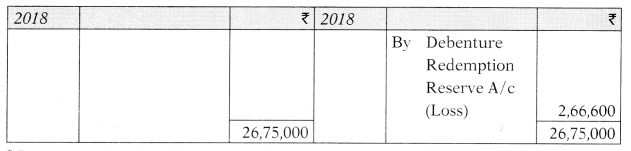

Question 12.

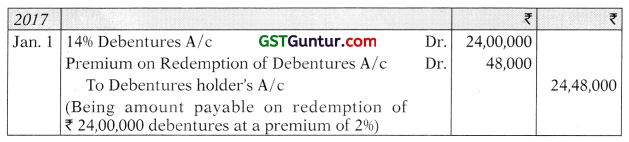

The following balances appeared in the books of a company as on December 31 st, 2017, 6% Mortgage 25,000 Debentures of ₹ 100 each. Debenture Redemption Reserve (for redemption of debentures) ₹ 26,05,000.

The following were the investments:

(i) ₹ 13,20,000, 4% Government Loan purchased at par (face value of ₹ 100 each)

(ii) ₹ 14,00,000, 31/2% Government paper purchased for ₹ 13,55,000 (face value of 100 each)

The interest on debentures had been paid up to December 31st, 2017.

On February 28th, 2018, the investments were sold at ₹ 87 and ₹ 90 respectively and the debentures were paid off at ₹ 101 together with accrued interest.

Write up the ledger accounts concerned.

Note: The Debenture Redemption Reserve is non-cumulative. (8 Marks) (May 2018)

Answer:

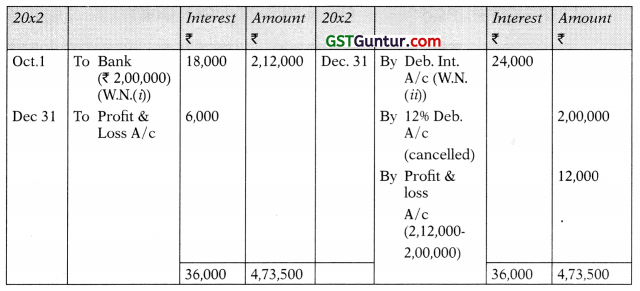

6% Debentures A/c

Premium on Redemption of Debentures A/c

Debentures Redemption Reserve Investment A/c

* Interest on investments on ₹ 13,20,000 (4% Govt. Loan) and ₹ 14,00,000 (3.5% Govt. Paper) not considered.

Debenture Interest A/c

Debenture Redemption Reserve A/c

![]()

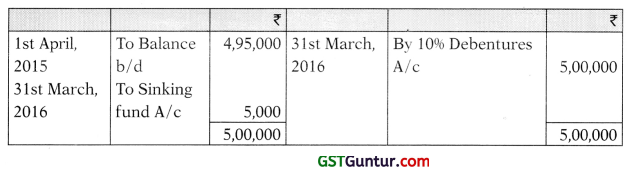

Question 13.

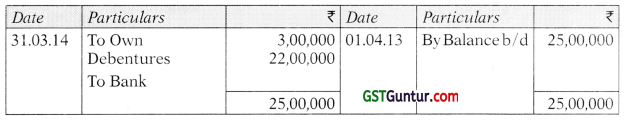

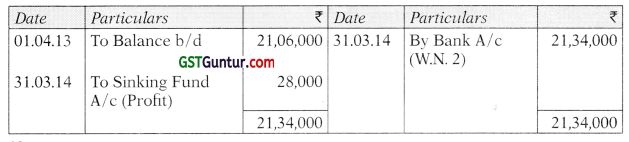

ZED Ltd. had 25,000, 10% Debentures of ₹ 100 each outstanding as on 1st April, 2013, redeemable on 31st March, 2014. On 1st April, 2013, Sinking Fund was ₹ 24 lakhs represented by 3,000 own Debentures purchased at the average price of ₹ 98 and 8% Stocks of face value of ₹ 22 lakhs. The annual instalment towards Sinking Fund was ₹ 90,000.

On 31st March, 2014, the investments w ere realized at ₹ 97 and the Debentures were redeemed.

Draw the following Accounts for the year ended 31st March, 2014: (8 Marks) (May 2014)

(i) 10% Debenture Account,

(ii) Debenture Redemption Sinking Fund Account, *

(iii) Show the necessary working notes.

*Now called DRR A/c.

Answer:

10% Debentures A/c

Debenture Redemption Sinking Fund A/c

Working Notes:

1. Stock as on 1st April, 2013

Sinking Fund Balance as on 1st April, 2013 – ₹ 24,00,000

Less: Own Debentures – ₹ 2,94,000

8% Stock – ₹ 21,06,000

2. Sale Value of 8% Stock

Number of Stock = ₹ 22 lakhs/ ₹ 100 = 22,000

Sale Value = 22,000 × ₹ 97 = ₹ 21,34,000

3. Interest credited to Sinking Fund Account*

Own Debentures A/c

8% Stock Account

Note:

As the balance of Debenture Redemption Sinking Fund Account is more than the nominal value of debentures redeemed, the amount equal to the amount of debentures redeemed may be transferred to General Reserve Account Le. ₹ 25,00,000 and excess of fund Le. ₹ 2,30,000 may be transferred to P&L Account.

![]()

Question 14.

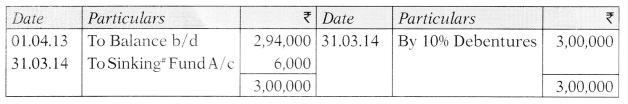

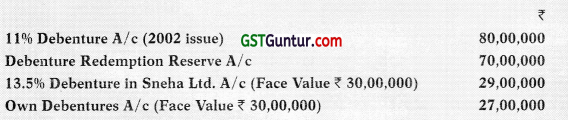

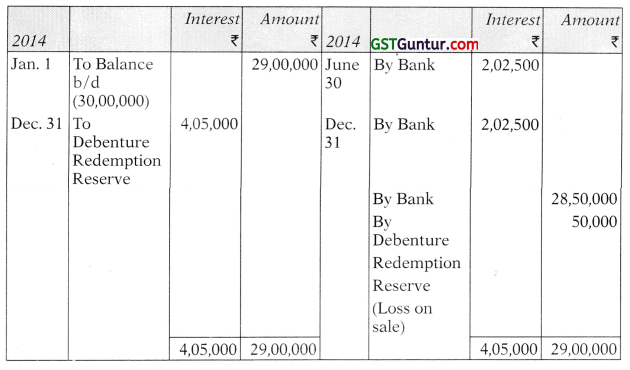

M/s. Piyush Ltd. had the following among their ledger opening balances on January 1, 2014;

As 31st December, 2014 was the date of redemption of the 2002 debentures, the company started buying own debentures and made the following purchases in the open market:

1-2-2014 – 5000 debentures at ₹ 98 cum-interest

1-6-2014 – 5000 debentures at ₹ 99 ex-interest.

Half yearly interest is due on the debentures on 30th June and 31st December in the case of both the companies.

On 31st December, 2014, the debentures in Sneha Ltd. were sold for ₹ 95 each ex-interest. On that date, the outstanding debentures of M/s. Piyush Ltd. were redeemed by payment and by cancellation.

Show the entries in the following ledger accounts of M/ s. Piyush Ltd. during 2014:

(i) Debenture Redemption Reserve Account,

(ii) Own Debenture Account.

The face value of a debenture was ₹ 100. (12 Marks) (May 2015)

Answer:

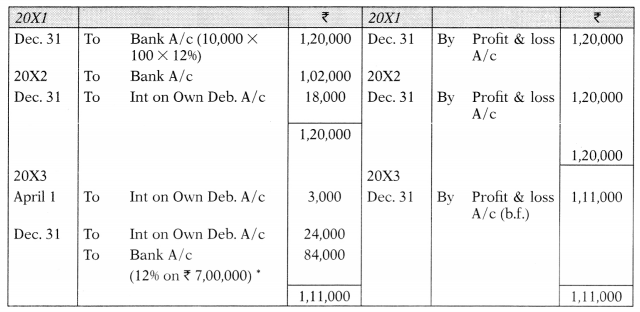

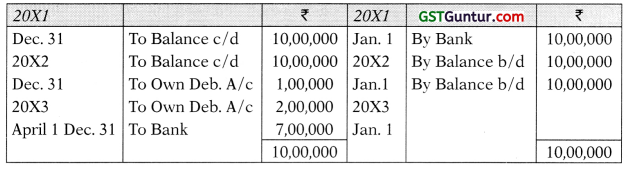

(i) Debenture Redemption Reserve A/c

(ii) Own Debentures A/c

Working Note:

13.5% Debentures A/c in Sneha Ltd.

11% Debentures A/c

Cost of debentures purchased on 1.2.2014

![]()

Question 15.

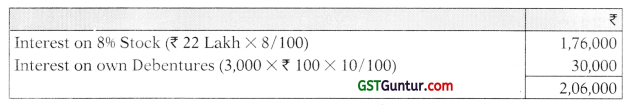

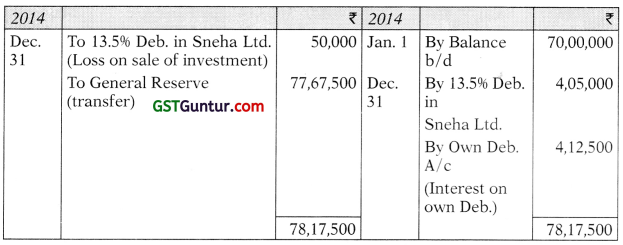

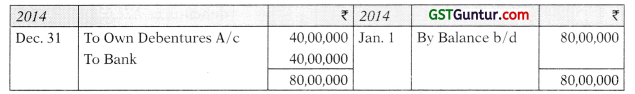

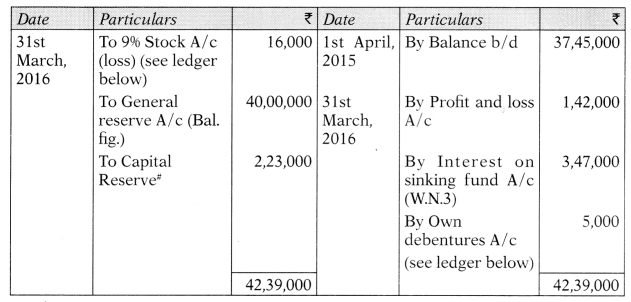

A company had 40,000; 10 debentures of 100 each outstanding on 1 April, 2015 redeemable on 31st March, 2016.

On that day, sinking fund was ₹ 37,45,000 represented by 5,000 own debentures purchased at average price of f 99 and 9% stocks of the face value of ₹ 33,00,000. The annual instalment was ₹ 1,42,000. On 31 st March, 2016, the investments were realized at ₹ 98 and the debentures were redeemed.

Draw the following accounts for the year ending 31st March, 2016:

(i) 10% Debentures Account.

(ii) Debenture Redemption Sinking Fund Account (10 Marks) (Nov. 2016)

Answer:

10% Debentures A/c

Debenture Redemption Sinking Fund A/c

Working Notes:

1. Amount of stock as on 1st April, 2015

2. Sales value of 9% stock

= Face vaIue/ per stock

= ₹ 33,00,000/ ₹ 1oo = 33,000 stock

Sales value = 33,000 stock × ₹ 98 per stock

= ₹ 32,34,000

3. Interest credited to Sinking Fund

Own Debentures A/c

9% Stock A/c

![]()

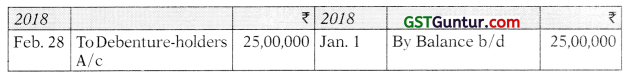

Question 16.

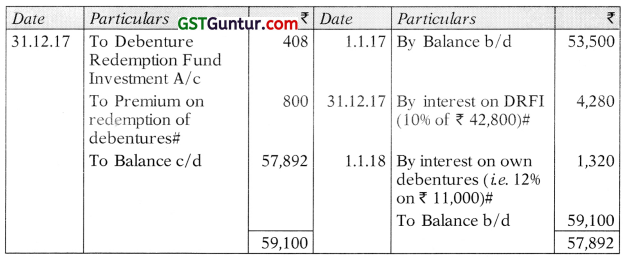

A Company had issued 1,000 12% debentures of ₹ 100 each redeemable at the company’s option at the end of 10 years at par or prior to that by purchase in open market or at ₹ 102 after giving 6 months’ notice. On 31st December, 2016, the accounts of the company showed the following balances:

Debenture redemption fund ₹ 53,500 represented by 10% Govt. Loan of a nominal value of ₹ 42,800 purchased at an average price of ₹ 101 and ₹ 10,272 uninvested cash in hand.

On 1st January 2017, the company purchased ? 11,000 of its own debentures at a cost of ₹ 10,272.

On 30th June, 2017, the company gave a six months’ notice to the holders of ₹ 40,000 debentures and on 31st December, 2017 carried out the redemption by sale of ₹ 40,800 worth of Govt. Loan at par and also cancelled the own debentures held by it.

Prepare ledger account of Debenture Redemption Fund Account and Debenture Redemption Fund Investment Account for the year ended 31.12.2017, assuming that, interest on company debentures & Govt, loan was payable on 31st December every year. (8 Marks) (November 2018)

Answer:

Debenture Redemption Fund A/c

Debenture Redemption Fund Investment A/c

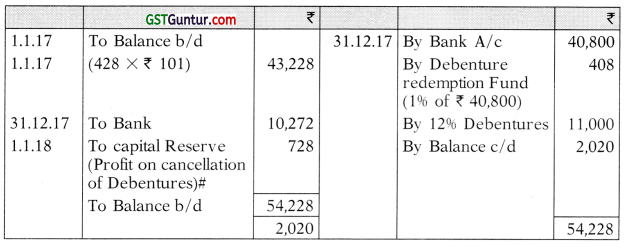

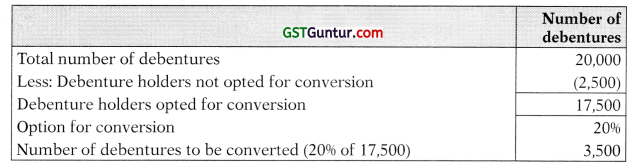

Question 17.

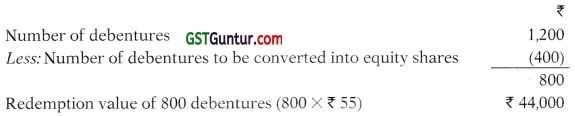

A Company had issued 20,000, 13% Convertible debentures of ₹ 100 each on 1st April, 2007. The debentures are due for redemption on 1st July, 2009. The terms of issue of debentures provided that they were redeemable at a premium of 5% and also conferred option to the debenture holders to convert 20% of their holding into equity shares (Nominal value ? 10) at a price of ₹ 15 per share. Debenture holders holding 2,500 debentures did not exercise the option. Calculate the number of equity shares to be allotted to the Debenture holders exercising the option to the maximum. (2 Marks) (May 2010)

Answer:

Computation of number of equity shares to be allotted

Redemption value of 3,500 debentures at a premium of 5% ₹ 3,67,500

[3,500 × ( 100 + 5)]

Equity shares of ₹ 10 each issued on conversion [₹ 3,67,500/₹ 15] = 24,500 shares

![]()

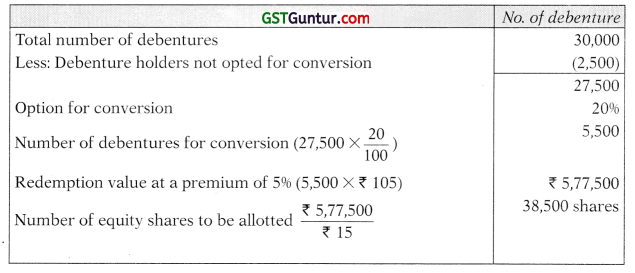

Question 18.

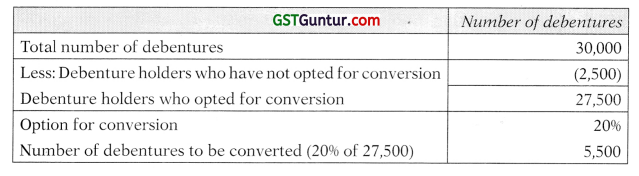

XYZ Ltd. had issued 30,000, 15% convertible debentures of ₹ 100 each on 1st April, 2008. The debentures are due for redemption on 1st March, 2011. The terms of issue of debentures provided that they were redeemable at a premium of 5% and also conferred option to the debenture holders to convert 20% of their holding into equity shares (Nominal Value ₹ 10) at a price of ₹ 15 per share. Debenture holders holding 2500 debentures did not exercise the option. Calculate the number of equity shares to be allotted to the Debenture holders exercising the option to the maximum. (4 Marks) (May 2011)

Answer:

Computation of number of equity shares allotted to be debenture holders

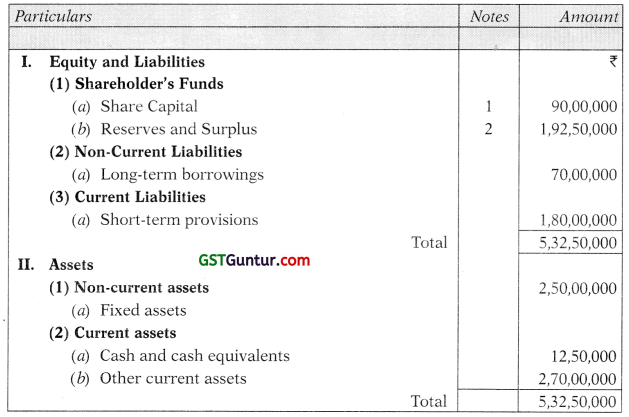

Question 19.

A company had issued 30,000,14% convertible debentures of ₹ 100 each on 1st April, 2014. The debentures are due for redemption on 1st July, 2016. The terms of issue of debentures provided that they were redeemable at a premium of 5% and also conferred option to the debenture holders to convert 20% of their holding into equity shares (Nominal value ₹ 10) at a price of ₹ 15 per share. Debenture holders holding 2,500 debentures did not exercise the option. Calculate the number of equity shares to be allotted to the debenture holders exercising the option to the maximum. (4 Marks) (May 2017)

Answer:

Computation of number of equity shares to be allotted

Redemption value of 5,500 debentures at a premium of 5% [5,500 × (100 + 5)] – ₹ 5,77,500

Equity shares of ₹ 10 each issued on conversion [₹ 5,77,500/₹ 15] – 38,500 shares

![]()

Redemption By Conversion And Cash

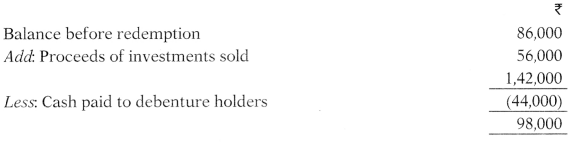

Question 20.

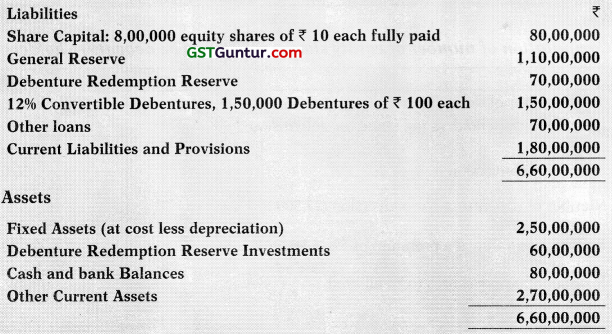

The summarised Balance Sheet of A Limited, as on 30th June, 2014, stood as follows:

The debentures are due for redemption on 30th June, 2014. The terms of issue of debentures provided that they were redeemable at a 10% premium and also conferred option to the debenture holders to convert 25% of their holding into equity shares at a predetermined price of ₹ 27.50 per share and the balance payment in cash.

Assuming that:

- except for 80 debenture holders holding totally 50,000 debentures, the rest of them exercised the option for maximum conversion.

- the investments realise ₹ 70 lakhs on sale; and

- all the transactions are put through, without any lag, on 30th June, 2014.

Redraft the balance sheet of the company as on 30th June, 2014 after giving effect to the redemption. Show your calculations in respect of the number of equity shares to be allotted and the cash payment necessary. (RTP)

Answer:

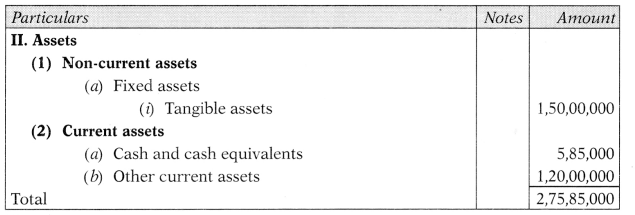

Balance Sheet as on June 30, 2014

Notes to Accounts

Working Notes:

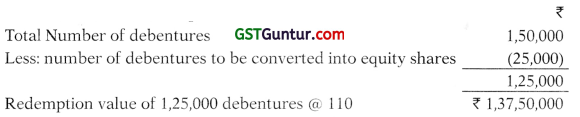

(i) Calculation of number of shares to be allotted:

Redemption value of 25,000 debentures @ 110 ₹ 27,50,000

Number of Equity Shares to be allotted:

= \(\frac{27,50,000}{27.50}\) = 1,00,000 shares of ₹ 10 each.

(ii) Calculation of cash to be paid:

(iii) Cash and Bank Balance:

![]()

Question 21.

M Ltd. have authorized capital of 8,00,000 equity shares of ₹ 10 each. But out of these 2,40,000 shares have been issued as fully paid.

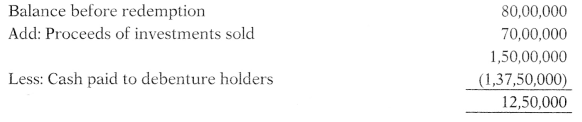

The company has an outstanding 14% Debentures loan of ₹ 24,00,000 redeemable at 102 per cent and interest has been paid up to date on December 31, 2016. On that date, the balance of the Debenture Redemption Reserve Account is ₹ 20,00,000 and corresponding Investment Account ₹ 29,00,000 (at cost) of which the market value is ₹ 18,00,000.

The directors resolved to redeem the Debentures on January 1, 2017 and the holders are given an option to receive payment either wholly in cash or wholly in fully paid equity shares @ 8 shares for every ₹ 100 of debentures.

75% of the holders decided to exercise the option for taking shares in repayment and cash for the rest is procured by realizing an adequate amount of investment at the prevailing market value.

Draw up journal entries (including Cash Book Entries) to give effect to the above transactions. (RTP)

Answer:

Journal Entries

Working Notes:

(1) For every ₹ 100 debenture, amount payable on redemption including premium is ₹ 102

Less: Face value of 8 shares of ₹ 10 each to be issued for redemption of each debenture (8 × ₹ 10) – ₹ 80

Premium on issue of 8 shares – ₹ 22

Therefore, premium on issue of each share ₹(\(\frac{22}{8}\)) – ₹ 2.75

(2) Shares to be issued for conversion of 75% Debentures into × shares @ 8 shares for every ₹ 100 Debenture i.e. ₹ 24,00,000

\(\frac{75}{100}\) × \(\frac{8}{100}\) = 1,44,000 shares

(3) Cash payment for remaining 25% debenture holders who exercised the option of cash i.e., ₹ 24,00,000 \(\frac{25}{100}\) × \(\frac{102}{100}\)

= ₹ 6,12,000

(4) Face value of investment to be sold to realize ₹ 6,12,000 will be ₹ 6,80,000 [ i.e. ₹ \(\frac{20,00,000}{18,00,000}\) × ₹ 6,12,000)

Loss on sale of investment = 6,80,000 – 6,12,000 = 68,000

(5) Debenture Redemption Reserve transferred to General Reserve:

20,00,000 – 48,000 – 68,000 = ₹ 18,84,000

![]()

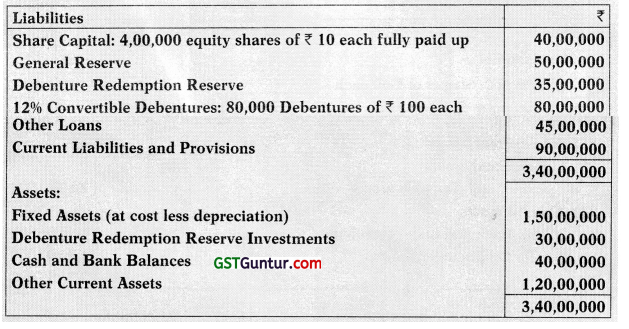

Question 22.

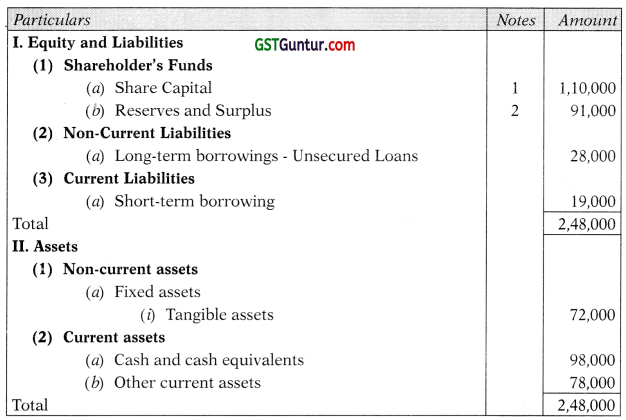

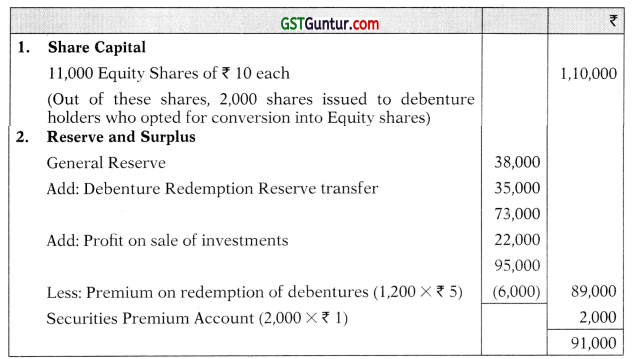

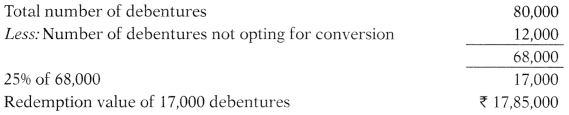

The summarized Balance Sheet of S Ltd. as on 31st March, 2018 read as under:

The debentures are due for redemption on 1st April, 2018. The terms of issue of debentures provided that they were redeemable at a premium 10% and also conferred option to the debenture holders to convert 40% of their holding into equity shares at a predetermined price of ₹ 11 per share and the balance payment in cash.

Assuming that:

- Except for debenture holders holding 200 debentures in aggregate, rest of them exercised the option for maximum conversion,

- The investments realized ₹ 56,000 on sale,

- All the transactions were taken place on 1st April, 2018,

- Premium on redemption of debentures is to be adjusted against General Reserve. You are required to

(a) Redraft the Balance Sheet of S Ltd. as on 01.04.2018 after giving effect to the redemption.

(b) Show your calculations in respect of the number of equity shares to be allotted and the cash payment necessary. (RTP)

Answer:

Balance Sheet as on 01.04.2018

Notes to Accounts

Working Notes:

(i) Calculation of number of shares to be allotted

(ii) Calculation of cash to be paid

(iii) Cash and Bank Balance

![]()

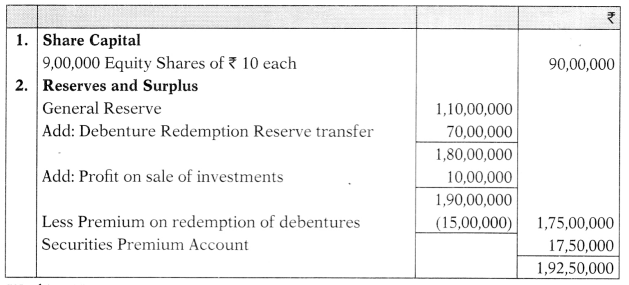

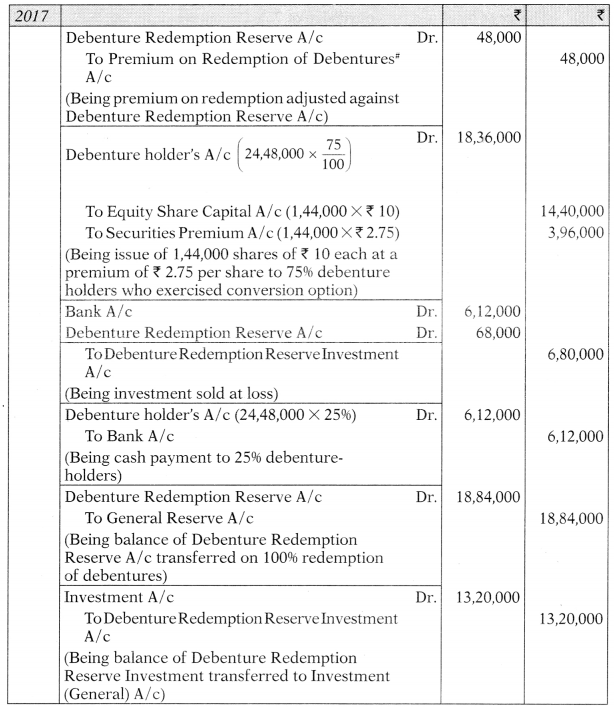

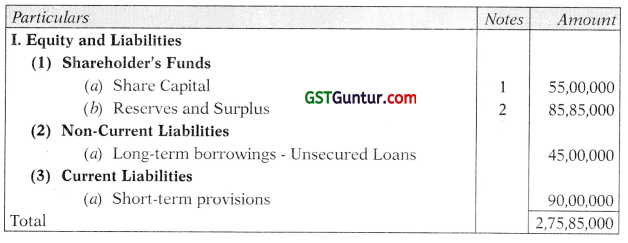

Question 23.

The summarized Balance Sheet of Entyce Ltd. as on 31st March, 2013 read as under:

The debentures are due for redemption on 1st April, 2013. The terms of issue of debentures provided that they were redeemable at a premium 5% and also conferred option to the debenture holders to convert 25% of their holding into equity shares at a pre-determined price of ₹ 11.90 per share and the balance payment in cash.

Assuming that:

- Except for debenture holders holding 12,000 debentures in aggregate, rest of them exercised the option for maximum conversion,

- The investments realized 32,00,000 on sale,

- All the transactions were taken place on 1st April, 2013 without any lag, and

- Premium on redemption of debentures is to be adjusted against General Reserve.

Redraft the Balance Sheet of Entyce Ltd. as on 01.04.2013 after giving effect to the redemption. Show your calculations in respect of the number of equity shares to be allotted and the cash payment necessary. (8 Marks) (Nov. 2013)

Answer:

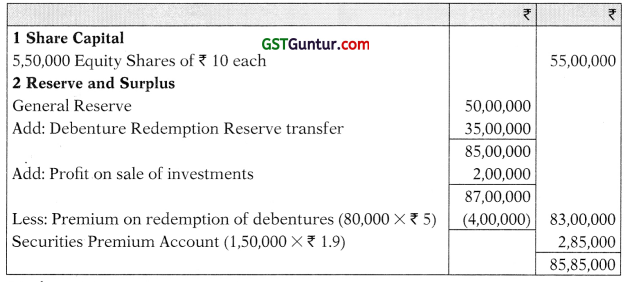

Balance Sheet as on 01.04.2013

Notes to Accounts

Working Notes:

(i) Calculation of number of shares to be allotted

Number of Equity Shares to be allotted:

\(\frac{17,85,000}{11.90}\)

= 1,50,000 shares of ₹ 10 each.

(ii) Calculation of cash to be paid

(iii) Cash and Bank Balance

![]()

Open Market Purchase – Own Debentures And Outside Investments

Question 24.

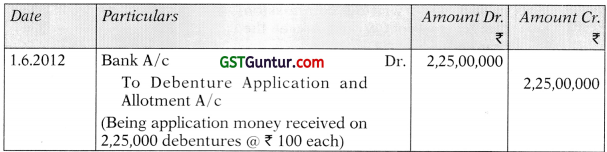

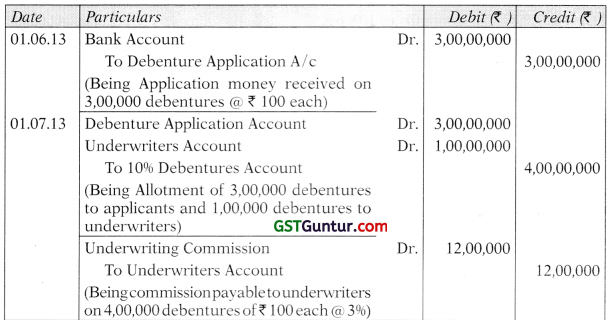

M Limited recently made a public issue of debentures. The following information is available in respect of the issue:

- 3,00,000 partly convertible debentures of face value and issue price of ₹ 100 per debenture were issued;

- Conversion of 50% of each debenture is to be done on expiry of 6 months from date of close of issue;

- Date of closure of subscription list is 1st June, 2012. Date of allotment is 1st July, 2012;

- Interest on debenture at the rate of 12% is payable from date of allotment;

- Equity share of ₹ 10 each are issued at ₹ 50 per share for the purpose of conversion;

- Underwriting commission is 2%;

- 2,25,000 debentures were applied for;

- Interest on debentures is payable half yearly on 30th September and 31st March.

Give Journal entries for all transactions relating to the above, including cash and bank entries for the year ended 31st March, 2013. (8 Marks) (Nov. 2013)

Answer:

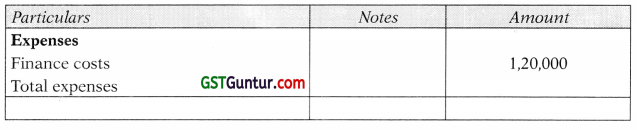

Journal Entries

Working Note:

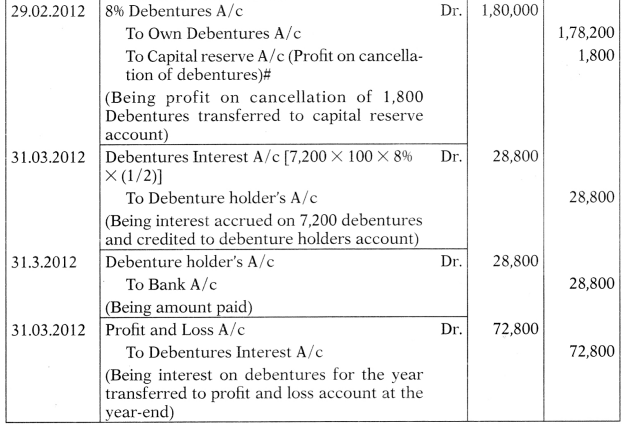

Calculation of Debenture Interest for the half year ended 31st March, 2013

![]()

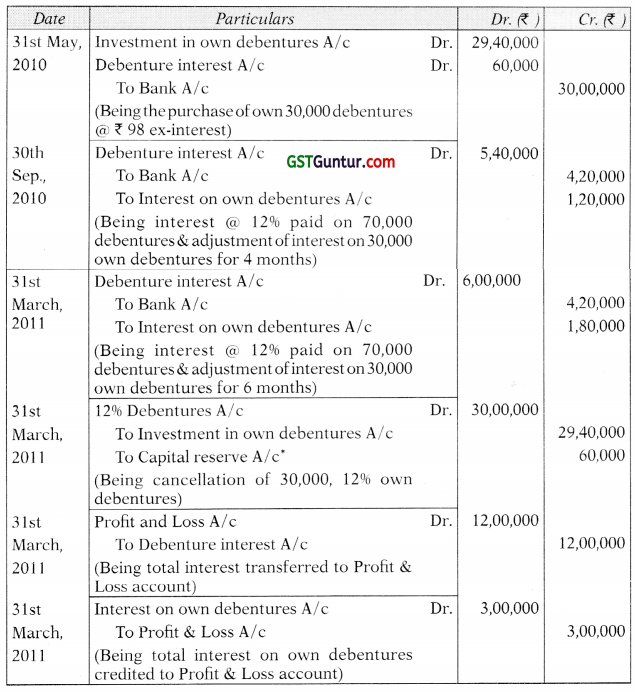

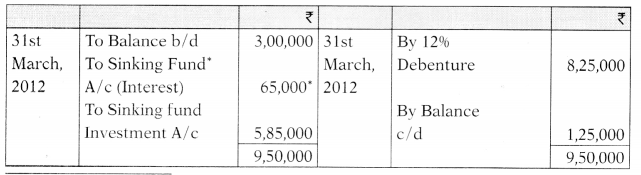

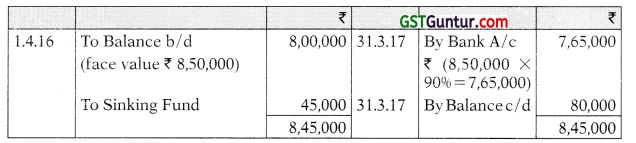

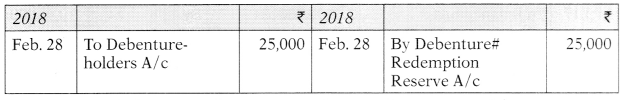

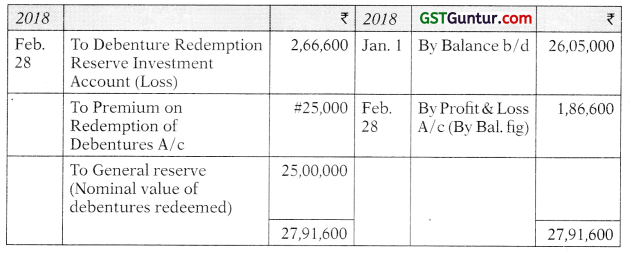

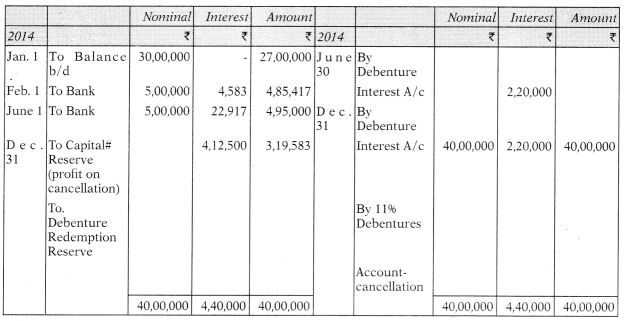

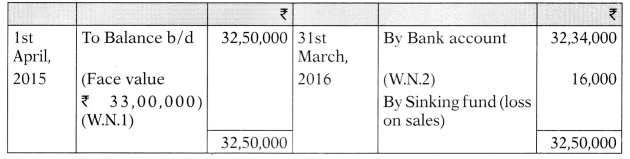

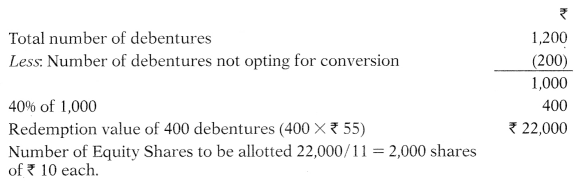

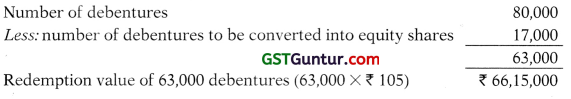

Question 25.

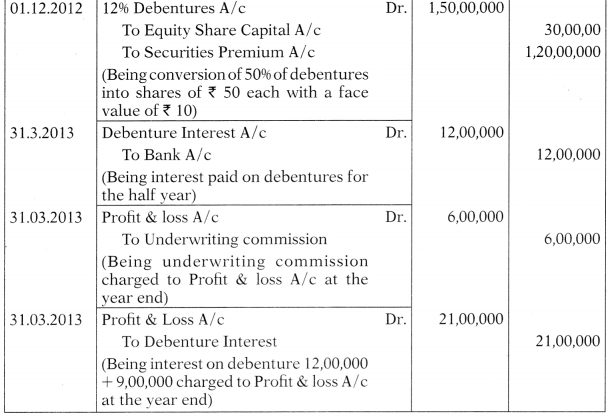

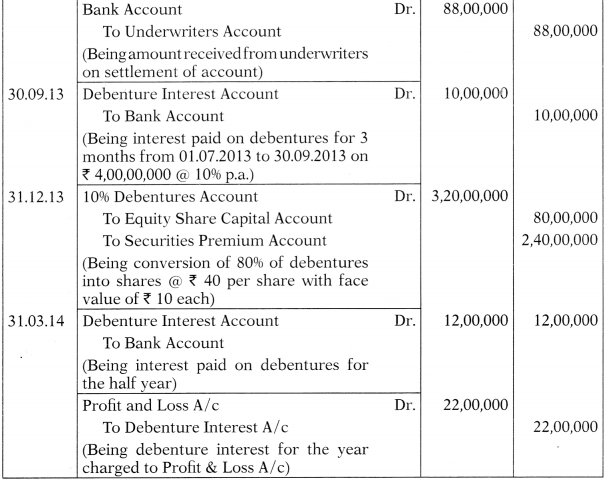

Venus Limited recently made a public issue in respect of which the following information is available:

- No. of partly convertible debentures issued 4,00,000; face value and issue price of ₹ 100 per debenture.

- Convertible portion per debenture – 80%, date of conversion – on expiry of 7 months from the date of closing of issue.

- Date of closure of subscription list – 01.06.2013, date of allotment – 01.07.2013, Rate of interest on debentures – 10% p.a. payable from the date of allotment. Value of equity share for the purpose of conversion – ₹ 40 (Face value ₹ 10)

- Underwriting commission – 3%

- No. of debentures applied for 3,00,000

- Interest payable on debentures – half yearly on 30th September and 31st March.

Write relevant journal entries for all transactions arising out of the above during the year ended on 31st March, 2014 (including cash and bank entries). (8 Marks) (Nov. 2014)

Answer:

Journal Entries

![]()

Working note:

Computation of debenture interest (for the half year ended 31st March, 2014)